- Our Process

WORLDMETRICS.ORG REPORT 2024

Global Travel Agency Industry Statistics: Revenue Soars, Mobile Bookings Surge

Inside the booming travel agency industry: $694.7B revenue, online dominance, and shifting trends ahead.

Collector: Alexander Eser

Published: 7/23/2024

Statistic 1

- Around 60% of travelers prefer to book their trips through a travel agency due to the convenience and expertise offered.

Statistic 2

- Mobile bookings account for around 25% of all online travel bookings, indicating a shift towards mobile usage.

Statistic 3

- The average revenue per user in the travel agency industry is projected to reach $1,007 in 2021.

Statistic 4

- The revenue of travel agencies and tour operators in the United States is forecasted to exceed $21 billion by 2024.

Statistic 5

- Mobile travel sales are projected to surpass $97 billion by 2022, indicating a shift towards mobile bookings.

Statistic 6

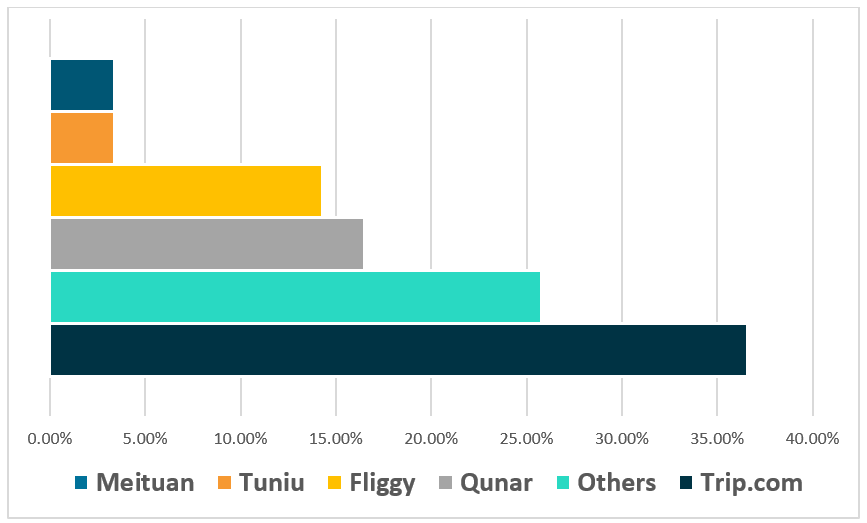

- The outbound Chinese travel market is expected to grow by 11% annually, creating opportunities for international travel agencies.

Statistic 7

- Travel agencies that offer sustainable travel options have seen a 25% increase in bookings over the past year.

Statistic 8

- The travel agency industry is expected to rebound strongly post-pandemic, with a growth rate of 7.9% in 2023.

Statistic 9

- The market share of traditional travel agencies is declining, as online agencies capture a larger percentage of bookings.

Statistic 10

- By 2025, it is estimated that over 50% of airline tickets will be sold through digital channels, impacting traditional travel agencies.

Statistic 11

- The average annual growth rate of the global travel agency and travel booking industry is projected to be 9.7% between 2021 and 2026.

Statistic 12

- The number of travel agency locations in the United States has been decreasing steadily, with a 6.8% decrease from 2019 to 2020.

Statistic 13

- Luxury travel agencies are experiencing a surge in demand, with a 15% increase in high-end bookings in the past year.

Statistic 14

- The average commission paid to travel agencies by airlines ranges from 1% to 10%, depending on the carrier and ticket type.

Statistic 15

- The market size of the global travel agency software industry is estimated to exceed $1.8 billion by 2025.

Statistic 16

- The global online travel agency market size is expected to reach $1,247 billion by 2028, with a CAGR of 10.3% from 2021 to 2028.

Statistic 17

- Travel agency revenue in the United States is projected to reach $19.2 billion in 2023.

Statistic 18

- The market size of the global travel agency industry is forecasted to exceed $36 billion by 2025.

Statistic 19

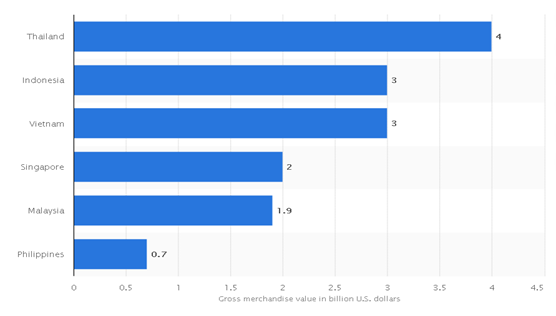

- The Asia-Pacific travel agency market is expected to grow at a CAGR of 10.1% from 2021 to 2028.

Statistic 20

- The average revenue per user in the online travel booking segment is projected to reach $422.99 in 2021.

Statistic 21

- The United States has over 10,000 travel agencies operating across the country.

Statistic 22

- The revenue of travel agencies in Europe is expected to reach $75 billion by 2023.

Statistic 23

- The market share of online travel agencies in the United States is estimated to be around 43%.

Statistic 24

- The global travel agency market is estimated to grow at a CAGR of 7.1% from 2021 to 2026.

Statistic 25

- The market value of the corporate travel agency sector is expected to exceed $1.7 trillion by 2024.

Statistic 26

- The average commission paid to travel agents for cruise bookings ranges from 10% to 15% of the total fare.

Statistic 27

- The market size of the global travel agency software industry is projected to grow to $1.8 billion by 2024.

Statistic 28

- The global market for travel agency services is estimated to surpass $43 billion by 2027.

Statistic 29

- The market share of corporate travel management companies is expected to grow by 8% in the next five years.

Statistic 30

- Online travel agencies contribute around 43% of the total revenue generated in the travel agency industry.

Statistic 31

- The market value of the global travel agency industry is expected to exceed $78 billion by 2026.

Statistic 32

- The United Kingdom travel agency industry experienced a 76% decrease in revenue in 2020 due to the impact of the COVID-19 pandemic.

Statistic 33

- The global travel agency industry is expected to reach a revenue of $694.7 billion in 2021.

Statistic 34

- In 2020, the global distribution systems (GDS) market size for travel agencies was valued at $8.0 billion.

Statistic 35

- The market size of the global online travel booking industry is estimated to reach $1,134 billion by 2023.

Statistic 36

- The market value of Corporate Travel Management companies in the U.S. exceeds $30 billion.

Statistic 37

- Online travel agencies account for around 45% of the total travel booking distribution.

Statistic 38

- The Asia Pacific region is expected to witness the highest CAGR in the travel agency market between 2021 and 2026.

Statistic 39

- The Middle East and Africa region is anticipated to witness significant growth in the travel agency market in the coming years.

Statistic 40

- The travel agency market in Latin America is expected to witness substantial growth due to increasing tourism activities in the region.

Our Reports have been cited by:

- • The global travel agency industry is expected to reach a revenue of $694.7 billion in 2021.

- • Online travel agencies account for around 45% of the total travel booking distribution.

- • The average revenue per user in the travel agency industry is projected to reach $1,007 in 2021.

- • In 2020, the global distribution systems (GDS) market size for travel agencies was valued at $8.0 billion.

- • The Asia Pacific region is expected to witness the highest CAGR in the travel agency market between 2021 and 2026.

- • The revenue of travel agencies and tour operators in the United States is forecasted to exceed $21 billion by 2024.

- • Around 60% of travelers prefer to book their trips through a travel agency due to the convenience and expertise offered.

- • The market size of the global online travel booking industry is estimated to reach $1,134 billion by 2023.

- • Mobile travel sales are projected to surpass $97 billion by 2022, indicating a shift towards mobile bookings.

- • The outbound Chinese travel market is expected to grow by 11% annually, creating opportunities for international travel agencies.

