Introduction to the Citi Travel Portal

Accessing the citi travel portal, citi credit cards that earn thankyou points, what to know about the citi travel portal, citi travel portal: your guide to booking and rewards.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Citi Strata Premier℠ Card, Citi Prestige® Card, Citi Custom Cash℠ Card, Citi® Double Cash Card, Citi Rewards+® Card. The details for these products have not been reviewed or provided by the issuer.

- If you have a Citi credit card that earns ThankYou points, you can book your travel with them.

- The Citi Travel Portal is like an online travel agency, allowing you to make bookings with ease.

- You can pay with points (worth 1 cent each), your Citi credit card, or a combination of both.

Citi ThankYou Rewards is a flexible points program that allows you to earn points from eligible Citi credit cards and banking products. You can redeem points in a number of ways, including for travel, cash back, or gift cards.

One of the best ways to use points is for travel, either by transferring Citi ThankYou points to airline partners for award flights (only available with certain Citi credit cards), or through an even easier option available to all program members — the Citi Travel portal.

Citi Travel recently got a big overhaul, and it's now partnered with Booking.com and powered by Rocket Travel by Agoda technology. Here's what to know about the new Citi Travel portal and what to expect if you decide to book.

Overview of the Portal

The Citi Travel Portal is an online travel booking platform that works in a similar way to Online Travel Agencies (OTAs) like Orbitz or Expedia. You can search for flights, hotels, rental cars, and attractions based on your destination, travel dates, and other preferences, and you have the option to pay with Citi ThankYou points, your Citi card, or a combination of both.

Benefits of Booking Through the Portal

Although Citi Travel doesn't get as much attention as American Express Travel or the Chase Ultimate Rewards® Travel Portal , it has many of the same benefits:

- You can book travel with no blackout dates

- There's no need to worry about loyalty program award charts or availability

- Your points are worth a flat 1 cent each toward travel, and you can combine them with cash if you don't have enough for a booking

- You'll still earn airline miles and elite-qualifying miles when you book flights, even when you pay entirely with points

- It's possible to pool Citi points from different credit cards (or even share with friends and family who have Citi ThankYou accounts)

A downside to using the Citi Travel Portal is you won't earn points or elite status credit for hotel stays, and you might not have your elite status recognized because it's considered a third-party booking.

If you're looking for the easiest way to cash in Citi points for travel, the Citi ThankYou Travel Portal is a better choice for most people. That said, it's possible to get more than 1 cent per point in value if you skip the Citi Portal and instead transfer your points at a 1:1 ratio to an airline or hotel partner for award travel — but that involves more legwork.

The full range of partners is available if you have the Citi Strata Premier℠ Card or Citi Prestige® Card (no longer available to new applicants). Otherwise, JetBlue, Choice, and Wyndham are the only airline and hotel options, with a reduced transfer ratio.

How to Log In

To access the Citi Travel Portal, you must be a Citi customer with a ThankYou rewards account. Once you sign in to your Citi account online and click the "View/Redeem" button in the rewards section, you'll land on a screen with several redemption options. Click "Book Travel" in the lower left-hand corner.

Alternatively, you can get to the same screen by signing in with your Citi login details at ThankYou.com .

Once you click "Book Travel," you'll be prompted to select the Citi card account you want to book with if you have multiple Citi cards. Then you'll land on the main Citi Travel search screen.

How to Book Flights with Citi Travel

To search for flights, click the "Flights" tab and enter your departure and destination airport and dates of travel. You'll also have options to select round-trip or one-way flights, class of service, number of passengers, and if you prefer non-stop flights. Then hit "Search."

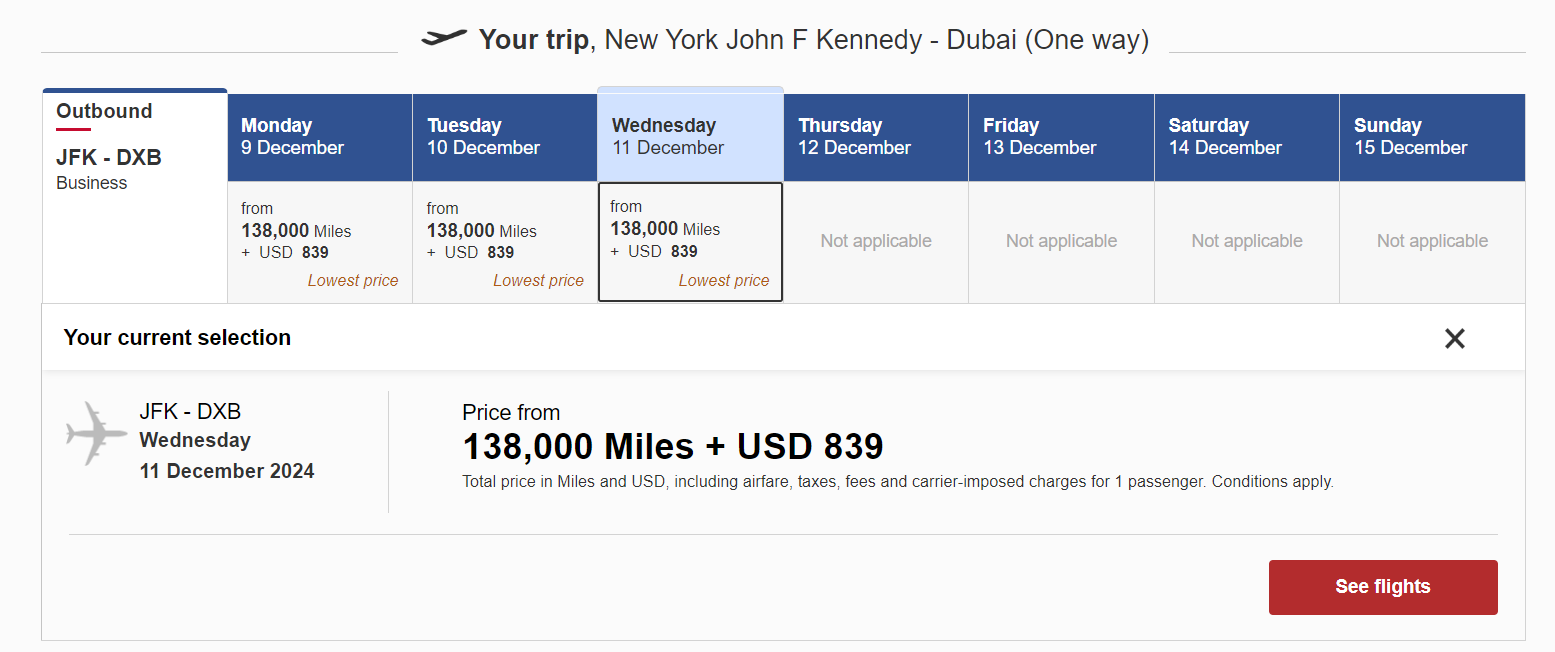

Next, you'll see a list of flight search results — starting with your outbound flight — which you can sort by price, number of stops, departure time, arrival time, duration, or "best overall" (cheap, short flights). On the left sidebar, there are also filters for the departure and arrival times, airline, number of stops, price range, and total journey duration. To choose a flight, click on the "Select" button, then repeat the process for your return leg if you've searched for a round-trip itinerary.

Once you've selected your flights, you'll be prompted to enter passenger details and will be given options to upgrade your fare (most folks will skip this step). Then, on the final booking screen, you'll have the opportunity to select your payment method — either using your Citi card, ThankYou points, or a combination of both.

