- Disney Cruise: Start Here 1️⃣

- 101 Disney Cruise Tips 💡

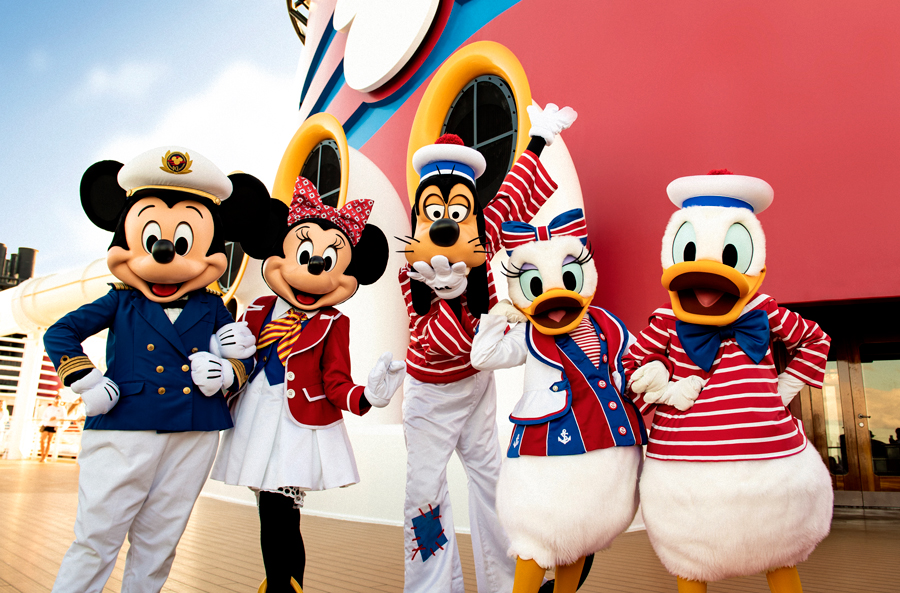

- What to Expect on Your First Disney Cruise 🚢

- Disney Cruise Packing List

- Castaway Cay Tips

- What’s Included Disney Cruise?

- Fish Extenders

- Disneyland Paris

- Disney Good Neighbor Hotels

- Animal Kingdom Lodge Tips

- Animal Kingdom Lodge Rooms

- Animal Kingdom Lodge Restaurants

- Aulani Tips

- All About the Aulani Spa

- Aulani Daily Iwa

- BoardWalk Inn Tips

- BoardWalk Inn Rooms

- BoardWalk Inn Dining

- 50 Magical Disney Coronado Springs Tips

- Disney Coronado Springs Dining: 2022 Guide

- Disney Coronado Springs Rooms: Full Guide & Reviews

- Polynesian Village Resort Tips

- All About Spirit of Aloha Luau

- Best Dining at Polynesian Village Resort

- 50 Magical Pop Century Resort Tips, Secrets & Hacks

- Disney Pop Century Dining: 2022 Guide

- Disney’s Pop Century Rooms: 2021 Guide

- Port Orleans Riverside Tips

- Port Orleans Riverside Rooms

- Port Orleans Riverside Dining

- Saratoga Springs Tips

- Saratoga Springs Rooms

- Saratoga Springs Dining

- Star Wars Hotel News

- Rent DVC Points

- 101 Disney Gift Ideas 🎁

- Latest Disney Deals 🔥

- Disney Black Friday Deals

- Disney World Tickets

- Disneyland Tickets

- Why Use a Disney Vacation Travel Agent

- Mickey Mouse Shirts

- Star Wars Shirts

- Moana Shirts

- Beauty and the Beast Shirts

- How to Get Two Free Audiobooks for Your Disney Vacation

- Disney Shirts

- 101 Disney Freebies

- Mickey Mouse Nails

- Minnie Mouse Nails

- Star Wars Tattoos

- Harry Potter Tattoos

- Disney Recipes

- Get Disney+ Free

- Disney Plus Gift Card

- Disney+ Bundle

- Best Movies on Disney+

- Best Shows on Disney+

- Disney+ Marvel

- Mickey Mouse Coloring Pages

- Minnie Mouse Coloring Pages

- Toy Story Coloring Pages

- Star Wars Coloring Pages

- Frozen Coloring Page

- Moana Coloring Pages

- Little Mermaid Coloring Pages

- Tangled Coloring Pages

- Avengers Coloring Pages

- Captain America Coloring Pages

- Spiderman Coloring Pages

- Coco Coloring Pages

- Frozen Font

- Star Wars Font

- Free Disney Character Pennant Banner

- Free Disney Vacation Scavenger Hunt

- What’s in the Cricut Mystery Box?

- The Cricut Maker…Everything You NEED to Know

- The Cricut EasyPress Mini – Everything You Need to Know

- 101 Disney Cricut Ideas

- Star Wars Cricut Ideas

- How to Make a Disney Shirt

- How to Make Disney Luggage Tags with Cricut

- How to Make a Disney Card

- How to Make a Disney Water Bottle

- How to Make Mickey Mouse Earrings

- How to Make a Mickey Mouse Inspired Wreath

- Best of 2022

- Travel Credit Cards

- Hotel Credit Cards

- Airline Credit Cards

- Cash Back Credit Cards

Disney Cruise Travel Insurance

Disclosure: This guide about Disney Cruise travel insurance contains affiliate links. Read full Disclosure Policy .

Disney Cruise Insurance

...do you need it?

By Alisha Molen

There's a 17% chance you'll need it*

* Source: US Travel Insurance Association Survey

You're spending $5000 or more on your Disney Cruise. Are you willing to gamble this money?

E ssentially, this is the question we're asking ourselves when deciding whether or not to purchase cruise travel insurance for a Disney Cruise . (Or Aulani vacation .)

For me , the answer is no. Disney Cruises are expensive. I'm not willing to gamble the money I'm spending on this dream vacation.

But everyone is different. Let's explore what might be right for you.

Why? What Could Go Wrong?

1 in 6 americans.

say their travel plans have been impacted by medical conditions, natural disasters including severe weather; or mechanical or carrier-caused problems.

Travel Can Bring the Unexpected

Here are some real-life examples of things that I have personally experienced or witnessed in my travels:

- Theft on beach in Hawaii

- Pickpocketers in Italy

- Stung by stingray in Mexico

- Trip to Cabo San Lucas cancelled due to hurricane

- Slept in Nashville airport thanks to severe weather forcing a flight cancellation

- Missed connection in Denver

- Lost luggage in Las Vegas, Salt Lake City & Phoenix

- Forced to stay extra day at sea on Disney Cruise thanks to Hurricane Matthew

How Your Disney Cruise Could Be Messed Up

"No one needs insurance until they need insurance."

21 REAL LIFE STORIES “Have you ever had to make a claim for Disney Cruise travel insurance?” Read 21 real life stories .

(I know I don’t.)

Unfortunately, Disney Cruises, despite all their magic , are not immune to accidents or unexpected mishaps.

What can happen on or before a Disney Cruise that could put your vacation dollars at risk?

You Miss the Boat

Your cruise ship has a schedule to keep. It will not wait for you.

You Have to Cancel

Sometimes people get sick, loved ones pass away, divorce can change plans. Depending on when "life happens", your deposit is at risk.

You Get Hurt

With a Disney Cruise brings new adventures. Unfortunately, accidents can happen.

You Lose Your Bags

Losing a bag en route to your cruise is, at best, inconvenient. You might not have time to buy replacements. And if you have to purchase anything on the ship -- that's expensive.

