Mister Prakan: is it legit? my review on the Thailand Insurance.

In this article I am going to share with you my personal review about Mister Prakan , one the most famous insurance broker in Thailand. Is Mister Prakan legit? Can you trust them? I will answer those questions in this article, and I will also share my personal experience.

What is Mister Prakan?

Mister Prakan is an Insurance Brokerage located in Thailand. Their website is www.misterprakan.com and They provide general Insurance for individuals, families, companies and expatriates in Thailand.

Mr Prakan work with over 20 different insurance companies and they provide a variety of solutions: Health insurance, travel insurance, retirement, motorbike, car, condo, accident, dental insurance and so many more.

Basically Mister Prakan is a comparison site for all types of insurance. Wether you are a tourist, an expat, a digital nomad or a retiree in Thailand, their goal is to help you find the best insurance deal for Thailand .

If you want to compare the best insurance prices with Mister Prakan, click here.

My experience with Mister Prakan

I personally started to use Mister Prakan in 2020, when I moved to Thailand and I was looking for a reliable insurance, both for my health and for my motorbike.

I love to ride my motorbike, but Thailand is one of the most dangerous countries to ride a motorbike , so I started to look for a solid insurance.

I did a little bit of research online, I asked a few friends, and everything was pointing me to Mister Prakan website. So I decided to give it a go, I insert my personal details and I compared the best insurances for Thailand.

To be honest, I was very surprised to see how many options they gave me, and how many insurance companies were available on the website, from the cheapest one, to the more premium ones.

After carefully checking different options, I ended up buying an Allianz policy for my health, medical and travel insurance . And for my motorbike, I bought an LMG policy , which will cover myself, my bike and any third parties, in case of an accident.

The process was extremely smooth and efficient, I paid with my debit card online, and within few minutes I received the insurance policy via E-mail. I also had a couple of questions and I decided to ring the office and ask them directly over the phone. In case you need it, Mister Prakan phone number is +66 02 114 8159

Since then, I renewed my Allianz and LMG policies every year and I also recommended the website to many of my friends here in Thailand.

Is Mister Prakan legit?

Is Mister Prakan a legit company? should you trust them? should you buy an insurance policy from them?

As I said before, Mister Prakan is not an insurance company, but simply an insurance brokerage . The job of Mister Prakan is to compare and find the best insurance that will meet your needs here while you are in Thailand.

Once you find the right insurance for you, the policy will be stipulated directly with one of the big insurance brands, such as Allianz, Tune protect, MSIG, LMG, AXA, Pacific Cross and so on.

So I would say that there Is nothing to worry about, because your policy is with those big insurance companies.

But here comes the good part, which I personally really like. In case of emergency, it can be challenging to get in touch with those big insurance companies. But because you bought the policy through Mister Prakan, you can always contact their customer service and get additional support from them. This is why I believe is very helpful to get a broker, because you will get additional help and support in case of emergency.

So is Mister Prakan legit? my answer is yes. I have been using them for more than 2 years now and I have recommended their website to many people.

I spoke with them over the phone, I sent them several emails, I chat with them over line. And I was always very impressed with their service and professionalism.

One of my friend that also uses Mister Prakan (He has a Tune Protect policy) unfortunately had a scooter accident few months ago here in Phuket. He had to go to the hospital, and he didn’t spend a single dollar for the treatment , as everything was taken care by his insurance.

Mister Prakan Reviews

Let’s talk now about Mister Prakan reviews, because many people online are looking for legit reviews of this Insurance brokerage in Thailand.

Well, for sure this article is already one review, because I am sharing my own personal experience, which has been very positive.

Here you can find some additional reviews that I found on the internet, by looking for Mister Prakan reviews:

- “ I called many insurance companies and brokers during my search for health insurance provider. I found that Mister Prakan gave me very good insight, especially my agent (her name is Mady) who was very helpful and knowledgeable. Info I got helped me make a better decision amidst the myriads of choices out there.

That’s the beauty of going through a broker, esp. when you don’t know what provider to pick. Since brokers offer plans from many providers, they will give you info on different providers out there without preference. At least it was like that for my experience. ” – Patra Jankovic

- “ Mister Prakan is the most helpful insurance broker I’ve ever been worked with. Their follow-up and communication are very fast and accurate, an example for others ” – Tom Knevels

- “ I have many questions about the insurance product and Mister Prakan has answered all of them and made me confident about the product I was going to buy. I appreciate their help in any insurance matter, their assistance was a big help. ” – Dan Astrom

- “ Mister Prakan has helped me sort out my insurance when I first arrived in Thailand. I just applied online and sent them some requirements and they did everything for me from then on. It was quick and easy. They also help out with claims and other problems we may have and I think that’s the best part about buying through them. They’ve been really helpful. ” – Emma Vanlooy

- “ I’m always getting very professional service for my health insurance. Im always getting all the updates, replies and support that I need. ” – Leyla Mayko

Does Mister Prakan have negative reviews and feedback? I am sure it does. Every company and business in the world has customer complaints, problems and negative reviews.

But as I said before, their customer service is really good and the most important thing is that they work with BIG INSURANCE companies, which you can trust and rely on.

Mr Prakan Insurance options

Mister Prakan offers many insurance options. From health insurance, to retirement insurance, accident, dental, motorbike, car, accident, and so much more. I am going to share them all with you right now.

Travel + Medical Insurance for Thailand (the most popular)

This Insurance is ideal for tourists visiting Thailand. Travel + Health insurance for foreigners entering Thailand. You can click here to compare the price and choose the best insurance policy. I personally recommend to consider Allianz or Tune Protect , both are great.

Health Insurance (Ideal for Expats and Retiree)

This options is great for Expats living in Thailand, such as Retiree, Digital nomads and all the foreigners living in Thailand long term. You can click here to compare the best health insurance packages. After you insert your sex, age and email address, you will immediately be shown many insurance policies with different prices and packages. Pacific Cross is one of the most popular option among Retiree and expats.

Global Insurance

This option is Ideal if you are visiting different countries , and not only Thailand. This insurance will cover you all around the world. Worry free. By clicking here , Mister Prakan will ask you “where are you traveling from”, your year of birth, nationality, starting date of the Insurance and immediately you will receive a quote.

The insurance company that Mister Prakan recommends in this case is ALLIANZ GLOBAL. Is the one that I personally use and it’s great.

Motorbike Insurance Thailand

This option is ideal if you own a Scooter or Motorbike in Thailand. Be careful! because this insurance is valid only if you own the scooter or motorbike, NOT if you rent one. In case you want to rent, it’s better if you consider an “Accident Insurance” or “Travel/Medical Insurance”. I personally use LMG insurance for my motorbike and I am happy with it.

Car Insurance Thailand

This option is ideal if you own a Car or Truck in Thailand. Be careful! because this insurance is valid only if you own a Car or Truck in Thailaone, NOT if you rent one. In case you want to rent, it’s better if you consider an “Accident Insurance” or “Travel/Medical Insurance”

Accident Insurance

Personal Accident insurance is different from Health Insurance. Health Insurance will cover you for any illness or accident while Personal Accident Insurance will only cover you for accidents. In the event that the insured will suffer an accident or disability. The insurance company will give a cash benefit to the insured or to the beneficiary. Some Personal Accident Insurance policies also have cover for Medical expenses should an accident occur.

Dental Insurance Thailand

There are 6 types of coverage included in Dental coverage, please see the benefits of the dental plans below. You can click here and see all the options available for you.

Home & Condo Insurance Thailand

Home and Condo Insurance covers both structural damages to your home space and furniture and belongings inside your home. Coverage against all potential risks. This type of insurance will also provide additional coverage against burglaries and damages that are made as well as third party liabilities.

