- COLLECTION AND DELIVERY

- TRAVEL MONEY CARD

- CURRENCY RATES

- SHOP FINDER

Travel Money

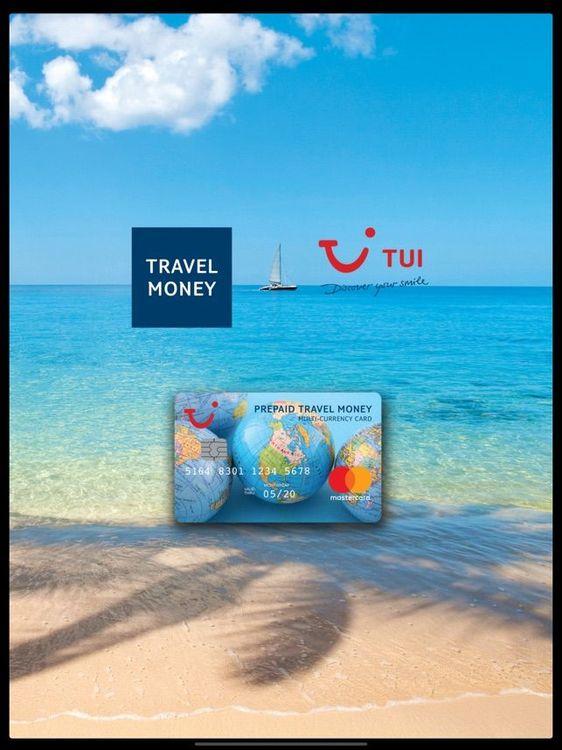

Tui travel money.

TRAVEL MONEY

- Order Travel Money

- Reload Travel Money Card

Enter either the currency amount or the cost (GBP) amount

- Result! You've bagged a better rate of {thisThresholdRate} because you spent over £{thisThresholdTop}.

- More bang for your buck? Spend over £{nextThresholdTop} to get an even better rate of {nextThresholdRate}.

- Keep going - You'll increase your rate to {nextThresholdRate} if you spend over £{nextThresholdTop}.

- Nice work! You've got the best rate on offer today.

- Holds up to 12 currencies at one time.

- FREE to use in bars, restaurants & shops, anywhere you see the Mastercard® Acceptance Mark.

- Manage your money in store, online or in the Travel Money Card App

Enter either the currency amount or the cost (GBP) amount.

Multi-Currency Travel Money Card Mastercard ®

Safe, secure, reloadable. The convenient way to take money abroad. Flexible money on the move:

- 1 card, 12 currencies

- The card is free - apply online or ask in-store

- Award winning - Won 'Best Travel Companion' in the Europe Paybefore Awards 2015

The Multi-Currency Travel Money Card is a safe and secure alternative to carrying cash abroad. It can hold up to twelve currencies at one time; Euro, US Dollars, Australian Dollars, Canadian Dollars, New Zealand Dollars, South African Rand, Turkish Lira, Thai Baht, Mexican Peso, Bulgarian Lev, UAE Dirham and Pounds Sterling.

Key benefits:

- Free to use in restaurants, bars and shops – anywhere you see the Mastercard® Acceptance Mark

- You’ll receive 2 cards linked to the same account, meaning the second card can be used for access to your cash should you lose one. If you should happen to misplace the card it’s not a problem as we can send you the funds via our Western Union money transfer service within 48 hours and at no at additional cost

- Travel Money Card App for checking balances, reloading, transferring funds between wallets and reviewing your transaction history

- The exchange rate is fixed at the time of purchase, so you don’t need to worry about fluctuating rates and the uncertainty of credit/debit card charges

No commission charges when you buy or reload your card

Safe and secure as it’s not linked to any bank account, plus it is Chip & Pin protected

- Can be used as a savings tool

Simply pre-load the Travel Money Card with your budgeted spend and use it to purchase goods or withdraw cash all over the world. The maximum card balance is £6000 and there is a £500† a day withdrawal limit. Please see table below for fees and daily limits.

For any questions, please refer to our FAQs

*2% load fee applies to Sterling cards

†charges apply, multiple ways to manage your account.

You can manage your holiday spending anywhere in the world through the new Travel Money Card App or through your online account:

- Check your balance

- Reload your card

- Transfer money between currency wallets

- Check your transaction history

The app is available to download now for both Apple and Android devices via the App Store or Google Play .

Access your online account here.

You can also manage your account in any TUI Travel Shop or check your balance by calling our helpline on +44(0)203 1300 133*

*Standard call charges apply

Summary of travel money card fees and limits.

Please note these are subject to variation in accordance with the Multi-Currency Travel Money Card Terms and Conditions.

Single Currency Travel Money Card

Please note, these are no longer available for purchase but can still be used until their expiry date. The below fees are subject to variation in accordance with the Single Currency Travel Money Card Terms and Conditions.

Minimum age limit for applicants is 18 years.

How to make a complaint

We will always aim to provide you with the very highest standard of service, but we know that sometimes things can go wrong. If that’s happened to you, please make sure you let us know by contacting us in any of the following ways:

By phone: Contact us by calling us on the following number - 0203 130 0133 (Calls may be monitored and/or recorded for quality and training purposes and for compliance within regulations)

By email: You can contact us by email at [email protected]

In writing: Please write to us at (please address the letter to TUI Complaints) - PO BOX 3883, Swindon, SN3 9EA.

Our Complaints Process

We will promptly acknowledge your complaint within 5 calendar days, from the receipt of your complaints request. We will aim to resolve within a maximum of 15 calendar days from receiving the complaint, keeping you informed of progress. If there is any reason for a delay or extension on this timeframe, we will let you know.

Financial Ombudsman Service

We are committed to resolve any issues you raise with us internally. However, where you are not satisfied with our final response, or if 15 calendar days have passed since you first raised the matter with us, you have the right to refer your case to the Financial Ombudsman Service - the contact details for the Financial Ombudsman are as follows:

Address: Financial Ombudsman Service, Exchange Tower, London, E14 9SR

Phone: 0800 023 4567, Free for people phoning from a fixed line (for example, a landline at home)

0300 123 9 123 Free for mobile phone users who pay a monthly charge for calls to numbers starting 01 or 02

Email: [email protected]

Web: www.financial-ombudsman.org.uk Link opens in a new window FOS provide an online complaint form which can be accessed online (https://help.financial-ombudsman.org.uk/help Link opens in a new window).

This card is issued by PrePay Technologies Limited pursuant to a licence by Mastercard International. PrePay Technologies Limited is an authorised Electronic Money Institution authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Your e-money issuer, Prepay Technologies Limited (referred to as "PPS" or "EPS" or "PPT") protects your money through a process known as safeguarding. As an e-money institution regulated by the FCA, EPS protects funds belonging to e-money customers through a process known as safeguarding. This means that client funds are kept separate from EPS’s own funds and it’s placed into a secure account with an authorised bank or covered through an insurance policy or similar guarantee. The services that EPS offers are not covered by the Financial Services Compensation Scheme (FSCS). In the event of EPS's insolvency, although relevant funds are safeguarded as per the requirement of regulation 21 of the EMRs 2011, it could take longer for monies to be refunded and some costs could be deducted by the administrator or liquidator of the Firm during the insolvency process (as per regulation 24 of the EMRs 2011). Customers may check the FCA website (https://www.fca.org.uk/consumers/using-payment-service-providers) to find guidance in deciding whether the level of protection the firm offers is appropriate in their circumstances.

Your browser is not supported. For more security, comfort and the best experience on this site, please consider updating your browser

- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

TUI Travel Money Review: Fees and Rates Explained 2024

If you’re planning an overseas trip or holiday, you’ll need to work out how to manage your money while you’re away.

Your options include getting foreign currency cash, using a preloaded travel card to buy foreign currency in advance, choosing a dedicated multi-currency card and account, or sticking with your normal bank debit or credit card. Each option has its own advantages and disadvantages - and most travellers choose to use several of these payment methods so there’s always a Plan B available if for some reason your primary payment method can’t be used.

