The FinCEN Travel Rule

- February 25, 2021

- AML Compliance , Banks , Blog , Casino and Gaming , FinTechs , MSBs

Disclaimer: The contents of this article are intended to provide a general understanding of the subject matter. However, this article is not intended to provide legal or other professional advice, and should not be relied on as such.

The FinCEN “Travel Rule” has many requirements and nuances that can challenge and confuse new and seasoned AML compliance professionals alike. From the basics of what types of transactions fall under the Rule, to mandatory versus optional data requirements, to its many exemptions – as well as the nuances addressed by subsequent FinCEN guidance not contained in the Rule itself – compliance professionals need to understand the details of this longstanding Bank Secrecy Act (BSA) regulation.

This article begins with a review of the fundamentals of the FinCEN Travel Rule , and why compliance is so important to anti-money laundering efforts. Learn about the nuances of complying with the Travel Rule, including a discussion of pending changes to the Travel Rule in an October 2020 Notice of Proposed Rulemaking; Fedwire versus Travel Rule requirements; aggregated funds transfers; Originator name issues; and transfers by non-customers.

What is the FinCEN Travel Rule?

In January 1995, the Board of Governors of the Federal Reserve and FinCEN jointly issued a Rule for banks and other nonbank financial institutions, relating to information required to be included in funds transfers. The Rule is comprised of two parts – the Recordkeeping Rule, and what’s come to be known as the Travel Rule. The Travel Rule was promoted by FinCEN, in keeping with their mandate to enforce the Bank Secrecy Act .

The Recordkeeping Rule and the Travel Rule are complementary. The Recordkeeping Rule requires financial institutions to collect and retain the information that in turn, per the Travel Rule, must be included with a funds transfer and passed along – or “travel” – to each successive bank in the funds transfer chain. The Recordkeeping Rule does however serve other purposes besides ensuring that information is available to include with funds transfers.

The terms “transfer” and “transmittal” are used throughout this regulation. The distinction between these two terms is simple: a bank performs transfers, and a non-bank financial institution performs transmittals. The term “transfer” will primarily be used from this point on to refer to both types of transactions.

The Underlying Objective

Fund transfers have been the tool of choice for money laundering, fraud, and much more, for decades. As FinCEN’s mission is to implement, administer, and enforce compliance with the Bank Secrecy Act, it has the authority to require financial institutions to keep records that, according to FinCEN, have a high degree of usefulness in criminal, tax, or regulatory investigations or proceedings, or even in intelligence or counterintelligence matters when terrorism is involved.

Ultimately, the Recordkeeping and Travel Rule is primarily designed to help law enforcement to detect, investigate and prosecute money laundering and financial crimes, by preserving the information trail about who’s sending and receiving money through funds transfer systems. In other words, it helps them follow the money.

Transactions Subject to the Recordkeeping and Travel Rule

The Recordkeeping and Travel Rule states that it applies to funds transfers. The definition of a funds transfer is very important, as highlighted later in the discussion of the most recent Notice of Proposed Rulemaking.

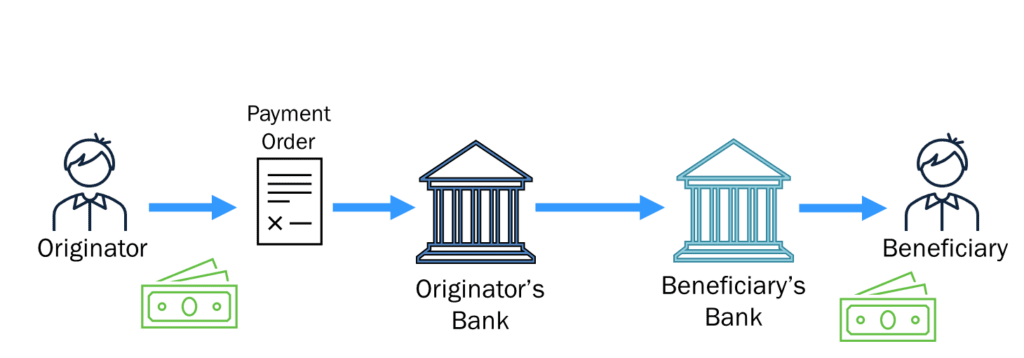

The Rule defines a funds transfer as a series of transactions, beginning with the Originator’s payment order, made for the purpose of making a payment of money to the Beneficiary of that payment order.

Below is a basic illustration of a funds transfer. An Originator creates a Payment Order to pay money to a specific Beneficiary. The Originator delivers the Payment Order to his bank, which then passes on the Payment Order details to the bank holding the Beneficiary’s account. The funds transfer is complete when the Beneficiary’s Bank accepts the Payment Order on behalf of the Beneficiary.

In today’s world, funds transfers are electronic, and a wire transfer is the most common form of electronic funds transfer. At its essence, a wire transfer is simply a message from one bank to another, passed through an electronic system, such as Fedwire, SWIFT , or CHIPS.

Electronic Funds Transfers That are Excluded

Besides wire transfers, there are many types of electronic funds transfers, or EFTs in use today. Although all are in essence funds transfers, these types of transactions are specifically excluded from the definition of a funds transfer or transmittal in the Recordkeeping and Travel Rule. Instead, these types of electronic funds transfers are defined in, and governed by, the Electronic Funds Transfer Act, otherwise known as Regulation E. [i] Currently, these are:

- ACH (automated clearing house) transactions

- ATM (automated teller machine) transactions

- Point of Sale (POS) transactions

- Direct deposits or withdrawals

- Telephone banking transfers

Terminology Review

The terminology used in the Recordkeeping and Travel Rule is in many cases unique. The more commonly-used terms when referring to wire transfers and other electronic funds transfers come from the Uniform Commercial Code’s Article 4A, which governs funds transfers. [ii]

Throughout this article, UCC 4A terminology will be used as it is more commonly understood:

* The spelling shown here is per the regulation; it is not the correct spelling of this word according to widely-accepted sources.

The term Sender per UCC 4A refers to the person who is delivering the Payment Order to the Receiving Bank. This person would typically be the Originator, but could potentially be a third party, as discussed further below.

Funds Transfer Data Requirements

The Rule divides the data requirements on a funds transfer into two groups: (1) data that is mandatory, and (2) data that, if the originator provides it , must be included.

First, the data that must be included on the funds transfer by the Originator’s Bank is:

- The Originator’s name

- The Originator’s address

- The Originator’s account number (if there is one)

- The identity of the Beneficiary’s Bank

- The payment amount

- The payment execution date

Typically, a bank will automatically populate the Originator’s name and address information on a wire transfer directly from the customer record. This is because it is very important that the Originator’s name reflects the actual party initiating the Payment Order. (This topic is explored further in the Deep Dives section below.)

The second group of data elements is optional – meaning, if the Originator provides any of this information, it must be included on the funds transfer record. This information includes:

- The Recipient’s (or Beneficiary’s) name

- The Beneficiary’s address

- The Beneficiary’s account number or other identifiers

- Any other message or payment instructions – what typically are entered in the freeform text fields on a wire transfer, such as the Originator to Beneficiary Information or OBI field on a Fedwire.

Even though this information is not mandatory per FinCEN’s Travel Rule requirements, nothing precludes a bank from mandating customers to supply it. From an operational perspective, at least the Beneficiary’s account number should be required information to minimize the risk that the transfer will be rejected and returned by the Receiving Bank as unpostable.