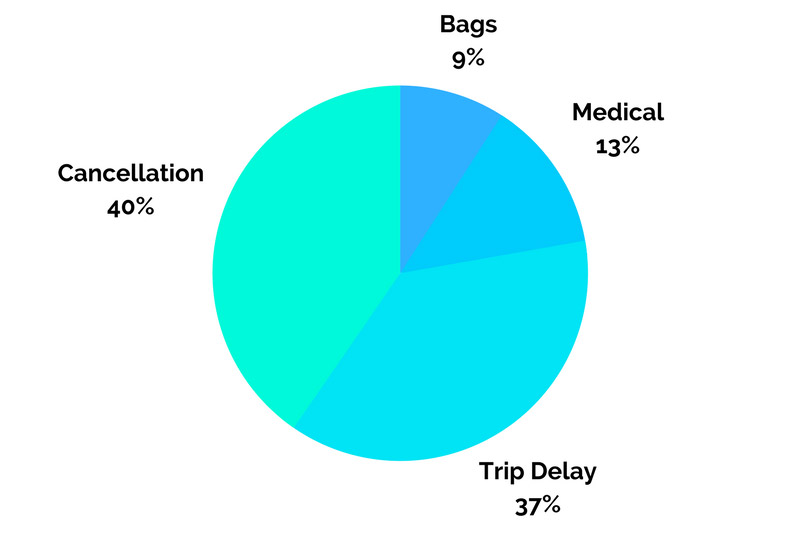

Breakdown of Claims: Why People are Using Trip Insurance

* Source: Tripinsurance.com claims data

Trip Cancellation: 40% of Claims

It happens every day. People have to cancel their Disney Cruises for many reasons. Having Disney Cruise cancellation insurance is a buffer against common reasons like these:

Bad Weather

Bad weather cancels or delays a flight en route to a connection or cruise.

Airline Delay

Airline delay or strike makes you miss a connection or cruise

Death, injury or illness

Death, injury, or illness of a family member

Car Trouble or Accident

Undriveable car or accident on the way

Home is damaged

Your home is damaged due to natural disaster, fire, or burglary

Court appearance

You are summoned by a judge to appear in court (jury duty, etc)

Divorce or Pregnancy

A divorce or unexpected pregnancy causes a change of plans

You're laid off due to no fault of your own

Trip Delays & Interruptions: 37% of Claims

Trip interruption is any situation that causes you to unexpectedly have to end your trip and return home. Trip delay is any time your trip has been delayed due to accident or a canceled flight or whatever.

What could cause a trip interruption or delay?

Natural Disaster

Floods, tornados, wildfires, whatever! Mandatory evacuations can really slow you down

Illness or injury

Getting sick or hurt is no fun. Especially on vacation!

Attack, Assault, Robbery

A vicious attack can interrupt or abruptly end a trip

Job or Money Problems

Have to work unexpectedly?

Labor Strike

When travel workers go on strike, it can really mess up your plans

Trip Provider Bankruptcy

A travel supplier (tour operator, etc) ceases operations due to financial default or bankruptcy

Medical Expense: 13% of Claims

If you get sick, hurt, or (heaven forbid) die while on your Disney Cruise, there can be a bevy of hefty costs. Here are just a few:

Hospitalization

Spending any amount of time in the hospital is expensive

If you get hurt in a remote spot, you'll need to be transported to a hospital

Return of Remains

Care for the deceased after unexpected death

Lost or Delayed Baggage: 9% of Claims

Stuck somewhere without your bathing suit, toiletries, Mickey Ears and fresh pair of undies ?

Yeah, it's a total bummer and inconvenience, but worse...last second replacements are often outrageously expensive.

VIDEO: How to Book Disney Cruise Insurance in 5 Minutes

4 reasons you might not need dcl travel insurance, cost of vacation is minimal.

Not spending much on flights or other travel? Got a screaming deal on a 3-day cruise and it just wasn't that expensive? (If yes, show me how!)

Your Domestic Health Insurance Will Cover Medical Emergencies Abroad

Check with your existing carrier to find out what they will or won't cover overseas.

You're Comfortable with Risk of Lost Luggage

You can deal with the inconvenience of lost or stolen baggage.

You're Okay with Losing Any Amount of Money

You can handle the loss of the cost of your trip plus any additional costs you incur due to medical emergencies, evacuations, or added travel expenses.

What Travel Insurance Should I Choose?

S o, are you leaning toward getting Disney Cruise travel insurance for your upcoming sailing?

Next step is to select an insurance provider.

I know, I know. Seems overwhelming, right?

Don't Stress! I'll Give You a Place to Start

Yes, there are a lot of options out there. A LOT. I definitely recommend you do comparison on your own. However... I've done a lot of research on this. I've got you.

There are two basic types of Disney Cruise travel insurance policy:

Individualized policies tend to cover specific worries you might have. If you want just one type of coverage in particular (e.g. medical) call your insurance company and ask for that.

Comprehensive

Comprehensive insurance policies cover basically everything I mentioned earlier (always read your policy to understand it) all in one package.

Here...let me make it simple

I've looked at a lot of travel insurance options.

To keep things simple, I have narrowed my comparison to two comprehensive options commonly selected by Disney Cruisers:

- Disney Cruise Line's Vacation Protection Plan

- Allianz Global Assistance

Let’s take a look at each...

Disney Cruise Vacation Protection Plan

D isney has Disney cruise insurance coverages that you can purchase through Disney (or your travel agent) that are underwritten by Transamerica Casualty Insurance Company. When Can You Buy Disney Cruise Vacation Protection Plan? You can purchase online, over the phone through DCL, or via your travel agent any time before your final payment is made. How Much Does Disney Cruise Vacation Protection Cost? 8% of the per person sailing fare. Minimum per person cost is $29; maximum per person cost is $399.

Convenience

You can book it at same time you book everything else through DCL or your travel agent.

Flights not covered

Unless you book your air travel through Disney, your flights aren't covered.

More expensive

Per person cost for DCL's insurance is higher than many other plans.

No pre-existing conditions

Pre-existing conditions are not covered

Allianz Global Assistance OneTrip Prime Plan

A llianz Global Assistance offers several plans that vary in coverages.

The most popular plan, and the one that is the best for a Disney Cruise, is called “OneTrip Prime” .

When Can You Buy Allianz Global Assistance's "Prime Plan"? You can purchase up to 11pm eastern of the night before you begin your travels. If you have a pre-existing condition, you'll want to purchase within 14 days of your first deposit, in order to meet an important condition for having pre-existing conditions covered.

How Much Does Allianz Global Assistance "Prime Plan" Cost? Around 2-6% of the total cost of your trip. My last quote was under 4% of my trip cost.

Kids are free

Kids under 18 are covered free when traveling with a parent or grandparent.

Better coverages

Overall better coverage limits.

Half the cost

Cost is about 4% of the total cost of your trip. Disney is 8%.

Pre-existing conditions

Buy policy within 14 days of making first deposit, it will also cover pre-existing conditions.

Umm...it's not Disney?

Only thing I can think of is you have to book Allianz Global Assistance outside of Disney .

What's Covered? Comparison

NOTE: Disney Cruise's own insurance (Vacation Protection Plan) has some restrictions in the fine print: - First, the trip cancellation plan only covers flights booked through Disney. If you make your own flight arrangements, you're not covered. - Second, if you must cancel for a reason that's not covered, all you get is a Disney cruise credit equal to 75 percent of the cancellation fees imposed.

* Benefits as of August 16, 2018

Why I Chose Allianz Global Assistance

Allianz Global Assistance offers quite a bit more coverage for your Disney Cruise travel insurance than the DCL protection plan.

In my personal experience and all of my research, Allianz Global Assistance has provided competitive prices, paid out claims, and given awesome customer service.

Disclosure: If you buy a DCL insurance policy through the Allianz Global Assistance links, I get a small commission. It’s not much but it helps keep the website running and doesn’t cost you any extra. You don’t have to use my links, but I’m very thankful when you do. I recommend them not because of the commission but because I use them myself.

GET A FREE (AND QUICK) QUOTE

Click the image below to get a quick quote from Allianz Global Assistance for your Disney Cruise travel insurance.

Understand Your Disney Cruise Cancellation Insurance Policy

Frequently asked questions, what if i have personal health insurance.

Check with your personal health insurance company and ask if they cover overseas personal travel. Most do not. Remember that Disney Cruise travel insurance (also known as DCL insurance) not only gives you more health coverage but also provides insurance for flight delays, travel interruptions and lost luggage.

Can I Change My Mind?

All trip insurance plans have a "Free Look" period that starts when the plan is purchased and lasts between 10 and 15 days (check your plan details).

This free look period gives you time to review your policy and return it for a refund within the time period.

How to Make an Travel Insurance Claim

Regardless of what Disney Cruise travel insurance provider you go with, here are three tips to help you if you ever have to make a claim:

Doctor Support

If you cancel a trip due to sickness or you have a medical emergency while traveling, you will need documentation from a doctor.

Keep All Documents

The more documentation you have of your expenses, the better. The insurance company will require proof of expenses, amounts you have paid, and any refunds you may receive.