How to Book Hotels with Citi Travel

The process of finding a hotel to book through the Citi Travel portal is similar to searching for flights. After selecting the "Hotels" option from the main menu, enter your destination, stay dates, and the number of guests in the search fields.

The results page allows you to sort by property class, price, distance, hotel name, and recommended results. You can filter by price, class, TripAdvisor rating, amenities, nearby landmarks, and even hotels offering deals. One useful feature is the ability to quickly identify properties that have discounted rates by looking for the "Sale" flag in the corner of the hotel listing.

To find out more about the hotel you're interested in, click on the hotel name and you'll be shown different bed options, rate types with cancellation policies, and available packages (breakfast included, for instance) if applicable. Select "Check out" next to the room you want to book. You'll then be asked for guest details (name, address, phone number, and email).

Once you've entered your information, you'll come to the final booking screen where, again, you can choose your method of payment.

How to Rent a Car with Citi Travel

Searching for a car rental through Citi Travel is similarly easy. Once you've clicked "Cars" on the main menu, enter your pick-up location (you can select a different drop-off location if needed), rental dates and times, and the driver's age.

The results list allows you to sort by price, rental company, or car type.

Once you find a car you like, click on its listing to learn more about the rental and enter the driver's name and details.

On the final booking screen, you'll choose your method of payment — again, your Citi card, ThankYou points, or a combination of both.

How to Book Attractions Through Citi Travel

Select the "Attractions" tab on the main search page, and enter the city name where you want to search.

Depending on the destination, you'll get a list of all kinds of activities — from tours and sightseeing tickets to airport transfers and excursions.

When you click on the attraction, you'll get more details about what's included in the activity.

Click "See options" to choose your activity dates, times, and the number of participants.

Once you select "Choose" you'll have the opportunity to enter your traveler details. Then, you'll be brought to the final booking screen where you can select your payment method.

Before you choose between booking through the Citi Portal or transferring points to a partner for an award flight, be sure to compare the number of points required in each case — and verify that an award flight is actually available before you decide on that route.

Earn a total of 10 ThankYou® Points per $1 spent on hotel, car rentals and attractions booked through CitiTravel.com. Earn 3X points per $1 on air travel and other hotel purchases, at restaurants, supermarkets, gas stations and EV charging stations. Earn 1X point per $1 on all other purchases.

21.24% - 29.24% variable

Earn 75,000 bonus points

Good to Excellent

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Earn 3x points on most travel, restaurants, gas/EV charging, and supermarkets

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Earn 10x points on hotels, rental cars, and attractions booked via Citi Travel

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. $100 annual hotel credit on a single stay of $500 or more

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. No foreign transaction fees

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Trip delay/interruption benefits and lost/damaged baggage coverage

- con icon Two crossed lines that form an 'X'. Has an annual fee

- con icon Two crossed lines that form an 'X'. Citi Travel rates often are higher than retail cost of travel

Citi offers several different cards that earn Citi ThankYou points:

- Citi Strata Premier℠ Card: Earn 75,000 bonus points after spending $4,000 in the first three months of account opening

- Citi Custom Cash℠ Card : Earn $200 cash back, fulfilled as 20,000 ThankYou® Points, after you spend $1,500 on purchases in the first six months of account opening

- Citi® Double Cash Card

- Citi Rewards+® Card : Earn 20,000 bonus points after spending $1,500 in the first three months of account opening

- Citi Prestige® Card: No longer available to new applicants

If you have the Citi Strata Premier℠ Card, there's an additional incentive to book through the Citi ThankYou portal. Once per calendar year, cardholders can get $100 off a hotel stay of $500 or more (before taxes and fees) when they book through the Citi portal — whether the stay is booked with points, charged to the Citi Strata Premier℠ Card, or a combination of both.

The Citi Travel Portal is a terrific tool if you're looking for a way to redeem points for flights, hotels, car rentals, and attractions without worrying about blackout dates or fussing with loyalty program award charts. You'll even earn frequent flyer miles and elite credits for flight bookings (but you won't earn hotel points or elite nights on hotel stays, because it's a third-party booking).

Anyone with an eligible Citi ThankYou credit card can redeem their points through the portal at a rate of 1 cent each. Or, if you don't have enough points to cover the entire booking, you can pay with your Citi card in combination with rewards to make up the difference.

Even though using the Citi Travel Portal is easy and convenient, it is usually possible to get more value from your Citi ThankYou points by transferring them to Citi's airline and hotel partners. This method requires jumping through more hoops and searching for award availability, so if you'd rather avoid that inconvenience, the Citi Travel Portal is an ideal booking method.

Citi cardholders can access the travel portal by logging into their online account and navigating to the travel section or directly through the Citi Travel website.

Yes, you can use your Citi points to book flights, hotels, car rentals, and more through the portal. Points can cover all or part of the booking cost.

Typically, bookings made through the portal using your Citi card will earn points according to your card's rewards program.

The portal does not usually charge additional booking fees, but it's always best to review the terms and conditions for any specific charges that may apply.

Yes, you can cancel or modify bookings, but the ability to do so without penalty depends on the specific terms of your booking. Always check the cancellation policy at the time of booking.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

28 Best Ways To Redeem Citi ThankYou Points for Max Value [2024]

Spencer Howard

Former Content Contributor

51 Published Articles

Countries Visited: 21 U.S. States Visited:

Senior Editor & Content Contributor

165 Published Articles 785 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

Keri Stooksbury

Editor-in-Chief

44 Published Articles 3391 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

![can i use citi points for travel 28 Best Ways To Redeem Citi ThankYou Points for Max Value [2024]](https://upgradedpoints.com/wp-content/uploads/2017/05/Singapore-Airlines-Business-Class-777-Cabin.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

Earning citi thankyou points, transferring citi thankyou points to travel partners, the 28 best ways to use your citi thankyou points, how to transfer citi thankyou points to partners, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Citi has an assembly of cards that earn Citi ThankYou Points, and one of the best ways to use these points is to transfer them to airline programs — that’s how you’re going to get the most value.

Unfortunately, not all redemption options are of equal value, but Citi offers many ways to use your Citi ThankYou Points for some amazing trips!

The best way to earn Citi ThankYou Points is through the strategic use of credit cards that earn these valuable points .

Cardholders of the Citi Strata Premier℠ Card and Citi Prestige ® Card (no longer open to new applicants) have the option to transfer their Citi ThankYou Points to all of Citi’s airline and hotel partners .

Those with the Citi Double Cash ® Card , Citi Rewards+ ® Card , Sears Mastercard ® with ThankYou ® Rewards, and Citi ThankYou ® Preferred Card (no longer open to new applicants) can only transfer ThankYou Points to Choice Privileges at a 1:1.5 ratio and Wyndham Rewards and JetBlue TrueBlue at a 1:0.8 ratio.

The Citi Strata Premier℠ Card is a great all-around travel rewards card that allows you to earn big rewards on a variety of purchases like air travel, at restaurants, supermarkets, gas stations, and more, along with flexible redemption options, all for a modest annual fee.

- 10x points on hotels, car rentals, and attractions booked through CitiTravel.com

- 3x points on air travel, other hotel purchases, restaurants, supermarkets, gas stations, and EV charging stations

- $100 annual hotel benefit

- $95 annual fee

- For a limited time: Earn 75,000 bonus points after spending $4,000 in the first 3 months of account opening, redeemable for $750 in gift cards or travel rewards on thankyou.com.

