Aaa Member Loyalty Travel Accident Insurance Reviews

Are you planning your next adventure and want to make sure you’re covered in case of an accident? Look no further than Aaa Member Loyalty Travel Accident Insurance. This insurance option provides peace of mind for all types of travelers, whether you’re heading out on a solo backpacking trip or taking the whole family on a vacation.

In this blog post, we’ll review the benefits and drawbacks of Aaa Member Loyalty Travel Accident Insurance, who it’s best suited for, and how to get the most out of this coverage option. So sit back, relax, and let us guide you through everything you need to know about Aaa Member Loyalty Travel Accident Insurance!

What is Aaa Member Loyalty Travel Accident Insurance?

Aaa Member Loyalty Travel Accident Insurance is a type of insurance plan that provides coverage for travelers in the event of an accident while traveling. This particular insurance option is available to members of Aaa, or the American Automobile Association, which is a well-known organization that offers various services and benefits to its members. This travel accident insurance covers a wide range of accidents that may occur while you’re on the road or in another country. It can include anything from accidental death and dismemberment to emergency medical evacuation and repatriation. Depending on your specific policy, it may also provide coverage for trip cancelations or delays due to unforeseen circumstances. One important aspect to note about Aaa Member Loyalty Travel Accident Insurance is that it only provides coverage for accidents related directly to travel. If you have any pre-existing medical conditions or other health concerns, be sure to check with your insurer regarding what might be covered under this plan. Aaa Member Loyalty Travel Accident Insurance is an excellent option for anyone who travels frequently and wants added peace of mind knowing they’re protected should an unfortunate incident occur during their trip.

How does Aaa Member Loyalty Travel Accident Insurance work?

Aaa Member Loyalty Travel Accident Insurance provides coverage for accidents that occur while traveling. This can include accidental death, dismemberment, or permanent paralysis. The insurance is available to AAA members who are covered by their auto insurance policy. If a covered accident occurs while on a trip, the insured member or their beneficiary will receive compensation based on the amount of coverage they have purchased. The amount of coverage ranges from $100,000 to $500,000 and premiums vary depending on the level of coverage selected. The insurance also includes additional benefits such as emergency medical transportation and travel assistance services. These services can help coordinate emergency medical care or transportation back home in case of an unforeseen event. It’s important to note that Aaa Member Loyalty Travel Accident Insurance only covers accidents while traveling and does not provide any other type of travel protection such as trip cancellation or lost luggage reimbursement. Members should consider purchasing separate travel insurance policies if they need this type of coverage. To purchase Aaa Member Loyalty Travel Accident Insurance, members can contact their local AAA branch or visit the AAA website to get a quote and enroll online. It’s important to review all terms and conditions before enrolling in any insurance policy to fully understand what is included in your plan.

What are the benefits of Aaa Member Loyalty Travel Accident Insurance?

Aaa Member Loyalty Travel Accident Insurance offers a variety of benefits that can make traveling less stressful for you and your loved ones. One major benefit is the peace of mind that comes with knowing you are protected in case of an accident while traveling. Traveling can be unpredictable, which makes having insurance all the more important. With Aaa Member Loyalty Travel Accident Insurance, you’ll have coverage for medical expenses related to accidents that occur during travel. This includes emergency medical transportation, hospital stays, and surgeries. Another great benefit is the 24/7 assistance provided by Aaa’s travel team. Whether it’s help finding a doctor or arranging transportation back home after an accident, they’re there to assist you every step of the way. Aaa Member Loyalty Travel Accident Insurance also offers coverage for loss of life or limb due to an accident while traveling. This can provide financial security for your loved ones in case something were to happen on your trip. Aaa Member Loyalty Travel Accident Insurance offers valuable benefits that can give you peace of mind when traveling. It’s always better to be safe than sorry!

What are the drawbacks of Aaa Member Loyalty Travel Accident Insurance?

While Aaa Member Loyalty Travel Accident Insurance offers a range of benefits, there are also some drawbacks to consider. One potential drawback is the limited coverage amount provided by this insurance policy. If you’re looking for more comprehensive and higher coverage limits, then this policy may not be suitable for your needs. Another potential concern with Aaa Member Loyalty Travel Accident Insurance is that it only provides accidental death and dismemberment coverage. This means that if you become ill during your travels or sustain injuries in an accident that doesn’t result in death or dismemberment, you won’t be covered under this policy. Additionally, while Aaa Member Loyalty Travel Accident Insurance does offer 24/7 customer support and emergency assistance services, their response time may not always be as quick as other travel insurance providers. This could potentially leave you stranded without immediate help in case of an emergency situation. It’s also important to note that pre-existing conditions aren’t covered under this policy, which can limit its usefulness for those with ongoing medical issues. Ultimately, when considering whether or not to purchase Aaa Member Loyalty Travel Accident Insurance, it’s crucial to weigh both the benefits and drawbacks carefully before making a decision.

Who is Aaa Member Loyalty Travel Accident Insurance best for?

Aaa Member Loyalty Travel Accident Insurance is best for those who frequently travel long distances, especially internationally. This insurance plan offers coverage for accidents that may occur while traveling, such as accidental death or dismemberment. It’s also ideal for those who participate in high-risk activities during their travels, like extreme sports or adventure activities. These types of activities can increase the risk of accidents and injuries, so having a reliable insurance plan can provide peace of mind. Furthermore, Aaa Member Loyalty Travel Accident Insurance is suitable for individuals with pre-existing medical conditions who are concerned about not being covered by other insurance plans. It offers coverage regardless of pre-existing conditions and doesn’t require any medical exams before enrollment. This insurance plan is perfect for frequent flyers looking to save money on trip-by-trip policies. With Aaa Member Loyalty Travel Accident Insurance annual policy options available at affordable prices, it eliminates the need to purchase individual travel accident policies every time you go on a trip. If you’re someone who values safety and security while traveling and wants an affordable way to protect yourself against unforeseen circumstances that could arise during your journeys – then Aaa Member Loyalty Travel Accident Insurance might be right up your alley!

How to get the most out of Aaa Member Loyalty Travel Accident Insurance

To get the most out of Aaa Member Loyalty Travel Accident Insurance, it’s important to thoroughly research and understand the policy before purchasing. Make sure you know what is covered and what isn’t, as well as any limits or exclusions that may apply. When traveling, always carry your insurance card with you and keep a copy stored digitally in case of loss or theft. In case of an accident or emergency, contact the 24/7 assistance service provided by Aaa for help navigating medical care and making claims. It’s also important to stay up-to-date on any changes or updates to your policy. Take advantage of any resources provided by Aaa for members, such as online account management tools and customer support services. Aaa Member Loyalty Travel Accident Insurance can be a valuable addition to your travel planning toolkit. While it may not cover every possible situation that could arise while traveling, having this type of coverage can provide peace of mind knowing that you’re protected in case something unexpected does happen.

Table of Contents

Privacy Overview

AAA Member Loyalty Travel Accident Insurance: A Comprehensive Guide

Traveling can be an amazing experience, full of fun, excitement, and new adventures. But accidents and emergencies can happen anywhere, even on vacation. That’s why having travel accident insurance is so valuable for AAA members.

AAA Member Loyalty Travel Accident Insurance provides protection in case you suffer an accidental injury or even death while traveling. This article will explain everything you need to know about this valuable coverage.

Overview of AAA Member Loyalty Travel Accident Insurance

This AAA insurance policy provides the following core benefits:

Accidental Death – Pays up to $300,000 if you die in a covered travel accident.

Dismemberment – Pays up to $300,000 for loss of limbs or eyesight from an accident.

Loss of Speech/Hearing – Provides benefits if you suffer loss of speech or hearing due to an accident.

It covers accidents that occur when traveling via common carrier, such as a plane, train, or bus. It also covers accidents during the process of boarding or disembarking these transportation methods.

This policy is automatically included with AAA Premier membership at no added cost.

Who is Eligible for Coverage?

To be eligible for AAA Member Loyalty Travel Accident Insurance, you must:

- Have a valid AAA Premier membership

- Purchase travel through the AAA Travel Agency

- Be under 70 years old

The insurance covers the primary AAA member as well as their spouse/domestic partner and any unmarried dependent children under 26 years old.

