English Use arrow key to access related widget.

- Customer Service

- My USPS ›

- Español

Top Searches

Alert: USPS.com is undergoing routine maintenance from 11 PM ET, Saturday, June 15th through 4 AM ET, Sunday June 16th, 2024. During this time, payment transactions on some applications will be temporarily unavailable. We apologize for any inconvenience.

Alert: USPS.com is undergoing routine maintenance from 10 PM ET, Saturday, May 18 through 4 AM ET, Sunday, May 19, 2024. During this time, you may not be able to sign in to your account and payment transactions on some applications may be temporarily unavailable. We apologize for any inconvenience.

Alert: Some of our applications may be unavailable during routine maintenance from Saturday, May 11 through Sunday, May 12. We apologize for any inconvenience.

Alert: Severe weather in the South, Southeast, and Midwest may impact package delivery. Read More ›

Alert: The online Postal Store is currently unavailable. We are working to resolve the issue and apologize for the inconvenience.

Alert: We are currently experiencing issues with some of our applications. We are working to resolve the issues and apologize for the inconvenience.

Alert: USPS.com is undergoing routine maintenance from 10 PM ET, Saturday, March 9 through 4 AM ET, Sunday, March 10, 2024. During this time, you may not be able to sign-in to your account and payment transactions on some applications may be temporarily unavailable. We apologize for any inconvenience.

Alert: Severe weather conditions across the U.S. may delay final delivery of your mail and packages. Read more ›

Alert: USPS.com is undergoing routine maintenance from 11 PM ET, Saturday, March 2 through 4 AM ET, March 3, 2024. During this time, payment transactions on some applications will be temporarily unavailable. We apologize for any inconvenience.

Alert: We are currently experiencing issues with some of our applications. We apologize for the inconvenience.

Alert: Payment transactions on some applications will be temporarily unavailable from 11 PM ET, Saturday, January 6 through 3 AM ET, Sunday, January 7, 2024. We apologize for any inconvenience.

Alert: Some of our applications are undergoing routine maintenance on Monday, October 30 from 10-11 PM ET and may be unavailable. We apologize for any inconvenience.

Alert: Some of our applications are undergoing routine maintenance from Saturday, August 26 through Sunday, August 27 and may be unavailable. We apologize for any inconvenience.

Thousands of Post Offices ™ accept first-time passport applications for the U.S. Department of State. Most of those locations can also take your passport photo.

- Renewing Passports : If you answer 'Yes' to all 5 eligibility questions in the " Renew a Passport by Mail " section, mail your renewal form directly to the State Department. If you don't meet all the renewal requirements, you'll need to go to a Post Office in person and do a new, first-time passport application.

- First-Time Passports (and Passport Photos) : Schedule your in-person appointment online.

Schedule an Appointment

Alert: --> online scheduler to make an appointment for passport services to ensure the safety of our employees and customers. The State Department has extremely limited passport services due to the COVID-19 pandemic. Expect significant delays of several months before receiving your new U.S. passport. Learn More

Alert: For first-time passport and photo services, please make an appointment using our online scheduler , a Post Office lobby self-service kiosk , or at a Post Office retail counter . We also offer limited Passport walk-in hours at select locations.

First-Time Passports

First-time applicants and people who aren’t allowed to get a new passport by mail.

Apply at a Post Office

Expedited Delivery

Renewing Passports

Most people renewing a passport should mail their application directly to the State Department.

Renew by Mail

Passports for Minors

Passports for children under 16 have special requirements. Make sure you are prepared.

Apply for a First-Time Passport

If you've never had a U.S. passport, are 16 or under, or aren't allowed to renew an existing passport by mail, you need to apply for a new passport in person at the Post Office.

Step 1: Gather Documents Early

Generally, you should apply for your new passport as soon as you know you’ll be traveling internationally—at least several months in advance. Passport processing times may vary, so be sure to check the latest State Department service estimates . First-time applicants, minors, and applicants who need a new passport but may not renew by mail may submit their passport application at the Post Office. The U.S. State Department website explains what you'll need to bring with you.

- Application forms (unsigned)

- Proof of identity document and a photocopy of the front and back

- Proof of U.S. Citizenship document and a photocopy of the front and back

- Passport fees

Apply for a Passport in Person

Step 2: Prepare Your Application Package

Visit the U.S. Department of State website to learn how to apply for a passport and what documents you need.

- Complete your Form DS-11 Application for U.S. Passport on the State Department website.

- Print your completed application. DO NOT SIGN YOUR APPLICATION. A Postal employee must witness your signature.

- Have a passport photo taken.

- Photocopy your proof of identity and U.S. Citizenship documents.

- Post Offices accept credit cards, checks, and money orders for Post Office acceptance fees.

- State Department fees are mailed with your application. You can pay with a personal, certified, cashier's, traveler's check, or money order, payable to "U.S. Department of State."

Get Started on Your Application

Step 3: Schedule an Appointment

Post Offices that offer passport services have set hours, and you'll need to schedule an appointment using the online Retail Customer Appointment Scheduler or a Post Office lobby self-service kiosk.

Scheduling Online

- Go to Schedule an Appointment .

- Choose the passport service you need, along with the number of adults and minors who need appointments.

- You can search for appointment by location or date first. If you search by location first, you'll then be asked to choose a date and time; if you search by date first, you'll then need to choose a location and time.

- After you choose your appointment location and time, provide your contact information, and agree to the Terms and Conditions.

- Click Review Appointment , then confirm your appointment.

If you need to modify or cancel your appointment, click the Manage Appointments tab and enter your confirmation number and email address or phone number.

Using a Self-Service Kiosk

- Go to a Post Office location with lobby self-service kiosks. Find USPS Locations

- At the self-service kiosk, touch the screen to begin, then select "Other Services," then "Passport Scheduler."

- Choose the passport service you need, then enter the number of adults and minors who need appointments.

- Search for Post Office locations by ZIP Code™ or City/State and choose a location.

- Select an available appointment date and time, then agree to the Terms and Conditions.

- Enter your contact information and decide if you'd like to receive SMS text notifications.

- Review and confirm your information, then select “Schedule Appointment” to finalize.

- Take your printed receipt listing your confirmation number and appointment details.

Step 4: Pay Passport Acceptance & Processing Fees

First-time passport applications have two types of basic fees, the application acceptance fee and the application processing fee. Passport photos and fees for faster processing are extra. Learn how to calculate fees and what you can use to pay for them.

Application Acceptance Fees – Postal Service

Pay acceptance fees in person at the Post Office. You may pay by check or money order, payable to "Postmaster," debit card, or credit card.

- $35.00 - Post Office acceptance fee

- $15.00 - Post Office photo fee (if needed)

Application Processing Fees – Department of State

State Department payment is sent with your application package. State Department fees are paid separately from USPS fees.

- State Department Fees State Department passport fees vary. Calculate passport fees online .

- Personal, certified, cashier's, or traveler's check, payable to "U.S. Department of State."

- Money order payable to "U.S. Department of State." You can buy a money order at the Post Office with cash, a debit card, or a traveler's check. You cannot pay with a credit card.

