Enable JavaScript

Please enable JavaScript to fully experience this site. How to enable JavaScript

- Payment options

Travel credit

Understanding travel credit options.

We offer different types of travel credit: Trip Credit, Flight Credit, and Travel Vouchers. Each type of travel credit has its own terms and conditions, so be sure to read them carefully before redeeming your credit. Keep in mind, travel credits can only be used to book flights, and can’t be used to pay for extras like seats or bags.

Types of travel credit

*Can’t be used for extras like seats or bags.

**For Trip Credit issued on or after April 2, 2024, AAdvantage® members have 12 months to use their Trip Credit when canceling their trip on aa.com or the American app and their AAdvantage® number is included in their reservation. Non-AAdvantage® members have 6 months.

***When booked on aa.com, Flight Credit can only be applied to flights within the U.S., Puerto Rico, and the U.S. Virgin Islands. (U.S. currency only)

Ready to book a trip?

Book a trip with your Trip Credit

Find your trip to use your Flight Credit

- Contact Reservations

How to find and redeem your travel credit

If you received a travel credit, you can use it to book your next trip. Here's how to find and redeem your Trip Credit and Flight Credit.

Trip Credit

If you're an AAdvantage ® member, most Trip Credits will appear in your AAdvantage ® account.

For Trip Credit issued on or after April 2, 2024, AAdvantage ® members have 12 months to use their Trip Credit when canceling their trip on aa.com or the American app and their AAdvantage ® number is included in their reservation. Non-AAdvantage ® members have 6 months.

Log in to your account

Step 1: Find your Trip Credit email

- Look for an email from American Airlines with the subject line ‘Your Trip Credit.’

- Your Trip Credit number is a 13-digit number that begins with ‘00115.’

Keep in mind there are separate ticket numbers for add-ons like seats, upgrades, and bags.

Step 2: Book and add your Trip Credit

- Go to aa.com and book your new flight.

- On the payment screen, select ‘Trip Credit.’

- Follow the prompts to pay using your Trip Credit.

- You may use a credit card to pay any remaining balance.

General rules

- Trip Credit is non-refundable, non-transferable, non-returnable, may not be redeemed for cash, check or credit (except where required by law) and has no implied warranties, including warranties of merchantability or fitness.

- Trip Credit is void if bought, sold or bartered, advertised for sale or used for commercial or promotional purposes.

- We won’t replace Trip Credit if lost or stolen. This may include inadvertent deletion, forwarding or access of the email containing your Trip Credit number. Please guard the Trip Credit number as you would cash.

- Except where prohibited by law, we reserve the right to refuse, void, cancel, reject or hold for review any Trip Credit mistakenly issued in an incorrect denomination or issued or obtained, directly or indirectly, in connection with fraudulent actions, fraudulent claims, compensation abuse or in connection with any violation of these terms and conditions.

Expiration and validity

- Valid until 11:59 p.m. (CT) on the date listed on the Trip Credit, and we won't reissue it past the expiration date.

- We won't accept invalid or expired Trip Credit.

- We won’t accept Trip Credit with an invalid number or if we are unable to locate it within the American Airlines systems.

- To receive Trip Credit, your original ticket must be canceled before the departure of the first flight (or the ticket loses any remaining value and cannot be used for future travel).

Redemption and usage

- You may redeem Trip Credit on aa.com or by contacting Reservations. Trip Credit is not redeemable through any other channels, including airport ticket counters or travel agencies.

- When contacting Reservations, tell the agent you have Trip Credit and you want to use it to book your travel.

- Trip Credit is redeemable toward air travel on flights operated by American, American Eagle ® or flights marketed by American (designated with an AA*). You can’t use Trip Credit for payment of air travel on any other airline on aa.com.

- Contact Reservations to use Trip Credit for qualifying one world ® or other airline partner itineraries.

- Trip Credit is redeemable toward the base air fare and directly associated taxes, fees and charges collected as part of the fare calculation.

- You may not use Trip Credit for products and / or services sold separate from the fare price or for taxes, fees or charges in connection with AAdvantage ® award travel, American Airlines Vacations℠ or any other non-flight products and / or services sold by American.

- You may only use non-taxable Trip Credit for single-passenger reservations on aa.com.

- Contact Reservations to use Trip Credit for more than 9 passengers.

- The recipient of Trip Credit can use it to pay for travel for themselves or others.

- You may redeem up to 8 Trip Credits in a single transaction on aa.com or through Reservations.

- If the ticket price is greater than the value of the Trip Credit, you may pay the difference only with a credit card accepted by American.

- If the ticket price is less than the value of the Trip Credit, we’ll issue any remaining value on a new Trip Credit, delivered via email to the passenger ticketed on the Trip Credit redemption. You may choose to have the new Trip Credit email sent to your email address and then use the remaining value on a new reservation for yourself or someone else.

- You may not combine Trip Credit with the value of an existing ticket to pay for a new ticket.

Flight Credit

If you're an AAdvantage ® member and had your account number listed in your reservation before cancellation, you can log in to your account and view available Flight Credit in your AAdvantage ® account.

Step 1: Find your canceled trip or confirmation email

- You'll need your 6-character confirmation code and 13-digit ticket number.

- American tickets have a 13-digit number that begins with '001'.

Step 2: View your canceled trip

- Go to aa.com and choose ‘Manage trips / Check-in’

- Choose ‘View canceled trips’ and enter your trip details.

- You’ll find your Flight Credit details on the ‘Your trip’ page.

Step 3: Rebook and add Flight Credit

- Go to aa.com and find your new flight.

- On the payment screen, choose ‘Add Flight Credit.’

- Enter the ticket number from your canceled trip and apply the credit.

Book a trip with your Flight Credit

- Flight Credit is non-refundable, non-transferable, non-returnable, may not be redeemed for cash, check or credit (except where required by law) and has no implied warranties, including warranties of merchantability or fitness.

- Flight Credit is void if bought, sold or bartered, advertised for sale or used for commercial or promotional purposes.

- We won’t replace Flight Credit if lost or stolen. This may include inadvertent deletion, forwarding or access of the email containing your Flight Credit number. Please guard the Flight Credit number as you would cash.

- Except where prohibited by law, we reserve the right to refuse, void, cancel, reject or hold for review any Flight Credit mistakenly issued in an incorrect denomination or issued or obtained, directly or indirectly, in connection with fraudulent actions, fraudulent claims, compensation abuse or in connection with any violation of these terms and conditions.

- Flight Credit is valid for 1 year from the date the ticket was issued. We will not extend or reissue once it expires.

- If you don't show for your flight, your ticket will no longer be valid or eligible for any credit.

- We won't accept invalid or expired Flight Credit.

- You may redeem Flight Credit on aa.com, in person at the airport or by contacting Reservations.

- When contacting Reservations, tell the agent you have Flight Credit and you want to use it to book your travel.

- The recipient of Flight Credit can use it to pay for travel for themselves only.

- Flight Credit is redeemable toward air travel on flights marketed and operated by American, by American Eagle ® carriers or on flights marketed and sold by American but operated by one of American’s codeshare or one world ® partners (i.e. flights designated with an AA*).

- Flight Credit is redeemable toward initial booking, the base air fare and directly associated taxes, fees and charges collected as part of the fare calculation.

- You may only redeem 1 Flight Credit for single-passenger trips on aa.com or through Reservations. In order to redeem up to 2 Flight Credits in a single transaction, you must contact Reservations.

- If the ticket price is greater than the value of the Flight Credit, you may pay the difference only with a credit card accepted by American.

- If the ticket price is less than the value of the Flight Credit, you can only use the value of Flight Credit needed for the current booking while remaining value will be issued as travel credit for future reservations.

- You may not use Flight Credit for products and / or services sold separately from the fare price or for taxes, fees or charges in connection with AAdvantage ® award travel, American Airlines Vacations℠ products or services or any other non-flight products and / or services sold by American.

Electronic Travel Voucher

- eVouchers are provided for U.S. customers only.

- eVouchers are non-refundable, non-transferable, non-returnable, may not be redeemed for cash, check or credit (except where required by law) and have no implied warranties, including warranties of merchantability or fitness.

- eVouchers are void if bought, sold or bartered, advertised for sale, or used for commercial or promotional purposes.

- We won’t replace eVouchers if lost or stolen. This may include inadvertent deletion, forwarding or access of the email containing your eVoucher number. Please guard the eVoucher number and PIN as you would cash.

