Wise Travel Debit Card Review: Fees, Exchange Rates, Limits and How to Use It

There are many things you need to keep track of as a digital nomad, such as visas , travel documents, and accommodation , to name a few.

But one of the most important things to work out is your finances. As a digital nomad, you are likely constantly moving between countries and switching currencies, so having a travel debit card is imperative .

The Wise debit card is an easy financial solution for frequent travelers, digital nomads, and expats . So, what is the fuss about this Wise travel card? How does it work? And most importantly, should you hop on the bandwagon and sign up for it?

I have been using the Wise Travel Card for quite some time now and, in this article, I will give you my honest opinion about it.

What is a Wise Travel Debit Card?

If you travel often, you have probably used or at least heard of Wise (formerly Transfer Wise) .

This UK-based tech company was founded in 2011 by Estonian businessmen Kristo Käärmann and Taavet Hinrikus on the principle of providing fast and fair exchange rates for international transfers without any sneaky fees or below-par exchange rates.

I have been personally using their Wise multi-currency account for years now, and it is still the primary way I transfer money abroad. But, I recently started using the Wise travel card , which added an entirely new dimension to my travels.

Can I Use The Wise Card For Traveling Abroad?

The Wise travel card it's not a credit card and functions pretty much like a regular debit card. You simply add funds to the account and insert, swipe, or tap to pay for items.

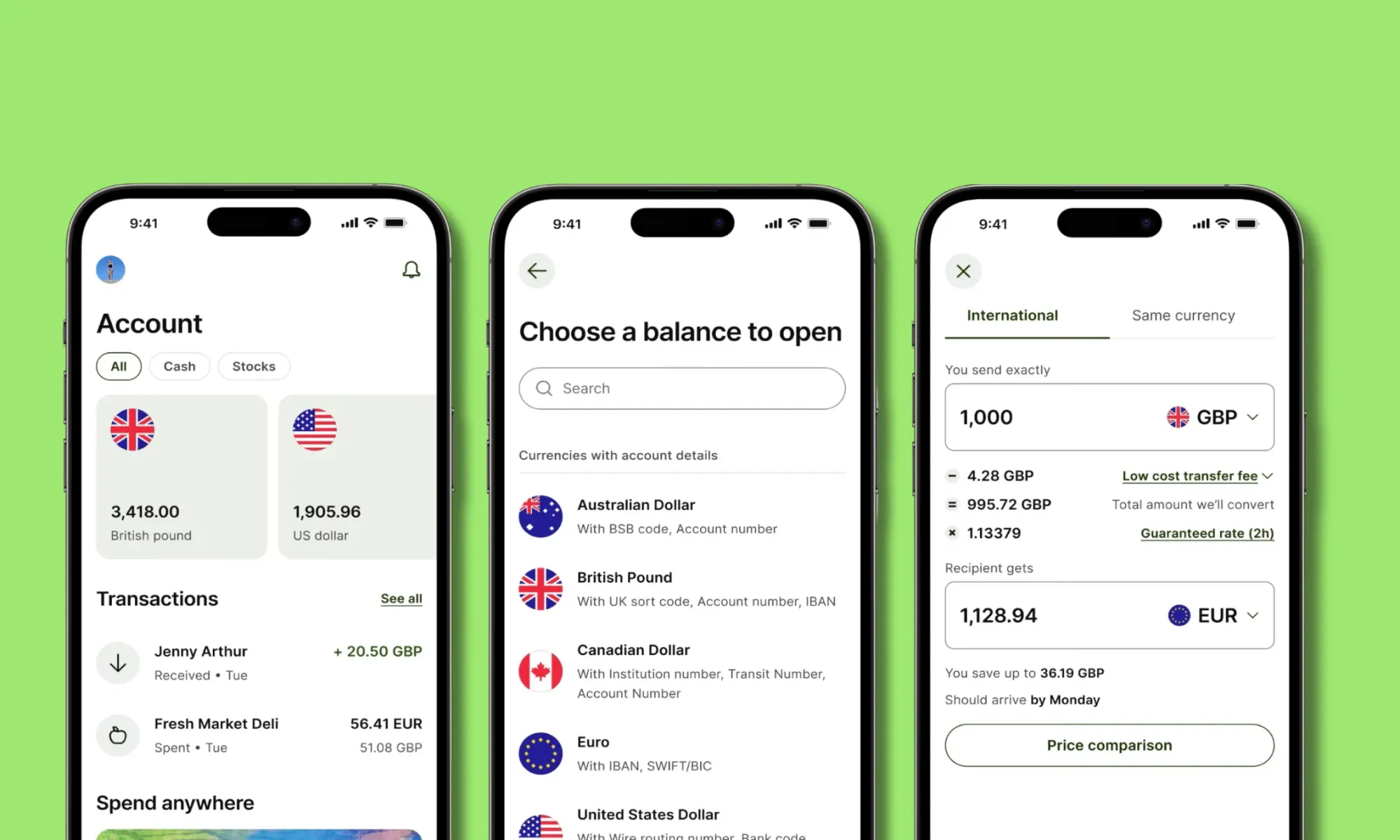

The main difference? With Wise, you can hold money in more than 40 different currencies and pay like a local for items in more than 160 countries worldwide without having to worry about hefty fees or markups on conversion rates.

Your Wise Travel Card is connected directly to your Wise account, so you can spend funds from your balances.

Who is the Wise Travel Card for?

Obviously, this is a “travel” card, so its primary purpose is for spending abroad while traveling . That said, you could totally use this for your day-to-day expenses. Traditional banks aren’t really designed to cater to frequent travelers or digital nomads , and the Wise Travel Card fills this gap.

For example, my wages are paid from the US, but I live abroad permanently, so I can easily transfer from my US-based bank to Wise and then simply use my Wise card for most of my daily expenses.

You should consider using the Wise Travel Card if one or more of the following applies to you:

- You frequently transfer funds from another country that uses a different currency.

- You travel internationally often and need a card with low currency conversion fees.

- You often shop online with international retailers that sell their products in a foreign currency.

- You own a business and need a card for international expenses.

- Your current bank card has high currency conversion fees and you want to get away from a traditional bank account

- Your current bank card has high fees for using international ATMs.

Wise Card Features for Traveling Abroad

If you have used a travel prepaid card like Revolut , Chime , or Monzo in the past, you can expect similar features from the Wise Travel Card. Let's see which ones are those:

- Low fees on conversions with the mid-market exchange rate

- Hold, spend, and exchange more than 40 different currencies in your Wise account

- Available to citizens and residents of more than 30 countries , including the UK, Canada, EU, USA, and Australia

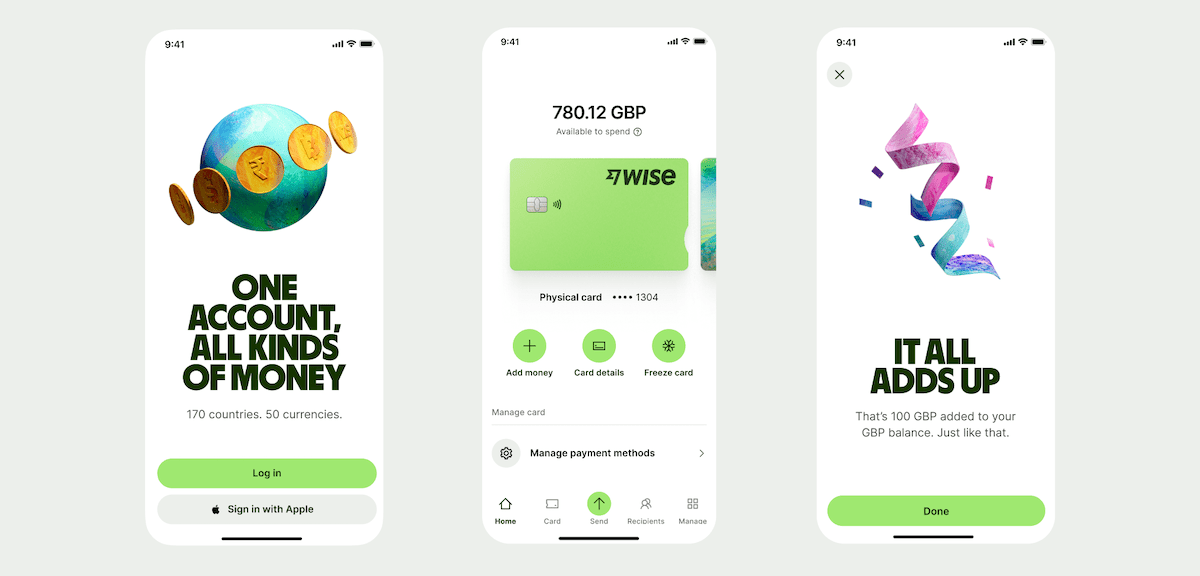

- Manage, top up, freeze, and view your card balance in the Wise App

- Use at over 2 million ATMs with free monthly withdrawals up to certain limits.

- Create up to 3 digital virtual cards for free

- Auto currency convert feature to automatically convert your funds at your set rate

- Ability to make Contactless payments

- Connect to most popular eWallets like Google Pay, Apple Pay, and more

- Free spending of any currency you hold in your Wise account

- Biodegradable and eco-friendly card design

Pros and Cons of the Wise Debit Card for Travel

When I first started my digital nomad journey, I quickly came to a rude awakening when I found that my bank was charging exorbitant markups on foreign exchange and fees for ATM withdrawals .

