The ultimate guide to Etihad Airways partners: How to earn and redeem Etihad Guest miles

Etihad is well known for its posh business- and first-class products , but did you know that the airline has a powerful loyalty program? The airline has partnerships with nearly two dozen airlines, giving you many options for earning and redeeming Etihad Guest miles during your travels.

Despite not being a member of a major airline alliance, Etihad has a broad range of airline partners worldwide. The airline has several non-airline partnerships that can help you earn Etihad Guest miles quickly.

These partnerships let you earn miles when staying at hotels, renting cars and making everyday purchases with select American Express , Capital One and Citi credit cards .

Here's a look at Etihad Guest's powerful partnerships.

Earning Etihad Guest miles with partner airlines

Etihad's partners have unique earning charts with varying rates.

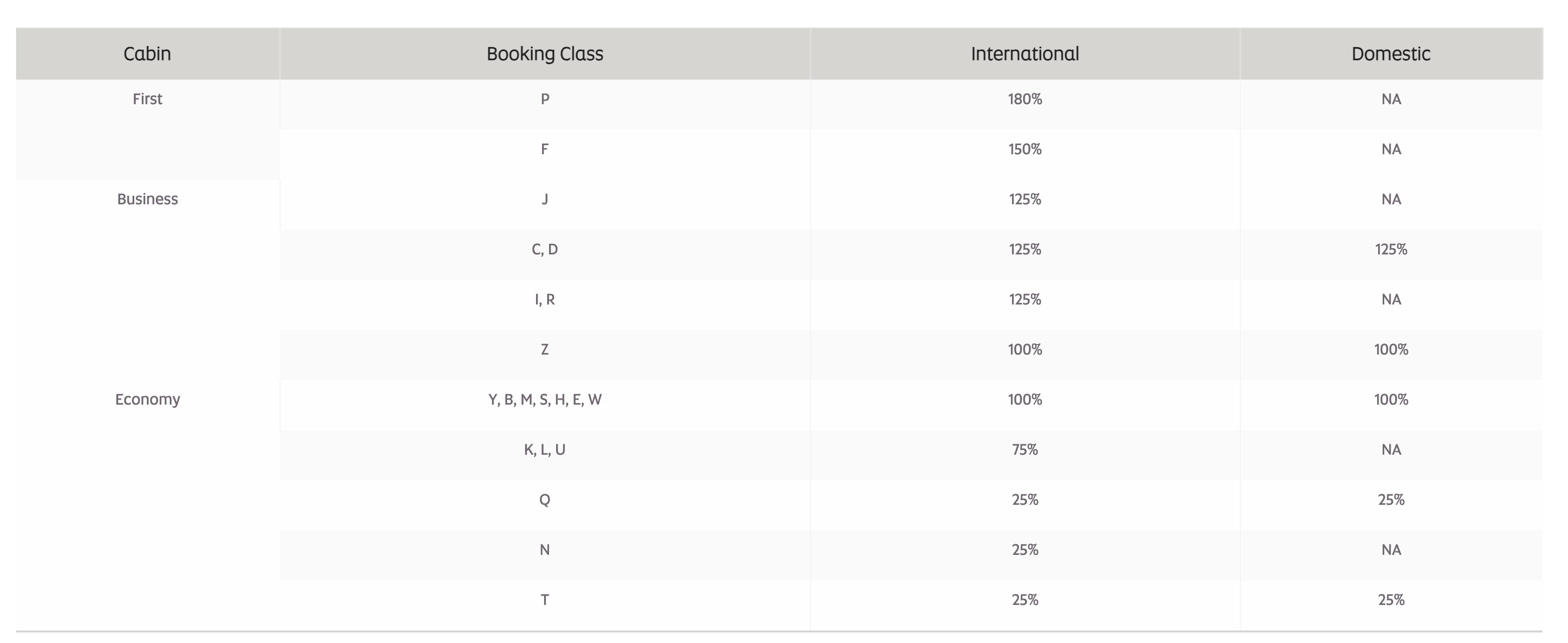

Etihad awards up to a 125% bonus on miles flown on Air Canada flights. The earning chart is extensive and has different earning rates for flights within Canada, as well as a chart for all other flights, including flights between Canada and the U.S., so make sure you're using the right chart to calculate your earnings.

Another thing to remember is that some Air Canada domestic fares earn no miles when credited to Etihad. Therefore, it's in your best interest to double-check the award chart to make sure your fare class will earn you miles.

Air New Zealand

You can earn Etihad Guest miles on all Air New Zealand flights at 100% of the distance flown for economy and premium economy or 150% for business class. You can find an up-to-date earning chart on the Etihad website . Multiply the distance of your flight by the percentage listed next to your booking class to see how many miles you'll earn on your partner flight.

Etihad Guest has two Air Serbia earning charts: one for short and mid-haul flights and another for its long-haul route to New York. Miles earned are based on class of service and distance flown, so you'll earn more miles for longer flights. You can view these earnings charts on Etihad's website .

Unfortunately, Economy Light fares — commonly referred to as "White" fares — aren't eligible to earn Etihad Guest miles. Thankfully, these fares are only sold on intra-Europe flights, so you will earn at least 25% of the miles flown in all other fare classes.

You'll earn Etihad Guest miles on SkyTeam member Air Europa based on the distance of your flight and fare class for up to 150% of the miles flown for full-fare business class. Note that several discounted economy fares are not eligible to earn Etihad Guest miles. You can see the latest Air Europa earning chart on Etihad's website .

Air France-KLM

Etihad announced on Monday, Nov. 27, that the airlines have launched frequent flyer reciprocity , enabling travelers to earn and redeem miles across the airline groups.

When you travel on an eligible Air France- or KLM-marketed and -operated ticket with your Etihad Guest membership, you'll earn Etihad Guest miles based on your fare class and the flight distance from 20% for "every discounted economy class" up to 275% for first class.

You can refer to this page (Air France) and this page (KLM) and select "Miles you'll earn" to see how many Etihad miles you'll earn on Air France and KLM.

Related: You can now book Etihad with Air France-KLM Flying Blue miles — and it can be a great use of transferrable points

All Nippon Airways

All Nippon Airways — commonly called "ANA" — is based in Tokyo and flies to most major cities in the U.S., Asia and the South Pacific. It also has extensive service in Europe, the Middle East and Africa.

Per the airline's earning chart , you'll earn Etihad miles on all ANA flights. Earning rates are pretty standard with ANA: You'll earn 50% to 150% of miles flown, with the 150% being reserved for paid first-class tickets. You can also credit your ANA flights to Star Alliance carriers and Virgin Atlantic. We recommend you use a tool like Where To Credit to find the best partner to credit your miles.

American Airlines

American miles have long been among the best ways to book Etihad awards; likewise, you can score excellent value when booking certain American Airlines award flights with Etihad Guest miles.

