Physician Jobs

Advanced practice jobs, locum tenens, staffing solutions, about weatherby, let's talk..

We appreciate you contacting us. A consultant will be reaching out to you shortly to discuss this job opportunity. You can also get in touch with us directly by calling 954.618.5296 .

How do locum tenens taxes work?

Taxes for locum tenens providers work differently depending on whether you’re a physician or an advanced practitioner. The business entity you’ve set up (if any) can also affect your tax responsibilities.

This introductory tax guide for locum tenens providers will prepare you for a productive conversation with a tax expert. If you’re a nurse practitioner or physician’s assistant looking for more information on locum tenens taxes, you can jump to our advanced practice section lower on the page.

Taxes for locum tenens physicians

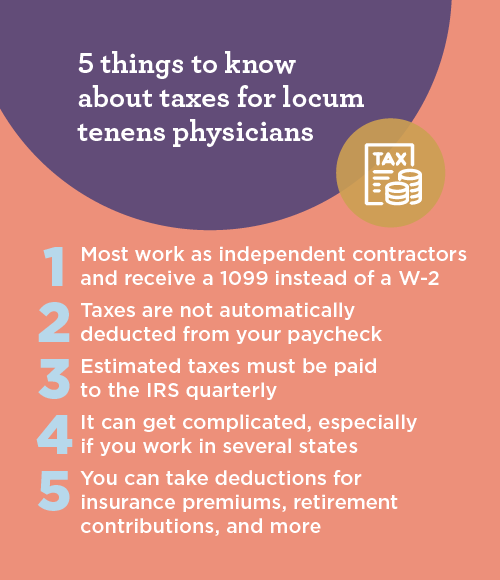

Locum tenens physicians are independent contractors, which means they’re responsible for paying their own taxes. Unlike W-2 employees who have taxes withheld from each paycheck by their employer, 1099 contract employees must put aside a portion of their earnings to pay their taxes.

Estimated quarterly tax payments

As you work and earn throughout the year, the IRS wants you to make regular income tax payments, usually due on the 15th of April, June, September, and January. While these tax bills can cause some sticker shock, keep in mind that locums assignments generally pay doctors more than permanent roles.

Self-employment taxes and state taxes

Independent contractors must also pay self-employment taxes, which cover your share of Medicare and Social Security. The current self-employment tax rate from the IRS is set at 15.3% of your net income.

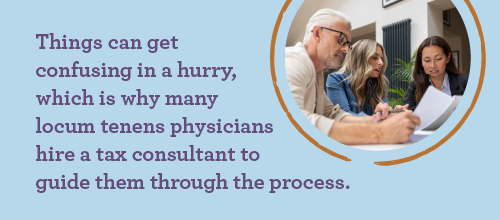

You’ll also need to pay state taxes in your home state, plus any states where you worked throughout the year. Each state has its own tax laws, so locums physicians who work in multiple locations should consult with an expert to make sure you fully understand your tax obligations.

Tax deductions for locum tenens physicians

As independent contractors, locum tenens physicians can deduct a variety of qualified work-related expenses. Be sure to keep detailed receipts for any deductions you plan to claim. Common tax deductions for locum tenens physicians include:

Retirement contributions

Health and dental insurance premiums

Health Savings Account (HSA) contributions

Home office expenses

Conference fees or continuing education courses

Work materials like scrubs, stethoscopes, and other supplies

Electronics like smartphones, tablets, or computers

Meals and other incidentals (for assignments under 1 year)

Other unreimbursed expenses like phone bills, vehicle mileage, parking, and tolls

Be diligent about collecting and organizing receipts for anything you plan to deduct from your taxes — the IRS will not accept credit card or bank statements. Your records should go back at least 3 years, though 7 years is even better.

Additional tax strategies for locums physicians

Aside from tax deductions for business expenses, locums physicians can also use other methods to lower their tax bill:

Income shifting: Certain business structures may allow you to “hire” your spouse or child to help with saving for retirement or for future education expenses.

Medical reimbursement plans (MERPs): These can make your business eligible to cover out-of-pocket medical expenses or insurance premiums.

Primary care preceptor initiatives: To help address the shortage of physicians, these incentivize current physicians to help train new PCPs.

Rural care tax credits: Rural areas often have severely limited access to care, and these encourage physicians to work where they’re needed most.

Whether you work locums full time or as an additional income stream, consult with a tax strategist or CPA to ensure you’re making the most of your status as an independent contractor. These documents can also be useful resources for preparing to meet with a tax professional.