TUI offers both travel money in cash, and the TUI Travel Money Card which is a preloaded multi-currency card . This guide covers all the details you need to know about getting your holiday money through TUI, plus a few alternatives, like Wise debit card or Revolut to compare to make sure you get the best possible deal.

What is TUI Travel Money?

TUI is one of the biggest travel agents in the UK , and also offers travel money services, including travel money for cash collection in 50 currencies, and a travel money card. If you’re ordering your travel money in cash, you’ll have the following options:

Order your travel money in cash online and collect in your local TUI store at any time in the following 2 - 7 days

Order your travel money in cash online by 2pm, to have it delivered to your home by 9pm the following day

TUI doesn’t charge a specific fee for travel money - instead their charges are rolled up into the exchange rate used to convert your pounds to the currency you need. If you’re choosing the home delivery option, there may be a delivery charge depending on how much you’re ordering, and someone must be home to sign for the delivery when it arrives.

While it’s very common for exchange services to state that they offer 0% commission currency conversion, that doesn’t mean that getting your travel money is actually free. We’ll look at the impact of the exchange rates used by TUI on the overall costs of your transaction in more detail later, plus a look at some alternatives which may offer more transparent fees.

If you don’t want foreign currency cash, you can also get a TUI Travel Money Card to hold 13 currencies, which we’ll cover in more detail next.

TUI Travel Money Card

If you’d rather not carry round all your spending money in cash, TUI also offers a dedicated multi-currency card called the TUI Travel Money Card. You can pop into a TUI branch to get 2 linked cards for free, or order online for home delivery. TUI provides 2 cards, so you’ll always have a backup if your primary card is lost - simply activate the second card to get your funds while you’re away.

TUI Travel Money Cards can hold 13 currencies which between them cover many of the popular destinations for British holidaymakers:

Australian dollars

Canadian dollars

New Zealand dollars

South African rand

Turkish lira

Mexican peso

Bulgarian lev

Croatian kuna

Pounds sterling

You’ll be able to top up your card in the currency you need online or in a TUI store, and then spend any currency you hold for free when you travel. If you’re making ATM withdrawals from the card there are fees which are in the region of 1.5 GBP, but varied by currency, and if you spend a currency you don’t hold in your account, there’s a cross-currency fee of 3%.

We’ll cover the full fee details later, but it’s also useful to note that you pay a 2% fee to top up your TUI Travel Money Card in pounds, with no upfront fee to add funds in a foreign currency. This may sound like a great deal, but in reality, it’s likely to simply mean that the fee for topping up in a foreign currency is wrapped up in the exchange rate used to convert your pounds to the currency you need. More on the TUI travel money exchange rates later.

What are the travel money card alternatives?

The TUI Travel Money Card isn’t your only option. Alternative providers may be able to offer more flexibility on the number of supported currencies, a better exchange rate, and lower overall costs. Here are a few to consider:

You can order a Wise card online or via an app, and manage or top up your money electronically whenever you need to. Wise supports over 50 currencies. Top up for free in GBP or another supported currency, with local bank details for up to 10 currencies.

Wise uses the mid-market exchange rate for currency conversion. The Wise card will automatically convert your balance to the currency you need with no extra charges - unlike the TUI Travel Money Card which uses 3% fee when you spend a currency you don’t hold in your account.

Starling is a full UK online bank, which offers a broader range of services compared to TUI. Even if you’re not in the market to get a new bank, a Starling account might be a good option for your travel needs, as accounts are free to open, with no monthly charges, and offer fee-free spending abroad using the Mastercard rate.

You can sign up for Starling online or with your phone in just a few minutes, and manage your account online or through the app easily. Starling works differently to TUI’s travel money card, in that you won’t be able to top up in a broad range of currencies - only pounds or euros. However, whenever you spend or withdraw with your card, Starling will convert your funds to the currency you need with the live Mastercard rate. That’s a popular option because the Mastercard exchange rate is generally very fair, and while it may include a markup, it’s normally very small.

Revolut offers multi-currency accounts which can hold and exchange 30+ currencies, with a linked card to spend in 150+ currencies. You can either choose a free Revolut plan or upgrade to a fee of up to 12.99 GBP/month to get more features. Even with the free Revolut plan you can convert currencies up to 1,000 GBP a month with no fees, and get some fee free international cash withdrawals too. That makes Revolut a strong alternative to the TUI Travel Money Card if you’re looking for fee free transactions.

Revolut accounts also come with additional features, including tools to budget and save, linked children’s accounts, cashback, insurance and travel perks. However, to get the full range of benefits you’ll need to pay a monthly fee.

What are the fees?

Whether you choose to get your travel money in cash from TUI, or prefer to order their dedicated multi-currency card, you’ll have a few costs to pay. Here’s what you need to know.

TUI Travel Money fees

As we mentioned earlier, TUI doesn’t use a specific fee for travel money in foreign currency cash. Instead their charges are added into the exchange rates used, so you’d need to compare the TUI exchange rate against the mid-market rate to be able to calculate the full TUI fee. More on that later.

The only upfront cost you’ll come across with TUI travel money is a delivery charge of 4.99 GBP if you’re ordering cash for home delivery valued at less than 600 GBP.

Tui Travel Money Card fees

Here are the charges you’ll usually see when using a TUI Travel Money Card:

How do I get a TUI travel money card?

You can pick up a TUI Travel Money Card instantly by visiting a TUI store. Alternatively you can order online for store collection - in which case your card will be ready for collection in a couple of days - or home delivery. If you choose the home delivery option it may take up to 2 weeks for your TUI Travel Money Card to arrive.

How do I activate my TUI card?

Depending on how you ordered your card, you may need to activate it before you can use it. You’ll always need to activate the second card provided by TUI if you want to use this instead of your primary card.

If your card needs to be activated, you’ll be able to do so by following the instructions in the letter that comes with your card. You’ll simply need to call the phone number given in the document, and give the activation code which is shown in your paperwork, following automated messages.

How much does it cost to buy travel money from TUI?

It can be a little bit tricky to work out what you’re actually paying when you buy travel money from TUI. That’s because the costs for buying foreign currency cash, or for topping up your travel money card in a foreign currency, are wrapped into the exchange rate that’s used to convert from pounds to the currency you need. That means that to see the actual fees you’re paying you’d need to take the TUI exchange rate and compare it to the mid-market exchange rate.

The mid-market exchange rate is a useful benchmark because this is the rate large providers like TUI get when they buy currencies themselves. To calculate the retail rate they use for their customers, they’ll then add in a percentage fee to cover their costs and generate a profit. This is really common - but makes it very hard to figure out the costs of buying travel money.

A couple of fees that TUI is upfront about include:

2% fee to top up your card in pounds

3% fee to spend a currency you don’t hold

It’s useful to note that the 3% fee applies to any currency you don’t have in your TUI account, even if it’s a currency supported by the card. So let’s say you topped up your card in pounds but spent in France without exchanging your funds. In this case you’d pay the 2% fee at the point of topping up, plus a 3% fee for spending euros when your card only holds pounds. That could mean you have quite a lot less to spend than you think.

What is the TUI exchange rate?

TUI exchange rates for online orders are available on their desktop site. Rates for in store purchases can vary so you’d need to ask in the store when you visit. In both cases, markups - extra fees - are likely to apply.

Not all travel money services bundle their fees into the exchange rates used.

Some of the providers we mentioned earlier as TUI alternatives are good examples. Wise splits out the costs of converting your currency transparently, they use the mid-market rate - and keeps costs down to around 0.4% to 1% for most currencies. Revolut allows customers to convert funds using the mid-market exchange rate up to limits which are set by the plan you choose - again making the process more transparent and keeping costs low.

How does the service work?

You can call into a TUI branch to get your travel money - or order your TUI travel money online for home delivery or in store collection. In this case the process is pretty simple:

Open the TUI website and select the travel money options

Select the currency you need and enter the amount in pounds you want to spend, or the value in foreign currency you want to receive

Add to your basket

Follow the prompts to enter your home delivery address, or the store to collect in

Check over the basket amount and make your payment

You’ll be shown a delivery time, or the earliest possible in store collection time, when you confirm your payment.

