- Mitchell Institute

- Air & Space Forces Magazine

- AFA’s Legislative Priorities

- AFA’s Letters to the Hill

- Recruiting Resources (AFA AIMS)

- CyberPatriot

- StellarXplorers

- Doolittle Leadership Center

- AFA’s Teacher of the Year Program

- Scholarships

- Pitsenbarger Awards

- Sponsor STEM

- Wounded Airmen & Guardians Program

- United Forces & Families (F2)

- National Awards

- Air, Space & Cyber Conference

- AFA Warfare Symposium

- AFA National Convention

- Air & Space Warfighters In Action

- Vietnam: 50 Years Later

- Events Calendar

- AFA in Action

- Individual Membership

- Corporate Membership

- Community Partners

Member Benefits

- Chapters & Field Leaders

- Emerging Leader Program

- Field Leader Resources

- Board of Directors

- Professional Staff

- Annual Report

- Governing Documents

- Careers at AFA

- Branding Guide & Logos

AFA connects members to a growing community of like-minded professionals, advocates, and experts. We strive to be a voice for Airmen and Guardians to make aerospace education accessible to all. When you become an AFA member, you become part of the force behind the Air and Space Forces.

Member benefits include:

- Stay informed and up-to-date with the Air and Space Forces community through the magazine, Daily Report, and podcasts.

- Attend a wide variety of events.

- Gain access to financial programs, health and wellness services, insurance, and legal services to making sure you and your family are covered.

- Save with shopping and travel discounts.

Open the sections below to learn about your specific AFA member benefits.

Scholarships and Grants

AFA offers a variety of scholarship and educational grants for students and STEM educators. Learn more about all of AFA’s educational support programs.

Hotel Engine

Hotel Engine is a free and exclusive members-only hotel booking platform that connects AFA members to deeply discounted hotel rates. Take advantage of an average of 26% off public rates at more than 150K+ hotels; no contracts, annual fees, or minimum spends; and superior 24/7, U.S.-based customer support.

Please log in to access this benefit.

Life is nonstop. We’re here to keep you moving. From the car to the accessories, choose what best fits you and your trip. So when you drive off, you’ll be ready for whatever the journey brings.

AFA members save up to 35% off base rates with Pay Now on your next car rental.

Avis Car Rental operates one of the world’s best-known car rental brands with approximately 5,450 locations in more than 165 countries. Avis has a long history of innovation in the car rental industry and is one of the world’s top brands for customer loyalty.

Adventure awaits. Save up to 35% off Budget base rates plus get other sweet deals.

AFA members can enjoy savings of up to 35% off Budget PAY NOW rates!

Budget Car Rental is one of the world’s best-known car rental brands with approximately 3,350 locations in more than 120 countries. Budget is an industry leader in providing vehicle rental services to value-conscious travelers and also operates the second-largest truck rental business in the United States, through a network of approximately 1,650 locations

USAA is proud to be the Preferred Provider of Financial Services for the Air & Space Forces Association. Please visit usaa.com/afa or call 877-618-2473.

Statera Retirement

Are you prepared for the risks you’ll face in retirement? Ever wonder how to insulate your retirement from stock market volatility? Inflation? Longevity? Statera Retirement has the answer, and the innovative SIM™ retirement system is now available as a benefit through your AFA membership. Click here to learn more and schedule your complimentary analysis!

Brookdale Senior Living

Brookdale Senior Living is the nation’s leading operator of senior living communities, and is committed to its mission of enriching the lives of the people it serves with compassion, respect, excellence and integrity. The Company operates more than 650 independent living, assisted living, and Alzheimer’s and dementia care communities across the US. Through its comprehensive network of services, Brookdale helps to provide seniors with care and services to support their lifestyle in an environment that feels like home. The Company’s expertise in healthcare, hospitality and real estate provides residents with opportunities to improve wellness, pursue passions and stay connected with friends and loved ones. Brookdale is a proud partner of the Air & Space Forces Association. AFA members and their family are eligible for exclusive benefits and discounts on senior living. To learn more or claim your benefits, visit Brookdale.com/afa today.

Life Line Screening

The Power of Prevention

Did you know that you may be at risk for life-threatening diseases and yet have no symptoms? Life Line Screening evaluates your risk for several of today’s most critical–and often undiagnosed–healthcare conditions.

The screenings are less than an hour, painless, and noninvasive and are performed conveniently in your own community by a skilled technologist and reviewed by a board-certified physician. You’ll receive a confidential written report within 21 days and are encouraged to share the results with your doctor.

Take advantage of your AFA Member Discount on these vital Screenings when Life Line comes to your neighborhood:

- AFA members save money on vital screenings

- Stroke, Vascular Disease and Heart Rhythm Package: $135 for AFA Members. Your savings: $105

- Complete Wellness Package: $145 for AFA Members. Your savings: $130 (includes all of the above plus Osteoporosis screening)

- Add 6 for Life Screenings: $224 for AFA Members. Your savings: $130 (includes all of the above plus “6 for Life” Health Assessment, Complete Lipid Panel and Blood Sugar Test–measures your risk for 6 major chronic diseases: stroke, diabetes, coronary heart disease, congestive heart failure, COPD)

Need help? Call 1-800-908-9121

Active & Fit Direct

Ready to up your fitness? Sign up at Active & Fit Direct and gain a gym membership to your choice of 12,200+ standard gyms and/or 5,800+ premium exercise studios with 20-70% discounts. You can find a flexible fitness lifestyle that will work out for you by joining today.

To access this benefit, please log in to your AFA member account.

AFA Insurance

AFA members are eligible to participate in a variety of group insurance programs. Like our Air Force, our membership is diverse and inclusive of individuals in all walks of life. We want to make sure that you’re covered no matter what.

Visit AFA’s insurance website for full details and to apply

Home and Auto

In return for our members’ efforts to support Airmen, the AFA has joined forces with USAA to protect your investments in life. Protect your home, car, and belongings with industry-leading service and coverage designed to fit your budget and your needs.

As an AFA member, you can smile and rest easy knowing that you’re protected against the rising cost of dental care with flexible dental insurance coverage. Take advantage of valuable and affordable dental protection for you and your family. All of our options are competitive, efficient and easy to access.

We are Airmen for life. Find flexibility to suit your needs now and in the future. As an AFA member, you can take advantage of various life insurance plans, including 10 Year Level Term Life, Decreasing Term Life, and Term Life Insurance.

Accidental Death

Accidents happen when we least expect them. As an AFA member you can have peace of mind that you and your family are protected year-round, and anywhere in the world by taking advantage of the AFA GroupAccidental Death & Dismemberment Insurance Plan.

Senior Whole Life

Help prepare for the unexpected and reinforce your family’s financial safety net with up to $25,000 in benefits. Take advantage of a permanent policy with guaranteed protection for your loved ones that lasts a lifetime.

Short Term Recovery

While Medicare and TRICARE are comprehensive plans, they simply weren’t designed to cover all of your hospital and home recovery care expenses. This member benefit helps take care of expenses during recovery at home or in the hospital that may not be covered by other plans. Benefits are paid in addition to other coverage that you may have.

Hospital Indemnity Insurance Plan

Ages 64 and under: Cash benefits complement your insurance and help pay for the unexpected and high out-of-pocket costs associated with a hospital stay.

