My TRS Claim

Browser not supported

The browser that you are using cannot run the TRS Claim application: it does not properly support html "canvas" elements and so cannot be used to generate a QR code.

Please install a more up-to-date browser, such as the latest version of Chrome , Firefox , or Edge .

- 1. Disclaimer

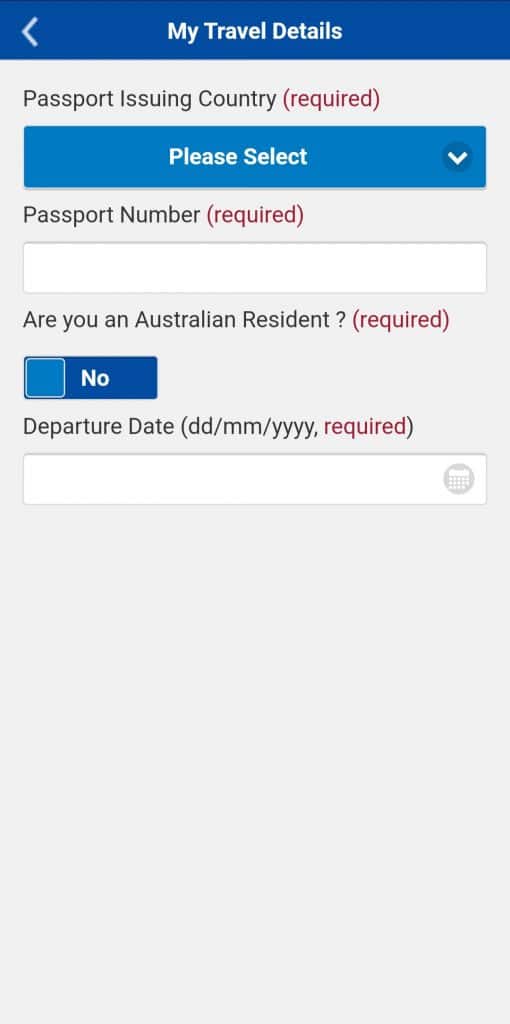

- 2. My Travel Details

- 3. My Invoices

- 4. My Payment Details

- 5. My Claim Code

Step 2 of 5 -

Important note to all claimants.

This web page will assist you to enter information required to lodge a Tourist Refund Scheme (TRS) claim.

When you have finished entering your information it will be stored in a QR code. This QR code is your TRS Claim Code, and it must be presented at the TRS location at the airport on the day you depart from Australia.

Creating a TRS Claim 'QR' Code may allow your claim to be processed faster at TRS as your claim information is pre-filled.

Your Privacy

The Department of Home Affairs collects and deals with personal information in accordance with its Privacy Policy.

Your use of this TRS Application is regulated by its Terms and Conditions, including the application's Privacy Statement.

By checking this box, I understand and accept the TRS Application's Terms and Conditions, including the Privacy Statement.

Tax Invoice Requirements

A valid tax invoice includes:

- the retailer's name, address and Australian Business Number (ABN)

- a description of the goods that allows us to match the goods to the invoice

- the purchase price of the goods, including the GST or WET paid (or total price including GST)

- the date of purchase

- the invoice must be in English.

Tax invoices for $1,000 or more must also show your name (and only your name) as it appears in your passport.

Tax Invoice s :

Invoice Date: Invoices must be dated within 60 days of your Departure Date Invoices cannot be dated in the future Invoice/Receipt Number:

Total for : $

Estimated Refund for ABN: $

The invoices for ABN are not eligible for a refund because they total less than $300.

Total Of All Invoices: $ Estimated Total GST/WET Refund Being Claimed: $

Each abn on the claim must have invoices totalling a minimum of $300. the highlighted abns do not qualify., up to 10 invoices may be added..

* How do you want your refund to be paid, if approved?

Credit Card

The following credit cards are accepted:

Please note Union Pay debit cards are not accepted.

This application does not collect credit card details. Present your credit card when submitting your claim on departure.

Australian Bank Account

Cheque (not recommended)

Cheques may take 2 months to arrive, from date of departure.

Travel Details:

Passport Issuing Country:

Passport Number:

Australian Resident:

Departure Date:

Invoice Date: Invoice/Receipt Number:

Total All Invoices: $

Estimated gst/wet refund in australian dollars being claimed against all invoices (if approved): $, payment details:.

Payment Method:

Present your credit card when submitting your claim on departure.

Account Name:

BSB Number:

Account Number:

Cheque Currency:

Declaration:

I claim the Goods and Services Tax (and Wine Equalisation Tax if applicable) under the Tourist Refund Scheme (TRS) for the goods described in this TRS claim application.

I confirm that:

- These goods were acquired by me within 60 days of my departure date, and paid in full for the amounts indicated in this TRS claim on the associated invoices;

- The goods in this TRS claim will be in my possession and exported by me on the specified date of departure from Australia.

I understand that if I return to Australia with the goods, I may be required to pay applicable duties including GST and WET.

You have finished supplying the information needed to process your TRS claim and it is now saved in the following claim code. Please print or save this claim code.

You may save the claim code by right-clicking it and selecting your browsers Save Image/Picture... option.

To submit your TRS claim, you must present this claim code and any additional claim codes you have created at the TRS location at your port of departure from Australia.

Ensure you have the following items ready to be inspected:

- The goods you are claiming a refund against;

- Your Tax Invoice(s);

- Your passport; and

- Your boarding pass.

If you cannot present your claim code, your claim will be processed manually.

If when requested by an ABF officer you cannot present some or any of the goods listed above, some or all of your claim may be rejected.

Please note: this claim contains invoices that do not meet eligibility requirements.

To submit your Tourist Refund Scheme (TRS) claim, you must present this claim code at the TRS facility at your port of departure.

If, when requested, you cannot present some or any of the items listed above prior to departing the country, some or all of your claim may be rejected.

Tax Invoice Summary

Tax Invoice s . Total:

Estimated Refund (subject to approval)

Terms and Conditions

Privacy statement.

The Department of Home Affairs (Home Affairs) is collecting and using your personal information for the purpose of assessing and refunding the Goods and Services (GST) and Wine Equalisation Tax (WET) in accordance with section 168 of the A New Tax System (Goods and Services Tax) Act 1999 (Cth). Home Affairs may disclose this information to the Australian Taxation Office and any retailers from whom you have attached invoices for the purposes of assessing and determining your eligibility for a GST/WET refund. If a tax refund is due to be paid to you, your personal information will be disclosed to a contracted commercial agency to facilitate the processing of that refund.

Failure to complete this application or provide this information may result in Home Affairs being unable to process your tax refund using this application.

Personal information will be collected, used, stored and disclosed by Home Affairs in accordance with the Australian Privacy Principles in Schedule 1 of the Privacy Act 1988 (Cth).

Further information regarding how Home Affairs handles personal information can be found in Home Affairs' privacy policy .

Warning: The TRS claim code generated by this app is not encrypted and can be read by any device capable of reading a QR code. You bear sole responsibility for the security of the code and its data.

Conditions on the use of this application, the eligibility rules for making a TRS claim, and the process for making a claim are detailed on the TRS information page .

Legal Statement

Making a false or misleading statement to an officer, including by presenting false documents, may result in the application of penalties.

Any goods subject to this TRS claim must be declared if they are brought back into Australia. You may be required to repay the GST/WET refunded under the TRS plus any additional customs duties and taxes payable on the ENTIRE VALUE of ALL the general goods you are importing.

Failure to declare imported goods may also result in the application of penalties (see the TRS Information page).

Invoice Details

What can i claim.

You can claim on most goods provided you can present a valid tax invoice.

You cannot claim against:

- GST-free goods

- Services, such as car hire and accommodation

- Beer, spirits, tobacco and tobacco products

- Goods consumed in Australia

- Dangerous goods (goods you can't take out with you on the aircraft)

- Goods which are not accompanying you on departure including goods you have freighted or posted out of Australia.

For more information refer to the TRS Information page .

Invoice Items:

* Please describe OTHER goods below. Your claim will be rejected if these goods do not meet the TRS requirements.

Amount Paid for Claimable Goods, including GST/WET

The Tourist Refund Scheme (TRS) allows you to claim a refund of the goods and services tax (GST) and wine equalisation tax (WET) that you pay on certain goods purchased in Australia.

Flight Info

Flight schedules.