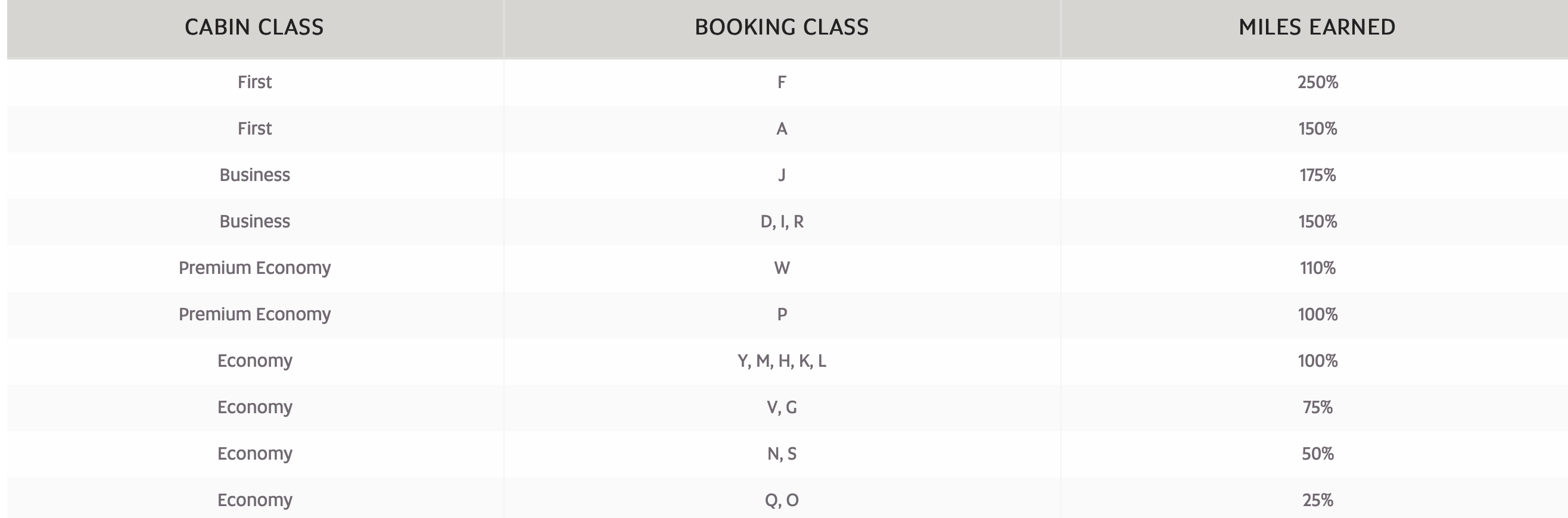

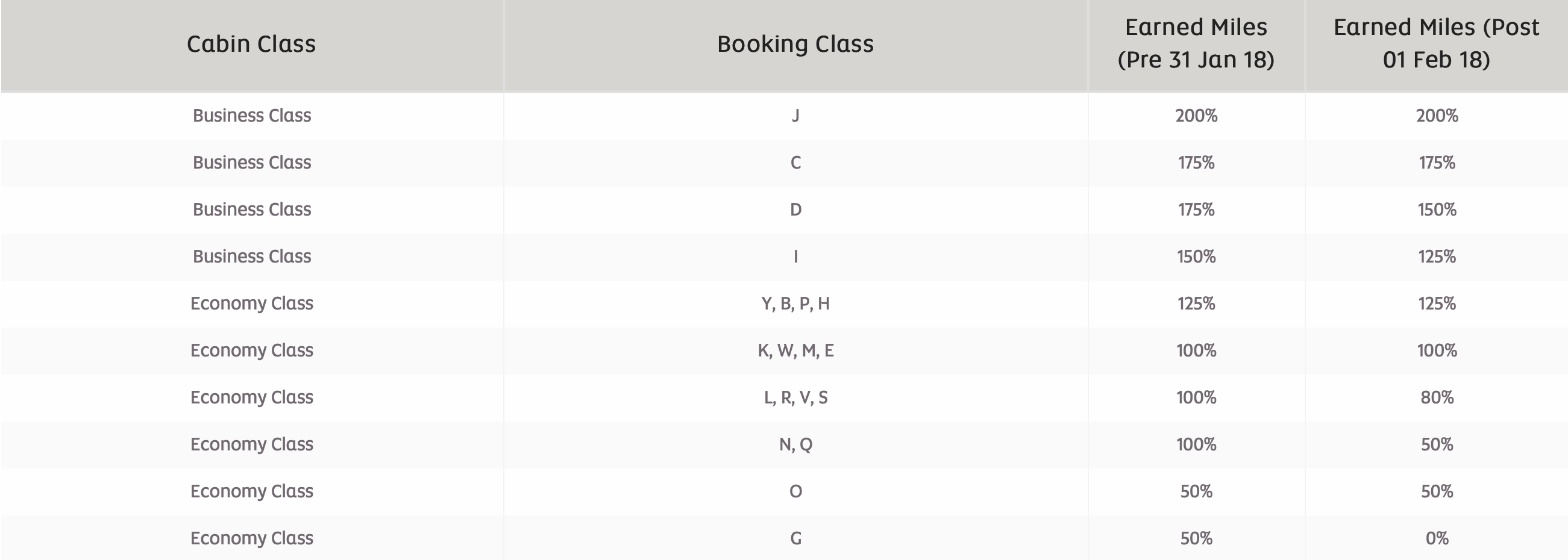

You can earn Etihad Guest miles based on your fare class and the distance of your flight. Based on the current earning chart , you can earn between 25% and 250% of miles flown, depending on your fare class.

Asiana Airlines

Asiana is based in South Korea, with flights to major cities in Asia, Europe and North America.

You can earn up to 135% of miles flown when crediting Asiana miles to Etihad Guest, but note that many of the airline's international economy fares are only eligible for 50% of miles earned. Additionally, domestic flights on Asiana offer different economy mileage rates than international flights. You can view the latest Asiana earning chart on Etihad's website .

Brussels Airlines

Brussels Airlines is a Lufthansa Group airline based in Belgium. While most of the airlines' routes are intra-Europe, it also offers extensive service to West Africa and nonstop flights to New York's John F. Kennedy International Airport (JFK) and Washington, D.C.'s Dulles International Airport (IAD).

You'll earn between 25% and 150% of miles flown when you credit Brussels Airlines flights to Etihad Guest. See the airline's earning chart for more details.

The flag carrier of Israel offers flights to nearly 50 destinations, including Europe, the Middle East and North America.

You can earn a minimum of 25% Etihad Guest miles for discounted economy-class tickets and up to 175% miles for full-fare business-class flights.

Garuda Indonesia

Garuda Indonesia is the largest airline in Indonesia, with hubs in Jakarta at Soekarno-Hatta International Airport (CGK) and four other major cities in Indonesia.

You can earn up to 200% of miles flown when you credit Garuda Indonesia flights to Etihad Guest. Unfortunately, the airline's cheapest economy tickets only earn 25% of miles flown with Etihad Guest, so make sure to assess all of your crediting options.

Gulf Air is an international airline based in Bahrain, with connections available to major cities in the Middle East, Asia, Europe and Africa.

You can earn up to 175% of miles flown when crediting Gulf Air flights to Etihad . The carrier often has solid deals from Europe to the Middle East, so this can be an interesting way to see another region, experience a new airline and rack up Etihad miles simultaneously.

Hainan Airlines

Hainan Airlines is a Chinese carrier offering flights to major cities in Asia, Europe, North America and the South Pacific. The carrier has a relatively new fleet with many of its long-haul routes being operated by a mixture of Boeing 787 and Airbus A350 aircraft.

Hainan Airlines' Etihad earning chart awards miles for nearly all booking classes (except some discount economy), with both domestic and international business-class tickets earning up to a generous 250% of miles flown.

Korean Airlines

Korean Airlines is the flag carrier of South Korea and is well known for its great service and excellent first-class flights .

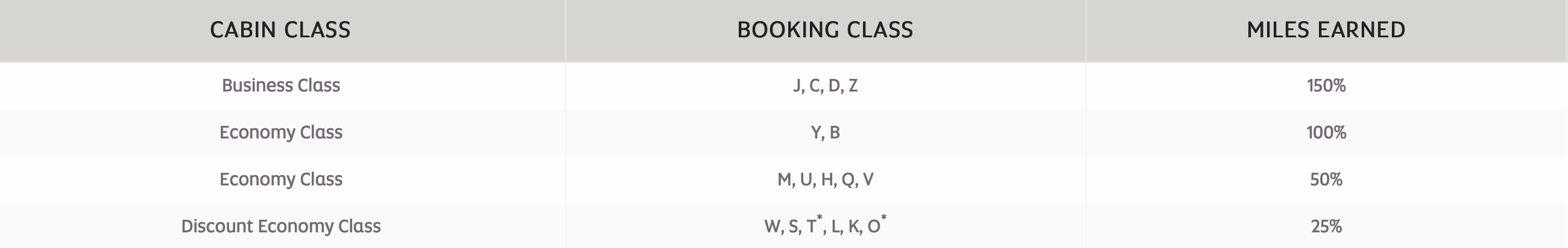

You can earn up to 180% of miles flown when crediting Korean Airlines international flights to Etihad Guest, with most fare classes eligible.

Malaysia Airlines

Malaysia Airlines is a Oneworld member and the flag carrier of Malaysia, connecting the country to major destinations worldwide. The airline currently serves major destinations in Asia, Europe and the South Pacific.

You can earn up to 150% of miles flown when crediting Malaysia Airlines flights to Etihad Guest.

Oman Air connects its home airport, Muscat International Airport (MCT), to over 40 destinations in the Middle East, Europe and Asia. It's known for its hospitality, and its economy, business- and first-class cabins all receive high marks in TPG's flight reviews .

Etihad revamped the Oman Air earning chart , raising the earning rates for several fare classes with an incredible 300% of miles flown. However, in 2019, the airline's cheapest economy "E" fare was downgraded to earning just 10% of miles flown.

Royal Air Maroc

Royal Air Maroc is Oneworld's newest member , but its non-alliance partnership with Etihad is here to stay.

Etihad's Royal Air Maroc earning chart was revamped in late 2019, but it kept earning rates the same for most of the popular business and economy booking classes. You can earn between 50% and 150% of miles flown, with the 150% rate being reserved for business-class tickets.

A fairly new partnership in place since 2021, Saudia's ties to Etihad make it possible for Etihad Guest members to earn 25% of miles flown for discounted economy fares when flying Saudia and 250% of miles flown for first class.

Scandinavian Airlines

Scandinavian Airlines — "SAS" for short — is the largest airline in Northern Europe. It maintains hubs in major Scandinavian cities and flies to major destinations in Asia, Europe and North America.

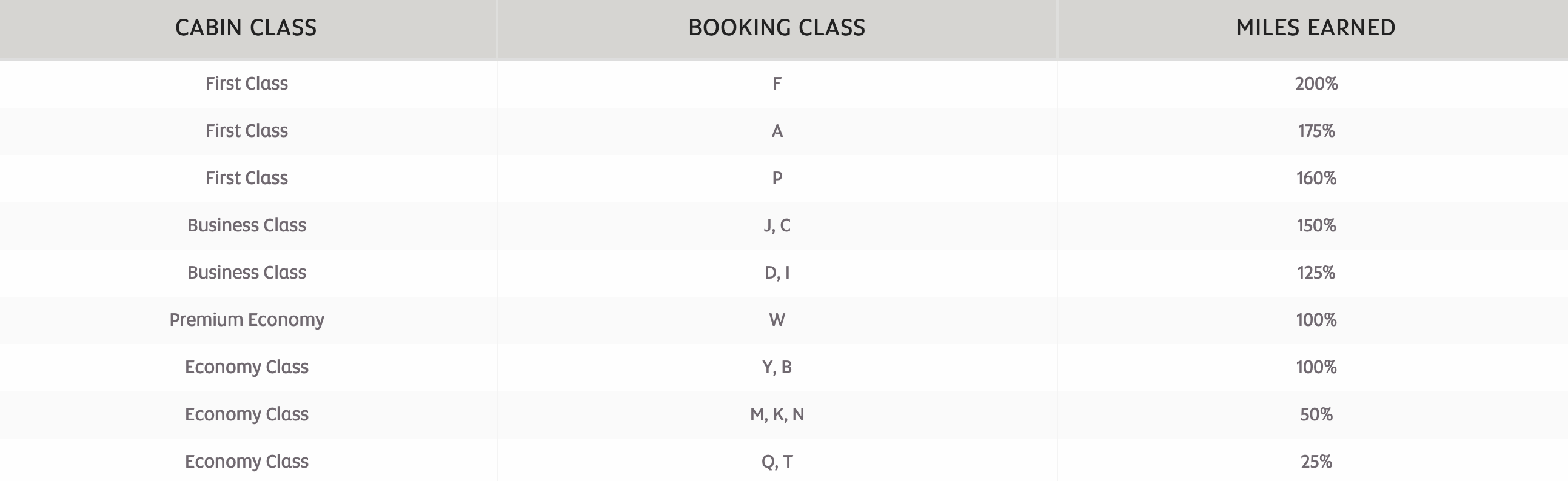

You can earn miles on all SAS routes, and, thankfully, the earning rates on these routes are high compared to many Star Alliance programs, with at least 50% for economy class and up to 200% for business class.