- • The market value of Corporate Travel Management companies in the U.S. exceeds $30 billion.

- • Travel agencies that offer sustainable travel options have seen a 25% increase in bookings over the past year.

- • The travel agency industry is expected to rebound strongly post-pandemic, with a growth rate of 7.9% in 2023.

- • The market share of traditional travel agencies is declining, as online agencies capture a larger percentage of bookings.

- • By 2025, it is estimated that over 50% of airline tickets will be sold through digital channels, impacting traditional travel agencies.

Pack your bags and buckle up, because the global travel agency industry is soaring to new heights with a projected revenue of $694.7 billion in 2021! As online travel agencies dominate nearly half of the booking distribution and the average revenue per user climbs to $1,007, its clear that travel enthusiasts are embracing the convenience and expertise offered by these wanderlust curators. From the rapid growth in mobile bookings to the rise of sustainable travel options, the industry is navigating turbulent times with finesse, promising a vibrant future post-pandemic filled with innovative adventures and luxurious escapades. So, sit back, relax, and let this blog post take you on a journey through the fascinating landscape of the ever-evolving travel agency realm.

Customer Preferences and Behavior

Interpretation.

In a world where convenience is king and expertise is the crown jewel of travel planning, it's no surprise that around 60% of travelers still choose the tried-and-true route of booking through a travel agency. With their insider knowledge and knack for turning mundane trips into unforgettable experiences, these industry gurus are the unsung heroes of our wanderlust-fueled adventures. And as mobile bookings continue to soar, comprising a hefty 25% of all online travel transactions, it's clear that we are living in an era where our travel dreams fit snugly in the palm of our hands. The future is not just bright—it's conveniently compact and expertly curated.

Industry Growth and Projections

In the ever-evolving world of travel, the statistics paint a vibrant picture of both challenges and opportunities for the industry. From the projected surge in mobile travel sales to the steady decline in traditional agency locations, it's clear that adaptation is the name of the game. Luxury agencies thrive on high-end bookings, while sustainability-minded travelers are driving a new wave of environmentally conscious tourism. As the industry navigates the post-pandemic landscape, one thing is certain: change is in the air, and those who can pivot towards digital channels and emerging markets stand to ride the wave of growth in the years to come.

Market Size and Value

With the global travel agency industry poised to rake in a staggering $694.7 billion in 2021, it seems that wanderlust knows no bounds - or budget constraints. The $8.0 billion valuation of global distribution systems (GDS) reminds us that even in the digital age, old school methods still hold their own. Looking ahead, the anticipated $1,134 billion market size for online travel booking suggests that clicking your way to a vacation destination is becoming the new norm. And with Corporate Travel Management companies in the U.S. commanding a market value exceeding $30 billion, it’s clear that jet-setting for business is big business indeed. The numbers don't lie – let the adventures (and expenses) begin!

Online Travel Agencies

Online travel agencies have taken the travel industry by storm, claiming a lion's share of the booking distribution pie at a whopping 45%. In a world where convenience reigns supreme, it seems that travelers are increasingly opting for the ease and efficiency of organizing their trips with just a few clicks. With traditional brick-and-mortar agencies left playing catch-up, it's clear that the digital realm is the new frontier for wanderlust seekers itching to explore the globe at the touch of a button.

Regional Market Trends

In a world where wanderlust is as contagious as a viral TikTok dance, the travel agency industry is gearing up for a global tour like no other. With the Asia Pacific region strutting towards the highest CAGR, the Middle East and Africa ready to break out in a crescendo of growth, and Latin America putting on its salsa shoes for a substantial rhythmic rise, it's clear that these regions are not just passport stamps on the travel agency's itinerary but the headline acts of a blockbuster world tour. So grab your boarding pass, ladies and gents, because the show is about to begin, and the travel agency market is promising a chart-topping performance that will have the world packing its bags and hitting the road in style.

ibisworld.com

statista.com

marketwatch.com

grandviewresearch.com

travelagentcentral.com

travelforknowledge.com

travelmarketreport.com

travelweekly.com

researchandmarkets.com

globenewswire.com

alliedmarketresearch.com

travelport.com

prnewswire.com

industryleadersmagazine.com

maonlinclikvision.com

channele2e.com

industrybuying.com

thomasnet.com

Online Travel Agencies Market

Exploring the Online Travel Agencies Market: A Comprehensive Examination by Transportation, Vacation Packages, Accommodation

Transforming the Travel Landscape- Exploring the Expanding Online Travel Agencies Market and the Influence of Artificial Intelligence on Personalized Travel Experiences. Find more with FMI

- Report Preview

- Request Methodology

Online Travel Agencies Market Outlook (2023 to 2033)

As per newly released data by Future Market Insights (FMI), the online travel agencies market is estimated at US$ 465.1 million in 2023 and is projected to reach US$ 1,694.2 million by 2033, at a CAGR of 13.8% from 2023 to 2033.

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

Revenue of Online Travel Agencies from 2018 to 2022 Compared to Demand Outlook for 2023 to 2033

As per the FMI analysis, the market for online travel agencies secured a 6.70% CAGR from 2018 to 2022, touching US$ 355.4 million in 2022.

The technological development in the tourism industry has digitalized the entire process of travel bookings. Nowadays traveler makes more use of online services for travel booking as they feel it is a convenient and hassle-free process.

The online process has led to the growth of the tourism and hospitality industry. Therefore, online travel agencies play a significant role in the tourism industry.

Online travel agencies comprise various travel bookings, hotel bookings, transportation service bookings, and many more.

Online travel agencies serve the purpose of selling travel services on online platforms. In the last few years, there is a significant rise in the growth of online travel agencies. The growth has helped to revolutionize the tourism industry.

The above-mentioned factors augur well for the online travel agencies market future trends, where it is predicted that the market likely reaches US$ 1,694.2 million by 2033 at 13.8% CAGR through 2033.

What are the Features and Convenience of Use that Drive the Demand for the Online Travel Agencies?

- Online travel agencies offer a range of services either directly from their own companies or act as intermediaries between travel and booking agencies and end users.

- The main purpose of online travel agencies is to provide booking services online, covering everything from selecting a service to the point of sale on the Internet.

- Online portals offered by these agencies provide various services including price comparison, cost estimation, accommodation options, destination information, transportation modes, and even tour packages.

- The convenience, speed, and ease of booking provided by online travel services attract travelers, offering a convenient and efficient way to plan their trips.

- By utilizing online travel services, travelers can save both time and money, making it an appealing option for those seeking efficient and cost-effective travel arrangements.

Principal Consultant

Talk to Analyst

Find your sweet spots for generating winning opportunities in this market.

What is Fostering the Expansion of the Market Size: The Rise in Disposable Income and New Development Initiatives?

- Increasing disposable income among individuals has played a significant role in driving the demand for online travel agencies, as people now have more financial resources to explore and travel to various destinations worldwide.

- Online travel agencies have successfully established a global reach, expanding their services and operations across different regions and countries, catering to the diverse travel needs and preferences of customers.

- To meet the evolving demands of the market, online travel agencies continuously adopt new strategies and upgrade their technologies, ensuring enhanced service offerings and improved customer experiences.

- The inclusion of travel insurance and baggage insurance by online travel agencies provides an added layer of security and peace of mind for travelers, contributing to the overall convenience and reliability of their services.

- Transparency throughout the booking process is a key focus for online travel agencies, ensuring customers have access to comprehensive information and pricing details, fostering trust and confidence in their decision-making.

- The initiatives taken by online travel agencies, such as integrating advanced technologies and providing comprehensive travel solutions, have successfully attracted the new generation of tech-savvy travelers, generating a strong demand in the market.

- Despite the challenges faced during the pandemic, the online travel agencies market remains resilient and continues to evolve, adapting to changing customer expectations and emerging market trends.

