Accelerating the creation of a sustainable future

Voyager invests in early-stage climate technology companies creating the foundation of a decarbonized global economy and a livable future for all.

The Decade of Decarbonization

.jpg)

The global carbon transition is underway.

Many billion-dollar climate technology companies will be founded this decade, creating new markets and swiftly overtaking incumbents across the modern economic system. A generation of climate-motivated founders is leveraging the technological opportunity enabled by years of foundational research and development in materials science and energy alongside breakthroughs in computing, sensing, and biotechnology.

Defined by superior product performance, competitive unit economics, and growing demand from businesses, consumers, and governments worldwide, these new technology companies are reshaping the foundation of the global economy.

This is a market opportunity worth trillions.

Technology for a Resilient Future

Voyager invests in technology companies creating the future of mobility, energy, materials, food, the built environment, analytics, industrial systems, and carbon removal.

Low-carbon chemicals production, starting with battery supply chains.

Microbes to replace synthetic fertilizer and sequester carbon in soils.

Predictive maintenance and optimization analytics for renewable assets.

Ultra-dense, safe, flexible batteries to enable ubiquitous energy storage.

.jpg)

Carbon-negative nickel production.

Carbon traceability software for commodities, manufacturing, and industrial supply chains.

Energy storage equipped appliances.

Portable energy storage for ultra-fast EV charging.

AI to eliminate energy waste in buildings.

The marketplace for local, low-carbon electricity.

Ultra-efficient computing chips.

Carbon-neutral fuels and chemicals.

.png)

Methane reduction throughout agricultural supply chains.

Transforming EVs into mobile power plants.

Carbon capture for trucking fleets.

.png)

Digital twin for cold chain facilities.

.jpg)

Real meat without the slaughter.

Voyager Press

Meet the team.

To Voyager, we bring 28 years of collective experience in climate stabilization. We have founded and built climate technology companies valued at nearly $2B and crafted climate policy at the International Energy Agency and Obama White House Office of Energy and Climate Change. Since 2015, we have individually invested in more than 25 climate technology companies. This is our lives' work.

We are hiring for new roles at Voyager.

To Voyager, Leo brings two decades of climate tech experience across consulting, startups, research, and policy. Leo joined Voyager from Global Founders Capital, where he was the Partner responsible for GFC's global climate and deep tech investing. Prior to GFC, Leo drove sustainable investing and energy transition strategy engagements at McKinsey and led product innovation at advanced desalination startup, Sandymount. Leo earned his PhD in Mechanical Engineering from MIT as an NSF Fellow focused on low-carbon desalination. He began his career as a scientist at two National Labs and researcher at the Department of Energy's office of Energy Efficiency and Renewable Energy.

A graduate of MIT and UNLV, Leo lives in San Francisco with his wife and two children.

Perspectives

Nare brings more than a decade of experience in decarbonization to Voyager. She joined Voyager from the management consulting firm Simon-Kucher, where she led teams developing go-to-market strategies for software and technology companies.

Nare is a graduate of UC Berkeley in Chemistry and earned her PhD in Chemical Physics from Harvard, where she researched metal-based nanomaterials for decarbonization of the chemical production industry. She lives in San Francisco.

We are hiring for new roles on our team.

Urgency and Opportunity

We recognize the stakes in stabilizing the climate and arresting mass extinction within our lifetimes. We are deeply alarmed by biodiversity loss as major natural systems hurtle towards tipping points - from the Amazon to the Arctic. And we recognize the power of markets and technology to swiftly shift our course at a global scale.

We are motivated by urgency and opportunity. Join us.

For Creditors of the Voyager Wind-Down Debtor

This website is intended to keep voyager creditors informed regarding the status of the voyager bankruptcy cases. if you are a creditor, please use the login button in the upper right hand corner to access additional information. if you are having trouble accessing your information, please visit the help center to view our faqs or submit a ticket ., for additional information related to the april 17, 2024 stretto data security incident, please see the key documents page here ., recent updates.

Plan Administrator's Sixth Status Report

Plan administrator's fifth status report, plan administrator's fourth status report, privacy policy, privacy disclosure, help center.

- Skip to main content

Voyager Capital

Dallas, Texas

Voyager Capital and its successor companies, have extensive global trade and investment experience that specializes in vetting investment opportunities in a variety of industries including: medical protective products, oil/gas, entertainment, retail, E-commerce, technology, blockchain, cyber security, real estate and insurance.