SriLankan Airlines

This Oneworld carrier flies from Colombo, Sri Lanka's Bandaranaike International Airport (CMB) hub to major destinations in Asia, the Middle East and Europe.

SriLankan Airlines doesn't serve the U.S., so its earning chart won't be too helpful unless you're taking a trip to West Asia. Regardless, Etihad offers solid earning rates in most booking classes and better earning rates than AAdvantage on business-class tickets.

Virgin Australia

Etihad Guest partners with Virgin Australia , with mileage earning from 25% for Lite economy class and up to 200% for all business-class fares.

Redeeming Etihad Guest miles with partner airlines

Etihad Guest previously used a different redemption chart for every airline partner. While this did have a few great sweet spots, such as transatlantic business-class flights on Brussels Airlines for just 44,000 miles each way, it was an enormously complex system for members to navigate many different charts.

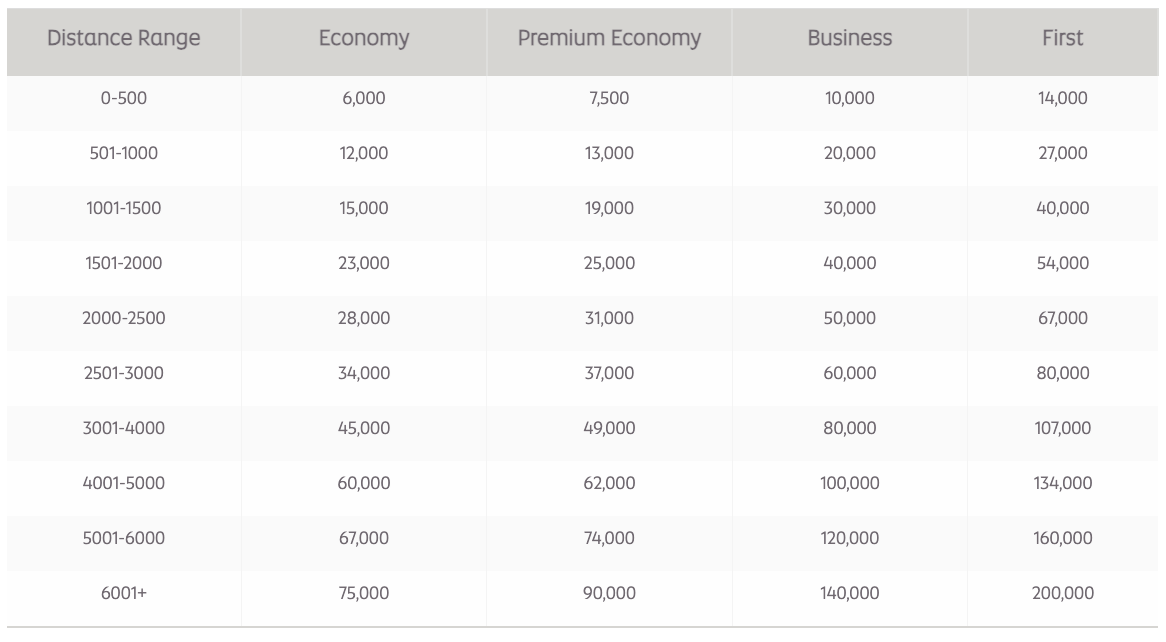

The program now uses a simplified award chart for all partners. While some sweet spots have gone, it is much easier to understand the pricing.

The loyalty program has an award calculator for Eithad, American Airlines and Virgin Australia flights. Often, the award rates shown on the calculator are far less than what you'll need to spend for an award flight.

Here's a look at Etihad's published partner award chart with introductory rates:

With the new Air France-KLM redemption option, you will need the following number of miles each way when Saver award space is available:

- Paris-Charles de Gaulle Airport (CDG) to JFK: 45,000 miles in economy, 49,000 miles in premium economy or 80,000 miles in business class

- Amsterdam Airport Schiphol (AMS) to Los Angeles International Airport (LAX): 67,000 miles in economy, 74,000 miles in premium economy or 120,000 miles in business class

You can book American Airlines and Virgin Australia redemptions on Etihad's website. You must call Etihad at 877-690-0767 for all other partner award bookings.

Again, the rates above are just starting rates. With dynamic pricing , you may see prices many times higher than these rates, but where you can find Saver rates, there are good deals to be had.

You'll also have to pay the taxes and fees on your award ticket, though Etihad Guest generally allows you to use additional miles to cover this cost.

Earning Etihad Guest miles with hotel and rental car partners

Etihad has partnerships with most major hotel chains. Some earn a set number of Etihad miles per stay, while others earn miles based on how much you spend on a hotel stay.

Many hotel loyalty programs let you transfer your hotel points to Etihad Guest, though you'll usually lose value in the process.

Hotel program

Third-party accommodation platform, rental car partners.

You can also earn Etihad miles when renting a car from select companies.

Earning Etihad Guest miles with credit card transfer partners

Etihad doesn't have a U.S.-based cobranded credit card. For a quick influx of Etihad Guest miles, you can transfer rewards from the following programs at a 1:1 ratio:

- American Express Membership Rewards

- Capital One

- Citi ThankYou Rewards

The following cards all currently offer strong welcome bonuses with points and miles that you can transfer to your Etihad Guest account:

- The Business Platinum Card® from American Express

- The Platinum Card® from American Express

- American Express® Gold Card

- Capital One Venture Rewards Credit Card

- Capital One Venture X Rewards Credit Card

In our tests, transfers from these programs to Etihad Guest are generally instantaneous.

Bottom line

TPG has long seen Etihad Guest as one of the most undervalued loyalty programs.

The airline has many unique airline partners and great earning and redemption rates, so it's worth a look if you're hoping to redeem miles for a premium award to the Middle East, Europe, Asia or beyond.

By continuing to use our website, you consent to the use of cookies. To know more, please refer to our cookie policy .

Hi , your miles balance is {{mileInformation}}

- Overview External website opens in a new window

- How it works External website opens in a new window

- Tiers & status External website opens in a new window

- Mobile app External website opens in a new window

- Miles on the Go External website opens in a new window

- Family membership External website opens in a new window

- FAQs External website opens in a new window

- Transfer miles External website opens in a new window

- Report fraud External website opens in a new window

- Flying External website opens in a new window

- Payment cards External website opens in a new window

- Accelerate your miles External website opens in a new window

- Cars & Hotels External website opens in a new window

- More partners External website opens in a new window

- Points transfer External website opens in a new window

- Shopping External website opens in a new window

- Hotels External website opens in a new window

- Pointspay External website opens in a new window

- Reward Card External website opens in a new window

- Miles calculator External website opens in a new window

- Donations External website opens in a new window

- Other External website opens in a new window

- Government Travel Holiday offer External website opens in a new window

- Account Summary External website opens in a new window

- Profile and Details External website opens in a new window

- Activity History External website opens in a new window

- Family Membership External website opens in a new window

- Claim Miles External website opens in a new window

- Transfer Miles External website opens in a new window

- Your benefits External website opens in a new window

- {{mileInformation}} miles opens some secure link on click,press tab key to navigate

button 1-- Please complete to continue

button 2-- Please complete to continue

Not a member yet? Start earning miles with our award-winning programme that rewards you with free flights, upgrades, gifts and so much more. Join now and enjoy free onboard Wi-Fi chat package.

Join Etihad Guest now

One time password is sent to your email id. Please verify.

- Book a flight

Current bookings

- PNR {{::currentBooking.pnr}} Flight no. {{::currentBooking.flightNumber}} From {{::currentBooking.origin.city}} Depart {{::flightCtrl.flightBooking.convertDt(currentBooking.departure)}} To {{::currentBooking.destination.city}} Arrive {{::flightCtrl.flightBooking.convertDt(currentBooking.arrival)}}

- noOfBookingsLimit"> View all bookings

- Retrieve a booking

- Manage your booking

Search flights:

- {{::airport.label}}

- The Residence

- {{::$index+1}}

- {{::$index}}

**Please select a payment method

Flight details:

Make changes to your flight details.

Modify booking allows you to make changes to an existing flight booking.

View itinerary displays your full itinerary (e-ticket) and allows you to view details of a chauffeur service or a rail connection that you have booked.

Make changes to your booking or upgrade

Book and pay for any extras you need for your trip, like an upgrade, additional baggage or our airport transfer service.

You can even reserve your favorite seat on board.

Your Profile and Details

Profile completeness.

Complete your profile

Congratulations!

Personal details.

Keep your account secure by changing your password regularly

Contact details

Membership card.

Family Membership

Combine, earn and share miles with the whole family.

Passenger information

Walletplus™.

Your walletplus

Introducing the pre-paid walletplus card.

Virtual clubs

As part of its ongoing commitment to deliver a truly rewarding programme experience, Etihad Guest and its partners offer a number of special ‘virtual’ clubs, dedicated to the needs of specific groups of members.

Book flights to your favourite destination, earn flybuys points.

Help us know you better

We want to get to know you better

Preferences

Tell us what you’re interested in and we’ll keep you updated

{{::promo.profilepromoheader}}

Etihad guest visa card.

