- Money Transfer

- Rate Alerts

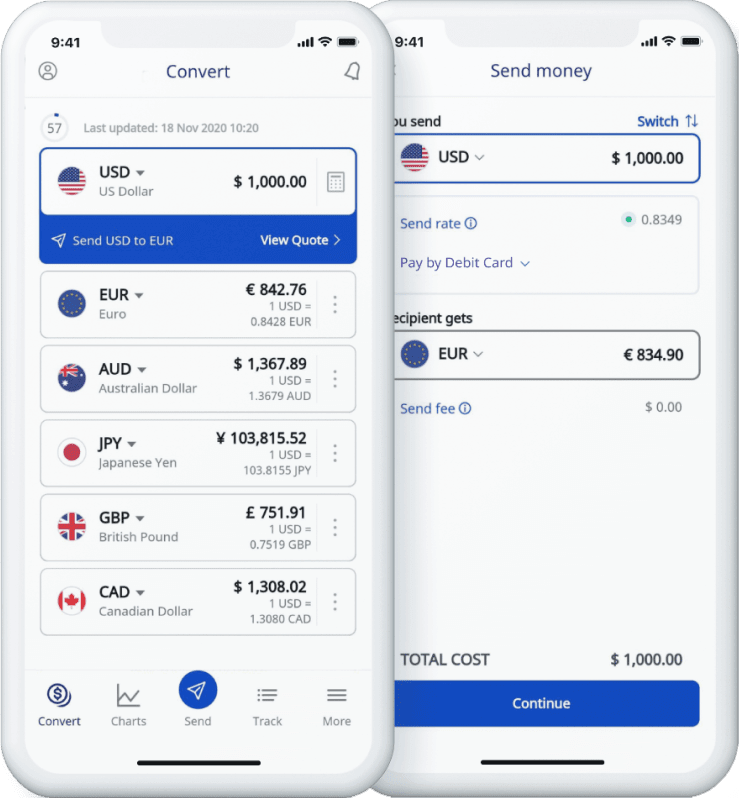

Xe Currency Converter

Check live foreign currency exchange rates

Xe Live Exchange Rates

The world's most popular currency tools, xe international money transfer.

Send money online fast, secure and easy. Live tracking and notifications + flexible delivery and payment options.

Xe Currency Charts

Create a chart for any currency pair in the world to see their currency history. These currency charts use live mid-market rates, are easy to use, and are very reliable.

Xe Rate Alerts

Need to know when a currency hits a specific rate? The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs.

Xe Currency Data API

Powering commercial grade rates at 300+ companies worldwide

Xe Currency Tools

Recommended by 65,000+ verified customers.

Download the Xe App

Check live rates, send money securely, set rate alerts, receive notifications and more.

Over 113 million downloads worldwide

Daily market updates straight to your inbox

Currency profiles, the original currency exchange rates calculator.

Since 1995, the Xe Currency Converter has provided free mid-market exchange rates for millions of users. Our latest currency calculator is a direct descendent of the fast and reliable original "Universal Currency Calculator" and of course it's still free! Learn more about Xe , our latest money transfer services, and how we became known as the world's currency data authority.

YOUR MONEY YOUR WAY

Travel money, hays travel foreign exchange, 4 great ways to buy your holiday money, click & collect.

Great rates & currency expertise come as standard with our Click & collect service & with no minimum spend, your holiday money is just a few clicks away.

This brings the total quotes to £000.00

£000.00 for currency

£000.00 for Buy Back Guarantee

Guarantee Peace of mind when buying your currency from Hays Travel

Save money on your unused currency with our Buyback Guarantee^

Return your unused currency for the same rate as you purchased it.

Available on all currencies sold in cash.

Available on multiple currency transactions

Available Instore & online

Terms & Conditions

^Please speak to one of our Hays Travel colleagues for the full Terms & Conditions of the Hays Travel Buy Back Guarantee. ^^In-branch rates will differ from our online rates. The rates displayed online are for currency banknotes pre-order only, and guaranteed if currency is collected before close of business on Tuesday 24th September 2024. ^^^Not all notes presented for buy back may be able to be exchanged, please ask our staff for more details. ^^^^Apple and the Apple logo are trademarks of Apple Inc. registered in the U.S. and other countries. App Store is a service of Apple Inc. registered in the U.S. and other countries. Google Play and the Google Play logo are trademarks of Google LLC. ^^^^^Hays Travel Prepaid Currency Card is issued by PrePay Technologies Limited pursuant to license by Mastercard International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Google Play and the Google Play logo are trademarks of Google LLC.

Exchange Rates

Always great value and no minimum spend*

Travel Money Card

- Use anywhere Mastercard® prepaid is accepted worldwide.

- Carry less cash.

- Top up in 22 currencies including Euro, US Dollar, Australian Dollars and UAE Dirhams.

- Phone support available worldwide 24/7.

- Manage on the go via Hays Travel Currency Card App.

BUY YOUR HAYS TRAVEL MASTERCARD

The Hays Travel Money Card is the safe and easy way to take your money on holiday!

It is free to use in millions of locations worldwide where Mastercard Prepaid is accepted: including restaurants, bars, and shops when you spend in a currency loaded on the card.

This easy-to-use pre-paid card allows contactless transactions, chip and PIN, worldwide cash withdrawals wherever you see the Mastercard Acceptance Mark, and also 24/7 phone support.

Take your money card with you on every holiday, simply top up and go!

- BUY IN BRANCH

WHY CHOOSE HAYS TRAVEL?

For your next departure, buy your holiday money from Hays Travel. Always commission free currency with competitive online and high street exchange rates.

- Wide selection of currencies available

- Hundreds of nationwide Hays Travel branches offering on-demand Foreign Exchange; buy from branch to receive high quality customer service from the travel experts or order online for convenient home delivery

- 0% commission when we buy and sell foreign currency

Home Delivery

Ordering currency from the comfort of you own home has never been easier, with our great rates & over 60 currencies to choose from as well as next day delivery why not choose your currency to be delivered to your doorstep?

Holiday Money to your door

Order before 3pm for next working day home delivery via Royal Mail Special Delivery. *Customer must be home to sign for delivery. Over 60 currencies to select from. Free delivery on all orders £500 and over Convenient Saturday delivery available for no extra charge Minimum order value of £200 up to a maximum of £2500 Peace of mind, your local Hays Travel branch will buy back any leftover currency purchased through Hays Home Delivery commission free

Call Into a Branch

With over 400 branches to choose from arranging your holiday money has never been more convenient – Why not call into branch today where one of our experienced & Friendly Foreign Exchange Consultants will be on hand with our great rates, expert advice & fantastic service.

Bank on our branches for your Holiday Money

Over 400 branches Nationwide - Use our branch locator to find your nearest Hays Travel branch.

A wide selection of currencies & Hays Travel Money Cards available Instantly in-store

Competitive high street rates and always commission free

Exotic Currency Ordering service – Over 70 currencies available to order

Buyback Guarantee – Save money on your leftover Currency.

All major currencies Bought Back Commission Free

Experienced & Friendly Staff instore

- FIND YOUR NEAREST BRANCH

Compare our best travel money deals

Get maximum value for your travel money, currency calculator.

Join our personal finance newsletter for top deals and insight

You can unsubscribe at any time - privacy notice .

Today’s best exchange rates

How do you get the best holiday money exchange rate, use our currency converter, high exchange rates, delivery charges, special offers, pros and cons, five golden rules of travel money, 1. know how much cash you'll need.

Carrying around a large amount of cash isn't the safest thing to do. At the same time, not having enough cash can cause a lot headaches too. It's a good idea to take a little more than you think you'll need.

But it's also good sense to have a backup prepaid , debit or travel credit card that you can rely on - assuming you're going to a destination that widely accepts card transactions.

2. Shop around

Not all currency exchange companies are created equal. Some may have good exchange rates, but higher fees. Others may have higher rates, but no fees. You have to make sure which one offers the best value to you.

This is why it’s worth comparing the deals on offer from several companies before ordering your travel money. Factor in the fees and the exchange rate and see where you end up better off. Often the amount of money you're exchanging can be a deciding factor.