Our team targets Texas-based forward-thinking portfolio companies in their early to mid-growth stage and use our extensive network in the region to bring value to our partners.

Voyager Capital has developed a network of logistics professionals, sourcing agents as well as a global network of sales professionals that provide turn-key solutions to strengthen supply chain and distribution strategies across various industries.

Voyager Capital Raises $100 Million in Fifth Fund

SEATTLE , Oct. 8, 2019 /PRNewswire/ -- Voyager Capital, a premier West Coast venture capital firm focused on first-round venture technology investments, today announced that it has raised $100 million to fuel innovation in the underserved Cascadia market, which includes Washington , Oregon , and Western Canada . The fund, Voyager's fifth, will power first-round investments in B2B startups across cloud infrastructure, software as a service (SaaS), and vertical markets such as FinTech, MediaTech, and AgTech. The firm has already closed five new investments.

The new fund has investor representation from the US, Canada , and Europe , including global family offices, foundations, trusts, fund of funds, and individuals interested in participating in the fast-growing Cascadia ecosystem.

" Cascadia is exploding with growth but underserved by venture capital," said Bill McAleer , Founder and Managing Director of Voyager Capital. "Seen as one of the most active early-stage startup locations in the country, this region is leading the major trends in computing, creating significant investment opportunities with exceptional outcomes at sub-unicorn valuations."

Voyager has established a consistent track record of repeatable results for investors and entrepreneurs alike, evidenced by 14 exits over the last four years—three to major cloud providers like Amazon Web Services and Google Cloud Platform. Defined by a strong mix of both financial and operational experience in early-stage tech investing, the Voyager team has over 60 years venture experience, and continues to grow. The firm has committed additional resources to the region with a senior associate in Seattle and a venture partner in Vancouver, British Columbia .

"With fresh capital, an expanded team, and active investments, we're charging ahead with great momentum in Seattle , Portland , and now Western Canada ," said Diane Fraiman , Managing Director at Voyager Capital. "As experienced investors as well as mentors and coaches who live in the communities we invest in, we partner with entrepreneurs to build outstanding companies of lasting value and drive the entire ecosystem."

The Voyager team is committed to developing founder relationships early on in the evaluation cycle and driving scale and value acceleration through active board leadership and go-to-market coaching. By providing focused attention throughout the early stages of company building, Voyager helps startups grow teams, broker strategic partnerships, and acquire new customers to accelerate time to revenue.

About Voyager Capital Since 1997, Voyager Capital has focused on first-round venture investments to help entrepreneurs in the Pacific Northwest and California create winning businesses. Built on the team's extensive experience with startups and its exceptional network across the industry, the firm's entrepreneur-centric approach accelerates the pace at which companies can build, execute, pivot and scale. Voyager has $520M under management investing in B2B software, cloud infrastructure, and applications driven by AI and machine learning. With offices in Seattle, Wash. , Portland, Ore. , and Vancouver, BC , Voyager provides its portfolio the unwavering support and stage-appropriate connections needed to disrupt markets and create sustainable competitive advantage.

US Contact: Jennifer Harris Phone: 206-438-1810 Email: [email protected]

Canadian Contact: Meredith Powell Phone: 604-614-9450 Email: [email protected]

SOURCE Voyager Capital

Company Logos

Downloadable files.

Voyager Worldwide logo

Voyager Planning Station logo

Voyager Fleet Insight logo

ADP- print use

ARCS- digital use

ARCS- print use

AVCS- digital use

AVCS- print use

AeNP - digital use

AeNP - print use

Guide to using Admiralty product logos

Request free trial

Request a callback, privacy overview.

Another rising star exits $47 billion Viking Global to launch their own fund

- Jeff Butler is the latest from $47 billion Viking Global to start his own fund.

- Butler was on Forbes' 30 under 30 list in 2019.

- Other recent launches from Viking include Divya Nettimi and Grant Wonders.

Another young investor has left $47 billion Viking Global with intentions of starting their own fund.

Jeff Butler, a member of Forbes' 2019 30 under 30 list , is in the early stages of starting his own firm, sources told Insider.

The 30-year-old covered several areas for Viking, including fintech and software, industrials, consumer, and energy. His new firm will be a long-short equity manager with a focus on growth stocks in different tech subsectors as well as more cyclical stocks. There are also plans to invest in private companies, according to a source close to Butler, following in the footsteps of his past employer and other concentrated equity investors.