Kindly note

Go select your benefits or they close within 30 days

View and compare your benefits

Here's a summary of your benefits. Go to the page to view more

Unlock more benefits in addition to yours: You're {totalMiles} tier miles away from unlocking more benefits

{{milesAwayString}}

Go select your beyond benefits

View, compare all the benefits Etihad has to offer

How can we help ?

- Book flights & hotel

- Book groups

- Book a stop over in Abu Dhabi

- Book with Etihad Guest Miles

- Book Rail & Fly

- Charter & special flight requests

- Unaccompanied minors

- Need a UAE visa?

- Special offers

- Book Etihad WorldPass

- Meals on board

- Flying with children

- Entertainment and Wi-Fi

- Travelling with pets

- Seat choices

Before you fly

- Airport information

- Baggage allowance

- Special assistance

- Travel insurance

- Clear US immigration

- Miles calculator

- Fare choices

- Discover Abu Dhabi

- Stop over in Abu Dhabi

- Abu Dhabi discounts

- Abu Dhabi Holidays

- Abu Dhabi Airport Guide

- Delayed or damaged baggage

- Baggage guide

- Lost and found

Get in touch

- Travel requirements

- Our mobile apps

Travel requirements by destination

It’s important that you read these guidelines below before you fly and check the regulations at both your departure and arrival destination.

Abu Dhabi travel information

Everything you need to know about flying to, from or transiting in Abu Dhabi.

Show me more

Travel Bank

Use your Travel Bank account to pay for flights with us or have Etihad Credit added to your account.

Find out more

Upload your documents

Upload your documents to get Verified to Fly, then arrive at the airport with total peace of mind.

Get Verified to Fly

Do I need to take a test before I fly with Etihad Airways?

You don’t need any test or vaccination if your final destination is Abu Dhabi.

If you’re flying to any other destination, you only need to take a test if it is required at your final destination.

Do I need a test to transit through Abu Dhabi?

If your final destination doesn’t require a test, you won’t need one to transit through Abu Dhabi regardless of your vaccination status. Always check the test requirements and exemptions for your final destination.

A test is required at my final destination. Where should I take my test?

You should take your test at the specified time at an accredited clinic. Depending on where you’re flying to, there may specific clinics where you need to take your test.

Check the latest travel requirements to find out where and when to take a test.

I need to change my flight. What are my options?

Our flexible fares give you the freedom to change your flight if you need to.

Find out how to change your flight at etihad.com/manage , or read more about what to do if your flight has been cancelled or changed.

Where do I upload my documents to get Verified to Fly?

You can upload your documents at etihad.com/manage from 72 to two hours before your flight.

You must have a confirmed flight reservations to view the requirements for your trip.

Read more at etihad.com/verifiedtofly .

Let us help you find a quarantine-free destination

Find quarantine-free destinations and green-list getaways around the world. Spend less time planning your trip and more time enjoying it.

Using third party sites

We work with a network of partners to offer you optional services that make your journey with us even better. When you click a link from one of our partners:

- You'll be redirected to a third-party website. Please carefully review the terms and conditions and product or service details before you use any third-party websites.

- Etihad does not own, operate or control in any respect any information, products or services available on third-party websites.

- Third-party website links are provided for your convenience and do not constitute any endorsement by Etihad.

- You assume sole responsibility and discretion for use and access to these third-party websites and links.

- Etihad makes no representation or warranties, either expressed or implied, with respect to any third-party website/service provider and strictly disclaims any and all liability arising out of, or in any way connected to the third-party websites and the use of these websites or links by you.

Nasıl yardımcı olabiliriz?

Travel bank.

Use your Travel Bank account to pay for flights, upgrades and extras. You can even use Travel Bank to reserve an extra legroom seat in Economy Space. Simply call us to book or email [email protected] to check the balance of your account.

What is Travel Bank?

Travel Bank lets you hold multiple credits in one account and spend them on future bookings. We’ll create a Travel Bank account for you if we need to issue you with a credit note. Once the account has been created, we’ll send you an email containing your Travel Bank account number and Travel Bank ID, which you’ll need to make a booking. You must have a valid Etihad Guest account to be eligible for a Travel bank account.

Everything you need to know about Travel Bank

What can i pay for using my travel bank credits.

You can use your Travel Bank credits to pay for flights, upgrades and extras. You cannot redeem Travel Bank credits to pay for infant tickets, miles redemption bookings, Etihad Holiday packages or bookings through travel agents.

How do I redeem my Travel Bank credits?

To redeem your Travel Bank credit, please call our Global Contact Centre . Please inform the agent that you’d like to use your Travel Bank credit at the start of the call. You’ll need to provide your Etihad Guest number when you book. Your credits cannot be used for bookings made with a travel agent.

Can I sign up for Travel Bank?

No, we’ll create a Travel Bank account for you if we need to issue you with a credit note.

We will contact you before we create your account and share all of your account details in a welcome email. The welcome email will contain your Travel Bank account number and your Travel Bank ID. Your Travel Bank ID number is your Etihad Guest number. You will need these details to redeem your Travel Bank credits.

What currency is used in Travel Bank?

Travel Bank accounts are created in the currency of the country you have listed in your Etihad Guest profile.

The currency of the account cannot be changed after it has been created, but your credits can be used towards bookings in any currency.

How do I know how much credit I have in my Travel Bank account?

To check your credit balance, please send an email to [email protected]

Can I combine my Travel Bank credits with another form of payment?

Yes, you can pay with a combination of Travel Bank credits and cash or card. Travel Bank credits and Etihad Guest Miles must be redeemed separately.

How long are my Travel Bank credits valid for?

Travel Bank credits are valid for 12 months from the date of issue. All credits expire at 11.59 pm EST on the expiration date. Once individual credits expire, they cannot be extended.

Travel Bank applies the “first to expire” logic on the credits that are used as a form of payment. For example, if you have 300 credits that will expire on 20 April 2018 and 200 credits that will expire on 11 June 2018, then the credits that will be used for the payment are the ones that will expire in April.

Travel does not have to be completed by the Travel Bank credit expiration date.

My Travel Bank credit is about to expire. Am I able to extend it?

Travel Bank credits cannot be extended.

Can I get a refund on my Travel Bank credits?

Refunds of tickets purchased with Travel Bank credits will be returned to the same Travel Bank account. The Travel Bank credit expiry will revert to the original Travel Bank expiry (12 months from the original issue date). For example, if the credit was issued on 15 Aug 2017 and the expiry date was 365 days, and the ticket was issued on 12 Feb 2018 and cancelled on 16 Feb 2018, the credit will revert to the expiry date of 14 Aug 2018. If the expiry date has passed, the credit will be cancelled and will not appear in your account again.

The amount of credits refunded depends on the fare rules of the ticket or product that is being refunded. For example, if you paid 500 Travel Bank credits for a ticket using your Travel Bank Credits and the refund cancellation fees is 50, then 450 Travel Bank credits will be added back to your account.

Can I transfer my Travel Bank credits to another person?

Travel Bank credits cannot be transferred.

Can I use my Travel Bank credits to pay for travel for another person?

Yes, you can use your Travel Bank credits to pay for a ticket for someone else.

I forgot I had a credit and booked a new reservation. Can you apply my credit and give me a refund?

You cannot apply a credit to a reservation that has already been paid for.

Can I view my Travel Bank credits online?

Travel Bank credits cannot be viewed or used online, but you will receive an email whenever credits have been redeemed or added to your account. If you need any help or information, please contact our helpdesk by emailing [email protected]

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Etihad Loyalty Program: What Travelers Need to Know

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

About Etihad Airlines

Etihad guest’s elite status program, etihad partner airlines, how to earn etihad miles, how to redeem etihad guest miles for maximum value, final thoughts on etihad guest miles.

Etihad Airways primarily flies to and from its hub in Abu Dhabi, United Arab Emirates, but that doesn’t mean that you can’t fly it to reach many destinations worldwide. Though Etihad isn't a member of any of the major airline alliances , it has more than 20 airline partners that fly around the world.

Here’s what a strategic points collector needs to know and understand about Etihad Airways and its loyalty program, Etihad Guest.

Here’s a quick overview of a few key features of the airline:

Fare types: Etihad operates economy class , business class and first class cabins. In economy, you can book Sale, Value, Choice, Choice Plus and Guest Seat fares. In business class, you can choose between Value, Choice, Choice Plus and Guest Seat fares. Flying first class offers two fare types only: First and Guest Seat. Each of the fare classes include different levels of perks. For example, a Sale economy ticket earns 25% miles and doesn’t allow refunds, while a Choice Plus ticket earns 100% miles and allows refunds for a fee.

Main U.S. routes: Etihad flies from its hub in Abu Dhabi to a handful of North American cities, including Boston, Chicago, Washington, D.C., New York City and Toronto.

Etihad frequent flyer program and points currency: Etihad’s loyalty program is called Etihad Guest, and the program's currency is simply called Etihad Guest Miles. With its excellent partner redemption options , it may be one of the most underrated airline programs.

Elite status levels : Etihad has four elite status levels: Bronze, Silver, Gold and Platinum.

» Learn more: The best airline credit cards right now

Similar to other airline loyalty programs, when you frequently fly on Etihad, you can earn elite status that gives you extra perks and boosts your mileage earnings when flying.

Etihad has four status tiers that range from Bronze at the lowest level up to Platinum at the top level. When you join Etihad Guest, you automatically earn Bronze status, which, as you would expect, doesn't offer many tangible benefits beyond a 10% discount on inflight Wi-Fi.

How to earn Etihad elite status

Here’s how you can earn status, broken down by tier*:

* As of June 2024, Etihad will remove tier segments as a metric for earning status.

