HSBC Cookie policy

- HSBC in Malaysia

- Global Service Centre

- News and media

- Main content

- Language selector

- Share on Facebook

- Share on LinkedIn

16 May 2023

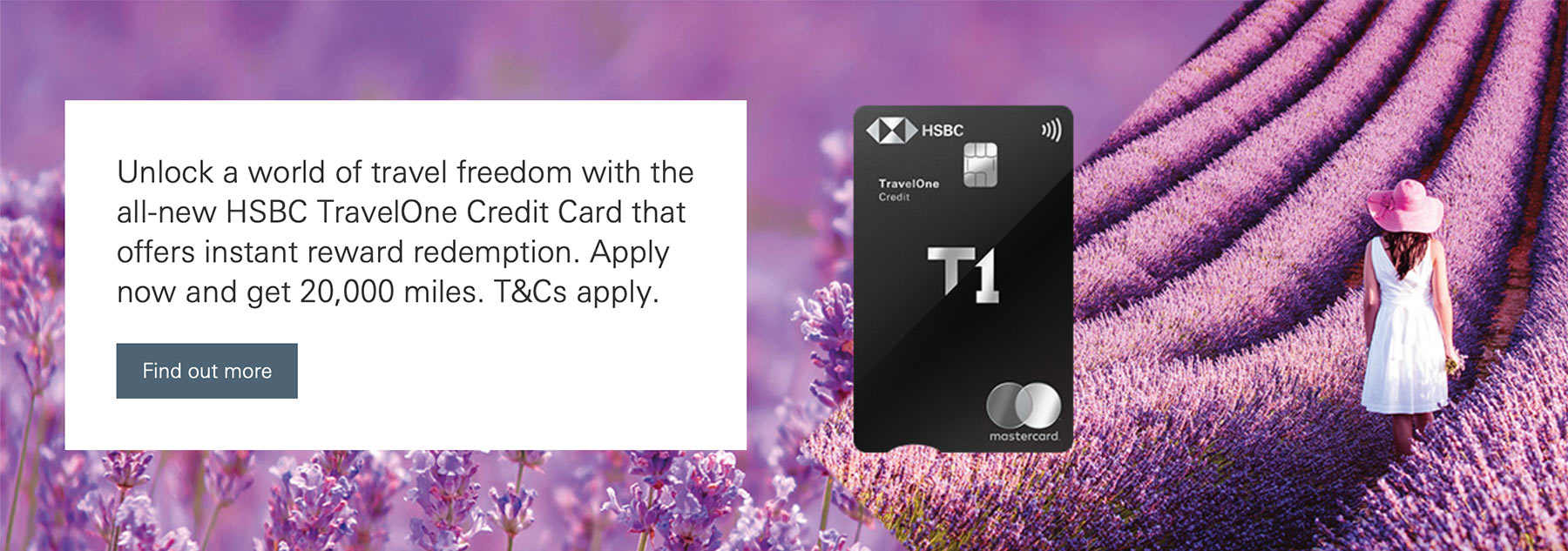

HSBC sets new benchmark for travel convenience with HSBC TravelOne Credit Card

HSBC has launched the HSBC TravelOne Credit Card in partnership with Mastercard. The card is a game changer for travel, as it is the first in the market that allows cardholders to instantly redeem their travel rewards with selected leading airlines and hotel chains via the HSBC mobile banking app.

Taylan Turan, Group Head of Retail Banking and Strategy, HSBC Wealth and Personal Banking (WPB) said: “Customers tell us they want flexibility, incentives and discounts when they travel. We’re bringing them exactly that by allowing our customers to redeem reward points instantly on our mobile banking app, converting their points with an extensive selection of the world’s leading airlines and hotels.

“Our ambition is to deliver products and services which meet the needs of our growing customer base in Southeast Asia. As part of this, we are doubling down on developing new digital capabilities that match the variety of their borrowing needs, as well as benefits they can use and enjoy instantly. The HSBC TravelOne Credit Card is a key part of our plans to grow our unique cross border international franchise, through offering a multi-market travel card in partnership with Mastercard.”

Beena Pothen, Country Manager for Malaysia and Brunei, Mastercard said: “Mastercard is excited to partner with HSBC to offer customers innovative payment solutions that cater to their unique lifestyles. With travel back after a long hiatus, the launch of the HSBC TravelOne Credit Card with its travel benefits and exclusive privileges, is well-timed. By enabling customers to instantly redeem their rewards via the mobile app while ensuring secure transactions anywhere at any time, the HSBC TravelOne Credit Card will provide frictionless and safe travel experiences for Malaysian cardholders when travelling around the world or closer to home.”

A card that rewards you, in the most convenient way

The HSBC TravelOne Credit Card is designed with customer convenience at the forefront. Not only does it offer instant redemption of reward points, it also allows customers to earn up to 8x reward points for their eligible spending, and they can also enjoy travel privileges such as complimentary travel insurance coverage and airport lounge access.

Renee Bullock-Cann, Head of Wealth and Personal Banking, HSBC Malaysia said: “In Malaysia, economic growth for this year is expected to be anchored by domestic demand. Central to this is household spending which remains resilient supported by better labour market conditions. This sets the stage for a pickup in travel and leisure activities.

With the HSBC TravelOne Credit Card, we want to make travel a seamless process by offering our customers great deals, in the most hassle free and convenient way. It opens up a world of opportunity for our customers to travel the world freely.”

Key features of the HSBC TravelOne Credit Card include:

- Instantly convert reward points to airline miles at leading airlines such as Malaysia Airlines, AirAsia, Singapore Airlines, Etihad, Cathay Pacific and many more.

- Instantly transfer reward points to top hotel chains in the world such as Marriott Bonvoy, IHG One Rewards and Wyndham Rewards.

- Both Primary and Supplementary Cardholder are also entitled to 6 times (combined) complimentary airport lounge access per year at 7 Plaza Premium Airport Lounges (KLIA, Singapore Changi Airport and Hong Kong International Airport).

- Complimentary travel insurance up to USD250K (including travel medical, travel inconvenience – flight delay, baggage delay, baggage loss, COVID coverage etc.). Registration with Mastercard is required to enjoy this privilege.

- Flexible Instalment Plans that suits the needs of cardholders.

- Notch Design that signals the correct end to insert into card readers and ATMs as part of Bank’s commitment to inclusivity.

For new to or existing HSBC Malaysia customers, HSBC TravelOne Credit Card is available at all HSBC branches nationwide (excluding HSBC Amanah), or can be applied online via www.hsbc.com.my/TravelOne Visit our website for more info and the applicable terms and conditions.

Media enquiries to:

Supriya T Surendran +6012 272 8648 [email protected]

Note to editors:

HSBC Malaysia HSBC's presence in Malaysia dates back to 1884 when the Hongkong and Shanghai Banking Corporation Limited established its first office in the country on the island of Penang, with the permission to issue currency notes. HSBC Bank Malaysia Berhad was locally incorporated in 1984 and is a wholly-owned subsidiary of The Hongkong and Shanghai Banking Corporation Limited, founding member of the HSBC Group. In 2007, HSBC Bank Malaysia was the first foreign bank to be awarded an Islamic banking subsidiary licence in Malaysia, namely HSBC Amanah Malaysia Berhad. HSBC Malaysia offers a comprehensive range of banking and financial services including Islamic financial solutions. HSBC Malaysia has also led innovation in Malaysia by introducing Malaysia’s first ATM and Electronic Touch Banking in the early 1980s. Today, HSBC Malaysia has launched innovative solutions such as HSBCnet for secure banking for businesses, Trade Transaction Tracker and Facial Recognition on supported mobile phones.

The Hongkong and Shanghai Banking Corporation Limited The Hongkong and Shanghai Banking Corporation Limited is the founding member of the HSBC Group. HSBC serves customers worldwide from offices in 62 countries and territories. With assets of US$2,990bn at 31 March 2023, HSBC is one of the world’s largest banking and financial services organisations.

About Mastercard (NYSE: MA) www.mastercard.com Mastercard is a global technology company in the payments industry. Our mission is to connect and power an inclusive, digital economy that benefits everyone, everywhere by making transactions safe, simple, smart and accessible. Using secure data and networks, partnerships and passion, our innovations and solutions help individuals, financial institutions, governments and businesses realize their greatest potential. With connections across more than 210 countries and territories, we are building a sustainable world that unlocks priceless possibilities for all.

- Privacy and security

- Website terms of use

- Hyperlink policy

You are leaving about.hsbc.com.my

Please be aware that the external site policies, or those of another HSBC group website, may differ from this website's terms and conditions and privacy policy. The next website will open in a new browser window or tab.

Note: HSBC is not responsible for any content on third party sites, nor does a link suggest endorsement of those sites and/or their content.

You are about to e-mail us

Before sending us your information, please read our privacy policy .

