- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Travel Insurance and Pregnancy: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

There’s a lot to think about when you’re pregnant — especially if you plan to travel. You’ll want to make sure your health care and your trip costs are covered if something goes wrong.

And while travel insurance for pregnancy may sound like a must-have, remember that not all plans will cover your specific needs. At the moment, there isn't a specific insurance option for those who are pregnant. Rather, pregnant people will need to consider travel insurance that includes coverage for trip cancellation and interruption, as well as emergency medical and evacuation costs.

Your decision to buy travel insurance while pregnant will depend on how much of your trip is nonrefundable, where you’re going and what coverages you already have. These coverages may include trip interruption insurance from your credit card issuer or emergency medical coverage from your current health insurer.

Here’s what you need to know to choose the best travel insurance for pregnancy.

Trip cancellation or interruption due to pregnancy

Most travel insurance policies will reimburse you for all or a portion of your nonrefundable travel costs if you have to cancel your trip for a covered reason. But for pregnant people, covered reasons are a little more complicated.

For most policies, normal pregnancy is not a valid reason to cancel your trip if you already knew you were pregnant when you purchased the insurance. But pregnancy may be a valid reason to cancel if you learn you're pregnant after you’ve booked your trip and paid for an insurance policy.

For example, if you prepay for a trip a year in advance, purchase Allianz travel insurance, and a few months later find out you’re pregnant and need to cancel your trip, the company will likely reimburse you for all or a portion of your lost travel costs. But you’ll have to prove that you learned about your pregnancy after you purchased the policy.

On the other hand, if you knew you were pregnant when you purchased the policy, you will likely not get reimbursed if you canceled your flight due to morning sickness, for example.

» Learn more: Can you fly while pregnant? It depends.

Trip cancellation or interruption due to complications of pregnancy

If you have complications during your pregnancy, travel insurance may cover your trip costs regardless of when you learned you were pregnant.

Keep in mind that only specific complications — like gestational diabetes, preeclampsia, hyperemesis gravidarum or miscarriage — are eligible, and a doctor must advise you not to travel due to your diagnosed condition.

» Learn more: What to know about Cancel For Any Reason (CFAR) travel insurance

Medical coverage for pregnant travelers

If you’re traveling domestically, your regular health insurance may be all the coverage you need. Check with your provider. If you’re going abroad, there’s a good chance your health insurance will not reimburse you for medical expenses while traveling. So for pregnant people traveling internationally, travel medical insurance is probably a good idea.

Secondary travel health insurance can be surprisingly affordable. Secondary plans kick in after you’ve used any applicable primary insurance coverage from your current health insurer.

Searching InsureMyTrip.com, we found secondary international medical insurance plans starting at $14 for a 30-year-old California resident traveling to France for 12 days in September. For this price, you receive coverage up to $50,000.

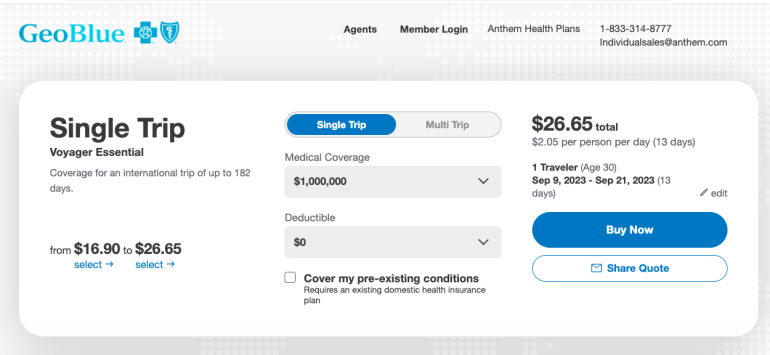

Want higher coverage limits? They’re available. For the same 30-year-old California-based traveler headed to France, GeoBlue 's Voyager Essential plan offers $1 million in travel medical coverage with a $0 deductible for $27 — again, that’s for the whole trip, not per day. This plan is not secondary coverage, meaning you can buy it even if you don’t have a primary health insurer.

» Learn more: Can I get travel insurance for pre-existing medical conditions?

Emergency medical evacuation due to pregnancy

If you’re traveling to large city, a health care facility is likely a short drive away. But if you’re traveling someplace remote, emergency transportation coverage , like a helicopter, can be a literal lifesaver. Covering this service with an insurance plan can save you a bundle.

Some credit cards give you automatic emergency medical evacuation when you use the card to book your trip, like the Chase Sapphire Reserve® . But if you didn’t use a credit card with emergency evacuation coverage or need higher limits, you may want to buy travel insurance. Most comprehensive plans include emergency medical evacuation insurance, but make sure it’s covered before you purchase your plan.

» Learn more: The best credit cards for travel insurance benefits

Where to buy insurance for traveling while pregnant

Different travel insurance companies have a variety of plans with varying coverage.

A policy from Travel Guard that was perfect for your nonpregnant friend when she traveled to Machu Picchu may not be as good as a policy from Travelex or Nationwide if you’re pregnant and cruising through Europe. Comparison shop and carefully note what’s covered and the deductible limits before you buy.

» Learn more: The best travel insurance companies

Travel insurance while pregnant recapped

You may not need travel insurance for pregnancy, especially if you’re traveling domestically and your trip is fully refundable — but don’t assume that’s always the case.

Read up on your existing coverage from your health plan and any insurance offered by your credit card . Then you can explore a little more of the world before baby arrives, knowing you’re covered for any scenario.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

Does Post Office Travel Insurance Cover Pregnancy? Exploring The Coverage Options

- Last updated Oct 24, 2023

- Difficulty Beginner

- Category Healthy pregnancy

Are you a soon-to-be parent planning to travel abroad? If so, you might be wondering if your post office travel insurance covers pregnancy. It's an important question to consider, as pregnancy can bring about unexpected medical expenses and complications. In this article, we will explore whether post office travel insurance provides coverage for pregnant women and discuss what you need to know before you embark on your journey.

What You'll Learn

Does post office travel insurance cover pregnancy-related medical expenses while traveling, what is the maximum coverage limit for pregnancy-related medical expenses under post office travel insurance, does post office travel insurance cover childbirth expenses if a woman goes into labor while traveling, are there any specific restrictions or conditions regarding coverage for pregnancy under post office travel insurance, can a pregnant woman purchase post office travel insurance if she is already beyond a certain gestational age.

Post Office Travel Insurance is a popular choice for those looking to protect themselves while traveling. However, many people wonder if this insurance covers pregnancy-related medical expenses. In this article, we will explore this question and provide you with the information you need.

When it comes to travel insurance, it is important to understand that each policy may offer different coverage options. However, in general, Post Office Travel Insurance does cover pregnancy-related medical expenses while traveling. This can be a great relief for expectant mothers who are planning to travel during their pregnancy.

It is important to note that there may be some restrictions and conditions when it comes to coverage for pregnancy-related medical expenses. For example, some policies may only cover expenses up to a certain gestation period, typically around 28 weeks. This means that if you are traveling after this point in your pregnancy, you may not be eligible for coverage.