Elite status benefits

Once you’ve earned status with Etihad Guest, you’ll start to enjoy benefits like earning bonus miles, getting upgraded, having lounge access and more.

Below is a comparison of the unique benefits that each status tier level offers. Bronze level gets you none of the benefits listed for the higher levels outside of a 10% Wi-Fi discount and instant upgrades with miles at the airport.

» Learn more: The beginner's guide to points and miles

Although Etihad isn’t in one of the three main airline alliances, Etihad has a solid network of 21 airline partners on which you can earn and redeem your miles.

Air Canada.

Air Europa.

Air France-KLM.

Air Serbia.

Air New Zealand.

All Nippon Airways.

American Airlines.

Asiana Airlines.

Brussels Airlines.

Garuda Indonesia.

Hainan Airlines.

Korean Air.

Malaysia Airlines.

Royal Air Maroc.

Scandinavian Airlines.

SriLankan Airlines.

Virgin Australia.

In addition to these airlines, Etihad also maintains a network of codeshare partners, and as long as the flight is sold and marketed by Etihad (your flight starts with EY), you can earn Guest miles on those flights.

The first step to start earning Etihad miles is to join the Etihad Guest program. Once you’re enrolled, you can earn miles when you fly with Etihad and any of Etihad’s partner airlines.

Earn by flying Etihad

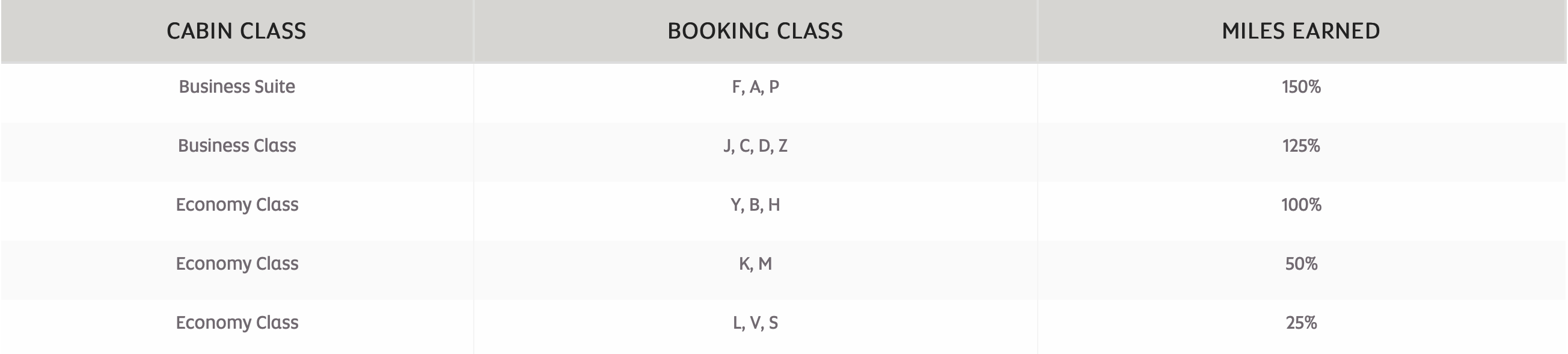

The most straightforward way to earn Etihad Guest miles is by flying on Etihad Airways. The earn rate is as follows:

The amount of miles you earn will also be affected by your elite status with Etihad. Silver, Gold and Platinum members earn 25%, 50% and 75% bonus miles, respectively, on flights. Bronze members do not earn any bonus miles.

Use the Etihad miles earning calculator to determine how many miles you can earn on your next trip.

Earn with Etihad airline partners

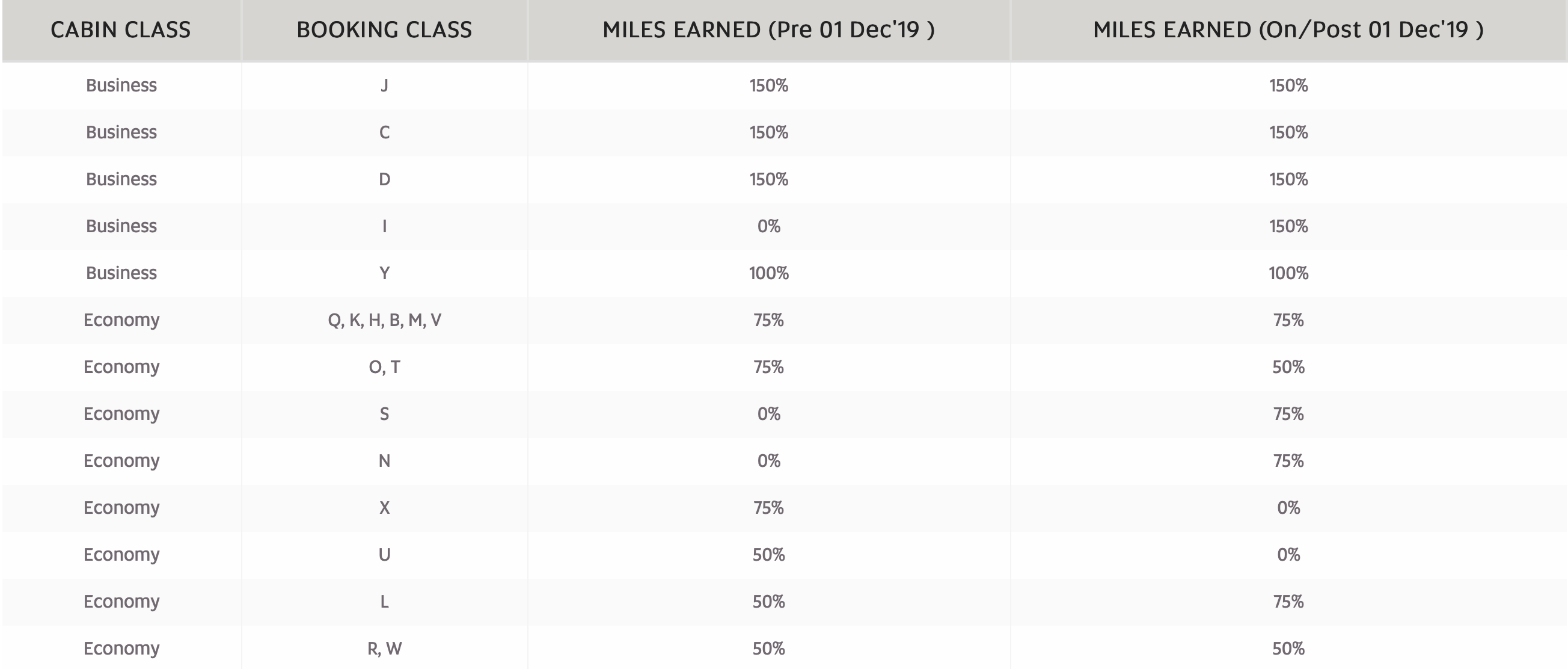

If you book a flight with a partner airline and input your Etihad Guest miles number, you’ll be able to earn Etihad miles on that ticket. Similar to flying Etihad, the number of miles you earn depends on the fare class you book. For example, if you’re flying with American Airlines, the number of Etihad miles you earn will be based on this chart:

So if you book an American Airlines economy seat in class N, you’ll earn 50% of the miles flown.

Earn by spending on credit cards

Unfortunately, Etihad doesn’t have a co-branded credit card in the U.S. that allows you to rack up miles with everyday purchases. The good news is that you can easily earn transferable points from other credit cards (more below).

» Learn more: The best credit cards for international travel

Sign up for transferable point cards and transfer points to Etihad

Etihad Guest is a transfer partner of American Express , Citi , Capital One and Marriott Bonvoy , which means that if you have a transferable point card from one of these programs, you will be able to transfer your points to Etihad. With the exception of Marriott, points transfers to Etihad are at a 1:1 ratio.

So, you’ll get 10,000 Etihad miles when you transfer 10,000 points from American Express, Citi or Capital One. For example, if you have the Citi Premier® Card you earn Citi ThankYou points, which you can then transfer to Etihad.

Although the transfer ratio between Marriott Bonvoy and Etihad isn't ideal, you will get an extra 5,000 Etihad Guest bonus miles every time you transfer 60,000 Marriott Bonvoy points. So if you transfer 60,000 Marriott points, you'll end up with 25,000 Etihad miles.

on American Express' website

on Citibank's application

• 5 points per $1 on flights booked directly with airlines or with American Express Travel, on up to $500,000 spent per year.

• 5 points per $1 on prepaid hotels booked with American Express Travel.

• 1 point per $1 on other eligible purchases.

Terms apply.

• 5 miles per $1 on hotels and rental cars booked through Capital One Travel.

• 2 miles per $1 on all other purchases.

• 10 ThankYou® points per $1 spent on hotels, car rentals and attractions booked through the Citi Travel site.

• 3 points per $1 on air travel and other hotel purchases.

• 3 points per $1 on supermarkets.

• 3 points per $1 on gas stations and EV charging stations.

• 3 points per $1 on restaurants.

• 1 point per $1 on all other purchases.

Earn Etihad miles by staying at hotels

There are two ways to earn Etihad miles when staying at hotels:

Book a stay through Etihad’s hotel platform called Travel Rewards.

Book a stay with one of Etihad’s hotel partners (using the link provided by Etihad or on the hotel’s website). Note that if you choose to earn Etihad miles when booking with a hotel directly, you’ll likely forego any hotel points earned.