Today’s Flights Tomorrow’s Flights International Arrival – 4 Week Forecast International Departure – 4 Week Forecast ...

Pick Up Zone

The Public Pick Up zones located outside the terminals are regulated and are strictly for pick-ups and drop-offs only. No waiting or parking is permitted and...

Destination Guide

Airport ambassadors.

The Airport Ambassadors at Cairns Airport are a dedicated group who volunteer some of their spare time each week to assist passengers and other airport users....

Page 1 of 58

COVID-19 Travel Advice

Latest News

Parking & Transport

Shop & Dine

- Free eBook guide

- Before coming to Australia

- Budget for your Working Holiday

- The Working Holiday Visa

- Which city to arrive

- Packing Guide

- Backpacker Travel Insurance

- Cheap flights to Australia

- What to do on arrival

- Open an bank account

- How to transfer money

- CurrencyFair 5 free transfers

- WISE money transfers

- How to migrate to Australia

- Tourist Visa

- Working Holiday Visa

- Student Visa

- TSS Visa Sponsorship

- Partner Visa

- Travel insurance options

- Australian healthcare system

- Working Holiday Insurance

- Backpacker travel insurance

- Short term travel insurance

- International student insurance

- Travel insurance companies

- Go Walkabout promo code

- Living in Australia

- Accommodation guide

- Phone Plans in Australia

- Driving in Australia

- Cost of living in Australia

- Climate and Seasons

- Claim GST on expenses

- How to claim your tax return

- Claim your Superannuation

- New South Wales

- South Australia

- Western Australia

- Northern Territory

- POPULAR SPOTS

- NEW ZEALAND

- ASIA PACIFIC

- Travel Budget

- Climate and seasons

- Customs in Australia

- Itineraries ideas

- Road Trip Complete Guide

- Budget Road Trip

- Where to camp in Australia

- Choose and buy a vehicle

- Tips for everyday life

- News in Australia

- Festivals & events in Australia

- Just for fun

- Best stopovers from Europe

- When to buy your plane ticket

- Rent a cheap campervan in Australia

- Motorhome rental in Australia

- Car rentals in Australia

- How to rent a vehicle in Australia

- Rent a cheap campervan in NZ

- Motorhome hire in New Zealand

- Best Diving spots in Australia

- Great Barrier Tours – Best tours

- Best spots to surf in Australia

- Working in Australia

- Setting yourself up for work

- Writing a resume in Australia

- Wages in Australia

- Typical Backpacker jobs and salaries

- Certificates & training

- Getting your Tax File Number

- How to get an ABN

- How to claim your superannuation

- Housekeeping work

- Hospitality jobs

- How to find a job in hospitality

- Working in a bar

- RSA Certificate

- Coffee Barista course

- Gambling establishments (RSG / RCG)

- Work in construction

- Work as a Traffic Controller

- White Card certificate

- Become an Au Pair in Australia

- Get your Blue Card

- Fruit picking jobs

- Fruit picking map – contacts

- Fruit picking season – calendar

- How to apply for a second year

- How to calculate your 88 days

- Eligible areas for a second year

- Eligibles jobs for a second year

- Volunteering in Australia

- Work as a freelance

- Best Outback jobs

- Work in a road house

- Working in a cattle station

- Become a Hairdresser in Australia

- Find a professional job

- More job experiences

- Study in Australia

- International Student insurance

- Budget to study

- Diploma equivalency

- How to finance your studies

- Universities in Australia

- ANU: Australia’s number one uni

- Medicine studies in Australia

- Top 10 online courses

- Getting ready for your IELTS Test

- Find a student job

- Orientation Week

- Free study advice

- Internship in Australia

- $25 OFF RSA Courses

- $16 OFF White Card Courses

- $25 OFF RSG / RCG Courses

- 5% OFF Travellers Autobarn

- Cheap Campervan rental

- 10% OFF Go Walkabout

- 5 Free transfer with CurrencyFair

- Great Barrier Tours - Best tours

- News in Australia Be up to date. Here you will find all the news from Australia that are relevant for backpackers! All news at a glance!

- Festivals & events in Australia

- Wildlife Discover Australia’s wildlife! Find everything you ever wanted to know about Australia’s animals. Kangaroos, wombats, koalas, wallabies, crocodiles, Tasmanian devil, kookaburras, sharks, wales and many more… Understand Australia s animal kingdom and discover some adorable Aussie animals.

- Just for fun Funny articles about random things happening in Australia: Unusual events, illustrations, competitions and much more. Just for fun is entertaining and funny!

- Certificates & training

- Fruit picking map - contacts

- Fruit picking season - calendar

- More info Australia is a popular destination for both Working Holiday Visas and tourists, however, it is also worth considering Australia as a destination for studying. Better yet, foreign students are in great demand, with many nationalities. Many choose to study in Australia to improve their English skills, travel around Australia and to gain an international degree. Many choose to study in Australia.

- ANU: Australia's number one uni

- Everyday life

- Travel Tips

Get your GST back when leaving Australia

If you have made purchases during your stay in Australia, you can claim a refund on the GST paid during your stay, thanks to the Tourist Refund Scheme (TRS). Indeed, the Tourist Refund Scheme allows for a full rebate of the 10% GST (goods and services tax) . You will have to leave Australia with these goods and have them in your carry-on luggage when checking in for your flight, unless they are oversized goods or liquids, aerosols and gels restricted to hold luggage for security reasons. You can request your refund at Sydney, Melbourne, Perth, Brisbane, Cairns, Adelaide, Darwin, Gold Coast, Canberra and Hobart international airports. This guide provides step-by-step instructions on how to get your GST back when leaving Australia, ensuring you leave with not just memories but possibly some extra cash in hand.

Table of Contents

What is the Goods and Services Tax (GST) ?

In the UK, VAT ( Value Added Tax) applies to all products and services purchased. The rate of VAT is variable, but 20% is the most common rate for purchases in the country.

The Australian GST is its equivalent. The rate is 10% of the price of the product or service. It applies to all goods and services purchased in Australia. For example, if you buy a $1,000 camera, you will pay $100 in tax.

If you are a tourist and therefore do not live in Australia permanently, you can request a refund of this tax when you leave the country. The TRS allows travelers to claim a refund of the GST (10%) paid on goods bought in Australia within 60 days before departure. This scheme is applicable only to goods that are taken out of Australia in the traveler’s personal luggage or carry-on.

Read also : GST in Australia – How it works

Conditions to get your GST back

To be able to claim your GST back, a few conditions apply:

You will need to have bought the goods in person in a period of 60 days before your departure date .

The total cost of the goods has to be at least $300 . Your purchases must be from a single business. They can be more than one item, but only if they have been bought in the same shop. If you bought items from one business, even on separate invoices, that together total $300, these items could be eligible for a tax refund.

You must have an original paper tax invoice for the goods. If you have an electronic invoice, remember to print it out before you go to the TRS counter. The invoice must include the shop’s Australian Business Number (ABN), the date of purchase, the description of the goods and the amount of GST paid. If you do not have an eligible tax invoice, you cannot make a claim. Present the original tax invoice, goods, passport, and boarding pass to the TRS facility.

You need to have the goods with you in your carry-on luggage when flying out of Australia. For oversized and restricted goods, they must be seen by ABF Client services before checking in and you will have to take the stamped invoices to the TRS Facility on your day of departure.

You cannot claim a refund on these goods :

- Tobacco products

- Alcohol except wine with alcohol content less than 22%

- Goods purchased over the internet and imported into Australia

- Services (hotel rooms, car rentals, tours, etc)

- GST-free goods where no GST was paid

- Goods prohibited on aircraft for safety reasons (gas cylinders, fireworks, aerosol etc)

- Products which have already been partially consumed, such as food and drinks or an open bottle of perfume. (However, you can claim GST on devices such as a laptop, camera or iPhone which have been used during your stay.)

💡 Good to know

You can remove your goods from the packaging and use them. You do not need to bring the packaging to make your TRS claim.

Claiming Your GST Refund

1. Keep Your Receipts : Save all tax invoices for purchases over AUD 300 from a single retailer, as you’ll need these for your claim.

2. Pack Smart : Ensure that the goods you’re claiming a refund on are easily accessible in your carry-on luggage, as you may need to show them at the TRS counter.