- The Star ePaper

- Subscriptions

- Manage Profile

- Change Password

- Manage Logins

- Manage Subscription

- Transaction History

- Manage Billing Info

- Manage For You

- Manage Bookmarks

- Package & Pricing

HSBC TravelOne Credit Card sets benchmark for travel convenience

Wednesday, 17 May 2023

Related News

Sarawak government raises stake in Affin Bank to 31%

China weighs capital injection into top banks, bank negara seeks feedback on three-year roadmap for full transition to myor/myor-i.

(From left) HSBC WPB cluster head Asia cards Saleh Anam, Pothen, Mastercard Global Account HSBC senior vice-president Marina Bacchiani, Turan, Bullock-Cann, HSBC WPB head of Asia cards Parul Anand, HSBC WPB head of products Asia cards Anantha S Vaikuntam and HSBC Malaysia head of retail products Doreen Lee at the launch of the HSBC TravelOne Credit Card.

PETALING JAYA: HSBC Malaysia has set a new benchmark for travel convenience by unveiling a new product, the HSBC TravelOne Credit Card, which allows customers to instantly redeem their travel rewards with selected leading airlines and hotel chains.

The TravelOne Credit Card, a product of a partnership between HSBC and Mastercard, was created with the convenience of the client in mind.

Officiating the launch, HSBC group head of retail banking and strategy wealth and personal banking (WPB) Taylan Turan mentioned three main key points that HSBC looked into, which are customers’ choice flexibility, incentives and having the ability to obtain all of this with ease.

“We’re bringing them exactly that by allowing our customers to redeem reward points instantly on our mobile banking app, converting their points with an extensive selection of the world’s leading airlines and hotels,” he added.

In a statement, Turan said HSBC’s TravelOne Credit card is a key part of HSBC’s plan to grow its unique cross-border international franchise by offering a multi-market travel card.

He then explained that in the fourth quarter of 2022, travellers from Malaysia spent 66% more on overseas retail compared to the fourth quarter of 2019.

Turan further stated that HSBC feels the responsibility to deliver the promise in meeting its customer needs by bringing great solutions, products and propositions to Malaysia, as it is one of the four key markets for the bank in South-East Asia.

HSBC Malaysia head of wealth and personal banking Renee Bullock-Cann said as credit cards remained the key method of payment for travel spending in Malaysia, HSBC wants to open up a world of opportunities for its customers.

“With the HSBC TravelOne Credit Card, we want to make travel a seamless process by offering our customers great deals in the most hassle-free and convenient way,” she added in the statement.

Mastercard country manager for Malaysia and Brunei Beena Pothen said in a statement that with travel back after a long hiatus, the launch of the HSBC TravelOne Credit Card with its travel benefits and exclusive privileges was well-timed.

“The HSBC TravelOne Credit Card provides frictionless and safe travel experiences for Malaysian cardholders when travelling around the world or closer to home via the mobile app, which also ensures secure transactions anywhere at any time,” she added.

Among the key features of the HSBC TravelOne Credit Card include instant conversion of reward points to top airlines and hotels, where cardholders are entitled to six times complimentary airport lounge access per year and complimentary travel insurance up to US$250,000 (RM1.12mil).

The credit card also provides its customers with flexible instalment plans that suit the needs of its cardholders, as well as a unique notch design to signal the correct end to insert into card readers for its customers with impairment as part of the bank’s commitment to inclusivity.

A welcome gift will also be awarded to customers that activate a new card and perform 10 swipes and 10 e-Wallet top-ups within the welcome period from May 16 until Aug 31.

Tags / Keywords: HSBCMalaysia , TravelOneCreditCard , Mastercard , rewards , airlines , hotels , conversion , travelinsurance

Found a mistake in this article?

Report it to us.

Thank you for your report!

15-minute city living at Elmina City Centre

Next in business news.

Trending in Business

Air pollutant index, highest api readings, select state and location to view the latest api reading.

- Select Location

Source: Department of Environment, Malaysia

Others Also Read

Best viewed on Chrome browsers.

We would love to keep you posted on the latest promotion. Kindly fill the form below

Thank you for downloading.

We hope you enjoy this feature!

HSBC TravelOne Credit Card

Refined points metric (rpm): 11.8, recommendation: poor, annual fee , annual income, airport lounge access.

6X access per year

International Lounges

Supplementary Access

RM60,000 per annum

Airline Miles Earn Rate

Local: 1 Airline Mile = RM21.00

Overseas: 1 Airline Mile = RM2.62

Dining/Travel = 1 Airline Mile = RM4.20

Payment Network

Review | HSBC TravelOne Mastercard Credit Card

HSBC Malaysia recently unveiled its HSBC TravelOne Mastercard Credit Card, in line with a parallel launch in Singapore. For the purposes of this discussion, we'll focus solely on the Malaysian iteration.

The launch was accompanied by significant fanfare, underscored by HSBC Malaysia's extensive promotional efforts. This included roadshows in major Klang Valley malls like Mid Valley and collaborations with digital content creators and influencers. Commendably, their marketing approach was pervasive, leading many within my circle to seek my perspective on the card's value proposition.

However, it's imperative to delve deeper than the surface-level allure. A notable aspect that catches the eye is the promotion of "8x reward points" on HSBC's official site. Many, understandably, may misconstrue this to mean 8x air miles, which is a significant misunderstanding.

Airline Miles Conversion

The distinction between reward points and air miles is crucial. To provide a straightforward assessment: if one were to critically evaluate the conversion rate of these reward points to air miles, the HSBC TravelOne might not rank among the best credit card options in Malaysia for those prioritizing air miles accumulation.

The information above shows how many airline miles you get when you use HSBC's "Reward Points". To get one Enrich air mile, you need to spend RM2.62 overseas, but if you spend locally and specifically on dining or travel, it costs more, RM4.20, to get the same one mile.

Any other transactions with the HSBC TravelOne credit card only earns you 1X points.

Here's a simpler way to see it:

For regular spending in Malaysia, you need to spend RM21.00 to get 1 airline mile.

If you spend money on dining or travel in Malaysia, you need to spend RM4.20 to get 1 airline mile.

When you spend money in other countries, you need to spend RM2.62 to get 1 airline mile.

Compared to other banks that focus on travel, HSBC's rates don't look as good. For example, the CIMB Travel Platinum Credit Card gives you 1 airline mile for every RM2.50 you spend in other countries, and you only need to earn RM24,000 a year to get this card.

Likewise, the Alliance Bank Visa Infinite credit card grants you 1 Airline Mile for every RM1.875 spent when strategically topping up your E-Wallets and spending using your E-Wallets.

You can choose to convert HSBC points into miles with other programs, not just Enrich Miles, but these rates aren't great either. For those who fly a lot from Malaysia, finding the best way to turn spending into miles is very important.

For example, to turn your points into JAL Mileage Bank miles, it costs RM7.50 for one JAL mile. This rate is high, but not many people might use their HSBC Reward Points for JAL miles anyway.

Be sure to check out my Ultimate Guide, KrisFlyer Ultimate Guide and Asia Miles Ultimate Guide for comparisons on the airline miles earning rates for various credit cards.

I know how important it is to obtain information about lounge access at a glance, so if you're queuing up to enter a lounge in ASEAN, here's the important details about the HSBC TravelOne Mastercard credit card:

Number of Lounge Access Passes: 6X per year

Supplementary Access: Yes, quota is shared with principal cardholder

Spend Conditions: No spend conditions

Lounge Access List by HSBC TravelOne Mastercard credit card:

Plaza Premium Lounge KLIA Terminal 1 Main Terminal Building

Plaza Premium Lounge Singapore Changi Terminal 1

TGM & Root98 Singapore Changi Terminal 1

BLOSSOM - SATS & Plaza Premium Lounge Singapore Changi Terminal 4

Plaza Premium Lounge Hong Kong International Airport Terminal 1 (Gate 1)

Plaza Premium Lounge Hong Kong International Airport Terminal 1 (Gate 35)

Plaza Premium Lounge Hong Kong International Airport Terminal 1 (Gate 60)

HSBC may update it's list from time to time, so be sure to check out their list here if you don't see your lounge on the list above and in the table below.

Lounge access by the HSBC TravelOne Mastercard are the only nominal advantages to the credit card on the whole, as the airline miles accrual package is underwhelming. The accompanying table above underscores that the HSBC TravelOne Credit Card provides lounge access to merely three airports: Kuala Lumpur International Airport, Singapore Changi Airport, and Hong Kong International Airport.

Interestingly, the provisions at Singapore Changi Airport are confined to the Plaza Premium Lounge in Terminal 1 and the Blossom Lounge in Terminal 4. Given that Terminal 4 isn't seamlessly connected via the skytrain, cardholders departing from Terminals 2 and 3 are left with the sole option of the Terminal 1 lounge.

