Mainly Miles

Maximise your miles.

Citi Rewards Card Review (2024)

Here’s our review of the Citi Rewards credit card issued in Singapore. It forms part of our series of credit card reviews, which are all summarised on our dedicated Credit Cards page .

Dollar amounts refer to SGD, and ‘miles’ refer to KrisFlyer Miles, except where stated. This review was updated on 20th February 2024 .

Mainly Miles Says

A $1,000 monthly cap for 4 mpd on most online spend, plus offline shopping, is the primary benefit of the Citi Rewards card, allowing you to accrue 48,000 miles per year and also tap into the bank’s extensive range of transfer partners.

Throw in $1 earning blocks and “up to five years” of points validity, 4 mpd for Amaze-linked physical transactions, plus regular Citi bonus miles offers, and it’s definitely one worth considering.

Two Versions?

The Citi Rewards card previously came in two varieties – a Visa and a Mastercard.

It was therefore possible to apply for and hold both cards (as I currently do) and enjoy double the monthly spend cap ($2,000 instead of $1,000) in the 4 mpd category.

Unfortunately the Visa card has now been discontinued, and it is only possible to apply for a new Citi Rewards Mastercard .

If you’re holding the Citi Rewards Visa card, or both cards, you’ll still be able to use the Visa card at least until it expires.

Eligibility

- Minimum Age: 21

- Minimum Income (Singaporean / PR): $30,000/yr

- Minimum Income (Non-Singaporean / PR): $42,000/yr

The Citi Rewards card has an annual income requirement of $30,000 for most applicants, an accessible entry-level threshold for Singaporeans and Permanent Residents, making it widely accessible.

Annual Fees & Interest Rates

- Annual Fee (principal): $196.20 (first year free)

- Annual Fee (supplementary): $98.10 (first year free, up to 2 cards)

The Citi Rewards card has an annual fee of $196.20 , waived for the first year. The supplementary card fee of $98.10 per card for up to two additional cards is also waived for the first year.

A third supplementary card and any further ones issued attract the $98.10 fee, even in the first year.

Most people have reported having the annual fee waived after the first year of card membership on request, though this is at Citi’s discretion and may also depend on your spending habits. Others have reported a $100 credit offered instead of the fee waiver.

Other fees and interest rates for the Citi Rewards card include:

- EIR: 27.9%

- Interest-free period: 21 days

- Minimum payment: 1% (or current balance if < $50)

- Late payment fee: $100

- Cash advance fee: 8% (minimum $15)

- Overlimit fee: $40

Full details can be found at the card’s information sheet .

Sign-up bonus

The current sign-up bonus for the Citi Rewards card is 16,800 miles , awarded as 40,000 ThankYou Points and subject to a minimum spend of only $800 in the first two full months from card approval.

The offer is valid for applications made by 30th April 2024.

All the details are available in our full article covering the deal here .

Regular earn rates

The Citi Rewards card earns:

- 0.4 mpd for every $1 of general local and overseas spend

That’s clearly not an attractive earn rate, since you should be earning at least 1.2 mpd / 1.3 mpd for general spend locally (outside bonus categories) and 2+ mpd overseas, however the big draw for this card is of course the bonus earn rate, outlined below.

You should not be using the Citi Rewards card for general spending outside the bonus categories (see entry-level general spend cards like the Citi PremierMiles , or DBS Altitude or UOB PRVI Miles for good general spend earn rates).

Bonus earn rates

- 4 mpd for every $1 spent online in eligible categories (local or overseas)

- 4 mpd for every $1 spent when you shop for shoes, bags and clothes online or in-store at retail merchants, or department stores (locally or overseas).

This excellent rate is capped at the first $1,000 spent in this category per statement cycle, so you’re limited to earning a maximum of 4,000 miles per statement month at the 4 mpd rate.

After that, further spend in the same statement month will earn the (very low) 0.4 miles per $1, though this is then unlimited.

Eligible transactions (general spend)

Citi maintains a list of merchants and / or MCC codes which will not earn Citi ThankYou Points here .

Some of the most important exclusion categories, which apply to this card whether you’re making transactions at the 0.4 mpd or what you think should be the 4 mpd rates, are:

- Education Institutions (MCC 8211 – 8299)

- Government Services, including tax payments (MCC 9000 – 9999)

- Hospitals (MCC 8062)

- Insurance (MCC 6300)

- Real Estate Agents and Managers – Rentals (MCC 6513)

- Utilities (MCC 4900)

Note that education, insurance, hospitals and tax payments are specifically excluded from miles earning.

Eligible transactions (bonus spend)

Here’s the full list of MCC codes which currently qualify for 4 mpd (10 Citi ThankYou points per dollar) both locally and overseas, including online transactions , according to the terms and conditions document :

- MCC 5311: Department Stores

- MCC 5611: Men’s and Boy’s Clothing and Accessories Stores

- MCC 5621: Women’s Ready to Wear Stores

- MCC 5631: Women’s Accessory and Specialty Stores

- MCC 5641: Children’s and Infant’s Wear Stores

- MCC 5651: Family Clothing Stores

- MCC 5655: Sports and Riding Apparel Stores

- MCC 5661: Shoe Stores

- MCC 5691: Men’s and Women’s Clothing Stores

- MCC 5699: Miscellaneous Apparel and Accessory Shops

- MCC 5948: Luggage and Leather Goods Stores

For online retail transactions outside of the above MCCs, which also qualify for 4 miles (10 Citi ThankYou points) per $1 spent both locally and overseas, there are exclusions to be aware of.

These are in-app mobile wallet transactions (e.g. using Apple Pay or Google Pay), plus the following travel-related transactions :

- MCC 3000 to 3350: Airlines, Air Carriers

- MCC 3351 to 3500: Car Rental Agencies

- MCC 3501 to 3999: Lodging – Hotels, Motels, Resorts

- MCC 4112: Passenger Railways

- MCC 4411: Cruise Lines

- MCC 4511: Airlines, Air Carriers (Not Elsewhere Classified)

- MCC 4722: Travel Agencies and Tour Operators

- MCC 5962: Direct Marketing – Travel-Related Arrangement Services

- MCC 7011: Lodging – Hotels, Motels, Resorts (Not Elsewhere Classified)

- MCC 7512: Car Rental Agencies (Not Elsewhere Classified)

These exclusions mean you should not be using the Citi Rewards Card for hotel bookings or to buy flights either directly with airlines or via online travel agents, including the likes of Marriott, Singapore Airlines, Jetstar and Expedia.

You would only earn 0.4 mpd in these cases , which is clearly very poor.

Also remember that tapping the card at a merchant (contactless payment) is not an online transaction.

From 1st April 2024, Citi is expanding its travel-related spend exclusions slightly, according to a new terms and conditions document .

- MCC 4111: Transportation – Suburban and Local Commuter Passenger, including Ferries

- MCC 4112: Passenger railways

- MCC 4789: Transportation Services Not Elsewhere Classified

Despite the exclusion of travel-related spend, 4 mpd in the online category is the most useful feature of the Citi Rewards card , which includes things like Grab and Gojek rides (MCC 4121 at the time of writing), online grocery shopping, StarHub or Singtel bills (but not for recurring), and food delivery services like Foodpanda and Deliveroo.

Be careful with in-app payments

With the Citi Rewards card it’s very important to remember that while most online spend earns you 4 mpd, in-app mobile wallet transactions (e.g. using Apple Pay or Google Pay) are specifically excluded .

For example:

- If you use your Citi Rewards Card via Apple Pay in the Foodpanda app when placing an order, you’ll earn only 0.4 mpd for the transaction.

- If you use your Citi Rewards card directly via the Foodpanda app when placing an order, you’ll earn 4 mpd for the transaction (provided you’re still within your first $1,000 of bonus spend in the statement cycle).

The exclusion also applies to Kris+, which since August 2021 moved exclusively to to in-app payments via Apple Pay or Google Pay. That means it’s no longer possible to tap into the Citi Rewards Card’s 4 mpd rate at any Kris+ merchant when paying via the app, since the offline payment method was removed.

Pair with Amaze for 4 mpd in-store

Another option with the Citi Rewards card is to pair it with a free Amaze card by Instarem.

You can only link a Mastercard to Amaze, so it’s the Citi Rewards Mastercard this will work with, not the Visa version.

Any spend made on the Amaze card comes with the same MCC as it would using your credit card directly, but codes as an online transaction, even for in-store spend.

That means you can use it for things like dining and shopping in Singapore or overseas and still tap into the card’s 4 mpd bonus category for online spend, provided you avoid travel-related transactions.

For example, you can earn 4 mpd at the likes of Cold Storage, 7-Eleven and Subway on your Citi Rewards card when paired with Amaze in this way.

This may be useful if you don’t maximise the $1,000 monthly cap in the regular online spend category directly with the card.

Are KrisFlyer miles credited directly?

No, rather than being credited miles directly you’ll accrue ‘Citi ThankYou Points’ for your spending on this card.

These transfer to KrisFlyer miles at a 2.5:1 ratio (so the standard accrual rate is 1 Citi ThankYou Point per $1 spent, which translates to 0.4 mpd , and the bonus rate is 10 Citi ThankYou Points per $1 spent, which is 4 mpd ).

For example, with a $1,000 eligible online spend (10x rewards points) per month over five months ($5,000 total spend), you’ll accrue 50,000 Citi ThankYou Points with this card, which can be converted to 20,000 KrisFlyer miles (4 mpd).

Which loyalty schemes can I transfer into?

One of the best things about Citi ThankYou Points in Singapore is the wide range of transfer partners compared with other bank loyalty points.

You can transfer your points into 10 different frequent flyer programmes (FFPs), plus into IHG points on the hotel loyalty side.

Here’s how Citi compares to other banks in Singapore.

Singapore credit card to FFP transfers

Citi Miles transfer at the same 1:1 ratio into all these programmes, giving you a wide range of flight redemption options including Oneworld and SkyTeam carriers.

Since Citi ThankYou Points transfer to most FFPs relatively quickly, there’s no rush to commit to a specific programme until you have a redemption in mind .

Simply transfer when you need to travel, into the scheme that works best for your preferred redemption.

↥ Is there a minimum transfer amount?

Yes, since March 2017 the minimum amount of Citi ThankYou Points you can transfer into airline miles is 25,000, and they must then be in blocks of 25,000. Previously, much more flexible 1,250-point block transfers were possible.

So if you have 99,999 Citi ThankYou Points, and you don’t have time to tick it over by making a small purchase (miles from purchases tend to reflect in your account within a few days), you’ll only be able to transfer 75,000 Citi ThankYou Points across to KrisFlyer (and will be left with 24,999 in your Citi ThankYou Points account).

When do points credit?

Citi ThankYou Points should reflect in your account once the transaction posts, which typically takes anywhere between one and three days.

This includes the bonus points for eligible 4 mpd transactions.

You won’t have to wait until your monthly statement for the Citi ThankYou Points to be added, so if you’re making a purchase to achieve a short-term top-up they should be available to you within a few days.

Checking your Citi TYPs

Previously, Citi allowed you to check the crediting of Citi ThankYou Points for your transactions on the Citi Rewards card on the Rewards portal via the Citi ThankYou Rewards Portal, using a desktop computer.

Here you could see what base points and bonus points you were awarded on a daily basis, and you could then tally those against transactions performed using your card, as illustrated below.

Points Summary page:

Unfortunately Citi no longer provides an online ThankYou Rewards Portal, and you can only view transactions and make points transfers via the Citi SG mobile app ( Apple | Google ).

I can see from the rewards portal that the $18.00 charge on 20th November was awarded 180 points (18 + 162) two days later on 22nd November, and the $29.83 charge on 23rd November was awarded 290 points (29 + 261) two days later on 25th November.

No transaction-level or date-based rewards points accrual summaries are available here, however you can see how many points you have accrued so far this month, for posted (not pending) transactions.

This should allow you to reconcile whether your transactions have earned base points and bonus points (total 10x rewards or 4 mpd) relatively easily, then you can query any shortfall with Citi via the customer service support channels if required.

Your Citi Rewards monthly statement also shows how many rewards points you accrued in that month, which should come to 10x your SGD spend if all your transactions were in the bonus category. If it doesn’t, it should be relatively easy to work out which ones didn’t qualify, earning only base points (1x), for example.

If you can work out that at least one transaction you expected to be in the bonus category does not have the 9x TYPs bonus when posted to your statement, and you haven’t reached $1,000 in bonus spend during that statement cycle, remember you’ll need to contact Citi to find out why.

Do Citi ThankYou Points expire?

Yes, Citi ThankYou points accrued using the Citi Rewards card points “are valid for a period of 60 months” . That’s five years, which sounds very generous, but it’s not as simple as they make out .

In fact you have to accrue and redeem your points in fixed five-year periods, which is not really the same thing. For example, if you open your card account on 1st July 2023 your first 60-month reward period ends on 30th June 2028. All remaining points accrued on that date will then expire 3 months later, no matter whether you earned them five years ago or in the last week of June 2028!

We have a full article outlining how the policy works and how you also need to be careful when approaching your five-year expiry date to ensure you won’t be left with wasted ‘orphan’ expiring miles, which takes a little planning on your part!

