- भारत सरकार GOVERNMENT OF INDIA

- वित्त मत्रांलय MINISTRY OF FINANCE

- Skip to Main Content

- Screen Reader Access

Travelling Allowance and Related matters

Website Content Managed by Owned by Department of Expenditure, Ministry of Finance, Government of India

Designed, Developed and Hosted by National Informatics Centre (NIC )

Last Updated : 22 August, 2024

Visitors : 3106842

- 7th Pay Commission

- Privacy Policy

- Post office

- Seventh Pay Commission

- 4th to 7th CPC

- Implementation of 7th CPC

- 7th CPC Recommendation

- Seventh Pay Commission Report

- 7th CPC Notification

- CGHS Clarification

- cghs empanelment

- CSD – FAQ

- Latest Price List and Contact Details

- CSD Purchasing Process

- AFD Dealer Contact Details for 4/2 wheeler prices

- Four Wheelers Available

- 2 Wheelers – Availability List

- List of Holidays

7th CPC TA Rules: Travelling Allowance on Transfer

RECOMMENDED FOR YOU

As per SR-116 (b) (ii) no travelling allowance would be admissible if a member added to the family after issue of transfer order. My query is :- (i) which date is taken in this case; (a) date of issue of transfer order or (b) date of move mentioned in Tfr order. since move is not implemented on due date due to administrative reasons. (ii) Whether transfer of luggage from old duty stn to new stn can be claimed as per entitlement?

Siir, For transport of personal belongings by road our office is paying only the rate in km multiplied by the proportional(proportion of max weight allowed by steamer) weight, though the circular says by kilometer only. Is this the correct practice.

Transportation of personal effects by road is as per kilometer basis as per entitlement maximum weight only irrespective of weight of personal belongings.

Dear sir I am mahesh recently i have transferred from Hyderabad to Vijayawada, Hence what are the entitlements i will get and how much reupees i will get I have paid for personal effewcts Rs.13700/-, Bus ticket Rs.1200/- if any other benefits are there please inform

I am Level-3 Employee

Sir i joined a station after completing 3 years tenure on April 3rd,at that time Itook Joining time of 10 days ,on May 12 th Iwas promoted and posted to North East, I joined at present station after relieving and taking 6 days Earned leave on 31.05.2023. I want to know whether my 1st transfer and working for 2 months before relieving to north east will be considered as on tour or not

Sir, I am a defnce employee , was posted from kashmir to Rajouri , I have produced the bills for the transportation of goods to DDO , and due to some.health issues went on medical.leave after joining the station, The laugage what was booked by me was delivered to me by the transporter , now the ddo has initiated the disciplinary action against me stating that I have not shown the laugage to him . Under which rule.am I supposed to show him.the laugage please guide.

production of transportation bill is enough, need not to show the luggage being transported. if insisted approach your higher authority.

Sir my brother is transfered in bsf from ITBP can I take advance Transfer TA if yes what is rule position.

Sir, In my Office; Reimbursement of transportation of vehicle is calculated as follows:- Distance × Rate (15/25/50) × Unladen weight of vehicle ÷ entitled weight.

Please quote the rule position/ order for the above calculation, as it is asked by PBOR through RTI.

Your early reply will be helpful a lot.

Pls clarify i have been transferred from North Andaman(Diglipur) to South Andaman(Port Blair) and what shall be my Composite Grant .Is it 80% or 100%. I work for a Govt Sector in A&N islands

I am a central government officer. my transfer order for transfer from Chennai to Delhi was issued on 08/02/2021. My relieving delayed and relieved on 05.04.2021. I performed journey on 06/04/2021. However my family moved to Delhi on 31.03.2021 because of admission entrance exam for my kids in one school in Delhi. Now PAO in Delhi says my family is not allowed for ticket fare.

Kindly clarify.

tranafer entitlement for family is also applicable 1 month prior to Transfer orders and within 6 months of transfer orders. U can find this rule in Swamy handbook, Transfer TA section as well. PAD is wrong in ur case. quote the rule and reply.

As per rules, family can go 1 month early on new posting station, or upto 6 months later of joining

Sir I detaied tempary duty from sjm to other area (oc 2019 to june 2020) but ta da given to 6 month but recovery to 7 month tpt plus coution money how is posible sir

Sir I wanted to know that if a Cpl in IAF gets promoted on 04 Jul as Sgt and his date of posting is 28 Jul then he will get CTG and other posting entitlements as per the basic pay of Sgt or as per the basic pay of last month(that is of Cpl).

Entitlement of sgt,and basic pay of July

Sir I am serving in BSF at pay matrix 6 and I get transfer on promotion from 6 to 7 level.. Now I want to know that am I eligible to claim my car transport charges..? I was travelled through by train with my family. My languages transport by truck. And my car transported by another container through transport agency..