What Impact Does the Increasing Number of Solo Travelers Have on the Growth of the Online Travel Agencies Industry?

- There has been a significant increase in the number of solo travelers in recent years, driven by specific reasons such as leisure, recreation, and engaging in activities like water sports, hiking, riding, skiing, and more.

- The influence of social media has played a major role in attracting a wide audience to explore different regions, leading to a rise in online travel agencies' booking transactions.

- Online travel agencies offer comprehensive tour plans, including vacation packages, and assist solo travelers in making travel, food, and accommodation arrangements through convenient platforms such as phones or other devices.

- This convenience and affordability make online travel agencies a preferred choice for solo travelers, who may lack extensive knowledge or prefer cost-effective options.

- In recent years, online travel agencies have surpassed offline tour operators and travel agents in terms of popularity and usage among solo travelers.

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need and save 40%!

Country-wise Insights

What is the growth outlook for the europe online travel agencies industry.

The growth outlook for the Europe online travel agencies industry is positive, with a value share of 22.30% in 2022. The industry is expected to continue growing steadily, supported by various factors such as increasing online travel bookings, technological advancements, and evolving customer preferences.

The CAGR of the United Kingdom at 5.00% from 2023 to 2033 indicates a promising growth trajectory for the market. The rising adoption of online platforms for travel planning and booking, along with the convenience and extensive range of services offered by online travel agencies, are driving the industry's growth.

The industry is likely to witness further advancements in mobile applications, personalized travel experiences, and innovative marketing strategies, contributing to the expansion of the Europe online travel agencies market in the coming years.

How Online Travel Agencies Market is Progressing in India?

In India online leading companies like Yatra.com, Kesari Tours, Veena World, Make My Trip, others are dominating the tourism industry in India, contributing to the country’s anticipated CAGR of 6.0% from 2023 to 2033.

India attracts many foreigners to discover and explore its culture and diversity. Foreigners find Indian travel agencies more affordable than booking tours from abroad. Hence, they use Indian online travel agencies’ websites for booking accommodation and transportation.

Meanwhile, India being one of the leading countries in the count of internet users, it can be concluded that the vast majority of the population is tech-savvy. Thus, online travel agencies try various marketing tools to connect with travelers and encourage them to avail of their services.

The attractive advertisements, loyalty programs, and offers from leading online travel agencies have influenced the domestic market. Therefore, the known online agencies have gained the trust of domestic travelers of the country over the years.

What are the Factors Driving the Online Travel Agencies Industry in the United States of America?

As per the FMI analysis, the market for online travel agencies in the United States was predicted to garner a value share of 5.50% in 2022.

United States is one of the major markets of tourism with millions of travelers visiting every year. Domestic travelers in the United States of America use online travel agencies’ websites and applications extensively.

Apart from this, the airline service is availed by United States citizens majorly. Therefore, there is a high demand for travelers using online travel agencies’ websites for airline travel booking.

With the high standard of living and high disposable income due to the high value of currency travelers are ready to spend a high amount of money on traveling and exploring new adventures. Thus, there is a high demand from travelers for luxury tourism, adventure sports, and various type of outdoor activities.

Category-wise Insights

Which service type is more preferred by travelers in online travel agencies market.

According to the analysis, in terms of service type the transportation service is widely preferred by travelers with the sub-segment holding a 22.0% value share in 2022.

Transportation services generate a high demand for their services. Few the transport services such as car rentals or bus travel agencies are in heavy demand as they are the part of daily mode of transport for many travelers.

Apart from this the attractive offers and schemes from the transportation services attract travelers to use these online services more often. Lastly, the transportation services are having a wide coverage of travelers as compared to the tour/vacation packages or accommodations as they generate demand only when there is a need.

How is the Competitive Landscape in the Market for Online Travel Agencies?

Leading players operating globally in the market are focusing on the expansion of their business. Also working on their service and creating advanced technology to attract new customers.

The competitive landscape in the market for online travel agencies is intense and dynamic. Numerous players, ranging from established companies to emerging startups, compete for market share.

Key industry players strive to differentiate themselves by offering unique features, enhanced user experiences, and a wide range of travel services.

They invest in advanced technologies, such as artificial intelligence and machine learning, to provide personalized recommendations and streamline booking processes. Additionally, partnerships with airlines, hotels, and other travel service providers are crucial to expand their offerings and provide competitive pricing.

Continuous innovation, customer-centric strategies, and effective marketing campaigns are vital for online travel agencies to gain a competitive edge in this rapidly evolving market.

Key Players

- Expedia Group Inc.

- Booking Holding Inc.

- Trip Advisor Inc.

- MakeMyTrip Pvt. Limited

- Hostelworld Group PLC (HSW)

- Trivago N.V

- Thomas Cook India Ltd.

- Lastminute.com Group

- Orbitz Worldwide

- Walt Disney World

For instance:

- In the year 2018, Booking.com announced a new product version of the booking.com application and website at Vacation Rental Management Association (VRMA). The new product features allow users to select the product of a partner’s brand beyond booking.com own products. Also, they introduced group connect, guest management, and enhance connectivity features in their new application.

- Recently in 2022, Expedia Group announced an Open World Technology platform. The technology is developed for partner agencies. The platform has a complete e-commerce suit, with various blocks like payments, chatbot, services, and fraud detection, and is perfect for the agency planning to enter the newly in online travel business.

Segmentation Analysis

By service type:.

- Transportation

- Vacation Packages

- Accommodation

By Device Platform:

By payment modes:.

- Debit / Credit Card

- Others (Vouchers, Discount Codes)

By Booking Type:

- Online Travel Agents

- Direct Travel Agents

By Customer Segment:

- Corporate Traveller

- Individual Traveller

By Age Group:

- 15-25 Years

- 26-35 Years

- 36-45 Years

- 46-55 Years

- 66-75 Years

- North America

- Latin America

Frequently Asked Questions

How is the historical performance of the market.

During 2018 to 2022, the market grew at a 6.70% CAGR.

Who are the Key Market Players of this market?

Airbnb, Trip Advisor Inc., and Trivago N.V. are key market players.

What factors contribute to the attraction of this market in Europe?

Increasing online travel bookings raises the market.

How Big is this market?

This market is valued at US$ 465.1 million in 2023.

How Big will be this Market by 2033?

This market is estimated to reach US$ 1,694.2 million by 2033.

Table of Content

Recommendations.

Travel and Tourism

Travel Agency Services Market

REP-GB-3038

Managed Travel Distribution Market

October 2022

REP-GB-3011

Explore Travel and Tourism Insights

- Get Free Brochure -

Your personal details are safe with us. Privacy Policy*

- Get a Free Sample -

- Request Methodology -

- Customize Now -

I need Country Specific Scope ( -30% )

- Talk To Analyst -

I am searching for Specific Info.

- Download Report Brochure -

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

- +1 551 333 1547

- +44 2070 979277

- live:skype_chat

- Join Our Team

Consumer Disc

Global Online Travel Agency (OTA)

Online Travel Agency (OTA) Comprehensive Study by Type (Merchant Model, Agency Model), Services (Transportation, Travel Accommodation, Vacation Packages), Destination (Domestic Travel, International Travel), Platform (Mobile, Desktop) Players and Region - Global Market Outlook to 2030

Online travel agency (ota) market by xx submarkets | forecast years 2024-2030 .