Contact your Disney Cruise travel insurance company as soon as possible. Virtually every good trip insurance company offers 24/7 support. Get in touch with them early and assume nothing. Ask a lot of questions.

Pin For Later

- Close

Does Disney offer travel insurance? ”

- Useful 1 Useful Please Log In to mark this question useful.

- Save Answer Please Log In to view your saved answers.

Meet the Panelist: JoVonn, Georgia

Related video.

Related Links

Visit Disney Cruise Line to view exciting itineraries and onboard amenities.

Thank a Panelist

Share a message of thanks with the knowledgeable panelist who provided a personalized answer to your disney vacation question..

256 Characters Remaining

Please do not include personal information such as full names and reservation numbers in your message.

- Whom do you want to thank?

- Close Submit

Thanks for submitting your comment!

Didn't find what you were looking for click the ask a question button to open the ask a question dialogue box. if you are not logged in a dialogue box will appear to signin in order to ask a question., to submit your question, please log in now if you have not already done so., ask plandisney, discover the magic of a disney parks family vacation from one of our knowledgeable online panelists..

Please do not include personal information such as full names and reservation numbers in your question.

- Relevant Tags Please select at least one tag related to your question from the choices below.

The menu below has been automatically set to the panelist you were reviewing, however, you can ask anyone on our panel.

- Close Ask a Question Opens the Ask a Question dialog box.

Thanks for submitting your question!

You'll receive an email if your question is answered., please note.

Email communication is the only way we can notify you when your question has been answered. If you choose to opt-out of receiving emails, you will need to return to the site to check if your question has been answered.

Update Browser

For a better experience browsing this website, please download an updated version of Internet Explorer .

Or you can continue browsing without updating.

Optimal Travel Insurance for Disney Cruise: Your Key to Stress-Free Sailing

Planning a Disney cruise is exciting, but have you thought about protecting your trip with the best travel insurance? Picture this: you’re all set for your magical voyage, but unexpected circumstances could disrupt your plans. What if your flight is delayed, or you need medical assistance during the trip? That’s where the right travel insurance can save the day.

In this article, you’ll discover the importance of choosing the best travel insurance for your Disney cruise. We’ll guide you through key factors to consider, ensuring you have peace of mind throughout your journey. Stay tuned to learn how to safeguard your vacation and make the most of your unforgettable Disney cruise experience.

Key Takeaways

- Travel insurance for a Disney cruise is essential to safeguard your trip against unforeseen circumstances like trip cancellations, medical emergencies, and lost luggage.

- Key components to ensure in your travel insurance coverage are trip interruption protection, emergency evacuation services, and coverage for adventure activities.

- When selecting the best travel insurance for a Disney cruise, prioritize options that include trip cancellation protection, medical coverage, and lost luggage assistance.

- Compare prices and policies of different insurance providers to make an informed decision that aligns with your budget and coverage needs.

- Consider reputable insurance providers like Provider A for comprehensive coverage, Provider B for budget-friendly plans, and Provider C for flexible policy add-ons when choosing travel insurance for your Disney cruise.

- Customer feedback through reviews and ratings is valuable in guiding your decision-making process when selecting the best travel insurance for your Disney cruise.

Understanding Travel Insurance for Cruises

When it comes to embarking on a Disney cruise, understanding the significance of travel insurance is crucial. Here’s why it’s essential and what aspects should be covered to ensure smooth sailing on your magical voyage:

Why It’s Essential

Travel insurance for your Disney cruise provides a safety net. It’s like having a reliable friend by your side, ready to assist you in times of need. Here’s why it’s imperative:

- Trip Cancellation Protection: Imagine you or a family member falls ill before the cruise. With travel insurance, you can potentially recoup your prepaid, non-refundable expenses.

- Medical Coverage: While Disney cruises are filled with fun activities, accidents can still happen. Travel insurance can cover unforeseen medical expenses during your trip.

- Lost Luggage Assistance: Misplaced luggage is the last thing you would want during your Disney adventure. Travel insurance can help replace essential items in case your bags go missing.

What Should Be Covered

When selecting travel insurance for your Disney cruise, ensure it includes the following key components:

- Trip Interruption Coverage: Sometimes, unexpected events can cut your trip short. Make sure your insurance covers trip interruptions, providing peace of mind in unforeseen circumstances.

- Emergency Evacuation Services: In rare cases of serious emergencies, having coverage for emergency medical evacuation can be a lifesaver. This ensures you can receive proper medical care promptly.

- Adventure Activities Protection: Disney cruises offer various exciting activities. Ensure your insurance covers any adventurous pursuits you plan on experiencing during your voyage.

By choosing the right travel insurance for your Disney cruise that covers these essential aspects, you can relax and enjoy your vacation with added security and peace of mind.

How to Choose the Best Travel Insurance for Disney Cruise

Coverage options to consider.

When selecting the best travel insurance for your Disney cruise, it’s vital to assess the coverage options available to ensure comprehensive protection during your voyage. Here are key coverage options to consider:

- Trip Cancellation Protection: This coverage safeguards your investment by reimbursing you for prepaid and non-refundable expenses if you need to cancel your trip for a covered reason.

- Medical Coverage: Ensure the policy includes adequate medical coverage to cater to unexpected illnesses or injuries during your Disney cruise.

- Lost Luggage Assistance: Look for coverage that provides reimbursement for lost, damaged, or stolen baggage to minimize disruptions to your vacation.

By prioritizing these coverage options, you can have peace of mind knowing that you’re well-protected throughout your Disney cruise adventure.

Comparing Prices and Policies

Before finalizing your travel insurance choice, it’s essential to compare prices and policies to make an informed decision. Here’s how you can effectively compare different options:

- Evaluate Coverage Limits: Compare the coverage limits of various policies to determine which one offers the most comprehensive protection for your needs.

- Assess Premium Costs: While comparing prices, consider the premium costs against the coverage provided to ensure you’re getting value for your investment.

- Review Policy Exclusions: Pay attention to the exclusions listed in each policy to understand what is not covered, helping you avoid unexpected surprises.

By carefully evaluating prices and policies, you can select the best travel insurance for your Disney cruise that aligns with your budget and provides extensive coverage for a worry-free and enjoyable trip.

Top Travel Insurance Providers for Disney Cruises

When choosing travel insurance for your Disney cruise, it’s crucial to select from the top providers that offer comprehensive coverage tailored to your needs. Here are some reputable insurance companies known for their excellent services:

Provider A: Comprehensive Coverage

For travelers seeking extensive coverage for their Disney cruise, Provider A stands out as a top choice. They offer a range of benefits that include trip cancellation protection, medical coverage, and assistance for lost luggage. With Provider A, you can have peace of mind knowing that you’re well protected throughout your voyage. Assess the policy details carefully to ensure it aligns with your specific requirements for a worry-free cruise experience.

Provider B: Budget-Friendly Plans

If you’re looking for budget-friendly travel insurance options without compromising on essential coverage, consider Provider B. They specialize in offering cost-effective plans that still provide adequate protection for Disney cruises. By opting for Provider B, you can enjoy your vacation without breaking the bank while ensuring that you’re covered in case of any unforeseen circumstances. Compare their plans to find one that fits your budget and needs perfectly.

Provider C: Flexible Policy Add-ons

Provider C stands out for its flexible policy add-ons that allow you to customize your travel insurance for a Disney cruise. Whether you need additional coverage for specific activities or want to enhance your existing plan with extra benefits, Provider C has you covered. Their customizable options give you the freedom to tailor your policy to suit your preferences, ensuring that you have comprehensive protection that meets all your needs during your Disney cruise.

By exploring the offerings of these top travel insurance providers for Disney cruises, you can make an informed decision that guarantees a smooth and secure travel experience. Remember to assess your coverage requirements, compare policies, and select a provider that aligns with your preferences for a worry-free vacation aboard a Disney cruise.

Examining Customer Reviews and Ratings

Importance of customer feedback.

When choosing the best travel insurance for your Disney cruise, the importance of customer feedback cannot be overstated. By looking at reviews and ratings, you gain valuable insights into the real experiences of other travelers. It’s like having a trusted friend sharing their honest opinions with you, guiding you in making an informed decision.

Analyzing Reviews for the Top Providers

When analyzing reviews for the top insurance providers, make sure to pay attention to specific details that matter to you. Look for feedback on customer service, ease of claiming process, coverage satisfaction, and any unique benefits mentioned by reviewers. It’s essential to focus on reviews that highlight aspects that are crucial for your peace of mind during your Disney cruise.