If you’d rather get a travel money card you can also order this online for home delivery or pop into a store. If you’re ordering online, simply take the same steps set out above, but select the option to buy a card rather than to get foreign cash. Online deliveries can take 2 weeks to arrive.

TUI has options for getting your travel money including cash for collection or delivery, and the prepaid TUI Travel Money Card. There are usually no upfront fees to pay when you get TUI travel money, but there are costs which are bundled into the exchange rates used. If you choose the travel money card you’ll also run into some other charges such as ATM fees and cross currency fees of 3%.

Depending on your specific needs you may find you can get a more flexible travel card with a different provider, which could also offer lower fees and a better exchange rate. Compare a few options before you pick the perfect travel money solution for your own needs.

TUI Travel Money Review - TUI

TUI issues travel money cards in partnership with Mastercard which is a large, trusted and fully regulated provider of card services. That means any balance you hold is safe - although you’ll still need to take normal common sense precautions to protect your card and account from criminals.

The TUI Travel Money Card can hold euros, US dollars, Australian dollars, Canadian dollars, New Zealand dollars, South African rand, Turkish lira, Thai baht, Mexican peso, Bulgarian lev, Croatian kuna, UAE dirham and pounds sterling.

Order your TUI Travel Money Card online for home delivery, or pop into a TUI store to collect one instantly.

TUI Travel Money 4+

Prepay technologies ltd, designed for ipad.

- 1.6 • 195 Ratings

Screenshots

Description.

The official TUI Travel Money App puts you in control of your holiday spending. As well as providing you access to your TUI Multi-currency Card to check your available balance, load and transfer funds between currencies and view transaction history the app now also has an ATM finder and currency converter. If you do not currently have a Travel Money Card, please visit https://www.money4travel.com/tuiuk/travel-money-card for more information. This is the official Travel Money Card app developed in partnership with Prepay Technologies Ltd

Version 7.7.1

- Fix for connectivity issues experienced by some users - Under the hood security improvements

Ratings and Reviews

195 Ratings

Not impressed. Wouldn’t use again.

I went away for 7 weeks with this card. About 4 weeks in the app stopped letting me top the card up with money, I tried multiple different cards, but no luck. Stuck in Thailand with no money, I was able to get money on it through friends and family kindly topping it up for me from a TUI shop, however that would have been very inconvenient if I had been away for longer for both them and me. I tried to email the help desk with the email address copied off the help page and the email address didn’t even work!!!!! Very expensive card to use! In Thailand it was costing me around £7 every time I got cash out of a cash point!! 100% wouldn’t use this card for a longer trip as it is too unreliable.

Developer Response ,

Hi, I'm so sorry to hear you've had a bad experience. If you would like to discuss it further please feel free to call us on 0203 130 0133.

Does not work.

Thought this was a good idea as I have a daughter who when she see’s cash, plans how it could be spent immediately. Hot he cards, went home, set up account, all good so far. Downloaded the app, skipped the reviews (first mistake), set up password, wasn’t good enough, set up another, went through ok, logged in via the laptop, all good. Tried to log in through the app, no, incorrect credentials, checked the password, still no, then the app lost the servers. Tried again this morning, still incorrect, even tried copying and pasting the details over. Then read reviews, of dear god, someone got stuck abroad when their card stopped working. That’s enough for me. There are issues with this app that most likely won’t be resolved in time for me going away, time to go back to the store and see if I can get the cash. And make sure our daughter doesn’t see it.

Hi Kieron, I'm so sorry to hear you've had issues. Most of the time when the app doesn't let you log in but the website does, it's because the login details are being entered incorrectly. That's not to say that you are making a mistake, but many mobile phones these days 'auto-space' or 'auto-capitalize' so it could be that your phone is doing this to your password and or username. Both are case sensitive so this would cause an issue. If you'd like to discuss it further however please feel free to call us on 0203 130 0133.

Frustrating

Have used this card before and while a bit clunky it was okay. Recently had to replace with new cards due to the old ones expiring. Getting ready to use it again after a break for a couple of years. I can log onto the app and see the remaining balance but can I top up, no. The app isn’t saving the card, the app doesn’t stay open while you go to your backing app to confirm the transaction. Tried with two different cards. I can’t see the cards in the app but if I put in the same card details again, using the same nickname, it states that the nickname is already in use. Even got as far as the banking app saying my transaction was complete only for the TUI app to say it had failed? Probably because in those few seconds the TUI app had logged my out. Come on developers sort out this app.

App Privacy

The developer, PrePay Technologies ltd , indicated that the app’s privacy practices may include handling of data as described below. For more information, see the developer’s privacy policy .

Data Linked to You

The following data may be collected and linked to your identity:

- Financial Info

- Contact Info

- Identifiers

Privacy practices may vary based on, for example, the features you use or your age. Learn More

Information

- Developer Website

- App Support

- Privacy Policy

More By This Developer

Quidity Plus Account

You Might Also Like

Post Office Travel

Virgin Atlantic Holidays

Thomas Cook

Holiday Extras HEHA! Smart App

Butlin’s Minehead

Copyright © 2024 Apple Inc. All rights reserved.

Discover every bank branch and currency exchange location in the UK.

You are here: Home / Blog / TUI Travel Money: Rates and Locations

TUI Travel Money: Rates and Locations

If you’re planning a trip abroad, you’ll need to think about the most convenient way to arrange your travel money.

This might mean exchanging currency before you leave, taking cash to exchange upon arrival, using a prepaid travel card, or relying on your credit or debit card, for example. You can also use a service like Wise and the free online Wise account . You’ll be able to hold and manage dozens of different currencies, access the mid-market exchange rate, and spend using your linked debit card all over the world.

Doing some research before you choose a provider - or providers - for your travel money will mean you can get the very best available deal for your holiday money. This guide covers all you need to know about travel money from TUI - as well as taking a look at Wise (formerly TransferWise) as a smart alternative.

TUI travel money services

TUI is famous as a travel agent offering holidays, cruises, hotel bookings and flights. You can also get all the extras you might need to make your trip comfortable and convenient - including your travel money.

The full range of travel money services includes in store exchange, click and collect foreign currency, travel money for home delivery, and a prepaid multi-currency card. The easiest way to check options and availability for your specific currency is to look online . Select the currency you need to see the options for collection and delivery - bearing in mind some services may be disrupted due to pandemic restrictions.

TUI Store collection

TUI offers travel money services in store, including currency exchange and click and collect travel money.

At the time of research many TUI stores have been forced to close due to restrictions and local lockdowns in place to combat the global pandemic. This may mean the in store and click and collect service is not available at a location convenient to you. However, some units are still operating, and the situation will change as restrictions evolve. You’ll be able to find a full list of all TUI travel money locations online - but do check out the most up to date information about store openings before you travel .

Here are some of TUI’s major London stores which are open at the time of writing:

*Store information and opening accurate at the time of writing - 14th December 2020

Home delivery

If you order travel money from TUI for home delivery, it’ll arrive the next working day as long as you submit your request before 2pm. It’s good to know that you’ll need to be home to sign for the delivery, and the delivery address used must be the same as the address your payment card is registered to.

TUI travel money card

As well as foreign currency in cash, TUI offers a travel money card which can be used for 13 different currencies. Apply online or in store for, and you’ll receive 2 separate cards linked to the same account. Top up your account and then switch to the currency you need online or using the app. You can then spend your travel money anywhere the Mastercard symbol is displayed.

It’s good to know that there are some fees and limits related to the TUI travel money card. It’s also well worth looking at the exchange rate that is offered to buy travel money or switch your sterling balance to the currency you need. Although it’s usually free to spend currencies you own, that doesn’t mean you won’t pay a fee wrapped up in the exchange rate on offer.