- Earn 10X points per $1 spent on hotels, car rentals, and attractions booked on CitiTravel.com.

- Earn 3X points per $1 on air travel and other hotel purchases, at restaurants, supermarkets, gas and EV charging stations.

- Earn 1X point per $1 spent on all other purchases.

- $100 Annual Hotel Benefit: Once per calendar year, enjoy $100 off a single hotel stay of $500 or more (excluding taxes and fees) when booked through CitiTravel.com. Benefit applied instantly at time of booking.

- No expiration and no limit to the amount of points you can earn with this card.

- No foreign transaction fees on purchases.

- APR: 21.24%- 29.24% Variable APR

- Foreign Transaction Fees: None

This no annual fee card rewards cardholders for everyday purchases. Earn bonus points at supermarkets and gas stations, plus your points are rounded up on every purchase.

- Earn 20,000 bonus points after you spend $1,500 in purchases with your card within 3 months of account opening; redeemable for $200 in gift cards at thankyou.com

- Plus, as a special offer, earn a total of 5 Thank You ® Points per $1 spent on hotel, car rentals and attractions booked on CitiTravel.com through December 31, 2025.*

- 0% Intro APR on balance transfers for 15 months from date of first transfer and on purchases from date of account opening. After that, the variable APR will be 18.74% – 28.74%, based on your creditworthiness. There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

- Earn 2X ThankYou ® Points at Supermarkets and Gas Stations for the first $6,000 per year and then 1X Points thereafter. Plus, earn 1X ThankYou ® Points on All Other Purchases.

- The Citi Rewards+ ® Card – the only credit card that automatically rounds up to the nearest 10 points on every purchase – with no cap.

- No Annual Fee

- APR: 0% intro APR on balance transfers and on purchases for 15 months. After that, the variable APR of 18.74% - 28.74%.

- Foreign Transaction Fees: 3% of each purchase transaction in US dollars

Great card for the average spender with no specific focus category; worry-free cash-back earning on everything!

The Citi Double Cash ® Card has long been one of the top cash-back credit cards on the market, and the card now has the ability to earn Citi ThankYou Points!

This means that cardholders of the Double Cash card will now earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. Cash back is earned in the form of ThankYou Points . This means each billing cycle, you will earn 1 ThankYou point per $1 spent on purchases and an additional ThankYou point for every $1 paid on your purchase balance as long as there is a corresponding balance in your Purchase Tracker.

Citi has turned the Double Cash card into a top choice for those who are looking for an everyday, no-fuss credit card.

- Uncapped 2% for every $1 spent (1% when you buy and another 1% when you pay)

- Flexible redemption options

- No annual fee

- No bonus categories

- 3% foreign transaction fees

- Bonus Offer: Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This offer will be fulfilled as 20,000 ThankYou ® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases.

- To earn cash back, pay at least the minimum due on time.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

- Citi Double Cash ® Card Travel Portal Limited Time Offer: Earn a total of 5 ThankYou Points per $1 spent on hotel, car rental, and attractions, excluding air travel, when booked through the Citi Travel SM portal on ThankYou.com or by calling 1-800-Thankyou and saying “Travel.” Offer is valid through 11:59 PM Eastern Time (ET) 12/31/2024.

- APR: 0% Intro APR for 18 months on balance transfers, then 19.24% - 29.24% Variable

- Foreign Transaction Fees: 3% of the U.S. dollar amount of each purchase

Citi ThankYou Rewards

Earn big on purchases in your top eligible spend category, up to the first $500 each billing cycle, with no annual fee!

The Citi Custom Cash ® Card is inventive when it comes to cash-back credit cards. Instead of earning a set amount of cash-back on predetermined bonus categories, the Citi Custom Cash card earns 5% cash-back on your highest eligible spend category each billing cycle, without an annual fee.

Thanks to that unique perk, you’ll never need to worry about whether you’re using the right card for the right purchase, as your Citi Custom Cash card will always pay you 5% back on whichever category you end up spending the most on each month.

- 5% cash-back (on up to $500 each billing cycle) from your largest purchase category, including restaurants, gas stations, grocery stores, select travel, select transit, select streaming services, drugstores, home improvement stores, fitness clubs, and live entertainment

- Multiple redemption options

- Your 5% category is limited to $500 in spend ($25 in cash-back) each month

- Not particularly rewarding for any purchases outside of your top 5% cash-back category

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou ® Points, which can be redeemed for $200 cash back.

- 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases. Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals, and attractions booked via the Citi Travel℠ portal through 6/30/2025.

- No rotating bonus categories to sign up for – as your spending changes each billing cycle, your earn adjusts automatically when you spend in any of the eligible categories.

- Citi will only issue one Citi Custom Cash ® Card account per person.

- APR: 0% Intro APR on balance transfers and purchases for 15 months. After that, the variable APR will be 19.24% - 29.24%.

- Foreign Transaction Fees: 3%

The Citi ThankYou Program provides 2 ways to redeem ThankYou Points for flights:

- Redemptions for flights through the Citi ThankYou travel portal

- Direct transfers to airline and hotel partners

Using the Citi ThankYou Travel Portal

Citi ThankYou cardholders can redeem points for flights through the Citi ThankYou travel portal at a rate of 1 cent per point.

The Citi ThankYou travel portal is a useful tool because it allows you to use your reward points with airlines other than the Citi ThankYou airline partners.

A great perk of using ThankYou Points to purchase flights via the Citi ThankYou travel portal is that you will earn miles with the airline you fly (or the airline you choose to credit the flight). In effect, this provides a nice rebate when you use ThankYou Points to book airfare.

Cardmembers can redeem ThankYou Points for flights at around a rate of 1 cent per point . This means that a $100 flight will cost 10,000 ThankYou Points.

Citi ThankYou Transfer Partners

Citi airline partners include some great programs, such as Cathay Pacific’s Cathay , Etihad Guest , JetBlue TrueBlue , Avianca LifeMiles , and Turkish Airlines Miles&Smiles . Most have a 1:1 transfer rate, depending on the card you hold.

Sure, you could use your points for statement credits, gift cards, or one of the other redemption options. But to get the maximum value from your Citi ThankYou Points, you should transfer your points to frequent flyer programs.

These redemptions are especially valuable for international flights.

Please keep in mind that these options aren’t the only options for redemption, but are some of the best ways to use your Citi ThankYou Points to boost your points’ value.

Hot Tip: Need to earn points first? See our article on the best ways to earn Citi ThankYou Points .

1. Fly Singapore Suites on the A380 (KrisFlyer)

Many people transfer points to Singapore Airlines’ KrisFlyer so that they can experience Singapore Suites, one of the premier first class products available. If you have a travel date, you can even enjoy a double bed in the sky! It’s safe to say this is one experience you don’t want to miss.

There is only 1 option to fly Singapore Suites from the U.S., and that’s out of New York. For 97,000 miles you can try Suites from New York to Frankfurt.

If 7 hours in suites class isn’t enough, you can continue on to Singapore for a total of 148,500 miles. Feeling adventurous? You can fly from New York to Sydney for 188,000 miles, which would give you over 24 hours in luxury!

If you aren’t based in New York, you can still enjoy suites after connecting there to start your journey.

Need help booking? See our step-by-step guide for booking Singapore Suites or first class .

2. Fly United Domestic Economy or Business Class (KrisFlyer)

If you’re looking for a transcontinental flight on United you can use KrisFlyer miles.

One-way in business class costs 26,000 KrisFlyer miles, and one-way in economy class will cost 14,000 KrisFlyer miles.