Related stories

According to his LinkedIn, Butler spent two years at Bank of America after graduating from Dartmouth before joining Viking in 2015. He lists his most recent title at the fund as a senior investment analyst, and a source close to Butler said he managed a team with more than $3 billion of gross exposure at the end of his time at Viking.

The source told Insider that Butler led the diligence process on several different private investments, including ones in coal mines, oil rigs, and airline start-ups.

Butler is the latest promising employee to leave billionaire Ole Andreas Halvorsen's fund. Divya Nettimi's new fund Avala Global is expected to start trading later this year with $1 billion in capital. Grant Wonders meanwhile launched Voyager Capital in 2021 with more than $1 billion after a successful run at Viking.

It's unclear how much Butler will raise for his new firm, as industry sources said he is still in the process of meeting with potential backers. Allocators have been keen to pump money into former Viking employees' new ventures thanks to the firm's structure that gives talented young investors more autonomy and control than at peers.

Viking is one of the original Tiger Cubs , the name given to hedge funds founded by former analysts from legendary Julian Robertson's Tiger Management. Halvorsen's fund has been one of the industry's most consistent performers since it launched in 1999, and alums of the firm include D1 Capital's Dan Sundheim, Alua Capital's Tom Purcell, and Anomaly Capital's Ben Jacobs.

Industry publication Hedge Fund Alert first reported the news of Butler's launch plans.

- Main content

- Homepage Analysis

- Web Presence Analysis

- Site Speed Analysis

- Create account

VoyagerCapital.com is a West Coast Digital Media VC

Company logo.

Company Name

Company contact, website screenshot, domain registration.

Website Analysis

- Home Page Analysis

- Web Presence

- Home Page Speed

Domain Whois

Voyager capital.

Voyager Capital is Seattle's leading information technology (IT) venture firm, providing entrepreneurs with the resources, experience, and connections to build successful companies. Voyager invests in early stage enterprise software and services, Internet infrastructure, and wireless companies. Their managing directors bring senior management, business development, and venture capital roles. Voyager's advisory board members and investors provide important contacts for early stage startups, and are among the most successful information technology executives and investors in Seattle, Portland and Silicon Valley.

- Daniel H. Ahn

- Erik Benson

- Curtis Feeny

- Enrique Godreau III

- Bill McAleer

- Randall Lucas

- Bruce Chizen

- Geoff Entress

- Diane Fraiman

- Tom Kippola

- Luis J. Salazar

- Bill Hughlett

- Trent Dawson

- Katherine McDonough

- Tessa Benedicktus

- Patricia J. Nell

- April Saenz

Portfolio Companies

- Russ Mann, Covario, Inc.

- Tom Romary, Yapta

Website Contact

Media contact.

Additional Locations

Additional information.

- News & Events

- Innovate - speakers series

Related Domains

Social media, edit page image.

- jpeg, png, or gif

- one megabyte or smaller

- will be resized to 270 pixels wide

Edit Contact Information

Address City State Country Postal Code Phone Fax Email

Edit Page Type

Page Type Business / Organization Person Place Thing Other

Edit Page Rating

Your Rating

Retrieved from " http://aboutus.com/index.php?title=VoyagerCapital.com&oldid=24914002 "

- Venture Capital

- Silicon Valley

- Pacific Nw Venture Firms

Investing in Growth Partnerships

Your trusted partner in hard asset investments.

Slide title

Performance You Can Count On

Recent deals.

With teams of dedicated professionals based in Minnesota, North Dakota, and Colorado focused on the oil & gas industry, Clifty Group, LLC combines decades of construction experience offering pipeline and facility solutions across the country. Whether installing large or small diameter pipe, providing maintenance & integrity services, or complete fabrication solutions, Clifty is committed to providing the best customer service and quality products for its clients, employees, and the communities where it works.

Arbor Wood Co., LLC is located in northern Minnesota and produces Thermally Modified Wood (TMW) for a variety of outdoor and indoor applications including siding, decking and architectural millwork. Its process starts by using domestically-sourced and sustainably-harvested wood which is then thermally modified using only heat and steam. The result is a high-quality, performance-driven material, which sustains the natural beauty and design element of wood all without the use of harsh chemicals.

