- Credit Cards

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

BMO Air Miles World Elite Mastercard Review 2024: Earn More Air Miles, Faster

Updated: Sep 4, 2024, 8:39am

Fact Checked

The BMO AIR MILES World Elite®* Mastercard®* offers earn rates on rewards that outpace most other Air Miles cards on the market. While it has some decent travel perks and discounts, this card is best thought of as an add-on to your basic Air Miles collector cards. That said, frequent flyers might see more benefit from another points or cash back card, since the value of Air Miles fluctuates.

- High Air Miles earn rates.

- Earn Bonus Miles with an Air Miles Membership Card.

- Comprehensive travel insurance.

- Miles don’t transfer between rewards categories.

- Inconsistent dollar value per mile.

- $80,000 minimum income requirement.

- $500 per month cap on grocery earnings.

Table of Contents

Introduction, quick facts, bmo air miles world elite mastercard rewards, bmo air miles world elite mastercard benefits, how the bmo air miles world elite mastercard stacks up, methodology, is the card name right for you.

- Welcome bonus of 3,000 Air Miles when you spend $3,000 in the first three months, enough for $310 towards purchases with AIR MILES Cash. Plus, get the $120 annual fee waived for the first year.

- 3 Miles for every $12 spent at participating Air Miles partners.

- 2 Miles for every $12 spent on groceries (up to $500 per month).

- 1 Mile for every $12 in eligible purchases.

- Collect points twice on purchases from Air Miles partners.

- Forbes Advisor estimates a rewards value of $188.63 in net annual earnings based on average Canadian spending, with the annual fee factored in.

- Emergency medical coverage: $2 million for 15 days (no coverage for ages 65 and older).

- Common carrier/travel accident insurance: $500,000.

- Trip cancellation: $2,500 per person ($5,000 per account).

- Trip interruption: $2,000 per person.

- Flight delay: $1,000 per account.

- Lost/stolen baggage: $750 per person ($2,000 per account).

- Delayed baggage: $200 per person.

- Hotel/motel burglary insurance: None.

- Car rental collision loss/damage: $65,000 for 48 days to cover rental car damage, loss or theft and $2,000 for personal effects ($1,000 per person).

The BMO AIR MILES World Elite®* Mastercard®* is among the best Air Miles credit cards available. On top of the welcome offer, cardholders collect 1 Mile on every $12 purchase. The base rate jumps up to 2 Miles at eligible grocery stores. Air Miles partners pay out 3 Miles plus extra Miles when you scan your Air Miles Collector Card. These earn rates gain more traction than most competitors and help offset the $120 annual fee.

This card also includes some incredibly useful travel perks, like comprehensive travel insurance, airport lounge access and a 25% discount on the Air Miles required to book one flight every year (with no blackout periods). The downside is you can only book flights departing from Canada. Aeroplan cards let you book flights in most countries, and they often have more flight options through Air Canada even though Air Miles has partnerships with multiple airlines.

Cardholders also have to choose between earning Cash Miles, Dream Miles or a combination of both. Cash Miles sound nice, but you can only redeem them in increments of 95 Miles for $10. Dream Miles, on the other hand, offer more value and over 800 reward options for flights, hotels, vacation packages, events and merchandise.

- Every $12 purchase earns 3 Miles at partner locations, 2 Miles at eligible grocery stores and 1 Mile everywhere else.

- Collect Miles twice at partner locations by scanning your Air Miles Collector Card at the time of purchase.

- Redeem Miles in-store as cash or online for travel, merchandise, events and more.

Earning rewards

The BMO Air Miles World Elite Mastercard rewards every $12 purchase with 3 Miles at partner locations, 2 Miles at eligible grocery stores and 1 Mile everywhere else. Cardholders can also double dip on points from partners by scanning an Air Miles Collector Card as well. These earn rates are a big jump from the standard Air Miles program that pays out 1 Mile per $20 spent at participating merchants.

New cardholders can skip the annual fees for the first year and earn 3,000 AIR MILES after spending $3,000 in the first three months. You have the option to collect the extra miles as cash or travel rewards. They’re worth about $310, depending on the rewards category you choose.

While this card has impressive Air Miles earn rates, its value is generally lower than other premium travel cards. For example, the American Express Cobalt Card offers up to 5 points for every dollar spent and you can transfer points to several frequent flyer programs at a 1:1 ratio.

Redeeming Rewards

BMO Air Miles World Elite Mastercard rewards can be Cash Miles or Dream Miles. You can choose to earn 100% of Miles in one category or split them up (e.g. 30% Cash Miles, 70% Dream Miles). Choose wisely—settings can be adjusted, but Miles can’t move between categories.

Miles collected on credit card purchases will show up in your Air Miles account. Cash Miles can be used online or in-store for gift cards and discounts with participating retailers. The catch is, you can only redeem Cash Miles in increments of 95 Miles for $10.

Dream Miles can be redeemed online for flights, hotels, events and merchandise. Flights generally offer the most value at 17.2 cents per mile (CPM). The BMO Air Miles World Elite Mastercard also comes with travel insurance, lounge access and a 25% discount on the Air Miles required to book one international flight every year.

At the end of the day, free money shouldn’t be this hard to spend. There are plenty of cash back cards with higher earn rates and flexible payouts.

Rewards Potential

To calculate the return on BMO Air Miles World Elite Mastercard rewards, Forbes Advisor uses data from multiple government agencies to determine baseline income and credit card spending averages across various categories. Based on this information, the average Canadian spends $30,965.70 in annual credit card charges .

With every $12 purchase earning up to 3 Miles, cardholders can collect around 2,931 Miles per year on top of the first-year welcome bonus. Based on an average reward value, that could be $308.63 in annual rewards. When you factor in the annual $120 fee, that becomes a return of $188.63. Not many credit cards earn Air Miles at this level, but some other travel cards offer more flexible rewards with a similar value. And, since there is such a fluctuation in rewards value, these amounts can vary.

- Travel Insurance: Plan your trip with built-in coverage for rental car collision and loss, trip interruption and cancellation, flight delays, lost or stolen luggage and 15 days of emergency medical care.

- Trip Assistance: Contact the Operations Centre while you’re away to get help with lost or stolen travel documents, emergency cash transfers, legal services and information about visa or vaccine requirements.

- Flight Discounts: Get a 25% discount on Air Miles for one flight anywhere in the world (750 Miles in total savings). There are no blackout periods and the discount resets every year.

Interest Rates

Regular APR (Purchases): 20.99% Regular APR (Cash Advances) 23.99%

Foreign Transaction Fee: 2.5% Annual Fee: $120 (waived in the first year) Balance Transfer Fee: 2%

BMO AIR MILES World Elite®* Mastercard®* vs. WestJet RBC® World Elite Mastercardǂ

The WestJet RBC® World Elite Mastercardǂ offers 2% back in Westjet dollars on Westjet purchases and 1.5% on everything else. This card is a good option for frequent flyers who only want to collect and redeem travel points with Westjet. Otherwise, the BMO Air Miles World Elite Mastercard offers $188.63 worth of annual rewards, compared to $311.69 with the WestJet RBC card (both using average rewards value with their respective annual fees factored in).

BMO AIR MILES World Elite®* Mastercard®* vs. BMO AIR MILES®† Mastercard®*

The BMO AIR MILES®† Mastercard®* has no annual fee or minimum income requirement. Rewards follow a similar structure, but it takes $25 to collect 1 Mile instead of $12. Other no-annual-fee AIR MILES credit cards offer 1 Mile for every $15 or $20 spent. The BMO AIR MILES®† Mastercard®* still earns $149 worth of annual rewards, only slightly less than the World Elite’s $188.63. If you can meet the World Elite Mastercard $80,000 income requirement, the accelerated earning rates are worth the $120 annual fee.

BMO AIR MILES World Elite®* Mastercard®* vs. CIBC Aeroplan Visa Infinite Card

The CIBC Aeroplan Visa Infinite Card earns 1.5 points per dollar spent on gas, groceries and Air Canada vacations and 1 point on all other purchases. Aeroplan points offer more perks for flight upgrades and priority status with Air Canada. Even with the annual fee factored in, the CIBC Aeroplan Visa Infinite can earn $527.32 in annual rewards, which makes it the clean winner, considering the BMO Air Miles only earns $188.63.

When determining a rating for individual credit cards, the Forbes Advisor Canada editorial team factors in an exhaustive list of data points. With travel, the scoring model used takes into account factors such as, but not limited to, miles earned, redemption flexibility, fees, welcome bonus, and other rewards and features. Keep in mind, what may be best for some people might not be right for you. Conduct informed research before deciding which cards will best help you achieve your financial goals.