3. Fly Between the Continental U.S. and Hawaii (KrisFlyer)

Flying to Hawaii is, without a doubt, one of the most popular uses of miles and reward points. KrisFlyer again provides a great way to utilize the Star Alliance network .

For economy or business/first class flights, you will need 19,500 miles or 39,000 miles, respectively. United charges much more than that for the same flights in many cases.

4. Fly to Europe From the U.S. (KrisFlyer)

Looking for a cheap way to get to Europe ? You can get a one-way flight in economy class on a Star Alliance partner for only 30,500 KrisFlyer miles.

5. Fly to the Middle East or North Africa From the U.S. (KrisFlyer)

The KrisFlyer program has some amazing partner redemption options to the Middle East and North Africa : one-way in economy class for 52,000 miles, one-way in business for 88,000 miles, or one-way in first class for 114,000 miles.

6. Fly From the U.S. to Central or South Africa (KrisFlyer)

Flying to central and South Africa is not always easy and often expensive, but KrisFlyer provides a great option in business class. You can book a one-way flight on a Star Alliance partner in business class for 111,000 miles.

7. Fly From Los Angeles to Tokyo (KrisFlyer)

Check out Singapore Airlines flights from Los Angeles to Tokyo. For 120,500 miles, you can enjoy a great first class experience.

8. Fly From San Francisco to Hong Kong (KrisFlyer)

If you’re looking for a premium experience to Southeast Asia , you can use KrisFlyer miles to fly Singapore business class to Hong Kong for 100,500 miles, or get to Singapore for 146,500 miles.

Need help booking? See our step-by-step guide for booking Singapore business class using points .

9. Fly Virgin Atlantic Upper Class to Europe (KrisFlyer)

While Singapore Airlines has 1 award chart for all Star Alliance partners , it has a separate one for flights on Virgin Atlantic .

However, you can experience Virgin Atlantic’s Upper Class product for only 58,500 miles one-way.

Need Help Booking? Check out our step-by-step guide to booking Virgin Atlantic Upper Class using points .

10. Fly Lufthansa First Class to Europe (Avianca LifeMiles)

Without a doubt, Lufthansa first class is an aspirational experience that should be on your list. For 87,000 Avianca LifeMiles, you can fly to Europe and enjoy one of the best first class products in the sky.

To top it off, if you connect in Frankfurt, you will have a chance to visit the Lufthansa First Class Terminal. This is a lounge experience of a lifetime, so make sure your connection leaves you a few hours.

Best of all, you won’t be hit with enormous fuel surcharges!

Need help booking? Check out our step-by-step guide to booking Lufthansa first class .

11. Fly Between the South Pacific Islands (KrisFlyer)

If you’d like to visit some South Pacific islands, KrisFlyer miles can be a great choice.

Singapore charges 13,500 miles in economy. At 34,500 miles for business, KrisFlyer is no longer the great deal it used to be. United charges 30,000 miles for business class, in comparison.

Availability on this one can be tough, but it will be worth the effort if you can make it work with your schedule. You can learn about more KrisFlyer redemptions by using Singapore Airlines’ Star Alliance award chart.

12. Fly Air France or KLM With Promo Rewards (Flying Blue)

Air France/KLM Flying Blue utilizes a variable award pricing calculator, which it says is tied to revenue prices. This simply isn’t true; as a result, it’s very difficult to pin down an exact cost, as there are many award pricing levels now.

Probably the best way to use the Flying Blue program is its Promo Rewards . These awards run throughout the year and change every few months. You will generally receive a 25% to 50% discount on economy and business class award tickets from Europe to specific cities.

Typically, Flying Blue awards between the U.S. and Europe cost 21,500 to 27,000 miles for economy class and 53,000 to 71,000 miles for business class. With just a 25% discount, that drops the mileage cost to 16,125 to 20,250 miles and 39,750 to 53,250 miles, respectively.

Flying Blue award flights do incur surcharges, so keep that in mind when booking these. Even with the surcharges, though, these awards can provide great value.

Hot Tip: If you need extra Flying Blue miles, you can also transfer any points you have with your Chase Ultimate Rewards cards, including the Chase Sapphire Preferred ® Card and Ink Business Preferred ® Credit Card .

13. Take Advantage of a Broad Definition of Europe (Flying Blue)

Flying Blue really shines with its broad definition of Europe. This gives you access to countries such as Algeria, Israel, Morocco, Tunisia, and the Canary Islands at a lower redemption level.

As mentioned above, a one-way business class award flight to “Europe” will cost 53,000 to 71,000 miles, which is a solid redemption. If you’re booking an economy class award flight, 21,500 to 27,000 miles for a one-way flight to Israel or North Africa is a fantastic deal.

14. Fly to Hawaii From the Continental U.S. (Flying Blue)

Another great redemption option is for flights from the continental U.S. to Hawaii. At only 15,000 miles for economy class and 30,000 miles for business class award flights on Flying Blue partner Delta , these are among the cheapest options available.

This is actually cheaper than using Delta’s own SkyMiles program to book an award flight with Delta! Read this article for more ideas on using Flying Blue miles .

15. Fly to Mexico at Domestic Redemption Rates (Flying Blue)

Unlike many programs, Flying Blue includes Mexico in the same region as the U.S. rather than the Caribbean and Central America. Because of this, you can book a one-way award flight from the U.S. to Mexico for only 12,500 miles.

16. Fly From the U.S. to the Caribbean (Flying Blue)

Speaking of the Caribbean , you can book an award flight from the U.S. for 15,000 miles one-way. This means you will save at least 5,000 miles per round-trip flight compared to using a U.S. carrier’s program.

17. Cheap Awards to Australia and the South Pacific (Flying Blue)

Flying Blue provides a solid redemption option to the South Pacific , with one-way business class award flights costing 75,000 miles. The program also provides the cheapest award option in economy class at 48,000 miles one-way.

At these rates to Australia , Flying Blue becomes a competitive program for flights down under. You can also fly directly from Los Angeles (LAX) to Tahiti (PPT) for 25,500 Flying Blue miles!

To see how many miles you would need for an award flight, check out Flying Blue’s miles price estimator .

18. A Cheap Business Class Flight to Europe (Etihad)

While Etihad may not be a member of a major airline alliance, it does have tons of partners. It also has a different award chart for each partner airline. Though the booking process may be tedious, there are some solid awards to be found.

One of these bookings is a round-trip business class trip on Brussels Airlines between New York (JFK) and Brussels (BRU) for 88,000 miles. You can book a round-trip economy class award flight for only 54,000 miles if economy is more your style. The same redemption rates can also be found from Toronto (YYZ) and Washington, D.C. (IAD).

Availability can be tough to find, but for one of the best award flight deals, it’s definitely worth the patience!

19. Fly American Airlines in Flagship Business or Flagship First (Etihad)

Etihad’s award chart for American allows you to book flights on American Airlines at some exceptional prices.

Let’s take a look at some of the great options you have by flying American Flagship First or Flagship Business with Etihad miles:

- Fly to Europe for 50,000 miles in business class or 62,500 miles in first class

- Fly to Asia 1 (Japan, Korea, Mongolia) for 50,000 miles in business class or 62,500 miles in first class

- Fly to Asia 2 (China, Thailand, Malaysia, Singapore, etc.) for 55,000 miles in business class and 67,500 miles in first class

- Fly to the South Pacific (Australia, New Zealand, Fiji, etc.) for 62,500 in business class and 67,500 in first class

Need Help Booking? See our step-by-step instructions on booking American Airlines first class or business class using points.