You’ll also pay an ATM withdrawal fee which is set by currency, a 2% fee for GBP top-ups, a 3% charge if you spend in an unsupported currency, and a dormancy fee if you don’t use the card regularly enough. Check out the full travel money card terms and conditions to make sure you don’t run into any surprise costs.

Save with Wise when you spend in any currency

Wise offers a smart alternative way to spend when you’re abroad, thanks to the Wise account .

The Wise account is free to open online, and comes with a linked Mastercard debit card . It’s free to top up your account in pounds - and you’ll also be able to receive money to your account in euros, US, Singapore, Australian and New Zealand dollars, Romanian leu and Hungarian forint. Once you have money in your account, you can switch it to the currency you need using the mid-market exchange rate with no markup. You’ll only ever pay a small transparent conversion cost - which works out 8x cheaper than using your bank.

It’s free to spend any currency you hold using your linked Mastercard, and ATM withdrawals are free to the currency value of £200 a month, too. Take a look at the Wise account today for a cheaper and more convenient way to manage your travel money.

TUI travel money rates and fees

You’ll be able to see the exchange rate used by TUI when you order, click and collect or home delivery travel money - or when you call into a TUI location for currency exchange.

It helps to know that currency services often add a markup or margin to the exchange rate they use for travel money. This is especially likely when the service advertises commission free exchange. Instead of an upfront fee, providers may add a markup to the exchange rates to protect their profits. Check the exchange rate against the mid-market exchange rate for your currency pair before you complete your purchase, to make sure you’re getting a good deal.

Not all travel money services add a markup to the exchange rate on offer for customers. Wise , for example, uses the mid-market exchange rate and a clear, low fee which keeps down costs and makes it far easier to see the real cost of your travel money.

Return to the blog .

- Credit Cards & Loans

- Saving & Banking

Household Bills

Spending abroad: should you use a debit, credit or prepaid card.

If you’re going abroad and you don’t want to carry cash, you have three options: a debit card, a credit card or a prepaid card. Each has its pros and cons.

A decade ago, holiday prep tended to involve a trip to the bank or Post Office to buy your foreign currency and Traveller’s Cheques. Today, all you really need for a trip abroad is a debit, credit or prepaid currency card.

All three cards have their pros and cons so it’s worth arming yourself with the facts before deciding which is right for you.

Debit cards

Debit cards are easy and convenient and are accepted in most places. But they can be expensive to use abroad.

Only four current accounts don’t charge any foreign transaction fees for using a debit card abroad, according to financial data firm Defaqto.

Metro Bank, Monzo and Starling are all free accounts, while Nationwide Flexplus comes with a £13 monthly charge. Monzo and Starling are both app-only banks so may not suit you if you’re not smartphone-savvy.

If you plan to withdraw cash from atm services abroad, watch out for fees. Only four current accounts let you withdraw cash for free – Metro Bank, Nationwide Flexplus, Starling and Monzo (although Monzo only lets you withdraw £200 a month for free and then it charges 3%).

Analysis of the whole market by Defaqto shows debit cards are the most expensive way for travellers in Europe to spend, particularly for small purchases. A daily €5 breakfast of coffee and a croissant over a fortnight could end up costing a whopping £21 in addition to the €70 spent on your breakfast.

Credit cards

Credit cards are also an easy way of spending and are accepted by most retailers.

They offer the added benefit of extra security under Section 75 on purchases costing between £100 and £30,000, meaning you should get your money back if something goes wrong.

According to Defaqto, one in six credit cards don’t charge a fee for spending in Europe, although five of these cards charge an annual fee including Natwest Reward Black, RBS Reward Black and Santander All in One.

A big downside of using a credit card abroad is withdrawing cash can be eye-wateringly expense. There is typically a hefty withdrawal fee, and interest accumulates from the day the money is withdrawn.

See table below for a list of credit cards with no foreign transaction fees in Europe.

Prepaid cards

With a prepaid card, you load on the foreign currency of your choice so you can only ever spend the balance on the card.

You can continue to top up your card when you’re travelling using a debit card, smartphone app or current account link. While they aren’t as convenient as a debit or credit card, they can be a useful budgeting tool as they help you keep a close eye on your spending.

Fee structures vary depending on which provider you go with.

Revolut, for example, is virtually free to use abroad (ATM withdrawals are free up to £200 a month then a 2% fee applies).

But some providers (TUI, Asda Money, ICE, for example) charge fees to load money onto the card from a debit card either as a percentage of the amount or a flat fee of between 50p and £3.

One point to note: you may not be able to use your prepaid card for car hire and some petrol stations may not accept them.

Credit Cards with no foreign transaction fees in Europe

Manage everything directly in the N26 app. Set payment limits, change your PIN number and lock and unlock your card. All in real-time, with N26 Card. Click here to find out more .

Top Stories

Ns&i cuts interest rates on guaranteed growth and income bonds, do you have a ‘digital plan’ included in your will here’s why it’s a good idea, renters’ rights bill seeks to address ‘disgraceful conditions’, economy ‘treading water’ as uk gdp flatlines in july 2024, ‘money mule’ cases jump as young account holders targeted, students warned over smishing scams ahead of university term, bank of england unlikely to push through back-to-back base rate cut, grocery price inflation eases as parents stock up on lunchbox essentials, state pension (for some) to increase to nearly £12,000 a year in 2025, last day to bag tsb’s £190 bank switch deal.

The UK’s best rated travel debit card

Save 85% compared to high street banks¹.

What our customers think

Our connected banks, we work with all the major uk high-street banks.

What is Currensea?

Pay safer and faster with Apple Pay

See how much you can save

Save in 180 currencies vs high street banks, prepaid travel cards and travel debit cards.

Find out more

Super convenient

Currensea works with your current bank account to make your holiday money go further.

No new bank account needed

Forget having to set-up and manage multiple accounts

Better than a pre-paid travel card

Currensea connects to your bank account, removing the hassle of pre-loading another card

Use your card globally

Spend abroad in 180 currencies without the normal bank fees!

Advanced Security

Currensea is the layer over your bank account, giving you increased security when you spend abroad..

All purchases are protected by Mastercard Chargeback Protection

Authorised by the Financial Conduct Authority

Secured with the latest bank security and encryption technology

All purchases protected by Mastercard Chargeback Protection

Pricing plans

Our plans are simple and transparent. we give you the best live exchange rate so you can spend in confidence, without the hidden fees. .

Essential Card - Free

0.5% FX Rate

For all transactions & ATM

Fee free ATM abroad

£500pm, 2% FX rate over

Spend in 180 currencies

Get the best live exchange rates

Market beating Money Transfer

Send £100 - £20,000 per transfer

Advanced security

Spend notifications, set spend limits & freeze/unfreeze card

Purchase protection

Mastercard 120-day chargeback protection

Spend in all 180 currencies

Get the best live interbank exchange rates

Singapore Airlines KrisFlyer air miles

Convert savings into air miles

Free card delivery

Mastercard travel debit card

Premium - £25/year

£500pm, 1% FX rate over

Premium Benefits

Hertz 5* status, Preferred Hotels discounts, and much more...

Market beating Money Transfer

Purchase protection

120-day Mastercard chargeback protection

Singapore Airlines KrisFlyer air miles Convert savings into air miles

Free card delivery

Premium offers

Access our latest offers for Premium travel debit card users

Car hire benefits

Including Hertz Gold Plus Rewards with complimentary Five Star Status and a 20% worldwide discount with Avis

Preferred Hotels & Resorts

Complimentary night's stay when booking a trip of 4 nights or more

- More about Premium

Elite - £120/year

Unbeatable 0% FX rate

£750pm, 1% FX rate over

Elite Benefits

Avis & Hertz president's club, concierge, hotel price guarantee, lounge access...