Long Term Care

Protect your assets against the cost of long term care with customized protection through the variety of individual plans available to AFA members. Members have access to special discounts, multiple carriers, multiple products, wider underwriting, and service for life.

TRICARE Supplements

Out of pocket medical expenses can add up quickly. That’s where supplemental insurance coverage can be helpful to you and your family. AFA Members who are eligible TRICARE recipients are also eligible for competitively priced supplement coverage that goes with you anywhere.

AFA members can have peace of mind knowing that every member of the family – even those with four legs – is fully secure. With a pet insurance plan, you’ll no longer have to worry about cost if your dog or cat has to make an emergency visit to the vet.

MetLife Legal Plans

YOUR LIFELONG SAFETY NET

You never know when legal problems will derail your plans. But with affordable services through AFA, you’ll always know you have protection.

For $216 a year, MetLife Legal Plans covers you, your spouse and your dependents for a range of personal legal issues, including:

- Debt collection defense

- Traffic ticket defense

UNPARALLELED VALUE

Choose from 15,000 attorneys across the United States for unlimited phone and office consultations, plus full representation. With no deductibles, no co-pays, and no claim forms, you can save hundreds on typical attorney fees.

AFA members can enroll every November through December for the following calendar year.

Need help? Call 1-800-291-8480.

“..my first experience with Hyatt Legal was awesome …The attorney was outstanding and helped me to resolve my issue WAY better than I expected… She is going to help me with some other issues that I need to address and I look forward to working with her and Hyatt Legal in the near future.”

— Mike S., plan member in Atlanta, GA

As a thank you for your support of the AFA and its mission, AFA members receive a variety of benefits, including financial assistance, insurance — and shopping discounts. Make your money go further with these with these member-only shopping discounts.

AFA Merchandise

Find all of your AFA merchandise at ShopAFA. Our store has t-shirts, hats, art prints, coins, and much more! Show your Airman for Life pride and support AFA by making a purchase today .

LifeLock by Norton

It can be dangerously easy to steal your identity. With LifeLock, it’s easy to help protect yourself.

The sensitive info you send online can easily be stolen by identity thieves. That’s why LifeLock by Norton detects and alerts you to potential identity threats that you may not spot on your own. If you become a victim, we work to fix it. Identity thieves have had it dangerously easy for too long. Now it’s easy to help protect yourself. LifeLock. Identity theft protection starts here.

Check out available products and receive a 35%* discount for the life of your membership. *Terms Apply.

Questions? Reach out to LifeLock at 800-868-2991.

Office Depot

Because you’re a member of the Air & Space Forces Association, you now have access to exclusive “members only” discounts through a variety of programs like Office Depot, OfficeMax, Lenovo, and more!

When it comes to office supplies, every penny counts. That’s why we’ve made your AFA savings even more rewarding. ODP Business Solutions™ is your one-stop shop for resources and solutions needed to help manage your budget.

Why ODP Business Solutions?

Here’s what you get when you register for an account and use your member benefits: Flexible Savings: up to 75% off Best Value products with thousands of items discounted below retail. You’ll save on:

- Office Supplies and Essentials

- Coffee, Breakroom & Janitorial Solutions

Ink & Toner Deals: discounted pricing on 400+ HP products and more Copy & Print Services: receive significant savings on copy & print | b&w copies start at 11¢ & color at 32¢ Free Next Business-Day Delivery: on qualifying orders over $30 Special Offers: see flash sales available on your dashboard when you login to your account

Sign in to access this AFA member benefit.

Move or store with PODS and get 10% off initial delivery, first month’s container rental, and long-distance transportation. PODS has been trusted by the military community for more than 15 years, making it easy with containers delivered right to you. You can pack and load on your schedule and when you’re ready, we’ll deliver your container across town, across the country — or if you need interim storage — to one of our secure facilities. And if you’re Active duty, we’re here to help with your next PPM/ DITY PCS Move.

PODS is honored to partner with the Air & Space Forces Association to provide exclusive offers and discounts to our valued members of the U.S. Air & Space Forces! To learn more, visit www.pods.com/afausa or call 866.556.9574

The world moves fast – and your AFA UPS® Savings Program has the tools you need to help you move even faster. We’re here to help you push envelopes and ride the edge of what’s possible. We’ll be right by your side with everything you need to keep blazing forward.

Let UPS® help make you unstoppable. Members enjoy the following savings every time you ship:

- 50% off Domestic Next Day / Deferred

- 30% off Ground Commercial / Residential

- 50% off International Exports & 40% off Imports

- Up to 50% off on additional services

- Plus, UPS Smart Pickup® service is free

MemberDeals

MemberDeals is excited to partner with AFA. Now you’ll have access to exclusive savings on theme parks, hotels, concerts, movie tickets, & more.

Check out MemberDeals who provides AFA members with a unique opportunity to access exclusive offers to the world’s greatest entertainment and travel brands, including Walt Disney World® Resort, Universal Orlando Resort™, Cirque du Soleil® and SeaWorld® Parks and Entertainment, and many other worldwide offers and attractions are available all with special pricing not available to the public.

Please sign in to access this AFA member benefit.

Your online history can secretly hurt your job search. Don’t let it define you; take control with Filtari.

In today’s digital age, even a single inappropriate social media post from years ago can overshadow your qualifications and derail your career aspirations. These lingering posts often silently cost job opportunities before you even realize it. Filtari scans and neutralizes these potential pitfalls, ensuring your online presence champions your professionalism and dedication. Filtari is your shield against unforeseen digital setbacks.

Exclusive for AFA Members: Receive a 33% discount on our services please login to utilize your AFA discount.

A Practical Guide to Buying Travel Insurance

Travel insurance could be the difference between a huge medical bill or a modest copay. use these tips to find the best policy for your trip..

- Copy Link copied

It’s far better to buy travel insurance and never use it than to not be covered in an emergency.

Courtesy of Shutterstock

For many, travel insurance seems like an unnecessary additional expense. But if you get stuck in a costly situation—a medical emergency, a canceled trip due to a pandemic , a stolen camera—it suddenly becomes a totally worthwhile investment that saves, not costs, you money.

This was the case for writer Chris Ciolli. After years of traveling without a safety net, she invested in travel insurance on a recent trip during which she was rushed to the hospital at 3 a.m. for a slew of just-in-case tests. She ended up with an underwhelming diagnosis of gastritis, but also a slow trickle of medical bills—a few hundred dollars here, a thousand there—that totaled nearly $6,000. Fortunately, her monthlong $185 World Nomads policy covered everything after an initial $80 copay.

But even if you understand the benefits and you’re committed to buying travel insurance, choosing the right policy for your needs—and even knowing what those needs are—can be tricky. To help you choose the best travel insurance for your trip, we’ve consulted a number of travel agents, insurance industry professionals, and lifelong travelers for advice. In this guide, you’ll find everything you need to know, from travel insurance reviews and comparisons to common questions answered, to pick the best policy for your next trip.

What is travel insurance?

Travel insurance is a plan, similar to health or auto insurance, that protects you from expenses incurred during unforeseen mishaps while traveling, such as lost luggage, trip cancellations, or medical emergencies.

Although your current homeowner’s, renter’s, auto, or health insurance may cover you for certain things while traveling, it usually doesn’t cover everything—especially on international trips. A good travel insurance plan will cover the gaps.