3. Early Arrival : Arrive at the airport with enough time to process your TRS claim before your flight. The TRS counters can be found in the international terminals of Australian airports.

4. Use the TRS App : The Australian Border Force (ABF) offers a TRS app that allows you to enter your claim details before reaching the airport. This can save time and streamline the process at the TRS counter.

The refund can be paid into an Australian bank account , to a credit card , or by cheque . The refund will be made within 60 days of the claim being lodged. You will need to present: – The goods – Your passport – The invoices – Your boarding pass

Although the TRS counters at airports don’t have fixed opening hours, they are open when an international flight is scheduled to depart.

Processing Your Refund

Once at the TRS counter, present your completed TRS claim (either via the app or on a provided form), along with the necessary documents and purchased goods. The refund can be paid into an Australian bank account, credited to an Australian credit card, or received by cheque. Some locations may offer immediate refunds to credit cards.

Use the TRS apps to prepare your application

To facilitate and accelerate the process of getting your GST refund, you can use The Tourist Refund Scheme (TRS) app . It allows you to get a head start by registering your personal details and uploading your receipts in advance. Then all you have to do is go to the TRS desk, which is located in the Duty Free area of the airport (where you find the shops). The Tourist Refund Scheme has a website and a free app available for iOS and Android. The only downside of the app is that it does not work in all airports! You can only use the app if you are travelling from the following airports: Sydney (NSW), Gold Coast or Sunshine Coast, Brisbane, Townsville, Cairns (QLD), Darwin (NT), Melbourne (VIC), Adelaide (SA) or Perth (WA).

How does the app work?

After downloading the app, type in the following:

- Details of your trip

- Details of the goods and invoices

- Preferred way to receive your refund

After saving the information, you will receive a Quick Response (QR) code that you can find in the “ Present My Claim ” section of the app. Once at the airport, you will need to present at the TRS counter. You will still need to attend a TRS facility with your tax invoice. This does not submit your claim .

Online statements are available at the following international airports: Adelaide, Brisbane, Cairns, Canberra, Darwin, Gold Coast, Melbourne, Perth, and Sydney.

Coming back to Australia with de-taxed goods

If you are bringing goods back into Australia for which you have claimed a TRS refund, know that you can bring up to AUD900 worth of goods without having to pay customs duties or GST. If you are a minor (under the age of 18), the amount you can bring in is $450. This is called your passenger concession .

Families travelling together can pool this allowance. For example, a couple can bring in a total of AUD900 x 2 = AUD1800 worth of goods into Australia without paying duty.

If the total value of the goods you are bringing back into Australia after claiming a refund is greater than your passenger concession (AUD$900):

- you must declare the goods

- you will need to repay the GST refund back on the goods you claimed under the TRS.

- customs duties and GST will apply to all items purchased, not just goods over your passenger concession limit ($900).

Tips for a Smooth TRS Experience

- Bulky Goods : For items that are too large to carry as hand luggage, you can show your goods to a TRS officer at the check-in area or customs before checking in the items.

- Group Claims : Families or groups traveling together can combine receipts to meet the minimum spend requirement but must present the claim together at the TRS counter.

- Exclusions : Note that some goods, such as consumables fully or partly consumed in Australia, are not eligible for a GST refund.

Contact info

If you need to contact the Tourist Refund Office (TRO) for a specific question, you can call them:

From within Australia: 1300 555 043 From outside Australia: +61 2 6245 5499.

You can also contact the TRO via email [email protected] or their enquiry form .

Yes, it must be the same as the name on your passport. You can’t claim a refund if the invoice has a name other than your own as the buyer.

Yes, you should be able to, as long as you respect the conditions mentioned above. Note that if you are bringing goods back into Australia for which you have claimed a TRS refund, you can only bring up to AUD900 worth of goods without having to pay customs duties or GST.

No, you can make several purchases over several days. If you have bought items from the same retailer but at different stores, check that each invoice has the same Australian Business Number (ABN). The same business might have different ABNs for each store.

No, you must do it at the TRS desk at your airport of departure at least 30 minutes before your flight.

You cannot get a cash refund for your GST. You can only get refunds paid to you or another person by credit card (Amex, Diners, JCB, MasterCard, Union Pay, Visa), Australian bank account or mailed cheque (not recommended).

RELATED ARTICLES MORE FROM AUTHOR

Traveling with children in New Zealand

Phone plans in Australia: Prepaid, Packages, Contracts

Budget a Road Trip in Australia – The East Coast in a Month

hello. is there a maximum cap limit to claim tax refund for local residents leaving Australia?

Hi Becca, could you please clarify?

Hi, Can I claim GST for a handbag costing AUD$4200 and later bring it back after my trip, do I have to pay back the GST amount? Thank you

Hi Carly, Please check the part “Coming back to Australia with de-taxed goods” and you will have your answer 😉 Cheers

LEAVE A REPLY Cancel reply

Save my name, email, and website in this browser for the next time I comment.

LATEST ARTICLES

Motorhome rental prices in Australia

The Coral Coast – Western Australia

- Terms of Use

- GDPR – Privacy Policy

- Partner visa (Temporary) (subclass 820)

- Partner visa (Permanent) (subclass 801)

- Prospective Marriage visa

- Aged Parent visa

- Parent visa

- Partner (Provisional) visa

- Partner (Migrant) visa

- Remaining Relative visa

- Adoption visa

- Dependent Child visa

- Aged Dependent Relative visa

- Contributory Aged Parent (Temporary) visa

- Contributory Aged Parent visa

- Contributory Parent (Temporary) visa

- New Zealand Citizen Family Relationship visa

- Orphan Relative visa

- Sponsored Parent (Temporary) visa

- Contributory Parent visa

- First Work and Holiday visa

- Second Work and Holiday visa

- Third Work and Holiday visa

- First Working Holiday Visa

- Second Working Holiday visa

- Third Working Holiday visa

- Direct Entry stream

- Labour agreement stream

- Temporary Residence Transition stream

- Skilled Nominated visa

- Points tested stream

- New Zealand stream

- Hong Kong stream

- Essential Skills Pathway

- Core Skills Pathway

- Specialist Skills Pathway

- Short-term stream

- Medium-term stream

- Labour Agreement stream

- Subsequent Entrant

- Regional provisional stream

- Direct entry stream

- Employer Sponsored stream

- Subsequent entrant

- Skilled-Recognised Graduate visa

- Skilled regional visa

- Global Talent visa

- Invited pathway

- Extended stay pathway

- Subsequent entry pathway

- Graduate Work stream

- Post-Study Work stream

- Second Post-Study Work stream

- Replacement Stream

- Temporary Work (Short Stay Specialist) visa

- Main applicant

- Training visa

- Government Agreement stream

- Foreign Government Agency stream

- Domestic Worker (Diplomatic or Consular) stream

- Privileges and Immunities stream

- Pacific Australia Labour Mobility stream

- Australian Government Endorsed Events

- Special Program

- Religious Work

- Research activities

- Invited for other social and cultural activity (Invited Participant)

- Sporting Activities

- Entertainment Activities

- Superyacht Crew

- Exchange Arrangements

- Domestic work for executives

- Tourist stream (apply in Australia)

- Tourist stream (apply outside Australia)

- Sponsored Family stream

- Business visitor stream

- Approved Destination Status stream

- Frequent traveller stream

- Transit visa

- Electronic Travel Authority

- Business owner visa

- Investor visa

- State or Territory Sponsored Business Owner visa

- State or Territory Sponsored Investor visa

- Business Innovation stream

- Investor stream

- Significant Investor stream

- Premium investor stream

- Entrepreneur stream

- Business Innovation Extension stream

- Significant Investor Extension stream

- Premium Investor stream

- Student visa

- Student Guardian visa

- Living in Australia

- Jobs in Australia

- Our services

Tourist Refund Scheme (TRS) in Australia: A Comprehensive Guide for International Travelers

Updated: July 1, 2024

G'day, fellow travelers! If you're planning a trip Down Under, you're in for a treat. Not only will you experience the breathtaking landscapes, unique wildlife, and warm Aussie hospitality, but you might also save some dollarydoos on your shopping spree. How, you ask? Well, let me introduce you to the Tourist Refund Scheme (TRS), a nifty little program that can put some cash back in your pocket when you leave Australia.

What is the Tourist Refund Scheme?