3. Don't buy your travel money at the airport

Airport holiday money providers have notoriously high prices because they offer a last-chance solution for those who are just about to board a plane. By planning ahead you can save a small fortune.

4. Don't carry too many large notes

Notes of large denominations can be tricky, as small shops and taxi cabs, which are more likely to require cash, might not have enough change to accept a large note.

Some retailers are also often wary of accepting large notes. Smaller notes and change can also be handy when it comes to tipping or buying small everyday items.

5. Don't use your credit card to buy travel money

Avoid buying foreign currency with a credit card as credit card providers treat the transaction as a 'cash advance' . Not only will you be charged daily interest, you're also likely to be hit with a fee.

Budgeting for your holiday

How much travel money you need to take depends on your plans. You'll need to budget for your holiday to make sure you don't run out of money before the end.

Deciding how much money to take depends on were you're going, whether debit or credit card usage is prevalent, and if you want to have some local currency on hand for emergencies.

Having some cash is extremely important, as there's always a possibility your cards could get declined or blocked for some reason, and it may take some time to resolve the issue.

Also, some countries still rely predominantly on cash transactions, so you should factor that into how much cash you decide to take.

What are the top alternatives to buying travel money?

Travel credit cards.

Travel credit cards - i.e. the ones with no foreign transaction fees - offer two key advantages over travel money:

Great exchange rates - when you spend on a travel credit card you get the Mastercard or Visa exchange rate, which is about the best you can find as a regular consumer

Purchase protection – for purchases costing between £100 and £30,000 you're covered by Section 75 of the consumer credit act , meaning if something goes wrong you can make a claim with your card provider should the vendor fail to pay up

However, not everywhere accepts travel credit cards and using them at a cash machine abroad can come with hefty fees. It can also be easier to overspend on a credit card, leaving you with debts on which interest is charged.

Travel money cards

Currency cards and travel bank accounts let you spend overseas without being charged a foreign transaction fee. Their key strengths are:

Great exchange rates - you card provider will pass on the Mastercard or Visa rate to you without adding extra charges

No charges for ATM use overseas - if you need extra cash on holiday, you can withdraw it without being charged by your provider. Watch out for local ATM fees though, as these might still apply

The downsides include that there can be limits on how much you can withdraw abroad using a travel money card, and that they're not accepted quite as widely as cash. Some travel current accounts also come with fees.

Prepaid travel cards

Prepaid travel cards can be loaded with currency and used abroad without paying foreign exchange fees. You can load a prepaid card with a specific foreign currency or a variety of different currencies, depending on your travel plans. The key advantages are:

Low or no fees to use abroad – prepaid travel card providers charge far less than traditional banks for overseas usage

Safer than carrying cash - you can cancel or freeze the card if it's lost or stolen, protecting your balance

However, you’ll need to watch out for general usage fees, which often apply when you load the card with cash and may also be charged monthly.

Can you get commission-free travel currency?

Yes and no. It depends on how you define it. Commission refers to the service fee that a currency exchange broker charges for exchanging your money.

Many companies advertise 0% commission to exchange money online or on the high street, but, instead of charging commission, they offer a less competitive exchange rate. This is why you need to compare the whole deal rather than just opting for a zero-fee travel money deal.

Are there restrictions on getting currency delivered?

When you buy your currency online, it's normally sent via Royal Mail's Special Delivery service. This means you have to sign for the package. Cash orders that exceed £2,500 will be sent in batches because that's the maximum value that can be insured for each delivery.

Can you get next-day delivery for currency?

Some travel money providers do offer next-day delivery. These brokers send out currency using Royal Mail's Special Delivery Guaranteed by 1pm service.

Our comparison shows which operators offer this option and how much they charge for it. With some companies, you also have the option to pre-order your travel money for collection in person from a local branch, meaning you don't have to pay for delivery.

Will anyone buy my currency back?

If you've got leftover travel money from a trip abroad, you can use a buy-back service to convert it back into pounds.

The buy-back rate tells you how much sterling you'll get back.

Remember to factor in the rate and delivery costs, and compare exchange rates. You can check out the best euro-to-pound exchange rate by looking at our comparison table.

About our comparison

Who do we include in this comparison.

We include every company that gives you the option of buying euros online. Discover how our website works .

How do we make money from our comparison?

We have commercial agreements with some of the companies in this comparison. We get paid commission if we help you take out one of their products or services. Find out more here .

You do not pay any extra and the deal you get is not affected.

Learn more about travel money

About the author

Didn't find what you were looking for?

Below you can find a list of currencies to exchange

Other products that you might need for your trip

We’ve been featured in

Customer Reviews

Hub of information!

Super accessible and easy to use

Very helpful

Travel money guide

Compare fees, convenience, rewards and more between three key payment methods..

- Online shopping

Traveling overseas involves a lot of planning — and that includes your money.

What is travel money?

Travel money, for lack of a better term, essentially means the options of credit cards, debit cards, prepaid cards and foreign currency — all designed for travel and foreign transactions. Each form of travel money has different pros and cons, so you’ll want to compare and contrast before choosing which’ll be best for you and your itinerary.

Compare travel money options

Compare the fees, convenience, rewards and more between prepaid travel cards, credit cards, debit cards and foreign currency while planning how you’re going to pay for food, souvenirs and other goods on your next trip.

How to decide which type of travel money is best for you?

Prepaid travel cards, credit cards and debit cards can all be effective ways to pay while you’re traveling. In fact, a combination of the three might be the safest and most convenient way to have all your bases covered. But the travel money you should embrace as your primary payment method depends on your situation:

Pick a credit card if…

- You travel frequently and want to earn rewards. Whether you’re a hotel fiend, a frequent flyer or just love earning cash back, a travel credit card can be the gift that keeps on giving — as long as you keep spending. Just make sure you have a plan for paying your balance in time.

- You want a safety net in case of emergencies. Even if it isn’t your primary payment method, keeping a travel credit card in your back pocket can help cover any unexpected expenses.

Pick a prepaid travel card if…

- You’re on a strict budget. A prepaid travel card can help ensure you don’t overspend, since you can only spend what you’ve already loaded onto the card.

- You want to lock in an exchange rate. Avoid unpleasant surprises by knowing exactly how much your US dollars are worth from the get-go.

Pick a debit card if…

- You plan on frequenting ATMs. If you like the feeling of cold, hard cash in your hands — or will be shopping at markets that only accept cash — you should consider a travel debit card that comes with zero ATM fees.

- You want direct access to your checking account. A travel debit card can be more convenient than a prepaid travel card, since you don’t need to preload money. It’s also ideal if you want to avoid racking up a credit card bill.

Travel credit cards

Browse travel credit cards to find an option with perks that match your travel style — just make sure you have a plan to pay it off.

- Access to credit. Credit access comes in handy for emergencies.

- Rewards. Earning cash back lets you have something to look forward to when you come home.

- Extras. Some cards come with complimentary travel insurance, purchase protection and concierge services.

- Availability. Some travel credit cards are banned in countries like Cuba, Iran, Myanmar, North Korea, Sudan and Syria due to economic sanctions.

- Lack of access to cash. You could be charged with hefty fees for using a travel credit card when you withdraw cash at an ATM.

- Inactivity fee. Some card issuers will charge you a monthly fee if you don’t use the prepaid card frequently enough.

40+ currencies supported

- 4.85% APY on USD balances

- $0 monthly fees

- Up to $100 free ATMs withdrawals worldwide

- Hold and convert 40+ currencies

Up to $300 cash bonus

- 0.50% APY on checking balance

- Up to 4.50% APY on savings

- $0 account or overdraft fees

- Get up to a $300 bonus with direct deposits of $5,000 or more

Free ATM transactions

- $50 waivable monthly fee

- 0% foreign transaction fee

- Securely move money domestically and globally

- 5 monthly out-of-network ATM reimbursements

- Free international HSBC ATM transactions

Prepaid travel money cards

Prepaid travel money cards are great for budgeting, since you can only spend what’s already on the card — but that could actually be a drawback in the event of an emergency.

- Lock in exchange rates. These cares allow you to lock in rates so you won’t be surprised by the fluctuating value of your US dollars.

- Earn cashback. Select cards like the Prepaid Travel Card by Mastercard can earn you some rewards.

- Use it worldwide. Most prepaid travel cards are either Visa or Mastercard, which are widely accepted.