Elite offers

Access our latest offers for Elite travel debit card users

Exclusive car hire benefits

Exclusive membership to Avis President's club and Hertz's President's Circle

Complimentary night's stay when booking a trip of 4 nights or more and other exclusive benefits with 'Elite I Prefer Member Status'

World-class concierge by “Ten”

24/7 travel concierge giving you truly luxurious benefits

Worldwide airport lounge access

LoungeKey TM warmly welcomes you to access 1100+ airport lounges

Luxury hotels and resorts perks

Explore 3,000+ locations with extravagant benefits incl, complimentary breakfast, room upgrades and much more

- More about Elite

No hidden fees

Currensea has no weekend charges, no foreign currency purchase fee, no dormant card fees, and no non-sterling transaction fees.

How does Currensea make its money?

Currensea pricing plans

Our plans are simple and transparent. we give you the best live exchange rate so you can spend in confidence, without the hidden fees..

Saves 85 % on bank charges*

Across card spend & ATM withdrawals

2% FX rate over £500pm

Mastercard chargeback protection

Saves 100 % on bank charges*

1% FX rate over £500pm

£ 120 /year

1% FX rate over £750pm

Send £100 - £20,000 per transfer

Mastercard World Elite travel debit card

Enjoy 4 nights for the price of 3 and other exclusive benefits with 'Elite I Prefer Member Status'

Explore 3,000+ locations with extravagant benefits incl complimentary breakfast, room upgrades and much more

*Terms and conditions apply

So, how does Currensea make its money?

How Currensea works

Giving back

We know our cards contain plastic, and we are working on different solutions to reduce this. In the meantime, we're focussed on reducing our impact and have committed to removing 2.5 times the plastic we produce every year from the world's oceans, by supporting Plastic Bank.

You may also want to offset part of your travel, so we've provided you the option to contribute a % of your savings to removing ocean plastic, and/or planting trees every time you spend.

Find out more about our commitment

¹ We calculate the average cost that high street banks would add to your transactions overseas. This includes: Barclays, HSBC, Lloyds Bank & RBS. We then subtract the cost whilst using Currensea, giving your estimated savings vs high street banks

MASTERCARD BENEFIT INQUIRIES

Within the U.S.: 1-800-Mastercard (1-800-627-8372) | Outside the U.S.: Mastercard Global Service Phone Numbers

Availability of insurance benefits on your card may vary by card issuer. Please refer to your issuing financial institution for complete insurance benefit coverage terms, conditions and exclusions.

*Card registration required. Certain exceptions apply. Click here for terms and conditions .

†Requirements may vary. See card packaging for details or contact card issuer.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

16 Best Travel Credit Cards of September 2024

The best travel credit card is one that brings your next trip a little closer every time you use it. Purchases earn points or miles you can use to pay for travel. If you're loyal to a specific airline or hotel chain, consider one of that company's branded travel credit cards. Otherwise, check out our picks for general-purpose travel cards that give you flexible travel rewards without the restrictions and blackout dates of branded cards.

400+ credit cards reviewed by our team of experts ( See our top picks )

80+ years of combined experience covering credit cards and personal finance

27,000+ hours spent researching and reviewing financial products in the last 12 months

Objective comprehensive ratings rubrics ( Methodology )

NerdWallet's credit cards content, including ratings and recommendations, is overseen by a team of writers and editors who specialize in credit cards. Their work has appeared in The Associated Press, USA Today, The New York Times, MarketWatch, MSN, NBC's "Today," ABC's "Good Morning America" and many other national, regional and local media outlets. Each writer and editor follows NerdWallet's strict guidelines for editorial integrity .

Show summary

NerdWallet's Best Travel Credit Cards of September 2024

Chase Sapphire Preferred® Card : Best for Max flexibility + big bonus

Capital One Venture Rewards Credit Card : Best for Flat-rate rewards

Capital One Venture X Rewards Credit Card : Best for Travel portal benefits

Chase Freedom Unlimited® : Best for Cash back for travel bookings

American Express® Gold Card : Best for Big rewards on everyday spending

Wells Fargo Autograph℠ Card : Best for Bonus rewards + no annual fee

The Platinum Card® from American Express : Best for Luxury travel perks

Ink Business Preferred® Credit Card : Best for Business travelers

Citi Strata Premier℠ Card : Best for Triple points on multiple categories

Capital One VentureOne Rewards Credit Card - Miles Boost : Best for Flat-rate rewards + no annual fee

Chase Sapphire Reserve® : Best for Bonus rewards + high-end perks

World of Hyatt Credit Card : Best for Best hotel card

Bilt World Elite Mastercard® Credit Card : Best for Travel rewards for rent payments

United℠ Explorer Card : Best for Best airline card

PenFed Pathfinder® Rewards Visa Signature® Card : Best for Credit union benefits

Wells Fargo Autograph Journey℠ Card : Best for Booking directly with airlines/hotels

Best Travel Credit Cards

Find the right credit card for you..

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Max flexibility + big bonus

Flat-rate rewards, travel portal benefits, cash back for travel bookings, big rewards on everyday spending, bonus rewards + no annual fee, luxury travel perks, business travelers, triple points on multiple categories, flat-rate rewards + no annual fee, bonus rewards + high-end perks, best hotel card, travel rewards for rent payments, best airline card, credit union benefits, booking directly with airlines/hotels, full list of editorial picks: best travel credit cards.

Before applying, confirm details on the issuer’s website.

Capital One Venture Rewards Credit Card

Our pick for: Flat-rate rewards

The Capital One Venture Rewards Credit Card is probably the best-known general-purpose travel credit card, thanks to its ubiquitous advertising. You earn 5 miles per dollar on hotels and car rentals booked through Capital One Travel and 2 miles per dollar on all other purchases. Miles can be redeemed at a value of 1 cent apiece for any travel purchase, without the blackout dates and other restrictions of branded hotel and airline cards. The card offers a great sign-up bonus and other worthwhile perks ( see rates and fees ). Read our review.

Capital One VentureOne Rewards Credit Card - Miles Boost

Our pick for: Flat-rate rewards + no annual fee

With the Capital One VentureOne Rewards Credit Card - Miles Boost , you don't pay an annual fee, but you also don't get rewards as rich as those on the regular Venture card ( see rates and fees ). Still, the bonus offer makes this a solid card for starting out with travel rewards. Read our review.

Chase Sapphire Reserve®

Our pick for: Bonus rewards + high-end perks

The high annual fee on the Chase Sapphire Reserve® gives many potential applicants pause, but frequent travelers should be able to wring enough value out of this card to more than make up for the cost. Cardholders get bonus rewards (up to 10X) on dining and travel, a fat bonus offer, annual travel credits, airport lounge access, and a 50% boost in point value when redeeming points for travel booked through Chase. Points can also be transferred to about a dozen airline and hotel partners. Read our review.

Chase Sapphire Preferred® Card

Our pick for: Max flexibility + big bonus

For a reasonable annual fee, the Chase Sapphire Preferred® Card earns bonus rewards (up to 5X) on travel, dining, select streaming services, and select online grocery purchases. Points are worth 25% more when you redeem them for travel booked through Chase, or you can transfer them to about a dozen airline and hotel partners. The sign-up bonus is stellar, too. Read our review.

Wells Fargo Autograph Journey℠ Card

Our pick for: Booking directly with airlines/hotels

The Wells Fargo Autograph Journey℠ Card stands out among general-purpose travel cards because it pays its highest rewards rates on travel bookings made directly with airlines and hotels, rather than requiring you to go through the issuer's travel agency, where prices might not be competitive. The points are flexible, you get a good bonus offer, and the card comes with a few other nice perks. Read our review.

Wells Fargo Autograph℠ Card

Our pick for: Bonus rewards + no annual fee

The Wells Fargo Autograph℠ Card offers so much value, it's hard to believe there's no annual fee. Start with a great bonus offer, then earn extra rewards in a host of common spending categories — restaurants, gas stations, transit, travel, streaming and more. Read our review.

Citi Strata Premier℠ Card

Our pick for: Triple points on everyday categories

The Citi Strata Premier℠ Card earns bonus points on select travel, supermarkets, dining, gas stations and EV stations. There's a solid sign-up bonus as well. Read our review.