Application Status Updates

- Use the Online Passport Status System to check your application status if you applied by mail or in person. You may not be able to get a status update for 2 weeks after you apply or renew. During these weeks, your application and supporting documents are on their way to the Department of State. See more information about current processing times on the Department of State page " U.S. Passports ."

Renew a Passport by Mail

If you are eligible to renew your passport, please complete Passport Renewal Application Form DS-82 (see completion instructions on the form), and mail your completed renewal application directly to the State Department for processing. To verify if your passport is eligible for renewal by mail, please visit State Department Renew By Mail .

Step 1: Check Your Eligibility to Renew by Mail

A minor's passport may not be renewed by mail; to renew a minor's passport, you need to submit a new, first-time passport application in person . An adult passport may be renewed by mail if it meets certain requirements.

You can renew your adult passport by mail if you answer "Yes" to all 5 of the following statements:

Your passport:

- Is in your possession to submit with your application.

- Is undamaged other than normal "wear and tear."

- Was issued when you were age 16 or older.

- Was issued within the last 15 years.

- Was issued in your current name or you can document your name change. (Name changes are explained on Change a Passport .)

If your passport does not meet all these requirements, do not mail your renewal application. You must prepare the same application package as a first-time passport applicant.

State Department Renew by Mail

Apply early for renewals as many countries require that passports be valid for at least 6 months after you enter their country. Learn how to properly prepare your application package and include all the necessary documents so your passport is processed on time.

- Complete your Passport Renewal Application Form DS-82 on the State Department website.

- Print and sign your DS-82 form.

- Have a passport photo taken. You can schedule a passport photo-only appointment at a Post Office ™ location.

- Calculate your passport renewal fees .

- Collect your most recent passport, completed and signed application, renewal fees, and name change documents, if needed.

- Use an envelope large enough to fit the application without folding it.

- TIP : Pay for Priority Mail Express ® or Priority Mail ® service and get free envelopes that are large enough to hold your application. Order easily online: Priority Mail Express Flat Rate Envelope or Priority Mail Flat Rate Envelope .

- Address the envelope to the location for your state. See page 2 of your DS-82 form.

How to Renew a Passport - Details

Step 3: Mail Your Renewal Application

Department of State recommends using a USPS delivery tracking service to mail your renewal application.

Choose one of the following services:

- USPS Priority Mail ® Service with Delivery Confirmation

- USPS Priority Mail ® Service with Signature Confirmation

- USPS Priority Mail Express ® Service (for overnight delivery requests)

Compare Delivery Tracking Services

Step 4: Follow Your Application Progress

If you use a USPS delivery tracking service, go to USPS Tracking ® to see when your package is delivered.

- With a USPS tracking service, you can see when your application arrived using the tracking number on your receipt.

USPS Tracking Status

U.S. Passport Application Status

Expedited Passport Delivery

Get a new passport faster in emergencies & special cases.

If you need your passport faster for emergency travel or another special case, you can send your passport application via Priority Mail Express ® service and pay the State Department fee for faster delivery.

Life-or-Death Emergency

If you need to travel within 72 hours (3 business days) for an immediate family member who is dead, dying, or has a life-threatening illness or injury:

- Visit the Life-or-Death Emergencies page on travel.state.gov to learn if you are eligible.

- The State Department processes these requests by appointment only.

- Your appointment date must be within 72 hours (3 business days) of travel.

Urgent Travel in Less than 10 Weeks

If you are traveling in less than 10 weeks, you must call the State Department Passport Agency to schedule an appointment:

- You can call 1-877-487-2778 (1-888-874-7793 TDD/TTY) to schedule an appointment.

- Your appointment date must be within 72 hours (3 business days) of travel, and you must provide proof of travel.

Note : An extremely limited number of appointments are available for customers who are traveling internationally in the next 72 hours (3 business days), and other restrictions apply .

Get My Passport Fast

Renew Your Passport Fast

If you pay an additional $60 for expedited service and mail it with Priority Mail Express , you can get your renewed passport within 10 weeks.

- Check your eligibility under Renew Your Passport by Mail, Step 1: Check Your Eligibility to Renew by Mail .

- Prepare your application as listed under Renew a Passport by Mail, Step 2: Prepare Your Application Package .

- Add these special fees, both payable to the U.S. Department of State, to your regular processing fees.

- $60.00—Expedited application processing at the State Department

- $19.53—1- to 2-day delivery service for faster return shipping to you from the State Department

- Clearly mark "EXPEDITE" on the outside of the envelope.

- Ship your application to the State Department by Priority Mail Express. Cost varies by location.

- Both parents/guardians must authorize the issuance of a child's passport. The best way to give consent is for both parents/guardians to go with the child when applying.

- Children need evidence of citizenship.

- Parents/guardians need proof of parental relationship.

- NOTE: Children's passports are only valid for 5 years. They are not "renewable": When a child's passport expires, you must apply for a new passport for them. When making a passport appointment for a child, please choose "New Passport Only" or "New Passport with Photo Services."

Apply for a Minor's Passport

- Department of State Passport Website English | Español

- Ask Questions at the National Passport Information Center

- Enroll in Smart Traveler Enrollment Program (STEP)

- Plan Your Trip with the Traveler's Checklist

- Get Help in an Emergency Overseas

Lost or Stolen Passports

If your passport has been lost or stolen, you should report it immediately to the U.S. Department of State.

Report Your Lost/Stolen Passport

Post Office Travel 4+

Travel money card & insurance, post office limited.

- #72 in Travel

- 4.5 • 7.6K Ratings

Screenshots

Description.

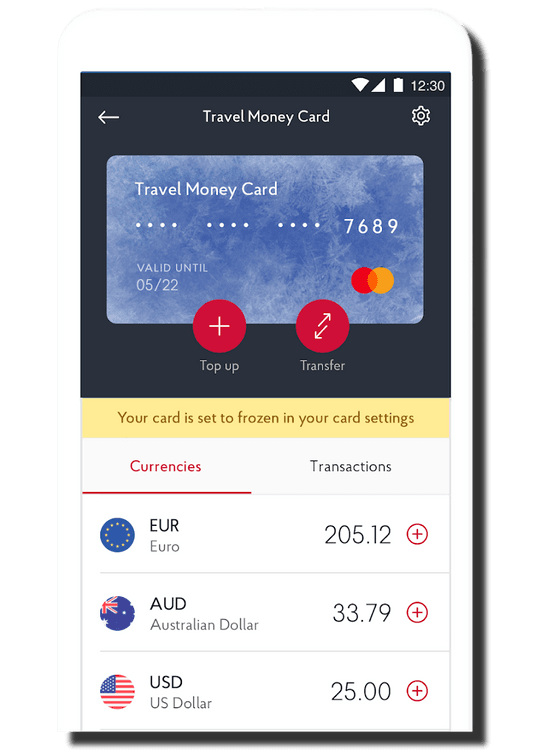

Buy, add, and manage your Travel Money Cards, travel insurance, holiday extras and more all in one place. Take the new-look Post Office travel app on your adventures today. Combining all the travel features our loyal app users love, this refreshed version’s now cleaner and simpler to use. So, it’s even easier to relax on your travels. Do all this on the move Manage your Post Office Travel Money Cards · Buy and activate new cards in the app · Add existing Travel Money Cards · Top up with any of 22 currencies, including US dollars and euros · Swap funds between different currencies · Check your PIN, balance, spending, and daily exchange rates · Freeze your card for security or to limit your spending · Add your cards to your Apple Wallet Buy and check your travel insurance · Get a quote and buy cover – plus any add-ons to tailor it to your trip · Link the app to your existing Post Office Travel Insurance policy · View and download your policy documents Get those holiday extras sorted · Book parking at 60 UK domestic airports · Find great deals on airport hotels · Check into lounges at 100+ airports · Fast track your security checks at 11 UK airports · Book airport transfers to your holiday accommodation · Hire a car with leading brands in over 60,000 locations What to do now Download the Post Office travel app today. Order or link your existing Travel Money Card and Travel Insurance policy. Or order a Travel Money Card at your nearest Post Office branch.