- Market Segments

- Table of Content

- List of Table & Figures

- Players Profiled

Report Objectives / Segmentation Covered

- Merchant Model

- Agency Model

- Transportation

- Travel Accommodation

- Vacation Packages

- Domestic Travel

- International Travel

- Rest of South America

- South Korea

- Rest of Asia-Pacific

- United Kingdom

- Netherlands

- Rest of Europe

- Middle East

- United States

- 1.1. Introduction

- 1.2.1. Research Objective

- 2.1. Introduction

- 3.1. Introduction

- 3.2.1. Rise in Internet Penetration and Innovative Mobile Apps

- 3.2.2. Increase in International and Domestic Tourism

- 3.3.1. High Competition among Established Players

- 3.3.2. Fluctuations in Demand Share Due to Enforcement of Stringent Lockdown Measures

- 3.4.1. Emergence of AI Chabot�s

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5.1. Introduction

- 5.2.1.1. Merchant Model

- 5.2.1.2. Agency Model

- 5.2.2.1. Transportation

- 5.2.2.2. Travel Accommodation

- 5.2.2.3. Vacation Packages

- 5.2.3.1. Domestic Travel

- 5.2.3.2. International Travel

- 5.2.4.1. Mobile

- 5.2.4.2. Desktop

- 5.2.5.1.1. Brazil

- 5.2.5.1.2. Argentina

- 5.2.5.1.3. Rest of South America

- 5.2.5.2.1. China

- 5.2.5.2.2. Japan

- 5.2.5.2.3. India

- 5.2.5.2.4. South Korea

- 5.2.5.2.5. Taiwan

- 5.2.5.2.6. Australia

- 5.2.5.2.7. Rest of Asia-Pacific

- 5.2.5.3.1. Germany

- 5.2.5.3.2. France

- 5.2.5.3.3. Italy

- 5.2.5.3.4. United Kingdom

- 5.2.5.3.5. Netherlands

- 5.2.5.3.6. Rest of Europe

- 5.2.5.4.1. Middle East

- 5.2.5.4.2. Africa

- 5.2.5.5.1. United States

- 5.2.5.5.2. Canada

- 5.2.5.5.3. Mexico

- 5.3.1. Global Online Travel Agency (OTA) by: Type (Price)

- 6.1.1.1. Top 3

- 6.1.1.2. Top 5

- 6.2. Peer Group Analysis (2023)

- 6.3. BCG Matrix

- 6.4.1.1. Business Overview

- 6.4.1.2. Products/Services Offerings

- 6.4.1.3. Financial Analysis

- 6.4.1.4. SWOT Analysis

- 6.4.2.1. Business Overview

- 6.4.2.2. Products/Services Offerings

- 6.4.2.3. Financial Analysis

- 6.4.2.4. SWOT Analysis

- 6.4.3.1. Business Overview

- 6.4.3.2. Products/Services Offerings

- 6.4.3.3. Financial Analysis

- 6.4.3.4. SWOT Analysis

- 6.4.4.1. Business Overview

- 6.4.4.2. Products/Services Offerings

- 6.4.4.3. Financial Analysis

- 6.4.4.4. SWOT Analysis

- 6.4.5.1. Business Overview

- 6.4.5.2. Products/Services Offerings

- 6.4.5.3. Financial Analysis

- 6.4.5.4. SWOT Analysis

- 6.4.6.1. Business Overview

- 6.4.6.2. Products/Services Offerings

- 6.4.6.3. Financial Analysis

- 6.4.6.4. SWOT Analysis

- 6.4.7.1. Business Overview

- 6.4.7.2. Products/Services Offerings

- 6.4.7.3. Financial Analysis

- 6.4.7.4. SWOT Analysis

- 6.4.8.1. Business Overview

- 6.4.8.2. Products/Services Offerings

- 6.4.8.3. Financial Analysis

- 6.4.8.4. SWOT Analysis

- 6.4.9.1. Business Overview

- 6.4.9.2. Products/Services Offerings

- 6.4.9.3. Financial Analysis

- 6.4.9.4. SWOT Analysis

- 6.4.10.1. Business Overview

- 6.4.10.2. Products/Services Offerings

- 6.4.10.3. Financial Analysis

- 6.4.10.4. SWOT Analysis

- 6.4.11.1. Business Overview

- 6.4.11.2. Products/Services Offerings

- 6.4.11.3. Financial Analysis

- 6.4.11.4. SWOT Analysis

- 6.4.12.1. Business Overview

- 6.4.12.2. Products/Services Offerings

- 6.4.12.3. Financial Analysis

- 6.4.12.4. SWOT Analysis

- 6.4.13.1. Business Overview

- 6.4.13.2. Products/Services Offerings

- 6.4.13.3. Financial Analysis

- 6.4.13.4. SWOT Analysis

- 7.1. Introduction

- 7.2.1.1. Merchant Model

- 7.2.1.2. Agency Model

- 7.2.2.1. Transportation

- 7.2.2.2. Travel Accommodation

- 7.2.2.3. Vacation Packages

- 7.2.3.1. Domestic Travel

- 7.2.3.2. International Travel

- 7.2.4.1. Mobile

- 7.2.4.2. Desktop

- 7.2.5.1.1. Brazil

- 7.2.5.1.2. Argentina

- 7.2.5.1.3. Rest of South America

- 7.2.5.2.1. China

- 7.2.5.2.2. Japan

- 7.2.5.2.3. India

- 7.2.5.2.4. South Korea

- 7.2.5.2.5. Taiwan

- 7.2.5.2.6. Australia

- 7.2.5.2.7. Rest of Asia-Pacific

- 7.2.5.3.1. Germany

- 7.2.5.3.2. France

- 7.2.5.3.3. Italy

- 7.2.5.3.4. United Kingdom

- 7.2.5.3.5. Netherlands

- 7.2.5.3.6. Rest of Europe

- 7.2.5.4.1. Middle East

- 7.2.5.4.2. Africa

- 7.2.5.5.1. United States

- 7.2.5.5.2. Canada

- 7.2.5.5.3. Mexico

- 7.3.1. Global Online Travel Agency (OTA) by: Type (Price)

- 8.1. Acronyms

- 9.1.1. Research Programs/Design

- 9.1.2. Market Size Estimation

- 9.1.3. Market Breakdown and Data Triangulation

- 9.2.1. Secondary Sources

- 9.2.2. Primary Sources

- 9.3. Disclaimer

- Table 1. Online Travel Agency (OTA): by Type(USD Million)

- Table 2. Online Travel Agency (OTA) Merchant Model , by Region USD Million (2018-2023)

- Table 3. Online Travel Agency (OTA) Agency Model , by Region USD Million (2018-2023)

- Table 4. Online Travel Agency (OTA): by Services(USD Million)

- Table 5. Online Travel Agency (OTA) Transportation , by Region USD Million (2018-2023)

- Table 6. Online Travel Agency (OTA) Travel Accommodation , by Region USD Million (2018-2023)

- Table 7. Online Travel Agency (OTA) Vacation Packages , by Region USD Million (2018-2023)

- Table 8. Online Travel Agency (OTA): by Destination(USD Million)

- Table 9. Online Travel Agency (OTA) Domestic Travel , by Region USD Million (2018-2023)

- Table 10. Online Travel Agency (OTA) International Travel , by Region USD Million (2018-2023)

- Table 11. Online Travel Agency (OTA): by Platform(USD Million)

- Table 12. Online Travel Agency (OTA) Mobile , by Region USD Million (2018-2023)

- Table 13. Online Travel Agency (OTA) Desktop , by Region USD Million (2018-2023)

- Table 14. South America Online Travel Agency (OTA), by Country USD Million (2018-2023)

- Table 15. South America Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 16. South America Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 17. South America Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 18. South America Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 19. Brazil Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 20. Brazil Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 21. Brazil Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 22. Brazil Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 23. Argentina Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 24. Argentina Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 25. Argentina Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 26. Argentina Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 27. Rest of South America Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 28. Rest of South America Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 29. Rest of South America Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 30. Rest of South America Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 31. Asia Pacific Online Travel Agency (OTA), by Country USD Million (2018-2023)