As well as being highly valuable to law enforcement, Beneficiary information is critical to a bank’s fraud detection , suspicious activity monitoring and sanctions compliance efforts. Without this information, detecting an unusual or suspicious wire transfer recipient, establishing a pattern of transaction activity to a particular recipient, or identifying a customer transaction with an OFAC-sanctioned party is impossible.

Exemptions from the Travel Rule

In addition to the types of EFTs that are not subject to the Rule (as they fall under the jurisdiction of Regulation E) there are several categories, or classes, of funds transfers that are exempt from FinCEN’s Travel Rule’s requirements. Specifically:

- A funds transfer that is less than $3,000.

- A funds transfer where the sender and the recipient are the same person . For example, if an individual is wiring money from her account at Bank A to her account at Bank B, Bank A does not have to obtain and retain the Travel Rule mandatory information for this transfer.

- A funds transfer made between two account holders at the same institution. Commonly known as a book transfer, this transaction is not processed through the Federal Reserve, but is simply a journal entry on the financial institution’s books.

- A bank, or a U.S. subsidiary thereof

- A commodities/futures broker, or a U.S. subsidiary thereof

- The U.S. government; a state or local government

- A securities broker/dealer, or a U.S. subsidiary thereof

- A mutual fund

- A federal, state or local government agency or instrumentality

Nothing prevents a financial institution from ignoring these exemptions; the institution is free to follow the Recordkeeping and Travel Rule requirements with every funds transfer. Such a practice benefits all the financial institutions involved in the transaction, as well as law enforcement.

Recordkeeping and Travel Rule Enforcement

FinCEN enforcement actions over the years have never solely targeted violations of the Recordkeeping and Travel Rule. This is likely because as a matter of operational efficiency, financial institutions typically populate the basic mandatory information on all outgoing funds transfers and maintain records of such.

However, it is important not to overlook the other key element of the Recordkeeping and Travel Rule: records retrievability.

A financial institution may be approached by federal, state, or local law enforcement, its regulator, another regulatory agency, or by subpoena, to provide specific funds transfer records.

If the institution is the Originator’s Bank, the mandatory funds transfer information to be collected and retained (Originator name & address, etc.) must be retrievable upon request, based on the Originator’s name . If the Originator is the institution’s established customer, transaction retrieval by the Originator’s account number may also be requested. A Beneficiary’s Bank must be able to retrieve funds transfer records by the Beneficiary’s name, and if an established customer, also by account number.

The FinCEN Travel Rule requires all funds transfer records to be retained for a minimum of five years from the date of the transaction.

Once funds transfer records are requested, the Rule states they must be supplied within a reasonable period – which may likely be negotiated between the financial institution and the requestor.

The 120-Hour Rule

However, financial institutions should be aware of a lesser-known clause within Section 314 of the USA PATRIOT Act that could impact records retrieval. Commonly known as the 120 Hour Rule , it states that any information, on any account that is opened, maintained, or managed in the U.S. requested by a federal banking agency, must be provided by the financial institution within 120 hours (5 days) after receiving the request. Funds transfer records would likely fall within the scope of this Rule.

Anecdotally, regulators have not imposed the 120 Hour Rule often. Financial institutions should nevertheless be prepared to respond to regulatory or law enforcement requests as quickly and efficiently as possible. IRS and civil case subpoenas requesting funds transfer records also typically have a short response window.

Recordkeeping and Travel Rule Guidance: A Deep Dive

The following sections explore deeper topics relating to Recordkeeping and Travel Rule guidance, including:

- The October 2020 Joint Notice of Proposed Rulemaking impacting the Rule

- Fedwire versus the Travel Rule

- Originator name issues

- Aggregated funds transfers

- Funds transfers for non-customers

Joint Notice of Proposed Rulemaking

On October 23, 2020, the Board of Governors of the Federal Reserve and FinCEN issued a Joint Notice of Proposed Rulemaking (NPRM) to amend the Recordkeeping and Travel Rule regulations. Written comments on the Proposed Rule were due by the end of November 2020. The next step is a publication of the Final Rule, but FinCEN has not set a date for this.

According to the website Regulations.gov , 2,882 comments were submitted for the NPRM. Commenters ranged from major banking groups such as the American Bankers Association to private individuals. The comments were overwhelmingly negative.

The NPRM proposes two major changes, discussed below.

Reducing the Minimum Dollar Threshold for Recordkeeping and Travel Rule Compliance on Cross-Border Funds Transfers

Part 1 of the NPRM proposes reducing the $3,000 threshold for Recordkeeping and Travel Rule compliance to $250 for cross-border transactions. The threshold for domestic transactions would remain at $3,000.

While this change may not have a major impact on financial institutions that ignore the dollar threshold exemption, it would significantly impact those institutions that follow it. There are some interesting nuances in this proposed change regarding what is meant by “cross border.”

Initially, a “cross-border” transaction is defined as one that, “begins or ends outside of the United States.” The United States includes the 50 states, the District of Columbia, the Indian lands (as that term is defined in the Indian Gaming Regulatory Act), and the Territories and Insular Possessions of the United States. [iii]

A funds transfer would be considered to “begin or end outside the United States” if the financial institution knows, or has reason to know, that the Originator, the Originator’s financial institution, the Recipient/Beneficiary, or the Recipient/Beneficiary’s financial institution is located in, is ordinarily resident in, or is organized under the laws of a jurisdiction other than the United States. Furthermore, a financial institution would have “reason to know” that a transaction begins or ends outside the United States only to the extent such information could be determined based on the information it receives in the payment order or otherwise collects from the Originator.

The driving factor behind this regulatory change is the benefit to law enforcement and national security. FinCEN’s analysis of SAR filings , as well as comments collected by the Department of Justice from agents and prosecutors at the Federal Bureau of Investigation, the U.S. Drug Enforcement Administration, the Internal Revenue Service, the U.S. Secret Service, and U.S. Immigration and Customs Enforcement, all supported lowering (or eliminating altogether) the reporting threshold, in order to disrupt illegal activity and increase its cost to the perpetrators.

According to FinCEN and these other law enforcement agencies, cross-border funds transfers, and especially lower dollar transfers in the $200 to $600 dollar range, are being used extensively in terrorist financing and narcotics trafficking to avoid reporting and detection.

For those institutions that abide by the minimum reporting threshold, the new lower cross-border threshold presents operational and programmatic challenges. The distinction between a cross-border and a domestic transaction is not always clear. For example, if a financial institution has no direct foreign correspondent banking relationships, its cross-border funds transfers must flow through a U.S. intermediary institution, and therefore the Federal Reserve. Automated systems may interpret such transactions as domestic because the first receiving institution will always be U.S.-based.

Recordkeeping and Travel Rule Applies to Virtual Currency

The second element of the NPRM would make funds transfers involving convertible virtual currency (CVC) and other digital assets, to be subject to the Recordkeeping and Travel Rule. CVC, more commonly known as cryptocurrency or cyber-currency, is a medium of exchange with an equivalent value in currency or acts as a substitute for currency, but at present does not fall under the regulatory definition of “money” (also known as legal tender).

The Proposed Rule now defines CVC as money. This is significant because transfers of CVC now legally fall within the meaning of “a transfer of money” to which the Recordkeeping and Travel Rule applies.

The “why” behind this aspect of the Proposed Rule is the exponential growth in CVC use for money laundering, terrorist financing, organized crime, weapons proliferation, and sanctions evasion. CVC’s anonymity makes it particularly attractive for financial crime. Bad actors can convert illegal proceeds into virtual currency and then transmit it to any destination anonymously within seconds, where it is redeemed for cash again or converted to another form. This makes CVC a perfect mechanism for the layering phase of money laundering.