California Withholding Discussion Physician Travel Tax Issues Contracting with Physician's Professional Corporation

Locum tenens taxes for advanced practice providers

Advanced practitioners working locum tenens with Weatherby Healthcare are W-2 employees, so taxes are automatically deducted from your paycheck like with most other jobs. However, you’ll still need to file state taxes in each state where you work an assignment.

While W-2 employees can’t claim all the same deductions as independent contractors, advanced practitioners working locums may still qualify for some tax advantages. These documents can help you determine your eligibility for tax breaks on travel expenses and learn more about your tax obligations in different states. They’re provided for informational purposes only — meeting with a tax expert is the surest way to get a solid grasp on your tax situation.

Tax resources:

Travel Tax Rules Tax Home Representation Form Commuting or Away from Home One-Year Limitation Break in Assignment State Tax FAQ

Choose a locums agency that puts providers first

Whether you’re interested in a full-time locums career or simply looking to supplement your income, a trusted staffing agency can be a valuable asset in accomplishing your goals.

When you work locums with Weatherby , you’ll connect with a personal consultant who learns all about your personal preferences and professional goals. They’ll deliver hand-picked assignments that match how, where, and when you like to work, and help you achieve a more fulfilling, flexible, and lucrative career.

Learn more about the benefits of working locum tenens , or explore our other helpful resources for healthcare providers .

Visit the blog.

How doctors use locums to work less and make more money, webinar recap: finances of locum tenens, the financial side of locums: what’s your strategy.

- 866.346.6758

- Medical Credentialing

- Locum Tenens Physicians

- Advanced Practice Providers

- Locum Tenens Specialties

- Healthcare Facilities and Practices

- MPLT Careers

Home » Resources » Know the Facts: Tax Deductions for Locum Tenens Providers

Know the Facts: Tax Deductions for Locum Tenens Providers

Does filing your taxes feel overwhelming? If you’re new to locum tenens work, you may not be aware of some of the many tax deductions that can be applied to expenses related to your assignments. It’s helpful to understand the deductions available so you document your expenses accordingly and file your taxes correctly. As you plan for next tax season or take advantage of the deadline extension for this year, here’s a quick breakdown of deductions that you should know about:

Health insurance and healthcare expenses .

If you're doing locum tenens work as an independent contractor who is not covered under an employer-sponsored health plan (and do not have access to a plan from an employer or spouse), your health insurance premiums are considered 100 percent tax-deductible. Additionally, health savings accounts (HSAs) are another useful tax-savings vehicle, as contributions to these types of accounts are taken out of your income as “pre-tax," making them tax-deductible.

Travel, lodging and meals .

As a locum tenens provider, travel and food make up a major part of your tax-deductible expenses. Unreimbursed travel, lodging and 50% of meal costs during a locum tenens assignment can be used as tax write-offs – as long as assignments are less than a year in duration . Throughout the course of each locum tenens job, it’s best to keep track of all your expenses by saving all your receipts or charging all eligible expenses on one credit card. As an alternative, you can opt to use per diem rates, which are lump-sum amounts designated to cover eligible expenses for an entire day. Using this method is an easy way to calculate meals and other related expenses during your assignment without having to keep tabs of every receipt.

Automobile expenses .

In addition to travel-related expenses related to flights, expenses incurred from driving your automobile between home and your locum tenens site are also tax-deductible. Eligible automobile expenses include gas, insurance, repairs, parking fees and lease payments (if applicable). You can calculate automobile expenses by using the IRS's standard mileage rate for each "business mile" driven, which also applies to tolls and parking costs. Another way to calculate this expense is to multiply the number of miles driven by your automobile for business purposes by the actual costs incurred throughout the year.

As you navigate your locum tenens career, being informed about the above tax deductions will make the tax filing process much easier and help ensure you keep track of all tax-deductible expenses during your assignments.

Are you ready to discover new locum tenens jobs ?

Get started with MPLT Healthcare and let our team help you find the locum assignments you want most!

- Advanced Practice

- Locum Tenens 1099

- Locum Tenens Tax Deductions

- Tax Advice for Locum Tenens

Other Articles

Avoiding Burnout as a Locum Tenens Advanced Practitioner

The Impact of Locum Tenens Roles on Patient Care

How to Achieve a Better Work-Life Balance With Locum Tenens

10 Essential Tax Planning Tips for Locum Tenens Providers

Share this post

Good tax planning is crucial for locum tenens providers. but as anyone who has ever juggled multiple 1099 forms can tell you: it can be complicated..

From understanding tax obligations to maximizing deductions and managing 1099 tax preparation, we’ve compiled tips and strategies to help locum tenens providers understand compliance with tax laws, navigate the complexities of tax season and maximize their financial well-being.