Where do you get travel insurance?

Some very basic forms of travel insurance are included if you booked your trip with a credit card such as World MasterCard, Capital One Venture Rewards, and Chase Ink and Sapphire cards. With these plans, you may be protected regarding some delay, luggage, and travel accident expenses, but the coverage is usually pretty basic.

You can also purchase it as an add-on while booking flights, cruises, or hotels. These plans are also limited and will only cover you in the event of an unavoidable cancellation due to events such as a natural disaster or a death in your family. “While it may seem less expensive, it may not cover all of the components of your trip,” says Andrew David Harris, vice president and COO of Harris Travel Service . While both of these are better than nothing, the most comprehensive and best travel insurance policies are sold by providers such as World Nomads, Allianz Global Assistance, Seven Corners, or TravelEx. You can purchase these plans through your travel agent, but it’s often less expensive to book directly with the travel insurance provider or through a comparison website, like SquareMouth .

What does travel insurance cover?

Every traveler and trip is different, which is reflected by the variety of travel insurance plans on the market. No matter what plan or provider you choose, below are some common things travel insurance covers. Experts agree that before you buy, you should absolutely look for specific exclusions in the fine print on potential policies. If you’re unsure about something, reach out. A good insurance company will be responsive and willing to clarify your questions.

Trip cancellation and interruption

Most travel insurance policies will include some form of trip cancellation and interruption coverage to reimburse you for nonrefundable expenses, like a prepaid hotel or plane ticket. Unless you add cancel for any reason (CFAR) insurance to your plan, there will be a limited set of acceptable reasons to claim this. Illness, death of an immediate family member, and weather are commonly accepted reasons.

Trip delays and missed connections

Also common is reimbursement for additional expenses incurred if a trip is delayed and meets criteria set out by the provider. With World Nomads, your flight must be delayed by at least six hours to qualify.

Baggage and personal effects

Most plans will cover the cost of lost or damaged luggage and personal belongings as well as the cost of purchasing additional items if your luggage is delayed.

Emergency medical and dental care

This covers the cost of medical care when you get sick or have an accident in another country and usually includes medical evacuation. However, travel insurance isn’t a substitute for regular health insurance so nonemergency medical expenses (physicals, anything cosmetic, eye exams) aren’t covered. Childbirth isn’t covered either, even for pregnant travelers who go into labor prematurely.

Shannon O’Donnell, 2013 National Geographic Traveler of the Year and blogger at A Little Adrift , mentions another coverage gap travelers miss: “You’re only covered for what you’re licensed to do back home—if you don’t have a permit for a motorbike and you drive one in Southeast Asia, you might not be covered in an accident.”

Emergency medical evacuation

This covers the cost of an emergency transfer (in an ambulance or helicopter, for example) from an area with inadequate medical care to the nearest medical center with the services you need. It’s costlier but essential in isolated and politically unstable parts of the world.

Accidental death and dismemberment and repatriation

Experts say that “truckloads of coverage for hospital costs and medical repatriation home” are the most important things to look for. “The rest is just window dressing.” A lot of basic plans won’t include this in their coverage, but you can easily add this on with an upgrade to a more premium tier.

Concierge and 24/7 service

Daniel Durazo, director of Marketing and Communications for Allianz Global Assistance , says that “a good policy includes a 24/7 contact line for both medical and travel emergencies.”

Common travel insurance add-ons to consider

A basic plan is usually enough for most travelers, but it may not cover everything you need if you’re older, have pre-existing medical conditions, participate in sports while traveling, book an expensive trip, or travel with expensive gear (such as a high-end camera). If you fall into any of these categories, consider an add-on or upgrade.

Upgrade lost luggage, trip delay, and cancellation amounts

“Standard travel insurance levels cover more modest belongings and lodging,” advises Annette Stellhorn, president and Group Luxury Travel designer at Accent on Travel . If you’re traveling with expensive gear or spending a lot on your trip, consider upgrading to a tier that covers your costs adequately.

Additional coverage for adventure and high-risk travel

Stellhorn also notes that adventure and high-risk travel “require higher benefit amounts for medical evacuation, which can run more than $250,000.” And Judy Perl at Judy Perl Worldwide Travel says that “most insurance companies will not insure high-risk travel at all, with the exception of big companies like First Allied and Travelex .” Even fewer risky activities and sports may only be covered to a limit: that is, climbing to certain heights and diving to certain depths.

Most sports are covered up to a certain level of intensity; any higher and you may have to purchase a different tier of insurance. World Nomads, for example, will cover a slew of adventure travel activities and sports, but at an additional cost on top of its basic insurance.

Cancel for any reason (CFAR) insurance

It’s important to read the fine print of any insurance plan because, even if it includes trip cancellation coverage, this often only kicks in under certain circumstances. As many travelers found out recently, trips canceled due to the recent coronavirus pandemic were not covered unless they had a CFAR add-on .

Jennifer Wilson-Buttigieg, co-owner and copresident at Valerie Wilson Travel , explains that these plans “only cover 75 percent of trip expenses [and only] if travelers cancel their trips at least 48 hours in advance.”

Does travel insurance cover pandemics?

No. “Once actual events have unfolded, such as the coronavirus outbreak, they are considered known or foreseeable events and are no longer covered by most travel insurance policies,” says Afar’s Michelle Baran . The exception is if you chose to upgrade your plan to include a CFAR add-on.

What are the best travel insurance policies?

The best travel insurance policy will depend on you and your trip. You’ll want to make sure you have a plan that covers the cost of your entire trip and the activities you want to do and won’t leave you in the dark if you have preexisting conditions. The following are some of the best travel insurance partners to consider:

Best for: Older travelers and those with preexisting conditions.

While Allianz provides great travel insurance for any traveler, it’s especially appropriate for those with pre-existing conditions, since those are covered in every one of its plans. However, its basic coverage only covers up to $500 in lost or damaged baggage, so consider an upgrade if you’re traveling with more expensive equipment.

Get a quote: allianztravelinsurance.com

Best for: Medical coverage only

GeoBlue’s Voyager basic medical coverage is not a comprehensive travel insurance plan that covers a slew of scenarios; rather it provides travelers with basic medical travel insurance. The deductible is a high $500, but at $19 to $35 per trip, it’s an inexpensive way to protect yourself in case something catastrophic happens. If you’re adequately covered for travel mishaps like lost luggage or stolen goods by other insurance (like your credit card or homeowner’s insurance), this might be the plan for you.

Get a quote: geobluetravelinsurance.com

Best for: Traveling with kids

With TravelEx, travelers can choose between a basic or select travel insurance package with options to customize it according to their needs. Both plans cover standard things like trip cancellation and emergency medical services and are an all-around comprehensive option. However, its Travel Select plan also includes free coverage for any children under 17 traveling with you. For families, TravelEx Select is a great money-saving option.

Get a quote: travelexinsurance.com

How much does travel insurance cost?

Complete travel insurance packages can cost as little as $8 per day but vary depending on the length of the trip, destination(s), and the tier of travel insurance you choose. Some, but not all, travel insurance may also cost more for travelers with pre-existing conditions or older adults.

