Enable JavaScript

Please enable JavaScript to fully experience this site. How to enable JavaScript

- Contact American

Trip insurance

How to contact our trip insurance providers.

Have questions about purchasing trip insurance or filing a claim? Trip insurance is available to residents of the U.S., Canada and Mexico and insurance providers vary by country. Choose your country of residence to contact the provider regarding benefits, coverage and other services.

Request delay / cancellation verification for trip insurance

Trip insurance is provided by Allianz Global Assistance

Contact by mail or phone

Allianz Global Assistance 9950 Mayland Drive Richmond, VA 23233 800-628-5404 (Toll-free) 804-281-5700 (Collect)

From the U.S. 800-628-5404 Collect 804-281-5700

Contact by email

Visit the Allianz Global Assistance website for more information

- Purchase trip insurance Opens another site in a new window that may not meet accessibility guidelines

- Manage an existing plan Opens another site in a new window that may not meet accessibility guidelines

- File a claim Opens another site in a new window that may not meet accessibility guidelines

- Check claim status Opens another site in a new window that may not meet accessibility guidelines

Travel insurance provided by Allianz Global Assistance

Allianz Global Assistance 700 Jamieson Parkway Cambridge, ON N3C 4N6 Canada

From Canada or U.S. 866-520-8831 Collect 519-742-9013

Daily: 24 hours

Contact by email or file a claim

Send an email

Trip insurance provided by Allianz Travel Mexico

Allianz Travel Av. Insurgentes Sur 1602 - 302 Col. Crédito Constructor CP 03940 CDMX, México

From Mexico 01-800-999-9922 From the U.S. 866-328-4280 Collect (52) 55 53 77 3860

Travel Insurance for Cuba: An Expert’s Guide for Travelers [2024]

Did you know that ALL visitors to Cuba must have proof of comprehensive insurance coverage to enter the country? It’s an entry requirement for Cuba that takes many travelers by surprise – ut with a basic understanding of Cuba travel insurance requirements, it can be easy to avoid any unexpected issues.

As locals and travel guides, we’ve navigated Cuba travel insurance requirements for years and consider ourselves experts on the latest in travel insurance plans for Cuba. Read on for the easiest (and least expensive!) way to find the travel insurance Cuba requires, plus the select few options for medical insurance to Cuba for US citizens.

This post contains affiliate links that may reward me monetarily or otherwise when you use them to make qualifying purchases – at no cost to you. As an Amazon Associate, I earn from qualifying purchases. For more information, please read our disclosure policy .

Travel Insurance for Cuba

Since 2010, proof of insurance coverage has been an entry require ment for all travelers to Cuba . If you a planning a trip to Cuba, you must make sure that you have insurance coverage for the duration of your trip.

Cuban entry requirements do not specify that you need travel insurance for Cuba—they simply require that travelers have comprehensive medical insurance coverage for Cuba. However, in almost every case, the only way to obtain comprehensive medical coverage in Cuba is through a travel insurance plan that covers medical expenses from applicable companies like Visitors Coverage or Insubuy .

Even if you have private health insurance at home, you can not assume that your home health insurance covers you in Cuba – it is very rare that domestic healthcare plans cover international travel, and even less common that they function as Cuban health insurance.

Cuba Travel 101

- Currency in Cuba: A Local’s Guide for Travelers

- How to Get Wifi in Cuba [Updated!]

- Is Cuba Safe? Updated Cuba Safety Guide

- Ultimate Cuba Travel Guide – A Local’s Advice for Travelers

Cuba Travel Insurance Coverage

Cuba does not maintain a list of accepted companies to meet their insurance, so make sure that your insurance plan shows that it covers you while in Cuba. There are very few travel insurance companies that cover travel to Cuba, unfortunately. These are the companies that we recommend:

- Visitors Coverage offers coverage for Cuba travel that is available to citizens of all countries. However, it is not currently available to residents of New York and Maryland in the United States.

- Insubuy offers coverage for Cuba travel available to citizens of all countries and states of the United States.

There are no specific requirements for types of documents that demonstrate proof of health coverage – a copy of your policy should be more than enough . There is also no specific coverage amount required for admission – as long as your policy covers medical and health expenses in Cuba, it is acceptable.

Proof of Insurance Coverage in Cuba

Travelers must have proof of insurance for Cuba when arriving in the country and should be prepared to show proof of their travel insurance policy when passing through immigration. (a hard copy or a digital copy of your plan is fine – but make sure it’s downloaded before you land !).

Immigration is not always consistent in asking visitors to present this information – I am occasionally asked for proof of health insurance for Cuba when entering Cuba, but other times it isn’t mentioned!

Regardless, you shouldn’t take a chance and arrive in Cuba without a Cuban health insurance plan that covers you, and proof of coverage. If you arrive without it, you will be forced to purchase a local policy at whatever the cost or you could be denied admission to Cuba.

What to Pack for Cuba

Check out our Ultimate Cuba Packing List to help you pack for your trip – we’re sharing exactly what to bring to Cuba and what we never travel without.

Best Cuba Travel Insurance Companies

Unfortunately, very few travel insurance companies cover travel to Cuba due to the decades-long embargo imposed on Cuba by the United States. Because of this, your go-to travel insurance provider or blanket travel insurance plans are not likely to cover your trip.

While these limitations impact all travelers, they impact travelers from the United States more than anyone else – even fewer travel insurance companies cover U.S. travelers in Cuba. Regardless of your nationality, these are some of the different companies that we recommend for travel insurance for Cuba:

Visitors Coverage

Visitors Coverage is a fantastic company with nearly 20 years of experience. Not only do they offer a variety of plans for covering your trip to Cuba, but their website is extremely user-friendly! You can get quotes in just a few minutes – it’s a breeze.

For most travelers headed to Cuba, we recommend checking Visitors Coverage travel insurance first. Visitors Coverage offers flexible and affordable travel insurance policies that cover all travelers – even travelers from the United States! – and go above and beyond the requirements for entering the country.

Note to travelers: Visitors Coverage currently does not cover travelers from the United States that are residents of New York or Maryland. Residents of other states from the U.S. are able to purchase coverage for travel to Cuba.

Insubuy is one of the few companies that provides Cuba travel insurance to travelers of all nationalities – the United States included – and doesn’t have any restrictions on travelers from different states.

Like Visitors Coverage, Insubuy offers an easy-to-use platform and helpful customer service, as well as highly competitive rates. It’s long been one of our top recommendations for travelers headed to Cuba.

Guides to Entry Requirements for Cuba

- Entry Requirements to Cuba: An Ultimate Guide

- Travelers Form for Cuba: What It Is and Where To Find It

- Cuba’s Required Tourist Visa: What It Is and How To Get It

- Travel Insurance for Cuba: Requirements and Approved Companies

Healthcare in Cuba for Tourists

Healthcare in Cuba is considered quite good, and it is readily available to all. Cuba is increasingly becoming a destination for healthcare “tourism” for those from other countries looking for more affordable yet quality procedures.

Healthcare is provided free of charge to all Cubans – but is not freely provided for foreigners. Use of most local clinics and hospitals is restricted to Cubans, meaning that tourists traveling to Cuba who happen to need medical attention during their stay are limited in where they can seek treatment.