Another detail of note is the shared access between principal and supplementary cardholders, capped at six visits per annum. This isn't really a big issue, as generally you'll find it difficult to enter 6 lounges in an entire year, unless you travel frequently for work. Nevertheless, the shortcoming in this case is that you'll only be able to enter the lounges a limited number of times if you are travelling with your partner or spouse.

Be sure to check out my Airport Lounge Ultimate Guide to compare the best credit cards for airport lounge access in Malaysia.

Final Thoughts

In assessing the HSBC TravelOne Credit Card, it's challenging to pinpoint any commendable features. While their marketing strategy was indeed captivating, given the card's increased visibility in Klang Valley, this might be more indicative of consumers not diligently scrutinizing the details and not undertaking necessary conversion assessments prior to application.

It's crucial to note that other perks, such as the Mastercard Concierge, Priceless, and associated Mastercard benefits, are far from exclusive to the HSBC TravelOne offering.

To be eligible for the HSBC TravelOne credit card, a minimum annual income of RM60,000 is stipulated, averaging to approximately RM5,000 monthly. For individuals within this income bracket, it might be disconcerting to recognize that alternative credit cards in the market offer a far more comprehensive suite of benefits, particularly in the domain of air miles and travel.

Join the Mailing List

Subscribe to our newsletter to stay on top of the latest credit card updates and news.

Thank you for subscribing!

We're Now on Social Media!

To celebrate reaching 100,000 views, we're officially launching our social media pages!

Follow us on social media to stay up to date on the latest and greatest from Refined Points.

Credit Card News

Fair Warning | Maybank TreatsPoints Fair 2024

First Look | Ambank Co-Branded Enrich Credit Cards

TNG eWallet Visa Prepaid Card offers 2% Cashback on Overseas Spend

Credit Card Updates

- 6 hours ago

Huge Devaluation | Is the RHB Premier Visa Infinite Still Relevant?

Oh Dear | RHB Introduces Confusing New Points System

CIMB Unveils Complimentary Premium Shuttle to KLIA Satellite Terminal for Cardholders!

- Money Management

HSBC Launches A New Instant Rewards Travel Card

- Link Copied!

HSBC has just launched a brand new travel card that is looking to be a massive game changer.

This TravelOne credit card was launched in partnership with Mastercard and is a first of its kind, allowing users to instantly redeem their travel rewards with selected leading airlines and hotel chains via the HSBC mobile banking app.

“Customers tell us they want flexibility, incentives and discounts when they travel. We’re bringing them exactly that by allowing our customers to redeem reward points instantly on our mobile banking app, converting their points with an extensive selection of the world’s leading airlines and hotels,” said Taylan Turan, Group Head of Retail Banking and Strategy, HSBC Wealth and Personal Banking (WPB) during the launch event.

With travel quickly regaining its popularity all around the world, HSBC seeks to offer customers innovative payment solutions that cater to their unique lifestyles.

Beena Pothen, Country Manager for Malaysia and Brunei, Mastercard, said that the HSBC TravelOne card and the instant rewards benefits that it brings comes at great time, allowing customers to redeem their rewards via the HSBC mobile app at any palace and at any time.

The HSBC TravelOne Credit Card was designed with customer convenience at the forefront of its functionality. As such, it not only offers users with instant reward points redemption, it also offers customers the opportunity to earn up to 8x the reward points for their eligible spending. Additionally, they can also enjoy travel privileges such as complimentary travel insurance coverage and airport lounge access.

Renee Bullock-Cann, Head of Wealth and Personal Banking, HSBC Malaysia said that Malaysia’s economic growth this year is expected to be anchored by domestic demand. At the centre of this demand is household spending, which remains resilient as it is being bolstered by improving labour market conditions. This makes it the perfect opportunity for a boost in travel and leisure activities.

Some of the key features of the HSBC TravelOne Credit Card include:

- Instantly convert reward points to airline miles at leading airlines such as Malaysia Airlines, AirAsia, Singapore Airlines, Etihad, Cathay Pacific and many more.

- Instantly transfer reward points to top hotel chains in the world such as Marriott Bonvoy, IHG One Rewards and Wyndham.

- Both primary and supplementary cardholders are also entitled to 6 times (combined) complimentary airport lounge access per year at 7 Plaza Premium Airport Lounges (KLIA, Singapore Changi Airport and Hong Kong International Airport).

- Complimentary travel insurance up to USD250,000 (including travel medical, travel inconvenience – flight delay, baggage delay, baggage loss, COVID coverage etc.). Registration with Mastercard is required to enjoy this privilege.

- Flexible instalment plans that suit the needs of cardholders.

- When making donations to an eligible charity, HSBC will contribute 1% to supported charities (Up to RM500,000 per year)

- A notched design that signals to visually-impaired users the correct end to insert into card readers and ATMs as part of the Bank’s commitment to inclusivity.

HSBC TravelOne Credit Card

Redeem your rewards instantly!

Did you like this article ?

You might also like these

How To Choose The Best Credit Card That Suits Your Needs

5 Credit Card Mistakes Almost Everyone Makes

What You Should Know About Balance Transfer Credit Cards

6 Credit Card Hacks To Avoid Paying Extra Fees And Charges

How Is Interest Charged On My Credit Card?

Get even more financial clarity with an iMoney account for FREE

We’ve tailored insightful tidbits just for you.

By signing up, I agree to iMoney’s Terms & Conditions and Privacy Policy

Get free weekly money tips!

Do you really want to leave?

- Credit Card

HSBC TravelOne Credit Card

.png?auto=webp&width=200)

- Limited to Malaysians only

- Min. Monthly Income of RM 5,000/month

.webp?auto=webp&quality=70&width=300)

Minimum monthly income

Interest rate p.a, balance transfer rate (fixed).

Special Offers

Win rm4,800 or get guaranteed rm600 touch 'n go ewallet credits when you apply, activate, and spend with hsbc live+ credit card via comparehero today. check terms and conditions here: https://comparehero.link/hsbc2409w42.

.png?auto=webp&width=144)

Minimum monthly income RM 300

Annual fee 1st year annual fee waived, with all subsequent years waived if total annual spending is rm20,000 or above. 15%, interest rate p.a 3.88%, balance transfer rate (fixed) special offers, product details.

- Eligibility

- Fees & Charges

- Document required

Auto Balance Conversion

- Automatically converts outstanding statement balances into a 36 monthly instalment plan

- Lower management fee at 13% p.a.

- No processing fee

- No early termination

Cash Advance

- Flexibility for emergency use or when a credit card payment is not acceptable

- No documents required

- 24-hour instant cash withdrawal from any ATM worldwide

Balance Transfer

- Consolidate credit card outstanding balances

- Enjoy a low 3.88% one-time upfront handling fee for 12 months of repayment tenure

- Transfer a minimum of RM1,000 only

Cash Instalment Plan

- Convert available credit limit (up to 60%) into cash

- Enjoy 3.88% p.a. for new-to-card customers and 4.88% p.a. for existing-to-card customers

- Monthly payment of up to 12 months

- Hassle-free thanks to an easy application process

- Examples of immediate needs: education, healthcare, vacation, wedding, renovation & furnishing

- Secure transactions when making online purchases

- Securepay One Time Password will be sent via sms for each online purchase.

Pin and Pay

- For improved financial security and to prevent credit card fraud

- 6-digit Personal Identification Number (PIN) will be used for all credit card payments at point-of-sale terminals in Malaysia.

- New credit cards have the contactless Paywave feature, which allows a fast, easy and convenient way to pay

- Safe purchase with just a tap for everyday purchases

Email statements

- Timely delivery of credit card statements in a secure and private manner

- No lost or misplaced statements

- No more physical filing

- HSBC Go Green Initiative - advocating a paperless environment and reducing the global carbon footprint

Balance Conversion

- Instant Approval

* The Bank will make a Charity Donation to Selected Charity Organization(s) which is equivalent to 1% of the Eligible Charity Spend made by Eligible Cardholders, up to a maximum of RM500,000 per year. List of Selected Charity Organization(s) found at www.hsbcamanah.com.my/charities

You will need to provide several documents such as (varies between different banks):

Salaried Employees (Malaysian):

Multinational / Public listed Companies/Government/Semi-Government office

- Photocopy of MyKad (both sides), and any 1 from below

- EPF statement - latest original PDF copy of non-password protected statement downloaded from KWSP website/App OR

- Bank statement - original PDF copy of non-password protected statement downloaded from online banking website/App showing latest 3 months salary credit OR

- Letter of confirmation from employer or latest month salary slip if employed less than 3 months OR

- Latest Income Tax Return Form (Form BE with tax receipt) OR

Other Companies

- Photocopy of MyKad (both sides), and any 2 from below

- EPF statement - latest original PDF copy of the non-password protected statement (latest 2 years EPF statement if contribution less than 6 months) downloaded from KWSP website/App AND/OR

- Bank statement - original PDF copy of non-password protected statement downloaded from online banking website/App showing latest 3 months salary credit AND/OR

- Latest 3 months salary slip AND/OR

- Latest Income Tax Return Form (Form BE with tax receipt) AND/OR

Self-Employed (Malaysian):

- Photocopy of MyKad (both sides), AND

- Photocopy of Business Registration Form (established minimum 3 years), AND any 1 from below

- Bank statement - latest 6 months original PDF copy of non-password protected statement downloaded from online banking website/App AND/OR

- Latest Income Tax Return Form (EPF Statement or Form B with payment receipts or CP02 attached)

Expatriate:

- Copy of passport showing personal details and work permit (must be valid for at least 1 year)

- Latest month's salary slip

- Letter of confirmation from employer stating position, remuneration and duration of employment

- Minimum RM10,000 per month AND working for multinational/public listed companies/government/semi-government/HSBC corporate lending employers

Product review by

Get rewarded for your travels and redeem them instantly with the HSBC TravelOne Credit Card. It's time to elevate the way you travel with airline and hotel perks you can redeem through the app.