If the same is happening to you, you’ll want to get your hands on this gem of a travel card . But before you sign up, let’s go over some of the upsides and downsides of the Wise Travel Card.

Pros and cons:

What to love about the wise debit card.

For me, the Wise card's standout features are the app's user-friendliness , the multi-currency account , and the low markup on exchange rates .

Being able to hold more than 40 currencies is a game changer. Transferring funds to different currencies in their app when I travel abroad is super easy. To give you an example, I spend quite a bit of time in Europe, the USA, and New Zealand. And with Wise , I can have separate accounts for USD, EUR, and NZD, which makes my life SO much more manageable when traveling to these countries!

On top of that, while there is a small markup fee on currency exchange, it is extremely minimal compared to other banks I have used .

What Could Be Improved About the Wise Debit Card?

The obvious downsides of the Wise Travel Card lie with ATM withdrawal limits , longer card delivery timeframes , and the lack of a premium option .

I am based in the USA, and my card took more than 2 weeks to arrive. Most digital nomads don’t spend too much time in each place, so this can make it difficult to receive your card initially if you are a frequent traveler .

Also, while card transactions are becoming the norm in many countries, cash is still king in several countries I have traveled to in the past few years. The Wise card is NOT exactly the ideal card for withdrawing cash . You’ll only get two transactions for free , and then you’ll be paying a usage fee as well as a 1.75% to 2% markup . This definitely isn’t a dealbreaker, but I hope Wise will improve this in the future.

What Currencies Can You Use With the Wise Travel Card?

One of the main reasons Wise has kept me on board as a customer all these years is their multi-currency account . This is truly the crown jewel of all of Wise’s features.

You can store 40+ currencies in various wallets in your Wise account , but this doesn’t mean you are limited to spending in those currencies. In fact, you can use the Wise debit card in more than 160+ countries ! If the currency you are spending in doesn’t have a wallet option, the Wise card will simply exchange the money into the payment currency at the time of your purchase .

For example, I was recently in Guatemala, and, unfortunately, I was not able to store Quetzal (the local currency) in my multi-currency account. But when I bought something, my funds were automatically converted from USD to Quetzal at the mid-market rate (plus 0.5%).

There are also 11 currencies for which you get account details to make bank transfers . This means you can transfer funds in the following currency balances directly from your Wise account to another bank account.

This is a feature of Wise that I use often. If I need to transfer funds from my US bank account to one in another country, I almost always use Wise as a “middleman” in order to avoid unexpected transfer fees .

While you won’t be able to make bank transfers in other currencies, you can hold them in your Wise account and spend with your travel card.

How Does the Wise Card Exactly Work?

As you can see, the Wise Travel Card is a wise decision for any traveler (see what I did there?), but how does it exactly work?

As with any new bank account or credit card, there is a bit of a learning curve when first using your Wise travel card . That said, using this card isn’t rocket science, so you’ll be saving money on exchange fees in no time!

How to Use the Wise Travel Card Abroad

The Wise travel card is specifically designed for spending money outside of your home country, so as you would expect, it is pretty easy to use abroad.

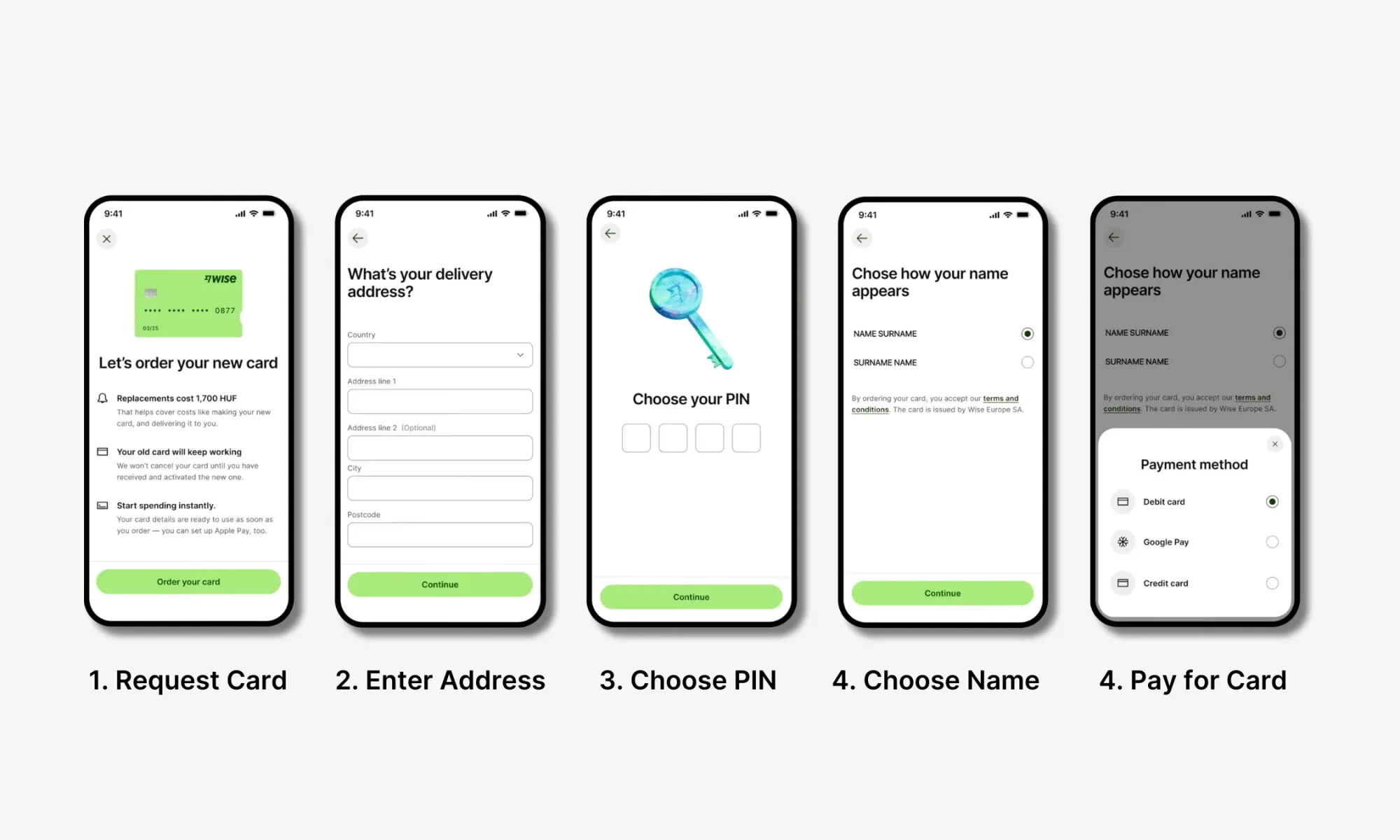

All you need to do is order your card , activate it, create a PIN, add money to your account, and you will be all set to use the card in a different country!

The Wise App

There is nothing more annoying than an app that is built for developers and not for the general public. Your banking and financial app should be easy to navigate and access.

I personally find the Wise app to be extremely user-friendly and intuitive . All features are easy to find, and when navigating through the app, I rarely got stuck or failed to find a setting.

I was easily able to change personal settings, connect bank accounts, exchange money, and send transfers from the app.

How to Order Your Wise Travel Card

Ordering your Wise Travel Card can take some time (mine took more than 2 weeks to arrive), so I recommend getting on this as soon as possible to ensure you have the card for your next trip!

These are the 3 simple steps you will need to go through:

Step 1: Create a Multi-Currency Account

If you don’t have one already, your first step will be to sign up for a Multi-Currency Account with Wise

Step 2: Start Using Your Virtual Card Immediately

After making an account and verifying your details, you will then be directed to choose a digital/virtual card or a physical card . Digital cards are free and can be added to Google/Apple Pay or used for online payments immediately!

Step 3: Order a Wise Debit Card (Recommended)

If you want instead a physical card, you can do so by clicking on the “Card” tab on the main page and then click on “ Order a Debit Card ”. Physical cards cost a one-off fee of 7 GBP/7 EUR/10 USD , and it will take 7 to 21 business days for the card to arrive, based on your location.

If you'd like to visualise the entire process, watch the instructional video below:

How to Activate Your Wise Card

Once your Wise travel card arrives, it is time to activate it and start spending ! Luckily, for most Wise account holders, you won’t need to take any steps to activate the card, simply make a chip and PIN payment, and the card is ready to go !

Activate Your Wise Card (for US and Japan Customers Only)

As I mentioned above, Wise customers in the USA or Japan must activate the card separately . This isn’t too much of a headache, just don’t forget you need to be in your home country .

Here is a step-by-step breakdown of activating your card if you are a US and Japan customer.

- Log into the Wise app and tap on “ Card ”.

- Then tap on “ Activate Card ”.

- You’ll then be prompted to enter a 6-digit code that you’ll find on your card.

- After entering the code, you’ll create your PIN .

If you'd like to visualise the steps to activate your Wise card for your region, watch the instructional video below:

How to Change the PIN for Your Wise Card

Did you forget your PIN? Don’t worry, it happens to the best of us!

Luckily, if you are a US card holder, you can easily change your PIN in the Wise app :

- Tap on “ Card ” in the Wise app

- Select “ Change PIN ”

- Enter your new PIN 2 times, and you are all set!