- Except where prohibited by law, we reserve the right to refuse, void, cancel, reject or hold for review any eVouchers mistakenly issued in an incorrect denomination, or issued or obtained, directly or indirectly, in connection with fraudulent actions, fraudulent claims, compensation abuse or in connection with any violation of these terms and conditions.

- eVouchers are valid for 1 year from the date of issue, and we won’t reissue them past the expiration date.

- We’re not responsible for honoring invalid or expired eVouchers.

- We won’t accept an eVoucher with an invalid number or if we are unable to locate it within the American Airlines systems.

- You may redeem eVouchers only on aa.com or by contacting Reservations. eVouchers are not redeemable through any other channels, including airport ticket counters or travel agencies.

- eVouchers are redeemable toward air travel on flights operated by American, American Eagle ® , one world ® partners or on flights marketed by American (designated with an AA*). You can’t use eVouchers for payment of air travel on any other airline.

- Flights sold or originating outside the U.S., Puerto Rico or U.S. Virgin Islands or operated by other carriers are not eligible.

- eVouchers are redeemable toward the base air fare and directly associated taxes, fees and charges collected as part of the fare calculation.

- You may not use eVouchers for products and / or services sold separate from the fare price or for taxes, fees or charges in connection with AAdvantage ® award travel, American Airlines Vacations℠ or any other non-flight products and / or services sold by American.

- The eVoucher recipient can use it to pay for travel for themselves or others.

- You may redeem up to 8 eVouchers in a single transaction.

- If the ticket price is greater than the value of the eVoucher(s), you may only pay the difference with a credit, debit or charge card with a billing address in the U.S., Puerto Rico or U.S. Virgin Islands.

- If the ticket price is less than the value of the eVoucher(s), the unused amount will remain on the eVoucher until it reaches zero, at which time the eVoucher will be deactivated.

- You may not combine eVouchers with the value of an existing ticket to pay for a new ticket.

You may also like...

- American Airlines Gift Card Opens another site in a new window that may not meet accessibility guidelines.

- Reservations and tickets FAQs

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Discover It® Cash Back Discover It® Student Chrome Discover It® Student Cash Back Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Cards Best Discover Cards Best American Express Cards Best Visa Credit Cards Best Bank of America Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Climate Change

- Corrections Policy

- Sports Betting

- Coach Salaries

- College Basketball (M)

- College Basketball (W)

- College Football

- Concacaf Champions Cup

- For The Win

- High School Sports

- H.S. Sports Awards

- Scores + Odds

- Sports Pulse

- Sports Seriously

- Women's Sports

- Youth Sports

- Celebrities

- Entertainment This!

- Celebrity Deaths

- Policing the USA

- Women of the Century

- Problem Solved

- Personal Finance

- Consumer Recalls

- Video Games

- Product Reviews

- Home Internet

- Destinations

- Airline News

- Experience America

- Great American Vacation

- Ingrid Jacques

- Nicole Russell

- Meet the Opinion team

- How to Submit

- Obituaries Obituaries

- Contributor Content Contributor Content

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit cards

Qatar Airways Privilege Club Visa Signature Credit Card review 2024: High earning potential but low ongoing benefits

Harrison Pierce

Robin Saks Frankel

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Grace Pilling

Updated 1:28 p.m. UTC May 7, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

The brand-new $99 annual fee Qatar Airways Privilege Club Visa Signature Credit Card * The information for the Qatar Airways Privilege Club Visa Signature Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. comes with industry-leading earning potential on spending with the airline. However, the absence of substantial perks might persuade you to go with the higher-annual-fee Qatar Airways Privilege Club Visa Infinite Credit Card * The information for the Qatar Airways Privilege Club Visa Infinite Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. or look elsewhere. Here’s our full Qatar Airways Privilege Club Visa Signature Credit Card review.

Qatar Airways Privilege Club Visa Signature Credit Card basics

- Annual fee: $99.

- Welcome bonus: 20,000 Avios after the first transaction, an additional 20,000 Avios, plus 150 Qpoints after spending $3,000 on purchases in the first 90 days of account opening.

- Rewards: 4 Avios per $1 spent on eligible Qatar Airways purchases, 2 Avios per $1 at restaurants and 1 Avios per $1 on other spend.

- APR: 21.24% to 28.24% variable APR on purchases.

- Recommended credit score: Good to excellent.

- Does the card offer preapproval ? No.

- Other benefits: One year of Silver Tier elite status, instant access upon approval.

Qatar Airways Privilege Club Visa Signature Credit Card review

As one of two new cards issued in partnership with Cardless, the Qatar Airways Privilege Club Visa Signature card has an annual fee of just $99 and impressive earning potential. However, the ongoing benefits of the card are lackluster, falling short of the standard of excellence the airline is known for. Outside of a first year of Silver elite status, the card doesn’t offer many extras to cardholders to justify the price.

This could be partly due to Qatar already having so many perks integrated into their in-flight experience. For example, the credit card doesn’t need to offer a checked bag allowance as a perk when all travelers receive at least one checked bag when flying.

If you don’t earn enough of the airline’s Qpoints to maintain your Silver tier status in Qatar’s elite status program after your first year as a cardholder, you might feel like you’re not getting your annual fee’s worth.

The Qatar Airways Privilege Club Visa Signature is best for a particular traveler. You need to fly Qatar Airways or Oneworld partners regularly enough to be willing to pay an annual cardholder fee in exchange for some benefits. But if that particular traveler is you, it’s worth considering the $499-annual-fee Qatar Airways Privilege Club Visa Infinite instead, which comes with an extensive array of perks for the price.

- High earning potential on Qatar Airways purchases: If your primary motivation for applying for the card is to earn Avios to use on flights, this card delivers.

- No foreign transaction fees : As is standard on cards issued by Cardless, you don’t have to worry about incurring additional fees when making purchases abroad.

- One year of Silver elite status: Upon being accepted for the card, you will earn one year of Silver elite status. This is the first tier of three and includes valuable benefits in the air and at the airport.

- Low non-bonus category earning: Outside of Qatar Airways and restaurant spending, the card earns just one point per dollar, so you’ll likely want a separate card for other spending.

- Minimal ongoing benefits: The elite status perk is valid for one year. If you don’t earn enough to renew your status, you’ll lose one of the card’s primary benefits.

Qatar Airways Privilege Club Visa Signature Credit Card rewards

One of the best parts of the Qatar Airways Privilege Club Visa Signature card is its bonus category earning potential. Cardholders will earn 4 Avios per $1 spent on eligible Qatar Airways purchases, 2 Avios per $1 at restaurants and 1 Avios per $1 on other spend. If you regularly fly Qatar Airways and want to maximize your earnings, this card is a great way to do it.

The airline is known for offering one of the most luxurious business class products in the sky and is well-regarded as a premier international airline. Headquartered in Doha, Qatar, the airline flies to nearly 170 destinations around the globe.

If you link your credit card to your Privilege Club account, you can collect and spend Avios at participating retail, dining, entertainment and lifestyle venues. The Avios you earn on payments with your linked credit card is in addition to the Avios you earn for using your card for payment. This is a great way to earn extra points on non-bonus category spending.

Additionally, cardholders will earn 2 Qpoints for every $2,000 spent on their card. Qpoints are the elite status metric with Qatar Airways. The exact number of Qpoints needed to earn status will depend on whether you want to renew your current tier or upgrade to the next one, as seen in the table below.

As a new cardholder, you receive one year of Silver elite status. This means you need to earn just 135 Qpoints to keep your status after your first year, rather than 150 to achieve status in the first place. If you prefer to upgrade to Gold, you’d need to earn 300 Qpoints. Note that you must earn at least 20% of your Qpoints on flights operated by Qatar Airways.

The number of Qpoints you earn on a flight will depend on your route, the fare class you choose and your current status. For example, I’m flying on a roundtrip, business class flight from Madrid to the Maldives in July 2024. I don’t currently hold elite status with Qatar, so this trip will earn 66 Qpoints. If I were a cardholder of the Qatar Airways Privilege Club Visa Signature Card, I’d be almost halfway to renewing my Silver status after this trip.

The welcome offer allows you to earn 20,000 Avios after the first transaction, an additional 20,000 Avios, plus 150 Qpoints after spending $3,000 on purchases in the first 90 days of account opening.