The Tourist Refund Scheme is a program that allows international travellers (including Australians heading overseas) to claim a refund on the Goods and Services Tax (GST) and Wine Equalisation Tax (WET) for certain goods purchased in Australia. It's like a parting gift from the Land Down Under, thanking you for visiting and hoping you'll come back soon!

The Basics: What You Need to Know

- Spend at least AUD 300 (including GST) in total from a single supplier with the same Australian Business Number (ABN).

- Buy your goods within 60 days of departure.

- Take the goods out of Australia as carry-on luggage.

- Claim in person at the TRS Facility on the day of your departure.

Sounds simple enough, right? Well, there's a bit more to it, so let's dive deeper into the nitty-gritty details.

Before You Buy: The Savvy Shopper's Checklist

Before you whip out your credit card and go on a shopping spree, keep these points in mind:

- Check the retailer's ABN : Make sure all your purchases from the same retailer have the same Australian Business Number. Some businesses might have different ABNs for each store, so double-check!

- Keep your receipts : You'll need a valid paper tax invoice in English for each purchase. If your invoice is $1,000 or more, it must have your name (and only your name) as it appears in your passport.

- Mind the time limit : You can buy goods up to 60 days before your departure. To calculate this, just count back 60 days from your scheduled departure date.

- Calculate your potential refund : The GST refund amount is roughly 1/11th of the total price. So, for every $100 you spend, you could get about $9 back. Not too shabby!

- Check what you can and can't take : Before you buy, check with your carrier about what you can and can't take on board. Some items might be restricted or prohibited.

The Shopping List: What You Can and Can't Claim

Now, let's talk about what you can and can't claim under the TRS. This is important because you don't want to get to the TRS Facility on departure day only to find out your purchases aren't eligible.

What You Can Claim

- Most goods that you can take as carry-on luggage

- Wine with alcohol content less than 22%

What You Can't Claim

- Cash refunds (sorry, no crisp Aussie bills for you!)

- Alcohol (except wine under 22%)

- Tobacco and tobacco products

- Dangerous goods prohibited on aircraft or ships

- Goods consumed in Australia (like that delicious flat white you had this morning)

- Cosmetic enhancements that are permanently attached (so no claiming those hair implants or dental work)

- Gift cards and vouchers (but goods purchased with them are eligible)

- Unaccompanied goods (unless you're exporting to an External Australian Territory and you live there)

- Goods purchased overseas and imported into Australia

- GST-free goods (like baby food, medications, and medical aids)

- Services (accommodation, taxis, tours, etc.)

The Claim Process: Your Departure Day Game Plan

Alright, the big day has arrived! You're leaving Australia (sad face), but you're also about to claim your TRS refund (happy face). Here's what you need to do:

- Arrive early : Get to the airport with plenty of time to spare. You need to claim at least 30 minutes before your scheduled departure at an airport, or 1-4 hours before departure at a seaport.

- Locate the TRS Facility : Each international departure point has a TRS Facility. If you can't find it, ask an Australian Border Force (ABF) officer for help.

- Prepare your documents : Have your passport, boarding pass, and original tax invoices ready.

- Be ready to show your goods : You might be asked to present your purchases, so keep them accessible in your carry-on luggage.

- Choose your refund method : You can get your refund via credit card, Australian bank account, or mailed cheque (though this last option isn't recommended).

- Be patient : Depending on the time of year and how busy the airport is, you might need to queue for a while. Think of it as your last chance to practise the laid-back Aussie attitude!

- Melbourne MEL

- Brisbane BNE

- Adelaide ADL

- Gold Coast OOL

- Canberra CBR

Top Tips for a Smooth TRS Experience

- Use My TRS Claim : This online service lets you enter your invoice information with My TRS Claim before you get to the airport. It doesn't submit your claim, but it can save you time at the TRS Facility.

- Print electronic invoices : If you have any electronic invoices, print them out before going to the airport.

- Keep copies of your invoices : You might need to leave the originals with the TRS staff, so having copies is a good idea.

- Check the description : Make sure the description on the invoice matches the goods you're taking with you.

- Claim at your last port : If you're taking multiple flights, only claim at your last port of departure from Australia.

- Be prepared for oversised items : If you have any oversised or restricted goods, have them sighted by ABF Client Services before checking in, and take the stamped invoices to the TRS Facility.

TRS Online , iOS , or Android apps do not lodge a claim, but they can significantly reduce the time you spend at the TRS Facility, as the officer won't have to type in your details. TRS apps allow you to store information in a Quick Response (QR) code, which can be scanned at some TRS Facilities. Please note that scanners are not available at all times. Read more about TRS apps here.

When Things Don't Go to Plan: The Fine Print

- Missing the claim window : If you arrive less than 30 minutes before your scheduled departure time, you won't be able to claim. The same goes if you try to claim at a domestic airport, online, or after you've left Australia.

- Bringing goods back to Australia : If you bring back goods for which you've claimed a TRS refund, you must declare them on your Incoming Passenger Card. You might need to pay GST or duty if the value exceeds the passenger concession allowance.

- Penalties for not declaring : Failing to declare items you've brought back could result in penalties. It's always better to be honest!

- Circumstances beyond your control : Sometimes, things happen that prevent you from making your claim. Unfortunately, there's not much that can be done in these situations, so try to allow as much time as possible for the claim process.

The TRS: More Than Just a Refund

While the prospect of getting some cash back is certainly appealing, the TRS is about more than just the money. It's a way for Australia to thank you for visiting and for supporting local businesses during your stay. It's an encouragement to explore the unique products and experiences that Australia has to offer, from opal jewellery in Coober Pedy to premium wines in the Barossa Valley.

Moreover, the TRS is a reflection of Australia's commitment to fairness. The scheme ensures that international visitors aren't unfairly taxed on goods they're taking out of the country. It's a small but significant gesture that says, "We're glad you came, we hope you enjoyed your stay, and we'd love to see you again!"

Wrapping Up: Your Aussie Adventure Continues

As you prepare to leave Australia, the Tourist Refund Scheme offers you one last uniquely Australian experience. It's a chance to interact with the friendly ABF officers, perhaps share a laugh about the mountain of UGG boots and Tim Tams you're taking home, and walk away with a few extra dollars in your pocket.

Remember, the key to a successful TRS claim is preparation. Keep your receipts, know what you can claim, arrive at the airport with plenty of time, and approach the process with that easy-going Aussie attitude.

And as you board your flight home, souvenirs packed and TRS refund processed, take a moment to reflect on your Australian adventure. The stunning landscapes you've seen, the unique wildlife you've encountered, the friendly people you've met, and yes, even the money you've saved through the TRS – all of these are part of the unforgettable tapestry of experiences that make up an Aussie holiday.

So, as we say down under, "Hooroo and safe travels!" We hope your TRS experience is as smooth as a kangaroo's hop, and that it leaves you with a few extra dollars to start planning your next trip to Australia. After all, there's always more to explore in this vast and beautiful country. Who knows? Maybe next time, you'll be claiming a refund on a genuine Akubra hat or a didgeridoo!

Safe travels, mate, and don't forget to declare those Tim Tams when you get home! Read about Making TRS claim

Considering a move to Australia or need assistance with your visa application? Book a consultation with our experienced Registered Migration Agents. Let us help you navigate the complexities of the Migration Program and take your first step towards a promising future in Australia.

Book a Visa Consultation

This post is for general informational purposes only and is not a substitute for professional immigration advice. Given the uniqueness of every case, engaging with a registered migration agent is highly recommended for bespoke guidance and to navigate the specific details of your situation effectively. Book a visa consultation with a Registered Migration Agent

Subscribe to our newsletter

Sign up to our weekly newsletter to get the latest news about all things visas & immigration.

