This website stores cookies on your computer. These cookies are used to collect information about how you interact with our website and allow us to remember you. We use this information in order to improve and customize your browsing experience and for analytics and metrics about our visitors both on this website and other media. To find out more about the cookies we use, see our Cookies Policy .

If you decline, your information won’t be tracked when you visit this website. A single cookie will be used in your browser to remember your preference not to be tracked.

Bahrain BH: International Tourism: Number of Arrivals

View bahrain's bahrain bh: international tourism: number of arrivals from 1995 to 2020 in the chart:.

What was Bahrain's Bahrain BH: International Tourism: Number of Arrivals in 2020?

Related indicators for bahrain bh: international tourism: number of arrivals, accurate macro & micro economic data you can trust.

Explore the most complete set of 6.6 million time series covering more than 200 economies, 20 industries and 18 macroeconomic sectors.

Bahrain Key Series

Buy selected data, more indicators for bahrain, request a demo of ceic.

CEIC’s economic databases cover over 200 global markets. Our Platform offers the most reliable macroeconomic data and advanced analytical tools.

Explore our Data

Bahrain - International tourism, number of arrivals

The value for International tourism, number of arrivals in Bahrain was 1,909,000 as of 2020. As the graph below shows, over the past 25 years this indicator reached a maximum value of 12,045,000 in 2018 and a minimum value of 1,909,000 in 2020.

Definition: International inbound tourists (overnight visitors) are the number of tourists who travel to a country other than that in which they have their usual residence, but outside their usual environment, for a period not exceeding 12 months and whose main purpose in visiting is other than an activity remunerated from within the country visited. When data on number of tourists are not available, the number of visitors, which includes tourists, same-day visitors, cruise passengers, and crew members, is shown instead. Sources and collection methods for arrivals differ across countries. In some cases data are from border statistics (police, immigration, and the like) and supplemented by border surveys. In other cases data are from tourism accommodation establishments. For some countries number of arrivals is limited to arrivals by air and for others to arrivals staying in hotels. Some countries include arrivals of nationals residing abroad while others do not. Caution should thus be used in comparing arrivals across countries. The data on inbound tourists refer to the number of arrivals, not to the number of people traveling. Thus a person who makes several trips to a country during a given period is counted each time as a new arrival.

Source: World Tourism Organization, Yearbook of Tourism Statistics, Compendium of Tourism Statistics and data files.

- Thematic map

- Country comparison

- Country ranking

- Download data to Excel

Development Relevance: Tourism is officially recognized as a directly measurable activity, enabling more accurate analysis and more effective policy. Whereas previously the sector relied mostly on approximations from related areas of measurement (e.g. Balance of Payments statistics), tourism today possesses a range of instruments to track its productive activities and the activities of the consumers that drive them: visitors (both tourists and excursionists). An increasing number of countries have opened up and invested in tourism development, making tourism a key driver of socio-economic progress through export revenues, the creation of jobs and enterprises, and infrastructure development. As an internationally traded service, inbound tourism has become one of the world's major trade categories. For many developing countries it is one of the main sources of foreign exchange income and a major component of exports, creating much needed employment and development opportunities.

Limitations and Exceptions: Tourism can be either domestic or international. The data refers to international tourism, where the traveler's country of residence differs from the visiting country. International tourism consists of inbound (arrival) and outbound (departures) tourism. The data are from the World Tourism Organization (WTO), a United Nations agency. The data on inbound and outbound tourists refer to the number of arrivals and departures, not to the number of people traveling. Thus a person who makes several trips to a country during a given period is counted each time as a new arrival. The data on inbound tourism show the arrivals of nonresident tourists (overnight visitors) at national borders. When data on international tourists are unavailable or incomplete, the data show the arrivals of international visitors, which include tourists, same-day visitors, cruise passengers, and crew members. Sources and collection methods for arrivals differ across countries. In some cases data are from border statistics (police, immigration, and the like) and supplemented by border surveys. In other cases data are from tourism accommodation establishments. For some countries number of arrivals is limited to arrivals by air and for others to arrivals staying in hotels. Some countries include arrivals of nationals residing abroad while others do not. Caution should thus be used in comparing arrivals across countries.

Statistical Concept and Methodology: Statistical information on tourism is based mainly on data on arrivals and overnight stays along with balance of payments information. These data do not completely capture the economic phenomenon of tourism or provide the information needed for effective public policies and efficient business operations. Data are needed on the scale and significance of tourism. Information on the role of tourism in national economies is particularly deficient. Although the World Tourism Organization reports progress in harmonizing definitions and measurement, differences in national practices still prevent full comparability. Arrivals data measure the flows of international visitors to the country of reference: each arrival corresponds to one in inbound tourism trip. If a person visits several countries during the course of a single trip, his/her arrival in each country is recorded separately. In an accounting period, arrivals are not necessarily equal to the number of persons travelling (when a person visits the same country several times a year, each trip by the same person is counted as a separate arrival). Arrivals data should correspond to inbound visitors by including both tourists and same-day non-resident visitors. All other types of travelers (such as border, seasonal and other short-term workers, long-term students and others) should be excluded as they do not qualify as visitors. Data are obtained from different sources: administrative records (immigration, traffic counts, and other possible types of controls), border surveys or a mix of them. If data are obtained from accommodation surveys, the number of guests is used as estimate of arrival figures; consequently, in this case, breakdowns by regions, main purpose of the trip, modes of transport used or forms of organization of the trip are based on complementary visitor surveys.

Aggregation method: Gap-filled total

Periodicity: Annual

Classification

Topic: Private Sector & Trade Indicators

Sub-Topic: Travel & tourism

Note: This page was last updated on December 28, 2019

Home | About | Search | Site Map | Blog | Indicadores en Español

Bahrain Tourist Arrivals

Tourist arrivals in bahrain increased to 17244.40 thousand in 2023 from 13770.15 thousand in 2022. tourist arrivals in bahrain averaged 11665.24 thousand from 2018 until 2023, reaching an all time high of 17244.40 thousand in 2023 and a record low of 2842.22 thousand in 2020. source: information & egovernment authority, bahrain, markets, gdp, labour, prices, money, trade, government, business, consumer, taxes, climate.

International tourism, number of departures - Bahrain

Selected Countries and Economies

All countries and economies.

- Privacy Notice

- Access to Information

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here.

Bahrain's tourism segment and its prospects

Introduction.

The travel & tourism segment has become one of the key contributors to the global economy in recent years. Before Covid-19, travel & tourism accounted for 10.3% of the global GDP and was worth over USD 9 trillion ( World Travel and Tourism Council, 2019 ). One out of four newly created jobs stemmed from this segment in 2019. ( World Travel and Tourism Council, 2019 ).

Consequently, Bahrain aims to become a major tourism hub in the region. The Kingdom seeks to implement strategies and policies to boost its tourism segment, provide a competitive edge, and stimulate the local economy. This will create more jobs and diversify economic activity even further away from hydrocarbon-based activities.

In this article, we will assess the current scenario of Bahrain's tourism segment and discuss potential challenges that may impact the prospects of local tourism in the future. This article will be divided into the following sections: An overview of Bahrain's tourism segment, An analysis of the current tourist portfolio, and a discussion & policy recommendations.