If you are a non-US Wise card holder , you cannot change your PIN in the app , unfortunately. Instead, you’ll need to change it using an ATM that supports PIN changes .

My best advice? Choose a PIN you’ll never forget, or keep it written down somewhere secure.

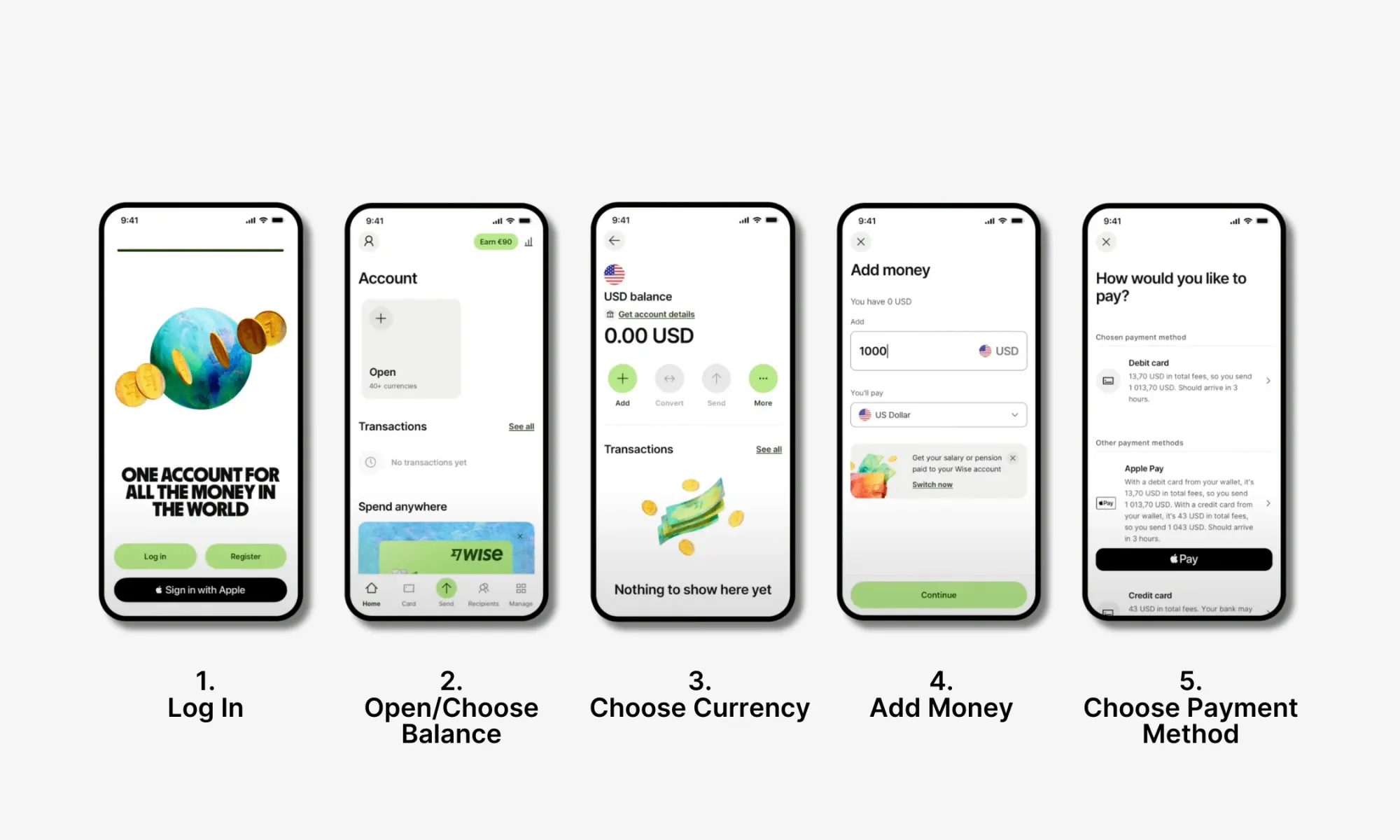

How to Add Money to Your Wise Travel Card

Your Wise travel card is linked to your Wise Multi-Currency account , so you’ll need to top up your Wise account with funds before using the card.

This is a pretty straightforward process:

- Logging into your account

- Choose which currency balance you want to add money to.

- Click “ Add ”.

- Choose which currency you want to use to top up the account.

- Type in the amount of money you want to add.

- Choose your payment method (bank transfer, debit card)

- Confirm the top-up and verify the money arrives in your balance.

Watch the instructional video below to visualise how to top up your Wise balance:

How to Freeze/Unfreeze Your Wise Card

One of the downsides of constant travel is that you put yourself at risk of fraud or losing your card. If you notice potential fraudulent transactions from your Wise card, or you believe your card is lost/stolen, you should freeze your card immediately . This way, you’ll avoid more fraud on your account.

Here are the steps to take to freeze your Wise Travel Card.

- After logging in to your Wise account, tap on “ Card .”

- Then simply click “ Freeze Card ”, or if you want to unfreeze, “ Unfreeze Card .”

- Fill out this transaction dispute form and contact customer support right away. They will be able to help you determine what to do next.

How to Replace a Lost or Stolen Wise Card

If you can confirm that your card has been lost or stolen, you’ll want to cancel the card and then order a new one.

- Log in to your Wise account and click on “ Card .”

- Tap “ Replace Card .”

- You’ll then be prompted to answer why you need a replacement card.

- Wait for the new card to arrive.

How to Use an ATM with Your Wise Travel Card

As mentioned above, ATM withdrawal is not the strongest feature with the Wise card, but you can definitely still use the card to take out cash. Spending with your Wise card is simple since the card can make contactless, chip, and swipe payments and is eligible for Google, Apple, Fitbit, and Garmin Pay. But how do you use an ATM with the Wise card?

Using an ATM with the Wise Travel Card is the same as using any other bank card. Simply insert your card into the machine, enter your PIN, determine how much cash you want to withdraw, and take your cash. Don’t forget to take your card back when you are done (I have made this mistake too many times…).

Wise Card ATM Limits

One of the biggest downsides with the Wise card is that you’ll have limited free ATM withdrawals. For all accounts, you’ll have 2 free ATM withdrawals each month, after which you will be charged an ATM usage fee and a percentage markup on the amount of cash you withdraw.

I use the Wise Travel Card for many of my day-to-day travel expenses, but I use my Charles Schwab Investor Checking account for ATMs. This card not only has a 0% ATM markup, but it also refunds any fees the ATM provider charges. This includes international withdrawals!

Wise Card Delivery Timeframe

Once you order your Wise Travel Card, you can expect it to take between 3 and 21 days to arrive, depending on your location. If you live in Singapore, you’ll get your card SUPER fast. Unfortunately for Americans like me, this isn’t the case.

Wise Travel Card Fees and Exchange Rates

One thing I really love is that using Wise itself is free, and you won’t have to pay an ongoing fee to Wise to use the card. In fact, there isn’t even a Premium account feature, so all users get 100% of the features for free. All this said, there are some charges and exchange rates you should know about before you start using the Wise Travel Card.

Comparison: How Does the Wise Card Holds Up Against Other Travel Cards?

Wise is a leader in the travel account realm, but it still has some major competitors. While all of these different companies vary, they all cater to digital nomads and frequent travelers. The table below will compare some key factors with Wise, Revolut, N26, and Chime.

You may also be interested in:

So, What Travel Card is the Best?

This is a close call and pretty dependent on where you are located. For example, N26 and Chime are awesome choices if you live in the EU or USA (respectively). But, with these options, you can’t hold different currencies like with Revolut and Wise.

For most digital nomads, Wise or Revolut will be the best option. You can hold a huge number of currencies, and they are available to many different nationalities. I have personally used both Wise and Revolut and can say they are both excellent options.

Spending Limits for the Wise Travel Card

The Wise Travel Card has set daily and monthly spending limits for all types of transactions. While these limits won’t be a deal breaker for the vast majority of users, they are still worth noting.

Keep in mind the above limits are for US Wise customers. The amounts will differ slightly for customers based in different regions.

Is It Safe to Use the Wise Travel Card?

Wise is a trusted and safe travel card provider, so you can rest assured that your funds will be protected when using the Wise Travel Card. A licensed and regulated financial institution, your funds are safeguarded in Wise. It is, however, worth noting that since Wise is not considered a bank, it is not FDIC insured. FDIC insures up to $250,000 of bank customer's money, but Wise works a bit differently. Wise safeguards users’ money and is required to ensure all customers have access to all of their funds.

So, is Wise safe to use? Yes, absolutely! We don’t recommend keeping all of your money in Wise, but in general, it is a perfectly secure financial institution.

Additionally, the company uses several security features to protect your data, including HTTPS encryption, a two-step login process, and 24/7 fraud prevention.

What to Do If Your Wise Card Is Lost, Stolen, or Compromised

If you lose your Wise card or suspect it to be stolen or compromised, you’ll need to act quickly to prevent any further fraud. Below, we will go over a step-by-step process for what to do if your card is lost, stolen, or compromised.

- Freeze your card in the Wise app.

- Contact Wise support if you suspect the card to be compromised.

- Cancel the card in the app if you confirm the card is lost or stolen or if fraud charges have been made.

- Order a new card.

- Wait for the new Wise card to arrive.

Bottom Line: Is the Wise Travel Card Worth it?