Additionally, it is important to make sure that you disclose your pregnancy to the insurance company when purchasing your policy. Failing to disclose this information could result in your claim being denied later on. It is always best to be upfront and honest when it comes to providing the insurance company with accurate information.

To give you a better understanding of how this coverage works, let's look at an example. Imagine you are four months pregnant and have purchased Post Office Travel Insurance for your upcoming trip. While traveling, you experience complications with your pregnancy and require medical attention. In this situation, your travel insurance should cover the cost of your medical expenses, as long as it falls within the coverage period and any other restrictions outlined in your policy.

To ensure that you have the necessary coverage in place, it is advisable to read your policy carefully and understand the terms and conditions. If you have any questions or concerns about the coverage for pregnancy-related medical expenses, it is best to contact the insurance provider directly. They will be able to provide you with accurate information based on your specific policy.

In conclusion, Post Office Travel Insurance does generally cover pregnancy-related medical expenses while traveling. However, there may be restrictions and conditions that apply, such as the gestation period. It is important to disclose your pregnancy to the insurance company and review your policy to ensure you have the necessary coverage in place. By doing so, you can enjoy your travels with peace of mind knowing that you are protected in case of any unexpected pregnancy-related medical expenses.

Is Taking Lax a Day Safe During Pregnancy?

You may want to see also

Post office travel insurance is a popular choice for those who are planning to travel and want to have peace of mind knowing that their medical expenses will be covered. For those who are pregnant and traveling, it is important to understand the maximum coverage limit for pregnancy-related medical expenses under post office travel insurance.

Post office travel insurance covers a wide range of medical expenses, including those related to pregnancy. However, it is important to note that post office travel insurance has a maximum coverage limit for pregnancy-related medical expenses. This means that there is a cap on the amount of money that can be claimed for pregnancy-related medical expenses.

The maximum coverage limit for pregnancy-related medical expenses under post office travel insurance varies depending on the specific policy you choose. It is important to carefully review the terms and conditions of your policy to understand the exact maximum coverage limit for pregnancy-related medical expenses.

Typically, the maximum coverage limit for pregnancy-related medical expenses under post office travel insurance ranges from £500 to £5,000. This amount is designed to cover the costs of medical treatments, consultations, and hospital stays related to pregnancy.

In order to make a claim for pregnancy-related medical expenses under post office travel insurance, you will need to provide documentation and proof of the expenses incurred. This may include medical bills, receipts, and any other relevant documentation.

It is important to note that post office travel insurance typically does not cover expenses related to routine prenatal care or pre-existing conditions. It is recommended to consult with your healthcare provider before traveling to ensure that you have appropriate coverage for your specific needs.

In addition to the maximum coverage limit for pregnancy-related medical expenses, post office travel insurance may also have other limitations and exclusions. For example, certain activities or destinations may not be covered under the policy. It is important to carefully review the terms and conditions of your policy and consult with the insurance provider if you have any specific questions or concerns.

Overall, post office travel insurance can provide valuable coverage for pregnancy-related medical expenses. However, it is important to review the policy and understand the maximum coverage limit and any other limitations or exclusions that may apply. By being informed and prepared, you can ensure that you have the coverage you need for a safe and worry-free trip.

The Growth Spurt: Do Babies Get Bigger with Each Pregnancy?

When it comes to traveling, unexpected situations can arise, and one such situation is going into labor while away from home. If you have post office travel insurance, you may be wondering if it covers childbirth expenses in such a scenario. In this article, we will explore the coverage provided by post office travel insurance for childbirth expenses and what you need to know.

First and foremost, it's essential to understand that post office travel insurance policies vary, and the coverage for childbirth expenses may differ as well. Therefore, it is crucial to carefully review your specific policy and contact the insurance provider directly to confirm what is covered.

In some cases, post office travel insurance may cover childbirth expenses if a woman goes into labor while traveling. However, there are typically some conditions that need to be met.

- Notification: The insurance provider must be notified as soon as possible when labor begins or when you anticipate giving birth during your trip. Timely communication is crucial to ensure proper assistance is provided.

- Medical documentation: You will likely need to provide medical documentation confirming the need for childbirth during your trip. This can include a doctor's letter or medical reports indicating your due date and any other relevant information.

- Pre-existing conditions: It's crucial to understand that post office travel insurance may not cover childbirth expenses if it is deemed a pre-existing condition. If you were already pregnant when you purchased the insurance or if you had any known complications, it may be considered a pre-existing condition and not covered.

- Coverage limits: Even if post office travel insurance covers childbirth expenses, there may be certain coverage limits in place. It's essential to review your policy to understand the maximum amount that can be claimed for childbirth-related expenses.

- Repatriation: In some cases, post office travel insurance may cover the cost of repatriation, which refers to transporting you back to your home country for childbirth. This can include medical assistance, transportation costs, and even travel arrangements for a companion or family member.

It is worth emphasizing that each insurance provider and policy may have different terms and conditions. Therefore, it is highly recommended to thoroughly read your policy documents and contact the post office travel insurance provider to get accurate and up-to-date information regarding childbirth coverage.

To give you a better understanding, let's consider an example. Sarah is seven months pregnant and has planned a babymoon trip to a tropical destination. She has purchased post office travel insurance for her trip, including coverage for medical emergencies. Unfortunately, Sarah's water breaks unexpectedly, and she goes into labor two weeks before her due date while she is still on vacation.

Sarah immediately contacts her insurance provider and informs them about her situation. The insurance provider guides her through the necessary steps and asks for medical documentation, including her doctor's letter and reports. Once Sarah provides the required documentation, her insurance provider confirms that her childbirth expenses will be covered, up to the specified limits in her policy. They also arrange for her safe repatriation back home, ensuring she receives the necessary medical assistance during her journey.

In conclusion, post office travel insurance may cover childbirth expenses if a woman goes into labor while traveling. However, it is crucial to carefully review your policy, notify the insurance provider, provide the necessary documentation, and adhere to any pre-existing condition clauses. Contacting the insurance provider directly and discussing your specific situation will provide the most accurate information about coverage for childbirth expenses.

The Prevalence of Chemical Pregnancy on Clomid: Exploring the Link

When it comes to travel insurance, many people are concerned about what coverage they will receive if they become pregnant while on their trip. Specifically, they want to know if there are any restrictions or conditions regarding coverage for pregnancy under post office travel insurance.

Fortunately, many travel insurance policies, including those offered by the post office, do provide coverage for pregnancy-related expenses. However, it is important to understand that there may be some restrictions or conditions that apply.

One common restriction is a timeframe for coverage. Most travel insurance policies, including those provided by the post office, will only provide coverage for pregnancy-related expenses up to a certain number of weeks into the pregnancy. This timeframe can vary depending on the specific policy, so it is important to review the terms and conditions of your policy to understand what coverage you are eligible for.