For more information, check out our blog on the crypto travel rule .

NPRM Background and the “FATF Travel Rule”

Events leading up to the NPRM provide an interesting background, especially as they are intertwined with global anti-money laundering efforts – specifically those of the Financial Actions Task Force (FATF) and what has come to be known as the “FATF Travel Rule.”

As virtual currency’s popularity began to grow exponentially, regulators in the United States and globally were caught off-guard. It was not well understood, and there were no real protocols in place to govern it. In March 2013 , FinCEN released initial guidance clarifying that virtual currency exchangers and administrators must register as money service businesses, pursuant to federal law. [iv]

In October 2018 , FATF published guidance that clearly defined just what are virtual assets and virtual asset service providers (VASPs). [v] FATF followed this up in February 2019 with a far-reaching Interpretive Note to Recommendation 15 (New Technologies), in a Public Statement titled “Mitigating Risks from Virtual Assets.” [vi]

This publication included two key proposals that generated backlash from the cryptocurrency sector:

For one, it proposed that VASPs should, at a minimum, be required to be licensed or registered in the jurisdiction(s) where they are created. As well, VASPs should be subject to effective systems for monitoring compliance with a country’s AML/CFT requirements, and be supervised by a competent authority – not a self-regulatory body.

Second, it introduced what’s come to be known as the FATF Travel Rule for funds transferred over $1,000 – specifically referencing virtual asset transfers. These requirements match up point-for-point with the United States Recordkeeping and Travel Rule in terms of required funds transfer data to be obtained, retained and passed on.

In May 2019 , FinCEN published lengthy and complex guidance [vii] effectively stating that CVC-based transfers processed by nonbank financial institutions that meet the definition of a money service business are subject to the Bank Secrecy Act (BSA), and thereby the Recordkeeping and Travel Rule. Furthermore, it clarified that a transfer of virtual currency involves a sender making a “transmittal order.”

One month later in June 2019 , the FATF formally adopted the proposals from their 2018 guidance by incorporating them into the FATF 40 Recommendations – specifically, Recommendation 16, Wire Transfers.

In October 2020, the Federal Reserve Board and FinCEN issued their Joint NPRM, which would codify their May 2019 guidance as well.

Fedwire vs. the FinCEN Travel Rule

With respect to the implementation and enforcement of the Recordkeeping and Travel Rule, there is an interesting disconnect between the two key divisions of the U.S. Treasury Department. FinCEN is tasked with administering and enforcing the BSA, of which the Recordkeeping and Travel Rule is a part. The Federal Reserve Banks, also part of the US Treasury Department, own and operate Fedwire , the country’s primary funds transfer service. Yet the Fedwire system does no validation whatsoever that funds transfers processed through it include the basic, mandatory information required by the Travel Rule. The only data elements required to process a Fedwire transfer are the sending and receiving banks’ Fed routing numbers, the transaction amount, and its effective date. [viii]

One might conclude that law enforcement could have much more information on funds transfers at its disposal if the federal government’s actual funds transfer system made that information required. Today, should an Originator’s Bank fail to include the Travel Rule’s mandatory information (Originator’s name and address, etc.) on a funds transfer, the Receiving Bank is under no obligation to return the transfer and request the mandatory information. Instead, the burden is solely on the Originator’s Bank to comply, and any subsequent Receiving Banks’ responsibility is simply to retain (and pass on, if necessary) the information received.

Aggregated Funds Transfers

A financial institution may aggregate, or combine, multiple individual funds transfer requests into a single, aggregated funds transfer/transmittal.

For purposes of the FinCEN Travel Rule, whenever a financial institution aggregates multiple parties’ transfer requests into one single transfer, the institution itself becomes the Originator. Similarly, if there are multiple Beneficiaries in this aggregated transfer, but all with accounts at the same Receiving institution, then that institution becomes the Beneficiary on the aggregated funds transfer.

Aggregated funds transfers are common with money service businesses , as illustrated here:

A money service business (MSB) in Texas has several transmittal orders from various individuals, who are all sending funds to recipients via one particular Mexican casa de cambio. The Texas MSB aggregates these transactions into a single transmittal order, submitted to the MSB’s bank in Texas, for which the Beneficiary is the Mexican casa de cambio. This transmittal order does not identify the individual Originators or Beneficiaries of the underlying transfers. The Texas bank passes on the aggregated transmittal order to the Mexican bank holding the account of the casa de cambio. Once this funds transfer is complete, the casa de cambio pays the Mexican recipients, based on separate individual transmittal orders it received directly from the Texas MSB.

In this aggregated funds transfer scenario, the Originators’ payments are completed through a combination of individual transmittal orders between the senders and recipients, and an aggregated funds transfer between the MSB and the casa de cambio.

To summarize, the Recordkeeping and Travel Rule requirements for the Texas MSB and its Texas bank are as follows.

The MSB must keep a record of each customer’s individual transmittal order. The MSB is the Originator’s Bank, and the individual sender is the Originator. The Beneficiary is the individual who will receive the money, and the Beneficiary’s Bank is the Mexican casa de cambio.

The Texas bank must retain and pass on the information on the aggregated funds transfer between the MSB and the casa de cambio. On this funds transfer record, the Originator is the Texas MSB, the Texas bank is the Originator’s Bank, the Mexican casa de cambio is the Beneficiary, and its bank is the Beneficiary’s Bank.

Originator Name Issues

The Originator’s full true name is a required data element per the Recordkeeping and Travel Rule. A financial institution will typically populate the Originator’s name and address information on a funds transfer directly from its customer record.

A financial institution may be faced with a situation where a customer does not want his/her/their actual name to be present on a funds transfer.

For example, a customer may ask the financial institution to replace the Originator name on a funds transfer with that of some other party. Oftentimes, the customer is sending funds from their own account on behalf of someone else. Individuals as well as business entities may make such a request, for a variety of underlying reasons.

Changing an Originator’s name from that of the account holder to that of a third party is clearly a violation of the spirit of the Travel Rule, although not specifically addressed within it. Further, it exposes the financial institution to risks of abetting fraud, tax evasion, and other illicit activities.

The FinCEN Travel Rule does, however, specifically prohibit the use of a code name or pseudonym in place of an individual Originator’s true name. However, there are some exceptions to this with respect to commercial/business customers. For instance, a business may have several accounts, each of which is titled in a manner that reflects the purpose of the account – such as “Acme Corporation Payroll Fund.” Use of an account name that reflects its commercial purpose is acceptable for an Originator name under the Travel Rule.

Other acceptable Originator names for business customers are names of unincorporated divisions or departments, trade names, and Doing Business As (DBA) names, such as these examples:

- “Giant Inc Engineering Division”

- “McDonald’s” (a trade name for the McDonald’s Corporation)

- “Sue’s Flowers” (the DBA name for a sole proprietorship owned by Sue Smith)

Joint Accounts

When a funds transfer is made from a joint account, technically both account holders are the Originators. However, automated funds transfer systems, including Fedwire, do not provide space for more than one Originator name and address. FinCEN provides financial institutions with a solution: [ix] simply identify the Originator on the transfer as the joint account holder who requested it.

Funds Transfers for Non-Customers

Additional rules apply when a financial institution accepts a funds transfer order from a party that is not an established customer (i.e., a non-customer).

If the payment order is made in person by the Originator, the financial institution must verify his/her identity, and obtain and retain the following information:

- Originator’s name and address

- Type of identification document reviewed, and its number and other details (e.g., driver’s license number, state where issued)

- The Originator’s tax ID number, or, if none, an alien identification number or passport number and country of issuance. Should the Originator state that he/she has no tax ID number, a record of this fact should also be retained.