How to Purchase Travel Insurance for Your Disney Cruise

When it comes to securing travel insurance for your Disney cruise, you have a few options. Here’s how you can make an informed decision:

Booking Directly Through Disney

If you choose to book your Disney cruise directly through Disney Cruise Line, you’ll have the opportunity to purchase travel insurance as part of your booking process. Disney offers its own travel insurance plans that you can add to your reservation. These plans typically cover trip cancellation, trip interruption, travel delays, medical emergencies, and baggage loss or delay. By opting for insurance through Disney, you can have peace of mind knowing that your coverage aligns seamlessly with your cruise booking.

Using Third-Party Insurance Companies

Alternatively, you can explore insurance options from third-party providers. Many reputable insurance companies offer specific cruise insurance that may provide comparable or even more extensive coverage than Disney’s offerings. When considering third-party insurance, be sure to research different providers and compare their policy details. Look for coverage that includes trip cancellation, emergency medical assistance, evacuation coverage, and coverage for pre-existing conditions if applicable. Obtaining travel insurance from a third-party company allows you to tailor your coverage to your specific needs and may offer more competitive pricing options.

By weighing the benefits of purchasing insurance directly through Disney or opting for a third-party provider, you can choose the option that best suits your preferences and provides the coverage you need for a worry-free Disney cruise experience.

Navigating Claims and Assistance During Your Cruise

Steps to file a claim.

When it comes to filing a claim during your Disney cruise, it’s crucial to follow the correct steps to ensure a smooth process. Here’s a simple guide to help you through:

- Report the Incident: If an unforeseen event occurs, such as lost luggage or a medical emergency, report it to the appropriate personnel on the cruise ship immediately.

- Document Everything: Keep detailed records of the incident, including photos, receipts, and any other relevant documentation that may support your claim.

- Contact Your Insurer: Reach out to your insurance provider as soon as possible to inform them of the situation and initiate the claims process. They will guide you on the necessary steps to take.

- Fill Out Claim Forms: Your insurer will provide you with claim forms to complete. Ensure you fill them out accurately and provide all the required information to expedite the process.

- Submit Claim Documents: Once you’ve filled out the necessary forms, submit them along with any supporting documents to your insurer for review.

By following these steps systematically, you can navigate the claims process efficiently and maximize your chances of a successful claim settlement.

Getting Emergency Assistance at Sea

In the event of an emergency while you’re at sea during your Disney cruise, knowing how to seek assistance is vital. Here’s what you should do:

- Alert the Ship’s Crew: If you or a fellow traveler requires immediate assistance, notify the ship’s crew or staff member closest to you. They are trained to handle emergencies and can provide immediate aid.

- Access Medical Services: Disney cruise ships are equipped with medical facilities and trained medical staff. In case of a medical emergency, seek help from the onboard medical team without delay.

- Contact your Insurer: Inform your insurance provider about the emergency situation. They can advise you on the best course of action and may assist in coordinating medical evacuation if necessary.

- Follow Instructions: Listen carefully to the crew’s instructions and cooperate with any requests they make. Your safety and well-being are their top priorities.

Being prepared for emergencies and knowing how to access assistance can give you peace of mind during your Disney cruise. Remember, safety always comes first, and having the right travel insurance can provide the necessary support in unexpected situations.

You’ve learned the importance of selecting the best travel insurance for your Disney cruise to safeguard against unexpected events. From trip cancellation protection to medical coverage and lost luggage assistance, having the right insurance is crucial. Remember to consider customer feedback when making your decision. Whether you opt for insurance through Disney Cruise Line or a third-party provider, tailor the coverage to suit your needs. In case of emergencies, knowing how to file a claim during your cruise is essential. Stay proactive by promptly reporting incidents, documenting thoroughly, contacting your insurer, filling out claim forms accurately, and submitting required documents. By being prepared and having the appropriate travel insurance, you can enjoy a worry-free Disney cruise experience.

Frequently Asked Questions

What are the essential coverage options in travel insurance for a disney cruise.

Travel insurance for a Disney cruise typically includes trip cancellation protection, medical coverage, and lost luggage assistance.

Should I review customer feedback before choosing a travel insurance plan?

Yes, reviewing customer feedback can provide valuable insights to help you make an informed decision about the best travel insurance plan for your Disney cruise.

How can I file a claim during a Disney cruise?

To file a claim during a Disney cruise, report incidents promptly, document thoroughly, contact the insurer, fill out claim forms accurately, and submit necessary documents.

What should I do in case of an emergency at sea during a Disney cruise?

In case of an emergency at sea during a Disney cruise, alert the ship’s crew, access onboard medical services, contact the insurer, and follow crew instructions for safety.

Hi, I'm Richard, a passionate traveler and cruise enthusiast. With over a decade of experience exploring the world's oceans, I've developed a deep love for all things related to cruising. Whether it's luxury liners or intimate river cruises, I enjoy sharing my insights and tips to help others plan their perfect getaway. When I'm not sailing the seas, you can find me writing about my adventures or planning my next voyage

Related Posts

Unlock the best website to search for cruises: your comprehensive guide to stress-free booking, enhance your cruise adventures with the best travel binoculars, best nile cruise for families: a guide to educational adventures and entertainment onboard.

Save my name, email, and website in this browser for the next time I comment.

Type above and press Enter to search. Press Esc to cancel.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Is Disney Travel Insurance Worth the Cost?

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What Disney travel insurance covers

How much is disney travel insurance, reasons to get disney travel insurance, reasons to skip disney travel insurance, better alternatives to disney travel insurance, when is disney travel insurance worth it.

Disney travel insurance has a flat fee: $82.50 per adult and $6 per child.

That's a great deal if your trip is expensive, not so much if you're on a budget.

Coverage is relatively limited.

Most travelers can consider other, more flexible options.

A Disney vacation can be a trip of a lifetime. It can also be the most expensive trip of your lifetime.

For many, buying travel insurance should be just as essential as buying a churro as you cruise down Main Street. Maybe you booked a vacation but later lost your job; you might want to delay until you regain a stable income stream. Maybe your kid breaks his leg and you want to rebook when it’s healed.

Trip insurance can be purchased from a dedicated travel insurance company , or you might already have it by holding certain credit cards. Otherwise, you might buy it directly from Disney, which offers insurance as an add-on for vacation packages at its U.S. theme parks.

Is Disney travel insurance worth it, or are there better deals out there?

If you’re heading to Walt Disney World in Florida or Disneyland in California and you’ve booked a vacation package (meaning a hotel and theme park tickets), you’re eligible to purchase Disney’s Travel Protection Plan. Underwritten by Arch Insurance Company, it’s available for purchase by U.S. residents and U.S. citizens living abroad who book through Disney’s website.

Exact coverage and benefit availability varies based on where you live, but it typically includes:

Trip cancellation or interruption: Reimburses prepaid travel up to your total trip cost for covered reasons including illness, injury, job loss or military service.

Trip delay: Reimburses eligible expenses of up to $200 per day ($600 per trip).

Baggage loss: Reimburses up to $2,000 for lost, stolen or damaged luggage.

Bag delay: Reimburses purchases of necessary items if your bags are delayed 12 or more hours.

Emergency medical expenses: Provides up to $25,000 of coverage if you get ill or injured while traveling.

Rental car damage: Reimburses repair costs up to $25,000 in the event of collision, theft, damage or vandalism.

While Disney doesn’t outright state its prices, a NerdWallet analysis of several travel packages found that it costs a flat rate of $95 per adult (children age 17 and under are free when travel protection is purchased for the adults on the reservation).

Flat-rate travel insurance can be good for ultra-expensive trips, but a bad deal for budget trips.

Take a seven-night stay during the week of Christmas 2022 for a family of four (two adults and two children) at Disney’s opulent Grand Floridian Resort & Spa. Book it alongside six-day theme park tickets with all the add-ons — like water park admission — and you’d pay about $12,000. Adding on travel insurance would cost $190, which is 1.6% of your overall cost.

But say you instead planned a trip at the end of September when the kids are back at school. Two adults could stay at Disney's All-Star Movies Resort with basic, two-day tickets for just $850. Adding Disney’s insurance would increase your package cost to over $1,000, which is an overall price increase of nearly 20%.