Sir I am a central govt. employee. I took Rs 50000/- advance on transfer for composite grant and other dues. My journey date is 12.09.2020. I submitted my bill on 04.12.2020 after more than two month. My composite Grant is Rs 45000/- and train fare is Rs4000/-. My office is saying that I have to return whole Rs50000/-. I want to know whether I will get the composite grant or not?

I transferred from portblair to Chennai on public interest. What are the TTA entitlements. Pay level 12.

Sir i am central govt employee transferred on compassionate grounds. Am I eligible for TA on transfer.

Sir I m serving in bsf and posted own request on medical treatment ground in state of Punjab from Himachal. I can claim transfer ta or not

Sir, am Ravi K presently working in BSF recently am attached with staff selection commission, Bengaluru for 3 years. I have a family persmission at old locatation i.e BSF with my own car purchased with permission of BSF MY PAY LEVEL 5. kindly inform what allowance my entailed during the attachment pse

Respected Sir Myself Jitender Sharma working in ncml Pvt ltd. As a Field Associate by third party. my joining 9 march 2017 & one year of provesion period. then i am working contineue to till date my cmpany has give the change of place order via email this is change location is 70 km from my old place. can may apply for the conyance of motorecycle or no any salary increase by employer. how can take the benefits of company.

Thanks & Regards

Jitender Sharma

Sir I m not living with my family at current place of posting and if I live with family at new place of posting with permission. Am I entitled for transportation of my personal effects and conveyance of my family from my home town to new place… what are the conditions

Since it is private transfer (individual), not allowed.

Sir, I m transferred from srinagar(j&k) to patna(bihar) availing travel time and earn leave. Am I entitled for transportation of my personal effects and conveyence from home town Delhi to patna. If so what are the conditions

If your transfer is in public transfer it will be allowed.

if i go on loan basis, will i be eligible for transfer allowance? kindly reply

Office is not doing Finances business. They are having some heads of funds in Budget allotment in so many times if any body has to go transfer the in the month of February/March T.A. funds may not available during that period, actually they have to barrow from outside with more interest & they have to proceed that transfer, otherwise their salary may not be given. If he goes new place of transfer then only his salary & his T.A. claim may be given in the next Financial Year funds only.

Your basic pay, service was protected & you will get increment on 7/18.

I had joined cisf on aug 2017 and joined department of post through proper channel (technical resignation) on march 2018.Am I eligible for transfer T.A.

No, it is not official duty. It is your request.

Sir I posted from Srinagar kashmir to tura Meghalaya north east reason.i have move there single.i am entitled to draw some more then plain area or some for language charge without showingshowing transpo charges slip.some one told me that in NE reasio transfer tax is more than plain area.kindly tell me procedure please

It will be recovered, advance amount with penal interest in your salary.

Sir, please clarify whether GST charged by truck owners over admissibility amount while transporting house hold goods is also reimbursible over restricted amount while restricting with per KM rate. eg A person paid Rs. 80000/- + GST 18% Rs. 14400 for transporting his house goods from A station to B station (distance 1400 KM). He is entitled for Rs.50/- per KM. Thus his entitlement restricted to Rs.70000/- . Whether 18% GST is also reimbursable to him over 70000/- or otherwise.

Entitlement restricted to total of Rs.70,000/- only.

Sir, I am working in central govt and my transfered order came on may 2017 but I relived on 27 Sep 17 and I joined new station on 28 Sep 17 and OM regarding submission of issued on ta bill on 13.03.18 and I have submitted my ta bill on 04.04.18. Pl let me know is it in submitted in due course of time or not?

Where can I download the form for TA. I have taken VRS and am shifting to native town.

how many days a govt servent spent on training with ta da

Sir, I am working in central government department, transferred on promotion in March 2018 and accordingly I drawn TTA advance . But my transfer defer up to 31/03/2019. please let me know can I give penal interest for TTA advance if I am not refund it or not ?

Sir I am working in swr. My transfer order came on may 2017. But l relieved on 31st October 2017. I joined on new place. But I vacated my railway quarter on 30th March 2018. Due to academic year..I claimed for CTG in April lst week.. Please clarify that it applicable or not.

Sir, I am working in central government department, transferred on promotion in August 2017 and accordingly joined at new station. An OM regarding submission of TA bill issued on 13.03.2018. I have submitted my transfer TA bill on 04.04.2018. please let me know is it submitted in due course of time or not ?

Sir, I am working in Central Govt. Department. i got transfer from chennai to Delhi. my lavel is 6. whether i am eligible for flight charges or not?