Check out our ten essential tips for locum tenens providers this tax season:

1. Be Proactive!

We get it––no one likes thinking about taxes. But being proactive about tax management can be the difference between owing thousands of dollars on your taxes at the end of the year, or optimizing your financial outcome. That’s why it’s so important to be proactive and start planning early when it comes to filing your taxes.

2. Hire a Professional

A qualified accountant––especially one that has experience working with locum tenens providers––can help you navigate the complexities of your taxes, and get the best deduction possible. We recommend looking for an accountant that specializes in healthcare, to ensure compliance and maximize your tax savings. Not sure where to look? Try asking one of your fellow locum providers for their recommendation!

3. Get an Understanding of your Tax Obligations

As 1099 employees, locum tenens providers are responsible for understanding Medicare and Social Security taxes. Unlike W2 employees, who have those amounts taken directly out of their paycheck by their employer, locums providers have to account for these funds themselves. As a locums provider, you may also be subject to other tax obligations, like self-employment taxes, or estimated tax payments (more on that below!). A qualified accountant can help you understand and navigate these various obligations.

4. Set up Estimated Tax Payments

If you owe $1,000 or more in taxes, and/or if locums work is your primary source of income, you will likely also be required to pay quarterly taxes: estimated tax payments that independent contractors must pay every four months. You must make your quarterly estimated tax payments by the due date, which is generally on the 15th of April, June, September, and January––otherwise, you’ll be on the hook for a penalty, which is usually 0.5% of the amount unpaid for each month the tax isn’t paid.

5. Maximize Your Deductions

It’s not all about the taxes you owe: as a locums provider, you are eligible to deduct any work-related expenses from your taxes, including but not limited to:

- Any travel expenses that haven’t already been reimbursed;

- Licensing fees and board exam fees;

- Cell phone bills;

- Health insurance payments;

- Unreimbursed mileage

6. Keep Accurate Records

Because there are so many things to keep track of, it’s especially important for locum providers to maintain detailed records of income, expenses, and deductions throughout the year. This will help you to facilitate tax preparation and avoid errors that will cost you. Be sure to scan and save any work-related receipts––you can do this easily through a receipt scanning app––and keep a spreadsheet to track income and expenses.

7. Plan for Retirement

As independent contractors, locum providers can’t rely on an employer’s retirement benefits or matching program. That means it’s up to you to make sure you’re saving for retirement. The good news is that contributing to retirement accounts such as IRAs and Solo 401(K) plans can offer you significant tax advantages! Your accountant can help you figure out how to maximize your savings and use what you save to lower your tax burden.

8. Invest in a Health Savings Account (HSA)

Similarly, investing in a Health Savings Account (HSA) is a great call for locum tenens providers, as it offers a way of paying for qualified medical expenses through tax-free withdrawals. Like your retirement account, it can also potentially lower your tax burden by offering deductions for contributions towards your HSA.

9. Consider your Tax Withholding Implications

To minimize your tax burden as an independent contractor, it’s important to be intentional when choosing your tax withholding allowances. Your withholding allowances will depend on your specific situation (whether you have dependents, file jointly with your spouse, etc). Your accountant can help you find the best balance for you, and you can adjust your withholding allowances on Form W-4.

10. Stay Informed

The tax code is always changing, so it’s important to stay up to date on the changes to tax laws and regulations that can have an impact on your tax planning strategies. That’s also why it’s helpful to hire an accountant that has experience working with people in the healthcare field, and locum tenens providers in particular. They can help keep you up to speed on any changes that are relevant to your situation.

QUESTIONS ABOUT HOW WE CAN SUPPORT YOUR TEAM?

Related posts.

5 Common Questions About the IMLC

Top 5 Questions to Ask About your Locum Tenens Malpractice Coverage

National Locum Tenens Week: Recognizing the Heroes Who Bridge Healthcare Gaps

Navigating Tax Season as a Traveling Provider

Tax season starts in late January and runs through Tax Day on April 15. Whether you’re a W-2 employee or 1099 independent contractor, it is best not to wait until the last minute to file your return. Be prepared before the deadline with these locum tenens tax strategies.

As a reminder, this article is not intended to give tax advice. We recommend that you work with a tax professional if you are unsure about filing taxes as a traveling medical professional. Federal and state requirements are subject to change, and the information presented may not apply to your situation.

How are my taxes different?

Some traveling nurses and locum tenens may be able to work as W-2 employees, which means the company or recruitment firm will pay taxes on your behalf. There will likely be no change to how you do your taxes because the hard part is done through your agency – they deduct federal and state taxes each pay period and send you a tax form annually that you use to file your return.