Travel insurance that nets out to just 1.6% of your overall trip cost is a deal, but 20% is far from it. After all, most travel insurance costs between 4% to 8% of the total trip, according to the U.S. Travel Insurance Association.

Flat-rate travel insurance, as Disney offers, is pretty rare. Most policies are priced based on factors including the length of your trip, your destination and the age of the policyholder.

Here’s why it might make a good deal:

Flat-rate pricing is better for more expensive trips: If a costly trip is going to result in equally costly travel insurance, opting for flat-rate pricing is smart. And it’s not just a fancy hotel and Disney theme park tickets with all the add-ons like front-of-the–line passes. Factor in other nonrefundable trip elements, such as airfare and pre-paid rental cars. If you’re flying first class , or you’re hit with rising rental car prices , then flat-rate insurance is especially appealing.

You’re an older adult: Travel insurance costs are based on risk, and insurance is more expensive for older travelers, who are more likely to experience health problems, according to Allianz Travel Insurance.

Because Disney’s only age differentiator is child versus adult, its plan might be cheaper for older adults versus going with an independent insurer.

Many other policies won’t cover theme park tickets: Ever since the COVID-19 pandemic, Disney has required travelers to make advance reservations to enter its U.S. theme parks. The days of buying tickets first thing in the morning are gone. For popular days, you’ll often have to reserve your tickets months in advance. But while most policies cover cruises, airfare, lodging and tours, it’s tough to find policies that cover theme park tickets.

Because of the high cost of Disney tickets (and the fact that most Disney tickets are nontransferable and nonrefundable), you likely want to be covered for those too.

But most people would be better off skipping Disney insurance. Here are a few reasons why:

Maximum coverage is relatively low: Disney’s insurance will pay out a maximum of $25,000 in the event of accidental death and dismemberment, while it’s common to find coverage of up to $500,000 elsewhere.

Similarly, Disney’s policy covers up to $2,000 for lost baggage. That might be insufficient if you’ve packed a fancy camera. With other insurance policies, coverage of at least $3,000 is common.

And Disney’s rental car coverage only reimburses repair costs of up to $25,000. Especially given rising car prices , that might not be enough for serious accidents.

Coverage is limited: Actually getting reimbursed with your Disney travel insurance can be tricky. Covered events are restricted to narrow situations, including injury, a family member’s death or jury duty. Plus, you must provide proof, like a court order or death certificate. Disney’s insurance also won’t cover pre-existing conditions.

You don’t want to book a Disney hotel: Disney’s insurance is only available to travelers staying at one of Disney’s own (expensive) resorts. If you’re going to Disney World on the cheap , staying off-property is almost always cheaper. Don’t let eligibility to purchase Disney insurance persuade you to book a Disney resort that’s outside of your ideal budget.

Before your Disney trip, compare travel insurance quotes from multiple providers. And don’t overlook these other types of travel insurance:

Cancel For Any Reason coverage

Perhaps an uptick in COVID-19 cases has you considering travel. Or maybe an injury is preventing you from travel, but you don’t have a doctor’s note to prove it. Given the limited number of reasons that qualify for coverage, you might be better off with “ Cancel For Any Reason ” coverage, which covers you no matter why you cancel.

Look to your credit card

Some credit cards offer travel insurance as a benefit, as long as you purchased the trip on that card. Given the high cost of travel insurance, this benefit alone can often be worth the often-high annual fees these cards charge.

Check with your bank to see what’s covered. For example, the insurance offered via many Chase credit cards explicitly won’t cover theme park tickets.

Given the uncertainty of travel these days, even a quick weekend getaway should have some degree of insurance. But you might not need to pay for Disney’s travel insurance.

As long as you’re OK with your theme park tickets not being insured, the travel insurance offered through many credit cards is likely a better bet, and might not cost you anything once you hold the card. If you really want to ensure coverage, paying for a Cancel For Any Reason might be even better.

Photo courtesy of Disneyland Resort.

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Disney Cruise Line

Disney Cruise Line Updates Concierge Level Vacation Protection Plan

by Sarah Phillips · May 17, 2021

More big news coming from Disney Cruise Line this morning! Starting today (May 17, 2021) for guests booked in a Concierge Suite or Concierge Stateroom, when Disney Cruise Line’s Vacation Protection Plan is added to their reservation it must be paid in full at that time. Currently this change only affects Concierge Suite or Concierge Stateroom guests.

When booking a Concierge Suite or Concierge Stateroom, Clients wishing to add Disney Cruise Line’s Vacation Protection Plan to the reservation must add and pay for the Vacation Protection Plan at the time the deposit is paid on the reservation . Deposits for Concierge Suites and Concierge Staterooms are non-refundable. Disney Cruise Line’s Vacation Protection Plan has to be paid prior to a non-refundable charge being applied to the reservation.

Similarly to Restricted Air, Concierge Suites and Concierge Staterooms are subject to cancellation fees as soon as the deposit payment is made; therefore, Disney Cruise Line’s Vacation Protection Plan cannot be added once the deposit has been paid. Should guests elect to decline Disney Cruise Line’s Vacation Protection Plan, they will be unable to add it later, even if they downgrade to a non-Concierge stateroom.

It’s important to add that for all other guests, when the Vacation Protection Plan is added to a non-Concierge Suite or Stateroom reservation it can be paid for (and subsequently activated) at a later date. It’s good to remember too that as of Feb. 3, 2021, Disney Cruise Line has begun to enforce the existing cancellation policy regarding the Vacation Protection Plan . The policy establishes that once the Vacation Protection Plan has been paid in full, it will no longer be refundable, with the exception of a “10-day look-back period” post-purchase to give insured guests appropriate time to review the full policy. Please note this enforcement does not apply to bookings made before Feb. 3, 2021, with the exception of situations where a non-refundable charge (i.e. air) is associated with the reservation.

Disney Cruise Line Concierge Vacation Protection Plan Update Credit: Disney

Do you want more help planning your next Disney vacation? As an Authorized Disney Vacation Planner, I can help you navigate the ever changing climate of Disney travel. The best part is that my services are complimentary to my clients! Get in touch by filling out the form below, calling toll-free at 1-800-454-4501, via email at [email protected] , or following me on Facebook!

Tags: Concierge DCL Disney Cruise Line Vacation Protection Plan

Sarah Phillips

Sarah is a wife, a mother of two awesome little boys, and a Disney fanatic. She has turned her passion into a dream career sharing Disney advice with the readers at MickeyBlog and helping families plan their perfect Disney Vacations with MickeyTravels. Reach out for a FREE, no obligation quote at 1-800-454-4501 or email at [email protected]!

Get a FREE Quote!

Interested in booking a Disney Vacation? Look no further! The award winning agents at MickeyTravels are ready to help you book a truly magical vacation!

- Name * First Last

- Number of Adults *

- Number of Children *

- Ages of Children *

- Select Your Destination * *hold ctrl or shift to select more Walt Disney World Disney Cruise Line Disneyland Adventures by Disney Aulani Hawaii Disney Special Event Tickets Universal Orlando

- Approximate Travel Dates *

You may also like...

Oaken Will Host “Arendelle: A Frozen Dining Adventure” Dining Experience on the Disney Wish

October 25, 2021

More Details Revealed For Disney Seas The Adventure Show Coming to Disney Wish

March 10, 2022

Renderings Reveal Disney Cruise Line’s New Terminal At Port Canaveral

November 5, 2018

Recent Posts

The First Toys of the Holiday Season Have Hit the Disney Store Website!

What Are the Best Slow Rides at Disney World?

Disney Headlines for September 10th, 2024

Sign-up for Our Newsletter

Disney Store / Merchandise / Shopping

September 10, 2024

Animal Kingdom / EPCOT / Hollywood Studios / Magic Kingdom / News / Walt Disney World

September 9, 2024

Disneyland Resort / News / The Walt Disney Company / Walt Disney World

News / Star Wars / The Walt Disney Company

Bob Iger Pays Tribute to James Earl Jones– “Gave Voice to Some of the Greatest Characters in Cinema History”

- Vacation Planning

Travel Insurance

- Trip Cancellation or Interruption – Helps protect your travel investment by reimbursing you for pre-paid, non-refundable dues and other out-of-pocket expenses if you must cancel or interrupt your trip due to a covered reason.

