- Just the issues

- News summary

Thai GDP in 2021 recovers from contraction in 2020, but tourism sector still nowhere near pre-pandemic levels

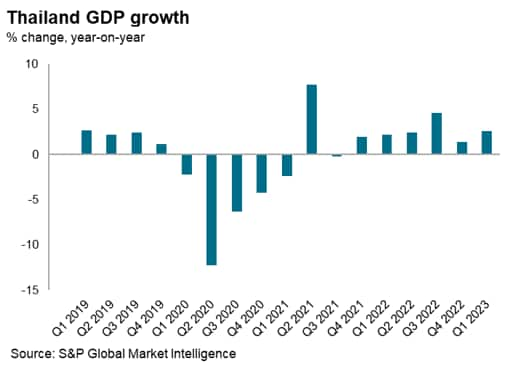

Thailand’s gross domestic product (GDP) in 2021 grew by 1.6 per cent, recovering from a 6.2-per-cent contraction in 2020, the government reported Monday. However, the country’s vital tourism sector continues to suffer as the pandemic’s impact lingers on.

The Office of the National Economic and Social Development Council (NESDC) released economic figures for the last quarter of 2021. The GDP in the fourth quarter rose 1.9 per cent year-on-year, following a drop of 0.2 per cent in the third quarter.

The quarterly rebound was driven by increased export value, government consumption expenditure, as well as the country’s reopening in November, the NESDC said.

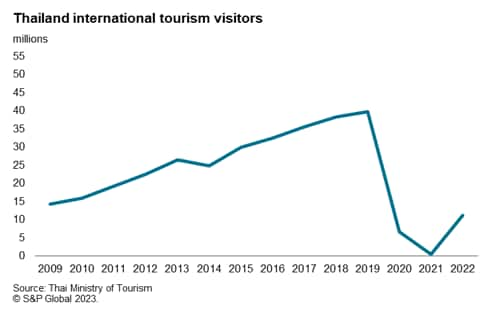

According to the report, the full-year number of foreign visitors in 2021 was around 342,000, with the majority coming from Europe. The number shows a 99 per cent decline compared to pre-pandemic figures of nearly 40 million in 2019.

Despite recovery in most sectors, the contribution from the hospitality and food sector still remains weak by dropping eight quarters in a row, the report shows. The 2021 full-year figure of the sector dipped 14.4 per cent from last year.

In 2021, Thailand recorded only 150 billion baht of tourism income from foreigners, compared to 1.85 trillion generated in 2019. The NESDC expects 470 billion baht of tourism income from foreigners in 2022 with 5.5 million tourists arriving.

2022 outlook

Looking ahead, the NESDC projects the economy to expand in the range of 3.5 – 4.5 per cent this year thanks to improved domestic demand and domestic tourism, export expansion, and public investment.

The report said the current outbreak of the Omicron variant remains a concerning factor to the economy. However, the NESDC estimates that the government is unlikely to impose strict control measures given the country’s vaccination status and low death rates.

Apart from uncertainty from the pandemic, rising headline inflation and mounting household debts also pose risks to the Thai economy, which could jeopardize the recovery momentum, the NESDC added.

Ivermectin not effective in treating Covid-19, joint Mahidol-Oxford study shows

Latest article, thai enquirer news summary – september 5, 2024, thai enquirer news summary – september 4, 2024, shares of bcp rises as thailand’s 2nd largest oil retailer targets ebitda of 100 billion baht by 2030, shares of 3 hospital groups rise amid reports of kuwaiti govt. approval for its citizens emerge, thai enquirer news summary – september 3, 2024, thai enquirer news summary – september 2, 2024.

ThaiNews Corp Co., Ltd.

Privacy Policy

Reimagining travel: Thailand tourism after the COVID-19 pandemic

Thailand’s economy is reliant on international tourism, a once-flourishing sector that has been impacted by pandemic restrictions. But there have been continual government efforts to boost domestic travel, and measures to support returning international demand after Thailand began reopening to vaccinated international travelers from 63 countries on November 1, 2021. 1 Pasika Khernamnuoy and Katie Silver, “Thailand reopens to vaccinated tourists from over 60 nations,” BBC, November 1 2021, bbc.com. Even as the world addresses emerging variants of the virus, Thailand’s lessons can act as a guide for other tourism-dependent countries facing similar dilemmas as they prepare for the resurgence of international travel.

A heavy blow, adjustments needed to support recovery

In 2019, Thailand ranked eighth globally in international tourist arrivals, with China being a key source market. 2 United Nations World Tourism Organization (UNWTO). Thailand recorded a high of 40 million visitors in 2019, with the top three spending categories for inbound visitors that year being in accommodation (28 percent), shopping (24 percent of spending), and food and beverages (21 percent). 3 “Summary of tourism income and expenses from foreign tourists entering Thailand in 2019,” Ministry of Tourism & Sports, October 28, 2020, mots.go.th. Furthermore, the Thai tourism sector created 36 million jobs between 2014 and 2019. 4 “Dashboard SME big data,” Office of Small and Medium Enterprises Promotion, accessed October 2021, sme.go.th.

Unfortunately, the pandemic and related restrictions have hit travel particularly hard, as international travel plunged. Passengers on international flights to Thailand dropped by 95 percent in September 2021, compared to the previous year. Hotels, in turn, only filled 9 percent of their rooms (Exhibit 1).

This decline in visitors had an outsize impact on tourism spending, as international travelers spent significantly more than their local counterparts (Exhibit 2). For instance, in 2019, international travelers made up 33 percent of overall travelers in Thailand yet accounted for almost 60 percent of all tourism spending—international tourists spent $1,543 per traveler on average, compared to $152 by domestic travelers. 5 “Tourism statistics 2019,” Ministry of Tourism & Sports, accessed October 2021, mots.go.th. This drop in expenditure undoubtedly caused a ripple effect on Thailand’s food and beverage retail industries, which include 1.2 million small and medium-size enterprises (SMEs). 6 “How to start business,” Office of Small and Medium Enterprises Promotion, accessed October 2021, sme.go.th.