However, in many cases, traveling medical providers are considered self-employed 1099 independent contractors. Taxes are not taken out on your income, so you must pay your own federal and state taxes. As a contractor, you will need to pay the federal self-employment tax. Your adjusted gross income (AGI) will determine your tax bracket and how much you have to pay.

State taxes for contractors

As a 1099 contractor, you must file non-resident tax returns for every state you worked in the prior year. Each state has different tax rates, so the amounts you pay will vary. You will also need to pay taxes on your home state as a resident.

Nine states do not require income taxes: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming. Many traveling medical professionals choose to go to these states so they will not have to file state returns on income.

Travel nursing and locum tenens tax strategies

Most travel jobs allow you a stipend or per diem for travel, housing and meals to cover your living costs while working in a different location. If you maintain a permanent residence, you can be reimbursed for those expenses by your agency, and the money is not considered taxable income.

However, to qualify for tax-free per diems, you must be able to show the IRS that you have a permanent residence or tax home. Essentially, you want to show that you are duplicating living costs by working in a different location.

You can show you have a tax home by meeting two of the following requirements:

- Have regular employment in the location of your tax home

- Spend at least 30 days (consecutive or nonconsecutive) days at your tax home

- Are financially responsible for the home when you are away

You can confirm state residency by keeping your state-issued driver’s license and voter registration while traveling to other hospitals and medical facilities.

Per diems may be included in your hourly pay or compensation package. Talk to your healthcare recruiter to learn how yours will be applied.

You may also qualify for reimbursements on business-related expenses beyond the travel and meal stipends. Talk with your placement agency to see if these items are eligible:

- Continuing education courses

- Certification expenses

- Professional association dues

- Malpractice insurance

Record-keeping

You need copies of your records to file your return. Keep track of income and expenses from your assignments, including employment contracts, travel mileage records, housing payments, credit card statements and receipts.

At tax time, you can reconcile your expenses and deductions. Some people use software like QuickBooks to scan their receipts and enter information so everything is in one place and can be accessed easily. Diligent record keeping can protect you in case of an IRS audit.

Find a professional

Doing your taxes as a traveling medical provider can be daunting. You can hire a professional tax preparer to help you with your locum tenens tax strategies. A professional will ensure your returns are complete and correct and that you have received all your qualifying write-offs.

If you plan to work as a travel nurse or locum tenens next year, you can pay quarterly taxes based on your estimated income. That can help you avoid the hefty tax bill in April. A tax preparer can help you determine your estimated taxes and show you how to make payments.

Look for a tax professional with experience with traveling medical providers, so they have experience working with complex returns that require filing in multiple states.

Want to be a traveling medical professional?

TinkBird is a comprehensive healthcare recruiting and job placement firm that can help you find placement as a traveling nurse or locum tenens. We provide support during the offer negotiation process to ensure you receive competitive pay and stipends to help you with travel and housing costs. Contact us to find your ideal travel provider position!

- Search Jobs

- Recruit Providers

919.326.4112 [email protected]

Start typing and press Enter to search

Top 15 Tax Deductions for Locum Doctors

- Updated April 4, 2024

- Posted in Blog / Taxes

As the founder of Locum Physicians United and a seasoned locum tenens physician, I’ve navigated the complex waters of tax deductions and strategies particularly beneficial for locum doctors. My journey, fueled by my passion for entrepreneurship and a desire to empower my fellow physicians, has revealed many tax-saving opportunities that are often overlooked. Here, I’ll share the top 15 tax deductions locum doctors must leverage to optimize their financial health.

1. Professional Fees and Dues

Membership fees for medical associations and licensing fees are essential for our profession. Thankfully, these are fully deductible. Leveraging these deductions helps keep professional costs manageable.

2. Continuing Medical Education (CME)

The medical field is ever-evolving, and staying abreast of the latest advancements is crucial. Expenses related to CME, including travel, can be deducted, making your pursuit of knowledge more affordable.

3. Travel Expenses

Locum tenens work takes us across the country. Fortunately, travel expenses, including airfare, mileage, lodging, and meals, are deductible. However, it’s essential to differentiate between what’s considered a work-related expense and what might be considered leisure to ensure compliance with IRS guidelines. There are ways to make every trip a business trip; join my LocumGuru telegram group for details. Click here.

4. Malpractice Insurance

Given our profession’s liabilities, malpractice insurance is non-negotiable. Make sure your locum company is paying for your malpractice. But if you run your practice, the premiums you pay for malpractice insurance are fully deductible, easing the financial burden of this necessary protection.