Time for the 1 million dollar question: Should you get the Wise Travel Card?

If you are a frequent traveler like me and you don’t already have a solid travel card with fair exchange rates, low ATM fees the answer is a resounding yes !

The Wise Travel Card is one of the best cards for digital nomads and expats, as it allows you to seamlessly spend money, withdraw cash, and transfer funds from anywhere around the globe without having to worry about excessive fees. The best part? After paying a one-time card order fee, your Wise account is completely free to use!

Ready To Save Money Abroad with Wise?

If you want more digital nomad guides like these, sign up for our free newsletter and get upcoming articles straight to your inbox!

Sign up for our Newsletter

Receive nomad stories, tips, news, and resources every week!

100% free. No spam. Unsubscribe anytime.

You can also follow us on Instagram and join our Facebook Group if you want to get in touch with other members of our growing digital nomad community!

We'll see you there, Freaking Nomads!

Disclosure: Hey, just a heads up that some of the links in this article are affiliate links. This means that, if you buy through our links, we may earn a small commission that helps us create helpful content for the community. We only recommend products if we think they will add value, so thanks for supporting us!

Heymondo Review: Is It a Good Travel Insurance?

How to set up and manage an esim on iphone, digital nomad internet: best wifi options for remote work anywhere.

International Money Made Simple

Top 7 Wise Alternatives

About Author: Hi, I’m Quinn Askeland. In 2014, I started Transumo after experiencing expensive, slow, and frustrating international money transfers and payments through banks. Once I discovered how to manage my own international currencies much better, I became driven to help others improve their transfers and payments. Fortunately, today, there are many excellent options. See My Full Bio .

I use Wise (formerly TransferWise) several times a week mostly for personal transfers, business and overseas travel.

But I don’t use them for everything. And perhaps you had a bad experience , want to send money instantly , need different payout methods (like cash) or send larger amounts . For large transfers, I think OFX or TorFX or Currencies Direct are better because they are have phone based customer support. For smaller transfers, cash transfers and even prepaid cards and multi currency accounts there are other great alternatives. Finally, I also want to let you know about Revolut which is Wise’s biggest competitor.

Let’s get stuck into it!

Disclosure: This post may contain offers and affiliate links to save you money and it also helps us to keep providing the best information. For more information, see our disclosures here .

Where Alternatives Can be Better

Instant Transfers Cash Transfers Even Lower Costs Larger Transfers (above $7000 USD) Personalised Service

When is Wise Work (And When it Doesn’t)

Wise has a great reputation on Trustpilot, with a 4.2/5 rating from more than 196K reviews. Most of the reviews are 5-star reviews (83%), while only a few are 1-star reviews (7%). People love Wise for its simple and speedy transfers.

Wise is a great way to transfer and even manage your international money especially if you want to send anything below $7000 USD ($7000 USD = Approx £4000 GBP, €6000 EUR, $10000 AUD, $10000 CAD, $10000 SGD, ¥800,000 JPY, ₹500,000 INR).

1.1 When Wise Works

Sending amounts below $7000 usd for individuals.

Generally, we highly recommend Wise for amounts below $7000 USD. Their focus on fast, inexpensive transfers as well as transparency and excellent online experience makes them hard to beat in many situations.

But don’t take our word for it.

For the best comparison we recommend starting with their fee calculator (opens new tab) and see for yourself what they charge. Perhaps write it down so you can compare with others we will discuss in a moment.

We have found, in terms of fees, they’re always low and transparent.

Fees depend on the amount, currency, and payment method.

Other fees include a low flat fee + a percentage fee based on the amount and currency (For example, the flat fee is about $0.90 USD for amounts below $7000 USD and the percentage fee ranges between 0.35%-1.5%).

What we also like is that there are no hidden fees because they have local bank accounts in all the areas they operate in.

For expats, travelers and people who earn overseas income.

If you live, work, or travel overseas frequently and send money home regularly to support your family, Wise goes way beyond simple money transfers.

You get a multi currency account to spend, send and receive your money. And you can hold money in over 40 currencies.

There is also a highly useful optional prepaid debit card to spend in over 40 currencies in over 150 countries.

Wise’s multi currency account (review) and associated Wise travel card (review) are especially useful to expats who need banking features in a new country to pay rent, buy groceries, or receive money like a local (Wise offers international bank details in 10 currencies). If you want to compare Wise with another service that enable you to get paid and pay others check out Wise Vs. Payoneer .

These features are great for international people who need the freedom to manage multiple currencies from one account.

1.2 When it doesn’t

If you’re sending more than $7000 usd.

As we uncover in our Wise review, there are things you should know about Wise for larger amounts, where things can get kind of messy.

In a nutshell, because of anti-money laundering (wiki) and anti-terrorism laws (wiki) , Wise (like any other financial service company) has to comply with a lot more regulations.

So while Wise makes it relatively easy to sign up for smaller amounts, and they have a wonderful online focused experience these positives can quickly turn into negatives.

This is because, you may need to provide more information or identity to make a transfer.

Unfortunately, this can end up in frozen accounts or transfer delays. And this can be an issue if you need money transferred urgently.

But there is something else:

Having the ability to easily call someone (ideally 24/7), can go a long way in resolving issues like transfer limits your bank may place (due to the same regulations). This can save time and a whole lot of stress.

For cash transfers

Currently, Wise only supports bank-to-bank or card-to-bank transfers. So if your recipient needs a payout in cash, Wise is not for you.

See Wise alternatives (below) for cash transfers below.

For instant transfers

If you’re looking to send money instantly (in a matter of minutes or at least hours), Wise may not be your best option.

Because Wise is focused on transfers that often involve banks at either end (which does help reduce fees) they may not always be the fastest.

In fact the whole process can take up to 5 days.

If instant transfers are your priority, we have a couple of great suggestions for you.

You need a wider selection of receiving countries

Although Wise supports money transfers to 60+ countries , your currency might still not be included.

Moreover, of the many currencies supported by Wise, some can only be transferred locally.

So if your supported receiving currency is not available on Wise, it’s worth looking at other services that have a wider receiving base internationally.

You need phone support

While Wise’s customer service is generally awesome, they’re an online-only platform.

So if you need more support (like speaking to a human on the phone) for setting up your transfer (especially large transfers over $7000 USD or £4500 GBP), or simply dealing with a frozen account. Wise is not the right service for you.

And since Wise is set up as a low-cost service, their customer service (though very responsive) can’t help with setting up transfers or tailoring services for you.

Here’s a recent reviewer who wasn’t too happy with Wise’s lack of in-person customer support:

If your transfers don’t matter to you then use “Wise” because they really don’t matter to them. They have no customer service when it goes wrong… Ross J

Ross is Not Alone: I have been reviewing and using Wise for years, but just in the last year, I believe something has changed and their customer service has become less awesome. For example, I have personally had a few issues now and the responses I get are sometimes very generic. Also others in my team have had issues. I think this is likely just growing pains and compliance but our experiences are not isolated. Over the years, Trustpilot has also seen them go from 4.7/5 in 2021 to 4.2/5 in 2024. To be fair, many other services have also lost their rankings over this same time frame so more difficult compliance may be to blame or perhaps Trustpilot changed its scoring system – or both. That said, I still think they are #1 for small transfers and light years ahead of banks but in some situations I also believe some alternatives may be better.

Note: The reality of using Wise for most people is very positive and our full Wise.com review looks at the positives and negatives in more detail. Spoiler Alert: They are pretty great, but it is insightful to see where the negative reviews come from and has helped us to find alternatives that may be better in some situations.

Quick Look — 7 Alternatives to Wise For Large and Small Amounts

Which Wise alternative is right for you?

Before we dive in deeper, here’s a quick snapshot so you can get the most out of your time here and make the right decision for your needs.

1. Revolut – Wise’s Closest Competitor

About: When it comes to multi-currency accounts and prepaid debit cards, Revolut (review) is considered to be Wise’s biggest rival.

Revolut offers personal and business plans to citizens and residents of the UK, US, European Economic Area (EEA), Singapore, Australia, Japan and Switzerland.

Double check if you can get a Revolut account here.

It supports deposits in more than 30 currencies and withdrawals in over 120 currencies and countries.

Best features:

- Free transfers within the EU and to other Revolut users

- Budgeting and analytical tools

- Cashback incentives

- Optional upgrades like airport lounges and spending rewards

Fees: Revolut has a transfer fee structure based on recipient country (Usually 0.3% – 0.75%) plus a small fixed fee. While Wise does not have a mark up on the exchange rate it does have a fee (0.66% on average) which is based on the currencies you are exchanging.

Transfers to other Revolut users, local payments without any exchange and payments within the Single European Payments (SEPA) area are free.

You can withdraw up to 5 ATM withdrawals or £200 (per rolling month) without any charges, after that a 2% fee applies. Please note that the maximum amount you can withdraw in cash per day is £3,000 or it’s equivalent in other currencies.

The debit card fee is £4.99 for the free plan and zero for premium plans (Plus, Premium and Metal).

When you use Revolut to exchange currencies on weekends, there will be a 1% markup applied to all currencies. However, during the weekdays when the market is open, Revolut matches the mid-market rate with no additional fees added.

Wise, on the other hand, offers you a rate without any markup.

Support: Email, live chat and automated phone service for blocking cards.

Verdict: How does Revolut compare with Wise?

If you travel primarily within Europe, Revolut is the best choice for you because they offer free transfers within the SEPA.