Insurance Malaysia

If you are traveling to Malaysia, Mister Prakan has a package for you.

Insurance Philippines

If you are traveling to the Philippines, Mister Prakan has a package for you.

Insurance Vietnam

If you are traveling to Vietnam, Mister Prakan has a package for you.

Insurance Indonesia

If you are traveling to Indonesia, Mister Prakan has a package for you.

Conclusions

Alright, we made it to the end of this article about Mister Prakan. Is Mister Prakan Legitimate? Should you trust them? well, I hope I have answered those questions for you.

Personally, I am a satisfied customer of Mister Prakan and I will continue to be a customer as long as I live in Thailand. Down below you can find their official website, and I sincerely hope that this article was valuable for your and provided an answer to your questions.

Official website of Mister Prakan: www.misterprakan.com

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Best Thailand Covid Insurance for Foreigners

Thailand Covid insurance is a health insurance that is mandatory for foreigners traveling to Thailand during pandemic. Just before the borders of Thailand were closed, the Thai government applied a new insurance requirement to cover COVID-19 treatment to all travelers entering Thailand.

All incoming foreign travelers must provide a health insurance policy with an insured amount of at least 10,000 USD, covering outpatient and inpatient treatment of the coronavirus type COVID-19 upon departure to Thailand. This rule came into effect on March 19, 2020.

Update! Starting from 1 July 2022 , insurance with minimum 10,000 USD coverage will NO LONGER required!

According to the Thailand Insurance Commission, COVID-19 insurance for foreigners is approved to cover travelers who pass through immigration in Thailand. The coverage should be valid for medical treatment after the diagnosis of COVID-19 infection and necessary treatment, the company should pay compensation up to 10,000 USD.

In the event of a COVID-19 illness in Thailand, health insurance should cover the costs of care and treatment by a general practitioner or specialist, the medicine prescribed by a doctor, necessary patient transport and hospitalization in a local hospital.

Thailand COVID-19 insurance policies

Health insurance policies that don’t mention the " COVID-19 " coverage may be refused. The certificate needs to state explicitly 3 conditions that the Health Insurance is for 10,000 USD or more, COVID-19 is covered and time of coverage. If your present insurance does not meet the requirements, it will not be accepted by Thai authorities and you will not be allowed to travel to Thailand.

Thailand COVID-19 insurance policy can be issued in English. If the policy is issued in another language, the policy should contain an English transcription.

Below is an example of COVID-19 Insurance Certificate

How much does Thailand COVID-19 insurance cost?

The price of Thailand COVID-19 insurance can be varying and depends on your age and how long you will be staying in Thailand. The insurance can cost anywhere from 280 THB for a 4 day stay to 100,000 THB for a yearly coverage with extra benefits.

How to buy insurance for entering Thailand?

You need to purchase COVID-19 insurance for Thailand before traveling. To find travel insurance policies that cover COVID-19 for Thailand travel is easy. There are two ways to check a health insurance policy that meets the requirements for entering Thailand:

- In person at the office of the insurance company

- Completely independently on the Internet using an online service

Keep in mind that you should also check for Coronavirus Coverage to see relevant policies and set the minimum cover to at least 10,000 USD. The purchased online and then printed insurance policy is accepted by Thai embassies or consulates.

Thai insurance companies are offering Thailand COVID-19 insurance for foreigners and the policies are tailored according to the government's requirements and therefore are accepted by Thai authorities with no trouble. Getting Thai insurance policy is easy as you can conveniently buy Thailand COVID-19 insurance online with credit card and the insurance policy and COVID-19 certificate will be sent to you instantly .

What is the best Thailand Covid insurance?

The best Thailand Covid insurance policies are listed below.

1. Sawasdee Thailand by AXA

Sawasdee Thailand is the special Covid insurance package offered by AXA Insurance . This inbound Thailand travel insurance was successfully used by thousands of travelers to enter Thailand during COVID-19 pandemic as it meets all the requirements:

- Meets 10,000 USD health insurance requirement of application for Thailand Pass

- Period from 7 days up to 180 days, for you to choose depending on visa type and duration of the trip

- Coverage starts immediately after clearing immigration in Thailand

- AXA Sawasdee Thailand is a comprehensive travel insurance covering NOT only Covid-19 medical expenses but other sicknesses, accidents and trips

- Insurance certificate including COVID-19 coverage statement is provided (this document needs to be submitted when applying for Thailand Pass)

- No waiting period, no deductible, no advance payment for hospitalization

- Large hospital network throughout Thailand and 24-hour hotline service.

The price of AXA COVID-19 insurance depends on the length of travel period, age and country of departure (Low Risk Zone, Medium Risk Zone or High Risk Zone). The price can be calculated and insurance can be purchased online here: Sawasdee Thailand .

Get AXA COVID-19 Insurance

To make sure that you are getting a good deal for COVID-19 insurance, you might wish to compare several offers .

2. Tune Protect iPass

Tune Protect Thailand is another Thai insurance company offering a very popular solution for satisfying Thailand COVID-19 insurance requirement – Tune Protect iPass . The insurance covers the entire period of stay in Thailand of the insured person. A variety of packages is offered in accordance with the insurance plans and the periods of stay in Thailand.

This Thailand inbound travel insurance policy can be easily bought online and covers COVID-19 treatment for more than 10,000 USD.

Get Tune Protect COVID Insurance

3. Allianz International COVID Insurance

Allianz International COVID-19 Insurance that fits Thailand entry requirements can also be easily purchased online via Thai insurance broker Mister Prakan .

Main benefits of Allianz International COVID Insurance for foreigners entering Thailand:

- Insurance certification for COVID-19 will be provided along with your policy so you will be able to show this to the immigration when entering Thailand.

- The policy covers the medical expenses of COVID-19 or Coronavirus as required by the Thai government for those entering Thailand.

- No waiting period. The coverage will start as soon as you leave the country of the departure point or as soon as you reach the Thai immigration points.

- Medical expenses cover, accidental cover, third-party cover, luggage insurance, 24/7 emergency assistance coverage.

Get Allianz International COVID Insurance

4. LUMA COVID Insurance

Please be noted that all COVID policies from LUMA are insured by Tune Protect Insurance therefore you should choose one of the plans from Tune Protect Insurance .

Get COVID Insurance

COVID-19 Insurance for Thais entering Thailand

Thai nationals don't need COVID-19 insurance for entering Thailand according any of the new Thailand reopening schemes.

For more detailed information in Thai, you can find here: COVID-19 Insurance for Thais entering Thailand

Cost of COVID-19 medical treatment

Diagnostics for the presence of coronavirus by PCR for foreigners in Thailand can cost from 3,000 THB to 14,000 THB, depending on where you are tested. For those who meet the PUI criteria, the government will support the cost of diagnosis (either public or private hospital).

The cost of treatment for coronavirus in hospitals in Thailand ranges from 700 USD to 1,000 USD per day, depending on the hospital. There may also be additional costs of staying in the intensive care unit (ICU). For foreigners who are positive for COVID-19 (SARS-CoV-2 infection), the cost of treatment will be covered by the health insurance package. Thai people who tested positive for COVID-19 are responsible for the cost of the treatment by themselves through their health insurance or gold card.

Others requirements to enter Thailand

Non-Thai nationals who are permitted to enter Thailand must have the following documents to enter Thailand:

- Valid visa or re-entry permit (or right to use visa exemption )

- Thailand Pass

- Health insurance policy which covers treatment and medical expenses in relation to COVID-19, with a minimum coverage of 10,000 USD

- COVID-19-Free Health Certificate with a laboratory test result indicating that COVID-19 is negative, using RT-PCR method, which has been certified or issued no more than 72 hours before departure (not required for fully vaccinated travelers from 1 April 2022)

- Confirmation of AQ Hotel booking for 5 days under Alternative Quarantine (AQ) program (only for unvaccinated travelers with no negative RT-PCR test result before travel)

General information about Medical Services in Thailand

Medical services in Thailand are some of the best in Asia so you don't have to worry about your health when you have a health insurance for treatment and related costs in case of an unforeseen situation.