- Fees. you may have to pay for loading, reloading, currency conversion, withdrawing cash and more.

- ATM withdrawal limits . you may have to pay extra for withdrawing larger amounts of money.

- Not great for emergencies. since you only have a finite amount of cash you may need another source of money in case you run out.

Compare prepaid travel money cards

If you’re leaning toward a prepaid travel money card, compare some of our favorites before signing up.

Travel debit cards

Many travel debit cards waive foreign transaction fees and ATM withdrawal fees, setting you up for an easy breeze experience — as long as you don’t overdraw your checking account.

- Fewer fees. Withdraw cash and buy all the souvenirs you want without getting dinged for it.

- ATM availability worldwide. Choose a travel debit card that’s compatible with the highest number of ATMs.

- Fraud protection. Your bank can help with damage control if your card is lost or stolen.

- No cushion for emergencies. If you make large purchases, they could drain your account, which may lead to overdraft fees.

- Long card replacement wait. If you lose your card it may take up to two weeks to get a new one.

Traveler’s checks

Traveler’s checks were once a widely used form of travel money, but they’re going the way of the dinosaur. You can weigh up whether they’re worth your time below — but we’d advise looking elsewhere.

- Secure. Traveler’s checks are an extremely secure method to spend money overseas.

- Safe. They can be easily replaced if lost or stolen.

- Initial cost. You might be charged a purchasing fee when you first pick up your traveler’s check.

- Acceptance. Traveler’s checks aren’t accepted as widely as other payment methods.

- Can be bulky and awkward to carry. Plus, you’ll have to go to the effort of getting them cashed rather than having immediate access to your cash like you would with a card.

Comprehensive guide to using debit cards overseas

Foreign cash

Holding a certain amount of foreign cash provides you with convenience and payment flexibility. Some stops on your destination may be cash-only and having extra on you can provide a smooth transition to wherever your destination may be.

Knowing how the dollar has performed against foreign currency in the past few years and months will enable you to get the best exchange rate for your foreign exchange transaction. Our travel money guides will inform you on some of the ways to access cash and ATMs worldwide.

Is it safe to travel with cash?

Yes! In fact, it’s usually safer to travel with some cash than none at all — though you don’t need to take large sums along with you. To keep your cash safe while traveling, avoid keeping it all in one place. Instead, divide it between your suitcase, purse and other safe places so that if some gets stolen you still have backup cash.

Keep in mind that carrying more than $10,000 at a time could actually be a headache, since you’ll need to declare it on your customs form to explain why you’re traveling with so much money.

5 places to do a foreign currency exchange

The best place to exchange your foreign currency is at your bank or credit union BEFORE you travel.

- Bank. Call your local branch beforehand to see if their services line up with what you need. Most nationwide banks, like PNC, offer competitive rates and no transaction fees.

- Credit unions. Similar to banks, credit unions generally offer competitive exchange rates and limited or no transaction fees.

But if you’re already in a foreign destination, your best bet is to use a travel debit card to withdraw funds at an ATM.

- Debit card. You should be able to withdraw cash from an international ATM with decent exchange rates and fees ranging from 1% to 3%.

Airport kiosks and currency exchange stores should only be used as a last resort.

- Airport kiosk. After disembarking from the plane, you can exchange your currency at the airport. But fees are high and exchange rates will be less-than-favorable.

- Currency exchange store. You can find exchange stories in most international cities, but again, the fees will be working against you.

Destination money guides

For your next international trip, plan ahead by knowing how much to bring, and which travel money option is best for you. Choose your destination to get the full guide:

- Czech Republic

- Hong Kong, China

- Netherlands

- New Zealand

- South Korea

Amy Stoltenberg

Amy Stoltenberg managed newsletters at Finder, gathering the best articles each week to help subscribers save money and stretch their hard-earned dollars. She also handles the Twitter account, dabbling in Instagram and Facebook too. When she's not on the computer, you can find her exploring Los Angeles with a good book in tow. She studied writing at Savannah College of Art and Design and has been featured on the Zoe Report. See full bio

Kyle Morgan

Kyle Morgan is SEO manager at Forbes Advisor and a former editor and content strategist at Finder. He has written for the USA Today network and Relix magazine, among other publications. He holds a BA in journalism and media from Rutgers University. See full bio

Read more on this topic

How to pay, how much to bring and travel money suggestions for your trip to USA.

How to pay, how much to bring and travel money suggestions for your trip to New Zealand.

How to pay, how much to bring and travel money suggestions for your trip to Thailand.

How to pay, how much to bring and travel money suggestions for your trip to Vietnam.

How to pay, how much to bring and travel money suggestions for your trip to Mexico.

How to pay, how much to bring and travel money suggestions for your trip to Portugal.

How to pay, how much to bring and travel money suggestions for your trip to Germany.

How to pay, how much to bring and travel money suggestions for your trip to Ecuador.

How to pay, how much to bring and travel money suggestions for your trip to Canada.

How to pay, how much to bring and travel money suggestions for your trip to Japan.

Ask a question

Click here to cancel reply.

4 Responses

My son did some work overseas and was paid in Macedonian Denars. He’s having a terrible time getting this exchanged to US money. Where can he do this?

Hi Foxtrotrn,

Thank you for reaching out to finder.

Macedonian Denar is a closed currency which is a currency that you can only get in the country of origin and that is the reason why it is quite difficult to have it exchanged to US dollars.

The options that you have for foreign currency exchange are:

– International exchange kiosks which can be found in airports – Banks – Online foreign exchange companies such as World First, XE and other similar companies which offer exchange services online

I hope this helps.

Cheers, Charisse

Can I get dirhams–Moroccan currency–from any Chase branches?

Thanks for your inquiry. Please note that we are not affiliated with Chase or any company we feature on our site and so we can only offer you general advice.

Yes, Chase offers international money transfers including dirhams. Aside from using your bank, you can also compare currency exchange companies that you can use to save on your next exchange.

Best regards, Rench

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Advertiser Disclosure

finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

Royal Mail strikes are expected in December.

There are planned Royal Mail Strikes confirmed for the 14th, 15th, 23rd and 24th of December. Royal Mail have advised to expect delays during these two weeks and to allow several days extra time to receive your delivery.

Why queue up? No Fuss, Travel Money Delivered to your Home

The rate provided above is for indication only. we will apply the best BUY BACK rate on the day we receive your currency

These words inspire us

WHAT WE OFFER

Easy and Fast Ordering

Select the currency you wish to buy and confirm your exchange rate

Our rates move with the market once you confirm your order you fix your rate.

Select your delivery date and then Make Payment

Deliveries are made by 1pm Monday to Saturday. Select the date most convenient for you.

Receive your currency the next day via Royal Mail Special Delivery

You will be notified once your order is on its way to you. Royal Mail will require a signature upon delivery.

Place a buy back order online

Place your buy back order online and you will be provided with an indicative buy back rate. A form will be generated for you to print off. Sign and enclose the form with your currency

Send your currency to us via Royal mail special delivery

Please make sure the item has been insured to the correct value in the event of loss or theft and keep hold of the tracking ID. Send to the following address: TCC TCC, PO BOX 66831, London, W27TB

Payment to your bank account

Once we have received your item in the cash center the buyback rate at the time will be applied and we shall make payment to the bank account details you have provided. You can expect an email notification once the amount has been paid

BEST CURRENCY EXCHANGE RATES

Rapid Travel Money vs The Competition*

Cards, Loans & Savings

Car & home insurance, pet insurance, travel insurance, travel money card, life insurance, travel money, exchange rate calculator.