Sir,i am working central govt employe and my spouse also same dept,now we going to transferred west bengal to Gujarat.so,we avail transfer ta ?

Sir I have Resigned previous Department on 18.06.2017 and joined on 19.06.2017. later on I was transferred on 20.07.2017 (400km) and from there transferred on 20.08.2017 (500km). If I am Entitled for three Composite Transfer and Packing Grant??

Sir i transfered from phaphund to jhinjhak station as a sse/sig on 31/72017 which is exactly 20 kms according to by rail. Can i get a transfer allowance and joining leave.

Sir my transfer order is 15 /4/17 but department says you claim old basic pay Please confirm I claim old basic pay or new basic pay

Revision in Allowances is applicable from 01.07.2017, any journey date should be 01.07.2017 or future.

Same in my office ,they charge on the basis of weight not on the basis of kilometres… Don’t know which rule they follow… But in rule it is clearly mentioned that charges is applicable on km basis only. Don’t know about the rule.. If any body knows please reply here ASAP

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Travelling Allowance-Certain Frequently Asked Questions

Charges for transportation of conveyance on transfer is admissible only when the conveyance is owned by the government servant..

[Q] One of the officer, on his permanent transfer from Lucknow to New Missamri preferred in his Transfer TA, claim charges for transporting a Motor Car from old station to new station registered in the name of his wife. However, CDA(O), Pune disallowed the same on the grounds that the car registered in the name of the officer alone is admissible for transportation. Please clarify.

[A] Charges for transporting the conveyance on transfer are admissible ONLY if it is owned by the Government Servant.

Time-limit for claiming TA is one year

[Q] Consequent upon the transfer of a Govt. Official in the interest of service to a place beyond 150 kms., the official has been granted Transfer TA for an amount equal to one month's basic pay. After expiry of one month from the date of his joining the new station, he has been directed by the DDO at his new office to deposit the entire amount drawn by him as Transfer TA along with an amount as interest calculated at the rate of 2% over the interest rate as applicable in GPF on the ground that the adjustment bill in respect of the Transfer TA has not been submitted within one month from his joining the new office. Kindly clarify whether the action of the DDO is in order.

[A] As per SR 194-A of "Swamy's Compilation of FR & SR – Part –II – Traveling Allowances Rules" claim for TA is to be preferred within one year. The action taken by your office is therefore, not in order. The one month time limit referred by your office is applicable to LTC claim only.

Production of Railway tickets along with TA claim is not compulsory

[Q] One of our Sr. Private Secretary who was transferred from Chennai to Mumbai submitted his Transfer TA claim. For his total 3 journeys, he has submitted two original tickets and for bringing family he has mentioned PNR number and ticket not enclosed as the same was lost. However DDO is insisting to produce the tickets. Kindly clarify whether production of ticket is compulsory ?

[A] There is no rule to demand the train tickets as the same are to be surrendered to the Railway Authorities at the destination station. Hence furnishing of PNR/Ticket number will be sufficient.

Option to claim either normal TA or conveyance hire charges for local journey beyond 8 kms, but within municipal limits.

[Q] In accordance with the earlier orders if a Govt. servant performs journey in the public interest within a radius of 8 kms, from his headquarters, he is entitled to reimbursement of actual conveyance charges in respect of the expenditure incurred by him in hiring taxi/scooter, etc. However, with the deletion of the words "a radius of 8 kms" a doubt has arisen whether a Govt. servant who performs the journey to or/and a place beyond a radius of 8 kms but within the municipal limits of the city in which his Headquarters is situated, will be entitled to Travelling Allowance or reimbursement of conveyance hire charges. While a plain reading of the amended para 1(a) in the said Annexure indicates that he shall be entitled to normal traveling Allowance (as admissible within the municipal limits), a doubt has been raised in certain quarters that even when the local journey is performed beyond a radius of 8 kms, from Headquarters, whether the claim shall be in the form of TA or merely reimbursement of actual conveyance hire charges. To exemplify, Sewa Bhawan in RK Puram is at a distance of about 8 kms from Shram Shakti Bhawan and a specific doubt has been raised whether in such circumstances a Govt. servant shall be entitled to normal TA or reimbursement of conveyance hire charges.

[A] Government Decision: For local journey performed by a Govt. servant in public interest within municipal limits but exceeding 8 kms, Govt. servant can either to claim reimbursement of conveyance hire charges under the D.F.P.Rs or to claim traveling allowance under the normal TA Rules.

Road mileage admissible between residence and Railway Station on both ends while on tour.