This strange policy is quite unlike the Citi PremierMiles card (see our review ) and Citi Prestige card (see our review ) where the miles earned never expire .

Citi ThankYou Points don’t pool between cards

Not all credit card points are perfect, and our main bugbear with Citi is that it does not pool points across your cards and allow you to transfer them to your preferred FFP as a single (accumulated) transfer.

For example, if you have 30,000 Citi Miles on your Citi PremierMiles card and 75,000 Citi ThankYou Points on your Citi Rewards card (worth 30,000 miles), you won’t have the option to transfer those two amounts into 60,000 KrisFlyer miles.

Instead, you will have to pay the transfer fee for each card (i.e. twice in this example).

It also means you have to transfer all your points into miles before cancelling any Citi cards you hold, since you generally won’t be allowed to combine them with those accumulated on other Citi cards.

What is the transfer cost to KrisFlyer miles?

It’s the same for all 11 transfer partners which are part of the programme, $27.25 each time you transfer Citi ThankYou Points to airline miles (like KrisFlyer miles).

This is the annoying fee you are being hit with for any transfer from each of your Citi cards, as explained above.

How long do miles take to credit to KrisFlyer?

The official line is “up to 5 working days” . In reality the last few times we converted, it took 24-48 hours on each occasion. Here are our recent data points for transfer times from Citi:

- KrisFlyer: 24 hours (48 hours for transfers initiated on a Sunday)

- Asia Miles: 2 days

- BA Avios: 2 days

- Qatar Avios: 4 days

That’s not a bad turnaround, especially if you are looking to jump on a flight redemption that’s currently available.

Instant free transfer to KrisFlyer miles via Kris+

Since October 2021, it’s become possible to link your Citi Rewards and KrisPay accounts and instantly transfer as little as 10,000 Citi ThankYou Points into KrisPay miles via the Kris+ app .

The transfer ratio is 10,000:3,400 (e.g. 10,000 Citi TYPs = 3,400 KrisPay miles).

You won’t want to be using the converted KrisPay miles against Kris+ merchant purchases, due to the awful value of 0.67 cents per mile, but you can immediately transfer them 1:1 into your KrisFlyer account as KrisFlyer miles.

As you’ll notice the ratio means taking a 15% ‘hit’ on the usual 25,000:10,000 Citi TYPs to KrisFlyer miles transfer ratio, so it’s only of interest if you need a small amount to meet a specific redemption threshold, or have a small balance ‘stuck’ in Citi ThankYou Points (more than 10,000 but less than 25,000), which you aren’t going to be adding to in future.

You shouldn’t be using this as your regular Citi TYPs to KrisFlyer transfer method, as it effectively devalues your bonus miles earning rate from 4 mpd to 3.4 mpd.

There are important factors to be aware of, firstly you’ll have to move any points transferred from Citi to KrisPay into KrisFlyer miles within seven days , otherwise they are stuck in KrisPay (where you definitely don’t want them).

The second is just as important, you cannot use any of the KrisPay miles you have earned from your Citi TYPs transfer for any Kris+ purchase, no matter how small, as that automatically renders the entire transfer stuck in Kris+ until expiry, six months later.

The golden rule therefore is to transfer in to KrisPay miles via Kris+, then transfer straight out to KrisFlyer. Even with that seven-day window available, our advice is don’t wait .

Points rounding

Every eligible transaction you make using the Citi Rewards card is rounded down to the next whole Singapore dollar (after conversion from foreign currency, if applicable), before Citi ThankYou Points are then assessed.

- $25.49 rounds down to $25

- $25.99 rounds down to $25

The appropriate multiplier of Citi ThankYou Points is then applied to the transaction, depending on its nature.

Example (regular 0.4 mpd earn rate):

- $25 x 1 TYP = 25 TYPs ( 10 Miles )

Example (4 mpd earn rate):

- $25 x 10 TYP = 250 TYPs ( 100 Miles )

↥ Minimum spend to earn points

Since every amount you spend is rounded down to the nearest dollar before Citi ThankYou Points are accounted for, $1.00 is the minimum transaction amount in order to earn points, or its equivalent in foreign currency for overseas spend.

This is a nice perk for Citi cards, with UOB, OCBC and now Maybank using the annoying $5 rounding method, where even a $4.99 transaction earns no rewards or miles at all!

No such worries with the Citi Rewards card, unless your transaction is extremely small.

FCY fee / cpm overseas

The Citi Rewards card has a 3.25% foreign currency transaction fee, which is among the highest on the market in Singapore.

You won’t be wanting to make transactions in foreign currency at the basic 0.4 mpd earn rate with this card, which would be equivalent to ‘buying’ miles at an unbelievable 8.6 cents each, an insanely poor proposition.

At the 4 mpd bonus rate though, which would apply for example to an online payment charged in US Dollars or a department store transaction in Sydney, it’s a different matter altogether.

Here’s how that cost per mile compares to other credit cards in Singapore offering 4 mpd for at least some form of eligible transactions in foreign currency.

Cost per mile on overseas credit card transactions (4 mpd cards) (Best to worst, February 2024)

Cost per mile also accounts for an additional 0.3% ‘spread’ over money changer currency rates, though this doesn’t apply to all banks and all foreign currencies, so is a worst-case scenario.

As you can see the Citi Rewards card comes in at a very competitive cost of 0.86 cents per mile , so you should definitely be using this card for online transactions in FCY (non-travel spend), subject to the monthly cap.

The Amaze card paired to your Citi Rewards Mastercard also comes into play here, allowing you to avoid the 3.25% fee when making overseas spend, instead being subject only to the Amaze FCY rate, which tends to be only around 0.5% higher than the spot rate.

What else can Citi ThankYou Points be used for?

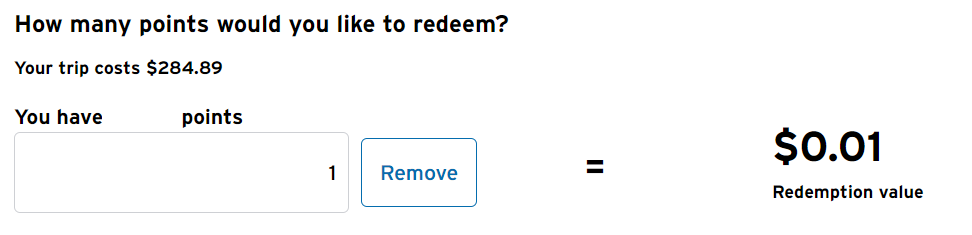

Under Citi’s ‘Pay with Points’ option via the mobile app, you can use your available points to offset for a statement credit instead of converting them into frequent flyer miles, transaction-by-transaction.

As you can see I can offset this S$73.39 on my Citi Rewards card using 27,447 ThankYou Points, but that’s terrible value – these could be converted to over 10,000 KrisFlyer miles!

This values your ThankYou Points at only 0.267 cents each, whereas you’ll get upwards of 0.76 cents if you convert them to airline miles, like KrisFlyer miles, assuming a valuation of 1.9 cents per mile.

Note that this includes a current 15% discount (till 29th February 2024) when you redeem points to offset transactions made on your card – the usual rate is even worse at 0.227 cents per point!

Even if you only value KrisFlyer miles at 1.5 cents each, your ThankYou Points are worth 0.60 cents each, so conversion into airline miles is by far the best deal .

Other benefits

There are a few other perks with the Citi Rewards cards, the key benefits which will be of most interest to our readers are:

- Complimentary travel insurance when you pay for your round-trip air ticket, or pay the taxes and fees on an award redemption ticket, using your Citi Rewards card. The complimentary travel insurance is underwritten by HL Assurance (full details here ).

- Citi World Privileges , available to all Citi cardholders. These include restaurant, shopping and lifestyle benefits plus up to 10% cashback at Booking.com (Visa cards only).

- Up to 14% fuel savings at Shell .

Citi PayAll

The Citi Rewards card participates in the bank’s ‘PayAll’ programme, a facility allowing you to pay a fee to use your card and still earn miles on a range of payment types that would otherwise be excluded from miles earning, or not usually possible with a credit card.

At the time of writing, PayAll supports:

- Tax payments to IRAS

- Rent payments to your landlord in Singapore

- Education payments to a school or tuition centre in Singapore

- Condo Management Fees

- Electricity payments in Singapore

- Renovation fees

- Wedding expenses

- Childcare services

- Domestic helper service fees

- Donations or charitable payments

- Utility bills

Citi charges a 2.2% service fee for PayAll transactions, so the bad news for Citi Rewards cardholders is that with an earn rate of only 0.4 mpd you are ‘buying’ miles for an outrageous 5.5 cents each when using your Rewards card at the local earn rate for these payments.

Example, for a $1,000 education payment:

- Total Spend: $1,000

- PayAll Fee (2.2%): $22

- Total Spent: $1,022

- TYPs Earned: 1,000

- Miles Earned: 400 (1,000 / 2.5)

- Cost per Mile: 5.50 cents ($22 / 400)

What’s the point of this option then?

Citi regularly runs promotions for its PayAll service, typically by hiking the earn rate on all its eligible cards (including the Rewards cards) to a higher level, allowing you to buy miles at a far more competitive rate for these expenses.

Here’s an example of the cost per mile available during four recent promotions.

During these promotions it goes from being a terrible deal to use your Citi Rewards card for PayAll payments to a great or even excellent deal, with the opportunity to buy miles at very competitive rates. The current offer ends on 29th February 2024, but watch out for the next one since there are typically two per year.

Citi also offers a zero-fee option for PayAll payments, which does not earn any card rewards.

This may be a useful way for you to defer your payment to the next statement cycle and hang on to the cash in your bank account for a little longer.

Terms and conditions

Here are links to the full terms and conditions applicable to the Citi Rewards card.

Citi Rewards 10X rewards T&C Citi Rewards 10X rewards T&C (from 1 Apr 2024) Citi Rewards 10X rewards FAQs Citi Rewards 10X rewards FAQs (from 1 Apr 2024) Citi Rewards Information Sheet Citi Rewards Cardmembers Agreement

Our Summary

The Citi Rewards Card doesn’t enjoy the $2,000 monthly cap you’ll get with the DBS WWMC alternative ( soon reducing to S$1,500 ), at least now that it’s not possible for new cardholders to pick up both the Visa and Mastercard version, so the $1,000 monthly cap on bonus spend is the major limitation.

Furthermore, online travel spend is unfortunately not awarded the bonus rate.

However, on the plus side you have Citi’s wide range of transfer partners to tap into and points can last up to five years (but sadly for or as little as three months towards the end of your first five-year card validity period).

There’s also the occasional opportunity to participate in bonus miles promotions, including competitive rates to buy miles through Citi PayAll, plus the option to pair the card with Amaze for 4 mpd on in-store spend too like restaurant dining and grocery shopping.

Links on Mainly Miles may pay us an affiliate commission.

(Cover Photo: Shutterstock)

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on Telegram (Opens in new window)

Currently I have the Visa version expiring in June 2024. Citi is giving me the option to convert but I have taken note of the $1000 cap.

This below is taken from their website. ( https://www.citibank.com.sg/gcb/credit_cards/mastercard_rewards-credit-card )

Is the conversion to Mastercard mandatory? No. It is not mandatory. Without your opt-in consent, your card will be renewed as Visa which will be sent to you before its expiry. However with your opt-in consent to convert to Mastercard, you will enjoy no annual fee charged to your account for the upcoming card anniversary.

I am going to call Citi and see if I can maintain both my Visa and also apply for a new MC card. I am unsure if anyone is in the same situation as me.

Leave a Reply Cancel reply

Discover more from mainly miles.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

Ultimate guide to the Citi travel portal

fCiti is a TPG advertising partner.

The new Citi travel portal launched earlier this year , offering an enhanced user experience, more hotel options and a new feature for booking activities and attractions. Citi Travel with Booking.com is powered by Rocket Travel by Agoda, utilizing the features and booking availability of Booking.com's brands.

In this article, we will explore the functionality of the new Citi travel portal, discuss any potential drawbacks and clarify who can access this booking engine. Additionally, we will provide a step-by-step guide on using the portal to book your desired travel experiences and explain how to pay using your ThankYou points.

What is the Citi travel portal?

There are four main selling points for using Citi Travel with Booking.com.

First, it provides a one-stop shop for travel that you can pay for with your Citi ThankYou points while booking multiple elements of a trip simultaneously. This can be simpler than transferring points to separate airline or hotel partners and booking your trip piece by piece — and you can even use as many or as few points as you want. The downside is that you might achieve less value from your points to gain simplicity.

Second, the portal allows you to use points to pay for travel beyond flights and hotels, such as guided tours and theme park tickets. You can't do this with Citi's list of transfer partners, and you may achieve better value paying for travel with points in Citi's portal than you would by cashing out your points .

Third, certain card benefits require using the Citi travel portal. This is true of hotel benefits built into the Citi Prestige® Card (no longer open to new applicants) and Citi Strata Premier℠ Card (see rates and fees ). We'll explore those below.