Another common condition is that the pregnancy must be considered uncomplicated. This means that if you have any pre-existing pregnancy-related conditions or complications, your coverage may be limited or excluded altogether. It is important to disclose any pre-existing conditions to your travel insurance provider before purchasing your policy to ensure that you will be covered in the event of an emergency.

Additionally, some travel insurance policies may require you to get clearance from your doctor before traveling while pregnant. This is to ensure that you are medically fit to travel and that there are no foreseeable risks to your health or the health of your baby. It is important to consult with your healthcare provider before making any travel plans to ensure that you are able to travel safely.

In some cases, travel insurance policies may also provide coverage for emergency medical expenses related to pregnancy, such as premature birth or complications that arise during the trip. Again, it is important to review your policy to understand what coverage you have and what conditions may apply.

In conclusion, while many travel insurance policies, including those offered by the post office, do provide coverage for pregnancy-related expenses, there may be restrictions or conditions that apply. It is important to review your policy carefully, disclose any pre-existing conditions, and consult with your healthcare provider before traveling while pregnant to ensure that you are adequately covered and able to travel safely.

The Best Beans for a Healthy Pregnancy: A Complete Guide

Pregnancy is an exciting time, filled with anticipation and planning. For expectant mothers who have travel plans during their pregnancy, securing the appropriate travel insurance is an important consideration. One question that often arises is whether a pregnant woman can purchase post office travel insurance if she is already beyond a certain gestational age.

The answer to this question depends on several factors, including the specific policy of the post office travel insurance provider and the gestational age of the expectant mother. It is always recommended to thoroughly review the terms and conditions of the insurance policy before making a purchase.

Many post office travel insurance providers have specific guidelines regarding the maximum gestational age at which they will provide coverage. This is typically done to mitigate the risk of any medical complications that may arise during the trip. However, these guidelines can vary from one provider to another, so it is crucial to check with the specific insurance company.

In general, most post office travel insurance providers offer coverage for pregnant women up to a certain gestational age, which is often around 32-36 weeks. Beyond this age, some insurers may still offer coverage but only under certain conditions, such as obtaining a medical clearance from a healthcare professional or limiting coverage to emergency medical expenses only.

To illustrate this with an example, consider a pregnant woman who is planning to travel when she is 34 weeks pregnant. She decides to purchase post office travel insurance but notices that the policy only provides coverage up to 32 weeks gestation. In this case, she could contact the insurance provider to inquire about any possible accommodations they may have for women beyond 32 weeks gestation. It is possible that they may be able to offer an extension or suggest alternative options.

In addition to the gestational age restrictions, it is important to note that not all post office travel insurance policies provide coverage for pregnancy-related complications or pre-existing conditions. This means that if a pregnant woman experiences any medical issues related to her pregnancy during the trip, she may not be eligible for coverage. It is crucial to carefully read the policy's terms and conditions to ensure that it provides adequate coverage for any potential scenarios that may arise during pregnancy.

To summarize, pregnant women should thoroughly review the terms and conditions of post office travel insurance policies before purchasing coverage. While some providers may have maximum gestational age restrictions, others may offer accommodations or provide coverage under certain conditions. It is essential to understand what the policy covers and to consider the specific needs and circumstances of the expectant mother. By doing so, pregnant women can make informed decisions about their travel insurance and ensure that they are adequately protected during their trip.

Is Hard Water Safe to Drink During Pregnancy?

Frequently asked questions.

Yes, post office travel insurance does cover pregnancy. However, it is important to note that there may be conditions and limitations regarding coverage. Most often, coverage is available up to a certain gestational age, typically up to the end of the 28th week of pregnancy. It is recommended to review the policy's terms and conditions or contact the post office travel insurance provider directly for specific details on coverage for pregnancy.

Post office travel insurance typically covers pregnancy-related medical expenses while traveling, such as emergency medical treatment and hospitalization. It may also cover any cancellation or curtailment of the trip due to complications with the pregnancy. However, it is essential to read the policy thoroughly and check for any exclusions or limitations, as coverage may vary depending on the specific plan and circumstances.

Yes, there may be restrictions or limitations for pregnancy coverage in post office travel insurance. Some common restrictions can include limitations on coverage after a certain gestational age, exclusions for pre-existing conditions related to pregnancy, and requirements for appropriate medical documentation or clearance from a healthcare provider. It is crucial to review the policy's terms and conditions carefully to understand the full extent of coverage and any necessary requirements. Additionally, it is recommended to contact the post office travel insurance provider directly for specific information regarding restrictions or limitations for pregnancy coverage.

- Elena Tapia Author Editor Reviewer

- Kezia Cochran Author Reviewer Doctor

It is awesome. Thank you for your feedback!

We are sorry. Plesae let us know what went wrong?

We will update our content. Thank you for your feedback!

Leave a comment

Healthy pregnancy photos, related posts.

The Prevalence of False Pregnancies: Sorting Fact from Fiction

- Oct 04, 2023

Understanding the Impact of Tachycardia During Pregnancy

- Nov 02, 2023

Toning Your Abdominal Muscles Post-Pregnancy: A Guide to Check for Diastasis Recti

- Oct 01, 2023

Understanding the Most Common Food Cravings During Pregnancy

- Oct 09, 2023

How Ectopic Pregnancies Impact Women and the Healthcare System

- Oct 13, 2023

Unusual Indications: Ectopic Pregnancy Without Bleeding – What You Should Know

- Oct 10, 2023

What are the best travel medical insurance options while pregnant?

- Are you planning international travels during your pregnancy? It is important to make sure that you have international insurance benefits that include coverage for complications.

- It is also extremely important that you are not traveling against medical advice. Always check with your doctor to make sure you are medically able to travel.

- Also check the Travel Warnings for your destination country. Certain disease outbreaks (Zika, for example) carry a higher risk for pregnant women.

- For those coming to the U.S., at this time, Good Neighbor Insurance does not carry a plan for maternity coverage to cover the birth for a person who is already pregnant.

- All of our long-term insurance plans have a minimum of 10-12 months waiting period for maternity coverage. We cannot recommend a plan for those wanting to have coverage for a U.S. birth.

For U.S. residents

The top two best insurance options

GeoBlue Voyager Choice and Essential Single Trip Travel Insurance

A great plan for U.S. travelers – single trip travel insurance with pre existing medical conditions

For non-U.S. residents

Atlas international travel medical insurance with personal liability option.

Affordable international medical travel insurance with option to add natural disaster evacuation benefit for ages 80+

What is covered? What is considered a “complication” of pregnancy?

- On international travel medical plans that include coverage for complications of pregnancy, a complication will be a condition that puts the life of the mother and/or baby in jeopardy.

- Examples of conditions that are NOT covered would be occasional spotting, false labor, or morning sickness.

If I give birth during my trip, will my delivery and baby be covered?

- Delivery of the baby is only covered if it’s due to an eligible complication (pre-eclampsia for example).

- If the pre-term labor puts the mother or child in danger, then it would be covered.

- Babies born during international travel will not be covered on the mother’s policy.