- Table 32. Asia Pacific Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 33. Asia Pacific Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 34. Asia Pacific Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 35. Asia Pacific Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 36. China Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 37. China Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 38. China Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 39. China Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 40. Japan Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 41. Japan Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 42. Japan Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 43. Japan Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 44. India Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 45. India Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 46. India Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 47. India Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 48. South Korea Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 49. South Korea Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 50. South Korea Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 51. South Korea Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 52. Taiwan Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 53. Taiwan Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 54. Taiwan Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 55. Taiwan Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 56. Australia Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 57. Australia Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 58. Australia Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 59. Australia Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 60. Rest of Asia-Pacific Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 61. Rest of Asia-Pacific Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 62. Rest of Asia-Pacific Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 63. Rest of Asia-Pacific Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 64. Europe Online Travel Agency (OTA), by Country USD Million (2018-2023)

- Table 65. Europe Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 66. Europe Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 67. Europe Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 68. Europe Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 69. Germany Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 70. Germany Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 71. Germany Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 72. Germany Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 73. France Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 74. France Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 75. France Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 76. France Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 77. Italy Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 78. Italy Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 79. Italy Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 80. Italy Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 81. United Kingdom Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 82. United Kingdom Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 83. United Kingdom Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 84. United Kingdom Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 85. Netherlands Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 86. Netherlands Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 87. Netherlands Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 88. Netherlands Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 89. Rest of Europe Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 90. Rest of Europe Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 91. Rest of Europe Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 92. Rest of Europe Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 93. MEA Online Travel Agency (OTA), by Country USD Million (2018-2023)

- Table 94. MEA Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 95. MEA Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 96. MEA Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 97. MEA Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 98. Middle East Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 99. Middle East Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 100. Middle East Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 101. Middle East Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 102. Africa Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 103. Africa Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 104. Africa Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 105. Africa Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 106. North America Online Travel Agency (OTA), by Country USD Million (2018-2023)

- Table 107. North America Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 108. North America Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 109. North America Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 110. North America Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 111. United States Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 112. United States Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 113. United States Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 114. United States Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 115. Canada Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 116. Canada Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 117. Canada Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 118. Canada Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 119. Mexico Online Travel Agency (OTA), by Type USD Million (2018-2023)

- Table 120. Mexico Online Travel Agency (OTA), by Services USD Million (2018-2023)

- Table 121. Mexico Online Travel Agency (OTA), by Destination USD Million (2018-2023)

- Table 122. Mexico Online Travel Agency (OTA), by Platform USD Million (2018-2023)

- Table 123. Online Travel Agency (OTA): by Type(USD/Units)

- Table 124. Company Basic Information, Sales Area and Its Competitors

- Table 125. Company Basic Information, Sales Area and Its Competitors

- Table 126. Company Basic Information, Sales Area and Its Competitors

- Table 127. Company Basic Information, Sales Area and Its Competitors

- Table 128. Company Basic Information, Sales Area and Its Competitors

- Table 129. Company Basic Information, Sales Area and Its Competitors

- Table 130. Company Basic Information, Sales Area and Its Competitors

- Table 131. Company Basic Information, Sales Area and Its Competitors

- Table 132. Company Basic Information, Sales Area and Its Competitors

- Table 133. Company Basic Information, Sales Area and Its Competitors

- Table 134. Company Basic Information, Sales Area and Its Competitors

- Table 135. Company Basic Information, Sales Area and Its Competitors

- Table 136. Company Basic Information, Sales Area and Its Competitors

- Table 137. Online Travel Agency (OTA): by Type(USD Million)

- Table 138. Online Travel Agency (OTA) Merchant Model , by Region USD Million (2025-2030)

- Table 139. Online Travel Agency (OTA) Agency Model , by Region USD Million (2025-2030)

- Table 140. Online Travel Agency (OTA): by Services(USD Million)

- Table 141. Online Travel Agency (OTA) Transportation , by Region USD Million (2025-2030)

- Table 142. Online Travel Agency (OTA) Travel Accommodation , by Region USD Million (2025-2030)

- Table 143. Online Travel Agency (OTA) Vacation Packages , by Region USD Million (2025-2030)

- Table 144. Online Travel Agency (OTA): by Destination(USD Million)

- Table 145. Online Travel Agency (OTA) Domestic Travel , by Region USD Million (2025-2030)

- Table 146. Online Travel Agency (OTA) International Travel , by Region USD Million (2025-2030)

- Table 147. Online Travel Agency (OTA): by Platform(USD Million)

- Table 148. Online Travel Agency (OTA) Mobile , by Region USD Million (2025-2030)

- Table 149. Online Travel Agency (OTA) Desktop , by Region USD Million (2025-2030)

- Table 150. South America Online Travel Agency (OTA), by Country USD Million (2025-2030)

- Table 151. South America Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 152. South America Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 153. South America Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 154. South America Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 155. Brazil Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 156. Brazil Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 157. Brazil Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 158. Brazil Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 159. Argentina Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 160. Argentina Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 161. Argentina Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 162. Argentina Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 163. Rest of South America Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 164. Rest of South America Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 165. Rest of South America Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 166. Rest of South America Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 167. Asia Pacific Online Travel Agency (OTA), by Country USD Million (2025-2030)

- Table 168. Asia Pacific Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 169. Asia Pacific Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 170. Asia Pacific Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 171. Asia Pacific Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 172. China Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 173. China Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 174. China Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 175. China Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 176. Japan Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 177. Japan Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 178. Japan Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 179. Japan Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 180. India Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 181. India Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 182. India Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 183. India Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 184. South Korea Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 185. South Korea Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 186. South Korea Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 187. South Korea Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 188. Taiwan Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 189. Taiwan Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 190. Taiwan Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 191. Taiwan Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 192. Australia Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 193. Australia Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 194. Australia Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 195. Australia Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 196. Rest of Asia-Pacific Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 197. Rest of Asia-Pacific Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 198. Rest of Asia-Pacific Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 199. Rest of Asia-Pacific Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 200. Europe Online Travel Agency (OTA), by Country USD Million (2025-2030)

- Table 201. Europe Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 202. Europe Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 203. Europe Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 204. Europe Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 205. Germany Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 206. Germany Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 207. Germany Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 208. Germany Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 209. France Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 210. France Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 211. France Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 212. France Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 213. Italy Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 214. Italy Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 215. Italy Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 216. Italy Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 217. United Kingdom Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 218. United Kingdom Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 219. United Kingdom Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 220. United Kingdom Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 221. Netherlands Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 222. Netherlands Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 223. Netherlands Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 224. Netherlands Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 225. Rest of Europe Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 226. Rest of Europe Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 227. Rest of Europe Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 228. Rest of Europe Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 229. MEA Online Travel Agency (OTA), by Country USD Million (2025-2030)

- Table 230. MEA Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 231. MEA Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 232. MEA Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 233. MEA Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 234. Middle East Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 235. Middle East Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 236. Middle East Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 237. Middle East Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 238. Africa Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 239. Africa Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 240. Africa Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 241. Africa Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 242. North America Online Travel Agency (OTA), by Country USD Million (2025-2030)

- Table 243. North America Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 244. North America Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 245. North America Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 246. North America Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 247. United States Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 248. United States Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 249. United States Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 250. United States Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 251. Canada Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 252. Canada Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 253. Canada Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 254. Canada Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 255. Mexico Online Travel Agency (OTA), by Type USD Million (2025-2030)

- Table 256. Mexico Online Travel Agency (OTA), by Services USD Million (2025-2030)

- Table 257. Mexico Online Travel Agency (OTA), by Destination USD Million (2025-2030)

- Table 258. Mexico Online Travel Agency (OTA), by Platform USD Million (2025-2030)

- Table 259. Online Travel Agency (OTA): by Type(USD/Units)

- Table 260. Research Programs/Design for This Report

- Table 261. Key Data Information from Secondary Sources

- Table 262. Key Data Information from Primary Sources

- Figure 1. Porters Five Forces

- Figure 2. Supply/Value Chain

- Figure 3. PESTEL analysis

- Figure 4. Global Online Travel Agency (OTA): by Type USD Million (2018-2023)

- Figure 5. Global Online Travel Agency (OTA): by Services USD Million (2018-2023)