The information for the Citi Prestige has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Lastly, if you're paying for travel (and not using points), you may be interested in the bonus points available when using Citi Travel with Booking.com. Competitors like the Chase Ultimate Rewards travel portal , American Express Travel and Capital One Travel offer higher earn rates (depending on which credit cards you have) when booking your travel in the bank's portal rather than directly.

With the Citi Strata Premier℠ Card , you can earn 10 points per dollar on reservations for hotels, rental cars and eligible attractions.

Through June 30, 2024, Citi cardholders can earn bonus points as follows:

- 10 points per dollar on reservations for hotels, rental cars and eligible attractions with the Citi Prestige® Card (no longer open to new applicants)

Through December 31, 2025, Citi cardholders can earn bonus points as follows:

- 5 points per dollar on these same bookings with the Citi ThankYou® Preferred Card (no longer open to new applicants) and the Citi Rewards+® Card (see rates and fees )

The information for the Citi ThankYou Preferred card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

The fact that Citi's portal provides a one-stop shop for your vacation is its main strength. The ability to book hotels, rental cars and even entrance tickets to tourist attractions in one place (and even pay for these with your points) provides great simplicity.

Related: The ultimate guide to Citi ThankYou Rewards

How to use the Citi travel portal

Citi's portal sets itself apart from competitors by being available to anyone with a credit card earning Citi ThankYou points . For comparison, some travel portals reserve their best features for cardholders with expensive premium credit cards . Thus, you can access the portal with the $495-a-year Citi Prestige Card and the no-annual-fee Citi Rewards+ Card .

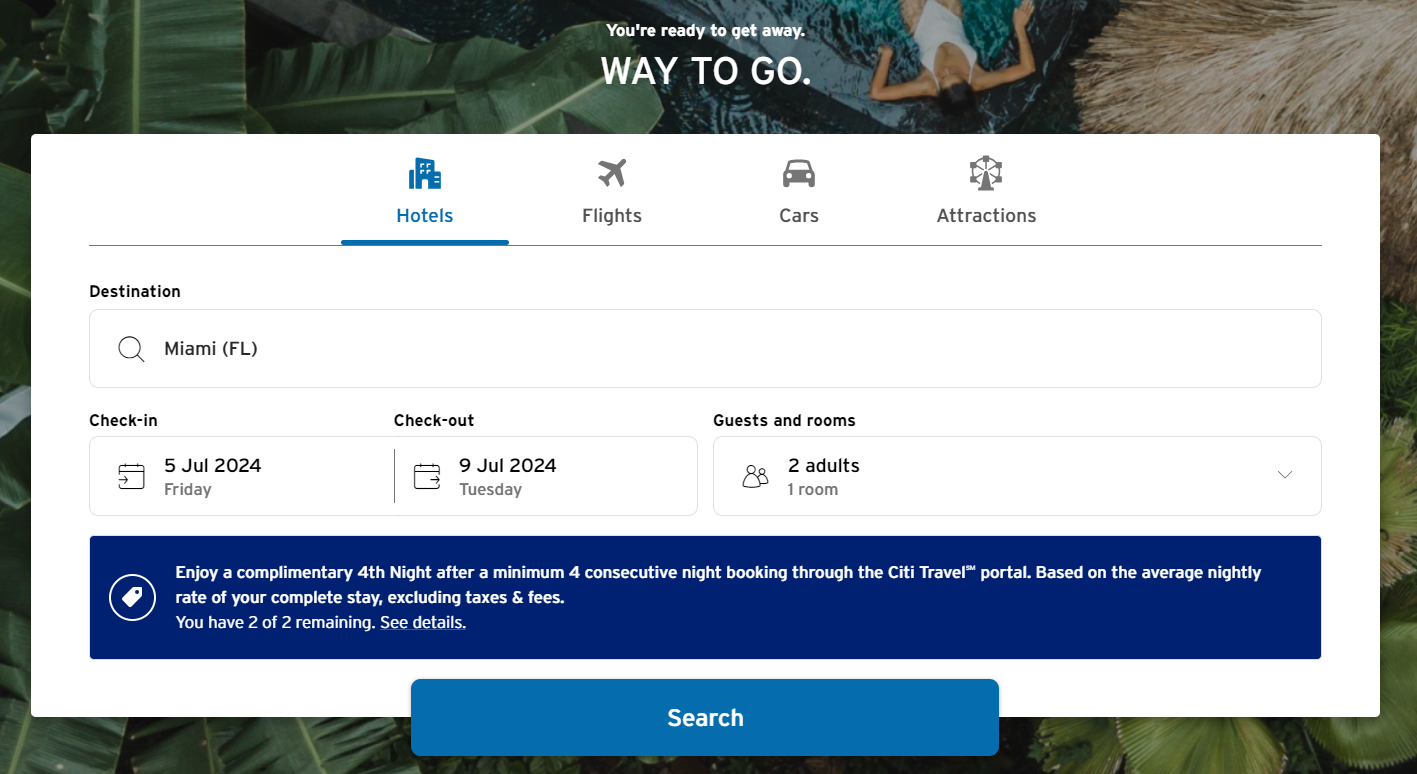

You can access Citi Travel with Booking.com by clicking this link and logging into your Citi account. If you have multiple Citi credit cards, you must select which card you want to use for booking travel. Once you select a card, you're ready to start booking travel.

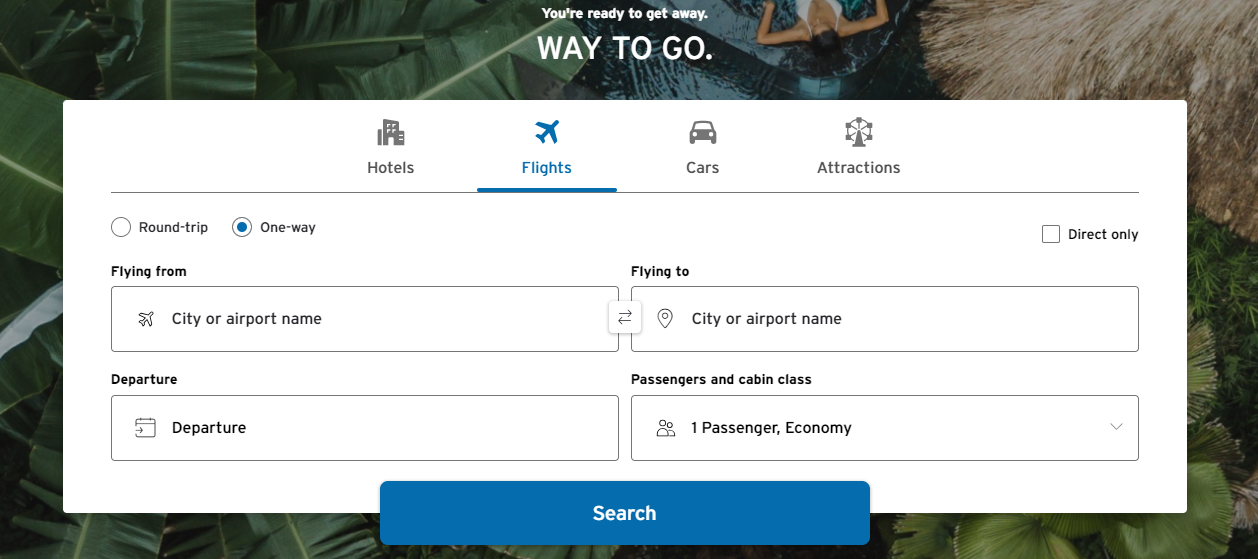

How to book flights using the Citi travel portal

Booking flights in Citi's portal functions similarly to other portals. You'll choose whether this is a one-way or round-trip flight and provide the route, number of passengers, dates and class of travel. Unfortunately, you can't book multi-city itineraries.

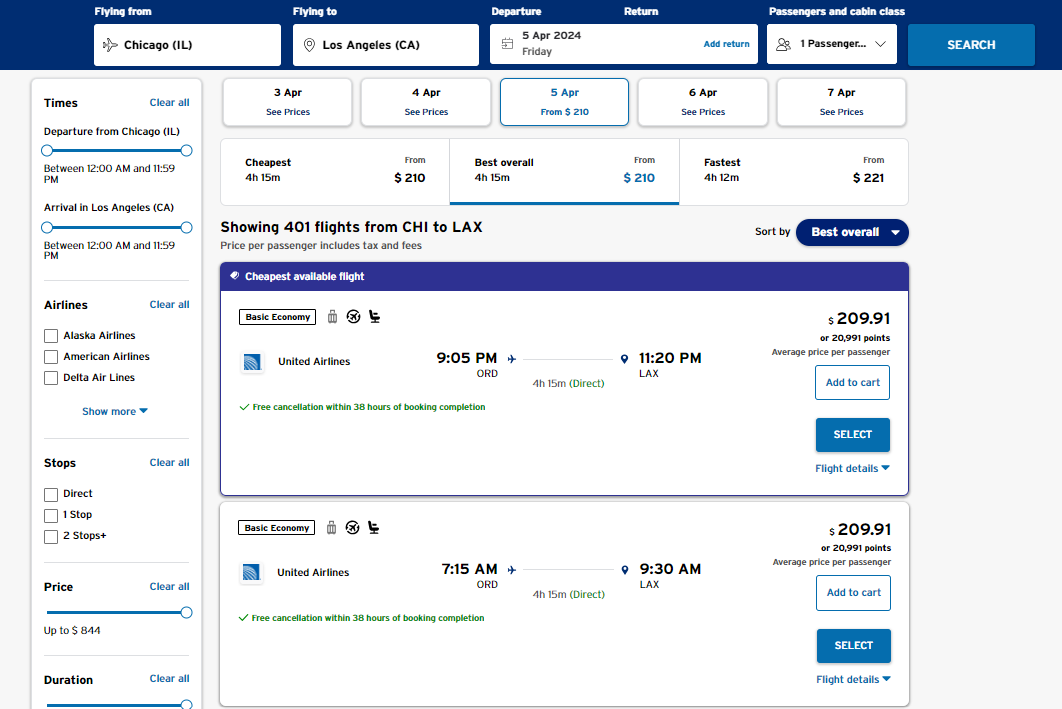

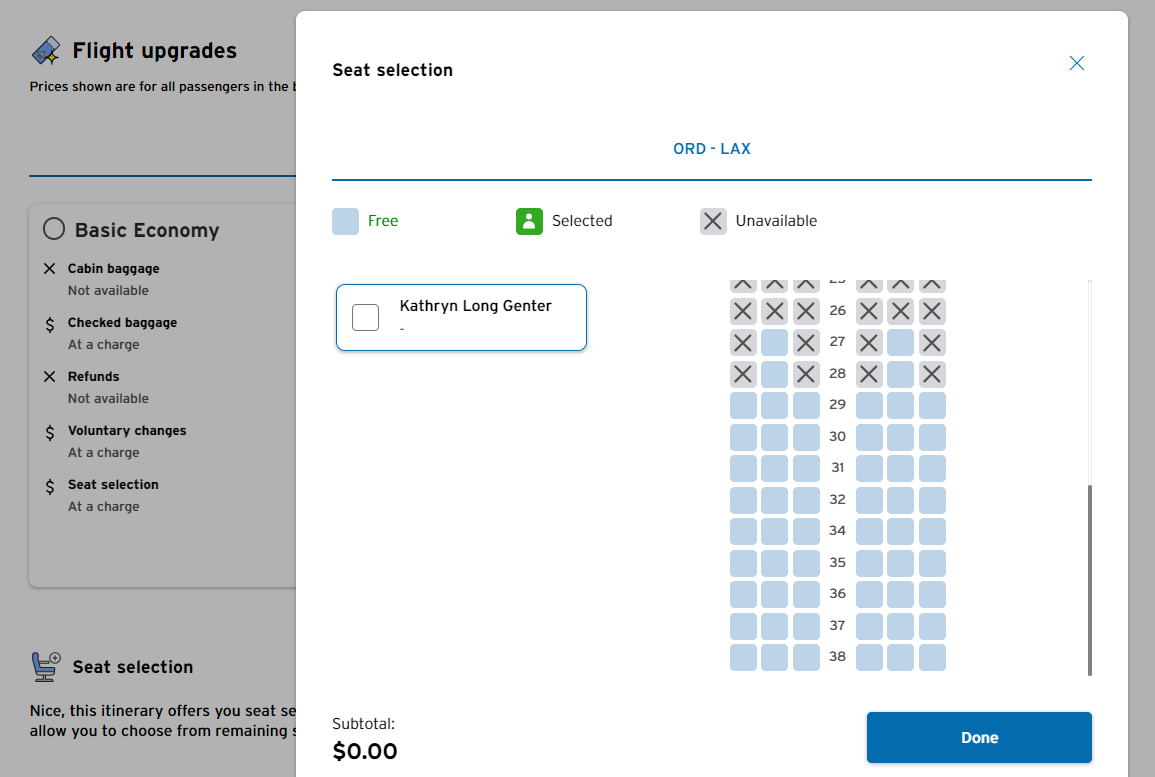

Here's an example search from Chicago to Los Angeles. Note that you can use cities for your search if you don't have a specific airport preference.