20. Fly Royal Air Maroc to Casablanca (Etihad)

Etihad’s award chart for Royal Air Maroc is distance-based. This is different than the region-based award chart for its partnership with American Airlines. It’s also different than an award chart with specific routes, like its partnerships with Brussels Airlines and Czech Airlines.

For flights of 2,001 miles or more on Royal Air Maroc, you can book a one-way ticket in economy for 22,000 miles or business for 44,000 miles. This includes the routes between New York (JFK) to Casablanca (CMN), Miami (MIA) to Casablanca (CMN), and Washington, D.C. (IAD) to Casablanca (CMN), which is an amazing way to reach North Africa!

21. Fly Oman Air in Business Class (Etihad)

Etihad has 2 great award flights on Oman Air. If you are in London, you can fly from London to Muscat one-way in business class for 44,000 miles.

If you are already in the Middle East, check out Oman Air’s route between Muscat and Singapore. For only 42,000 Etihad miles, you can fly one-way in business class on Oman Air .

While not as well known as some major international airlines, Oman Air’s business class has received great reviews.

22. Fly Delta One Suites Round-trip (Virgin Atlantic)

Have you always wanted to try Delta One Suites, the phenomenal business class product from Delta Air Lines? You’re in luck! Virgin Atlantic, a Delta partner, has some of the best redemption rates for Delta One Suites.

Here are the routes you can take:

A350 Routes

- Atlanta (ATL) – Seoul (ICN)

- Detroit (DTW) – Amsterdam (AMS)

- Detroit (DTW) – Beijing (PEK)

- Detroit (DTW) – Seoul (ICN)

- Detroit (DTW) – Shanghai (PVG)

- Detroit (DTW) – Tokyo (NRT)

- Los Angeles (LAX) – Shanghai (PVG)

- Los Angeles (LAX) – Tokyo (HND)

- Seattle (SEA) – Tokyo (NRT)

In general, the best sweet spots are flights between the U.S. and Europe (excluding the United Kingdom), which cost 50,000 miles one-way in Delta One Suites. All other flights will be significantly more expensive, including flights to the U.K., Asia, and Australia.

If you’d like to see some other great ways to book Delta One flights , check out our booking guide!

23. U.S. to Australia on Cathay Pacific (Asia Miles)

On Cathay Pacific, U.S. to Australia awards now price under the ultra-long-haul one-way price of 85,000 miles in business or 125,000 in first.

Remember that for each of these award prices, you will need to stop in Hong Kong before continuing to Australia. Here are a few routes you can use:

- Boston (BOS) – Hong Kong (HKG) – Adelaide (ADL)

- Chicago (ORD) – Hong Kong (HKG) – Melbourne (MEL)

- Los Angeles (LAX) – Hong Kong (HKG) – Brisbane (BNE)

- New York (JFK) – Hong Kong (HKG) – Perth (PER)

- San Francisco (SFO) – Hong Kong (HKG) – Sydney (SYD)

24. See 2 Asian Cities and 3 Pacific Islands (EVA Air)

EVA Air’s Infinity MileageLands program doesn’t provide many great options for award bookings, but it does have some solid options in Asia. It also allows 2 stopovers and an open-jaw on round-trip Star Alliance award flights.

To see 3 islands and 2 Asian cities, you can fly round-trip in business class on United Airlines and Asiana for 55,000 miles.

For example, you can start in Tokyo and stopover in Guam with Saipan as your destination. You can then open-jaw to Palau by using 12,500 United miles for an economy class flight. From Palau, you can then fly to Seoul for your second stopover before returning to Tokyo.

25. Fly to Hawaii, Then Central America (EVA Air)

If you want a fun island adventure, you can fly round-trip in business class for 80,000 EVA Air miles to see Hawaii and 2 Caribbean islands.

Here’s an example of a possible routing: fly from San Francisco to St. Thomas with a stopover in Hawaii, then open-jaw to St. Maarten, and finally stopover in Toronto before returning to San Francisco.

26. Fly Around Europe (EVA Air)

Another fun option with EVA Infinity MileageLand miles is to fly around Europe. For 30,000 miles in economy class or 55,000 miles in business class, you can see several cities in Europe.

EVA Air’s award chart includes both Iceland and Russia in “Europe,” so you have a lot of options!

A sample routing could include a flight from Istanbul to Rome (stopover) and then on to Frankfurt (destination). You could then open-jaw to Berlin before flying to Copenhagen (stopover) and back to Istanbul. This route would include flights on Turkish Airlines, Lufthansa, and SAS.

Other than the above options, Singapore Airlines is probably the better deal for transferring points from the Citi ThankYou reward program to a partner airline. For more award flights, see EVA’s award charts .

Hot Tip: For more information, check out these ways to redeem EVA Air Miles for maximum value .

27. Fly Qatar Airways in Business Class (Qatar)

The Qatar Airways Privilege Club doesn’t provide a lot of great redemptions, but you can fly in business class to Doha at a reasonable redemption rate.

For 70,000 Avios, you can book a one-way award flight from the U.S. to Doha on Qatar Airways and experience one of the best business class products in the sky.

You can even try one of the most coveted business class products in the world: Qatar Airways Qsuites .

28. East Coast to Dubai Round-Trip on Emirates (Qantas)

Emirates is known to have one of the best economy products and a fantastic business class .

There are several East Coast cities in this points range that fly direct to Dubai , including Boston (BOS), New York (JFK), and Toronto (YYZ). For Emirates award flights, you should reference the first Qantas award chart ; since the one-way distance is less than 7,000 flown miles, Zone 7 pricing applies.

Need Help Booking? Read our guide on how to book Emirates business class using points .

You can visit the Citi ThankYou travel portal and click Travel, then select Points Transfer from the dropdown menu, or you can jump straight to the Points Transfer page .

Now, it’s time to choose which airline you want to transfer your ThankYou Points to.

Once you select a transfer partner, you’ll need to choose how many points you would like to transfer.

Then it’s time to enter your loyalty program number.

Once you accept the terms and conditions, you are only 1 step away from completing the transfer.

Once you confirm the transfer, there is no way to reverse it . Make sure you want to transfer the points before confirming!

Bottom Line: Still have more questions? Check out this list of FAQs about Citi ThankYou Points to get answers.

Transferring your Citi ThankYou Points to one of its partner airlines can provide some fantastic travel options, and is in our opinion the best way to use Citi points.

Make sure you do your research when deciding between transferring your miles to a partner’s program and using the Citi ThankYou travel portal.

With a little planning, you’ll be on your way to Frankfurt in Singapore’s luxury suites class or to Brussels in business class for the fewest points possible.

The information regarding the Sears Mastercard ® with ThankYou ® Rewards was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

The information for the Citi Prestige ® Card has been collected independently by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Citi Double Cash ® Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Citi Rewards+ ® Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information for the Citi ThankYou ® Preferred Card has been collected independently by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Citi Strata Premier℠ Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Discover It® Cash Back Discover It® Student Chrome Discover It® Student Cash Back Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Cards Best Discover Cards Best American Express Cards Best Visa Credit Cards Best Bank of America Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Climate Change

- Corrections Policy

- Sports Betting

- Coach Salaries

- College Basketball (M)

- College Basketball (W)

- College Football

- Concacaf Champions Cup

- For The Win

- High School Sports

- H.S. Sports Awards

- Scores + Odds

- Sports Pulse

- Sports Seriously

- Women's Sports

- Youth Sports

- Celebrities

- Entertainment This!