Recovery appears to be on the horizon for Thailand. Assuming virus recurrence, slow long-term growth, muted world recovery, and minimal changes to global tourism strategies, Thailand’s tourism sector could only recover to pre-crisis levels by 2024.

Given that Thailand’s GDP relies significantly on foreign tourism income, the domestic tourism market alone is not sufficient to bring the nation’s tourism revenue back to 2019 figures; the sector’s recovery would depend on a resurgence in international travel (Exhibit 3). Globally, this recovery scenario would likely reshape the landscape of the world’s travel industry and create a strong imperative for both the public and private sectors to act to ensure the industry’s survival.

Efforts to stimulate tourism

Thailand has deployed various efforts to compensate for the loss of inbound tourism. Given that for most of the first quarter of 2020, Thailand saw less than 1,000 daily COVID-19 cases nationwide, with cases not rising above 4,000 until November 2020, domestic tourism was still a viable option for travelers. The Thai government’s attempt to boost domestic travel took the form of providing subsidies for hotel stays and flights for travelers. The government also rolled out measures to stimulate international travel to Thailand’s beach destinations and attract high-end travelers from international markets.

Travel together—stimulating domestic tourism

In August 2020, the Thai government launched the Rao Tiew Duay Gun (We Travel Together) program, where it set aside a budget of $640 million to help boost domestic tourism. 7 “Thailand approves domestic tourism package worth 22.4 billion baht,” Tourism Authority of Thailand Newsroom, June 17, 2020, tatnews.org.

The government subsidized a total of six million nights of hotel accommodation at 40 percent of normal room rates. The subsidy was capped at 3,000 baht ($100) per night for up to five nights. Subsidies for other services, including food, were capped at 600 baht ($20) per room per night. This subsidy was initially limited to facilities outside tourists’ home provinces, but that restriction was lifted in the second phase of the rollout in December 2020. In addition, domestic tourists traveling by air would qualify for a government refund of 40 percent of the ticket price. This was capped at 1,000 baht ($32) per seat, with a quota of 2 million seats.

The program reached its total quota of six million hotel-room nights in February 2021, seven months after its launch. 8 “FPO reveals the money we travel together, 20,000 million,” Bangkok Business News , January 4, 2021, bangkokbiznews.com; “‘We travel together’ the parade has already reserved 6 million rights. But there are still 1.35 million rights left!” Bangkok Business News , February 8, 2021, bangkokbiznews.com. During that time, at least $1 billion had been added to the Thai economy. 9 “NESDB-TAT has not yet knocked on ‘we travel together, phase 3,’” Thai PBS News , March 16, 2021, news.thaipbs.or.th.

Many operators grasped this opportunity, shifted their focus to the domestic market, and attracted local travelers by promoting flights and hotels in collaboration with the We Travel Together campaign. Destinations that once served mainly international visitors welcomed more local travelers, which has helped their economies wade through this difficult period. Many luxury hotels offered deep discounts and attractive promotions to capture the medium- to high-spend domestic-tourist segment.

These efforts to stimulate domestic travel were temporarily paused as COVID-19 cases reached a new high in July 2021. Domestic air travel in and out of red zones, including Bangkok, was banned during July to September 2021 in response to the nation’s effort to control the spread of the Delta variant. 10 “Domestic flight bans in force,” Bangkok Post , July 21, 2021, bangkokpost.com. Phase three of the We Travel Together campaign was paused during the same period, but resumed in October 2021.

Bringing back international travelers with the ‘sandbox’ approach

Despite promotional efforts for domestic travel, Thailand’s total revenue from domestic travel still saw a significant dip. The country’s revenue from domestic travel dropped from $34.5 billion to $15.4 billion in 2020. An increase in domestic spending alone would not compensate for the impact of the pandemic on the Thai economy. The country has largely been dependent on international markets, which represented about $62 billion or 60 percent of total tourism spend in 2019. 11 “Tourism statistics 2019,” Ministry of Tourism & Sports, accessed October 2021, mots.go.th.

In response, Thailand launched the “Phuket Sandbox” in July 2021, an effort to recapture demand from international travelers. The initiative offered fully vaccinated travelers (between 14 days and one year before their travel date) exemption from quarantine, provided they remain in Phuket for at least 14 days before traveling to other parts of Thailand. 12 “General information—Phuket Sandbox,” Tourism Authority of Thailand Newsroom, October 1, 2021, tatnews.org. Additionally, travelers’ stay in Phuket was restricted to accommodation establishments that have been certified by the Safety & Health Administration of the Thai government. Visitors staying in Phuket for less than 14 days were permitted to leave Phuket only if their destination was outside of Thailand.

The model hoped to draw visitors during the year-end season in Asia, Europe, and America—all key origin markets for Thailand. Several other reopening plans followed, including the “Samui Plus” and “Andaman Sandbox” plans. 13 “Samui Plus plan to generate B180m,” Bangkok Post , July 18, 2021, bangkokpost.com; “‘Adaman Sandbox’ next on govt agenda,” Bangkok Post , July 21, 2021, bangkokpost.com. Together, the schemes created a network of reopened destinations, which hoped to position Thailand as an attractive destination for international and domestic travelers alike.

The economic uplift from the Phuket Sandbox were moderate. In the period from July 1 to August 31, Phuket welcomed about 26,400 visitors, who were estimated to have spent at least $48.8 million while staying on the resort island (Exhibit 4). 14 “Phuket Sandbox generates B1,634m in two months,” Bangkok Post , September 5, 2021, bangkokpost.com.

A nationwide rise in COVID-19 infection rates in the same period meant that the government had to reconsider social distancing and other measures to minimize risk to visitors.