One key advantage is that there are no medical exams or health questions required to qualify. Coverage is guaranteed for all eligible Premier members.

When Does AAA Travel Accident Coverage Apply?

This AAA insurance policy covers accidents that occur:

While riding as a ticketed passenger on any licensed common carrier, such as a plane, train, bus, taxi, or rideshare.

During the process of boarding or disembarking these transportation methods.

While riding to/from the terminal or station immediately before or after your trip.

While riding in a rental car or personal vehicle to/from an airport, station or terminal.

So you have protection for accidents throughout your travels when booked through AAA.

AAA Travel Accident Insurance Benefits

Here are details on the benefits provided by AAA Member Loyalty Travel Accident Insurance:

Accidental Death

- Pays $300,000 for accidental death while traveling

Dismemberment

- $300,000 for loss of 2+ limbs, eyesight, speech, and hearing

- $150,000 for loss of 1 limb, eye, speech, or hearing

- $75,000 for loss of 1 hand, 1 foot, or thumb/index finger of same hand

Loss of Life Benefit for Dependent Child(ren)

- $25,000 per child if caused by a covered accident

Benefits are paid directly to you or your selected beneficiaries. The coverage has a maximum limit of $20 million per any one accident.

Additional AAA Member Benefits

AAA Member Loyalty Travel Accident Insurance also includes these extra benefits:

Spouse Membership – If the primary member passes away in a covered accident, the spouse receives a complimentary AAA membership for life.

Bereavement Counseling – Up to 5 sessions of grief counseling are provided if you suffer a covered loss.

Seat Belt Benefit – An additional 10% is paid, up to $50,000, if you die while properly wearing a seat belt in a private vehicle accident.

Airbag Benefit – An extra 5%, up to $5,000, is paid if you die while wearing a seat belt and the airbag deploys in a private vehicle accident.

Job Assistance – Up to $5,000 is provided to your spouse for job skills training and job placement assistance if you die in an accident.

AAA Members receive comprehensive support and protection while traveling with this coverage.

What Accidents and Losses Are Not Covered?

While AAA Travel Accident Insurance provides valuable benefits, there are some limitations on what is covered:

Excluded Accidents/Losses:

Illness or disease

Mental or emotional disorders

Pregnancy and childbirth

Strokes or cerebrovascular accidents

Suicide or attempted suicide

Declared or undeclared war

Commuting accidents (only covers while in direct transit to the trip)

Other Exclusions:

Injuries while piloting an aircraft

Accidents on personally owned, leased, or chartered aircraft

Races or speed contests

Injuries while driving under the influence

Be sure to read the full exclusions section of the policy. But in general, the coverage is designed for unforeseen accidents while traveling, not pre-existing conditions or high risk activities.

How Much Does AAA Travel Accident Insurance Cost?

A major advantage of this coverage is that there are no direct costs for eligible AAA Premier members.

The travel accident insurance is included automatically when you join AAA Premier. The premium costs are built into the AAA Premier membership dues.

AAA Premier membership starts at just $99 per year in most states, with rates varying based on your location. This covers the entire household, including spouse/partner and dependents under 26 years old.

Considering a AAA Premier membership can save you hundreds on travel, automotive and shopping discounts, the travel accident insurance coverage provides even more value and protection.

How to File a AAA Travel Insurance Claim

If you need to file a claim due to an accident on your trip, follow these steps:

Report the accident to AAA as soon as possible. Claims should be filed within 60 days.

Submit a written claim form, which can be obtained from your local AAA branch.

Provide documentation such as medical records, death certificates, and police reports to verify the loss.

You or your beneficiaries will need to provide proof of travel purchases through AAA and documentation of the accident.

A claims examiner will review the documentation and investigate the circumstances of the accident.

If approved, the applicable benefit amount will be paid via check.

Contact your local AAA branch anytime you need assistance filing a claim.

Why AAA Travel Accident Insurance is Worth It

Travel insurance is always smart when venturing away from home. With AAA Member Loyalty Travel Accident Insurance, you get these key benefits:

Peace of Mind – Travel worry-free knowing your accident risks are covered.

Convenient – The coverage is built into your AAA membership automatically.

Affordable – There are no extra costs or premiums for eligible members.

Comprehensive – Benefits cover everything from small injuries to the unthinkable.

Worldwide – Protection applies wherever you travel globally.

Worry-Free Claims – AAA agents help handle paperwork if a claim occurs.

For AAA members, this insurance provides protection for life’s unexpected events without the hassle or cost of a separate policy. Learn more about this coverage when planning your next adventure away from home.

AAA Member Loyalty Accident Insurance Review: Pros and Cons

What does AAA travel Accident Insurance cover?

What does travel Accident Insurance cover?

What is AAA loyalty program?

What is group travel Accident Insurance?

Related posts:

- Finding the Best Car Insurance Quotes in Jacksonville, North Carolina

- Finding the Best Oklahoma Small Business Health Insurance

- The Costly Consequences of Driving Without Insurance in Michigan

- Can You Sell a Car Without Insurance? What to Know Before Transferring Ownership

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Is AAA Member Loyalty Travel Accident Insurance Worth It?

AAA is a well-known organization that provides a variety of services to its members, including travel accident insurance. This type of insurance can be a valuable asset for members who are planning to travel, as it can help to cover the costs of medical expenses, lost wages, and other expenses that may arise in the event of an accident. However, it is important to weigh the benefits of AAA member loyalty travel accident insurance against the cost before making a decision about whether or not to purchase it.

In this article, we will take a closer look at AAA member loyalty travel accident insurance to help you determine if it is worth it for you. We will discuss the benefits of this type of insurance, the costs involved, and some of the things to consider before making a purchase.

We will also provide some tips on how to save money on AAA member loyalty travel accident insurance.

AAA Member Loyalty Travel Accident Insurance is a type of travel insurance that is offered to AAA members. It provides coverage for medical expenses, lost wages, and travel delays that may occur while you are traveling. AAA Member Loyalty Travel Accident Insurance also offers discounts on car rentals, hotels, and other travel expenses.

In this article, we will discuss the benefits and drawbacks of AAA Member Loyalty Travel Accident Insurance. We will also provide information on how to purchase a policy and what to expect if you file a claim.

Benefits of AAA Member Loyalty Travel Accident Insurance

AAA Member Loyalty Travel Accident Insurance offers a number of benefits that can make it a valuable investment for travelers. These benefits include:

- Coverage for medical expenses . If you are injured while traveling, AAA Member Loyalty Travel Accident Insurance can help to cover the cost of your medical expenses. This includes expenses such as doctor’s visits, hospital stays, and prescription drugs.

- Coverage for lost wages . If you are unable to work due to an injury or illness while traveling, AAA Member Loyalty Travel Accident Insurance can help to cover your lost wages. This can help to ensure that you are able to pay your bills and support your family while you are recovering.

- Coverage for travel delays . If your travel plans are delayed or canceled due to an emergency, AAA Member Loyalty Travel Accident Insurance can help to cover the cost of your expenses. This includes expenses such as hotel stays, meals, and transportation.

- Discounts on car rentals, hotels, and other travel expenses . AAA Member Loyalty Travel Accident Insurance can also provide you with discounts on car rentals, hotels, and other travel expenses. This can help you to save money on your next trip.

Drawbacks of AAA Member Loyalty Travel Accident Insurance

AAA Member Loyalty Travel Accident Insurance does have some drawbacks that you should be aware of before you purchase a policy. These drawbacks include:

- Higher premiums than other travel insurance policies . AAA Member Loyalty Travel Accident Insurance is typically more expensive than other travel insurance policies. This is because AAA offers a higher level of coverage than many other policies.

- Limited coverage for certain activities . AAA Member Loyalty Travel Accident Insurance does not cover all activities. For example, it does not cover extreme sports or scuba diving. If you plan on participating in these activities while you are traveling, you will need to purchase a separate policy.

