Activate Your Post Office Travel Card: How to Do It Right

Are you looking to activate your Post Office Travel Card and not sure where to start? Don’t worry, I’ve got you covered! With a few simple steps, you’ll have your travel card up and running in no time – the perfect way to take control of your finances on holiday. In this article, I’m going to be sharing my personal experience with activating post office travel cards so that YOU can get it right first time around.

We will look at everything from understanding when you need the card and how long it takes for activation, what documents are required during the process, as well as security precautions that help protect against fraud attempts. By the end of this article, you will possess a complete knowledge base on how to activate your Post Office Travel Card securely and easily! So let’s get started – put all worries aside- we’re here for a smooth ride!

Understanding the Activation Process for Your Post Office Travel Card

So, you’ve just received your brand new Post Office Travel Card and now you’re itching to start using it for all your globetrotting adventures. But hold on a second! Before you can start swiping away, there’s one crucial step you need to complete: the activation process.

To activate your card, simply visit the official Post Office website and look for the activation section. Once there, you’ll be prompted to enter some basic information such as your card number and personal details. Don’t worry, this is just a standard security measure to ensure that only you are able to activate and use the card.

Once you’ve entered all the required information, hit that “Activate” button – like giving life to Frankenstein’s monster but without any of the scary stuff – and voila! Your Post Office Travel Card is now officially activated and ready for action.

Now let’s dive into why this activation process is so important. You see, by activating your travel card, you are essentially linking it to your own personal identity. This allows the Post Office system to recognize who owns the card whenever it is being used. It also adds an extra layer of security in case anything fishy happens with your account or if someone tries to use your card without permission (naughty naughty!).

But wait, there’s more! Activating your travel card also unlocks a whole range of convenient features that make managing your finances while abroad a breeze. With an activated travel card in hand (or wallet), not only can you safely store multiple currencies on one single card – say goodbye to juggling different banknotes – but you can also easily reload funds onto it whenever needed using various methods such as online top-ups or even at selected post office branches.

So remember folks: don’t forget about activating that shiny new travel card before jetting off into uncharted territories. Not only will it provide peace of mind knowing that unauthorized usage won’t be a problem, but it will also make your travel experience more seamless and enjoyable. Happy travels!

Why Should You Activate Your Post Office Travel Card?

Heading: Why Should You Activate Your Post Office Travel Card?

Paragraph 1: So, you’ve recently acquired a shiny new Post Office Travel Card. Congratulations! But now the big question looms over you like a rain cloud on a sunny day – should you activate it? And if so, what’s in it for you? Well, my friend, let me enlighten you. Activating your travel card is like unlocking an entire world of convenience and security. With just a few simple clicks or phone calls, you can ensure that your travels will be smooth sailing from start to finish.

Paragraph 2: First and foremost, activating your travel card means saying goodbye to the cumbersome task of carrying heaps of cash wherever you go. Picture this: strolling through the vibrant streets of Paris with nothing more than a sleek card tucked safely in your pocket. No more fumbling around for loose change or worrying about pickpockets targeting unsuspecting tourists. By activating your travel card, you gain peace of mind knowing that your money is secure and accessible whenever and wherever adventure takes you.

But wait… there’s more! **Bold tag** *By activating your Post Office Travel Card*, *you also unlock exclusive perks*. Imagine skipping those long queues at currency exchange offices when arriving in foreign lands. With just one swipe (or tap), foreign currencies are magically transformed into spending power at local stores and restaurants. Plus, no transaction fees abroad! That means no surprise charges nibbling away at your hard-earned vacation budget while indulging in gelato under the Tuscan sun or sipping margaritas on pristine Mexican beaches.

Paragraph 3: Last but certainly not least, once activated; this versatile little gem doubles as a backup plan if disaster strikes during transit *including loss or theft*. Misplaced baggage? Delayed flights leaving you stranded without funds? Fear not! Thanks to activation magic – err I mean technology – contacting customer service is a breeze, and they can quickly freeze your card to prevent any unauthorized transactions. No more panicking in foreign lands, desperately trying to communicate with perplexed locals while frantically searching for an ATM.

So, dear traveler, it’s clear as crystal: activating your Post Office Travel Card opens up a world of convenience, security, and exclusive perks. Say goodbye to worrying about cash or unexpected fees and hello to stress-free adventures. Embrace the magic of activation and let the journey begin!

Getting to Know Your Post Office Travel Card: A Comprehensive Overview

So, you’ve decided to get yourself a Post Office Travel Card? Wise choice, my friend! This little piece of plastic is an absolute lifesaver when it comes to jetting off on your adventures. But before you start swiping away like there’s no tomorrow, let me give you the lowdown on everything you need to know about this nifty travel companion.

First things first, let’s talk about what exactly a Post Office Travel Card is. It’s essentially a prepaid card that allows you to load money onto it and use it just like any other debit or credit card while abroad. The beauty of this bad boy is that it saves you from carrying wads of cash around with you everywhere. Plus, with its chip and pin technology, your transactions are secure as Fort Knox!

Now let me break down the perks for ya:

1. **Spend in Multiple Currencies:** One of the best things about the Post Office Travel Card is that it can hold up to 13 different currencies all at once! So whether you’re sipping espresso in Rome or munching on sushi in Tokyo, this trusty card has got your back.

2. **Lock in Exchange Rates:** Picture this: You exchange your hard-earned cash for foreign currency at today’s rate and then boom – next week the rates skyrocket! Well fear not because with this magical travel card, once you load up your funds, the exchange rate locks in place so there are no nasty surprises later.

3. **Top Up On-the-Go:** Forgot to load enough moolah onto your card? No worries! With online and mobile app access available 24/7, topping up your funds whenever and wherever couldn’t be easier – even if that means doing it from under a palm tree by the beach!

So there you have it – a comprehensive overview of why getting yourself a Post Office Travel Card is an absolute game-changer for any globetrotter. Say goodbye to fumbling for cash, worrying about exchange rates, and hello to a stress-free travel experience. Now go forth and explore the world with this little pocket rocket by your side!

A late Apple convert, Dom has spent countless hours determining the best way to increase productivity using apps and shortcuts. When he's not on his Macbook, you can find him serving as Dungeon Master in local D&D meetups.

Read more from Dom

How to Cancel Your OurTime Subscription: A Step-by-Step Guide

Solving the netflix error m7083-2107: a step-by-step guide, leave a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Apps UK International House 12 Constance Street London, E16 2DQ

Privacy Policy

Suggested companies

Post Office Travel Money Card Reviews

Visit this website

Company activity See all

Write a review

Reviews 3.8.

Most relevant

Ease of use, flexible choice of currencies.

I love how easy this card is to set up, top up, and generally manage. The app is easily accessible, and you can view your pin and freeze the card in an instant. I loved that I could go into a post office in the UK with cash and pay it directly to the card as well. Super easy. I used it in Tenerife this September (2024), and it was accepted at every place I went. I used it in bars, restaurants, cafes, shops and supermarkets, and never had a problem at all. You can use chip and pin or as contactless. We will definitely be using it again.

Date of experience : September 27, 2024

Reply from Post Office Travel Money Card

Hi Karen, Thank you for your great review and feedback, it really helps us. It’s really good to hear that you found the app easy to use and had great features, glad to hear you will be using the card again and you are enjoying your Travel Money Card - Margaret

I have used the Post Office travel card many times

I have used the Post Office travel card succesfully for the past yearsand have always been very pleased with it.This year however having topped it up with curency my first two transanctions were declined.on contacting the help line it was found that my card had expired 12/2023.I did not realise that the card was date sensitive,but if it is why did it allow me to put funds on it,or why was a new card not sent out?ps. the helpline was brilliant,cant fault them.

Date of experience : September 03, 2024

Hi Richard - Thank you for your review, we’re sorry to read that the Travel Money Card hasn’t met with your expectations on this occasion, we would like to understand more so we can help resolve this. Could you call us at 0207 937 0280 or email us at [email protected] - Margaret

Poor thinking Post Office!!