- Figure 6. Global Online Travel Agency (OTA): by Destination USD Million (2018-2023)

- Figure 7. Global Online Travel Agency (OTA): by Platform USD Million (2018-2023)

- Figure 8. South America Online Travel Agency (OTA) Share (%), by Country

- Figure 9. Asia Pacific Online Travel Agency (OTA) Share (%), by Country

- Figure 10. Europe Online Travel Agency (OTA) Share (%), by Country

- Figure 11. MEA Online Travel Agency (OTA) Share (%), by Country

- Figure 12. North America Online Travel Agency (OTA) Share (%), by Country

- Figure 13. Global Online Travel Agency (OTA): by Type USD/Units (2018-2023)

- Figure 14. Global Online Travel Agency (OTA) share by Players 2023 (%)

- Figure 15. Global Online Travel Agency (OTA) share by Players (Top 3) 2023(%)

- Figure 16. Global Online Travel Agency (OTA) share by Players (Top 5) 2023(%)

- Figure 17. BCG Matrix for key Companies

- Figure 18. Hotels.com (United States) Revenue, Net Income and Gross profit

- Figure 19. Hotels.com (United States) Revenue: by Geography 2023

- Figure 20. Agoda (Singapore) Revenue, Net Income and Gross profit

- Figure 21. Agoda (Singapore) Revenue: by Geography 2023

- Figure 22. Despegar (Argentina) Revenue, Net Income and Gross profit

- Figure 23. Despegar (Argentina) Revenue: by Geography 2023

- Figure 24. Expedia Group (United States) Revenue, Net Income and Gross profit

- Figure 25. Expedia Group (United States) Revenue: by Geography 2023

- Figure 26. Booking Holdings Inc. (United States) Revenue, Net Income and Gross profit

- Figure 27. Booking Holdings Inc. (United States) Revenue: by Geography 2023

- Figure 28. Trip.com (China) Revenue, Net Income and Gross profit

- Figure 29. Trip.com (China) Revenue: by Geography 2023

- Figure 30. MakeMyTrip (India) Revenue, Net Income and Gross profit

- Figure 31. MakeMyTrip (India) Revenue: by Geography 2023

- Figure 32. American Express Global Business Travel (United States) Revenue, Net Income and Gross profit

- Figure 33. American Express Global Business Travel (United States) Revenue: by Geography 2023

- Figure 34. Rakuten (Japan) Revenue, Net Income and Gross profit

- Figure 35. Rakuten (Japan) Revenue: by Geography 2023

- Figure 36. TripAdvisor (United States) Revenue, Net Income and Gross profit

- Figure 37. TripAdvisor (United States) Revenue: by Geography 2023

- Figure 38. Trivago N.V. (Germany) Revenue, Net Income and Gross profit

- Figure 39. Trivago N.V. (Germany) Revenue: by Geography 2023

- Figure 40. Thomas Cook Group (United Kingdom) Revenue, Net Income and Gross profit

- Figure 41. Thomas Cook Group (United Kingdom) Revenue: by Geography 2023

- Figure 42. Airbnb Inc. (United States) Revenue, Net Income and Gross profit

- Figure 43. Airbnb Inc. (United States) Revenue: by Geography 2023

- Figure 44. Global Online Travel Agency (OTA): by Type USD Million (2025-2030)

- Figure 45. Global Online Travel Agency (OTA): by Services USD Million (2025-2030)

- Figure 46. Global Online Travel Agency (OTA): by Destination USD Million (2025-2030)

- Figure 47. Global Online Travel Agency (OTA): by Platform USD Million (2025-2030)

- Figure 48. South America Online Travel Agency (OTA) Share (%), by Country

- Figure 49. Asia Pacific Online Travel Agency (OTA) Share (%), by Country

- Figure 50. Europe Online Travel Agency (OTA) Share (%), by Country

- Figure 51. MEA Online Travel Agency (OTA) Share (%), by Country

- Figure 52. North America Online Travel Agency (OTA) Share (%), by Country

- Figure 53. Global Online Travel Agency (OTA): by Type USD/Units (2025-2030)

- Hotels.com (United States)

- Agoda (Singapore)

- Despegar (Argentina)

- Expedia Group (United States)

- Booking Holdings Inc. (United States)

- Trip.com (China)

- MakeMyTrip (India)

- American Express Global Business Travel (United States)

- Rakuten (Japan)

- TripAdvisor (United States)

- Trivago N.V. (Germany)

- Thomas Cook Group (United Kingdom)

- Airbnb Inc. (United States)

- Single User $ 3800

- Corporate User $ 7000

Key Highlights of Report

Budget constraints? Get in touch with us for special pricing

Talk to Our Experts

Want to customize study.

"We employ Market statistics, Industry benchmarking, Patent analysis, and Technological Insights to derive requirements and provide customize scope of work."

Frequently Asked Questions (FAQ):

What all players are profiled in the study, can we have customized study for online travel agency (ota) market, what trending factors would impact online travel agency (ota) market growth most, why are some of the most well-known companies left out of the online travel agency (ota) market report, know more about global online travel agency (ota) report, other related reports.

- Request Sample Report

- AI Marketing

- App Store Optimization

- Apple Search Ads

- Growth Marketing

- Mobile Marketing

- Mobile Game Marketing

- Performance Marketing

- Customer Engagement

- Marketing Automation

- In-app Messaging

- iOS Push Notifications

- Android Push Notifications

- SMS Marketing

- Mobile Attribution

- Mobile Measurement Partners

- Crash Reporting

- App Monitoring

- A/B Testing

- Mobile Game Monetization

- Subscription Platforms

- Paywall Platforms

- App Investors

- Social Media Marketing

- TikTok Marketing

- Mobile Ad Networks

- Ad Networks

- CTV Advertising

- In-game Advertising

- Ad Exchanges

- Ad Fraud Tools

- Mobile Ad Analytics

- Mobile DSPs

- Retargeting

- Browse all Categories

- Content Lock

- Incentivized Ads

- Interstitial

- Offer Walls

- Rewarded Video

- Browse all Ad Formats

- Pay Per Call

- Programmatic

- Real Time Bidding

- Self Service

- Augmented Reality

- Browse all Platforms

- Los Angeles

- San Francisco

- Browse all Verticals

- App Builders

- Mobile Games

- Entertainment

- Browse all Offer Types

- Lead Generation

- Sweepstakes

- App Marketing

- User Acquisition

- App Engagement

- App Development

- App Revenue

- App Analytics

- App Talk Interviews

- Subscriptions

- App Benchmarks

- App Reports

- App Sectors

- App Rankings

- App Growth Awards

- News & Announcements

- App Leaders

Travel App Revenue and Usage Statistics (2024)

Updated: September 11, 2024

The online travel booking industry was one of the hardest hit by the coronavirus pandemic, with some apps reporting more than 70 percent less traffic and bookings than 2019.

Curious to learn more about the travel app industry? Check out our premium report

It took two years for most online travel agencies, hotels, and airlines to see a return to form, although for some the levels of revenue and occupancy are still below 2019 figures.

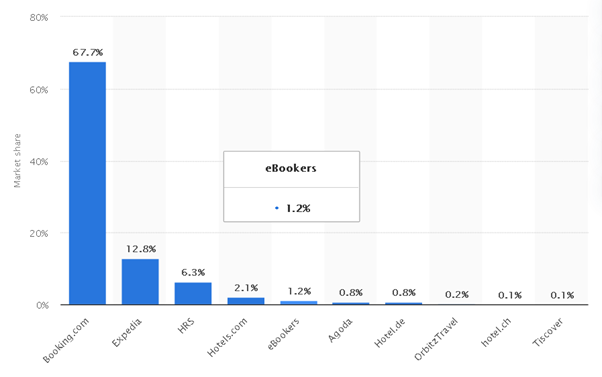

One of the ways Booking.com and Expedia have managed to maintain their market share is through the acquisition of competitor websites and apps. Booking owns Priceline.com, KAYAK, and Agoda, while Expedia Group has Orbitz, Travelocity, and Vrbo in its portfolio.