- Cancellation fees . If you cancel your AAA Member Loyalty Travel Accident Insurance policy after you purchase it, you may be subject to a cancellation fee. This fee can be as much as 25% of the total cost of the policy.

How to Purchase AAA Member Loyalty Travel Accident Insurance

AAA Member Loyalty Travel Accident Insurance can be purchased online, by phone, or at your local AAA office. When you purchase a policy, you will need to provide your name, address, and contact information. You will also need to provide information about your trip, such as your destination, dates of travel, and mode of transportation.

The cost of AAA Member Loyalty Travel Accident Insurance will vary depending on the length of your trip, your age, and your health status. You can get a quote for your policy online or by calling AAA.

What to Expect if You File a Claim

If you file a claim on your AAA Member Loyalty Travel Accident Insurance policy, you will need to provide documentation of your claim. This documentation may include medical bills, receipts for lost wages, and proof of your travel delay.

AAA will review your claim and make a decision on whether or not to approve it. If your claim is approved, AAA will pay for your covered expenses.

AAA Member Loyalty Travel Accident Insurance can be a valuable investment for travelers. It provides a number of benefits that can help to protect you in the event of an emergency while you are traveling. However, it is important to be aware of the drawbacks of AAA Member Loyalty Travel Accident Insurance before you purchase a policy.

If you are considering purchasing AAA Member Loyalty Travel Accident Insurance, you should compare it to other travel insurance policies to make sure that it is the best option for you. You should also consider your budget and the activities that you plan on participating in while you are traveling.

- Coverage for lost wages . If you are unable to work due to an injury or illness while traveling, AAA Member Loyalty Travel Accident Insurance can help to cover your lost wages. This can help to

AAA Member Loyalty Travel Accident Insurance is a type of supplemental travel insurance that provides coverage for medical expenses, trip cancellation, and other travel-related expenses. It is offered by AAA to its members at a discounted rate.

AAA Member Loyalty Travel Accident Insurance can be a valuable investment for people who travel frequently or who have a high-risk job or hobby. It can help to cover the cost of medical care if you are injured while traveling, and it can also help to reimburse you for expenses if your trip is cancelled or interrupted.

However, it is important to note that AAA Member Loyalty Travel Accident Insurance is not a comprehensive travel insurance policy. It does not cover all types of travel-related expenses, and it may not be the best option for people who are traveling to high-risk destinations.

To determine whether AAA Member Loyalty Travel Accident Insurance is worth it for you, you should consider the following factors:

- The cost of the policy

- The types of coverage that are included

- Your travel habits

- Your health status

If you are looking for a comprehensive travel insurance policy, AAA Member Loyalty Travel Accident Insurance may not be the best option for you. However, if you are looking for a relatively affordable way to protect yourself from some of the most common travel-related risks, it may be a good choice.

Who Should Get AAA Member Loyalty Travel Accident Insurance?

AAA Member Loyalty Travel Accident Insurance is a good option for people who travel frequently or who have a high-risk job or hobby. It can also be a good option for people who are concerned about the cost of medical care abroad.

Some of the people who may benefit from AAA Member Loyalty Travel Accident Insurance include:

- People who travel for business

- People who travel with children

- People who have a high-risk job or hobby

- People who are concerned about the cost of medical care abroad

If you are not sure whether AAA Member Loyalty Travel Accident Insurance is right for you, you can talk to your AAA representative to get more information.

How to Get AAA Member Loyalty Travel Accident Insurance

AAA Member Loyalty Travel Accident Insurance can be purchased through your local AAA office, online, or over the phone. To purchase a policy, you will need to provide your name, address, and contact information. You will also need to provide information about your trip, such as your destination, dates of travel, and mode of transportation.

Once you have purchased a policy, you will be issued a certificate of insurance. This certificate will contain information about your coverage, including the types of expenses that are covered, the limits of coverage, and the deductible.

You should keep your certificate of insurance with you when you travel. If you need to file a claim, you will need to provide a copy of your certificate of insurance.

To determine whether AAA Member Loyalty Travel Accident Insurance is worth it for you, you should consider the factors discussed in this article. If you are looking for a relatively affordable way to protect yourself from some of the most common travel-related risks, it may be a good choice.

AAA Member Loyalty Travel Accident Insurance can be a valuable addition to your travel plans, especially if you are an active traveler. The policy provides coverage for a wide range of accidents, including injuries sustained while traveling, medical expenses, and lost wages. Additionally, the policy includes a number of helpful features, such as 24/7 emergency assistance and travel planning services.

However, it is important to note that AAA Member Loyalty Travel Accident Insurance is not a comprehensive travel insurance policy. It does not cover all types of accidents or expenses, and it may not be the best option for all travelers.

To determine if AAA Member Loyalty Travel Accident Insurance is worth it for you, you should consider the following factors:

- The types of activities you plan to do on your trip

- Your health insurance coverage

- Your budget

If you are an active traveler who is looking for a comprehensive travel insurance policy, AAA Member Loyalty Travel Accident Insurance may be a good option for you. However, if you are only planning on taking a few short trips each year, or if you already have comprehensive health insurance coverage, you may not need this type of policy.

Here are some additional FAQs about AAA Member Loyalty Travel Accident Insurance:

- What is covered by AAA Member Loyalty Travel Accident Insurance?

AAA Member Loyalty Travel Accident Insurance covers a wide range of accidents, including:

- Injuries sustained while traveling

- Medical expenses

- Emergency transportation

- Trip interruption

- Baggage loss

- Cancellation fees

- What is not covered by AAA Member Loyalty Travel Accident Insurance?

AAA Member Loyalty Travel Accident Insurance does not cover all types of accidents or expenses. Some of the exclusions include:

- Pre-existing conditions

- Injuries sustained while participating in dangerous activities

- Intentional acts

- War or terrorism

- Loss of or damage to property

- How much does AAA Member Loyalty Travel Accident Insurance cost?

The cost of AAA Member Loyalty Travel Accident Insurance varies depending on the length of your trip, your age, and your health status. For example, a one-week trip for a healthy 20-year-old might cost around $50. A three-month trip for a 60-year-old with a pre-existing condition might cost around $200.

- How do I file a claim for AAA Member Loyalty Travel Accident Insurance?

If you are injured while traveling and you need to file a claim for AAA Member Loyalty Travel Accident Insurance, you should follow these steps:

1. Contact AAA as soon as possible after the accident. 2. Provide AAA with a copy of your police report and medical records. 3. Submit a claim form to AAA. 4. Follow up with AAA to ensure that your claim is processed correctly.

- Is AAA Member Loyalty Travel Accident Insurance the best travel insurance policy for me?

AAA Member Loyalty Travel Accident Insurance is a good option for active travelers who are looking for a comprehensive travel insurance policy. However, it is important to compare this policy to other travel insurance policies before you make a decision. You should consider the cost of the policy, the types of activities you plan to do on your trip, and your health insurance coverage.

If you are not sure whether AAA Member Loyalty Travel Accident Insurance is the best option for you, you can speak to a travel insurance agent for advice.

AAA Member Loyalty Travel Accident Insurance can be a valuable investment for some travelers. It offers a wide range of coverage options, including medical expenses, trip interruption, and lost luggage. However, it is important to weigh the benefits of the policy against the cost before making a decision. For travelers who are frequently on the go, AAA Member Loyalty Travel Accident Insurance can provide peace of mind and financial protection in the event of an accident.

Author Profile

Latest entries

- January 19, 2024 Hiking How to Lace Hiking Boots for a Perfect Fit

- January 19, 2024 Camping How to Dispose of Camping Propane Tanks the Right Way

- January 19, 2024 Traveling Information Is Buffalo Still Under Travel Ban? (Updated for 2023)

- January 19, 2024 Cruise/Cruising Which Carnival Cruise Is Best for Families?

AAA Member Loyalty Travel Accident Insurance: Is It Worth It? Pros and Cons Reviewed

AAA Member Loyalty Accident Insurance is worth it. It offers key coverage for accidents, including hospitalization, emergency treatment, and recuperation. This insurance provides financial protection and peace of mind for AAA members. It reassures members in unexpected situations and helps manage the stress of potential medical costs.