Version iOS App version 461.2

Bug fixes and performance improvements, all to make your experience the best that it can be. Recent updates include fixes to Apple Wallet, sign up and login journeys.

Ratings and Reviews

7.6K Ratings

Post office travel application

Now, the post office application has been very useful, as one can top up money whilst travelling as well as check ones balance on the travel money card. In conclusion, lastly, I found the travel money card particularly useful on 16th November 2019, evening time as one can search for useful tips and questions that one maybe concerned about before travelling, during and after travel, and for me, I found this application extremely useful, as there was information I needed to know before my travel, such as the currency of the country I am travelling to, and where to obtain the currency of the country I am travelling to shortly. Moreover, I thank the developers for making this useful, and appropriate travel application as I believe it is a safe as well as secure method of travelling with money, to the country of ones choice instead of carrying loads of cash around in different currencies, and risking theft issues or lost issues. Also, I found the help and advice section on the website useful, as I had forgotten my PIN number as I never used my travel money card for a while, and I was able to call up a number from the travel money website, and follow the on phone instructions to retrieve my PIN number once again. Next, thank you developers for making this travel application once again. Many thanks Hannah Boyce

Developer Response ,

Thanks very much for the fantastic feedback, glad you like the app and the product.

Dreadful new App not working for 3 days now

Rang customer services 3 days ago now as newly downloaded App top up button gives an error that it can’t fetch the rates right now so have to go on main website to do that. Then when you use the card it doesn’t update the balance. It retrieve the pin either. The card was then unsupported in an ATM when I tried doing a balance enquiry. Different information from service staff who told me I needed to load another £50 minimum on card and buy something using chip and pin to use card for for first time. However that’s £3 commission just to load on £50 of your own money ! I don’t even need sterling on the card as the whole point is for using it abroad to TRAVEL!! So I had already bought Euros. The lady in the post office said I can’t use the card at all for online purchases however I managed to pay for my holiday eventually over the phone in euros once they had removed the security 3 times! A smarter assistant also said I don’t need to add sterling to buy something in U.K. - the euros will auto convert- which they did. Still stuck with a non working app and took 3 hours to finally get the card loaded and working to pay for holiday. Agh. Why so complicated

Thank you for your feedback. This will be shared with our development teams who are committed to improving the app experience for all.

No problems at all

I have had and used this Post Office Travel Card for the last eight years with no issues whatsoever, it expired earlier this year and a replacement arrived in good time for this year’s use. I did have a little hiccup with the first login online for the first use but very soon sorted out and hay presto of and running again, brilliant. I did have a lot of issues with another company travel card whereby EVERY TIME I tried to login on the app or online it wouldn’t recognise me and had to reset password wasted six and a half hours, still getting no results so cancel the subscription 😡. Update to review April 2024 I have been away from UK to USA and CANADA this time and have had no end of problems trying to login into the app on my phone or Laptop, issue with the app freezing on my phone or going round in circles on laptop with password/security reset issues I’ve uninstalled and reinstalled all to no avail it would not let me use face recognition ID Very disappointed after such a brilliant service the first time around until the new card and updated app 😡😡😡 I to like so many others am looking for an alternative card & app.

Thank you for your feedback. It looks like you might need more help here, please contact us directly at [email protected]

App Privacy

The developer, Post Office Limited , indicated that the app’s privacy practices may include handling of data as described below. For more information, see the developer’s privacy policy .

Data Used to Track You

The following data may be used to track you across apps and websites owned by other companies:

Data Linked to You

The following data may be collected and linked to your identity:

- Contact Info

- Identifiers

Data Not Linked to You

The following data may be collected but it is not linked to your identity:

- Diagnostics

Privacy practices may vary based on, for example, the features you use or your age. Learn More

Information

- App Support

- Privacy Policy

Get all of your passes, tickets, cards, and more in one place.

More by this developer.

Post Office EasyID

You Might Also Like

Holiday Extras HEHA! Smart App

Virgin Atlantic Holidays

Jet2 - Holidays and Flights

loveholidays: hotels & flights

On the Beach Holiday App

- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

Post Office Travel Card review

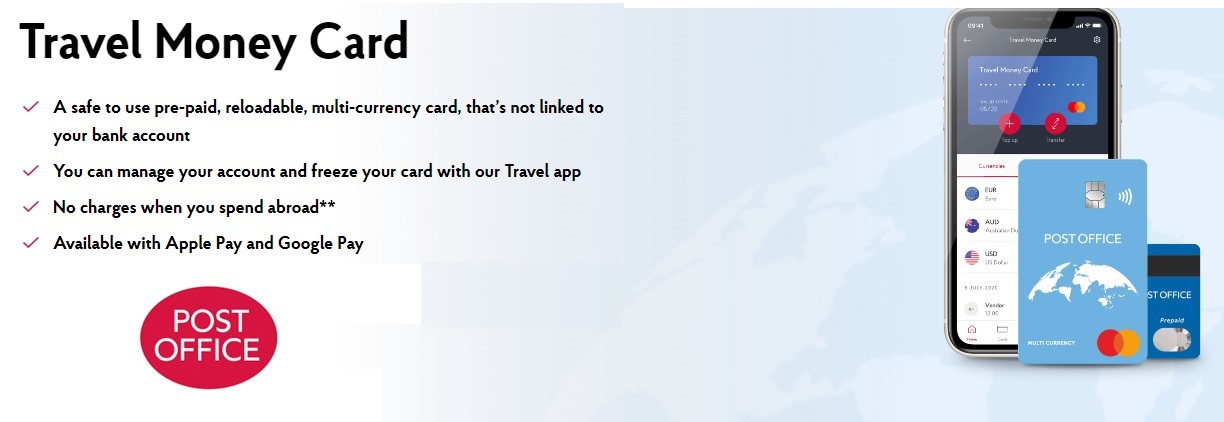

The Post Office Travel Card is a prepaid travel card you can load in cash or online, to switch to the currency you need for spending and withdrawals. It’s not linked to your regular bank account, and can be managed from your smartphone, for secure spending across 23 currencies.

Before you order a Post Office Travel Card check out this full review - we’ll look at what the card can do , how to order your card and how much it’ll cost .

And to help you compare we’ll also touch on Post Office Travel Card alternatives like Wise and Starling, which may offer cheaper and more flexible options for taking travel money abroad.