If the person delivering the payment order is not the Originator, the financial institution should record that person’s name, address, and tax ID number (or alternative as described above), or note the lack thereof. The institution should also request the actual Originator’s tax ID number (or alternative as described above) or a notation of the lack thereof. The institution must also keep a record of the method of payment for the funds transfer (such as a check or credit card transaction).

- The Recordkeeping and Travel Rule is a joint regulation under the Bank Secrecy Act, issued by the Federal Reserve Board and FinCEN.

- Record retrieval is equally important as record creation. Financial institutions should ensure full records of all outgoing and incoming funds transfers are retained for five years and can be retrieved by Originator name or account number (for established customers).

- Exemptions to the Rule, such as funds transfers under $3,000, are not mandatory . Financial institutions may choose to fully comply with the Recordkeeping and Travel Rule for every funds transfer sent or received, no matter the dollar amount or the parties involved.

- If the Originator is not required to provide the Beneficiary’s name, address, and account number on every wire transfer, this will have a significant detrimental impact on the financial institution’s suspicious activity monitoring, fraud detection, and sanctions compliance efforts.

- The October 2020 Notice of Proposed Rulemaking impacts cross-border funds transfers and the virtual currency industry. No date has yet been set for the publication of a Final Rule.

- A customer should not be allowed to substitute another name for the Originator on an outgoing funds transfer, as this exposes the financial institution to the risk of acting as a conduit for fraud, tax evasion, and other illicit activity, no matter how innocent or legitimate the customer’s request may seem.

- A financial institution that sends or receives aggregated funds transfers, or transfers for non-customers, should examine its existing processes to ensure compliance with the special rules for these activities.

How Alessa Can Help

Alessa is an integrated AML compliance software solution for due diligence, sanctions screening , real-time transaction monitoring , regulatory reporting and more. The solution integrates with existing core systems and includes:

- Identity verification and customer due diligence for KYC/KYB

- Real-time transaction monitoring and screening

- Sanctions, PEPs, watch list, crypto and other forms of screening

- Configurable risk scoring

- Automated regulatory reporting

- Advanced analytics like anomaly detection and machine learning

- Dashboards, workflows and case management

With Alessa, customers can monitor their wire transactions and ensure that the appropriate process is in place to collect and record the right information in order to comply with regulatory bodies. Contact us today to see how we can help you implement or enhance the AML program at your financial institution to comply with mandates such as the FinCEN Travel Rule.

[i] 15 USC 1693 et seq.

[ii] The Uniform Commercial Code (UCC) is a comprehensive set of laws governing all commercial transactions in the United States. It is not a federal law, but a uniformly adopted state law. Uniformity of law is essential in this area for the interstate transaction of business. Source: Uniform Law Commission, www.uniformlaws.org

[iii] 31 CFR 1010.100(hhh)

[iv] Financial Crimes Enforcement Network. “Application of FinCEN’s Regulations to Persons Administering, Exchanging, or Using Virtual Currencies.” FIN-2013-G001, 18 March 2013.

[v] Financial Actions Task Force. “Regulation of Virtual Assets.” 19 October 2018.

[vi] Financial Actions Task Force. “Public Statement – Mitigating Risks from Virtual Assets.” 22 February 2019.

[vii] Financial Crimes Enforcement Network. “Application of FinCEN’s Regulations to Certain Business Models Involving Convertible Virtual Currencies.” FIN-2019-G001, 9 May 2019.

[viii] Various codes are also required data on a Fedwire transfer; however, these codes are for system processing purposes and have no relation to originator or beneficiary data.

[ix] Financial Crimes Enforcement Network. “Funds ‘Travel’ Regulations: Questions and Answers.” FIN-2010-G004, 9 November 2010.

Schedule a free demo

See how alessa can help your organization.

100% Commitment Free

Recent Posts

Navigating New AML Regulations

View a webinar playback discussing best practices for navigating new anti-money laundering (AML) regulations for financial compliance.

The KYC Onboarding Process: A Guide for Compliance Professionals

Learn the key steps for KYC onboarding, from verifying identities to monitoring customer transactions. Find out how to stay compliant and minimize risks in financial services.

5 Best Practices to Maintain FCA Compliance

Learn five best practices to ensure FCA compliance and boost trust and stability in financial markets.

Sign up for our newsletter

Join the thousands of AML professionals who receive our monthly newsletter to stay on top of what is happening in the industry. You may opt-out at any time.

Customer Support

Customer Support Portal

Copyright © 2024 Alessa Inc.

Please fill out the form to access the webinar:

- Agribusiness Construction Dealerships Distribution Education Financial Institutions Financial Services Fintech Governments Healthcare Hospitality Accommodations Insurance Manufacturing Nonprofits Private Equity Real Estate Technology Tribal Gaming and Government

- Assurance Accounting services Audit and assurance Organizational performance Leadership development Strategy and operations Outsourcing Finance and accounting Human resources Technology Operations C-suite Private client services Estate and tax planning Business transition strategy Wealth management and investment advisory services Risk advisory ESG services Forensic advisory Fraud investigation and litigation support Governance risk and controls Internal controls Operational risk Regulatory and compliance Technology Tax Credits and incentives Individual tax International tax State and local tax services Transaction advisory Buy-side Sell-side Investment banking Valuation services Wipfli Digital Custom software & apps Cybersecurity Data & analytics Digital strategy E-commerce Enterprise solutions Managed services

- Business Intelligence Microsoft Power BI Microsoft Fabric Planful Qlik Snowflake CRM Microsoft D365 Sales Microsoft D365 Marketing Microsoft D365 Customer Insights Salesforce Wipfli Move ERP business software Microsoft Dynamics 365 Business Central Microsoft Dynamics 365 Project Service Automation Microsoft Dynamics GP Oracle NetSuite Sage Intacct ERP for job shops Financial solutions Microsoft Dynamics 365 Business Central Microsoft Dynamics GP Microsoft Dynamics SL Oracle NetSuite Procore QuickBooks Sage Intacct iPaaS solutions Boomi MuleSoft Technology management Microsoft Azure Microsoft Office 365 Wipfli Marketplace Wipfli Connect Industry CRM Solutions Wipfli Connect for Banking Wipfli Connect for Contractors Wipfli Connect for Manufacturing Wipfli Connect for Nonprofits Wipfli Connect for Real Estate Integrated Products for Sage Intacct AssetEdge CFO Connect for Sage Intacct Concur Connectors for Sage Intacct EMRConnect for Sage Intacct HCMConnect LM-2 on Sage Intacct PositivePay for Sage Intacct Integrate invoice processing & AP automation with Concur Connectors Connectors for Dynamics 365 Business Central Connectors for Dynamics GP Connectors for Dynamics SL Connectors for Finance and Operations Connectors for NetSuite Connectors for Sage Intacct

- About us The Wipfli Way Living our values DEI Serving our communities The Wipfli Foundation Awards Corporate development Annual report Partners and associates Leadership team Window into Wipfli Media Logo and trademark

- RESOURCE HUB

- All openings Careers at Wipfli Diversity, equity and inclusion Experienced professionals How we invest in your growth Student opportunities

How to adopt FinCEN’s proposed recordkeeping, travel rules

- Financial Institutions

Are you ready for FinCEN’s proposal to amend the recordkeeping and travel rules under the Bank Secrecy Act?