Nectar members get better rates on travel money*

- Europe - Euro (EUR)

- USA - U.S. Dollar (USD)

- United Arab Emirates - UAE Dirham (AED)

- Australia - Australian Dollar (AUD)

- Canada - Canadian Dollar (CAD)

- New Zealand - New Zealand Dollar (NZD)

- Switzerland - Swiss Franc (CHF)

- Thailand - Thai Baht (THB)

- Aland Islands - Euro (EUR)

- American Samoa - U.S. Dollar (USD)

- Andorra - Euro (EUR)

- Anguilla - East Caribbean Dollar (XCD)

- Antigua and Barbuda - East Caribbean Dollar (XCD)

- Austria - Euro (EUR)

- Bahrain - Bahraini Dinar (BHD)

- Barbados - Barbadian Dollar (BBD)

- Belgium - Euro (EUR)

- Bulgaria - Bulgarian Lev (BGN)

- China - Chinese Renminbi (CNY)

- Cook Islands - New Zealand Dollar (NZD)

- Costa Rica - Costa Rican Colon (CRC)

- Croatia - Euro (EUR)

- Cyprus - Euro (EUR)

- Czech Republic - Czech Koruna (CZK)

- Denmark - Danish Krone (DKK)

- Dominica - East Caribbean Dollar (XCD)

- Dominican Republic - Dominican Peso (DOP)

- Ecuador - U.S. Dollar (USD)

- El Salvador - U.S. Dollar (USD)

- Estonia - Euro (EUR)

- Faroe Islands - Danish Krone (DKK)

- Fiji - Fijian Dollar (FJD)

- Finland - Euro (EUR)

- France - Euro (EUR)

- French Guiana - Euro (EUR)

- French Southern Territories - Euro (EUR)

- Greece - Euro (EUR)

- Greenland - Danish Krone (DKK)

- Grenada - East Caribbean Dollar (XCD)

- Guadeloupe - Euro (EUR)

- Guam - U.S. Dollar (USD)

- Haiti - U.S. Dollar (USD)

- Holy See (Vatican City State) - Euro (EUR)

- Hong Kong - Hong Kong Dollar (HKD)

- Hungary - Hungarian Forint (HUF)

- Iceland - Icelandic Króna (ISK)

- Indonesia - Indonesian Rupiah (IDR)

- Ireland - Euro (EUR)

- Israel - Israeli New Sheqel (ILS)

- Italy - Euro (EUR)

- Jamaica - Jamaican Dollar (JMD)

- Japan - Japanese Yen (JPY)

- Jordan - Jordanian Dinar (JOD)

- Kiribati - Australian Dollar (AUD)

- Kuwait - Kuwaiti Dinar (KWD)

- Liechtenstein - Swiss Franc (CHF)

- Lithuania - Euro (EUR)

- Luxembourg - Euro (EUR)

- Malaysia - Malaysian Ringgit (MYR)

- Malta - Euro (EUR)

- Marshall Islands - U.S. Dollar (USD)

- Martinique - Euro (EUR)

- Mauritius - Mauritian Rupee (MUR)

- Mayotte - Euro (EUR)

- Mexico - Mexican Peso (MXN)

- Micronesia, Federated States of - U.S. Dollar (USD)

- Monaco - Euro (EUR)

- Montenegro - Euro (EUR)

- Montserrat - East Caribbean Dollar (XCD)

- Nauru - Australian Dollar (AUD)

- Netherlands - Euro (EUR)

- Niue - New Zealand Dollar (NZD)

- Norfolk Island - Australian Dollar (AUD)

- Northern Mariana Islands - U.S. Dollar (USD)

- Norway - Norwegian Krone (NOK)

- Oman - Omani Rial (OMR)

- Palau - U.S. Dollar (USD)

- Panama - U.S. Dollar (USD)

- Philippines - Philippine Peso (PHP)

- Pitcairn - New Zealand Dollar (NZD)

- Poland - Polish Zloty (PLN)

- Portugal - Euro (EUR)

- Puerto Rico - U.S. Dollar (USD)

- Qatar - Qatari Riyal (QAR)

- Romania - Romanian Leu (RON)

- Saint Barthélemy - Euro (EUR)

- Saint Kitts and Nevis - East Caribbean Dollar (XCD)

- Saint Lucia - East Caribbean Dollar (XCD)

- Saint Martin (French part) - Euro (EUR)

- Saint Vincent and the Grenadines - East Caribbean Dollar (XCD)

- San Marino - Euro (EUR)

- Saudi Arabia - Saudi Riyal (SAR)

- Singapore - Singapore Dollar (SGD)

- Slovakia - Euro (EUR)

- Slovenia - Euro (EUR)

- South Africa - South African Rand (ZAR)

- Spain - Euro (EUR)

- Sweden - Swedish Krona (SEK)

- Taiwan - New Taiwan Dollar (TWD)

- Timor-Leste - U.S. Dollar (USD)

- Tokelau - New Zealand Dollar (NZD)

- Türkiye - Turkish New Lira (TRY)

- Turks and Caicos Islands - U.S. Dollar (USD)

- Tuvalu - Australian Dollar (AUD)

- Vietnam - Vietnamese Dong (VND)

- Virgin Islands, British - U.S. Dollar (USD)

- Virgin Islands, U.S. - U.S. Dollar (USD)

- No matches found

Exchange rates may vary depending on whether you buy instore, online or by phone.

^ Travel money cards are available on selected currencies only.

Buy travel money

You can buy, exchange or order foreign currency online, by phone, or at one of our in store bureaux.

How to get travel money with Sainsbury’s Bank

Need holiday money? Order currency online, by phone or visit a Sainsbury’s store with a bureau today. Or get a Sainsbury’s Bank Travel Money Card for easy and secure spending overseas.

There are various ways to buy travel money with Sainsbury’s Bank. Choose the method that’s easiest for you.

1. Buy currency online for home delivery. T&Cs apply. 2. Order currency online and collect instore. 4-hour click and collect available for Euros and US Dollars only. T&Cs apply. 3. Buy currency via telephone. 4. Visit one of our bureaux to buy currency in a Sainsbury’s store.

Buy a prepaid travel money card

Our travel money card makes it safe and easy to manage and spend your holiday money. 1. Order for collection – Collect your travel money card from your nearest Sainsbury’s Bank bureau. 2. Order for delivery – We’ll send your travel money card straight to you. T&Cs apply. 3. Download the app or log in online – Check your balance, exchange between currencies, top up and manage your account.

Where can you get foreign currency with Sainsbury’s?

Get travel money delivered to you.

Order online or by phone and we’ll mail your holiday money to you securely via special delivery. Order more than £400 of foreign currency and get free delivery.

Collect travel money instore

Visit a store with an instore travel bureau to collect your travel money on your next weekly shop.

In a hurry? You can now order and collect Euros, US Dollars, and Travel Money Card pre-paid orders in as little as 4 hours with our click and collect travel money service^.

Click and collect currency the same day at a Sainsbury’s Bank travel money bureau when you:

- Order Euros, US Dollars, or a travel money card

- Place your order on a Monday to Friday, and

- Order at least four hours before the bureau’s scheduled closure time

For orders made outside of this period, or for any other currency, you will be able to select your preferred collection date when placing your online order.

Get your travel money card delivered to you

We’ll send your travel money card straight to you, with your PIN arriving separately for security.

Visit one of our bureaux

We have stores with instore travel bureaux across the UK where you can pick up holiday money on the day.

Why use Sainsbury’s Bank for foreign currency

- Wide range of currencies, including USD and EUR We offer over 50 different foreign currencies, so it’s easy to get the holiday money you need.

- Nectar Prices Nectar members get better exchange rates online, on the phone and at one of our in store bureaux. See our Nectar member benefits .*

- Currency buy-back Got holiday money left over when you get home? We’ll buy back most foreign currency, so you’re not out of pocket.

- Pick up your travel money in one of our stores Within travel bureaux across the UK, it’s convenient to pick up holiday money as you shop with Sainsbury’s Bank.

- Multiple ways to order and receive travel money Order online or by telephone, collect instore or receive holiday money by post – the choice is yours.

- 24/7 telephone assistance and online portal Our team are on hand to help with your travel money card any time of the day or night, no matter where you are in the world.

- Access to Western Union You can send an international money transfer instore with Western Union Money Transfer® services .

Choose your foreign currency

From Euros and US Dollars to Swedish Kronor and Japanese Yen, we have more than 50 foreign currencies from all over the world.

Take a look at our most popular currencies.

Add to your travel money card to withdraw and spend on holiday.

US Dollar (USD)

Order by telephone and receive your travel money in the post.

Dirham (AED)

Order online for bureau collection or buy directly instore.

Turkish Lira (TRK)

Buy travel money at one of our bureaux de change.

Thai Baht (THB)

Order currency online and get free delivery over £400.