If you’re deciding between Wise and Revolut, it’s worth noting that although Revolut may not operate in as many countries as Wise, they have some innovative features that make them stand out.

Revolut provides various budgeting and analytical tools on their app that Wise does not have.

Unlike Wise, Revolut also allows you to link your bank account to their app, so you can keep track of all your finances in one place.

Use Revolut if…

You frequently travel within Europe. OR You’re looking for a single app to manage your finances (UK/Europe) OR Revolut has a few additional features you might like.

2. Remitly – Small amounts home, fast

About: Remitly (review) supports transfers from 16 developed countries (including the US, Canada, the UK, etc.) to 50+ developing countries.

Make sure your countries are covered here – for both countries!

They’re an international money transfer company with a unique mission: Helping expat workers send money home fast and at affordable rates.

Their focus is on personal transfers of small amounts.

- Express services (transfers can be completed in hours for an additional fee)

- Multiple ways for money to be received (direct deposit, cash pick-up, mobile wallet transfer, cash home delivery)

Currently Remitly is running a limited time new customer offer. Check out the Remitly offer.

Fees: Remitly’s fees depend on the amount, currency, and chosen service. They charge a flat fee and a margin on the exchange rate.

For some currency pairs (for example USD to INR), Remitly even waives the flat fees if you send more than $1000 USD.

Their Express service lets you send money in a matter of minutes or hours (depending on the recipient country), while their Economy service is an affordable option to send money home when you’re not in a hurry.

Other fees to watch out for include credit card fees for their Express service (3%) and fees charged by an intermediary or receiving bank.

Support: Online chat or troubleshooting on the phone (in English and Spanish)

Verdict: How does Remitly compare with Wise?

In terms of fees and exchange rate, Remitly is comparable to Wise (although we have found Wise to be slightly cheaper generally). However, Wise has a more transparent fee structure where you will see exactly the amount the receiver will get before you hit “send”.

With Remitly, there may be certain instances where you might get a surprise fee if you’re funding the transfer through a bank account (banks on either side might charge their own fee).

Use Remitly if…

You live and work in one of the 16 supported countries AND You need an option to send money instantly if required (and can fund the transfer with a credit card) OR You want cash pickup for the receiver

3. WorldRemit — Small amounts in cash

About: WorldRemit (review) supports both personal and business transfers.

They offer transfers to over 130+ countries worldwide in cash, bank transfer, or top-up mobile wallets.

Best Features:

- Multiple ways for money to be received (bank transfer, cash pick-up, mobile wallet transfer)

- Supports transfer to a wide range of countries (130+)

- Fast — most transfers are completed within minutes

Fees: WorldRemit’s fees are determined based on a number of factors, including transfer amount, currency pair, and payout method.

But they do have a nice bonus offer:

When you sign up you will get your first four transfers fee free (using the code ‘ 3FREE ‘*). * Offer available in US, UK, Australia, Belgium, Netherlands, South Africa, Sweden, New Zealand, and Norway only.

WorldRemit has introduced a flat fee for payout methods and a tiered exchange rate system (3 tiers).

With the flat fee for payouts, your fees remain fixed for each method (cash, bank transfer, or mobile wallet transfer), no matter how much you send.

For example, whether you send £100 GBP or £1000 GBP in cash from the UK to the Philippines, you will pay the same £2.49 GBP fee.

Next, the tiered exchange rate makes sure you get a better exchange rate if you send more money.

Other fees to watch out for include credit card fees and commissions charged by local partners.

Support: They’re easiest to reach by chat or email. While they have country-specific phone support, it’s hard to get a hold of their customer service team on the phone.

Verdict: How does WorldRemit compare with Wise?

WorldRemit beats Wise in terms of the number of countries it supports, speed of transaction, and payout methods. Although WorldRemit’s rates are better than going through the bank, Wise still comes out on top as the cheaper option.

Use WorldRemit if…

– You have family, employees, contractors, and suppliers in many countries and need a transfer provider with a wide base of receiving countries – You want the receiver to be to receive the money in cash – You need to transfer money quickly (minutes for most transactions)

4. CurrencyFair — Lowest cost

About: CurrencyFair (review) is one of the most affordable options for sending money to bank accounts internationally (in many cases, cheaper than Wise!).

But that is not the best bit:

You can also get your first 10 transfers fee free here (opens a new tab) .

Sometimes, currency matching can take a while. So if you don’t want to wait, CurrencyFair also has the option to step in and complete the transfer.

They support 38 currencies for sending and receiving money (21 for sending; 17 for receiving).

- One of the lowest exchange rates

- Choose to exchange at the prevailing rate or on their P2P marketplace (The CurrencyFair Exchange) — set your own rate and wait for another user who wants to buy your currency at your proposed rate.

Fees: CurrencyFair transfers range from 0.4%-0.6% of the amount + a fixed €3 EUR transfer fee (or equivalent) + a margin on the exchange rate.

They’re extremely affordable compared to banks and sometimes even Wise (whose fees ranged between 0.35%-1.65%).

Another cost you should be aware of is the receiving bank charges in countries where CurrencyFair doesn’t have a local bank account (they don’t have local bank accounts in Canada and New Zealand yet, so receiving CAD and NZD can be relatively expensive for smaller amounts as the receiving banks charge a fee usually $15 – $30).

Support: Email and chat

Verdict: How does CurrencyFair compare with Wise?

CurrencyFair is one of the services that consistently beats Wise in terms of exchange rates.

But here’s the big catch — there is the risk of additional “surprise” bank fees if they don’t have local bank accounts in the country where you sending money.

Other than that, this is definitely a service that’s worth trying if looking for the best rate is top of your priorities.

Use CurrencyFair if…

– You’re looking for the lowest rates for bank-to-bank international transfers – You want to send small amounts – You’re fine not having phone support

5. OFX – Amounts over $7000 USD

About: OFX (review) offers bank-to-bank transfers in 50+ currencies to over 190 countries.

OFX always out as a top pick of ours when it comes to international money transfer comparison over $7000 USD ($7000 USD = Approx £4000 GBP, €6000 EUR, $9500 AUD, $9500 CAD, $10000 SGD, ¥800,000 JPY, ₹500,000 INR).

And to make it even more affordable, OFX may charge a fixed fee of $15, however if you click here you can avoid this fee for ever!

They also offer 24×7 phone support for troubleshooting and to help you set up your transfers.

In fact, they try to get all the necessary ID checks and regulatory checks out of the way when you sign up to avoid bottlenecks during transfers (including larger ones).

OFX also has an intuitive online platform and app, which makes it easy to keep an eye on rates, setup transfers, and track transfers.

Helpful 24/7 phone support Intuitive online platform Lock rates for up to 12 months

Fees: OFX has been built from the ground up to make large transfers affordable.

In some countries, for amounts below $10,000 OFX charges a flat fee of $15 on the exchange rate.

Bonus: OFX may charge a fixed fee of $15, however if you click here you can avoid these fees all together.

But above that amount, the flat fee is waived and the margin reduces as the amount increases.

Sometimes the receiving bank may deduct a fee from your recipient. But you can speak to OFX’s customer support to understand how you can best manage or avoid this extra cost.

Support: 24×7 phone support and email

Verdict: How does OFX compare with Wise?

OFX is a better option than Wise when you want to send over $7000 USD because of the better rates and helpful phone support.

While “helpful phone support” may not sound like a big deal it is! All services like OFX, Wise and the banks you use have limitations once you start sending above about $7,000. This means each bank has its own limitations and rules on the amounts it will transfer (usually within certain timeframes). Transferring large amounts (over $7000) can mean that issues can occur during a transfer, which without great phone support can become a much bigger problem. With helpful phone support, these issues can be resolved very easily.

Of the recommended “above $7000 USD” transfer services on this list, OFX has one of the best rates. And yet, does not compromise on phone support — so you can always speak to an actual human to check on your transfers.

It also has an intuitive online platform that’s simple to use and navigate which makes initiating your transaction easy.

Their set up process is also streamlined where they get you to verify all your documents from the start to minimize any hiccups along the way.

Use OFX if …

– You want to get the best rates for larger-amount transfers ($7000 USD) – You live in the US, Canada, the UK, Europe, Singapore, Hong Kong, Australia, or New Zealand (where they have local customer service 24/7) – You need a lot of flexibility for your large transfers (OFX allows you to lock rates for up to 12 months) – You want the option of phone support to stay on top of your transfer

6. Currencies Direct — Personalized Service

About: Currencies Direct is known for low-cost large transfers (above $7000 USD) since they typically don’t charge transfer fees.

They support both individuals and businesses and help you set up your transfer over the phone. They also offer tailored solutions based on your specific transfer needs.

You can send up to £25,000 GBP with Currencies Direct.

Start by getting the Currencies Direct exchange rate from desktop or mobile here .

- No transfer fees

- Easily transfer larger amounts of money

- More personalized support through phone and email

- Caters to both personal and business transfers

Fees: In most cases, Currencies Direct only charges a margin on the exchange rate and no fees. If a fee is applicable, they let you know upfront.

However, intermediary banks or receiving banks may charge fees.

Support: phone and email

Verdict: How does Currencies Direct compare with Wise?

From the outset, you can clearly see that Currencies Direct is targeting a different market from Wise.

Currencies Direct is a lot more geared towards businesses or high-amount personal transfers while Wise focuses on smaller-amount personal transfers.