As a comparison, here are some examples of travel insurance costs for a 45-year-old traveler on a $5,000, one-week trip to Mexico:

- $138 for an explorer plan with World Nomads

- $179 for a basic plan with Allianz

- $248 for an essential plan with AIG

- $261 for a basic plan with Travelex

While some of these plans may seem expensive, keep in mind that if they provide you the coverage you need, they can be a huge money saver. Insurer World Nomads says that its average claim amount for 2017 was $1,634, and its most expensive claim—a medical evacuation of a child from Sitka, Alaska, to Seattle—was nearly $200,000. Suddenly, that $8 per day makes travel insurance worth it . But, as Michael Holtz, founder and CEO of the travel agency SmartFlyer , says, “People don’t think they need it until they need it.”

How do I buy travel insurance?

You should always buy travel insurance from an official, reputable provider or website, such as purchasing directly through the insurance provider, a travel agent, or a comparison website; these “offer a way to search, compare, and purchase from a wide array of plans,” says Stan Sandberg, cofounder of TravelInsurance.com .

Comparison sites to buy travel insurance include:

- Travelinsurance.com

- SquareMouth

- Insuremytrip

Sandberg strongly recommends consumers speak with a licensed agent when they are unsure about benefits. The website Elliott Report is another good resource and features a list of reputable travel insurance companies compiled by consumer advocate Christopher Elliott.

When to buy travel insurance

Generally, you should book your travel insurance as soon as you can after booking your flights and hotels. If you’re traveling to a destination affected by hurricanes , book sooner rather than later, because you can’t buy insurance to cover delays or cancellations related to a storm that already has a name.

People with preexisting conditions need to consider other factors. Most insurers will cover only expenses related to prior illnesses in very specific circumstances; travelers with preexisting conditions must book coverage within a specific time frame, usually between 14 and 21 days, following their initial trip reservation, and they must be medically able to travel on the date they purchase the insurance.

Your travel insurance policy period should be for the duration of your trip from door to door (no gaps or shortcuts, please) and cover you for every place you plan to visit, whether it’s in-state, out-of-state, or international. Some destinations are at higher risk than others, so insurers don’t offer the same coverage for the same price everywhere.

What does your existing insurance cover while traveling?

While your existing health, auto, renter’s, or homeowner’s insurance may cover a few things while you’re traveling, it likely doesn’t cover everything.

- Health insurance: Many U.S. health-care policies, including Medicare, don’t cover travelers on international trips. Some plans will cover you abroad, so check with your provider. If your health insurance only covers you domestically, both the Centers for Disease Control and the U.S. State Department recommend purchasing medical travel insurance.

- Travel insurance: Credit cards can provide limited coverage of some delay, luggage, and travel accident expenses, as well as part of your rental car insurance.

- Homeowner’s and renter’s insurance: Home contents or rental insurance may cover some lost, stolen, or damaged valuables or even offer a reasonably priced floater policy (an add-on to your regular policy that covers easily moveable property) if you travel with expensive equipment.

- Auto insurance: Within the United States, your primary auto insurance will almost always cover rental vehicles. There are a few exceptions for domestic rentals, like if your current auto insurance has low coverage limits. International car rentals are a different story. In Mexico, for example, rental car insurance is mandatory , even if you have insurance at home. Always be sure to check local rules before you reserve a rental car.

Tips for filing claims and getting reimbursed

Unlike most domestic health insurance policies, travel insurance doesn’t typically have a deductible. Some inexpensive policies will require you to pay a small, nonrefundable, initial policy excess amount before further costs up to the benefit limit are covered. Many policies work on a reimbursement plan: You pay upfront, save your receipts, and file a claim, then after processing, your insurance company pays you back for covered expenses.

Most policies require you pay non-emergency expenses out of pocket and submit your claim for reimbursement afterward. In a non-life-threatening emergency, call your insurer for instruction if you’re able; it will make the claims process easier, and the insurer may be able to direct you to a hospital or medical center where your care can be billed directly to it.

Hannah Logan, of the blog Eat Sleep Breathe Travel , says this step is especially important because the small print on many policies “reads that calling the contact number [may be] a requirement for coverage.”

No matter what, document everything. Whether it’s lost baggage, a medical expense, or damage to your rental car, gather and keep anything that can help your claims case: your original rental car agreement, receipts, photos, medical paperwork, a copy of your boarding pass.

Buying travel insurance is a little like packing a suitcase: It can seem overwhelming at first, but eventually it becomes routine and a necessary part of every trip. Once it does, you can travel worry-free, secure in the knowledge that you’ve saved yourself from a possible $6,000 mistake.

This article originally appeared online in 2018; it was updated on June 19, 2020, and on May 15, 2024, to include current information.

World Nomads provides travel insurance for travelers in over 100 countries. As an affiliate, we receive a fee when you get a quote from World Nomads using this link. We do not represent World Nomads. This is information only and not a recommendation to buy travel insurance.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel insurance

Best travel insurance companies of June 2024

Amy Fontinelle

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 2:16 p.m. UTC June 7, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

WorldTrips is the best travel insurance company of 2024 , based on our in-depth analysis of travel insurance policies. Its Atlas Journey Elevate plan gets the top score in our rating because of the extensive coverage it provides for the price. It offers best-in-class emergency medical and evacuation benefits, as well as high limits for baggage insurance.

Best travel insurance of 2024

- WorldTrips : Best travel insurance.

- Travel Insured International : Best for emergency evacuation.

- TravelSafe : Best for missed connections.

- Aegis : Cheapest travel insurance.

- Travelex : Best for families.

- AIG : Best for add-on coverage options.

- Nationwide : Best for cruise itinerary changes.

Why trust our travel insurance experts

Our travel insurance experts evaluate hundreds of insurance products and analyze thousands of data points to help you find the best trip insurance for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content . You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

Travel insurance quotes comparison

Best travel insurance companies, best travel insurance.

Top travel insurance plans

Average cost, medical limit per person, why it’s the best.

If you’re looking for the best travel insurance for international travel , WorldTrips’ Atlas Journey Elevate plan gives you $250,000 in travel medical insurance with primary coverage. This plan is a good option if health insurance for international travel is a priority. It also has $1 million in emergency evacuation coverage.

See our full WorldTrips travel insurance review .

Pros and cons

- $250,000 in primary medical coverage.

- $1 million per person in medical evacuation coverage.

- Primary damage or loss baggage coverage of $500 per item, up to $2,500.

- 5 optional upgrades, including pet care, adventure sports and rental car damage and theft.

- No non-medical evacuation coverage.

Customer reviews

WorldTrips has a rating of 4.27 stars out of 5 on Squaremouth, based on 428 reviews of policies purchased through the travel insurance comparison site since 2008.

Heidi’s expert take: “WorldTrips offers primary coverage for emergency medical expense and for baggage damage or loss. This means the insurer will pay for your claim first and then seek recovery from any responsible third party, such as your health insurance provider, airline or homeowners insurance company (if your belongings are stolen). Travel insurance with secondary medical coverage might be cheaper, but then you’d have to file claims with third parties yourself, before you could turn to your travel insurance for help.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Best travel insurance for emergency evacuation

Travel insured international.