Using government data and other publicly available information, we estimate that a household in the U.S. that would be in the market for this card has around $29,525 in annual expenses that can be charged to a credit card. Here’s how our sample household’s rewards could break down:

The cardholder in this example earns a grand total of 37,406 Avios annually. The value of an Avios will depend on the redemption method, but you can generally expect to be able to purchase a flight with this earning.

To redeem your points, you can purchase flights on Qatar Airways or on Oneworld partners which include Alaska Airlines, American Airlines, British Airways, Cathay Pacific, Finnair, Iberia, Japan Airlines Malaysia Airlines, Qantas, Royal Air Maroc, Royal Jordanian and SriLankan Airlines. You can also redeem your Avios on partner airlines including Bangkok Airways, JetBlue, Latam Airlines, Middle East Airlines, Oman Air, RwandAir, S7 Airlines and Virgin Australia.

Avios can also be used to purchase upgrades, preferred seat selection and extra baggage. You can also use them to access the Privilege Club Collection, to book packages with Qatar Airways Holidays and to dine and shop at Qatar Duty Free.

Qatar Airways has connectivity for 12 major cities in the U.S.: New York, Los Angeles, Seattle, San Francisco, Atlanta, Boston, Chicago, Philadelphia, Miami, Houston, Dallas Fort Worth and Washington, D.C.

Let’s look at some popular routes and how many Avios it will cost to get there. A flight from Miami (MIA) to Dubai (DXB) with a layover in Doha (DOH) will cost just 45,000 Avios one-way in economy, plus $136.40 in taxes and fees.

If you love hiking, you can fly from Seattle (SEA) to Kilimanjaro (JRO) with a layover in Doha for just 85,000 Avios round-trip, plus $338.80 in taxes and fees.

With the number of routes offered by the airline and its partners, you can certainly go places with the points you earn on your card.

Qatar Airways Privilege Club Visa Signature Credit Card perks

One of the most notable perks of the Qatar Airways Privilege Club Visa Signature card is one year of Silver elite status. As a Silver elite member, you will receive:

- 25% tier bonus on earning Avios with eligible flights.

- Priority stand-by, check-in and boarding.

- Complimentary access to lounges in airports and two guest lounge passes every year.

- Extra baggage allowance of 1 piece or 15 kg (33 lbs) and 20% savings on preferred seat selection.

- Savings of up to 15% when paying with Avios on shopping at Qatar Duty Free.

Qatar Airways is a member of the oneworld alliance, which means your Silver elite status gives you oneworld Ruby status and the opportunity to collect Avios when flying with oneworld airlines.

Ruby privileges include access to Business Class priority check-in, access to preferred or pre-reserved seating and priority on waitlists and when on standby.

Qatar Airways Privilege Club Visa Signature Credit Card drawbacks

Although the fast track to one year of Silver Elite status is a fantastic perk, it would be great to see that perk be a permanent feature of the card. Once that year ends, the card won’t have many concrete perks outside of earning Avios. Other airline cards with comparable annual fees might include annual statement credits, discounts on award redemptions, discounts on in-flight purchases or priority boarding.

our partner

Blueprint receives compensation from our partners for featured offers, which impacts how and where the placement is displayed.

The Platinum Card® from American Express

Welcome bonus

Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on the Card in your first 6 months of Card Membership.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Editor’s take

- Over $1,500 in travel and entertainment credits can offset the annual fee.

- Comprehensive lounge access benefit.

- Generous travel and purchase protections.

- High annual fee and spending requirements.

- Amex’s once-per-lifetime rule limits welcome bonus eligibility.

- Annual statement credits have limited use.

Card details

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings through American Express Travel using your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $199 CLEAR® Plus Credit: CLEAR® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $199 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That’s up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.¤

- Terms Apply.

How the Qatar Airways Privilege Club Visa Signature Credit Card compares to other airline cards

Qatar airways privilege club visa signature credit card vs. qatar airways privilege club visa infinite credit card * the information for the qatar airways privilege club visa infinite credit card has been collected independently by blueprint. the card details on this page have not been reviewed or provided by the card issuer..

The Qatar Airways Privilege Club Visa Infinite is the higher-end sibling of the Visa Signature card. As such, the card has many more benefits, but at a cost of $499 per year. The earning potential is higher as you can earn 5 Avios per $1 on eligible Qatar Airways spend, 3 Avios per $1 at restaurants and 1 Avios per $1 on other spend. Plus, for every $1,500 you spend on your card, you’ll earn 2 Qpoints.

The welcome offer is slightly elevated, too, allowing you to earn up to 5 Avios per $1 on eligible Qatar Airways spend, 3 Avios per $1 at restaurants and 1 Avios per $1 on other spend. The card also comes with one year of Gold elite status, which means the bonus Qpoints put you more than halfway to being able to renew your status for another year.

As a Visa Infinite card, you will have access to the Visa Infinite Concierge service, the luxury hotel collection, a primary auto rental collision damage waiver, a reimbursement via statement credit for the application fees for TSA PreCheck or Global Entry (up to $100) and more.

Between the two cards, the Visa Infinite comes out on top for both earning potential and perks but not every traveler wants to add a $499-annual-fee card to their wallet. The Signature might make sense if you’re looking for a lower cost way to accrue Avios with Qatar Airways.

Qatar Airways Privilege Club Visa Signature Credit Card vs. United℠ Explorer Card * The information for the United℠ Explorer Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

The United℠ Explorer Card * The information for the United℠ Explorer Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. is the entry-level credit card for United Airlines travelers, with $0 intro annual fee for the first year, then $95. It earns 2 miles per $1 on dining including eligible delivery services, hotel stays and United purchases and 1 mile per $1 on all other purchases. Cardholders get their first checked bag free for themselves and a companion, an up to $100 statement credit for the application fee for TSA PreCheck or Global Entry and priority boarding. In addition, cardholders get two, one-time United Club passes each year and Premier upgrades on award tickets.

The Qatar Airways Privilege Club Visa Signature is the better choice based on earning alone. However, the United Explorer card has more benefits than the Qatar card and is for a U.S.-based airline, which means it will be better for domestic travel. Additionally, cardholders of this or any United credit card get access to “hidden” reward space with the airline that only cardholders or those with United Premier status have access to. The Qatar card doesn’t unlock any additional reward flight availability.

Qatar Airways Privilege Club Visa Signature Credit Card vs. Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card is one of the best airline credit cards due to its earning potential, multiple airline transfer partners and relatively low annual fee. For just $95 per year, cardholders can earn 5 points per $1 on travel purchased through Chase Travel℠, 3 points per $1 on dining, select streaming services, and online grocery purchases (excluding Walmart, Target and wholesale clubs), 2 points per $1 on all other travel purchases and 1 point per $1 on all other purchases. Plus, cardholders can earn up to $50 in statement credits each year for hotel stays booked through Chase Travel.

The Chase Sapphire Preferred allows you to transfer your points to 11 airline partners and three hotel partners, giving you greater flexibility to redeem your points. While the Chase Sapphire Preferred might have more utility for you overall, it doesn’t offer point transfers to Qatar, so there might be room in your wallet for both cards.

Is the Qatar Airways Privilege Club Visa Signature Credit Card worth it?

The Qatar Airways Privilege Club Visa Signature card is a welcome addition to the market. Qatar Airways is known for its luxury travel experience, and with increased routes serving U.S. travelers the card is worth the annual fee for a specific type of Qatar Airways frequent flyer.

The benefits of the card aren’t substantial, so you’ll want other cards in your wallet that will give you better travel perks, like a statement credit for TSA PreCheck or Global Entry application fees , lounge access, bonus points on everyday spending and comprehensive travel protections and insurance coverage. If you already have cards that include those benefits, you can justify the annual fee by the earning potential alone.

If you do apply for the card, you’ll want to work toward earning at least 135 Qpoints so you can keep your Silver elite status, as it’s a primary benefit of the card. However, if you don’t fly Qatar Airways regularly enough to meet the threshold to earn status, you might be better off with a general travel rewards card with a transferable point currency. American Express Membership Rewards® and Citi ThankYou® points transfer to Qatar Airways at a 1:1 ratio, so you can book award flights using those points.

The Qatar Airways Privilege Club Visa Signature Credit Card is right for you if:

- You fly Qatar Airways frequently enough to justify paying an annual fee but not enough to justify getting the Visa Infinite card.

- You plan on taking enough flights throughout the year to earn Silver elite status.

- Your primary motivation for applying is earning bonus points on Qatar Airways purchases.