In Havana, most foreigners seeking medical care are attended at these locations:

- Clínica Central Cira Garcia in the Miramar neighborhood

- Hospital Hermanos Ameijeiras in the Havana neighborhood of Centro Habana, right along the Malecón sea wall.

Many larger hotels and resorts provide services of doctors who can make visits to their guests or will be able to point to medical care should you need it. Travel insurance Cuba plans, including those from Visitors Coverage and Insubuy , will generally cover this even if you don’t have to leave your hotel!

Plus, even if you’re staying in a rental apartment, the host should always be able to direct you to assistance.

More Cuba Travel Guides

- 25+ Best Things To Do in Cuba

- 10 Best Cities in Cuba for Travelers

- 20 Best Places to Visit in Cuba

While Cuba doesn’t specifically require a travel insurance policy (rather than other medical insurance policies), choosing a travel insurance policy that covers health and medical expenses in case of an emergency while traveling is the best way to meet health insurance requirements.

These travel insurance for Cuba policies provide you with the coverage you need and more. Travel insurance policies also give you additional protection that can make or break your trip. Most policies include reimbursement for canceled or delayed trips, covering things like stolen travel gear in case of a robbery, and much more.

Carley Rojas Avila

Carley Rojas Avila is a bilingual travel writer, editor, content marketer, and the founder of the digital travel publications Home to Havana and Explorers Away. She is a serial expat and traveler, having visited 40+ countries and counting. Carley has written for publications like Travel + Leisure, MSN, Associated Press, Weather Channel, Wealth of Geeks, and more. Find her front row at a Bad Bunny concert, befriending street cats, and taste-testing every pizza in Havana.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Guide to American Airlines Travel Insurance

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Travel insurance can be one of the most confusing parts of booking a trip. Since many credit cards already include travel insurance, the question of whether to buy airline insurance can make sense.

Why would you pay twice for the same benefits? But, that’s the thing: Not every type of credit card covers the same travel insurance perks.

You’ll want to check if the card you use to book a flight covers a cancellation , lost baggage or an abrupt change to your travel plans — perhaps due to a medical emergency. Being prepared can save you a lot of money in the long run.

This is especially true if you cannot take a trip, which would mean forfeiting the money you spent on nonrefundable flights and hotels.

If you want maximum protection, consider your credit card insurance with an airline’s policy like from American Airlines travel insurance.

Understanding the American Airlines insurance policies can protect you on your next trip with the carrier.

American Airlines trip insurance plans

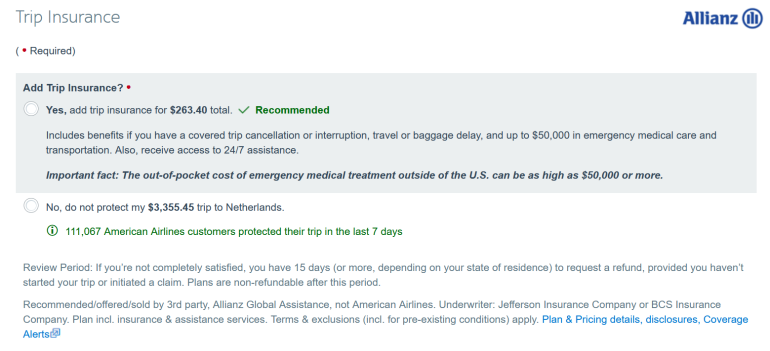

American has plans for international and domestic trips you book with the carrier, and the services are administered by Allianz Global Assistance . You’ll see the offer when completing a flight reservation on the website.

When you qualify, the policy can refund part of an itinerary or the entire purchase based on any travel costs or emergency medical expenses in case of a disruption or delay. The promotional offer you receive when booking a ticket is based on the cost of your flight. It is valid for that trip only, unlike annual or multi-trip plans that you would buy from Allianz directly.

Often, you won’t see the trip insurance policy on your American reservation, as it's sold by a third party. But keep a record of the policy information.

» Learn more: What to know before buying travel insurance

What does American Airlines travel insurance cover?

When you buy American Airlines travel insurance, you will be eligible for coverage for various travel issues like delayed or lost bags, medical expenses during the trip or if you have to cancel the trip altogether.

Some features of travel insurance can vary depending on where you live, so be sure to read the fine print.

This is what the flight insurance from American Airlines covers:

Trip cancellation and trip interruption costs. If you paid for any nonrefundable expenses and have to cancel or change your trip due to reasons like illness or injury, you’ll receive a refund for those costs. This can be especially valuable for bucket-list trips like cruise or safari vacations where you spend a lot of money. Each U.S. state sets a limit for the refund amount, so be sure to review those details.

Emergency medical transportation. If you need to be airlifted or driven a long distance to the nearest appropriate hospital or urgent care center, this would be covered by insurance. This can be pretty expensive in some remote locations, and insurance can cover the cost of a helicopter airlift if needed. The American travel insurance benefit for emergency medical transportation is as much as $50,000.

Emergency medical and dental protection. While at the hospital or urgent care facility, you may need immediate care. American Airlines trip insurance would cover up to $10,000 in medical and dental expenses for an eligible occurrence.

Travel delay. This is a valuable benefit, one covered by many credit cards. If you encounter a trip delay of at least six consecutive hours, this insurance will provide meal and accommodation reimbursements. The maximum coverage limits vary by U.S. state. Airlines have their own policies in these situations, and if traveling from the European Union or on an E.U.-based carrier to Europe, you may also be covered for additional compensation.

Lost or damaged baggage. If your baggage is lost, damaged or stolen, American Airlines travel insurance reimburses you up to $500 for your personal items.

Baggage delay. This protection covers the contents of your bag if your baggage was delayed for more than 24 hours. You’ll want to keep eligible receipts of your purchase to submit a reimbursement claim, typically up to $100 per person.

24-hour assistance. This policy would provide you with direct access to someone who can assist you with any travel-related emergencies.

Rental car collision and damage. You would be eligible for primary coverage without a deductible.

» Learn more: Best credit cards for travel insurance benefits

What isn't covered by American Airlines travel insurance?

Remember that airlines like American receive a percentage of the sale of travel insurance, so they are eager to promote it. But not all circumstances are covered. This means it is important to review the exclusions.

These are some of the situations that wouldn't be eligible for reimbursement or assistance.

Losses due to government restrictions, travel advisories or warnings (For example: If the U.S. government issues a warning not to travel somewhere).

Losses due to known, foreseeable and expected events (like a hurricane where advance warnings are available).

Epidemics, natural disasters, pollution leading to flight disruption and war.

Preexisting medical conditions.

Pregnancy, fertility treatment and childbirth.

Health issues related to alcohol or drug use.

Injury during professional or amateur sports training.

» Learn more: Airline travel insurance vs. independent travel insurance: Which is right for you?

American Airlines international travel insurance cost

The cost will vary depending on where you are going, often based on the total nonrefundable trip cost and the state where you reside.