In any case, Thailand has gathered its learnings from the “sandbox” approach and proceeded to reopen the country to receive international travelers. As of November 1, 2021, the Thai government commenced a phased reopening of the country, allowing fully vaccinated tourists from 63 low-risk countries to visit with one day of quarantine, provided they pass a COVID-19 test upon arrival. The government has also replaced the slow-paced Certificate of Entry (COE) system with the Thailand Pass System, in an effort to make the documentation process of travelers entering Thailand more efficient than the COE application. 15 “Thailand pass,” ThaiEmbassy.com, accessed on November 1, 2021, thaiembassy.com.

The program also expanded the number of provinces open to international visitors to 17, including major tourism destinations such as Bangkok and Chiang Mai. Subject to readiness, additional major provinces are expected to reopen from December 2021 onwards. To ensure visitor safety, some COVID-19 measures remain in place, although most businesses have been allowed to reopen and nighttime curfews have been lifted in almost every province. The reopening has welcomed tourists globally, with top visitors coming from Thailand’s key source markets—the United States, Germany, and the United Kingdom (Exhibit 5).

Attracting ‘quality’ travelers, with an eye on new markets

Pre-COVID-19, China was one of the main contributors to Thailand’s tourism income, accounting for more than 27 percent of 2019 tourism receipts. 16 “Tourism statistics 2019,” Ministry of Tourism & Sports, accessed October 2021, mots.go.th. Given the current prudent approach of the Chinese government toward international travel, the road of return for Chinese visitors to Thailand will be a long one. China’s international-flight seat capacity and passenger numbers remain down by 95 percent compared to pre-COVID-19 levels, and stringent public-health measures for international travel remain in place. Thailand, therefore, needs to reimagine its strategy and try to capture new sources of international travelers in markets where there are more rapid recoveries of international travel demand.

The situation may change rapidly, particularly in these volatile times; closely monitoring the revival of these top source markets, particularly around the country’s stance towards viral control measures, will help industry players plan their recovery efforts and capture untapped value.

Recognizing these shifting traveler trends, and the resilient nature of premium traveler groups, the Thai government is striving to attract “quality” travelers from these source countries. Measures include revisiting and relaxing certain regulations—such as yachting regulations and taxes on personal belongings and luxury goods—to improve and stimulate the premium travel experience.

Taking this a step further, the Thai government is preparing to launch a long-term residence program to attract foreigners to the country through new Long-Term Resident (LTR) visas (up to ten years), tax and investment incentives, foreigners’ residential property ownership relaxations, and more. The program will target four key personas: the wealthy global citizen, the wealthy retiree, the work-from-Thailand professional, and the high-skilled professional. The country’s ambition is to welcome over one million of these target personas and generate over 1 trillion baht in domestic spending in the next five years, beginning in 2022.

Emerging from the storm: Actions for travel and tourism

Thailand has put innovative measures in place to help its vitally important travel and tourism sector wade through the COVID-19 crisis. As new variants of the coronavirus emerge, health and safety should remain the foremost priority as countries contemplate their travel programs. Once it is safe to do so, there are actions that stakeholders can take to steer into and thrive within the next normal.

Adjust offerings and pricing strategy to meet market needs. Hotels, tour operators, restaurants, and transport providers could look to explore opportunities to offer services and products that meet new travel demands.

Bundle products, such as hotel and flights, offer upselling and cross-selling opportunities as well as a diversified revenue stream.

Travel companies could also devise and deploy targeted pricing strategies to drive long-term loyalty and stickiness for when international travel fully returns. Given the phased reopening of popular provinces in Thailand, and the inclusion of more visitors from select countries on a quarantine-exemption list, travel companies can leverage data on traveler behaviors to set the right prices and conduct targeted campaigns by country of origin and destination.

Explore opportunities within the mass-affluent traveler segment. Focusing on premium travel experiences may be a viable strategy in some markets, but it may have limited impact in Thailand. Given that the top three inbound visitor-spending categories in 2019 were shopping, accommodations, and food, targeting the high-end market would only benefit a small segment of travel companies and would not contribute to the country’s economic recovery across all relevant sectors.

By promoting more differentiated travel experiences and attractions such as ecotourism and cultural tourism, which are naturally location based and sought after by younger mass-affluent travelers, operators could contribute to greater aviation and transportation use in Thailand.

Form partnerships across the travel ecosystem. As a result of the government’s We Travel Together program, which subsidizes travel through a digital redemption mechanism (the Pao Tang app), the country has seen an estimated 30 to 40 million users join and use the platform. 17 Krung Thai Bank equity research, April 2021. This has created an opportunity for domestic consumer data to be collected and analyzed to provide more personalized tourism offerings that consumers are more likely to consider spending on.

Taking this a step further, tour operators, restaurants, and shopping malls might link up, creating a connected ecosystem where a traveler could be strategically engaged through multiple personalized services, products, and loyalty programs along their journeys.

Expand the network of destinations. There is an opportunity to offer travelers a wider variety of destinations in first- and second-tier cities, such as Nakhon Si Thammarat, Chiang Rai, Nakhon Nayok, Ratchaburi, and Loei. These locations have been able to sustain visitor numbers at a relatively low rate of decline, largely due to domestic travelers looking for new places to visit during international travel restrictions.

With a boost in promotion and appropriate infrastructure investment, tourism will not only contribute to the survival of the industry in these cities, but it could also lead to enduring tourist appeal that extends beyond domestic traveler groups, especially with the gradual return of international visitors. For example, the Tourism Authority of Thailand is collaborating with airlines to offer direct flights to alternative second-tier tourism destinations.

Leverage digital to connect, attract, and retain travelers. Travel companies can digitalize the customer journey from check-in through payment, including the provision of maps and information. Traveler preferences can be tracked in real time to design better and more relevant offerings, while digital booking channels can target different customer segments. Digital marketing can also entice visitors to return and to share their experiences on social media.

For instance, the Tourism Council of Thailand is working with Singapore-based IsWhere to deploy a digital-marketing platform for tourism business operators to better connect and engage with a potentially sizeable number of domestic and international travelers; the platform’s prior partnership with a major tech company has enabled it to reach 600 million digital customers worldwide.