On the downside, AAA Member Loyalty Travel Accident Insurance may not be necessary for everyone. Those who already have comprehensive travel insurance might find it redundant. Additionally, the coverage limits might not cover all potential costs associated with travel accidents. Members should also review their existing policies to ensure adequate protection before enrolling.

Ultimately, whether AAA Member Loyalty Travel Accident Insurance is worth it depends on individual travel habits and existing coverage. Assessing personal risk and travel frequency helps in making an informed decision.

In the next section, we will explore alternatives to AAA Member Loyalty Travel Accident Insurance. This will help you identify other options for protecting yourself during your travels.

Table of Contents

What Is AAA Member Loyalty Travel Accident Insurance and What Does It Cover?

AAA Member Loyalty Travel Accident Insurance is a coverage plan that provides financial protection for members in the event of accidents occurring during their travels. This insurance typically covers medical expenses, accidental death benefits, and dismemberment.

According to the American Automobile Association (AAA), travel accident insurance ensures that members receive support for unforeseen events that may disrupt their travel plans. Such protection can be essential for peace of mind while traveling.

The insurance encompasses various aspects, including reimbursement for emergency medical treatment, travel-related accidental death benefits, and compensation for severe injuries leading to permanent disability. These features help travelers manage unexpected costs effectively.

Further elaboration from the National Association of Insurance Commissioners (NAIC) indicates that travel accident insurance is designed specifically for risks associated with travel, distinct from standard health insurance policies.

Key causes for utilizing this insurance include increased travel frequency, heightened awareness of potential accidents, and rising healthcare costs while away from home. Travelers seek this coverage to mitigate financial risks related to accidents.

Statistics from the U.S. Federal Aviation Administration reveal that approximately 3.5 billion passengers traveled by air in 2019, highlighting a growing necessity for travel insurance.

The broader impacts include enhancing safety perceptions, promoting responsible travel, and contributing to the travel industry’s resilience during crises.

From health, environmental, and economic perspectives, this insurance can influence travelers’ choices, demand for safer travel options, and support for local economies dependent on tourism.

For instance, travel accident insurance can support local healthcare facilities by ensuring patients can afford necessary treatments.

Preventative measures include investing in awareness campaigns about travel safety and encouraging policies that support comprehensive travel insurance coverage. Experts recommend regular evaluations of insurance plans to ensure adequate coverage.

Recommended practices involve utilizing technology for travel tracking, emergency alerts, and real-time information access, helping travelers stay informed and prepared.

What Types of Accidents Does AAA Member Loyalty Travel Accident Insurance Protect Against?

AAA Member Loyalty Travel Accident Insurance protects against a variety of incidents that can occur during travel.

- Accidental death

- Dismemberment

- Accidental injury

- Flight accidents

- Land accidents

- Travel-related accidents

AAA Member Loyalty Travel Accident Insurance covers various accident types that travelers may face.

Accidental Death : Accidental death refers to a fatality resulting from unintentional injury while traveling. This coverage provides financial support to the beneficiaries of the deceased. For instance, if a policyholder dies in a car accident, the insurance pays out a predetermined benefit amount to their family. According to a study by the National Highway Traffic Safety Administration (NHTSA), car accidents remain one of the leading causes of accidental death during travel.

Dismemberment : Dismemberment refers to the permanent loss of limbs or bodily functions due to an accident. This form of coverage offers a financial payout based on the severity of the injury. For example, losing a limb in a travel-related incident would qualify the insured for compensation. The World Health Organization (WHO) notes that unintentional injuries, including those resulting in dismemberment, are a global concern and insurance can alleviate some of the associated financial burdens.

Accidental Injury : Accidental injury involves any non-fatal injury sustained during a trip. This insurance may cover medical expenses, which can become significant when traveling. For instance, if a traveler sustains a fractured bone while hiking, their insurance may cover hospital bills. The Centers for Disease Control and Prevention (CDC) states that injuries are among the top health issues travelers face.

Flight Accidents : Flight accidents refer specifically to incidents occurring during air travel that lead to injury or death. This coverage ensures travelers are protected against the risks associated with flying. An example would be a plane crash resulting in fatalities. A 2020 report from the Aviation Safety Network indicated that while relatively rare, flight accidents can have catastrophic outcomes, underscoring the need for appropriate insurance.

Land Accidents : Land accidents involve incidents occurring on the ground, such as car or bus accidents. This category provides compensation for injuries sustained in these types of accidents while traveling. For example, if a traveler is injured due to a bus crash, the insurance would cover their medical expenses. The National Safety Council (NSC) emphasizes that vehicle-related accidents constitute a significant risk for all travelers.

Travel-related Accidents : Travel-related accidents can encompass a range of incidents that arise during a trip. Examples include slips, trips, or falls in unfamiliar locations. This coverage aims to support travelers experiencing unexpected liabilities. According to a 2019 study published by the International Journal of Environmental Research and Public Health, accidents during travel can lead to significant injuries, highlighting the importance of having coverage.

Overall, AAA Member Loyalty Travel Accident Insurance offers essential protections for various unfortunate situations that could occur when traveling.

Who Can Enroll in AAA Member Loyalty Travel Accident Insurance?

AAA Member Loyalty Travel Accident Insurance is available to AAA members. To enroll, individuals must maintain active membership status with AAA. This insurance provides coverage while traveling, offering peace of mind to members. It covers injuries or accidents that occur during trips organized through AAA. Members should check specific policy details to understand eligibility requirements fully.

What Are the Key Benefits of AAA Member Loyalty Travel Accident Insurance?

AAA Member Loyalty Travel Accident Insurance offers several key benefits to protect travelers.

- Coverage for Accidental Death and Dismemberment

- Benefits for Emergency Medical Expenses

- Trip Interruption Assistance

- 24/7 Travel Assistance Services

- Loss of Baggage Protection

These benefits demonstrate the value of AAA Member Loyalty Travel Accident Insurance. However, some individuals may feel that purchasing a separate travel insurance policy provides better coverage.

Coverage for Accidental Death and Dismemberment : Coverage for accidental death and dismemberment provides monetary benefits to the insured or their beneficiaries if a covered accident leads to death or the loss of limbs. This insurance offers peace of mind during travel. According to a report by Insurance Information Institute (2020), such coverage is essential for international trips where medical care may be limited.

Benefits for Emergency Medical Expenses : Benefits for emergency medical expenses cover the cost of necessary medical care due to an accident while traveling. This can include hospital stays, surgeries, and medication. For example, a traveler who trips and fractures a bone in a foreign country can receive coverage for their hospital bills. According to a study by TravelGuard (2021), emergency medical expenses often lead to significant out-of-pocket costs for travelers without insurance.

Trip Interruption Assistance : Trip interruption assistance helps cover costs in the event a trip must be halted due to unforeseen circumstances, such as a family emergency or natural disaster. This benefit ensures that travelers are not financially burdened by changes in their travel plans. A case study from the National Association of Insurance Commissioners (NAIC, 2022) highlighted the importance of this benefit amid increasing travel-related interruptions.

24/7 Travel Assistance Services : 24/7 travel assistance services provide guidance and support during emergencies, including finding medical care or arranging transportation home. This benefit offers travelers reliable access to assistance, which can be crucial during unexpected situations. A survey by AAA (2022) indicated that access to real-time assistance greatly improves customer satisfaction during travel.

Loss of Baggage Protection : Loss of baggage protection compensates travelers for lost or damaged luggage during a trip. This benefit can alleviate frustration and financial loss due to the mishandling of bags by airlines. According to a report by the International Air Transport Association (IATA, 2021), nearly 21 million bags are lost each year, underscoring the necessity of this protection.

In conclusion, AAA Member Loyalty Travel Accident Insurance provides valuable benefits tailored for the safety and assistance of travelers. Understanding these benefits can highlight its importance. However, potential policyholders may also compare it with other insurance options to ensure they have adequate coverage for their specific travel needs.

How Can AAA Member Loyalty Travel Accident Insurance Provide Peace of Mind While Traveling?

AAA Member Loyalty Travel Accident Insurance provides peace of mind while traveling by offering financial protection, emergency assistance, and specialized coverage tailored for travelers.