TL;DR - it's a solid prepaid card

- The card supports most major currencies for holidays, including Euros (Europe), Lira (Turkey) and UAE Dirhams (Dubai)

- Several top-up methods , with the option of doing so online or in-store

- Only convert what you want to spend; good for holiday budgeting

However, there are some downsides.

- There are better exchange rates available with other travel cards

- You'll get a worse exchange rate (a.k.a "buy-back rates") when converting leftover foreign currency to pounds

Find out more about the card on the Post Office website or click the button below to purchase a card. Order a card

Not sure yet? Continue reading to decide whether this is the right prepaid card for you.

What's in this guide?

What is the post office travel money card, how does it work.

- Fees & limits

How do I get a Post Office Travel Money Card?

What happens when the card expires, what are the alternatives.

The Post Office Travel Money Card is a prepaid card you can top up in cash or from your bank account, in any of 23 supported currencies.

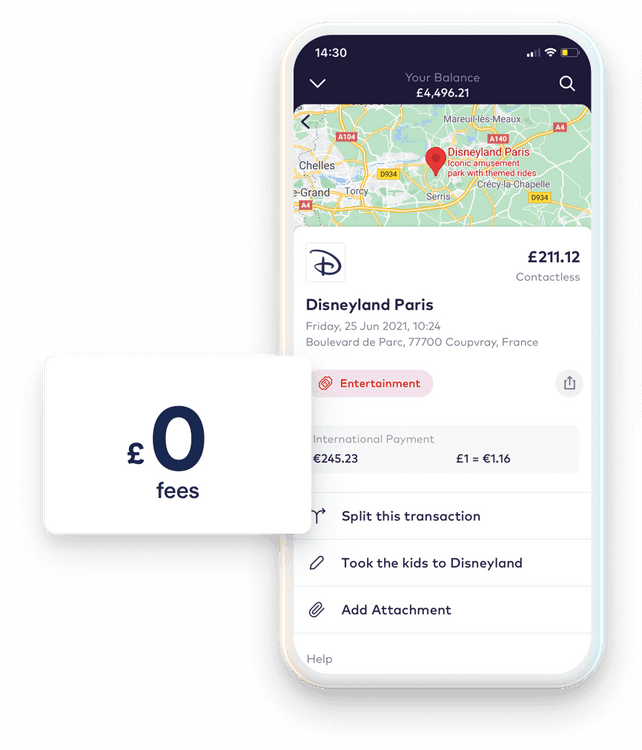

Once you have funds on your card you can use it as you would a regular debit card, for contactless and mobile payments, and cash withdrawals. There’s no fee to spend currencies you hold on your card, although other transaction fees do apply depending on how you use the account.

Use your Post Office card to buy travel money before you head off on holiday, or top up as you go online.

As pictured, you can also manage, view and freeze your card in the Post Office app for security.

- Top up your card in cash at a Post Office or online by purchasing one of 23 different currencies

- If you choose to top up in GBP and convert later, you’ll be charged an administration fee of 1.5%, from a minimum of 3 GBP up to a maximum of 50 GBP

- Exchange rates are shown in the Post Office app, and may include a markup on the market exchange rate - but rates often improve if you top up more

- It’s free to spend currencies you hold. You can also spend unsupported currencies, but a foreign transaction fee of 3% will apply

It’s worth noting that the Post Office exchange rates are shown in the Post Office app before you convert your funds. They may include a markup, which is an extra fee added into the rate applied to switch to the currency you need.

Another thing worth noting is that the exchange rate gets better for higher top up amounts - meaning you’ll pay a smaller markup the more you add to your card.

Using a markup is pretty common but does make it tricky to see what you’re really paying for your foreign currency transactions.

Spending limits and card fees

Before you order a Post Office Travel Card it’s good to know a bit about the fees and limits that apply to card usage.

When you transact with your Post Office Travel Money Card, there are also fees to pay.

While these do vary slightly by currency, they’re roughly similar.

It’s easy to get your Post Office Travel Card online or in person by calling into a Post Office near you. Here’s what you’ll need to do.

- Head to the Post Office website

- Select "Order Your Card >"

- Top up in your preferred currency - there’s a minimum top up of 50 GBP, through to a maximum of 5,000 GBP

- Input personal details following the prompts

- Delivery of your card will take 2-3 days by post

- Head to your local Post Office branch

- Show a valid form of ID (driving licence, passport or EEA ID card)

- Apply in branch and load your card

The expiry date for your card will be printed on the back of the card - usually it’s valid for 3 years from the point you order it.

Once your card has expired you’ll pay a monthly inactivity fee of £2 per month if you don’t redeem your balance within 12 months of the card expiring. This fee continues until there’s no remaining balance, at which point your account will be closed.

If you’re not sure whether the Post Office Card is right for you, check out a few alternatives to see which gives you the best balance of cost and convenience.

The Wise card allows you to hold and exchange 50+ currencies, and spend in 170+ countries. It's a fully-fledged debit card, meaning it works at home just as well as it does abroad.

There’s no markup on the exchange rate, and they are super transparent about the fees (usually around 0.4% for foreign spending) they'll charge you.

Starling card

The Starling debit card is a good option for international spending as there are no foreign transaction fees and no ATM fees .

You can sign up entirely online for an account with no monthly fees which you can manage from your phone, with instant notifications and a whole range of banking features. Get a Starling Card

Frequently Asked Questions

Post Office is a trusted institution and will keep customer funds safe according to all applicable legal requirements.

When it comes to travel money, the Post Office works in partnership with First Rate Exchange Services, which is a registered business and holds a Money Services Business License in the UK.

You can hold up to 23 different currencies:

- Australian dollars

- Canadian dollars

- New Zealand dollars

- Croatian kuna

- Turkish lira

- South African rand

- Swiss francs

- Polish zloty

- Pounds sterling

- Chinese yuan

- Czech koruna

- Danish kroner

- Hong Kong dollars

- Hungarian forint

- Japanese yen

- Norwegian krone

- Saudi riyal

- Singapore dollar

- Swedish kronor

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

- Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Help & Support

With the Post Office travel app you can manage your Travel Money Card, access your travel insurance policy and book holiday extras on the move.

Here you’ll find help topics for both the app and the services it brings together.

New-look travel app out now

Our revamped travel app’s out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user experience. Find out what’s changed below.

- Our new app

What's changing and why

Why are we changing the travel app.

Our original travel app was built on a platform that’s no longer able to scale to support the volume of users we experience.

By building a new app, we can also keep up to date with the mobile technology our customers use, which the older platform can’t do.

What are the benefits of the new app?

The new-look travel app offers improved performance across all devices, and a platform we can grow and improve continuously in the future. That means an experience that keeps getting better for its users.

This update also makes sure our app remains current with mobile technologies and what they make possible.

Updating to the new app

Why can’t i use the old travel app on my phone.

The old app will be switched off on 27 March 2024, so won’t work after this date.

Our improved travel app is available now. It supports any device running on iOS 13 or Android 8 operating systems and above.

If you have an older operating system, here’s what to do:

- Check if you can update to a newer version of your operating system in your phone’s settings

- If you can’t, you can still access your Travel Money Card via our website.