- Emergency Medical Expenses – Ensures you receive adequate medical care when traveling and can cover the cost of transporting you to the nearest medical facility in an emergency.

- Trip Delay – Provides coverage if you are delayed for 5 hours or more while en route to or from your destination.

- Primary Coverage – Provides easy claims handling and less time and hassle to receive reimbursement for eligible losses with no deductibles. Funds may be recovered from your medical or other collectible insurance plans.

- Baggage & Baggage Delay – Safeguards personal articles and expenses if bags are lost, stolen, damaged or delayed for 12 hours or more while traveling.

- Security Deposit Protection – Provides coverage for accidental and unintentional damage to your unit and its contents

We Value Your Opinion!

Will you please complete a brief survey about your experience on this website today?

10 Frequently Asked Questions About Travel Insurance for Your Disney Cruise

If only I had a dollar for every question I get about travel insurance! Well I might just be able to pay for another cruise. A short 3-night cruise in the off season in an inside cabin, but still. Insurance is a mysterious creature. Coverage is hardly ever cut and dry, and there are reasons for that. And it’s not cheap! Trust me, I understand it’s painful to pay for something you may or may not ever use. In fact, you are paying for something we hope you never have to use! I can’t tell you what to do, but maybe I can help you approach the insurance choice for your Disney cruise from a more informed place. Here are 10 frequently asked questions!

I even used my trip insurance one time to get reimbursed for having to spend the night in Seattle when weather prevented us from getting to Vancouver from Colorado for an Alaskan cruise. That was in May. No snow, no storms, just a windy day! Just remember, a cruise isn’t like a normal vacation where you can just go a day late should travel delays or weather occur. If you miss the ship, you miss your vacation! Insurance is important for so many reasons on a cruise.

3. Is It Refundable? – I’ve been asked multiple times (even by beloved family members) the following question in one form or another: “Will I get a refund after my cruise for my travel insurance if I don’t use it?” I think the answer is obvious, but a quote from a favorite commercial always pops into my mind, “That’s not how this works, that’s not how any of this works…” Many plans will give you a few days to change your mind after purchase, but otherwise, once you’ve bought it, that money is gone. One exception to this is adding Disney’s insurance to your cruise before final payment. You don’t actually pay for it and Disney does not actually purchase your policy until you have made final payment. So, no matter how early you add it, you can remove it up until final payment.

5. Does It Cover Air? – Maybe. Disney’s insurance plan will not cover air if you do not purchase the air through Disney. For other plans? It depends on the coverage, but usually air is wrapped up in the cost of your trip and is covered.

7. What if I Can’t Go? – Trip Insurance may help, it depends on your policy and why you are cancelling. Some reasons will be covered with most policies. Life-threatening illness of an immediate family member for example. Some companies offer “cancel for any reason” insurance. You can literally decide you don’t want to leave your dog Fluffy and get your money back. “Cancel for any reason” policies can be awfully expensive though. If your main fear is cancelling, Disney’s insurance plan is a great option and has a cancel for any reason clause. Disney’s insurance plan will give you back 75% of your non-refundable cost back in the form of a future cruise credit if you cancel for a reason that’s not covered and thus not entitled to a full refund. In my opinion, it’s the number one reason to get insurance through Disney.

9. Are Claims Usually Accepted? – Let’s face it, insurance companies make their money when they don’t have to actually pay claims. Read the fine print before you purchase a plan, and cross your t’s and dot your i’s when you file a claim. If it’s a health related claim, you will usually be asked to file with your personal health insurance company first, and then file with the travel insurance company for anything that is denied. For other claims, they may need receipts for additional expenses incurred, proof of flight delays, or other pertinent information. I won’t lie, it’s not a quick process. But worth it when it works!

10. I Travel Frequently, is There a Better Option? – There is! I’m a big fan of annual travel insurance. One purchase will cover your travel for a year. Allianz and Travel Guard are two of the big companies that offer annual travel insurance. It’s not cheap, but it’s a whole lot less than buying insurance even two or three times a year.

So are there any travel insurance tidbits you have to share? Any advice for those looking for travel insurance? Any stories (good or bad) of having to use travel insurance or wishing you had purchased it? Share with us!

Tammy Whiting is the owner of Storybook Destinations . Did you know Storybook Destinations offers a complimentary subscription to TouringPlans with qualified Disney and Universal bookings? Click here for a no-obligation quote on your next vacation.

You May Also Like...

Disney Cruise Line has added several cruises to their previously announced schedule for the Disney Dream. The dates for the new…

Disney Cruise Line and Adventures by Disney are both currently on hiatus, through at least October 2020, but that doesn't stop…

Our friend Scott Sanders at the Disney Cruise Line Blog is reporting exciting information about some possible changes to communication systems…

TouringPlans is pleased to welcome guest authors Brian and Samantha, The DCLDuo. Thomas Mazloum, President of Disney Signature Experiences, which oversees…

- New Bus Service Available From Theme Parks to Disney Springs

- Morimoto Asia Omakase: Fine Dining At Its Best

Tammy Whiting

Tammy has been a lover of all things Disney for most of her life. There’s nowhere on this Earth she’d rather be than on a Disney cruise with her family. She’s a Space Force wife and proud mom of two wonderful children and one beautiful daughter-in-law . She fulfilled a lifelong dream in 2008 and became a travel agent specializing in Disney vacations. She now owns her own travel agency - Storybook Destinations. You can reach Tammy at [email protected].

9 thoughts on “ 10 Frequently Asked Questions About Travel Insurance for Your Disney Cruise ”

Great post! Thanksgiving of 2014 our family’s plan was a week long Royal carribean cruise. Flew from Omaha to Tampa only for both my husband and I to get the stomach flu the night before boarding. Thank goodness we had trip insurance. There was no cruise but we used the insurance money to take the kids to Disney the summer 2015. Of course we were so sad to miss our cruise but it could have been so much worse if we would have been out thousands of dollars.

Yes! Thank goodness you did! So glad it worked out. 🙂

Travel Insured has been awesome to us with two Disney vacations – one we had to cancel the week before leaving because of illness, and one that got interrupted due to illness. They’ve been professional, helpful, and prompt paying claims. No hassle at all, and well worth the money. We won’t plan any vacation longer than a weekend without insuring it through them.

Great review, Carol! Thank you!

I bought Travelex trip insurance for a family trip to Quebec last summer. It worked – my daughter had an urgent care visit and antibiotics the day before we left for home. Paid out of pocket, did not file with our normal insurance, and Travelex reimbursed us completely. The only delay was on our side because we took our time (months) to file.

That’s good to hear!

I recently got a new Citibank credit card. I read the fine print and saw that trip cancellation, trip interruption, and trip delay coverage was offered for any travel purchased with that card. I figured it was minimal coverage, so I compared it to the travel insurance I purchased for a recent cruise, and I found that in most cases the credit card was about the same and in a handful of places it was more generous than the coverage. So make sure you don’t pay for a service your credit card already pays for; find and read the fine print!

Good point, we planned on doing a Disney cruise a few years ago but plans changed before we booked. I gave Visa a call to ask them about coverage and they told me pretty much the same detail that our card, which we pay annual due on, covers everything that the cruise insurance does with some slight variations. However the major concern area such as emergency medical evacuation is covered.

Tammy what is your experience with credit card insurance coverage?

That’s a great point! Card coverage varies widely, but there is a chance yours will fit your needs. I’ve never heard of one having a cancel for any reason clause, and coverage for a pre-existing condition is also very rare, but there are a few cards out there with great coverage. You should definitely check your cards fine print to see if it covers your major concerns.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Notify me of followup comments via e-mail. You can also subscribe without commenting.

How Much is Disney Travel Insurance?

Whether you want to finally see Cinderella’s castle or book a Disney Cruise , a Disney vacation is sure to be a memorable trip. However, it could also be one of the most costly trips of your lifetime; for many, travel insurance is crucial. After all, there are many uncertainties in travel these days.

By the Numbers

You can purchase travel insurance from a reputable company, or you may already have it available through certain credit cards. If not, you may buy it directly from Disney, which provides insurance as an add-on for various vacation packages at its United States theme parks. Disney’s travel insurance costs approximately $6 per child and $82.50 per adult for its theme park vacation packages at Walt Disney World Resort in Florida.