There are about 400 hospitals in Thailand that are accessible to anyone and most of them offer high standard medical services. Moreover, most of the clinics with all the necessary equipment are located in large cities. In the tourist areas you will find many international clinics. In rural areas, it is still not hard to find local clinics, so basic care is definitely available everywhere. They can provide any qualified assistance and conduct an examination.

Furthermore, if you need any medications , you can buy them freely at any pharmacy at low price. Almost all medicines in Thailand are sold without a prescription.

Medical services are generally cheaper in Thailand, but the bill can add up quickly when you go to private hospitals. Bills from doctors and hospitals in Thailand must be paid immediately in cash or by credit card. You can then get the costs reimbursed in most cases if you have an appropriate insurance covering traveling abroad.

Car Insurance in Thailand – A Guide for Expats

If you're thinking of driving a car in Thailand then you'll need car insurance.

Sure, you may have heard that some locals don't take out a policy and get away with driving locally, but this is completely irresponsible and illegal.

If you're getting behind the wheel, you'll need a policy.

Thailand has a high volume of road traffic accidents and the risk of a crash is higher in certain areas than others ( 1 ).

One of the reasons the risk is high is because of sheer volume of traffic in some areas, particularly the number of motorcycles on the road that cut in and out of traffic. But it's also because of poor driving standards.

Test standards are better than they were some years ago, but there are still many people on the road who learned to drive in rural areas without formal instruction. This means lots of random lane cutting and poor signaling.

The high volume of cars in built up areas like Bangkok means that even when stationary there can be a high risk of being hit.

And so insurance is a must.

There's a ton of companies to choose from, many of which can be compared here on Mr Prakan , where you'll see the most competitive quotes.

In this post, I'll walk you through everything there is to know about car insurance in Thailand. I'll cover everything from types of insurance, must-know terms, the claims process and more.

Car Insurance Options

Insurance coverage types, policy coverage, coverage exclusions, policy pricing.

- Insurance Policy Terms

- Choosing a Company

- Making a Claim

- Applying for Insurance

- My Recommendation

Thailand has two types of car insurance:

- Compulsory Third-Party Liability Insurance

Private Insurance

Compulsory third-party liability insurance (ctpl).

Compulsory Third-Party Liability Insurance, known as Por Ror Bor, is required for all registered cars and motorcycles in Thailand under the Road Protection Act.

The policy costs approximately 650 Baht per year and provides basic coverage for death and injury resulting from a road accident.

CTPL insurance offers standard coverage of 80,000 Baht for injury and 300,000 Baht for death if the accident is not your fault. However, coverage decreases to 30,000 Baht for injury and 35,000 Baht for death if the accident is your fault.

To claim the maximum amount, a police report indicating that the accident was not your fault is required.

The insurance is renewed annually through the Department of Land Transport or a car insurance company, and most people renew it simultaneously with their annual car tax.

While this type of insurance is mandatory, those who can afford it often opt for private insurance for additional coverage on their vehicle and injury compensation.

Private Insurance provides access to professional help and greater control over the repair of your car after an accident, which is particularly beneficial in Thailand where many accidents are minor collisions.

With private insurance, a representative from the company will come to the accident scene to consult with the other party, provide assistance on next steps, and issue relevant claims documents. This saves you from getting into a dispute with the other party.

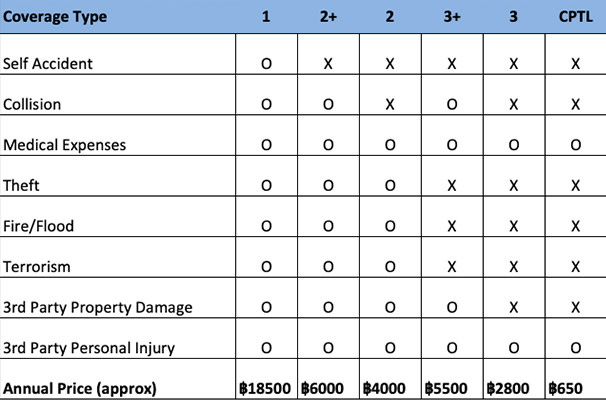

Private insurance coverage is categorized into five types: 1, 2+,2, 3+ and 3.

Type 1 is the most expensive and provides the best coverage, while Type 3 is the cheapest and provides the lowest level of coverage.

+ Get Quotes Here

Let's have a look at the different types of insurance cover in Thailand.

This is the only insurance that covers you for all accidents, including those not involving a third party.

For example, if you swerve to avoid a dog and crash your car or accidentally reverse into a post while parking, these accidents will be covered. Depending on the policy, you may or may not have to pay an excess of 1,000 Baht or more.

Generally, this type of insurance is available for cars less than seven years old, but it is still possible to obtain it for an older car in good repair and without any major accident history.

Type 2+ is similar to Type 1 insurance but does not cover non third party accidents like Type 1.

Additionally, unlike Type 1 insurance, which typically sends your car for repairs at official garages, Type 2+ insurance usually sends cars to independent garages.

Type 2 insurance is similar to Type 2+ but does not come with collision coverage. Type 2+ is widely preferred for this reason. Very few insurance companies offer Type 2 now.

Type 3+ insurance provides road accident protection, collision coverage, and third party property damage, but does not cover theft, fire, flood, and terrorism.

Type 3 is a popular insurance for low value cars. It's very basic, covering only medical expenses and third-party liability.

For a newer car like this Honda, you will want to get Type 1 insurance.

Let's have a look at some of the specific aspects of a policy and which type of insurance covers each.

Type 1, 2+, and 3+ insurance usually offer collision coverage.

This covers the cost of repairing your car as long as the damage is caused by a collision with another car.

The key difference between policies is usually where the car is fixed. A more expensive plan will allow you to take a car to the official dealer, whereas a cheaper plan will mean going to an independent garage.

When a car is written off (deemed irreparable), you will usually be offered 70-100% of the insurance payout limit, depending on the finer details of your policy.

Medical Expenses

All the aforementioned insurance types cover medical expenses incurred by a road accident. The coverage is usually similar across all types, and usually lower if you cause the accident.

The insurance company will require a medical receipt, unless you attend a partner hospital, in which case they will liaise directly with the hospital.

You also have the option to use your car insurance, health insurance, or family insurance policy to cover your medical expenses after a car accident.

Types 1, 2+ and 2 all cover theft, but remember that personal responsibility is a factor when a claim is being processed. For example: if you forget to lock your car and get burgled, you may receive a lower payout.

Flood damage related to accidental, as in a flash flood that swamps your car. Don't expect to be compensated if you drive through floodwaters. You'll see a lot of people make this mistake during rainy season. Similarly, you can't torch your car and claim it was subject to a fire.

Like theft, Types 1, 2 and 2+ cover fire and flood damage.

3rd Party Property Damage

3rd Party Property Damage covers the opposing party in the accident. Type 3 insurance, for example, covers the third party but not you. So you pay for your own damage but not the other person's damage.

3rd Party Personal Injury

All the insurance types, including Compulsory Third-Party Liability Insurance, have 3rd Party Personal Injury coverage. So you can claim compensation if a car hits you when walking down the street.

You may already have this coverage on other policies such as your medical insurance policy.

Equally important to knowing what's covered is to know what's excluded.

These are standard exclusions you'll find with insurance companies back home, but you should be aware that these also apply in Thailand.