If you already collect Air Miles, the BMO AIR MILES World Elite®* Mastercard®* is worth adding to your wallet. This card is essentially an extension of the Air Miles Collector Card with better earn rates and extra travel perks. On the other hand, anyone that isn’t married to Air Miles should check out some other premium travel cards that offer cash back or points.

Related : Best Credit Cards in Canada

Frequently Asked Questions (FAQs)

How do i use my bmo air miles.

Choose from over 800 reward options for BMO Air Miles, including merchandise, gift cards, travel, leisure and entertainment items. The dollar value of your BMO Air Miles depends on the rewards program (Cash Miles or Dream Miles) and what you redeem your Air Miles for.

Related: Everything You Need To Know About The New Air Miles

How many Air Miles do I get with the BMO Air Miles World Elite Mastercard?

The BMO AIR MILES World Elite®* Mastercard®* earns Air Miles on every $12 purchase. The number of Air Miles you receive will depend on where you shop. Every $12 you spend will earn 3 Miles at partner locations, 2 Miles at eligible grocery stores and 1 Mile on everything else you buy.

Is the BMO World Elite Mastercard good?

The BMO AIR MILES World Elite®* Mastercard®* is one of the best Air Miles credit cards on the market. Cardholders collect 1 Mile for every $12 purchase compared to the standard earn rate of 1 Mile for $20. However, the BMO CashBack World Elite Mastercard is a favourable alternative for people that want to get paid in cash instead of Air Miles.

Candice Reeves is a financial writer based out of Nova Scotia. She specializes in personal finance, investing, and cryptocurrency. Her work is featured in leading publications across various industries, including Wealth Rocket, CryptoVantage, and StackCompare.

Aaron Broverman is the lead editor of Forbes Advisor Canada. He has over a decade of experience writing in the personal finance space for outlets such as Creditcards.com, creditcardGenius.ca, Yahoo Finance Canada, Nerd Wallet Canada and Greedyrates.ca. He lives in Waterloo, Ontario with his wife and son.

- Best Credit Cards

- Best Travel Credit Cards

- Best Cash Back Credit Cards

- Best No Foreign Transaction Fee Credit Cards

- Best Airport Lounge Access Credit Cards

- Best Aeroplan Credit Cards

- Best Student Credit Cards

- Best Rewards Credit Cards

- Best Mastercards

- Best Credit Cards for Bad Credit

- Best Business Credit Cards

- Most Exclusive Credit Cards In Canada

- Best Prepaid Credit Cards

- Best TD Credit Cards

- Best Low-Interest Credit Cards

- Best Visa Cards

- Best RBC Credit Cards

- Best of Instant Approval Credit Cards

- Best Cash Back Credit Cards With No Annual Fee

- Best Secured Credit Cards in Canada

- American Express Cobalt Review

- KOHO Prepaid Mastercard Review

- EQ Bank Card Review

- Neo Standard Mastercard Review

- TD Aeroplan Visa Infinite Privilege Review

- TD First Class Travel Visa Infinite Card

- RBC Avion Visa Infinite Review

- Simplii Financial Cash Back Visa Review

- MBNA Rewards World Elite Mastercard

- Scotiabank Passport Visa Infinite Review

- Neo Secured Credit Card Review

- MBNA True Line Mastercard Review

- TD Aeroplan Visa Platinum Card Review

- TD Cash Back Visa Infinite Review

- BMO CashBack World Elite Mastercard Review

- Platinum Card From American Express Review

- TD Platinum Travel Visa Card Review

- TD® Aeroplan® Visa Infinite* Card Review

- American Express Aeroplan Card Review

- American Express Green Card Review

- Credit Card Interest Calculator

- Credit Card Minimum Payment Calculator

- American Express Cobalt vs. Scotiabank Gold American Express Card

- TD First Class Travel Vs. TD Aeroplan

- What's The Best Day & Time To Book Flights

- Air Canada Aeroplan: The Ultimate Guide

- Guide To American Express Credit Card Levels

- What Credit Cards Does Costco Accept In Canada?

- Is American Express Better Than Visa Or Mastercard?

- How To Get The Apple Card In Canada

- What Happens If You Overpay Your Credit Card?

- How To Redeem Aeroplan Points

- Foreign Transaction Fees: How To Avoid Them

- How To Spot A Credit Card Skimmer

- What Is The Highest Limit Credit Card In Canada?

- Benefits And Perks Of Amex Platinum Card

- How Much Is The Amex Platinum Foreign Transaction Fee?

- Negative Balance On A Credit Card: What To Do?

- Fee Increases Here For Both Platinum Cards From Amex

More from

Capital one smart rewards mastercard review 2024, rogers red world elite mastercard review 2024, rogers red mastercard review 2024, bmo ascend world elite mastercard review 2024, home trust preferred visa card review 2024, float secured business credit card review 2024: canada’s only secured business credit card.

10 Reasons to keep a BMO Air Miles World Elite MasterCard in your wallet

by Anne Betts | Jul 9, 2024 | Travel Hacking | 6 comments

Updated July 9, 2024

Does the BMO Air Miles World Elite MasterCard deserve a place in your wallet? According to Credit Card Genius, it’s the best Air Miles credit card on the market. If most of the following features appeal to you, it certainly deserves some consideration.

Table of Contents

1. First year Free (FYF)

2. sign-up bonus of 3,000 air miles, 3. air miles are useful for travel, 4. a decent mastercard is handy to have, 5. limited 25% discount on flight redemptions, 6. earning rates between 1 and 3 mile(s) for each $12 spent, 8. airport lounge access, 9. insurance benefits, 10. access to wi-fi hotspots.

It’s usually offered with a first-year waiver of the annual fee ($120). The current ‘Offer Period’ from May 1, 2020 to November 30, 2024 includes such an offer. The fee appears as a charge on the first statement, accompanied by a credit for the same amount. A FYF promotion and an attractive sign-up bonus are key features of a tempting credit card offer.

The standard sign-up bonus is 2,000 miles on a $3,000 Minimum Spend Requirement (MSR) within the first three months. However, look for exclusive offers of 3,000 Air Miles at the BMO site, or at financial and miles-and-points blogs such a Credit Card Genius, Ratehub, Milesopedia, or Frugal Flyer.

If you like to have a healthy cushion of Air Miles in your portfolio, this offer allows you to rack up over 3,000 Air Miles within a short period. The average collector takes years to accumulate anywhere near this amount.

Air Miles will never lead to a suite or shower in the sky. Those luxuries are the stuff of frequent flyer programs offering redemptions in first or business class cabins. Air Miles is a poor cousin occupying a small, but useful corner of a diversified miles-and-points portfolio.

Air Miles can be redeemed for a variety of travel expenses including vacation packages, cruises, hotels, and car rentals.

For those of us who don’t live in or near busy airport hubs, Air Miles can be beneficial for short positioning flights to hubs served by airlines with other (and better) frequent flyer programs. This is my favourite use of Air Miles. For my trip from Halifax to Sydney, Australia next February, I’ve redeemed Avios points for a business-class QSuites redemption with Qatar Airways from Montreal. A flight from Halifax to Montreal costs 1,470 Air Miles and $99 in taxes and fees.

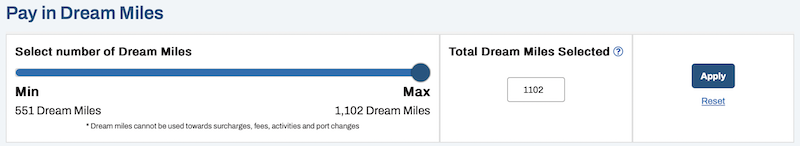

However, with the 25% discount for holding a BMO Air Miles World Elite MasterCard, the cost is reduced to 1,102 Air Miles.

For other travel, discounts of up to 20% are available on National Car Rentals and Alamo Rent A Car, and up to 5% on Enterprise Rent-A-Car at locations worldwide using the Car Rental Booking Tool .

Savings of up to 7% are available at Booking dot com properties with the MasterCard label .

I love American Express. But, let’s face it, there are places where AMEX cards aren’t accepted and it’s handy to have a decent Visa and MasterCard in your wallet.

And then there’s the in-store MasterCard-only policy of Costco.

Another dilemma concerns the MSR. It’s higher than that of many premium credit cards. For many people, it’s achievable by switching everyday spend to the card for the first three months. One disadvantage of doing so is that your other miles-and-points programs don’t benefit from a $3,000 spend. It’s a more difficult choice if it means missing out on one or two other attractive sign-up bonuses because you’re diverting such a significant spend to this one card.

The BMO Air Miles World Elite MasterCard is an easier choice when:

- There are expenses within the first three months with merchants that don’t accept American Express (but they do accept MasterCard).