The Citi Travel portal offers many filters and sorting options to help you find the most suitable travel options. These filters allow you to refine your search based on price, duration, departure and arrival times, number of connections and even your preferred airline. Furthermore, you can sort the results using these options without losing any filtering choices.

To change the sorting order of the results, click on the "Best overall" drop-down menu on the right side above the price of the first result.

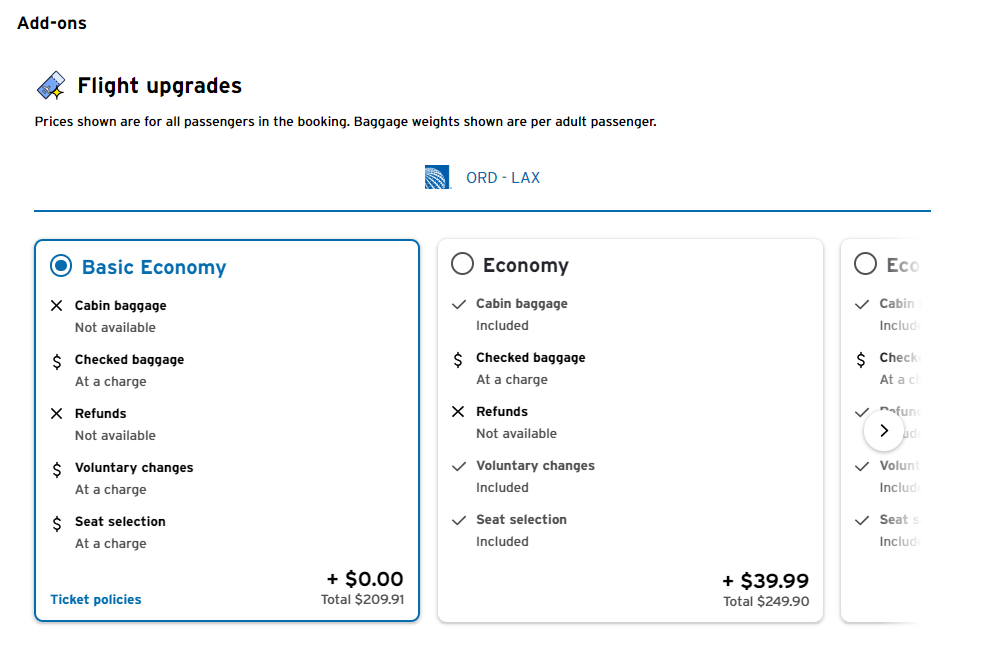

Once you have selected a flight, you will be prompted to provide passenger information, including names, dates of birth, frequent flyer numbers and known traveler numbers for TSA PreCheck and Global Entry (if applicable).

Additionally, before making your payment, you can upgrade to a higher class of travel if it is available. This is the first time you'll see the cost to book a main cabin fare instead of a basic economy fare.

And if your fare class lets you select a seat, you can do so before heading to the payment page.

On the final page, you'll choose how you want to pay (with your points, credit card or a mix of the two) and complete your purchase. The redemption rate is an underwhelming 1 cent per point. For context, our valuations peg ThankYou points at 1.8 cents apiece, which you should be able to get by maximizing Citi's transfer partners .

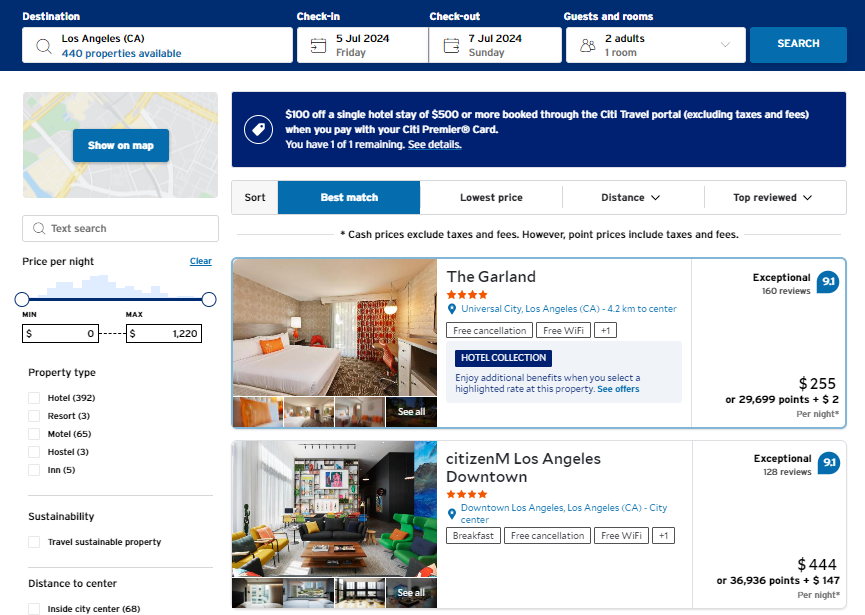

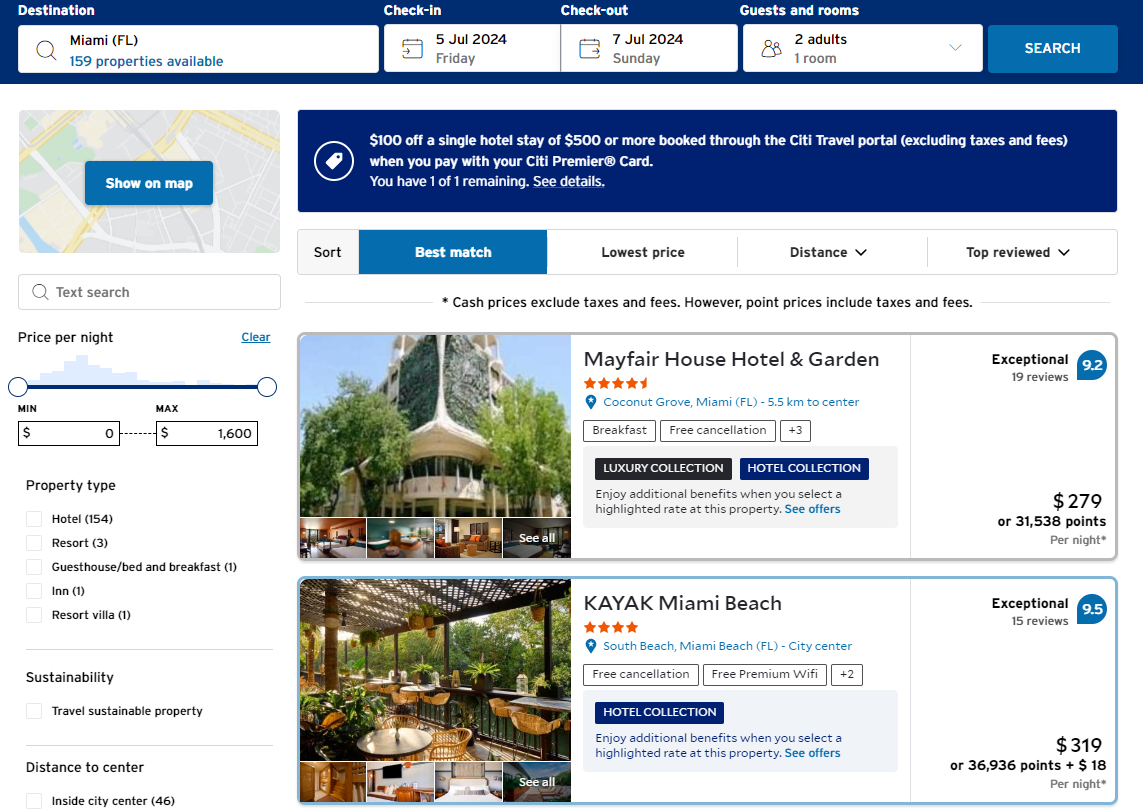

How to book hotels using the Citi travel portal

Booking hotels will feel familiar to those who have used other portals.

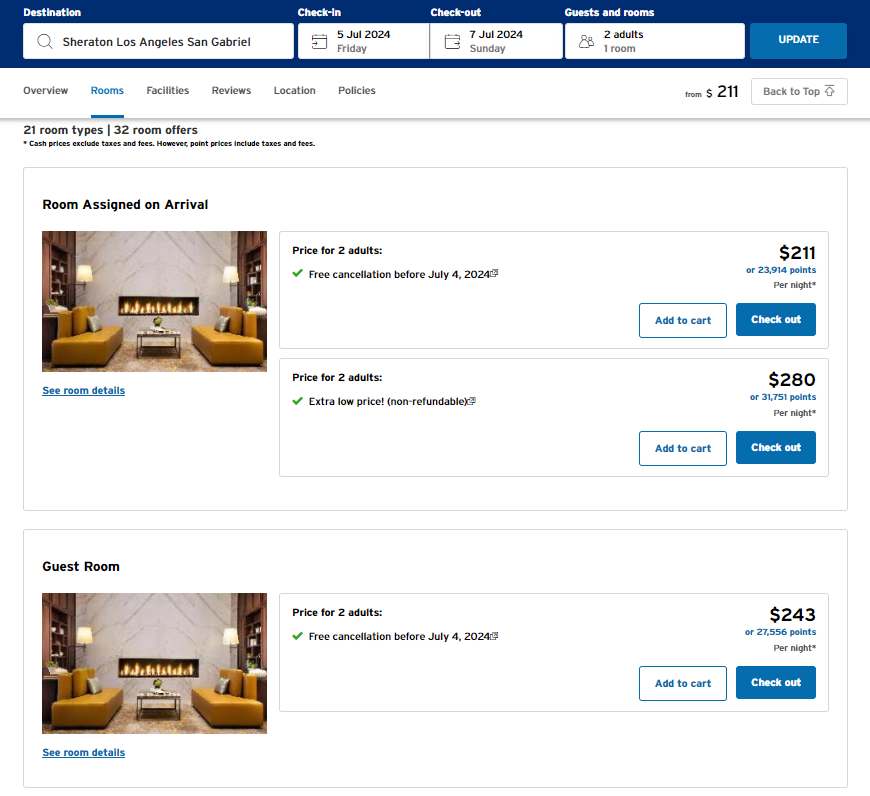

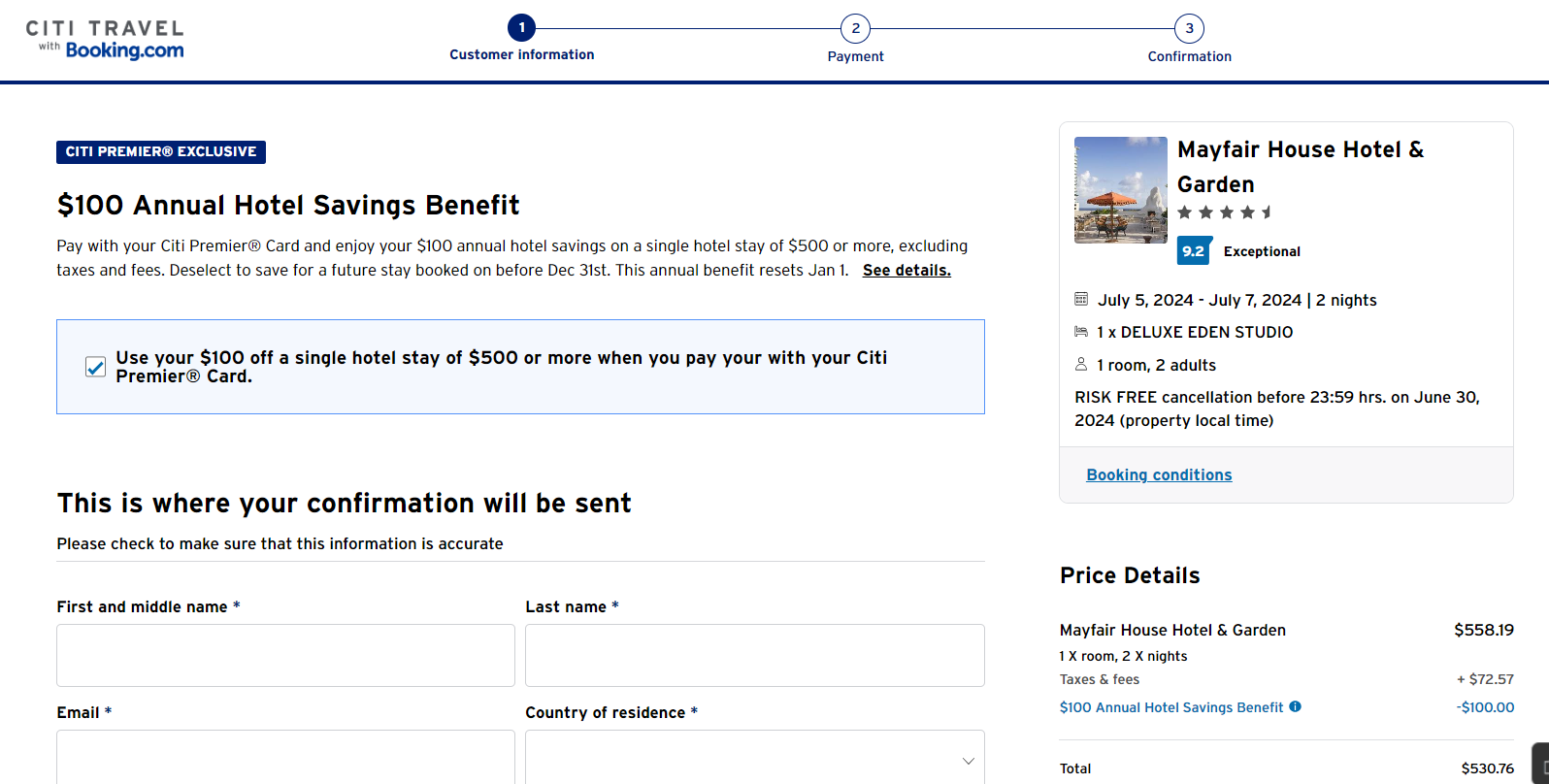

You should choose your Citi Strata Premier or Citi Prestige card before beginning your hotel search if you intend to use those cards' benefits. Strata Premier cardholders can use a $100 hotel credit each calendar year on a booking of $500 or more. In contrast, Prestige cardholders get a fourth night free on hotel bookings in the portal, available up to twice per calendar year.