On October 27, 2020, in the midst of all the COVID-19 chaos, FinCEN and the Board of Governors of the Federal Reserve System issued a joint advance notice of proposed rulemaking (ANPRM) to lower the thresholds under the Recordkeeping Rule and the Travel Rule from $3,000 for funds transfers and transmittals of funds that begin or end outside the United States down to $250. Written comments on the proposed change were due on November 27, 2020.

While the proposed changes are undoubtedly intended to help law enforcement identify and address financial crimes, there is also a potential compliance burden for financial institutions that process international transfers.

Here are proposed changes and what you can do now to ensure a successful transition to any new requirements.

The current rule

On January 3, 1995, the agencies jointly issued the recordkeeping rule, which requires banks and nonbank financial institutions (NBFIs) to collect and retain information related to funds transfers and transmittals of funds in amounts of $3,000 or more. At the same time, FinCEN issued a separate rule, the travel rule, which requires banks and NBFIs to transmit information on certain funds transfers and transmittals of funds to other banks or NBFIs participating in the transfer or transmittal. The Travel Rule and the Recordkeeping Rule complement each other: The recordkeeping rule requires banks to collect and retain the information that, under the Travel Rule, must be included with transmittal orders.

The proposed rule

The proposed modification would reduce the recordkeeping threshold from $3,000 to $250 for funds transfers and transmittals of funds that begin or end outside the United States. A funds transfer or transmittal of funds would be considered to begin or end outside the United States if the bank or NBFI knows or has reason to know that the originator, originator’s financial institution, beneficiary or beneficiary’s financial institution is located in, is ordinarily resident in or is organized under the laws of a jurisdiction other than the United States. The rule would remain unchanged for domestic funds transfers.

The agencies are also proposing to expand the definition of money to include convertible virtual currency (CVC). Currently, the recordkeeping rule does not define the term money but references the definition set forth in the Uniform Commercial Code (UCC). The UCC defines money as “a medium of exchange currently authorized or adopted by a domestic or foreign government.” While this change may or may not affect your organization, it is something to keep in mind if you are already offering or are considering offering services related to virtual currency.

Potential impact and preparation

The agencies have stated that the burden of lowering the $3,000 threshold on financial institutions is low, stating some financial institutions are already collecting information on at least some of the information on some of those transactions already.

However, there are a few things you and your team can start thinking about to better position yourselves for any changes that may come down the road:

- Consider what procedures will be needed to capture funds transfers and transmittals of funds at $250 or more that begin or end outside the United States, keeping in mind how you will determine whether a transaction is, in fact, cross-border in nature. If you use an automated surveillance monitoring system, consider what reporting capabilities are already available to help capture this information.

- In light of new processes and procedures, plan for how employees tasked with capturing and retaining the information required under the Recordkeeping and Travel Rules receive updated training on the proposed changes.

- Ensure sufficient resources, such as appropriate staffing levels, are available for the compliance department and BSA officer to implement the new rules.

- Consider the changes to internal controls and quality review processes that are necessary to be in line with the new regulatory guidance and best practices.

How Wipfli can help

Taking the time now to review the full ANPRM and working to get ahead of the curve will ensure successful implementation of procedures that are compliant with the new rules. Our team knows how to help you navigate FinCEN rules while saying in compliance. To learn more, visit our web page or learn more from our team with these resources:

- How you can help with BSA/AML and COVID-19-related fraud (podcast)

- Bank Secrecy Act and COVID-19 fraud

- Updates to FFIEC BSA/AML manual

- Is your BSA/AML training program adequate?

Fill out the form below, and we’ll be in touch to discuss your financial institution’s needs.

2024 banking outlook

Fewer mergers, tighter margins

Article Download

Please register, contact information.

* = required fields

First Name *

Last Name *

Phone number *

- CCI Magazine

- Writing for CCI

- Career Connection

- NEW: CCI Press – Book Publishing

- Advertise With Us

- See All Articles

- Internal Audit

- HR Compliance

- Cybersecurity

- Data Privacy

- Financial Services

- Well-Being at Work

- Leadership and Career

- Vendor News

- Submit an Event

- Download Whitepapers & Reports

- Download eBooks

- New: Living Your Best Compliance Life by Mary Shirley

- New: Ethics and Compliance for Humans by Adam Balfour

- 2021: Raise Your Game, Not Your Voice by Lentini-Walker & Tschida

- CCI Press & Compliance Bookshelf

- On Demand Webinar

- On-Demand with CEUs

- Leadership & Career

- Getting Governance Right

- Adam Balfour

- Jim DeLoach

- Mary Shirley

FinCEN’s Proposed Changes to the Recordkeeping and Travel Rule Thresholds

Does the benefit to law enforcement outweigh the increased cost to regulated entities.

FinCEN has proposed lowering the “Recordkeeping Rule” and “Travel Rule” thresholds, and although the changes would benefit law enforcement, they could also result in increased cost to regulated entities. BDO’s Chuck Pine discusses the potential compliance burden the proposed changes could pose.

On October 27, 2020, the U.S. Department of the Treasury Financial Crimes Enforcement Network (FinCEN) and the Board of Governors of the Federal Reserve System (Board) (collectively known as the Agencies) issued a joint advanced notice of proposed rulemaking (ANPRM) to lower the thresholds under the Recordkeeping Rule and the Travel Rule to $250 for fund transfers and transmittals of funds that begin or end outside the United States. Written comments to the ANPRM were due on or before November 27, 2020.

While these proposed changes are intended to help law enforcement address financial crimes , they could also potentially create a compliance burden on financial institutions that process international payments. However, financial institutions that make proactive preparations for the changes ahead can help minimize that burden and ensure the successful implementation of new processes and procedures.

The Recordkeeping Rule and Travel Rule

On January 3, 1995, the Agencies jointly issued a recordkeeping rule (the “Recordkeeping Rule”) that requires banks and nonbank financial institutions (NBFIs) to collect and retain information related to funds transfers and transmittals of funds in amounts of $3,000 or more, codified at 31 CFR 1020.410(a) and 1010.410(e). As stated by the Agencies, the Recordkeeping Rule is intended to help law enforcement and regulatory authorities detect, investigate and prosecute money laundering and other financial crimes by preserving an information trail about persons sending and receiving funds through the funds transfer system.

At the same time, FinCEN issued a separate rule — the “Travel Rule” — that requires banks and NBFIs to transmit information on certain funds transfers and transmittals of funds to other banks or NBFIs participating in the transfer or transmittal, codified at 31 CFR 1010.410(f). The Travel Rule and the Recordkeeping Rule complement each other: The Recordkeeping Rule requires banks to collect and retain the information that, under the Travel Rule, must be included with transmittal orders.

The information required to be collected and retained includes, at a minimum:

- Name and address of the originator/transmitter,

- Amount of the payment,

- Date of the payment,

- Any payment instructions received from the originator and

- Identity of the beneficiary’s financial institution.

Moreover, if received, the originating institution must retain and transmit:

- The beneficiary’s name and address,

- The beneficiary’s account number and

- Any other information identifying the beneficiary.

Proposed Changes

The proposed modification would reduce the threshold from $3,000 to $250 for funds transfers and transmittals of funds that begin or end outside the United States . A funds transfer or transmittal of funds would be considered to begin or end outside the United States if the bank or NBFI knows or has reason to know that the originator, originator’s financial institution, beneficiary or beneficiary’s financial institution is located in, is ordinarily resident in or is organized under the laws of a jurisdiction other than the United States. Of note, the rule would remain unchanged for domestic funds transfers.