Fixed-fee travel insurance policies are perfect for ultra-expensive vacations but a lousy option for budget vacations. Take a five-night stay during the Easter holiday for a family of five at Four Seasons Resort Orlando at Walt Disney Resort, for instance. If you book your stay alongside four-day theme park tickets and opt for add-ons such as water park admission, you may pay approximately $15,000. Adding travel insurance may cost $183; roughly 1.22% of your overall travel cost.

But suppose you planned a trip in May when the children are at school–two adults can stay at Disney’s Wyndham Lake Buena Vista, for example, with three-day tickets for $1,200. When you include Disney travel insurance, your cost increases to $1,365—an overall price increase of approximately 14%.

Travel insurance that works out to 1.2% of your overall vacation cost is a good deal, but 14% is far from that. Most travel insurance costs between 5% and 10% of the total vacation cost, per the United States Travel Insurance Association.

A Disney Cruise, on the other hand, has a different price structure for its travel insurance. The price for a Disney Cruise travel protection plan is based on a percentage of the voyage fare (typically around 8%) rather than a fixed dollar amount; but there is also a minimum cost ($35 per person) and maximum cost ($1,600 per person) limit in place to ensure that the premium cost is never too low or high.

As an example, a 7-night European cruise for two people in summer 2023 had a trip price of $8,078 (before taxes and port fees), and travel insurance was an additional $646.24 (8% of the fare).

What Does Disney Travel Insurance Cover?

If you’re planning to visit Disneyland in California or Walt Disney World in Florida and have booked hotel and theme park tickets, you qualify for Disney’s Travel Protection Plan. This insurance plan was underwritten by Arch Insurance Company and is available for United States residents or United States residents living abroad who book via Disney’s website. (If you have questions about where to purchase Disney World tickets , take a look at our other articles on the subject).

The exact benefits and coverage availability of Disney’s Travel Insurance depend on your location, but usually include:

- Trip interruption or cancellation–this provides prepaid vacations up to your total cost for covered reasons, such as injury, illness, military service, or job loss.

- Trip delay–this reimburses expenses of up to $600 per trip or $200 per day.

- Luggage loss–this reimburses $2,000 for stolen, damaged, or lost luggage.

- Luggage delay–this reimburses essential items if your luggage is delayed for twelve or more hours.

- Emergency medical costs–this offers a maximum of $25,000 if you become ill or injured while traveling.

- Rental vehicle damage–this reimburses repair expenses of up to $25,000 in case of theft, collision, vandalism, or vehicle damage.

- Travel accident–this offers a maximum of $25,000 in case of dismemberment or accidental death.

- Emergency help–this qualifies you for 24/7 medical aid, travel assistance, and emergency services.

- Emergency repatriation and evacuation–this insurance policy covers emergency medical transportation and other costs if you’re injured while traveling.

Remember, this is the coverage for theme park based vacations; Disney Cruise Line coverage and Adventures by Disney trip coverage has different terms.

Final Thoughts

Given the uncertainty of vacations nowadays, even a quick two-day getaway requires insurance, which is where Disney’s Travel Insurance comes in handy. With this insurance plan, you can get reimbursement for trip cancellation, trip delay, luggage delay, and even rental car damage.

If you’re looking for a completely new experience, check out our recent article, Disney Difference – Adventures by Disney .

For help pricing out Disney Travel Insurance or any other part of your Disney vacation, contact the Disney experts at The Vacationeer !

Get your free, no-obligation trip quote today… their services are provided at no additional cost to you!

Related Posts:

Share This Page: Choose Your Platform!

Related posts.

Leave A Comment Cancel reply

- Disney Cruise Line

Trip insurance

By CruisinMama33 , January 3, 2017 in Disney Cruise Line

Recommended Posts

CruisinMama33

Does anyone have experience with Disney's travel protection plan or is there another insurance provider that you recommend? Thank you.

Link to comment

Share on other sites, kamrynkylene.

Disney trip insurance in my opinion is way over priced! We went through Allianz and got 4 people covered for the price of one through Disney. Also includes medical coverage outside the country.

Sent from my iPhone using Forums

We always use insuremytrip to get coverage. You'll often find plans with more coverage, for a lower price that way.

Most travel insurance sold through cruise lines (any cruise line) is overpriced, and very limited in what they cover.

moki'smommy

The ONLY good thing about DCL's insurance is that if the insurance company rejects your claim for any reason, a portion of what you lost will be applied to a future cruise (and there is fine print on that.) Another big negative is that only things booked thru DCL are covered--book air on your own and it isn't insured.

There are MANY good, private insurance companies that will cover pre-existing conditions if purchased within 14 or 21 days of booking your cruise, provide a complimentary child's policy with each parent or grandparent policy purchased, and give a whole lot more coverage than you get thru DCL. In my experience, many companies offer several levels of coverage. The cheapest is a "bare bones" that provides relatively little. One tier up typically costs only a little more and may double your coverage.

A good place to compare companies and policies is insuremytrip.com.

To decide how much you need to buy, look at the cost of non-refundable stuff. Example, if your airline would allow you to change your tickets for $50, that's the amount you need to insure for air. If you book a hotel for the night before the cruise but can cancel that up to 6pm at no charge, don't count that (it is refundable or won't be billed till check in). You purchase it in $500 increments and price is based on the amount purchased, age of cruiser, and where you are going. Consider the cost of the first 2 people in the room. DO NOT take the cost of 4 people and divide by 4. If one of the first 2 had to cancel, you'd be under-insured if you did that.

Reality--we've made 2 insurance claims ever. One was a visit to the ship's doctor and one was a weather event when the ship was delayed by 24 hours. We've spent more than that on insurance over the years. BUT my medical insurance will not cover us outside the US. We've been fortunate in not having anything major come up, but I'm in my 60s and my daughter has a progressive disability. I'm not going without medical coverage.

RCI Cruisers 004

We use insuremytrip.com , and pick the coverage that works for us. It's about half the price of what the cruise lines offer.

Flatbush Flyer

We always use insuremytrip to get coverage. You'll often find plans with more coverage, for a lower price that way. Most travel insurance sold through cruise lines (any cruise line) is overpriced, and very limited in what they cover.

Insuremytrip is a brokerage and a good resource to help identify which insurance company's offerings will work best for you. However, do know that insuremytrip's version of a particular policy may not include all the options/allowances that you will get by paying the same price for the same named policy directly with the particular insurer (via web or phone).

Insuremytrip is a brokerage and a good resource to help identify which insurance company's offerings will work best for you. However, do know that insuremytrip's version of a particular policy may not include all the options/allowances that you will get by paying the same price for the same named policy directly with the particular insurer (via web or phone). Sent from my iPhone using Forums

Excellent point. But it does make a good place to start. Another suggestion--your TA may sell a particular insurance company. It is worth asking about. I've found that the prices are identical for the policy I choose, whether thru the company, insuremytrip, or my TA.

Steelers0854

I found a good policy from Nationwide that covers cruise specific items such as changes in itineraries, etc. it also has high coverage limits for evacuation costs, some policies only go to $25,000 which if you have to be airlifted and then flown home probably won't cover it all. It's best to look at each individual coverage and make sure it meets what you feel you may need.

ETA: it's also important your understand if your insurance is primary or secondary. Equally as important is that you have the means to pay for treatment up front. Some foreign hospitals will require some, if not all, the costs to be paid for before treatment. Always a good idea to travel with a credit card that you can put these costs on until the insurance reimburses you for them.

Another thing to think about--you may have some "hidden" travel insurance. For instance, we have a credit card that includes travel insurance if we purchase the trip with the card. However, it isn't very good coverage and the claim must be filed within 14 days of the incident (in some cases, you could still be traveling then!)

That said, it is worth to remember that it might be there for you if needed or if the coverage you purchase has a deductible.