Reimagine support needed by industry players. In the short term, industry players would need stimulus, support, and guidance on health and safety policies from the government. In the medium term, small and medium-size players would benefit from the government’s support in adjusting to online travel services and digital marketing, such as a one-stop digital platform to connect industry players with international travelers.

As such, the Tourism Authority of Thailand announced its plan to establish a private digital firm to work on creating a digital infrastructure for tourism, utilize big data in the industry, and potentially introduce blockchain-based e-vouchers and nonfungible tokens to provide tourism operators with more options for reaching travelers online and offline.

In the wake of the COVID-19 pandemic, tourism recovery in Thailand will be gradual and complex and requires varied strategies from both industry and government. As the world eagerly prepares for the eventual revival of international travel, Thailand and other countries can draw important lessons from its experience during this difficult interim period.

Steve Saxon is a partner in McKinsey’s Shenzhen office; Jan Sodprasert is a partner in the Bangkok office, where Voramon Sucharitakul is an associate partner.

The authors wish to thank Margaux Constantin , Kamila Dolinska, Steffen Köpke, Alan Laichareonsup, Jason Li, Georgie Songsantiphap, and Jackey Yu for their contributions to this article.

Explore a career with us

Related articles.

Reimagining the $9 trillion tourism economy—what will it take?

Make it better, not just safer: The opportunity to reinvent travel

A new approach in tracking travel demand

- Where We Work

Thailand Economic Monitor July 2021: The Road to Recovery

Key Findings

Successive waves of COVID-19 disrupted the Thai economy in the first half of 2021, but their impact was mitigated by recovering global demand and substantial fiscal support.

- The shock of the second wave caused the economy to contract by -2.6 percent in the first quarter of 2021, following a 6.1 percent drop in GDP in 2020—one of the steepest contractions among Association of Southeast Asian Nations (ASEAN) member states.

- A third wave of infections emerged in April 2021 has proven especially severe with strict containment measures reducing mobility and negatively affecting consumption and business sentiment.

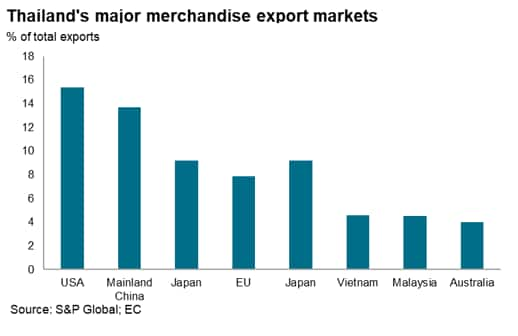

- Exports of goods have provided substantial support to the Thai economy, driven by recovering global demand for automotive parts, electronics, machinery, and agricultural products.

Economic activity is not expected to return to its pre-pandemic levels until 2022, and the recovery is projected to be slow and uneven.

- The growth forecast for 2021 has been revised downward from 3.4 percent in March to 2.2 percent, reflecting the anticipated impact of the third wave of COVID-19 infections on private consumption, and the likelihood that international tourist arrivals will remain very low through the end of 2021.

- Private consumption is expected to see a small expansion of 2.4 percent, with the impact of mobility reductions, projection on vaccination progress, containment measures and income losses partially offset by social assistance measures.

- The recovery is expected to accelerate in 2022, with the annual GDP growth rate projected to rise to 5.1 percent depending on: (i) solid progress on domestic vaccination rates; (ii) an improvement in the global trajectory of COVID-19 sufficient to allow international tourism to partially recover; and (iii) the full disbursement of the recently approved THB 500 billion fiscal response package.

- The government plans to vaccinate 70 percent of the population (50 million people) by the end of 2021, and any delay in the rollout schedule could adversely impact domestic mobility, consumption, and tourism.

The economic shock associated with COVID-19 has adversely affected employment, income, and poverty, but the government’s quick response has mitigated its impact .

- The official unemployment rate remained at 2 percent in the first quarter of 2021, up from 1 percent in the first quarter of 2020. More than half of all unemployed workers were formerly engaged in the services sector. By the first quarter of 2021, there were 710,000 fewer jobs than in the fourth quarter of 2020.

- Employment in agriculture declined by 10.9 percent, but employment in all other sectors increased by 2.5 percent, in line with the recovery in global demand for goods exports. The automotive and construction industries posted the highest quarterly rates of employment growth at 3.3 percent and 7.5 percent, respectively.

- World Bank simulations demonstrate that in the absence of the government’s relief measures, the headcount poverty rate would have increased from 6.2 percent in 2019 to 7.4 percent in 2020—representing an additional 700,000 people falling below the poverty line—before declining to 7 percent in 2021.

- Poverty rates would have increased by 1.6 percent in rural areas and by 1 percent in urban centers, with the largest increase in northeastern Thailand, which had the country’s highest regional poverty rate in 2019.

- The government earmarked about 1 trillion baht in public spending for economic stimulus and support to the most vulnerable households. Around 70 percent of the authorized COVID-19 response spending has been allocated to support households, largely through cash transfers and subsidies, with a smaller share being directed to support the recovery of the private sector.

- Between the social assistance and social insurance schemes, over 44 million Thais have now directly benefited or compensated to some degree. Preliminary estimates suggest that more than 80 percent of households received social assistance during 2020.

- The total cost of transfers in 2020 was estimated at B386 billion baht or about 2.3 percent of GDP bringing total social assistance to about 3 percent of GDP, more than tripling the 0.77 percent figure of 2019. The bulk of the transfers went to the informal workers and farmers who would have not been considered vulnerable prior the pandemic.

- In May 2021, the government announced the approval of an additional 500 billion baht in borrowing, which will fund further support to households and could boost GDP by around 1.5 percentage points over the counterfactual scenario.

While its COVID-19 social assistance response was impressive in many ways, Thailand can strengthen its social protection system further going forward.