Financial protection: This insurance safeguards against unexpected financial burdens resulting from accidents. According to a study by the National Association of Insurance Commissioners (NAIC, 2020), emergency medical costs abroad can range from $1,000 to $100,000, depending on the severity of the situation. Having insurance helps cover these expenses, preventing travelers from facing high out-of-pocket costs.

Emergency assistance: AAA’s coverage includes access to 24/7 emergency assistance services. This feature ensures that travelers can quickly reach support in case of accidents or medical emergencies. The ability to contact local medical services or even coordinate evacuation can significantly reduce stress during crises.

Specialized coverage: Members benefit from policies that cater specifically to travel-related risks, such as trip cancellation or delays due to accidents. Research from the U.S. Travel Association (2021) indicates that over 25% of travelers have experienced trip interruptions. Insurance that provides compensation helps mitigate financial losses and enhances overall satisfaction during trips.

In summary, AAA Member Loyalty Travel Accident Insurance enhances travel experiences by offering financial security, round-the-clock support, and coverage tailored for the needs of travelers. These benefits create a sense of safety and confidence while exploring new destinations.

Are There Financial Advantages to Having AAA Member Loyalty Travel Accident Insurance?

Yes, there are financial advantages to having AAA Member Loyalty Travel Accident Insurance. This insurance provides coverage for accidents that may occur while traveling, which can result in significant cost savings due to medical expenses or emergency services.

When comparing AAA Member Loyalty Travel Accident Insurance with other travel insurance products, there are both similarities and differences. Similar products typically offer medical coverage, trip interruption, and personal liability options. However, AAA’s plan is tailored for its members, often focusing on specific travel needs and scenarios that frequent travelers may encounter. For example, AAA may offer unique benefits such as access to travel assistance services and discounts on travel-related services, which may not be available in standard travel insurance policies.

The benefits of AAA Member Loyalty Travel Accident Insurance are notable. It can provide peace of mind, knowing that members are protected from high medical costs while traveling. According to a study by the International Air Transport Association, travelers without insurance risk incurring medical bills averaging $1,000 to $5,000 due to accidents abroad. AAA insurance can help cover these costs, thus preventing significant out-of-pocket expenses.

On the downside, this type of insurance may not cover all incidents or emergencies. For instance, pre-existing medical conditions might not be included, limiting the overall coverage for certain individuals. An article by the National Association of Insurance Commissioners (2020) indicates that some travel accident policies have exclusions that could leave travelers unprotected in particular situations. Therefore, it is essential to read the terms and conditions carefully.

In conclusion, individuals considering AAA Member Loyalty Travel Accident Insurance should evaluate their specific travel habits and potential risks. For frequent travelers, this insurance might offer valuable protection. It is advisable to compare AAA’s offerings with other insurance plans to choose the best fit based on one’s travel needs and health status. Additionally, consulting with an insurance advisor can provide personalized recommendations tailored to individual situations.

What Are the Potential Drawbacks of AAA Member Loyalty Travel Accident Insurance?

The potential drawbacks of AAA Member Loyalty Travel Accident Insurance include various limitations and exclusions.

- Coverage Limitations

- Exclusions for High-Risk Activities

- Geographic Restrictions

- Premium Costs vs. Benefits

- Claim Process Complexity

Understanding these drawbacks is critical to evaluate the overall value of the insurance.

Coverage Limitations: Coverage limitations refer to the boundaries of what the insurance policy will cover in terms of financial compensation and types of incidents. For example, AAA Member Loyalty Travel Accident Insurance may provide limited coverage for medical expenses or lost luggage. According to the National Association of Insurance Commissioners, many travelers are unaware that policies can limit payouts based on specific terms outlined in the policy. Members should carefully review the fine print to understand any restrictions that may lead to unexpected out-of-pocket expenses.

Exclusions for High-Risk Activities: AAA Member Loyalty Travel Accident Insurance typically excludes coverage for high-risk activities such as extreme sports or adventure travel. Insurers often label activities like bungee jumping or scuba diving as high risk, meaning that injuries incurred while participating in them may not be covered. The Insurance Information Institute recommends speaking with an insurance agent to clarify which activities are classified as high-risk to avoid misunderstandings.

Geographic Restrictions: Geographic restrictions indicate that coverage may not apply in certain regions or countries. For instance, travel insurance from AAA may exclude countries experiencing conflict or political instability. According to travel risk assessment studies, insurance not covering these areas can leave travelers vulnerable to unexpected emergencies. It is essential for members to verify where their coverage is valid and to consider purchasing additional insurance for travels to higher-risk locations.

Premium Costs vs. Benefits: The cost of premiums in relation to the benefits provided can be a downside. Some travelers might pay relatively high premiums for coverage that may not fully meet their needs. A survey by the Insurance Research Council noted that many travelers opt for standard policies and may find better value in specialized coverage. Members are encouraged to compare different insurance options to ensure they are not overspending for inadequate protection.

Claim Process Complexity: Claim process complexity highlights the hurdles that members may face when trying to file a claim. Many insurance policies, including travel accident insurance, specify numerous documentation requirements that can complicate the process. A report by the Better Business Bureau indicates that delays and denials can occur if the claimed information is not thorough or accurate. As a result, members should keep meticulous records and contact customer service proactively when filing claims to mitigate complications.

By considering these potential drawbacks, travelers can better assess whether AAA Member Loyalty Travel Accident Insurance aligns with their travel needs and preferences.

What Limitations and Exclusions Should You Be Aware of in AAA Member Loyalty Travel Accident Insurance?

AAA Member Loyalty Travel Accident Insurance has several limitations and exclusions that members should be aware of before relying on it for coverage.

- Coverage for specific travel activities may be limited.

- Pre-existing medical conditions are often excluded.

- Benefits may not apply if traveling against government advisories.

- Accidents occurring while under the influence of drugs or alcohol may not be covered.

- Business-related activities may have restrictions.

- Limited coverage for personal belongings lost or damaged during travel.

These points highlight various restrictions that can affect the overall utility of the insurance policy. Understanding these limitations is crucial to making informed travel decisions.

Coverage for Specific Travel Activities : AAA Member Loyalty Travel Accident Insurance specifically outlines which activities are covered. Coverage may not extend to high-risk activities like skydiving, scuba diving, or extreme sports. According to AAA guidelines, members should review their policy to confirm which activities are included. Failure to do so can lead to unexpected out-of-pocket expenses in case of an accident.

Pre-existing Medical Conditions : AAA insurance often excludes coverage for pre-existing medical conditions. This means that if you suffer an accident related to a condition you had before the insurance was purchased, you may not receive benefits. The definition of a pre-existing condition varies by insurer. Thus, it is vital to understand this aspect thoroughly. The U.S. Department of Health & Human Services recommends notifying your insurer about any known conditions to avoid disputes.

Traveling Against Government Advisories : Benefits are typically voided if a member travels to a location under government warnings or advisories due to safety concerns. This information is usually accessible through government travel websites. Members may face challenges when claiming benefits if they disregard such advisories, highlighting the importance of staying informed.

Alcohol or Drug Influence : AAA Member Loyalty Travel Accident Insurance generally excludes coverage for accidents that occur while the insured is intoxicated or under the influence of drugs not prescribed by a physician. This limitation aims to mitigate irresponsible behavior while traveling. Statistics from the National Highway Traffic Safety Administration reveal that alcohol is involved in 29% of all fatal motor vehicle crashes, emphasizing the serious implications of this limitation.

Business-Related Activities : Coverage under AAA insurance can be limited if the trip is primarily for business purposes. Activities such as attending conferences or conducting business meetings may fall outside the insurance policy’s scope. Members engaging in business travel should check if additional coverage is necessary. This is significant as a lack of appropriate insurance may lead to financial loss during business trips.

Limited Coverage for Personal Belongings : While travel accident insurance focuses on injuries or accidents, losses related to personal belongings may have limited coverage. This includes belongings lost, stolen, or damaged while traveling. Members should review their policy to understand the scope of coverage for personal items. According to the Insurance Information Institute, travel insurance policies often have lower caps on reimbursement for lost belongings, which can leave travelers underinsured.