Another way the duopoly has continued is through an expansion to services offered. Both Booking and Expedia have branched out into flights, car rental, experiences, taxis, and cruises. The model is similar across both platforms, with the OTA receiving a small commission for each booking.

The aim is to be a one-stop destination for a holiday, similar to how a travel agency pre-internet would organise the flight, transport, hotel, and events in a packaged holiday.

Airbnb has started this augmentation as well, with the introduction of Experiences in 2016. It also started to promote long-term stays in 2020, in response to the pandemic halting short-term travel. Transport and co-working services may be next on its list.

Even though Booking, Expedia and Airbnb are the three main platforms, there are others, such as Hopper, TripAdvisor and Trip.com.

We have collected data and statistics on the online travel booking market. Read on below to find out more.

Key Travel App Statistics

- The travel app market generated $629 billion in revenue last year, a 13% increase on the previous year

- Booking generated the most revenue out of all online travel agencies in 2023

- Over 850 million people used a travel app in 2023

- Expedia holds a slight lead in the US market, at 19.3% market share

- Booking was the most downloaded travel app in 2023, with over 80 million downloads

Travel App Report 2024

Want to learn more about the travel app industry? In our Travel App report , we cover financials, usage, downloads, and demographics by age and gender, alongside market share, and benchmarks.

Top Travel Apps

Travel app revenue.

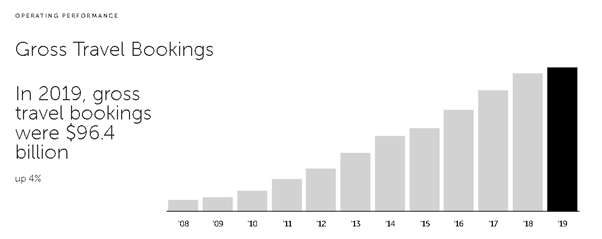

The travel app industry generated $629 billion revenue in 2022, with hotels and accommodation responsible for the majority of that.

Travel app global revenues 2016 to 2023 ($bn)

Travel revenue by app.

Booking Holdings remained the top online travel agency company in terms of revenue in 2023.

Travel booking app revenues 2017 to 2023 ($bn)

Travel app users.

Just over 850 million people used travel apps in 2023, another increase but still shy of 2019 levels.

Travel booking app users 2016 to 2023 (mm)

Travel app market share united states.

Expedia has a lead in the US market, however, Booking has been catching up in recent years.

Travel booking app market share in United States 2023 (%)

Travel app downloads.

Booking had the highest annual downloads worldwide, followed by Airbnb.

Travel booking downloads by app 2023 (mm)

More travel & local app data.

- Vrbo Revenue and Usage Statistics (2024)

- what3words Revenue and Usage Statistics (2024)

- Expedia Revenue and Usage Statistics (2024)

- Lyft Revenue and Usage Statistics (2024)

- Zillow Revenue and Usage Statistics (2024)

- Hopper Revenue and Usage Statistics (2024)

- Uber Revenue and Usage Statistics (2024)

- Taxi App Revenue and Usage Statistics (2024)

- Airbnb Revenue and Usage Statistics (2024)

- Booking Revenue and Usage Statistics (2024)

Global Online Travel Market by Service type (Transportation, Travel Accommodation, and Vacation Packages), by Platform (Mobile and Desktop), Mode of Booking (Online Travel Agencies (OTAs) and Direct Travel Suppliers); By Region (U.S., Canada, Mexico, Rest of North America, The UK, France, Germany, Italy, Spain, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, the Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America) – Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2021-2030

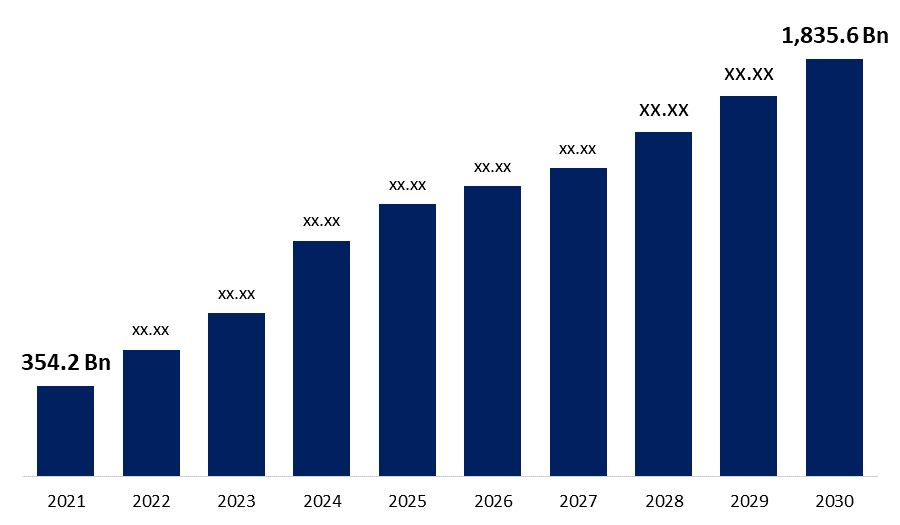

The Global Online Travel Market size was valued at USD 354.2 Bn in 2021. The market is projected to grow USD 1,835.6 Bn in 2030, at a CAGR of 14.8 %. Review sites and travel e-commerce sites make up the majority of the internet travel sector. It provides the convenience of reserving from the comfort of one's own home and frequently entices customers with package deals and cost-cutting choices. As a result, many tourists are opting to book their trips online rather than through traditional brick-and-mortar travel firms. Furthermore, the primary global online travel market is being driven by greater consumer spending power, a government initiative to promote tourism, growing internet and credit card usage, and the creation of new online segments. The increasing penetration of international flight and hotel bookings supplied by online portals such as Booking.com, TripAdvisor.com, .

Get more details on this report -

The emergence of the travel and tourism business, as well as shifting patterns in standard of life, has resulted in a steady increase in the online travel market. The demand for online travels varies depending on the property type and is impacted by factors including location, size, and on-site amenities. The market is likely to be driven by rising disposable income, popularizing weekend culture, the introduction of low-cost airline services, and the developing service industry. The rise in spending power and the style of living are two of the most important factors driving people to luxury resorts. The demand for online travels is also fueled by a city's or country's hosting of sporting events. The development of the market has been hastened by the emergence of online lodging booking services. Marriott International, for example, published a new edition of its mobile app, Marriott Bonvoy, on February 10, 2021, with new features like better booking possibilities, greater personalized experiences, and customizations in earning and redeeming points. As a result, the industry is expected to consolidate due to growing demand for premium services with better booking options.

COVID-19 Analysis

The epidemic of COVID-19 has had a significant influence on the tourism and travel industries. The global implementation of social distancing, stay-at-home, and travel restrictions has stifled the expansion of the online travel industry. According to the American Hotel and Lodging Association 2021 study, hotel occupancy in the United States fell from 66 percent to around 40 percent in 2020, compared to the previous year. As a result of the pandemic, the hotel industry is likely to suffer a severe slowdown; nevertheless, the market is expected to return to its prior growth trajectory in the coming years.

Service Type Outlook

The travel accommodation segment accounted largest market share for the global online travel market in 2020. Market competitors are gradually providing travellers with a varied selection of hotel options at reasonable prices. Customers evaluate lodging options across multiple websites in order to get the most cost-effective option. Because they offer a diverse range of housing options, travelers prefer specialized online accommodation providers such as Airbnb, Inc. and OYO Rooms. As a result, the aforementioned reasons are responsible for the market's rise in the travel accommodation segment. These hotels usually have high-end designer interiors created with cutting-edge technology propels the demand for the growth of the global online travel market.