Another thing to think about--you may have some "hidden" travel insurance. For instance' date=' we have a credit card that includes travel insurance if we purchase the trip with the card. However, it isn't very good coverage and the claim must be filed within 14 days of the incident (in some cases, you could still be traveling then!) That said, it is worth to remember that it might be there for you if needed or if the coverage you purchase has a deductible.[/quote'] United Airlines' Explorer Visa (and other similar Chase cards) actually have some (not all) decent travel benefits that, at least augment any other insurance you may have. However, and while these credit cards don't offer supplemental health coverage, they still do not provide waivers for travel related claims resulting from preexisting medical conditions. Sent from my iPhone using Forums

United Airlines' Explorer Visa (and other similar Chase cards) actually have some (not all) decent travel benefits that, at least augment any other insurance you may have. However, and while these credit cards don't offer supplemental health coverage, they still do not provide waivers for travel related claims resulting from preexisting medical conditions. Sent from my iPhone using Forums

The details you provided were exactly my point that I consider this an augmentation to any other insurance I purchase, but not a replacement. Still, it doesn't hurt to know that it is there. I probably could have used it when our cruise was delayed by 24 hours, but by the time I looked at the details, I was beyond the 14 day filing deadline (7 days of it was during the cruise, and I certainly wasn't thinking insurance at that time).

firegal2539

TravelGuard is my go to because it covers out of the country and my flights. I broke my hip and needed surgery, 5 cruises were cancelled, two of which were paid and the other three with a$100 balance. It covered all 5.

Sent from my iPhone using Tapatalk

TravelGuard is my go to because it covers out of the country and my flights. I broke my hip and needed surgery, 5 cruises were cancelled, two of which were paid and the other three with a$100 balance. It covered all 5. Sent from my iPhone using Tapatalk

Agree. We book travelguard for every trip and when my DH and I book the 9 yr old is free.

CruizinTigers

I concur with everything already mentioned here. Insurance through DCL is highly over priced. However, one positive plug I would make is based on one experience when we had to cancel a cruise last minute due to Hurricane Sandy. Because we had the insurance through DCL for that one, DCL offered us the full cost of the trip to put towards a future cruise. Now I'm not sure if they still do this, or if it's even worth the much greater cost. Instead, we insure all of our trips now a days with TravelGuard.

One last note... if you have a membership with Costco, you might want to check their travel offerings. We booked our current DCL cruise with them, and they offer a link to purchase a TravelGuard policy at a reduced rate (and better coverage). Perhaps BJs or Same Club offer something similar as well. TravelGuard is already a good value, but if you can get it discounted via Costco or another wholesale chain...

But Costco's trio insurance doesn't cover the flight so if you are flying in for the cruise go with travel guard.

But Costco's trio insurance doesn't cover the flight so if you are flying in for the cruise go with travel guard. Sent from my iPhone using Forums

Again, this depends on your motivation in purchasing the insurance. If your airline will allow you to reschedule your flight for a small fee or no fee, you may opt to not insure the air travel. On the other hand, the cost difference may be minimal to add coverage for the air if you are using private insurance. You need to look at the options for each trip individually.

Obviously, the insurance company would like you to pay for coverage from the minute you leave your home until you return...but that may not be necessary. You will only benefit from insuring those items that cannot be refunded if canceled or altered. Example--if you insure a hotel room that will be refunded when you call them before 6pm and you experience a flight delay so that you know at 4pm you can't get to the hotel, the insurance will likely not cover that hotel stay--you are expected to minimize the loss by making that phone call.

- 2 weeks later...

luvincruising

Quotewright and Squaremouth are two other sites to use for comparing policies. Squaremouth has better search filters [than Insuremytrip] to find the policy that fits your needs. IMHO.

Wheeling TravelingMom

We have used insuremytrip.com to buy the highest level Nationwide Cruise Plan for our last couple of cruises. We also have an annual MedJet membership. Our primary heath insurance will cover us abroad in many places but our secondary will not. My son has significant special needs and I feel we are well covered with these arrangements. As an additional bonus I do book our travel through a credit card that offers insurance. Every family situation is different and a broker like insuremytrip can help you figure out what works best for you.

- 1 month later...

Do you recommend purchasing insurance when the booking is made many months before PIF date (ie: opening day)? Since the cruise is fully refundable prior to that, the policy would effectively insure nothing if cancelled before then, right?

Do you recommend purchasing insurance when the booking is made many months before PIF date (ie: opening day)? Since the cruise is fully refundable prior to that, the policy would effectively insure nothing if cancelled before then, right? LAX

True, but there are sometimes added benefits to purchasing insurance when you book the cruise (if you insure privately.) Some will give coverage for pre-existing conditions IF you purchase coverage within 14 or 21 days of the booking. Most insurance policies will allow you to move the policy once; more than that and you lose the cost of the insurance. If you've read this thread, you know about private vs thru DCL.

Again' date=' this depends on your motivation in purchasing the insurance. If your airline will allow you to reschedule your flight for a small fee or no fee, you may opt to not insure the air travel. On the other hand, the cost difference may be minimal to add coverage for the air if you are using private insurance. You need to look at the options for each trip individually. Obviously, the insurance company would like you to pay for coverage from the minute you leave your home until you return...but that may not be necessary. [b']You will only benefit from insuring those items that cannot be refunded if canceled or altered. Example--if you insure a hotel room that will be refunded when you call them before 6pm and you experience a flight delay so that you know at 4pm you can't get to the hotel, the insurance will likely not cover that hotel stay--you are expected to minimize the loss by making that phone call[/b].

One more point about insuring hotel costs: do so ONLY if the hotel is prepaid and non-refundable. If you make a cancellable hotel reservation with no prepayment, but miss the cancellation deadline to avoid paying a penalty - your trip insurance probably won't cover that charge because it wasn't prepaid.

The Trip Insurance Store ( www.tripinsurancestore.com ) is my insurance broker of choice.

Has anyone ever found insurance that would cover prepaid excursions? For example, we will be booking on our own for our family and pre paying in two ports. If for some reason, we didn't dock or the weather caused a cancellation, would that be covered by trip insurance?

It has been my experience that a reputable excursion operator will not bill or refund your payment if the ship cannot dock/tender or if they cannot offer the excursion due to weather.

For instance, I booked a couple of times thru Captain Marvin's in Grand Cayman. Their policy is that you must give them a credit card to reserve your booking but they do not bill the card until the excursion actually takes place. We had two occasions when we couldn't tender due to rough seas--no charge ever appeared on my card.

To answer your question, I'm not aware of any trip insurance that covers canceled excursions as the tour operators usually refund your pre-payment in that circumstance.

Yes. Check the Nationwide Cruise policies. We get the luxury policy as it has higher limits and isn't much more. I actually did a review on a claim we filed just a few months back.

http://boards.cruisecritic.com/showthread.php?t=2459043

I would think most trip insurance policies would cover a prepaid excursion if it is non-refundable - as long as you buy enough insurance coverage to include the excursion costs. As moki'smommy said - an excursion provider will generally refund your payment if your ship can't get to the port. However, if you can't go on the excursion because you are sick, you probably won't get a refund from the vendor.

Please sign in to comment

You will be able to leave a comment after signing in

- Welcome to Cruise Critic

- Hurricane Zone 2024

- Cruise Insurance Q&A w/ Steve Dasseos of Tripinsurancestore.com Summer 2024

- New Cruisers

- Cruise Lines “A – O”

- Cruise Lines “P – Z”

- River Cruising

- Cruise Critic News & Features

- Digital Photography & Cruise Technology

- Special Interest Cruising

- Cruise Discussion Topics

- UK Cruising

- Australia & New Zealand Cruisers

- Canadian Cruisers

- North American Homeports

- Ports of Call

- Cruise Conversations

Announcements

- New to Cruise Critic? Join our Community!

- How To: Follow Topics & Forums (Get Notifications)

Write An Amazing Review !

Click this photo by member XFrancophileX to share your review w/ photos too!

Parliament, Budapest

Features & News

LauraS · Started 9 hours ago

LauraS · Started 14 hours ago

LauraS · Started 15 hours ago

LauraS · Started Friday at 09:08 PM

LauraS · Started Thursday at 10:09 PM

Cruise Planning

Find a cruise, popular ports, member reviews.

© 1995— 2024 , The Independent Traveler, Inc.

- Existing user? Sign in OR Create an Account

- Find Your Roll Call

- Meet & Mingle

- Community Help Center

- All Activity

- Member Photo Albums

- Meet & Mingle Photos

- Favorite Cruise Memories

- Cruise Food Photos

- Cruise Ship Photos

- Ports of Call Photos

- Towel Animal Photos

- Amazing, Funny & Totally Awesome Cruise Photos

- Write a Review

- Live Cruise Reports

- Member Cruise Reviews

- Create New...

Cruise travel insurance: What it covers and why you need it

What does cruise travel insurance cover? And does it pay to buy cruise travel insurance?