The Agencies are also proposing to expand the definition of “money” to include convertible virtual currency (CVC). Currently, the Recordkeeping Rule does not define the term “money,” but references the definition set forth in the Uniform Commercial Code (UCC). The UCC defines “money” as “a medium of exchange currently authorized or adopted by a domestic or foreign government” [see U.C.C. 1-201(b)(24) (2001)]. Some have argued that because CVCs are not authorized or adopted by any government, they cannot be defined as “money.”

Rationale for Proposed Changes

Threshold Lowering for Cross-Border Transfers

In proposing these modifications, the Agencies considered the usefulness of transaction information associated with smaller-value cross-border transfers and transmittals of funds in criminal, tax or regulatory investigations or proceedings.

Specifically, the Agencies reviewed nearly 2,000 Suspicious Activity Reports (SARs) filed by money transmitters, which indicate that a substantial volume of potentially illicit funds transfers and transmittals of funds occur below the $3,000 threshold. The Agencies also studied recent prosecutions showing that individuals were sending and receiving funds to finance terrorist activity in amounts below (and in some cases, well below) the current $3,000 recordkeeping threshold.

FinCEN found that 99 percent of the underlying transactions reported in the reviewed SARs began or ended outside of the United States. As a result of these observations, FinCEN and the Board suggest lowering the cross-border threshold to $250. Because the underlying reported transactions in the reviewed SARs were predominantly not domestic in nature, FinCEN recommends maintaining the threshold for domestic transactions at $3,000.

Moreover, the proposed lowered threshold for the Recordkeeping and Travel Rules has garnered support from law enforcement, including the Money Laundering and Asset Recovery Section (MLARS) of the Criminal Division of the Department of Justice (DOJ).

Finally, the Agencies noted that the Financial Action Task Force (FATF) has indicated that records of smaller-value transactions are valuable to law enforcement, particularly with respect to terrorist financing investigations. The European Union and many jurisdictions around the world have adopted a 1,000 USD/EUR de minimis cross-border threshold specified in the FATF Recommendations.

Definition of “Money” to Include Virtual Currencies

As the Agencies note, since the issuance of the Recordkeeping Rule and the Travel Rule , a number of CVCs (such as Bitcoin and Ethereum) have been created, and public use of CVCs has grown significantly in recent years. The expanded public use also includes bad actors, who have used CVCs for purposes of international terrorist financing, weapons proliferation, sanctions evasion, money laundering, in addition to predicated crimes like narcotics trafficking. Explicitly including CVCs within the definition of “money” eliminates any ambiguity as to whether virtual currencies come within the purview of the Recordkeeping and Travel Rules.

The inclusion of CVCs within the definition of “money” aligns with recommendations from FATF, which has advised to consider virtual assets as “property” or “funds,” and consequently, should apply relevant FATF anti-money laundering/counter-terrorist-financing measures to virtual assets.

In furtherance of the proposed changes, the Agencies also note that “[i]n addition to CVCs, foreign governments — including Iran, Venezuela and Russia — have created or expressed interest in creating digital currencies that could be used to engage in sanctions evasion” (ANPRM).

Potential Burden on Financial Institutions and Other Entities

The Agencies believe that the effect of lowering the $3,000 threshold on banks and NBFIs is likely to be low, stating that some banks are already collecting information on at least a portion of transactions taking place under the current threshold for purposes of reporting suspicious transactions to FinCEN.

Notwithstanding the Agency’s statements, the proposed rule change will likely increase the cost of compliance for banks, NBFIs and other regulated entities. For one, as noted by FinCEN, banks and NBFIs are collecting information on some transactions (those over $3,000), but not all. The lowering of the thresholds will necessarily mandate, at a minimum, the updating of procedures and processes already in place, additional training and increased recordkeeping costs.

Moreover, unlike banks and NBFIs, most virtual currency businesses are not equipped with the tools to collect and retain information required by the Recordkeeping and Travel Rules. Some argue that the burden on these types of businesses is higher, because the information required under the Rules is far more information that is generally required to transfer an amount of virtual currency between two parties. Moreover, banks and NBFIs already have required customer information programs (CIP) in place to identify and verify the identity of their customers, while virtual currency businesses do not.

In light of these proposed new obligations, it is important for businesses to get ahead and prepare for the coming changes and to avoid future compliance challenges by considering:

- Implementing processes and procedures to capture funds transfers and transmittals of funds at $250 or more that begin or end outside the United States, keeping in mind to include specifics as to how to determine whether a transaction is, in fact, cross-border in nature.

- In light of new processes and procedures, ensuring that employees tasked with capturing and retaining the information required under the Rules receive updated training on the proposed changes.

- Ensuring sufficient funding for the compliance department and BSA Officer.

- Installing robust internal controls and quality review processes in line with the new regulatory guidance and best practices.

With these enhancement opportunities, banks and other entities can stay ahead of the curve to ensure successful implementation of processes and procedures to capture and retain information required under the amended Recordkeeping and Travel Rules.

Adverse Media Screening: Relying on Google Alone Can Expose Organizations to Risk

Cyber risk quantification and prioritization is the future of grc.

Related Posts

FinCEN Has Proposed New AML/CFT Rules; Here Are 2 Areas Where Risk Assessment Can Make a Difference

AML/CFT programs should expect increased enforcement actions

News Roundup: With Court Challenge Ongoing and Deadline Approaching Rapidly, CTA Awareness Lags

Data protection struggles amid cloud & AI expansion

What Banks Need to Know About Investing in Lower & Middle-Income Countries

Political unrest, currency fluctuation & criminal threats challenge international investors

Timeline of SEC’s 2-Year-Old Crackdown on Ephemeral Messaging

What’s next in the regulator’s WhatsApp probe?

Privacy Policy

Founded in 2010, CCI is the web’s premier global independent news source for compliance, ethics, risk and information security.

Got a news tip? Get in touch . Want a weekly round-up in your inbox? Sign up for free. No subscription fees, no paywalls.

Browse Topics:

- Compliance Podcasts

- eBooks Published by CCI

- GRC Vendor News

- On Demand Webinars

- Resource Library

- Uncategorized

- Whitepapers

© 2024 Corporate Compliance Insights

Privacy Overview

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

- Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

- Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

- Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Climate Action

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the Administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

Federal travel regulation and related files

Ftr amendments (federal register), travel/per diem bulletins.

If you have any issues reading the documents, please contact Regulatory Secretariat by phone: 202-501-4755 .

PER DIEM LOOK-UP

1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2022 and 09/30/2025.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

NAFCU is now America’s Credit Unions. A stronger voice to advance the credit union industry.

- Credit Union and Bank Mergers

- IRS Reporting Requirement

- Regulatory Relief

- CFPB Improvements

- 2024 Policy Priorities

- Congressional Testimony

- Letters & Comments

- Proposed Regulation

- Grassroots Action Center

- Credit Union Policy Podcast

- Board & Supervisory Committees

- Compliance, Risk & BSA

- Executive Leadership

- Growth & Marketing

- Certifications and Training Certificates

- Conferences

- Online Training

- Search All Educational Resources

- Compliance Calendar

- Compliance Guides & Manuals

- Compliance Policy Sharing

- Final Regulation Summaries

- Newsletters & Blog

- Ask Compliance

- Search All Compliance Resources

- Economic and CU Research Enewsletter

- Macroeconomic Data Flash Reports

- Salary Comparison Report

- Credit Union Federal Tax Exemption Study

- NAFCU Report on Credit Unions

- CU Industry Trends Quarterly Report

- Benchmark & Research Tools

- Financial CalCUlators

- Data Sources

- Contribute Your Data

- Rewards Program

- Vendor Management

- Retirement & Financial Planning

- Partner Directory

- In the News

- Become a Preferred Partner

- NAFCU Services Blog

- About NAFCU Services

20-EA-22: FinCEN - Recordkeeping and Travel Rule

O n October 27, 2020, the Financial Crimes Enforcement Network (FinCEN) and Board of Governors of the Federal Reserve System (Board) issued a joint notice of proposed rule making (NPRM) amending the Recordkeeping and Travel Rules.