An Overview of Bahrain’s Tourism Segment

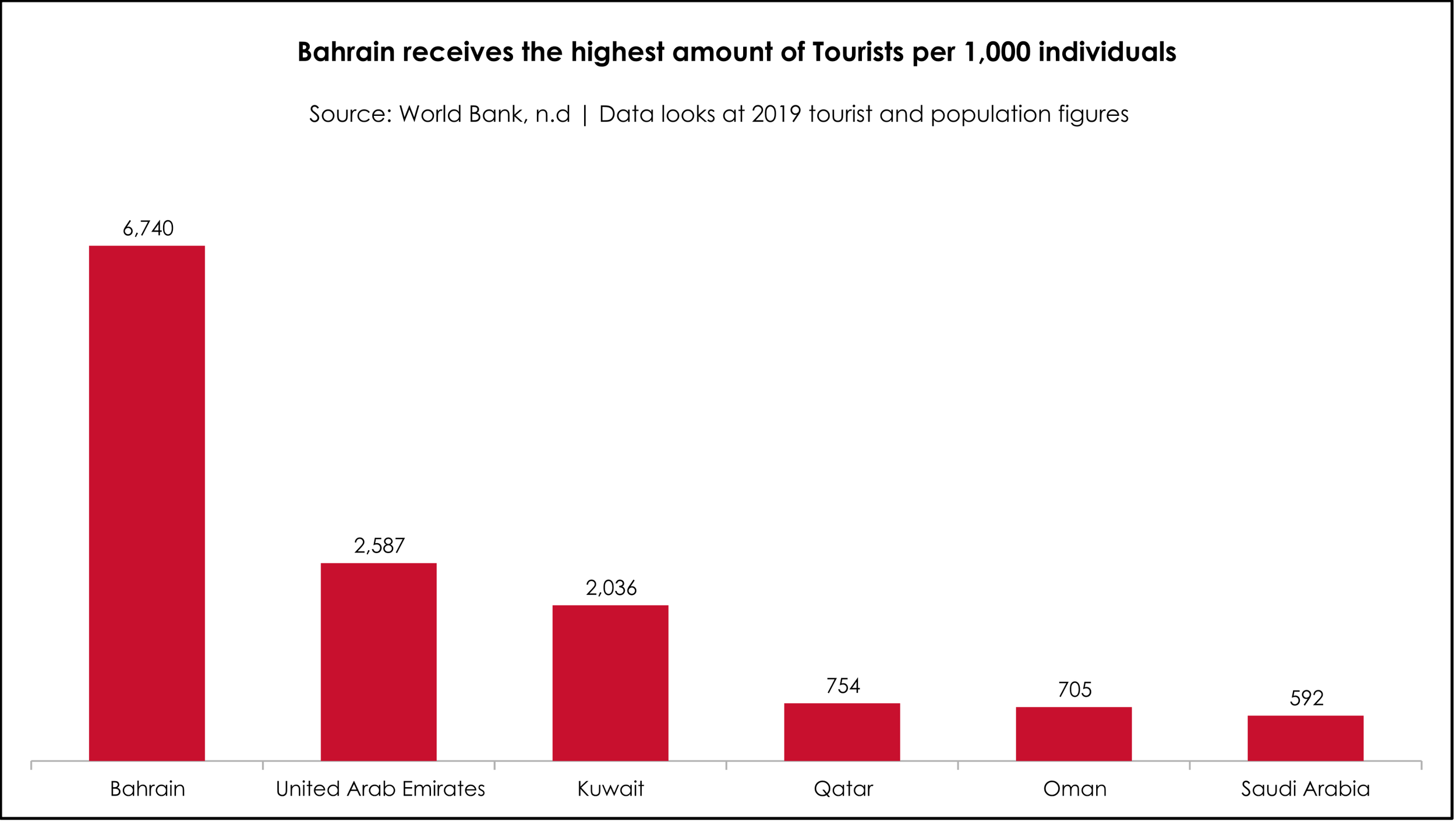

Bahrain is the smallest and only island country in the GCC region. Relative to its neighbors, some regulatory policies are more “relaxed”, such as surrounding the consumption of alcohol and other activities ( gov.uk, n.d ), making it a more compelling tourist destination within the GCC. As a result, we can see that the more “liberal” rules and regulations are associated with some of the highest inbound tourism figures:

Since 2011, the number of inbound visitors to Bahrain has been rising, from 6.7 million tourists to approximately 11.1 million tourists by 2019. This marks a growth rate of roughly 6.4% since 2019 ( World Bank, n.d ). As an objective, the government plans to continue to increase the number of tourists to cross the 14.1 million mark by 2026 ( BTEA, 2021 ). We also see that tourists specifically prefer Bahrain for holiday, leisure, and shopping purposes as an average of more than 71% of total tourists during the last five years arrived in Bahrain for these purposes ( IGA Bahrain, n.d. ). The importance of tourism is that tourism spending has increased since 2011 in both absolute and relative terms, with absolute figures increasing from 1.8 billion USD to 3.9 Billion USD in 2019, and per capita from 262USD per visitor to 349USD per visitor in 2019 ( World Bank, n.d ).

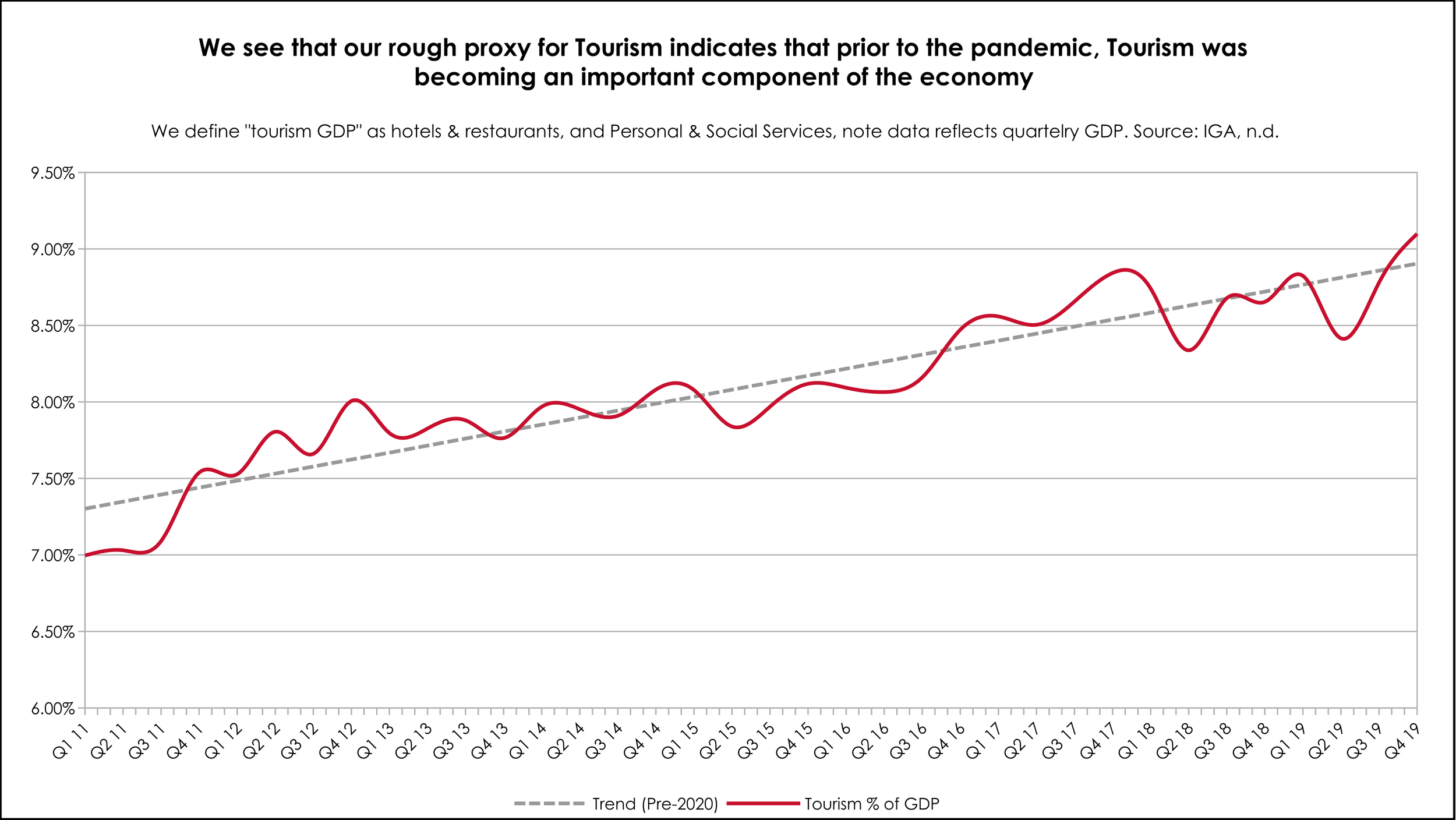

The increase in tourism spending in absolute and relative terms has important implications for the economy. Suppose we define restaurant & hotels, and personal & social service GDP as a rough proxy for the “tourism” sector. We see that tourism before the pandemic was becoming a more prominent component of the economy:

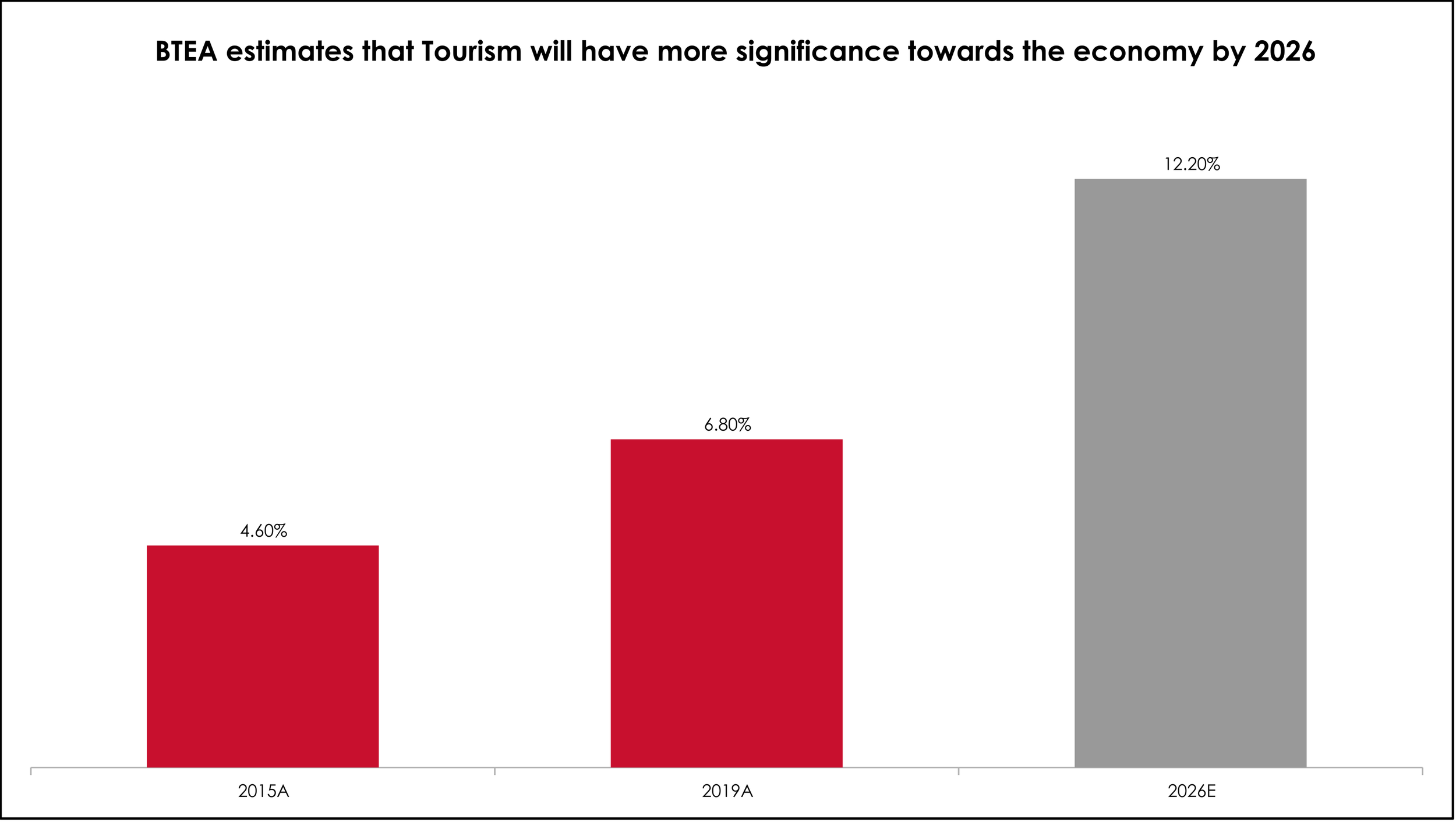

Furthermore, looking at the BTEA projection of the percentage of tourism as a percentage of GDP ( note, BTEA defines the tourism sector differently than how we define the tourism sector above ), we see that the tourism sector is indicated to be a significant contributor to the economy by 2026:

Amidst the recent improvement in the local tourism metrics, along with the expectation that Bahrain would emerge as the region's next tourism hub, the country's hospitality segment has been expanding its capacity. Local hotels have increased the number of available rooms by 14% from 2015 to 2019, whereas the number of total bed places has grown by 28% ( IGA, n.d ), indicating that the tourism sector has a positive outlook moving forward into the future.

Although Bahrain's tourism sector and its figures have significantly improved over the past ten years, there are potential challenges it may face. The largest is the tourism segment's lack of diversity in its tourist portfolio. In the next section, we will explore the data regarding significant reliance on GCC tourists and what challenges this may pose.

RELIANCE ON GCC TOURISTS

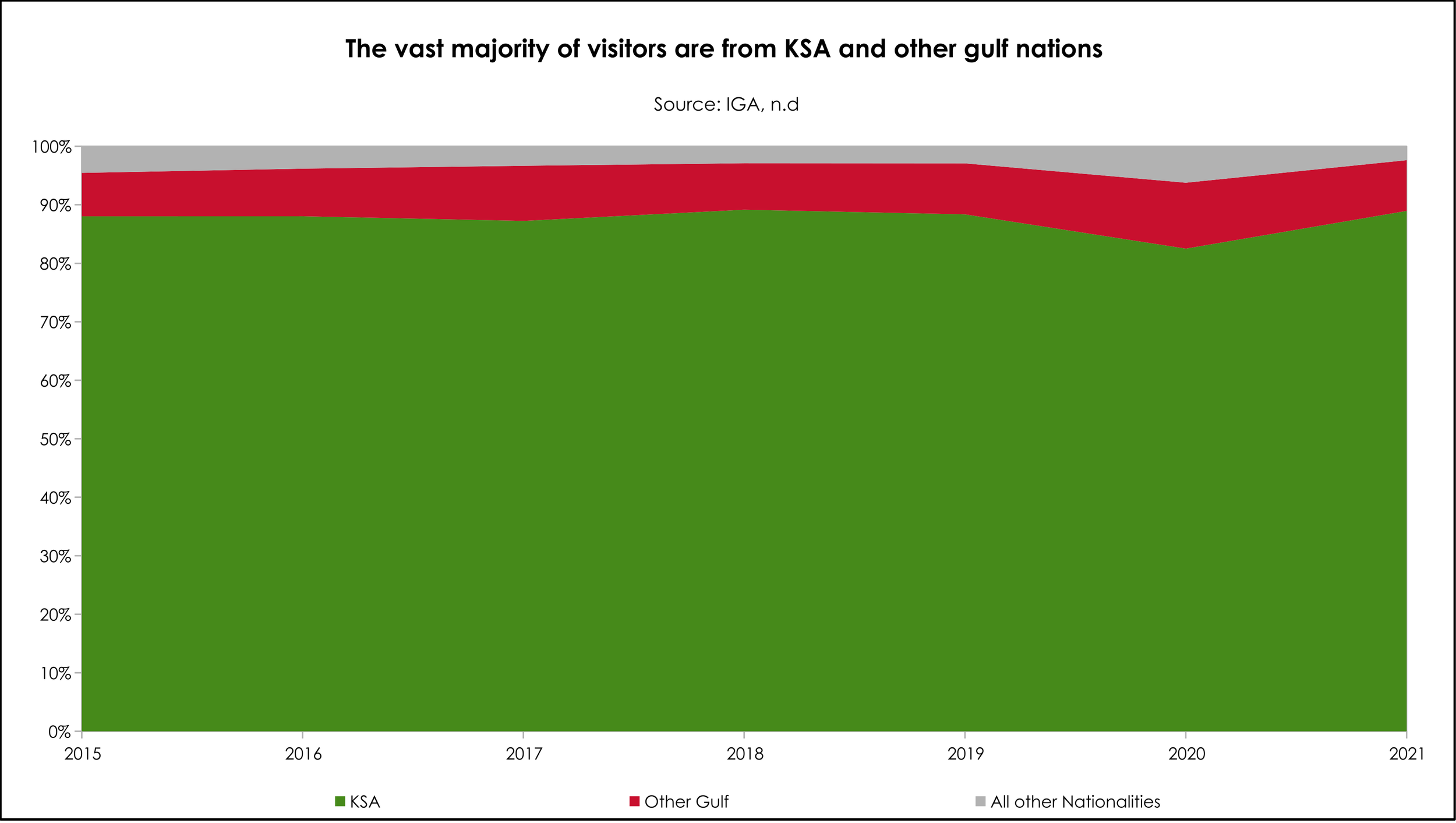

Bahrain is a regional connecting hub with a flight time of less than an hour from all GCC countries. The country is also linked with Saudi Arabia, the largest economy in GCC, via the King Fahad Causeway, which makes it convenient to commute between the two countries via road. On average, nearly 89% of tourists arrive via the causeway between 2015 and 2019. Furthermore, Bahrain relies on 88% of its total inbound visitors from Saudi Arabia ( on average between 2015 and 2019 ) ( IGA, 2021 ).