Redeem your rewards instantly

Redeem your rewards as soon as you want to with the HSBC TravelOne Credit Card's instant redemption feature. Redeem perks from a wide selection of hotel and airline partners through HSBC Malaysia's Mobile Banking app. For most of the partner merchants, you can use your chosen reward/s as soon as you select it in the app.

Earn up to 8x Reward points

Using your HSBC TravelOne Credit Card will lead you to your desired reward fast with its accelerated Reward points, especially when it comes to travel-related spend. Below are the number of Reward points you'll receive for every spend.

For more information, you may click on the links below:

HSBC TravelOne Credit Card Terms and Conditions

HSBC Credit Cards Product Disclosure Sheet

What are HSBC TravelOne Credit Card's main benefits?

- Instant rewards redemption through HSBC Malaysia Mobile Banking app

- Up to 8x Reward points on various local and international spend

- Complimentary travel insurance coverage up to USD250,000

- 6 complimentary access every year at selected Plaza Premium international airport lounges

- Exclusive travel offers on Agoda

Is there an annual fee for the HSBC TravelOne Credit Card?

Yes, there's an annual fee of RM300 for primary cardholders and RM150 for supplementary cardholders.

The first year is free but for the subsequent years, you will need to spend a minimum of RM20,000 or above per year to enjoy a waiver.

What are the requirements to get an HSBC TravelOne Credit Card?

You need to be at least 21 years old and have a minimum annual income of RM60,000 to apply.

Does the HSBC TravelOne Credit Card have additional fees and charges?

The HSBC TravelOne Credit card has the following fees and charges:

- RM25 for sales and service tax purposes

- Late payment fee of 1% or a minimum of RM10 from the overdue amount, whichever is higher. Maximum is RM100.

- Interest rate of 15% annually, provided you make the minimum monthly repayment which is 5% or RM50 from the overdue amount, depending on which amount is higher.

Will the HSBC TravelOne Credit Card suit my lifestyle?

If you frequently travel and want to use your rewards as soon as you have the required Reward points, the HSBC TravelOne Credit Card is the right card for you with its travel perks from merchants such as Singapore Airlines, Marriott Bonvoy, Agoda and other travel partners.

Looking for more options?

- Mon - Fri 10:00am - 7:00pm

.webp?auto=webp&width=150)

Mainly Miles

Maximise your miles.

HSBC launches TravelOne credit card – with 9 frequent flyer partners

HSBC launched a new travel credit card last week – the TravelOne card – a general spend option which boasts nine frequent flyer transfer partners and a 20,000 miles sign-up bonus when you apply between now and the end of August 2023.

The card also boasts fee-free transfers to frequent flyer miles until the end of 2023, while the transfers themselves will be instant, or in the worst case take only one business day.

Another plus that might make you keen to dive in with this one – the sign-up bonus is also open to existing HSBC cardholders too, not just new-to-bank applicants, as is usually the case with these promotions.

The annual fee is non-waivable in year one. It is waived each year from the second membership year onwards, provided you spent at least S$25,000 in the previous membership year.

To apply for an HSBC TravelOne card, you must be aged 21 or above and have a minimum annual income of:

- S$30,000 for Singapore Citizens and Permanent Residents, or

- S$40,000 for self-employed or commission-based Singapore Citizens or Permanent Residents, and for foreigners residing in Singapore

If you do not meet the income requirements, a minimum fixed deposit collateral of S$10,000 will suffice instead.

Earn rates

The HSBC TravelOne card earns:

- 1.2 mpd for local spend (i.e. transacted in SGD), and

- 2.4 mpd for overseas spend (i.e. transacted in foreign currency).

No minimum spend or upper cap applies on earning with this card, but do note that unfortunately CardUp and ipaymy transactions do not earn miles on this (or any HSBC) card.

Here’s how that compares to some other general spend cards with similar income requirements on the market in Singapore.

Earn rates (general spend cards) (Best to worst, May 2023)

* During June and December only, otherwise the local spend rate applies

As you can see while the local earn rate of 1.2 mpd is run-of-the-mill, the FCY rate is on the more attractive side at 2.4 mpd, matching the UOB PRVI Miles cards.

The minimum spend to earn points with HSBC is also attractive at S$0.50, with some cards like those issued by OCBC and UOB earning no points at all for transactions less of than S$5.

Sign-up bonus

HSBC is running a sign-up deal for those applying for the TravelOne credit card between now and 31st August 2023, with 20,000 bonus miles (paid as 50,000 HSBC Reward points) on offer when you spend S$800 or more by the end of the calendar month following the month of card approval.

The great thing about this offer is that it’s open to new and existing HSBC credit card holders.

That means if you’re already holding on to another HSBC card, like the Revolution or Visa Infinite products, you can still benefit from these bonus miles if you also pick up the TravelOne card between now and the end of August.

To be eligible you will need to:

- Apply by 31st August 2023

- Consent to receive marketing and promotional materials from HSBC

- Pay the annual fee of S$194.40

- Charge a minimum of S$800 in qualifying transactions by the end of the calendar month following the month of card approval (e.g. approved 19th May = meet the spend by 30th June)

Provided you have S$800 spend coming up, these 20,000 bonus miles cost 0.97 cents each based on payment of the S$194.40 annual fee.

There is a slightly higher cost, however, if you have to divert some or all the spend away from 4 mpd / 6 mpd credit cards to meet this threshold with the TravelOne card, which will be the case for some of our readers. It doesn’t dramatically change the equation though – this bonus is still worth it .

Qualifying transactions for the S$800 minimum spend comes with the usual HSBC exclusions, as shown below.

Spend exclusion categories

- Foreign exchange transactions (including but not limited to Forex.com);

- Donations and payments to charitable, social organisations and religious organisations;

- Quasi-cash transactions (including but not limited to transactions relating to money orders, traveler’s checks, gaming related transactions, lottery tickets and gambling);

- Payments made to financial institutions, securities brokerages or dealers (including but not limited to the trading of securities, investments or crypto-currencies of any kind);

- Payments on money payments/transfers (including but not limited to Paypal , SKR skrill.com, CardUp , SmoovPay, iPayMy );

- Payments to any professional services provider (including but not limited to GOOGLE Ads, Facebook Ads, Amazon Web Services, MEDIA TRAFFIC AGENCY INC);

- Top-ups, money transfers or purchase of credits of prepaid cards, stored-value cards or e-wallets (including but not limited to EZ-Link, Transitlink, NETS Flashpay and Youtrip);

- Payments in connection with any government institutions and/or services (including but not limited to court costs, fines, bail and bond payment);

- Any AXS and ATM transactions;

- Tax payments (except HSBC Tax Payment Facility);

- Payments for cleaning, maintenance and janitorial services (including property management fees);

- Payments to insurance companies (including but not limited to sales, underwriting, premiums and insurance services);

- Payments to educational institutions ;

- Payments on utilities ;

- The monthly instalment amounts under the HSBC Spend Instalment;

- Balance transfers, fund transfers, cash advances, finance charges, late charges, HSBC’s Cash Instalment Plan, any fees charged by HSBC;

- Any unposted, cancelled, disputed and refunded transactions.

Full terms and conditions for the sign-up bonus are available here .

Transfer partners

The most significant leap for this card is a new variety of airline and hotel loyalty programme partners for you to transfer your HSBC Reward points across to.

For other HSBC products like the Revolution and Visa Infinite cards, transfers are only supported to Singapore Airlines KrisFlyer miles and Cathay Pacific Asia Miles, but the HBSC TravelOne card allows you to transfer into nine FFPs , as shown below.