A simple guide to travel insurance for pregnant women

Like many moms-to-be, you might also be planning one last stress-free journey before baby arrives and turns your world upside down. Whether you are only flying overseas for a weekend getaway, or planning longer holidays by the beach, make sure that you have valid travel insurance in place. And while we all hope that our vacations will go smoothly, mishaps do happen and can potentially leave you with sky high medical bills, lost flights, and extra accommodation bills.

According to the recent consumer research awareness initiative by Travel Insurance Explained, many clients lack the knowledge about rules and regulations regarding traveling while pregnant. Concerned about this finding, today’s Kwiksure article is aimed at answering the most common questions pregnant travelers might have.

Do I need special travel insurance if I'm pregnant?

Yes, and no. If you have international private medical insurance with maternity benefits, you are covered virtually anywhere in the world. Childbirth costs and newborn care are all included. Please note, however, that exclusions will apply to plans that exclude the US.

When it comes to travel insurance, however, there are a number of restrictions. In general, travel insurance for pregnant women covers the same benefits as any other travel insurance: emergency medical expenses, medical repatriation, personal liability, lost and stolen luggage, and flight cancellations, but there are certain limitations, rules, and exceptions.

Is pregnancy covered by travel insurance?

Since all travel policies cover unexpected medical expenses, all emergencies associated with pregnancy are typically covered under standard travel insurance plans. However, emergency expenses are covered up to a specific date limit. Pregnancy complications or pregnancy emergencies might include miscarriage, gestational diabetes, preeclampsia, placenta previa, and other emergency conditions (covered only up to the policy date restriction limits).

Travel insurance and childbirth

Since most insurers do not see pregnancy and normal childbirth to be either an unforeseen event or illness, these benefits are almost always excluded from standard travel insurance policies, as they can be reasonably anticipated. Normal childbirth is excluded from virtually all travel insurance policies, and shall it happen to you while you’re away, you are solely responsible for covering its costs.

Is my baby covered?

Yes, your baby will always be covered under your travel insurance policy, up to the benefit limits, and it doesn’t matter whether the delivery was normal or with complications. One thing to consider is that prematurely born babies should not fly until after their due date, which in turn, may considerably extend your holidays, and your accommodation fees along with it.

Travelling while pregnant tip: Make sure to purchase travel insurance with family support benefits, which will cover the costs of accommodation, food, and essential baby items in case the baby is born prematurely.

Date restrictions in coverage

Another rule is that most insurers only cover emergency medical expenses for pregnancy and childbirth from week 0 to week 20 , depending on the policy. That means that if you are traveling after the 20th week of your pregnancy, you can’t make any claims related to childbirth and trip cancellations.

Pregnancy and trip cancellation

Plans may cover trip cancellations due to unforeseen pregnancy complications, such as gestational diabetes, or premature childbirth. If after the date restriction stated in your policy has passed, and you are, for example, denied to board a plane, most insurers will not cover your losses for that either.

Is it easy to obtain and choose pregnancy travel insurance?

The main thing to remember is that insurance policies can vary significantly in their terms and conditions. Also, there is no specific pregnancy travel insurance, but you can tailor certain plans so that they include benefits that matter to you most. If you genuinely want to have a stress-free holiday during your pregnancy, make sure that your policy covers you for any eventuality. This includes early childbirth, medical care during labor, and expenses related to changing the date of your return trip due to premature delivery.

The safest approach is to secure international maternity insurance , that covers all costs related to pregnancy: pre- and post- natal treatments & examinations, medically prescribed Cesarean section, normal delivery, and delivery with complications or following fertility treatment, as well as care of newborn children.

An insurance broker, such as Kwiksure , will be able to research different providers and find a suitable policy for you. Our advisors are on hand to present you with different plan options, price quotations, and most importantly, advise on the best benefits based on your specific needs.

Contact us today, or fill in our online quotation tool for an instant quote!

Recent Posts

- 5 Tax-free EV Models in 2024 under the One-for-One Program

- 5 Considerations When Buying a Used Tesla/Electric Vehicle

- 22 great electric vehicles for 2024 (continuously updated)

- Comparison of 13 Hybrid Car Models in Hong Kong in 2024

- 12 Popular Cars for Less Than HK$100K for New Drivers

We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

News & Insights

Travel Insurance When Pregnant

May 11, 2023 — 04:42 pm EDT

Written by Nicole Williams for Money.com ->

If you’re pregnant and have upcoming travel plans, your protection and peace of mind are important. Though there are some exceptions and special considerations, the best travel medical insurance might be a good idea if you’re traveling when pregnant.

Read on to learn about travel insurance options when you’re expecting, what it does and doesn’t cover and suggestions to get the most out of your policy.

Does Travel Insurance cover Pregnancy?

Travel insurance does cover pregnancy, but only under certain circumstances. While the specifics vary by policy, travel insurance can cover emergency medical costs associated with unforeseen complications if you travel while pregnant. If you become pregnant after purchasing insurance and decide to cancel your trip, trip cancellation coverage may reimburse you.

Unexpected pregnancy and trip cancellation insurance

Let’s say you and your spouse are planning a two-week vacation to Japan — a trip at the top of your bucket list. A year in advance, you book the flights and purchase travel insurance, only to find out three weeks later that you’re pregnant. Does travel insurance cover pregnancy in this case?

An unexpected pregnancy after purchasing travel insurance is not an uncommon situation, and it’s one that’s covered by many travel insurance policies. Check with your provider to see if unexpected pregnancy is a covered reason for trip cancellation. If it is, then not wanting to travel when pregnant or having a due date that’s too close to your trip would be considered valid reasons to cancel your travel plans. However, you’ll likely need to provide medical proof that the pregnancy occurred after you purchased your policy.

Pregnancy complications

Imagine that towards the end of your first trimester, just a few days before you’re scheduled to visit France for business, you begin to feel unusually thirsty and fatigued. During a visit to your doctor, you’re diagnosed with gestational diabetes and told that your pregnancy is now high-risk. Can you cancel your trip and get reimbursed?

If you were already pregnant when you purchased travel insurance, cancellation because of normal pregnancy symptoms likely isn’t covered. However, if you experience unforeseen complications before your trip and your doctor advises you not to travel, you can file a trip cancellation insurance claim to have non refundable trip costs reimbursed. Health conditions like gestational diabetes, hyperemesis gravidarum and acute nephritis may be covered.

If you start getting pregnancy-related complications during your trip, your medical expenses can be reimbursed with travel insurance that covers pregnancy, up to policy limits. Dig into the details when choosing your policy, as different travel insurance companies define complications of pregnancy differently. Your plan may also help you recoup travel costs if complications interrupt your trip or end it early.

Pregnancy and Cruises

Don’t try to sneak in that ten-day Caribbean cruise a month before your due date. The major cruise lines all have the same pregnancy policy: guests may not sail beyond 23 weeks of pregnancy. If you enter your 24th week of pregnancy before or at any point during your trip, you won’t be allowed to board.