As previously mentioned, the Kingdom appears to have more “relaxed” rules and regulations surrounding the consumption of alcohol and other entertainment avenues, which makes it an attractive tourist destination. Looking at the data, we can see that the vast majority of tourists originate from Saudi Arabia and other GCC nations:

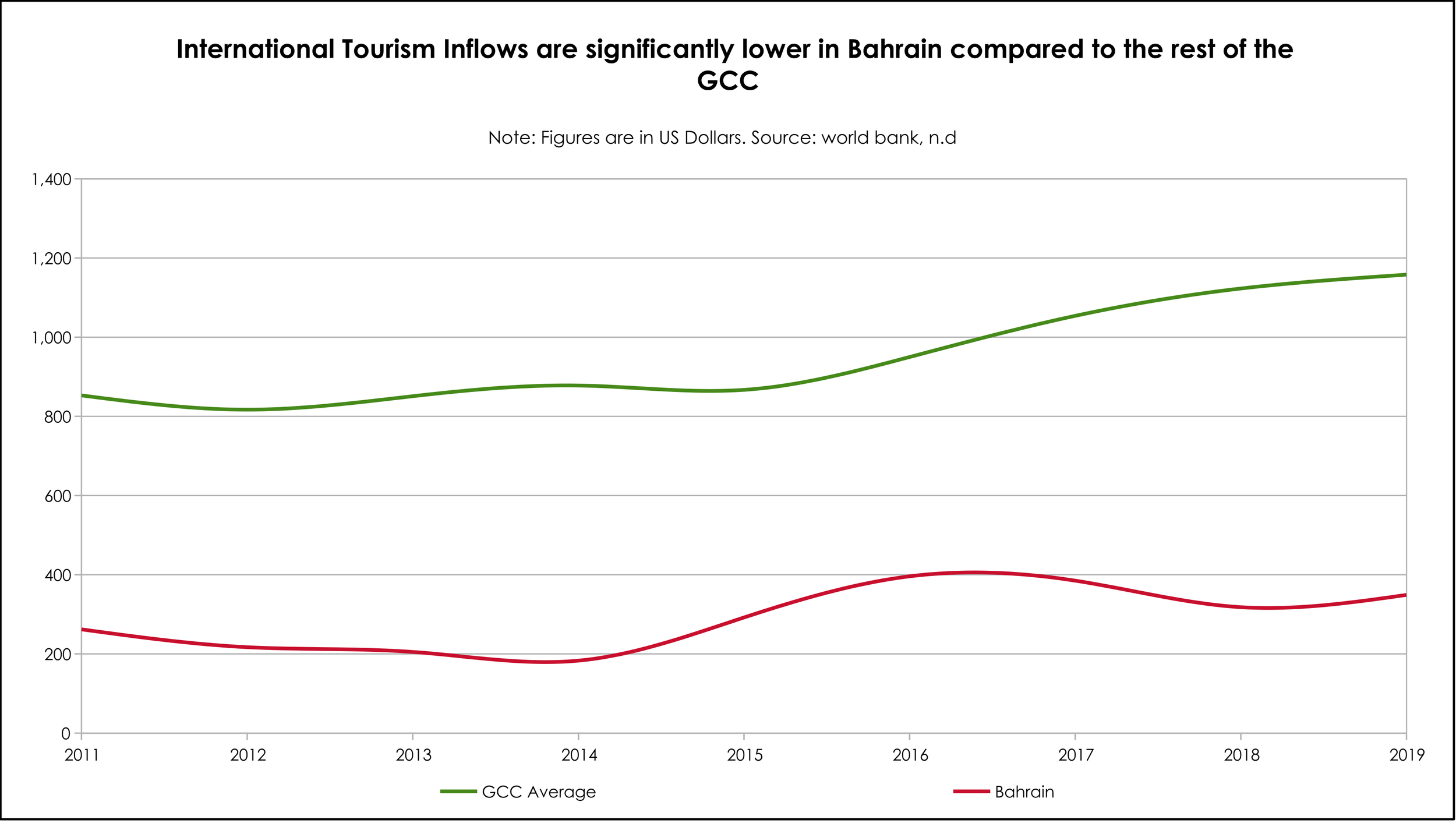

When comparing other GCC nations, we see that the portfolio of Bahrain is less diversified. For example, tourists from the top 5 origins only accounted for 40% of the total tourists inflow to UAE, 43% for Oman, 42% for Saudi Arabia, and 70% for Kuwait (World Travel and Tourism Council, 2019). Comparing this to Bahrain, we see that, on average, 96% of all tourist inflows are from GCC nations. This leads to two key challenges: lower international tourism receipts by inbound visitors and the potential for a decreased inflow if and when other GCC nations develop their tourism industries.

We can define international tourism receipts as “expenditure of international inbound visitors in the country including their payments to national carriers for international transport. They also include any other payments or payments afterwards made for goods and services received in the destination country”. Looking at the data, we can see that Bahrain is the 2nd lowest GCC nation in terms of international tourism receipts per visitor:

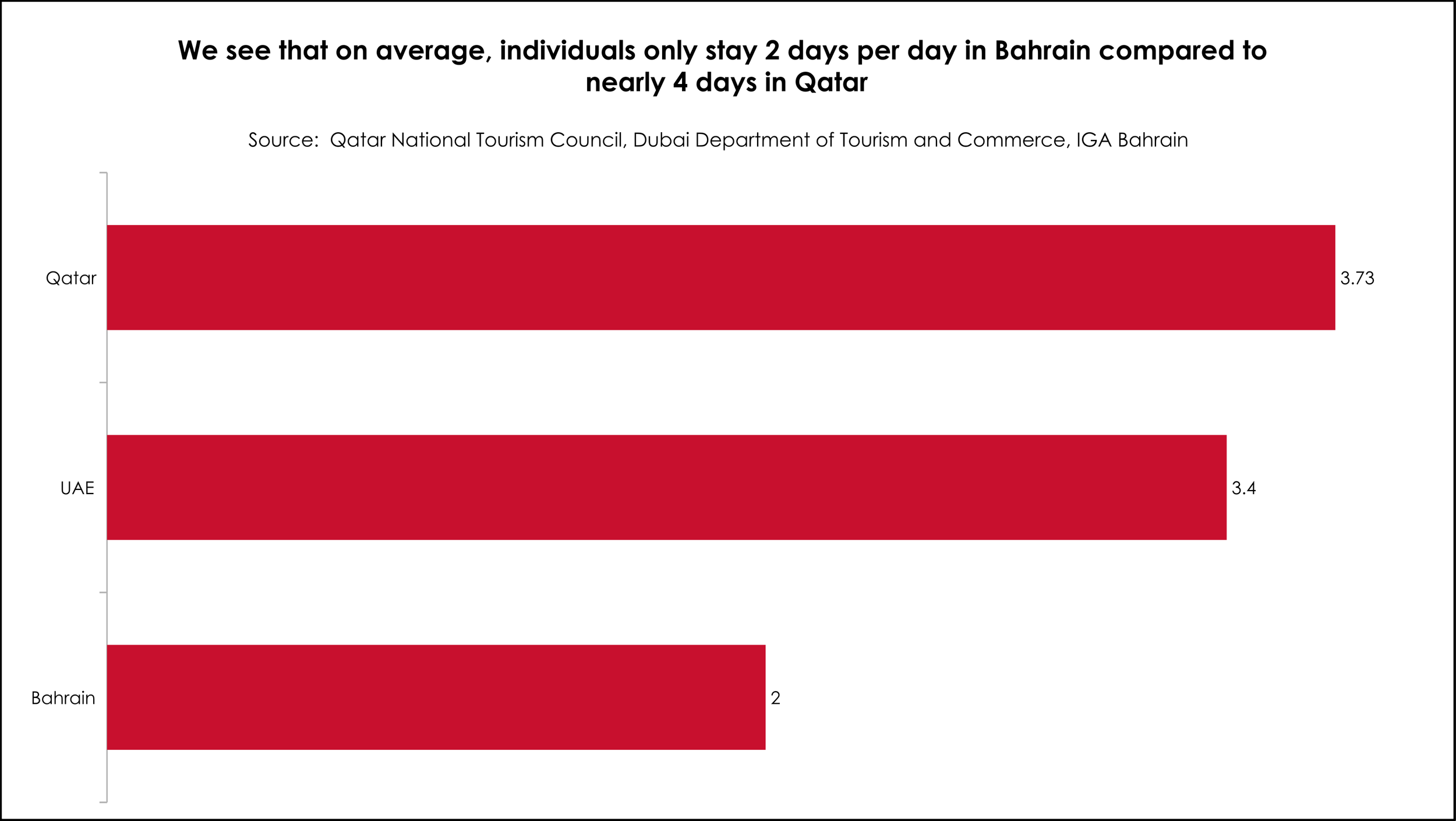

Given that the vast majority of foreign visitors arrive via the King Fahad causeway, the below-average tourism expenditure is certainly not unusual given the lack of spending on air & domestic transport. As of 2019, only 6.5% of the total international tourism receipts were spent on air & domestic transport and car rentals ( IGA Bahrain, 2021 ). Another reason for lower spending by inbound visitors is that the visit duration is generally lower than in other GCC nations:

The combination of lower spending on transportation and less visiting time may explain the lower expenditure inflow compared to the rest of the Gulf. In the next part, we will analyze potential challenges arising from a reliance on GCC tourists.

Potential challenges that may arise from a reliance on GCC tourists:

From the above, we've established that Saudi Arabia accounts for nearly 88% of inbound visitors on average between 2015 and 2021, and Other Gulf nations account for nearly 9%. While reliance on neighboring countries is not a necessary problem given the tight interlink between gulf nations in terms of culture and socio-economic characteristics, challenges may arise due to changes in other GCC nations' domestic tourism conditions.

Primarily looking at Saudi Arabia, approximately 30 billion USD have been spent abroad annually on entertainment and leisure in other parts of the GCC ( Saudi Ministry of Tourism, 2020 ). Hence, the theme of investing in the local entertainment and leisure segment is a lucrative economic strategy. As a result, Saudi Arabia aims to increase the contribution of its “tourism” sector towards GDP from the current 3% to well over 10% by 2030, which includes over 1 trillion US Dollars worth of investments in several new entertainment and leisure projects ( Saudi Ministry of Tourism, 2021 ). Before 2018, there were no cinemas in Saudi Arabia; however, nearly 40 cinemas are planned to be available across the Kingdom over the next five years, and Dubai’s VOX cinema aims to develop 600 screens in Saudi Arabia ( Mubasher, 2019 ). Furthermore, the Kingdom has had 100 concerts in 2019, which is aimed to increase by up to 600% by 2022. ( Saudi Ministry of Tourism, 2021 ).

With the increased development of Saudi Arabia's domestic tourism market, there may be a potential for consumers from Saudi Arabia and other Gulf nations to substitute their visits from Bahrain towards Saudi Arabia's tourism market or their domestic tourism market if similar developments are occurring in such markets. The extent of such a substitution effect is unknown now; however, it will likely be significant. Therefore, some potential policy recommendations are needed to counter what appears to be an "inevitable" substitution by Saudi and other gulf country consumers.

Policy Recommendations and Conclusion

While the development of Saudi Arabia's tourism market may appear to be a challenge to Bahrain's tourism industry, it is important to stress that such a perception is what it seems to be. It is important to note that the potential development of Saudi Arabia's tourism sector could also positively impact Bahrain's tourism industry. For example, say that the development of Saudi's tourism industry attracts international visitors. This, in turn, could create a "spillover" effect of tourists either stopping by Bahrain or potentially also visiting Bahrain and other Gulf nations. Nevertheless, it is important that the substitution effect we have discussed above is likely to be present and may outweigh any increase in potential spillover effects from increased international tourism elsewhere in the Gulf.

As for policy recommendations, this article recommends that Bahrain should not only attempt to diversify its tourist portfolio away from GCC nationals but also be applied to the rest of the Gulf. Given the similar historical, cultural and socioeconomic ties that Gulf nations have, potentially advertising tourism across the Gulf rather than each Gulf nation can benefit each member state under a unified “tourism” banner. This will allow each member state to decrease its reliance on regional tourism (Gulf nationals) and increase tourism from international sources. This, in turn, will enable the GCC to have a competitive international tourism destination while providing a domestic tourism sector for each member state.

In conclusion, we have seen that the “tourism” sector is an essential component of the Bahraini economy and will continue to do so going forward. However, we have also seen that the largest potential challenge is the reliance on Saudi Arabia and Gulf nationals as its tourism portfolio, which with the recent developments of domestic tourism in other Gulf nations, could lead to a decrease in future inflows of visitors from around the Gulf. Therefore, as recommended above, a solution that will benefit not only Bahrain but the entire Gulf region is to potentially create a campaign and policy framework that promotes Gulf tourism around the whole region towards international tourists instead of each Gulf nation attempting to promote individual domestic tourism as one.

ABOUT THIS AUTHOR

Saim is a corporate finance and strategy professional with over 3 years of experience. He has a penchant for development economics and an inclination towards policy making.

Email: [email protected]

Sign up with your email address to receive news and updates.

Licence or Product Purchase Required

You have reached the limit of premium articles you can view for free.

Already have an account? Login here

Get expert, on-the-ground insights into the latest business and economic trends in more than 30 high-growth global markets. Produced by a dedicated team of in-country analysts, our research provides the in-depth business intelligence you need to evaluate, enter and excel in these exciting markets.

View licence options

Suitable for

- Executives and entrepreneurs

- Bankers and hedge fund managers

- Journalists and communications professionals

- Consultants and advisors of all kinds

- Academics and students

- Government and policy-research delegations

- Diplomats and expatriates

This article also features in The Report: Bahrain 2022 . Read more about this report and view purchase options in our online store.

Tourism From The Report: Bahrain 2022 View in Online Reader

Bahrain has targeted the tourism sector as a top driver of growth and diversification as the economy recovers from the Covid-19 pandemic. Indeed, as the only island nation in the Middle East and home to large-scale events such as the Formula 1 Bahrain Grand Prix event, the country is well positioned to meet these goals. It has long been a top destination for travellers from Saudi Arabia – attracted by its entertainment, dining and shopping options – with the two countries connected via the King Fahd Causeway. Officials are looking to diversify both source markets and offerings, and have implemented a series of measures and projects aimed at meeting these objectives.

This chapter contains an interview with Nasser Ali Qaedi, CEO, Bahrain Tourism and Exhibitions Authority.

Articles from this Chapter

Myriad attractions: large-scale public and private works set to diversify and expand the kingdom’s offering for tourists obg plus.