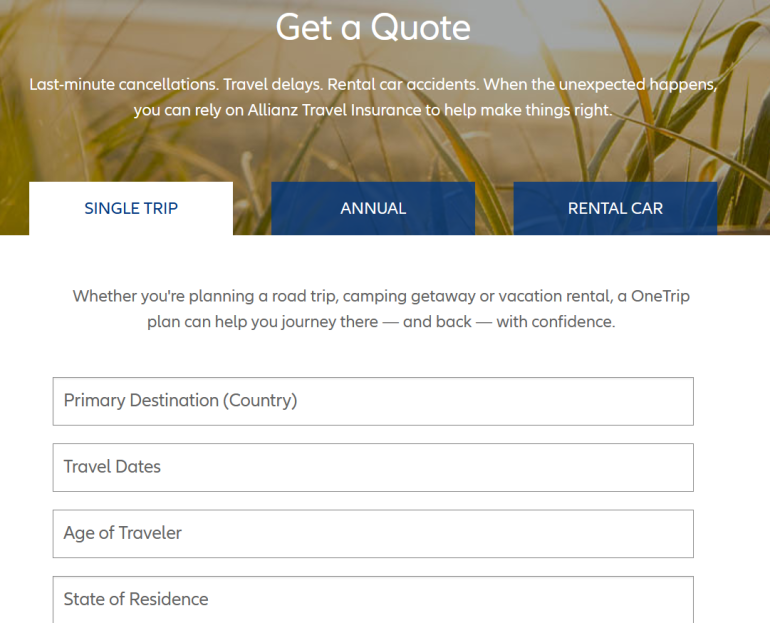

To get a more detailed idea of an American Airlines travel insurance plan, an online form calculates your trip details to give an approximate cost. After purchasing it, you have 15 days to change your mind and request a refund as long as your trip hasn't started or you haven't filed a claim.

» Learn more: The best travel insurance companies

This travel protection plan offers insurance for just one trip itinerary unless you buy an annual plan. A single trip insurance plan otherwise does not cover additional trips or mishaps that happen before or after your flight journey. It comes with protections for lost bags or emergency medical assistance, which can be helpful — especially if you don’t use a credit card to pay for the trip that has its own insurance protections. Other benefits can include trip interruption or cancellation, emergency dental care, rental car insurance and baggage delay.

You can pay for this when you purchase a flight on American’s website or any time after you buy a ticket on the Allianz website.

American travel insurance plans come underwritten by Jefferson Insurance Company or BCS Insurance Company. They use AGA Service Company as the licensed producer. These plans are recommended and sold by Allianz Global Assistance, not American Airlines.

Yes, if canceled within 15 days of purchase and your trip has not begun. If you have filed a claim, then you would not be able to cancel.

You can pay for this when you purchase a flight on American’s website or

any time after you buy a ticket

on the Allianz website.

Is American Airlines travel insurance worth it?

This will come down to your own personal risk tolerance, but with so many exclusions on the list, it may not be. That’s because you are already protected by your credit card in many instances.

If you use a card like The Platinum Card® from American Express or the Chase Sapphire Reserve® to pay for your trip, you may end up paying again on certain benefits when buying flight insurance from American.

Be sure to compare the benefits, as the amount of lost baggage or emergency medical coverage can be different for each credit card or airline.

» Learn more: The best travel credit cards right now

Buying a nonrefundable flight ticket may be one of the top reasons to consider this flight insurance, but make sure that the exclusions don’t apply to you. Also, you will want to consider your finances if you are required to cover the cost of lost bags or flights.

If not, the small added cost of insurance could be decent protection in the long run if something were to go wrong during the journey.

(Top photo courtesy of American Airlines)

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

on Citibank's application

1x Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

70,000 Earn 70,000 American Airlines AAdvantage® bonus miles after spending $7,000 within the first 3 months of account opening.

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Search Search Search …

- Search Search …

The Cuba Travel Insurance & Medical Cover Guide

Since 2010 the Cuban government has required that tourists and visitors obtain medical travel insurance before being allowed entry to the country. If you are traveling to Cuba you need to take out travel insurance for that reason alone, let alone all the other reasons for taking out travel insurance. As of 2021, it’s also been a requirement that your Cuban travel insurance provides coverage for Covid-19. In this article, we’ll cover the reasons for Cuba Travel Insurance and some of the risks of traveling to Cuba to consider before you buy your health insurance for Cuba.

THIS POST MAY CONTAIN COMPENSATED AND AFFILIATE LINKS. MORE INFORMATION IN OUR DISCLAIMER

TOP PRODUCT PICK

Travel Insurance for Cuba

Visitor’s Coverage provides medical and travel insurance for Cuba – for Americans and for international visitors.

Why Do You Need Travel Insurance for Cuba?

There are a variety of reasons why you should take out travel insurance before visiting Cuba, and for ensuring that you have proof of your Cuban travel insurance when you arrive in the country. There are limited options of companies that provide insurance cover for Cuba and any annual policies that you have *may* not cover Cuba automatically. Here are two options for travel insurance for Cuba

1. Visitors Coverage – get a price for Cuba travel insurance here

2. Civitatis insurance – get a price for travel insurance for Cuba here.

The Cuban Government Require Proof of Medical Insurance

Since May 2010 the Cuban government has required that all foreign visitors purchase travel health insurance. This rule applies to Cuban living abroad as well as foreign tourists. The reason for this is to ensure that those holidaying on the island nation have adequate medical coverage before arriving in Cuba. If you are ill and need medical assistance while you are visiting Cuba, then Cuban authorities will delay your return home until you have paid your outstanding medical bills.

You may be asked for proof of your Cuban travel and health insurance at immigration when arriving in Cuba. If you do not have this you will have to buy health insurance from the local provider, or you will be denied entry to Cuba. There is a local provider in the immigration area at Havana airport.

You can read more here about what to expect on arrival in Cuba. The other item you’ll need to enter Cuba is a Cuban eVisa or Cuban Tourist Card – read here about how to get a Cuba eVisa here.

EASIEST WAY TO GET AN EVISA

Easiest Way to Get a Cuba eVISA

Buy online, get your Cuban eVisa without needing to visit a Cuban consulate, send money to the embassy. Buy from EasyTouristCard – an approved Cuban evisa vendor. It’s quick, easy and safe. Choose standard or expedited delivery!

Why Wait? Get a quote for medical insurance in Cuba NOW from Visitors Coverage

Or the Civitatis travel insurance option is here.

The Cuban Government Requires that Travel Insurance provides Covid-19 coverage

It is a requirement of entry to Cuba that your medical insurance for your trip to Cuba also covers Covid-19 coverage. If you test positive for Coronavirus while in Cuba you will be taken to a hospital or medical center and must pay for your treatment and any medications on your discharge. This is likely to be around US$200 a day. Get a quote for medical insurance that includes Covid-19 coverage for Cuba here. Or the Civitatis travel insurance option is here.

Not all companies will cover US Citizens to travel to Cuba, check with your provider.

Get a quote for Cuba Travel and Medical Insurance here.

Read about restrictions related to Covid-19 and traveling to Cuba here.

Avoid Unforeseen Costs with Cuba Travel Insurance

If your funds are unlimited then you might not take out travel insurance, however, the avoidance of unforeseen costs is why we all buy travel insurance. It means we have the peace of mind that if something goes wrong, and there are additional costs to bear – like an emergency flight home or medical costs, or your luggage gets lost or stolen – that it’s covered and you don’t have to pay the cost yourself.