While a restful cruise with 24/7 food offerings to satisfy any craving may sound like a welcome escape, there’s a good reason why you can’t cruise during your third trimester. Emergency medical care is limited on board and at many ports of call, and the third trimester is a riskier time for both mother and child. In the U.S., fetuses are considered viable at the gestational age of 24 weeks, but a cruise ship’s medical facilities are not equipped to care for a preterm baby.

Though you shouldn’t be out on the high seas and far from medical care towards the end of your pregnancy, you can still sail before 24 weeks. However, many cruise lines will require a doctor’s certificate stating that you are fit to travel and that your pregnancy is not high-risk. Consider looking into the best cruise travel insurance companies to learn more about coverage while pregnant.

Overseas births

If you travel internationally in a late stage of pregnancy and go into labor during your trip, normal childbirth will likely not be covered by your travel insurance policy. This means you’ll need to pay out of pocket for labor and delivery costs, as well as your family’s extended stay in your vacation destination.

However, if you experience complications during delivery, travel insurance may cover the associated emergency medical expenses.

If you give birth overseas, you’ll need to report the birth of your child as soon as possible to the nearest U.S. embassy or consulate. Keep in mind, too, that many airlines don’t allow newborns on flights.

Travel medical coverage

In addition to reimbursing emergency care expenses if you travel during pregnancy, travel medical coverage can help in a lot of other scenarios as well. Most travel insurance plans cover the costs of doctor’s visits, hospitalization, prescription medications, surgeries, emergency services (like ambulance rides and ER visits), lab tests and x-rays if you become ill or injured during your vacation. Reimbursement is up to the specific limits listed in your policy.

However, travel medical insurance won’t cover pre-existing conditions, like cancer, diabetes or asthma, unless you have an exclusion waiver. You’ll only be able to use your travel medical benefits for pre-existing conditions if you get a waiver from your travel insurance company. While pregnancy itself is not considered a pre-existing condition, some pregnancy-related complications may be.

Read up on your specific policy and ask your provider plenty of questions to find out exactly what is (and isn’t) included, the maximum dollar amount that’s covered and whether you need a pre-existing medical condition exclusion waiver.

What Travel Insurance Won’t cover if you’re Pregnant

Unfortunately, travel insurance won’t cover every pregnancy-related cost. If you’re already pregnant when you purchase travel insurance, you won’t be covered for trip cancellation due to normal pregnancy. This means that even if morning sickness has made the thought of vacationing in Cozumel unbearable, it isn’t a covered reason to cancel your trip. If you’re entering late-term pregnancy and your doctor advises you not to travel as a precaution, you won’t be covered for trip cancellation because there aren’t any complications with your pregnancy.

Normal pregnancy care expenses incurred during your trip won’t be covered, even if you have a waiver for pre-existing conditions. This includes the costs of routine office visits and ultrasounds. You can’t recoup expenses associated with uncomplicated childbirth, either, should you go into labor on your trip.

Other pregnancy-related costs that are excluded from coverage include traveling to seek medical advice or treatment, fertility treatments and any trips you take when you’re not approved by your doctor to travel.

Best practices for getting Travel Insurance for Pregnancy

To maximize your protection, keep these best practices in mind as you search for travel insurance when pregnant.

Purchase your policy early

If you’re getting travel insurance, it should be one of the first things you check off on your vacation to-do list. Purchase a plan as early as possible to give yourself the best chance at trip cancellation protection. The best travel insurance companies have plans with benefits for nonrefundable trip costs and unexpected events like delays, loss of luggage and medical emergencies.

If you buy a plan right after booking your tip, you may also be eligible for cancellation upgrades that make travel insurance even more accommodating for pregnant individuals.

Research local medical facilities in your destination country

While you’re looking into some of the best international places to travel , you’ll also want to research local medical facilities. Find out where the closest hospital is to your destination and what its capabilities are should you go into early labor or experience complications during your trip.

If you’re embarking on international travel while pregnant, you might also consider purchasing emergency medical evacuation insurance that will cover you if you need care beyond what’s locally available. This type of insurance can reimburse you for medevac costs if you need to be transported to a more adequate medical facility that’s further away — or even all the way back home.

Check airline restrictions for pregnant travelers

Unfortunately, travel insurance won’t reimburse you for a missed flight if your carrier doesn’t allow you to board. As with cruises, airlines have specific rules about traveling while pregnant, and travel insurance companies consider it your responsibility to research restrictions for pregnant travelers.

Some carriers require a doctor’s certificate to fly during later stages of pregnancy. For example, if you want to board during or after 36 weeks of pregnancy, United Airlines requires you to provide an obstetrician’s certificate stating that you’re cleared to travel, dated within three days of departure.

What’s the best Travel Insurance for Pregnancy?

Cancel for any reason travel insurance (CFAR) may be a great travel insurance option when you’re pregnant. While basic travel insurance policies will only cover trip cancellation under certain circumstances, cancel for any reason insurance allows you to call off your trip for any reason at all and still receive partial reimbursement for nonrefundable trip costs.

This type of travel insurance is a rider that you can add to your basic policy. It will likely increase the cost of your travel insurance by about 50%, but depending on your plan, it can pay up to 75% of nonrefundable trip costs. Typically, you’ll have up to two weeks from when you make your first trip deposit to add a CFAR rider to your plan.

Not all travel insurance plans offer cancel for any reason upgrades, so check with your provider to see if they’re available.

When should you Stop Traveling when Pregnant?

Determining when you should stop traveling when pregnant is a decision you make in partnership with your doctor. The Royal Academy of Obstetricians and Gynaecologists (RCOG) and the International Air Travel Association (IATA) recommend that individuals with normal pregnancies avoid air travel beyond the 37th week. Those with risk factors, such as carrying twins, are recommended to stop traveling after 32 weeks of pregnancy.

Keep in mind that cruise lines and airlines impose their own restrictions on pregnant travelers. Also, buses, trains and planes often have small bathrooms and narrow aisles that can be difficult to navigate while pregnant, and the motion of a cruise ship can worsen morning sickness.

Before you travel internationally, you should also talk with your doctor about immunizations and other safety considerations for yourself and your baby.

Does Travel Insurance cost more when Pregnant?

No, getting basic travel insurance while pregnant won’t cost more than usual. However, add-ons such as CFAR riders can increase the cost of your plan while also providing additional benefits.

Travel Insurance when pregnant can give you peace of mind

Getting travel insurance when pregnant can enhance your vacation experience by alleviating some of your biggest worries. With many policies, you can rest assured that you’re covered if you experience complications during your trip, if you unexpectedly become pregnant after purchasing travel insurance or if your doctor advises you not to travel due to an unforeseen complication. For extra protection, you can also add a cancel for any reason rider to your plan.

With so many different companies and policies out there, be sure to shop around to find a travel insurance plan that best meets your needs. Some of the best travel credit cards also have limited travel insurance benefits, in addition to bonus miles, rental car upgrades and more.

If you’re traveling while pregnant, ask plenty of questions of your insurance provider to help you plan for every situation possible.