Bahrain has targeted the tourism sector to be a main driver for growth and diversification as the economy recovers from the Covid-19 pandemic. Indeed, as the only island nation in the Middle East and home to large-scale events such as the Formula 1 Bahrain Grand Prix event, the country is well positioned to meet these goals. It has long been a top destination for travellers from Saudi Arabia — attracted to its entertainment, dining and shopping options — with the two countries connected via the…

Open market: Nasser Ali Qaedi, CEO, Bahrain Tourism and Exhibitions Authority, on creating new business opportunities OBG plus

Interview:Nasser Ali Qaedi Where do you identify the main challenges and opportunities in Bahrain’s tourism sector in the post-pandemic recovery? NASEER ALI QAEDI: Bahrain is an established destination for regional and international tourism, with a rich culture and history at the crossroads of civilisations that has spanned thousands of years. As such, the Bahraini tradition of welcoming travellers and visitors has helped to fuel a productive tourism industry. Over the past decade Bahrain…

Niche itineraries: Regional and domestic attractions, complemented by renewed promotional campaigns, are opening up new markets OBG plus

With tourism tipped to be an important driver of growth and recovery in the wake of the Covid-19 pandemic, the sector is projected to play a major role in wider economic expansion and attracting investment in the kingdom. Bahrain has several large-scale projects in the pipeline that are designed to position the country as a top destination in the region, leveraging its location in the Gulf between Qatar and Saudi Arabia, as well as its natural environment. As an archipelago with 33 white sand islands,…

Greener destinations: The global tourism industry looks to adopt sustainable practices in its post-pandemic recovery strategy OBG plus

The global tourism industry faces numerous challenges when it comes to decarbonisation, as highlighted by a November 2021 report from the World Travel & Tourism Council (WTTC), in collaboration with the UN Environment Programme and multinational consulting firm Accenture. In the years prior to the pandemic the sector thrived, recording its 10th consecutive year of growth in 2019. Moreover, with 1.5bn international tourist arrivals worldwide, it contributed more than 10% of global GDP and accounted…

Privacy Overview

Bahrain’s Tourism Boom: 51% Surge in Visitors in 2023

Exploring the enchanting island nation's growth as a premier tourist destination.

The Kingdom of Bahrain, celebrated for its abundant cultural heritage, thriving shopping scenes, and diverse array of tourist attractions, has emerged as an alluring destination for global travelers. It is consistently advancing in its tourism sector. Recently, the Bahrain Tourism and Exhibition Authority (BTEA) released its latest statistics for the January-to-June 2023 period, revealing remarkable growth in the tourism sector.

As per the most recent BTEA data, Bahrain played host to an impressive 5.9 million visitors during the initial six months of 2023, marking a remarkable 51% surge from the corresponding period in the previous year, when 3.9 million tourists visited the country. This substantial increase in arrivals underscores Bahrain’s escalating appeal as a premier tourist hotspot.

Bahrain, a picturesque island nation nestled in the heart of the Arabian Gulf, has become the favored choice of tourists in search of a distinctive blend of culture, history, and modernity.

Visitors are captivated by its historic sites, such as the UNESCO World Heritage-listed Bahrain Pearling Trail and the ancient Qal’at al-Bahrain (Bahrain Fort), offering a glimpse into the nation’s rich history, which spans over 4,000 years.

Furthermore, Bahrain’s cultural festivals, impressive architecture, and warm hospitality continue to draw visitors from around the world. This showcases the country’s commitment to embracing global cultural diversity while preserving its own traditions. Bahrain’s culinary scene also stands out, with numerous restaurants offering a delectable fusion of Middle Eastern and international cuisines. From authentic local dishes to gourmet experiences, Bahrain caters to every palate.

A noteworthy trend observed during this period is the increasing number of tourists from India. The country witnessed an 87% surge in the number of Indians visiting Bahrain. In the first half of 2023, the number of Indian visitors soared to 504,173 compared to 269,302 for the same period in 2022, indicating substantial growth in this tourist segment. The Indian market has shown tremendous interest in Bahrain as a preferred destination for weddings, vacations, and relaxation. The Kingdom’s proximity to India, convenient connectivity, and a diverse range of offerings cater to the preferences of Indian travelers, making Bahrain an attractive choice for both leisure and business purposes.

Maryam Toorani, Director of Marketing & Promotion at BETA, remarked, “Bahrain’s significant growth in tourism during the first half of 2023 is a testament to the enduring charm of our country. We are delighted to welcome 5.9 million visitors who have chosen Bahrain as their destination of choice. As we continue to evolve and welcome travelers from around the world, we remain committed to crafting unforgettable experiences that showcase our rich culture, history, and the warmth of our hospitality.”

Bahrain’s government continues to invest in its infrastructure and initiatives to ensure the sustainability and growth of its tourism sector. These efforts include enhancing accommodation options, expanding transportation networks, and promoting cultural and recreational activities.

Electronica India, productronica India, and SEMICON India 2024 Conclude with…

IWTMA & PDA Ventures Announce Sixth Edition of Windergy India in Chennai

Unveiling the Power of the Middle East Pharmaceutical Industry: The 6th Arab Pharma…

GREAT FUTURES: Pioneering Saudi-UK Trade Expo

Welcome, Login to your account.

Recover your password.

A password will be e-mailed to you.

- Travel, Tourism & Hospitality ›

- Leisure Travel

Industry-specific and extensively researched technical data (partially from exclusive partnerships). A paid subscription is required for full access.

Tourism coverage in Bahrain 2009-2020

Inbound tourism as a share of outbound tourism in bahrain from 2009 to 2020.

- Immediate access to 1m+ statistics

- Incl. source references

- Download as PNG, PDF, XLS, PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

October 2022

Bahrain, MENA

2009 to 2020

Note: the figures present the ratio of inbound over outbound tourism expenditures which can also be referred to as tourism coverage according to the source. values have been rounded.

Other statistics on the topic

Travel, Tourism & Hospitality

- Passport visa free score in Africa 2024, by country

- Contribution of travel and tourism to GDP in South Africa 2005-2021

Accommodation

- Occupancy rate of hotels in South Africa from 2000 to 2021

- Total contribution of travel and tourism to employment in South Africa 2019-2021

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

* For commercial use only

Basic Account

- Free Statistics

Starter Account

- Premium Statistics

The statistic on this page is a Premium Statistic and is included in this account.

Professional Account

- Free + Premium Statistics

- Market Insights

1 All prices do not include sales tax. The account requires an annual contract and will renew after one year to the regular list price.

Statistics on " Tourism industry in South Africa "

- Visa openness index in Africa 2021, by indicator

- Number of countries with visa free access to South Africans 2010-2022

- International tourist arrivals in Africa 2020, by country

- Value added of travel and tourism to GDP in South Africa 2019-2021

- Tourism direct gross value added in South Africa 2015-2021

- Tourism direct gross value added in South Africa 2021, by industry

- Number of international tourist arrivals in South Africa 2014-2029

- Number of tourists arriving in South Africa from 2011 to 2022, by mode of travel

- Number of tourists arriving in South Africa from 2014-2022, by purpose of visit

- Total traveler departures from South Africa 2014-2022

- Number of foreign traveler departures from South Africa 2014-2022

- Foreign tourism visitor spending in South Africa 2009-2021

- Foreign tourism visitor spending as a share of exports in South Africa 2009-2020

- Share of domestic and international travel spending in South Africa 2019-2020

- Tourism expenditure in South Africa 2019-2021, by type

- Expenditure per capita on international tourism in South Africa 2001-2029

- International tourism receipts per capita in South Africa 2001-2029

- Monthly number of foreign overnight visitors in South Africa 2022

- Available hotel rooms in South Africa 2000-2021

- Income generated from tourist accommodation in South Africa 2016-2023

- Monthly income from tourist accommodation in South Africa 2019-2023

Other statistics that may interest you Tourism industry in South Africa

- Basic Statistic Passport visa free score in Africa 2024, by country

- Premium Statistic Visa openness index in Africa 2021, by indicator

- Basic Statistic Number of countries with visa free access to South Africans 2010-2022

- Premium Statistic International tourist arrivals in Africa 2020, by country

Economic contribution

- Basic Statistic Contribution of travel and tourism to GDP in South Africa 2005-2021

- Basic Statistic Value added of travel and tourism to GDP in South Africa 2019-2021

- Basic Statistic Tourism direct gross value added in South Africa 2015-2021

- Basic Statistic Tourism direct gross value added in South Africa 2021, by industry

- Basic Statistic Total contribution of travel and tourism to employment in South Africa 2019-2021

Inbound and outbound tourists

- Premium Statistic Number of international tourist arrivals in South Africa 2014-2029

- Basic Statistic Number of tourists arriving in South Africa from 2011 to 2022, by mode of travel

- Basic Statistic Number of tourists arriving in South Africa from 2014-2022, by purpose of visit

- Basic Statistic Total traveler departures from South Africa 2014-2022

- Basic Statistic Number of foreign traveler departures from South Africa 2014-2022

Tourism expenditure

- Basic Statistic Foreign tourism visitor spending in South Africa 2009-2021

- Basic Statistic Foreign tourism visitor spending as a share of exports in South Africa 2009-2020