5. Home Office Deduction

Many of us manage the administrative aspects of our locum work from home. Suppose you use a portion of your home exclusively for business. In that case, you may qualify for the home office deduction, including a portion of your rent or mortgage, utilities, and internet service.

6. Health Insurance Premiums

Self-employed individuals can deduct 100% of their health insurance premiums, including dental and long-term care insurance, for themselves, their spouses, and dependents.

7. Retirement Contributions

Contributions to SEP-IRA, Solo 401(k), or a similar self-employed retirement plan secure your financial future and offer significant tax deductions.

8. Equipment and Supplies

Purchasing medical equipment, electronics, and office supplies necessary for your locum assignments and administrative tasks can quickly add up. These expenses are deductible, helping to offset the costs of essential tools.

9. Internet and Phone Expenses

In today’s digital age, staying connected is non-negotiable. A portion of your internet and phone expenses can be deducted, provided they are used for business purposes.

10. Marketing and Advertising

Marketing expenses are fully deductible if you’re launching a side hustle and promoting your services through digital platforms or traditional mediums. This deduction supports your efforts to grow your business.

11. Contract Labor

Hiring a virtual assistant or other contractors to manage administrative tasks can enhance efficiency. These expenses are deductible, allowing you to invest in support without bearing the total financial weight.

12. Professional Liability Insurance

Aside from malpractice insurance, other professional liability insurances that protect your business interests are deductible, offering another layer of financial prudence.

13. Business Meals

Networking over meals or discussing contracts with potential employers can contribute significantly to your success. The IRS allows you to deduct 50% of your business meal expenses, making these meetings more palatable financially.

14. Vehicle Use

Using your vehicle for business, like traveling to different hospitals, allows you to deduct either the standard mileage rate or actual expenses. Keeping detailed records is critical to maximizing this deduction.

15. Section 179 Deduction

One of the most impactful yet underutilized deductions is Section 179. This part of the tax code permits locum tenens physicians to deduct a significant portion of equipment or software purchased or financed during the tax year. Instead of depreciating these purchases over several years, Section 179 allows you to write off a significant portion of the year it was purchased. This deduction can significantly lower your taxable income, providing substantial tax relief. However, consulting with a tax professional is essential to navigate the specifics and ensure eligibility.

Navigating the tax landscape as a locum tenens physician doesn’t have to be daunting. By leveraging these top 15 tax deductions, you can substantially reduce your taxable income, ultimately leading to more significant savings and a more robust financial foundation. As you work to improve lives through your locum work, pay attention to the importance of managing your financial health with as much care and diligence as possible.

Remember, while this guide provides a solid foundation, the complexities of tax law and individual circumstances mean it’s always wise to consult a tax professional. They can provide tailored advice and strategies to maximize your deductions, ensuring you’re compliant and optimizing your financial health.

About The Author

See author's posts

Share my adventures Share this content

- Opens in a new window X

- Opens in a new window Facebook

- Opens in a new window Pinterest

- Opens in a new window LinkedIn

- Opens in a new window Viber

- Opens in a new window VK

- Opens in a new window Reddit

- Opens in a new window Tumblr

- Opens in a new window Viadeo

- Opens in a new window WhatsApp

You Might Also Like

What Are the Challenges of a Locum Venture?

Financial Planning for Locum Tenens Physicians

15 Packing Essentials for Your Locum Exploration

Leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

To respond on your own website, enter the URL of your response which should contain a link to this post's permalink URL. Your response will then appear (possibly after moderation) on this page. Want to update or remove your response? Update or delete your post and re-enter your post's URL again. ( Learn More )

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Locum Tenens Guy

Make the most of your locum tenens work!

Do locum tenens doctors pay less in taxes?

Let’s find out!

Now you can estimate your 2020 taxes online. This calculator gives an estimate of self-employment/FICA, federal tax and includes locum tenens tax deductions.

Just enter the numbers below to figure out how much you owe Uncle Sam.

To estimate any state’s income tax, check out this site .

Also, check out my detailed locum tenens tax deductions post .

© 2017-2022 LOCUMTENENSGUY LLC ALL RIGHTS RESERVED

400 Nw Gilman Blvd #811 Issaquah, WA, 98006

Privacy Policy and Terms of Use

Please follow & like :)

SEARCH BY REGION

Specialties, comphealth blog, locum tenens physician taxes: a beginner’s guide.

Locum tenens is an exciting career alternative for physicians , giving you the freedom to choose where you work and set your own schedule. However, it also means the process for filing and paying taxes will be different. Don’t worry! As long as you're aware of the differences and plan for them, it shouldn’t be a big deal. The road to mastering locum tenens physician taxes starts here.

Locum tenens physicians work as independent contractors. What does that mean?