Global Online Travel Market Report Coverage

Platform Outlook

The mobile segment accounted largest market share for the global online travel market in 2020 owing to the expansion of the market through the mobile sector is mostly due to an increase in mobile usage and the development of novel mobile travel apps. The way people communicate and travel throughout the world has changed as a result of technological advancements. With the advancement of technology and the increased usage of mobile phones, simple and effective techniques are being developed to make travelling simple and comfortable, hence boosting the travel industry's growth. Travelers prefer to make their travel reservations using mobile travel apps, which are gradually gaining traction in the market. As a result, the expansion of the internet travel business is projected to be fueled by an increase in smart phone usage and a rise in digital literacy.

Mode of Booking Outlook

The online travel agencies (OTAs) segment accounted largest market share for the global online travel market in 2020. Online travel firms are becoming the most popular method of making reservations around the world. The rise of online travel agencies has been one of the most striking examples of industry and society's digital revolution in the last 25 years. OTAs have evolved into digital marketplaces that provide direct access to a wide range of online travel options for both B2B and B2C consumers. OTAs can be thought of as a cross between an e-commerce platform and a travel agency. Expedia, Booking.com, and Trip.com, among others, have dominated the global online travel business (hotels, airlines, packaged tours, rail and cruises).

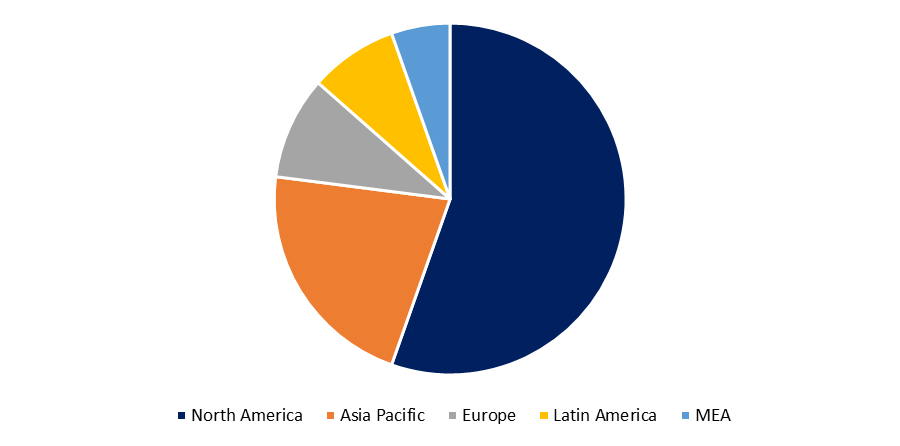

Regional Outlook

Asia Pacific dominated largest market share for the global online travel market in 2020 owing to has the most potential for growth in the internet travel business, with India and China being the most profitable areas. The increase in discretionary income, rise in the middle-class section, and increasing penetration of internet facilities are all factors contributing to the expansion. In China, Ctrip is the most popular online travel agency (OTA), whereas in India, MakeMyTrip, Yatra, and Cleartrip are the most popular OTAs.

Europe is anticipated to emerge as the fastest-growing region over the forecast period. This is due to the presence of some of the world's most popular tourist spots. According to the UNWTO's Foreign Tourism Highlights 2019 Edition, Europe accounted for half of all international visitor arrivals in 2018. The survey also reveals that five major European countries are among the top ten destinations based on foreign tourist arrivals in 2018.

Key Companies & Recent Developments

Partnerships, strategic mergers, and acquisitions are expected to be the most successful strategies for industry participants to get speedy access to growing markets while also improving technological capabilities.

In addition, product differentiation and developments, as well as service expansion, are projected to help organizations thrive in the market.

Market Segmentation of Global Online travel Market

By Service Type

- Transportation

- Travel Accommodation

- Vacation Packages

By Platform

By Mode of booking

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

Key Players:

- Alibaba Group

- Elong, Inc.

- Tuniu Corporation

- AirGorilla, LLC

- Hays Travel limited

- Airbnb, Inc.

- Yatra Online Private Limited, India

- Trip Advisor Inc.

- MakeMyTrip Limited

- Hostelworld Group PLC (HSW)

- Trivago N.V

- Despegar.com, Corp

- Lastminute.com Group

- Single User: $3550 Access to only 1 person; cannot be shared; cannot be printed

- Multi User: $5550 Access for 2 to 5 users only within same department of one company

- Enterprise User: $7550 Access to a company wide audience; includes subsidiary companies or other companies within a group of companies

Premium Report Details

15% free customization.

Share your Requirements

We Covered in Market

- 24/7 Analyst Support

- Worldwide Clients

- Tailored Insights

- Technology Evolution

- Competitive Intelligence

- Custom Research

- Syndicated Market Research

- Market Snapshot

- Market Segmentation

- Growth Dynamics

- Market Opportunities

- Regulatory Overview

- Innovation & Sustainability

Connect with us

- smartphone USA- +1 303 800 4326

- smartphone APAC- +91 9561448932

- email [email protected]

- email [email protected]

Need help to buy this report?

Global Travel Agency Services - Market Research Report (2014-2029)

Past 5-Year Growth

Global travel agency services industry analysis.

Global travel agencies' revenue has grown despite core services dramatically changing due to consumers using online channels to research and book travel. Online booking agents now play a much more significant role alongside traditional brick-and-mortar travel agencies. International tourism thrived before COVID-19, but it severely cut into revenue in 2020, followed by a rebound in 2021 as the economy returned to normal. However, historically high inflation rates have pressured the potential revenue recovery as people cut back on travel when disposable income falls. Global travel agencies' revenue is expected to fall at a CAGR of 5.1% to $295.7 billion through the end of 2024, including a 2.3% increase in 2024 alone.

Trends and Insights

Travel activities thrived before the COVID-19 pandemic. Travel restrictions and decreasing consumer confidence resulted in a mass cancellation of vacation trips.

- Travel agents generate more revenue through client service fees rather than vendor commissions. This business model has placed more responsibility on travel agents, who are forced to provide a higher level of service to retain clients.

- A country or region's share of the global population is a key factor affecting the regional distribution of global travel agencies. A region's share of global GDP is also critical regarding available discretionary income and economic activity.

- Travelers are price sensitive since airfare and accommodation are discretionary purchases. Travel agencies compete fiercely on price in a highly saturated market where consumers are attracted to the best deal.

Everything you need in one report

- Reliable market estimates from 2014-2029

- Competitive analysis, industry segmentation, financial benchmarks

- Powerful SWOT, Porter’s Five Forces and risk management frameworks

- Online membership platform with PDF, Word, Excel and PPT exports

Industry Overview

Table of contents, methodology, market size and recent performance (2014-2029).

Industry revenue has declined at a CAGR of 5.1 % over the past five years, to reach an estimated $295.7bn in 2024.

Travel agents have grown and adapted to reflect new changes and demand

- The industry comprises thousands of travel agencies focused on making their clients' travel arrangements seamless and stress-free. Travel agents find the most affordable airfares, accommodations and other travel-related services for business and leisure customers.

- Additional trends and insights available with purchase

Industry outlook (2024-2029)

Market size is projected to grow over the next five years.

Travel increases at a slower pace

- With the global GDP forecasts appearing positive, global household income will improve. Growth will be robust in Asia, where GDP growth is highest. With access to higher disposable income, more consumers worldwide will spend on international trips.

Biggest companies in the Global Travel Agency Services

To view the market share and analysis for all 5 top companies in this industry, view purchase options.

Products & Services Segmentation