By grasping these limitations and exclusions, AAA members can make more informed decisions about their travel insurance needs.

How Does the Cost of AAA Member Loyalty Travel Accident Insurance Compare to Other Travel Insurance Options?

The cost of AAA Member Loyalty Travel Accident Insurance often compares favorably to other travel insurance options. First, AAA insurance typically includes essential coverage such as accidental death and dismemberment for travel-related incidents. This specific type of insurance is designed for members who travel frequently and may benefit from supplemental coverage.

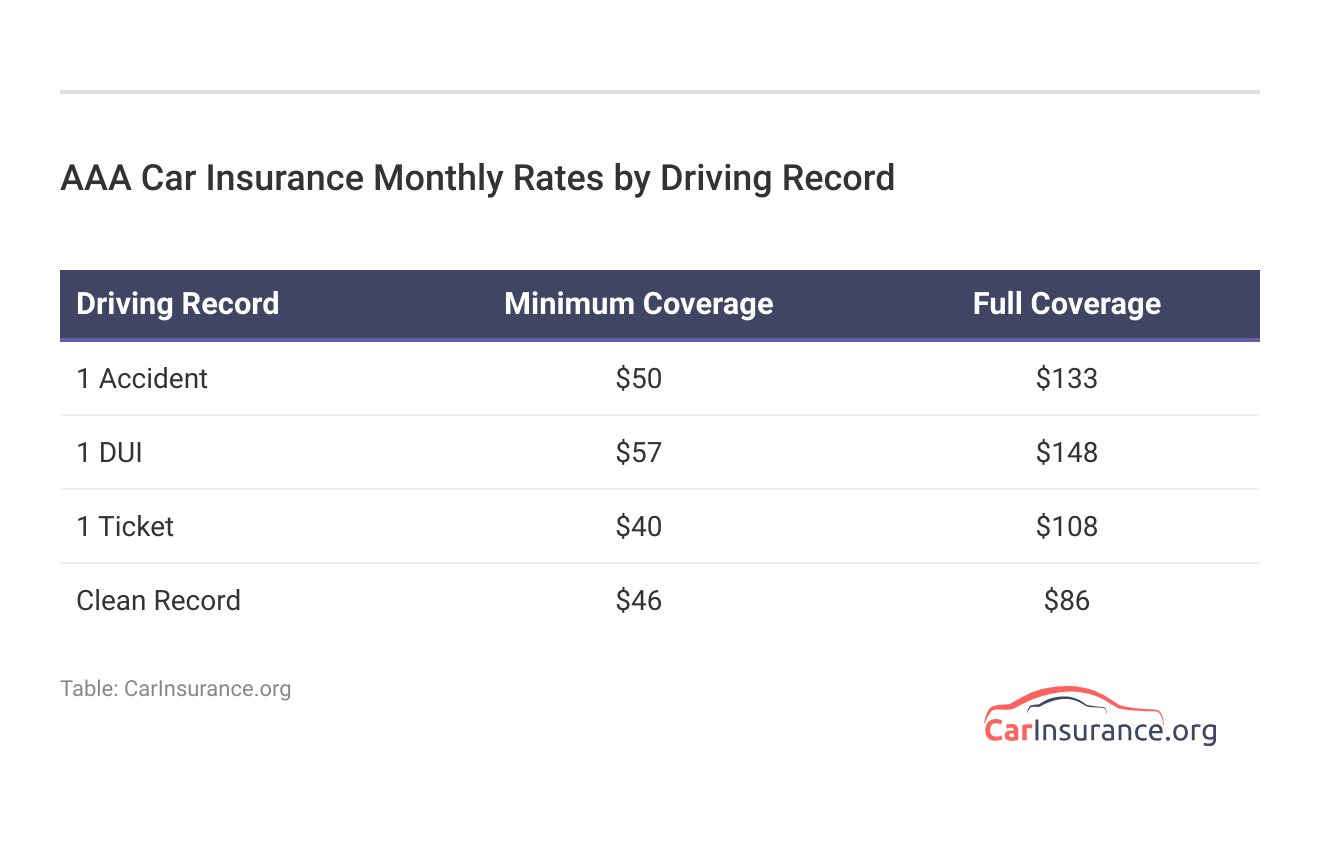

Next, the premiums for AAA insurance usually range from $10 to $20 per trip, depending on the coverage limits and the traveler’s age. In contrast, comprehensive travel insurance policies can cost significantly more, ranging from $50 to over $150 per trip. These comprehensive policies often include additional benefits, such as trip cancellation, lost baggage, and medical expenses.

When analyzing the benefits, the AAA insurance provides essential protections but may lack the extensive coverage of comprehensive policies. Travelers needing broader financial protection may find that standard travel insurance options offer better value.

Ultimately, AAA Member Loyalty Travel Accident Insurance offers a cost-effective solution for travelers seeking basic accident protection. However, it may not cover all potential risks associated with travel, making it crucial for travelers to assess their needs before purchasing insurance.

Who Might Benefit the Most from AAA Member Loyalty Travel Accident Insurance?

Individuals who travel frequently might benefit the most from AAA Member Loyalty Travel Accident Insurance. This insurance offers protection during trips. It is ideal for those who take business trips, family vacations, or adventure travels. Travelers seeking peace of mind will find this insurance valuable. Families with children, senior citizens, and solo travelers may also gain significant advantages. The protection includes coverage for accidental injuries or fatalities that occur while traveling. Overall, anyone who values financial security during their travels stands to benefit the most from this insurance.

What Kind of Travelers Should Seriously Consider AAA Member Loyalty Travel Accident Insurance?

Travelers who frequently venture far from home or seek high-adventure activities should seriously consider AAA Member Loyalty Travel Accident Insurance.

- Frequent Travelers

- Adventure Seekers

- Families Traveling with Children

- Seniors or Health-Conscious Travelers

- Business Travelers

- International Travelers

- Travelers Engaging in Risky Activities

The above categories provide a basis for understanding who might benefit the most from this insurance. Each group has unique travel needs and risks that this insurance can address effectively.

Frequent Travelers: Frequent travelers are individuals who travel often for leisure or business. AAA Member Loyalty Travel Accident Insurance benefits them by offering financial protection against unforeseen incidents. According to the U.S. Travel Association, the average person takes 2-3 leisure trips annually, increasing potential exposure to accidents. Insurance can cover medical expenses and provide peace of mind, contributing to a more enjoyable travel experience.

Adventure Seekers: Adventure seekers engage in activities like hiking, skiing, or scuba diving. These activities often carry a higher risk of accidents. AAA Member Loyalty Travel Accident Insurance typically covers injuries resulting from such high-risk behaviors. A report from the National Safety Council found that outdoor recreation injuries have been rising consistently, underscoring the need for protective measures for these travelers.

Families Traveling with Children: Families traveling with children face unique challenges on the road. AAA Member Loyalty Travel Accident Insurance offers financial security to families in case of an accident. According to a study by the Child Safety Network, injuries are the leading cause of death for children during vacations, making this coverage crucial for families aiming to keep their loved ones safe while traveling.

Seniors or Health-Conscious Travelers: Seniors or health-conscious travelers often have pre-existing medical conditions. They may require medical attention while traveling, and AAA Member Loyalty Travel Accident Insurance can facilitate access to medical care worldwide. A study published in The Journal of Travel Medicine noted that seniors are at a higher risk for health-related incidents while traveling, affirming the importance of insurance for this demographic.

Business Travelers: Business travelers frequently face tight schedules and significant responsibilities. They might travel to unfamiliar locations and encounter potential hazards. Insurance coverage can protect them from accident-related disruptions, thus preserving work commitments. According to the Global Business Travel Association, business travel spending is projected to reach $1.6 trillion by 2028, indicating a growing need for safety solutions.

International Travelers: International travelers may find themselves far from familiar healthcare systems. They face unique risks relating to travel across borders, such as differing medical standards. AAA Member Loyalty Travel Accident Insurance typically offers international support, ensuring travelers can access the care they need in emergencies. The Centers for Disease Control and Prevention reports that injuries are among the top health risks for international travelers, highlighting the need for comprehensive insurance.