- You regularly shop at Costco. If you come up short in meeting the minimum spend, consider investing in one or more Costco Shop Cards to use on future visits.

Back in 2017, BMO devalued the BMO Air Miles World Elite Mastercard flight benefit from a 25% discount to 15%.

Then in 2022, the flight redemption discount changed yet again. BMO Air Miles World Elite MasterCard cardholders now receive a 25% discount on one worldwide flight booking per calendar year, up to a maximum of 750 Reward Miles. This replaces the previous 15% discount flight benefit and can be spread across all tickets on the booking. To take full advantage of the discount, the combined cost of all flights on the booking would need to amount to 5,000 miles.

While the 15% discount was limited to North American destinations, the updated flight discount now provides cardholders with an additional 10% savings available on flights anywhere in the world. You don’t need to use your BMO Air Miles World Elite MasterCard to pay the taxes and fees to be eligible for the discount.

The option to use the flight discount benefit appears during the booking phase once flights have been chosen.

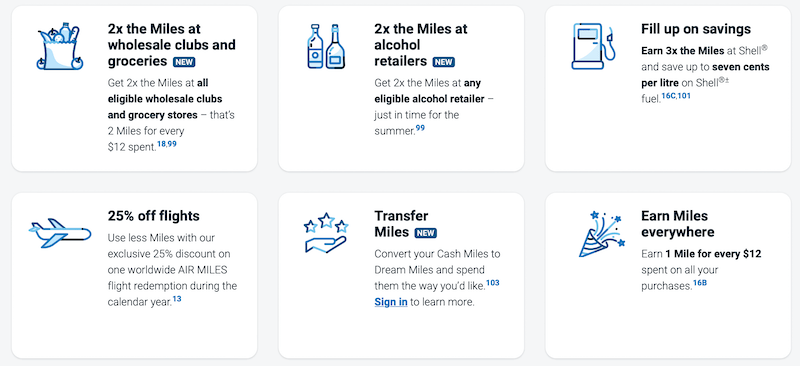

On each $12 spend, the base earning rate of 1 mile is now 2 miles at non-partner grocery stores and wholesale warehouses (such as Costco), and 3 miles at participating Air Miles partners.

Accumulating Air Miles based on organic spend can be a long and tedious journey. Credit card sign-up bonuses and points-boosting promotions are the best ways to accelerate earning rates. Newsletters from Air Miles will keep you abreast of points-boosting promotions.

Since BMO acquired Air Miles in June 2023, several new merchants and earning opportunities have boosted the desirability of the program. Hopefully, it is a sign of further improvements on the horizon.

7. Automatic Onyx status

Collectors who earn 5,000 or more Air Miles in a calendar year qualify for Onyx status.

A BMO Air Miles World Elite cardholder automatically qualifies for Onyx status.

Onyx members can enjoy bonus offers, up to 10% fewer miles when redeeming for merchandise, priority customer service, unlimited transfer of dream miles and cash miles, and select flight discounts. Beginning in 2025, a special travel discount of 40% or 500 miles off a flight will be offered for one month each year.

The card offers a Mastercard Travel Pass membership by DragonPass that includes access to over 1000 lounges globally, including Plaza Premium Lounges. At the time of this update, it remains to be seen if BMO Air Miles World Elite MasterCard cardholders will join BMO Ascend World Elite MasterCard cardholders with four annual complimentary passes. Otherwise, each visit costs USD 32.

Registration is required at MasterCard Travel Pass/Dragon Pass or use the MasterCard Travel Pass mobile app.

Despite the devaluation of the trip cancellation, trip interruption/trip delay and flight delay insurance for trips funded on points from different reward programs, the BMO Air Miles World Elite MasterCard offers a decent suite of insurance benefits:

Emergency medical insurance for the first 15 days on out-of-province/out-of-contry trips, up to $5 million in coverage (under age 65

Trip cancellation insurance for up to $1,500 per insured person and $5,000 per trip

- Trip interruption insurance for up to $2,000 per insured person and $10,000 per trip

Flight delay benefits of up to $500 per trip for reasonable expenses incurred on a flight delay of four hours or more

Car rental insurance and Collision Damage Waiver benefits, which allow you to save on the insurance fees that car rental companies usually charge

- Extended warranty and purchase protection where the manufacturer’s warranty is doubled, up to a maximum of one additional year and purchases are automatically insured against theft and damage for 90 days from the date of purchase

Enjoy free access to over one million Wi-Fi hotspots around the world with Boingo Wi-Fi for Mastercard Cardholders. Register at wifi.mastercard.com and d ownload Boingo’s Wi-Finder app for the easiest way to gain access.

Does the BMO Air Miles World Elite MasterCard deserve a place in your wallet? It’s a worthy card to have if you

- don’t live in or near a major hub and use Air Miles for positioning flights

- use a variety of sources (e.g., miles, points, and cash) to fund travel

Might you be interested in my other miles-and-points posts?

- When a no-FOREX-fee credit isn’t the best travel choice

- Polaris review of United Airlines’ lounge and in-flight experience

- How to use TD Rewards points to reduce travel costs

- How to use Scene+ points to reduce travel costs

- How to use CIBC Aventura points to reduce travel costs

- 9 Effective ways of meeting Minimum Spend Requirements

If you found this post helpful, please share it by selecting one or more social media buttons. Is the BMO World Elite MasterCard in your wallet? Why? Why not? Please share your thoughts in the comments Thank you.

Pin it for later?

Great article. I didn’t clearly understand the idea of cancelling & reapplying esp this issue of doing it b4 the effective date of the new promotion. Does that mean if I have a bmo elite card now acquired in the last promotion (2017/18) I can’t cancel this card to apply under 2018/19 promotion becoz it began a few months a few months ago?

I will be 70 in May. I am planning a 30 day European trip in September 2022. I have full medical coverage through my former employer, no age limit, no maximum in medical costs. I have a BMO World Elite Airmiles card that covers trip cancellation age 65 and under. My travel agent is trying to sell me more insurance for $690 for trip cancellation….does this make any sense? Thanks.

It’s not a blanket age restriction. The age restriction applies to pre-existing conditions. Take a look at the policy at 4.3.4 to see if it applies to you. $690? That’s steep!! That kind of premium would cover at least $7,000 of non-refundable travel bookings and I would presume that some of your bookings are refundable. Keep in mind that it’s only non-refundable bookings that are covered. I find that many travel providers are encouraging folks to travel, offering bookings that are completely refundable as incentives. Here’s a link to the BMO insurance booklet: https://www.bmo.com/pdf/AM_WE_Travel_Medical_Protection_Insurance_Certificate_En.pdf

What’s the minimum spend to get the 3,000 bonus airmiles on Creditcardgenius.ca? Also if I get this card as well as the American Express Airmiles Reserve, can I double dip on the benefit? BMO offers 25% off up to 750 airmiles, while the Amex offers annual companion voucher up to 1,700 airmiles back?

The Credit Card Genius MSR was the same as BMO’s public offer: $3,000. I haven’t seen any restrictive language limiting access to both benefits. Unlike the buddy pass, they’re different benefits.

Trackbacks/Pingbacks

- 25 Tips on earning Aeroplan miles - Packing Light Travel - […] Is the BMO Air Miles World Elite MasterCard a good deal? […]

- Is the TD Rewards program worth it? - Packing Light Travel - […] Is the BMO Air Miles World Elite MasterCard a good deal? […]

- Why the Best Western loyalty program is good for travellers - Packing Light Travel - […] Is the BMO Air Miles World Elite MasterCard a good deal? […]

- What’s the best use of Scotia Rewards? - Packing Light Travel - […] Is the BMO Air Miles World Elite MasterCard a good deal? […]

- Lounge and flight review of United Airlines’ Polaris experience | Packing Light Travel - […] Is the BMO Air Miles World Elite MasterCard a good deal? […]

- Finding Aeroplan flights: a step-by-step guide - Packing Light Travel - […] Is the BMO Air Miles World Elite MasterCard a good deal? […]

- Is a no-FOREX-fee credit card always the best choice for international travel? - Packing Light Travel - […] Is the BMO Air Miles World Elite MasterCard a good deal? […]

- BMO Air Miles World Elite Mastercard - Money, Eh? - […] https://packinglighttravel.com/travel-tips/travel-hacking/is-the-bmo-air-miles-world-elite-mastercar… 0 […]

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search this site

Welcome to Packing Light Travel. I'm Anne, a dedicated carry-on traveller. For information on the site, please see the About page.

Book: The Ernie Diaries

Packing Light

Join the mailing list for updates, and access to the Resource Library.

You have Successfully Subscribed!