Because of this, their service is more personal. Unlike Wise, you can’t get an instant calculation of how much it would cost to transfer your money. You have to input your details on their website and someone will personally contact you.

This might seem inconvenient. But if you’re dealing with larger amounts, it’s much better to speak to a proper representative that can actually guide you through the process.

They also don’t support as many currencies as Wise (40 in total). So this may be a drawback for some.

Use Currencies Direct if …

– You want to send large bank transfers – You live in the UK, Canada (not Quebec), US, Spain, Portugal, South Africa, or India where they have physical offices (For transferring large amounts, we recommend going with a provided who has a physical presence in your country) – You want access to currency products like spot contracts or forward contracts – You appreciate high-touch support from your international money transfer provider

7. TorFX — Recommended for personal account manager

About: TorFX is actually owned by the same group as Currencies Direct. As a result, its customer is also one of the best in the money transfer market.

This makes them one of the most reliable (and frankly reassuring) services for sending large amounts (above $7000 USD) worldwide.

In fact, they’re happy to get on the phone with you to help you through the signup process and when you need to set up a transfer.

Start in the right spot:

AUS/NZ and Asia – Get a quote online or by phone

UK and Europe – Get a quote online or by phone

- Easily handles large amount transfers

- Personal account manager for individualized service

- Phone support

- Offers forward contracts, spot contracts, and market orders

Fees: TorFX doesn’t charge any fixed fees, but instead adds a margin to the exchange rate (mid-market rate). This makes them extremely affordable for your large transfers.

However, banks at either end may charge fees, so it’s a great idea to check with the receiving bank about typical fees for large amounts.

Support: Phone and email

Verdict: How does TorFX compare with Wise?

TorFX is another service on our list that differentiates itself from Wise by focusing on larger-amount transfers.

What stands out about TorFX is that you’ll get a personal account manager to help you through your transaction — crucial when you’re handling larger amounts and want to be able to communicate easily with the transfer service.

They also support a decent number of currencies (40+), but this is still not as many as Wise. And unfortunately, TorFX is not available in the US and Canada (their sister brand, Currencies Direct, handles that region). TorFX focuses on customers in the Australasia and European regions.

As you can tell we really like these two and we compare Wise Vs TorFX in greater detail.

Use TorFX if …

– You live in Australia, New Zealand, Asia, UK, and Europe and want to send money worldwide (TorFX has offices in the UK, Singapore, and Australia) – You want to send large amounts – You value individualised service and would like a personal account manager and phone support to guide you through the process – You don’t want to pay transfer fees

Bonus: XE – English, Spanish, and French telephone support

About: You can send up to $500,000 USD or equivalent with XE (review) and they support transfers in 98+ currencies to over 130 countries.

They’re one of the most trusted service providers for large bank-to-bank transfers.

- Supports a wide range for currencies

- Phone support in multiple languages

Fees: XE charges fixed fees and a margin on the exchange rate for amounts below $7000 USD.

Usually, they don’t charge a fixed fee for large transfers and keep these transfers affordable by reducing the margin as the amount goes up.

To start with as you can see here – XE give you an instant quote ( opens tab, so you can keep reading).

Support: Phone

Verdict: How does XE compare with Wise?

Like Wise, XE is very focused on online transactions. So this is best for those who want to perform quick online transfers without personal support from a representative.

And although it handles transfers of all sizes, we’ve found that Wise’s rates for smaller transfers are consistently more competitive than XE.

The 2 areas where it beats Wise are in the number of currencies it supports and its rates for higher transfers (XE doesn’t charge a transfer fee for larger amounts).

However, they are less transparent on fees compared to Wise as banks on either side may still charge their own fees when you transfer with XE. Check out our Wise Vs XE money transfer comparison

Use XE if …

– You are comfortable performing large-amount transfers online – You live in the US, Canada, the UK, Europe, Australia, and New Zealand (where their customer support teams are based) – You’re looking for many receiving currency options – You need multilingual phone support for your transfers (although XE is mostly online-focused)

For the majority of people, Wise (formerly TransferWise) is awesome. And that’s why we have voted it the best money transfer company for amounts below $7000 USD / £4500.

But there are many moving parts to money transfer.

And, while most services try to be comprehensive and all-inclusive, it’s not always possible ( jump up to see our summary of when Wise may not be good for you ).

The main reasons why you would want to choose another service over Wise usually comes down to a few factors:

Larger amounts (above $7000 USD).

We found that OFX was designed from the ground up for larger amounts. This means that sign up can be more involved (but less likely to be an issue later on) and they have a mix of online with phone support (which is expensive for them to run, but can be vital for your larger transfers). To top it off, their fees are very competitive as their fees in percentage terms reduce as amounts increase.

Click here to learn how you can get transfers through OFX fee free.

But again, you may have other priorities that may come into play. (Maybe you need cash pickup for the receiver? Or your currency isn’t supported by a service you’re interested in.)

So it’s important to stay in the know about each service’s strengths ( we’ve summarized them here for you ) so you can choose the right one for your needs.

The reality is, in many cases, it makes sense to use more than one service.

So take your time to shop around and find a few that you can turn to, depending on the situation.

Happy Transfers!

Similar Posts

Worldremit alternatives.

There are many other great WorldRemit alternatives available, each with its own unique features and benefits: Let’s explore the options and find the perfect alternative for you! Disclosure: This post contains affiliate links and savings on transfers if you use some of the links! For more information, see my disclosures here. 1. Quick Look WorldRemit…

Top 6 Revolut Alternatives

I use Revolut on a regular basis and I do think for some people they can be an excellent choice. But I think others could be better based on different needs. Or perhaps you simply had a bad experience? For international people and travelers, Wise is more minimalist, with no monthly fees and can be a…

Remitly Alternatives

There are a number of great Remitly alternatives, each with its own unique advantages. Our aim is to provide you with a comprehensive analysis of reliable alternatives, each offering unique advantages that will suit your special needs and preferences. Let’s dive and find the perfect alternative for you! Disclosure: This post contains affiliate links and…

Western Union Alternatives

There are many Western Union alternatives that may offer better exchange rates, lower fees, faster delivery, or more convenience. But the key here is to make it easy for you to choose the best alternative to Western Union. Let’s get started! Disclosure: This post contains affiliate links and savings on transfers if you use some…

Tangerine Wire Transfer

Over 2 million Canadians use Tangerine to save money on their banking, invest and even borrow. Can you do a Tangerine wire transfer? Well no, Tangerine cannot be used for wire transfers! But there are great and inexpensive options – which can be used easily with Tangerine. In the next few minutes, we will show…

Xoom Alternatives

I have been using several great alternatives to Xoom for many years now, and each has its own strengths and weaknesses. Here are the best alternatives to Xoom: Let’s take a look at the options and find the ideal one for you! Disclosure: This post contains affiliate links and savings on transfers if you use…

Great post! 👏 I’ve been checking out other options of Wise after they froze my transactions, and this breakdown is super helpful. Revolut looks interesting, is it safe/good to use for sending a significant amount? Thanks for sharing this info ✨

Glad you found us and found it helpful. Personally I would not send a large amount with Revolut and many others for a number of reasons.

The biggest is that (like Wise) they do not have customer support designed for large transfers.

Regulations mean there is potential for amounts to get frozen and the problem with services designed for smaller amounts is that they need to be super efficient and inexpensive to be competitive which means no telephone number to sort things out easily.

Check out OFX I use them personally for large amounts. Once my bank had an issue with a transfer and they called me to sort it out. I didn’t even know I had an issue and after the call the issue was resolved.

Hope this helps.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Here Are the Four Best Travel Money Cards in 2024

François Briod

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Jarrod Suda

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

From the multitude of bank fees and ATM charges to hidden currency conversion fees, there's no question that spending your money abroad while travelling can be costly — and that's saying nothing about the cost of the holiday itself!

As you prepare for your trip abroad, the golden rule is that you'll save the most money by using the local currency of your destination. This means withdrawing local cash at foreign ATMs and using a debit card to pay directly in the local currency. For example, if you're from the UK, using your bank's debit card that accesses your British pounds will likely lose you money to hidden fees at ATMs abroad and at local merchants.

In general, we rate Revolut as the best travel card all around. Its versatile account and card can be used to spend like a local pretty much anywhere in the world. ✨ Get 3 months of free Revolut Premium as a Monito reader with our exclusive link .

If you're from the EU, UK, or US, here are a few more specific recommendations to explore:

- Best for travelling from the UK: Chase

- Best for travelling from the US: Chime ®

- Best for travelling from the Eurozone: N26

If it's not possible for you to spend in the local currency when travelling abroad, then spending in your home currency while using a card that doesn't charge any hidden exchange rate markups from your bank (e.g. only the VISA or Mastercard exchange rates to convert currency) is still a good bet for most people.

In this guide, we explore cards that waive or lower ATM fees and that hold multiple currencies. Spend on your holiday like a local and enjoy peace of mind after each tap and swipe!

Best Travel Cards (And More!) at a Glance

Best travel money cards.

- 01. What is the best best multi currency card? scroll down

- 02. Are prepaid currency cards really it? scroll down

- 03. Monito's best travel money card tips scroll down

- 04. FAQ about the best travel cards scroll down

Revolut: Best All-Rounder

Revolut is one of the most well-known fintechs in the world because it offers services across Europe, the Americas, Asia, and Oceania.