When you want to travel abroad without having to carry cash a pre-loaded card seems to be the ideal choice. However, from where would you usually source your funds from? Your Bank account would seem to be the 1st obvious choice. BUT why can you only top up your card by means of a Credit card!! Bank DEBIT cards cannot be used!!! How inflexible, how poor customer service, how stupid!!!!! So you have to incur possible interest charges on your Credit card! NOT a clever idea!

Date of experience : September 23, 2024

Hi Jeremy, thank you for your review. We do allow the Travel Money Card to be topped up with a debit card, our app may sometimes display "Add Credit Card" only, but this is something we are looking to update as you can use a debit card to top up on the app, website and in branch. Thank you again for your feedback, apologies for any inconvenience and we will ensure this is passed over to the relevant teams.

Helpful customer service staff

Helpful customer service staff Card is easy to set up and run with the app and worked perfectly abroad - I was confident with using it

Date of experience : September 21, 2024

Hi Suzanne! Thank you for your great review and feedback, it really helps us. It’s really good to hear that you are enjoying your Travel Money Card. - Shannon

Brilliant service from going into post…

Brilliant service from going into post office where the lady behind the counter explained how it works & help both myself & my partner get the money onto the card as well as helping us put the post office app on our phones so everything was at hand

Date of experience : September 07, 2024

Hi Craig, thank you so much for your great feedback!

This card would not work on the toll…

This card would not work on the toll roads A7 in Spain also it was rejected in three restaurants in Estapona Spain. Very disappointed.

Hi Peter, thank you for your review. We are sorry to hear this. Please can you either contact us on 0344 335 0109, or email us at [email protected] so we can look into this and advise further. Thank you.

Like the fact that I can add funds to…

Like the fact that I can add funds to use in other countries, without huge bank charges. But cannot use the app on my iPhone or iPad. This makes it a bit more difficult to keep track of money on my card whilst abroad.

Date of experience : September 16, 2024

Hi Carol. Great to hear you enjoyed using your Post Office Travel Money card and I apologise if the app wasn't working properly for yourself. If you would like us to look at this in more detail with the view to getting your app up and running, can you call us on 0344 335 0109 and one of our agents will help troubleshoot the issue. - Stephen

Really useful plus competitive rates

Needed a Euro card for a holiday as we didn't want to carry much cash. The PO Money card was easy to order online and the rate was competitive. We got one each and downloaded the app which told us exactly how much we were spending and where - and what was left. Unlike other cards I've had, we had the option to change back to £ (or any other currency) using the app and we can carry on spending at home.

Date of experience : September 05, 2024

Hi Caroline, thank you for your review and great feedback!

Useless. Waste of time.

Got the card at local PO, loaded small amount of money onto it. Downloaded app. Activated card. Every attempt to load funds (from different cards) since then has failed and triggered security issues with my bank, resulting in my credit card being suspended. Waste of my time on the phone to bank and PO. Useless. I certainly won't risk trying to use the PO Money card abroad with the funds already on it.

Date of experience : September 18, 2024

Thank you for your review, were sorry to read that the Travel Money Card hasn’t met with your expectations on this occasion, we would like to understand more so we can help resolve this. Could you call us at 0207 937 0208 or email us at [email protected], Thanks, - Rhys

Wasn’t able to change the PIN on this card, only two places abroad I was able to use it, couldn’t draw money out on it abroad, said my PIN was invalid even though I was using the one shown on my app. Local post office hopeless at sorting it out. Have withdrawn all funds and cancelled card.

Date of experience : September 09, 2024

Wasn’t made aware by counter staff…

Wasn’t made aware by counter staff before I bought the card about the commission charges for topping up so I haven’t used it & wouldn’t have bought it had it been made clear.

Date of experience : September 20, 2024

Hi Andrew, really sorry to hear this. Could you please send an email to [email protected] quoting reference 34861979, confirming your full name, contact details and some information about your in branch experience? We'd like to get this over to our Customer Complaints team to look into and respond.

I've had good use out of the card and I…

I've had good use out of the card and I was sent a new one in the post when it expired. However, my son has one that has expired and he was not sent a replacement. He is now being charged two pounds per month with no communication from the post office. How can he renew it? We looked on the app but there is no option for this.

Hi Bill, sorry to hear this. As stated in the Terms and Conditions we charge a £2 maintenance fee a year after expiry. Please can your son give us a call using the number on the back of his card to resolve this. Thank you

The card is great to use anywhere. Very accessible and easy to use. I didn't carry any currency with me. I just topped up the card as necessary.

Hi Joan, thank you very much for your review!

Highly recommended

Very practical debit card to use abroad and pay in local currency and avoid costly foreign currency transaction fees applied by credit cards. Checking balances & topping up using the app is a breeze. Beware your bank may charge you interest / fee if you use your credit card for top-up. Highly recommended

Date of experience : September 08, 2024

Hi Alpaslan, Thank you for your great review and feedback, it really helps us. It’s really good to hear that you are enjoying your Travel Money Card. - Brooke

Highly recommend for an easy experience!

This was very easy and simple to set up. I had no problems at all using the card abroad with all shops, transport etc able to take the card! Will highly recommend it and I will be using it myself again for future holidays!

Date of experience : September 12, 2024

Hi Natasha, thank you so much for your review! We hope you enjoy any future holidays you may have planned!

I ordered my card but unfortunately it came when I was on holiday but never mind keeping for future holidays when I went onto app it cleared all information so rang advisor and was informed as what to do so problem was solved look forward to using it

Date of experience : September 26, 2024

Hi Felicity, thank you for your review!

Easy to apply for

Easy to apply for, quick delivery, app is very straightforward.

Hi Pat! Thank you for your great review and feedback, it really helps us. It’s really good to hear that you are enjoying your Travel Money Card. - Shannon

This was an easy set up.

This was easy to set up at the post office, information was provided and we used the card with the local currency at a good exchange rate

Date of experience : August 19, 2024

Hi there, thank you so much for your great review!

First time using, really easy to use, top up and keep a track of spending definitely recommend

Thank you for your great review and feedback, it really helps us. It’s really good to hear that you are enjoying your Travel Money Card. - Katie

Easy site to navigate It would have…

Easy site to navigate It would have been helpful if I could have ordered 3 cards at the same time but this did not appear to be possible. Travellers often like to spread their money for safety reasons.

Date of experience : September 11, 2024

Hi there, thank you for your review, and feedback!

- About Antique Wolrd

- Antique News

- Cards & Envelopes

The Post Office Travel Money Card Review: Key Features, Rates and Fees

If you’re heading overseas, a travel card could be a handy solution for covering your spending. They tend to be cheaper to use than your ordinary bank debit card, and can even offer better exchange rates compared to buying currency.

- Top 5 Best Bubble Mailers for Sports Cards

- Free birthday eCards

- Effortless Cardinal Order Express Login: Simplify Your Online Experience

- How Much Does PSA Grading Cost?

There are lots of travel cards out there, but here we’re going to focus on the Post Office Travel card. We’ll run through what it is and how it works, along with fees, exchange rates, supported currencies and how to apply for one.

You are watching: The Post Office Travel Money Card Review: Key Features, Rates and Fees

And while you’re comparing spending options ahead of your trip, make sure to check out the Wise card. This international card can be used in 175 countries worldwide, automatically converting your pounds to the local currency at the mid-market rate. There’s only a small fee to pay for the conversion¹, or it’s free if you already have the currency in your Wise account.

But for now, let’s focus on the Post Office travel card.

¹ Please see Terms of Use for your region or visit Wise Fees & Pricing: Only Pay for What You Use for the most up-to-date pricing and fee information.

What is the Post Office travel card?

The Post Office Travel card is a prepaid Mastercard that you can load up with up to 23 currencies. You can use it for spending and ATM withdrawals in over 200 countries, in 36 million locations².