Serious Crime is low, but Robbery Can Occur

Serious crime and levels of robbery are very low when they do occur it tends to be opportunistic. It’s necessary, always, to be aware of your surroundings and protect valuables. We always travel with a portable safe and secure our valuables in it in the room when we leave. Here’s our guide to the best portable travel safes for Cuba.

Best Portable Travel Safe for Cuba

This fabulous portable travel safe is big enough for laptops, phones, cameras, and a whole lot more. It packs flat and secures to just about anything!

Our 12-litre Pacsafe can fit two laptops, two kindles and a camera, passports and money in it. We locked our valuables inside it when snorkeled and dived from beaches in Cuba (and padlocked it to a tree!) and also left it in our rooms in our Casa Particulars too.

Cuba is primarily a cash-based society

Cuba is primarily a cash-based society, ATMs do not always work for every traveler’s debit and cash cards, so tourists tend to travel with more cash than in other countries. (Read our guide to Cuban currency here .) The potential for petty theft and pickpocketing is higher because of this. Ensure that your case is safely locked away (use something like the Pacsafe for this).

Safe Drinking Water isn’t always available

The general rule in Cuba is that you should avoid drinking tap water in Cuba. While the local population may drink tap water, your stomach might not be as resilient. Tap water in Cuba is treated with chlorine to kill bacteria, so it also usually tastes a little bit like swimming pool water. Our guide to drinking water in Cuba is here

Best Filter Water Bottle For Cuba

The Lifestraw Go Water Filter Bottle has a 22-ounce capacity, it has a two-stage carbon filter that lasts for 100 liters of water and a membrane microfilter that lasts up to 4,000 liters of water. The bottle itself is reusable, extremely durable, and BPA-free.

This is the best filter water bottle for Cuba

In many parts of Cuba, it is possible to buy bottled water, if it’s available. However, we recommend using a filter water bottle – which will save the environment and your money. It’s much safer than ending up with traveler’s diarrhoea and ruining your holiday!

Cuba has a high risk of dengue fever and the Zika virus

You should take steps to avoid being bitten by mosquitoes as Cuba is classified as having a risk of dengue fever and the Zika virus. My guide and all you need to know about mosquitoes in Cuba is here. While Havana’s health facilities are better than other areas of Cuba if you need to be evacuated for medical reasons then a hospital stay can cost US$200 a day.

Best Bug Spray For Cuba

Effective bug spray deters mosquitoes, gnats, and ticks. This pump spray is good for protecting you against bugs and contains 40% DEET.

A good Cuba health insurance policy will protect you from this cost. With proof of medical insurance, Cuban authorities may also bill your insurance company directly.

Road Conditions in Cuba Can be Dire

Road conditions in parts of Cuba can be pretty dire . While there are occasional weather situations that affect this, like hurricanes, for instance, the primary reason for poor road conditions is the lack of maintenance.

In 2019 there were 29 traffic accidents per day in the first 3 months of 2019.

The main roads in Havana are generally well maintained, but smaller streets tend not to be. There’s a lack of road lighting at night and lights on vehicles aren’t always what you’ve come to expect at home. Add to that, Cuban cars tend to be very old and often in poor condition without 21 st -century safety equipment.

You’ll also find many pedestrians, farm equipment, bicycles, and horse-drawn vehicles on more rural roads – as well as areas that are unfenced and where livestock roams free.

Now you might not be renting a car (it’s quite unusual in Cuba to rent cars), but it’s likely you’ll be using transport to get around – so a car and driver or a Viazul Bus and so you will be using the roads! Read more about Cuban transport options here.

Adventure Activities Are Higher Risk

Do you plan on hiking, diving, horse-riding, or biking when you visit Cuba? These activities come with higher risks of injuries than sitting on the beach.

Flight Delays and Cancellations are possible

Hurricane season in Cuba runs from June until November, which can mean flash floods and landslides as well as the hurricane itself. If you’re caught in a Cuban hurricane, then you can expect the loss of power, communications, and water. Flights are likely to be delayed or canceled.

The Risks of Traveling to Cuba

The risks of traveling to Cuba are no different from other countries and islands in the Caribbean area. Depending on the time of year that you travel hurricanes could be an issue, but the risks of Cuban travel include, but are not limited to

- Health – dengue fever and the Zika virus are present

- Lack of safe drinking water

- Poor road conditions

- Flight cancellations and delays

- Adventure activities carry risks – like diving

- Cash society means more likelihood of opportunistic pickpocketing

Why do you need travel insurance for Cuba?

Some people never buy travel insurance and it is possible to anywhere without travel insurance, mostly, if you so choose. Apart from Cuba, where the government mandates that you must have health insurance before entering the country. You may be lucky, and you may not be asked to provide evidence of your travel insurance, but if you are asked and you don’t have it, then you’ll either have to buy it on the spot at the rates quoted, or you’ll be denied entry.

Travel insurance is there for you to pay for the unknown. The cost of hospital and doctor’s bills if you get sick, replacement items if your gear gets stolen, the cost of flying you home if you need to be repatriated, or if events with family members mean that you need to return home.

Get a quote for Cuba Travel Insurance here from Visitors Coverage. Or the Civitatis travel insurance option is here.

Do you need special travel insurance for Cuba?

Yes. Medical insurance for Cuba is required to enter the country. Cuba is usually included in the group of countries that include the USA and the Caribbean, which attract higher insurance premiums, usually due to either the higher cost of medical assistance or the difficulties of providing more advanced medical support in smaller communities.

It’s extremely important to check the small print of your policy to ensure that your policy covers you for, for instance, diving if you plan to dive.

What do you need to take into account when buying Travel Insurance for Cuba?

There are several things you need to take into consideration when buying travel insurance for Cuba. We’ve detailed these below.

The activities you plan to undertake

Cuba is a unique location to visit. You won’t necessarily find all the adventure sports and activities that you would in other Caribbean locations – but you will find boat trips, diving, snorkeling, bicycling, rock climbing, and horse riding.

If you plan to undertake any of these activities, then you need to ensure that it’s covered by your insurance.

Where you are when you take out the insurance policy

Most travel and health insurance companies only provide insurance if you are leaving on your trip from your home address. Other require that you have been resident in that country for six months or more, and you will likely also have to be registered with a local doctor.

We found this out when we started our travels in 2014 – have returned from 4 years working in the USA, we were not registered with a doctor and had been in the country 6 days not 6 months!

So if you’re already on the road or find yourself living a nomadic lifestyle I really recommend that you take a look at providers who can cover that for your holiday insurance for Cuba. You can get a quote for Cuba Medical Insurance from Visitor Coverage here.

Your age and the age of travelers on the same policy

If you’re 55 or old, then you’ll need to review your travel insurance provider. Many companies change their policies at this age and you need to ensure that you’re covered.

Pre-existing medical conditions

If you live with and are traveling with existing medical conditions then you’ll need to declare them, otherwise, if something happens related o that condition while you’re in Cuba then your insurance won’t cover it. It’s also worth checking to see if you need to declare if you’re had surgery in the last 12 months, regardless of what that surgery was before you buy your travel insurance policy.

FAQS on Cuba Travel Insurance

Got questions about travel and medical insurance for Cuba? Or want to know more about Cuban medical insurance and we haven’t answered your questions? Check out our frequently asked questions about travel insurance for Cuba below, or ask us yours in the comments.