Top travel insurance plan

If you’re traveling to a remote area, consider Travel Insured International’s Worldwide Trip Protector. It has the best travel insurance for emergency evacuation of travel insurance policies in our rating. This top travel insurance plan provides up to $1 million in emergency evacuation coverage per person and $150,000 in non-medical evacuation per person. It also has primary coverage for travel medical insurance benefits.

- Only plan in our rating that offers $150,000 in non-medical evacuation coverage.

- $500 per person baggage delay benefit only requires a 3-hour delay.

- Optional rental car damage benefit up to $50,000.

- Missed connection benefit of $500 per person is only available for cruises and tours.

Travel Insured International has a rating of 4.39 stars out of 5 on Squaremouth, based on 3,402 reviews of policies purchased on the travel insurance comparison site since 2004.

Heidi’s expert take: “The Worldwide Trip Protector plan provides rare non-medical evacuation benefits of up to $150,000. If you’re traveling to an area at risk of a political, security or national disaster, this emergency evacuation coverage could help get you back to safety.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Best travel insurance for missed connections

TravelSafe offers good travel insurance for missed connections , with $2,500 in missed connection coverage for each person on the plan.

- Best-in-class $2,500 per person in missed connection coverage.

- $1 million per person in medical evacuation and $25,000 in non-medical evacuation coverage.

- Generous $2,500 per person baggage and personal items loss benefit.

- Most expensive of our best-rated travel insurance plans.

- No “interruption for any reason” coverage option.

- Weak baggage delay coverage of $250 per person after 12 hours.

TravelSafe has a rating of 4.3 stars out of 5 on Squaremouth, based on 1,506 reviews of policies purchased on the travel insurance comparison site since 2004.

Heidi’s expert take: “If you miss out on prepaid vacation plans because you didn’t make a connecting flight, you’ll be glad for the $2,500 missed connection coverage. Some policies only provide missed connection coverage for cruises and tours, but TravelSafe Classic doesn’t impose that restriction.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Cheapest travel insurance

Go Ready Choice by Aegis has the most affordable travel insurance of the best-rated travel insurance companies in our rating. This is based on the average cost of seven international trips of varying lengths and values for travelers of different ages.

See our full Aegis travel insurance review .

- Cheapest of our best trip insurance plans.

- Pet care benefit of $500 under travel delay benefits.

- Low emergency medical and evacuation limits.

- Low missed connection benefit of $500 per person for cruises and tours only.

- Low baggage and personal items loss benefit of $500 per person.

Aegis has a rating of 4.06 stars out of 5 on Squaremouth, based on 1,111 reviews of policies purchased on the travel insurance comparison site since 2013.

Heidi’s expert take: “If you’re looking for a budget travel insurance policy , Go Ready Choice may fit the bill. It has comparably low coverage limits, but if you have health insurance that will cover you on your trip, its $50,000 in secondary medical coverage may be sufficient.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Best travel insurance for families

Top-scoring plan

Travelex Insurance Services has the best travel insurance for families because you can add kids aged 17 and younger to your Travel Select plan at no additional charge.

See our full Travelex travel insurance review .

- Free coverage for children 17 and under on the same policy.

- Robust travel delay coverage of $2,000 per person ($250 per day) after 5 hours.

- Hurricane and weather coverage after a common carrier delay of any amount of time.

- Low emergency medical coverage of $50,000 per person.

- Non-medical evacuation is not included.

- Low baggage delay coverage of $200 requires a 12-hour delay.

Travelex has a rating of 4.43 stars out of 5 on Squaremouth, based on 2,048 reviews of policies purchased on the travel insurance comparison site since 2004.

Heidi’s expert take: “If you’re traveling with kids, a Travelex policy will cover them, too. The number of children you can add to your policy is unlimited and they’ll get travel protection at no additional cost.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Best travel insurance for add-on coverage options

Travel Guard Preferred from AIG allows you to customize your policy with a host of available upgrades, making it the best traveler insurance for add-on options . These include “cancel for any reason” (CFAR) coverage , rental vehicle damage coverage and bundles that offer additional benefits for adventure sports, travel inconvenience, quarantine, pets, security and weddings.

There’s also a medical bundle that increases the travel medical benefit to $100,000 and emergency evacuation to $1 million. This is a good option if you’re looking for foreign travel health insurance.

See our full AIG travel insurance review .

- Bundle upgrades allow you to customize your travel insurance policy.

- Emergency medical and evacuation limits can be doubled with optional upgrade.

- Base travel insurance policy has relatively low medical limits.

- $300 baggage delay benefit requires a 12-hour delay.

- Optional CFAR upgrade only reimburses up to 50% of trip cost.

Heidi’s expert take: “You can add riders to your AIG travel insurance policy to maximize your coverage. Choose from these bundles: adventure sports, medical, pet, quarantine, security and wedding. You may also want to add “cancel for any reason” coverage and rental vehicle damage coverage.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Best travel insurance for cruise itinerary changes

Nationwide’s Choice Cruise is good travel insurance for cruises . It has a $500 per person benefit if a cruise itinerary change causes you to miss a prepaid excursion.

Choice Cruise also has a missed connections benefit of $1,500 per person after only a 3-hour delay when you’re taking a cruise or tour. But note that this coverage is secondary coverage to any compensation provided by a common carrier.

See our full Nationwide travel insurance review .

- Benefits for cruise itinerary changes, ship-based mechanical breakdowns and covered shipboard service disruptions.

- Non-medical evacuation benefit of $25,000 per person.

- Missed connection coverage of $1,500 per person for tours and cruises, after a 3-hour delay.

- Baggage loss benefits of $2,500 per person.

- Travel medical coverage is secondary.

- Trip cancellation benefit for losing your job requires three years of continuous employment.

- No “cancel for any reason” upgrade available.

Nationwide has a rating of 4.02 stars out of 5 on Squaremouth, based on 570 reviews of policies purchased on the travel insurance comparison site since 2018.

Heidi’s expert take: “This plan has protections for cruisers when it comes to prepaid expenses. But its emergency medical coverage is secondary, which means you’d have to file medical claims with your health insurance company first. Since U.S. health insurance won’t help you at sea, you may want to look for cruise travel insurance with primary medical coverage instead.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

Compare the best travel insurance plans

Via Compare Coverage’s website

Heidi’s expert take: “Here are my tips on how to buy travel insurance that gets you the most coverage for the lowest price: Buy early . Getting travel insurance within two weeks of making your first trip deposit may qualify you for coverage of pre-existing medical conditions, and it won’t cost you any extra. Look for primary emergency medical coverage . If you buy a plan with secondary coverage, you’ll have to file a claim with your health insurance first, even if you know it will be denied. Don’t overinsure . Calculate the value of only your prepaid, nonrefundable trip expenses that are not already covered by other insurance (like credit card travel insurance or health insurance, if your coverage extends to where you are traveling). Even if this value is $0, you can still buy travel insurance for the travel medical insurance benefits, and you’ll only be paying for the insurance you need. Understand exclusions . If you are planning to go scuba diving, for instance, make sure this adventure activity is not excluded from a policy’s coverage. If so, you may need to pay for a rider or shop for another plan that offers the coverage you need.” Heidi Gollub, Managing Editor of Insurance, USA TODAY Blueprint

What is the best travel insurance?

The best travel insurance for international travel is sold by WorldTrips, according to our in-depth trip insurance comparison.

The best travel insurance plan for you will depend on the trip you are planning and the coverage areas that are most important to you.