Connect on instagram, if you find this information useful, subscribe to the newsletter and free access to packing lists, checklists, and other tools in packing light travel's resource library..

Your email address will never be shared. Guaranteed.

Pin It on Pinterest

BMO AIR MILES ® † World Elite ® * Mastercard ® * 🇨🇦

- 3X miles at participating AIR MILES partners

- Premium Insurance

- Accepted at Costco

- Limited-time offer : Earn up to 3,000 Bonus Miles , plus save 25¢/L at Shell on 8 fill-ups , on top of automatic savings of 7¢/L on Shell V-Power ® NiTRO+ fuel or 2¢/L on all other fuel. That’s up to 32¢/L for a limited time only! Plus, get the $120 annual fee waived for the first year .

- Get 3x the Miles for every $12 spent at participating AIR MILES Partners and

- 2x the Miles for every $12 spent at any eligible grocery store *.

- 2x the Miles for every $12 spent at any eligible wholesale clubs , membership-based retailers and alcohol retailers *

- Plus, 1 Mile for every $12 that you spend with your credit card everywhere else*

- Plus, you now have the flexibility to move your Miles between Cash and Dream with our new Transfer Miles feature, so if you want to turn your Cash Miles into a dream vacation, go for it!

- Enjoy a 7¢/L discount on Shell V-Power®± premium fuel and 2¢/L on all other Shell fuel every time you fuel up!

- Use fewer miles with our exclusive 25% discount on an AIR MILES flight to any destination during the calendar year*.

- Complimentary membership in Mastercard Travel Pass provided by DragonPass .*

- Get valuable benefits and offers for digital everyday services from a variety of on-demand apps and subscription services

- Unlock Mastercard Travel Rewards cashback offers when you travel and shop outside of Canada

- Access over 1 million Wi-Fi hotspots around the world – all at no added cost, and no added fees or roaming charges*

Card Awards

Fees & conditions.

Per dollar of purchases

Travel Insurance

There may be a daily maximum amount depending on the type of fees paid

Other Insurance

With this exclusive offer for the BMO® AIR MILES® World Elite Mastercard®*, you can earn 3,000 miles after $3,000 in purchases , representing a cash value of $315 .

Get 25¢ per liter off your next eight fill-ups (maximum 50 L) at Shell, plus automatic rebates of 7¢ per liter on Shell V-Power® NiTRO+ premium fuel or 2¢ per liter on other types of fuel. These savings can amount to as much as $128 in fuel .

Besides, the annual fee is waived in the first year!

With this card, you earn 3 miles for every $12 spent at participating AIR MILES Partners. Then, earn 2 miles for every $12 in purchases at any eligible grocery store and wholesale club (warehouse like Costco) or alcohol retailer (SAQ, LCBO, etc.). Everywhere else, you’ll earn 1 AIR MILES mile for every $12 in purchases , including Walmart.

And it’s the only AIR MILES credit card in Canada to offer a 25% discount on one worldwide AIR MILES flight redemption during the calendar year

The BMO® AIR MILES® World Elite®* Mastercard®* card also offers:

- 7 ¢/L discount on Shell V-Power fuel and 2 ¢/L discount on all other Shell fuels

- Excellent insurance for your travels and purchases

- 2X miles for car rentals with National or Alamo

- Best BMO Credit Cards - Bank of Montreal - September 2024

- Best AIR MILES Credit Cards - September 2024

- Canada's Best Credit Card Offers - August 2024

Frequently Asked Questions

How can i take advantage of the bmo® air miles® world elite®* mastercard®* welcome offer.

Take advantage of an exceptional welcome offer: earn 3,000 AIR MILES Bonus Miles and get the first year’s $120 annual fee waived. To get this, you’ll need to spend $3,000 in the first three months after joining.

How many miles does the BMO® AIR MILES® World Elite®* Mastercard®* earn at AIR MILES partners?

Earn 3x miles for every $12 in purchases at participating AIR MILES partners like Shell.

How are miles earned on grocery store purchases with the BMO® AIR MILES® World Elite Mastercard®*?

Earn 2x miles for every $12 in purchases at any eligible grocery store, wholesale club (like Costco) and alcohol retailer*.

How to use the exclusive 25% discount on an AIR MILES flight with the BMO® AIR MILES® World Elite Mastercard®*?

Use fewer miles with our exclusive 25% discount on an AIR MILES flight to any destination during the calendar year.

What are the digital benefits of the BMO® AIR MILES® World Elite Mastercard®*?

Take advantage of the valuable benefits and attractive offers of current digital services provided by various on-demand applications and subscription services.

How do I access World Access Points with my BMO® AIR MILES® World Elite Mastercard®*?

Access over a million hotspots worldwide at no extra cost and with no roaming charges. To do this, you must register your Mastercard on the Boingo website .

What is the free Mastercard Travel Pass membership provided by DragonPass with the BMO® AIR MILES® World Elite Mastercard®*?

Benefit from a free Mastercard Travel Pass membership supplied by DragonPass with your card. Please read our article for more information on DragonPass .

How does travel insurance work with the BMO® AIR MILES® World Elite Mastercard®*?

Take advantage of BMO AIR MILES World Elite travel insurance for peace of mind and security.

How can I receive offers when I travel with the BMO® AIR MILES® World Elite Mastercard®*?

Store, dine and relax with our partners to receive exclusive offers when you travel and pay with your BMO World Elite Mastercard outside Canada.

What rewards does the BMO® AIR MILES® World Elite Mastercard®* offer?

Explore a world of rewards with the card, earning miles on every purchase and enjoying exclusive discounts on AIR MILES flights.

What are the annual fees for the BMO® AIR MILES® World Elite Mastercard®*?

The annual fee is $120, but it’s waived for the first year to save you even more.

What are the income requirements for the BMO® AIR MILES® World Elite Mastercard®*?

A personal income of $80,000 or a household income of $150,000 is required to apply for the card.

If you don’t have this income level, you may want to consider the BMO® AIR MILES® Mastercard®* .

How do foreign currency conversion fees work with the BMO® AIR MILES® World Elite®* Mastercard?

Foreign currency conversion charges are 2.5% for each international transaction.

What is the interest rate on BMO® AIR MILES® World Elite®* Mastercard®* purchases?

The interest rate applicable to purchases is 20.99%.

How is interest calculated on cash advances with the BMO® AIR MILES® World Elite®* Mastercard?

Cash advances are subject to an interest rate of 23.99%.

What is the balance transfer policy of the BMO® AIR MILES® World Elite Mastercard®*?

The balance transfer is subject to an interest rate of 23.99%.

What are the fees for an additional BMO® AIR MILES® World Elite®* Mastercard®*?

The first additional card is $50, and the other additional cards are also $50 each.

How can I use my AIR MILES Reward Miles earned with the BMO® AIR MILES® World Elite Mastercard®*?

Use your miles to travel, shop or enjoy exclusive rewards with AIR MILES partners.

How can I contact BMO® AIR MILES® World Elite Mastercard®* customer service?

If you have any questions or require assistance, please contact BMO AIR MILES® World Elite Mastercard®* Customer Service at 1-800-263-2263.

Alternative Cards

*Terms and conditions apply

BMO is not responsible for maintaining the content on this site. Please click on the Apply now link for the most up to date information

This browser is not supported. Please use another browser to view this site.

- All Save & Spending

- Best credit cards

- Best rewards cards

- Best travel cards

- Best cash back cards

- Best low interest cards

- Best balance transfer cards

- Newcomers to Canada

- All Investing

- ETF finder tool

- Best crypto

- Couch potato

- Fixed rates

- Variable rates

- Mortgage calculator

- Income property

- Renovations + maintenance

- All Insurance

- All Personal Finance

- Finance basics

- Compound interest calculator

- Household finances

- All Resources + Guides

- Find a Qualified Advisor

- Monthly budget template

- ETF Finder Tool

- Student money

- First-time home buyers

- Guide For New Immigrants

- Best dividend stocks

- Best online brokers

- Where to buy real estate

- Best robo-advisors

- All Columns

- Making sense of the markets

Ask a Planner

- A Rich Life

- Interviews + profiles

- Retired Money

Advertisement

By Winston Sih on May 14, 2021 Estimated reading time: 5 minutes

BMO Air Miles World Elite Mastercard Review

Savvy Air Miles collectors know they can boost their earn rate by using the right credit card—and with its wide selection of partners and recently enhanced redemption options, this is one of the best.