Frequently asked questions (FAQs)

A free checked bag is not a cardholder benefit, but Qatar Airways allows at least one checked bag on every flight, regardless of fare class. Cardholders also receive one year of Silver elite status, which includes an additional checked bag allowance.

The exact value of an Avios will vary depending on the redemption method. Using the previous example of the flight from Miami to Dubai, you can pay 45,000 Avios or $477, giving you a valuation of roughly one cent per point. However, you can likely find much better valuations, especially in higher fare classes.

The number of points you will need to purchase a Qatar Airways flight will depend on several factors, like the time of year, route, availability and more. If you are curious about how much a flight will cost, you can visit the airline’s Qatar Airways My Calculator page to compare routes.

The annual fee for the Qatar Airways Privilege Club Visa Signature is $99.

*The information for the Qatar Airways Privilege Club Visa Infinite Credit Card, Qatar Airways Privilege Club Visa Signature Credit Card and United℠ Explorer Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Harrison Pierce is a freelance writer and digital nomad that is passionate about all things personal finance and travel. While traveling full-time, he refined his love for writing and now enjoys working with various brands to tell stories and create meaningful content.

Robin Saks Frankel is a former credit cards lead editor at USA TODAY Blueprint. Robin has covered credit cards and related content for national web publications including NerdWallet, Bankrate and HerMoney for more than a decade. Robin has been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace and NASDAQ's Trade Talks. She has also appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University.

Grace Pilling is a deputy editor for credit cards at USA TODAY Blueprint. She believes credit cards are the ultimate choose-your-own-adventure tools of the financial world and gets excited about helping people discover the best credit card strategy for their unique goals. Prior to joining Blueprint, Grace worked on and led personal finance teams at Bankrate, CreditCards.com, MoneyUnder30 and MoneyGeek. She has a bachelor’s degree in English and writing and a diploma in editing and publishing.

Capital One SavorOne Card review: No-annual-fee card for foodies

Reviews Emily Sherman

One Key Card review 2024: Book travel, and earn rewards with no annual fee

Reviews Jason Steele

One Key+ Card review 2024: Earn rewards towards free travel with Expedia, Hotels.com and Vrbo

Capital One SavorOne Rewards for Students Credit Card review 2024: Excellent cash-back rewards for new-to-credit students

Reviews Kelli Pate

Bank of America Business Advantage Travel Rewards World Mastercard credit card review 2024

Reviews Julie Sherrier

PNC Cash Unlimited Visa Signature Credit Card review 2024: Get 2% cash back with no annual fee

Reviews Eric Rosenberg

OpenSky Secured Card review 2024: No credit check required, but there is a cost

Reviews Ben Luthi

Wells Fargo Attune Card review 2024: Bonus cash-back categories galore

Reviews Michael Dempster

The Platinum Card from American Express review 2024: Flashy perks, but requires expert mode to maximize

Reviews Ariana Arghandewal

Bank of America Travel Rewards credit card review: A travel credit card for the fee-averse

U.S. Bank Business Altitude Power World Elite Mastercard review 2024: Unlimited earnings and simple bonus structure

Reviews Juan Ruiz

FutureCard Visa® Debit Card review 2024: A rewarding card for climate-conscious spenders

Avianca LifeMiles American Express Credit Card review 2024

Reviews Harrison Pierce

Citi Strata Premier Card review 2024: Takes the Premier Card to the next level

Reviews Carissa Rawson

Avianca LifeMiles American Express Elite Card review 2024: Built for points-and-miles fanatics

Qatar Airways Privilege Club

Qatar Airways

Privilege Club

Credit Card

40,000 Avios

20,000 Avios

After your first transaction

After spending a total of $3,000 in the first 90 days *

$99 annual fee †

* Offer Terms

† Rates & Fees

50,000 Avios

25,000 Avios

150 Qpoints

After spending a total of $5,000 in the first 90 days **

$499 annual fee ‡

** Offer Terms

‡ Rates & Fees

No matter where you shop, you’ll earn Avios when you use your Privilege Club credit card.

Avios on qatar airways purchases *, avios on dining *, avios when you use your privilege club card everywhere else *, you’ll get 2 qpoints for every 2,000 avios you earn using your card *, avios on qatar airways purchases **, avios on dining **, avios when you use your privilege club card everywhere else **, you’ll get 2 qpoints for every 1,500 avios you earn using your card **.

After spending a total of $3,000 in the first 90 days

After spending a total of $5,000 in the first 90 days

And get access to benefits like Privilege Club Silver or Gold.

And benefits like, privilege club silver or gold and more…, avios on qatar airways, avios on dining, avios everywhere else, get 2 qpoints for every 2,000 avios you earn using your card, get 2 qpoints for every 1,500 avios you earn using your card.

In your first year, experience Privilege Club Silver with access to benefits, like...

25% tier bonus on eligible flights, priority stand-by, priority check-in & boarding, save 20% on seat selection, 15kg extra baggage allowance, lounge access, 33 lbs extra baggage allowance, oneworld tier: ruby.

Benefits available from Qatar Airways with your Privilege Club credit card.

In your first year, experience Privilege Club Gold with access to benefits, like...

75% tier bonus on eligible flights, preferred seats, 20kg extra baggage allowance , 40 qcredits to redeem for upgrades, excess baggage and much more, al maha 'meet and assist' service, discount on online redemptions, 44 lbs extra baggage allowance , oneworld tier: sapphire.

Miles do not expire for as long as you use your card

No foreign transaction fee †

Visa Zero Liability

Travel Emergency Assistance

Roadside Dispatch®

In your first year, experience Privilege Club Silver

Extended Warranty Protection

Purchase Security

Return Protection

Visa Infinite Concierge

Visa Infinite Luxury Hotel Collection

Auto rental collision damage waiver

Car rental discounts

Trip Cancellation or Interruption

Lost Luggage Reimbursement

Travel Accident Insurance

In your first year, experience Privilege Club Gold

Cardless makes the Qatar Airways Privilege Club Credit Cards. Everything you need for your Privilege Club credit card is available through Cardless, backed by the safety and security of Visa.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

5 Sweet Spots of Qatar Airways Qmiles

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

For the past few years, it’s been easy to write off the Qatar Privilege Club program. Between high award costs and out-of-pocket fees, there was little value to be found — especially for travelers based in the U.S.

Then, an unexpected thing happened. In November 2020, Qatar Airways lowered award redemption rates by up to 49%. Between this and reduced award fees, suddenly awards through the Qatar Privilege Club cost much less than before.

So, let’s take a look at the sweet spots of Qatar’s newly re-valued Qmiles program — including cheap Qsuite (business class) awards that will cost you less than $20 out of pocket.

How to get Qmiles

Before we get to the sweet spots, we need to address the elephant in the room: How is a U.S.-based traveler supposed to get Qatar Qmiles? Thankfully, you don’t have to fly Qatar or even credit partner flights to Qatar’s Privilege Club.

Why not? Qatar’s Privilege Club partners with two major transferable points programs: Citi ThankYou and Marriott Bonvoy . U.S.-based travelers can use either — or a combination of both — to get enough Qmiles for the newly cheap Qsuite awards.

Citi cardholders can transfer ThankYou points to Qatar Qmiles at a 1:1 transfer ratio. Thanks to this transfer rate, you can essentially earn 5 Qmiles per dollar spent on restaurant and airfare purchases using the Citi Prestige® Card , or effectively earn 3x Qmiles at supermarkets, gas stations and hotels using the Citi Strata Premier℠ Card .

Marriott members can transfer Bonvoy points to Qmiles at a rate of 3 Bonvoy points to 1 Qmile. Plus, you’ll get a 5,000-mile bonus for every increment of 60,000 Bonvoy points you transfer at a time. That means you can transfer 180,000 Bonvoy points to get 75,000 Qmiles.

Transfers from both Citi ThankYou and Marriott Bonvoy to Qatar Privilege Club may take a few days, so make sure to factor this into your award booking timing.