- Driver’s License: You will not be insured if you don't have a driver's license.

- Drunk Driving: If your blood alcohol concentration (BAC) is more than 50mg, you are considered drunk (according to Thai law). This will invalidate your insurance claim.

- Unauthorized Driver: Depending on your policy, you may be authorized to have other drivers on the insurance. However, if the person isn't listed or automatically covered, your insurance will be invalidated.

- Incorrect Purpose: a car is to be used for a specific purpose; that is transporting the allowed number of people in a safe manner. So don't carry more passengers than the vehicle should, install an NGV or LPG gas systems without giving notification, or do something silly like strap a fridge to the top of the car when you move home.

- Leaving the Scene of an Accident: This is considered a crime in Thailand, and you won't get your insurance payout either. Always stop in the event of an accident.

- War: If your car is damaged by an act of war, or even a street protest, it's likely that you won't be covered.

Of course policies differ considerably in price. The price is dependent on numerous factors such as whether the garage sends the car to a dealership or independent garage.

Some policies offer deductibles, too, and then there are no-claims bonuses, excesses, and driver specification choices.

Below is a table that provides a visual overview of what's included in each insurance type, and an estimate of what an average policy might cost.

Insurance Policy Terms You Should Know

An excess is a fixed amount that you agree to pay out of your own pocket when making a claim.

The excess is usually waived if the accident wasn't your fault but is enforced when no third party is involved.

In Thailand, excess usually starts at 1,000 Baht. In general, the higher the excess, the lower the insurance premium.

A deductible is often confused with an excess, but it's a fixed amount that you agree to pay the insurer whenever you make a claim, and it's never waived. Unlike an excess, which may be waived if the accident wasn't your fault, a deductible always applies.

The good thing about a deductible is that it can considerably lower the cost of your insurance. For example, a 20,000 Baht policy might be reduced to 13,000 Baht if you have a deductible of 3,000 Baht.

A deductible usually applies to major accidents and not claims for minor damage such as scratches caused by a tree.

Note that the word for excess and deductible is the same in Thai and is therefore often confused by policyholders and insurance representatives.

As with all aspects of a policy, it's important to read the small print to make sure you understand your excess/deductible clause.

No-Claims Bonus

The no-claims bonus may be called a “bonus,” but it heavily favors the insurer.

It rewards you for not claiming by lowering your annual premium, but this in turn discourages people from making claims due to the fear of increasing the cost of their premium. Drivers end up paying to fix their own car so that they don't see a rise in their premium.

If you have a no-claims bonus in Thailand, you will receive a discounted premium. To be eligible for the bonus, you need to have driven for a minimum of one year without making any claims.

Dealership Vs. Independent Garage

If you have bought a new car in the last 5 years, you may want all repair work to be done at an official dealership. This will result in a more expensive premium. It may also mean a longer wait time to get your car fixed because dealerships are fewer in number, particularly in rural areas.

The key benefits of a dealership are:

- Fully qualified mechanics

- Genuine parts

- Warranty guaranteed work

Independent garages are hit and miss. Find a good one and keep it for life, but find a bad one and it could cost you. Stories of sub-quality parts being used, bad paint jobs, and temporary fixes are not hard to come by online.

I would argue that it is worth paying a little extra on your premium for the dealership option.

That said, the benefits of an independent garage are:

- Easier to find one in a remote area

- Faster turnaround times

- Cheaper labour, keeping your insurance premium lower

Driver Specification

This refers to specifying the names of the drivers on the policy.

If you have a maximum of two named people on the policy, you can save up to 20% (based on age and history), as opposed to a policy where anyone can drive the car who is legally fit to do so.

Pay Per Use

As the title suggests, this is a pay as you go car insurance option.

A company called Thaivivat introduced this concept. Vehicle usage is covered for a specific number of hours such as 144 hours for 30 days, or 600 hours for 108 day.

This is an option that suits those who only drive for a few hours each day. The pricing is lower than an average insurance policy but you can only use your car for a specified – usually 3 or 5 – number of hours per day.

This sounds like a good option but in reality it can be a hassle. You have to turn on an app before driving so that the company can monitor usage. You turn the app off when you finish.

If you are driving in a rural area and have no internet signal, you would have to call and notify the company of when you want to drive.

As with all insurance polices, there are extras that you can add-on for coverage outside of the regular items. These may include the following:

- Compensation for stolen goods

- Coverage for a loan car

- Additional medical care

- Coverage for travel expenses incurred as a result of an accident

Probably Type 3 Insurance for this old boy.

Choosing Your Insurance Company

There are over 20 car insurance companies in Thailand, each advertising different benefits with their policies.

As with all types of insurance, it can be a minefield wading through websites to find out which is best suited to your situation,

In addition, if you look on the web for reviews you will always find contrasting experiences from company to company. The same is true for Internet providers and utility companies.

In reality, being in a foreign country like Thailand, it is wise to go for a company that you have real confidence in, even if it means paying a little bit more.

Here are a few things you should consider:

In your home country you might be inclined to choose a small independent company that offers better rates due to smaller business overheads. In Thailand, however, it's probably a better idea to go with the brand name that you have heard of before and possibly seen commercially advertised.

If the company has been in business for 20 years as opposed to two or three, then it's probably a safer bet, even if a tad more expensive.

Customer Service

If you want to know the level of customer service that you can expect from a company in the event of a claim, then give them a call prior to taking out the policy and ask a few questions.

If the person on the other end of the phone is patient with you and goes the extra mile to help you out, that's a good indication of what you can expect going forward.

If your Thai isn't very good, then you will want to find a company that has English speaking customer support. The last thing you want in the event of a claim is to have to battle through a language barrier.

This is why I recommend Mr Prakan ; because they have excellent English-speaking support.

Nearby Garage

If you live in a fairly remote area, then it may be worth looking at your options for garages before taking out a policy.

If you have a brand-new Toyota from a local dealership, then you will obviously be taking out insurance that would allow you to get your car fixed at that garage.

Conversely, if you have an old pickup truck, you may want to check which insurance companies your local independent company deals with.

Insurance Companies

The following are well-known, reputable insurance companies:

- Bangkok Insurance

- Tokio Marine

- and Asia Insurance

In addition, a number of well-known banks offer car insurance, including Thanachart , SCB, Kasikorn, Krungsri, and TMB.

Smaller car insurances companies include:

+ Get Quotes On Mr Prakan

How to Make a Claim

If the worst happens and you have a road accident, the first thing you should do is call the insurance company and speak to a representative. The company will send out a representative to you at the scene.

Get out of your car and take photos from a number of angles, showing your license plate from both the front and rear of the vehicle.

Don't attempt to move the car, and stand well clear if there is oncoming traffic.

If it is a minor accident, then there is no need to call the police, who may not show up or even stop, unless you are blocking traffic, anyway.

However, if it is a more serious accident and there are casualties involved, the third party will likely call the police, or you can ask your insurance company representative to do that for you.

The insurance representative will come out and help determine which party is responsible for the accident.

This is one of the best reasons for having good car insurance in Thailand because it means that you don't need to engage with the third party and avoids the need for an argument over who is responsible.

It is possible to sort out a claim without a representative being present, in what's known as a knock-for-knock agreement.

In this situation, as long as both parties have Type 1 insurance coverage and there are no deaths, they can agree on liability and exchange a claim form with all the correct information filled in. This form can then be submitted to the insurance company.

One of the best ways to ensure that you are not wrongly accused of being at fault is to have a dashcam. These cameras are very popular in Thailand, and a good one is easily obtained for 5-10,000 Baht.

These Mercedes 190s are worth a lot of money in good condition.

Claiming Procedure

If a representative gives you a claim form at the scene of the accident, you can then submit this to a partner garage to begin repair of your car.