- Immigration & Visa Info

- Working in Australia

- Studying in Australia

- Expat Experiences

- Tourist Destinations

- Healthcare in Australia

- Property & Housing in Australia

- Financial Planning in Australia

- Australian Laws and Regulations

You may also like

Understanding the Different Types of Australian Partner Visas

Updated: August 27, 2024

How to Apply for an Australian Partner Visa If You Are Not Married

A Complete Guide to Applying for an Australian Partner Visa While Offshore

Is a Migration Agent Worth It? Understanding the Value of Professional Assistance

Updated: August 16, 2024

What Does a Migration Agent Do? A Comprehensive Guide to Their Role in Australian Migration

Victoria’s Skilled Nominated Visa (Subclass 190) Nominations Now Open for 2024-25

Updated: August 14, 2024

Aus Migration: Your Comprehensive Guide to Australian Migration

Updated: July 16, 2024

Navigating the Australian Temporary Skill Shortage (TSS) Visa Subclass 482

Updated: July 12, 2024

What our customers say about us

Let’s hear their great stories

Patricia Benavides

Waruna Balagalle

Shaikh Aziz Alqassimi

Snehal Patel

Nancy Vijo K

Upul Dassanayake

Wilfried Van Den Abbeele

Luis Eduardo Cabrera

Terence Hart

LURDES RODRIGUES MARTINS

CAROLINE HELEN LAUGHLIN

JANE SKIPPER

Jodi Loren Kerbel

EDWARD SHEMIN CHUN

HERBERT MICHAEL TATE

ELEN ASCHIRIA

Stay in touch!

Join our newsletter to receive the best traveling tips

- Work and Holiday visa (subclass 462)

- Working Holiday visa (subclass 417)

- Skilled visas

- Skilled-Recognised Graduate Visa (subclass 476)

- Temporary Graduate visa (subclass 485)

- Skilled regional visa (subclass 887)

- Skilled Independent visa (subclass 189)

- Skilled Nominated visa (subclass 190)

- Skilled Work Regional (Provisional) visa (subclass 491)

- Permanent Residence (Skilled Regional) visa (subclass 191)

- Skilled Regional (Provisional) visa(subclass 489)

- Global Talent visa (subclass 858)

- Employer sponsored

- Skills in Demand Visa

- 482 Visa (TSS VISA)

- Employer Nomination Scheme visa (subclass 186)

- Temporary Work (Short Stay Specialist) visa (subclass 400) – Highly Specialised Work stream

- Skilled Employer Sponsored Regional (Provisional) visa (subclass 494)

- Regional Sponsored Migration Scheme visa (subclass 187)

- Training visa (subclass 407)

- Temporary Work (International Relations) visa (subclass 403)

- Temporary Activity visa (subclass 408)

- Student visa (subclass 500)

- Student Guardian visa (subclass 590)

- Partner visas

- Partner visa (apply in Australia)(subclasses 820 and 801)

- Partner visa (apply overseas)(subclasses 309 and 100)

- Prospective Marriage visa (subclass 300)

- Parent visas

- Contributory Parent visa (subclass 143)

- Aged Parent visa (subclass 804)

- Parent visa (subclass 103)

- Contributory Parent (Temporary) visa (subclass 173)

- Sponsored Parent (Temporary) visa (subclass 870)

- Contributory Aged Parent visa (subclass 864)

- Child visas

- Adoption visa (subclass 102)

- Child visa (subclass 101)

- Child visa (subclass 802)

- Dependent Child visa (subclass 445)

- Relative visas

- Aged Dependent Relative visa (subclass 114)

- Aged Dependent Relative visa (subclass 838)

- New Zealand Citizen Family Relationship visa (subclass 461)

- Orphan Relative visa (subclass 117)

- Orphan Relative visa (subclass 837)

- Remaining Relative visa (subclass 835)

- Remaining Relative visa (subclass 115)

- Carer visa (subclass 836)

- Carer visa (subclass 116)

- eVisitor (subclass 651)

- Visitor visa (subclass 600)

- Electronic Travel Authority (subclass 601)

- Transit visa (subclass 771)

- Business Innovation and Investment (Permanent) visa (subclass 888)

- Business Innovation and Investment (Provisional) visa (subclass 188)

- Business owner visa (subclass 890)

- Investor visa (subclass 891)

- State or Territory Sponsored Business Owner visa (subclass 892)

- State or Territory Sponsored Investor visa (subclass 893)

- Bridging visa C (subclass 030)

- Bridging visa B (subclass 020)

- Bridging visa A (subclass 010)

- Bridging visa E (BVE) (subclasses 050 and 051)

- Crew Travel Authority visa (subclass 942)

- Former Resident visa (subclass 151)

- Maritime Crew visa (subclass 988)

- Medical Treatment visa (subclass 602)

- Resident Return visas (subclasses 155 and 157)

- Special Purpose visa

- Confirmatory (Residence) visa (subclass 808)

- Special Category visa (subclass 444)

- Pacific Engagement Visa (Subclass 192)

- Australian Citizenship Application

Welcome! Sign in to access your account and stay connected with all the latest updates and features.

New customer? Start here

Address: Migration Agents | Migration Expert | Suite 131/101 Moray Street, South Melbourne, Victoria 3205, Australia.

Tel: 1300 853 877

Australian owned and operated.

migrationexpert.com.au

- About Migration Expert

- Migration & Visa Services

- Customer Reviews

- Migration & Visa Blogs

- Affiliate Programme

- Registered Migration Agents

- Business Sponsorship & Corporate Services

- Skills Assessment Guidance

- Migration Agents Melbourne

- Immigration and Visa News

Moving to Australia

- Australian Embassies

Sales & Support

- Contact Migration Expert

- 24/5 Customer support

- Schedule an Appointment

- Privacy Policy

- Terms & Conditions

- Code of Conduct

- Healthcare and Medical Jobs in Australia

- Law Jobs in Australia

- Mining Jobs in Australia

- Education and Training Jobs in Australia

- Construction Jobs in Australia

Melbourne Office

Disclaimer: The information on this website is for general informational purposes only and does not constitute legal or immigration advice. It is not a substitute for professional or personalised advice and should not be relied upon as such. Due to frequent changes in Australian immigration laws, consult our registered migration agents before making any decisions. For the latest information, refer to the Department of Home Affairs website. For professional advice and assistance, consult an Australian MARA registered migration agent or lawyer before making any application.

Migration Expert acknowledges the Traditional Custodians of Country throughout Australia and their continuing connection to land, sea and community. We pay our respects to all Aboriginal and Torres Strait Islander peoples, their cultures and elders past, present and emerging.

Secure SSL Encryption: Your information is protected with SSL encryption You need cookies enabled to run our site.

Copyright © 2002–2024 Migration Expert Pty Ltd. ABN:13 101 197 157

Getting ready to apply for a visa?

- Read Today's Paper

The best tourist tax refunds when travelling

Hear tax and cringe? When it comes to travelling overseas, those three little letters can mean a nice bit of extra cash in your pocket.

Don't miss out on the headlines from Lifestyle. Followed categories will be added to My News.

Want 10 per cent back on purchases over $300 when you leave Australia? You need to know about this.

Known as the Tourist Refund Scheme (TRS) , international travellers (including Australians) are able to claim a GST (Goods and Services Tax) and WET (Wine Equalisation Tax) refund for some goods bought in Australia when they take them out of the country on a plane or ship.

Here’s what you need to do:

- Spend at least $300 including GST from a store with the same Australian Business Number (ABN)

- Buy the good within 60 days of departure

- Pack your goods with you on board as carry-on luggage as you’ll need to show them at the airport

- The day you fly out after passing through security, you need to go to the TRS facility and make the claim in person by showing your goods, boarding pass and original tax invoices or receipts. You can only make the claim more than 30 minutes before your scheduled departure at an airport or 1-4 hours before your scheduled departure at a seaport, so best get there early in case there is a queue

For purchases over $1,000, your name must appear on the invoice as it is on your passport. The invoice must include a description of the goods that allows the TRS to match the goods to the invoice, the retailer's name, address and ABN (ACNs and ARNs not accepted), the amount of GST or WET paid (or total price including GST) and the the date of purchase.

The TRS will send you the refund to your credit card (Amex, Diners, JCB, MasterCard, Union Pay, Visa) or Australian bank account. Cash refunds are unfortunately not an option.

To speed up the process, download the My TRS Claim app or visit the My TRS Claim online portal. It’s the official government portal that allows you to prefill details of your claim like the receipt, your passport number and how you’d like to be refunded.Once you’ve entered all your details, you’ll be issued a QR code which you can present along with the original paper receipt and the goods. The app and portal don’t issue the claim, but rather help speed the process up. Both accept up to 10 invoices per QR code.

Why you should shop with your passport in Europe

Aussies leaving the Europe Union to go home or travel outside the EU are eligible to be refunded VAT (Value Added Tax) – the European version of GST. When you’re shopping, ask the store if they provide VAT-free prices. You’ll still need to pay the full price in store, but you can make a claim when you leave.