You can use the Travel Money Card website to:

- View your balance

- Top up your card

- Move money between currencies

- View transactions

- Activate a new card

These functions aren’t available on the website at the moment:

- View your PIN

- Freeze your card

- Find your nearest ATM

- Find your nearest Post Office branch

- Add card to Apple Pay

- Authorise online transactions

Can I use my old travel app login?

If you have the previous version of the travel app installed and update to the new version, your login details will remain the same.

However, for security, you’ll need to reverify the email address you signed up with. You’ll also need to set up a new passcode and/or biometric login, which will involve confirming some personal details.

Can I view my existing Travel Money Cards?

If you’ve already bought a Travel Money Card through the previous app or in a branch, you can link it to the new app and keep using it. Currencies you’ve loaded using the app will still be available in the new one.

When can I update to the new travel app on my device?

We’re migrating users of the existing travel app first. If you’re one of them and your device has auto updates turned on, the new travel app should install to it automatically. If you’re a new user and have an iOS device, you can download our app from the App Store now . It will be available to download in app stores for Android devices once we’ve finished migrating existing users.

Travel Money Card in the new app

Are the same currencies available.

All currencies available in the previous version of the travel app can be topped up and swapped in the new and improved version.

Can I buy new Travel Money Cards in the app?

You can still order new cards within the new version of the travel app.

Can I add my Travel Money Card to Apple Pay?

Yes, you can add your Travel Money Cards to your Apple Pay account in the new app just as you could in the previous version.

Can I add my Travel Money Card to Google Wallet?

Sorry, not just yet. The updated app won’t support Google Wallet at launch. But we’re working on it.

Why can I only see my last 20 transactions?

You’ll see a summary of your last 20 transactions displayed on the Travel Money Card page. To see more, press the ‘View all’ button at the bottom of the screen to show all previous transactions.

Can I upgrade to the new app while I’m abroad?

If your device is set to download from your UK app store, you should be able to download the new app while abroad. You’ll need access to Wi-Fi or mobile data. Please note, using mobile data abroad can come with high charges.

If you can’t download the app, you can register any Travel Money Cards you have with us in your online account instead. Then you can download the new app when you get home and link it to your account. Your cards and/or policies should then appear within it.

Register a Travel Money Card

Features in the works

Where is the atm finder.

We’ve removed the ATM finder feature from the new app for its initial launch. We want to make sure it provides the right experience before it goes live.

Where is the branch finder?

The branch finder feature has been removed from the initial launch version of the new app. We want to make sure it provides the right experience before it goes live.

Where is the currency converter?

We've removed the currency converter finder feature from the new app for its initial launch. We want to make sure it provides the right experience before it goes live.

Can I download app on an iPad or Android tablet?

No, sorry. At launch the new travel app will only be available on smartphone devices, not tablets.

Other app questions

Can i use biometric login.

The new travel app continues to support biometric login. If you use an iOS device, you can use Touch ID and Face ID to access it. On Android devices, you can log in using fingerprint authentication.

Why does the app want to know my location?

Location data will be used when the ATM and branch finder features are added later.

You’re free to decline location permissions, or withdraw these at any time, without restricting the use of any features in the launch version of the app.

Will the travel app have Welsh language support like the Identity apps?

There are no plans for Welsh language to be added to the app currently.

How can I request my personal data be deleted?

Please let us know using our general enquiries form .

Download the app

The Post Office travel app is free to download to both Apple and Android devices. Get it from your store of choice and start using it today.

Post Office travel app

Download now from your device’s app store:

Need more help with our travel products?

Travel money card help.

To read all Travel Money Card FAQs, manage your card online or contact us about using it:

Visit our Travel Money Card support page

Holiday extras help

Get help with travel extras booked online through Post Office

Visit our holiday extras support page

New Travel Money Cards

How can i order my card.

You can get hold on a Travel Money Card in three ways. Each is very simple.

- In our travel app: order and store up to three Travel Money Cards in the Post Office travel app . Delivery will take 2-3 days

- Online: follow our application process to order your card online. Your card will take 2-3 days to be delivered. Once it arrives you can link it to our travel app to manage on the go

- In branch: simply find a nearby Post Office branch and pop in to get your Travel Money Card there. Please remember to take a valid passport, UK driving licence or a valid EEA card to obtain your card, and you can take it away the same day

Please note, you must be a UK resident over the age of 18 to obtain a Travel Monday Card.

Whichever way you choose to order your card, don't forget to activate it once it arrives. Full details of how to activate your card will be provided in your welcome letter, to which your card will be attached if it’s been sent in the post.

How long will my card take to arrive?

Whether you order your card in the app or on our website, it will be delivered to your home address in two to three working days.

If you need a card in a shorter time, please check with your local Post Office branch. Exchange rates vary between online and branch.

Currency questions

What currencies can i load onto my card.

The Post Office Travel Money Card can be loaded with up to 22 currencies at any one time. Top up with one or a few, if that’s all you need, or with all currencies at the same time.

You can top up funds in each currency’s wallet, or transfer funds between the different wallets, in our free travel app or online.

We recommend topping up with the currency of the country you're travelling to, rather than in pounds sterling (GBP).

The currencies available are:

EUR – euro USD – US dollar AUD – Australian dollar AED - UAE dirham CAD – Canadian dollar CHF – Swiss franc CNY – Chinese yuan CZK – Czech koruna DKK – Danish krone GBP – pound sterling HKD – Hong Kong dollar HUF – Hungarian forint JPY – Japanese yen NOK – Norwegian krone NZD – New Zealand dollar PLN – Polish zloty SAR – Saudi riyal SEK – Swedish Krona SGD – Singapore dollar THB – Thai baht TRY – Turkish lira ZAR – South African rand

How do I top up my Travel Money Card?

There are a few ways you can top up your card – either in branch, online or in our travel app.

In the app, just click ‘Cards’ in the navigation bar at the bottom. This will take you to your Travel Money Card summary page, where you can see all the cards you’ve linked.

Tap ‘View card activity’ on the card you want to top up. This will take you to a screen for that specific card, showing all currencies you have loaded onto it.

To quickly top up a currency that’s already loaded, click the plus (+) sign next to the currency and enter the amount you wish to top up (minimum amount £50).

You can also select the plus (+) sign by ‘Top up’ and choose an amount to top up with before selecting which of the 22 currencies to apply the top-up to.

Tap ‘Continue’ to see your order summary, where you can amend your order if needed or continue to payment.

If it’s your first top up, you’ll need to enter your payment card details on the next screen (‘Payment card’).

I have money left on my card. What do I do?

You have 4 options:

- Leave the money on your card for your next holiday

- Visit any Post Office branch and withdraw the balance over the counter in Sterling. There’s a daily withdrawal limit of £300 per day

- Spend your money in the UK as normal. We’ll move the money to Sterling every time you pay for something. Anything you don’t spend stays in the currency you have on the card. No fees apply, we just use the day’s exchange rate

- Call us to ask for a refund. Please note that you’ll get a better exchange rate by spending on your card or withdrawing cash from a Post Office branch

Using and managing your card

What do i do if my card is lost or stolen.

You need to call us immediately on +44 (0) 20 7937 0280 . We’re here 24 hours a day.

We’ll cancel your card and work out the best way to replace it. A fee may be charged if we need to courier a replacement card overseas.