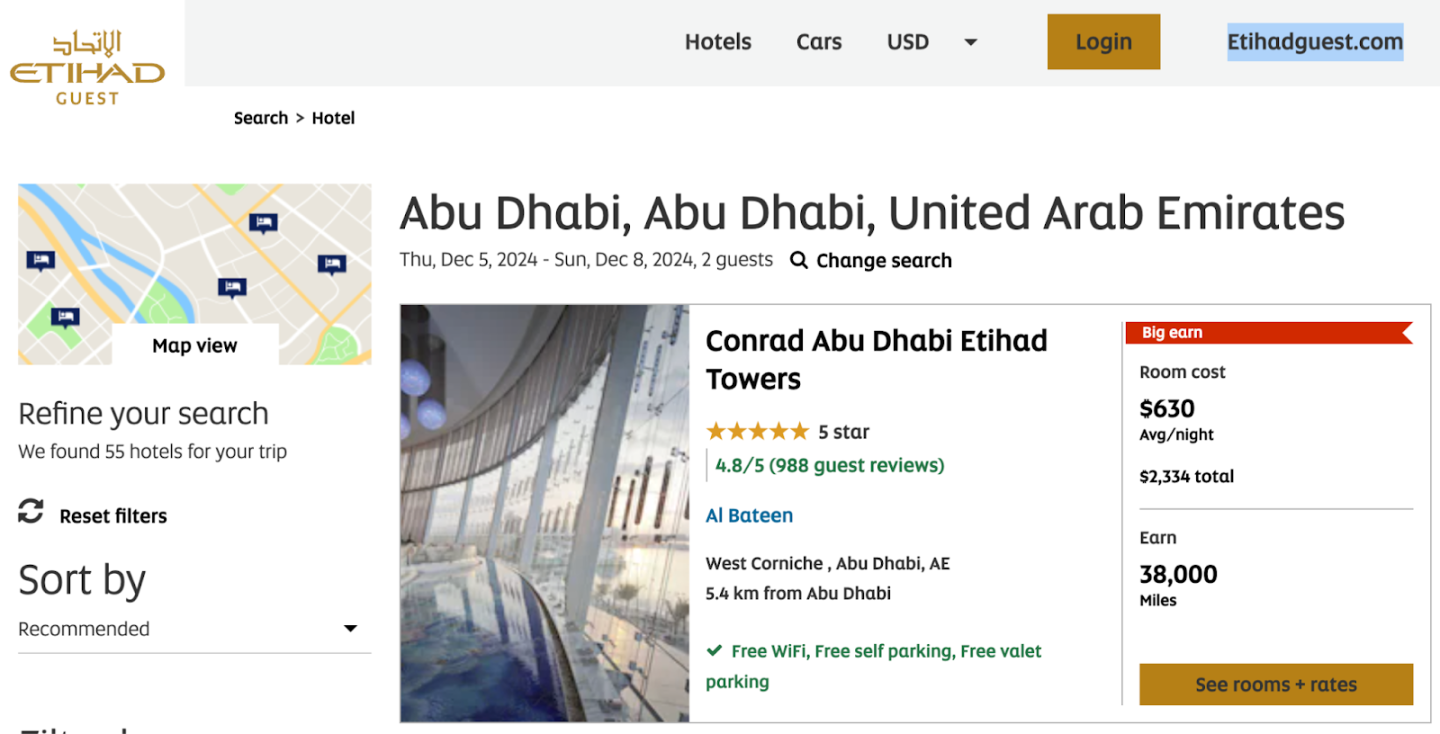

Etihad hotel booked through Travel Rewards

A three-night hotel stay in Abu Dhabi booked through Etihad’s hotel platform shows the number of Etihad miles you’d earn on a specific booking.

So, if you wanted to book the Conrad, you’d earn 38,000 Etihad miles on this stay. It's important to note that Conrad is part of Hilton, so if you book on this platform, you’d forgo any Hilton points (or loyalty perks) earned. If you’re a Hilton loyalist and want to earn your Honors points and elite status privileges, you’d be better off booking directly on Hilton’s website or app.

However, if you don’t care about earning Hilton points and would rather earn Etihad miles, or if the hotel you choose isn’t part of a chain that you want to earn points or loyalty privileges with, booking on this platform could be an easy way to earn Etihad miles.

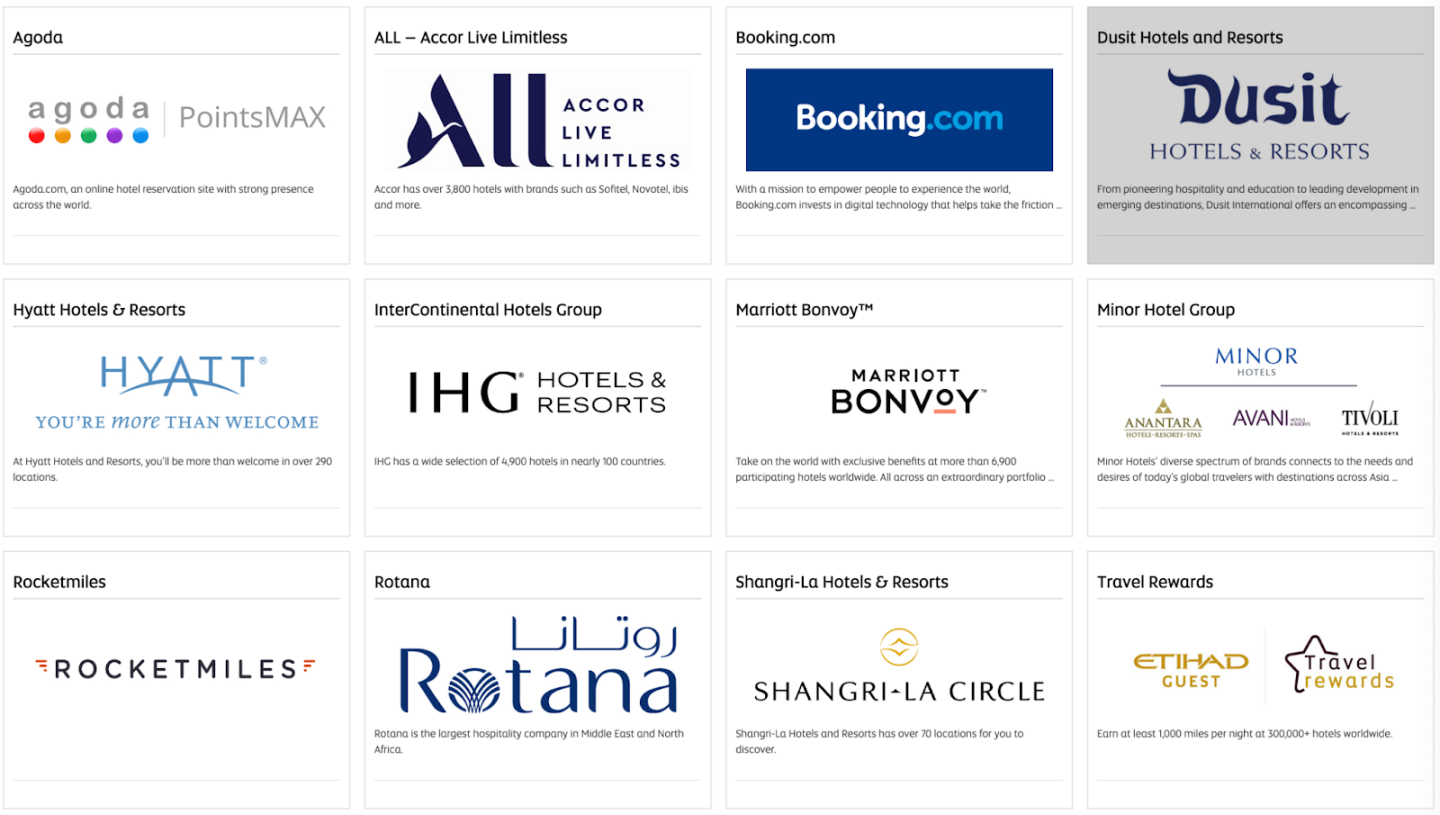

Earn Etihad miles with specific hotels

Etihad is also partnered with some hotels and online travel agencies (OTAs), allowing you to earn Etihad miles on your bookings. Current partners include Hyatt, IHG, Marriott, Booking.com and more.

Each program has a different earn rate so you’ll want to do the math to figure out if booking makes sense. Some of these programs also allow you to convert your hotel points to Etihad.

For example, you can earn 500 Etihad miles for each qualifying hotel stay at an IHG property. In addition, you can also convert IHG One Rewards points to Etihad miles at a rate of 10,000 IHG points = 2,000 Etihad miles.

Earn Etihad miles for renting a car with Avis or Budget

You can also earn Etihad miles when you book a car rental with Avis or Budget . Both programs allow you to earn up to 5 Etihad miles per $1 spent and up to a 5,000 mile bonus on your first rental. The earn rate and bonus amount depends on your Etihad status tier.

When reserving with Avis, you can pick up an extra 1,000 Etihad miles if you sign up for Avis Preferred.

» Learn more: The best car rental company

Earn Etihad miles for shopping online

You can earn bonus miles when you shop with Etihad’s shopping partners . The stores include a luxury jewelry store, an optical shop and a global community membership.

Buy Etihad miles

You also can buy Etihad guest miles on Etihad’s website. You can buy up to 100,000 miles per year unless you are a Platinum elite, in which case you can buy up to 150,000 miles. However, buying miles is generally not a good idea.

You'll pay 2 cents per mile when buying miles, which is quite expensive. The smallest increment for purchase is 1,000 miles, which will cost $20. However, if you’re a few thousand miles short of a valuable award ticket, a miles purchase could make sense.

» Learn more: Is buying miles worth it?

There are a few important things to know when redeeming Etihad Guest miles for maximum value. If you’re trying to redeem an award ticket with Etihad, American Airlines, SriLankan Airlines or Virgin Australia, you can use the Etihad guest miles r e d e m p t i o n calculator to help you find out the cost of your redemption.

On Etihad flights

Etihad allows award redemptions in economy, business and first class. All redemptions are according to Etihad’s distance based award chart, with award prices starting at the rates shown below.

