- Asia Pacific

- Latin America

- Middle East & Africa

- North America

- Australia & New Zealand

Mainland China

- Hong Kong SAR, China

- Philippines

- Taiwan, China

- Channel Islands

- Netherlands

- Switzerland

- United Kingdom

- Saudi Arabia

- South Africa

- United Arab Emirates

- United States

From startups to legacy brands, you're making your mark. We're here to help.

- Innovation Economy Fueling the success of early-stage startups, venture-backed and high-growth companies.

- Midsize Businesses Keep your company growing with custom banking solutions for middle market businesses and specialized industries.

- Large Corporations Innovative banking solutions tailored to corporations and specialized industries.

- Commercial Real Estate Capitalize on opportunities and prepare for challenges throughout the real estate cycle.

- Community Impact Banking When our communities succeed, we all succeed. Local businesses, organizations and community institutions need capital, expertise and connections to thrive.

- International Banking Power your business' global growth and operations at every stage.

- Client Stories

Prepare for future growth with customized loan services, succession planning and capital for business equipment.

- Asset Based Lending Enhance your liquidity and gain the flexibility to capitalize on growth opportunities.

- Equipment Financing Maximize working capital with flexible equipment and technology financing.

- Trade & Working Capital Experience our market-leading supply chain finance solutions that help buyers and suppliers meet their working capital, risk mitigation and cash flow objectives.

- Syndicated Financing Leverage customized loan syndication services from a dedicated resource.

- Employee Stock Ownership Plans Plan for your business’s future—and your employees’ futures too—with objective advice and financing.

Institutional Investing

Serving the world's largest corporate clients and institutional investors, we support the entire investment cycle with market-leading research, analytics, execution and investor services.

- Institutional Investors We put our long-tenured investment teams on the line to earn the trust of institutional investors.

- Markets Direct access to market leading liquidity harnessed through world-class research, tools, data and analytics.

- Prime Services Helping hedge funds, asset managers and institutional investors meet the demands of a rapidly evolving market.

- Global Research Leveraging cutting-edge technology and innovative tools to bring clients industry-leading analysis and investment advice.

- Securities Services Helping institutional investors, traditional and alternative asset and fund managers, broker dealers and equity issuers meet the demands of changing markets.

- Financial Professionals

- Liquidity Investors

Providing investment banking solutions, including mergers and acquisitions, capital raising and risk management, for a broad range of corporations, institutions and governments.

- Center for Carbon Transition J.P. Morgan’s center of excellence that provides clients the data and firmwide expertise needed to navigate the challenges of transitioning to a low-carbon future.

- Corporate Finance Advisory Corporate Finance Advisory (“CFA”) is a global, multi-disciplinary solutions team specializing in structured M&A and capital markets. Learn more.

- Development Finance Institution Financing opportunities with anticipated development impact in emerging economies.

- Sustainable Solutions Offering ESG-related advisory and coordinating the firm's EMEA coverage of clients in emerging green economy sectors.

- Mergers and Acquisitions Bespoke M&A solutions on a global scale.

- Capital Markets Holistic coverage across capital markets.

- Capital Connect

- In Context Newsletter from J.P. Morgan

- Director Advisory Services

Accept Payments

Explore blockchain, client service, process payments, manage funds, safeguard information, banking-as-a-service, send payments.

- Partner Network

A uniquely elevated private banking experience shaped around you.

- Banking We have extensive personal and business banking resources that are fine-tuned to your specific needs.

- Investing We deliver tailored investing guidance and access to unique investment opportunities from world-class specialists.

- Lending We take a strategic approach to lending, working with you to craft the fight financing solutions matched to your goals.

- Planning No matter where you are in your life, or how complex your needs might be, we’re ready to provide a tailored approach to helping your reach your goals.

Whether you want to invest on your own or work with an advisor to design a personalized investment strategy, we have opportunities for every investor.

- Invest on your own Unlimited $0 commission-free online stock, ETF and options trades with access to powerful tools to research, trade and manage your investments.

- Work with our advisors When you work with our advisors, you'll get a personalized financial strategy and investment portfolio built around your unique goals-backed by our industry-leading expertise.

- Expertise for Substantial Wealth Our Wealth Advisors & Wealth Partners leverage their experience and robust firm resources to deliver highly-personalized, comprehensive solutions across Banking, Lending, Investing, and Wealth Planning.

- Why Wealth Management?

- Retirement Calculators

- Market Commentary

Who We Serve

INDUSTRIES WE SERVE

Explore a variety of insights.

Global Research

- Newsletters

Insights by Topic

Explore a variety of insights organized by different topics.

Insights by Type

Explore a variety of insights organized by different types of content and media.

- All Insights

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Is the outlook for the cruise industry plain sailing?

Key takeaways

- While Baby Boomers once formed the core consumer base for the cruise industry, an increasing number of younger travelers and first-time passengers are now coming on board.

Cruise operators are investing in new hardware, including mega-ships and private destinations, to acquire new customers.

- Against a tighter consumer spending backdrop, cruise voyages — which often work out cheaper than land-based vacations — are growing in popularity.

Looking ahead, J.P. Morgan Research estimates the cruise industry will capture ~3.8% of the $1.9T global vacation market by 2028.

The cruise industry has markedly picked up speed after taking a major hit during the COVID-19 pandemic. According to the Cruise Lines International Association (CLIA), about 35.7 million passengers are expected to set sail in 2024, 6% more than in 2019. Indeed, major cruise lines have enjoyed a successful 2024 wave season — the period from January to March, when operators offer their best deals.

“An important point underscoring our more constructive view of the cruise industry post-pandemic is market share gains from the larger $1.9T global vacation market and accelerated new-to-cruise customer acquisition,” said Matt Boss, Head of Leisure and Retailing (Department Stores & Specialty Softlines) at J.P. Morgan. “Demand remains robust, with not a single historical lead indicator in the business, notably booking curve and on-board spend, signaling any softening.”

Ahead of the summer travel season, what is the outlook for the cruise industry, and what’s driving its rebound?

The cruise industry is picking up speed, with about 35.7 million passengers expected to set sail in 2024. (Source: Cruise Lines International Association)

While Baby Boomers once formed the industry's core consumer base, an increasing number of young travelers and first-time passengers are coming on board.

The number of cruise passengers is growing

The annual number of cruise passengers from 2023 to 2027 is expected to exceed pre-COVID levels.

Positive demographic shifts

In the past, Baby Boomers formed the core consumer base for the cruise industry. Today however, an increasing number of younger travelers are coming on board. According to the CLIA, 73% of Millennials and Gen X travelers say they would consider a cruise vacation. And during its first-quarter earnings call, Royal Caribbean International noted that half of its cruise customers are Millennials or younger.