What about Medical Insurance for Americans traveling to Cuba?

Note that if you’re a US citizen then many insurance providers will not provide cover for Cuba. Your AIRLINE ticket may cover you – please check – and retain your boarding pass for proof of coverage. Your existing health coverage may also cover you, but again, please check. There is an Asistur office at Havana airport arrivals that can sell you the insurance for around US$4.50 a day for US citizens. Get a quote for Cuba Travel Insurance here from Visitors Coverage. Or the Civitatis travel insurance option is here.

Is medical insurance for Cuba mandatory?

Yes. Travel insurance for Cuba must contain a medical insurance element. You may be denied entrance to Cuba if you’re unable to provide proof of your medical insurance.

What travel insurance do I need for Cuba?

It is the medical element of travel insurance that is required for entry to Cuba. Get a quote for Medical Insurance for Cuba here. Or the Civitatis travel insurance option is here.

What happens if I don’t have medical travel insurance when I arrive in Cuba?

If you arrive in Cuba without travel health insurance or with an invalid policy then you can buy a policy at the airport where you enter Cuba. Cuba travel health insurance that you buy at the airport is unlikely to be as comprehensive as the policy that you buy before entering the country. If you have medical bills while you are in Cuba you will NOT be allowed to leave the country until they are settled.

ESSENTIAL TIPS FOR EXPLORING CUBA INDEPENDENTLY

These are the resources and booking sites that we use when traveling to Cuba.

-Get a Cuba Travel and Medical Insurance Quote from Visitors Coverage here – Alternatively, Civitatis Insurance is a great option for the required insurance for Cuba. Read about the Cuba eVisa , and buy your Cuban eVisa here.

Flying via the USA and relying on entry with an ESTA? Read this.

Book your Viazul Bus tickets here Use Daytrip to book transport between cities AND to sightsee along the way

Pre-book and prepay shared & private shuttles here Book the best FREE Walking Tours in Cuba Reserve attractions, day trips, and activities in Cuba here Get online in Cuba EASILY with a Cuba SIM Card – prepay for a Cuba SIM card here , or read my guide to Cuba physical SIMs here.

Download and install a VPN BEFORE you travel to Cuba > discount coupon here Book Accommodation in Cuba’s Casa Particular here

Final words on Cuba Travel Insurance

We have had no issues traveling to Cuba. Our travels have taken us from Havana to Baracoa in the far west of the country. We took many buses, we hiked, we scuba dived, we snorkeled. We stayed in Casa Particulars, ate street food, drank some great Cuban cocktails, and thoroughly enjoyed ourselves in Cuba. We have traveled on endless Viazul buses, we took taxis and colectivos that ran out of fuel and spewed fumes into the car. We did, however, have a comprehensive insurance policy – and learned from other trips where we have had to claim on our insurance that it is well worth it!

Cuba’s Best is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com, amazon.co.uk, amazon.ca. Amazon and the Amazon logo are trademarks of Amazon.com, Inc. or its affiliates .

Sarah Carter

One thought on “ the cuba travel insurance & medical cover guide ”.

- 1 Comment

Thank you for this content. Very well written and helpful. Cheers from Brazil.

Comments are closed.

Privacy Overview

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Dog Insurance

- Senior Dog Insurance

- Exotic Pet Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- Cat vaccinations cost

- Dog vaccinations cost

- Dog dental cleaning cost

- Dog cataract surgery cost

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

- Best Credit Cards of 2024

- Best Credit Card Sign-Up Bonuses

- Best Instant Approval Credit Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Best Credit Cards for Bad Credit

- Best Balance Transfer Credit Cards

- Best College Student Credit Cards

- Best 0% APR Credit Cards

- Best First Credit Cards

- Best No Annual Fee Cards

- Best Travel Credit Cards

- Best Hotel Credit Cards

- Best American Express Cards

- Best Amex Delta SkyMiles Cards

- Best American Express Business Cards

- Best Capital One Cards

- Best Capital One Business Cards

- Best Chase Cards

- Best Chase Business Cards

- Best Citi Credit Cards

- Best U.S. Bank Cards

- Best Discover Cards

- Amex Platinum Card Review

- Amex Gold Card Review

- Amex Blue Cash Preferred Review

- Amex Blue Cash Everyday Review

- Capital One Venture Card Review

- Capital One Venture X Card Review

- Capital One SavorOne Card Review

- Capital One Quicksilver Card Review

- Chase Sapphire Reserve Review

- Chase Sapphire Preferred Review

- United Explorer Review

- United Club Infinite Review

- Amex Gold vs. Platinum

- Amex Platinum vs. Chase Sapphire Reserve

- Capital One Venture vs. Venture X

- Capital One Venture X vs. Chase Sapphire Reserve

- Capital One SavorOne vs. Quicksilver

- Chase Sapphire Preferred vs. Capital One Venture

- Chase Sapphire Preferred vs. Amex Gold

- Delta Reserve vs. Amex Platinum

- Chase Sapphire Preferred vs. Reserve

- How to Get Amex Pre-Approval

- Amex Travel Insurance Explained

- Chase Sapphire Travel Insurance Guide

- Chase Pay Yourself Back

- CLEAR vs. TSA PreCheck

- Global Entry vs. TSA Precheck

- Costco Payment Methods

- Chase Ultimate Rewards Guide

- Capital One Rewards Guide

- Amex Membership Rewards Guide

- All Credit Card Guides

- Raisin (SaveBetter) Interest Rates

- Citibank Savings Account Interest Rate

- Capital One Savings Account Interest Rate

- American Express Savings Account Interest Rate

- Western Alliance Savings Account Interest Rate

- Barclays Savings Account Interest Rate

- Discover Savings Account Interest Rate

- Chase Savings Account Interest Rate

- U.S. Bank Savings Account Interest Rate

- Marcus Savings Account Interest Rate

- Synchrony Bank Savings Account Interest Rate

- Ally Savings Account Interest Rate

- Bank of America Savings Account Interest Rate

- Wells Fargo Savings Account Interest Rates

- SoFi Savings Account Interest Rate

- UFB Direct Savings Account Interest Rate

- Best Savings Accounts & Interest Rates

- Best High Yield Savings Accounts

- Best 7% Interest Savings Accounts

- Best 5% Interest Savings Accounts

- Savings Interest Calculator

- Emergency Fund Calculator

- How much will $1,000 earn in a HYSA?

- How much will $10,000 make in a HYSA?

- Pros and Cons of High-Yield Savings Accounts

- Types of Savings Accounts

- Is Savings Account Interest Taxable?

- Checking vs Savings Accounts

- Average Savings by Age

- How Much Should I Have in Savings?

- How to Save Money

- Compare Best Checking Accounts

- Compare Online Checking Accounts

- Best Business Checking Accounts

- Compare Best Teen Checking Accounts

- Best Student Checking Accounts

- Best Joint Checking Accounts

- Best Second Chance Checking Accounts

- Chase Checking Account Review

- Bluevine Business Checking Review

- Amex Rewards Checking Account Review

- Best Money Market Accounts

- U.S. Bank Money Market Account

- Money Market vs. Savings Account

- How much will $10,000 make in a MMA?