From here, you can add filters to help you reduce your results, such as by price, neighborhood, star rating and nearby attractions.

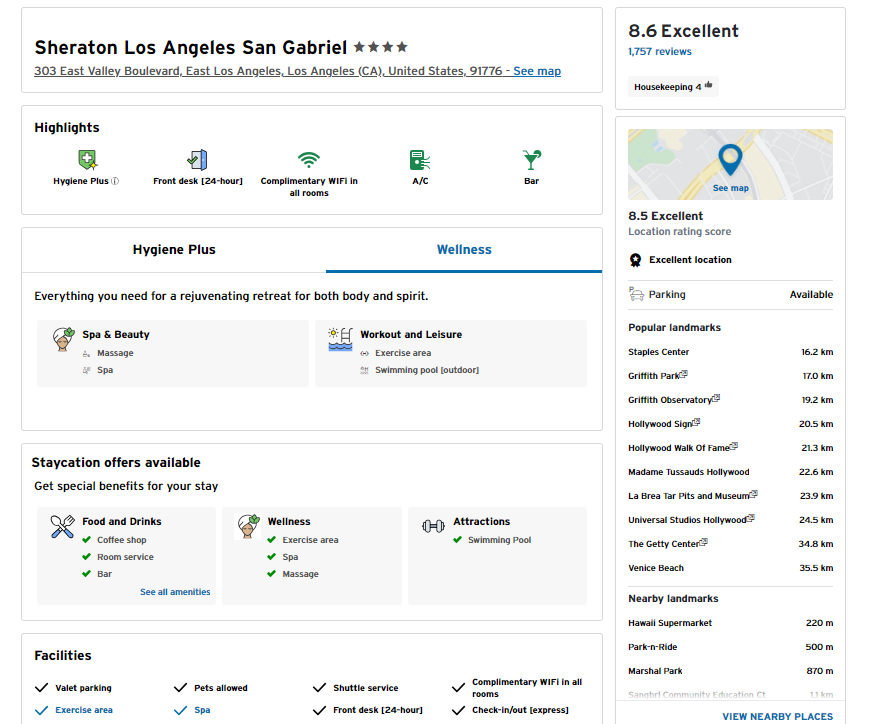

Once you pick a property, you'll see details on its amenities and features.

Then, you can select your desired room.

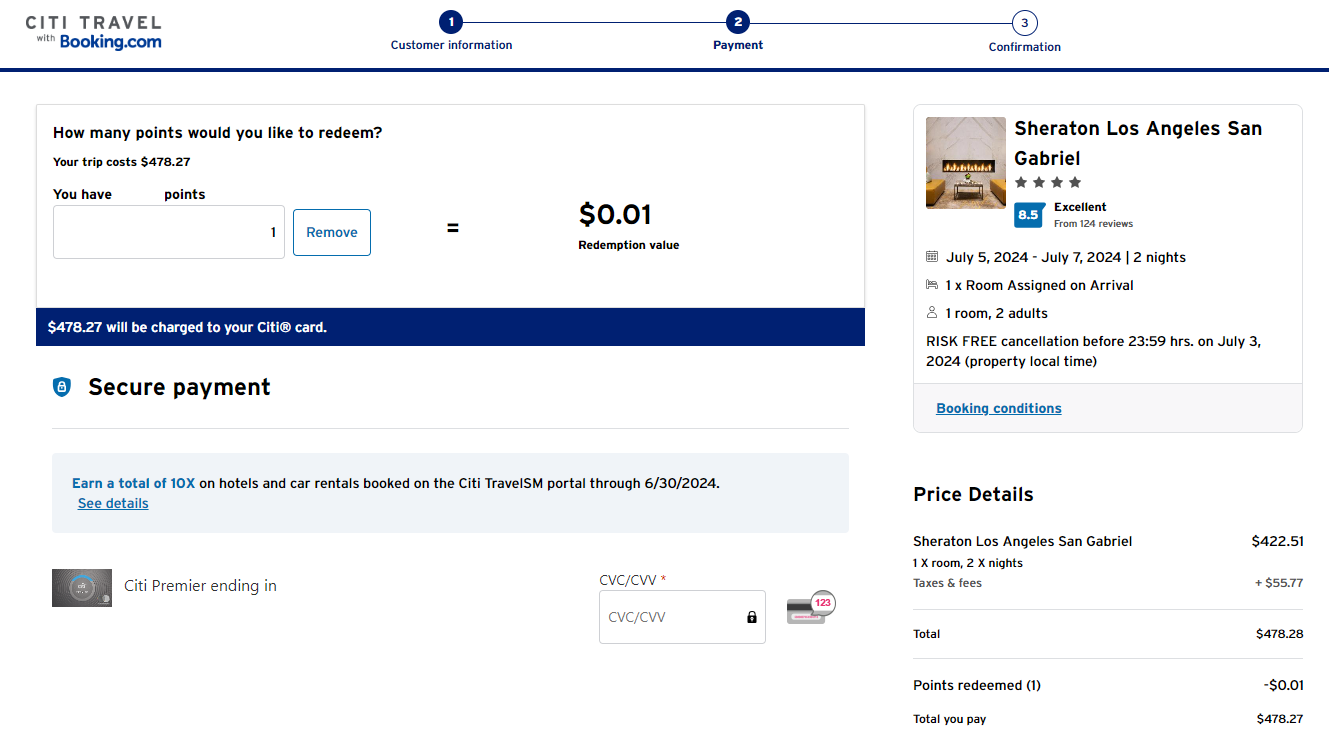

After choosing a room type, you can pay with points at checkout. Again, each point is worth a lackluster 1 cent.

You'll also have the option to view the cancellation policy before paying. Since policies can vary, ensure you know whether it's possible to change or cancel your booking before you make the final payment.

However, if you book a hotel that's part of a major loyalty program — like Hilton Honors or Marriott Bonvoy — through Citi, you likely won't earn points, nor will you enjoy any elite status perks on your reservation.

Hotel Collection and Luxury Collection properties

Alongside its revamped portal, Citi has introduced two new hotel programs, namely the Hotel Collection and the Luxury Collection. These programs offer similar advantages to other luxury hotel programs offered by credit cards .

Reservations through the Hotel and Luxury Collection have no minimum stay requirements. However, access to the Luxury Collection is exclusive to Citi Strata Premier and Citi Prestige cardholders.

You will receive guaranteed benefits such as daily breakfast for two people and complimentary Wi-Fi for Hotel Collection bookings. In addition to these perks, the Luxury Collection offers a $100 on-property credit, which can be used based on the policies of each hotel. Both programs also provide other benefits, such as early check-in, late checkout and room upgrades (specifically for Luxury Collection bookings, subject to availability at check-in).

Unfortunately, you can't filter search results specifically for Hotel and Luxury collections properties. To identify these properties, you must look for a tag or description indicating their inclusion in your search results.

Related: A comparison of luxury hotel programs from credit card issuers: Amex, Capital One, Chase and Citi

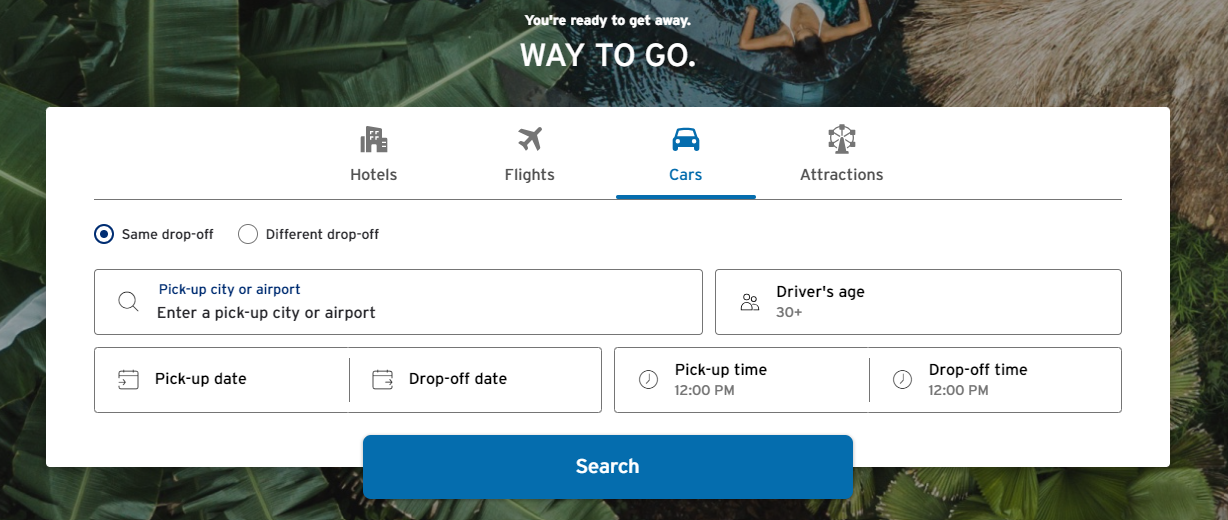

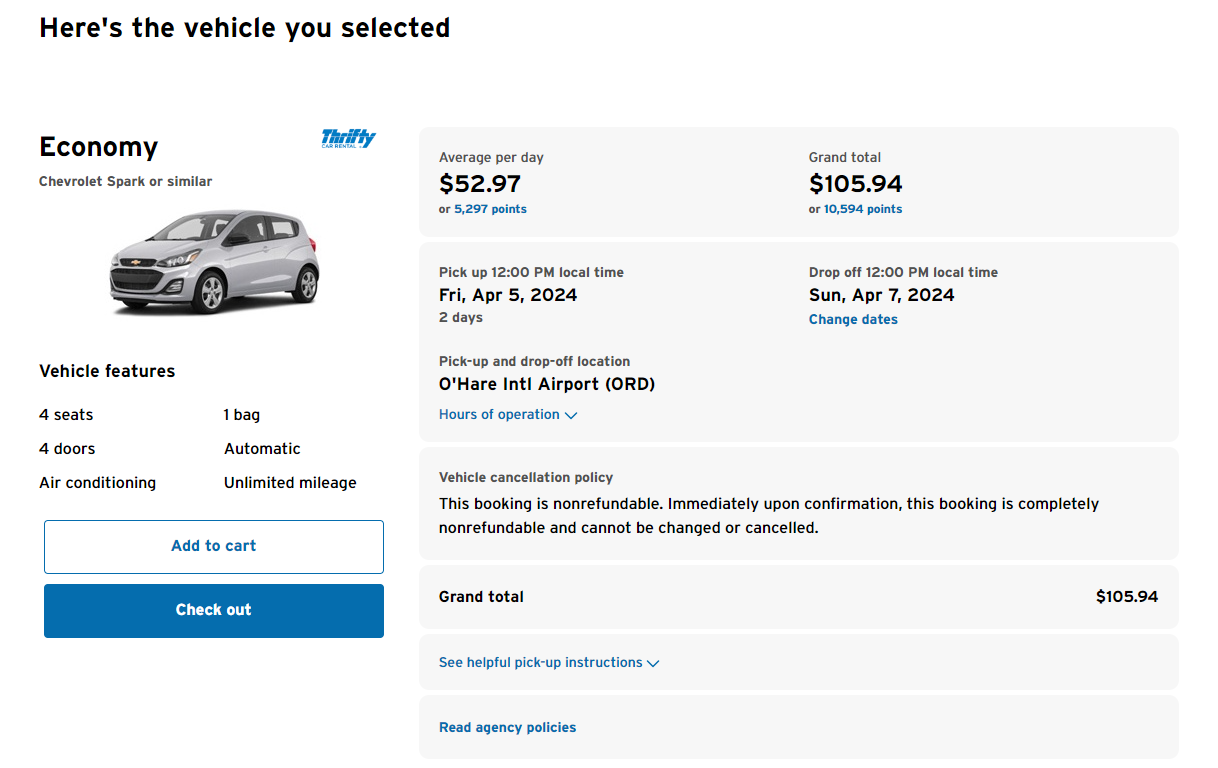

How to book rental cars using the Citi travel portal

Searching for rental cars feels familiar and works quickly.