This is in part due to rising affluence. “Importantly, the spending capacity of the Millennial customer has grown ~49% since 2019, with the average net worth today for an individual aged 40 or under now standing at ~$259K,” Boss observed.

Cruises are also attracting more first-time passengers. During its first-quarter earnings call, Carnival Cruise Line noted there was a healthy mix of “new-to-cruise” in its 2025 bookings to date, with the customer group increasing by over 30% versus a year ago.

Elevated product and destination offerings

Cruise operators are overhauling their offerings in order to appeal to consumers. “Key operators are investing in new hardware, notably mega-ships and private destinations. This is driving more eyeballs to the industry, accelerating new-to-cruise acquisition,” Boss said.

In April 2024, Norwegian Cruise Line placed the largest ship order in its history to meet rising demand for cruise travel. The company will receive eight new vessels between 2026 and 2036.

Investments in land-based offerings are burgeoning, too. For instance, Royal Caribbean’s private island in the Bahamas, Perfect Day at CocoCay, is expected to draw over 3 million visitors in 2024. In the same vein, Carnival Cruise Line is developing a private beach destination, Celebration Key, on Grand Bahama. Opening in 2025, it will feature five areas, each with its own distinct amenities. “Investments in such attractions provide the cruise industry with the improved ability to give customers an experience that is better able to compete with land-based alternatives,” Boss added.

“Key operators are investing in new hardware, notably mega-ships and private destinations. This is driving more eyeballs to the industry, accelerating new-to-cruise acquisition.”

Head of Leisure and Retailing (Department Stores & Specialty Softlines), J.P. Morgan

Consumers favor cruises over land-based activities

According to J.P. Morgan Research’s recent Cost of Living survey conducted in April, only 29% of respondents still have excess savings, and 45% expect to spend less in discretionary categories over the next 12 months. This illustrates an increasingly cautious spending environment even in the face of moderating inflation.

This puts cruise voyages, which often work out cheaper than land-based vacations, in good stead. “We see the consumer increasingly focused on value within discretionary categories, with the value spread between cruises and land-based alternatives standing at 25–30% today versus 10–15% pre-pandemic,” Boss noted. “Cruise lines have focused on improved experiences with no step down in quality or service despite inflation, further amplifying their value.”

Despite the tighter consumer spending environment however, both ticket and onboard prices have increased in recent months. Royal Caribbean International cited that in addition to record ticket pricing, consumer spending onboard and pre-cruise purchases continue to exceed prior years. In the same vein, Carnival Cruise Line’s onboard revenue in the first quarter of 2024 was +17.6% versus the first quarter of 2019.

Overall, the demand backdrop remains robust for the cruise industry. “We estimate that 85%+ of tickets have been booked for 2024, and the focus is turning to 2025, with bookings to date already ahead of historical levels,” Boss said. “Looking ahead, we see the industry growing revenues by high-single digits over the next five years, capturing ~3.8% of the global vacation market by 2028.”

Related insights

Leveraging cutting-edge technology and innovative tools to bring clients industry-leading analysis and investment advice.

Will rising cocoa prices trigger a chocolate crisis?

April 03, 2024

Are sweet treats about to get more expensive? Discover why cocoa prices are rising and what chocolate brands are doing to adapt.

Will the US labor market boom continue?

April 18, 2024

The U.S. labor market has remained surprisingly resilient. What’s behind the tight labor market and will it begin to tail off?

This communication is provided for information purposes only. Please read J.P. Morgan research reports related to its contents for more information, including important disclosures. JPMorgan Chase & Co. or its affiliates and/or subsidiaries (collectively, J.P. Morgan) normally make a market and trade as principal in securities, other financial products and other asset classes that may be discussed in this communication.

This communication has been prepared based upon information, including market prices, data and other information, from sources believed to be reliable, but J.P. Morgan does not warrant its completeness or accuracy except with respect to any disclosures relative to J.P. Morgan and/or its affiliates and an analyst's involvement with any company (or security, other financial product or other asset class) that may be the subject of this communication. Any opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This communication is not intended as an offer or solicitation for the purchase or sale of any financial instrument. J.P. Morgan Research does not provide individually tailored investment advice. Any opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. You must make your own independent decisions regarding any securities, financial instruments or strategies mentioned or related to the information herein. Periodic updates may be provided on companies, issuers or industries based on specific developments or announcements, market conditions or any other publicly available information. However, J.P. Morgan may be restricted from updating information contained in this communication for regulatory or other reasons. Clients should contact analysts and execute transactions through a J.P. Morgan subsidiary or affiliate in their home jurisdiction unless governing law permits otherwise.

This communication may not be redistributed or retransmitted, in whole or in part, or in any form or manner, without the express written consent of J.P. Morgan. Any unauthorized use or disclosure is prohibited. Receipt and review of this information constitutes your agreement not to redistribute or retransmit the contents and information contained in this communication without first obtaining express permission from an authorized officer of J.P. Morgan.

Copyright 2024 JPMorgan Chase & Co. All rights reserved.

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Newsletters

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- The Morning Brief

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds Rates

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Stock Comparison

- Advanced Chart

- Currency Converter

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Best Free Checking

- Student Loans

- Personal Loans

- Car insurance

- Mortgage Refinancing

- Mortgage Calculator

- Editor's Picks

- Investing Insights

- Trending Stocks

- Morning Brief

- Opening Bid

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Key trends and market analysis in the cruise industry: 2024 overview featuring carnival, celebrity, disney, norwegian cruise lines, royal caribbean, seabourn, and silversea.

Dublin, Feb. 19, 2024 (GLOBE NEWSWIRE) -- The "Key Trends in Cruises (2024)" report has been added to ResearchAndMarkets.com's offering.

The report presents an in-depth analysis of the cruise industry, highlighting the ongoing recovery and transformation influenced by the COVID-19 pandemic.

Highlights from the Research:

18% of survey respondents favor cruise holidays, signaling a steady interest in cruise tourism.

ESG considerations now play a pivotal role for 4.2% of businesses in shaping their operations in the upcoming year.

A surge in environmentally conscious consumers, with 62% expressing loyalty to brands that uphold green practices.

The Bahamas' cruise sector rebound with a 119.02% increase in sea arrivals in 2023, indicating substantial market recovery.

The report encapsulates a detailed study based on consumer surveys and industry polls that reflect the evolving preferences in cruise tourism. In the wake of significant disruptions due to global lockdowns and travel restrictions, the cruise sector is adapting to new challenges and opportunities presented in the post-pandemic landscape.