Simply top up with your chosen currency before you travel, then spend overseas without needing to convert currency.

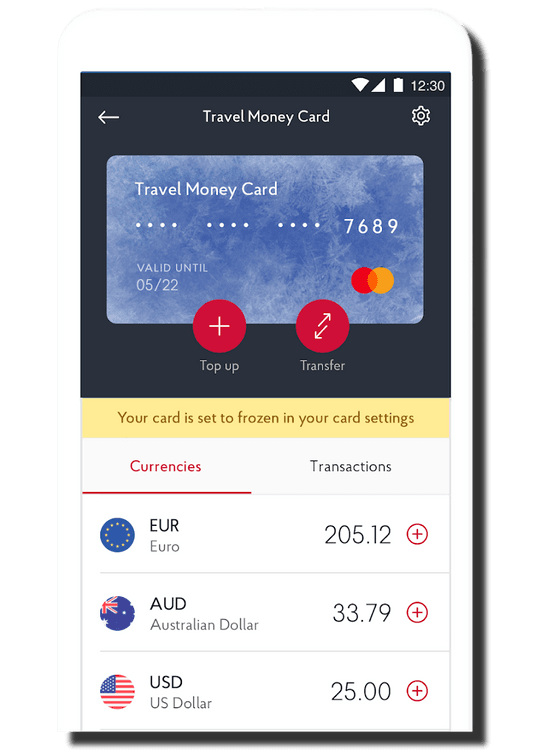

The card is contactless and can be managed using the Post Office Travel app.

Key features and benefits

Here’s your quick at-a-glance guide to the main features and benefits of the Post Office Travel card ²:

- Contactless for making fast and convenient low-value transactions

- Available with Google Pay and Apple Pay

- Manage, top up, transfer between currencies and freeze your card using the Travel app

- Reload whenever you need to, with up to 23 currencies available

- Can be used wherever Mastercard is accepted

- 24/7 call centre help is available if you need it

- Wallet-to-wallet feature – where you can transfer any leftover currency to a new currency of your choice

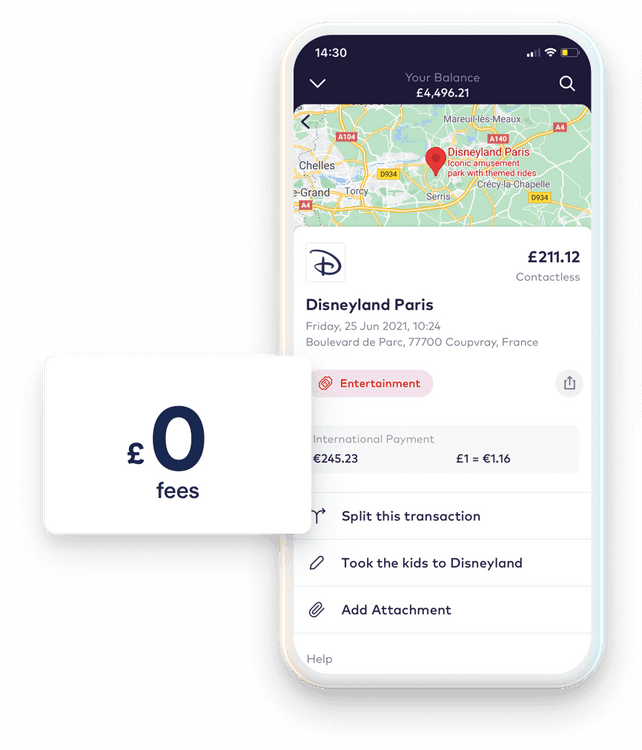

- No charges when you spend abroad using an available balance of a local currency supported by the card (although there are some fees to know about – we’ll look at those next).

Post Office travel card fees and charges

Post Office travel cards are free to order and there are no charges for paying retailers in the currencies held on your travel money card. So, you can spend in shops, bars and restaurants without any charge – as long as you’re paying with an available balance of a currency supported by the card².

If you do use your card in a country with a local currency that isn’t supported by the card, you’ll be charged a cross-border fee of 3%². For example, if you go to Brazil and use your card at a local restaurant, you’ll be charged the cross-border fee of 3% as Brazilian real isn’t supported by the card.

You’ll also be charged for withdrawing cash from any ATM, even in currencies supported by the card. These ATM fees vary depending on the currency used. For example ²:

- Euro – 2 EUR

- US Dollar – 2.5 USD

- Australian Dollar – 3 AUD

- Pound Sterling – 1.5 GBP + commission of 1.5%

- Swiss Franc – 2.5 CHF

- Canadian Dollar – 3 CAD.

One last thing to note on the subject of fees. All Post Office Travel cards are valid for up to 3 years. Exactly 12 months after your card expires, you’ll start to be charged a monthly maintenance fee of £2².

Here is also a list of the European countries that charge the highest ATM fees.

Exchange rates

The Post Office offers exchange rates that move up and down according to the demand for currencies. So, the exact amount of travel money you’ll receive on your travel card will depend on the rate at the time of your purchase.

You can check the Post Office exchange rates on its website, travel money card app and branches. Keep in mind though that rates may vary whether you’re buying online, via phone or in-store.

The Post Office exchange rate is also likely to include a margin or mark-up on the mid-market rate. This is the rate you’ll find on Google or currency sites like XE.com, and is generally considered to be a fair rate. A margin added on top of this makes the rate worse for you, so you’ll get less EUR, USD or whatever other currency you’re exchanging.

Read more : ‘Hallmark Postcard from a Family Member’ Virus

Wise only ever uses the mid-market exchange rate, with no mark-ups or margins. This means that your pounds go further, wherever you’re travelling to.

Currencies supported

You can load your Post Office prepaid travel card with funds in any of these 23 currencies²:

- EUR – Euro

- USD – US dollar

- AUD – Australian dollar

- AED – UAE dirham

- CAD – Canadian dollar

- CHF – Swiss franc

- CNY – Chinese yuan

- CZK – Czech koruna

- DKK – Danish kroner

- GBP – Pound sterling

- HKD – Hong Kong dollar

- HRK – Croatian kuna

- HUF – Hungarian forint

- JPY – Japanese yen

- NOK – Norwegian krone

- NZD – New Zealand dollar

- PLN – Polish zloty

- SAR – Saudi riyal

- SEK – Swedish kronor

- SGD – Singapore dollar

- THB – Thai baht

- TRY – Turkish lira

- ZAR – South African rand

You can top up your card with between £50 and £5,000 in any of the currencies listed above. The maximum you can hold is £10,000, plus you can load and spend up to £30,000 on your card each year².

Cash withdrawal limits vary from currency to currency. For example, you can withdraw a maximum of €450 euros or $500 US dollars² in a single transaction.

App overview

The Post Office Travel app is free to download from the Google Play and Apple App stores. You can use it to order and activate your card, monitor your balance and top up with currencies. Using the new wallet-to-wallet feature, you can also transfer leftover currency to other currencies of your choice in just a few taps.

You can also buy Post Office travel insurance, book airport parking and access other features through the app.

How good is the Post Office prepaid travel card?

The Post Office travel card is handy to have if you’re travelling and want to keep your money safe. You won’t need to carry cash around with you, or have to take time out of your trip to change currency.

Paying in local currencies is quick and easy, especially as it’s a contactless card. Plus, you can only spend what’s on it, so this can help you to budget.

As you can store 23 currencies on it, the card is convenient if you travel regularly or are taking multi-destination holidays. If you love visiting far-flung places, however, you might need a card that supports more currencies.

One drawback to consider is the exchange rate. While rates may be competitive (compared to changing money at the airport, for example), the Post Office is likely to include a margin or mark-up on the mid-market rate. There are also charges for using your card at an ATM.

So, it’s important to shop around and compare other travel money cards, as some could offer you a better deal.