- Basic Statistic Share of domestic and international travel spending in South Africa 2019-2020

- Basic Statistic Tourism expenditure in South Africa 2019-2021, by type

- Premium Statistic Expenditure per capita on international tourism in South Africa 2001-2029

- Premium Statistic International tourism receipts per capita in South Africa 2001-2029

Hotels and accommodation

- Premium Statistic Monthly number of foreign overnight visitors in South Africa 2022

- Premium Statistic Available hotel rooms in South Africa 2000-2021

- Premium Statistic Occupancy rate of hotels in South Africa from 2000 to 2021

- Premium Statistic Income generated from tourist accommodation in South Africa 2016-2023

- Premium Statistic Monthly income from tourist accommodation in South Africa 2019-2023

Further related statistics

- Premium Statistic International tourist arrivals in Europe 2006-2023

- Premium Statistic Countries with the highest number of inbound tourist arrivals worldwide 2019-2023

- Premium Statistic Number of international tourist arrivals APAC 2019, by country or region

- Premium Statistic Music tourist spending at concerts and festivals in the United Kingdom (UK) 2012-2016

- Premium Statistic Amenities affecting accommodation choice for business travelers worlwide 2015

- Premium Statistic Annual revenue of China Tourism Group Duty Free 2013-2023

- Premium Statistic Employee compensation and benefits at Deutsche Bank 2006-2022

- Premium Statistic Total assets of the InterContinental Hotels Group 2007-2023

- Premium Statistic Income of the InterContinental Hotels Group 2007-2023

- Basic Statistic Revenue of the InterContinental Hotels Group 2008-2023, by ownership type

Further Content: You might find this interesting as well

- International tourist arrivals in Europe 2006-2023

- Countries with the highest number of inbound tourist arrivals worldwide 2019-2023

- Number of international tourist arrivals APAC 2019, by country or region

- Music tourist spending at concerts and festivals in the United Kingdom (UK) 2012-2016

- Amenities affecting accommodation choice for business travelers worlwide 2015

- Annual revenue of China Tourism Group Duty Free 2013-2023

- Employee compensation and benefits at Deutsche Bank 2006-2022

- Total assets of the InterContinental Hotels Group 2007-2023

- Income of the InterContinental Hotels Group 2007-2023

- Revenue of the InterContinental Hotels Group 2008-2023, by ownership type

Popular searches

Tourism in Bahrain, Growth & Opportunities

Every year, millions of tourists from across the Gulf Cooperation Council (GCC) and beyond experience the best Bahrain has to offer. So, what is Bahrain known for?

/ Foreign Investment Opportunities / Tourism in Bahrain, Growth & Opportunities

Of all the places to visit, tourists choose the Kingdom for our superb island setting; our cosmopolitan, relaxed way of life; our rich history and culture; exciting major events; delicious food and varied shopping choices. All of these ingredients combine to create a thriving tourism and hospitality sector, which offers investors world-class infrastructure and a broad range of retail, leisure, food and hotel investment opportunities in Bahrain.

Opportunities in a unique destination

It’s all about priorities. When it comes to tourism and hospitality, we concentrate on the 300 million people who can readily reach us – from across the GCC and within two hours’ flying time. As a result, we house up to a million visitors each month and the majority of these tourists are increasingly spending more while they are here.

Tourism in Bahrain is back on the rise after the decrease the global tourism industry saw in 2020. Experts predict tourism in the GCC will be back to pre-COVID levels before the end of 2021, even predicting that tourism will contribute USD 133.6 Billion to the Middle East’s GDP by the end of 2028. The opportunity to take advantage of Bahrain’s growing tourism industry has never been better.

9.9 million

visitors in 2022 with a growth rate of 175% compared to 2021 (BTEA, IGA)

USD 3.9 billion

Total inbound expenditure in 2022 (BTEA, IGA)

of inbound tourism flows during 2022 is from GCC (BTEA, IGA)

Did you know about these top tourist attractions?

Bahrain has 3 designated UNESCO heritage sites offering visitors a unique experience: Dilmun Burial Mounds, Pearl Route, and Qal’at Al-Bahrain.

A clear strategy

To ensure the best possible results for investors, we take a focussed approach to Bahrain tourism. Central to this is the development and growth of three primary consumer sectors within tourism and hospitality. Food service, retail and leisure all offer opportunities for profitable investments in the Kingdom as the tourism industry continues to expand. Additionally, as part of our National Economic Strategy, we ensure digital technology is at the centre of the industry to enhance and transform each sector.

What we focus on

Events and festivals.

Bahrain and the surrounding region have a young population with an appetite for unique experiences. Events such as Formula1 Racing and Ramadan bring tourists to the country in droves. With a handful of annual events already set in place, this sector is set to grow abundantly in the future.

Beach and Maritime

Beaches in Bahrain are unlike any others. Feel the sand between your toes with both private and public beaches across the island. From spa resorts and recreational sports, like water skiing and wakeboarding, to wildlife exploration, Bahrain’s beaches offer it all. As an island country, it is the perfect place for businesses that specialise in beach and maritime services to grow.

Foodservice

Our vibrant culinary scene is at the heart of tourism in Bahrain. This dynamic industry includes local flavours, regional favourites and global brands that serve growing domestic and international consumers. There are development projects across the Kingdom with openings for a diverse mix of proven concepts.

Flagship FB & Retail

The country’s retail sector continues to evolve. There’s a wide variety of concepts located in special environments, including traditional souks, modern retail and entertainment destinations and lifestyle malls.

Leisure and Entertainment

The rich culture and history of Bahrain mixed with modern amenities create a world of possibilities for the leisure and entertainment industry. Recreational activities such as boat rentals, museum tours, theatre performances and festivals are just a few of the many successful entertainment services on offer. The combined resident and visitor consumer base provide a strong audience for leisure entertainment companies to expand here.

Ancillary Services

Bahrain lays the foundation for ancillary services in the GCC. Companies looking to enter this industry can benefit greatly from all the Kingdom has to offer, including customer service solutions and secure electronic payment options.

Why people visit

Ongoing investment

Ours. yours. bahrain.

A strong brand helps consumers understand what we stand for. Our national tourism identity ‘Ours. Yours. Bahrain’, championed by the Bahrain Tourism & Exhibitions Authority (BTEA), communicates the authenticity that visitors to the Kingdom experience through our tourism and hospitality sector.

Infrastructure

We’re investing more than $10 billion directly in tourism infrastructure projects, such as new hotels and museums, to provide a strong support for exploration and tourism in Bahrain. Bahrain is creating the foundation to support public and private investments’ customers, services and facilities.

Meet the team

Senior executive, get in touch with us.

- Ready to learn more? Fill out our contact form and a member of our team will follow up with you shortly.

- Full name *

- Email Address *

- Phone number *

- Your Job Title * CEO CFO Chief Strategy Officer Executive Founder/Co-Founder Managing Director Other