Canadian Dollar (CAD)

Get a travel money card instore to use on holiday in Canada.

Frequently asked questions

Are there any administration fees.

No, we don't charge any administration fees when you order currency from us.

Will I be charged for using my credit/debit card?

No, we don’t charge any extra when you buy foreign currency by card.

Some card providers may charge a cash advance fee and interest for buying currencies. Cash advance fees will not show on your travel money order, but you’ll be able to see them on your card statement. If you’re not sure, you should check with your card issuer.

There is no cash advance fee when you use a Sainsbury’s Bank Credit Card. No interest will be charged, as long as the full outstanding balance on the credit card is cleared during the current billing cycle. If a balance remains on the account at the end of the billing cycle, interest will be charged and may apply to the currency purchased.

Do I get any benefits for being a Nectar member?

Yes, you do. If you tell us your Nectar card number when you place your order, we’ll give you a better exchange rate*. Not a Nectar member? Sign up today .

When will I receive my home delivery order?

You can select a specific working day delivery date up to seven days in advance. Please note Saturday deliveries are not guaranteed. Also, if you’ve chosen a Monday delivery, Royal Mail may try to deliver on Saturday.

The earliest day you’ll be able to select for delivery is:

^ Please note – next day delivery only applies to Euros, US Dollar and t ravel money card orders.

What are the home delivery fees?

How much money can i order online.

Orders for collection at any Sainsbury's Bank Travel Money Bureau or for home delivery are subject to a maximum value of £4,500 per person per day.

All home delivery orders are subject to a minimum value of £100** and a maximum of £2,500. There is no minimum order value for orders for collection at a Sainsbury's Bank Travel Money Bureau.

How long will my travel money card take to arrive?

We’ll send out your travel money card as soon as you order it, so it should be with you in three to five working days. You can also get a travel money card immediately at our bureaux if you need yours at short notice.

Can I exchange unused travel money?

Yes, we can buy back your foreign currency. Just bring your unused currency back to a Sainsbury’s Bank travel money bureau and we’ll exchange it back to sterling. Please note that we can buy back notes but not coins.

Can I pay using Apple Pay?

Yes, as long as the card issuer you are using is Maestro, Mastercard or VISA.

Terms and conditions

*Nectar members receive better exchange rates on single purchase transactions of all available foreign currencies. Excludes travel money card home delivery orders and online reloads. Exchange rates may vary depending on whether you buy instore, online or by phone.© You need to tell us your Nectar card number at the time of your transaction. No cash alternative is available. We reserve the right to change or cancel this offer without notice.

**You can order currency for a secure home delivery by 1pm on the day of your choice by Royal Mail (Mon- Sat). For next day delivery your order needs to be confirmed before 2pm (Mon- Fri). Please note that whilst Royal Mail make every effort to delivery on schedule, we cannot guarantee this as it is beyond our control. Highlands and Islands (including Channel Islands) are not guaranteed next day delivery. Delivery is free on all cash orders £400 or more (£4.99 for orders between £100 and £399.99). The minimum order for home delivery is £100. The delivery day quoted is dependent on the order day being a working day; if one of those days is a public holiday then additional day(s) will be added accordingly. All home delivery orders are sent via Royal Mail Special Delivery, unless we advise you otherwise, to your billing address, and a signature will be required upon delivery. A valid telephone number is required for home delivery. ^For Euro, US Dollar and Travel Money Card only: If you selected same-day collection your order will be available 4 hours from the initial order confirmation email received or if your order was placed before 6am then the earliest your order will be available to collect is from 10 am. Please allow at least 4 hours for your order to be processed. Remember to check the bureau opening hours before collecting your order.

If you selected tomorrow or a future date your order will be ready from 10 am on your chosen collection date. For all other currencies Your order will be available from 2.00 pm on your chosen collection date. Your order should be collected within 72 hours or will be subject to cancellation. Sainsbury's Bank Travel Money Card is issued by PrePay Technologies Limited pursuant to license by Mastercard International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Find more Terms & Conditions here

Nectar prices for Nectar members*

Insurance servicing

- Life insurance (opens in a new window)

- Home insurance (opens in a new window)

- Travel insurance (opens in a new window)

- Car insurance (opens in a new window)

Internet Banking

- Sign in to internet banking (opens in a new window)

- Register for internet banking (opens in a new window)

- M&S Travel Money

Buy Travel Money

Currency calculator.

Our currency calculator is a quick and easy way to check our latest foreign currency exchange rates.

What do I need to bring to collect my foreign currency?

The benefits of exchanging your holiday money with M&S Bank

Wide range of foreign currencies.

We offer a wide range of foreign currencies in our Bureaux, with more available to order online. It is easy to compare travel money with M&S Bank. See footnote * *

As well as the euro and US dollar , our range includes currencies such as the UAE dirham, Bulgarian lev , Turkish lira , Thai baht and Mexican peso .

Travel money sale now on!

Click & Collect sale on euro and US dollar available until 11 April 2023.

£150 minimum order. Exchange rates will still fluctuate daily during the sale period, but you’ll receive the best rate applicable on the date your order is placed. Rates shown when placing your order are sale rates. Offer subject to availability, buy back not included. Cancellation fee and full T&Cs apply.

SameDay Click & Collect

- Order between £150 and £2,500

- Euro and US dollars available to order and collect in over 450 stores *

- Order and collect euro , US dollars , Turkish lira , New Zealand dollar , Australian dollar , Thai baht , Canadian dollar , South African rand and UAE dirham, from our Bureau the same day

Find my nearest Click and Collect store

Click & Collect † See footnote †

- A wide range of currencies available to collect from our in store Bureaux See footnote * *

- Order and collect from the next day

Our best rates on euro and US dollar when you Click & Collect

To get an even better exchange rate on euro and US dollar , use our Click & Collect service. Pay now and lock in today's rate, then collect from a store at a time convenient for you.

CHANGE4CHANGE

If you would like to donate your unused foreign currency to charity we have Change4Change collection boxes in our Bureaux, with all the money we collect going to Breast Cancer Now. Since 2007, we have raised over £630,000 for the charity via your Change4Change donations.

Find a Bureau

Travel money buy-back service

When your holiday is over, we'll buy back your leftover holiday money at the buy-back rate on the day you return it to the Bureau de Change. That's all unused notes in any denomination we sell.

Find out more about M&S Travel Money Buy Back service

If you would like to donate your unused foreign currency to charity we have Change4Change collection boxes in our Bureau stores, with all the money we collect going to Breast Cancer Now. Since 2007, we have raised over £630,000 for the charity via your Change4Change donations.

Find a bureau

When your holiday is over, we'll buy back your leftover holiday money at the buy-back rate on the day you return it to the bureau de change. That's all unused notes in any denomination we sell. Proof of purchase may be required so please retain your receipt, just in case.

Up to 55 days' interest-free credit when purchasing with an M&S Credit Card See footnote ** **

Representative example: based on an assumed credit limit of £1,200, our 24.9% rate per annum (variable) for purchases gives a representative rate of 24.9% APR (variable). Credit is subject to status.

No cash advance fee when M&S Travel Money is purchased using an M&S Credit Card.

What you'll need to bring

To collect foreign currency you've purchased online, you will need:

- A valid UK photographic driving licence, passport or EU national identity card (Romanian & Greek National ID Cards are not accepted)

- Your card you used to place your order - both ID and payment card must have the same name

- Your order number (this can be found on your confirmation email)

To purchase foreign currency in one of our Bureaux, you will need:

- A valid UK photographic driving licence, passport or EU national identity card - both ID and payment card must have the same name

Find my nearest M&S Bureau de Change

Use the M&S Bank Bureau Finder to find your nearest M&S Bureau de Change and opening hours.

Find a Bureau de Change

Manage your existing travel insurance policy

Want to renew, change or cancel your policy or need to make a claim?

Find out more - about managing your travel insurance policy

Need some winter sun?

Planning a winter sunshine break? Use our handy guide to help with your planning.

Ready to hit the slopes?

Thinking about a skiing holiday in Europe, North America or Asia? Use our guide to help you with your trip.

Planning to travel with cash?

Our guide explains how much money you can take abroad.

Learn more about the euro

How many countries use the euro? When was the euro first introduced? Find out more.