The minimum spend depends on the country. For example France’s threshold is €100.01 whereas Italy is €154.95 but it’s as little as €25 in Germany. Each country has a different VAT refund rate but it generally ranges from 11 per cent to 15 per cent. Say you buy a €150 handbag in France from a store that offers VAT-free shopping. The bag will actually cost you €132 after 12 per cent VAT is deducted from your purchase. When purchasing the bag, the shop assistant will provide you with a refund form and ask to show your Australia passport to prove you are visiting the EU.

When you fly out of the EU, show the receipt, refund form, the goods and other required documents to the customs officer. They must stamp the form as proof of export – without this stamp, the refund can’t be processed. It takes up to two months to receive your refund. Here’s a comprehensive guide for the EU. The United States and United Kingdom unfortunately don’t refund sales tax to foreign visitors.

More Coverage

Originally published as The best tourist tax refunds when travelling

I found the Cook Islands’ best-kept secret

Rarotonga’s untouristed interior reveals a paradise that is lost on most travellers.

I flew 1600km for love and got ghosted at the airport

Model River Blake flew to meet a man she had been chatting to online for three years, only to be left stranded at the airport.

- ATO Community

- Legal Database

- What's New

Log in to ATO online services

Access our secure services. If you use myGovID, its name is changing to myID but you’ll use it the same way.

Tourist refund scheme

The tourist refund scheme applies to goods purchased at prices that include GST or WET.

Last updated 21 April 2022

Travellers departing Australia can get a GST or WET refund under the tourist refund scheme (TRS), administered by the Department of Home Affairs and its operational arm the Australian Border Force (ABF).

The scheme applies to goods purchased at prices that include GST or WET, from a retailer with an ABN and registered for GST.

It does not apply to services such as accommodation. GST-free goods cannot get a refund under the scheme, as no GST has been paid.

Crew members of an aircraft or ship are not eligible to claim refunds under the scheme.

A traveller may claim a refund under the TRS if the purchases meet the following requirements.

- The purchases are from a single business with the same Australian business number (ABN) and total AUD$300 (GST inclusive) or more. For example, if you bought items from one business, even on separate invoices, that together total AUD$300 the goods were purchased within 60 days of departure from Australia.

- The traveller has original tax invoice/s for the goods.

- The travelling passenger paid for the goods.

- Carry or wear the goods on board the aircraft or ship as cabin baggage unless they are oversized or subject to aviation security measures and the airline requires them to be checked in as hold luggage.

- Present their tax invoices (in English), goods, passport and boarding pass to the TRS facility when departing Australia.

- Make the claim at the TRS facility at an airport at least 30 minutes prior to the scheduled departure time or 60 minutes if travelling on a cruise.

Residents of Australia's external territories, such as Norfolk Island, Christmas Island and the Cocos (Keeling) Islands, can also get a GST refund if they export the goods to their home territory as accompanied or unaccompanied baggage or as cargo.

Travellers bringing goods back into Australia for which they have already claimed a TRS refund

You must declare any goods you bring back to Australia, for which a TRS claim was made by you or another person when the goods left Australia. You can do this by declaring the goods at question 3 on your incoming passenger card when you return to Australia.

Unless another concession applies, for example concessions on personal clothing (excluding furs), you may need to pay GST on goods you bring back into Australia. This happens when the value of those goods, combined with any other goods you import for which another concession doesn’t apply, exceeds the passenger concession allowance External Link .

Penalties may apply if you fail to declare these items.

What retailers are required to do

When a customer requests a full refund you should check their invoice to determine if they have already claimed under the Tourist refund scheme External Link . If a claim has been approved the invoice will contain a stamp from the ABF.

Customers applying for a refund when they have already obtained a TRS refund are not entitled to receive a refund for the GST/WET portion of the invoice.

To obtain a full refund, a customer must provide proof that the GST/WET has been repaid when they declared the goods on their return to Australia.

- Cruise Deals

- Subscribe & Save!

Never Miss a Cruise Deal

- Thank you for signing up!

- Click here to learn more about our specials

Help Center

Travel documentation and online check-in.

- Travel Documents

- Online Check-In

Getting There

- Cruise Terminal Information and Parking

- Airport and Pier Transportation

- Air Information

Before You Board

- Embarkation Day Check-In

Youth and Family

- Youth Programs (Under 2 and 2-11 years old)

- Teen Programs (12-17 years old)

- Age Policies

Things to Know

- Youth Program Overview

Onboard Experiences

- Shore - Excursions

- Outdoor Fun

- Entertainment and Activities

- For Your Convenience

- Onboard Guidelines and Policies

- Past Guest Recognition Programs

Onboard Celebrations

- The Fun Shops

- Special Occasions

- Wedding Cruises and Vow Renewals

Dining and Beverages

- Dining and Snacking Options

- Beverage Options

- Liquor and Beverage Policy

Onboard Communication

- WI FI Service and Carnivals HUB App

- Staying Connected

Money and Gratuities

- Gratuities (Tips)

- Sail & Sign Onboard Account

- Forms of Payment

- Financial Access

Shipboard Health and Safety

- General Health Information

- What to Pack

- Cruise Ticket Contract

- Guests with Disabilities

- Carnival EasyPay

Debarkation - After Your Cruise

- Preparing to Go Home

- Post Cruise Inquiries

What is the Tourist Refund Scheme?

Was this answer helpful, answers others found helpful.

- Duty-Free allowance

- Mobile Phones Onboard

- Is Water Included in the Bottomless Bubbles Program?

- Internet Cafe / Wireless Internet Services (Wi-Fi)

- Theme Nights Onboard

Special Offers

- Last Minute Cruises

Book a Cruise

- Find a Cruise

- Destinations

- Short Cruises

- Travel Agent Finder

- Melbourne Cup

- Cruise from Sydney

- Cruise from Brisbane

- Cruise from Australia

Already Booked

- Manage My Cruise

- Dining Reservations

- Shore Excursions

- In-Room Gifts & Shopping

- Internet & WiFi Plans

- Beverage Packages

- Carnival HUB App

Customer Service

- Carnival FAQs

- Need Help Planning?

- Post-Cruise Inquiries

- Travel Documentation

- Port Information

- Travel Insurance

- Legal Notices for EU & UK Guests

About Carnival

- Conga For Kids

- Press / Media

- Press/Media

- Legal Notices

- Privacy & Cookies

- © Carnival Corporation. All rights reserved.

- 0 items - $ 0.00

- Page Search

Tourist Refund Scheme (TRS)

Are you a traveller?

The Tourist Refund Scheme (TRS) lets you claim a refund of the Goods and Services Tax (GST) and Wine Equalisation Tax (WET) that you pay on certain goods you buy in Australia and then take out of Australia with you or in your checked luggage or carry-on bags.

Who can get a refund?

TRS is open to all overseas visitors and Australian residents, except for operating air and sea crew.

What purchases are eligible for a refund?

Purchases are eligible for refunds if:

- they are purchased in the 60 days before you leave Australia

- your purchases from any single business total $300 (GST inclusive) or more. For example, if you bought items from one business – even on separate invoices – that together total $300, these items may be eligible for a tax refund under TRS

- you, the passenger, paid for the goods

- you have an original tax invoice for the goods

- you wear or carry the goods (unless they are liquids, gels or aerosols or oversized or bulky goods which the airline require to be checked in) as hand luggage aboard the aircraft or ship as you leave Australia, or check the goods in with your luggage after they have been verified by an officer at a Client Services counter.

Purchases are not eligible for refunds if they are:

- beer, spirits or tobacco products

- goods that did not have GST/WET paid on them (e.g. medicines, some foods)

- services (e.g., accommodation, vehicle hire, food, tours warranties, etc.)

- gift cards or vouchers

- items that have already been used (in part or in full) in Australia (e.g. food, perfume etc.). It’s ok to use cameras, iPhones, clothing, etc.

- do not accompany you on your flight or ship out of Australia. Check your tax invoice; some tax invoices indicate if GST or WET has been applied to each item.

How do I make a claim?

You can make a claim for a tax refund by visiting the TRS facility in an international airport or the cruise liner terminal of some Australian seaports.

You can speed up the process by filling out the TRS form online at https://trs.border.gov.au/. When you have finished entering your information it will be stored in a QR code. This QR code is your TRS Claim Code, and it must be presented at the TRS facility at the airport on the day you depart from Australia.