Already a member? Log in

If you are already logged in and believe you should have access to member-only content, please contact us for assistance at [email protected] .

Try our advanced lawyer search

Fincen and the federal reserve board propose travel rule amendments to lower the threshold for cross-border transfers and to explicitly cover convertible virtual currencies and digital money.

The Financial Crimes Enforcement Network ( FinCEN ) and the Federal Reserve Board (together the Agencies ) last week proposed amendments (the Proposed Rules ) to the Travel Rule regulations and related Recordkeeping Rules under the Bank Secrecy Act (together the Rules ). 1

Lowering the threshold for cross-border transfers . The Rules currently require banks and nonbank financial institutions to collect, retain, and transmit specified information related to funds transfers and transmittals of funds in amounts of $3,000 or more, with the goal of helping law enforcement and regulatory authorities detect, investigate, and prosecute money laundering, and other financial crimes by preserving an information trail about persons sending and receiving funds. 2 In an effort to enhance the information available for law enforcement and national security investigations, the Proposed Rules lower the $3,000 threshold to $250 for transactions that begin or end outside the United States, while leaving unchanged the $3,000 threshold for domestic transactions. 3

The Agencies based the new threshold on data showing that malign actors are using smaller-value cross-border wire transfers to facilitate or commit terrorist financing, narcotics trafficking, and other illicit activities, and their understanding that changes in compliance practices and technology since the Rules were originally promulgated in 1996 should minimize the burden on financial institutions of this move to a lower dollar value threshold for cross-border funds transfers. If adopted, the Proposed Rules would bring the United States in line with Financial Action Task Force ( FATF ) recommendations that provide that countries should adopt a de minimis threshold of no higher than USD/EUR 1,000 for recordkeeping requirements applicable to cross-border transactions.

Defining “money” to explicitly cover CVCs and digital money. The Proposed Rules also clarify the definition of “money” to explicitly provide that the Rules apply to domestic and cross-border transactions involving convertible virtual currencies ( CVCs ) 4 and digital forms of fiat money. The Recordkeeping Rule applies to funds transfers 5 and transmittals of funds, 6 which are instructions to pay a fixed or determinable amount of money . The Travel Rule applies to transmittal orders , which “include a payment order that is an instruction of a sender to a receiving financial institution, transmitted orally, electronically, or in writing, to pay, or cause another financial institution or foreign financial agency to pay, a fixed or determinable amount of money to a recipient[.]” 7

The term “money” is not currently defined in the Rules. However, the Agencies have explained that terms not defined in the Rules, but that are defined in the UCC have the meaning given to them in the UCC. 8 Article 1 of the UCC defines money as “a medium of exchange currently authorized or adopted by a domestic or foreign government .” 9 This definition would not, by its terms, include most types of CVCs.

FinCEN stated in 2019 guidance that transfers of CVCs effectuated by a nonbank financial institution may constitute transmittal orders and therefore fall within the scope of the Rules. The Proposed Rule would codify the substance of the FinCEN guidance by defining money in the Rules to include: (1) a medium of exchange currently authorized or adopted by a domestic or foreign government, including any digital asset that has legal tender status in any jurisdiction, including a monetary unit established by an intragovernmental organization or by agreement between two or more countries; and (2) CVC, which is defined as a medium of exchange (such as cryptocurrency) that either has an equivalent value as currency, or acts as a substitute for currency, but lacks legal tender status. This definition would thus make explicit that the Rules apply to transfers and transmittal orders of CVCs and digital fiat money.

Next steps . Comments on the Proposed Rules are due November 26, 2020. While the Agencies request comment on all aspects of the Proposed Rule, they in particular request comment from financial institutions, law enforcement and members of the public on eight questions covering the following topics: the extent of the burden the Proposed Rule will have on financial institutions, the benefit the Proposed Rule will have for law enforcement, any additional costs that clarifying the meaning of “money” will have on complying with the Rules, and what mechanisms have persons that engage in CVC transactions developed to comply with the Rules.

Law Clerk Boaz B. Goldwater contributed to this post.

- 1 The travel rule and related recordkeeping regulations are codified at 31 CFR 1010.410(e) and 1020.410(a), respectively. The Federal Reserve Board separately promulgated subpart B to Regulation S, which cross-references the requirements of 31 CFR 1020.410 (a) and 1010.410(e). Because the Federal Reserve Board’s Regulation S generally cross-references 31 CFR 1020.410 (a) and 1010.410(e), which were jointly promulgated by FinCEN and the Federal Reserve Board, the Agencies think it is unnecessary to propose conforming amendments to Regulation S.

- 2 Under the Recordkeeping Rule, the originator’s bank or transmittor’s financial institution must collect and retain certain information. The complementary Travel Rule requires the originator’s bank or transmittor’s financial institution to include certain information, including all information required under the Recordkeeping Rule, in a payment or transmittal order sent by the bank or nonbank financial institution to another bank or nonbank financial institution in the payment chain. Intermediary banks or financial institutions are also required to transmit this information to other banks or nonbank financial institutions in the payment chain, to the extent that the information is received by the intermediary bank or financial institution.

- 3 Transactions would be considered to begin or end outside of the United States if the financial institution “knows or has reason to know that the transmittor, transmittor’s financial institution, recipient, or recipient’s financial institution is located in, is ordinarily a resident in, or is organized under the laws of a jurisdiction other than the United States.” What a financial institution “knows or has reason to know” is based on the information the financial institution receives in the transmittal order, collects from the transmitter to effectuate the transmittal of funds, or otherwise collects from the transmitter or recipient to comply with regulations implementing the Bank Secrecy Act.

- 4 FinCEN guidance defines CVC as convertible virtual currency that is a type of virtual currency that “either has an equivalent value as currency, or acts as a substitute for currency, and is therefore a type of ‘value that substitutes for currency.’” See Application of FinCEN’s Regulations to Certain Business Models Involving Convertible Virtual Currencies. FINCEN (May 9, 2019) available here .

- 5 In general, terms used in the Rules are intended to parallel the same or similar terms used in Article 4A of the Uniform Commercial Code ( UCC ). Funds transfers is defined in the UCC as “[t]he series of transactions begging with the originator’s payment order, made for the purpose of making payment to the beneficiary of the order,” with the Recordkeeping Rule defining “payment order” as “[a]n instruction of a sender to a receiving bank … to pay, or to cause another bank or foreign bank to pay a fixed or determinable amount of money to a beneficiary.” See 1 CFR 1010.100(ll); see also UCC 4A-103(a)(1).

- 6 Transmittal of funds is defined in the Recordkeeping Rule as “[a] series of transactions beginning with the transmittor’s transmittal order, made for the purpose of making payment to the recipient … .” and transmittal order is defined as “[t]he term transmittal order includes a payment order and is an instruction of a sender to a receiving financial institution … to pay, a fixed or determinable amount of money to a recipient …” See 31 CFR 1010.100(ddd); see also 31 CFR 1010.100(eee).