One of the largest travel rewards programs in Canada, Air Miles is affiliated with a wide variety of everyday retail partners, from grocery stores and gas stations, to liquor stores and travel outlets, where members earn points on their purchases. Savvy collectors know they can boost their earn rate by using the right credit card—and with its wide selection of partners and recently enhanced redemption options, the BMO Air Miles World Elite Mastercard is one of the best Air Miles credit cards in Canada, made even better with an annual fee rebate if you have the BMO Premium chequing account. Rounded out with travel insurance benefits, and purchase protection, this BMO credit card gives other premium travel rewards credit cards a run for their money.

BMO Air Miles World Elite Mastercard quick facts

6 things to know about the bmo air miles world elite mastercard, you can earn air miles at an accelerated rate.

If you already shop at Air Miles-affiliated retailers, it’s easy to accelerate your earn rate. The card features a flat earn rate of 1 Mile for every $12 spent anywhere. Additionally, if you scan your Air Miles Collector Card (either the physical or digital wallet card), you can earn three times the rewards at Air Miles partners and two times at eligible grocery stores.

There’s a generous sign-up bonus

A welcome bonus that allows you to earn up to 3,000 Bonus Miles, plus save 25c/L at Shell on 8 fill-ups, on top of automatic savings of 7c/L on Shell V-Power® NiTRO+ fuel or 2c/L on all other fuel. That's up to 32c/L for a limited time only! The bonus miles are nearly enough for a free flight almost anywhere in North America—makes this one of the best Air Miles credit cards in Canada .

In addition, the card’s $120 annual fee is waived for your first year. (The waiver will continue if you have a BMO Premium chequing account, which offers an annual credit card rebate of up to $150 on a card of your choice.)

Flight discounts in North America

BMO Air Miles World Elite Mastercard cardholders can take advantage of a 15% discount when booking flights within North America using their Air Miles Reward Miles.

Additionally, there are no blackout periods—a big plus that isn’t offered by competing cards like those in the Aeroplan portfolio. Plus, you get an exclusive 25% discount on one worldwide Air Miles flight redemption during the calendar year.

It comes with great travel insurance

As this card is part of the World Elite Mastercard portfolio, you’ll find a robust travel insurance offering from $5 million in travel medical emergency coverage on an unlimited number of annual trips to trip cancellation, interruption, delay, lost and delayed baggage insurance. If you’re renting a car, the card’s coverage of vehicles up to $65,000 protects drivers against collision, loss, and damage.

It’s a Mastercard, so it’s widely accepted

BMO’s credit cards are widely accepted around the world on the Mastercard network and, for added versatility, you can use your card through digital wallets like Apple Pay, as well.

If you like to shop at No Frills and Costco stores, you’ll be pleased to note that you can make purchases on your BMO Air Miles World Elite Mastercard to earn Miles with those retailers, neither of which accepts Visa or American Express cards. And it comes with a complimentary membership in Mastercard Travel Pass provided by DragonPass.

How do I redeem my Air Miles?

Air Miles users can decide how they want to earn their rewards for future redemption: either through Air Miles Cash Miles for redemption on everyday purchases; Air Miles Dream Miles for travel; or a combination of the two. Through the Air Miles’ app, simply how you’d like to split your Miles, by percentage, and they will be divided accordingly as you earn. Make sure you carry both your Air Miles credit card and Collector Card (or load them on your mobile wallet) to ensure you’re earning twice at affiliated partners.

Air Miles Cash Miles can be redeemed at 95 Miles to a $10 voucher for use at participating retailers like Sobeys, Metro grocery stores, Shell gas stations, and Staples Canada, while Air Miles Dream Miles are allocated for travel redemption, including flights, hotels, and vacation packages. These are booked through the Air Miles travel portal, where the number of Miles required vary from distance to time of year. This easy-to-use tool allows you to preview destination options based on number of Miles to be redeemed, along with low- and high-season fluctuations.

Air Miles members must pay additional taxes and surcharges on travel redemptions, and these costs cannot generally be covered with Air Miles.

Are there any drawbacks to the BMO Air Miles World Elite?

While the Air Miles program has a wide spectrum of retail partners, the redemption system can be harder to navigate and isn’t as straightforward than other bank-run cards. Competitor cards like the Scotiabank Gold American Express and BMO World Elite Mastercard offer earn accelerators in bonus categories like travel, dining, and entertainment, and do allow users to cover the cost of travel taxes and fees by redeeming points.

While the card’s benefits represent incredible value, there are similar credit cards with airport lounge access out there that offer four free visits per year.

What does the * mean?

Affiliate (monetized) links can sometimes result in a payment to MoneySense (owned by Ratehub Inc.), which helps our website stay free to our users. If a link has an asterisk (*) or is labelled as “Featured,” it is an affiliate link. If a link is labelled as “Sponsored,” it is a paid placement, which may or may not have an affiliate link. Our editorial content will never be influenced by these links. We are committed to looking at all available products in the market. Where a product ranks in our article, and whether or not it’s included in the first place, is never driven by compensation. For more details, read our MoneySense Monetization policy .

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

Comments Cancel reply

Your email address will not be published. Required fields are marked *

You can not book the flights that you want, only the flights available on their site. I tried to book klam without stops montreal amsterdam, no problem with klm but impossible with rewards, only with stops in france, and that is no option for me because of the covid, will change cards soon.

This has changed now! Airmiles revamped their program and you can now find the same flights you can buy with cash on any operator between any city. So you may want to have another look at AirMiles

Related Articles

Credit Cards

“I’m interested in visiting Europe”: How this student can build a credit score while earning valuable travel rewards

We pick two credit cards that could be the perfect match for a student with modest income and big...

Canada’s inflation rate falls to 2%, paving way for another interest rate cut

Canada’s inflation rate hits 2% target, reaches lowest level in more than three years.

Why is rent so expensive in Canada?

Rent is expensive in Canada. What’s contributing to high and ever-increasing rent prices? Find out and see how you...

10 common crypto scams and how to avoid them

Crypto scams are rising in Canada. Learn about the most prevalent schemes and how to protect yourself.

New mortgage changes for 2024: Wider access to 30-year mortgages and more

Liberals announce expansion to mortgage eligibility, draft rights for renters, buyers.

Borrowing from your HELOC to invest in equities

You can use a HELOC for leveraged investing. But what happens if you sell your home and want to...

Guide to inflation: Price changes, the pandemic and your pocketbook

This guide will help you understand what inflation is, how it's calculated, and what it means for your personal...

Common questions from newcomers about working in Canada

Sponsored By

National Bank of Canada

Making sense of the markets this week: September 15, 2024

Inflation’s down, a nuclear-powered Oracle rises, Empire and Dollarama thrive, and the S&P 500 welcomes new family members.

The best credit cards for airport lounge access in Canada for 2024

If you want to make your travels a little more comfortable, airport lounge access is key. Here are the...

BMO Air Miles World Elite Mastercard Review for 2023

By Heidi Unrau | Published on 10 Aug 2023

There are Air Miles, and then there are World Elite Air Miles. The BMO Air Miles World Elite Mastercard has one of the best Air Miles earn rates of all the credit cards in Canada and offers all the exclusive VIP travel perks you’d expect from an elite credit card. This card offers great flexibility to those who love to travel and shop. Additional perks and benefits ensure all your bases are covered whether your shopping, travelling, or both.

Annual Fee: $120, waived the first year

Welcome Offer: 2,000 bonus Air Miles when you spend $3,000 in the first 3 months

Interest Rates: 20.99%, Cash advances 23.99%, Quebec Residents 21.99%

Air Miles Earn Rate: 1 mile for every $12 spent on every card purchase

Additional Card: $50

Min. Income Required: $80,000 annual personal income or $150,000 annual household income

BMO Air Miles World Elite Mastercard Welcome Offer

Travel credit card lovers are welcomed to BMO with up to 2,000 bonus Air Miles when you sign up and spend $3,000 in the first 3 months. They’ll also waive the annual fee of $120 for your first year. New and returning cardholders also get a special offer for Apple Music.

Elite Travel Benefits at a Glance

The BMO Air Miles World Elite Mastercard is loaded with travel perks and benefits, and with bmorewards.com you can easily cash out your rewards or book and redeem travel, anytime, anywhere without restrictions. You can also book discount flights, hotels, and rental cars, or even plan your entire vacation from the website. Other travel benefits include, but are not limited to:

- Earn a 15% flight discount on all AIR MILES flights in North America with no blackout periods

- Earn 2X the reward miles at National Car Rental

- Complimentary MasterCard Airport Experiences with access to over 850 VIP lounges

- Two annual complementary LoungeKey passes

- Earn up to a 25% discount at participating National Car Rental and Alamo Car Rental locations

- Free trip cancellation insurance

- Free purchase protection against theft or damage for 90 days

Earning Air Miles at a Glance

BMO offers one of the largest loyalty programs in Canada, and that means you earn more miles on everyday purchases at national retailers such as Costco, Staples, Transat, and Shell. You can also earn miles at participating grocery stores. Here’s the numbers on your Air Miles rewards:

- Earn 1 mile for every $12 in credit card purchases

- Earn 3x the miles when you use your card at participating Air Miles partners

- Earn additional Air Miles for purchases charged to Supplementary Cards.