- What is your enquiry about? * Setting up Business in Bahrain General enquiries

- Current Business Location * Afghanistan Albania Algeria American Samoa Andorra Angola Anguilla Antarctica Antigua and Barbuda Argentina Armenia Aruba Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bermuda Bhutan Bolivia Bonaire, Sint Eustatius and Saba Bosnia and Herzegovina Botswana Bouvet Island Brazil British Indian Ocean Territory Brunei Darrussalam Bulgaria Burkina Faso Burundi Cambodia Cameroon Canada Cape Verde Cayman Islands Central African Republic Chad Chile China Christmas Island Cocos Islands Colombia Comoros Congo, Democratic Republic of the Congo, Republic of the Cook Islands Costa Rica Croatia Cuba Curaçao Cyprus Czech Republic Côte d'Ivoire Denmark Djibouti Dominica Dominican Republic Ecuador Egypt El Salvador Equatorial Guinea Eritrea Estonia Eswatini (Swaziland) Ethiopia Falkland Islands Faroe Islands Fiji Finland France French Guiana French Polynesia French Southern Territories Gabon Gambia Georgia Germany Ghana Gibraltar Greece Greenland Grenada Guadeloupe Guam Guatemala Guernsey Guinea Guinea-Bissau Guyana Haiti Heard and McDonald Islands Holy See Honduras Hong Kong Hungary Iceland India Indonesia Iran Iraq Ireland Isle of Man Italy Jamaica Japan Jersey Jordan Kazakhstan Kenya Kiribati Kuwait Kyrgyzstan Lao People's Democratic Republic Latvia Lebanon Lesotho Liberia Libya Liechtenstein Lithuania Luxembourg Macau Macedonia Madagascar Malawi Malaysia Maldives Mali Malta Marshall Islands Martinique Mauritania Mauritius Mayotte Mexico Micronesia Moldova Monaco Mongolia Montenegro Montserrat Morocco Mozambique Myanmar Namibia Nauru Nepal Netherlands New Caledonia New Zealand Nicaragua Niger Nigeria Niue Norfolk Island North Korea Northern Mariana Islands Norway Oman Pakistan Palau Palestine, State of Panama Papua New Guinea Paraguay Peru Philippines Pitcairn Poland Portugal Puerto Rico Qatar Romania Russia Rwanda Réunion Saint Barthélemy Saint Helena Saint Kitts and Nevis Saint Lucia Saint Martin Saint Pierre and Miquelon Saint Vincent and the Grenadines Samoa San Marino Sao Tome and Principe Saudi Arabia Senegal Serbia Seychelles Sierra Leone Singapore Sint Maarten Slovakia Slovenia Solomon Islands Somalia South Africa South Georgia South Korea South Sudan Spain Sri Lanka Sudan Suriname Svalbard and Jan Mayen Islands Sweden Switzerland Syria Taiwan Tajikistan Tanzania Thailand Timor-Leste Togo Tokelau Tonga Trinidad and Tobago Tunisia Turkey Turkmenistan Turks and Caicos Islands Tuvalu US Minor Outlying Islands Uganda Ukraine United Arab Emirates United Kingdom United States Uruguay Uzbekistan Vanuatu Venezuela Vietnam Virgin Islands, British Virgin Islands, U.S. Wallis and Futuna Western Sahara Yemen Zambia Zimbabwe Åland Islands

- Business Name *

- Your proposed investment size (USD) * Below 3m 3m – 10m 10m – 50m Above 50m

- Please share your Business Proposal *

- I consent to having this website store my submitted information so they can respond to my inquiry.

IMAGES

VIDEO

COMMENTS

International tourism, number of arrivals - Bahrain World Tourism Organization, Yearbook of Tourism Statistics, Compendium of Tourism Statistics and data files. License : CC BY-4.0

Bahrain tourism statistics for 2020 was 724,000,000.00, a 81.24% decline from 2019. Bahrain tourism statistics for 2019 was 3,860,000,000.00, a 0.68% increase from 2018. International tourism receipts are expenditures by international inbound visitors, including payments to national carriers for international transport.

The data reached an all-time high of 12,045,000.000 Person in 2018 and a record low of 1,909,000.000 Person in 2020. BH: International Tourism: Number of Arrivals data remains active status in CEIC and is reported by World Bank. The data is categorized under Global Database's Bahrain - Table BH.World Bank.WDI: Tourism Statistics.

Bahrain Visitor Arrivals recorded 1,909,000 person in Dec 2020, compared with 11,061,000 person in the previous year. Bahrain Visitor Arrivals data is updated yearly, available from Dec 1995 to Dec 2020. The data reached an all-time high of 12,045,000 person in Dec 2018 and a record low of 1,909,000 person in Dec 2020.

The data reached an all-time high of 12,045,000.000 Person in 2018 and a record low of 1,909,000.000 Person in 2020. Bahrain BH: International Tourism: Number of Arrivals data remains active status in CEIC and is reported by World Bank. The data is categorized under Global Database's Bahrain - Table BH.World Bank.WDI: Tourism Statistics.

The value for International tourism, number of arrivals in Bahrain was 1,909,000 as of 2020. As the graph below shows, over the past 25 years this indicator reached a maximum value of 12,045,000 in 2018 and a minimum value of 1,909,000 in 2020. Definition: International inbound tourists (overnight visitors) are the number of tourists who travel ...

Number of hotel rooms in Bahrain 2010-2021; Number of bed-places in hotels Bahrain 2011-2021; Inbound tourism expenditure as a share of GDP Bahrain 2009-2020; Outbound tourism expenditure as a ...

International tourism, number of arrivals in Bahrain was reported at 1909000 in 2020, according to the World Bank collection of development indicators, compiled from officially recognized sources. Bahrain - International tourism, number of arrivals - actual values, historical data, forecasts and projections were sourced from the World Bank on ...

Summary. Download. Tourist Arrivals in Bahrain increased to 17244.40 Thousand in 2023 from 13770.15 Thousand in 2022. Tourist Arrivals in Bahrain averaged 11665.24 Thousand from 2018 until 2023, reaching an all time high of 17244.40 Thousand in 2023 and a record low of 2842.22 Thousand in 2020. source: Information & eGovernment Authority ...

International tourism, expenditures (current US$) - Bahrain. World Tourism Organization, Yearbook of Tourism Statistics, Compendium of Tourism Statistics and data files. License : CC BY-4.0. LineBarMap. Also Show Share Details. Label. 1995 - 2019.

International tourism, number of departures - Bahrain. World Tourism Organization, Yearbook of Tourism Statistics, Compendium of Tourism Statistics and data files. License : CC BY-4.0. LineBarMap. Also Show Share Details. Label. 2015 - 2019.

ABOUT THIS AUTHOR. The travel & tourism segment has become one of the key contributors to the global economy in recent years. Before Covid-19, travel & tourism accounted for 10.3% of the global GDP and was worth over USD 9 trillion (World Travel and Tourism Council, 2019). One out of four newly created jobs stemmed from this segment in 2019.

Travel, Tourism & Hospitality. Number of international visitor arrivals to New Zealand FY 2024, by country ... Number of international tourists arriving in Bahrain from 2012 to 2022 (in millions ...

Learn about the history, attractions and statistics of tourism in Bahrain, a Persian Gulf island nation. Find out about its islands, malls, museums, mosques, wildlife park and more.

TourismFrom The Report: Bahrain 2023View in Online Reader. Tourism. Bahrain is implementing a long-term strategy to transform its tourism sector into a major engine of growth under Bahrain Economic Vision 2030, the kingdom's blueprint for economic diversification. The country is seeking to leverage its location at a continental crossroads and ...

TourismFrom The Report: Bahrain 2022View in Online Reader. Tourism. Bahrain has targeted the tourism sector as a top driver of growth and diversification as the economy recovers from the Covid-19 pandemic. Indeed, as the only island nation in the Middle East and home to large-scale events such as the Formula 1 Bahrain Grand Prix event, the ...

The Ministry of Tourism announced, based on the latest statistics issued by the Information and eGovernment Authority, that the number of tourists who visited Bahrain in the second quarter of 2022 increased by 38% compared to the first quarter of the same year. The ministry also indicated that the tourism sector's recovery rate reached 82% ...

Bahrain - International tourism, number of arrivals. 1,909,000 (number) in 2020 Bahrain number of arrivals was at level of 1.91 million in 2020, down from 11.1 million previous year, this is a change of 82.74%. The description is composed by our digital data assistant.

Published by Salma Saleh, Jun 16, 2023. The largest number of international tourist arrivals in Bahrain were from Saudi Arabia at about 1.14 million in 2019. Bahrain was highly dependent on trade ...

Recently, the Bahrain Tourism and Exhibition Authority (BTEA) released its latest statistics for the January-to-June 2023 period, revealing remarkable growth in the tourism sector. ... The country witnessed an 87% surge in the number of Indians visiting Bahrain. In the first half of 2023, the number of Indian visitors soared to 504,173 compared ...

In 2019, the Bahraini tourism sector grew 6.8%, and the industry jumped from accounting for just 2.4% of Bahrain's GDP in 2015 up to 7% at the end of 2021, according to the BTEA - which hopes ...

Number of countries with visa free access to South Africans 2010-2022; ... Inbound tourism as a share of outbound tourism in Bahrain from 2009 to 2020 [Graph], World Tourism Organization (UN ...

Tourism in Bahrain is back on the rise after the decrease the global tourism industry saw in 2020. Experts predict tourism in the GCC will be back to pre-COVID levels before the end of 2021, even predicting that tourism will contribute USD 133.6 Billion to the Middle East's GDP by the end of 2028. The opportunity to take advantage of Bahrain ...