- By investing in effective targeting to ensure that vulnerable beneficiaries receive adequate support.

- Defining and tracking the minimum and maximum package of benefits that households may receive to limit the overall fiscal burden.

- Incorporating the large informal sector in Thailand’s social protection system so that everyone can receive the needed support at all times not only during crises.

- Press Release: COVID-19 Crisis Lowers Thailand’s Growth, Continued Support for the Poor Needed

- Download Report

- Download Executive Summary

- Video: Protecting the Poor in Thailand during COVID-19

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

No spam. We promise.

Thailand Travel & Tourism Economic Impact Factsheet

Discover the total economic contribution that the Travel & Tourism sector brings to Thailand and the world in this data-rich, two-page factsheet.

Discover the total economic contribution that the Travel & Tourism sector brings to the Thailand’s economies and to the world in this data-rich, two-page factsheet.

Create an account for free or login to download

Over the next few weeks we will be releasing the newest Economic Impact Research factsheets for a wide range of economies and regions. If the factsheet you're interested in is not yet available, sign up to be notified via the form on this page .

Factsheet details

This factsheet highlights the importance of Travel & Tourism to Thailand across many metrics, and features details such as:

- Contribution of the sector to overall GDP and employment

- Comparisons between 2019 and 2023

- Forecasts for 2024 and 2034

- International and domestic visitor spending

- Proportion of leisure vs business spending

- Top 5 inbound and outbound markets

This factsheet highlights the importance of Travel & Tourism to the Thailand across many metrics, and features details such as:

- Contribution of the sector to overall GDP and employment in the group and globally

- Contribution of the sector to overall GDP and employment in the region and globally

This factsheet highlights the importance of T&T to this city across many metrics, and features details such as:

- Contribution of the sector to overall GDP and employment in the city

- Comparisons between 2019, 2020 and 2021, plus 2022 forecast

- Proportion of the T&T at city level towards overall T&T contribution at a country level

- Top 5 inbound source markets

Report sponsors

Research support partners.

Other factsheets you may like

New zealand fact sheet.

Stockholm Fact Sheet

Doha fact sheet.

International tourism, receipts (current US$) - Thailand

Selected Countries and Economies

All countries and economies.

- Privacy Notice

- Access to Information

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here.

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

- S&P Dow Jones Indices

- S&P Global Market Intelligence

- S&P Global Mobility

- S&P Global Commodity Insights

- S&P Global Ratings

- S&P Global Sustainable1

- Investor Relations Overview

- Investor Presentations

- Investor Fact Book

- News Releases

- Quarterly Earnings

- SEC Filings & Reports

- Executive Committee

- Corporate Governance

- Merger Information

- Stock & Dividends

- Shareholder Services

- Contact Investor Relations

- Email Subscription Center

- Media Center

Thailand's economy rebounds in early 2023 as tourism surges

Executive Director and Asia-Pacific Chief Economist, S&P Global Market Intelligence

Thailand has shown a gradual economic recovery from the COVID-19 pandemic during 2022, helped by rising international tourism arrivals. Real GDP growth rose from 1.5% in 2021 to 2.6% in 2022, with growth momentum expected to improve further in 2023.

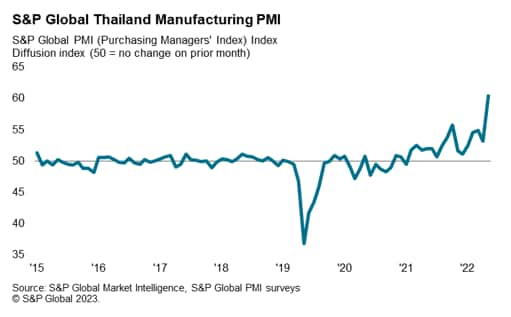

The latest S&P Global Thailand Manufacturing PMI survey results for April 2023 showed a strong upturn in manufacturing output and new orders. Due to the importance of international tourism for the Thai economy, the strong rebound in international tourism inflows evident in early 2023 signals that the tourism economy will be a key growth driver in 2023.

Thailand's economic recovery from the pandemic

The Thai economy has shown an upturn in economic growth momentum in early 2023, with first quarter GDP growth up by 2.7% year-on-year (y/y), compared with 1.4% y/y growth in the fourth quarter of 2022.

The strong first quarter growth rate was underpinned by rapid growth in private consumption, which rose by 5.4% y/y, helped by surging international tourism arrivals. Expenditure on services rose by 11.1% y/y due to buoyant spending in hotels and restaurants. However private investment grew at a modest pace of just 2.6% y/y, while public investment grew by 4.7% y/y.

Thailand's growth rate in 2022 was quite moderate in comparison with other large ASEAN economies such as Malaysia, Vietnam and Philippines, which posted very high growth rates as they rebounded from the pandemic. Thailand recorded real GDP growth of 2.6% in 2022, representing a relatively modest pace of economic recovery from the recessionary conditions caused by the COVID-19 pandemic.

A key driver for improving economic growth in 2022 was the recovery of private consumption, which grew by 6.3% compared with just 0.6% y/y growth in 2021. Private investment growth also improved from a pace of 3.0% in 2021 to 5.1% in 2022. However public investment contracted by 4.9% in 2022, while government consumption was flat.

Strong growth in private consumption and investment as well as rising energy import prices helped to boost import growth, which rose by 15.3% in 2022, while exports rose by just 5.5%, measured in USD terms. Consequently, the trade balance narrowed from USD 32.4 billion in 2021 to USD 10.8 billion in 2022.

Due to the important contribution of international tourism to Thailand's GDP, a key factor that constrained the rate of recovery of the Thai economy in 2022 was the slow pace of reopening of international tourism, although this gathered momentum in the second half of 2022.

The S&P Global Thailand Manufacturing PMI surged to 60.4 in April from 53.1 in March, signalling a rapid improvement in overall business conditions and the strongest performance in any month since the survey started in December 2015. The month-on-month increase in the headline PMI, at 7.3 points, was also by far the biggest on record (the next-largest upward movement was 4.8 points in May 2020).