- Earn more Air Miles when retailers run Mega Miles promotions

- Double dip Air Miles rewards when you use your BMO Air Miles World Elite Mastercard and show your Air Miles membership card

Air Miles Reward Flexibility

The Air Miles program is one of Canada’s biggest and most loved rewards programs. Not only does the BMO Air Miles World Elite Mastercard help you earn them faster, Air Miles can be redeem in different ways based on your preferences. If you’re an avid traveler, you’ll want to focus on earning Dream Miles that can be redeemed for travel expenses like flights, hotels, car rentals as well as merchandise and gift cards. If you’re less into travel and more into free stuff and discounts, you’ll want to focus on earning Cash Miles that can be used for in-store purchases at Air Miles partner retailers, as well as travel.

Be careful though, when a reward is earned in one category, like Dream Miles, you can’t transfer it to the other category, like Cash Miles. When you get your BMO Air Miles World Elite Mastercard , make sure you also set up an Air Miles account on the airmiles.ca website. There, you can choose how you earn miles in each category, like splitting them equally or something like 75% to one category and 25% to the other. You have a lot of flexibility to decide what’s more important to you here: discount travel, or discount stuff. Keep in mind that Dream Miles have a higher conversion value when you redeem them to book flights and eligible travel expenses.

Additional Travel Perks of the BMO Air Miles World Elite Mastercard

BMO Air Miles World Elite Mastercard offers travel insurance and medical protection insurance on bookings are made with the card. Customers under 65 will automatically get emergency medical protection up to $2 million when they travel of the province or country for 15 days. You’ll also get a Collision Damage Waiver when you rent a car with your BMO Air Miles World Elite Mastercard . You’ll also get access to Trip Assistance Services like emergency cash transfers, lost document and ticket replacement, help with lost luggage, and pre-trip information.

Additional travel benefits include trip cancellation, interruption, and delay coverage, benefits for delayed or lost baggage, coverage for damage to qualified personal effects from theft or damage to your rental car, legal assistance, and more.

When you book flights with your BMO Air Miles World Elite Mastercard you’ll get a complimentary Mastercard Airport Experiences membership provided by LoungeKey, which gives you access to air port lounges. You’ll also get a complimentary Boingo account giving you free access to over a million Wi-Fi Hotspots around the world.

BMO Air Miles World Elite Mastercard also offers cardholders exclusive cash back offers when they shop with partners around the world. You’ll continue to earn Air Miles rewards anywhere in the world when you use your card to shop, dine, and unwind with their partner merchants while travelling abroad.

New BMO Air Miles World Elite Mastercard customers get will get Apple Music free for the first 4 months. Return customers will get 3 months free, but current cardholders are not eligible for this offer. Apple Music gives you access to 90 million songs that you can listen to across all your devices.

Available Add-ons for your BMO Air Miles World Elite Mastercard

Customize the card to fit your needs. The BMO Air Miles World Elite Mastercard offer a la carte add-on’s to added security and to help you get the most of your card. There are 4 additional features you can add to your card, each for a monthly subscription fee:

- Credit Alert costs $19.99 a month to help protect you against identity theft and fraud. You’ll get quarterly credit report summaries, an update credit score every month, alerts when there is activity on your report, and additional support.

- BMO Roadside Assistance is $69 per year for the basic package or $98 per year for the enhanced package. You’ll get access to free emergency calls and tow truck services anywhere in North America for non-commercial passenger cars.

- InfoProtector360 is $9.99 and protects all your personal information and important documents whether you’re home or traveling abroad. Lost Wallet Protection will cancel all your cards and offer identity fraud support. Information Protection backs up your important personal information and documents so they can be accessed from anywhere in the event of an emergency. It also monitors and sends alerts if your information is being used in the public domain. Travel Protection provides resources and alerts about your travel destinations.

- Balance Protection costs $1 per $100 of your credit card balance. Covers your balance up to $20,000 and protects your credit in the event you are unable to work from a job loss, disability, or death.

Digital Features and Security

Use the BMO mobile app to have full control over your BMO Air Miles World Elite Mastercard . From the app, you can report your card lost or stolen, lock it, unlock it, and even reset your Personal Identification Number (PIN). Keep track of your spending, balance, dispute a transaction, and even get 24/7 access to your credit score through CreditView.

The BMO Air Miles World Elite Mastercard offers zero liability protection if you suffer a monetary loss from the unauthorized use of your card. Online purchases include an identity check. You’ll also get alerts on suspicious activity and large purchases.

BMO Air Miles World Elite Mastercard Rating

Benefits and perks.

- 15% flight discount when you book with Air Miles

- Air Miles can book any flight(s) in North America with no blackout periods

- Air Miles high conversion rate when redeemed for flights

- Earn 2X the rewards at select car rental companies

- Earn 3X the rewards at Air Miles partner retailer

- Double dip rewards with BMO Air Miles World Elite Mastercard and your Air Miles membership card

- Stack Air Miles rewards with Mega Miles events

- Earn additional AIR MILES points for purchases charged to Supplementary Cards

- Free 24/7 BMO Concierge Service

- 2 Complimentary Lounge Passes

- 12 other insurance coverage benefits and protections

- Discounts and exclusive offers on dining & entertainment

- Access to over 1 million Wi-Fi hotspots around the world

- Apple Music free for 4 months

- App with self-serve security features

- Customize card to your needs with optional add-ons

Heidi Unrau

BMO AIR MILES ®† World Elite ® * Mastercard ® * review

Welcome Offer Ends Nov 30, 2024

Limited time offer: Get 3,000 AIR MILES Bonus Miles! * That's enough for $310 towards purchases with AIR MILES Cash!* Plus, get the $120 annual fee waived for your first anniversary

- Rates & Fees

Eligibility

3x Cardholders earn an accelerated 3x the Miles per $12 spent at participating AIR MILES partners*

2x the Miles for every $12 spent at any eligible grocery store*

1x Earn 1 Mile for every $12 in credit card purchases, everywhere you spend*

25% Get a 25% discount on one worldwide AIR MILES flight redemption during the calendar year*

20.99% Purchase APR

23.99% Balance Transfer Rate

23.99% Cash Advance APR 21.99% for Quebec residents

$120 Annual Fee $50 for a supplementary card

Excellent Recommended Credit Score

$80,000 Required Annual Personal Income

$150,000 Required Annual Household Income

By Barry Choi

- Best BMO credit cards

- BMO CashBack® World Elite®* Mastercard®*

- BMO CashBack® Mastercard®*

- BMO eclipse Visa Infinite* Card

- Best travel credit cards in Canada

- BMO AIR MILES®† Mastercard®*

- TD® Aeroplan® Visa Infinite* Card

- Rogers™ World Elite® Mastercard®

- Best Mastercard credit cards in Canada

- PC® World Elite Mastercard®

- HSBC World Elite® Mastercard® review

- Capital One® Guaranteed Mastercard review

Quick overview of BMO AIR MILES World Elite Mastercard

Canadians have a love/hate relationship with AIR MILES. The loyalty program is one of the oldest out there and has a huge following, but some Canadians have found it difficult to make redemptions over the years. That being said, AIR MILES has made recent improvements to the program and new changes to the BMO AIR MILES ®† World Elite ® * Mastercard ® * will have many travellers taking a second look at the card.

Who’s the BMO AIR MILES World Elite Mastercard for?

If you’re a frequent traveler who collects AIR MILES, this card is a great option for you as you can get closer to redeeming a free flight faster. The nice thing about AIR MILES is that participants have the ability to earn miles at many national Canadian retailers such as Shell, Children’s Place, Staples, Alamo and Transat. AIR MILES can also be collected at some regional grocery stores. When you pay with your BMO AIR MILES®† World Elite®* MasterCard®*, you earn additional miles so you’re able to ‘double dip.’ In our estimation the BMO AIR MILES®† World Elite®* MasterCard®* is the best AIR MILES credit card on the market.