U.S. Bank Altitude® Connect Visa Signature® Card

Our pick for: Road trips

The U.S. Bank Altitude® Connect Visa Signature® Card is one of the most generous cards on the market if you're taking to the skies or the road, thanks to the quadruple points it earns on travel and purchases at gas stations and EV charging stations. It's also a solid card for everyday expenses like groceries, dining and streaming, all for a $0 annual fee. Read our review .

Capital One Venture X Rewards Credit Card

Our pick for: Travel portal benefits

Capital One's premium travel credit card can deliver terrific benefits — provided you're willing to do your travel spending through the issuer's online booking portal. That's where you'll earn the highest rewards rates plus credits that can make back the bulk of your annual fee ( see rates and fees ). Read our review.

Chase Freedom Unlimited®

Our pick for: Cash back for travel bookings

The Chase Freedom Unlimited® was already a fine card when it offered 1.5% cash back on all purchases. Now it's even better, with bonus rewards on travel booked through Chase, as well as at restaurants and drugstores. On top of all that, new cardholders get a 0% introductory APR period and the opportunity to earn a sweet bonus. Read our review.

The Platinum Card® from American Express

Our pick for: Luxury travel perks

The Platinum Card® from American Express comes with a hefty annual fee, but travelers who like to go in style (and aren't afraid to pay for comfort) can more than get their money's worth. Enjoy extensive airport lounge access, hundreds of dollars a year in travel and shopping credits, hotel benefits and more. That's not even getting into the high rewards rate on eligible travel purchases and the rich welcome offer for new cardholders. Read our review.

American Express® Gold Card

Our pick for: Big rewards on everyday spending

The American Express® Gold Card can earn you a pile of points from everyday spending, with generous rewards at U.S. supermarkets, at restaurants and on certain flights booked through amextravel.com. Other benefits include hundreds of dollars a year in available dining and travel credits and a solid welcome offer for new cardholders. There's an annual fee, though, and a pretty substantial one, so it's not for smaller spenders. Read our review.

Bilt World Elite Mastercard® Credit Card

Our pick for: Travel rewards on rent payments

The Bilt World Elite Mastercard® Credit Card stands out by offering credit card rewards on rent payments without incurring an additional transaction fee. The ability to earn rewards on what for many people is their single biggest monthly expense makes this card worth a look for any renter. You also get bonus points on dining and travel when you make at least five transactions on the card each statement period, and redemption options include point transfers to partner hotel and loyalty programs. Read our review.

PenFed Pathfinder® Rewards Visa Signature® Card

Our pick for: Credit union rewards

With premium perks for a $95 annual fee (which can be waived in some cases), jet-setters will get a lot of value from the PenFed Pathfinder® Rewards Visa Signature® Card . It also offers a generous rewards rate on travel purchases and a decent flat rate on everything else. Plus, you’ll get travel credits and a Priority Pass membership that offers airport lounge access for $32 per visit. Read our review.

United℠ Explorer Card

Our pick for: B est airline card

The United℠ Explorer Card earns bonus rewards not only on spending with United Airlines but also at restaurants and on eligible hotel stays. And the perks are outstanding for a basic airline card — a free checked bag, priority boarding, lounge passes and more. Read our review.

» Not a United frequent flyer? See our best airline cards for other options

World of Hyatt Credit Card

Our pick for: Best hotel card

Hyatt isn't as big as its competitors, but World of Hyatt Credit Card is worth a look for anyone who spends a lot of time on the road. You can earn a lot of points even on non-Hyatt spending, and those points have a high value compared with rival programs. There's a great sign-up bonus, free nights, automatic elite status and more. Read our review.

» Not a Hyatt customer? See our best hotel cards for other options.

Ink Business Preferred® Credit Card

Our pick for: Business travelers

The Ink Business Preferred® Credit Card starts you off with one of the biggest sign-up bonuses of any credit card anywhere: Earn 90,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. You also get bonus rewards on travel expenses and common business spending categories, like advertising, shipping and internet, cable and phone service. Points are worth 25% more when redeemed for travel booked through Chase, or you can transfer them to about a dozen airline and hotel partners. Learn more and apply .

OTHER RESOURCES

How travel rewards work.

Modern-day adventurers and once-a-year vacationers alike love the idea of earning rewards toward their next big trip. According to a NerdWallet study , 68% of American adults say they have a credit card that earns travel rewards.

With a travel rewards credit card, you earn points or miles every time you use the card, but you can often earn more points per dollar in select categories. Some top travel credit cards, such as the Chase Sapphire Reserve® , offer bonus points on any travel spending, while the Marriott Bonvoy Boundless® Credit Card grants bonus points when you use the card at Marriott hotels, grocery stores, restaurants or gas stations.

Not all points and miles earned on travel rewards credit cards are the same:

General-purpose travel credit cards — including the Chase Sapphire Preferred® Card , the American Express® Gold Card and the Capital One Venture Rewards Credit Card — give you rewards that can be used like cash to pay for travel or that can be exchanged for points in airline or hotel loyalty programs. With their flexible rewards, general-purpose options are usually the best travel credit cards for those who don't stick to a single airline or hotel chain.

Airline- and hotel-specific cards — such as the United℠ Explorer Card and the Hilton Honors American Express Card — give points and miles that can be used only with the brand on the card. (Although it's possible in some cases to transfer hotel points to airlines, we recommend against it because you get a poor value.) These so-called co-branded cards are usually the best travel credit cards for those who always fly one particular airline or stay with one hotel group.

How do we value points and miles? With the rewards earned on general travel cards, it's simple: They have a fixed value, usually between 1 and 1.5 cents per point, and you can spend them like cash. With airline miles and hotel points, finding the true value is more difficult. How much value you get depends on how you redeem them.

To better understand what miles are worth, NerdWallet researched the cash prices and reward-redemption values for hundreds of flights. Our results:

Keep in mind that the airline values are based on main cabin economy tickets and exclude premium cabin redemptions. See our valuations page for business class valuations and details about our methodology.

Our valuations are different from many others you may find. That’s because we looked at the average value of a point based on reasonable price searches that anyone can perform, not a maximized value that only travel rewards experts can expect to reach.

You should therefore use these values as a baseline for your own redemptions. If you can redeem your points for the values listed on our valuations page, you are doing well. Of course, if you are able to get higher value out of your miles, that’s even better.

HOW TO CHOOSE A TRAVEL CREDIT CARD

There are scores of travel rewards cards to choose from. The best travel credit card for you has as much to do with you as with the card. How often you travel, how much flexibility you want, how much you value airline or hotel perks — these are all things to take into account when deciding on a travel card. Our article on how to choose a travel credit card recommends that you prioritize:

Rewards you will actually use (points and miles are only as good as your ability to redeem them for travel).

A high earning rate (how much value you get in rewards for every dollar spent on the card).

A sign-up bonus (a windfall of points for meeting a spending requirement in your first few months).

Even with these goals in mind, there are all kinds of considerations that will influence your decision on a travel rewards credit card.

Travel cards are for travelers

Travel cards vs. cash-back cards.

The very first question to ask yourself when choosing a travel credit card is: Should I get a travel card at all? Travel credit cards are best for frequent travelers, who are more likely to get enough value from rewards and perks to make up for the annual fees that the best travel credit cards charge. (Some travel cards charge no annual fee, but they tend to offer lesser rewards than full-fee cards.) A NerdWallet study found that those who travel only occasionally — say, once a year — will probably get greater overall rewards from cash-back credit cards , most of which charge no annual fee, than from a travel card.

Flexibility and perks: A trade-off

Co-branded cards vs. general travel cards.

Travel credit cards fall into two basic categories: co-branded cards and general travel cards.

Co-branded cards carry the name of an airline or hotel group, such as the United℠ Explorer Card or the Marriott Bonvoy Boundless® Credit Card . The rewards you earn are redeemable only with that particular brand, which can limit your flexibility, sometimes sharply. For example, if your credit card's co-branded airline partner doesn't have any award seats available on the flight you want on the day you want, you're out of luck. On the other hand, co-branded cards commonly offer airline- or hotel-specific perks that general travel cards can't match.