» Learn more: The best transferable points currencies and who they partner with

Best redemptions for Qatar's Qmiles program

As part of this “revaluation,” Qatar Airways lowered award redemption rates by up to 49% across its entire route network. However, Qatar doesn’t publish an award chart. So, you’ll need to use its Qcalculator to find the mileage cost for an award flight. That makes it harder to uncover great options. But we did some digging for you. Here are the best redemptions for U.S.-based travelers in the recently updated Qmiles program:

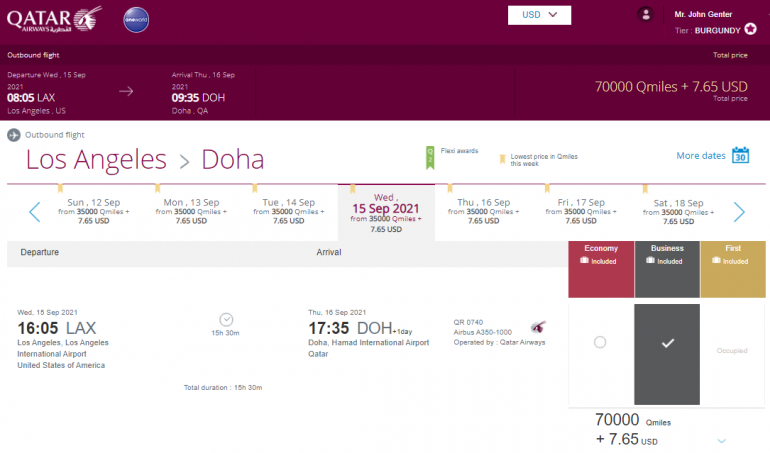

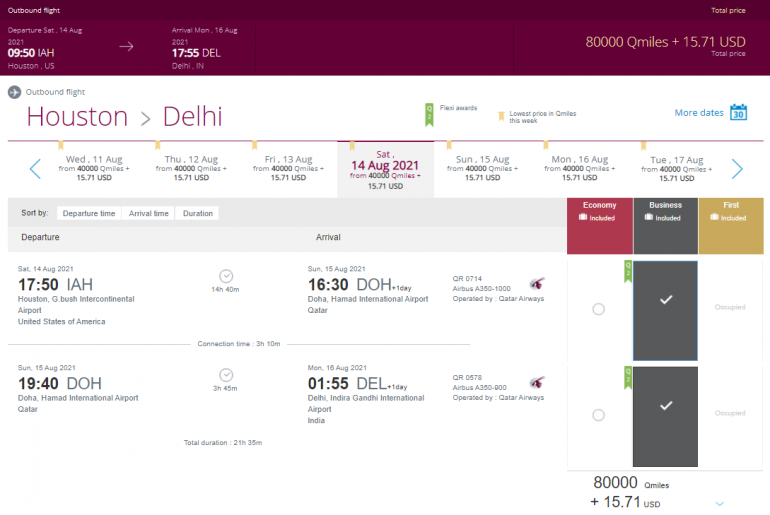

1. Qatar in business class for 70,000 Qmiles one way

Qatar Airways has an extensive network, but virtually all flights connect through Doha, Qatar. If you’re looking to go no further than Qatar, Qmiles is now a competitive option.

Award flights between Doha and anywhere in the U.S. cost just 70,000 Qmiles each way in business class. That’s an excellent rate for up to 15.5 hours in an excellent business class product.

You can book Qatar business class award flights through American Airlines AAdvantage at the same 70,000-mile rate. However, AAdvantage isn’t a transfer partner of any major bank point program. So it may be easier to get Qmiles and redeem an award through Qatar Privilege Club.

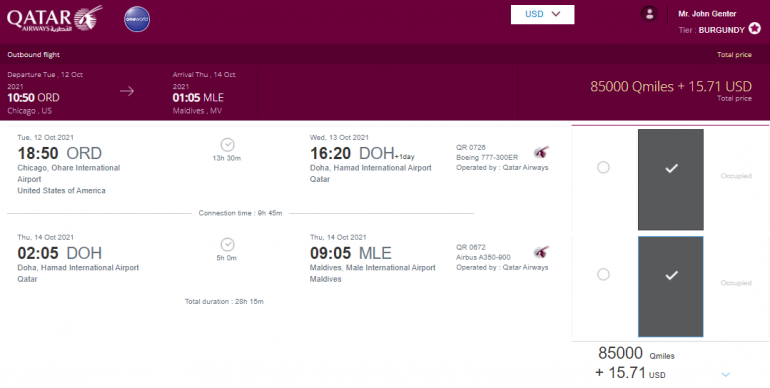

2. The Maldives in business class for 85,000 Qmiles one-way

Whether it’s for a honeymoon or another special occasion, the Maldives is a spectacular destination on many bucket lists. What better way to get there than by flying in Qatar’s Qsuite? You can book business class award flights from the U.S. to the Maldives for just 85,000 Qmiles each way, plus $15.71 in taxes and fees.

Male, the capital of the Maldives, is a reasonable five-hour flight from Doha, but Qatar still uses some of its finest business class products on this route. So you’ll get to fly to your Maldives getaway in comfort every leg of the journey.

3. India in business class for 80,000 Qmiles one way

Likewise, you can fly from anywhere in the U.S. in a business class Qsuite to India or Pakistan for only a few more Qmiles than it costs to fly to Doha. The trip will cost you 80,000 Qmiles each way and $15.71 in taxes and fees, and includes destinations throughout India and Pakistan like:

Ahmedabad, India.

Delhi, India.

Goa, India.

Islamabad, Pakistan.

Karachi, Pakistan.

Mumbai, India.

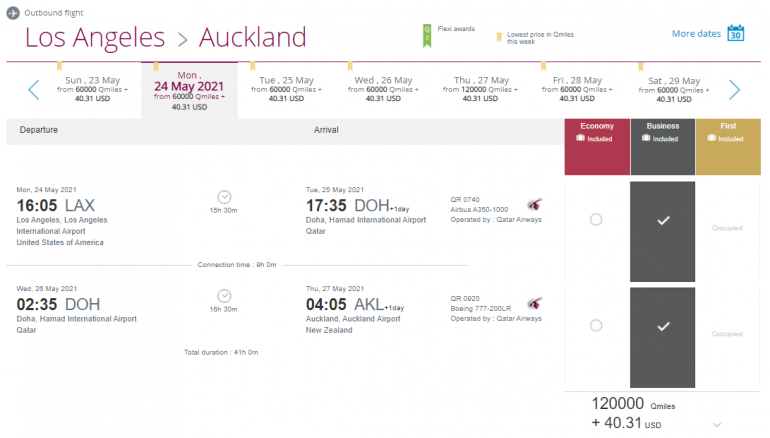

4. New Zealand in business class for 120,000 Qmiles one way

Anyone that’s flown from the U.S. to New Zealand can attest that it’s a long way between the countries. But Qsuite lovers can stretch this flight even longer by flying through Qatar. Flying Qatar business class on this route costs “just” 120,000 Qmiles.

While that’s more than many other mileage programs, this routing lets you enjoy Qsuite for a whopping 32 hours. This route of a combined 17,000+ miles lets you fly Qatar’s two longest flights back to back for just over $40 out of pocket.

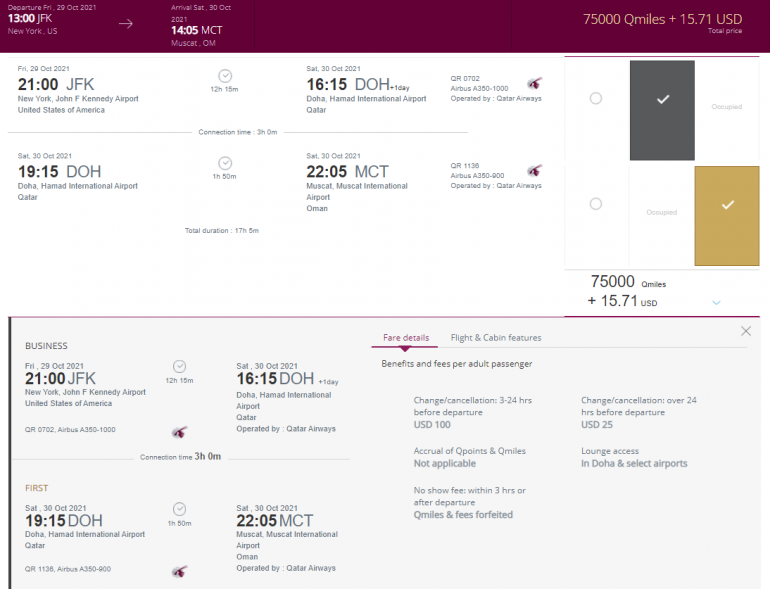

5. Short-haul first class awards

In Doha, Qatar operates one of the best lounges in the world: the Qatar Airways Al Safwa First Class Lounge . However, flying Qsuite business class or holding Oneworld elite status isn’t going to get you into this lounge. Instead, you must be a Qatar first class passenger, a Privilege Club Platinum elite flying in Qatar business class or pay a hefty upgrade fee as a business class passenger to enter.