So for a flight from Chicago-O'Hare to Abu Dhabi (AUD), which is nearly 7,300 miles, the price of your award ticket would start at 60,000 miles for economy, 110,000 miles for business class and 220,000 miles for first class.

On partner flights

Etihad isn't part of the three major airline alliances. However, it does have a long list of partner airlines, which makes it possible to use your miles to fly to almost anywhere in the world. The airline has a partner award chart that it uses for travel on all its partners:

Just like its own award chart, the partner award chart is also distance based. As you expect, with a distance-based award chart, it often takes a bit of legwork to find which partner offers the best value when it comes to redemptions.

To book an award flight on one of Etihad’s partners, you may have luck booking the award flight online. However, you may need to call Etihad’s guest service center if you don’t see the airline listed that you’re trying to book. Similar to other airline programs, this can be a hit-or-miss experience.

There are some exceptional sweet spots that you’ll want to be aware of when redeeming Etihad Guest miles. These include:

Prague to Seoul in business class for 25,610 miles one way.

U.S. East Coast to Brussels in business class for 44,000 miles one way.

U.S. East Coast to Morocco (and potentially continue on to Europe) in business class for 44,000 miles one way.

Other redemption options

Upgrade with miles: You can use your Etihad miles to upgrade your ticket to first or business class.

Etihad holidays: Use your miles to book a complete holiday package, in partnership with over 300,000 hotels worldwide.

Shopping: You can spend miles through Etihad’s shopping portal, but we generally don’t recommend this as you get less value per mile than if you redeemed miles on flights.

Pay for hotels and car rentals: Redeem miles to book a hotel stay or car rental.

» Learn more: Unexpected sweet spots for international airline award programs

Although Etihad Airways may not be a household name for the average U.S.-based flyer, it’s still worth considering if you’re looking to maximize your credit card rewards points.

You can use Guest Miles to book tickets with Etihad partners and given that the program is a transfer partner of three major credit card rewards programs , it’s considerably easy to acquire enough miles to book an award flight.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

These are the best bank account features for travelers

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn LinkedIn

- Share this article via email Email

- • Consumer banking

- • Personal finance

- Connect with Marcos Cabello on Twitter Twitter

- Connect with Marcos Cabello on LinkedIn LinkedIn

- • Budgeting

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Here is a list of our banking partners .

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Our writers and editors used an in-house natural language generation platform to assist with portions of this article, allowing them to focus on adding information that is uniquely helpful. The article was reviewed, fact-checked and edited by our editorial staff prior to publication.

Traveling can be an exciting and enriching experience, but it also comes with its share of challenges, especially when it comes to the financial aspect of your trip. You want to ensure you’re not wasting funds on fees, saving money where you can and keeping your money safe while traveling .

Whether you’re a frequent flyer or planning your first overseas trip, the right bank account features can make a world of difference to your travel experience. From wide ATM access and no foreign transaction fees to earning rewards for travel, here are some of the best bank account features to look out for if you’re a traveler.

Key takeaways

- The right bank account features can make a big difference for travelers, including access to ATMs with no fees and wide global coverage.

- Accounts that don't charge foreign transaction fees on debit card purchases can help you save money when traveling abroad.

- Other important bank account features for travelers include free wire transfers, favorable foreign currency exchange rates, solid customer service and rewards for travel expenses.

Best bank account features for travelers

Wide atm access, no fees and atm reimbursements.

Credit cards are often preferred by travelers over debit cards in circumstances where the credit card offers zero-liability protection, quick ability to dispute charges and other consumer protections. However, if you prefer to use a debit card and utilize ATMs, you’ll want to ensure access and minimal fees.

Whether you’re traveling domestically or internationally, the last thing you want to worry about is finding an ATM that accepts your debit card. Banks with wide international ATM access can take that worry off your plate. Certain banks offer free ATM access worldwide, with some even reimbursing any ATM fees you might incur.

Even once you’ve found an ATM that will accept your debit card, you’ll want to temper the amount you’re paying in ATM fees, especially when you’re traveling internationally. The average ATM fee is $4.77, according to Bankrate’s 2024 Checking Account Survey .

Banks like Betterment, Charles Schwab, Capital One, Alliant Credit Union and USAA are star performers when it comes to minimizing the costs associated with ATM usage. These financial institutions either don’t charge ATM fees or reimburse you for any fees incurred during your transaction up to certain amounts, making them an ideal choice for travelers.

No foreign transaction fees on debit card purchases

A foreign transaction fee is a surcharge on your credit or debit card when you complete a transaction in a currency other than the U.S. dollar, or when you make a purchase that passes through a foreign bank. As with ATM fees, shelling out on these surcharges more than necessary can make your trip more expensive. Typically, a foreign transaction fee ranges from 1 to 3 percent of a purchase. While it may seem like a small percentage, this can quickly add up on your trip and end up costing you more than you might think.

Certain banks offer debit cards that don’t charge foreign transaction fees under certain circumstances, including Betterment, Charles Schwab, Capital One and Discover Bank. This feature is incredibly beneficial for travelers, as it means you can make purchases abroad without worrying about extra charges.

Free international and domestic wire transfers

If you need to quickly send or receive money while traveling, you may consider doing a wire transfer. Free wire transfers can save you a significant amount of money, especially when you consider that traditional wire transfers can come with fees costing up to $50 per transaction. Banks like Citibank, Chase and CIT Bank offer free international and/or domestic wire transfers under certain conditions, offering significant cost savings and the convenience of quickly and securely moving funds between accounts.

Foreign currency exchange at a good rate

Finding a good foreign currency exchange rate is crucial as it directly impacts the cost of goods and services purchased abroad. A favorable exchange rate means you get more foreign currency for your money, making your expenses lower when traveling or shopping internationally. Therefore, getting a good exchange rate can lead to significant savings and better financial outcomes for travelers.

Travelers looking for good rates on foreign currency exchange should consider local banks, credit unions and major banks like Chase and Bank of America . These institutions often offer the best rates and the lowest fees, with the added convenience of having ATMs overseas, and even options to conduct transactions online or have the currency mailed to you.

Rewards for travel

When it comes to earning points, miles and cash back for travel, credit cards are perhaps the best known financial product. But there are some checking and savings accounts that earn these perks, too. So, if you plan on using your debit card to pay for flights, dining or lodging, finding an account with perks that puts your spending to use is important. These rewards can help offset your travel expenses, making your next trip even more affordable.

Some checking accounts offering points, miles and cash back for travel include Discover, Quontic Bank and American Express.

Great customer support, easy online banking and intuitive mobile apps

Having accessible, responsive customer service is crucial when you’re traveling, especially if you encounter any issues with your account. Of note, banks and credit unions with 24/7 customer support, online chat and toll-free service numbers are immensely helpful.

Some banks that offer 24/7 customer support include Ally, Discover and American Express.

In addition to good customer support, having an easily accessible online banking platform or mobile app to check your accounts on the go is a must for any traveler. In particular, mobile apps that send alerts to your phone for suspected fraud and low balances can be immensely helpful.

Alerts for suspected fraud in particular are essential, especially when traveling internationally, as folks with bad intentions don’t necessarily need your physical card to commit fraud.

“I received an alert from Chase that someone had tried to use my credit card while I was on a trip,” said Karen Bennett, a senior writer at Bankrate. “My credit card was still safely tucked in my wallet, but the person attempted to charge several thousand dollars at a resort that was hours away from where I was actually vacationing. I was grateful their fraud protection prevented the charge from going through, and Chase canceled that card and sent me a new one.”

Other features that could be helpful include the ability to easily lock and unlock your debit card in the event you lose it, quickly dispute charges and being able to easily notify your bank of upcoming travel plans.

When looking for a bank or credit union with good customer support and easy online banking, you may benefit from checking various J.D. Power studies that outline customer satisfaction on these topics among banks. Additionally, user reviews within the Apple App and Google Play stores can help you discern a good mobile app from a bad one.

Easy way to save for your next trip

With the right bank account, saving for your next adventure can be a breeze. Look for accounts with competitive annual percentage yields (APYs), minimal fees and features like automatic savings to help your travel fund grow.

Some bank accounts, like Ally’s savings account , feature a system where you can create multiple savings buckets, depending on your goal. With a feature like this, you can compartmentalize your savings into different categories, including travel, and you may even be able to automate how much money goes into each bucket every pay period.

Bottom Line

Traveling can be a costly endeavor, but don’t let the financial barriers hold you back from exploring the world. With the right bank account features — including little to no ATM or foreign transaction fees — you can save money and have a more enjoyable trip. Additionally, having 24/7 customer support, easy online banking and features like automatic savings can make saving for your next trip even easier.

Related Articles

What is a checking account?

The best places to save your money: Money market accounts, savings accounts and CDs

Best mobile banking features of 2024

Best travel credit cards for people with bad or fair credit

I fly dozens of times a year. Chase's new lounges are a game changer — and don't require a first-class ticket.

- My Chase Sapphire Reserve credit card gives me access to airport lounges around the world.

- Most are part of the Priority Pass network, but new Chase-branded ones have joined the lineup.

- Chase's New York locations are cozy, modern, and can be enjoyed by economy-class passengers — regardless of airline.

As an avid traveler who traverses the Atlantic at least a dozen times a year and flies mostly in economy , one of my biggest comforts is airport lounge access.

I have a Priority Pass membership through my Chase Sapphire Reserve credit card . It costs me $550 yearly and provides access to hundreds of lounges worldwide.

Many of these offer free food and drinks (including alcohol), while some offer complimentary showers. A rare few also provide beds and swimming pools .

Most lounges are owned by airlines, requiring a ticket on that specific carrier, or independent service providers with their own membership networks, like Priority Pass , which many credit cards provide access to.