A key factor driving the improvement in manufacturing operating conditions was a marked expansion in new orders during April. The rate of growth was the fastest on record and largely driven by domestic demand.

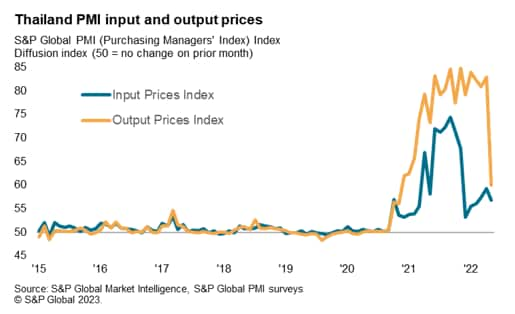

Despite rising demand for raw materials and components in April, manufacturers reported shorter suppliers' delivery times for the first time since April 2022. This reflected a wider recovery in regional and global supply chains. Price pressures eased in April, with input prices having increased at the slowest rate in three months.

Thailand's headline CPI inflation rate eased to 2.7% y/y in April 2023 compared with 5.0% y/y in January 2023 and 7.9% y/y in August 2022. The Monetary Policy Committee (MPC) of the Bank of Thailand decided to raise the policy rate by 0.25% from 1.25% to 1.50% at their Monetary Policy meeting on 25 January 2023, with a further 0.25% rate hike implemented on 29 March 2023. This follows three 25bp rate hikes by the MPC in 2022, In 2022, the Monetary Policy Committee (MPC) decided to increase the policy rate three times by 25 basis points each in August, September and November. The MPC assessed that headline inflation will likely return to the target range by mid-2023, with average CPI inflation projected to decline to 2.9% in 2023 and 2.4% in 2024.

Recovery of international tourism sector

International tourism was a key part of Thailand's GDP prior to the COVID-19 pandemic, contributing an estimated 11.5% of GDP in 2019. However, foreign tourism visits collapsed after April 2020 as many international borders worldwide were closed, including Thailand's own restrictions on foreign visitors.

As COVID-19 border restrictions were gradually relaxed in Thailand and also in many of Thailand's largest tourism source countries during 2022, international tourism showed a significant improvement during the second half of the year. The number of international tourist arrivals reached 11.15 million in 2022, compared with just 430,000 in 2021. However, the total number of visits was still far below the 2019 peak of 39.8 million, indicating considerable scope for further rapid growth in the tourism sector during 2023.

International tourism arrivals in the first quarter of 2023 surged to 6.5 million visitors, which was more than half the total number of international tourist visits in 2022. Total tourism receipts in the first quarter for both domestic and international tourism spending was estimated at 499 billion baht, up by 127% y/y. The Tourism Authority of Thailand has increased its estimated target for international tourism visits in 2023 to 25 million, which is more than double the total number of international tourism arrivals in 2022.

Thailand economic outlook

Despite the upturn in private consumption and international tourism arrivals in 2022, the overall pace of economic expansion was relatively moderate, at just 2.6%. Easing of pandemic-related travel restrictions during 2022 has also allowed a gradual reopening of domestic and international tourism travel, which gathered momentum in the second half of 2022.

With more normal conditions expected for international tourism travel in 2023, this should provide a significant boost to the economy. Due to the importance of tourism inflows from mainland China prior to the pandemic, the reopening of mainland China's international borders will be an important factor contributing to the further recovery of Thailand's tourism market.

Helped by the continued recovery of the international tourism sector, some upturn in GDP growth to a pace of around 3.4% is expected in 2023.

Over the next decade Thailand's economy is forecast to continue to grow at a steady pace, with total GDP increasing from USD 500 billion in 2022 to USD 860 billion in 2032. A key driver will be rapid growth in private consumption spending, buoyed by rapidly rising urban household incomes.

The international tourism sector will continue to be a dynamic part of Thailand economy, buoyed by rapidly rising tourism arrivals the populous Asian emerging markets, notably mainland China, India and Indonesia.

By 2036, Thailand is forecast to become one of the Asia-Pacific region's one trillion-dollar economies, joining mainland China, Japan, India, South Korea, Australia, Taiwan, Philippines and Indonesia in this grouping of the largest economies in APAC. The substantial expansion in the size of Thailand's economy is also expected to drive rapidly rising per capita GDP, from USD 6,900 in 2022 to USD 11,900 by 2032. This will help to underpin the growth of Thailand's domestic consumer market, supporting the expansion of the manufacturing and service sector industries.

However, rising per capita GDP levels will also put pressures on Thailand's competitiveness in certain segments of its manufacturing export industry. Therefore, an important policy priority for nation will be to continue to transform manufacturing export industries towards higher value-added processing in advanced manufacturing industries.

One of the key economic and social challenges facing Thailand is its rapidly ageing population, which will result in a rising burden of health care and social welfare costs over the next two decades. This will be a drag on Thailand's long-term potential growth rate, making investment in technology and innovation increasingly important to mitigate the economic impact of demographic ageing.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI ® ) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn more about PMI data

Request a demo

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Top five economic takeaways from August's PMI as the global manufacturing decline continues

US manufacturing PMI sends warning signals on economic conditions

Week Ahead Economic Preview: Week of 2 September 2024

Travel, Tourism & Hospitality

Industry-specific and extensively researched technical data (partially from exclusive partnerships). A paid subscription is required for full access.

- Direct contribution of tourism to gross domestic product Thailand 2017-2022

In 2022, the tourism industry directly contributed to around 482.81 billion Thai baht to Thailand's GDP. This was a significant increase compared to the previous year.

Direct contribution of the tourism industry to the gross domestic product (GDP) in Thailand from 2017 to 2022 (in billion Thai baht)

To access all Premium Statistics, you need a paid Statista Account

- Immediate access to all statistics

- Incl. source references

- Download as PDF, XLS, PNG and PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

Asia, Thailand

2017 to 2022

One Thai baht equals 0.027 U.S. dollars and 0.025 euros as of June 2024. The figures have been rounded.