It may be the case that the insurance company has an online claim system, in which case you will go online, fill out your details and then be issued a claim number. You will submit this number to the garage where you intend to fix your car.

Double check the details of the claim before you proceed, making sure that it has clearly been identified that you are not at fault and the full cost of repair is approved.

If the garage fixing your car ask for a deposit, check back with your insurance company as to whether you should be handing this over, as this may be an indication that you are expected to pay for some of the repair.

Documents Required

To make a claim, the following documents are required. These are usually scanned and sent to the insurer.

- copy of car registration

- copy of the first page of a passport

- copy of driver license

- copy of insurance policy

It is always easier to have your car fixed at a partner garage of the insurance company. The process is straightforward because the insurance company and the garage will liaise back and forth without any need for you to be involved.

You can choose to repair the car with a garage that is not a partner of the insurance company, but this will require you to contact the insurer and obtain a budget for the repair. This may require you to send pictures of your car. This process could take a couple of weeks, depending on how efficient the insurer is.

If the repair budget the insurance company gives you is lower than the cost of the repair, then you will have to pay the remainder. Bear in mind that the garage might also charge a fee outside of the insurer's budget, such as a processing fee for having to liaise with your insurance company.

Applying for Your Insurance

The large majority of people in Thailand buy insurance through brokers.

The price is approximately the same as buying through an insurance company but brokers tend to offer different benefits due to the competitive nature of the industry.

For example, this may include additional help with the purchase process or with claims. And some will even offer a loan car while yours is under maintenance.

To have your car insured, you require the following documents;

- copy of the car’s registration

- copy of the first page of your passport

- copy of your driver’s license

- copy of your previous insurance policy (if you have one)

My Thai Car Insurance Recommendation

I recommend that any foreign national driving in Thailand take out Type 1 car insurance.

The chances of having an accident in Thailand are far higher than back home, no matter how good of a driver you are.

If you have an accident, it probably won't be your fault, and you will want the best possible coverage – especially if you are planning on buying a new car or a car that is under seven years old.

The good thing about Type 1 insurance is that a representative will come out to the scene of the accident.

If you don't speak the language proficiently, communicating with the third party isn't going to be a pleasant experience.

Consider this too: The representative is always going to try and argue the accident in your favor because they have a vested interest in winning the argument on your behalf.

The insurance representative can also help liaise with the police, call a tow truck, or arrange a loan car.

You can also avoid overcharging on repair costs. If the insurance company is liaising with the garage, then you do not have to negotiate the repair price, and don't have to worry that you will be charged 20, 30, or even 50,000 Baht over what you should be paying.

At the end of the day, you are paying for peace of mind. And if that means paying an extra 2,000 or 5,000 Baht a year, then I think it's worth it.

I hope you found this information useful when deciding on your car insurance.

Insurance is a constantly evolving landscape, with changing regulations and policies. This means that the information presented here may contain one or two aspects that are out of date or no longer relevant. However, to the best of my knowledge it is up-to-date and useful as of the time of writing.

At the very least I hope you now have an understanding of the different types of insurance in Thailand and the claims process.

The best thing you can do now is to get yourself a range of quotes and decide which one best fits your expectations and budget.

My recommended broker in Thailand is Mr Prakan.

+ Get Your Quotes Here

GET MY NEWSLETTER

Join thousands of others who receive my monthly roundup of content & insider tips on how to survive & thrive in Thailand.

Last Updated on April 12, 2023

Comments Sort by : newest | oldest

Martin1 says

March 14, 2023 at 11:08 pm

Mar 14, 2023 at 11:08 pm

Jose/Lerm da Silva says

June 2, 2022 at 10:19 am

Jun 02, 2022 at 10:19 am

TheThailandLife says

June 2, 2022 at 3:46 pm

Jun 02, 2022 at 3:46 pm

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Notify me when new comments are added.

Best Overall Travel Insurance

Best travel insurance runner-up, best travel insurance for cruises, best travel insurance for reputation, best travel insurance for pre-existing conditions, best travel insurance for digital nomads, best travel insurance for affordability, best travel insurance for road trips, best for adventure traveling, get travel insurance quotes, how we reviewed the best travel insurance companies, ultimate guide to choosing the best travel insurance.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate travel insurance products to write unbiased product reviews.

Traveling is an adventure, a leap into the unknown, a story waiting to unfold. But every story needs a safety net, and that's where travel insurance comes in. In this guide to the best travel insurance, we'll embark on a journey to help you better understand travel insurance and uncover the benefits that make it an indispensable companion for any traveler.

Best Travel Insurance Companies of 2024

- Best Overall: Nationwide Travel Insurance

- Runner-Up: AXA Assistance USA

- Best for Cruises: Travel Guard

- Best Reputation: C&F Travel Insured

- Best for Pre-existing Conditions: Tin Leg Travel Insurance

- Best for Digital Nomads: WorldTrips Travel Insurance

- Best Low-Cost Option: Trawick International Travel Insurance

- Best for Road Trips: Travelex Travel Insurance

- Best for Adventure Sports : World Nomads Travel Insurance

Best Travel Insurance Companies

The best travel insurance companies offer comprehensive coverage options for a wide range of people and needs. For this guide, we looked at coverage options, customizability, and the best companies for specific situations, such as pre-existing conditions.

Here are Business Insider's picks for the best travel insurance companies in 2024.

Nationwide Travel Insurance

Nationwide is of the largest players in the travel insurance space, offering nearly endless options for any customer on the travel spectrum, including annual travel insurance plans which can offer frequent travelers the flexibility to "set it and forget it" on their travel insurance coverage.

Nationwide Essential also offers some of the most affordable policies in the market compared to similar plans from competitors, which makes it a great pick for just about anyone. Buyers can discuss bundling options as Nationwide also sells homeowners, auto, pet, and other insurance products. Its travel insurance quoting is just as easy as it has been with other Nationwide insurance products.

Read our Nationwide travel insurance review .

AXA Assistance USA

AXA offers consumers a great option for no-stress travel insurance: low-priced plans, generous coverage limits on key categories including primary insurance on lost luggage, and up to 150% reimbursement for qualifying trip cancellations.

While add-ons are limited and rental car coverage is not included by default on cheaper plans, AXA is a perfect fit for travelers who don't plan to drive (or who already hold a travel credit card with rental car coverage), and don't need any additional bells and whistles.

Read our AXA Assistance USA travel insurance review .

Travel Guard

AIG is well-known insurance provider, and a great fit for travelers who want to ensure that they can get their money back in the event of canceled or interrupted travel plans.

While the company's policies can be pricey compared to its competitors, the high medical and evacuation limits make AIG a solid choice for older travelers who value peace of mind and simplicity over highly customizable plans that may be bolstered with medical upgrades.

Read our AIG Travel Guard travel insurance review .

C&F Travel Insured

While every travel insurance company has negative reviews about its claims process, C&F Travel Insured 's claims process has a consistent stream of positive reviews. One customer wrote that C&F processed a claim within 48 hours. Additionally, C&F regularly responds to customer reviews within one business week, making reviews a consistent way to reach the company.

Additionally, in C&F's fine print, it mentions that any claims that take more than 30 days to pay out will begin to accrue interest at 9% APY.

C&F's reputation isn't the only thing to speak highly of. It offers an array of add-ons uncommon in the travel insurance industry, such as Interruption for Any Reason insurance and CFAR coverage for annual plans. C&F also offers discounts for children on its Protector Edge plan and free coverage on its Protector plan.

Read our C&F Travel Insured review .

Tin Leg Travel Insurance

Tin Leg is a great fit for travelers with medical issues in particular. Seven of Tin Leg's eight travel plans include coverage for pre-existing conditions as long as you purchase your policy within 15 days of your initial trip payment.