Most locum tenens physicians work as an independent contractor . That means you’ll most likely receive a 1099 form to report your income, as opposed to the more common W-2. This might sound daunting, but really, it isn’t.

Jerry Callahan, a director at Pearce, Bevill, Leesburg, and Moore , a tax firm that specializes in physician taxes, points out two important things to keep in mind if this is your first time filing with a 1099.

First, a 1099 independent contractor is responsible for paying both portions of the Medicare and Social Security taxes. This is something that W-2 employees don’t have to think about because the payment is taken out of their paychecks automatically by their employer. In addition — and this is the second key difference, says Callahan — 1099 independent contractors are typically required to pay quarterly taxes. This means paying an estimated tax payment four times a year.

You may wonder why independent contractors have to pay in spring, summer, fall, and winter when everyone else seems to be paying only once. The answer is actually quite simple: If you were a W-2 employee, your employer would be subtracting an appropriate amount from each of your paychecks and making those payments for you. You’re just taking over that responsibility.

Dollars and cents: How does locum tenens pay and salary work for physicians?

Make a budget to pay your locum tenens physician taxes

The moral of the story here is that locum tenens physicians need to be a little more proactive with their budgeting — calculating what they’ll likely owe and putting it somewhere safe until taxes are due. Callahan suggests opening a second bank account and regularly setting aside an appropriate amount. Avoid putting these funds into potentially volatile or even long-term investment vehicles such as stocks or even ETFs .

Your quarterly taxes as a locum tenens physician are only estimates. The dollar amount doesn’t have to be exact. Just take the percentage of your income that you paid in taxes last year, plus the amount paid to Social Security and Medicare, and divide by four. The answer is your quarterly payment. If your income is significantly more or less this year than last, you may want to confirm that you haven’t slipped into an adjacent tax bracket, in which case you’d need to adjust your calculations accordingly.

Of course, mixed in with these numbers is the possibility of tax credits, deductions, and refunds — not to mention paying income tax in the various states you might have worked (in some cases, a city or municipality might have additional tax requirements to consider).

This extra expense will often save you money in the end and prevent you from making any mistakes. Callahan recommends choosing a licensed CPA who has worked with locum tenens physicians' taxes before and is familiar with the industry.

Dr. Marye McCroskey, a family medicine physician, agrees. She works with a professional to handle her taxes while working locum tenens. “I’d highly recommend getting an experienced accountant,” she says. “At the moment, I’ve got income from several different contracts, and it’s easier to have someone who specializes in physician taxes.”

Does a locum tenens physician need to start his or her own business entity?

Locum tenens physicians often wonder if they need to set up an S-corp or LLC to make sure that they’re not paying too much in taxes. They may have heard from a friend or relative that the legal arrangement will somehow lower their taxes. According to Callahan, this usually isn’t the case. Whether you set up a business entity or not, your taxes will be essentially the same.

What an S-corp can do is insulate your medical career from other income-generating activities you might be involved in, and vice-versa. Think real estate , for example, or some other investment. Callahan recommends talking to a professional to find out if the extra hassle makes it worth it or not. Generally speaking, the benefits become more tangible the more valuable the other investment or activity is.

Dr. Jim Mock, emergency medicine physician, uses an S corp to take care of his income from locum tenens. By paying himself a monthly base salary and doing a shareholder distribution, if he exceeds his salary, he’s able to take advantage of some tax benefits.

Make sure you’re covered: How to get health insurance as a locums physician

Take advantage of tax deductions for locum tenens physicians

Locum tenens physicians have several expenses they can deduct from their taxes, beginning with the cost of their premiums for health and dental insurance. Other common expenses to deduct include cellphones, computers, iPads, lab coats — anything you use or wear at work that you pay for out of your own pocket.

As Callahan points out, the IRS used to categorize these items as “mixed use,” meaning the taxpayer had to estimate how much of the item’s expense was for work and how much was for personal activity. “They finally gave that argument up a long time ago,” he says, “because the fact is either you have a phone or you don’t, so there’s no way to really estimate that.”

Just keep track of your receipts. The IRS doesn’t accept credit card statements as proof of purchase. In fact, Callahan even suggests jotting down a note or two on the back of the receipt to bolster the documentation even more. For example, say you have a meal expense that you want to deduct. On the back of the receipt, you might write the name of the person or people who attended and even a sentence or two on what was discussed.

Locum tenens physicians should also consider deducting contributions they make towards retirement — Roth IRA, IRA, and 401(k) , for example.

In fact, you’ll likely have more freedom arranging and managing these accounts on your own, as a self-employed individual, than you would if you were working for a large company as a W-2.