- 7 31 CFR 1010.100(eee).

- 8 60 FR 220, 221—222 (Jan. 3, 1995).

- 9 U.C.C. 1-201(b)(24) (2001); see also U.C.C. 4A-105(d) (2012) (stating that Article 1 general definitions are applicable throughout Article 4A).

If you have any questions regarding the matters covered in this publication, please reach out to any of the lawyers listed below or your usual Davis Polk contact.

Will schisa, related capabilities, related lawyers.

More From Forbes

After the fed rate cut: soft landing checklist.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

While the aggressive rate cut was a good start, whether it will prevent the economy from descending ... [+] into recession remain unknown. This article will identify some data to gauge the effectiveness of the Fed’s actions in supporting the economy.

Chair Powell and the Federal Reserve delivered a larger-than-expected half percentage point (0.50%) decrease in short-term interest rates last week. While the rate cut was a virtual certainty, the path forward and whether it will prevent the economy from descending into recession remain unknown. This piece will identify some data to gauge the effectiveness of the Fed’s actions in supporting the economy.

Because of the aggressive first move from the Fed, the odds of an economic soft landing should be considered higher than before the move. Though the real (after-inflation) Federal Funds rate remains above 2023, there are likely more rate cuts in the pipeline.

After-Inflation Federal Funds Rate

Futures pricing assumes another cut to short-term interest rates of at least 25 (0.25%) basis points at the November Fed meeting and a 50% chance of a 50 (0.50%) basis point rate cut. The December meeting has expectations identical to those for November.

Number Of Rate Cuts Expected

Best High-Yield Savings Accounts Of 2024

Best 5% interest savings accounts of 2024.

In seven of the last nine easing cycles, the economy was either in recession when the rate cuts began or ended in recession. Still, stocks usually rose in the twelve months after the cuts started .

Stocks and the Magnificent 7 reacted positively to the outsized rate cut. The Magnificent 7, consisting of Microsoft (MSFT), Meta Platforms (META), Amazon.com (AMZN), Apple (AAPL), NVIDIA SPDR Dow Jones Industrial Average ETF Trust (NVDA), Alphabet (GOOGL), and Tesla (TSLA), underperformed the S&P 500 on the week but are now only 6.6% below their early July highs. The S&P 500 reached a new all-time high during the week, eclipsing the July 16 high.

Stock Market Performance

The U.S. economy remains resilient, with the Atlanta Fed’s estimate of third-quarter GDP at 2.9%. These estimates provide a real-time estimate of economic growth since quarterly GDP reports are provided with a significant lag.

3Q 2024 U.S. GDP Growth Estimate

Other valuable high-frequency reports are the initial and continuing filings for unemployment benefits. These claims have improved lately, but any significant softening in the labor market should be seen here first.

Initial Jobless Claims

The job market has softened. While the unemployment rate at 4.2% remains low on an absolute basis, it has risen off the lows enough to trigger the Sahm Rule, which has an unblemished track record of forecasting recession. There are several reasons to believe that the Sahm Rule might be overstating the risk of recession during this cycle.

Monitoring the prime-age, 25 to 54 years old, employment-to-population ratio should help signal when concern about the rising unemployment rate is warranted. The rising prime-age employment-to-population ratio is evidence of some less dire outcomes in the labor market and the economy so far. The employment-to-population ratio is a monthly statistic updated in the monthly jobs report, and so is the unemployment rate.

Prime-Age Employment-To-Population Ratio: 3 Month Average

Separately, defensive stocks, less impacted by the economy, have often outperformed the more economically sensitive cyclical stocks during these easing cycles since they tend to correspond with periods of economic uncertainty or eventual contraction. Last week showed a better performance for economically sensitive stocks, bolstering the case that markets also viewed the Fed’s actions as supportive of better odds of avoiding recession.

Cyclicals Versus Defensives

Banks tend to underperform the S&P 500 before and often during recessions since their loan losses and profits are inexorably tied to the economy. Bank stocks significantly outperformed last week, adding to the optimistic view of the impacts of the more significant Fed rate cut on the economy.

U.S. Banks Relative Performance

Finally, the consumer is crucial for the health of the economy. Looking at the relative performance of the consumer discretionary sector can help indicate when the consumer and, by extension, the U.S. economy might be in trouble. The equal-weighted S&P 500 consumer discretionary index is used; otherwise, Amazon.com (AMZN) would dominate the analysis given its massive size in the capitalization-weighted index. Consistent with the other measures shown, consumer discretionary stocks outperformed.

Consumer Discretionary Relative Strength

Based on the indicators reviewed in this analysis and current economic data, the base case remains a soft landing. This COVID-related economic cycle is unlike any other, so our typically reliable yield curve and Sahm rule indicators should be viewed more skeptically than usual. The initial reaction to the larger-than-expected 50 basis point rate cut from the Fed has been positive across the soft landing checklist. It indicates that market participants are assigning higher odds of avoiding recession following Chair Powell’s aggressive start to easing monetary policy.

If history is any indicator, success in avoiding a recession is no sure thing. Since markets reflect a higher likelihood of a soft landing, investors should expect price declines for stocks and other risk assets if recession probabilities increase. Since the eventual outcome remains unknown, investors should be mindful of their asset allocation and consider rebalancing after the robust stock gains. Owning high-quality and less economically sensitive stocks alongside technology and cyclical companies should benefit equity portfolios if the economy and earnings falter.

Disclosure: Glenview Trust currently has holdings of Microsoft (MSFT), Meta Platforms (META), Amazon.com (AMZN), Apple (AAPL), NVIDIA (NVDA), and Alphabet (GOOGL) within its recommended investment strategies.

- Editorial Standards

- Forbes Accolades

FINCEN ISSUES AMENDMENTS TO THE FUNDS TRANSFER RULES

Today, the U.S. Department of the Treasury's Financial Crimes Enforcement Network (FinCEN) and the Federal Reserve Board issued amendments to the two funds transmittal (wire transfer) rules that were published in January 1995 and extended the effective date of the rules, as amended, to May 28, 1996.

The rules and the amendments were issued under the Bank Secrecy Act (BSA) which is a key component of Treasury's counter-money laundering efforts. The BSA is administered by FinCEN.

The first rule, issued jointly by Treasury and the Federal Reserve Board, requires banks and non-bank financial institutions to collect and retain information about transmittals of funds in the amount of $3,000 or more; it also requires the verification of the identity of non-account holders that are parties to such transmittals of funds. The second rule (known as the travel rule), issued by Treasury alone, requires each financial institution that participates in a wire transfer to pass along certain information about the transfer to any other financial institution that participates in the transmittal.

The amendments to the two rules were made in response to the financial services industry's request for clarification and to reduce the compliance burden on financial institutions.

Electronic wire transfer systems move funds between financial institutions and handle a daily volume in excess of 500,000 transactions, moving more than $2 trillion around the world each day. Wire transfers offer criminal organizations an easy, efficient and secure method of transferring huge sums of money over a very short period of time. "Because wire transfer messages are often sent through several banks and wire transfer systems, money launderers have been able to easily confuse the money trail, making it difficult for law enforcement to trace the criminal proceeds," according to Stanley E. Morris, FinCEN's Director.

The wire transfer rules are designed to help law enforcement agencies detect and investigate money laundering and other financial crimes by preserving an information trail about persons sending and receiving funds through wire transfer systems.

In August 1993, FinCEN issued proposed wire transfer rules, and asked for and received extensive comments from the financial services industry. Those comments were incorporated into the final rules which were issued in January 1995.