HSBC FFP Transfer Partners

This is a strong list, including Star Alliance, Oneworld and SkyTeam options, and introduces Vietnam Airlines Lotusmiles as a credit card conversion partner for the first time in Singapore.

Qatar Airways Privilege Club (QRPC) is also a de-facto inclusion, since you can link your British Airways Avios and QRPC accounts and make unlimited instant free 1:1 transfers of any amount between them, whenever you like.

In all cases with these nine FFPs, the same transfer ratio of 25,000 HSBC Reward points to 10,000 miles applies (2.5:1), so the ‘advertised’ miles per dollar rates on this card are true for all of them.

Of less interest, but still potentially useful for some readers, you can also transfer HSBC Reward points accrued on the TravelOne card to three hotel loyalty programmes:

- Accor Live Limitless (25,000 : 5,000)

- IHG One Rewards (25,000 : 10,000)

- Marriott Bonvoy (25,000 : 10,000)

Hotel points value shouldn’t be totally discounted of course – the 50,000 Reward points (20,000 miles) sign-up bonus for this card could instead be transferred into 10,000 Accor points – worth EUR200 (S$290) against a future hotel stay.

That alone makes the annual fee of S$194.40 worth paying, provided you can hit S$800 spend.

More to come?

By end of 2023, HSBC is promising to have more than 20 airline and hotel transfer partners available, at least eight more than it has now, so it will be interesting to see what the new options are in due course.

Fingers crossed for some useful additions like Turkish Miles&Smiles, Alaska Mileage Plan and Air Canada Aeroplan (some of these are already launch partners for the TravelOne card in Malaysia ).

Hopefully all these partners can also be added as options for other HSBC credit cards in future, not just the TravelOne card.

Transfers are instant (or are they?)

One useful feature HSBC is promising with the TravelOne card is instant conversion from HSBC Rewards points to frequent flyer miles or hotel points.

This will be possible through the HSBC Singapore app ( App Store | Google Play ), and is currently exclusive to this card within the bank’s lineup.

Here’s HSBC’s step-by-step summary of how it will work.

There’s a little caveat, however, with a sneaky “or within one business day” get-out for the bank, plus if you’re transferring to Accor Live Limitless it will take up to five business days.

Air miles and hotel points redemptions will be completed instantly or within 1 business day. For Accor Live Limitless, it will take up to 5 business days. Please note that this list may be updated from time to time. HSBC

That could mean a Friday night transfer not crediting until Monday or Tuesday the following week in some cases.

It will be interesting to pick up some data points from readers on the actual transfer times in the months ahead – hopefully it is indeed simply instant!

↥ Minimum transfer quantity

The minimum transfer quantity is 25,000 HSBC Reward points, into 10,000 miles.

After that though, transfers can be made in 5 HSBC Reward point (2-mile) denominations.

That’s good news, because to unlock the sign-up bonus by spending S$800 you’ll accrue 960 miles for local spend (800 x 1.2) or 1,920 miles for FCY spend (800 x 2.4), in addition to the bonus itself.

That means you’ll have at least 20,960 miles and perhaps upwards of 21,920 miles in your rewards account for an exact spend of S$800 once the bonus miles come in, and thankfully you can transfer that exact quantity to miles, (since it’s greater than 10,000).

2-mile redemption blocks also avoids having ‘orphan miles’ stuck on your card, but only provided you keep your balance above 25,000 Reward points (10,000 miles) at all times.

Unfortunately HSBC does not allow you to combine points accrued on different cards, so if you have 24,999 HSBC Reward points on your TravelOne card it’s impossible to pool those with your Revolution card points, for example, to achieve a transfer.

Free transfers till December 2023

Another good thing about the TravelOne card is that unlimited transfers to frequent flyer programmes are free of charge until 31st December 2023.

That can also help you split up your miles stash and transfer them into different FFPs, provided each transfer is at least 10,000 miles, without incurring any additional cost.

For example, if you accrue 22,000 miles you could transfer 10,000 into KrisFlyer and 12,000 into British Airways Avios if you wished, with no fees to pay for either transfer during the rest of 2023.

From 1st January 2024 it’s not clear whether HSBC will require TravelOne cardholders to subscribe to the HSBC Mileage Programme (S$43.20 per year for unlimited transfers), or charge a one-time fee for each transfer (typically S$25-27).

Lounge access

The TravelOne card comes with four complimentary lounge visits per calendar year, under the DragonPass programme.

This includes a wide range of 1,300 lounges globally, with all 10 third-party options here in Singapore at Changi Airport accounted for.

The great thing about the lounge visits being based on calendar year , assuming you pick up the TravelOne card in the coming months, is that you’ll be able to use up four visits in 2023, then a fresh four visit allowance will be loaded on 1st January 2024 for you to use next year.

If you then cancel the card before the second year annual fee is due – you’ve potentially scored eight lounge visits in your first card membership year (for your single S$194.40 annual fee).

Lounge visits can only be used by the principal cardholder, and unused visits do not carry over to the next calendar year. Terms and conditions are available here .

HSBC Reward points expire

HSBC Reward points expire at the end of a 37-month period commencing from the month subsequent to the month in which such points were awarded.

That gives you three years and one month of validity. For example any points awarded in May 2023 will expire on 30th June 2026. Something to bear in mind with this card, especially once the (unknown) miles transfer fee kicks in next year.

Other benefits

- Travel insurance Complimentary travel insurance coverage (including COVID-19) of up to US$100,000 for you and your family when you charge the full cost of your air ticket to the card. Full policy wording here .

- Mastercard Travel Rewards Cashback and discounts in-store and online at several retailers worldwide. Details here .

- Mastercard Priceless Specials A range of offers and benefits from Mastercard, like 3 nights for 2 at selected hotels. Details here .

HSBC has launched the TravelOne credit card in Singapore, which is a good general spend option with a typical earn rate for local spend (1.2 mpd) and arguably a more decent one than most cards offer for transacting in foreign currency (2.4 mpd).

While this clearly doesn’t eclipse specialised bonus 4 mpd or 6 mpd cards, as an uncapped general spend option it’s not a bad one .

The sign-up bonus of 20,000 miles for payment of the annual fee and a moderate spend in the first full calendar month after approval means buying miles at an attractive 0.97 cents each, and is also available to existing cardholders, plus there are up to eight lounge visits in your first card membership year – if you play it right.

The big benefit though is a myriad of new transfer partners across the main alliances, with more supposedly to come later this year, though this will only be truly useful if the list can be tapped by those holding other HSBC credit cards in Singapore – especially the 4 mpd Revolution card .

What do you think of the new HSBC TravelOne credit card? Let us know in the comments section below.

(Cover Photo: Shutterstock)

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Pingback: Revealed: Conversion ratios for OCBC's 8 new transfer partners - Tech News Comchasm

Leave a Reply Cancel reply

Discover more from mainly miles.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

Myinfo will be going through system maintenance on 29 Sep, 12am to 6am. During this period, FIN data retrieval will be unavailable. For FIN holders only -

Mobile and Tablet Banking Apps – You will not be able to retrieve government data for SGFindex. Everyday Global Account – To open an account during this period, please verify your identity via HSBC Photo ID. Alternatively, you may access the applications after system maintenance is complete. Credit cards and Loans – To apply for credit cards or loans, please do so after the system maintenance is complete.

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Privacy Policy .

HSBC TravelOne Credit Card

Information

For HSBC TravelOne Credit Card Campaign 2024, please click here .

Unlock a world of travel freedom

Unlock instant travel rewards and elevated travel experiences everywhere you go with the one and only travel card you need.

Welcome gift

Apply now and enjoy instant approval[@cards-instant-approval-tnc]. What's more, receive 30,000 miles – in the form of 75,000 Reward points – when you meet these criteria:

- pay the annual fee of SGD196.20 (inclusive of GST)

- spend at least SGD500 in qualifying transactions within the qualifying spend period

- provide marketing consent when you apply

That's equivalent to a round trip air ticket to Bangkok!

Open up a world of elevated travel

Instant redemption

The first HSBC credit card to offer instant redemptions with an extensive selection of airline and hotel partners, all within the convenience of your mobile app.

Earn accelerated points

Get up to 2.4 miles (6X Reward points) for your spending.

Travel privileges

Complimentary travel insurance coverage, airport lounge visits and more.

Split flexibly

Split your purchases across a range of flexible tenors that suits your needs with HSBC Instalment Plans – find out more .

dpws-tools-calculator-creator

The calculated amount shown is indicative only, based on qualifying transactions. Terms and conditions apply .

How many miles you'll need to redeem a flight?

Note: The miles shown in the table are indicative only, based on the 'Miles Calculator – Redeem Miles' by Singapore Airlines as of 4 September 2023. The miles indicated are for an entire journey for 1 passenger from Singapore and they do not include taxes, fees or any promotional discounts that may apply.