© Copyright 2023 Money Group, LLC . All Rights Reserved. This article originally appeared on Money.com and may contain affiliate links for which Money receives compensation. Opinions expressed in this article are the author's alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Offers may be subject to change without notice. For more information, read Money’s full disclaimer .

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

More Related Articles

This data feed is not available at this time.

Sign up for the TradeTalks newsletter to receive your weekly dose of trading news, trends and education. Delivered Wednesdays.

To add symbols:

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

- Copy and paste multiple symbols separated by spaces.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.

- Type a symbol or company name. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return.

Opt in to Smart Portfolio

Smart Portfolio is supported by our partner TipRanks. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use .

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Travel During Pregnancy: What Does Travel Insurance Cover?

Some of the most common questions we get at Allianz Global Assistance are about traveling while pregnant. While most pregnant women can safely travel without incident, sometimes complications arise and customers wonder, "What does travel insurance cover?"

Here’s the quick answer: Travel insurance can cover certain situations that result from unforeseen pregnancy complications, or a pregnancy that occurs after you’ve purchased your plan. Travel insurance typically does not cover trip cancellations or other travel losses resulting from normal pregnancy.

Like any other kind of insurance, travel insurance includes specific coverage definitions and restrictions. Read your agreement carefully, and if you have any questions about coverage, call. Pregnant women should consult their doctors with concerns and questions about safe travel.

If you’re pregnant, or you might be soon, it’s wise to protect upcoming trips. Maximize your coverage window by purchasing travel protection as soon as possible. Our most popular plan is OneTrip Prime , which includes substantial benefits for trip cancellation/interruption and medical emergencies.

Read on for a detailed guide to travel insurance and pregnancy from Allianz Global Assistance.

Pregnancy Complications: What Does Travel Insurance Cover?

You're in the first trimester of your pregnancy and feeling fine — until you begin feeling extremely nauseous a week before you're supposed to fly to New York on business. Your doctor diagnoses you with hyperemesis gravidarum, a severe and serious form of morning sickness, and you end up in the hospital on the day of your scheduled flight. Can travel insurance reimburse you for the canceled trip?

Yes. Travel insurance from Allianz Global Assistance can cover losses resulting from unforeseen pregnancy complications, such as pre-eclampsia, gestational diabetes or hyperemesis gravidarum. That means your travel insurance may reimburse you for nonrefundable trip costs lost if you must cancel or interrupt your trip because of pregnancy complications. The illness, injury, or medical condition you’re experiencing must be disabling enough to make a reasonable person cancel their trip, and a doctor must advise you to cancel it. For example, normal morning sickness would not be a covered reason for trip cancellation. When you’re filing a claim for trip cancellation/interruption related to a pregnancy complication, you’ll need documentation from your physician.

All travel insurance plans from Allianz Global Assistance include access to 24-Hour Emergency Assistance . If you experience a medical emergency while traveling, or any other problem, contact our hotline via phone or the TravelSmart TM app for rapid assistance. If your plan includes emergency medical benefits, your insurance may reimburse you for the cost of emergency medical care that you received for covered pregnancy complications while traveling.

Please note that travel insurance does not cover the chance that a complication might occur. For example, if you delivered prematurely with your first two pregnancies, your doctor might advise you to cancel the trip to Paris you planned for the sixth month of your third pregnancy. However, this is still considered a normal pregnancy because no complication has been diagnosed. Travel insurance would not cover the trip cancellation.

Surprise Pregnancy and Trip Cancellation

You and your spouse are planning a week-long European river cruise to celebrate your third anniversary. Tickets are hard to come by, so you book your trip a year in advance. You schedule the flights and purchase your travel insurance — and two months later, you discover you're pregnant. Will travel insurance cover your trip cancellation?

On some plans, Allianz Global Assistance lists pregnancy as a covered reason for trip cancellation if you find out you are pregnant after purchasing your policy. For your trip cancellation to be covered, you must provide medical records to verify the pregnancy occurred after that date. Please see your policy documents for your plan’s specific coverage. And if you’re planning a trip now, don’t wait to buy travel insurance! Get a quote today.

Late-Term Pregnancy and Trip Cancellation

You decide to plan a babymoon getaway so you and your sweetie can enjoy some time together before the baby arrives. You book your plane tickets and a bed-and-breakfast on the beach. You're feeling fine and getting excited. Then your doctor advises you, as a precaution, not to travel in the eighth month of pregnancy. Will travel insurance cover this pregnancy-related trip cancellation?

No. In this scenario, there are no medical complications with your pregnancy, so the cancellation will not be covered. Please understand that Allianz Global Assistance is not disagreeing with your doctor's recommendation not to travel — you should do what's best for you and your baby's health. However, most travel insurance plans from Allianz Global Assistance do not include normal pregnancy as a covered reason for trip cancellation (except as described above.)

Airline Rules for Flying While Pregnant

You're flying to Los Angeles to see your sister one last time before the baby's born. But when you get to the gate, the airline won't let you on board because you're too close to your due date. Will your travel insurance plan reimburse you for the missed flight?

No. Being refused service by a carrier because of normal pregnancy is not a covered reason for trip cancellation. Cruise ships and airlines have very specific rules about travel while pregnant. Here are selected airline pregnancy policies, but you should also call your travel supplier to check before you book your trip. Please note that this information is subject to change.

- American Airlines: A medical certificate is required to fly within four weeks of your delivery date in a normal, uncomplicated pregnancy. Travel is not permitted within seven days of your due date on domestic flights under five hours, or within four weeks of your due date on international flights, unless you get a medical certificate and clearance from a Special Assistance Coordinator. 1

- Delta: Delta does not impose restrictions on flying for pregnant women. However, ticket change fees and penalties cannot be waived for pregnancy. 2

- JetBlue: Pregnant passengers expecting to deliver within seven days are prohibited from travel, unless they provide a doctor's certificate dated no more than 72 hours prior to departure stating that the passenger is physically fit for air travel and that the estimated date of delivery is after the date of the last flight. 3

- Southwest: Southwest has no pregnancy prohibitions, but recommends against air travel beginning at the 38th week of pregnancy. 4

- United: To fly in or after your 36 th week of pregnancy, you must provide the original and two copies of an obstetrician’s certificate, dated within three days (72 hours) prior to your flight departure, that says you’re fit to fly. 5

Travel Insurance and Childbirth

You're enjoying your babymoon vacation in Cozumel when suddenly you feel the first twinge of labor. Twelve hours later, you're the proud mother of a baby girl. Will travel insurance cover the cost of labor and delivery?

No. Normal childbirth is not covered by travel insurance from Allianz Global Assistance. However, if complications arise in delivery, the costs of emergency medical care may be covered. Also, attending the childbirth of a family member can be a covered reason for trip cancellation, depending on your plan.

While travel insurance from Allianz Global Assistance can't cover every possible pregnancy scenario, we want to do our best to help! Our Assistance team is available 24 hours a day to provide expert advice and aid.