General travel cards aren't tied to a specific airline or hotel, so they offer much greater flexibility. Well-known general travel cards include the Capital One Venture Rewards Credit Card and the Chase Sapphire Preferred® Card . Rewards on general travel cards come as points (sometimes called "miles" but they're really points) that you can redeem for any travel expense. You're not locked into using a single airline or hotel, but you also won't enjoy the perks of a co-branded card.

Evaluating general travel credit cards

What you get with a general travel card.

The credit cards featured at the top of this page are general travel cards. They're issued by a bank (such as Chase or Capital One), carry only that bank's name, and aren't tied to any single airline or hotel group. With these cards, you earn points on every purchase — usually 1 to 2 points per dollar spent, sometimes with additional points in certain categories.

Issuers of general travel cards typically entice new applicants with big sign-up bonuses (also known as "welcome offers") — tens of thousands of miles that you can earn by spending a certain amount of money on the card in your first few months.

» MORE: NerdWallet's best credit card sign-up offers

What do you do with those points? Depending on the card, you may have several ways to redeem them:

Booking travel. With this option, your points pay for travel booked through the issuer's website, using a utility similar to Orbitz or Expedia. For example, if points were worth 1 cent apiece when redeemed this way, you could book a $400 flight on the issuer's portal and pay for it with 40,000 points

Statement credit. This lets you essentially erase travel purchases by using your points for credit on your statement. You make travel arrangements however you want (directly with an airline or hotel, through a travel agency, etc.) and charge it to your card. Once the charge shows up on your account, you apply the necessary points and eliminate the cost.

Transferring to partners. The card issuer may allow you to transfer your points to loyalty programs for airlines or hotel chains, turning your general card into something like a co-branded card (although you don't get the perks of a co-brand).

Cash back, gift cards or merchandise. If you don't plan to travel, you can burn off your rewards with these options, although you'll often get a lower value per point.

Airline and hotel cards sharply limit your choice, but they make up for it with perks that only they can offer, like free checked bags or room upgrades. General travel cards, on the other hand, offer maximum flexibility but can't provide the same kinds of perks, because the banks that issue them don't operate the airlines or hotels. Still, there are some noteworthy perks on general travel cards, including:

Travel credit. This is automatic reimbursement for travel-related spending. Some top travel credit cards offer hundreds of dollars a year in travel credit.

Trusted traveler reimbursement. More and more travel credit cards are covering the application fee for TSA Precheck and Global Entry, programs that allow you to move through airport security and customs more quickly.

Airport lounge access. Hundreds of lounges worldwide operate separately from airlines under such networks as Priority Pass and Airspace, and several general travel cards offer access to these lounges.

Points programs

Every major card issuer has at least one travel card with a points program. American Express calls its program Membership Rewards, while Chase has Ultimate Rewards® and Citi pays in ThankYou points. Wells Fargo has Wells Fargo Rewards, and U.S. Bank has FlexPerks. Bank of America® travel cards offer points without a fancy name. Travel cards from Capital One, Barclays and Discover all call their points "miles."

These programs differ in how much their points are worth and how you can use them. Some offer the full range of redemption options, including transfers to loyalty programs. Others let you use them only to book travel or get statement credit.

» MORE: Travel loyalty program reviews

Evaluating airline credit cards

What you get with an airline credit card.

Airline credit cards earn "miles" with each purchase. You typically get 1 mile per dollar spent, with a higher rate (2 or more miles per dollar) on purchases with the airline itself. (Some airline cards have also begun offering extra miles for purchases in additional categories, such as restaurants or car rental agencies.) These miles go into the same frequent-flyer account as the ones you earn by flying the airline, and you can redeem them for free flights with the airline or its alliance partners.

Co-branded airline cards typically offer sign-up bonuses (or welcome offers). But what really sets them apart are the perks they give you. With some cards, for example, the checked-bag benefit alone can make up for the annual fee after a single roundtrip by a couple. Common perks of airline cards include:

Free checked bags. This commonly applies to the first checked bag for you and at least one companion on your reservation. Some cards extend this perk to more people, and higher-end cards (with higher annual fees) may even let you check two bags apiece for free.

Priority boarding. Holders of co-branded airline credit cards often get to board the plane early — after the airline's elite-status frequent flyers but before the general population. This gives you time to settle in and gives you a leg up on claiming that coveted overhead bin space.

In-flight discounts or freebies. You might get, say, 25% off the cost of food and beverages during the flight, or free Wi-Fi.

Airport lounge access. High-end cards often include a membership to the airline's airport lounges, where you can get away from the frenzy in the terminal and enjoy a complimentary snack. Some less-expensive airline cards give you only limited or discounted lounge access; others give you none at all.

Companion fares. This perk lets you bring someone with you for a lower cost when you buy a ticket at full price.

A boost toward elite status. Miles earned with a credit card, as opposed to those earned from actually flying on the airline, usually do not count toward earning elite status in an airline's frequent-flyer program. However, carrying an airline's high-end card might automatically qualify you for a higher tier within the program.

The biggest U.S. airlines — American, United and Delta — offer an array of credit cards. Each airline has a no-annual-fee card that earns miles on purchases but provides little in the way of perks (no free bags or priority boarding). Each has a high-end card with an annual fee in the neighborhood of $450 that offers lounge access and sumptuous perks. And each has a "middle-class" card with a fee of around $100 and solid ongoing perks. Southwest offers three credit cards with varying fees; smaller carriers may just have a single card.

» MORE: NerdWallet's best airline credit cards

Choosing an airline

Which airline card you get depends in large part on what airline you fly, and that's heavily influenced by where you live. Alaska Airlines, for example, has an outstanding credit card, but the airline's routes are concentrated primarily on the West Coast. So it's not a great option for those who live in, say, Buffalo, New York, or Montgomery, Alabama.

If your local airport is dominated by a single airline, then you're probably flying that carrier most (or all) of the time by default. Delta, for example, is the 800-pound gorilla at Minneapolis-St. Paul and Salt Lake City. United has the bulk of the traffic at Newark and Washington Dulles. American calls the shots at Charlotte and Dallas-Fort Worth. That airline's credit card may be your only realistic option. If you're in a large or midsize market with frequent service from multiple airlines, you have more choice.

» MORE: How to choose an airline credit card

Evaluating hotel credit cards

What you get with a hotel card.

Hotel credit cards earn points with each purchase. As with airline cards, you typically get more points per dollar for purchases from the co-brand partner, and some cards also give bonus points in additional categories. (Hotel cards tend to give you a greater number of points overall than airline cards, but each individual point is generally worth less than a typical airline mile.) Similar to the airline model, the points you earn with the card go into the same loyalty account as the points you earn from actually staying at a hotel. You redeem your points for free stays.

Hotel cards usually offer a sign-up bonus, but like airline cards, they really make their bones with the ongoing perks. Common perks on hotel cards include:

Free nights. Several cards offer this perk, which can make up for the card's annual fee. You may get a free night automatically every year, or you may unlock it by spending a certain amount within a year. In the latter case, it comes on top of the points you earn for your spending.

Upgrades and freebies. Cardholders may qualify for automatic room upgrades when available, or free or discounted amenities such as meals or spa packages.

Early check-in/late check-out. No one likes having to cool their heels in the hotel lobby waiting for 3 o'clock to check in. And no one likes have to vacate their room by 11 a.m. when their flight doesn't leave till evening.

Accelerated elite status. Some hotel cards automatically bump you up a level in their loyalty program just for being a cardholder.

» MORE: NerdWallet's best hotel credit cards

Choosing a hotel group

If you decide to go the hotel-card route, you'll need to decide which hotel group gets your business. Hotels aren't as market-concentrated as airlines, so if your travels take you mostly to metropolitan areas, you'll have a decent amount of choice. Keep in mind that even though there are dozens of nationally recognizable hotel brands, ranging from budget inns to luxury resorts, many of them are just units in a larger hotel company, and that company's card can unlock benefits across the group.