Using your credit card abroad

Going on holiday? Get to grips with how you can use a credit card outside of the UK.

What is RFID blocking technology?

If you are concerned about having your passport or credit card skimmed whilst abroad learn more about RFID technology.

What influences exchange rates?

Discover what factors contribute to the exchange rates that you see today.

How to budget for long term travel

Going on a long-term trip? Read our guide on how to budget successfully to ensure you have the most memorable time possible.

Visiting a Christmas market?

Learn more about the many Christmas markets across Europe.

Frequently asked questions

Can i use a credit card to purchase travel money.

Yes, you can use a credit card to purchase travel money. However, please check with your card provider as they may apply fees or charges e.g. cash advance fees or other fees.

Our Bureaux accept the majority of UK issued major credit cards.

How much cash can I travel with?

You can learn more about taking cash in and out of Great Britain and declaring cash by visiting gov.uk .

Should I get foreign currency before I travel?

Buying your travel money before you travel can be an important part of pre-holiday preparation. You can use our Currency Converter to get the latest exchange rates across worldwide holiday destinations.

Where can I collect M&S Travel Money from?

You can collect M&S Travel Money from over 100 bureaux de change or from over 350 stores nationwide. You can find your nearest M&S Bureau de Change using our Bureau Finder .

Where can I get the best exchange rate?

Exchange rates change on a regular basis and vary depending on the currency you order. At M&S Bank, we offer our best rates for euro and US dollar via the Click & Collect service, where you can order your currency and collect from the next day in an M&S location local to you. If you order online before 4pm, you can collect the same day. For all other currencies, check our website for more information.

How much travel money can I order?

For orders placed via Click & Collect, there is a minimum £150 order and maximum of £2,500. For Bureau de Change walk-ups, there is no minimum order.

How do I confirm my Travel Money purchase using my M&S Credit Card?

There are three ways to verify your payments - you can use our M&S Banking App, a one-time passcode via text message or by using a card reader to verify your payment. Use our how-to videos or step-by-step guides to find out more.

Have a question about travel money or other travel products?

Ask our Virtual Assistant

Useful information

View exchange rates

Find out more about euro rates

Find out more about US dollar rates

Find out more about Australian dollar rates

Find out more about Canadian dollar rates

Find out more about New Zealand dollar rates

Find out about M&S Travel Insurance

Important documents

M&S Travel Money Terms and Conditions

You may require Adobe PDF reader to view these documents. Download Adobe Reader

* Subject to availability

** With the M&S Credit Card, you'll receive up to 55 days' interest-free credit when you pay your balance in full and on time each month.

† Next Day collection is subject to availability. Please confirm your collection date and location at the checkout.

- Partnership Card

- Home Insurance

- Car Insurance

- International Payments

- Investments

- Partnership Credit Card

- Points calculator

- Mobile payments & app

- Online account

- Fraud & security

- Cardholder exclusives

- Guides & articles

Customer support

- Contents Insurance

- Buildings Insurance

- High-Value Home Insurance

- Get a quote

- Show your saved quote

- Renew your policy

- Make a claim

- Policy documents

- Older drivers

- Retrieve a quote

- Things to consider

- How to register

- Pet Insurance

- Dog Insurance

- Cat Insurance

- Travel Money

- Bureau de Change

- Click & Collect

- Travel Money Delivered

- Pre-packed Currency

- Currency Buy Back

- Currency exchange rate table

- Regular transfers

- One-off payments

Click & Collect Travel Money

Click & collect your travel money in-store.

Get a great rate and pay no commission

Pick up on the next available working day

Free delivery for orders over £500

Over 50 currencies available, including Euros and Dollars

Click & Collect is available to UK residents only.

- Euro ( EUR ) eu

- US Dollar ( USD ) us

- Australian Dollar ( AUD ) au

- Canadian Dollar ( CAD ) ca

- Swiss Franc ( CHF ) ch

- UAE Dirham ( AED ) ae

- Bahamian Dollar ( BSD ) bs

- Bahraini Dinar ( BHD ) bh

- Barbadian Dollar ( BBD ) bb

- Bermudian Dollar ( BMD ) bm

- Brazilian Real ( BRL ) br

- Brunei Dollar ( BND ) bn

- Bulgarian Lev ( BGN ) bg

- Chilean Peso ( CLP ) cl

- Chinese Yuan Renminbi ( CNY ) cn

- Colombian Peso ( COP ) co

- Costa Rican Colon ( CRC ) cr

- Czech Koruna ( CZK ) cz

- Danish Krone ( DKK ) dk

- Dominican Peso ( DOP ) do

- East Caribbean Dollar ( XCD ) xc

- Fijian Dollar ( FJD ) fj

- French Polynesian Franc ( XPF ) pf

- Guatemalan Quetzal ( GTQ ) gt

- Hong Kong Dollar ( HKD ) hk

- Hungarian Forint ( HUF ) hu

- Icelandic Krona ( ISK ) is

- Indonesian Rupiah ( IDR ) id

- Israeli Sheqel ( ILS ) il

- Jamaican Dollar ( JMD ) jm

- Japanese Yen ( JPY ) jp

- Jordanian Dinar ( JOD ) jo

- Kuwaiti Dinar ( KWD ) kw

- Malaysian Ringgit ( MYR ) my

- Mauritian Rupee ( MUR ) mu

- Mexican Peso ( MXN ) mx

- New Zealand Dollar ( NZD ) nz

- Norwegian Krone ( NOK ) no

- Omani Rial ( OMR ) om

- Philippine Peso ( PHP ) ph

- Polish Zloty ( PLN ) pl

- Qatari Rial ( QAR ) qa

- Romanian Leu ( RON ) ro

- Saudi Riyal ( SAR ) sa

- Singapore Dollar ( SGD ) sg

- South African Rand ( ZAR ) za

- South Korean Won ( KRW ) kr

- Swedish Krona ( SEK ) se

- Taiwan Dollar ( TWD ) tw

- Thai Baht ( THB ) th

- Trinidad and Tobago Dollar ( TTD ) tt

- Turkish Lira ( TRY ) tr

- Vietnamese Dong ( VND ) vn

£1 = 1.2070 USD

Earn points when you pay with your Partnership Credit Card. Representative 28.9% APR (variable)*

Online orders can include multiple currencies. Minimum online order value £250. Exchange rates in our shops may vary from those offered online. Click here for our bureau rates .

*John Lewis plc is a broker. NewDay Ltd is the lender. Credit subject to status. 18 years +. UK residents. T&Cs apply .

Find your nearest collection point

The store locator map will load here

What you'll need to bring

When collecting your money, you'll need to have some valid ID with you. This can be any of the following:

- Full UK photographic Driving Licence

- EU National Identity Photocard

Occasionally we may ask you for additional ID dependent upon the transaction. In this case we would accept recent utility bills, bank or credit card statements or other formal ID that shows your address.

To pick up the currency you'll also need to bring your order reference number. You don’t need to print your order confirmation email, just have your order number to hand.

Exchanging currency at John Lewis

We have a range of currencies available to buy instantly from our in-store Bureaux de Change , located in 30 John Lewis & Partners stores across the UK.

To find out if your nearest Bureau de Change carries the currency you want to buy, please call us .

You can also visit the store to ask one of our partners. They’ll have a record of the currencies available and our in-store rates.

If we don’t have your currency on that day, you can check online and order with the option to click and collect or have it delivered to your home by the next working day.

Today's online rates

Rates on Monday 23 September 2024, 09:50

Exchange rates in our shops may vary from those offered online

Click & Collect currency from John Lewis

Click & Collect is a convenient way to order and pick up your holiday money. We also offer next-working-day home delivery , but if you’re out and about running errands at your local John Lewis or Waitrose, choosing to click and collect can save you time.

Your currency will be available to pick up at the earliest collection date, and we’ll make sure to hold onto it for up to a week.

Pick up at any John Lewis or Waitrose

Free Click & Collect for orders over £500

Over 50 currencies available online

Expert Quote

“Holidays are a nice pause from your day-to-day, but we know life can’t just stop before your trip. It’s easy to Click & Collect your currency, so you can pick it up while you’re doing your weekly Waitrose shop.”