If you think you have misplaced your card and want peace of mind, you can freeze spend on your card using the Post Office travel app, available on the App Store and Google Play . You can unfreeze just as easily if you find your card again.

How do I get or change my PIN?

The easiest way to get your PIN is in the app. With it you can check your PIN wherever you are in the world.

Alternatively, you can call our automated line on +44 (0)20 7937 0280 and select Option 1. Your change of PIN can only be done at UK ATMs that accept Mastercard and offer the PIN change facility.

Where can I use my card?

Your card is accepted at 2.1. million ATMs and in 36 million retail outlets around the world – wherever you see the Mastercard logo.

Please remember if you use the card in a currency other than the 22, we offer you will be charged a 3% cross boarder fee.

Can I withdraw money from ATMs?

Yes, you can. You can use any ATM that accepts Mastercard. Fees will apply for every cash withdrawal. These fees are detailed online or on your welcome letter.

Please be aware some ATMs may also charge you and this should always be displayed on the ATM screen. We always recommend you withdraw cash in local currency and don’t choose to pay in Sterling or accept their currency conversion.

How do I delete my account?

Please contact our customer support team if you’d like to delete your Post Office travel account. Call +44 (0)20 7937 0280 any time, 24/7.

About travel insurance

Why is travel insurance important.

Travel insurance is an important purchase for anyone going abroad for their holidays.

Even in relatively safe locations such as central Europe, a myriad of things can go wrong. Flights can be delayed. Airlines can lose your luggage. Thieves often operate in tourist areas. And you could eat something that disagrees with you anywhere in the world.

We hope none of these events happen to you. But, if they do, you could be out of pocket – and with emergency medical problems it could be by tens or even hundreds of thousands of pounds.

Travel insurance may be able to help protect you against some of this risk. It’s a way to insure travel for you, those travelling with you and your belongings.

If your luggage is lost, holiday insurance may not be able to replace it, but the payout from a claim can help recover any costs that you have had to pay to get temporary alternatives.

In particular, the medical cover outside of the EU offered by insurance is a necessity.

Within the EU, meanwhile, you may think an Ehic, or its replacement the Ghic, can cover all your medical needs. This isn’t true. Some of the most expensive medical services, such as repatriation, aren’t covered by the Ehic or Ghic. They’re limited to health cover and won’t help with things like cancellation, loss or theft.

Even if you’re staying in the UK for your break, having holiday insurance will provide cover for lost, damaged or stolen possessions such as baggage, and cancellation, cutting your trip short or delay to your trip in some circumstances.

What does travel insurance cover?

Post Office Travel Insurance can cover you for a single trip of up to 365 days*, or multiple trips** in a single year, anywhere in the UK or abroad. We also offer backpacker cover> for a single trip of up to 18 months.

The type and level of cover provided depends on the policy type and options you choose, but can include cover for cancellation, cutting your trip short and abandonment of your trip, emergency medical expenses, lost, stolen or damaged baggage, lost, stolen or damaged passports or personal money, personal accidents and liability, legal protection.

Optional additional cover available includes Covid-19 Cover upgrade, Gadget Cover, Sport and Activities Cover (including golf), Trip Disruption Cover (including Terrorism), Natural Catastrophe and Air Space Disruption) and Excess Waiver, plus 31-, 45- or 60-day trip extensions (on Annual Multi-trip policies only).

Winter Sports Cover is compulsory for winter sports trips and Cruise Cover is compulsory if you’re going on a cruise. It’s important to check the different travel insurances available, and their various options and add-ons, to ensure you’ll be sufficiently covered for your trip and all you’ll do on it.

* For Economy, Standard and Premier policies, the Singe trip policy will cover you for one trip up to:

365 days for persons aged up to and including age 70

90 days for persons aged between 71 and 75

31 days for persons aged between 76 and above

**For Economy, Standard and Premier policies under Annual Multi-trip policy although you can take as many trips as you want within the policy year, there is a maximum duration for each individual trip. This limit varies depending on the cover level chosen and will be 17 or 31 days. On some policies the limit can be extended to 31, 45 or 60 days for an additional premium.

> Backpacker policies only available on the Economy level of cover

Emergencies and claims

I’m on my trip and need emergency medical assistance. what should i do.

Call our emergency medical assistance line any time, 24/7.

0208 865 3074

How do I make claim on my travel insurance?

For non-emergency claims, the quickest and easiest way to submit a claim is online.

There’s no need to send or wait for documents in the post. Just upload them instead. And you can save your progress if you don’t have all the information you need, then return to complete your claim later.

For some claims you could get an instant decision.

Visit our claims page

Manage your policy and options

How do i renew or cancel the renewal of my travel insurance policy.

When you buy an annual multi-trip policy, it can be renewed automatically or manually. Or, if you prefer it doesn’t renew, you can turn off the auto-renewal.

Whatever your choice, we’ll write to you around 28 days before the date your current policy is due to end. We’ll detail any changes we’ll make should you wish to renew the policy and give you a quote for the next year’s cover.

Automatic renewal: when you buy a multi-trip policy, it will be set up to automatically renew at the end of its term. If you want to opt out of this renewal, you can do so when making your purchase or at any time during the policy. Equally, if you don’t select auto renewal upfront you can turn it on later by calling our contact centre.

Manual renewal: if you’ve opted out of auto renewal, you can opt in manually later, such as when we send your renewal reminder or by calling our contact centre to set this up. It’s easy to renew through your online account or by calling our contact centre. If you miss the renewal date, you can still take out a new policy later. You’ll need to start a new quote, as the renewal quote is only valid until your current policy’s expiry date. This may also mean a gap in your cover until the new policy starts.

Turning off auto-renewal: if your existing policy is set to renew automatically but you change your mind later, simply turn it off at any point during the policy’s life, either in the app, in your online account or by calling our contact centre team.

If you’re within the last 8 days of your policy, you’ll need to call our contact centre to do so. The later you do this the greater the chance a renewal payment will be taken by the bank. If this happens before your renewal cancellation is processed, we’ll make sure your payment is refunded.

My policy includes flight delay assistance. How do I register a flight?

If you bought a Post Office Travel Insurance policy with our Premier level of cover, which includes flight delay assistance , you should have received an email from us with details of how to register for this service.

If you can’t find the email or you arranged your policy in a Post Office branch or don't have an email address, all the information you need will be in your policy confirmation pack. You can only register your flight via the special link provided to you.

- Read all travel insurance FAQs

How can I claim my account balance?

Your POca account is now closed and you should have received a letter notifying you of the date your account closed. From that date you will no longer be able to access your account either in branches or via ATMs.

Until the 30th November you (or third parties) can access balances on closed accounts by completing and returning either an account closure form P6703 or a third party closure form P6702 via your local branch. The form provides the option to transfer your balance to a bank or building society account or you can choose to have a cheque sent to you. If you have been moved to the imovo voucher service and do not have an account to transfer your balance into, you can speak to the POca contact centre on 03457 22 33 44 and they will be able to discuss other options that are available to you.

From 1 December 2022 Post Office Limited will no longer offer any services relating to Post Office card account and closed accounts will be managed by J. P. Morgan Europe Limited. A new customer service helpline will be provided from this date and full details of how to contact J.P.Morgan Europe Limited from 1 December will be provided on this page nearer the time.