An extensive examination of Environmental, Social, and Governance (ESG) impacts reveals a growing concern among consumers regarding eco-friendly and sustainable practices. The research highlights a substantial shift in consumer loyalty towards brands that prioritize green initiatives and environmental stewardship.

The analysis extends to geographical trends, spotlighting specific regions such as The Bahamas, which witnessed a significant uptick in cruise visitation. With a comprehensive breakdown of traveler demands and flows, the study provides insights into the dynamic patterns of cruise tourism across international destinations.

Scope of Report:

Impact analysis of key market trends with a focus on ESG credentials and consumer preferences post-COVID-19.

Strategic insights into major cruise line operators and their market positioning.

Thorough analysis of M&A activities and strategic partnerships within the cruise industry.

Identification of challenges and lucrative opportunities for stakeholders in the cruise sector.

Reasons to Integrate this Report:

Gain a competitive edge with insights on the leading players in the cruise industry and the strategies they employ.

Understand the evolving demands and preferences of cruise travelers to better tailor offerings and services.

Explore the latest product developments and the reasons behind their appeal in the current market scenario.

Acquire a comprehensive understanding of the macro and micro factors impacting cruise operators today.

This comprehensive analysis provides industry stakeholders with the necessary insights to drive their business forward in the evolving landscape of cruise tourism, making it a valuable component of market intelligence resources.

A selection of companies mentioned in this report includes

Norwegian Cruise Lines

Royal Caribbean

For more information about this report visit https://www.researchandmarkets.com/r/6kg60t

About ResearchAndMarkets.com ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Christmas and New Year Offer : Single User - 20% Discount | Corporate User - 25% Discount | Regional Report - 15% Discount

Cruise Market: Global Industry Analysis and Forecast (2024-2030)

“ Christmas and New Year Offer : Single User - 20% Discount | Corporate User - 25% Discount | Regional Report - 15% Discount ”

- Request Sample

- Customization

Cruise Market Overview and Scope

Cruise Market Dynamics

Global cruise market segment analysis, regional analysis, global cruise market competitive analysis, cruise market scope : inquire before buying, cruise market, by region, cruise key players, about this report.

- INQUIRE BEFORE BUYING

Report Payment

Get call back from us.

- IT & Telecommunication

- Electronics

- Chemical & Material

- Energy & Power

- Food & Beverages

- Automotive & Transportation

- Aerospace & Defense

- Life Science

- Biotechnology

- Automation & Process Control

- Mining & Metals

- Engineering Equipment

- Medical Devices

- Consumer Goods & Services

- Semiconductor

- Aerospace and Defense

- Automation & Process Control

- Automotive And Transportation

- Consumer Goods & Services

- Energy & Power

- Food & Beverages

- Information Technology & Telecommunication

- Material & Chemical

- Mining And Metals

- Why Advertise

- Media Information

- eMagazine Archive

- eNewsletter Subscription

- Ports and Destinations

- Products and Services

View e-magazine editions

Free Magazine subscription

Subscribe to eNewsletters

Events calendar around the world

CruiseTimes media information

CruiseTimes is published three times a year and sent free of charge to cruise line executives worldwide. It is also sent to cruise-only travel agents and many other associated businesses.

CruiseTimes specialises in unbiased analysis of all business aspects of the cruise industry, including:

- Financial reporting;

- Orderbook analysis;

- Environmental impacts;

- Industry trends;

- Exclusive interviews;

- Insights on ports and destinations;

- Design trends;

- New-vessel previews and reviews; Refurbishment reviews; Marine operations; Hotel operations; Conference reports

Join CruiseTimes eNewsletter

Subscribe to cruisetimes magazine, cruise line executives only, non cruise line executives, testimonials.

‘I have just received and read the CruiseTimes Issue 23, and I would like to congratulate you with your magazine. The articles and information are always of a high quality, and so is the magazine in all other aspects.’

‘I always make time in my day to read the latest issue of CruiseTimes, quality reporting from a brilliant editorial…’

‘CruiseTimes provides the best financial analysis in the industry, by far’

‘We use information from CruiseTimes in our strategic business meetings’

‘I read CruiseTimes from cover to cover – it is really great!’

‘I would like to thank you for the magazine … Excellent job’

‘Congrats on the second issue of CruiseTimes. It is getting better and better’

Privacy Overview

Growth of the Ocean Cruise Line Industry

Worldwide, the ocean cruise industry experienced an annual passenger compound annual growth rate of 5.9% from 1990 to 2024.

While the COVID-19 pandemic brought the ocean passenger cruise industry to a standstill for nearly two years, it also prompted the accelerated retirement of numerous older ships. Simultaneously, new additions to fleets adopted a more modern and environmentally friendly approach. In 2024, passenger numbers are expected to surpass the pre-COVID levels of 2019.

Between 2023 and 2024, a total of 10 new ships, with a combined passenger capacity of 25,450, are set to be added (refer to the tables below). This influx will bring the worldwide ocean cruise passenger capacity to 673,000, spread across 360 ships. These vessels are projected to carry a total of 30.0 million passengers by the end of 2024, representing a 4.2% increase over 2023 and a 9.2% increase over 2019.

Shipbuilding Summary

Sources: Royal Caribbean Cruises, Ltd., Carnival Corporation and plc, NCL Corporation Ltd., Thomson/First Call, Cruise Lines International Association (CLIA) , The Florida-Caribbean Cruise Association (FCCA) , DVB Bank and proprietary Cruise Market Watch Cruise Pulse data.

- View Record

TRID the TRIS and ITRD database

The global cruise industry: Financial performance evaluation

The global cruise industry has experienced persistent growth dynamics over the last two decades, with an impressive rebound after the 2008 financial crisis, unlike commercial shipping. Globalization, restructurings, mergers and a diverse bundle of travel and tourism services to cater for different passenger profiles have boosted robust revenue and profitability growth. Major cruise companies deploy ambitious investment plans to expand and renew their expensive fleet with larger modern vessels of high value. The mix of funding sources to finance these capital-intensive projects is critical and exerts a direct impact on the cost of capital. The paper contributes a rigorous corporate financial performance evaluation in the cruise sector and attempts to shed light on managerial financial efficiency, capital structure options, solvency conditions and corporate value dynamics. A sample of leading cruise companies, jointly holding a dominant market position, is incorporated to empirically investigate and assess their financial, accounting and stock market performance, based on convenient financial ratios and established market metrics. The detrimental impact of the recent coronavirus pandemic on the cruise sector is also discussed. This original study attempts to bridge the relevant research gap, as past literature remains surprisingly thin on this critical topic. A set of challenging and innovative contributions is delivered for the financial performance of major cruise companies, for the first time to the authors' knowledge, in support of efficient managerial implications and recommendations.