- Best CD Rates

- Best 1-Year CD Rates

- Best 6-Month CD Rates

- Best 3-Month CD Rates

- 6% CD Rates

- How much will a $10,000 CD earn?

- How much will a $50,000 CD earn?

- Synchrony Bank CD Rates

- Capital One CD Rates

- Barclays CD Rates

- How To Get A Loan

- Loan Interest Calculator

- How To Prequalify for a Personal Loan

- What is a Payday Loan?

- How To Get a Loan With No Credit History

- Financial Hardship Loans

- Low-Income Personal Loans

- No Credit Check Loans

- Why Can't I Get a Loan?

- Cash Advance Apps

- All Insurance Guides

- Cuba Travel Insurance

On This Page

- KEY TAKEAWAYS

Do I need travel insurance to visit Cuba?

Our top picks for the best cuba travel insurance, cuba travel information & requirements, why should i get travel insurance for cuba, what types of coverage do i need to travel to cuba, what isn’t covered by travel insurance for a trip to cuba, how much does travel insurance for cuba cost, tips for buying the best travel insurance for cuba, faq: travel insurance for cuba, cuba travel insurance.

Travel Insurance for Trips Cuba: Tips & Safety Info

- All travelers to Cuba are required to have health insurance , but U.S. plans are not accepted.

- Comprehensive travel insurance can provide the required medical coverage and help you cover the costs of trip delays, cancellations, and lost or stolen personal items.

- Cuba does not have the same safety standards or infrastructure as the United States, so travel insurance can be extremely useful after an accident.

- Travel insurance for Cuban tourists starts at around $7 per day, but your actual costs will vary.

- Try using our online comparison tool to find the right policy for your trip. Compare all your coverage options and find the best price to suit your needs.

Our top picks for the best cuba travel insurance

- Detour Insurance: Best Value Coverage

- IMG: Best Rated for Travel Delay

- Travel Insured International: Best for Non-Medical Evac Coverage

Detour Insurance

Travel Insured International

Cuban rules require all travelers to carry medical insurance for the duration of their trip. Your U.S.-based health insurance won’t work — you’ll need to buy separate coverage. At a minimum, the policy should provide medical coverage .

Many U.S. airlines automatically add insurance to your ticket price. American Airlines and United Airlines both charge $25 for a policy that’s active for 30 days. If you’re staying longer, you’ll need to buy extra coverage.

The Cuban government doesn’t publish specific insurance requirements. As a general rule, your policy should provide coverage for emergency medical care and evacuation.

Best Value Coverage

Best rated for travel delay, why we like it.

- Purchase your plan up until one day before you depart

- Generous limits for trip delays, emergency evacuation, and more

- Pre-existing condition waiver available if purchased within 20 days of initial trip deposit

- 24/7 emergency travel assistance included

- Coronavirus-related medical expenses covered

- Plan gets notably more expensive with age

Best for Non-Medical Evac Coverage

- Travel delay coverage kicks in after just six hours

- Generous $150,000 non-medical evacuation coverage

- CFAR and IFAR coverage not included

- Baggage delay coverage only kicks in after 12 hours

- No rental car coverage

Cuban travel rules for Americans have changed several times in the last decade. Here’s a quick overview of the current requirements:

Do I need a visa or passport to visit Cuba?

Americans need a passport and a license to visit Cuba. Your passport must be valid for a minimum of 6 months from the date you land. In addition, you should have two free passport pages to accommodate entry and exit stamps.

To travel to a Cuban city directly from the United States, you must qualify for a license from the Department of Treasury’s Office of Foreign Assets Control (OFAC). If your reason for travel falls into one of 12 approved categories — including family visits, journalistic activity, educational activities, or humanitarian projects — you can travel under a general license. You don’t need to apply for this license, but you should be able to prove that you meet the requirements for the appropriate category.

Need to visit for another reason? You must apply for a specific license from OFAC. Keep in mind that American citizens are not allowed to travel to Cuba from the United States purely for tourism.

COVID-19 restrictions

The Cuban government no longer requires incoming travelers to provide proof of a COVID-19 vaccine or a negative COVID-19 test.

Is it safe to visit Cuba?

It’s safe to travel to Cuba — just make sure you take normal precautions. The U.S. Department of State gives the country a Level 2 travel advisory , largely due to the potential for petty crime.

The Cuban security situation can change quickly. To get updates, sign up for the Smart Traveler Enrollment Program (STEP). Your STEP registration also helps the government find you and provide assistance in case of an emergency. When you’re in the country, the emergency numbers are 104 (ambulance), 105 (fire), and 106 (police), and you can always call the State Department’s 24-hour line for help.

Risk of petty or violent crime

Petty crime is common in Cuba. Pickpocketing and theft of personal items are possible, both in public and in your hotel room. Use the same safety strategies you would in any major city. Don’t carry large amounts of cash, protect your wallet or bag, avoid flashy displays of wealth , and stay alert to your surroundings at all times. Theft can still happen, of course, and many travel insurance policies can reimburse you for stolen items.

Violent crime rates are low in Cuba. However, female travelers have reported incidents of harassment or assault. Stay safe by paying close attention to your drinks, staying away from isolated areas, and avoiding going out alone after dark. In the unlikely event that you’re attacked, travel insurance is critical for both treatment and repatriation to the United States.

Potential for demonstrations

You may run into demonstrations during your trip. Keep your distance — the government may respond with violence, as they did during widespread protests in 2021 . Travelers should never participate in any type of demonstration; if you’re hurt in the process, your insurance may not pay. If you’re injured accidentally, however, a travel policy can help cover the costs of medical care and transportation.

Swimming safety

When you’re accustomed to the safety standards at beaches and pools in the United States, the conditions in Cuba may come as a surprise. Lifeguards aren’t always present, and rescue services might not be equipped to offer adequate assistance. As long as you’re not participating in water activities that the insurance provider excludes, your policy can be useful after a potential injury or accident.

Poor road safety conditions

Roads in Cuba tend to be poorly maintained, especially in rural areas. Safety standards aren’t the same as in the United States; drivers may not follow expected laws or procedures, and you may see livestock wandering freely. As a result, there is a risk of getting in an accident, damaging a rental car, or experiencing delays. Choose a travel insurance policy that helps make up any costs you incur as a result.

Travel insurance for a Cuban trip usually falls into one of two categories:

Medical-based travel insurance

- Comprehensive travel insurance

Coverage can vary significantly between these policies, so it’s important to understand the difference before you buy.

These policies are designed to cover expenses for emergency medical treatment you need. It’s a good option if you need cheap travel insurance .

Most plans also provide coverage for medical evacuation. This is critical for trips to Cuba — hospitals are often underfunded, understaffed, and poorly supplied, so you may need to return home to get treatment. Because transport often happens on special medically equipped planes, it can be extremely expensive. Make sure your policy offers ample coverage.

Comprehensive travel coverage

Comprehensive travel insurance is an all-in-one option. In addition to medical coverage, it helps cover the costs in case of trip cancellation, delays, damaged personal items, and baggage loss.

Given the challenging economic conditions in Cuba and the country’s tense relations with the U.S. government, the situation on the ground can change rapidly. A comprehensive policy helps minimize your losses if something goes wrong.