Take the Wise card, for example. With this contactless international card, you can spend in 175 countries and manage over 50 currencies in your Wise account. There are no ATM fees¹ for withdrawing up to £200 a month (2 or less withdrawals) and you’ll get the mid-market exchange rate on every transaction. Note, that Wise will not charge you for these withdrawals, but some additional charges may occur from independent ATM networks.

The Wise card will automatically convert your money to the local currency at the mid-market rate when you spend, for just a small conversion fee¹.

How to get and use a Post Office travel card

You can only get a travel card from the Post Office if you’re aged over 18 and a resident of the UK.

Ordering your card

There are three ways to order a Post Office Travel card:

- Download the Post Office Travel app and place an order there.

- Apply online at the Post Office website.

- Pop into a local Post Office branch to apply for a card. You’ll need to take a form of photo ID with you, such as a passport or UK driving licence.

If you’re applying in a branch, you should be able to pick up your card there and then. For applications made online or in the app, you’ll need to wait 2-3 days for your card to be delivered.

Card activation

You’ll need to activate your travel card before you can use it.

Read more : Are Trading Cards Considered Media Mail?

You’ll be given instructions on how to do this in the welcome letter delivered along with your new card.

Using your card

You can use your Post Office travel card anywhere that accepts MasterCard, online and at ATMs³.

If you’re buying something in person, you’ll need to enter your PIN. If you’re in a country where Chip & PIN isn’t as widely available (such as the USA), you may be asked to sign to verify your purchase instead.

You can also make contactless payments for small amounts, although different countries have different rules and limits for this.

The Post Office’s terms and conditions list a handful of situations in which you shouldn’t use your card. These include the following³:

- Self-service petrol pumps

- Car hire or hotel check-in deposits

- Transactions on planes or cruise ships.

How to top up your card

The easiest way to top up your Post Office Travel card is using the app. If you prefer, you can also top up at the Post Office website or in a local branch³.

Buying back currencies

If you have unused currency on your card, there are a couple of options available. You may be able to withdraw it at a local Post Office branch or ATM, although fees may apply³.

Alternatively, you can use the new wallet-to-wallet feature in the app³. This lets you transfer unused balance in one currency over to another. For example, you can transfer unused USD to EUR, ready for your next trip to Europe.

How to contact the Post Office about your card

You can call the contact centre on 0344 335 0109 when you’re in the UK or +44 (0) 20 7937 0280 when you’re overseas³. Lines are open 24 hours a day, seven days a week.

You can also contact the Post Office Travel Card Customer Services department via the following methods³:

- By post at Post Office Travel card, PO Box 3232, Cumbernauld, G67 1YU

- By email at [email protected].

Post Office Travel Card: troubleshooting tips

Here’s how to deal with some common problems you might have with your travel card.

How do I report a lost or damaged card?

If you lose your Post Office currency card or discover that it’s damaged, just phone the contact centre. They’ll block it and send you another. You can also freeze your card using the app.

What should I do if my card is declined or blocked?

Firstly, check your account via the app to make sure you have enough money in it. If you have enough to pay for your item or have less than you should have in your account, call the contact centre.

What if I’ve forgotten my PIN?

If you can’t remember your travel money card PIN, phone the contact centre. They can issue you with a new one.

What happens when my card expires?

You should receive a new card automatically³. If it hasn’t arrived after the expiry date, call the contact centre and they’ll issue you with one.

And that’s pretty much it – everything you need to know about the Post Office Travel card. It’s handy if you don’t want to carry cash around or exchange currency while on holiday. And you can use it in multiple countries, as it supports 23 currencies. The app is another great feature, letting you top up and manage your money on the move.

But just remember to compare exchange rates and fees (especially for those all-important ATM withdrawals) before choosing a travel card for your trip – as you could be getting a better deal elsewhere.

Sources used:

- Wise – terms and conditions & pricing

- Post Office – Travel Money Card

- Post Office Travel card – Terms and Conditions

Source: https://antiquewolrd.com Categories: Cards & Envelopes

Join Lenon Blur

I am a JOIN LENON BLUR - world-leading expert, and I am the admin of Antiqueworld with many years of experience researching antiques and postal publications. I hope to provide the audience with the most accurate and informative information.

- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

Post Office Travel Card review

The Post Office Travel Card is a prepaid travel card you can load in cash or online, to switch to the currency you need for spending and withdrawals. It’s not linked to your regular bank account, and can be managed from your smartphone, for secure spending across 23 currencies.

Before you order a Post Office Travel Card check out this full review - we’ll look at what the card can do , how to order your card and how much it’ll cost .

And to help you compare we’ll also touch on Post Office Travel Card alternatives like Wise and Starling, which may offer cheaper and more flexible options for taking travel money abroad.

TL;DR - it's a solid prepaid card

- The card supports most major currencies for holidays, including Euros (Europe), Lira (Turkey) and UAE Dirhams (Dubai)

- Several top-up methods , with the option of doing so online or in-store

- Only convert what you want to spend; good for holiday budgeting

However, there are some downsides.

- There are better exchange rates available with other travel cards

- You'll get a worse exchange rate (a.k.a "buy-back rates") when converting leftover foreign currency to pounds

Find out more about the card on the Post Office website or click the button below to purchase a card. Order a card

Not sure yet? Continue reading to decide whether this is the right prepaid card for you.

What's in this guide?

What is the post office travel money card, how does it work.

- Fees & limits

How do I get a Post Office Travel Money Card?

What happens when the card expires, what are the alternatives.

The Post Office Travel Money Card is a prepaid card you can top up in cash or from your bank account, in any of 23 supported currencies.

Once you have funds on your card you can use it as you would a regular debit card, for contactless and mobile payments, and cash withdrawals. There’s no fee to spend currencies you hold on your card, although other transaction fees do apply depending on how you use the account.

Use your Post Office card to buy travel money before you head off on holiday, or top up as you go online.

As pictured, you can also manage, view and freeze your card in the Post Office app for security.

- Top up your card in cash at a Post Office or online by purchasing one of 23 different currencies

- If you choose to top up in GBP and convert later, you’ll be charged an administration fee of 1.5%, from a minimum of 3 GBP up to a maximum of 50 GBP

- Exchange rates are shown in the Post Office app, and may include a markup on the market exchange rate - but rates often improve if you top up more

- It’s free to spend currencies you hold. You can also spend unsupported currencies, but a foreign transaction fee of 3% will apply

It’s worth noting that the Post Office exchange rates are shown in the Post Office app before you convert your funds. They may include a markup, which is an extra fee added into the rate applied to switch to the currency you need.

Another thing worth noting is that the exchange rate gets better for higher top up amounts - meaning you’ll pay a smaller markup the more you add to your card.

Using a markup is pretty common but does make it tricky to see what you’re really paying for your foreign currency transactions.

Spending limits and card fees

Before you order a Post Office Travel Card it’s good to know a bit about the fees and limits that apply to card usage.

When you transact with your Post Office Travel Money Card, there are also fees to pay.

While these do vary slightly by currency, they’re roughly similar.

It’s easy to get your Post Office Travel Card online or in person by calling into a Post Office near you. Here’s what you’ll need to do.

- Head to the Post Office website

- Select "Order Your Card >"

- Top up in your preferred currency - there’s a minimum top up of 50 GBP, through to a maximum of 5,000 GBP

- Input personal details following the prompts

- Delivery of your card will take 2-3 days by post

- Head to your local Post Office branch

- Show a valid form of ID (driving licence, passport or EEA ID card)

- Apply in branch and load your card

The expiry date for your card will be printed on the back of the card - usually it’s valid for 3 years from the point you order it.

Once your card has expired you’ll pay a monthly inactivity fee of £2 per month if you don’t redeem your balance within 12 months of the card expiring. This fee continues until there’s no remaining balance, at which point your account will be closed.

If you’re not sure whether the Post Office Card is right for you, check out a few alternatives to see which gives you the best balance of cost and convenience.