- Record URL: https://doi.org/10.1016/j.rtbm.2020.100558

- Record URL: http://www.sciencedirect.com/science/article/pii/S2210539520301000

- Find a library where document is available. Order URL: http://worldcat.org/issn/22105395

- © 2020 Elsevier Ltd. All rights reserved. Abstract reprinted with permission of Elsevier.

- Syriopoulos, Theodore

- Tsatsaronis, Michael

- Gorila, Martha

- Publication Date: 2022-12

- Media Type: Digital/other

- Features: Appendices; Figures; References; Tables;

- Pagination: 100558

- Research in Transportation Business & Management

- Issue Number: 0

- Publisher: Elsevier

- ISSN: 2210-5395

- Serial URL: http://www.sciencedirect.com/science/journal/22105395

Subject/Index Terms

- TRT Terms: Business practices ; Cruise lines ; Finance ; Investments ; Profitability ; Tourism ; Vehicle fleets

- Subject Areas: Administration and Management; Finance; Marine Transportation;

Filing Info

- Accession Number: 01756025

- Record Type: Publication

- Files: TRIS

- Created Date: Oct 27 2020 12:25PM

- Travel, Tourism & Hospitality ›

- Leisure Travel

Cruise industry in the United States - statistics & facts

How many cruise passengers travel from the u.s. every year, what are the leading u.s. cruise companies, key insights.

Detailed statistics

Revenue of the cruises industry in the U.S. 2020-2029

Revenue growth of cruises in the U.S. 2020-2029

Employment in the cruise line operator industry in the U.S. 2023-2024

Editor’s Picks Current statistics on this topic

Number of global ocean cruise passengers 2019-2023, by source market

Number of cruise passengers from the U.S. 2016-2023

Further recommended statistics

- Premium Statistic Number of global ocean cruise passengers 2009-2027

- Premium Statistic Number of global ocean cruise passengers 2019-2023, by source market

- Premium Statistic Main global cruise destinations 2019-2023, by number of passengers

- Premium Statistic Revenue of the cruises industry in the U.S. 2020-2029

- Premium Statistic Revenue growth of cruises in the U.S. 2020-2029

- Premium Statistic Direct spending in the cruise industry in the U.S. 2021-2022, by type

- Premium Statistic Businesses in the cruise line operator industry in the U.S. 2022-2024

- Premium Statistic Employment in the cruise line operator industry in the U.S. 2023-2024

Number of global ocean cruise passengers 2009-2027

Number of ocean cruise passengers worldwide from 2009 to 2023, with a forecast until 2027 (in millions)

Number of ocean cruise passengers worldwide from 2019 to 2023, by source region (in 1,000s)

Main global cruise destinations 2019-2023, by number of passengers

Leading ocean cruise destinations worldwide from 2019 to 2023, by number of passengers (in 1,000s)

Revenue of the cruises market in the United States from 2020 to 2029 (in billion U.S. dollars)

Revenue growth of the cruises market in the United States from 2020 to 2029

Direct spending in the cruise industry in the U.S. 2021-2022, by type

Direct spending in the cruise industry in the United States in 2021 and 2022, by type (in billion U.S. dollars)

Businesses in the cruise line operator industry in the U.S. 2022-2024

Number of businesses in the cruise line operator industry in the United States in 2022 and 2023, with a forecast for 2024

Number of employees in the cruise line operator industry in the United States in 2023, with a forecast for 2024

Cruise passengers

- Premium Statistic Number of cruise passengers from North America 2016-2023

- Premium Statistic Number of cruise passengers from the U.S. 2016-2023

- Premium Statistic Growth rate of the cruise passenger volume from the U.S. 2017-2023

- Premium Statistic Cruise passenger movements at leading ports worldwide 2019-2023

- Premium Statistic Interest in taking a cruise vacation in the U.S. 2024

Number of cruise passengers from North America 2016-2023

Number of cruise passengers sourced from North America from 2016 to 2023 (in 1,000s)

Number of cruise passengers sourced from the United States from 2016 to 2023 (in 1,000s)

Growth rate of the cruise passenger volume from the U.S. 2017-2023

Year-over-year percentage change in the number of cruise passengers sourced from the United States from 2017 to 2023

Cruise passenger movements at leading ports worldwide 2019-2023

Number of cruise passenger movements at selected leading ports worldwide from 2019 to 2023 (in 1,000s)

Interest in taking a cruise vacation in the U.S. 2024

Share of adults who were interested in taking a cruise vacation in the United States from 2022 to 2024

Cruise companies

- Premium Statistic Revenue of Carnival Corporation & plc worldwide 2008-2023

- Premium Statistic Net income of Carnival Corporation & plc 2008-2023

- Premium Statistic Revenue of Royal Caribbean Cruises worldwide 1988-2023

- Premium Statistic Net income of Royal Caribbean Cruises worldwide 2007-2023

- Premium Statistic Revenue of Norwegian Cruise Line worldwide 2011-2023

- Premium Statistic Net income of Norwegian Cruise Line worldwide 2011-2023

- Premium Statistic Tour revenue of Lindblad Expeditions Holdings worldwide 2014-2023

- Premium Statistic Net income of Lindblad Expeditions Holdings worldwide 2014-2023

Revenue of Carnival Corporation & plc worldwide 2008-2023

Revenue of Carnival Corporation & plc worldwide from 2008 to 2023 (in billion U.S. dollars)

Net income of Carnival Corporation & plc 2008-2023

Net income of Carnival Corporation & plc worldwide from 2008 to 2023 (in billion U.S. dollars)

Revenue of Royal Caribbean Cruises worldwide 1988-2023

Revenue of Royal Caribbean Cruises Ltd. worldwide from 1988 to 2023 (in billion U.S. dollars)

Net income of Royal Caribbean Cruises worldwide 2007-2023

Net income of Royal Caribbean Cruises Ltd. worldwide from 2007 to 2023 (in million U.S. dollars)

Revenue of Norwegian Cruise Line worldwide 2011-2023

Revenue of Norwegian Cruise Line Holdings Ltd. worldwide from 2011 to 2023 (in billion U.S. dollars)

Net income of Norwegian Cruise Line worldwide 2011-2023

Net Income of Norwegian Cruise Line Holdings Ltd. worldwide from 2011 to 2023 (in million U.S. dollars)

Tour revenue of Lindblad Expeditions Holdings worldwide 2014-2023

Total tour revenue of Lindblad Expeditions Holdings, Inc. worldwide from 2014 to 2023 (in 1,000 U.S. dollars)