Ready to conquer your locum tenens physician taxes?

Okay, maybe “conquer” is too strong of a word here. But at least you have a sense of what the primary concerns are when it comes to planning for and paying your taxes as a locum tenens physician.

No matter who you are, taxes can be overwhelming and stressful. With a little more research and consultation with a qualified tax consultant, you’ll be able to handle your locum tenens physician taxes while reaping all the advantages that this exciting career path has to offer.

Want to work for yourself? Learn why one physician thinks locums is a great low-overhead solution to self-employment

This article was updated on 1/17/2024 .

The information contained herein is general in nature and is subject to change. Tax information contained in this document is not intended to be used and cannot be used by any person as a basis for avoiding tax penalties that may be imposed by the IRS or any state. We recommend each taxpayer seek advice based on their circumstances from an independent tax advisor.

Dave Nielsen

Dave Nielsen lives in Salt Lake City. He writes about healthcare, technology, and business.

See all articles from this author

Working Locum Tenens

Finding Permanent Jobs

Physician Careers

Advanced Practice

Allied Healthcare

Residents & Fellows

Credentialing & Licensing

Medical Staffing Resources

Work with a recruiter

Tell us how to reach you and who you need..

Complete the form and we will help you get started.

Our Melbourne Office has moved! We look forward to seeing you soon at 412 St Kilda Road.

Call 1800 376 376

- Medical Students

Recent Posts

[UPDATED] 24 best medical podcasts for medical students in 2024

Kick start 2023 with these saving goals for medical students

For interns.

- Tax & Accounting

- Personal Insurance

- Private Wealth

- Property Advocacy

- Legal Services

Taking a Career Break? What to Consider to Plan Financially

For residents.

Time in the Market vs Timing the Market: The Power of Long-Term Investing

For registrars.

- Private Practice

For Consultants

For Private Practices

Services Trusts for Visiting Medical Officers and Anaesthetists

Discover your roadmap.

What’s changing with Vacant Residential Land Tax

Vacant Residential Land Tax What Medical Professionals with Holiday Homes Need to Know Recently the Victorian Government announced the expansion of Vacant Residential Land Tax (VRLT) to apply across Victoria,

Services Trusts for Visiting Medical Officers and Anaesthetists In the intricate web of Australia’s healthcare system, doctors stand as pivotal figures, orchestrating critical interventions and specialised care. However, beyond their

Podcast | Updates to payroll tax you need to know

Since early 2023 there have been many updates regarding payroll tax rulings as well as the introduction of amnesties and other measures that aim to clarify payroll issues in the

- Career Stage * Career Stage Medical Student Doctor in Training Consultant Private Practice

Start your journey with DPM today.

Melbourne office.

16/412 St Kilda Road Melbourne VIC 3004 PO Box 810 South Melbourne VIC 3205 P: 1800 376 376 Directions

Sydney Office

Level 10, 133 Castlereagh Street Sydney NSW 2000 GPO Box 5391 Sydney NSW 2001 P: 1800 376 376 Directions

- Doctors in Training

- Consultants

- Financial Education for Doctors

- Media Library

DPM acknowledges the Traditional Owners of the land where we live and work. We pay our respects to Elders past, present and emerging, and Elders from other communities we may visit and walk beside. We recognise their connection to Country and their role in caring for and maintaining Country over thousands of years.

Copyright © DPM 2024 | Privacy Policy | Disclaimer | View DPM Financial Services Guide | Making a complaint

Website by Arthur St

IMAGES

VIDEO

COMMENTS

A lot of doctors want to know how much money they can deduct from their 1099 taxable income. In my experience, if you travel away from home and work locum tenens full time, you will be looking at anywhere between $5000 to $15,000. So, if you are in the 30% tax brackets, you will save $5000 * 30%, or $1500 per year on the lower end and $15000 ...

You can send both the expense spreadsheet and your saved receipts directly to your accountant, so they can use it to get you the best possible locum tenens tax deduction. Questions about filing your 2022 taxes? Let's talk. Call 1-888-837-3172.

burden. Let's say you earn $10,000 as a locum tenens independent contractor and have $6,000 of unreimbursed. professional expenses. In this case, you'll only pay taxes on $4,000 of your net locum tenens income. To qualify as an allowable deduction, an expense must be both "ordinary" and "necessary" in connection with your.

Many locum providers feel overwhelmed with figuring out what exactly is deductible from their travel, housing, and health expenses come tax season. That's why Barton Associates annually partners with tax advisor Andrew Schwartz, CPA, who has been providing tax and financial planning services to healthcare professionals since 1993.