Thanks to coverage for pre-existing medical conditions as well as for potential COVID-19 infection while traveling, this company offers some of the best financial investment options for travelers who are or will be exposed to higher health risks and issues.

Read our Tin Leg travel insurance review .

WorldTrips Travel Insurance

WorldTrips has affordable premiums, highly customizable add-ons, and generous coverage for core categories of travel insurance. All this makes it a great option for digital nomads, students studying abroad and backpackers.

However, travelers should keep in mind that plans are not particularly flexible, and coverage amounts are limited unless you plan ahead to pay for the areas and amounts that you need.

Read our WorldTrips travel insurance review .

Trawick International Travel Insurance

Trawick offers low premiums across its five plans, most of which offer coverage for pre-existing conditions. You'll find robust medical travel insurance that can help higher-risk and anxious travelers find peace of mind while on the road. This company also offers high medical evacuation coverage limits, up to $1,000,000.

Read our Trawick travel insurance review .

Travelex Travel Insurance

Travelex offers three plans:

- Travel Basic

- Travel Select

- Travel America

The Travelex America plan is meant for trips limited to the U.S., but it has the highest coverage limits in many areas compared to its other programs. If you're flying somewhere, the lost baggage limits are higher. Its natural strengths shine for road trippers, though. Travelex America adds coverage for roadside service and rental car coverage for unexpected accidents. It also covers pets should you be involved in an accident while on the road.

While your standard auto insurance does extend to car rentals within the U.S. for a limited time, any accident would affect future rates. Travelex would eliminate the risk of reporting to your auto insurance provider for minor incidents within its purview.

Read our Travelex Travel Insurance review .

World Nomads Travel Insurance

World Nomads distinguishes itself from others by covering over 300 sports and activities, from skydiving to golf. Additionally, its one of the few travel insurance companies that allow you to purchase after departing for your destination. However, you'll have a 72-hour waiting period before coverage kicks in.

That said, World Nomads doesn't have the highest coverage limits compared to its competitors on this list, travel medical insurance capping out at $100,000. It also isn't the most flexible provider, only providing two plans to choose from with no options for pre-existing condition coverage. Yet, World Nomads still stands out for its sports coverage and post-departure coverage.

Read our World Nomads travel insurance review .

Introduction to Travel Insurance

Why travel insurance is a must-have.

The unpredictable nature of traveling – from flight cancellations to medical emergencies – can turn your dream vacation into a nightmare. Travel insurance acts as a personal safeguard, ensuring that unexpected events don't drain your wallet or ruin your trip.

Understanding Different Types of Travel Insurance

Not all travel insurance policies are created equal. From single-trip travel insurance policies to annual travel insurance plans , from minimal coverage to comprehensive protection, understanding the spectrum of options is your first step in finding the right fit for your journey.

Key Features to Look for in Travel Insurance Coverage

Travel insurance for medical emergencies.

Imagine falling ill in a foreign country; daunting, right? A robust travel insurance plan ensures you don't have to worry about how much emergency medical care while traveling will cost, even in the most remote corners of the globe. This coverage will often come in tandem with emergency medical evacuation coverage.

Trip Cancellation and Interruption Benefits

Life is full of surprises, some less pleasant than others. Trip cancellation and interruption coverage ensures that you're not left out of pocket if unforeseen circumstances force you to cancel or cut your trip short. You may also look for cancel for any reason and interruption for any reason options, which will reimburse you for a percentage of your nonrefundable fees, but expands the covered reasons you can cancel a trip. You can find our guide on the best CFAR travel insurance companies here.

Coverage for Personal Belongings and Baggage Loss

Losing your belongings is more than an inconvenience; it's losing a piece of your world. Insurance that covers personal belongings and baggage loss ensures that you're compensated for your loss, helping you to rebound and continue your adventure.

Support and Assistance Services

In times of trouble, having a lifeline can make all the difference. Look for insurance that offers 24/7 support and assistance services, giving you peace of mind that help is just a phone call away. Also, check websites that field customer reviews like Trustpilot, the Better Business Bureau, and InsureMyTrip , to see how well a company responds to customer requests.

Choosing the Best Travel Insurance

Reputation and reliability of the travel insurance provider.

A provider's reputation is not just about being well-known; it's about reliability, customer satisfaction, and the ability to deliver on promises. Researching and choosing a reputable provider is a cornerstone in ensuring your safety and satisfaction.

Understanding the Policy's Fine Print

The devil is in the details, and understanding the fine print of what your travel insurance policy covers is crucial. Be aware of coverage limits, exclusions, and the process for filing a claim to avoid any unpleasant surprises.

For example, to get coverage for a canceled trip due to work, many travel insurance companies require that you've been with that company for at least a year.

Customer Reviews and Feedback

In the age of information, customer reviews and feedback are goldmines of insight. Learn from the experiences of others to gauge the reliability and customer service of the insurance provider you're considering. While the ratings are important, you should also look at whether or not a company responds to customer complaints.

How to Get the Most Out of Your Travel Insurance

Knowing your policy inside out.

Familiarize yourself with every aspect of your policy — what it covers, what it doesn't, how to file a claim, and who to contact in an emergency. Being informed means being prepared. At the very least, you should have the terms readily available while you're on your trip.

Steps to Take When a Problem Arises

If you face an issue during your travels, knowing the immediate steps to take can make all the difference. Your insurance company may even have a 24/7 assistance hotline that can walk you through an emergency during your trip, even issues that don't involve claims.

When a problem arises. you'll want to document as much as possible, in case you need proof when filing a claim. Ask for receipts and invoices when possible.

How to Pick the Best Travel Insurance Company for You

There isn't a one-size-fits-all policy that works perfectly for every traveler. Young, healthy solo travelers can opt for much cheaper plans that offer bare-bones coverage, while families juggling complex itineraries will do best by investing in a robust policy that can help defray any costs associated with lost baggage, delayed transportation or other trip-impeding obstacles.

That being said, you can't go wrong with a travel insurance provider that boasts a reputable history and offers a wide range of customizable plans. In some cases, you may be comparing plans that are only a few dollars' apart from each other. In such situations, you should generally opt for the insurance company that offers the strongest customer service. It's also worth considering whether or not the travel insurance provider has been reviewed by other travelers with similar itineraries to your own.

An insurance aggregator like InsureMyTrip or Squaremouth is one of the best tools for searching travel insurance policies. Once you input the specifics of your travel itinerary, you'll be able to see hundreds of search results to compare the ones that catch your eye. If the options are too overwhelming, use the filters to the left of your search page to eliminate as many irrelevant plans as possible.

To come up with our list of the best travel insurance companies, Business Insider evaluated each insurer based on the following factors:

Guide Methodology: What We Considered

Policy Types

Travel insurance is essential, but often underused partly because people aren't getting what they want. Business Insider's 2023 travel study showed 10.65% of travelers surveyed bought cancel for any reason insurance. Cost may be a factor, but in many cases, the coverage is more affordable than you might think. Regardless, companies must offer a diverse range of coverage options. We award five stars to companies offering all standard coverages and additional options like pet and sports equipment protection.

Our 2023 travel study indicated the majority of purchases were made through the travel provider (ex: flight protection insurance when you're purchasing your airline tickets). While these may be sufficient for some customers, we look for companies offering a more comprehensive range of services.

According to the U.S. Travel Insurance Association, the average cost of travel insurance will be between 4% and 8% of total travel expenses. Anything beyond that price point should include additional benefits beyond the standard inclusions, such as CFAR protection or upgraded medical coverage. Anything below that 4% threshold may leave you lacking important or sufficient coverage in an emergency.