Travelers Engaging in Risky Activities: Travelers engaging in risky activities should prioritize insurance that covers accidents. This group includes those participating in activities like bungee jumping, rock climbing, or extreme sports. Coverage helps mitigate financial losses related to injuries sustained during these adventures. A report from the American College of Sports Medicine shows a surge in extreme sports popularity further amplifying the importance of protective insurance for these enthusiasts.

- Are travel agents worth it

- Is a step through a travel

- Can you travel to canada without a passport

- How wide is a travel trailer

- How were the explorers able to travel such great distances

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

AAA Life Insurance Review 2024

Andrew Marder is a former lead writer for NerdWallet focusing on insurance and data analysis. He has over a decade of experience in finance, with previous roles at Barclays, The Motley Fool and Gartner. His work has appeared in The Week, The Washington Post and other national news outlets. He has presented his work at the Gartner Marketing Symposium/Xpo and Accountex.

Katia Iervasi is an assistant assigning editor at NerdWallet. An insurance authority, she previously spent over six years covering insurance topics as a writer, where she loved untangling complicated topics and answering readers’ burning money questions. She holds a Bachelor of Arts in communication and has studied writing, fact-checking and editing with Poynter. Her writing and analysis has been featured in The Washington Post, Forbes, Yahoo, Entrepreneur, Best Company and FT Advisor. Originally from Sydney, Australia, Katia currently lives in New York City.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

on Nerdwallet

Financial strength rating These ratings indicate an insurer’s ability to pay future claims.

Online purchase This indicates whether the company offers a way to apply for and purchase policies entirely online.

NAIC complaints Ratings are based on complaints to state regulators relative to a company’s size, according to three years’ worth of data from the National Association of Insurance Commissioners. NerdWallet conducts its data analysis and reaches conclusions independently and without the endorsement of the NAIC.

Policies offered Term policies last a set number of years, while permanent policies typically last a lifetime. No-exam policies don’t require a medical exam.

- Large term life coverage amounts are available with a medical exam.

- Potential discounts for AAA members.

- Low coverage amount on whole life, making it function more as a final expense policy.

In our life insurance reviews, our editorial team considers the customer and the insurer. These are some of the factors we take into account:

Policies offered. There are many types of life insurance on the market, and they fall into three key categories:

Term life insurance offers temporary coverage and a guaranteed payout if the policyholder dies during the term.

Permanent life insurance typically lasts a lifetime and builds cash value that can be borrowed against in the future.

No-exam life insurance issues coverage without the need for a medical exam.

Financial strength. We use AM Best ratings to confirm an insurer’s long-term financial stability and ability to pay claims. For life insurance, NerdWallet typically recommends considering insurers with ratings of A- or higher. Here’s the breakdown:

Exceptional: A+, A++.

Strong: A-, A.

Moderate: B, B+.

Complaints. These ratings are based on complaints to state regulators relative to a company’s size, according to three years’ worth of data from the National Association of Insurance Commissioners. The best life insurance companies have fewer than the expected number of complaints.

Buy online. This indicates whether an insurer allows you to apply for and buy a policy completely online.

Dive deeper: Ratings methodology for life insurance

AAA Life Insurance Company was founded in 1969 by AAA, the group of motor clubs best known for emergency roadside assistance and travel services. The company offers term, whole and universal life insurance. You don’t have to be an AAA member to buy life insurance from the company, but there are some discounts for those who are.

» MORE: Compare life insurance quotes

- AAA life insurance rating

AAA Life Insurance Company earned 3 stars out of 5 for overall performance. NerdWallet’s ratings are determined by our editorial team. The scoring formula takes into account consumer experience, complaint data from the National Association of Insurance Commissioners and financial strength ratings.

» MORE: Best life insurance companies

- AAA life insurance policies

Term life insurance. AAA offers two types of term life insurance , both of which are available in 10-, 15-, 20- and 30-year terms. Members save 10% on premiums.

Traditional term life insurance. You’ll need to answer health questions and agree to a possible life insurance medical exam to qualify for this policy. Coverage amounts range from $50,000 to more than $5 million depending on your age, and you can add a return of premium rider. AAA members may be able to get discounts on their home or auto insurance by bundling with traditional term life.

Instant life insurance. ExpressTerm offers life insurance with no medical exam in most cases. You can choose $25,000 to $500,000 in coverage and apply for and buy this policy online after answering questions about your health. Coverage goes into effect right away if you’re approved.

Whole life insurance. These whole life insurance policies provide lifelong coverage and build cash value over time.

Traditional whole life insurance. You’ll need to work with an agent to apply for this policy. Coverage ranges from $5,000 to $75,000, though you may need to take a medical exam if you want $30,000 or more. An AAA membership will get you 10% off the base rate.

Guaranteed issue life insurance. AAA offers $3,000 to $25,000 of guaranteed issue life insurance , which doesn’t require a questionnaire or medical exam. Applicants ages 45 to 85 can qualify automatically, but if the insured dies during the first two years, AAA won’t pay out the full policy amount, unless the death is accidental. AAA members and their spouses are eligible for a $60 annual discount.

Universal life insurance. Coverage amounts range from $100,000 to more than $5 million. AAA offers two types of universal life insurance : LifeTime and Accumulator. The Accumulator product is geared toward people who may want to use the cash value later to supplement retirement or cover other expenses, such as their children’s college education. The LifeTime product features more guarantees, like fixed premiums.

» MORE: Best instant life insurance companies

- AAA life insurance rates

Below are monthly rates for a 20-year, $500,000 term life insurance policy from AAA. These are sample rates for a nonsmoking man and woman in excellent health — the final quote you’re offered will depend on factors like your age, health, lifestyle, occupation and driving record.

AAA non-member rates

Aaa member rates.

» MORE: Cheapest life insurance companies

- AAA customer complaints and satisfaction

Over three years, AAA has drawn more than the expected number of complaints to state regulators than expected for a company of its size, according to a NerdWallet analysis of data from the National Association of Insurance Commissioners.

- What Reddit users say about AAA life insurance

Reddit is an online forum where users share their thoughts in “threads” on various topics. The popular site includes plenty of discussion on financial subjects like life insurance, so we sifted through Reddit forums to get a pulse check on how users feel about insurers. People post anonymously, so we cannot confirm their individual experiences or circumstances.

Reddit users tend to discuss AAA auto insurance a lot more than AAA life insurance, but overall, the reviews on life insurance policies are mixed. Some Reddit users complained that they’ve received life insurance marketing materials from AAA disguised as a bill. Other users report that they were confused by the language in AAA’s quotes or policy documents.

- Questions from Reddit: Our experts answer

When I applied for AAA life insurance, the agent told me I probably wouldn’t need a physical because of my age, but now they’re saying I need a medical exam. What gives?

Many carriers offer something called simplified issue life insurance, which offers an expedited application process that bypasses the standard life insurance medical exam. Approval is typically based on a questionnaire about your health and lifestyle, as well as third-party reports like your prescription drug history and driving records.

However, you may not qualify for simplified issue life insurance if you have certain health issues. In that case, you may need to go through the typical underwriting process, which often includes an exam.

A life insurance medical exam typically takes less than an hour. A paramedical professional will often come to your home and measure your blood pressure, height and weight, and also take a blood and urine sample for lab testing.

Though a life insurance medical exam can be stressful, it may help you save money on premiums. Policies that don’t require a medical exam usually cost more and provide less coverage because insurers tend to assume that you’re a riskier applicant.

I got a letter from AAA saying I could apply for life insurance. Is life insurance worth it if I’m healthy and single with no kids?

You may not need life insurance if you don’t have anyone who depends on you financially, i.e., children, a spouse who relies on your income or a relative you care for. But even if you don’t have financial dependents, buying life insurance could make sense in some circumstances:

You don’t want your survivors to pay for your final expenses. If you’re worried your loved ones would struggle to pay for your funeral and other end-of-life expenses, life insurance can provide peace of mind.