- Other sections:

Post Office Travel Card Review

Travelling is one of the most exciting and liberating experiences out there. Whether you’re jetting off to a far-off destination or just exploring your own country, having the right travel card can make the whole experience easier and more enjoyable.

Are you planning a trip? If so, you may be wondering if the Post Office Travel Money Card is a good option for you. In this article, we’ll take a close look at the Post Office Travel Money Card, how it works, and what you need to know before using it.

By the end of this guide, you’ll have all the information you need to make an informed decision about whether or not the Post Office Travel Money Card is right for your next trip.

Table of Contents

Benefits of Having a Travel Card

First and foremost, travel cards are an excellent way to earn miles and points. This can be incredibly valuable if you are a frequent traveller or want to visit somewhere far off where you’ll have to pay high airfare. Plus, you can use these miles and points to book travel, hotels, flights, vacation packages, and more.

Another major advantage of travel cards is their versatility. As you travel, you’ll have the ability to withdraw cash from ATMs using your card, pay for purchases using your card, and even get roadside assistance on select cards. You’ll also have access to excellent trip cancellation and travel insurance.

Plus, travel cards are typically easier to qualify for than other types of credit cards. This is because many companies view travel cards as a “safe” type of credit. However, having a travel card can also help to improve your credit score.

Post Office Travel Cards: What Are They?

The Post Office Travel card is a Mastercard prepaid card, which can be loaded with a choice of 23 currencies. ATMs are available in more than 200 countries where you can spend and withdraw money.

You can load your account with any currency before travelling and then use it abroad without having to convert your currency.

Post Office Travel offers a contactless card that can be accessed through its app.

Post Office Travel Cards Benefits and Features

Here’s a quick look at the Post Office Travel card’s main features and benefits:

- Payments for low-value items can be made quickly and conveniently using contactless technology

- Compatible with Apple Pay and Google Pay

- With the Travel app, you can manage your card, top it up, transfer currencies, as well as freeze it.

- You can choose from 23 different currencies and top it up whenever you need it

- Accepted everywhere Mastercard is accepted

- Call centre assistance is available 24/7

- Whenever there is currency left over, it can be transferred into another currency by using the wallet-to-wallet feature

- If you use a local currency supported by your card to spend abroad, there are no fees

Post Office Travel Card Costs

Travel money cards from the Post Office cost nothing to order and no fees apply when you pay for purchases using the currency you hold. Provided your available balance is in a currency accepted by the card, you can shop, dine, and drink without any charges.

When using your card in a country that doesn’t support the currency of your card, you will have to pay a 3% foreign transaction fee. Using your card in Brazil, for example, will result in a 3% foreign transaction fee since the Brazilian Real isn’t a supported currency.

Despite the card’s currency support, you’ll still have to pay ATM withdrawal fees. Each currency has a different ATM fee.

An example would be:

- Euro – 2 Euros

- Canadian Dollar – 3 Canadian Dollars

- US Dollar – 2.5 United States Dollars

- Swiss Franc – 2.5 Switzerland Francs

- Australian Dollar – 3 Australian Dollars

- Pound Sterling – 1.5 Pounds Sterling plus 1.5% commission

Regarding fees, one final note. There is a three-year validity period on all Post Office Travel cards. After your card expires, you will be charged a maintenance fee of £2 per month.

Exchange Rates

Exchange rates fluctuate based on the demand for currencies at the Post Office. Thus, you’ll receive a particular amount of travel money depending on the current exchange rate.

For travel money cards, you can get exchange rates at Post Office branches and on the website. Be sure to remember that rates may differ whether you are purchasing online, by phone, or in person.

In addition to the margin, the exchange rate at the Post Office will probably include a markup. When you search for the rate on Google or currency websites, you’ll most likely get an accurate one. Consequently, a margin will reduce the amount you receive when exchanging EUR, USD, or another currency.

A Post Office Travel Money company profits by offering its customers a better rate than the base rate. U.K. pounds are converted into U.S. dollars at a rate of 1.23 dollars per pound, for example.

If you exchange £400 through Post Office Travel Money, you can get 1.18 USD per pound. In this case, there is a difference of £16 or 4%. Exchange rates are better when you exchange large sums of money .

Exchange Rates for In-Branch Travel Money

According to the Post Office, in-branch exchange rates are determined by many factors, including branch location, competitor pricing, convenience, etc. The company will always strive to offer the best possible rate within these parameters. Online orders/distribution is the cheapest method for many retailers, as they can use centralised packing costs. Because of this, online exchange rates are always better than branch rates.

Comparing Post Office Travel Money Rates to Other Providers

There are several new services that it’s worth comparing directly to Post Office Travel Money.

Online-Only Banks

There have been several purely mobile banks launched in recent years both in the UK and across Europe. With services like Monzo, N26, Revolut, Monese, or Bunq, consumers can access a wide range of banking options.

Each of these modern financial institutions provides services such as money transfer agencies and international travel cards, and it makes sense to compare them with Post Office Travel Money.

For example, Monzo facilitates international money transfers through the popular exchange company Wise. For example, when sending a thousand pounds to a Swedish account using Monzo/Wise, the recipient receives 12,103 Swedish crowns versus 11,546 with Western Union, a difference of around 5%.

Other Currency Providers

It may also be possible to transfer money at a better rate in some countries. Using Xendpay, you could send 500 pounds to Saudi Arabia, and the beneficiary would receive 2,289 Saudi Riyals instead of 2,158 Saudi Riyals with Post Office Travel Money.

Supported Currencies

Prepaid travel cards from Post Office can be loaded with any of the following 23 currencies:

- CAD – Canadian dollar

- JPY – Japanese yen

- USD – US dollar

- AUD – Australian dollar

- CHF – Swiss franc

- AED – UAE dirham

- CNY – Chinese yuan

- DKK – Danish kroner

- PLN – Polish zloty

- CZK – Czech koruna

- ZAR – South African rand

- GBP – Pound sterling

- TRY – Turkish lira

- HKD – Hong Kong dollar

- THB – Thai baht

- HRK – Croatian kuna

- SGD – Singapore dollar

- HUF – Hungarian forint

- SEK – Swedish kronor

- SAR – Saudi riyal

- NOK – Norwegian krone

- NZD – New Zealand dollar

Sending Money With the UK Post Office

Many Post Office branches and their website offer Post Office Travel Money. They offer convenient and quick foreign exchange services. They are useful for local currency exchanges because they are so widely available. Post Office services like international money transfers and travel cards offer additional options for sending and spending overseas.

How to Get and Use a Post Office Travel Card?

Post Office travel cards are only available to UK residents over 18 years old.

Ordering Your Card

To order a Post Office Travel card, you can do one of three things:

- You can order through the Post Office Travel app

- Visit the Post Office website to apply online

- Get your card at your local Post Office. It will be necessary to bring photo identification, like a passport or driver’s licence

Your card should be available immediately if you apply at a branch. Your card will be delivered within two to three days after you apply online or via the app.

Card Activation

It’s necessary to activate your travel card before you can use it. You’ll find detailed instructions in your welcome letter.