Convenience and Flexibility

Whether you're an infrequent traveler or a suitcase warrior, a good travel insurance company should have you covered. In many cases, you might not even have to talk to a person in order to purchase your policy.

Many people think of travel insurance in context with specific trips, but most of these top contenders sell both single-trip and multi-trip policies, also known as annual travel insurance. Some companies also offer plans specifically designed for cruisers, students abroad, and business travelers. (Read our guide to the best cruise travel insurance companies for more details.) Finally, all of these providers offer multiple options for getting the specific areas and amounts of coverage that you want.

Claims Handling

Most travelers never have a large claim. Premiums are low, and it provides peace of mind for the just in case situations. So they leave reviews based on their reduced stress levels. But what happens if you lose your luggage or have to stay a few extra days due to an unexpected accident? Will your insurance carrier cover your claim without all the hassle? We check real customer reviews to sort this out for you.

Ease of Use and Support

When purchasing, during your trip, and throughout the claims process, you may need extra support. Does the company have a 24/7 help line? Does it have an online or mobile system allowing you to self-manage? Essentially, what are the options when you need help? We look at the big picture to evaluate the average customer experience with each company.

You can read more about how Business Insider rates travel insurance for even more details. And see our guide to the best travel insurance in California if you're traveling to that state, specifically.

Best Travel Insurance FAQs

There isn't one best travel insurance company; there are many great providers on the travel insurance market today. Our overall winner was Nationwide for its breadth of coverage options. AIG Travel Guard, AXA, Berkshire Hathaway, Tin Leg, WorldTrips and Trawick also made the cut. The best pick for you will depend on what features you value the most, like a low premium or high coverage limits.

While coverage varies by policy, common exclusions often include pre-existing medical conditions (unless you have purchased a waiver), accidents caused by high-risk activities if not specifically covered (e.g., skydiving, scuba diving), travel for medical procedures, and events known before purchasing the policy (e.g., traveling during a pandemic). Always read your policy carefully to understand the exclusions.

The average cost of travel insurance is 4% to 8% of your total trip cost, so it could vary widely depending on where you're traveling and the length of your trip. Your age, the number of people in your group, and other factors can also influence how much you'll pay.

Yes, travel insurance typically offers some coverage of canceled flights, but if this benefit is important to you, make sure you read the fine print of your policy to make sure it offers adequate reimbursement. If you think you may need to cancel your travel plans, you should consider purchasing cancel for any reason (CFAR) travel insurance .

The right amount of travel insurance depends on your trip, but $100,000 should be sufficient for most travel plans. You may want more coverage for travel medical insurance and emergency medical evacuation coverage.

- Retail investing

- The stock market

- Debt management

- Credit scores

- Credit bureaus

- Identity theft and protection

- Main content

Health insurance

can you guys tell me what you use for health insurance? Currently I'm looking at 1 year $1mm policy with my son for $325/mo with $1500 deductible. Call me crazy I don't know why I thought it would be cheaper.

Hello.can you guys tell me what you use for health insurance? Currently I'm looking at 1 year $1mm policy with my son for $325/mo with $1500 deductible. Call me crazy I don't know why I thought it would be cheaper. -@davecndn

I will call you crazy if that's the insurance you're going for. That's a very expensive policy and the cover is ridiculously high. You dont seem to know anything about hospital costs in Thailand. Who needs a $1mn health insurance? The most expensive procedure in a private hospital in Thailand is probably heart surgery and the average cost is maybe 600.000-650.000 Baht. Even a 3.5 million Baht insurance is overkill. Check out thai companies instead and don't listen to clueless people.

For starters,check this out:

https://misterprakan.com/th/health/main?lg=en

The low premium is due to the pretty high $1500 deductible which would cover all first aid help on any issue

@Leeds forever!

Hey thanks! 😊 I will check out your advice. No i don't know nothing as I am finding out. I just arrived here from Chicago. I visited Thailand multiple times on multiple occasions but living here is a completely different beast. I am currently sitting here waited 2 hours at Bangkok Bank trying to open a savings account which I have to pay 500 baht for fraud insurance. They baht you to death here. What a waste of time. where are all the go getters?

Guys what about the cancer coverage? i think probably cancer, heart attack, liver etc are the most costly. i want to get the most of the high priced items covered, then if the price is right ill take more but man these people come at my thai wife they smell farangs from miles away i guess. My wife is Thai we met in usa. she has nit been back in over 20 years. As of today, we are both regretting our move here actually but its too late now so we are trying to do our best not to be Thai here.

@Leeds forever! Hey thanks! 😊 I will check out your advice. No i don't know nothing as I am finding out. I just arrived here from Chicago. I visited Thailand multiple times on multiple occasions but living here is a completely different beast. I am currently sitting here waited 2 hours at Bangkok Bank trying to open a savings account which I have to pay 500 baht for fraud insurance. They baht you to death here. What a waste of time. where are all the go getters?

Go for the insurance,it's still worth it and you can skip it next year.Its more of a Personal Accident insurance than a health insurance. The insurance isn't a fraud but I don't know how well it works outside Bangkok. Bangkok Bank is imo a very good bank for foreigners. -@davecndn

i will look at that when i get home. thank you so much for your help

Guys what about the cancer coverage? i think probably cancer, heart attack, liver etc are the most costly. i want to get the most of the high priced items covered, then if the price is right ill take more but man these people come at my thai wife they smell farangs from miles away i guess. My wife is Thai we met in usa. she has nit been back in over 20 years. As of today, we are both regretting our move here actually but its too late now so we are trying to do our best not to be Thai here. -@davecndn

If you don't have any pre-existing conditions you don't have to worry about costs. It's about coverage. You should do a qualified guess about what could happen based on your health/current condition.Cancer treatment like chemotherapy is an Outpatient thing, and surgery of any kind while staying in the hospital is Inpatient. It's also about age. How old are you? Premiums goes up every 5 year, for example 60-65,66-71. From 66 years of age you're considered overaged,that's a word most Thai insurance companies are using. Then the cost goes up. You'll also need a medical check-up to be able to apply for an insurance. That's not normally the case when younger than 66.

Ok thanks. Cigna forewarned me that their premuim will go up every year. Luckily I do not have any health issues or pre existing but I do take Lipitor.

i am currently 47. i have 8 year old son. my Thai wife is Thai citizen. Thanks.

so what do people do after 66? rawdog it?

This is the thing I read about alot of stuff on the internet but i dont know the source. if the guy lives like a trump or bum. Dont need it, its cheap etc you really don't know til the time comes 🤷♂️ find out the hard way.

regardless thank uou fir your help i appreciate it

Ok thanks. Cigna forewarned me that their premuim will go up every year. Luckily I do not have any health issues or pre existing but I do take Lipitor. i am currently 47. i have 8 year old son. my Thai wife is Thai citizen. Thanks.so what do people do after 66? rawdog it? This is the thing I read about alot of stuff on the internet but i dont know the source. if the guy lives like a trump or bum. Dont need it, its cheap etc you really don't know til the time comes 🤷♂️ find out the hard way.regardless thank uou fir your help i appreciate it -@davecndn

My insurance company is Pacific Cross and it's imo

a serious company. They have loads of different premiums. I just filled out a questionnaire and my application was approved.The premium goes up every 5 year but I get a discount every year. First year was 10%, second 15% and third 20%. I also got 20% the fourth year. Cigna's and AXA's premiums are imo overpriced. After 66 I can still go with PC but the premium will go up a bit. I will still get my discount, though and no medical is needed. At your age the premium at PC will be very low even if you go for a quite high coverage. Google them and check out their website.Again,don't go for a ridiculously high coverage especially if you're healthy and in good condition. It's just a waste of money.