Here are six things every traveler should know to make filing your taxes easier. 1. Understand the difference between 1099 and W-2. A 1099 employee is a self-employed independent contractor who is paid according to their contract and uses a 1099 form to report income on their tax return. At CompHealth, advanced practice providers and allied ...

Unreimbursed travel, lodging, and 50 percent of meal costs incurred during a locum job outside the general vicinity of where you live are deductible. However, the job must be for a specific period ... 2023-2024 Locum Tenens Tax Guide Automobile Expenses Driving between job sites is deductible. So is driving between your home and a temporary job ...

Tax deductions for locum tenens physicians. As independent contractors, locum tenens physicians can deduct a variety of qualified work-related expenses. Be sure to keep detailed receipts for any deductions you plan to claim. Common tax deductions for locum tenens physicians include: Work materials like scrubs, stethoscopes, and other supplies.

The cost of continuing medical education (CME) is 100% deductible for locum tenens doctors. This deduction can really add up, especially if you're attending multiple conferences or courses throughout the year. Remember, as long as the expenses are business related, they may be eligible for tax deduction.

Lodging and transportation are two major tax-deductible expenses for many professions, especially when it comes to locum tenens work. Any housing and travel costs that were not reimbursed by your employer can constitute as tax write-offs throughout your locum tenens career. Travel costs can include flights, car rentals, gas, car insurance, car ...

As a locum tenens provider, travel and food make up a major part of your tax-deductible expenses. Unreimbursed travel, lodging and 50% of meal costs during a locum tenens assignment can be used as tax write-offs - as long as assignments are less than a year in duration. Throughout the course of each locum tenens job, it's best to keep track ...

Unreimbursed mileage. 6. Keep Accurate Records. Because there are so many things to keep track of, it's especially important for locum providers to maintain detailed records of income, expenses, and deductions throughout the year. This will help you to facilitate tax preparation and avoid errors that will cost you.

Travel nursing and locum tenens tax strategies Most travel jobs allow you a stipend or per diem for travel, housing and meals to cover your living costs while working in a different location. If you maintain a permanent residence, you can be reimbursed for those expenses by your agency, and the money is not considered taxable income.

agency so they can report all travel expenses as taxable income along with your cash compensation on year-end Form 1099-MISC. You cannot deduct travel expenses the locum tenens agency pays or reimburses you. However, if your actual expenses are greater than the amount the agency paid, you may be able to claim a tax deduction for the

Leveraging these deductions helps keep professional costs manageable. 2. Continuing Medical Education (CME) The medical field is ever-evolving, and staying abreast of the latest advancements is crucial. Expenses related to CME, including travel, can be deducted, making your pursuit of knowledge more affordable. 3.

Travel expenses: You can deduct the costs of traveling to and from your locum tenens assignments, such as airfare, car rental, mileage, tolls, parking, and baggage fees. You can also deduct the costs of lodging and meals while you are away from your tax home. ... Another tax benefit of locum tenens is the concept of maintaining a tax home. A ...

Besides travel expenses that locum tenens doctors are encouraged to use as deductions, physicians who work as independent contractors year-round can also deduct business expenses. This includes "office equipment and supplies, medical equipment, CME expenses, licensing fees, communication expenses, board exam fees," explains the White Coat ...

Now you can estimate your 2020 taxes online. This calculator gives an estimate of self-employment/FICA, federal tax and includes locum tenens tax deductions. Just enter the numbers below to figure out how much you owe Uncle Sam. To estimate any state's income tax, check out this site. Also, check out my detailed locum tenens tax deductions post.

The best way to avoid being penalized is to pay 90% of the current year's tax or 100% (110% if income over $150k) of your prior year's taxes. Estimated taxes generally need to be made evenly over the year unless the income isn't earned evenly over the year; in that case, you would complete and attach a Form 2210 to your personal tax ...

Take advantage of tax deductions for locum tenens physicians. Locum tenens physicians have several expenses they can deduct from their taxes, beginning with the cost of their premiums for health and dental insurance. Other common expenses to deduct include cellphones, computers, iPads, lab coats — anything you use or wear at work that you pay ...

Costs associated with attending conferences, workshops, seminars, and courses relevant to your medical practice as a locum doctor can be claimed as deductions. This includes registration fees, travel expenses, and accommodation. There are a few extra criteria that must be met also. The course or study material must be relevant to your current ...

As a self-employed locum GP, you may be able to claim a range of allowable expenses. If created "wholly and exclusively" as a result of your locum GP work, HMRC allows you to deduct these from your earnings via your Self Assessment tax return, which reduces your yearly profits and tax bill. Allowable expenses can include use of a home ...