Net income of Lindblad Expeditions Holdings worldwide 2014-2023

Net income of Lindblad Expeditions Holdings, Inc. worldwide from 2014 to 2023 (in 1,000 U.S. dollars)

Consumer opinions

- Premium Statistic Key factors that would enhance the appeal of cruises in the U.S. 2024

- Premium Statistic Ideal length of time to spend on a cruise vacation in the U.S. 2024

- Premium Statistic Main cruise lines chosen by cruise travelers in the U.S. 2024

- Basic Statistic Best-rated mega-ship cruise lines by travelers worldwide 2023

- Basic Statistic Best-rated large-ship cruise lines by travelers worldwide 2023

- Basic Statistic Best-rated midsize-ship cruise lines by travelers worldwide 2023

- Basic Statistic Best-rated small-ship cruise lines by travelers worldwide 2023

- Basic Statistic Best-rated river cruise lines by travelers worldwide 2023

Key factors that would enhance the appeal of cruises in the U.S. 2024

Main factors that would enhance the appeal of cruises in the United States as of February 2024

Ideal length of time to spend on a cruise vacation in the U.S. 2024

Ideal length of time to spend on a cruise vacation according to adults in the United States as of February 2024

Main cruise lines chosen by cruise travelers in the U.S. 2024

Main cruise lines chosen by cruise travelers in the United States as of February 2024

Best-rated mega-ship cruise lines by travelers worldwide 2023

Best-rated mega-ship cruise lines by travelers worldwide as of June 2023

Best-rated large-ship cruise lines by travelers worldwide 2023

Best-rated large-ship cruise lines by travelers worldwide as of June 2023

Best-rated midsize-ship cruise lines by travelers worldwide 2023

Best-rated midsize-ship cruise lines by travelers worldwide as of June 2023

Best-rated small-ship cruise lines by travelers worldwide 2023

Best-rated small-ship cruise lines by travelers worldwide as of June 2023

Best-rated river cruise lines by travelers worldwide 2023

Best-rated river cruise lines by travelers worldwide as of June 2023

Further reports

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Cruise Line Operators in the US - Market Research Report (2014-2029)

Past 5-Year Growth

Cruise line operators in the us industry analysis.

Cruise line operators are involved in no activities outside of the deep-sea transportation of passengers to and from foreign ports across coastal waters, rivers and lakes. Demand for cruise lines comes directly from the consumers, who are affected by a slew of different factors. COVID-19 devastated the cruise line industry. To comply with both national and global health initiatives, cruises were shut down for the majority of 2020, leading to a massive decline in revenue. But elastic demand for cruises saved the industry in 2021, as pent-up consumer demand led to a two-year boom in both demand and revenue. So operators were able to return to pre-pandemic revenue levels in 2022, off the back of large-scale vaccine efforts and the opening of US economy. Consequently, revenue is expected to grow by a CAGR of 3.9% to $36.5 billion in 2024, with an anticipated 4.9% increase during the year as profit approaches 12.6%.

Trends and Insights

- Oil hikes and rising inflation are dampening the downstream demand from consumers and jamming up operations across the board. While both are expected to recover, these trends could carry over into the next period.

Pent-up demand has increased cruise bookings in the wake of the pandemic. Still, inflation has made it difficult for consumers to afford cruises.

The companies in the industry face high levels of competition from each other. Thus, new products and services, as well as marketing efforts are crucial to success.

Everything you need in one report

- Reliable market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Powerful SWOT, Porter’s Five Forces and risk management frameworks

- Online membership platform with PDF, Word, Excel and PPT exports

Industry Overview

Table of contents, methodology, market size and recent performance (2014-2029).

Industry revenue has grown at a CAGR of 3.9 % over the past five years, to reach an estimated $36.5bn in 2024.

A massive influx of pent-up demand lifted the industry in 2021

- Following a double-digit downturn in the industry in 2020, pent-up demand would propel the industry past where it was during COVID-19, eventually passing pre-pandemic levels in 2022.

- Additional trends and insights available with purchase

Industry outlook (2024-2029)

Market size is projected to grow over the next five years.

The major comeback of demand seen in the previous period is expected to level off

- The post-pandemic growth exhibited during the recovery in 2021 has run its course, and demand is set to return to a more normal rate moving forward into the next period.

Biggest companies in the Cruise Line Operators in the US

There are no companies that hold a large enough market share in the Cruise Line Operators in the US industry for IBISWorld to include in this product.

Products & Services Segmentation

Industry revenue is measured across several distinct product and services lines, including Passenger ticket sales and Onboard services sales. Passenger ticket sales is the largest segment of the Cruise Line Operators in the US.

Passenger ticket sales affected by seasonality

- Passenger tickets typically include the fare to get on the cruise, reserve a room and gain access to onboard activities, amenities, meals and entertainment. A lot of baseline activities are provided with the purchase of a ticket.

- More insights available in the full report

Unbiased research for even more industries at your fingertips

- 5000+ Industries covered

- 100+ Local analysts

- 250k+ Hours of detailed analysis

- 100k+ Subscriber community

Purchase a membership to access this industry and so much more.

Widen you competitive advantage with related industries

Competitors.

- Inland Water Transportation in the US

- Hotels & Motels in the US

Complementors

- Ship Building in the US

- Ocean & Coastal Transportation in the US

- Travel Agencies in the US

International industries

- Global Travel Agency Services

View all industries in United States

About this industry

Industry definition.

This industry provides deep-sea transportation of passengers to or from foreign ports, in coastal waters, the Great Lakes or deep seas between ports of the United States, Puerto Rico and US island possessions and protectorates.

What's included in this industry?

Purchase this report to view all major companies in this industry.

Related Terms

Industry code.

NAICS 483112 - Cruise Line Operators in the US

Performance

Get an indication of the industry's health through historical, current and forward-looking trends in the performance indicators that make or break businesses.

Analyst insights

Oil hikes and rising inflation are dampening the downstream demand from consumers and jamming up operations across the board. While both are expected to recover, these trends...

In this chapter (4)

- Current Performance

Key metrics

- Annual Revenue, Recent Growth, Forecast, Revenue Volatility

- Number of Employees, Recent Growth, Forecast, Employees per Business, Revenue per Employee

- Number of Businesses, Recent Growth, Forecast, Employees per Business, Revenue per Business

- Total Profit, Profit Margin, Profit per Business

- Revenue, including historical (2014-2023) and forecast (2024-2029)

- Employees, including historical (2014-2023) and forecast (2024-2029)

- Businesses, including historical (2014-2023) and forecast (2024-2029)

- Profit, including historical (2014-2024)

- Industry Volatility vs. Revenue Growth

- Industry Life Cycle

Detailed analysis

- Trends in supply, demand and current events that are driving current industry performance

- Expected trends, economic factors and ongoing events that drive the industry's outlook

- Factors that influence volatility in the industry

- Key success factors for businesses to overcome volatility

Products and Markets

Learn about an industry's products and services, markets and trends in international trade.