But Qatar doesn’t sell first class tickets to many destinations. For example, Qatar doesn’t operate an aircraft with first class to any U.S. destination. While you could find first class on Qatar’s Airbus A380s, Qatar doesn’t expect to fly its A380s again until at least 2022.

So, to check out Qatar’s Al Safwa First Class Lounge, you’ll need to fly first class on short-haul routes. And thanks to Qatar’s distance-based award chart, these flights won’t break the mileage bank.

For example, you can tack on a first class flight to a business class award flight from the U.S. for as few as 75,000 Qmiles, plus under $16 in taxes and fees. That’s just 5,000 more Qmiles than booking a business class award from New York-JFK to Doha.

Alternatively, you can book an award flight from Doha to Kuwait or Muscat, Oman, for just 21,000 Qmiles each way in first class. Although these are short flights, paying just 21,000 miles to experience the Al Safwa First Class Lounge is quite a bargain.

» Learn more: Why airlines like Qatar Airways are launching new international routes, despite COVID

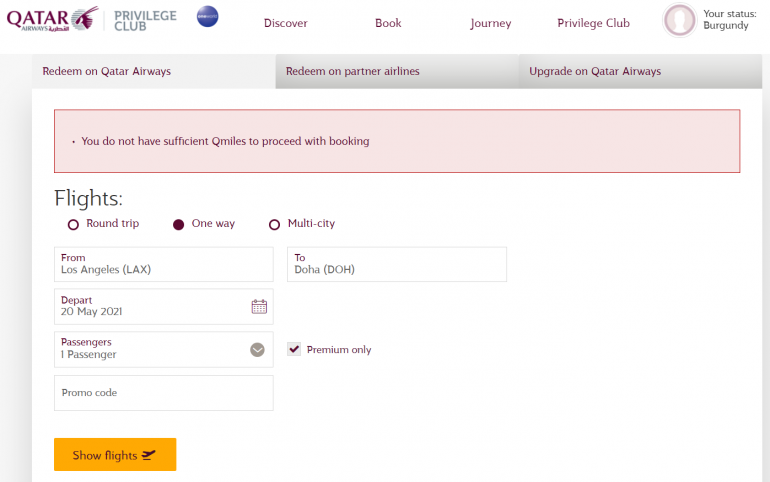

How to find Qatar Privilege Club awards

Before transferring your Citi ThankYou or Marriott Bonvoy points to Qatar, check to see if there’s award availability on the flight that you want.

The airline makes this a little hard to do if you don't have enough Qmiles in your account, displaying an error message that doesn't let you move forward. This can be frustrating if you're still deciding whether to transfer any points into your Qatar Privilege Club account.

We've found a workaround.

You can still search for award availability before you transfer points to Qatar. Instead of using the award search tool, start on the Qatar homepage and search for a cash ticket on the route you want. Once the search results come up, click the “book an award ticket” button at the top right corner.

You’ll be prompted to log in to your Privilege Club account, if you haven't already. After logging in, you should be able to see award availability on this date and route. Select the option that you want to see the final mileage and out-of-pocket price.

Qmiles are worth more now

If you haven’t paid attention to the Qatar Privilege Club recently, you haven’t missed out on much. Awards through the Qatar Privilege Club used to cost too many miles and had too many fees. But after recent changes, it’s worth considering the program once again for booking cheap Qsuite awards to Doha and beyond.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Qatar Airways Privilege Club: How to earn and redeem Avios, elite status and more

Editor's Note

- Qatar Airways Privilege Club uses Avios as its currency.

- Because Qatar Airways is a Oneworld member, it is possible to earn Privilege Club elite status when flying with the carrier or partner airlines such as American Airlines, Alaska Airlines and British Airways.

- Avios are easy to earn through spending on cobranded credit cards, transferring credit card points and traveling, making it a popular frequent flyer currency.

Qatar Airways is one of the world's top airlines, with an excellent business-class product and great lounges at its hub in Doha's Hamad International Airport (DOH). The airline has a huge route network as well, with routes to major U.S. airports like Chicago's O'Hare International Airport (ORD), Dallas Fort Worth International Airport (DFW) and Philadelphia International Airport (PHL).

The Oneworld member has its own loyalty program called Qatar Airways Privilege Club and uses the increasingly popular Avios currency . With this loyalty program, you can earn and redeem Avios when flying Qatar Airways and its Oneworld partners. Plus, it has three elite status levels that give frequent flyers special privileges like entry to lounges and access to preferred seating.

New to the carrier's Privilege Club? You're in the right place. Here is everything you need to know about the program.

What is Avios?

Avios is the currency used by the following loyalty programs:

- British Airways Executive Club

- Iberia Plus

- Aer Lingus AerClub

- Qatar Airways Privilege Club

- Finnair Plus

Avios can be transferred between any of these programs at a ratio of 1:1, so each Avios is theoretically worth the same in each program. However, there are different ways in which Avios can be redeemed in each program, meaning the savvy reader can achieve different values depending on which program they are used in ... and how.

This guide focuses on Avios earned and redeemed through the Qatar Airways Privilege Club program.

Related: 5 versions of Avios: When to use Aer Lingus, British Airways, Finnair, Iberia and Qatar Airways

Qatar Airways elite status

Qatar Airways has three elite status tiers beyond the entry-level Burgundy level: Silver, Gold and Platinum. You can qualify for these tiers by earning a certain number of Qpoints when flying with Qatar Airways and its partners (these are separate from Avios and only used to count toward your status). To view how many Qpoints you'll earn with each flight, use Qatar Airways' My Calculator .

Below is a look at how many Qpoints you'll need to qualify for each tier. You must earn these within a single 12-month period. Once you've qualified for Silver, you can upgrade by earning more points within 12 months. This is considered your renewal date.

Fewer Qpoints are required to renew your elite status. You can either earn a smaller number of Qpoints in 12 months or a higher number in 24 months — each calculated from your renewal date.

If you fail to meet renewal requirements, you'll drop to the tier you did qualify for.

Additionally, you must earn at least 20% of your Qpoints on flights marketed or operated by Qatar Airways to qualify. Alternatively, you can fly four Qatar Airways segments on 12-month renewals or eight Qatar Airways segments on 24-month renewals to meet this requirement.

Elite status benefits

Silver (Oneworld Ruby) is Qatar's lowest elite status tier and includes the following benefits:

- Discounted seat reservation

- 25% bonus Avios

- Family member bonus

- Lounge access (no guests)

- Two guest lounge passes

- Free checked baggage

- Priority boarding and check-in

- Priority wait-listing

Gold status (Oneworld Sapphire) includes all Silver benefits, plus the following perks:

- Preferred seating

- Guaranteed economy awards

- 75% bonus Avios

- 5% discount on redemptions

- Award-fee waivers

- Lounge access (one guest)

- Four guest lounge passes

- Priority baggage handling

- Extra baggage

- Priority phone support

- Al Maha Gold service

Qatar's top-tier Platinum elite status is the equivalent of the valuable Oneworld Emerald status. This tier includes all Gold status benefits, plus the following perks:

- 100% bonus Avios

- Lounge access (two guests), with first-class lounge access when flying in business class

- Five guest lounge passes

How to earn Avios with Qatar Airways Privilege Club

Cardless credit cards

Cardless has recently launched two new Qatar Airways cobranded credit cards .

The Qatar Airways Privilege Club Visa Infinite Credit Card, which comes with a $499 annual fee, offers:

- A welcome offer of up to 70,000 Avios: 45,000 Avios after the first transaction and an additional 25,000 Avios and 150 Qpoints after you spend $5,000 in the first 90 days; this is slightly lower than the current welcome bonuses on Chase's three Avios-earning credit cards

- 5 Avios per dollar spent on Qatar Airways purchases, 3 Avios per dollar spent on restaurant purchases and 1 Avios per dollar spent on all other purchases

- 2 Qpoints for every 1,500 Avios earned

- One year of complimentary Qatar Airways Privilege Club Gold status

- Visa Infinite benefits like concierge services, access to the Luxury Hotel Collection and rental car privileges

The information for the Qatar Airways Privilege Club Visa Infinite and Signature cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

With this card, you can effectively buy Gold status with the program for $499 annually. Also, with the 150 Qpoints in the welcome offer, you'll be 25% of the way to Platinum status.