Spend, earn, and go further

Earn points and redeem them instantly[@cards-instantly].

- 2.4 miles (6× Reward points)[@cards-travelonetnc] per SGD1 charged on foreign currency spend.

- 1.2 miles (3× Reward points)[@cards-travelonetnc] per SGD1 charged on local spend.

- Share the perks with a supplementary card[@cards-supplementarycard].

- No redemption fee when you redeem for air miles or hotel points. This offer ends on 31 January 2025.

Be spoilt for choice with instant miles and hotel points redemption with a wide range of airline and hotel partners such as Cathay Pacific, Singapore Airlines, Marriott Bonvoy and more.

- Find out how to redeem instantly

Travel in style

- Airport lounge: enjoy 4 complimentary lounge visits per year to over 1,300 global airport lounges for primary cardholders – register now .

- Priceless™ Specials: discover top-tier benefits and a world of privileged access with curated offers and benefits from Mastercard – explore all offers .

- Travel offers: enjoy a variety of travel privileges when you plan your trip – find out more .

Put your mind at ease

- Travel insurance[@cards-travelinsurancecoverage]: enjoy complimentary travel insurance with coverage of up to SGD150,000 for Overseas Medical Expenses when you charge the full cost of your air ticket to your HSBC TravelOne Credit Card - read the full policy . Read Frequently asked questions .

- ID Theft Protection™: enjoy peace of mind when surfing and purchasing online. Proactive monitoring and alerts help to ensure the security of your personal data from identity theft or fraud. Enrol online for complimentary access – find out more .

Who can apply?

To apply for an HSBC TravelOne card, you must be aged 21 or above and have a minimum annual income of:

- SGD30,000, if you're a Singaporean or Permanent Resident

- SGD40,000, if you're a self-employed or commission-based Singaporean or Permanent Resident

- SGD40,000, if you're a foreigner residing in Singapore

If you do not meet these income requirements, a minimum fixed deposit collateral of SGD10,000 will apply.

What you need to apply

Apply using MyInfo via Singpass and save the hassle of providing supporting documents.

Alternatively, prepare the following supporting documents with your application.

- ID documents of the primary and any supplementary applicants

- income documents of the primary applicant

What documents are acceptable?

Important documents

- ABS consumer guide for credit cards (PDF) ABS consumer guide for credit cards (PDF) Download

- Consumer guide for credit cards Consumer guide for credit cards Modal

- Credit card FAQs Credit card FAQs Modal

- Credit card security Credit card security Modal

- Credit card terms (PDF) Credit card terms (PDF) Download

- TravelOne credit card reward points programme terms and conditions (PDF) TravelOne credit card reward points programme terms and conditions (PDF) Download

- TravelOne sign-up gift offer terms and conditions (PDF) TravelOne sign-up gift offer terms and conditions (PDF) Download

What you need to know

Your credit limit

Your credit limit is subject to our review and approval. Where you've stated a preferred credit limit, the amount we grant may be lower than what you requested.

Finance charges

A finance charge will be imposed based on the amount withdrawn, from the date the transaction is posted to your account to the date the payment is made in full or the next statement date, whichever is earlier.

Effective rate: 27.8% p.a. (minimum)

Minimum charge: SGD2.50

The annual fee is at SGD196.20 including GST, starting from the issue date for your credit card. From the second year onwards, we'll waive the annual fee for your card if you spend more than SGD25,000 per year.

Receive 10,000 miles (in the form of 25,000 Reward points) when you pay for your annual fee from the second year onwards. The Reward points will be credited to your account within the next 2 months after the annual fee is charged to your card. Valid till 31 December 2024.

No Reward points will be awarded if your annual fee is waived when you spend more than SGD25,000 per year.

Get the miles

Get up to 30,000 miles (in the form of 75,000 Reward points) when you successfully apply for the HSBC TravelOne Credit Card, pay the annual fee of SGD196.20 (including GST), spend a minimum of SGD500 in qualifying transactions and provide marketing consent when you apply!

Share the perks with a supplementary card

Our HSBC credit cards open up a world of banking convenience, benefits and privileges. And now, you can share it with your family too.

- Earn reward points each time your loved ones spend on their cards

- Get up to 5 supplementary cards, free to you and your family for life

- Any loved one can hold a supplementary credit card as long as they're aged 18 or above

Other ways to apply

Leave us your contact details online or by SMS, and we'll give you a call within 3 working days to help you apply for this card.

Text HSAPP <space> Name <space> to 74722, or request a callback online .

Why bank with us

AsiaMoney Best Bank For Digital Solutions – Singapore

HSBC is the recent recipient of the 'AsiaMoney Best Bank For Digital Solutions – Singapore' Award 2023

Customer Satisfaction Index

HSBC ranked #1 in Credit Card sector for 3 consecutive years (2020 to 2022) in the Customer Satisfaction Index of Singapore.

Additional information

How can i enjoy the complimentary airport lounge .

Start enjoying your benefit

- Step 1: download Mastercard Travel Pass app (available on the Apple App Store and Google Play)

- Step 2: select 'Sign up' to register for the programme, or log on to your account if you're already a member

- Step 3: enter your HSBC TravelOne Credit Card details for a one-time verification

- Step 4: complete your personal details for Mastercard Travel Pass account registration (enter your name as shown in your passport)

- Step 5: set your account password

Simply use the membership number stored under 'my visits' when visiting airport lounges.

With the app, you can also view the airport lounges and restaurants available, keep track of your usage history and access many more services.

Note: Primary cardholders may use their complimentary lounge visits to redeem free meals at selected airport restaurants.

Terms and conditions apply .

Check out Mastercard Travel Pass

You might also be interested in

Entertainer with hsbc entertainer with hsbc this link will open in a new window, credit card features , hsbc singapore app .

Discover Campaign 2024

For TravelOne credit cardholders who receive an eDM and/or push notification from HSBC on this campaign, please see the details, terms and conditions .

Escapade Campaign 2024

Voyage Campaign 2024

Note: The code to access the relevant page is indicated in the eDM and push notification.

The miles shown are for illustrative purposes only, based on the redemption rate of 25,000 HSBC Reward points to 10,000 air miles from Cathay Pacific – Asia Miles and Singapore Airlines – KrisFlyer in any brochures, marketing or promotional materials. Visit our full list of airlines and hotel partners' programmes' redemption rate.

Connect with us

- HSBC Amanah

Commercial Cards

HSBC Commercial Cards Programme

Hsbc virtual card, hsbc corporate mastercard®, online management and reporting.

- Reward types, points & expiry

- What card do I use for…

- Current Credit Card Sign Up Bonuses

- Credit Card Lounge Benefits

- Credit Card Airport Limo Benefits

- Credit Card Reviews

- Points Transfer Partners

- Singapore Airlines First & Business Class Seat Guide

- Singapore Airlines Book The Cook Wiki

- Singapore Airlines Wi-Fi guide

- The Milelion’s KrisFlyer Guide

- What is the value of a mile?

- Best Rate Guarantees (BRGs) for beginners

- Singapore Staycation Guide

- Trip Report Index

- Credit Cards

- For Great Justice

- General Travel

- Other Loyalty Programs

- Trip Reports

HSBC TravelOne Card: Miles game, meet shake-up

The HSBC TravelOne Card boasts competitive earn rates and lounge entitlements, but what excites me the most are its transfer partners.

HSBC has launched the HSBC TravelOne Card, its first entry-level miles card for the Singapore market.

Do we really need another miles card? Well, that’s the thing- it’d be a mistake to dismiss the TravelOne as “just another miles card”.

I attended the launch event today and spoke with the team behind the product. There’s a lot to get into, but here’s the key highlights:

- A 20,000 miles sign-up offer with S$800 min. spend, valid for new and existing customers

- 1.2 mpd on local spend, 2.4 mpd on FCY spend

- 4 complimentary lounge visits per calendar year

- No conversion fees till 31 December 2023

- Transfers completed “instantly or within one business day”

- 12 hotel and airline transfer partners

I want to focus specifically on the final point, because that’s what’s got me the most excited. Not only does HSBC now have the most transfer partners in Singapore (taking the crown from Citi), it intends to add new airline and hotel partners at an aggressive pace, and I mean aggressive. The goal is more than 20 partners by the end of 2023!

I’ve seen the roadmap, and while I can’t share specifics, there are some names that would make the miles community here very happy…

Overview: HSBC TravelOne Card

The HSBC TravelOne Card (which I suspect we’ll soon be calling the T1 Card, given the styling on the card face) has a minimum income requirement of S$30,000 . If you do not meet the minimum income requirement, a minimum fixed deposit collateral of S$10,000 will apply.

Cardholders will pay an annual fee of S$194.40, waived from the second year onwards if they spend at least S$25,000 in a membership year.