Pros and cons

Offers the largest Air Miles sign-up bonus on the market with a waived annual fee for the first anniversary*

High earn rates of up to 3x the Miles on eligible purchases

Exclusive travel discounts like 25% off one worldwide AIR MILES flight redemption annually

Airport lounge access through complimentary Mastercard Travel Pass membership

Comprehensive insurance package which covers medical, trip, flight delay, lost luggage and more

Additional Perks include Boingo Wi-Fi, BMO Concierge, digital subscriptions, and cash back promotions

An $80,000 personal/$150,000 household income is needed to qualify

Ideal for AIR MILES loyalists, may not suit those with a casual approach

The fixed redemption value for flights may not appeal to everyone

Optimal value only when frequently shopping at AIR MILES partners

BMO AIR MILES World Elite Mastercard welcome bonus

Get 3,000 AIR MILES Bonus Miles! * That's enough for $310 towards purchases with AIR MILES Cash!* Plus, get the $120 annual fee waived for your first anniversary

How to earn AIR MILES with the BMO AIR MILES World Elite Mastercard

With the BMO AIR MILES ®† World Elite ® * MasterCard ® *, cardholders earn an accelerated 3.00x the Miles for every $12 spent at participating AIR MILES Partners and 2.00x the Miles for every $12 spent at any eligible grocery store*, 2.00x the Miles for every $12 spent at any eligible wholesale clubs, membership-based retailers and alcohol retailers* and 1.00 Mile for every $12 that you spend with your credit card everywhere else*. Other AIR MILES Mastercards on the market only generate around a single mile per $15 or $20 spent at all merchants, so you’re getting the best bang for your buck with the BMO AIR MILES ®† World Elite ® * MasterCard ® *.

As an added bonus, you get an exclusive 25.00% discount on one worldwide AIR MILES flight redemption during the calendar year.*

How to redeem AIR MILES with the BMO AIR MILES World Elite Mastercard

You can use your AIR MILES and redeem them for flights to your dream destination. The amount of AIR MILES needed will depend on the destination you're flying to. You can also convert AIR MILES to Cash Miles. 95 Cash Miles= $10, which can be used towards your purchases at participating AIR MILES partner locations. Learn more about redeeming AIR MILES .

Plus, you now have the flexibility to move your Miles between Cash and Dream with the new Transfer Miles feature, so if you want to turn your Cash Miles into a dream vacation, go for it!

BMO AIR MILES World Elite Mastercard key benefits

Here are the notable key benefits that come with this card:

- Complimentary membership in Mastercard Travel Pass provided by DragonPass*

- Complimentary access to 1M Boingo Wi-Fi hotspots around the world*

- Access to BMO Concierge Service

- Enjoy a 7¢/L discount on Shell V-Power®± premium fuel and 2¢/L on all other Shell fuel every time you fuel up

BMO AIR MILES World Elite Mastercard insurance coverage

One of the most underrated features of the card is the BMO AIR MILES World Elite Travel and Medical Protection*, a comprehensive travel insurance package, which includes:

- Emergency travel medical insurance*

- Trip cancellation*

- Trip interruption/trip delay*

- Flight delay insurance*

- Lost, delayed, or stole luggage insurance*

- Rental car collision/loss damage insurance*

- Travel accident insurance*

With emergency travel medical insurance, cardholders under the age of 65 are automatically covered for 15 days. Those 65 or older will need to purchase a separate travel insurance policy.

Keep in mind that you need to charge the full amount of your trip (usually just the flights and car rental) to your BMO AIR MILES ®† World Elite ® * MasterCard ® * to qualify for all the additional insurance. The included travel insurance package does not include hotel/motel burglary insurance, but overall, it’s competitive with some of the top travel insurance credit cards in Canada .

What people have to say about this card

I have the BMO Airmiles MC World Elite card. It’s okay, you just get double the air miles, but the amount of air miles you get is so little if you don’t use air mile offer smarter...I use it primarily for buying gas from shell /u/cm0011

As Reddit user, cm0011 shows, if you don't really use your AIR MILES smartly, the card's rewards program may seem lack lustre to you. If you're looking for a more flexible credit card rewards program, see how the card compares to its competitors below.

How BMO AIR MILES World Elite Mastercard compares

Before you finalize your credit card, see how the BMO AIR MILES World Elite Mastercard fares against other great credit cards on the Canadian market.

American Express Cobalt® Card

Earn up to 15,000 Membership Rewards® points

High earn rates (up to 5% return on spending!)

Flexible month-by-month fee structure

Free supplementary cards

1:1 points transfer with selected hotels, airlines and frequent flyer programs

Accelerated earn rates only apply to purchases in Canada (not to purchases made abroad)

Amex has a more limited merchant acceptance rate than Visa and Mastercard

Slightly higher than average annual fee

Recommended Credit Score

Required Annual Personal Income

Required Annual Household Income

Earn 5 times the points on eligible eats and drinks in Canada, including groceries and food delivery. Spend cap applies.

Earn 3 times the points on eligible streaming subscriptions in Canada.

Get 2 times the points on eligible ride shares, transit & gas in Canada.

Earn 1 additional point on eligible hotel and car rental bookings via American Express Travel Online

Earn 1 point for every $1 in Card purchases everywhere else

Get up to $100 USD hotel credit to use on amenities when charged to the room for a stay of 2 or more consecutive nights through The Hotel Collection from American Express Travel.

Purchase APR on purchases

Cash Advance APR

Annual Fee 12.99/month

Foreign Transaction Fee 2.5% of the transaction in CDN

Purchase APR

Foreign Transaction Fee

BMO AIR MILES World Elite Mastercard vs. American Express Cobalt Card

While both the BMO AIR MILES®† World Elite®* Mastercard®* and the American Express Cobalt are good choices for earning travel rewards, the Amex Cobalt stands out for its flexibility. The American Express Cobalt offers accelerated points accumulation across multiple categories like dining, groceries, transportation and travel, making it particularly beneficial for everyday spending. Additionally, the Amex Cobalt's redemption program provides greater flexibility; points can be transferred to various airlines partners or used for gift cards, statement credit, or merchandise. The eligibility criteria for the Amex Cobalt are also lower when compared to the BMO AIR MILES®† World Elite®* Mastercard®*. As far as additional perks go, the BMO AIR MILES®† World Elite®* Mastercard®* comes out on top as it offers lounge access and has a higher card acceptance rate than American Express.

Scotiabank Passport® Visa Infinite* Card

up to 35K pts

Earn up to $1,100* in value in the first 12 months, including up to 35,000 bonus Scene+ points

Nov 1, 2024

No FX fees means the card saves you significant expenses on foreign transaction fees

Earn up to 3x Scene+ points per $1 spent on eligible purchases

Flexible and straightforward redemption program

Visa acceptance globally compared to American Express, especially outside major cities.

Enjoy six annual visits to airport lounges

Robust insurance offerings, including extended travel emergency medical coverage

Access to Visa Infinite Program benefits, with added advantages like a free supplementary card

High annual fee

Limited rewards categories for earning reward max rate on purchases

Primarily best for travel within Canada

Scene+ points¹ on every $1 you spend at Sobeys, Safeway, IGA, Foodland and participating Co-ops and more

Scene+ points¹ for every $1 you spend on other eligible grocery stores, dining, eligible entertainment purchases and eligible daily transit options (including ride shares, buses, subways, taxis and more)

Scene+ point for every $1 spent on all other eligible everyday purchases

Balance Transfer Rate

Annual Fee First supplementary Card is $0/year ($50/year on each additional Card)

BMO AIR MILES World Elite Mastercard vs. Scotiabank Passport Visa Infinite

Let's compare the BMO AIR MILES®† World Elite®* Mastercard®* with the Scotiabank Passport Visa Infinite card . Both cards come with an annual fee, with Scotiabank's Passport Visa Infinite being pricier at $150.00 annually. When evaluating rewards programs, Scotia's SCENE+ offers greater flexibility in redemption options. You can utilize your points for instant statement credit, travel credit, free movie tickets, gift cards and merchandise. Moreover, SCENE+ points grant discounts at partners like Swiss Chalet. Both cards provide lounge access, yet with the BMO AIR MILES®† World Elite®* Mastercard®*, complimentary DragonPass network lounge membership requires a paid admission of $32 USD per person, while the Passport Infinite offers 6 free lounge visits per year under Visa Airport Companion. The standout feature of the Scotia Visa Passport Infinite card is its absence of foreign transaction fees, a significant boon for frequent travelers.

BMO AIR MILES World Elite Mastercard vs. BMO Eclipse Visa Infinite

If you're looking to maximize your everyday spending, then the BMO Eclipse Visa Infinite credit card is a better option as you can earn points at a faster rate. You also have the flexibility of redeeming your BMO rewards points for travel rewards, gift cards, merchandise, statement credit, or BMO investments. For someone who is an avid traveler, the BMO AIR MILES®† World Elite®* Mastercard®* may be more suitable due to its better travel insurance coverage and travel perks.

Is it worth it?