Optional add-ons

Some insurance providers offer add-ons that expand your policy’s coverage. A common example is “ cancel for any reason” (CFAR) coverage . With this add-on, you can get a partial reimbursement for non-refundable trip costs — even if your reason for cancellation isn’t covered under the original policy. So, if something comes up at work or a pre-existing health condition flares up, the trip won’t be a total loss.

In most cases, your travel insurance will not cover :

- Extreme sports

- Forecasted storms or natural disasters

- Routine medical care

- Pre-existing conditions

- Traveling against the advice of government agencies

According to official sales data from Squaremouth , travel insurance for Cuba costs an average of $214.98.

Our official sales figures over the past year show that our customers paid an average of $123.35 for travel insurance to Cuba.

Cuba travel insurance is relatively expensive compared to other destinations close to the United States. We compiled a variety of quotes to help you understand what to expect. Each price below is for a 35-year-old from Illinois who’s visiting the country for 7 days at a price of $2,000.

Based on these quotes, an insurance policy for a weeklong Cuban trip costs an average of $83.52. Your actual price could be considerably higher or lower depending on factors such as:

- State of residence

- Trip length

- Number of travelers

Buying the best travel insurance is a matter of making sure you’ve got the coverage you need. While there’s no one-size-fits-all solution, we’ve put together a list of the best tips to ensure you get the right coverage for your needs.

Look at how you’re planning to travel

Some travel insurance policies only cover certain modes of transportation.

Review your planned activities

Are you planning any adventure sports during your trip? Make sure your travel insurance covers each activity. If not, look into additional high-risk coverage.

Check with your airline

When you fly on a U.S. carrier, your ticket usually includes insurance. Review the coverage limits to make sure they meet your needs

Read your credit card terms

If you booked your trip with a credit card, read the benefits statement carefully. Certain cards offer coverage for trip cancellation, delays, interruption, and lost baggage

Look into flexible coverage options

Some providers offer extra services that expand your coverage and make it easier to get reimbursed

Is travel insurance required to visit Cuba?

Yes — the country requires every tourist to have travel health insurance.

Can I use my U.S. health insurance in Cuba?

You cannot use your U.S. health insurance on a Cuban trip. Instead, you’ll need to purchase a separate policy that’s valid in Cuba.

How much is travel insurance for Cuba?

The cost of Cuba travel insurance varies based on your age, trip length, and place of residence. If you want coverage for cancellation or interruption , the policy will also account for the cost of the trip. On average, a 30-year-old can expect to pay around $83 to cover a weeklong Cuban trip.

About the Author

Imogen Sharma is an experienced writer, specializing in business, culture, and financial guidance for young adults. She has contributed to articles for Varo Bank , Lendzi , MoneyTips and Indeed , providing invaluable insights into budgeting, financial planning, and lines of credit.

As a dedicated self-employed writer, she cherishes the opportunity to share her knowledge and experience with others, offering advice so they can master their bank accounts and secure their financial futures. Her articles, published in CMSWire , Reworked , WalletGenius and The Customer , serve as actionable guides to help people make solid financial decisions.

Prior to her writing career, Imogen honed her financial acumen in management roles, excelling in P&L analysis, budgeting and HR. During her tenure at Smith & Wollensky in London, her strategic contributions contributed to a 2% increase in EBITDA over a year, demonstrating her ability to drive financial performance and organizational success.

Imogen’s writing style combines expertise with accessibility, making complex financial topics easily understandable and actionable. With a focus on the long game, she encourages readers to approach financial matters with enthusiasm and determination.

Explore related articles by topic

- All Travel Insurance Articles

- Learn the Basics

- Health & Medical

- Insurance Provider Reviews

- Insurance by Destination

- Trip Planning & Ideas

3 Best Travel Insurance Companies & Plans in 2024

The Best Travel Insurance for Seniors in 2024

Best Medical Evacuation Insurance Plans 2024

Best Cruise Insurance Plans for 2024

Best COVID-19 Travel Insurance Plans for 2024

Best Cheap Travel Insurance Companies - Top Plans 2024

Best Cancel for Any Reason (CFAR) Travel Insurance

Best Annual Travel Insurance: Multi-Trip Coverage

Best Travel Medical Insurance - Top Plans & Providers 2024

- Is Travel Insurance Worth It?

Is Flight Insurance Worth It? | Airlines' Limited Coverage Explained

Pregnancy Travel Insurance: Tips for Traveling while Pregnant

10 Romantic Anniversary Getaway Ideas for 2023

Best Travel Insurance for Pre-Existing Medical Conditions September 2024

22 Places to Travel Without a Passport in 2024

Costa Rica Travel Insurance: Requirements, Tips & Safety Info

Best Spain Travel Insurance: Top Plans & Cost

Best Italy Travel Insurance: Plans, Cost, & Tips

Best Travel Insurance for your Vacation to Disney World

Guide to Chase Sapphire Travel Insurance Benefits 2024

2024 Complete Guide to American Express Travel Insurance

Schengen Travel Insurance: Coverage for your Schengen Visa Application

Mexico Travel Insurance: Top Plans in 2024

Best Places to Spend Christmas in Mexico this December

Travel Insurance to Canada: Plans for US Visitors

Best Travel Insurance for France Vacations in 2024

Travel Insurance for Germany: Top Plans 2024

Best UK Travel Insurance: Coverage Tips & Plans September 2024

Bahamas Travel Insurance: Plans & Cost Breakdown (2024)

Europe Travel Insurance: Your Essential Coverage Guide

Trip Cancellation Insurance: Plans & Coverage Explained

What Countries Require Travel Insurance for Entry?

Philippines Travel Insurance: Coverage Requirements & Costs

Travel Insurance for the Dominican Republic: Requirements & Tips

AXA Travel Insurance Review September 2024

Best Travel Insurance for Thailand in 2024

Travel Insurance for a Trip to Ireland: Compare Plans & Prices

Best Travel Insurance for a Japan Vacation in 2024

Faye Travel Insurance Review September 2024

Travel Insurance for Brazil: Plans & Coverage 2024

Best Travel Insurance for Bali, Indonesia (2024)

Travel Insurance for Turkey: U.S. Visitor Quotes & Requirements

Travel Insurance for India: U.S. Visitor Requirements & Quotes

Australia Travel Insurance: Trip Info & Quotes for U.S. Visitors

Generali Travel Insurance Review September 2024

Travelex Travel Insurance Review for 2024

Tin Leg Insurance Review for September 2024

Travel Insured International Review for 2024

Seven Corners Travel Insurance Review September 2024

HTH WorldWide Travel Insurance Review 2024: Is It Worth It?

Medjet Travel Insurance Review 2024: What You Need To Know

Antarctica Travel Insurance: Tips & Requirements for US Visitors

Travel Insurance for Kenya: Recommendations & Requirements

Travel Insurance for Botswana: Compare Your Coverage Options

Travel Insurance for Tanzania: Compare Your Coverage Options

Travel Insurance for an African Safari: Coverage Options & Costs

Nationwide Cruise Insurance Review 2024: Is It Worth It?

The Best Hurricane Travel Insurance for 2024

AARP Travel Insurance? - Plans & Discounts for Seniors

- Travel Insurance

- Travel Insurance for Seniors

- Cheap Travel Insurance

- Cancel for Any Reason Travel Insurance

- Travel Health Insurance

- How Much is Travel Insurance?