- Natalie Townsend, FX expert

Click & Collect FAQs

What is click & collect.

Click & Collect allows you to order online and collect in store at selected Waitrose and John Lewis shops. Simply select the Click & collect option after you have confirmed the currency you are ordering.

A collection date will be detailed in your confirmation email - we will send an email and an SMS message when your order is ready to collect. Your order will be held for seven days from the collection date.

You can collect your order at any time during the opening hours of the store .

Whereabouts in my selected John Lewis or Waitrose shop can I collect my order?

The place where you collect your online order varies according to the type of shop you choose to collect from:

- Full size John Lewis department stores: our Bureau de Change desks

- John Lewis at Home: Customer Collection point

- Waitrose: the Welcome Desk

- Little Waitrose: any till desk

Is there a charge for Click & Collect?

Click & Collect is free for all orders of £500 or more. There is a £5.50 charge for orders between £250 and £499.99. We do not offer the Click & Collect service on orders under £250.

What happens if I don't collect my Click & Collect order?

Your order will be held for seven days at the Bureau de Change desks in our shops or at your Waitrose Click & collect destination before it is sent back.

You will be refunded within 28 working days from the date it is sent back, less any fees or charges. Please see the Terms & conditions for more information.

Can someone else collect my order?

Why do i need to show id when buying currency in a bureau de change or picking up a click & collect order.

When making a purchase in the Bureau de Change, to adhere to anti-money laundering regulations we may ask for a photo ID. Please ensure you bring this with you to make your purchase.

We also reserve the right to ask for a photo ID on any transaction which we deem requires enhanced due diligence checks.

Travel money

John Lewis Money, John Lewis Finance and John Lewis & Partners Bureau de Change are trading names of John Lewis plc.

John Lewis plc introduces the panel of carefully chosen providers in Bureau de Change products and services, who each hold the appropriate licences with the Financial Conduct Authority and HMRC.

Travel Money online from John Lewis Money, John Lewis Finance, and John Lewis & Partners, is provided by First Rate Exchange Services Limited (company number: 04287490 and Money Service Business licence number: MLR-64068). Registered office: Great West House, Great West Road, Brentford, West London, TW8 9DF, England.

For UK clients: International Payments are provided by HiFX Europe Limited. HiFX is authorised by the Financial Conduct Authority under the Payment Services Regulations 2017 (firm reference number: 462444), for the provision of payment services. HiFX is a limited company registered in England and Wales (company number: 3517451). Registered office: Maxis 1, Western Road, Bracknell, Berkshire, RG12 1RT.

For EEA clients: International Payments are provided by XE Europe B.V.. XE Europe B.V. is authorised by the Dutch Central Bank (De Nederlandsche Bank) under the Payment Services Directive II (licence number R149006) for the provision of payment services. XE Europe B.V. is a limited company registered in The Netherlands (company number: 72587873). Registered office: Rozengracht 12,1, 1016NB Amsterdam, The Netherlands.

Our products

The partnership.

- About John Lewis Money

- Accessibility

- Meet our money experts

- John Lewis & Partners

- Payment Plans

- Waitrose & Partners

- Terms and conditions

- Modern slavery statement

- Privacy notice

- Sustainability

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Travel Money

Get competitive rates and 0% commission for your holiday cash

Foreign currency

Find our best exchange rates online and enjoy 0% commission on over 60 currencies. And you can choose collection from your nearest branch or delivery to your home

Go cashless with our prepaid Mastercard®. Take advantage of contactless payment, load up to 22 currencies and manage everything with our app, making travel simple and secure

Order travel money

- UAE Dirham AED

- Australian Dollar AUD

- Barbados Dollar BBD

- Bangladesh Taka BDT

- Bulgarian Lev BGN

- Bahrain Dinar BHD

- Bermuda Dollar BMD

- Brunei Dollar BND

- Canadian Dollar CAD

- Swiss Franc CHF

- Chilean Peso CLP

- Chinese Yuan CNY

- Colombian Peso COP

- Costa Rican Colon CRC

- Czech Koruna CZK

- Danish Kroner DKK

- Dominican Peso DOP

- Fiji Dollar FJD

- Guatemalan Quetzal GTQ

- Hong Kong Dollar HKD

- Hungarian Forint HUF

- Indonesian Rupiah IDR

- Israeli Sheqel ILS

- Icelandic Krona ISK

- Jamaican Dollar JMD

- Jordanian Dinar JOD

- Japanese Yen JPY

- Kenyan Shilling KES

- Korean Won KRW

- Kuwaiti Dinar KWD

- Mauritius Rupee MUR

- Mexican Peso MXN

- Malaysian Ringgit MYR

- Norwegian Krone NOK

- New Zealand Dollar NZD

- Omani Rial OMR

- Peru Nuevo Sol PEN

- Philippino Peso PHP

- Polish Zloty PLN

- Romanian New Leu RON

- Saudi Riyal SAR

- Swedish Kronor SEK

- Singapore Dollar SGD

- Thai Baht THB

- Turkish Lira TRY

- Trinidad Tobago Dollar TTD

- Taiwan Dollar TWD

- US Dollar USD

- Uruguay Peso UYU

- Vietnamese Dong VND

- East Caribbean Dollar XCD

- French Polynesian Franc XPF

- South African Rand ZAR

- Brazilian Real BRL

- Qatar Riyal QAR

Delivery options, available branches and fees may vary by value and currency. Branch rates will differ from online rates. T&Cs apply .

Why get your holiday cash from Post Office?

- Order online, buy in branch, or choose delivery to your home or local branch

- 100% refund guarantee* if your holiday’s cancelled, at the same exchange rate, excluding bank and delivery charges. Just send your receipts and evidence of cancellation to us within 28 days of purchase. *T&Cs apply

- Order euros or US dollars to collect in branch in as little as 2 hours

Euros and US dollars in 2 hours

Click and collect euros and US dollars in 2 hours. Terms and conditions apply

Today’s online rates

Rate correct as of 24/09/2024

Travel Money Card (TMC) rates may differ. Branch rates may vary. Delivery methods may vary. Terms and conditions apply

Safe and secure holiday spending

Manage your holiday funds on a Travel Money Card with our free travel app. Top it up, freeze it, swap currencies, view your PIN and more.

New-look travel app out now

Our revamped travel app’s out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user experience. Find out what’s changed .

Need some help?

Travel money card lost or stolen.

Please immediately call: 020 7937 0280

Available 24/7

Travel money help and support

Read our travel money FAQs or contact our team about buying currency online or in branch:

Visit our travel money support page

Other related services

Travel smarter with the Post Office travel app. Paired with a Travel Money ...

Kickstarting your festive prep with a short getaway this year? The Post Office ...

Travelling abroad? These tips will help you get sorted with your foreign ...

To avoid currency conversion fees abroad, always choose ‘local currency’ ...

From European hotspots to far-flung destinations, UK travellers are making ...

Hoi An in Vietnam is still the best-value long haul destination for UK ...

If you’re driving in Europe this year, Andorra’s your best bet for the cheapest ...

One of the joys of summer are the many music festivals playing across the ...

Post Office Travel Money unveils the first Islands in the Sun Holiday Barometer ...

Going on holiday is an exciting time for families. To make sure it stays fun, ...

We all look forward to our holidays. Unfortunately, though, more and more ...

Looking to enjoy the sunshine without breaking the bank? New research from Post ...

Prepaid currency cards are a secure way to make purchases on trips abroad. They ...

Long-haul destinations offer the best value for UK holidaymakers this year, ...

Eastern Europe leads the way for the best value city breaks this year. And ...

Our annual survey of European ski resorts compares local prices for adults and ...

Thinking of heading off to Europe for a quick city break, but don’t want to ...

Knowing how much to tip in a café, restaurant, taxi or for another service can ...

JavaScript is currently disabled on this computer/device. As such, cookies for this site are currently disabled. In order to have access to all the features of our fully-optimised website, please enable your JavaScript settings via your browser. For a list of all the cookies we use and what they do, please read our Cookie Policy.

You are in section Home Travel and international Travel money Current Page

Travel money

Look no further than your own bank for your Travel Money with fee free deliveries straight to your door.