It’s not clear from the T&Cs whether cardholders will receive any miles for paying the annual fee each year.

HSBC TravelOne Cardholders earn:

- 3X HSBC points per S$1 (1.2 mpd) on local spend

- 6X HSBC points per S$1 (2.4 mpd) on foreign currency spend

There is no minimum spend required, nor cap on the points that can be earned.

While it won’t be a substitute for a 4/6 mpd card, these are very compelling earn rates compared with other entry-level general spending cards. That’s all the more when you remember that HSBC awards points for transactions as small as S$0.50, compared to S$5 for the UOB PRVI Miles Card and OCBC 90 ° N Card, its two closest rivals.

My main concern here is the lack of a bonus category. While earn rates of 1.2/2.4 mpd are decent, it’ll take quite a lot of spending to reach a critical mass of points, especially since HSBC excludes CardUp and ipaymy transactions from earning rewards, and because points don’t pool with other HSBC cards.

Sign-up bonus

From 11 May to 31 August 2023 , customers who apply for a HSBC TravelOne Card will enjoy 20,000 bonus miles (in the form of 50,000 HSBC points) when they:

- Pay the annual fee of S$194.40

- Spend at least S$800 by the end of the month following approval

- Opt-in for marketing communications during the sign-up

This offer is valid for both new and existing HSBC cardholders.

The qualifying spending period is as follows:

20,000 miles for S$800 spend and a S$194.40 annual fee is a tidy return; put it another way, you’re paying about 0.97 cents per mile (S$194.40/20,000 miles), which is a great price especially when you factor in transfer partner variety.

If you’re a new HSBC cardholder, you’ll also receive a further S$30 cash when you apply via SingSaver. You can use any of the links in this post, or refer to this article.

Bonus crediting

Bonus miles (in the form of HSBC points) will be credited within 90 days from the card opening date, provided the eligibility criteria is met.

Terms & Conditions

The terms and conditions for the welcome offer can be found here.

Points Expiry

HSBC points earned on the HSBC TravelOne Card expire after 37 months, same as other HSBC credit cards.

Transfer Partners

Here’s what I think is the biggest selling point of the HSBC TravelOne Card: transfer partners.

HSBC points could previously be transferred to just Singapore Airlines KrisFlyer and Cathay Pacific Asia Miles, but the HBSC TravelOne Card comes with nine airline and three hotel partners.

Conversions can be done via the HSBC Singapore app ( Android | iOS ) and are processed “instantly or within one business day” (except Accor, which takes five business days). During the media event, they consistently emphasised the “instant” aspect, but the website uses more nuanced language “instant or within one business day”. I suppose that’s just in case.

All conversion fees will be waived until 31 December 2023. It’s unclear what they’ll be after that, so stay tuned.

The upshot is that HSBC (9 airlines, 3 hotels) has now wrestled the “most transfer partners” crown from Citibank (10 airlines, 1 hotel).

It’s nice to see three hotel partners, although the transfer ratios won’t be worthwhile for most people. This isn’t a HSBC-specific problem, mind you; Citibank and Standard Chartered have similarly weak ratios for hotels. We might just need to accept that we’ll never have a decent hotel points card in Singapore.

On the airline side, all three alliances are represented: Star Alliance (SIA, EVA) oneworld (BA, Cathay, Qantas) and SkyTeam (Air France/KLM, Vietnam).

In addition to mainstays like Singapore Airlines KrisFlyer and Cathay Pacific Asia Miles, it’s great to see British Airways Executive Club with their sweet spots for short-haul Economy travel. Don’t forget that British Airways Avios can also be used within Qatar Privilege Club too, which offers great value for Singapore-Europe/North America travel, with no fuel surcharges.

This will also be the first time Vietnam Airlines LotusMiles has partnered with a bank in Singapore. I don’t know a lot about this programme, but based on some quick research I don’t think there’s much to get excited about; award tickets cost significantly more during peak periods, there are fuel surcharges, and partner awards can’t be booked online.

What you should be excited about, however, are HSBC’s plans to ramp up its airline and hotel partner count over the rest of 2023. HSBC aims to have more than 20(!) airline and hotel partners by the end of 2023, including one name I can’t disclose now, but let me put it this way: if it happens, it’s going to make a lot of miles chasers very happy.

Lounge Visits

HSBC TravelOne Cardholders enjoy four complimentary lounge visits per calendar year, provided by DragonPass.

This is a relatively generous allowance for the segment in which the card competes.

Two interesting things to note.

First, the allowance is based on calendar year , not membership year. This means that a HSBC TravelOne Cardholder who gets approved in May 2023 will receive four visits to use from May to December 2023, then another four visits come 1 January 2024 (unused visits cannot be carried forward).

They could theoretically use up to eight lounge visits in their first membership year, regardless of whether they choose to renew the card.

Second, it’s interesting to see that HSBC is going with DragonPass for the TravelOne Card, since the HSBC Visa Infinite uses LoungeKey.

And yet I’m glad they have, because the DragonPass network is arguably more useful given Plaza Premium’s divorce from The Collinson Group (which runs Priority Pass and LoungeKey). DragonPass members can still access Plaza Premium Lounges as per normal, and at some airports (e.g. Kuching, Penang) that’s the sole contract lounge option.

Lounge visits can only be used by the principal cardholder, however. That’s a bit odd, since you can normally share allowances with other cards.

Travel Insurance

An expected feature, but still worth mentioning: HSBC TravelOne Cardholders who charge their air tickets to the card will receive complimentary travel insurance coverage (including COVID-19) of up to US$100,000, underwritten by HSBC Life.

This covers both the cardholder and their family.

HSBC has confirmed that coverage will also apply in situations where you redeem a ticket with miles and use the HSBC TravelOne Card to pay the taxes and surcharges.

What excites me most about the HSBC TravelOne Card is not its earn rates or lounge access, competitive though they may be. It’s the possibilities.

This card isn’t even one day old and it’s already dethroned Citi in terms of transfer partners, with plans to pull even further ahead as 2023 progresses. Granted, not all the new partners will be “useful” to miles chasers, and otherwise useful ones may have transfer ratios that negate their value. We simply don’t know at this point.

But I’m choosing to be optimistic here. After a steady diet of KrisFlyer and Asia Miles (nothing wrong with them, mind you), it’s refreshing to see the miles universe expanding in Singapore. New programmes mean new sweet spots, new routing rules, new quirks and loopholes that diligent users can leverage. It’s about time, if you ask me.

What’s missing here is the addition of a bonus category. With earn rates of 1.2/2.4 mpd, it would take a significant amount of spending to earn your way to a redemption. The next step here would be to expand the new partners to the HSBC Revolution , because that’s when things will truly fall into place.

What do you make of the new HSBC TravelOne Card?

- credit cards

Similar Articles

Wow: dbs yuu card now earns 10 mpd at cold storage, foodpanda, gojek and all other yuu merchants, citi premiermiles card offering 30,000 miles & s$100 trip.com gift card welcome bonus, 51 comments.

No mention when the HSBC points will expire?

standard 37 month expiry policy, same as rest of hsbc cards. will update the post.

Does it work with amaze to hit the minimum spend of $800??? Cardup is excluded but not shown whether amaze spend is included.

hsbc has not excluded amaze- yet.

does paying annual fee renewal get you 10k miles?

The article says lounge can be used by principal cardholder bringing their guest with them. But the T&C that’s linked doesn’t mention?

clarified with hsbc that lounge visits are only for principal cardholder. updated, thanks.

Aaron, I understand that HSBC Points can’t be transferred to new airline partners yet, but when do you think that will happen? Asking as my Revolution points expire in October. Thanks

i do not know.

can i pool them together with hsbc revo card?

points do not pool.

im assuming TravelOne Card and Revolution card cant be pooled?

Would the points here pool with Revolution? Thanks!

just saw it does NOT. thanks

why singsaver?

Can’t milelion run its own redemption program?

yeah why not have run your own redemption program

yeah why not have your own redemption program

yeah not have run your own redemption program

Great to see development in the miles game in Singapore. I hope HSBC joins the fray for premium cards, 120k and 500k segments as well!

Competition is only good for the consumer.

They already do have a 120K card?

The Visa Infinite

Exciting times!!!

Unless I’m forgetting anything, 2.4mpd for FCY is best in class right?

well SCB VI offers 3 mpd, but has a min spend of $2k. it would be best in class for a general spending card.

Hard pass for me if the points don’t pool. Never going to be earning enough miles to make sense.

Also why do cards like these and the revised Amaze come with those concave cut outs at the end?

tiny bit of comfort for pushing it into the card reader, and also helps users instantly tell which side to push in.

an accessibility feature for visually impaired individuals, it lets them know which end to insert

Interesting… but somewhat unconvinced that the broader list of transfer partners is worth skipping 4/6 mpd. I would love to be proven wrong though.