After providing your location, dates, times and age, click "Search." From the available results, you can use the following filters:

- Vehicle type

- Rental company

- Free cancellation option availability

After choosing a car, you can see the full details and cancellation policy on the next page.

As with other items in Citi Travel with Booking.com , you can add your rental car to the shopping cart (if booking multiple travel elements) or go straight to check out to pay and reserve. Again, you can pay with points at a rate of 1 cent apiece.

How to book attractions using the Citi travel portal

One standout feature of Citi's travel portal is the ability to book attractions along with your hotels, flights and rental cars. This convenient option allows you to make a single transaction for all your travel needs, and you can even use your points to pay for them.

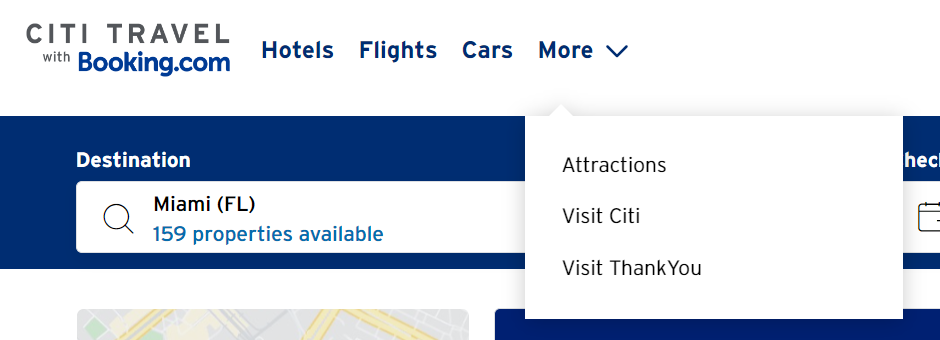

To access this feature, look for the "Attractions" option in the main search bar. However, depending on your location within the portal, you may need to click "More" in the drop-down menu and select "Attractions" from there.

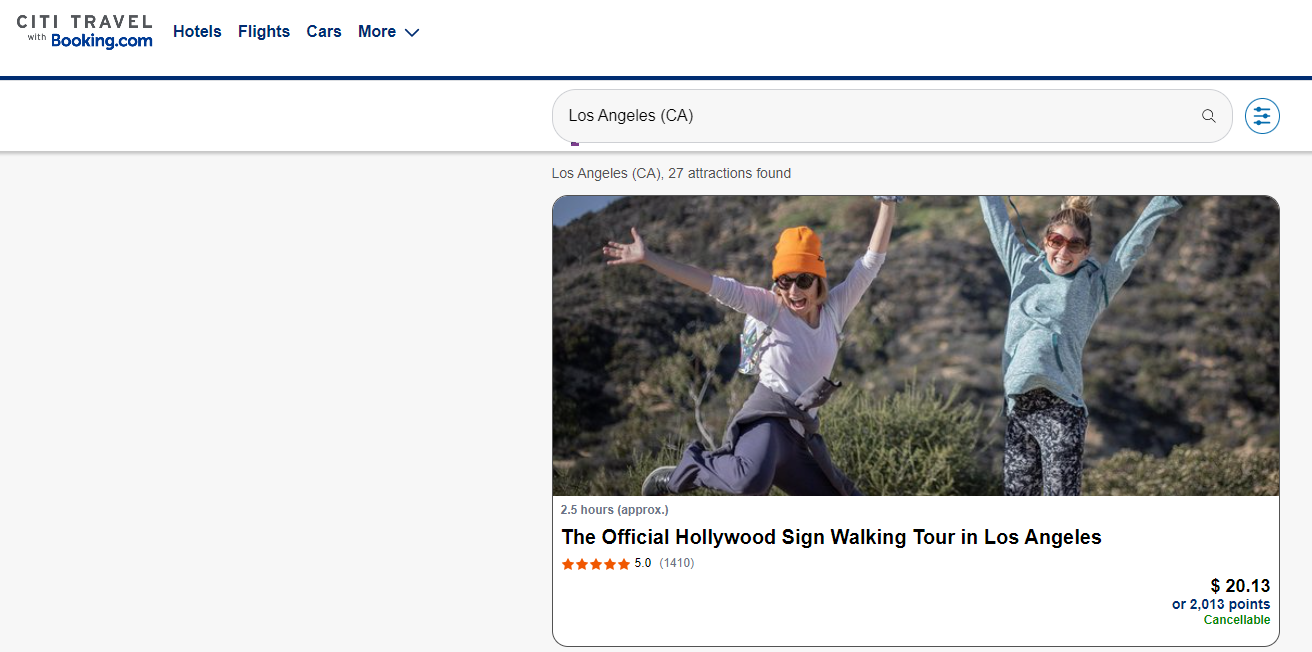

Once you search for a destination, you'll see all available options— from entrance tickets for tourist sights to guided tours. For example, you can book a guided walking tour of the Hollywood Sign.

When you see an activity or tickets you want to purchase, click on the tile. This will take you to a page with details about this offering and cancellation policies.

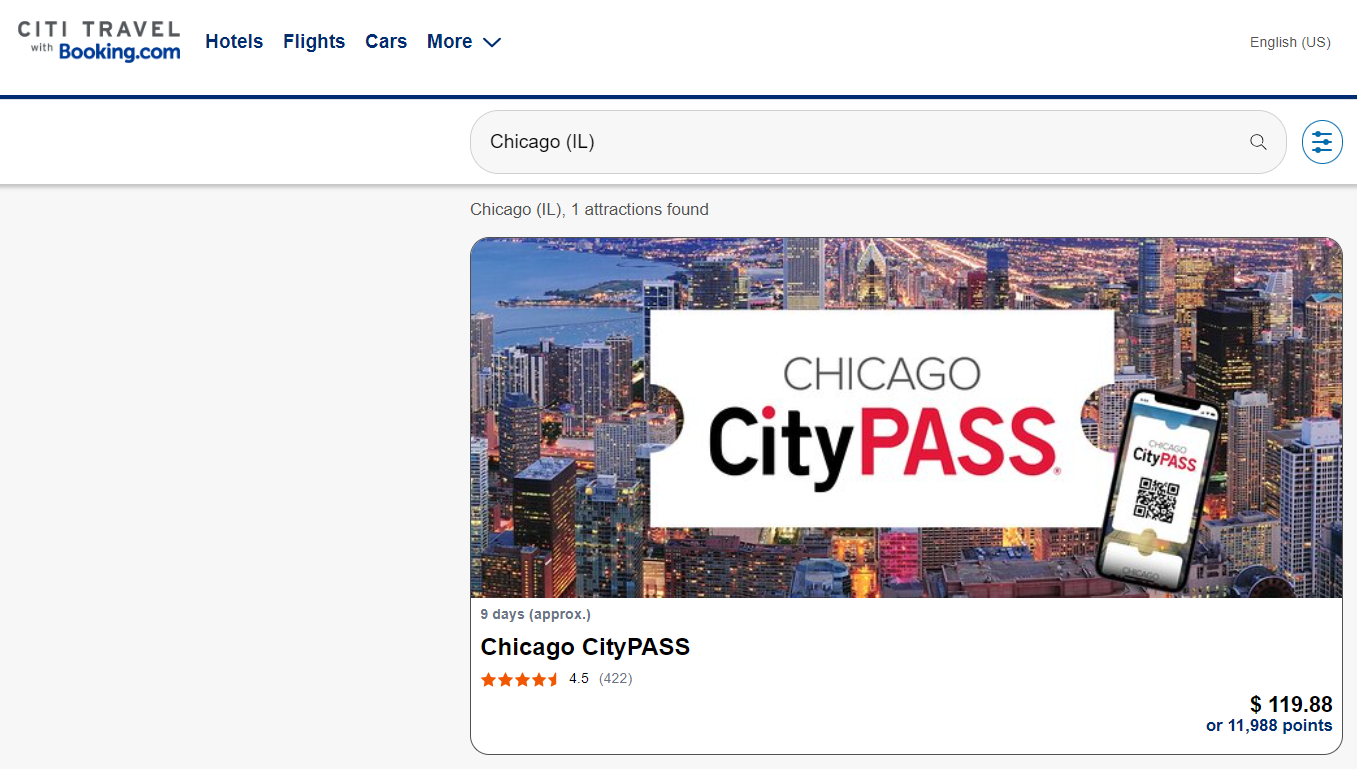

One noteworthy option is Chicago CityPASS tickets, including access to five popular attractions. Click on "Check availability" in the top right corner to choose your preferred date to find pricing and availability.

As with other elements of Citi's portal, you can pay for attraction bookings using ThankYou points with a value of 1 cent apiece.

More things to consider about the Citi travel portal

Now that you know how to use the Citi travel portal, here's some general guidance to maximize your experience.

As always, we recommend comparing prices. There is no guarantee that Citi Travel with Booking.com will offer the best price for your trip. It's recommended to compare the prices you see on the portal with prices available when booking directly with hotels, airlines, rental car companies or tour providers.

If you plan to pay with points, check if you can get better value by using fewer points with Citi's transfer partners . Transferring points to programs like Wyndham Rewards may let you get more value from your points. Check out our guide to redeeming Citi ThankYou points for high-value redemption ideas.

Also, if you book hotels or car rentals through Citi's travel portal, you may forfeit any elite status earnings and benefits. Many loyalty programs require direct bookings to recognize elite status and provide associated perks. Evaluate whether the benefits you would be giving up are worth it.

Finally, Citi Strata Premier and Citi Prestige cardholders have exclusive benefits within the travel portal. Premier cardholders can enjoy $100 off a hotel stay of $500 or more once a calendar year, while Prestige cardholders can get a fourth night free on hotel stays of four nights or more twice a calendar year. If you're making an eligible hotel reservation, you'll see the option to use your available benefit on the payment screen.

You'll also see the benefit(s) highlighted on the hotel search page if you have one of these cards. This includes information on how many more times your benefit can be used.

If you don't see these benefits, check the top right corner of the portal and ensure your Premier or Prestige card is the active card for your searches.

Bottom line

Citi's revamped travel portal allows you to search and make travel reservations for flights, hotels, rental cars, and even tours and attractions. You can book travel up to a year in advance and pay using your Citi ThankYou points or any travel credit card .

Additionally, if you hold the Citi Strata Premier or Citi Prestige, you can utilize your hotel benefits through the portal.

However, it's important to consider potential tradeoffs. Assess your elite status with hotel or rental car companies and determine if you might get better value by booking your travel through another platform. If convenience is your deciding factor, this user-friendly portal offers many results when planning your upcoming vacation.

Additional reporting by Kyle Olsen.

- Credit Cards

- Travel Rewards

When Do Hotels Charge Your Credit Card?

Fact Checked

Published: Sep 19, 2024, 9:00am

Table of Contents

When do hotels charge your card, do hotels charge before or after your stay, charges when booking through third-party websites, the best hotel credit cards, frequently asked questions (faqs).

If you’ve ever checked into a hotel, you’ve gone through the motions of handing over your credit card and ID in order to gain access to your room. But what exactly are hotels asking for your credit card upon arrival for? Didn’t you put a card down when you booked online, well before your arrival at the hotel itself? And what if you add charges to your room, like room-service, internet usage or laundry services?

It can feel confusing to understand when exactly a hotel charges your credit card. Unfortunately, there’s no exact formula or specific time that fits each reservation. Instead, we’ve compiled factors to help you determine when you’ll be charged—whether that’s the time you booked, at check-in itself or at checkout.

Featured Partner Offers

There are many factors to determine when a hotel charges your credit card. These include, but are not limited to, what platform you used to book your room, whether you are traveling on points and the cancellation policy.

Almost always, however, upon check-in, you should expect to put a card down for incidentals. The incidental hold charge is a temporary hold on your credit card that will be released following check out, provided there are no damages or deep-cleaning required. Additionally, the card you put down for incidentals is the card that will be used for additional fees beyond the cost of your room. These charges may include dining, minibar usage, gratuities, spa or fitness services and internet fees, if applicable.

Beyond incidentals, it’s also possible to determine when your credit will be charged based on how you booked your stay.

At the Time of Booking

In order to book a hotel, you’re going to need a payment to confirm the reservation. Does this mean your card is charged as soon as you click submit? Well, that depends.

Sometimes, when using third-party booking sites such as Booking.com and Hotels.com, you have a “Pay Now” option, where your card is charged in full upon booking. Nonrefundable room rates are typically charged at the time of booking, as well.

Chase Travel℠ , like all major credit card travel portals, charges your card upon booking, though there are some fees that might not be reflected in the price—such as resort fees. These specific fees will be collected upon check-in instead.

Additionally, if you’re redeeming points through your travel credit card, such as American Express Membership Rewards® , you must pay with points at the time of booking. Your purchase will be reflected in your point balance immediately, meaning you pay at the time of booking.

Prior to Check-In

Being charged prior to check-in is a gray area and proves the importance of reading the terms and conditions prior to booking. EVEN Hotels by IHG, for example, states that your credit card will be charged between the time of booking and time of arrival for the total amount of your stay. In this case, your card can be charged at any point after you’ve booked and until you arrive.