There’s no denying that the sign-up bonus of Air Miles and the first anniversary* annual fee waiver make this an appealing card, but who is the card best suited for in the long run?

Those loyal to Air Miles should not hesitate to sign up for the card, since they’ll get the highest earn rate of any Air Miles Mastercard out there. And if you happen to shop often at Air Miles partners you’ll get even greater value, as you can double dip on the points.

If you happen to fly often within a province, this card may also appeal to you since those flights are usually expensive if you’re paying out of pocket. With Air Miles, those same flights have a fixed redemption value, so it can work out in your favour.

On the other hand, if you view Air Miles as a secondary loyalty program that you only collect casually, you’re likely better off applying for a credit card where you can earn points in your preferred loyalty program .

BMO AIR MILES World Elite Mastercard eligibility criteria

To qualify for the BMO AIR MILES®† World Elite®* Mastercard®*, you must have an excellent credit score and a minimum of $80000.00in annual personal income or $150000.00in total household annual income.

*Terms and conditions apply

BMO is not responsible for maintaining the content on this site. Please click on the Apply now link for the most up to date information.

Barry Choi is a Toronto-based personal finance and travel expert who makes frequent media appearances. When he's not educating people on how to be smarter with money, he's earning and burning miles and points for luxury travel.

Compare other BMO credit cards

Compare other travel credit cards, compare other mastercard credit cards, latest articles, cheapest province to live in canada, robert kiyosaki's advice on alternative investment, grant cordone: quit saving, start investing, warren buffett's preference for index funds, warren buffett is buying a canadian p&c firm, impact on microsoft stock with new union vote.

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

BMO AIR MILES ® † World Elite ® * MasterCard ® *

Summary of flytrippers' review, why get this card.

- Excellent welcome bonus of ≈ $475 (≈ $367 in Miles and ≈ $108 in fuel discounts)

- The highest AIR MILES welcome bonus seen in a long time

- Rewards of the more simple type that can be used for almost any travel expense

- Annual 25% discount on AIR MILES reward flight and AIR MILES Onyx elite status

- Excellent insurance coverage

WHO SHOULD GET THIS CARD

- Those who want rewards that are more simple and can be applied to almost any travel

- Those with a higher income

- Those who can reach minimum spend of $3,000 in 3 months

How to learn more

- Go to our editorial card review page (coming soon)

- Keep scrolling here for all the details

- Apply now via CIBC secure link

- See all the best credit cards in Canada

All card details

Offer structure (2 separate bonuses)

- 3,000 Miles Bonus after spending $3,000 (in a maximum of 3 months)

- 25¢/L off fuel Discount on 8 fill-ups of maximum 50L from November 1, 2024 to January 31, 2025 (in addition to the regular 2¢/L discount with this card)

3,000 Miles + Fuel discount Total with the welcome bonus

‣ Apply for the BMO AIR MILES World Elite MasterCard

Total rewards by unlocking the welcome bonus

- 3,000 Miles Welcome bonus (Miles)

- ≈ $108 Fuel discount

- 375 Miles Estimated earn on the $3,000 minimum spending requirement (50% at multiplier earn rate of 2 pts/$12 and 50% at base earn rate of 1 pt/$12)

- 123 Miles Estimated earn on the 8 fuel fill-ups of 50L (conservative pre-discount price of $1.50/L at multiplier earn rate of 3 pts/$12)

3,498 Miles + ≈ $108 fuel discount Welcome bonus + Earn on the minimum spending requirement to unlock the welcome bonus

Net value (at our Flytrippers Valuation of 10.5¢/pt)

- ≈ $315 Bonus after min. spending (3,000 pts)

- ≈ $39 Earn on the required spending (375 pts)

- ≈ $108 Fuel discount (27¢/L on 400L)

- –$0 Card fee (first-year annual fee rebated)

≈ $475 Total net value by unlocking the welcome bonus

‣ Details about our Flytrippers Valuation of welcome bonuses

Effective return rate

≈ 13.6% Return on the minimum spending requirement of $3,000 in 3 months and ≈ $492 in fuel spending

‣ Details about effective return rates (coming soon)

Rewards acquisition summary

≈ $475 Rewards you get for $0 in fees paid

Value of redemption options (welcome bonus)

For each available redemption option, here is the value of the 3,498 AIR MILES Miles you get by unlocking the welcome bonus:

- ≈ $367 to ≈ $420: Any trips on the AIR MILES website

- $367: Merchandise at participating stores

- ≈ $280: Merchandise online

‣ Details about the AIR MILES program (coming soon)

Value of redemption options (per point)

For each available redemption option, here is the value per AIR MILES Mile to help you understand:

- ≈ 10.5¢ to ≈ 12¢: Any trips on the AIR MILES website

- 10.5¢: Merchandise at participating stores

- ≈ 8¢: Merchandise online

‣ Details of the value per point

For each available redemption option, here is the value of the 3,375 AIR MILES Miles you get by unlocking the welcome bonus:

- ≈ $354 to ≈ $405: Any trips on the AIR MILES website

- $354: Merchandise at participating stores

- ≈ $270: Merchandise online

25% discount on a Miles redemption for flights You get 25% off a flight booking every calendar year (so 2 in your first year with the card). It is capped at a 750 Miles discount (flight costing 3,000 Miles).

‣ Details about the BMO AIR MILES discount (coming soon)

Automatic AIR MILES Onyx elite status You get a few benefits like unlimited transfers between Cash Miles and Dream Miles, bonus points on travel, and more.

‣ Details about the AIR MILES elite status benefit (coming soon)

Up to 7¢/L off fuel at Shell You save 2¢/L on fuel at Shell or even 7¢/L on Shell V-Power NiTRO+ fuel.

‣ Details about the BMO Shell benefit (coming soon)

Free global access to Boingo Wi-Fi You can access over 1 million Wi-Fi hotspots worldwide through the Boingo program, including on 1300 aircraft on 26 airlines.

‣ Details about the Boingo Wi-Fi benefit

Automatic registration to the AIR MILES Card Linked Offers benefit You can take advantage of the discounts and credits of the Card Linked Offers benefit without having to register your card.

‣ Details about the AIR MILES Card Linked Offers benefit (coming soon)

Free membership in the Mastercard TravelPass network of VIP airport lounges Warning: Many cards offer free membership AND free passes; this one just gives membership and no free passes. You should avoid paying for this.

‣ Learn more about the airport lounge access

Insurance included

- Medical travel insurance for ages 64 and under (15 days; $5M)

- Trip cancelation insurance ($1500 per insured person, per trip)

- Trip interruption and delay insurance ($2000 per insured person, per trip)

- Flight delay insurance ($500, 4hr minimum)

- Baggage delay insurance ($500/person, $1000 total)

- Lost or stolen baggage insurance ($500/person, $1000 total)

- Hotel burglary insurance ($1000)

- Rental car insurance ($65k maximum MSRP)

- Extended warranty on purchases (doubled, 1 year maximum)

- Protection insurance on purchases (90 days)

‣ Details about the insurance coverage included with the card (coming soon)

Insurance not included (among the main types)

- Medical travel insurance for ages 65 and above

- Travel accident insurance

- Mobile device insurance

‣ Details about the different types of insurance coverage (coming soon)

Earn rates (and effective return at our Flytrippers Valuation)

3 Miles per $12 / 0.25 Miles per $ (≈ 2.63% ):

- AIR MILES retail partners (Shell, Global Pet Foods, Pharmasave, Timber Mart, etc.)

- AIR MILES car rental partners (Budget, National, Alamo)

2 Miles per $12 / 0.17 Miles per $ (≈ 1.75% ):

- Costco and other membership clubs

- Liquor stores

1 Mile per $12 / 0.08 Miles per $ (≈ 0.88% ):

- Everywhere else

‣ Details about credit card earn rates (coming soon)

Pooling (with additional cards) You can pool AIR MILES Miles with up to 3 additional cards (“joint” cards) added to this account. Additional cards have a fee of $50 (the first-year fee is rebated for 3 additional cards if they’re added during the application).

‣ Details about pooling rewards with additional cards (coming soon)

Pooling (with separate cards that earn AIR MILES Miles) You can pool points across your separate cards that earn AIR MILES Miles.

‣ Details about pooling AIR MILES Miles from separate cards (coming soon)

Pooling (with travel companions) You cannot pool AIR MILES Miles with travel companions. But the points are so easy to redeem that you don’t need to pool them either.

‣ Details about pooling AIR MILES Miles with travel companions (coming soon)

Expiration (if you have the card) AIR MILES Miles never expire as long as you have the BMO AIR MILES World Elite MasterCard !

‣ Details about AIR MILES Miles expiration (coming soon)