The Wise card allows you to hold and exchange 50+ currencies, and spend in 170+ countries. It's a fully-fledged debit card, meaning it works at home just as well as it does abroad.

There’s no markup on the exchange rate, and they are super transparent about the fees (usually around 0.4% for foreign spending) they'll charge you.

Starling card

The Starling debit card is a good option for international spending as there are no foreign transaction fees and no ATM fees .

You can sign up entirely online for an account with no monthly fees which you can manage from your phone, with instant notifications and a whole range of banking features. Get a Starling Card

Frequently Asked Questions

Post Office is a trusted institution and will keep customer funds safe according to all applicable legal requirements.

When it comes to travel money, the Post Office works in partnership with First Rate Exchange Services, which is a registered business and holds a Money Services Business License in the UK.

You can hold up to 23 different currencies:

- Australian dollars

- Canadian dollars

- New Zealand dollars

- Croatian kuna

- Turkish lira

- South African rand

- Swiss francs

- Polish zloty

- Pounds sterling

- Chinese yuan

- Czech koruna

- Danish kroner

- Hong Kong dollars

- Hungarian forint

- Japanese yen

- Norwegian krone

- Saudi riyal

- Singapore dollar

- Swedish kronor

Post Office Travel 4+

Travel money card & insurance, post office limited.

- #90 in Travel

- 4.7 • 21.9K Ratings

Screenshots

Description.

Buy, add, and manage your Travel Money Cards, travel insurance, holiday extras and more all in one place. Take the new-look Post Office travel app on your adventures today. Combining all the travel features our loyal app users love, this refreshed version’s now cleaner and simpler to use. So, it’s even easier to relax on your travels. Do all this on the move Manage your Post Office Travel Money Cards · Buy and activate new cards in the app · Add existing Travel Money Cards · Top up with any of 22 currencies, including US dollars and euros · Swap funds between different currencies · Check your PIN, balance, spending, and daily exchange rates · Freeze your card for security or to limit your spending · Add your cards to your Apple Wallet Buy and check your travel insurance · Get a quote and buy cover – plus any add-ons to tailor it to your trip · Link the app to your existing Post Office Travel Insurance policy · View and download your policy documents Get those holiday extras sorted · Book parking at 60 UK domestic airports · Find great deals on airport hotels · Check into lounges at 100+ airports · Fast track your security checks at 11 UK airports · Book airport transfers to your holiday accommodation · Hire a car with leading brands in over 60,000 locations What to do now Download the Post Office travel app today. Order or link your existing Travel Money Card and Travel Insurance policy. Or order a Travel Money Card at your nearest Post Office branch.

Version iOS App version 463.1

Bug fixes and performance improvements, all to make your experience the best it can be.

Ratings and Reviews

21.9K Ratings

Post office travel application

Now, the post office application has been very useful, as one can top up money whilst travelling as well as check ones balance on the travel money card. In conclusion, lastly, I found the travel money card particularly useful on 16th November 2019, evening time as one can search for useful tips and questions that one maybe concerned about before travelling, during and after travel, and for me, I found this application extremely useful, as there was information I needed to know before my travel, such as the currency of the country I am travelling to, and where to obtain the currency of the country I am travelling to shortly. Moreover, I thank the developers for making this useful, and appropriate travel application as I believe it is a safe as well as secure method of travelling with money, to the country of ones choice instead of carrying loads of cash around in different currencies, and risking theft issues or lost issues. Also, I found the help and advice section on the website useful, as I had forgotten my PIN number as I never used my travel money card for a while, and I was able to call up a number from the travel money website, and follow the on phone instructions to retrieve my PIN number once again. Next, thank you developers for making this travel application once again. Many thanks Hannah Boyce

Developer Response ,

Thanks very much for the fantastic feedback, glad you like the app and the product.

Dreadful new App not working for 3 days now

Rang customer services 3 days ago now as newly downloaded App top up button gives an error that it can’t fetch the rates right now so have to go on main website to do that. Then when you use the card it doesn’t update the balance. It retrieve the pin either. The card was then unsupported in an ATM when I tried doing a balance enquiry. Different information from service staff who told me I needed to load another £50 minimum on card and buy something using chip and pin to use card for for first time. However that’s £3 commission just to load on £50 of your own money ! I don’t even need sterling on the card as the whole point is for using it abroad to TRAVEL!! So I had already bought Euros. The lady in the post office said I can’t use the card at all for online purchases however I managed to pay for my holiday eventually over the phone in euros once they had removed the security 3 times! A smarter assistant also said I don’t need to add sterling to buy something in U.K. - the euros will auto convert- which they did. Still stuck with a non working app and took 3 hours to finally get the card loaded and working to pay for holiday. Agh. Why so complicated

Thank you for your feedback. This will be shared with our development teams who are committed to improving the app experience for all.

No problems at all

I have had and used this Post Office Travel Card for the last eight years with no issues whatsoever, it expired earlier this year and a replacement arrived in good time for this year’s use. I did have a little hiccup with the first login online for the first use but very soon sorted out and hay presto of and running again, brilliant. I did have a lot of issues with another company travel card whereby EVERY TIME I tried to login on the app or online it wouldn’t recognise me and had to reset password wasted six and a half hours, still getting no results so cancel the subscription 😡. Update to review April 2024 I have been away from UK to USA and CANADA this time and have had no end of problems trying to login into the app on my phone or Laptop, issue with the app freezing on my phone or going round in circles on laptop with password/security reset issues I’ve uninstalled and reinstalled all to no avail it would not let me use face recognition ID Very disappointed after such a brilliant service the first time around until the new card and updated app 😡😡😡 I to like so many others am looking for an alternative card & app.

Thank you for your feedback. It looks like you might need more help here, please contact us directly at [email protected]

App Privacy

The developer, Post Office Limited , indicated that the app’s privacy practices may include handling of data as described below. For more information, see the developer’s privacy policy .

Data Used to Track You

The following data may be used to track you across apps and websites owned by other companies:

Data Linked to You

The following data may be collected and linked to your identity:

- Contact Info

- Identifiers

Data Not Linked to You

The following data may be collected but it is not linked to your identity:

- Diagnostics

Privacy practices may vary based on, for example, the features you use or your age. Learn More

Information

- App Support

- Privacy Policy

Get all of your passes, tickets, cards, and more in one place.

More by this developer.

Post Office EasyID

You Might Also Like

Holiday Extras HEHA! Smart App

Jet2 - Holidays and Flights

loveholidays: hotels & flights

On the Beach Holiday App

Virgin Atlantic Holidays

Copyright © 2024 Apple Inc. All rights reserved.

- TRAVEL MONEY

- TRAVEL ADVICE

Currensea vs Post Office: Which travel card should you use?

So we’ve compared the Post Office's Terms and Conditions for spending abroad with our own, to help you make the right decision.

What is the Post Office?

The Post Office is a well-known high-street brand, trusted by millions for postage, government, and financial services through its wide network of branches. However they are not the ones to deliver your mail- that is the Royal Mail, and is a different business to the Post Office.

What are they offering?

The Post Office offers a prepaid multi-currency travel card which allows you to hold up to 22 different currencies. The aim is to provide an easy and secure solution to managing your travel money abroad.

What travel money card options and plans do the Post Office have?

The Post Office has one simple plan, their basic Post Office Travel Money Card. While the card is free to get, there is a minimum load amount of £50 of whichever of the 22 currencies you choose.

So what does the Post Office charge you to spend abroad?

Since it is a prepaid card, the Post Office won't charge you any transaction fees while spending abroad if you use the correct currency for the country you're in. However, you will be charged a rate of 1.5% to top up your card with currency in the first place- this is where the fees kick in, with a minimum fee of £3 per top up .

Their exchange rates also include a significant markup . For example, we took a look at the EUR exchange rate they offered to top up your card- when we compared this to the interbank (real) bank, we observed an additional hidden charge of 3.8%. Please note- this charge is variable across different currencies.