Try our new apps!

To make processing your claim faster at your port of departure, you can pre-enter the details of your claim using the TRS web or mobile applications (apps). For more information on the apps visit the Tourist Refund Scheme applications webpage.

How much will I get?

You will be refunded:

- the total GST (price you paid divided by 11), and/or

- the total WET (14.5% of the price you paid for the wine)

on all of your eligible goods. Refunds to a credit card or to an Australian bank account will generally be paid within 60 days. Refunds by cheque can take up to two months.

What do I need to bring to the TRS facility? Bring your goods, original tax invoices, passport and boarding pass to the TRS facility.

If you have pre-entered your claim details using the TRS web or mobile app you must also present your TRS claim code to an officer at the TRS counter. For more information on the TRS claim code visit the Tourist Refund Scheme applications webpage.

A tax invoice has the word ‘tax invoice’ on it and shows the business name and Australian Business Number (ABN) of the retailer, the purchase price including the GST and/or WET paid, a description of the goods and the date you purchased the goods. For tax invoices over $1,000, the tax invoice must also show your name and address. If you are unable to present some or all of your goods and/or tax invoices on request, or cannot provide evidence that an officer has sighted your goods, some or all of your claim may be rejected.

Different rules apply for people wanting to claim the TRS on liquids, aerosols, gels and oversized items. You can read about these below.

How long before I depart Australia should I go to the TRS facility? At airports You can make a claim up to 30 minutes prior to your flight’s scheduled departure time. To make sure you have enough time to make your TRS claim, you should complete your departure immigration clearance at least 90 minutes before the scheduled departure time of your flight. After you have passed through departure immigration, go to the TRS facility, where you can lodge your claim. TRS counters are staffed while outward flights are being processed at Sydney, Melbourne, Brisbane, Perth, Darwin, Adelaide, Cairns and Coolangatta international airports. To find the location of the TRS facility, check the website of the airport where you will depart from Australia. At seaports At seaports, you can make a claim between one and four hours before your ship’s scheduled departure time. Claims can only be made at the last Australian port before departure for overseas, which may be a different port to where you boarded the ship. Make sure you have purchased the goods within 60 days of departing from the final port of departure for overseas. TRS facilities will be available at terminals in Sydney, Brisbane, Melbourne, Cairns, Darwin, Fremantle and Hobart. Other ports If you are leaving from another airport or seaport, contact the Department to find out how to make a claim.

What if my goods are liquids, aerosols or gels, or oversized? There are limits to the amount of liquids, aerosols or gels that you can take into the cabin on flights to and from Australia. To find out more about this, see Department of Infrastructure and Transport’s website.

If you want to make a TRS claim for liquids, aerosols or gels that you are not able to take on board because of these limits, take your goods to the Client Services counter before they are packed in your checked luggage and checked in with the airline.

This also applies to oversized items, like skis, snowboards and golf clubs and other goods that you will check in.

To find the location of the Client Services counter, check the website of the airport where you will depart from Australia.

I claimed a TRS refund for some goods that I now want to bring back into Australia.

What do I need to know? If you are aged 18 years or over, you can bring in up to A$900 worth of general goods into Australia duty-free, or A$450 if you are younger than 18. Families travelling together can pool this allowance (so a couple with a child can bring in a total of A$900 + $900 + A$450 = A$2250 worth of general goods into Australia without paying duty or tax). This is called your Passenger Concession.

General goods include gifts, souvenirs, cameras, electronic equipment, leather goods, perfume concentrates, jewellery, watches and sporting equipment.

If the total value of the goods you are bringing in is greater than your Passenger Concession, including goods for which you have previously claimed a tax refund under TRS:

- you must declare all of these goods

- for goods where you have previously claimed a tax refund under TRS, you will need to pay that refund back

- duty and tax will apply to all items of this type, not just goods over the limit of your passenger concession.

Penalties may apply if you don’t declare that you have goods in excess of your concession.

Further information can be obtained from Department of Immigration and Border

Protection on: Phone: Within Australia – 1300 363 263 Internet: https://www.border.gov.au Email: [email protected]

- My Favourites

- Travel Advice

Australian Tourist Refund Scheme: Pack this in your carry-on and make money at the airport

Everyone tells you to pack light, but if you haven’t been packing these items in your cabin luggage then you’re missing out on one of the biggest airport perks.

This article may contain links from our affiliate and advertising partners. When you click on them, or share this content, we may earn a commission. Learn more

Everything you need to know about the Qantas Points Club

The Calile is named No.1 Aussie hotel

Why I don’t hate TikTok’s airport tray trend

Tossing up whether to buy duty-free goods at the airport on your next holiday?

You might find you get a better bargain using the Government’s Tourist Refund Scheme.

If you’re travelling overseas, the Government allows you to shop at a regular retail store and then claim a GST refund at the airport or cruise liner terminal at your final port of departure from Australia.

The refund only applies to items you wear on the plane or are in your carry-on, and excludes liquor (except wine).

THE CHEAPEST ITEM TO BUY DUTY FREE

THE BIG MISTAKE YOU’RE MAKING WITH CARRY-ON

FLIGHT SECRETS ONLY FREQUENT FLYERS KNOW

Travellers can claim on items bought up to 60 days prior to departure with a value of $300 or more. The claim must include a tax invoice.

Just take your goods and services tax invoice to a TRS facility along with your passport and boarding pass up to 30 minutes before your flight departs. You can find the facilities beyond Customs and Immigration at the international terminals of Sydney, Brisbane, Melbourne, Perth, Cairns, Adelaide, Darwin and the Gold Coast.

The GST rebate is calculated by dividing the GST-inclusive price by 11. (You’ll get $60 back from a $660 purchase). For wine, you’ll get a 14.5 per cent refund. Only the person who actually bought the goods can make a claim.

The best bit – you can wear or use most of the goods beforehand, apart from drinking the wine of course.

For more information see border.gov.au

For more travel advice and inspiration sign up to Escape’s newsletter .

Rowena caught the travel bug at an early age making her first trip overseas at seven months old. She has eaten her way through Hong Kong, believes she was Parisian in another life and says nothing beats a ski holiday. She joined Escape as associate editor in 2015.

Escape’s points expert, Sabine Leroy, answers your questions about frequent-flyer programs.

The Calile continues to work its magic around the world winning the best hotel in Oceania for the second year running, at the prestigious The World's 50 Best Hotels awards.

Maybe, just maybe, it’s a sign of something much bigger and more important.

11 best things to pack for an Aussie road trip

The vastness of Australia seems custom built for exploring on four wheels. Pile the crew into your car and set that GPS. Just be sure you’ve everything you need to keep the kids happy.

Tourist Refund Scheme

- July 4, 2016

- Articles / Client Information Newsletter / News

Tourist refund scheme

The sun, the surf , the shopping! Australia has enough temptations on offer to keep the credit card running hot. But there’s no need to stress, because there is a little known scheme that might help take the bite out of the credit card bill.

The Tourist Refund Scheme (TRS) lets you claim a refund on the goods and services tax (GST) and wine equalisation tax (WET) on goods you have bought in Australia.

It is not “duty-free” shopping, which is where you need to actually leave the country before you use the goods you have bought. The TRS allows you to use the items you buy, such as clothing or cameras, before leaving Australia, but then get certain amounts back (but not for consumables like wine or chocolates). The scheme is open to all overseas visitors and Australian residents, with the exception of air and sea crew.

The tourist refund is subject to certain conditions. You need to:

– spend $300 (GST inclusive) or more at the one retailer

– buy goods no more than 60 days before departure

– be sure the retailer will provide you with a tax invoice for each relevant purchase (all stores registered for GST will be able to give you a tax invoice, and a refund cannot be given without it)

– wear or carry the goods on board the aircraft or ship (with regard to security-based limitations of course) and present them along with your original tax invoice, passport and international boarding pass to a Border Force officer at a TRS facility within the air or sea port.

You can buy several items from one retailer (that is, one Australian Business Number holder, which means there could be several outlets) over a number of occasions in the 60-day period, as long as the total purchase adds up to $300 GST inclusive or more. You may buy goods from several stores, and claim the GST for each of those, as long as each store’s tax invoice totals at least $300 (GST inclusive).