- Best cruise travel insurance

- Best COVID travel insurance

- Best “cancel for any reason” travel insurance

- Best senior travel insurance

Best travel insurance for cruises

The best cruise travel insurance is Atlas Journey Preferred sold by WorldTrips . This plan offers solid travel insurance for cruises for a low rate.

Best travel insurance for COVID-19

The best COVID travel insurance is the Trip Protection Basic plan sold by Seven Corners . It is a relatively low cost travel insurance plan with optional “cancel for any reason” coverage that reimburses up to 75% of your prepaid, nonrefundable trip expenses.

Best travel insurance for “cancel for any reason”

The best “cancel for any reason” (CFAR) travel insurance is Seven Corners’ Trip Protection Basic. Adding CFAR coverage to a RoundTrip Basic plan only increases the cost by about 40%, which is lower than other plans we analyzed. For the extra cost, you get coverage of 75% of your prepaid, nonrefundable trip expenses, as long as you cancel at least 48 hours before your scheduled departure.

Best travel insurance for seniors

The best senior travel insurance is the Gold plan sold by Tin Leg . It is an affordable travel insurance plan with travel medical primary coverage of $500,000 and a pre-existing conditions waiver if you insure the full amount of your trip within 14 days of your first trip deposit.

How much is travel insurance?

The average cost of travel insurance is 5% to 6% of your prepaid, nonrefundable trip costs .

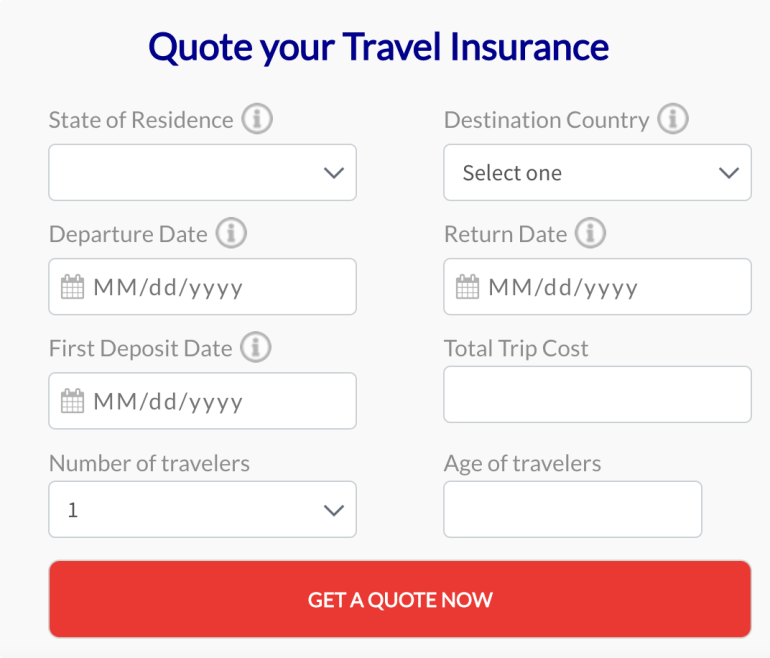

How much you pay for travel insurance will depend on:

- The cost of your trip.

- Your destination.

- The length of your trip.

- The ages of travelers being insured.

- Your state of residence.

- The travel insurance policy you choose.

- The total coverage amounts in your policy.

- Any travel insurance add-ons you select.

Here are average travel insurance rates for a 30-year-old female who is insuring a 14-day trip to Mexico.

Looking to save? Discover cheap travel insurance options.

How much travel insurance should I buy?

Travel insurance companies typically offer several plans with varying maximum limits. The higher the coverage limits, the more you’ll pay for travel insurance.

Squaremouth, a travel insurance comparison site, recommends the following coverage limits for international travel:

- Emergency medical coverage: At least $50,000.

- Medical evacuation coverage: At least $100,000.

If you’re going on a cruise, or to a remote location, Squaremouth recommends:

- Emergency medical coverage: At least $100,000.

- Medical evacuation coverage: At least $250,000.

When evaluating travel insurance plans, our team of insurance analysts considered the best medical travel insurance policies to have at least $250,000 in emergency medical coverage and at least $500,000 in medical evacuation coverage.

When should I buy travel insurance?

The best time to buy travel insurance is within two weeks of making your first nonrefundable travel payment, whether it’s for a plane ticket, hotel stay, cruise or excursion.

Travel insurance costs the same whether you buy it early or last minute, and buying it early has added benefits:

- You may be able to add on “ cancel for any reason” (CFAR) coverage , an upgrade that is typically only available for a limited time after you’ve started paying for your trip.

- You may qualify for a pre-existing medical conditions exclusion waiver, meaning your pre-existing conditions will be covered by travel insurance. This waiver is generally added to your policy automatically, provided you buy the travel insurance within a certain window after your first trip deposit.

- You will be covered over a longer period of time for unforeseen events that could cause you to cancel your trip, such as medical emergencies, inclement weather and natural disasters.

Expert tip: You can buy travel insurance up to the day before you leave on your trip, but waiting may cost you the opportunity to qualify for a pre-existing conditions exclusion waiver or to buy a “cancel for any reason” upgrade.

Where can I buy travel insurance?

You can buy a travel insurance plan:

- Online. Visit a travel insurance company’s website to buy a policy directly or use a comparison website like Squaremouth or Travelinsurance.com to see your options and compare plans. You may also be able to purchase travel insurance online through an airline, cruise, hotel, rental car company or other provider you book a ticket with.

- In person. A travel agent or insurance agent may be able to assist you in buying travel insurance.

Travel insurance trends in 2024

Americans are changing the way they travel and this includes buying travel insurance when they might have skipped it in the past. As spending on trips continues to rise , travelers have more to lose if their plans are disrupted.

Based on travel insurance quote requests on the Squaremouth website last month, these are the main benefits travelers are looking for in a travel insurance policy.

*Source: Squaremouth.com. Travel insurance quote filter usage from April 28 to May 28, 2024.

Methodology

Our insurance experts reviewed 1,855 coverage details and 567 rates to determine the best travel insurance of 2024. For companies with more than one travel insurance plan, we shared information about the highest-scoring plan.

Insurers could score up to 100 points based on the following factors:

- $3,000, 8-day trip to Mexico for two travelers age 30.

- $3,000, 8-day trip to Mexico for two travelers age 70.

- $6,000, 17-day trip to Italy for two travelers age 40.

- $6,000, 17-day trip to Italy for two travelers age 65.

- $15,000, 17-day trip to Italy for four travelers ages 40, 40, 10 and 7.

- $15,000, 17-day trip to France for four travelers ages 40, 40, 10 and 7.

- $15,000, 17-day trip to the U.K. for four travelers ages 40, 40, 10 and 7.

- Medical expenses: 10 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with emergency medical expense benefits of $250,000 or more per person were given the highest score of 10 points.

- Medical evacuation: 10 points. We scored each plan’s emergency medical evacuation coverage by coverage amount. Travel insurance policies with medical evacuation expense benefits of $500,000 or more per person were given the highest score of 10 points.

- Pre-existing medical condition exclusion waiver: 10 points. We gave full points to travel insurance policies that cover pre-existing medical conditions if certain conditions are met.