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

- Customer Satisfaction 9.4

Revolut is available in many countries. You can double-check if it's available in yours below:

Here's an overview of Revolut's plans:

Revolut Ultra is currently only available in the UK and EU.

Like Wise, Revolut converts your currency to the local currency of your travel destination at an excellent exchange rate (called the 'Revolut Rate', which, on weekdays, is basically on par with the rate you see on Google), making it a good way to buy foreign currency before travelling abroad. As always though, bear in mind that Revolut's exchange rates might be subject to change.

Revolut's Standard Plan only allows currency exchange at the base mid-market exchange rate for transfers worth £1,000 per month. ATM withdrawals are also free for the first €200 (although third-party providers may charge a withdrawal fee, and weekend surcharges may also apply). These allowances can be waived by upgrading memberships.

N26: Good Bank For EU Travellers

One of the most well-known neobanks in Europe, N26 and its debit card operate in euros only. However, N26 is a partner with Wise and has fully integrated Wise's technology so that you never have to pay foreign transaction fees on your purchases outside of the eurozone. While N26 does not have multi-currency functionality, N26 will apply the real exchange rate on all your foreign purchases and will never charge a commission fee — making N26's card a powerful card for EU/EEA residents who travel across the globe.

- Trust & Credibility 7.9

- Service & Quality 8.0

- Fees & Exchange Rates 9.3

- Customer Satisfaction 8.1

These are the countries in which you can register for an N26 account:

And here is an overview of the various plans and account:

This low-fee option for banking is also ideal for travellers who do not belong to a European bank but frequent the Eurozone. For example, N26 is available for residents and citizens of Switzerland, Norway, and other European Economic Area countries that do not run on the Euro.

These citizens, who are in close proximity to the Eurozone, will save each time they spend with an N26 card while in Europe. N26 provides three free ATM withdrawals per month in euros but does charge a 1.7% fee per ATM withdrawal outside of Europe.

Take a look at our guide to the best travel cards for Europe to learn more.

Wise: Best For Multi-Currency Balances

Load up to 54 currencies onto this card at the real exchange rate, giving you access to truly global travel.

- Trust & Credibility 9.3

- Service & Quality 8.9

- Fees & Exchange Rates 7.6

- Customer Satisfaction 9.6

These are the countries in which you can order a Wise debit card:

Unlike banks, credit unions, airport kiosks, and foreign ATMs, Wise is transparent about never charging a hidden exchange rate margin when you convert your home currency into up to 54 currencies. The live rate you see on Google or XE.com is the one you get with Wise.

An industry-low commission fee per transaction will range from 0.35% to 2.85%, depending on the currency.

Chase: Great UK Bank For Travel

A recent arrival from the USA, Chase is one of the UK’s newest digital challenger banks and comes with a rock-solid reputation and no monthly charges, no currency conversion charges, no withdrawal fees, and no other charges for everyday banking from Chase. It’s a simple, streamlined bank account with an excellent mobile banking app and a great cashback offer. However, it doesn’t yet offer more advanced features like international money transfers, joint accounts, business banking, overdrafts and loans, and teen or child accounts.

- Trust & Credibility 10

- Fees & Exchange Rates 10

- Customer Satisfaction 8.7

Chime: Great Account For US Travelers

Chime is a good debit card for international travel thanks to its no foreign transaction fees¹. Unlike multi-currency accounts like Revolut (which let you hold local currency), Chime uses the live exchange rate applied by VISA. This rate is close to the mid-market rate, and Chime does not add any extra markup to your purchases, although out-of-network ATM withdrawal and over-the-counter advance fees may still apply.

- Trust & Credibility 9.5

- Service & Quality 8.8

- Fees & Exchange Rates 9.8

While Chime waives ATM fees at all MoneyPass, AllPoint, and VISA Plus Alliance ATMs within the United States, this fee waiver does not extend to withdrawals made outside the country. For withdrawals abroad, Chime applies a $2.50 fee per transaction, with a daily withdrawal limit of $515 or its equivalent. This is in addition to any fees charged by the ATM owner. Therefore, we recommend Chime primarily for card purchases rather than relying on it for withdrawing cash while traveling internationally.

- No foreign transaction fees ¹;

- Uses VISA's exchange rate ( monitor here ):

- A $2.50 fee per ATM withdrawal made outside of the United States;

- More info: Read our Chime review or visit their website .

Best Travel Money Cards in 2024 Compared by Country

In the table below, see our comparison summary of the four best travel cards for 2024 by country:

Last updated: 8 January 2024

What's The Best Prepaid Card to Use Abroad?

Travel cards come in many varieties, such as standard credit cards or debit cards with no foreign transaction fees or cards that waive all foreign ATM withdrawal fees.

What is a Multi-Currency Card?

Multi-currency cards are a specific type of travel card that allows you to own all kinds of foreign currencies, which you can instantly access when you pay with your card abroad. By spending the local currency in the region of travel , you bypass poor foreign exchange rates. ATMs and cashless payment machines will treat your card like a local card.

We have already mentioned a few multi-currency cards in this review, but we will also introduce Travelex . Travelex's Money Card also allows you to top up several foreign currencies — albeit at exchange rates slightly poorer than the real mid-market rate .

Wise Account

Wise has one of the best multi-currency cards available on the market.

Read our full review for more details.

Revolut is impressive for its vast options in currencies and its additional services.

Our in-depth review explores Revolut's services in detail.

Travelex offers a prepaid travel money card that supports 10 currencies and waives all ATM withdrawal fees abroad.

- Trust & Credibility 9.0

- Service & Quality 5.8

- Fees & Exchange Rates 7.1

- Customer Satisfaction 9.3

Travelex charges fees, which fluctuate according to the exchange rates of the day, in order to convert your home currency into the currencies that it supports. But once the currency is on the card, you'll be able to spend like a local. Learn more with our full review .

Don’t Let Banks, Bureaux de Change, and ATMs Eat Your Lunch 🍕!

Are you withdrawing cash at an ATM in the streets of Paris? Exchanging currencies at Gatwick airport? Paying for a pizza with your card during a holiday in Milano? Every time you exchange currencies, you could lose between 2% to 20% of your money in hidden fees . Keep reading below to make sure you recognize and avoid them.

Currency Exchange Fees Eating My Lunch? What’s That?

You’re often charged a hidden fee in the form of an alarming exchange rate.

At any given time, there is a so-called “ mid-market exchange rate ” — this is the real exchange rate you can see on Google . However, the money transfer provider or bank you use to exchange currencies rarely offers this exchange rate. Instead, you will get a much worse exchange rate. They pocket this margin between the actual rate and the poor exchange rate they apply, allowing the bank or money transfer provider to profit from the currency exchange.

In other words, you or your recipient will receive less foreign currency for each unit of currency you exchange. All the while, the provider will claim that they charge zero commission or zero fees.

So the question now is… how can you avoid them? Thankfully, the best travel money cards will allow you to hold the local currency, which you can access instantly with a tap or swipe. Carrying the local currency avoids exchange rate margins on every purchase.

Top Travel Money Tips

- Avoid bureaux de change. They charge between 2.15% and 16.6% of the money exchanged.

- Always pay in the local currency and never accept the dynamic currency conversion .

- Don't use your ordinary debit or credit card unless it's specifically geared toward international use. Doing this will typically cost you between 1.75% and 4.25% per transaction. Instead, use one of the innovative travel money cards below.

By opting for a travel card without FX fees, you can freely swipe your card abroad without worrying about additional charges. However, saving money doesn't stop there. To make the most out of your travel budget, consider using Skyscanner , one of the most powerful flight search engines available that allows you to compare prices from various airlines and find the best deals.

With Skyscanner's user-friendly interface and comprehensive search options, you can discover cheap flights and enjoy your holidays with peace of mind and more money in your pocket.

Best Travel Money Card Tips

When you convert your home currency into a foreign currency, foreign exchange service providers will charge you two kinds of fees :

- Exchange Rate Margin: Providers apply an exchange rate that is poorer than the true "mid-market" exchange rate . They keep the difference, called an exchange rate margin .

- Commission Fee: This fee is usually a percentage of the amount converted, which is charged for the service provided.

With these facts in mind, let's see what practices are useful to avoid ATM fees, foreign transaction fees, and other charges you may encounter while on your travels.

Tip 1: While Traveling, Avoid Bureaux de Change At All Costs

Have you ever wondered how bureaux de change and currency exchange desks are able to secure prime real estate in tourist locations like the Champs-Élysées in Paris or Covent Carden in London while claiming to take no commission? It’s easy: they make (plenty of) money through hidden fees on the exchange rates they give you.

Our study shows that Bureaux de Change in Paris charges a margin ranging from 2.15% at CEN Change Dollar Boulevard de Strasbourg to 16.6% (!!) at Travelex Champs-Élysées when exchanging 500 US dollars into euros for example.

If you really want cash and can’t wait to withdraw it with a card at an ATM at your destination, ordering currencies online before your trip is usually cheaper than exchanging currencies at a bureau de change, but it’s still a very expensive way to get foreign currency which we, therefore, would not recommend.

Tip 2: Always Choose To Pay In the Local Currency

Don’t fall for the dynamic currency conversion trap! When using your card abroad to pay at a terminal or withdraw cash at an ATM, you’ve probably been asked whether you’d prefer to pay in your home currency instead of the local currency of the foreign country. This little trick is called dynamic currency conversion , and the right answer to this sneaky question will help you save big on currency exchange fees.