Analyst insight

In this chapter.

- Products & Services

- Major Markets

- Largest market segment and value in 2024

- Product innovation level

- Products & services segmentation in 2024

- Major market segmentation in 2024

- Trends impacting the recent performance of the industry's various segments

- Innovations in the industry's product or service offering, specialization or delivery method

- Key factors that successful businesses consider in their offerings

- Buying segments and key trends influencing demand for industry products and services

Geographic Breakdown

Discover where business activity is most concentrated in an industry and the factors driving these trends to find opportunities and conduct regional benchmarking.

Purchase this report to unlock analyst insights.

In this chapter (1)

- Business Locations

- Share of revenue, establishment, wages and employment in each state

- Share of population compared to establishments in each region in 2024

- Number and share of establishments in each state in 2024

- Number and share of revenue each state accounts for in 2024

- Number and share of wages each state accounts for in 2024

- Number and share of employees in each state in 2024

- Key success factors for businesses to use location to their advantage

Competitive Forces

Get data and insights on what's driving competition in an industry and the challenges industry operators and new entrants may face, with analysis built around Porter's Five Forces framework.

- Concentration

- Barriers to Entry

- Substitutes

- Buyer & Supplier Analysis

- Industry concentration level

- Industry competition level and trend

- Barriers to entry level and trend

- Substitutes level and trend

- Buyer power level and trend

- Supplier power level and trend

- Market share concentration among the top 4 suppliers from 2019-2024

- Supply chain including upstream supplying industries and downstream buying industries, flow chart

External Environment

Understand the demographic, economic and regulatory factors that shape how businesses in an industry perform.

The federal government maintains exclusive jurisdiction over the navigable water of the United States, including the nation's deep draft channels and harbors. This authority ...

- External Drivers

- Regulation & Policy

- Regulation & policy level and trend

- Assistance level and trend

- Demographic and macroeconomic factors influencing the industry, including Regulation & Policy and Assistance

Financial Benchmarks

View average costs for industry operators and compare financial data against an industry's financial benchmarks over time.

Fuel is one of the most significant expenses. Cruise lines reserve the right to charge per-day costs to patrons traveling on board; these can range anywhere from $5.00 to hun...

- Cost Structure

- Financial Ratios

- Profit margin, and how it compares to the sector-wide margin

- Average wages, and how it compares to the sector-wide average wage

- Largest cost component as a percentage of revenue

- Industry average ratios for days' receivables, industry coverage and debt-to-net-worth ratio

- Average industry operating costs as a share of revenue, including purchases, wages, depreciation, utilities, rent, other costs and profit in 2024

- Average sector operating costs as a share of revenue, including purchases, wages, depreciation, utilities, rent, other costs and profit in 2024

- Investment vs. share of economy

Data tables

- Industry Multiples (2017-2022)

- Industry Tax Structure (2017-2022)

- Income Statement (2017-2022)

- Balance Sheet (2017-2022)

- Liquidity Ratios (2017-2022)

- Coverage Ratios (2017-2022)

- Leverage Ratios (2017-2022)

- Operating Ratios (2017-2022)

- Cash Flow & Debt Service Ratios (2014-2029)

- Revenue per Employee (2014-2029)

- Revenue per Enterprise (2014-2029)

- Employees per Establishment (2014-2029)

- Employees per Enterprise (2014-2029)

- Average Wage (2014-2029)

- Wages/Revenue (2014-2029)

- Establishments per Enterprise (2014-2029)

- IVA/Revenue (2014-2029)

- Imports/Demand (2014-2029)

- Exports/Revenue (2014-2029)

- Trends in the cost component for industry operators and their impact on industry costs and profitability

Key Statistics

Industry data, data tables.

Including values and annual change:

- Revenue (2014-2029)

- IVA (2014-2029)

- Establishments (2014-2029)

- Enterprises (2014-2029)

- Employment (2014-2029)

- Exports (2014-2029)

- Imports (2014-2029)

- Wages (2014-2029)

How are IBISWorld reports created?

IBISWorld has been a leading provider of trusted industry research for over 50 years to the most successful companies worldwide. With offices in Australia, the United States, the United Kingdom, Germany and China, we are proud to have local teams of analysts that conduct research, data analysis and forecasting to produce data-driven industry reports.

Our analysts start with official, verified and publicly available sources of data to build the most accurate picture of each industry. Analysts then leverage their expertise and knowledge of the local markets to synthesize trends into digestible content for IBISWorld readers. Finally, each report is reviewed by one of IBISWorld’s editors, who provide quality assurance to ensure accuracy and readability.

IBISWorld relies on human-verified data and human-written analysis to compile each standard industry report. We do not use generative AI tools to write insights, although members can choose to leverage AI-based tools within the platform to generate additional analysis formats.

What data sources do IBISWorld analysts use?

Each industry report incorporates data and research from government databases, industry-specific sources, industry contacts, and our own proprietary database of statistics and analysis to provide balanced, independent and accurate insights.

Key data sources in the US include:

- US Census Bureau

- US Bureau of Labor Statistics

- US International Trade Commission

Analysts also use industry specific sources to complement catch-all sources, although their perspective may focus on a particular organization or representative body, rather than a clear overview of all industry operations. However, when balanced against other perspectives, industry-specific sources provide insights into industry trends.

These sources include:

- Industry and trade associations

- Industry federations or regulators

- Major industry players annual or quarterly filings

Finally, IBISWorld’s global data scientists maintain a proprietary database of macroeconomic and demand drivers, which our analysts use to help inform industry data and trends. They also maintain a database of statistics and analysis on thousands of industries, which has been built over our more than 50-year history and offers comprehensive insights into long-term trends.

How does IBISWorld forecast its data?

IBISWorld’s analysts and data scientists use the sources above to create forecasts for our proprietary datasets and industry statistics. Depending on the dataset, they may use regression analysis, multivariate analysis, time-series analysis or exponential smoothing techniques to project future data for the industry or driver. Additionally, analysts will leverage their local knowledge of industry operating and regulatory conditions to impart their best judgment on the forecast model.