Related Articles

- Traveling While Pregnant: Key Considerations

- The Essential Packing Checklist for Flying With An Infant

- Great Babymoon Destinations in the US

- JetBlue.com

- Southwest.com

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

Friendly Call Centre

0330 053 3747

01279 967019

Monday to Friday 9am - 7pm. Saturday and Sunday 9am - 5.30pm. Customer service: Monday to Friday 9am - 5pm." class="underline" >Opening times

- { if ($data.searchOpen) $refs.searchInput.focus(); })"> Search

- Get quote Retrieve quote

Pregnancy travel insurance

Pregnant? No Problem

We provide travel insurance that covers you to holiday abroad when you when you are pregnant.

- 24-hour emergency medical support

- Covid-19 cover included

- Retrieve quote

Awards & Accreditations

Total Travel Protection is brought to you by Ancile Insurance Group Limited who have been specialising in travel insurance cover for medical conditions and older travellers since 2010.

Travel insurance cover when you are pregnant

Being pregnant is not an illness and it certainly doesn’t prevent you from travelling abroad for a holiday, but you should make sure you are properly covered by your travel insurance.

Suffering pregnancy complications abroad which result in emergency medical treatment could work out costly if you are not covered by insurance.

All travel insurance policies from Total Travel Protection will provide our standard levels of cover for you to travel when pregnant, up to 28 weeks for a single pregnancy or 24 weeks for a multiple pregnancy, so long as your airline or transport provider is happy to carry you and you are not travelling against your doctor’s advice.

From 29 weeks (25 weeks for a multiple pregnancy) there are some restrictions to cover, please see the details below.

There is no extra charge for travel insurance if you are pregnant and you don’t need to declare your pregnancy when you buy your policy.

Travel insurance cover and benefits

- Emergency medical & repatriation up to £10 million (Platinum Cover)

- 24 hour emergency medical assistance

- Cancellation cover up to £6,000 (Platinum Cover)

- Cover for mobility aids and prescription medication

- Personal property up to £3,000 (Platinum Cover)

- Personal liability up to £2 million (Platinum Cover)

- Legal expenses up to £25,000

All travel insurance policies from Total Travel Protection provide the following cover if you are pregnant:

You will be covered to travel up to week 28 of a single pregnancy, or week 24 of a multiple pregnancy as long as your airline or other transport provider is happy to carry you and you are not travelling against doctor's advice.

We will provide emergency medical expenses and cancellation cover for pregnancy and childbirth up to week 28 for a single pregnancy and for a multiple pregnancy up to week 24.

From week 29 – 40 (or week 25 - 40 for a multiple pregnancy) cover for medical expenses and cancellation cover is only provided if complications occur.

Pregnancy travel insurance – the details

Our policies are designed to include cover under the Cancellation section, Curtailment section and Medical and Repatriations Expenses section for Pregnancy and Childbirth from week 0 to week 28 inclusive for a single pregnancy, or week 0 to week 24 inclusive for a multiple pregnancy, whilst you are away.

From the start of week 29 and up until week 40 for a single pregnancy, or the start of week 25 and up until week 40 for a multiple pregnancy, cover is only provided under the Cancellation section, Curtailment section and Medical and Repatriations Expenses section if any of the following complications arise: Toxaemia, Gestational hypertension, Ectopic pregnancy, Post-partum haemorrhage, Pre-eclampsia, Molar pregnancy or hydatidiform mole, Retained placenta membrane, Placental abruption, Hyperemesis gravidarum, Placenta praevia, Stillbirth, Miscarriage, medically necessary Emergency Caesarean, A termination needed for medical reasons, Premature birth more than 12 weeks (or 16 weeks if you know you are having more than one baby) before the expected delivery date.

The policy will not cover any claims relating to normal pregnancy or normal childbirth.

Please note we will not cover denial of boarding by your carrier, so you should check that you will be able to travel with the carrier/airline in advance.

It is essential, if at the time of booking your trip you are aware that you are pregnant, that you ensure that you are able to have the required vaccinations for that trip; no cover will be provided for cancellation in the event that, after booking you discover travel is advised against, or you are unable to receive the appropriate and required vaccinations for that country.

Please make sure your Medical Practitioner and Midwife are aware of your travel plans, and that there are no known complications, and you are fit to undertake the planned trip.

Our travel insurance to cover your pregnancy online, 24 hours a day, 7 days a week.

Travel cover by phone

If you’d like to speak to someone about your travel insurance requirements, our fully trained team will be happy to take your call.

You can call us on 0330 053 3747

We are open Sales:Monday to Friday 9am - 7pm.Saturday and Sunday 9am - 5.30pm.Customer service:Monday to Friday 9am - 5pm..

Additional cover options

Additional cover including gadget, natural catastrophe and waiting list cover can be selected during the quote process.

Natural catastrophe

Natural catastrophe provides extra travel insurance cover for cancellation and unexpected additional expenses caused by catastrophic natural events such as hurricanes, fire, flood and volcanic eruptons. Read More

Gadget cover

This optional cover extends your travel insurance to include cover for loss, theft and damage to your gadgets, such as phones, tablets and smartwatches whilst you are away on your holiday. Read More .

Hazardous sports and activities

Our travel insurance policies provide cover for a number of sports and activities as standard, including trekking up to 2000 metres, sailing within 12 nautical miles of shore and glass bottomed boat trips. Additional cover for more adventurous activities can be added. Read More

Missed connection cover

Ideal for cruise, coach or rail holidays that start from an overseas location, our Missed Connection option extends your travel insurance to include cover for additional expenses if you miss a connecting flight, ferry, cruise ship, train, or motor vehicle as a result of a delay to your initial international outbound transport.

Terrorism cover extension

Our terrorism cover extension provides additional travel insurance cover to enable you to cancel or cut short your trip if a terrorist act occurs within a 40-mile radius of your pre-booked accommodation.

Pet cancellation cover

This option extends the cancellation and curtailment section of your travel insurance to include unrecoverable holiday costs, such as transport, accommodation, and foreign car hire, if your pet dog or cat needs emergency life-saving treatment. Read More

Additional waiting list cover

Additional cancellation and curtailment cover if you are on a waiting list for treatment or investigation for a diagnosed condition.

- { if ($data.searchOpen) $refs.searchInput.focus(); } )">

You are using an outdated browser. Please upgrade your browser to improve your experience.

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

- Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

What is ABTA?

Over 60 million people travel from the UK most years for holidays or business. The vast majority enjoy smooth, trouble-free journeys. Sometimes, though, things go wrong.

Perhaps you don't receive the service you expected. Or your travel company runs into financial problems. ABTA may be able to give urgent spport. But few people know about the protection it offers.

Posted: 22/8/2022 | By Amanda Duffy

ABTA is the operating name of what was formerly known as the Association of British Travel Agents. Founded over 60 years ago, ABTA is the UK’s largest travel association, representing travel agents and tour operators. ABTA protection is designed to enforce standards and provide insurance for holidaymakers in the event of financial problems for travel companies.

What does ABTA do?

The name ABTA means that holidaymakers are afforded protection. It is specifically designed to cover holidays bought in the UK that don’t include flights. So, if you buy a land or sea based package holiday, such as a coach, rail or cruise holiday from an ABTA member, your money and holiday will be protected by ABTA’s financial protection scheme.