Many third-party sites waive the cancellation period in exchange for a lower nightly rate. Booking.com, for example, offers a nonrefundable rate or free cancellation until a certain date for a slightly higher price. In this case, you pay more for the added convenience of cancellation. Once the date for free cancellations has passed, your card may be charged. Hilton has a similar policy, where if a reservation is canceled after the nonrefundable period begins, you will be charged upon cancellation.

At Check-In

If you have not paid in full already, you may be charged once you check in. It’s standard for hotels to charge an incidental fee. It’s becoming more and more likely that you will be charged a daily property fee or resort fee—these cover the cost of property amenities. While there’s not one formula for what the incidental fee might be, it could be a daily charge or even a daily charge per person.

So, when you check in and hand over your card, make sure you understand exactly what is being charged. If it seems high, confirm what the incidental fee is. But it’s better to do your research before booking. Make sure you consider incidental fees like parking and property fees when evaluating your booking.

While putting a card down to book a hotel is required, it is possible to pay with a different card upon check-in if you have not yet been charged. For example, Hilton accepts debit and credit cards at check-in even if they are different from the one used to book, as long as the name matches the name on the reservation.

In rare cases, like Disney resorts, you may have an amount placed on hold to cover incidentals on day one and be charged the current balance on the room at some point during your stay for reservations longer than five days.

At Checkout

In many cases, the card you provide at check-in isn’t charged at that point. Think of it instead as starting a bar tab and keeping it open until it’s time to hit the road. Checking out is often when your card is finally charged. This delay in payment allows for people to acquire charges during their stay, whether it’s room-service, spa services or babysitting services. Those charges cannot be confirmed until it’s time to checkout.

This greatly depends on your booking terms and conditions. If you booked using points, your points are going to be deducted from your account immediately. If you use a third-party site, you may pay for the room in advance. In most cases, additional fees and charges, such as resort fees, and any charges incurred throughout the duration of your stay will be charged after.

Major hotel chains and groups strongly discourage guests from using third-party sites, from Four Seasons Hotels and Resorts to IHG. They claim booking directly guarantees the lowest rate and avoids any additional fees. However, there are benefits to booking through third-party websites—namely the convenience of being able to search a wide range of chain and boutique hotels in one place. The question is, when do third-party websites charge you for your hotel stay?

- Offers a “Book Now, Pay Later” program where guests are guaranteed to pay upon arrival at the hotel

- Book Now, Pay Later gives great flexibility for those who need to cancel or change their plans

- Note that not every hotel is a part of Book Now, Pay Later, and while Expedia doesn’t charge cancellation fees, some hotels might, so double check before booking

- Allows users to book nonrefundable rooms in which case their cards get charged upon booking

- For an additional charge, many rooms are available to book for a fully refundable rate up until a certain date under a “Reserve Now, Pay Later” policy

Booking.com

- After searching for your preferred city and dates, you’ll see a green checkmark that says “No prepayment needed – pay at the property,” where you will be charged upon check-in (be sure to read the cancellation policy)

- Alternatively, Booking.com has nonrefundable options, generally for a lower rate, where you’ll pay upon booking

- Some room choices offer the option to book with a free cancellation prior to your travel date, charging your card on a specified date, sometime between booking and between the date of check-in

- Offers a “Pay Now” option where you can pay in full upon booking

- “Book Now, Pay Later” option, where you can pay either at check-in or checkout at the hotel. With Book Now, Pay Later, you’ll receive an e-mail confirmation with the approximate amount due upon arrival at the hotel

- Pay in monthly installments with Affirm, if eligible

If you’re going to put your hotel stay on a credit card, you might as well put it on one of the best hotel credit cards on the market. This way, you’ll garner benefits, like points and loyalty rewards that make traveling all that much sweeter.

Chase Sapphire Preferred® Card

- Receive up to $50 in Chase Travel℠ Hotel Credit annually.

- Receive 25% more value on travel redemptions through Chase.

- Earn 5 points per dollar on hotels booked through the Chase Travel℠ portal.

- Earn 2 points per dollar on all other travel purchases.

IHG One Rewards Premier Credit Card

- Earn up to 10 points per dollar spent at IHG Properties.

- Earn 140,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

- Earn 5 points per dollar on travel, dining, and at gas stations.

- Redeem points for three nights, get the fourth free.

Capital One Venture X Rewards Credit Card

- Receive a $300 annual credit for bookings through Capital One Travel which can be applied to hotels

- Earn 10 miles per dollar on hotels booked through Capital One Travel

- 10,000 miles anniversary bonus—or the equivalent of $100 toward travel each year

- Earn 2 miles per dollar on all other purchases

Find the Best Hotel Rewards Credit Cards of 2024

How much do hotels usually hold on a credit card.

Upon checking in, if your hotel isn’t already paid for, a hotel will typically hold the full room charge, along with an incidental fee. Incidental fees vary based on hotel, with some charging a daily incidental fee, and others charging a flat rate. They are typically in the $100 to $200 range.

Can I book a hotel with a debit card?

Most hotels will accept a debit card. If you choose to use a debit card to pay for a hotel, the biggest risk you encounter is that you might be asked to put down a security deposit upon check-in. This deposit could tie up your cash for the remainder of the stay.

Credit cards are generally a safer option when booking travel, thanks to more robust purchase protections—not to mention the reward potential.

How can I book a hotel room for someone else using my credit card?

If you want to book a hotel room for someone else, there are two things you need to do. First, ensure their name is on the reservation. Secondly, prepay for the room prior to checking in, but note that companies have differing policies on prepayment.

For example, Marriott requires you to call the hotel directly to receive a credit card authorization form, whereas Booking.com allows guests to book using a card belonging to someone other than the guest on the reservation. More likely than not, the person on the reservation will still need to provide a card for incidentals upon check-in. Note that you cannot gain loyalty points when booking a room for someone else, unless you will also be using that room.

Do hotels charge when you book?

Whether hotels charge when you book or not depends on various factors like the booking platform or the cancellation policy. When using credit card travel portals such as Chase Travel or Capital One Travel, oftentimes, in order to receive the benefits that come with using these cards, you need to use that card when you book. Additionally, when you book through third-party platforms, you have the option to pay now.

- Best Credit Cards 2024

- Best Travel Credit Cards

- Best Rewards Credit Cards

- Best No-Annual-Fee Cards For Travel

- Best No Annual Fee Travel Credit Cards

- Best Hotel Credit Cards

- Best Airline Credit Cards

- Best Travel Insurance

- Best Covid-19 Travel Insurance

- American Express Rewards

- Chase Rewards

- Capital One Miles

- Airline & Hotel Dining Rewards

- Southwest Rapid Rewards

- Delta Skymiles

- United Mileage Plus

- American Airlines Aadvantage

- Marriott Bonvoy

- Hilton Honors

- Chase Sapphire Reserve

- Capital One Venture X

- Chase Sapphire Preferred

- American Express Platinum

- Hotel Status Matches

- How Much Are Marriott Points Worth

- TSA PreCheck & Global Entry

- How To Avoid Hotel & Resort Fees

Next Up In Travel

- Best No Annual Fee Cards For Travel

- Chase Sapphire Preferred Credit Card Review

- Capital One Venture X Card Review

- When Should You Apply For A Travel Rewards Credit Card?

- Chase Sapphire Reserve Card Review

Minute Suites: How To Get A Private Room At The Airport

Guide To Using Virgin Atlantic Points

Forbes Advisor’s List Of The Best Flight Trackers

How To Redeem Citi Costco Rewards

Boost Your United Balance With The MileagePlus X App

How My Amex Credit Card Benefits Provide Peace Of Mind While Traveling

Having solo traveled to over 80 countries across six continents, credit cards enthusiast Kaitlyn Rosati knows a thing or two about travel. Her work has been featured in publications like New York Daily News and Time Out, and she runs the blog No Man Nomad to provide tips on various destinations around the globe.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Citi ThankYou Points: How to Earn and Use Them

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

The Citi ThankYou® rewards program lets eligible credit card holders collect rewards, known as ThankYou® points, on purchases made with a qualifying card.

ThankYou® points can be valuable, especially for travelers, but the rewards program can be a bit of a challenge to navigate:

Redemption options vary depending on what specific Citi card you have.

Point values can also range widely.

While Citi does allow point transfers to multiple travel loyalty programs, access to this feature again depends on which card you have. And only a handful of Citi's travel partners are domestic programs.

Still, ThankYou® points are flexible and versatile, especially if you have specific redemptions in mind. Here’s how to make the most out of Citi ThankYou® points.

» MORE: NerdWallet's best Citi credit cards

In this article

Citi thankyou® points: the basics, how much are citi thankyou® points worth.

Credit cards that earn ThankYou® points

Other ways to earn ThankYou® points

The fine print

You can earn ThankYou® points by paying for purchases with an eligible Citi credit card. Rewards can be accessed by logging into your Citi account or by visiting the ThankYou website .

Generally, ThankYou® points can be redeemed for:

Gift cards.

Cash back or statement credits.

Shopping at participating retailers.

Charity donations.

If you have an eligible Citi credit card, you can also transfer points to certain travel loyalty programs or share points with other ThankYou rewards members .

» MORE: Citi trifecta: Earn 2%-5% on every purchase

The value of a Citi ThankYou® point can vary greatly depending on how you redeem it — for travel, cash back or something else.

There are two ways to use Citi ThankYou® points for travel: redeeming points through Citi or transferring to a qualifying travel program.

Booking your travel through Citi

When you book your travel through Citi and pay for your booking with points, ThankYou® points are worth 1 cent apiece.

» Learn more: The guide to the Citi Travel portal

Transferring points to Citi's partner airline and hotel programs

The exact value you get per point depends on what you do with it after you transfer, but NerdWallet estimates the overall transfer value at 1 cent per point.

Citi's airline transfer partners are mostly foreign carriers. JetBlue is the only domestic airline on the list, although a few of the carriers are members of alliances that include U.S. airlines.

Aeromexico (1:1 ratio).

Air France/KLM (1:1 ratio).

Asia Miles (1:1 ratio).

Avianca (1:1 ratio).

Emirates (1:1 ratio).

Etihad (1:1 ratio).

Eva Air (1:1 ratio).

JetBlue (1:1 or 1:0.8 ratio, depending on which card you have).

Qantas (1:1 ratio).

Qatar Airways (1:1 ratio).

Singapore Airlines (1:1 ratio).

Thai Airways (1:1 ratio).

Turkish Airlines (1:1 ratio).

Virgin Atlantic (1:1 ratio).

Accor Live Limitless (2:1 ratio).

Choice Hotels (1:2 or 1:1.5 ratio, depending on which card you have).

The Leading Hotels of the World (5:1 ratio).

Wyndham (1:1 ratio or 1:0.8 ratio, depending on which card you have).

Virgin Red (1:1 ratio).

The transfer ratio is frequently 1:1, meaning for every ThankYou® point you transfer, you get 1 point or mile in the partner program. However, there are a few exceptions. With JetBlue, for instance, the transfer ratios can vary:

If you have the Citi Strata Premier℠ Card or the Citi Prestige® Card , then you can transfer points to JetBlue at a 1:1 ratio.

For other cards, the ratio is 1:0.8, meaning for each ThankYou® point you transfer, you get 0.8 TrueBlue points from JetBlue. So 1,000 points translates into 800 TrueBlue points.

JetBlue, Wyndham and Choice are the only eligible travel partners for the Citi Rewards+® Card and the Citi Double Cash® Card . To unlock access to more transfer partners, you'd also need an eligible travel card like the Citi Strata Premier℠ Card .

You can also transfer points to Citi's hotel partners. There are four:

Because these ratios are less favorable, we recommend only using ThankYou points to top off your account for a specific redemption.

Booking events with Virgin Red

Use a 1:1 ratio to transfer Citi ThankYou points to Virgin Red, the loyalty program of Virgin Group. Virgin Red members redeem Virgin Points for events like virtual masterclasses, sporting matches or cruises.

Cash or cash-like redemptions

Redeeming for cash can cut the value of your rewards in half. For some cards, cash redeems at a rate of 0.5 cent per point in denominations of $50 and $100. And you can’t redeem cash into your bank account; you have to wait for a check to arrive in the mail.

Statement credit

When you redeem for a credit on your statement, you may get the same weak value as with cash back — 0.5 cent per point — but you have more flexibility in how much you redeem for. The redemption rate for a statement credit varies by card. Statement credits show up on your account within two billing cycles. It can help pay down your overall balance, but you’ll still be on the hook for the minimum payment.

Gift card redemptions typically start at 2,500 points. They generally redeem at a rate of 1 cent per point. Citi's ThankYou website has several brands and categories to choose from, including restaurants, department stores, travel and electronics, among others.

You can donate points (starting at 1,000) to charities on Citi's ThankYou.com site .

Shop With Points program

You can redeem ThankYou® points at participating retailers, including Amazon , Walmart and Walgreens, to name a few. But it's generally a poor value, as points used with those two retailers are worth only 0.8 cent each.