- Celebrity Deaths

- Policing the USA

- Women of the Century

- Problem Solved

- Personal Finance

- Consumer Recalls

- Video Games

- Product Reviews

- Home Internet

- Destinations

- Airline News

- Experience America

- Great American Vacation

- Ingrid Jacques

- Nicole Russell

- Meet the Opinion team

- How to Submit

- Obituaries Obituaries

- Contributor Content Contributor Content

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit cards

Guide to Citi ThankYou Points

Stella Shon

Robin Saks Frankel

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Glen Luke Flanagan

Updated 11:32 a.m. UTC May 30, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

rikkyal, Getty Images

Citi® is one of the largest banks in the United States, and offers customers a robust rewards program known as Citi ThankYou® Points. You can earn ThankYou points with a number of Citi credit cards, which can then be redeemed for travel, gift cards, cash back, shopping online and more.

While you have flexibility to choose how you want to redeem your ThankYou points, some options are admittedly better than others. In this guide, we’ll detail how you can earn ThankYou points from eligible Citi cash-back and travel credit cards, as well as the ways to strategically redeem your rewards for maximum value.

What are Citi ThankYou points?

Similar to American Express Membership Rewards® and Chase Ultimate Rewards® , Citi ThankYou points are a rewards currency offered by Citibank on eligible credit cards. The value of these points will depend on how you choose to redeem your points and even on which card you’re using.

Citi ThankYou points are often referred to as transferable points, as you can transfer them to Citi’s partnering airline and hotel loyalty programs to book award travel directly. Knowing when and how to transfer your points to the right programs can unlock much greater value for your rewards — especially if you’re interested in booking business class flights or luxury hotel nights for a fraction of the cost with ThankYou points compared to what you’d pay in cash.

How Citi ThankYou points work

The Citi Strata Premier℠ Card * The information for the Citi Strata Premier℠ Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. is the only card available to new applicants at the time of writing that earns fully-fledged ThankYou points. In other words, Citi Strata Premier cardholders have the capability to transfer ThankYou points earned on the card to the issuer’s full list of airline and hotel transfer partners, along with accessing redemption options such as bookings through the Citi travel portal, cash back, gift cards and more.

Citi also offers three no-annual-fee rewards credit cards that earn ThankYou points. In addition, the only co-branded card available for new applicants is AT&T Points Plus® Card from Citi * The information for the AT&T Points Plus® Card from Citi has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , which also earns ThankYou points. But with these cards alone, you won’t be able to access Citi’s full suite of transfer partners as you would with the Citi Strata Premier card.

With the Citi Double Cash® Card * The information for the Citi Double Cash® Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. and the Citi Rewards+® Card * The information for the Citi Rewards+® Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , you’ll only get three transfer options (Choice Privileges Rewards, JetBlue TrueBlue and Wyndham Rewards), and the transfer ratios are less favorable than with the Strata Premier. You’ll get just 0.8 points with JetBlue and Wyndham for each ThankYou point instead of a 1:1 transfer, and 1.5 points per ThankYou point with Choice Privileges instead of a 1:2 transfer.

The Citi Custom Cash® Card * The information for the Citi Custom Cash® Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. alone does not offer access to any of Citi’s transfer partners.

As such, you’ll need to hold the Citi Strata Premier℠ Card * The information for the Citi Strata Premier℠ Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. in addition to be able to leverage all of Citi’s transfer partners. But with complementary rewards structures, it often makes sense to carry a couple Citi cards in your wallet.

How to earn Citi ThankYou points

The easiest way to earn Citi ThankYou points is by applying for one of the issuer’s credit cards and earning a welcome offer. But know that you’ll need to carry the Citi Strata Premier℠ Card * The information for the Citi Strata Premier℠ Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. in order to be able to transfer your ThankYou points to all the airline and hotel loyalty programs that Citi partners with.

This popular travel rewards card earns 10 ThankYou® points per $1 spent on hotel, car rentals and attractions booked through CitiTravel.com, 3 points per $1 on air travel and other hotel purchases, at restaurants, supermarkets, gas stations and EV charging stations and 1 point per $1 on other purchases. Although there’s a $95 annual fee, there’s a generous welcome offer of 75,000 points after spending $4,000 on purchases in the first three months of account opening.

Plus, with no foreign transaction fees, the Citi Strata Premier is the perfect accompaniment to your international travels.

We’ve also included Citi’s no-annual-fee card options in the table below, as you can combine the ThankYou points earned on these cards over to the Citi Strata Premier Card, then take advantage of the full range of redemption options.

Plus, Citi introduced a feature called Citi Shop in January 2024. Citi Shopping is a browser extension, allowing eligible cardholders to get offers and coupons at more than 5,000 merchants when shopping online. In addition to the offer or coupon applied, you’ll earn points or miles according to your Citi card’s rewards structure. Some of the item categories you can find through the program include clothing, beauty products, household items and pet essentials.

How to redeem your ThankYou points

Citi ThankYou points are versatile and won’t expire as long as you keep your credit card account open. Here’s a list of the ways you can redeem your ThankYou points — in many cases, you can achieve a value of 1 cent per point, such as for most cash-back redemptions and when booking travel through Citi’s portal. But some redemption options will net you less than that, such as using points to shop at Amazon for a value of just 0.8 cents each.

- Gift cards.

- New travel bookings (flights, hotels, car rentals) through the Citi ThankYou portal.

- Shop with Points online at Amazon and PayPal.

- Shop with Points in-store at CVS and Walmart.

- Redeem at eligible bp, Amoco, and Shell gas stations.

- Redeem for statement credit for 1-800-Flowers and Best Buy purchases.

- Cash back (statement credit, direct deposit, check).

- Cover recent purchases for dining, grocery, gas, clothing & department stores, utility, entertainment and drugstores.

- Share with another member with an eligible Citi card.

- Transfer points to Choice Privileges Rewards, JetBlue TrueBlue and Wyndham Rewards, or to the full list of partners if you have the Citi Strata Premier card.

- Donate to charity.

Be aware that if you have only the Citi Rewards+ card, opting for cash back will net you just half a cent per point, unlike the 1 cent per point you can get if you hold a card such as the Double Cash, Custom Cash or Strata Premier. But if you hold one of the other cards in addition to the Rewards+, you can get the full cash-back value for your points.

If you’re looking for outsized value from your ThankYou points, consider applying for the Citi Strata Premier Card to gain full access to Citi’s travel partners. In the next section, we’ll cover how you can transfer ThankYou points to a robust list of airline and hotel loyalty programs.

How to transfer your ThankYou points

As you can see, there’s no shortage of ways to redeem your Citi ThankYou points. However, the maximum value you’ll receive from your points with the options above is 1 cent apiece. But by converting your ThankYou points to hotel points or airline miles through Citi’s travel partners, you can often find award travel bookings that net you outsized value from your rewards.

We’ve included the full list of transfer partners below, but there are a few standout examples of how this works in practice. If you’re interested in flying business class from the U.S. to Europe, it can often cost you nearly $5,000 round-trip. However, at the time of writing, you could transfer your points to Air France/KLM Flying Blue to book a round-trip business class flight for around 106,000 miles and approximately $600 in taxes and fees. That’s an incredible value of more than 4 cents per point in this scenario.

If you want to save your points, the same principle works for economy tickets, too. At the time of writing, you could book a one-way flight from the East Coast to London on Virgin Atlantic starting at 10,000 Flying Club points and just over $150 in taxes and fees. And, Virgin Atlantic is also part of the SkyTeam alliance, so you can leverage this partnership to book domestic flights on Delta Air Lines, starting at just 7,500 points and $5.60 in taxes and fees one-way.