2 things ok? General vs category spending card

I know we shouldn’t just a credit card by its looks, but that’s a beautiful card design!

Actually, what interest me is the hotel points transfer. 10k initial pts on Accor that should be EUR200? Better than IHG 20k @ USD0.5cents/pts

Qatar Privilege Club does charge fuel surcharge:

- Long haul economy: US$70

- Long haul business: US$140

- Short haul economy: US$35

- Short haul business: US$70

these are award segment fees, not fuel surcharge. they’re annoying for sure, but nowhere as bad as YQ. *shrugs*

Now I wonder how they gonna upgrade their VI card given the poor earning rate on the card

Curious to know if any miles will be given upon renewal from 2nd year onwards.

Good card but sadly I think it doesn’t offer any annual fee renewal. I am wondering if it’s possible to get subsequent annual fee waive if not I may not hold this for long other than potential cardup exploit.

I mean amaze* exploit

Can you tell us which is the one partner which will make a lot of mile chasers happy? I promise not to tell anyone.

Transfer partner would be – just like the partnership HSBC has for EveryMile Credit Card in Hong Kong.

Frequent flyer programmes

Aeroplan Asia Miles™ British Airways Executive Club Avios* Etihad Guest Emirates Skywards Finnair Plus Flying Blue Infinity MileageLands* Lotusmiles Turkish Airlines Miles&Smiles Qantas Frequent Flyer Qatar Airways Privilege Club* Singapore Airlines KrisFlyer*

Hotel loyalty programmes

ALL – Accor Live Limitless* IHG® Rewards Marriott Bonvoy™

Talking about a massive hype up heading, leading into a product that whilst good also comes with some major issues that means it fizzles out, and then an unspecified promise that it is goong to be so awesome later on at some unspecified point in the future. Quite a let down as you sift through how this product could have so easily been improved but as it is now is decidedly so-so. It is a bit sad that what is actually a decent product is going to be let down by uncertainty over one factor – annual fee. Is this … Read more »

thanks for taking the time to share your thoughts! some valid points here worth discussing. is it a perfect product? hardly- but few things are. Re: annual fee, we’ll need to see what happens towards the end of the first year, but let’s cross that bridge when we get to it. In the meantime, paying the first year AF gets you the sign-up bonus (even for existing customers, mind you- that’s very rare among banks), so it’s something I’m ok with. Obviously if the AF cannot be waived in the second year, there’ll be an exodus of cardholders- and then … Read more »

Pass for me. HSBC service & support sucks big time and this is where I don’t want to stuck with them. Also the sign up offer 20,000 if I spend 600 & pay the annual fee. The cost of the mile is > 1c (including the 600). Payall can give me that without another card.

Waive annual fee liao

miles devaluation is so bad nowadays, paying such rates now also need to think twice

Is it me? or does the card looks like a world elite mastercard?

Not just you. It really looks like the logo- but it’s a world mc

Same. I think it’s coz the logo is silver, not the red and yellow one.

How about payment of NTU fee using the card?

CREDIT CARD SIGN UP BONUSES

Featured Deals

© Copyright 2024 The Milelion All Rights Reserved | Web Design by Enchant.sg

Anti-fraud measures

Please make sure your web browser is up to date for uninterrupted access to HSBC Malaysia Online Banking. To protect yourself, don't visit unknown links or download apps from unknown sources. Don't share your credentials, account details or authentication codes with unknown websites or apps either. Learn more

We use cookies to give you the best possible experience on our website. For more details please read our cookie policy . By continuing to browse this site, you give consent for cookies to be used.

Our website doesn't support your browser so please upgrade.

- HSBC Malaysia online banking

HSBC Premier Travel Mastercard Credit Card

Earn 1.1 Air Miles for every RM1 overseas spend

By Invitation only

Ideal for frequent flyers

HSBC Premier Travel Credit Card, the best companion for your overseas travel with air miles rewards.

eWelcome pack (PDF)

By invitation only

Eligibility:

Exclusively for HSBC Premier Elite account holders. A primary cardholder must be at least 21 years old with a minimum RM3,000,000 in total relationship balance with HSBC.

At a glance

- 1.1X Air Miles on all overseas spend 1

- 1X Air Miles for every RM4.00 local spend

- Complimentary access to Plaza Premium Lounges worldwide 2 Get away from the hustle and bustle of a busy airport and relax whilst you enjoy a range of refreshments, newspapers, television and business facilities.

- Enjoy Global Data Roaming by Flexiroam in over 150+ countries 3 Including redemption of one free 3GB 10-day Global Data Roaming pass per eligible card, per calendar year, and a 15% discount on future data plans. Learn more .

- Get free unlimited access to Digital Health services 4 Experience free consultation via Video Teleconsultations by Doctor Anywhere and Digital Health Assistant by Medi24 24/7. Register here .

- This HSBC Credit Card is now made from 100% recycled plastic

- Enjoy added peace of mind when you shop online with an HSBC Premier Travel Mastercard now 5 The e-Commerce Protection insurance by Mastercard provides you with worldwide coverage and reimbursements of up to USD200. Find out more on the Mastercard website .

- Enjoy savings with Expedia and Agoda 6 Enjoy 10% 6 discount on Expedia hotel bookings and 7% 6 discount on Agoda hotel bookings other than Air Miles rewards.

Enjoy 50% off green fees at 42 golf clubs and golf lessons at 1 participating golf academy in Singapore – Book now . Terms & Conditions apply.

Valid until: 15 January 2025

Card Privileges

Premier Junior Savers Account 7

Convert Air Miles to cashback into Premier Junior Savers Account

Premier SmartPrivileges 8

Indulge in exclusive deals and special VIP treatments from us while enjoying great savings at more than 2,000 shopping outlets nationwide with your HSBC Premier Travel Mastercard. With new and exciting offers every month, you'll be spoilt for choices.

Reward Redemption 9

Explore the extensive Premier Travel Rewards Catalogue, with wide selection of items at great value. You can redeem gifts, vouchers or frequent flyer miles with selected airlines.

Document Required

Things you should know.

Important notes

1 Amended Terms & Conditions For HSBC Premier Travel Mastercard Credit Card apply. Air Miles awarded are capped at 20,000 Air Miles for overseas spend and 30,000 Air Miles for local spend per calendar month. Earn 1 Air Mile for every RM4 local spend.

2 Terms and Conditions for HSBC Plaza Premium Lounge Programme . This programme is only applicable to Primary cardholder. Each Eligible Cardholder is entitled to a maximum number of 12 complimentary visits a year. Lounge access for the 13th and subsequent visit and accompanying guests (including Supplementary Cardholders) will be charged the lounge prevailing rates. Any subsequent visit on the same day and any visit exceeding the 3-hour limit will be subject to the applicable charges listed at the respective lounge. List of eligible Plaza Premium Lounges.

- List of eligible Plaza Premium Lounges (PDF) List of eligible Plaza Premium Lounges (PDF) Download

3 Subject to Global Data Roaming by Flexiroam Terms and Conditions apply.

4 Subject to Digital Health by Allianz Terms and Conditions apply.

5 Subject to Mastercard Terms and Conditions apply.

6 10% discount on Expedia is applicable for 1 hotel room booking. Both Agoda and Expedia's discounts are subject to their respective Terms and Conditions.

7 Protected by PIDM up to RM250,000 for each depositor.

8 Terms & Conditions for HSBC SmartPrivileges .

9 Terms and Conditions for HSBC Premier Travel Rewards Programme 2023 . Effective January 2023.

- Product Disclosure Sheet (PDF) ENG Product Disclosure Sheet (PDF) ENG Download

- Product Disclosure Sheet (PDF) BM Product Disclosure Sheet (PDF) BM Download

Everyday Global Account

The all-in-one savings account for your everyday needs, here in Malaysia and overseas.

Open an account online today in 3 simple steps.

Card features & services

Cash instalment plan.

Convert your available credit limit into instant cash.

Balance Transfer Instalment (BTI)

Consolidate all of the outstanding balances from your other credit cards to your HSBC credit card.

Cash Advance

Use cash advance for instant cash relief.

Mastercard Automatic Biller Update (Effective 12 June 2020)

HSBC Mastercard credit cardholders will automatically enjoy Mastercard Automatic Billing Updater (ABU) service. Mastercard ABU allows us to securely communicate cardholder’s account changes (credit card number updates) for card-on-file and recurring payments to participating merchants. This will help maintain existing recurring payment arrangements and reduce transaction declines that can occur due to such changes. Not all merchants participate in the ABU service. Complete the form to opt out of Mastercard Automatic Billing Updater (ABU) service.

More on credit card

Check out more credit card features.

Connect with us

IMAGES

COMMENTS