- At a glance

Start your holiday before you go. We'll deliver your holiday money to your door so you can focus on the important stuff (finding your sunglasses, planning what you want to buy in duty free...).

- quick and easy to order

- all major currencies available

- travel money delivered direct to your door for no fee.

Travel Money is provided in association with Travelex Currency Services Limited.

To order Travel Money you need to be 18+ and live in the UK.

How much will I be charged to buy travel money through first direct's service?

Order Requirements

- online orders must be paid for using your first direct , HSBC debit or credit card or Marks and Spencer credit card

- you will be advised of any charges payable before you confirm your order. Where applicable, these will also be shown on your order confirmation

- the service is free unless you use a credit card. If you use a credit card, you’ll usually pay a fee, which you can check with your provider before placing your order

When will you get your travel money?

- for orders confirmed before 2pm, Monday to Friday, we will aim to deliver your Travel Money by the next working day

- for any orders confirmed after 2pm, Monday to Friday, on a Saturday or Sunday, or on a Bank/Public Holiday, we will aim to deliver your Travel Money within 2-3 working days

- these delivery times are not guaranteed and deliveries to remote parts of the UK may take longer

- if we accept your order, we'll deliver your Travel Money to you at the address we hold for you. Your order needs to be signed for, so if you are not at home when your order is delivered, Royal Mail should leave a card giving details of where the order can be collected

Working day means Monday to Friday excluding UK Bank or Public Holidays.

Frequently asked questions

Can i order more than one currency at the same time.

Yes, you can add more than one currency to the same order.

How much can I order online from first direct?

You can buy travel money, only for you, worth between £100 - £2,500, by ordering it online at our website.

Can my order be cancelled?

You can’t cancel an order once you’ve placed it. You can refuse to accept delivery. If you do so, we’ll provide a refund using our buy-back rate. This is not the same rate as the purchase rate, so you may lose money on the transaction. Also, if you paid by credit card, the credit card fee will not be refunded.

We can cancel or refuse your order if we believe it isn’t for personal use or think that the order may cause us issues with any laws or regulations.

What exchange rate will I get?

Your rate will be shown on the ordering screen at the time you place your order.

What else do I need to know?

Any complaint can be made to 03 450 511 378 or by secured message in our App and online banking or by writing to us at first direct, 40 Wakefield Road, Leeds, LS98 1FD. If we are unable to resolve it, you can go to the Financial Ombudsman Service at Financial Ombudsman Service, Exchange Tower, London E14 9SR or [email protected] Opens an overlay [Will show a security message first] or by calling 0800 0 234 567.

The laws of England and Wales apply to these terms. We may need you to give us information and documentation relating to your tax liability (both within the UK and overseas, where appropriate). We may share this with tax authorities to establish your tax liability in other countries.

Order your Travel Money Using your first direct debit card

Order online now.

For details on how we will use your personal information, please see our Privacy Notice . first direct Travel money is provided by Travelex Currency Services Limited. Please read their Privacy Notice shown within the order form.

- Buy US Dollars

- Buy Turkish Lira

- Buy Australian Dollars

- Buy Bulgarian Lev

- Buy Canadian Dollars

- Buy Czech Koruna

- Buy New Zealand Dollar

- Buy UAE Dirham

- Buy Norwegian Krone

- Buy Polish Zloty

- Buy South African Rand

- Buy Thai Baht

- View all currencies

- Buy Back Guarantee

- Compare Rates

- Travel Guides

- Travel Money FAQs

- Order & Collection Timetable

- Home Delivery Timetable

- Find Nearest Store

- Multi Currency Card

- What is a Ramsdens Multi Currency Card?

- Top up / Login

- Order Your Card - Online

- Order Your Card - In Branch

- Download on the App Store

- Get it on Google Play

- Multi Currency Card FAQs

- Multi Currency Card Terms & Conditions

- Multi Currency Card Fees & Limits

- Have an old Ramsdens Travel Card?

- Find out more

- Login (Existing Money Transfer Customers)

- Money Transfer FAQs

- Compare Rates Compare Rates

- Find Store Find Store

- Contact Us - 01642 579975

- All Services

0% COMMISSION

CLICK AND COLLECT

& HOME DELIVERY AVAILABLE

OVER 40 CURRENCIES

AVAILABLE ONLINE

GREAT RATES

Your cart is empty.

Continue Shopping

Exchange Rates

Welcome to Ramsdens Currency, where you can exchange over 40 currencies with confidence, ease, and great rates. Our exchange rates page is where you will find our most up-to-date rates, so you can make informed decisions about your currency exchange.

At Ramsdens Currency, we believe that getting your currency before you fly is an essential part of any successful travel experience. This is because exchanging currency at the airport can be expensive and time-consuming, often resulting in poor exchange rates and high fees. With Ramsdens, you can avoid the long lines and steep fees and have the convenience of receiving your money at one of our over 150 branches throughout the UK.

So, why should Ramsdens be the place to exchange your currency? First and foremost, we pride ourselves on providing the most competitive exchange rates. We update our rates regularly to ensure that we always offer our customers the most up-to-date exchange rates, and our exchange rates are often better than our competitors' rates.

Another reason why Ramsdens Currency is a great place to exchange your currency is our exceptional customer service. We believe that providing excellent customer service is crucial to maintaining our customers' trust and loyalty. That's why we have a team of knowledgeable and friendly staff who are always on hand to help you with any queries or concerns you may have.

Convenience is also a key factor in our currency exchange service. With over 160 branches across the UK, you can easily find a Ramsdens branch near you.

Now, let's address some of the most common questions that travellers have about exchanging currency:

When is the best time to exchange currency?

The best time to exchange currency is when the exchange rate is favourable to you. Exchange rates can be influenced by a variety of factors, including economic and political events, so it's important to keep an eye on the exchange rate before you make your currency exchange. We recommend that you keep an eye on our exchange rates page to stay up-to-date with the latest rates.

How much cash should I carry when travelling abroad?

The amount of cash you carry when travelling abroad depends on your destination and your travel plans. We recommend carrying enough cash to cover your immediate expenses, such as transportation, meals, and accommodation, and keeping the rest of your money in a bank account or on a credit or debit card. This way, you can avoid carrying too much cash and reduce the risk of losing money.

Can I use my credit or debit card abroad?

You can use your credit or debit card abroad, but you may incur additional fees, such as foreign transaction fees and currency conversion fees. It's always a good idea to check with your bank or card provider before you travel to find out what fees you may be charged.

Can I exchange currency at the airport?

You can exchange currency at the airport, but the exchange rates and fees can be high. We recommend that you exchange your currency before you travel to ensure that you get great exchange rates and avoid additional fees.

What can I do with leftover currency?

We have a buyback guarantee that allows you to sell back up to 30% (and to a maximum of £750 per currency) of any unused foreign currency you purchased from Ramsdens, at the same exchange rate you originally bought it for.

Ramsdens Currency is a fantastic place to exchange your currency before you travel. With our competitive exchange rates, exceptional customer service, and convenient branch locations, we are confident that you will have a hassle-free and seamless currency exchange experience with us. Visit our exchange rates page today and find out why Ramsdens Currency is the number one choice for travellers across the UK.

TomorrowMoney

eBook Download

- Reading time: 3 minutes

More ways to pay if you’re travelling overseas

- Marlene Scicluna

- Money Lessons

FACTSHEET: Understanding HECS/HELP debt

- Keiena Aspinall-Ivey & First Nations Foundation

- Credit & Debt

FACTSHEET: Understanding interest

- Credit & Debt , Home Ownership

‘Pride and purpose’: The benefits of working in remote Aboriginal arts centres

- Career & Business

Travel money: Choosing the right way to pay overseas

- Reading time: 4 minutes

Log on and switch off: Could dropping social media help your finances?

- Career & Business , Money Lessons

- Reading time: 2 minutes

Could you be in a financially abusive relationship? Here are some signs

- First Nations Foundation

Quick tips to cut your holiday costs

- Uncategorized

- Reading time: 7 minutes

Community kid

- Cassandra Baldini

“We acknowledge the Traditional Custodians of country throughout Australia and their connections to land, sea and community. We pay our respect to their elders past and present and extend that respect to all Aboriginal and Torres Strait Islander peoples today.”

- Name * First Last

- Tell us a little about yourself *