IBISWorld prides itself on being a trusted, independent source of data, with over 50 years of experience building and maintaining rich datasets and forecasting tools. We are proud to be the keystone source of industry information for thousands of companies across the world.

Learn more about our methodology and data sourcing on the Help Center .

Frequently Asked Questions

Unlock comprehensive answers and precise data upon purchase. View purchase options.

What is the market size of the Cruise Line Operators in the US industry in United States in 2024?

The market size of the Cruise Line Operators in the US industry in United States is $36.5bn in 2024.

How many businesses are there in the Cruise Line Operators in the US industry in 2024?

There are 71 businesses in the Cruise Line Operators in the US industry in United States, which has grown at a CAGR of 4.5 % between 2019 and 2024.

Has the Cruise Line Operators in the US industry in United States grown or declined over the past 5 years?

The market size of the Cruise Line Operators in the US industry in United States has been growing at a CAGR of 3.9 % between 2019 and 2024.

What is the forecast growth of the Cruise Line Operators in the US industry in United States over the next 5 years?

Over the next five years, the Cruise Line Operators in the US industry in United States is expected to grow.

What does the Cruise Line Operators in the US in United States include?

Deep-sea passenger transportation and Ocean passenger transportation are part of the Cruise Line Operators in the US industry.

How competitive is the Cruise Line Operators in the US industry in United States?

The level of competition is moderate and steady in the Cruise Line Operators in the US industry in United States.

Turn insights into your advantage

- Instant download

- 145 analyst insights

100% money back guarantee

Leaders win with IBISWorld. Learn how.

Discover. Grow. Succeed.

More than 10,000 businesses partner with ibisworld to achieve and exceed their most ambitious goals..

Accelerate growth with the insights you need. Flexible license options for the entire team.

Cruise Industry News Annual Report and Industry Growth Forecast

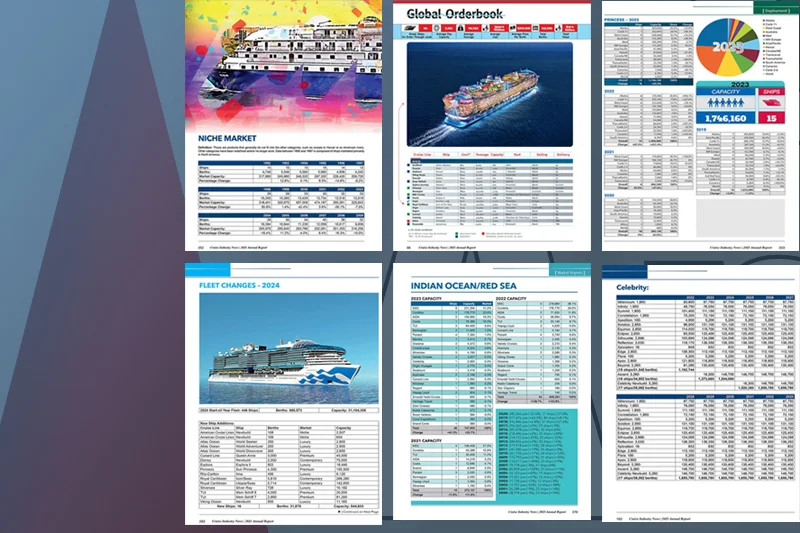

The Cruise Industry News Annual Report is the only information resource of its kind — presenting the entire worldwide cruise industry in 400 pages with cruise industry analytics and statistics , in print and PDF formats.

The 2024 Annual Report is available for order in both print and PDF formats.

About the Annual Report:

The 400-page report covers everything from new ships on order to supply-and-demand scenarios from the early 1990s through 2033.

Plus there is a future outlook through 2033 , completely independent cruise industry statistics , growth projections for each cruise line, cruise industry market reports , and detailed ship deployment by region and market, covering all the cruise lines.

Projections for capacity growth going forward take into account pandemic effects, ship delivery timeline adjustments and more.

Bought by suppliers, ports banks, financial analysts, cruise lines, and more. Useful in planning budgets and for key industry stakeholders for future forecasting.

If you are looking for a complete past, present and future global briefing on the cruise industry, look no further.

All this and more stating at $1195.

The Annual Report has been published since 1988.

Preview Pages of the Annual Report | 2024 Table of Contents

• If you are a cruise line executive: CINA gives you a total and objective overview of the industry, including profiles and growth forecasts for all the cruise lines through at least 2033.

• If you are a financial analyst : CINA gives you independent company and market growth forecasts, including supply/demand scenarios through 2033.

• If you are a port executive : CINA tells you about each line’s ship deployments in your region, and tracks the growth of each port and each sailing region.

• If you are a supplier : CINA gives you the information you need to make informed decisions about your involvement in the cruise industry.

• If you are a new supplier: CINA gives you the market intelligence and sales leads you need to target the industry.

Click here to order.

Who buys this report? Cruise lines, ports, suppliers, accounting firms, consulting companies, investment banks, think-tanks, universities and many more!

Macro Level: Big picture data and cruise industry analytics for the major and minor players, showing their footprints in 2024 and projected out through 2033.

Micro Level: Additional data includes just about everything pertaining to deployment, berth breakdown, capacity projections, historical trends and much more. 400 pages of detailed information at your fingertips.

Brand Level Data : CINA goes ship by ship, brand by brand, with data reflecting market capacity, berths, market share and more.

Ship by Ship: Every ship in the global cruise fleet is accounted for in our research, from the latest mega ships to niche expedition vessels.

Region Analysis: Each major cruise region is broken down by brand, with number of ships, projected market capacity and market shares, with past data showing trends.

Get the latest breaking cruise news . Sign up.

67 Ships | 172,156 Berths | $57.1 Billion | View

Highlights:

- Mkt. Overview

- Record Year

- Refit Schedule

- PDF Download

- Order Today

- 2033 Industry Outlook

- All Operators

- Easy to Use

- Instant Access

- Advertising

- Cruise News

- Magazine Articles

- Quarterly Magazine

- Annual Report

- Email Newsletter

- Executive Guide

- Digital Reports

Privacy Overview

IMAGES

COMMENTS

Against a tighter consumer spending backdrop, cruise voyages — which often work out cheaper than land-based vacations — are growing in popularity. Looking ahead, J.P. Morgan Research estimates the cruise industry will capture ~3.8% of the $1.9T global vacation market by 2028. The cruise industry has markedly picked up speed after taking a ...

The global cruise industry has experienced persistent growth dynamics over the last two decades, with an impressive rebound after the 2008 financial crisis, unlike commercial shipping. ... The consolidated financial statements of the sample cruise companies have been incorporated for the empirical financial analysis. These cruise companies own ...