Need extra protection? Consider travel insurance for you and your family before you go.

What does abta protected mean.

ABTA protection means that if your travel company goes out of business, you will be entitled to a refund which includes hotel costs. If you are abroad, your transport home will be covered. It provides a quick, clear and simple process to follow, so you are able to continue your holiday as planned, or get your money back.

How else can ABTA offer protection?

ABTA also has a Code of Conduct which governs areas such as accurate advertising, fair terms of trading, changes to bookings and managing customer complaints, plus guidance on providing travellers with the right paperwork and handling complaints. An ABTA member cannot cancel your booking after the date for payment of the full price unless it is necessary to do so for reasons outside its control. If this happens, it must offer you the choice of getting all your money back or choosing alternative travel arrangements. Moreover, if there is a significant change to your travel arrangements they must offer you the choice of accepting the changed travel arrangements or getting your money back.

All ABTA members have to abide by its code and those that breach it can face sanctions from the organisation.

What is the difference between ABTA and ATOL?

ATOL (Air Travel Organiser’s Licensing) sits alongside ABTA but is specifically designed to cover people who fly. Whereas ABTA covers rail, road, or sea travel holidays. Many ABTA tour operators also provide bonds to the Civil Aviation Authority under the ATOL scheme.

How do I know if I’m covered by ABTA?

You should always check your travel company is ATOL and ABTA protected. Check your receipt shows the name of the company that's providing the holiday service - for example, the tour operator. Where your holiday services are being provided by more than one company, you should receive a separate receipt for each service. Ensure that the name that appears on the receipt is the name of the company to which the payment is made.

This information should also be clearly listed on company websites and covered on the certificates that are legally provided. Be sure to take your protection certificate in case of an emergency while you’re away.

How to make a complaint to ABTA

If you’ve been unable to resolve your issues with your tour operator or received no reply from them within 28 days you can appeal to ABTA. It provides an arbitration scheme and will apply its strict guidelines.

To complain go to ABTA’s online complaints hub

You will need to provide all documentation and copies of all relevant correspondence. ABTA will reply within seven days and attempt to resolve your dispute.

Do I still need travel insurance if a company is covered by ABTA?

Even if a company is an ABTA member you still need to take out personal holiday insurance covering personal effects, delays and medical issues.

Interested in travel insurance?

Other travel products.

Order foreign currency online or in selected branches. Pick up in any branch or get it delivered to your home.

One prepaid Mastercard™ that stores up to 22 currencies.

Get your passport application right the first time. We can even complete and submit it for you digitally.

This might interest you

ATOL stands for Air Travel Organisers' Licensing, a scheme that helps make sure ...

The last thing you want to happen on holiday is standing the luggage carousel ...

Learn the difference between embassies and consulates, and why you might need ...

Finding out that your airline or holiday company has gone bust is a shock – ...

Exploring the globe can be scary, but there’s so much to find at the edge of ...

There’s nothing worse than falling ill while away from home. Along with the ...

Most of the time, getting a flight is a hassle-free event. If you only take ...

IMAGES

VIDEO

COMMENTS

Accidents Happen. Get Travel Insurance Protection. Worldwide Coverage. Compare Plans. Expert Reviews & Analysis. Ratings Updated June. Trusted by Over 1,000,000 Customers

Compare coverage, review travel protection plans with our Cancel for Any Reason benefit! Protect the cost of your hotels while you're on the road. Travel secure!

Our revamped travel app's out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user experience.

Travel insurance companies use different definitions for "complications of pregnancy," so be sure to ask for details when choosing a travel insurance plan. The most generous travel insurance ...

Trip cancellation or interruption due to pregnancy. Most travel insurance policies will reimburse you for all or a portion of your nonrefundable travel costs if you have to cancel your trip for a ...

Most travel insurance policies, including those provided by the post office, will only provide coverage for pregnancy-related expenses up to a certain number of weeks into the pregnancy. This timeframe can vary depending on the specific policy, so it is important to review the terms and conditions of your policy to understand what coverage you ...

You can purchase travel insurance anytime during pregnancy; however, most US airlines restrict airline travel for moms-to-be once they reach 36 weeks, and some international airlines and cruises ...

For those coming to the U.S., at this time, Good Neighbor Insurance does not carry a plan for maternity coverage to cover the birth for a person who is already pregnant. All of our long-term insurance plans have a minimum of 10-12 months waiting period for maternity coverage. We cannot recommend a plan for those wanting to have coverage for a U ...

When it comes to travel insurance, however, there are a number of restrictions. In general, travel insurance for pregnant women covers the same benefits as any other travel insurance: emergency medical expenses, medical repatriation, personal liability, lost and stolen luggage, and flight cancellations, but there are certain limitations, rules ...

Take plenty of breaks. Stay hydrated. Add a SafeTrip travel medical insurance and travel protection policy to your trip for the extra confidence knowing you are covered against unexpected medical expenses and itinerary changes. This way, you can have fun and take all those pregnancy photos in special places which can serve as a lifelong memory.

If you start getting pregnancy-related complications during your trip, your medical expenses can be reimbursed with travel insurance that covers pregnancy, up to policy limits.

Even if a pregnancy occurs after the purchase of the insurance, you must provide proof that the conception date of your pregnancy was after the effective date of the travel insurance. That is, your physician will have to provide a document that indicates so. Otherwise, it would be considered a pre-existing condition and there will be no coverage.

Get a quote today to see if we can cover you. If you have a serious pre-existing medical condition that Post Office Travel Insurance cannot offer cover for, the Money and Pensions Service (MaPS) have launched a travel insurance directory listing companies that may be able to help you. You can also call 0800 138 7777.

Yes. Travel insurance from Allianz Global Assistance can cover losses resulting from unforeseen pregnancy complications, such as pre-eclampsia, gestational diabetes or hyperemesis gravidarum. That means your travel insurance may reimburse you for nonrefundable trip costs lost if you must cancel or interrupt your trip because of pregnancy ...

Suffering pregnancy complications abroad which result in emergency medical treatment could work out costly if you are not covered by insurance. All travel insurance policies from Total Travel Protection will provide our standard levels of cover for you to travel when pregnant, up to 28 weeks for a single pregnancy or 24 weeks for a multiple ...

Travel insurance policies don't cover fear of travel. But with CFAR coverage it doesn't matter what your reason is—you can get partial reimbursement of your non-refundable trip costs.

Allianz has been great for travel pre-pregnancy. Now that I'm pregnant, I've been spending the extra money on refundable hotels (usually up to 24 hours before check-in) and delta flights which you can change at any time for free or the cost difference only or you might get a credit if price is lower. Haven't found any travel insurance ...

Special Coverage for Pregnancy. Fortunately for moms-to-be, most travel insurance providers offer special coverage for pregnancy. Note that most doctors advise against traveling during the third trimester, which is when pregnant women tend to be particularly vulnerable to complications. Most policies only cover pregnant travelers for ...