You'll also be charged £1.50 per ATM withdrawal , and this can be higher in other currencies (check their T&C's page 12-15 for more info).

Finally, if you spend abroad in a currency not supported by the Post Office, you'll incur a 3% transaction fee . Given they only support 22 out of 180 currencies, there is a significant risk you'll be hit with this rate.

What is Currensea?

Currensea is a travel debit card that allows you to spend money directly from your trusted bank account, rather than having to open up a new one or top up a prepaid card. It is based on open banking, which was introduced several years ago to promote innovation and competition in financial services so that you have access to a wider range of options and rates.

What card options does Currensea offer?

Currensea has three travel cards, including Currensea Premium and Currensea Elite. For the purposes of this comparison, we'll be focusing on Currensea Essential, which is free like the Post Office Travel Money Card.

What is different about Currensea?

What Currensea offers is a product focused on providing you with the best possible rates as you spend abroad. Our card partners directly with your trusted bank account (unlike other travel cards), meaning that you can spend with your Currensea card abroad just as you would at home with your regular debit card. Funds come straight out of your bank account, and you can spend whatever balance you have.

Because it’s not a prepaid card, you never have to top up your Currensea card. You don’t have to worry about losing it and any funds that might remain on it, nor do you have to constantly top it up and remember how much you have on it: we offer travel, but without the hassle.

We also check how much your bank would have charged you to use your regular debit card abroad- and we can tell you exactly how much money you saved by using your Currensea card.

What does Currensea charge to spend abroad?

We convert your currency based on the real-time interbank exchange rate, with an additional markup of 0.5% per transaction no matter when you use it or how much you spend with it. No hidden fees, no weekend fees, no increases to the markup - just clear, transparent information on how much we charge and how much you save.

What other fees does Currensea charge?

Cash withdrawal .

We charge our usual fee of 0.5% for withdrawals up to £500 a month, and for anything over this amount we charge 2%.

Replacement cards

While your first card is free, we charge a £5 replacement fee (but no delivery fees).

How does Currensea stack up against the Post Office?

We compared how much it would cost spending with Currensea versus the Post Office on a week-long holiday to Spain for a family of four. Take a look at the table to see the breakdown of spend- we've also included the average extra hidden fees that the Post Office charges.

*All values to 2 decimal places

*We looked at a few main currencies and calculated an average markup of 3.78%, however this will vary depending on the currency and amount.

Total saved with Currensea vs using the Post Office: £197.34

% saved with Currensea vs using the Post Office: 90.73%

The Post Office travel card could be a good solution if you have younger family members travelling abroad and want to help them with a little bit of spending money their trip, but don’t want to give access to large amounts of money or for them to use their bank card. The card could then allow you to top up from afar and with smaller amounts.

For personal travel use, the card is far from ideal. Of all the cards we've benchmarked, the Post Office card is the second worse for charges, with costs significantly more than most high street banks. Since it is a prepaid card, you'll need to remember how much is on it and faff around topping it up as you spend abroad. And if you don't spend all the money you top it up with, you'll also have to remember to take the unspent balance off your card when you get home, incurring yet more charges. On average in the UK in 2023, prepay travel card users returned home with £78 on their card..

With Currensea on the other hand, you can spend abroad just as you would at home with your regular debit card, since your card partners with your existing bank account. We offer travel, but without the hassle.

If you are after the best foreign exchange rates possible, then Currensea clearly has the edge. While the Post Office charge a 1.5% fee to top up your card and a 3% fee for transactions in non-supported currencies, not to mention several other hidden fees, Currensea charges just a 0.5% markup from the interbank (real) exchange rate. This means that Currensea will always be the cheaper option for spending abroad, and you'll save at least three times as much as you would with the Post Office card.

Overall, if you're looking for a prepaid card to give to younger family members while they travel, then the Post Office could be a good option. But if you want a card you don't have to continually top up that focuses on providing the best rates possible, then Currensea is the right choice for you.

Get your free Currensea card today

You may also like

Currensea vs fairfx:..., currensea vs curve: ..., currensea vs zing: w....

- Exchange rates

- Giving back

Už máte svou Karlovy VARY REGION CARD?

5. 6. 2020 | Tipy a rady , Z Infocentra , Z Karlových Varů

Kdy jste naposledy prozkoumali atraktivní místa Karlových Varů a okolí a vypravili se tam, kam obyčejně míří turisté z celého světa? Teď je ten vhodný čas, a když si pořídíte turistickou kartu Infocentra města Karlovy Vary, na spoustu míst se dostanete úplně zdarma, na další s výraznou slevou. Karlovy VARY REGION CARD je letos v létě dostupná za speciální ceny .

Kupte si v období do 31. srpna v Infocentru města Karlovy Vary svou kartu a ihned můžete vybírat z více než 40 míst ZDARMA či ve více než 30 místech čerpat SLEVU . S Karlovy VARY REGION CARD se projdete nejen Karlovými Vary, ale i Mariánskými Lázněmi i ostatními městy, jak v pověstném lázeňském trojúhelníku, tak i mimo něj. Navštívíte muzea, galerie, koncerty či divadelní představení, projedete se autovláčkem, necháte na sebe působit ducha historických sídel, protáhnete své tělo při sportovních aktivitách či procházkou lázeňskými lesy, proniknete do tajů tradiční výroby světoznámých produktů, ochutnáte místní speciality…

Nevíte, jak se k jednotlivým místům dopravit? Nevadí, pomůže vám opět Karlovy VARY REGION CARD. Její důležitou součástí je totiž také bezplatná městská doprava v Karlových Varech i v Mariánských Lázních . Cestovat zdarma můžete nejen autobusy MHD, ale také vyjet lanovkou na karlovarskou Dianu nebo se svézt populárním autovláčkem.

Nabídka turistické karty Karlovy VARY REGION CARD je široká a vybere si z ní každý. Někdo je více na přírodu, jiný má rád památky, další si chce především odpočinout a relaxovat. Někdo si chce vše vychutnat sám, jiný rád sdílí zážitky s rodinou či přáteli.

Veškeré informace a nabídky jednotlivých míst nyní najdete přehledně na novém webu www.karlovyvarycard.cz

Aktuality můžete sledovat také na instagramovém a facebookovém profilu karty.

další články

Karlovy VARY REGION CARD letos ještě výhodněji

Kam za sportem v Karlových Varech a okolí

Hledat Hledat

co ve varech

- Kalendář akcí

- Výhodné balíčky

- Prameny a kolonády

- Zajímavá místa

O karlových varech

Karlovy Vary mají světový unikát v počtu léčivých horkých pramenů na světě.

Více o Karlových Varech

Pomůžeme vám

Web provozuje Infocentrum Karlovy Vary, zavolejte nám či napište.

Kontakt na Infocentrum

Zpět nahoru

- Pomůžeme Vám

- Zobrazit standardní verzi webu

© Infocentrum města Karlovy Vary

O webu - Kontakt - Pro média, partnery a podnikatele

Zásady zpracování osobních údajů a používání cookies

Facebook Youtube Karlovy Vary na Instagramu

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

- Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Travel Money

- What Is a prepaid currency card

Prepaid currency cards are a secure way to make purchases on trips abroad. They can be a handy alternative to paying with cash and debit or credit cards.

They can also help you manage your spending and stick to a holiday budget. This guide explains how they work and how to use them effectively.

What is a prepaid currency card?

A prepaid currency card is a type of payment card. It allows you to load and store multiple currencies to use on your travels or for online purchases. You can even use it to spend in the UK if you like.

You might have heard this type of payment method referred to as a prepaid travel card , multi-currency card, Travel Money Card , foreign currency card or even forex card. They’re all similar, though their features can differ by card provider.

These cards are a convenient and secure way to manage your foreign currency and spending needs without having to carry lots of cash. Carrying one also avoids the need to use a debit or credit card, which could charge higher fees for transactions overseas.