In 2023, the number of ocean cruise passengers worldwide recovered from the impact of the health crisis, while the cruise industry's global revenue nearly caught up with pre-pandemic levels ...

Gen Z. Source: CLIA Cruise Traveler Sentiment, Perception, and Intent Survey (March 2024); cruise travelers who have cruised in the past two years. % of Cruise Travelers who Plan to Cruise Again. 84% 84% 81%. 74%. s Baby BoomersGen-XMillennials74%Gen-Z9Cruise is a global industry, with cruise.

The report presents an in-depth analysis of the cruise industry, highlighting the ongoing recovery and transformation influenced by the COVID-19 pandemic. Highlights from the Research:

The global cruise industry has experienced persistent growth dynamics over the last two decades, with an impressive rebound after the 2008 financial crisis, unlike commercial shipping. Globalization, restructurings, mergers and a diverse bundle of travel and tourism services to cater for different passenger profiles have boosted robust revenue and profitability growth.

The global cruise industry has experienced persistent growth dynamics over the last two decades, with an impressive rebound after the 2008 financial crisis, unlike commercial shipping.

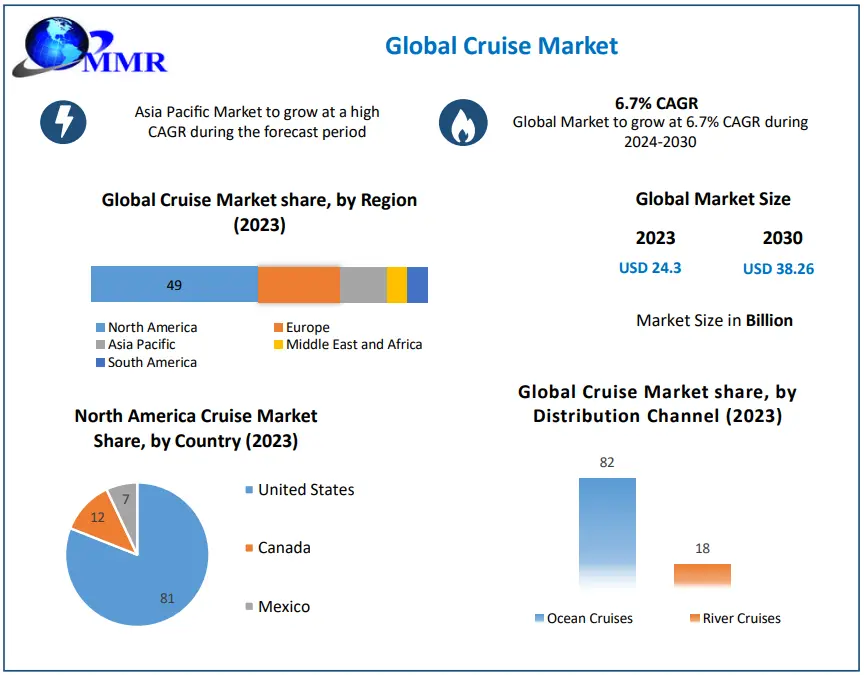

The global cruise market was valued at USD 24.3 billion in 2023 and is forecast to grow at a CAGR of 6.7% from 2024 to 2030, reaching USD 38.26 billion by 2030 Cruise Market Overview and Scope The cruise market is a thriving sector in the travel and tourism industry, offering unique experiences to global travellers.

The Cruise Industry News Annual Report 2022 is the only information resource of its kind — presenting the entire worldwide cruise industry in 400 pages with cruise industry analytics and statistics, in print and PDF formats. Click here to order. About the Annual Report: The 400-page report covers everything from new ships on order to supply-and-demand scenarios from the early 1990s through ...

Cruise Lines International Association (CLIA) has released its 2024 State of the Cruise Industry report. This year's report includes the release of 2023 passenger volume, which reached 31.7 million— surpassing 2019 by 7%.The report also shows continued demand for cruise holidays, noting intent to cruise at 82%. The forecast for cruise ...

CruiseTimes specialises in unbiased analysis of all business aspects of the cruise industry, including: Financial reporting; Orderbook analysis; Environmental impacts; Industry trends; Exclusive interviews; Insights on ports and destinations; Design trends; New-vessel previews and reviews; Refurbishment reviews; Marine operations; Hotel ...

Growth of the Ocean Cruise Line Industry. Worldwide, the ocean cruise industry experienced an annual passenger compound annual growth rate of 5.9% from 1990 to 2024. While the COVID-19 pandemic brought the ocean passenger cruise industry to a standstill for nearly two years, it also prompted the accelerated retirement of numerous older ships.

Offering cruise ship statistics for more than 30 years, Cruise Industry News is truly the only independent and objective source on industry market data and statistics. The 2018-2019 Annual Report will feature 400 pages of in-depth statistical analysis, providing an outlook of the global cruise industry through 2027. Preview Pages of the Cruise ...

The global cruise industry has experienced persistent growth dynamics over the last two decades, with an impressive rebound after the 2008 financial crisis, unlike commercial shipping. Globalization, restructurings, mergers and a diverse bundle of travel and tourism services to cater for different passenger profiles have boosted robust revenue ...

Direct spending in the cruise industry in the United States in 2021 and 2022, by type (in billion U.S. dollars) Premium Statistic Businesses in the cruise line operator industry in the U.S. 2022-2024

So operators were able to return to pre-pandemic revenue levels in 2022, off the back of large-scale vaccine efforts and the opening of US economy. Consequently, revenue is expected to grow by a CAGR of 3.9% to $36.5 billion in 2024, with an anticipated 4.9% increase during the year as profit approaches 12.6%.

In summary, a total of 24.4 million passengers were sourced from the top ten countries in 2018, up from 22.9 million in 2017. This accounts for 85 percent of global cruise passengers, virtually unchanged from last year. As indicated in Figure 5, these countries are located in all major global regions.

The 2022 Cruise Industry News Annual Report is now available in print and PDF. This 400-page resource book has supply projections through 2027 with fresh data, analysis and much more. ... • If you are a financial analyst: CINA 2022 gives you independent company and market growth forecasts, including supply/demand scenarios through 2027 ...

The Cruise Industry News Annual Report is the only information resource of its kind — presenting the entire worldwide cruise industry in 400 pages with cruise industry analytics and statistics, in print and PDF formats.. The 2024 Annual Report is available for order in both print and PDF formats.. About the Annual Report: The 400-page report covers everything from new ships on order to ...

Based on sentiment data from travelers across the globe, a significant number plan to book a future cruise. In fact, over one-third of respondents (35%) are already looking to book a future cruise ...