The Qatar Airways Privilege Club Visa Signature Credit Card, the other cobranded card option, has a $99 annual fee and comes with:

- A welcome offer of up to 50,000 Avios: 30,000 Avios after the first transaction and an additional 20,000 Avios after you spend $3,000 in the first 90 days

- 4 Avios per dollar spent on Qatar Airways purchases, 2 Avios per dollar spent on restaurant purchases and 1 Avios per dollar spent on all other purchases

- 2 Qpoints for every 2,000 Avios earned

- Automatic Silver status with Qatar Airways Privilege Club

Citi ThankYou Rewards

Another easy way for U.S. travelers to earn Qatar Avios is by transferring Citi ThankYou Rewards points to Qatar Airways Privilege Club. Points transfer to Qatar at a 1:1 ratio, though transfers usually take around two days to process .

Note that if you're still holding on to the Citi Prestige® Card , which is no longer open to new applicants, you can transfer ThankYou Rewards points to Privilege Club.

That said, as with Chase Ultimate Rewards points, you can combine your Citi ThankYou Rewards points into a single account for select products, allowing you to effectively "convert" your fixed-value earnings from cards like the Citi Rewards+® Card (see rates and fees ) and the Citi Double Cash® Card (see rates and fees ) into fully transferable ThankYou points.

The information for the Citi Prestige has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: Better together: Why the Citi Strata Premier and Rewards+ cards are a great pair

Transfer from other Avios programs

You can also transfer Avios from British Airways Executive Club, Iberia Plus or Aer Lingus AerClub at a 1:1 rate in any direction.

The following cards all currently offer strong welcome bonuses that you could easily convert to Avios in these three programs (and then transfer to Qatar Airways Privilege Club):

- American Express® Gold Card : Earn 60,000 bonus points after spending $6,000 on purchases in the first six months of card membership. Plus, receive 20% back in statement credits on eligible restaurant purchases (up to $100) within the first six months of card membership. Terms apply.

- The Platinum Card® from American Express : Earn 80,000 Membership Rewards points after you spend $8,000 on purchases within the first six months of card membership. Check to see if you're targeted for a higher welcome offer through CardMatch (offer subject to change at any time). Terms apply.

- Capital One Venture Rewards Credit Card : Earn 75,000 bonus miles after you spend $4,000 on purchases within the first three months from account opening.

- Capital One Venture X Rewards Credit Card : Earn 75,000 bonus miles after you spend $4,000 on purchases within the first three months from account opening.

- Chase Sapphire Preferred® Card : Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

- Chase Sapphire Reserve® : Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

Transfer from Marriott Bonvoy

Alternatively, you can transfer Marriott Bonvoy points to Qatar Airways Privilege Club at a 3:1 ratio. As an added perk, you'll get a 5,000-Avios bonus when you transfer 60,000 points. This means transferring 60,000 points nets you 25,000 Privilege Club Avios.

Earn Avios by flying Qatar Airways

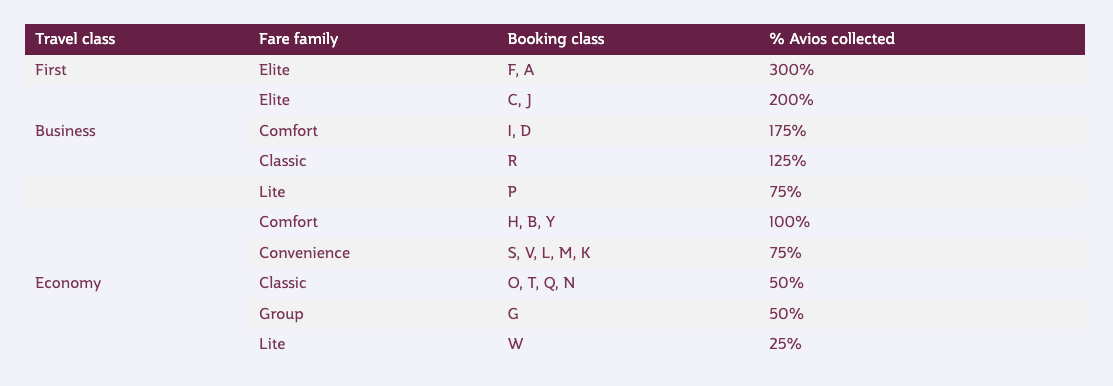

You can also earn Avios when taking paid Qatar-operated flights around the world. The number of Avios you earn depends on your cabin and ticketed fare class. Qatar Airways Privilege Club still awards Avios based on the distance flown, but remember that most discounted fare classes will earn much lower than higher-tier fares.

Here's a table that details how you'll accrue Avios on Qatar flights.

You can use Qatar's online calculator to see information for a specific itinerary.

Earn Avios with program partners

You can also earn Qatar Avios for flights on any of the following Oneworld airlines:

- Alaska Airlines

- American Airlines

- British Airways

- Cathay Pacific

- Fiji Airways (Oneworld Connect partner; fully joining the Oneworld alliance by 2025 )

- Iberia, including Iberia Express and Air Nostrum

- Japan Airlines

- Malaysia Airlines

- Qantas, including QantasLink and Jetconnect

- Royal Air Maroc

- Royal Jordanian Airlines

- S7 Airlines (currently suspended)

- SriLankan Airlines

Qatar Airways Privilege Club also partners with the following airlines outside of Oneworld:

- Bangkok Airways

- Middle East Airlines

- Oman Air (joining the Oneworld alliance in 2024)

- Virgin Australia

Flights on these airlines follow Qatar Airways' earning scheme, but you can use the calculator for more details.

Redeeming Qatar Airways Privilege Club Avios

Booking Qatar Airways flights with Avios

Qatar Airways' award-winning Qsuite product is widely considered one of the world's best business-class products . Even the carrier's economy product is a solid option. Here are the prices for popular one-way itineraries per person on any date (there is now peak and off-peak pricing).

Availability can be limited, especially in premium cabins, so the further in advance you can book, the more likely you are to find one or more seats on the dates you need.

Off-peak redemption rates in business class are a great way to redeem Qatar Avios if you can find availability, given the carrier's excellent product.