Marriott, for example, includes not only its namesake properties but nearly 30 other brands, including Courtyard, Fairfield, Renaissance, Residence Inn, Ritz-Carlton, Sheraton and Westin. The Hilton family includes DoubleTree, Embassy Suites, Hampton Inn and Waldorf-Astoria. InterContinental includes Holiday Inn, Candlewood, Staybridge and Crowne Plaza. Wyndham and Choice have more than 15 mid-tier and budget-oriented brands between them.

HOW TO COMPARE TRAVEL CREDIT CARDS

No travel rewards credit card is going to have everything you want. You're going to be disappointed if you expect to find a high rewards rate, a generous sign-up bonus, top-notch perks and no annual fee. Each card delivers value through a different combination of features; it's up to you to compare cards based on the following features and choose the best travel credit card for your needs and preferences.

Most of the best travel cards charge an annual fee. Fees in the range of $90 to $100 are standard for travel cards. Premium cards with extensive perks will have fees of $450 or more. Weigh the value of the rewards and perks you'll get to make sure they'll make up for the fee.

Can you find good cards without an annual fee? Absolutely! There are no-fee options on our list of the best travel credit cards, and we've rounded up more here . Just be aware that if you go with a no-fee travel card, you'll earn rewards at a lower rate, your sign-up bonus will be smaller, and you won't get as many (if any) perks.

Rewards rate

Rewards can be thought of in terms of "earn rate" and "burn rate".

The earn rate is how many points or miles you receive per dollar spent. Some general travel cards offer flat-rate rewards, meaning you get the same rate on all purchases, all the time — 2 miles per dollar, for example, or 1.5 points per dollar. Others, including most co-branded cards, offer a base rate of maybe 1 point per dollar and then pay a higher rate in certain categories, such as airline tickets, hotel stays, general travel expenses or restaurant meals.

The burn rate is the value you get for those points or miles when you redeem them. The industry average is about 1 cent per point or mile. Some cards, particularly hotel cards, have lower value per point on the "burn" side but give you more points per dollar on the earning side.

When comparing rewards rates, don't just look at the numbers. Look at the categories to which those numbers apply, and find a card that matches your spending patterns. Getting 5 points per dollar seems great — but if those 5X points come only on purchases at, say, office supply stores, and you don't spend money on office supplies, then you're getting lousy value.

Sign-up bonus

Travel cards tend to have the biggest sign-up bonuses — tens of thousands of points that you earn by hitting a certain amount of spending. But there's more to consider when comparing sign-up bonuses than just how many points or miles you earn. You must also take into account how much you have to spend to earn the bonus. While cash-back credit cards often require just $500 to $1,000 in spending over three months to unlock a bonus, travel cards commonly have thresholds of $3,000 to $5,000.

Never spend money you don't have just to earn a sign-up bonus. Carrying $3,000 in debt for a year in order to earn a $500 bonus doesn't make economic sense — the interest you'll pay could easily wipe out the value of the bonus.

Finally, keep in mind that the biggest bonuses will come on cards with annual fees.

Foreign transaction fees

A good travel card will not charge a foreign transaction fee. These fees are surcharges on purchases made outside the U.S. The industry standard is about 3%, which is enough to wipe out most if not all of the rewards you earn on a purchase. If you never leave the U.S., then this isn't much of a concern, but anyone who travels abroad should bring a no-foreign-transaction-fee card with them.

Some issuers don't charge foreign transaction fees on any of their cards. Others charge them on some cards but not all.

International acceptance

Not all travel credit cards are great companions for international travel. While Visa and Mastercard are good pretty much worldwide, you may encounter limited acceptance for American Express and, especially, Discover, depending on the destination. This doesn't mean world travelers should dismiss AmEx and Discover. Just know that if you take one of these cards with you overseas, you'd be smart to bring along a backup in case you run into acceptance problems. (Having a backup card is good advice within the U.S., too, really.)

Travel protections

Consider which travel protections — car rental insurance , trip cancellation coverage , lost baggage protection — are important to you.

"Rewards" are what you get for using a credit card — the points earned with each transaction and the bonuses you unlock with your spending. "Perks" are goodies that you get just for carrying the card. There's a very close correlation between the annual fee on a card and the perks you get for carrying it. Cards with no annual fee are all about rewards and go very light on perks. Premium cards with annual fees of $450 or more are laden with perks (although sometimes their rewards aren't too special). Midtier cards (in the $100 range) tend to have solid rewards and a handful of high-value perks.

Assuming you take advantage of them, the perks often make up for the annual fee on a card quite easily. This is especially true with co-branded cards. Free checked bags can pay for an airline card several times over, and a free night is usually worth more than the fee on a hotel card. When comparing the perks of various cards, be realistic about which ones you will and won't use. Sure, that card may entitle you to a free spa package the next time you're at a five-star hotel, but how often do you stay at five-star hotels?

SHOULD YOU GET A TRAVEL CARD? PROS AND CONS

Pros: why it's worth getting a travel card.

The sign-up bonus gives you a big head-start on travel. Bonuses on the best travel credit cards typically run $500 or more — enough for a roundtrip ticket in many instances.

Perks make travel less expensive and more relaxing. You won't have to worry about cramming a week's worth of clothes into a carry-on if your travel credit card gives you a free checked bag (or automatically reimburses you for the bag fee). Hate the crush of travelers in the terminal? Escape to the airport lounge. Renting a car? Use a travel card that provides primary rental car insurance.

Rewards get you closer to your next trip with every purchase. Spending money on the mundane activities of daily life has a silver lining when you know that every $1,000 you spend will knock $10 or $20 off the cost of that future beach vacation or trip home to see Mom and Dad.

No foreign transaction fee can mean big savings. Take just any old credit card with you on vacation outside the U.S., and $1,000 worth of purchases can cost you $30 off the top due to the foreign transaction surcharge. Good travel cards don't charge this fee.

"Double dipping" gives you more points on travel purchases. Buy a plane ticket or book a hotel room, and you'll earn loyalty points or miles regardless of how you pay. Use the right credit card, though, and you'll earn even more points and miles on top of those.

Strategic redemption can multiply your value. With cash-back credit cards, 1 cent is worth 1 cent, and that's just how it goes. The points and miles on many travel credit cards have variable value based on how you redeem them — booking travel with them vs. transferring them to a partner, booking domestic vs. international flights and economy vs. business class, staying at budget hotels vs. high-end resorts, and so on.

Cons: Why a travel card might not be for you

The best cards charge annual fees. In many cases, the value you get from a credit card more than makes up for the annual fee. But some people are dead set against paying a fee under any circumstances. If that's you, your options in travel cards will be sharply limited, and you won't get the perks that provide a big portion of the value on many cards.

Sign-up bonus spending requirements can be steep. A bonus worth $500, $600 or $700 is attractive, but only if you can afford to earn it with spending you were going to do anyway. If you have to amass thousands of dollars in debt and then pay interest on it, it's not worth it.

Travel cards aren't ideal for infrequent travelers. In the first year with a travel card, you're probably going to come out ahead: You can earn a big sign-up bonus, and several popular cards waive the first year's annual fee, too. In subsequent years, though, you'll break even on that fee only if you use the card enough to make up for it (with the rewards you earn and redeem and the perks you use). Infrequent travelers are more likely to get more total rewards from a cash-back card with no annual fee.

Cash back is simpler and more flexible. Some travel cards allow you to redeem your rewards only for travel. Others give you poor value unless you redeem for travel. Still others have complicated redemption options, making it hard to get the most out of your rewards. With cash-back credit cards, you can use your rewards on anything, you know exactly how much your rewards are worth, and redemption is usually simple.

Rewards cards tend to charge higher interest rates. If you regularly carry a balance from month to month, a travel credit card — or any rewards credit card — probably isn't your best choice. The interest you pay is eating up the value of your rewards. You're better off with a low-interest card that reduces the cost of carrying debt.

MAKING THE MOST OF YOUR TRAVEL CARD

Maximize your rewards with the following tips:

Plan your credit card application around a big purchase to earn the sign-up bonus.