How much will I get back? The GST refund: Divide the total amount of the purchase by 11. The WET refund: 14.5% of the price paid for the wine. You can collect your refund through one of the following methods:

– cheque (posted within 15 business days)

– credit to an Australian bank account

– payment to a credit card (this and above, both issued within five business days subject to issuer).

What can I buy? Unlike “duty-free” shopping – where you are unable to use the goods within Australia – most goods under the TRS such as clothing, cameras and electrical equipment can be used in Australia prior to departure.

The refund only applies to goods you can take with you as hand luggage or wear on to the aircraft or ship when you leave Australia (subject to aviation security measures regarding liquids, aerosols and gels). It may therefore pay to check with your airline to find out what you can and cannot take on-board as hand luggage before going to the airport.

The following goods are excluded from the TRS:

- alcohol such as beer and spirits (wine and wine products are okay) and tobacco products (these goods can be purchased from duty-free shops)

- GST-free goods — no refund can be claimed if no GST was paid

- consumables wholly or partially consumed in Australia

- goods that are prohibited on aircraft or ships for safety reasons. These include items such as gas cylinders, fireworks and aerosol sprays (all airlines provide information to passengers on prohibited items)

- goods that fail to meet airline cabin-size or ship hand luggage restrictions

- unaccompanied goods (including freighted or posted goods)

- services such as accommodation, tours and car rental and labour charges

- goods bought online and imported into Australia

- gift cards/vouchers (although goods purchased with these are eligible, subject to all TRS requirements being met)

How do I do it? At the airport: Once you’ve cleared Immigration and Border Protection, TRS facilities can be found at the international airports at Darwin, Perth, Cairns, Adelaide, Melbourne, Brisbane, Sydney and the Gold Coast.

At seaports: Cruise liner terminals have TRS facilities at the seaports of Circular Quay and Darling Harbour in Sydney, Melbourne’s Station Pier and also Darwin, Brisbane, Cairns, Hobart and Fremantle. Contact Border Force to find out if you can, and where to make a claim.

You will need to have with you the items you are taking out of the country, the original tax invoices, your passport, and your international boarding pass or other proof of travel. It should only take a relatively short time to process the claim, but no-one likes holding up their flights (or worse yet, missing it altogether), so make sure you leave plenty of time to get to the airport, check-in, clear Border Protection, buy the duty-free perfume you promised your aunty, and queue-up to make your TRS claim.

To make processing your claim faster at your port of departure, you can pre-enter the details of your claim using a TRS web or mobile applications (apps). For more information on the apps visit the Tourist Refund Scheme applications webpage .

As far as the amount of time you should allow; at the:

– airport; you have up to 30 minutes prior to the scheduled departure of your flight to make your claim

– seaport; claims cannot be made earlier than four hours and no later than one hour prior to the scheduled departure time of the vessel.

It is a legal requirement that the person who purchases the goods must be the person who makes the claim for a refund of GST.

More details are available at Immigration and Border Protection , but you can also call 131 881 if you are within Australia, or +61 2 6246 1325 if you are outside Australia.

DISCLAIMER: All information provided in this publication is of a general nature only and is not personal financial or investment advice. It does not take into account your particular objectives and circumstances. No person should act on the basis of this information without first obtaining and following the advice of a suitably qualified professional advisor. To the fullest extent permitted by law, no person involved in producing, distributing or providing the information in this publication (including Taxpayers Australia Incorporated, each of its directors, councillors, employees and contractors and the editors or authors of the information) will be liable in any way for any loss or damage suffered by any person through the use of or access to this information. The Copyright is owned exclusively by Taxpayers Australia Ltd (ABN 96 075 950 284).

- Skip to navigation

- Skip to main content

Popular searches

Your previous searches.

- Integrated Cargo System (ICS)

Tourist Refund Scheme enquiry form

Save as draft.

Please enter your e-mail address:

Security Check

Form reference number:

Need a hand?

- Australia & New Zealand Cruisers

Tourist Refund Scheme

By Relaxing Robbies , July 31, 2022 in Australia & New Zealand Cruisers

Recommended Posts

Aus Traveller

6 hours ago, Stickman1990 said: Did you check it out? Is anyone able to tell me how TRS is processed at Cairns cruise terminal - its our last port in Australia before we head to PNG so I'm hoping to make a TRS claim at the cruise terminal and would appreciate any feedback on how easy that is going to be

On our cruises to Cairns via Willis Is (June-July and Aug-Sept), I looked carefully to see if there was a TRS desk in the Cairns terminal. There was not. I also enquired when we boarded in Brisbane and I was told that there would be TRS on 'proper international cruises'.

On our Pacific Island cruise on 5th Nov, the TRS in the Brisbane terminal was set up just after the Border Force desks.

Link to comment

Share on other sites.

Stickman1990

4 minutes ago, Aus Traveller said: I also enquired when we boarded in Brisbane and I was told that there would be TRS on 'proper international cruises'.

Thanks - I’ve sent the TRS an email asking about Cairns - we leave Australia from Cairns on Silver Muse next month so I’m hoping I can make a claim at the cruise terminal as we pass through customs processing

Just now, Stickman1990 said: Thanks - I’ve sent the TRS an email asking about Cairns - we leave Australia from Cairns on Silver Muse next month so I’m hoping I can make a claim at the cruise terminal as we pass through customs processing

Good idea. That is the best way to find out if TRS will be operating in Cairns during your cruise. It is possible that it just wasn't organised for our cruises last year.

- 8 months later...

On 7/31/2022 at 3:59 PM, Porky55 said: I think the “Duty Free” circuit around Willis Island is for the purchase of alcohol and a minimal few cigarettes. In all reality it is a domestic cruise.

Hi, digging up this thread for a question. What is the criteria for claiming GST? My understanding is it needs to be international. But beyond that, it is very unclear to me.

We talk about cruises and duty free shops operating in open waters, does this mean that a 3 days open water cruise can claim GST? Or does it need to be around the waters of say Willis island?

Will be travelling on a 12 days South Australia cruise and unsure if it meets the criteria: https://www.princess.com/cruise-search/details/?voyageCode=8339

10 minutes ago, Zetta83 said: Will be travelling on a 12 days South Australia cruise and unsure if it meets the criteria: https://www.princess.com/cruise-search/details/?voyageCode=8339

Never leaves Australia - sorry it won’t qualify

5 minutes ago, Stickman1990 said: Never leaves Australia - sorry it won’t qualify

All good. Never ask never know.

They haven't come up with a surrogate island to cruise around and qualify for southern itineraries for duty free. For QLD and Willis Island it works via a long standing agreement, as it doesn't meet all the rules either.

2 minutes ago, arxcards said: They haven't come up with a surrogate island to cruise around and qualify for southern itineraries for duty free. For QLD and Willis Island it works via a long standing agreement, as it doesn't meet all the rules either.

Thanks. Being a greenhorn to TRS, I wonder the difference between the cruise selling duty free on international waters vs us claiming GST leaving Australian waters.

Maybe it is to do with the actual sale taking place in international waters by Princess vs me buying in Australia and bring it to international waters.

13 minutes ago, Zetta83 said: T Thanks. Being a greenhorn to TRS, I wonder the difference between the cruise selling duty free on international waters vs us claiming GST leaving Australian waters. Maybe it is to do with the actual sale taking place in international waters by Princess vs me buying in Australia and bring it to international waters.

For those QLD coastal cruises going outside Willis Island, you can claim TRS. It is impractical for alcohol as you only get to claim GST back (1/11th of the item cost). Given alcohol is taxed with a whole lot of extra taxes, TRS won't make it duty free.

38 minutes ago, arxcards said: For those QLD coastal cruises going outside Willis Island, you can claim TRS. It is impractical for alcohol as you only get to claim GST back (1/11th of the item cost). Given alcohol is taxed with a whole lot of extra taxes, TRS won't make it duty free.

I meant cruise selling alcohol. The ones you can only purchase on international waters and collect on leaving the ship.

I guess I got my answer. Like casinos, these products will not need to follow Australian laws/taxation whilst on international which is completely different from a product purchased in Australia leaving Australia.

As the product hasn't reached another country, TRS cannot apply.

1 minute ago, Zetta83 said: As the product hasn't reached another country, TRS cannot apply.

Yes, it can.

You can claim TRS on a Willis Island QLD Coastal. It is more problematic now though. You used to be able to claim during embarkation in Brisbane, but now you need to do it at your final domestic port prior to Willis Island.