Using Your Card

ATMs and online sites that accept MasterCard accept Post Office travel cards, too. If you are buying something in person, you’ll need your PIN to verify your purchase and possibly your signature if the Chip and PIN system is not widely available in the country.

In some countries, contactless payments are also allowed for small amounts, although the rules and limitations vary.

According to its terms and conditions, you should not use your Post Office card in certain situations.

Some of them include:

- Tolls on the road

- Petrol pumps with self-service

- Deposits for car rentals or hotels

- Airline or cruise ship transactions

Adding Money to Your Card

With the Post Office Travel app, you can add money to your card easily. Additionally, you can add money at a local branch or on the Post Office website.

Buying Back Currencies

Having unused currency on your card gives you a few options. You may be able to withdraw cash at your local Post Office branch or ATM, but there may be a fee.

Wallet-to-wallet transfers are also available in the app. You can transfer unused balances from one currency to another. In preparation for your next trip to Europe, you can convert unused USD into EUR.

Each currency listed above can be topped up for between fifty pounds and five thousand pounds on your card. Your card can hold up to ten thousand pounds, as well as carry out transactions of up to thirty thousand pounds annually.

Different currencies have different limitations on cash withdrawals. For example, in a single transaction, you may withdraw up to 450 euros or 500 dollars.

App Overview

On Google Play and the App Store, you can download the Post Office Travel app for free. With the app, you can activate and order your card, check your balance, add money to it, and more.

In addition to transferring leftover currency between wallets, it’s possible to convert it to another currency you prefer by using the new wallet-to-wallet feature.

Furthermore, you can book airport parking, purchase travel insurance through the app, and use other features.

Contacting the Post Office

If you need assistance, you may reach the contact centre by dialling 0344 335 0109 in the United Kingdom or 0044 20 7937 0280 from abroad. Customer service is available each day of the week at any time of the day.

In addition, you can reach Customer Services at the Post Office in the following ways:

- Postal mail at PO Box 3232, Cumbernauld, G67 1YU, Post Office Travel Card

- Send an email to [email protected]

Post Office Travel Card: FAQs

Here are some common travel card problems you might encounter.

When I lose or damage a card, what do I do?

Post Office currency cards are easy to replace if lost or damaged. Your card will be blocked, and another one will be sent to you. App users can also freeze their cards.

How should I deal with a declined or blocked card?

The first thing you need to do is ensure that you have enough money in your account via the app. If you don’t have enough money in your account to purchase your item, call the customer care centre.

If I forget my PIN, what should I do?

Call the customer service centre if you cannot remember your travel money card PIN. If you need a new one, they can issue it for you.

My card is about to expire. What should I do?

A new card should automatically be sent to you. You can call the contact centre if it hasn’t arrived after the expiration date, and they’ll issue you another.

Post Office Prepaid Travel Card Summary

Travel cards from the Post Office are handy if you want to keep your money safe while you’re away from home. The convenience of not carrying cash around with you and not having to change money during your trip will make your trip much more enjoyable.

Because it’s a contactless card, you can pay in local currencies quickly and easily. This helps you budget because you can only spend what’s on it.

If you travel frequently or take multi-destination holidays, the card is convenient since you can store 23 currencies on it. A card that supports a variety of currencies might be more useful if you love exploring far-flung areas.

The exchange rate is a drawback to take into account. Post Office rates may be competitive (compared to airport exchange rates, for example), but they will likely include a margin or markup. ATMs also charge fees when you use your card.

Comparing other travel money cards could help you find a better deal, so make sure to shop around.

by Matt Woodley

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock Locked padlock icon ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

How to apply for or renew a U.S. tourist visa

If you visit the U.S. for tourism or business, you may need a visitor visa, also known as a tourist visa. Learn how to get and renew this type of nonimmigrant visa.

Find out if you need a visa to visit the U.S.

Check if your country participates in the U.S. Visa Waiver Program (VWP) . If it does, you can get a waiver and will not need a visa. If you do not see your country listed, you will need a visitor visa.

Visitor (tourist) visas and other travel documents for entering the U.S.

The visitor visa is a type of nonimmigrant visa for people who wish to temporarily enter the U.S. There are two categories:

- B-1 for business travel

- B-2 for tourism and medical treatment

Learn about B-1 and B-2 visas , including:

- Reasons you would need each type of visitor visa

- How to apply

- What documents you will need

- Application fees

- How to prepare for your interview at your U.S. embassy or consulate

Along with your visa, you must bring a passport issued by your country of citizenship. When you arrive at your port of entry into the U.S., officials will issue you a Form I-94, which electronically records your arrival and departure dates. Learn more about Form I-94.

How to renew a visitor visa

The process to renew a visitor visa is the same as getting one for the first time. Follow the process to apply for a visitor visa from the Department of State.

Find the contact information for your nearest U.S. embassy or consulate and contact them for visa renewal information.

Understand expiration dates for visas and I-94 forms

- The date you must depart the U.S. will be shown on your Form I-94. This date is determined by the Customs and Border Protection officer when you arrive at the port-of-entry into the U.S.

- Only diplomatic visa holders and their dependents can renew their visas while they are in the U.S.

LAST UPDATED: May 31, 2024

Have a question?

Ask a real person any government-related question for free. They will get you the answer or let you know where to find it.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Climate Change

- Corrections Policy

- Sports Betting

- Coach Salaries

- College Basketball (M)

- College Basketball (W)

- College Football

- Concacaf Champions Cup

- For The Win

- High School Sports

- H.S. Sports Awards

- Scores + Odds

- Sports Pulse

- Sports Seriously

- Women's Sports

- Youth Sports

- Celebrities

- Entertainment This!

- Celebrity Deaths

- Policing the USA

- Women of the Century

- Problem Solved

- Personal Finance

- Consumer Recalls

- Video Games

- Product Reviews

- Home Internet

- Destinations

- Airline News

- Experience America

- Great American Vacation

- Ingrid Jacques

- Nicole Russell

- Meet the Opinion team

- How to Submit

- Obituaries Obituaries

- Contributor Content Contributor Content

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit cards

Best travel credit cards of June 2024

Robin Saks Frankel

Grace Pilling

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 12:58 p.m. UTC June 5, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

The best credit cards for travel set themselves apart from other credit cards by offering an array of benefits that make it easier and more rewarding to explore the world. These travel credit card offerings provide generous rewards and perks tailored to the needs of those on the go.

We analyzed all of the available options in this category, from issuers both large and small, to curate a list of the very best travel credit cards of 2024. Here are our selections.

our partner

Blueprint receives compensation from our partners for featured offers, which impacts how and where the placement is displayed.

The Platinum Card® from American Express

Welcome bonus

Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on the Card in your first 6 months of Card Membership.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Editor’s take

- Over $1,500 in travel and entertainment credits can offset the annual fee.

- Comprehensive lounge access benefit.

- Generous travel and purchase protections.

- High annual fee and spending requirements.

- Amex’s once-per-lifetime rule limits welcome bonus eligibility.

- Annual statement credits have limited use.

Card details

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR® Plus Credit: CLEAR® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck® application fee for a 5-year plan only (through a TSA PreCheck® official enrollment provider), when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That’s up to $50 in statement credits semi-annually. Enrollment required.