Finally, Choice Privileges is an underrated hotel loyalty program that deserves a closer look. With a favorable 1:1.5 transfer ratio, this means that 1 Citi ThankYou point converts into 1.5 Choice Privileges points — and things are even better for Citi Strata Premier cardholders, who enjoy a 1:2 transfer ratio, receiving 2 Choice Privileges points for every Citi ThankYou point transferred.

With more than 7,100 hotels worldwide, you can lock in award nights with this hotel chain from just 6,000 to 35,000 points per night (but know that most stays will require 8,000 or more points, and some international locations can require up to 75,000 points).

Citi ThankYou transfer partners

Citi offers a diverse range of airline and hotel transfer partners. You can transfer your points at a 1:1 ratio to most of the partner loyalty programs, with the exception of ALL – Accor Live Limitless (2:1) and Leaders Club (5:1), as well as Choice Privileges, JetBlue TrueBlue and Wyndham Rewards, which offer varying transfer ratios depending on the Citi card or cards you have.

Frequently asked questions (FAQs)

The value of Citi ThankYou points can vary depending on how you redeem them (and even on what Citi card you have). For example, you’ll only achieve 0.8 cents in value when redeeming your points for Amazon purchases, or you can redeem your points for cash back at up to 1 cent each. For potentially higher-value options, you’ll want to transfer your points to Citi’s travel transfer partners, where you can often get outsized value.

You can redeem your Citi ThankYou points for all or part of your Amazon purchases at a rate of 0.8 cents apiece. You’ll want to enroll your Citi card here so you can choose the points option under “Payment Method” at checkout. But be aware that using your points to shop at Amazon will net you a subpar value compared with some of the other available redemption options.

Citi ThankYou points don’t expire as long as you keep your credit card open.

Yes. One of the ways you can redeem your Citi ThankYou points is for cash back as a statement credit, direct deposit or paper check.

*The information for the AT&T Points Plus® Card from Citi, Citi Custom Cash® Card, Citi Double Cash® Card, Citi Rewards+® Card and Citi Strata Premier℠ Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Stella Shon is a freelance writer that connects the dots between personal finance and travel. Her work has appeared in The Points Guy, ValuePenguin and MoneyUnder30, and she's been interviewed by The New York Times, CNBC and more.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

Glen Luke Flanagan is a deputy editor on the USA TODAY Blueprint credit cards team. Prior to joining Blueprint, he served as a deputy editor on the credit cards team at Forbes Advisor, and covered credit cards, credit scoring and related topics as a senior writer at LendingTree. He’s passionate about helping people understand personal finance so they can make the best decisions possible for their wallet. Glen holds a master's degree in technical and professional communication from East Carolina University and a bachelor's degree in journalism from Radford University.

How to book a luxury vacation for a fraction of the cost

Credit cards Harrison Pierce

Applying for your first student credit card? I just did — here’s how I chose the best card for me

Credit cards Clara Baron

How to redeem points for boutique luxury hotels

Why I chose the Wells Fargo Active Cash® Card over other cash-back cards

Credit cards Jason Steele

Big Changes to the American Express Gold Card

Credit cards Carissa Rawson

Chase Freedom Flex vs Freedom Unlimited

Credit cards Sarah Brady

Study: Over two-thirds of Americans are stressed by everyday expenses – these are the most frustrating ones

Credit cards Stella Shon

Chase trifecta: What it is and how to maximize it

Credit cards Ryan Smith

Best credit cards for families of September 2024

Credit cards Dawn Papandrea

Citi Strata vs. Chase Sapphire Preferred

Citi Merchant offers: Everything you need to know

Credit cards Louis DeNicola

Best credit cards for young adults of September 2024

How to redeem Citi Double Cash credit card rewards

Credit cards Rebecca Safier

Chase Ink Business Preferred welcome offer reaches new heights with 120k points for big spenders

Guide to Citi ThankYou transfer partners

Credit cards Lee Huffman

Citi transfer partners: Maximize your ThankYou points with these loyalty programs

Editor's Note

Many Citi cardholders redeem their Citi ThankYou Rewards points for gift cards or bookings through the Citi travel portal . But if you have a premium Citi ThankYou card, you may get greater value from your points by utilizing the Citi transfer partners.

In this guide, we'll discuss how to earn Citi ThankYou points you can redeem with the Citi transfer partners.

Earning points you can use with Citi transfer partners

You can earn Citi ThankYou points through some Citi credit cards , including:

- Citi Strata Premier℠ Card (see rates and fees ): Best for supermarkets, gas stations, EV charging stations, restaurants and air travel

- Citi Rewards+® Card (see rates and fees ): Best for earning rewards with no annual fee

- Citi Double Cash® Card (see rates and fees ; via a linked ThankYou account): Best for everyday purchases

- Citi Custom Cash® Card (see rates and fees ; via a linked ThankYou account): Best for flexible earning

Keep in mind, though, that not all ThankYou points have the same value. To transfer Citi ThankYou points to most partners described in this guide, you must hold a premium Citi ThankYou card such as the Citi Prestige® Card (no longer available to applications) or the Citi Strata Premier.

If you only have the Citi Rewards+ Card, you'll earn more limited ThankYou points that you can transfer to JetBlue TrueBlue, Choice Privileges and Wyndham Rewards. If you only have the Citi Double Cash Card or the Citi Custom Cash Card, you earn cash back as "basic" ThankYou points that you can't transfer to partner programs.

However, if you also hold the Citi Prestige or the Citi Strata Premier , you can combine your limited and basic ThankYou points with those from your Citi Prestige or Citi Strata Premier account. Then, you can transfer your combined rewards to any Citi ThankYou transfer partners.

The information for the Citi Prestige card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Citi transfer partner overview

The Citi ThankYou Rewards program currently has 19 transfer partners: 14 airline loyalty programs, four hotel loyalty programs and one retail loyalty program.

Here's an overview of the Citi transfer partners and the ratios at which you can transfer ThankYou points:

- Accor Live Limitless : 2:1 transfer ratio

- Aeromexico Rewards : 1:1 transfer ratio

- Air France-KLM Flying Blue : 1:1 transfer ratio

- Avianca LifeMiles : 1:1 transfer ratio

- Cathay Pacific Asia Miles : 1:1 transfer ratio

- Choice Privileges : 1:2 transfer ratio (2:3 transfer ratio for cards that earn limited ThankYou points)

- Emirates Skywards : 1:1 transfer ratio

- Etihad Guest : 1:1 transfer ratio

- EVA Air Infinity MileageLands : 1:1 transfer ratio

- JetBlue TrueBlue : 1:1 transfer ratio (5:4 transfer ratio for cards that earn limited ThankYou points)

- Leaders Club : 5:1 transfer ratio

- Qantas Frequent Flyer : 1:1 transfer ratio

- Qatar Airways Privilege Club : 1:1 transfer ratio

- Singapore Airlines KrisFlyer : 1:1 transfer ratio

- Shop Your Way : 1:10 transfer ratio

- Thai Royal Orchid Plus : 1:1 transfer ratio

- Turkish Airlines Miles&Smiles : 1:1 transfer ratio

- Virgin Atlantic Flying Club : 1:1 transfer ratio

- Wyndham Rewards : 1:1 transfer ratio (5:4 transfer ratio for cards that earn limited ThankYou points)

Occasionally, you may be able to transfer Citi points to select partners at a higher ratio during a transfer bonus .