Gotcha thanks for the great info! whats the main difference between mister prakan vs Pacific Cross? more reliable company? Im going to check out both but wanted to hear you opinion on it.

Tganks again! 🙏

i agree about the high coverage and when healthy. Thats why i was initially looking at higher deductibles.

Gotcha thanks for the great info! whats the main difference between mister prakan vs Pacific Cross? more reliable company? Im going to check out both but wanted to hear you opinion on it. Tganks again! 🙏 -@davecndn

Mr Prakan Insurances have different insurance companies to chose from. It's like a platform.Pacific Cross is an insurance company, and might even show up on Mr Prakan.

Got it thank you sir!

@davecndn That's way too expensive! Send me your age and email, I'll send you quotes from a few different insurers

@samw16330 . Message sent, thanks!

@davecndn I didn't see a message, can you send again?

My insurance company is Pacific Cross and it's imo a serious company. They have loads of different premiums. I just filled out a questionnaire and my application was approved.The premium goes up every 5 year but I get a discount every year. First year was 10%, second 15% and third 20%. I also got 20% the fourth year. Cigna's and AXA's premiums are imo overpriced. After 66 I can still go with PC but the premium will go up a bit. I will still get my discount, though and no medical is needed. At your age the premium at PC will be very low even if you go for a quite high coverage. Google them and check out their website.Again,don't go for a ridiculously high coverage especially if you're healthy and in good condition. It's just a waste of money. -@Leeds forever!

I looked at Pacific Cross but the comparison website shows Falcon as being much cheaper. Is Pacific Cross for Worldwide excluding USA?

Thanks for sharing this rbaker. I just filled it out and running a comparison against Cigna now.

Much appreciated!

Hi LeedsForever,

I think I'm in the same boat as you - under 65 (I'm nearly 62), no major health problems. What sort of coverage would you recommend? Basically I would like to know what you have with Pacific Cross, if you wouldn't mind. The name of the policy, the height of the coverage, the size of the deductible and most importantly what it costs (with or without the discounts)!

Sorry for being so forward but I'm having trouble picking a good insurance provider. If anyone else wants to chime in with details of their insurance (that you're happy with) then please do so. I assume I should be looking at health insurance for people living in Thailand, not travel insurance.

thanks and regards

Hi LeedsForever, I think I'm in the same boat as you - under 65 (I'm nearly 62), no major health problems. What sort of coverage would you recommend? Basically I would like to know what you have with Pacific Cross, if you wouldn't mind. The name of the policy, the height of the coverage, the size of the deductible and most importantly what it costs (with or without the discounts)! Sorry for being so forward but I'm having trouble picking a good insurance provider. If anyone else wants to chime in with details of their insurance (that you're happy with) then please do so. I assume I should be looking at health insurance for people living in Thailand, not travel insurance. thanks and regards rbakker -@rbakker

I just made one with SBC. They offer Zürich insurance coverage and have 3 levels.

Check and see:

https://amo.to/K/KDQGAC/KD6ZOE

Find more topics on the Thailand forum

Articles to help you in your expat project in thailand.

Thailand is one of the most visited countries in the world. It is also home to a large number of long-term expats ...

Thailand is one of the safest countries in Southeast Asia. Crime rates are low. Society favors social harmony ...

Thailand is one of the world's most popular retirement destinations. There are a number of reasons for that ...

Many times your employer will offer health insurance as part of your compensation. The first school I worked at ...

In Thailand, medical care is provided for all expatriate employees (work permit holders) who see a deduction of ...

Compare and Save on Insurance in Thailand

Across every plan, beyond every premium at checkdi.

House & Condo

Critical Illness

Rental Motorbike

Professional Indemnity

Compensation

Car Extended Warranty Insurance

Health/travel/covid to thailand, business property/shop insurance (sme), checkdi app, some of our clients.

Insurance in just Simple Steps

Real Reviews

I called many insurance companies and brokers during my search for health insurance provider. I found that CheckDi gave me very good insight, especially my agent (her name is Mady) who was very helpful and knowledgeable. Info I got helped me make a better decision amidst the myriads of choices out there. That's the beauty of going through a broker, esp. when you don't know what provider to pick. Since brokers offer plans from many providers, they will give you info on different providers out there without preference. At least it was like that for my experience.

CheckDi is the most helpful insurance broker I’ve ever been worked with. Their follow-up and communication are very fast and accurate, an example for others.

I have many questions about the insurance product and CheckDi has answered all of them and made me confident about the product I was going to buy. I appreciate their help in any insurance matter, their assistance was a big help.

I'm always getting very professional service for my health insurance. Im always getting all the updates, replies and support that I need.

Buy Insurance with Confidence

Insurance Partners

We’re here to help

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

7 Best Cheap Travel Insurance Companies in July 2024

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Finding the cheapest travel insurance is often a priority for travelers hoping to protect themselves and their finances while away from home.

But is it better to err on the side of affordable travel insurance or opt for a more comprehensive plan? That depends on your needs .

On average, a comprehensive plan that covers some combination of trip cancellation and interruption costs, medical coverage and baggage protection (and perhaps a number of other things) will cost you 5%-10% of what you paid for the trip, according to NerdWallet partner Squaremouth, a travel insurance marketplace.

That means a comprehensive policy for a trip that costs you $3,000 could run you anywhere between $150 and $300. Factors like the cost and length of your trip, the age of the travelers and how much protection you want can significantly influence what you pay for your plan.

Ultimately, Squaremouth recommends “the least expensive policy that offers the coverage [travelers] need.”

» Learn more: The best travel insurance companies right now

Factors we considered when picking cheap travel insurance plans

We considered a few factors as we looked for the most affordable travel insurance plans.

Price: If your goal is to find cheaper travel insurance, you want the price to be affordable.

Breadth of coverage: The best budget travel insurance is typically going to be a plan that offers a wide range of protections at an affordable cost, ensuring you’re protected with at least some coverage for a wide range of scenarios.

Uniqueness or customizability : While many travel insurance plans have similar protections, some stand out for particular coverage that can be helpful to certain travelers, like those needing to Cancel For Any Reason , those going on a cruise, or travelers with preexisting health conditions. We didn’t spring for the priciest plans with broad, deep coverage; instead, we picked those that meet a sort of budget "sweet spot" when it comes to cost efficiency.

» Learn more: Is travel insurance worth getting?

An overview of the best cheap travel insurance plans

We looked at travel insurance quotes for a hypothetical 10-day trip to Italy in October 2023. The traveler is a 40-year-old man living in North Carolina who spent $2,000 on the trip, including airfare.

Reliable but cheap travel insurance providers

1. axa assistance usa (silver plan: $70).

Why we picked it:

The $500 missed connection benefit is great for cruise and tour participants. It covers additional transportation, accommodations and meal costs when you miss a cruise or tour departure.

Full trip cancellation and interruption coverage, along with up to $25,000 for out-of-pocket medical costs and baggage coverage.

Among the lowest prices we found.

If you’re willing to spend a bit more than AXA's $70 Silver plan, a Gold plan only costs $19 more and gets you deeper coverage amounts and up to $35,000 in collision rental car insurance.

2. Berkshire Hathaway Travel Protection (ExactCare Value plan: $56)

Cheapest plan we found while still offering a wide array of protections.

Includes a preexisting medical condition waiver.

Add-on rental car collision coverage optional for $10 per day. You can pick how many days you want the additional coverage — it’s not all or nothing.

At $56, this plan comes in at less than 3% of the $2,000 trip cost.

3. IMG (iTravelInsured Lite plan: $77)

Treats COVID-19 like any other illness, which is to say, if your claim accepts flu, strep throat or appendicitis as an acceptable, covered condition, the coronavirus is, too.

Covers costs related to trip interruption up to 125%