Pay With Points

After you've made an online or in-store out-of-pocket purchase, you're notified via the Citi mobile app whether that item is eligible to be covered by ThankYou® points. If so, you can apply your ThankYou points to the purchase in exchange for a statement credit that arrives within two to three business days. Purchase categories that may be eligible include dining out, groceries, entertainment and department stores, among others. You'll have to set up alerts to stay on top of purchases that qualify. If you decide to Pay With Points, a redemption value of 0.8 cent per point will apply. That's lower than the industry standard of a penny per point.

Credit cards that earn ThankYou points

Citi offers multiple products that earn the ThankYou® rewards currency. Here are some of its most prominent:

Citi Double Cash® Card

2% cash back on purchases (in the form of ThankYou® Points) distributed in two stages: 1% back for every dollar spent and 1% back for every dollar paid off.

Annual fee: $0

Sign-up bonus: Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

» MORE: Full review of the Citi Double Cash® Card

Citi Rewards+® Card

2 ThankYou points per $1 spent at supermarkets and gas stations (on up to $6,000 in purchases per year).

1 ThankYou point per $1 spent on all other purchases.

Rewards are rounded up to the nearest 10 points on every purchase.

Get 10% points back for the first 100,000 points you redeem per year.

Sign-up bonus: Earn 20,000 bonus points after you spend $1,500 in purchases with your card within 3 months of account opening; redeemable for $200 in gift cards at thankyou.com. Plus, as a special offer, earn a total of 5 ThankYou® Points per $1 spent on hotel, car rentals and attractions booked on CitiTravel.com through December 31, 2025.

» MORE: Full review of the Citi Rewards+® Card

Citi Custom Cash® Card

Earn 5% cash back (in the form of ThankYou® Points) on purchases in your top eligible spend category each billing cycle, on up to $500; earn 1% back on all other purchases.

Eligible categories include restaurants, gas stations, grocery stores, select travel, select transit, select streaming services, drugstores, home improvement stores, fitness clubs and live entertainment.

0% intro APR for 15 months on purchases and balance transfers and then the ongoing 19.24%-29.24% Variable APR .

Citi Rewards+℠ Student Card

The Citi Rewards+ Student Card has been discontinued, but existing cardholders can continue using the card and earning rewards.

Citi Strata Premier℠ Card

10 ThankYou points per $1 spent on hotels, car rentals and attractions booked through Citi.

3 ThankYou points per $1 spent on restaurants, supermarkets, air travel, hotels not purchased through Citi, gas stations and EV stations.

$100 annual hotel savings on a single hotel stay of $500 or more purchased through Citi.

Annual fee: $95

Sign-up bonus: Earn 70,000 bonus ThankYou® Points after spending $4,000 in the first 3 months of account opening, redeemable for $700 in gift cards or travel rewards at thankyou.com

» MORE: Full review of the Citi Strata Premier℠ Card

Citi Prestige® Card

5 ThankYou points per dollar spent on dining out and air travel purchases.

3 ThankYou points per dollar spent on cruise lines and hotel purchases.

1 ThankYou point per dollar on all other purchases.

Annual fee: $495

Sign-up bonus: This offer is no longer valid on our site.

The Citi Prestige Card is no longer accepting applications, but existing cardholders may continue using their card and earning rewards.

AT&T Points Plus Card

3 ThankYou points per dollar spent at gas stations.

2 ThankYou points per dollar spent at grocery stores (including grocery delivery services).

1 ThankYou point for every dollar spent on all other purchases.

Annual fee: $0.

Sign-up bonus: Earn a $100 statement credit after you spend $1,000 on purchases in the first 3 months of account opening. Plus Earn up to $240 back toward your qualifying AT&T wireless bills every year after qualifying activities.

» READ : 5 things to know about the AT&T Points Plus Card

With a Citi ThankYou® credit card, you may earn ThankYou® points as long as your account is open and current. Review your card's terms and conditions to know when ThankYou® points may expire.

It also helps to understand your credit card’s terms and conditions so that you’re aware of nonqualifying purchases. For instance, some cards earn points in categories like restaurants, but your purchase may not qualify for the higher rewards rate if the restaurant is located inside a department store.

Information related to the Citi Prestige® Card and the AT&T Points Plus Card has been collected by NerdWallet and has not been reviewed or provided by the issuer of this card.

On a similar note...

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

- Credit Cards

- View All Credit Cards

- See If You're Pre-Selected

- Balance Transfer Credit Cards

- 0% Intro APR Credit Cards

- Rewards Credit Cards

- Cash Back Credit Cards

- Travel Credit Cards

- Retail Store Cards

- Small Business Credit Cards

Quick Links

- Banking Overview

- Certificates of Deposit

- Banking IRAs

- class="ssr-key" Small Business Banking

- Personal Loans

- Overdraft Line of Credit

- Home Lending

- Refinance Your Home

- Use Your Home Equity

- Small Business Lending

- Investing Overview

- Self-Directed Investing

- Guided Investing

- Working with an Advisor

- Wealth Management

- Citigold ® Private Client

- Citi Priority

- Open an Account

Notificación importante

Por favor, tenga en cuenta que las comunicaciones verbales y escritas de Citi podrían estar únicamente en inglés, ya que, tal vez, no podamos proporcionar comunicaciones relacionadas con los servicios en todos los idiomas. Estas comunicaciones podrían incluir, entre otras, contratos, divulgaciones y estados de cuenta, cambios en los términos o en los cargos, así como cualquier documento de mantenimiento de su cuenta.

Please be advised that verbal and written communications from Citi may be in English as we may not be able to provide servicing related communications in all languages. These communications may include, but are not limited to, account agreements, statements and disclosures, change in terms or fees; or any servicing of your account. If you need assistance in a language other than English, please contact us as we have language services that may be of assistance to you.

CITI TRAVEL with Booking.com

Introducing citi travel℠: your first stop to your next destination.

Earn ThankYou ® Points when you pay for part, or all, of your trip with your eligible Citi Card through the Citi Travel portal. Plus, you can redeem your points towards even more adventures through the Citi Travel portal. With customizable options and booking right from your Citi Mobile ® App for eligible cardholders, the way to go is now way easier.

Earn More ThankYou ® Points on Select Bookings Through the Citi Travel portal

10x the fun with citi strata premier℠.

Earn a total of 10x ThankYou ® Points on hotels and car rentals when you book on the Citi Travel portal. 1

5X the Fun with Rewards+ ®

Earn a total of 5x ThankYou ® Points on hotels and car rentals when you book on the Citi Travel portal. Offer expires December 31, 2025. 2

More Points, More Fun with Double Cash ®

Earn a total of 5 ThankYou ® Points per $1 spent on hotels and car rentals when you book on the Citi Travel portal. Offers expires December 31, 2024. 3

Offer provides 3 additional points on top of the 1 point per dollar on purchases and 1 point per dollar for payments on purchases

Earn More Points with Custom Cash ®

Earn an unlimited additional 4 ThankYou ® Points per $1 spent on hotels and car rentals when you book on the Citi Travel portal. Offers expires June 30, 2025. 4

Additional Citi Travel Portal Benefits

The citi travel portal offers perks to make your travel booking experience easier and more convenient., access to over 1.4 million hotel and resort options, competitive prices when booking flights, hotels, cars and attractions, 24/7 customer service support for your booking needs.

ThankYou ® Cards Make Every Day More Rewarding

It's easy to earn ThankYou ® Points with Citi credit cards. Find the one that helps you earn the most on your daily spending.

Citi Travel: Frequently Asked Questions

What is the citi travel portal.

Citi Travel is a travel booking portal that gives eligible Citi card members access to book flights, hotels, rental cars, and attractions at competitive prices, along with 24/7 customer support. Additionally, when you book through the Citi Travel portal using ThankYou ® rewards cards, you can earn ThankYou ® points on your travel spending which can then be redeemed to be used on your next journey.

How do I book through the Citi Travel portal?

To book through the Citi Travel portal:

- Login into your Citi Mobile App or directly into the Citi Travel portal using your Citi Online User ID and password.

- After that, search for the flights, hotels, car rentals or attractions you want to book and enter the necessary information (such as number of guests or passengers, travel dates, etc.)

- Confirm your booking and choose whether you want to pay with card, points, or a combination of these purchase options.ns.

Can I use any Citi ® card to book through Citi Travel?

All Citi ThankYou ® Rewards Credit Cards

Citi Travel℠ is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with Booking.com.

1 You will earn 10 ThankYou Points for each $1 spent on hotels, car rentals, and attractions when you use your Citi Strata Premier Card to book them through the Citi Travel site via CitiTravel.com or 1-833-737-1288 (TTY: 711). For bookings made with a combination of points and your Citi Strata Premier Card, only the portion paid with your card will earn points. Points are not earned on cancelled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with Booking.com.

2 Earn a total of 5 ThankYou ® Points per $1 spent on hotel, car rental and attractions excluding air travel when booked through the Citi Travel℠ portal on cititravel.com or by calling 1-833-737-1288 and saying "Travel". Offer is valid through 11:59 PM 12/31/2025. You earn 1 ThankYou ® Point per $1 spent on the Citi Travel portal bookings. You will earn an additional 4 bonus ThankYou ® Points per $1 spent on hotel, car rental and attractions excluding air travel when booked through the Citi Travel portal or by calling 1-833-737-1288 through 11:59 PM 12/31/2025. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Rewards+ ® Card registered at the Citi Travel portal to earn the bonus points . For bookings made with a combination of points and your Citi Rewards+ ® Card, only the portion paid with your card will earn points. Bonus points will take up to 3 billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with booking.com.

3 Earn a total of 5 ThankYou Points per $1 spent on hotel, car rental, and attractions excluding air travel when booked through the Citi Travel℠ portal on cititravel.com or by calling 1-833-737-1288 and saying "Travel". Offer is valid through 11:59 PM Eastern Time (ET) 12/31/2024. You earn 1 ThankYou Point per $1 spent on the Citi Travel portal bookings and an additional 1 ThankYou Point per $1 paid on Eligible Payments (as defined in the Citi ThankYou ® Rewards Terms and Conditions for Citi Double Cash ® Card Accounts) made to your Citi Double Cash card account. You will earn an additional 3 bonus ThankYou Points per $1 spent on hotel, car rental, and attractions excluding air travel when booked through the Citi Travel portal or by calling 1-833-737-1288 through 11:59 PM Eastern Time (ET) 12/31/2024. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Double Cash Card registered at the Citi Travel portal to earn the bonus points . For bookings made with a combination of points and your eligible Citi Double Cash card, only the portion paid with your card will earn the additional points. Bonus points may take one or two billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with booking.com.

4 Earn an additional 4 Thank You Points per $1 spent on hotel, car rental, and attractions excluding air travel through the Citi Travel℠ portal or by calling 1-833-737-1288 (TTY: 711). Offer is valid through 11:59 PM Eastern Time (ET) 6/30/2025. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Custom Cash ® Card registered at the Citi Travel portal to earn the bonus points . For bookings made with a combination of points and your eligible Citi card, only the portion paid with your card will earn the additional points. Bonus points may take one or two billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with booking.com.

To provide you with extra security, we may need to ask for more information before you can use the feature you selected.

Just a moment, please...

Get Citibank information on the countries & jurisdictions we serve

You are leaving a Citi Website and going to a third party site. That site may have a privacy policy different from Citi and may provide less security than this Citi site. Citi and its affiliates are not responsible for the products, services, and content on the third party website. Do you want to go to the third party site?

Citi is not responsible for the products, services or facilities provided and/or owned by other companies.

Por favor, tenga en cuenta que las comunicaciones verbales y escritas de Citi podrían estar únicamente en inglés, ya que, tal vez, no podamos proporcionar comunicaciones relacionadas con los servicios en todos los idiomas. Estas comunicaciones podrían incluir, entre otras, contratos, divulgaciones y estados de cuenta, cambios en los términos o en los cargos, así como cualquier documento de mantenimiento de su cuenta. Si necesita ayuda en un idioma distinto al inglés, por favor, comuníquese con nosotros, ya que tenemos servicios de idiomas que podrían serle útiles.

Share Your Screen With A Phone Representative

During your call, you may be asked to share your screen for a faster, more efficient experience. If you agree, the phone representative you're speaking with will give you a Service Code to enter below.

If you need assistance from a Citi representative, contact us via chat or phone

Citi Rewards Credit Card Lets You Accumulate Points for Miles, Cash Rebates and More—MoneySmart Review 2024

If you shop a lot, buy groceries for the whole family, dine out often and take rides everywhere, the Citi Rewards Credit Card may be the most worth it for you.

Its main draw is points accumulation which can be converted into frequent flyer miles or cash rebates. It offers 10X rewards points or $1 for 4 miles for online purchases across several categories such as online groceries, food delivery, ride-hailing, and offline purchases in department stores and several fashion brands.

Let’s dig in to see what else this card offers.

Citi Rewards Credit Card—MoneySmart Review 2024

Citi rewards card: summary.

- Citi Rewards Card —How does it work?

Should I get the Citi Rewards Card?

- Citi Rewards Card —Sign-up promo

Alternatives to the Citi Rewards Card

See our credit card ranking rubric to find out how we rank credit cards.