Someone else is legally responsible for your debt. Surviving loved ones typically aren’t responsible for your debt when you die, but there are a few exceptions. For example, if your parent co-signed a private student loan, they could be on the hook if you die owing money. Obtaining a policy with a death benefit large enough to cover the debt can provide financial protection to your loved ones.

You want to have a family someday. If you expect to eventually have a family, you may want to lock in coverage while you’re relatively young. Life insurance rates tend to increase with age, as does your risk of developing health problems that could make it tough to qualify for affordable coverage. Securing a policy now could help you lock in lower rates.

- More about AAA

AAA Life Insurance Company also sells accident insurance to AAA members only, and the amount of coverage you can get depends on how long you’ve been a member. The policy covers injuries and death caused by accidents such as falling off a roof. It doesn’t cover accidents caused by extreme sports, acts of war or self-inflicted injuries like suicide or drunk driving.

AAA offers three annuity options, two with $3,000 minimum deposits and one requiring $10,000 upfront. If you’re considering an annuity, you should talk to a fee-only financial advisor to find the right option for your retirement needs.

Other AAA products include:

AAA auto insurance .

AAA homeowners insurance .

AAA renters insurance .

Boat insurance.

Flood insurance.

Motorcycle insurance.

RV insurance.

Travel insurance .

How to contact AAA

AAA’s life insurance department can be reached by:

Phone: If you have a policy with AAA, you can call 855-598-0890 on weekdays from 8 a.m. to 8 p.m. ET and Saturdays from 11 a.m. to 3 p.m. ET. Otherwise, call 888-422-7020 Monday through Thursday from 8 a.m. to 10 p.m. ET, Fridays from 8 a.m. to 8 p.m. ET and Saturdays from 9 a.m. to 3 p.m. ET.

Email: Send a message to [email protected] . For questions about filing a claim, contact [email protected] .

Live chat: Chat with a customer service representative on weekdays from 8 a.m. to 8 p.m. ET and Saturdays from 11 a.m. to 3 p.m. ET.

- Life insurance buying guide

Before you start comparing companies, choose the type of life insurance you want, such as term or whole life. Decide which life insurance riders , if any, you want the policy to include. Calculate how much life insurance you need and how long you want the coverage to last. Check that the insurers you’re considering offer the coverage you’re looking for.

When comparing rates, be sure the quotes are for the same amount of coverage over the same period of time. It’s also important to make sure the policy’s medical requirements match your needs. For example, if you want to skip the life insurance medical exam but don’t mind answering health questions, confirm that the application process for each policy you're comparing aligns with that.

Price may not be the biggest driver behind your decision to buy. Look at the number of consumer complaints each company receives, as high numbers can be a red flag about the quality of service.

For more guidance, see our life insurance buying guide .

- Methodology

Life insurance ratings methodology

NerdWallet’s life insurance ratings are based on consumer experience, complaint index scores from the National Association of Insurance Commissioners for individual life insurance, and weighted averages of financial strength ratings, which indicate a company’s ability to pay future claims. Within the consumer experience category, we consider ease of communication and website transparency, which looks at the depth of policy details available online. To calculate each insurer’s rating, we adjusted the scores to a curved 5-point scale.

These ratings are a guide, but we encourage you to shop around and compare several insurance quotes to find the best rate for you. NerdWallet does not receive compensation for any reviews. Read our editorial guidelines .

Insurer complaints methodology

NerdWallet examined complaints received by state insurance regulators and reported to the National Association of Insurance Commissioners in 2020-2022. To assess how insurers compare with one another, the NAIC calculates a complaint index each year for each subsidiary, measuring its share of total complaints relative to its size, or share of total premiums in the industry. To evaluate a company’s complaint history, NerdWallet calculated a similar index for each insurer, weighted by market shares of each subsidiary, over the three-year period. NerdWallet conducts its data analysis and reaches conclusions independently and without the endorsement of the NAIC. Ratios are determined separately for auto, home (including renters and condo) and life insurance.

In This Review . . .

- Cost of EV ownership

- How to charge an EV at home

- How to shop for an EV

- How to shop for an auto loan

- How to shop for auto insurance

- About Humana

- Compare Medicare Part D companies

- Find the right Medicare Part D prescription drug plan

- Still deciding on the right carrier? Compare Medicare Part D Plans

- About Blue Cross Blue Shield

- Compare Medicare Advantage providers

- Find the right Medicare Advantage plan

- Can I get financing for a solar panel system?

- About Aetna

- About CarePlus

- Compare Medicare Supplement Insurance companies

- About Mutual of Omaha

- Find the right Medicare Supplement Insurance plan

- Still deciding on the right carrier? Compare Medigap plans

- About Wellcare

- How to choose a Medicare Advantage plan

- Still deciding on the right carrier? Compare Medicare Advantage plans

- You're our first priority. Every time.

- What is the best home security system?

- How do home warranties work?

- What types of car-buying apps are available?

- Blue Cross Blue Shield Medicare Advantage

- Cigna Medicare Advantage

- Best Medicare Advantage companies in 2024

- Best Medicare Supplement Insurance companies

- How we found the best home security systems

- How we selected the best car-buying apps

- Best overall: Liberty Home Guard

- Where to find auto sales listings

- UnitedHealthcare Medicare Advantage

- Best for inclusive coverage: American Home Shield

- Best for high coverage limits: First American Home Warranty

- Runner-up for high coverage limits: Choice Home Warranty

- Best basic plan coverage: Old Republic Home Protection

- Best repair guarantee: 2-10 Home Buyers Warranty

- Best for pre-existing conditions: Cinch Home Services

- Other companies we considered

- Is a home warranty worth it?

- About Trupanion pet insurance

- About Hanover renters insurance

- About The Andover Companies home insurance

- About Progressive pet insurance

- About Spot pet insurance

- About Progressive renters insurance

- About Liberty Mutual pet insurance

- About Toggle renters insurance

- About Erie home insurance

- About Fetch pet insurance

- About Travelers renters insurance

- Nationwide pet insurance review

- About MetLife pet insurance

- The best pet insurance companies at a glance

- Which cellular network is best for you?

- Homeowners of America home insurance review

- 9 of the best apps to make money

- A. Personal Information We Collect, Disclose for a Business Purpose, and Sell

- Nationwide home insurance review

- Openly home insurance review

- Allstate home insurance review

- Best banks and credit unions

- About State Farm home insurance

- About Farmers home insurance

- The best pet insurance companies of 2024

- Full TurboTax review

- Chase checking accounts

- What are non-custodial crypto wallets?

- Best tax software 2024

- Kin home insurance review

- About Hartville pet insurance

- The best money-making apps

- About Pumpkin pet insurance

- State availability for Hippo home insurance

- How do expense trackers work?

- Securian Financial life insurance rating

- AAA auto insurance pros and cons

- B. Categories of Sources

- Top 7 Denver financial advisors

- The best burial insurance in September 2024

- Compare to other insurers

- Where Chubb stands out

- Northwestern Mutual life insurance rating

- AAA home insurance star ratings and availability

- New York Life insurance rating

- Guardian Life insurance rating

- Where Progressive stands out

- Where Amica stands out

- Allstate life insurance

- Where Geico stands out

- What LifeLock does and what it costs

- Where The Hanover stands out

- AAA auto insurance

- Where The Andover Companies stands out

- Progressive pet insurance plans and coverage

- TurboTax pricing

- Top brokers for forex trading

- Where Toggle stands out

- C. Why We Collect, Use, and Share California Information

- Foresters life insurance rating

- Where Erie home insurance stands out

- Fetch pet insurance plans and coverage

- Where Erie stands out

- Best affordable homeowners insurance in Michigan: Frankenmuth

- Where Travelers stands out

- Bankers Life insurance rating

- MassMutual life insurance rating

- Nationwide auto insurance coverage

- Trupanion pet insurance plans and coverage

- Hartville pet insurance plans and coverage

- Best car insurance in Colorado overall: Travelers

- How Farmers home insurance stacks up

- GoAuto insurance coverage

- Acceptance auto insurance coverage

- Liberty Mutual pet insurance plans and coverage