As a general rule, you always want to pay in the local currency (euros in Europe, sterling in the UK, kroner in Denmark, bahts in Thailand, etc.) when using your card abroad, instead of accepting the currency exchange and paying in your home currency.

This seems like a trick question - why not opt to pay in your home currency? On the plus side, you would know exactly what amount you would be paying in your home currency instead of accepting the unknown exchange rate determined by your card issuer a few days later.

What is a Dynamic Currency Conversion?

However, when choosing to pay in your home currency instead of the local one, you will carry out what’s called a “dynamic currency conversion”. This is just a complicated way of saying that you’re exchanging between the foreign currency and your home currency at the exact time you use your card to pay or withdraw cash in a foreign currency, and not a few days later. For this privilege, the local payment terminal or ATM will apply an exchange rate that is often significantly worse than even a traditional bank’s exchange rate (we’ve seen margins of up to 8%!), and of course, much worse than the exchange rate you would get by using an innovative multi-currency card (see tip #3).

In the vast majority of times, knowing with complete certainty what amount you will pay in your home currency is not worth the additional steep cost of the dynamic currency conversion, hence why we recommend always choosing to pay in the local currency.

Tip 3: Don't Use a Traditional Card To Pay in Foreign Currency/Withdraw Cash Abroad

As mentioned before, providers make money on foreign currency conversions by charging poor exchange rates — and pocketing the difference between that and the true mid-market rate. They also make money by charging commission fees, which can either come as flat fees or as a percentage of the transaction.

Have a look at traditional bank cards to see how much you can be charged in fees for spending or withdrawing $500 while on your holiday.

These fees can very quickly add up. For example, take a couple and a child travelling to the US on a two-week mid-range holiday. According to this study , the total cost of their holiday would amount to around $4200. If you withdraw $200 in cash four times and spend the rest with your card, you would pay $123 in hidden currency exchange and ATM withdrawal fees with HSBC or $110 with La Banque Postale. With this money, our travellers could pay for a nice dinner, the entrance fee to Yosemite Park, or many other priceless memories.

Thankfully, new innovative multi-currency cards will help you save a lot of money while travelling. Opening an N26 Classic account and using the N26 card during the same US holidays would only cost $13.60.

Need Foreign Cash Anyway?

In many countries, carrying a wad of banknotes is not only useful but necessary to pay your way since not every shop, market stall, or street vendor will accept card payments. In these cases you'll have two options to exchange foreign currency cheaply:

1. Withraw at an ATM

As we've explored in great depth in this article, withdrawing money from a foreign ATM will almost always come with fees — at the very least from the ATM itself, and so it's therefore the best strategy to use a travel debit card that doesn't charge in specific ATM withdraw fees on its own to add insult to injury. That said, if you need cash, we recommend making one large withdrawal rather than multiple smaller ones . This way, you'll be able to dodge the fees being incurred multiple times.

2. Buy Banknotes (at a Reasonable Rate!)

As we've also seen, buying foreign currency at the airport, at foreign bank branches, or in bureaux de change in tourist hotspots can be surprisingly expensive. Still, not all exchange offices are equally pricey . If you're looking for a well-priced way to exchange your cash into foreign currency banknotes before you travel, Change Group will let you order foreign currency online and pick them up at the airport, train station, or a Change Group branch just before you leave for your holiday. A few pick-up locations in the UK include:

- London centre (multiple locations),

- Glasgow centre,

- Oxford centre,

- Luton Airport,

- Gatwick Airport,

- St. Pancras Station.

(Note that Change Group also has locations in the USA, Australia, Germany, Spain, Sweden, Austria, and Finland!)

Although its exchange rates aren't quite as good as using a low-fee debit card like Revolut, Change Group's exchange rates between popular currencies tend to be between 2% to 3%, which is still a lot better than you'll get at the bank or at a touristy bureau de change in the middle or Paris or Prague!

FAQ About the Best Travel Money Cards

Having reviewed and compared several of the industry's leading neobanks, experts at Monito have found the Wise Account to offer the best multi-currency card in 2024.

In general, yes! You can get a much better deal with new innovative travel cards than traditional banks' debit/credit cards. However, not all cards are made equal, so make sure to compare the fees to withdraw cash abroad, the exchange rates and monthly fees to make sure you're getting the best deal possible.

- Sign up for a multi-currency account;

- Link your bank to the account and add your home currency;

- Convert amount to the local currency of holiday destination ( Wise and Revolut convert at the actual mid-market rate);

- Tap and swipe like a local when you pay at vendors.

Yes, the Wise Multi-Currency Card is uniquely worthwhile because it actually converts your home currency into foreign currency at the real mid-market exchange rate . Wise charges a transparent and industry-low commission fee for the service instead.

More traditional currency cards like the Travelex Money Card are good alternatives, but they will apply an exchange rate that is weaker than the mid-market rate.

The Wise Multi-Currency Card is the best money card for euros because unlike banks, credit unions, airport kiosks, and foreign ATMs, Wise is transparent about never charging a hidden exchange rate margin when you convert your local currency into euros with them.

The live rate you see on Google or XE.com is the one you get with Wise . An industry-low commission fee will range from 0.35% to 2.85%. USD to EUR transfers generally incur a 1.6% fee.

Learn more about how to buy euros in the United States before your trip.

There are usually three types of travel cards, prepaid travel cards, debit travel cards and credit travel cards. Each have pros and cons, here's a short summary:

- Prepaid travel cards: You usually need to load cards with your home currency via a bank wire or credit/debit card top-up. You're then able to manage the balance from an attached mobile app and can use it to pay in foreign currencies or withdraw cash at an ATM abroad tapping into your home currency prepaid balance. With prepaid travel cards, as the name indicates, you can't spend more than what you've loaded before hand. Some prepaid card providers will provide ways to "auto top-up" when your balance reaches a certain level that you can customize. On Revolut for example, you can decide to top-up £100/£200/£500 from your debit card each time your balance reaches below £50.

- Debit travel cards: Some innovative digital banks, like N26 or Monzo, offer travel debit cards that have the same advantages than a Prepaid Travel Cards, except that they're debit card directly tapping into your current account balance. Like a Prepaid travel card, you can't spend more than the balance you have in your current account with N26 or Monzo, but you can activate an overdraft (between €1,000 or €10,000 for N26 or £1,000 for Monzo) if you need it, for a fee though.

Note that even if they're Prepaid or Debit cards, you can use them for Internet payments like a normal credit card.

- Credit travel cards: You can find credit cards made for international payments offering good exchange rates and low fees to withdraw money abroad, but you'll need to pay interests in your international payment if you don't pay in FULL at the end of every month and interest on your ATM withdrawals each day until you pay them back.

Why You Can Trust Monito

Our recommendations are built on rock-solid experience.

- We've reviewed 70+ digital finance apps and online banks

- We've made 100's of card transactions

- Our writers have been testing providers since 2013

Other Monito Guides and Reviews on Top Multi Currency Cards

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

What are you looking for?

Wise vs revolut: which is better in 2024 [detailed & unbiased].

One of the top tips I can give you while travelling is to invest in a great travel card - trust me you won’t regret it!

There are plenty to choose from, but this guide is going to dive into the similarities and key differences between Wise and Revolut .

We started using Revolut back in 2016 on our backpacking trip around South America , and we’ve used Wise since early 2019 so we’ve got a few years of experience with both...

To give you a good idea of which travel card is most suited to you, I’m going to go through the pros and cons of each for both personal and business accounts.

So, let’s get stuck in…

Travellerspoint

Great features of Wise for travel

First of all, let’s take a look at Wise and the features that benefit us travellers so much…

- Although not travel-specific, Wise is FREE to sign up for and there are no monthly fees

- You can hold money in 50+ currencies and convert between them for the real exchange rate

- With Wise, you can withdraw up to 200 GBP per month from international ATMs for FREE

- You can use the Wise debit card abroad like you would any other debit card

- You can freeze your card if it gets lost or stolen

- Low transfer fees

- Better exchange rate than many other platforms out there

- Wise is great for receiving payments in foreign currencies and then offering great exchange rates and low fees to convert to pounds

- Available in over 60 countries, and your card will be shipped out for you (for a fee)

- Wise offers virtual cards as well as plastic ones

Wise Business

Now, let’s take a look at the benefits of opening a Wise Business account !

Of course, this is tailored specifically towards individuals who are self-employed but if you’re a keen traveller and a digital nomad then it’s likely that you may fall under this bracket.

With a Wise Business account, you’ll have many benefits of business banking but without any hidden charges, monthly fees, or high rates.

So, what are these benefits?

Key Features of a Wise Business account

- International invoices can be paid in one click with a real (and live) exchange rate

- Charges regarding payments can be up to 19x cheaper than the likes of Paypal

- Quick payments - 50% of payments are instant or arrive within the hour

- You can easily make batch payments in just one click (up to 1,000 people)

- Money can be moved between currencies in seconds, avoiding high conversion fees

- Your Wise Business account can be connected with other platforms like Xero

The best part about having a Wise Business account is that they’re very affordable.

For those who are in the EEA or UK, there's one-off set-up fee of £45 (50 euros).

The price of this one-off fee will differ depending on where you're from (and where the business is registered), but typically you'll be paying between £16-£42. With some countries, it does cost more to verify your account so you may be charged a higher fee.