To transfer Citi ThankYou points, go to thankyou.com and sign in to your account. You may need to select the ThankYou account you want to use. Then, click "Travel" on the top navigation bar and select "Points transfer." Each transfer must be at least 1,000 ThankYou points but no more than 500,000. ThankYou points can only be transferred in increments of 1,000.

Some partners recognize transfers from Citi ThankYou Rewards quicker than others. Citi says transfers can take up to 14 days to process, but our tests on how long Citi ThankYou points take to transfer show most transfers occur much quicker.

In the remainder of this guide, we'll discuss each Citi transfer partner and whether they'll likely provide good value if you transfer Citi points.

Related: Best ways to redeem Citi ThankYou points

Accor Live Limitless

Accor Live Limitless has 53 brands, including popular names like Sotifel, Fairmont, Raffles and Movenpick. Its redemptions are simple — 2,000 points are worth 40 euros (around $44, based on current exchange rates). That means each Accor point is worth around 2.2 cents.

Transferring Citi points to Accor at a 2:1 ratio means you'll get just over 1 cent per Citi point (significantly lower than TPG's valuation of Citi points at 1.8 cents each). That said, if you have a limited number of Citi points, Accor Live Limitless could be a compelling transfer partner that will offer slightly more value than redeeming your points for travel through the Citi travel portal.

Aeromexico Rewards

While Aeromexico Rewards has an award chart for limited-availability classic award tickets, it uses dynamic pricing for most award tickets operated by Aeromexico, Delta, KLM and Air France. This dynamic pricing varies depending on demand, availability, destination and your class of service — but the rates usually aren't compelling. Even if you book your award online, you'll still need to pay an award booking fee of 365 Mexican pesos (about $22).

You may get good value from Aeromexico if you use your points in the right situations, but generally, Aeromexico Rewards isn't one of the most valuable Citi transfer partners.

Air France-KLM Flying Blue

Air France-KLM Flying Blue is a popular program that some might argue is one of the best Citi transfer partners. However, Flying Blue uses dynamic award pricing and adds fuel surcharges that can be hefty on some routes.

Flying Blue standardized prices of saver-level redemptions to Europe in late 2023, and you can find great value through the monthly Flying Blue Promo Rewards and Flying Blue stopovers . You can also use Flying Blue's calendar search tool to find cheaper award tickets.

Related: How to find the cheapest redemption rates using Flying Blue miles

Avianca LifeMiles

With its mixed cabin ticketing and low taxes and fees, Avianca LifeMiles is a popular currency for booking flights on Star Alliance carriers. Unlike some frequent flyer programs, LifeMiles doesn't pass along carrier surcharges on award tickets.

Although Avianca LifeMiles raised award costs to Asia in late 2022, two of our favorite sweet spots remain:

- Lufthansa business class one-way to Europe for 63,000 miles

- One-way economy domestic awards on United Airlines for as few as 6,500 miles

You'll also often find inexpensive Avianca-operated award flights within the Americas.

Related: The best websites to search for Star Alliance award availability

Cathay Pacific Asia Miles

Cathay Pacific Asia Miles uses distance-based award charts for flights on its own metal and Oneworld partner awards. Long-haul flights, such as those between the U.S. and Hong Kong, can be expensive. Specifically, you can book one-way "ultra-long" Cathay Pacific flights of 7,501 miles or longer for 160,000 Asia Miles in first class, 110,000 miles in business, 75,000 miles in premium economy and 38,000 miles in economy.

Cathay Pacific Asia Miles passes on fees and surcharges from other carriers and often charges significant fees on its own tickets. But, even after Cathay increased most Asia Miles award rates in late 2023, you'll still occasionally find award flights where booking through Asia Miles is the best option.

Related: Traveling soon? These 10 apps and websites make award redemptions easier to find

Choice Privileges

Choice integrated Radisson Rewards Americas into its loyalty program in mid-2023. Now you can book Choice hotels, including legacy Radisson Rewards Americas brands, through Choice Privileges . Award nights at most properties worldwide range from 6,000 to 35,000 points per night.

You can transfer Citi points to Choice at a 1:2 ratio (2:3 ratio for cards that earn limited ThankYou points), which makes it easier to get good value. Check out our stories on Choice Hotels Sweet Spot Rewards and unique ways to redeem Choice points to learn how to maximize Choice points.

Related: Register for Choice Hotels Your Extras to earn gift cards or other perks on weekday stays

Emirates Skywards

Emirates Skywards is perhaps most useful for booking Emirates business-class or first-class award tickets, but its award prices are high. For example, a business-class one-way flight from New York to Dubai costs 138,000 miles and $839 in taxes and fees.

A more viable option is to look at one of the carrier's fifth-freedom routes between the U.S. and Europe. For example, you can book a one-way business-class award from New York to Milan for 87,000 miles plus $106 in taxes and fees, but if you can find round-trip, saver-level awards, your total price for the New York-to-Milan fifth-freedom route drops to 108,000 miles plus $248.

Related: The complete guide to the Emirates A380 onboard bar and lounge

Etihad Guest

Etihad Guest used to be a fantastic program for maximizing partner redemptions. Unfortunately, Etihad slashed its sweet spots and increased award rates by over 300% on some routes in 2023.

Etihad is making more loyalty program changes this year, including reduced GuestSeat award prices and the ability to redeem miles to upgrade to the Residence on some A380 flights . However, Etihad Guest award rates tend to be high, and the award charts you'll find only list introductory rates, so the rates you'll find when you go to book will often be significantly higher.

Related: Your ultimate guide to searching award availability for the major airlines

EVA Air Infinity MileageLands

EVA Air Infinity MileageLands generally won't be your program of choice. After all, it is often beaten by other programs and is rather difficult to understand. But there are a few notable cases in which you might want to use Infinity MileageLands.

One particular area to consider is intra-region round-trip itineraries. You're allowed up to two stopovers, up to six segments and one open jaw on round-trip Star Alliance awards — and some regions are very broad. For example, the "North Asia" region consists of "Guam, Japan, Micronesia, Palau, Russian Far East, South Korea, Marshall Islands, Mongolia, Saipan." So, you could piece together a nice island hopper for just 30,000 miles round trip in economy or 55,000 miles in business class. Likewise, the "South West Pacific" and "South America" regions also look appealing.

Check out the award chart for Star Alliance awards and the award chart for EVA Air awards .

Related: Is EVA Air business class worth it on the Boeing 787-10?

JetBlue TrueBlue

Redeeming JetBlue TrueBlue points for the carrier's flights is simple: The more a flight costs in cash, the more it will require in points. According to TPG's valuations, you can expect to get roughly 1.4 cents of value for every TrueBlue point you redeem, but some flights may yield slightly better or worse value.

Another option is to redeem JetBlue points for travel on Hawaiian Airlines . You can usually book nonstop, one-way intra-Hawaii economy flights for 7,500 points plus $5.60. However, this isn't as good of a deal as it sounds since paid flights are often inexpensive on these routes.

Leaders Club

The newest Citi transfer partner is Leaders Club , the loyalty program of The Leading Hotels of the World. Leaders Club uses dynamic award pricing, but you'll usually get between 6 and 8 cents per point. Given that you can transfer Citi points to Leaders Club at a 5:1 ratio, you'll usually get between 1.2 and 1.6 cents per Citi point (lower than TPG's 1.8 cents per ThankYou point valuation).