Other statistics on the topic Tourism industry in Thailand

- Value of tourism GDP Thailand 2017-2022

Leisure Travel

- Most used online travel agencies Thailand 2023

- Number of local tourists Thailand 2023

- International tourist arrivals revenue Thailand 2023

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

* For commercial use only

Basic Account

- Free Statistics

Starter Account

- Premium Statistics

The statistic on this page is a Premium Statistic and is included in this account.

Professional Account

- Free + Premium Statistics

- Market Insights

1 All prices do not include sales tax. The account requires an annual contract and will renew after one year to the regular list price.

Statistics on " Tourism industry in Thailand "

- Number of quarterly foreign visitors Thailand Q1 2021-Q1 2024

- Size of employment in tourism sector Thailand 2017-2022

- Indirect contribution of tourism to gross domestic product Thailand 2017-2022

- Value of tourism tax Thailand 2017-2022

- Local tourists revenue Thailand 2023

- Number of international visitors Thailand 2023, by region of origin

- Number of foreign visitors Thailand 2023, by region

- Revenue generated from foreign visitors Thailand 2023, by region

- Number of traveling locals Thailand 2023, by region

- Revenue generated from traveling locals Thailand 2023, by region

- Share of foreign visitors to total guests of accommodations Thailand 2015-2023

- Share of foreign visitors to total guests of accommodations Thailand 2023, by region

- Advance reservation rate of accommodations Thailand 2015-2023

- ADR of accommodations Thailand 2015-2023

- Popular accommodations for Thais when travelling Thailand Q2 2021

- Ideal travel destinations in Asia among Thais 2023

- Online travel agency usage Thailand 2023

- Most common duration before a trip to purchase travel tickets on OTAs Thailand 2023

- Reasons for using online travel agencies for purchasing tickets Thailand 2023

- Reasons for not using online travel agencies for purchasing tickets Thailand 2023

Other statistics that may interest you Tourism industry in Thailand

- Premium Statistic Value of tourism GDP Thailand 2017-2022

- Basic Statistic Number of quarterly foreign visitors Thailand Q1 2021-Q1 2024

- Premium Statistic Number of local tourists Thailand 2023

- Premium Statistic Size of employment in tourism sector Thailand 2017-2022

Economic impact

- Premium Statistic Direct contribution of tourism to gross domestic product Thailand 2017-2022

- Premium Statistic Indirect contribution of tourism to gross domestic product Thailand 2017-2022

- Premium Statistic Value of tourism tax Thailand 2017-2022

- Premium Statistic International tourist arrivals revenue Thailand 2023

- Premium Statistic Local tourists revenue Thailand 2023

- Premium Statistic Number of international visitors Thailand 2023, by region of origin

- Premium Statistic Number of foreign visitors Thailand 2023, by region

- Premium Statistic Revenue generated from foreign visitors Thailand 2023, by region

- Premium Statistic Number of traveling locals Thailand 2023, by region

- Premium Statistic Revenue generated from traveling locals Thailand 2023, by region

Accommodation

- Premium Statistic Share of foreign visitors to total guests of accommodations Thailand 2015-2023

- Premium Statistic Share of foreign visitors to total guests of accommodations Thailand 2023, by region

- Premium Statistic Advance reservation rate of accommodations Thailand 2015-2023

- Premium Statistic ADR of accommodations Thailand 2015-2023

- Premium Statistic Popular accommodations for Thais when travelling Thailand Q2 2021

Tourist perspectives

- Premium Statistic Ideal travel destinations in Asia among Thais 2023

- Premium Statistic Online travel agency usage Thailand 2023

- Premium Statistic Most used online travel agencies Thailand 2023

- Premium Statistic Most common duration before a trip to purchase travel tickets on OTAs Thailand 2023

- Premium Statistic Reasons for using online travel agencies for purchasing tickets Thailand 2023

- Premium Statistic Reasons for not using online travel agencies for purchasing tickets Thailand 2023

Further related statistics

- Premium Statistic Annual value added of the tourism industry in Norway 2011-2019

- Premium Statistic Annual added value of the tourism industry in Italy 2016, by region

- Premium Statistic Inbound tourism expenditure over current account credits Indonesia 2012-2021

- Premium Statistic Inbound tourism expenditure over exports of services Indonesia 2012-2021

- Premium Statistic Tourism balance over GDP in Croatia 2010-2021

- Premium Statistic Inbound tourism expenditure over exports of goods Indonesia 2012-2021

- Premium Statistic Tourism openness over GDP in Russia 2010-2020

- Premium Statistic Expenditures shopping services in domestic tourism Philippines 2012-2021

- Premium Statistic Tourism openness over GDP Indonesia 2011-2020

- Premium Statistic Tourism balance over GDP in Bulgaria 2010-2021

- Premium Statistic Tourism balance over GDP in Estonia 2010-2021

- Premium Statistic Tourism balance over GDP in Russia 2010-2020

- Premium Statistic Tourism intensity in Albania 2010-2021

- Premium Statistic Argentina TTCI in 2013-2019

- Premium Statistic Outbound tourism expenditure as a share of total imports Thailand 2010-2021

Further Content: You might find this interesting as well

- Annual value added of the tourism industry in Norway 2011-2019

- Annual added value of the tourism industry in Italy 2016, by region

- Inbound tourism expenditure over current account credits Indonesia 2012-2021

- Inbound tourism expenditure over exports of services Indonesia 2012-2021

- Tourism balance over GDP in Croatia 2010-2021

- Inbound tourism expenditure over exports of goods Indonesia 2012-2021

- Tourism openness over GDP in Russia 2010-2020

- Expenditures shopping services in domestic tourism Philippines 2012-2021

- Tourism openness over GDP Indonesia 2011-2020

- Tourism balance over GDP in Bulgaria 2010-2021

- Tourism balance over GDP in Estonia 2010-2021

- Tourism balance over GDP in Russia 2010-2020

- Tourism intensity in Albania 2010-2021

- Argentina TTCI in 2013-2019

- Outbound tourism expenditure as a share of total imports Thailand 2010-2021

IMAGES

VIDEO

COMMENTS

Total value of the tourism's contribution to the Gross Domestic Product in Thailand from 2017 to 2022 (in billion Thai baht) Number of international tourists in Thailand from 1st quarter 2021 to ...