- Missed connection: 10 points. Travel insurance plans with missed connection benefits of $1,000 per person or more received full points.

- “Cancel for any reason” upgrade: 5 points. We gave points to travel insurance plans with optional “cancel for any reason” coverage that reimburses up to 75%.

- Travel delay required waiting time: 5 points. We gave 5 points to travel insurance policies with travel delay benefits that kick in after a delay of 6 hours or less.

- Cancel for work reasons: 5 points. If a travel insurance plan allows you to cancel your trip for work reasons, such as your boss requiring you to stay and work, we gave it 5 points.

- Hurricane and severe weather: 5 points. Travel insurance plans that have a required waiting period for hurricane and weather coverage of 12 hours or less received 5 points.

Some travel insurance companies may offer plans with additional benefits or lower prices than the plans that scored the highest, so make sure to compare travel insurance quotes to see your full range of options.

Best travel insurance FAQs

According to our analysis, WorldTrips has the best trip insurance. Two of its plans — Atlas Journey Explore and Atlas Journey Elevate — get 5 stars in our rating.

The best travel insurance policy for you will depend on what type of coverage you need. With so many different policies and carriers, the policy that was best for your friend’s trip to California might not be ideal for your trip to Japan. If you’re looking for the best travel insurance for international travel, you may be willing to pay more for higher coverage levels.

A comprehensive travel insurance plan bundles several types of travel insurance coverage, each with its own limits. To ensure you have adequate financial protection for your trip, your travel insurance policy should include the following travel insurance coverages:

- Trip cancellation . With trip cancellation insurance , you’re covered if you need to call off your trip because of a reason listed in your policy, such as unexpected illness, injury or death of you, a family member or a travel companion, severe weather, jury duty and your travel supplier going out of business.

- Travel delay. Once your trip has started, travel delay insurance reimburses you for unexpected expenses you incur after a minimum delay, such as five hours. It can cover needs like airport meals, transportation and even overnight accommodation.

- Trip interruption. If you need to cut your trip early for a reason listed in your policy, trip interruption insurance can reimburse you for any prepaid, nonrefundable payments you’ll lose by leaving early. It can also pay for a last-minute one-way ticket home.

- Travel medical . Emergency medical benefits are especially important if you need international health insurance for travel outside of the country. Your domestic health insurance may provide limited coverage once you leave the U.S. The best travel medical insurance pays for ambulance service, doctor visits, hospital stays, X-rays, lab work and prescription medication you may require while traveling.

- Emergency medical evacuation. If you’re traveling to a remote area, or planning excursions such as boating to an island, emergency medical evacuation coverage is a good idea. This coverage pays to transport you to the nearest adequate medical facility if you are injured or sick while traveling.

- Baggage delay. After a certain waiting period, such as six or 12 hours, this coverage will reimburse you for necessities you need to buy to tide you over while you wait for your bag to arrive. Be sure to save your receipts and look at your coverage limit, as some caps are low, like $200.

- Baggage loss. Baggage insurance can reimburse you if your bag never arrives, or if your personal belongings are stolen during your travels. Coverage limits apply here, as well as exclusions for certain items such as electronics.

“Typically, travelers are expected to pay their expenses out of pocket, and then file a claim for reimbursement,” said James Clark, spokesperson for Squaremouth. “However, there are medical situations in which a provider may be required to pre-authorize payment to make sure the policyholder receives the treatment they need.”

According to Clark, “Providers can pre-authorize payment for medical care and emergency evacuations. With that said, every circumstance is unique, and providers will handle each situation on a case-by-case basis.”

Travel insurance covers your prepaid, nonrefundable trip costs — as well as extra money you may need to spend due to unforeseen circumstances and emergencies — both before and during your trip.

Travel insurance coverage varies by plan, but in general travel insurance covers costs associated with these problems:

- Bankruptcy of a travel insurance company, such as your airline or tour operator.

- Dangerous weather conditions.

- Delayed and lost luggage.

- Illness or death in your family that requires you to stay home or cut your trip short.

- Illness that needs medical attention.

- Injury requiring medical evacuation.

- Jury duty.

- Travel delays and missed connections.

- Theft of your personal belongings while traveling.

- Unexpected job loss.

Travel insurance policies often exclude or limit “foreseeable” losses. Typical travel insurance exclusions include:

- Accidents or injuries caused by drinking or drug use.

- Canceling your trip because you changed your mind.

- Ending your trip early because you changed your mind.

- Losses caused by intentional self harm, including suicide.

- Losses due to war, civil disorder or riots.

- Medical tourism.

- Medical treatment for pre-existing conditions.

- Mental health care.

- Natural disasters that begin before you buy travel insurance.

- Non-medical evacuation.

- Normal pregnancy.

- Medical treatment related to high-risk activities.

- Routine medical care, such as physicals or dental care.

- Search and rescue.

Your U.S. health insurance may provide little or no coverage in foreign countries. Check with your health insurance company to see if you have any global benefits and ask how they work. If your health care does extend across the border, the benefits it provides abroad may not be the same benefits it provides domestically.

Medicare usually won’t pay for health care outside of the United States and its territories, so older travelers planning an international trip should look into the best senior travel insurance with robust medical benefits.

The best time to buy travel insurance is immediately after booking your trip and making a nonrefundable payment — in other words, as soon as you’re at risk of losing money. This way, you’ll know the total cost that you need to insure and you’ll have the longest window to take advantage of your policy’s benefits if something goes wrong.

You can’t wait until something goes wrong and then buy travel insurance to get reimbursed for your loss. Travel insurance only covers unexpected losses.

Travel insurance companies can decline to cover travel to certain countries. For example, you may find that some trip insurance companies don’t offer coverage to countries with a Level 4: Do Not Travel advisory from the U.S. State Department.

Travel insurance policies also frequently exclude certain risks that you’re more likely to encounter in Level 4 or Level 3 countries. For example, your policy may not cover losses related to declared or undeclared wars or acts of war or losses related to known or foreseeable conditions or events.

Some credit cards , such as the Chase Sapphire Preferred® Card , offer benefits such as trip cancellation and interruption insurance, baggage delay insurance and trip delay reimbursement when you use your card to pay for your trip.

Ask your credit card issuer for your card’s benefits guide to see what coverage you may have. Keep in mind that it may not cover all the risks you want to protect against, such as the cost of international health care or emergency medical evacuation .

Business travel insurance makes sense if you are self-employed and paying for your own travel expenses, or if you are traveling internationally and want medical coverage abroad.

You might also consider buying travel insurance for a business trip if your company won’t cover extra expenses if your flight is delayed or you need to head home early.

Cruise travel insurance can help protect you financially if you need emergency medical care in a remote location, or if a delayed flight causes you to miss embarkation and you need to pay extra to catch up to your cruise.

Experts caution that travel insurance you buy through a cruise line may not be as comprehensive as plans you can buy directly from travel insurance companies.

Some travel insurance plans cover rental cars as an optional upgrade, for an additional cost. The 5-star rated travel insurance companies in our rating offer these optional rental car benefits:

- Travel Insured International — Rental car damage and theft coverage of $50,000.

- WorldTrips — Rental car damage and theft coverage of $50,000 with a $250 deductible.

Travel insurance typically only covers a single trip, although your insured trip can have multiple destinations.