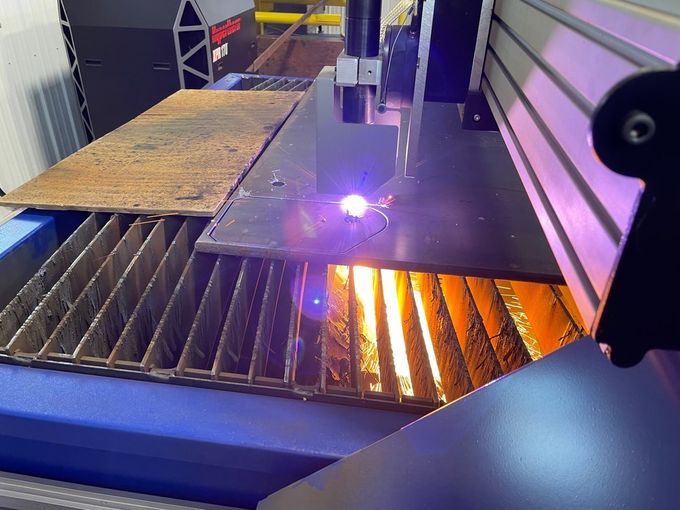

Clear Arc Industries, LLC is a shop-fabrication company based in northern Minnesota where dedicated specialists in metal working provide solutions to clients from design to completion. Clear Arc combines industrial know-how and state-of-the-art plasma cutting technology to manufacture individual parts and fabricated modules in a safety-driven and eco-conscious environment. Services offered include: Plasma cutting; powder- coating and wet paint; press brake, lathe cutting, CNC milling, and pulse welding.

Voyageur is a significant investor in Highland Pellets Holdings, LTD is providing sustainably sourced, premium wood pellets while sustaining the integrity and strength of the nation’s forestry. The Pine Bluff, Arkansas, facility is undergoing a $135 million expansion and upgrade using the best available technology to produce a consistently high-quality pellet at the lowest possible cost with minimal use of fossil fuels.

Grand Rapids Industrial Park

Voyageur Capital is developing the largest warehouse and logistics center in northern Minnesota with 400,000 square feet of storage space and 138 acres.

Our Strategy

Our team of experts identifies opportunities in industries where Voyageur can bring its capabilities to the table.

Our proven deal structures simplify complexities to align partners and and improve returns.

We move quickly to develop, draft, and execute the necessary transactions to make great businesses even better.

Meet the partners who build value for a living.

Dennis Wagner

Dennis Wagner has been Chief Executive Officer of Wagner Construction, Inc. since 1986. Mr.

Wagner is an expert in civil works contracting and timber

industries with over fifty years of experience.

He has successfully grown his family businesses into a legacy in northern Minnesota. Mr. Wagner

served on the board of Granite Falls Energy from 2009 to 2012 and today, serves as an elected official

mayor of the town of Ranier, Minnesota; he also serves on several county boards

Kalan Wagner

Founding Partner

Marty Goulet

Craig mckenzie, investor portal, investment insights, understand assets, document organizaion, performance analytics.

(218) 283-3700

3151 Hwy 53, Suite 1, International Falls, MN, 56649

© All Rights Reserved.

IMAGES

VIDEO

COMMENTS

With a focus on Software, Cloud and Big Data Applications in the Pacific Northwest and Western Canada, we create a relationship with entrepreneurs early in a company's lifecycle. We're entrepreneur centric — so when we invest in your business, we invest in you. Our team is available, responsive and committed to you when and where you need ...

Founded in 1997, Voyager has over $520 million under management in B2B, early-stage venture capital. When you work with Voyager, you get investment beyond the dollar signs. With a focus on Software, Cloud and Big Data Applications in the Pacific Northwest and Western Canada, we create a relationship with you early in your company's lifecycle.

Leo joined Voyager from Global Founders Capital, where he was the Partner responsible for GFC's global climate and deep tech investing. Prior to GFC, Leo drove sustainable investing and energy transition strategy engagements at McKinsey and led product innovation at advanced desalination startup, Sandymount. Leo earned his PhD in Mechanical ...

Voyager Capital is a leading Pacific Northwest venture firm providing entrepreneurs with the resources, experience and connections to build successful technology companies. Voyager leads first ...