But a new crop of lounges has popped up in recent years sponsored by banks and credit card issuers. American Express leads the pack with its more than two dozen global Centurion Lounge locations, and Chase is now opening its own branded airport spaces.

I recently visited the Chase Sapphire Lounge by The Club locations at New York's John F. Kennedy and LaGuardia airports. I think Chase has created a well-balanced pre-flight experience — and I like that you don't need airline status or a business-class ticket to access it.

There are five Chase locations in the US and one overseas.

According to Chase, it has two "Club" locations in New York (the JFK one is partnered with Etihad), one in Boston, and one in Hong Kong.

Reserve cardholders can also use the other Chase-partnered Etihad Lounge at Washington Dulles International Airport and the "Sapphire Terrace" in Austin.

Chase plans to also open locations in Los Angeles, Las Vegas, Philadelphia, Phoenix, and San Diego.

I get unlimited access, but there's also the option to pay.

For years, Chase has offered Priority Pass as a perk of one of its highest-tier credit cards. This means people can access myriad global lounges owned by service providers, airlines, and, now, Chase. Air France, Lufthansa, Turkish Airlines, Virgin Atlantic Airways , Korean Air, and Air India are all part of the network at JFK, for example.

Chase Sapphire Reserve cardholders like myself get unlimited access to the bank's "Club" lounges, and they can be visited regardless of which airline you're flying.

Travelers in any cabin can also purchase access. People with Priority Pass not through Chase can access the locations once, with subsequent visits costing $75.

I was stoked to use both NYC locations for the first time this year.

Chase's NYC lounge spaces opened in January. The latter two compete with AMEX's ever-popular Centurion lounges operating at both airports. Capital One also has lounges in Dallas-Fort Worth, Denver, and Washington Dulles, with one also planned for JFK.

Chase's New York-JFK location is in Terminal 4. Travelers from other terminals can't access it without clearing security again, so it's most suitable for those flying on carriers operating there, like Delta Air Lines and its Skyteam partners.

Chase's LaGuardia location is in Terminal B. This means passengers on almost every US airline except Delta and Spirit, which operate out of Terminal C and A, respectively, can access it.

Neither is over-the-top luxurious, but they are cozy with all the needed amenities.

Many mainline carriers have created airport lounges with extravagant amenities, such as huge chandeliers and full restaurants. Think Delta's new business-class-only space at JFK and United Airlines' Polaris lounge at Washington Dulles, for example.

Chase's lounges are more low-key, with simple but aesthetically pleasing decor, like greenery and velvet couches. I liked that nothing was too bright or flashy and that they still offered freebies like food and alcohol.

The LaGuardia lounge is much bigger than Chase's JFK location.

Both Chase lounges have a bar, seating, and a buffet, but their main difference is their size.

At LaGuardia, passengers can enjoy a two-story lounge complete with several rooms and games. Amenities like rest pods and facial treatments are also available, and guests can book a private " Retreat Suite " for a fee. It comes with a shower and concierge, among other perks.

The JFK space was much smaller by comparison, but the cozy lounge overlooking the ramp still had everything I needed to relax before a long-haul flight.

I liked the quiet space upstairs at LaGuardia.

The second level at LaGuardia featured a few open spaces, a help desk, and a drink station with coffee and other beverages.

It'd be perfect for getting work done.

LaGuardia's also has an arcade and a kids playroom.

Tucked away in the LaGuardia lounge is a retro-themed arcade with a pinball machine and shuffleboard. There were also vinal records, a jukebox, and other random oldies decor.

There were plenty of good food and drink options.

I visited both lounges during the morning and was happy to find many breakfast options, including eggs, bacon, potatoes, fruit, and coffee.

The food at both locations tasted fresh, not pre-packaged or frozen, as I've found at other Priority Pass lounges.

I enjoyed the a-la-carte meals, too.

I had a salmon egg Benedict and breakfast bao at JFK and an egg omelette at LaGuardia.

Other menu options included egg polenta and a tofu spinach wrap, among other options.

The JFK lounge has free showers.

I liked the showers at the JFK location, which can come in handy between long flights. The LaGuardia location did not have the same free perk, but customers could access one by paying for one of the Retreat Suites.

LGA isn't a long-haul hub, so I can imagine showering isn't as much of a priority.

Like its sister lounge, Chase at JFK also has a cozy fireplace and a bar.

Despite its smaller size, JFK has plenty of seating options for relaxing or working — and I think it's the best Priority Pass option at the airport.

The other Priority Pass lounges at Terminal 4 include Virgin Atlantic and Air Inda's business lounges and the independent Primeclass Lounge. In my experience, the airline options can get crowded, while the Chase location was more tame, and I thought the food was easily better.

The Chase Lounge at LaGuardia is the only Priority Pass option at that airport. Otherwise, AMEX is next door at Terminal B, and Delta has SkyClubs in Terminal C.

The JFK location offers the best views.

Unlike the LaGuardia location, Chase's JFK spot overlooks the tarmac.

I love sitting by the window with a coffee and watching planes before an early-morning flight.

I'm thrilled to have reliable lounges to look forward to in NYC.

Priority Pass is ideal for me as it doesn't require on airline status , and I can justify $550 a year for almost guaranteed lounge access at airports worldwide (which is really $250 once you factor in the $300 annual travel credit).

Granted, some airports (like Newark Liberty and previously LaGuardia) don't have any Priority Pass options, while many of the lounges that do exist have few or poor food options. Further, the airline-owned ones can often get so overcrowded that they restrict Priority Pass members from entering.

However, Chase joining the lineup with branded lounges at my two home airports means I now have solid, reliable options I know will be available and comfortable with good food — and I can enjoy unlimited access with even a basic economy ticket.

Hopefully Chase can quickly add more locations to better compete with Amex.

Amex pioneered credit card-sponsored airport lounges and has a strong customer base. Its sprawling Centurion locations make it much more accessible than Chase's smaller network, plus cardholders can also visit hundreds of airline and independent lounges, including Delta's SkyClubs.

There are many reasons to invest in an Amex card, but I hesitate because of the pricier $695 annual fee; plus, I'm a longtime Chase customer and prefer Visa for international travel.

As it's unlikely I'd pay over $1,000 to have both Chase and Amex, I'm hoping Chase can quickly catch up. Its nearly a dozen existing and planned locations are a good start.

- Main content

COMMENTS

Etihad Airways: Don't use Travel Bank Account/Etihad Credit - FRAUD - See 19,280 traveler reviews, 6,446 candid photos, and great deals for Etihad Airways, at Tripadvisor.

Start earning miles with our award-winning programme that rewards you with free flights, upgrades, gifts and so much more. Join today and receive 500 bonus miles on your first flight.

Etihad Airways: Book a flight ticket using Travel Bank Account. - See 19,270 traveler reviews, 6,443 candid photos, and great deals for Etihad Airways, at Tripadvisor.

Travel Bank If you've opted for Etihad Credit, we'll add the value of your credit to a Travel Bank account, which you can use to pay for flights, upgrades and extras.

Etihad Airways: Travel Bank Account is Fraud - See 19,153 traveller reviews, 6,415 candid photos, and great deals for Etihad Airways, at Tripadvisor.

Etihad Airways: Etihad travel bank account is cheating - See 19,213 traveler reviews, 6,427 candid photos, and great deals for Etihad Airways, at Tripadvisor.

Travel Bank is an account that allows Etihad Airways guests to hold multiple credits in one account to use towards future bookings.

Etihad Guest is one of the most powerful airline loyalty programs. Here's how to earn and redeem miles by flying, staying at hotels and using U.S. credit cards.

Etihad Airways | Etihad Guest - Will the travel bank date be extended? - I have $10k in the travel bank but expiring on May 31. If the pandemic is still raging at that point and I can't make a new booking, will they cancel the credit, or are there plans to extend the dates given the situation, eg by 6 months?

Etihad Guest Visa card Kindly note Choose your benefits now or they close within 30 days View and compare your benefits

Travel Bank Use your Travel Bank account to pay for flights with us or have Etihad Credit added to your account.

Use your Travel Bank account to pay for flights, upgrades and extras. You can even use Travel Bank to reserve an extra legroom seat in Economy Space. Simply call us to book or email [email protected] to check the balance of your account.

This UAE-based airline's miles are easy to earn, and its partners offer great redemptions. Here's what to know about the Etihad Guest loyalty program.

Etihad Airways' loyalty program, Etihad Guest, is an underdog in the points and miles world. Because the airline is based outside the U.S. and doesn't offer a credit card for U.S. residents, the ...

Etihad Travel Bank Credit Hi Everyone. Hope you are well and keeping safe. On the 7th May I have submitted my cancellation request for Etihad flight of 2nd July, which Etihad would offer the credit back in the form of Travel Bank. However, up until now, I still have not receive any confirmation or anything from them.

Etihad Airways: ETIHAD TRAVEL BANK, TRICK OR TRIP ? - See 19,269 traveler reviews, 6,443 candid photos, and great deals for Etihad Airways, at Tripadvisor.

Etihad Airways is ranked 34 among 221 companies in the Airlines and Air Travel category. #32 WestJet Airlines #33 LastMinute.com #34 Etihad Airways #35 Virgin Atlantic Airways #36 Aeromexico. Consumer complaints and reviews about Etihad Airways. Travel bank refund. Airlines and Air Travel.

Look for accounts with competitive annual percentage yields (APYs), minimal fees and features like automatic savings to help your travel fund grow. Some bank accounts, like Ally's savings ...

Etihad Airways: Travel Bank Account is Fraud - See 19,264 traveler reviews, 6,439 candid photos, and great deals for Etihad Airways, at Tripadvisor.

My Chase Sapphire Reserve credit card gives me access to airport lounges around the world. Most are part of the Priority Pass network, but new Chase-branded ones have joined the lineup. Chase's ...