- Is Flight Insurance Worth It?

- Anniversary Trip Ideas

- Travel Insurance for Pre-Existing Conditions

- Places to Travel Without a Passport

- Christmas In Mexico

- Europe Travel Insurance

- Compulsory Insurance Destinations

- Philippines Travel Insurance

- Dominican Republic Travel Insurance

- AXA Travel Insurance Review

- Travel Insurance for Thailand

- Ireland Travel Insurance

- Japan Travel Insurance

- Faye Travel Insurance Review

- Brazil Travel Insurance

- Travel Insurance Bali

- Travel Insurance Turkey

- India Travel Insurance

- Australia Travel Insurance

- Generali Travel Insurance Review

- Travelex Travel Insurance Review

- Tin Leg Travel Insurance Review

- Travel Insured International Travel Insurance Review

- Seven Corners Travel Insurance Review

- HTH WorldWide Travel Insurance Review

- Medjet Travel Insurance Review

- Antarctica Travel Insurance

- Kenya Travel Insurance

- Botswana Travel Insurance

- Tanzania Travel Insurance

- Safari Travel Insurance

- Nationwide Cruise Insurance Review

- Hurricane Travel Insurance

- Does AARP Offer Travel Insurance?

Policy Details

LA Times Compare is committed to helping you compare products and services in a safe and helpful manner. It’s our goal to help you make sound financial decisions and choose financial products with confidence. Although we don’t feature all of the products and services available on the market, we are confident in our ability to sound advice and guidance.

We work to ensure that the information and advice we offer on our website is objective, unbiased, verifiable, easy to understand for all audiences, and free of charge to our users.

We are able to offer this and our services thanks to partners that compensate us. This may affect which products we write about as well as where and how product offers appear on our website – such as the order in which they appear. This does not affect our ability to offer unbiased reviews and information about these products and all partner offers are clearly marked. Given our collaboration with top providers, it’s important to note that our partners are not involved in deciding the order in which brands and products appear. We leave this to our expert freelance writers who review and rate each product independently.

At LA Times Compare, our mission is to help our readers reach their financial goals by making smarter choices. As such, we follow stringent editorial guidelines to ensure we offer accurate, fact-checked and unbiased information that aligns with the needs of the Los Angeles Times audience. Learn how we are compensated by our partners.

- Group Tours

- Private Tours

- Custom Tours

- Browse All Tours

- Entrepreneurs

- Festivals & Events

- Family Travel

- Celebrations

- Solo Travel

- Affinity Groups

- Educational Groups

- Corporate Groups

- Yoga Groups

- Heritage Groups

- Photography Workshops

- Events & Conferences

- U.S.-Cuba Travel Rules

- Visa and Travel License

- Best Hotels in Cuba

- Why Visit Cuba

- When to Visit

- Where to Go

- Experience Gallery

- Meet the Cuban People

- Why Candela?

- Our Promise

- Safety First

- Meet Our Team

- Destination Specialist

- You Are Family

- Social Impact

- How to Get to Cuba

- Cuban Souvenirs: What You Can Bring Back

- The Ultimate Cuba Packing List

- Food in Cuba

- Cuba and the Art of Tobacco

- Money in Cuba

Travel Medical Insurance: Preparing For Your Trip To Cuba

Traveling to any destination requires proper planning and preparation , and Cuba is no different. An important thing to remember is that travelers to Cuba are required to have travel medical insurance upon their arrival. Obtaining travel medical insurance is easy and inexpensive.

The most common way of purchasing travel medical insurance is simply by buying your plane ticket on a commercial flight flying directly from the U.S. to Cuba . Most major U.S. airline providers like United, Delta, American Airlines and Jet Blue automatically include the cost of this insurance in your ticket price. Your boarding pass serves as proof of insurance. You will want to be sure to keep your boarding pass with you throughout your trip in the unlikely event that you need to use it. For travelers flying to Cuba from outside of the United States, ask your airline provider if travel medical insurance is included in your plane ticket.

ASISTUR is a Cuban company that organizes medical and healthcare services to travelers and provides the medical coverage that is included in most U.S. plane tickets. ASISTUR medical coverage is only valid for the dates of your stay in Cuba. This coverage is limited to emergency medical issues that may arise while in Cuba. This policy does not include non-emergency treatment or non-emergency services for pre-existing conditions. ASISTUR coverage includes general emergency medical services and procedures while in Cuba up to $25,000 as well as medical evacuation from Cuba up to $7,000. This travel medical insurance coverage is limited. In the unlikely case of an extreme medical emergency, this coverage may not be sufficient.

Travelers who wish for more coverage or who are not covered through their purchase of a plane ticket may purchase coverage from a travel insurance provider like Allianz. Click here to learn more about Allianz and its travel medical plans.

Cuba Candela travelers are well taken care of. In the unlikely case that you do need medical assistance on your trip, your Cuba Candela host will assist you. Below please note the address and contact information of the Cuban hospital for travelers, “Clinica Central Cira Garcia”.

Address: Calle 20 #4101 corner of Avenida 41, Miramar, Playa

Phone number: +53 7204-2811

Website: http://www.cirag.cu/en/

Transportation In Cuba: How To Get Around Safely

How To Connect To The Internet In Cuba

How To Use Your Mobile Phone In Cuba

Privacy overview.

IMAGES

COMMENTS

Everyone entering Cuba must have a visa and health insurance with coverage in the area. For insurance, a $25 fee is added to your ticket price. Special visa requirements apply to Cuban-born travelers, regardless of citizenship.

Top reasons to buy trip insurance. Financial reimbursement if you have to cancel or interrupt your trip due to a covered illness, injury, jury duty, and more. Emergency medical benefits in and outside the U.S. – where many personal health insurance policies (like Medicare) won’t cover you.

Have questions about purchasing trip insurance or filing a claim? Trip insurance is available to residents of the U.S., Canada and Mexico and insurance providers vary by country. Choose your country of residence to contact the provider regarding benefits, coverage and other services.

Medical Insurance. • American’s Cuba flights include the cost of specific medical insurance required by the Cuban government for all customers travelling on U.S. airlines’ flights to Cuba. Effective December 7, 2016, the Cuba Health Insurance appears in the price quote and on the ticket as tax code H3.

Just me saying I was covered by Asistur, the Cuban insurance included in the price of all US airline tickets has always resulted in me never receiving any bill. Bottom line: you are good to go with only your boarding pass and passport for all medical treatment.

Travelers must have proof of insurance for Cuba when arriving in the country and should be prepared to show proof of their travel insurance policy when passing through immigration. (a hard copy or a digital copy of your plan is fine – but make sure it’s downloaded before you land!).

What does American Airlines travel insurance cover? When you buy American Airlines travel insurance, you will be eligible for coverage for various travel issues like delayed or lost...

Visitor’s Coverage provides medical and travel insurance for Cuba – for Americans and for international visitors.

Travel insurance for Cuban tourists starts at around $7 per day, but your actual costs will vary. Try using our online comparison tool to find the right policy for your trip. Compare all your...

For travelers flying to Cuba from outside of the United States, ask your airline provider if travel medical insurance is included in your plane ticket. Most major U.S. airline providers include the cost of insurance in your ticket price. Your boarding pass serves as proof of insurance.