In 2022, the tourism industry contributed around 1.3 trillion Thai baht to Thailand's GDP. This was a significant increase, compared to the previous year. Thailand is one of the most popular ...

Thailand has shown a gradual economic recovery from the COVID-19 pandemic during 2022, helped by rising international tourism arrivals. Real GDP growth rose from 1.5% in 2021 to 2.6% in 2022, with growth momentum expected to improve further in 2023. The latest S&P Global Thailand Manufacturing PMI survey results for February 2023 continued to ...

Thailand's gross domestic product (GDP) in 2021 grew by 1.6 per cent, recovering from a 6.2-per-cent contraction in 2020, the government reported Monday. However, the country's vital tourism sector continues to suffer as the pandemic's impact lingers on.

ase volatility in the financial markets.For Thailand, the economy in 2021 expanded by 1.5 percent from the previous year and was driven by recoveri. s in both external and domestic demands. The impact of the new wave of infections on the Thai economy was not as severe as the first wave thanks to less restrictive containment measures compared to ...

Like many countries, Thailand's economy was hit hard by the COVID-19 pandemic last year. The country's GDP fell by over 6 percent in 2020 and many workers, especially those related to the tourism sector, lost their jobs.

Thailand's economy is reliant on international tourism, a once-flourishing sector that has been impacted by pandemic restrictions. But there have been continual government efforts to boost domestic travel, and measures to support returning international demand after Thailand began reopening to vaccinated international travelers from 63 countries on November 1, 2021. 1 Even as the world ...

Revenue from tourism, which used to account for 11% of GDP in 2019, when it reached US$59.8bn, dropped to a dismal US$5bn or 1% of GDP in 2021. In the first half of 2022 travel receipts were roughly on a par with the level seen in the full year of 2021. As arrivals picked up further in the third quarter of 2022, the recovery of travel receipts ...

Economic activity is not expected to return to its pre-pandemic levels until 2022, and the recovery is projected to be slow and uneven. The growth forecast for 2021 has been revised downward from 3.4 percent in March to 2.2 percent, reflecting the anticipated impact of the third wave of COVID-19 infections on private consumption, and the ...

by Bank of Thailand Tourism sector has been one of the key engines of Thai economy. In 2019, nearly 40 million foreign tourists visited Thailand which helped generate revenue of about 2 trillion Baht (11% of GDP) and employed more than 7 million persons (20% of total employment).

in 2019 to 3.2 percent of GDP in 2020 (Table 3), largely reflecting the collapse in tourism receipts. The economic recovery is expected to be sluggish, uneven, and subject to heightened uncertainty. Real GDP is projected to expand by 2.6 percent in 2021, led by a gradual recovery in domestic demand and goods exports.

Thailand's economy grew at its fastest pace in more than a year last quarter, boosted by a rebound in tourism and private consumption, but the outlook was clouded by risks of a global economic ...

In 2022, the tourism industry contributed around 7.24 percent to Thailand's GDP, which increased from the previous year since the country reopened fully for tourism.

Thailand's economy grew faster than expected last quarter, buoyed by rising exports and tourist arrivals, firming its recovery as it faces risks this year from inflation and the omicron variant.

Discover the total economic contribution that the Travel & Tourism sector brings to Thailand and the world in this data-rich, two-page factsheet.

Thailand has shown a gradual economic recovery from the COVID-19 pandemic during 2022, helped by rising international tourism arrivals. Real GDP growth rose from 1.5% in 2021 to 2.6% in 2022, with growth momentum expected to strengthen further in 2023.

License : CC BY-4.0 Line Bar Map Also Show Label 1995 2000 2005 2010 2015 2020 10 20 30 40 50 60 Thailand 1995 - 2020 International tourism, receipts (% of total exports) International tourism, expenditures for passenger transport items (current US$) International tourism, expenditures (% of total imports) International tourism, expenditures (current US$) International tourism, number of ...

Thailand tourism statistics for 2021 was 0.00, a 100% decline from 2020. Thailand tourism statistics for 2020 was 15,360,000,000.00, a 76.14% decline from 2019.

THAILAND The Thai economy continued to expand in 2022 due to robust private consumption and tourism recovery. Tourism and private consumption are expected to be the main growth drivers in 2023-2024. However, a global economic slowdown may derail the Thai economy from its recovery path as risks are tilted to the downside. Transitioning to a net-zero carbon emissions economy is a policy ...

Thailand gdp for 2022 was $495.42B, a 2.01% decline from 2021. Thailand gdp for 2021 was $505.57B, a 1.02% increase from 2020. Thailand gdp for 2020 was $500.46B, a 8% decline from 2019. Thailand gdp for 2019 was $543.98B, a 7.35% increase from 2018. GDP at purchaser's prices is the sum of gross value added by all resident producers in the ...

Thailand has shown a gradual economic recovery from the COVID-19 pandemic during 2022, helped by rising international tourism arrivals. Real GDP growth rose from 1.5% in 2021 to 2.6% in 2022, with growth momentum expected to improve further in 2023.

In 2022, the tourism industry directly contributed to around 482.81 billion Thai baht to Thailand's GDP.

The aims of this study are to evaluate the influence of air transport and tourism on economic growth in selected Southeast Asian countries such as Thailand, Philippines, Vietnam, Indonesia, Malaysia, and Singapore in the period 1970 to 2021. The study applies the ordinary least squares (OLS), fixed effects (FEM), and random effects (REM), especially to robustness test of the research results ...