For additional information related to the April 17, 2024 Stretto Data Security Incident, please see the Key Documents page here. Track Your Claim and Recovery in Voyager's Bankruptcy Case. Our platform provides real-time updates on your claim's status, initial recovery progress, and essential details about the Voyager bankruptcy proceedings.

Company Description. Founded in 1997, Voyager Capital is a venture capital firm based in Seattle, Washington. The firm seeks to invest in seed-stage, early-stage, and later-stage companies. The firm seeks to invest in business products, business services, information technology, SaaS, big data, TMT, internet of things, robotics, artificial ...

Voyager Pacific Capital. 66 West Flagler Street. Suite 900 #3420. Miami, FL 33130. 954-884-0000. [email protected]. A unique combination of asset classes designed for years of reliable, passive income for you.

Our team comes from start ups - we've lived them. We're passionate about them. And we know what it takes to help you build, pivot and scale a business. We provide clear, consistent communication from the first meeting through the life of our partnership. And with our entrepreneur-centric approach, the Voyager team delivers the high ...

About. Voyager Capital and its successor companies, have extensive global trade and investment experience that specializes in vetting investment opportunities in a variety of industries including: medical protective products, oil/gas, entertainment, retail, E-commerce, technology, blockchain, cyber security, real estate and insurance.

Bill McAleer, GeekWire, Voyager Capital. Despite venture capital slowdown, these investors remain bullish on Seattle. JAN 3, 2023. James Newell. How 6 venture capitalists are thinking about 2023 — and their advice to startups. JUL 14, 2022. Diane Fraiman. Despite a bleaker Portland venture picture, investors not panicking.

That alone was apparently a mortal wound. On July 1, Voyager froze customer funds. Just days later, it filed for bankruptcy protection in New York. Voyager is in a bleak situation. "The Debtors ...

Offering a collaborative approach at exit. Keeping an even keel amidst inevitable growth turbulence. Helping you fill the funding gaps along the way. That's how our portfolio companies describe what it's like to work with Voyager. Our approach centers around you, the entrepreneur. "We weren't a traditional bay area investment.

Voyager brings the passion, network, unwavering support and venture capital to help you break through. ... The result is fast-tracked time to revenue with less capital. MEET OUR TEAM. VOYAGER NEWS. Goats, Chickens and AI, Oh My: What it's Like to Work at Carbon Robotics. FEB 15, 2024.

SEATTLE, Oct. 8, 2019 /PRNewswire/ -- Voyager Capital, a premier West Coast venture capital firm focused on first-round venture technology investm...

Welcome back, Please login to continue. Email Email

Voyager previously raised $100 million for its fifth fund in 2019, following a $50 million fund in 2013.. Founded in 1997, Voyager has backed more than 75 companies in the Pacific Northwest ...

History. In June 2022, Voyager Digital announced that Three Arrows Capital had not repaid loans totaling $666 Million. [1] On July 1, the company suspended "trading, deposits, withdrawals and loyalty rewards" [2] and subsequently on July 5, the company filed for Chapter 11 bankruptcy protection. [3]

Bill McAleer, GeekWire, Voyager Capital. Despite venture capital slowdown, these investors remain bullish on Seattle. JAN 3, 2023. James Newell. How 6 venture capitalists are thinking about 2023 — and their advice to startups. JUL 14, 2022. Diane Fraiman. Despite a bleaker Portland venture picture, investors not panicking.

Voyager Worldwide is a leading provider of maritime technology solutions. Over 1000 shipping companies worldwide use Voyager solutions and services to streamline processes, improve vessel safety and compliance and improve knowledge and understanding. ... Voyager Fleet Insight logo. PNG format. Download. ADP- print use. Download. ARCS- digital ...

Grant Wonders meanwhile launched Voyager Capital in 2021 with more than $1 billion after a successful run at Viking. It's unclear how much Butler will raise for his new firm, as industry sources ...

Voyager Capital is Seattle's leading information technology (IT) venture firm, providing entrepreneurs with the resources, experience, and connections to build successful companies. ... Company Logo . Company Name . Voyager Capital. Company Contact 719 Second Avenue, Suite 1400. Seattle, WA 982104. USA. phone: 206.438.1800. email: Website Analysis.

Your Trusted Partner in Hard Asset Investments. Voyageur Capital Group is a North America-focused private capital firm with an opportunistic approach to investing in manufacturing, construction, real estate, and infrastructure projects. We partner with private business owners and proven management teams who have unique objectives to create value.