What’s more, many prepaid currency cards aren’t linked to your bank account but topped up with an amount of your choosing instead, they make budgeting for your travels easier.

Benefits of a prepaid currency card

There are lots of potential benefits of using this kind of card.

- They’re convenient: You can use a prepaid currency card to pay at shops, restaurants, online merchants and anywhere else that accepts payments from the major network the card is linked to (eg Mastercard®, Visa). You can also withdraw cash at any ATM linked to that network.

- They hold multiple currencies: While some cards hold just one specific currency (eg, a prepaid euro card), many enable you to load and store several. You can move funds between different currencies if, for instance, you’re interrailing between different destinations and need to spend in different currencies.

- They’re accepted worldwide: Just like debit and credit cards, travel cards are widely accepted around the world. They’re usually linked to one of the major credit card networks, Mastercard, Visa or AmEx, and accepted anywhere you see their mark.

- They’re secure: With PIN protection and the ability on some prepaid currency cards to easily block or unblock them, they keep your funds protected if they get lost or stolen.

- You can top up any time: Most prepaid currency cards are reloadable, allowing you to add more funds to the card as needed. Some enable you to do this online or through a mobile app. You may also be able to top up by visiting a bank or a partner location of the card provider. This flexibility ensures that you can access funds whenever necessary.

- You can top up when the rate’s good: You can lock in savings by loading currencies onto your card when their exchange rates are favourable. Its value won’t change if the currency fluctuates.

- They help you budget: By loading a set amount of money onto your card, you can avoid overspending. Many cards let you to track your spending online or with a mobile app too.

- You may save on fees: The fees for foreign transactions, currency conversion and overseas ATM withdrawals may also be lower than using debit or credit cards.

How do I use a prepaid currency card?

Here's how you can make the best use of a prepaid currency card:

- Do your research: You need to know a card is going to work for you, your spending plans and any holiday budget you’re hoping to set. So research different prepaid currency card providers to compare the features and exchange rates they offer, and what customers say about them online. Look for a card that’s accepted worldwide and can provide reliable support – like the ability to get help fast if your card is lost or stolen.

- Understand the fees: Depending on the card, you may need to pay a fee to activate or reload it, perform transactions or use it to withdraw cash at an ATM. There may also be a fee if the card is left inactive for a period. So compare the fees from different providers carefully to see which setup suits you.

- Get familiar with the security features: Find out about the card’s security measures to safeguard your money. These should include how to block or unblock the card, transfer funds to other cards, and order a replacement if yours is lost or stolen.

- Keep an eye on exchange rates: If you’ve got the luxury of time before you travel, monitor the exchange rates and try to buy at a time where you’ll get a favourable exchange rate for your pound to the currencies you’re loading. Some providers hold flash sales on currencies, offering them at discounted rates, so look out for their sales.

- Use it like a regular card: Use your pre-loaded travel card as you would your debit or credit card: to make purchases in shops and restaurants, buy things online and withdraw cash at ATMs. You may also be able to make contactless payments, such as by adding them to Apple Pay or Google Pay on your mobile device with some cards.

- Keep track of what you’re spending: The balance on your card (and so the amount you can spend) is limited to the funds you load onto it, which is handy for budgeting. You can typically manage it online or with an app with most cards, including checking your transaction history. If anything that looks out of place it’s easy to spot and report quickly.

- Keep a backup: It's usually worth taking a backup card or some cash on your trip in case of emergencies or situations where the card may not be accepted. Some providers’ apps enable you to add and manage multiple currency cards, if you prefer to take more than one as a precaution.

Remember to always review a card's terms and conditions to understand its features and any limitations, and decide which option is right for you.

Does Post Office offer a prepaid currency card?

Yes, we do. It’s called the Post Office Travel Money Card .

Here’s a summary of what it offers:

- Accepted at millions of locations worldwide, wherever Mastercard is accepted.

- You can load and store up to 22 different currencies onto a single card.

- Competitive exchange rates mean value for money when you convert currencies.

- Top up online, with our free travel app, via our website , or at any Post Office branch across the UK.

- You can also move funds between different currencies in the app or online.

Did you know?

Prepaid currency cards can be a handy and secure way to spend at music festivals both in the UK and abroad. Read our guide to using a travel card at music festivals .

Find out more about our Travel Money Card

Common questions, how does a prepaid currency card differ from a regular debit or credit card, how do i load money onto a prepaid currency card.

You’ll usually be able to load money onto a prepaid currency card using a card provider’s secure online portal or mobile apps. These enable you to top up funds on the card from an account of your choice. Card issuers may also let you know about designated places where you can top up in person, using cash or card. For the Post Office Travel Money Card , you can do this in any of our branches.

Can I use a prepaid currency card in multiple countries and currencies?

Yes, most prepaid currency cards are multi-currency, meaning you can load them with different currencies and use them in multiple countries. They’re a convenient way to store, manage and pay with your holiday funds, without carrying lots of physical currency, especially if you’ll be visiting several destinations.

Be sure to check the card you choose supports the currencies you need as this could save you money. If the currency you need isn't supported, cross-border fees may be charged to move the amount you need from a different currency.

Are prepaid currency cards a better option for travel than cash or other cards?

It really depends on what you need. It can be handy to have some physical currency for smaller payments like public transport and tolls, or for situations when cards aren’t accepted. But a prepaid currency card can provide convenience and security, as well as competitive exchange rates.

While you may like to take a debit or credit card as a backup, paying with them may incur foreign transaction fees you may not have to pay using a multi-currency card instead. Note, though, that using a card in country whose currency it doesn’t support may incur a cross-border fee.

Some prepaid cards also offer extra protection if they get lost or stolen, if they aren’t linked to your bank account or line of credit.

Are there any fees for using a prepaid currency card?

The fees you can expect to pay for using a prepaid multi-currency travel card can vary by provider. They may charge a fee for purchases or ATM withdrawals, or to convert funds between currencies. Check the Terms and Conditions of any card you’re considering and compare providers with other options to make an informed choice.

How do I check my balance and transactions?

Most card providers enable you to check your card balance and review your transactions online or using a mobile app. Set up and log into your account, then navigate to the balance or transactions sections to see them listed. You may also be able to check the funds remaining on your card, move them between different currencies, and check your transaction history for any signs of fraudulent activity.

Check latest currency exchange rates

Related travel products.

Order foreign currency online or in selected branches. Pick up in any branch or get it delivered to your home.

Protect your trip with cover for cancellation, curtailment, emergency medical costs and more from an award-winning provider.

Get your application for a first or renewed passport right first time with our digital and paper Passport Check & Send services for adults and children.

Other travel services and guides

Avoid dynamic currency conversion

To avoid currency conversion fees abroad, always choose ‘local currency’ ...

Christmas Markets Report 2023

Kickstarting your festive prep with a short getaway this year? The Post Office ...

4 travel money scams and watchouts: keep your holiday funds safe

Going on holiday is an exciting time for families. To make sure it stays fun, ...

Autumn sunshine report – which islands offer best value for tourists?

Post Office Travel Money unveils the first Islands in the Sun Holiday Barometer ...

Holiday Money Report 2024

Long-haul destinations offer the best value for UK holidaymakers this year, ...

Long Haul Holiday Report 2023

Hoi An in Vietnam is still the best-value long haul destination for UK ...

Family Holiday Report 2024

Looking to enjoy the sunshine without breaking the bank? New research from Post ...

Motoring on the Continent Report

If you’re driving in Europe this year, Andorra’s your best bet for the cheapest ...

Free yourself from the hassle of cash at festivals

One of the joys of summer are the many music festivals playing across the ...

Savvy holiday spending with the Post Office travel app

Travel smarter with the Post Office travel app. Paired with a Travel Money ...

City Costs Barometer: the best value city breaks

Eastern Europe leads the way for the best value city breaks this year. And ...