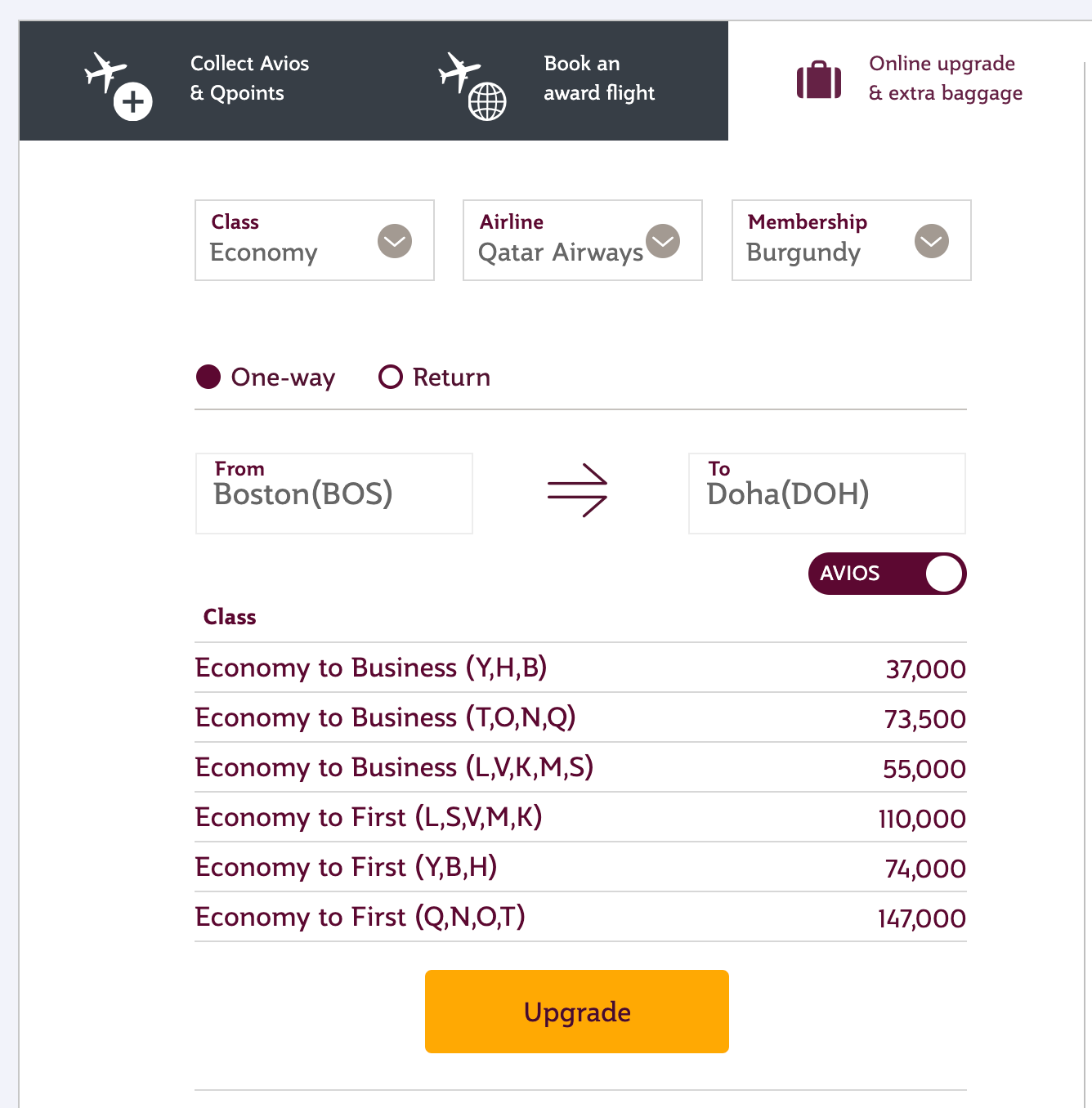

Upgrading Qatar Airways flights with Avios

You can also use your Qatar Avios to upgrade paid flights operated by the airline. You must use the airline's calculator to find the cost of upgrading a specific flight based on your route and fare class.

For example, you can upgrade the cheapest economy ticket from the East Coast to Doha to a business-class seat on the same route for 55,000 Avios one-way. This isn't much cheaper than booking an award ticket, so we recommend steering clear of this option unless you have booked an extremely cheap cash fare.

Additionally, you need to find available upgrade space in order to upgrade your ticket. You can do this by calling the airline or attempting to upgrade a ticket online.

Booking partner flights with Avios

Qatar has lowered the award prices for many partner-operated flights, bringing them in line with other Avios programs. Here's the award chart for all Qatar Airways Privilege Club partner redemptions, including Oneworld members and other carriers, except for flights 3,000 miles and under and those operated by American Airlines and Alaska Airlines:

Being able to book flights from just 6,000 Avios is a terrific deal.

Following a recent devaluation , short-haul flights operated by American Airlines and Alaska Airlines are now priced as follows:

You can redeem many partner awards, including flights operated by American Airlines, JetBlue, British Airways and Virgin Australia, online. To redeem your Qatar Avios on a partner flight that does not appear online, you can call Qatar Airways Privilege Club at 800-988-6128. Know, though, that the call center is only open during working hours on weekdays.

You can also see partner flight schedules by selecting "Book my award flight" on Qatar's website . You can then submit a request to book a partner flight, and a Qatar agent will process your reservation if there's award space. We don't recommend this option since award space can rapidly change. Instead, we suggest transferring Avios to British Airways so you have more partner flight options you can book online.

Related: The best ways to redeem British Airways Avios

Other redemption options

You can also use your Qatar Avios for merchandise, duty-free items, hotel stays and more. However, we generally recommend staying away from these types of redemptions, as they almost always offer less value than a free flight, often dropping the value to half a cent per Avios (or less).

Bottom line

Qatar Airways has fabulous products on the ground and in the air. If you have never flown long-haul business class, you cannot go wrong with the world-famous Qsuite to Doha and beyond.

While the program previously flew under the radar due to some uncompetitive pricing and complex booking options, adopting the already popular Avios currency in 2022 has opened up new ways to easily earn and redeem Avios in the program.

The ability to easily transfer Avios between five airline loyalty programs makes the program much more attractive, especially as Qatar Airways Privilege Club now has similar short-haul pricing that many appreciate when redeeming Avios through the British Airways Executive Club program.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

The Best Ways To Book Qatar Airways Qsuites With Points and Miles

Former Senior Content Contributor

483 Published Articles

Countries Visited: 24 U.S. States Visited: 22

Keri Stooksbury

Editor-in-Chief

47 Published Articles 3398 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

Director of Operations & Compliance

6 Published Articles 1206 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Table of Contents

Key takeaways, a look inside qatar airways qsuites, how to find qatar airways qsuites, how to fly qatar qsuites (business class) using miles, great qsuites redemptions and the points required, how to earn enough points for qsuites, when should you search for award space, what makes qsuites a great redemption, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

- Qsuites is one of the best business class products in the world, with a fully flat bed, a privacy door, and even pajamas from The White Company. You can also access the Al Mourjan Business Class Lounge in Doha.

- Booking Qatar Airways Qsuites using points and miles offers exceptional value, especially through programs like American AAdvantage, British Airways Avios, and Qatar Privilege Club.

- Points from programs like Amex Membership Rewards, Chase Ultimate Rewards, and Citi ThankYou can be converted to Avios.

Qatar Airways has consistently taken the airline industry by storm. With the fame of its Qsuites business class, it’s no secret that Qatar Airways has made a name for itself.

Perhaps the biggest way Qatar Airways has impressed the frequent flyer world recently is the speed with which it has rolled out Qsuites. This flagship business class product is arguably the best business class around . The experience even outshines some other airlines’ first class products.

Award availability is generally solid if you plan in advance, and the number of routes offering the product continues to grow.

The most difficulty you’ll have is figuring out which planes have Qsuites and which don’t. Not to worry — we have you covered!

Arranged in a 1-2-1 configuration, you’ll have direct aisle access no matter which seat you pick. You’ll also have access to some of the best inflight dining there is, featuring Middle Eastern and Western cuisine.

You’ll also be graciously anointed with stylish amenity kits, fluffy bedding, comfy pajamas, and posh treatment under the care of Qatar Airways flight attendants!

We’ll get more into this in the later sections.

Qatar Airways operates a few types of long-haul business class products. We want to focus on booking Qsuites, which are among the best business class seats.

To find out which flights offer Qsuites, you have to consult the seat map . The best way to do so is with ExpertFlyer, a paid service that costs $9.99 per month or $99 for 12 months. You can also get a more basic version for $4.99 per month with more limited features.

Here’s what Qsuites looks like with a 1-2-1 configuration:

Here’s what the Qatar Airways old business class looks like:

Alternatively, you can try to use the free service of SeatGuru , but we find ExpertFlyer more reliable .

Qatar Airways has quite a varied wide-body fleet, but Qsuites availability differs between their many aircraft types. Qatar Airways Qsuites can be found on 4 aircraft types: the Boeing 777-200LR, the Boeing 777-300ER, the Airbus A350-900, and the Airbus A350-1000.

All of Qatar’s Airbus A350-1000s feature Qsuites. Of the 9 Boeing 777-200LRs, 7 of them feature Qsuites, and the other 2 feature business class seats in a 2-2-2 configuration. More than half of the 56 Boeing 777-300ER aircraft also feature Qsuites. About a third of Qatar’s A350-900s feature Qsuites.

Qatar has frequent and unannounced equipment swaps, so even if a route is typically flown in an aircraft with Qsuites, that can always change.

When it comes to booking Qsuites using points and miles, you have plenty of options. Now that Qatar has joined the Avios network, this opens up even more options to book Qsuites. You can use Qatar’s own Avios program, its Oneworld partners, or even non-alliance partners like JetBlue to book Qsuites.

Oneworld partners are eligible to book Qatar Airways flights , so long as Qatar Airways releases award availability to these partners. We’ll talk more about that in the sections below.

With so many different options to cover, let’s get started.

Qatar Airways Privilege Club

The first method we’ll discuss is none other than Qatar Airways’ own frequent flyer program, Privilege Club .

Qatar Airways transitioned away from its old “Qmiles” currency in March 2022 and adopted Avios, the same currency used by Iberia, British Airways, Aer Lingus, and Vueling.

While all the airlines use the same Avios currency, each airline program uses a different award chart. This opens up plenty of redemption opportunities as you can choose to book award flights with whatever program has the cheapest redemption rates.