If you’re looking to insure several trips in the same year, annual travel insurance may be a good option for you.

Travel insurance may be required, depending on the country you plan to visit. But it’s smart to consider buying a travel insurance policy for international travel, even when it is not required. A good travel insurance policy can protect you financially if you need emergency medical assistance when traveling, or if you need to cut your trip short and buy a last-minute plane ticket home because an immediate family member is ill.

Wondering if travel insurance is worth it? What travel insurance covers

Editor’s Note: This article contains updated information from previously published stories:

- Spirit Airlines scrubs 60% of its Wednesday flights, says cancellations will drop ‘in the days to come.’

- ‘Just a parade of incompetency’: Spirit Airlines passengers with ‘nightmare’ stories want more than apology, $50 vouchers

- ‘This is not our proudest moment’: Spirit Airlines CEO says more flight cancellations expected this weekend

- Hurricane Irma: Flight cancellations top 12,500; even more expected

- Is an annual travel insurance policy right for you?

- How 2020 and COVID-19 changed travel forever – and what that means for you

- COVID-19 or delta variant have you ready to scrap your trip? Here’s how to cancel like a pro

- Sunday: Snow is over, but flight cancellations top 12,000

- After nearly 13,000 Harvey cancellations, Irma is new threat to airline flights

- What’s the difference between travel insurance and trip ‘protection’?

- How to choose the right travel insurance for your next vacation

- Travel insurance can save the day

- Angry passengers brawl after Spirit cancels flights

- What to do when travel insurance doesn’t work

- How lockdowns, quarantines and COVID-19 testing will change summer travel in 2021

- Travelers will pay and worry more on summer vacation this year. But they won’t cancel

- How to find a hotel with COVID testing and quarantine facilities wherever you travel

- Yearning to travel in 2022? First, figure out your budget – then pick a destination

- Pro tips for surviving a long flight during a pandemic: Get the right mask, bring a pillow

- Want to steer clear of contracting COVID-19 on your next vacation? Follow these guidelines

- Post-pandemic travel: Is it OK to ask another passenger’s vaccine status or request they mask up?

- These days, forgetting these important travel items could cost you thousands of dollars

- International travel hacks: When to book flights and hotels, how to deal with COVID-19 rules

- Traveling post-coronavirus: How do you book your next trip when so much remains uncertain?

- The COVID-19 guide to holiday travel – and the case for why you shouldn’t go this year

- Should you travel during the holidays? Americans struggle with their decision

- ‘There’s still pent-up demand’: What you should know about fall travel

- Planning for life after coronavirus: When will we know it’s safe to travel again?

- ‘Busiest camping season’: Travelers choose outdoor recreation close to home amid COVID-19 pandemic

- Considering a camping trip this summer? Tips to make sure your gear is good to go

- RVing for the first time? 8 tips for newbies I wish I’d known during my first trip

- Five myths about travel agents

- Should I buy travel insurance?

- Is travel insurance stacked against you?

- Five myths about travel insurance and terrorism

- These eight things could get your travel insurance claims rejected

- There’s a good chance that your credit card already gives you some kind of travel insurance coverage

- How to avoid a hotel cancellation penalty

- Change fees and travel insurance continue to rise

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Amy Fontinelle has more than 15 years of experience helping people make informed decisions about their money, whether they’re refinancing a mortgage, buying insurance or choosing a credit card. As a freelance writer trained in journalism and specializing in personal finance, Amy digs into the details to explain the products and strategies that can help (or hurt) people seeking greater financial security and wealth. Her work has been published by Forbes Advisor, Capital One, MassMutual, Investopedia and many other outlets.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

10 worst US airports for flight cancellations this week

Travel insurance Heidi Gollub

10 worst US airports for flight cancellations last week

Our travel insurance ratings methodology

AXA Assistance USA travel insurance review 2024

Travel insurance Jennifer Simonson

Cheapest travel insurance of June 2024

Travel insurance Mandy Sleight

Average flight costs: Travel, airfare and flight statistics 2024

Travel insurance Timothy Moore

John Hancock travel insurance review 2024

HTH Worldwide travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Trawick International travel insurance review 2024

Travel insurance for Canada

Travelex travel insurance review 2024

Best travel insurance for a Disney World vacation in 2024

World Nomads travel insurance review 2024

- Your Account

Benefits, Pay, and Travel

MEC Benefits Committee

Latest Benefits Updates

- Quarterly Incentive Compensation to be Paid on October 16 Pay Advice (October 12, 2023)

- Our Responsibility for Benefit Premiums While on a Leave of Absence (October 5, 2023)

- 2024 Vacation Process (September 22, 2023)

- AFA Voluntary Long-Term Care Insurance Special Enrollment Opportunity (August 8, 2023)

- Filing Grievance Worksheets and Other Reports with United AFA Reminder (July 21, 2023)

- United Benefit’s LearnLux Financial Planning Program (July 14, 2023)

- Restoration of Days Off (July 6, 2023)

- Attendance Bonus Point Application (July 6, 2023)

- Communications with Crew Pay For Pairing & White Flag Updates (June 28, 2023)

- Corporate Compliance CBT Reminder - Due June 20! (June 13, 2023)

- AFA Voluntary Supplemental Benefits Enrollment Closes May 26th! (May 23, 2023)

- AFA Supplemental Benefits Open Enrollment Announced (May 2, 2023)

- Trimester CBT Compensation (May 2, 2023)

- Advance Vacation Fly Through Request Deadline for June: May 5th at 10:00 HDT (May 2, 2023)

- Fidelity Automatic Increase Program Alert Communication (April 21, 2023)

- Safety Checks: Start Your Flight Right! (April 6, 2023)

- Drug and Alcohol Testing Pay (April 4, 2023)

- Notification of Delays or Cancellations to Flight Attendants (March 28, 2023)

- The Interaction of Benefits Premiums and Time Away from Work (March 21, 2023)

- Profit Sharing Payments (February 21, 2023)

Share this page:

1998-2024 © Association of Flight Attendants-CWA, AFL-CIO. About AFA | AFA International | Contact Us

Helping You provide for Your Family

Insurance protection from top-rated carriers exclusively for Air & Space Forces Association members.

Term Life Insurance

Dental Insurance

Hospital Indemnity Insurance Plans

TRICARE Supplement Insurance Plans

Accidental Death & Dismemberment Insurance

Legal Services Plan

Our partners.

Why Choose AFA Insurance?

Policies designed for active duty & retired Air Force personnel and their families

Exclusive group rates on coverages from top-rated carriers you know and can trust

Your purchase helps support the mission of the Air & Space Forces Association

TRICARE Supplement helps save on medical costs

You (probably) need more life insurance. Here’s why

Understanding Decreasing Term Life

COVID Information | Click here to learn more about our COVID Travel Insurance

Why should I purchase Travel Insurance?

Whether you're embarking on a weekend getaway or a month-long adventure, unexpected events can happen. An AXA protection plan can help ease your mind and help safeguard your trip, offer reimbursement for covered medical costs, and provide travelers with 24/7 access to assistance services, among other benefits.

Need to cancel your trip due to an unforeseen event?

Get coverage for your trip against illnesses, injuries, and natural disasters. Travel insurance can reimburse you for your prepaid, non-refundable trip costs.

Was your luggage lost or stolen?