How to plan a European city break on a budget

Thinking of heading off to Europe for a quick city break, but don’t want to ...

Guide to tipping abroad

Knowing how much to tip in a café, restaurant, taxi or for another service can ...

Travel money tips

Travelling abroad? These tips will help you get sorted with your foreign ...

How to avoid holiday scams

We all look forward to our holidays. Unfortunately, though, more and more ...

Holiday Spending Report

From European hotspots to far-flung destinations, UK travellers are making ...

Post Office Travel Money Ski Report 2024

Our annual survey of European ski resorts compares local prices for adults and ...

Post Office Travel Money Card is an electronic money product issued by First Rate Exchange Services Ltd pursuant to license by Mastercard International. First Rate Exchange Services Ltd, a company registered in England and Wales with number 4287490 whose registered office is Great West House, Great West Road, Brentford, TW8 9DF, (Financial Services Register No. 900412). Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Podzemí Vřídla je přístupné denně mimo pondělí

Prohlídka vřídelního podzemí je pro návštěvníky otevřena denně mimo pondělí v časech 11-17 hodin.

Rezervujte si prohlídku předem!!!

Další aktuality

Karlovy VARY REGION CARD šetří Váš čas i peníze!

atrakcí a památek VSTUP ZDARMA

atrakcí a památek SLEVA AŽ 50 %

doprava výhodně ZDARMA NEBO SE SLEVOU

© 2020 KARLOVY VARY REGION CARD Projekt vznikl za finanční podpory Karlovarského kraje . Partneři projektu

Nastavení Cookies

Webdesign AETO

IMAGES

VIDEO

COMMENTS

Before leaving the UK, make sure you have activated your Travel Money Card. Activation can be done through the free Post Office Travel app - download now from the Apple App Store or Google Play. The app allows you to top up, track spend, view balances and freeze spend. Activation can also be done by calling our automated line on +44(0) 20 ...

Online (Travel Money Card) and the Travel App Top-up limit: minimum £10 - maximum £5,000 ; Branch Top-up limit: minimum £50 - maximum £5,000 ... Post Office Travel Money Card is an electronic money product issued by First Rate Exchange Services Ltd pursuant to license by Mastercard International. First Rate Exchange Services Ltd, a ...

New-look travel app out now. Our revamped travel app's out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user ...

But hold on a second! Before you can start swiping away, there's one crucial step you need to complete: the activation process. To activate your card, simply visit the official Post Office website and look for the activation section. Once there, you'll be prompted to enter some basic information such as your card number and personal details.

Before leaving the UK, make sure you have activated your Travel Money Card. Activation can be done through the free Post Office Travel app, click the link below to download. The app allows you to top up, track spend, view balances and freeze spend. Activation can also be done by calling our automated line on +44(0) 20 7937 0280.

The Post Office Travel card is a prepaid Mastercard that you can load up with up to 23 currencies. You can use it for spending and ATM withdrawals in over 200 countries, in 36 million locations². Simply top up with your chosen currency before you travel, then spend overseas without needing to convert currency. The card is contactless and can ...

Spend in up to 210 countries around the world. Top up and check your balance via our Travel app. Post Office Travel Money Card is an electronic money product issued by First Rate Exchange Services Ltd pursuant to license by Mastercard International. First Rate Exchange Services Ltd, a company registered in England and Wales with number 4287490 ...

Inactivity fee: £2 per month once the card expires. £5 replacement card fee. Post Office Travel Money Card: 22: Rates set by First Rate: Commission charge of 1.5% applicable to GBP top-ups. Fee changes depending where cash is being withdrawn. £50 / £5000: £10,000: £300, but varies per currency: Inactivity fee: £2 per month 12 months ...

322 people have already reviewed Post Office Travel Money Card. Read about their experiences and share your own! ... BUT why can you only top up your card by means of a Credit card!! Bank DEBIT cards cannot be used!!! How inflexible, how poor customer service, how stupid!!!!! So you have to incur possible interest charges on your Credit card!

Pound Sterling - 1.5 GBP + commission of 1.5%. Swiss Franc - 2.5 CHF. Canadian Dollar - 3 CAD. One last thing to note on the subject of fees. All Post Office Travel cards are valid for up to 3 years. Exactly 12 months after your card expires, you'll start to be charged a monthly maintenance fee of £2².

Top up your card in cash at a Post Office or online by purchasing one of 23 different currencies. If you choose to top up in GBP and convert later, you'll be charged an administration fee of 1.5%, from a minimum of 3 GBP up to a maximum of 50 GBP. Exchange rates are shown in the Post Office app, and may include a markup on the market exchange ...

New-look travel app out now. Our revamped travel app's out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user ...

Manage your Post Office Travel Money Cards. · Buy and activate new cards in the app. · Add existing Travel Money Cards. · Top up with any of 22 currencies, including US dollars and euros. · Swap funds between different currencies. · Check your PIN, balance, spending, and daily exchange rates. · Freeze your card for security or to limit ...

Post Office Travelcard Beware! BIG RANT. My son and I purchased a Post Office travel card a few days before he went to Thailand last month. We loaded the card at the Post Office with £750 complete with their £11.25 charge. I asked at the time if I would be able to load this card/top it up if necessary during his stay of 6 weeks this August.

The #1 subreddit for Brits and non-Brits to ask questions about life and culture in the United Kingdom. We invite users to post interesting questions about the UK that create informative, good to read, insightful, helpful, or light-hearted discussions.

While the Post Office charge a 1.5% fee to top up your card and a 3% fee for transactions in non-supported currencies, not to mention several other hidden fees, Currensea charges just a 0.5% markup from the interbank (real) exchange rate. This means that Currensea will always be the cheaper option for spending abroad, and you'll save at least ...

Or taken the cash out on the Lloyds card at the Post Office (thanks dzug1). I (wrongly) assumed that the transaction would be taken a a simple payment not as an oversea's transaction with the £4.50 charge. Topping up the PO Travel card can only be done via a credit or debit card, my current MBNA one will charge 3% for the transaction and ...

Rezervujte si prohlídky předem! Vzhledem k velkému zájmu návštěvníků o prohlídky důrazně doporučujeme rezervaci. Jedná se především o turisticky nejvytíženější místa, ve kterých probíhají komentované prohlídky s průvodcem (např. Podzemí Vřídla, Návštěvnické centrum Becherovka, Muzeum a Sklářská huť Moser ...

Simpler, safer holiday spending. Buy, activate, top up and manage your Travel Money Card - for safe, easy payment anywhere in the world. Use the app to move funds between 22 currencies to suit your travel plans. Check your balance, transactions, PIN and daily exchange rates. Make secure payments using your phone or smart device.

NÁKUP turistické karty Karlovy VARY REGION CARD je možný nově i on-line!. Chcete si ušetřit cestu na prodejní místo karty?. Chcete si kartu objednat s předstihem v klidu domova?. Chcete s kartou navštívit některá místa již cestou na Vaši dovolenou?. Kupte si Karlovy VARY REGION CARD za zvýhodněnou cenu on-line. https://karlovyvarycard.cz/cs/online

Karlovy VARY REGION CARD je letos v létě dostupná za speciální ceny. Kupte si v období do 31. srpna v Infocentru města Karlovy Vary svou kartu a ihned můžete vybírat z více než 40 míst ZDARMA či ve více než 30 místech čerpat SLEVU. S Karlovy VARY REGION CARD se projdete nejen Karlovými Vary, ale i Mariánskými Lázněmi i ...

A prepaid currency card is a type of payment card. It allows you to load and store multiple currencies to use on your travels or for online purchases. You can even use it to spend in the UK if you like. You might have heard this type of payment method referred to as a prepaid travel card, multi-currency card, Travel Money Card, foreign currency ...

Prohlídka vřídelního podzemí je pro návštěvníky otevřena denně mimo pondělí v časech 11-17 hodin. Rezervujte si prohlídku předem!!!