[Q] One of the Government Employee has traveled by his own car on official tour from his residence at New Delhi to Chandigarh and claimed road mileage, i.e., taxi fare from his residence at New Delhi to New Delhi Railway Station and AC-II-tier fare, i.e., entitled class fare from New Delhi Railway Station to Chandigarh Railway Station. The Accounts Section restricted his claim to New Delhi Railway Station to Chandigarh Railway Station only and denied the road milage he claimed for the travel by his own car from his residence to New Delhi Railway Station. Kindly clarify whether road mileage from residence to Railway Station is admissible or not.

[A] As per GID (2) below SR 46, the official is entitled to Road Mileage between residence and Railway Station at both ends.

Sir, I am posted at Gangtok, Sikkim. The nearest railway station / airport is at New Jalpaiguri (NJP)/ Bagdogra, West Bengal. So, while in office tour at Delhi, Kolkata or so may I claim the hired / reserved taxi fare from Gangtok to NJP/ Dagdogra and NJP / Bagdogra to Gangtok while on return journey. The distance of NJP from Gangtok is 125 Km & taht of Bagdogra is 135 Km. Please clearify the matter. regards, Gautam Kr. Paul, NIC-Sikkim State Unit.

I am central govt employee and have transported my belongings by road consequent upon my transfer from hyderabad to Delhi.

i have claimed the transport charges against the bill provided by the movers and packers. I am in the grade pay of Rs.4600 and so I am entitled for Rs.37.50 per Km for maximum of 60 quintals of goods. however, the my office says that I will be getting the charges only as per the rates of Rail/CONCOR.

I am afraid that rail charges would be too low and they have written to the CONCOR for the tariffs. and Rail authorities have replied by saying that the rate is Rs.1920/- per ton.

please tell me if there is any circular which says that i will be getting TA as per RAilway rates or I am eligible to get road rates. Please reply

I am a employee of central govt. with a grade pay of Rs 4200, under which i am entitled to travel in 2nd AC .Will i get reimbursed for my 2nd Ac entitlement, if i travel by air and whatever the difference amount i am ready to pay for that.

I was transferred from gwalior to jaipur. My familywwaswwith me in gwalior. In jaipur there is no govt quart are availabl. Hence I quit my family in odisha. Gwalior to my home town 1250 km and jaipuris 350 km. When iI claim transfer ta my office ccalculate only from ggwalior to jaipur but not home town. Plz clarify.

WHEN AN EMPLOYEE WHILE RETURNING FROM TOUR (TRAINING) AVAILING CASUL LEAVE AND GOING TO HIS NATIVE PLACE FROM THE PLACE OF TRAINING . hOW THE CLAIM SHOULD RESTRICTED? WHETHER N ATIVE PLACE TO HQ OR THE PLACE OF TRAINING TO HQ

How to calculate DA and TA in TA claim form?

How to calculate DA and TA in TA claim form? I’m a state govt employee with gp of rs 3200/-.

One of the our official, transferred from Shahdol (Madhya Pradesh) to Ahmedabad (Gujarat). claimed Rs.38,000/- (Rs. Thirty-eight thousands only) charges for transporting a Motor Car from old station to new station. What is the ceiling of it ? Any rates, available for that?

one officer was transferred from Surat to Ahmedabad and brought only some of his goods which were necessary for day to day life. He claimed only one component of transfer TA i.e one month’s basic of his salary and was paid to him . Subsequently his brought the remaining goods and his family at Ahmedabad. Now he is claiming the remaining components of transfer TA i.e cost of personal effect travelling allowance and cost of transportation of scooter. Can DDO object to this? ,

Comments are closed.

Travelling Allowance Rules – Journeys on Transfer

7. entitlements for journey on transfer:.

I. Unless it is otherwise indicated in this para, the entitlements of a Govt. employee for journey on transfer shall continue to be guided by the provisions laid down in rule 99 read with 100 of the West Bengal Service Rules, Part – II .

II. In supersession of Finance Department Memo No. 5299-F, dt. 01.06.90, a Govt. employee on transfer will be entitled to the following concessions:

A. Transfer Grant & Packing Allowance:

The rates of lump sum transfer grant and packing allowance will be as follows:

Notes: Packing allowance is admissible to a Govt. employee subject to the conditions detailed below:

- Packing allowance is in the of lump sum transfer grant and is sanctioned at flat rate. The same can be sanctioned without insisting on production of receipts relating to packing of personal effects.

- Packing allowance will be admissible if any quantum of luggage is carried by the officers irrespective of the fact whether he has claimed transportation charges for the personal effects or not.

- Packing allowance is admissible even if the officer does not shift his family but shifts his personal effects.

- Packing allowance is admissible in full even if the officer carries only very little personal effects.

- Full amount of lump sum transfer grant and packing allowance will be admissible only when a change of residence is involved as a result of transfer and the transfer involves a change of station located at a distance of more than 20 km from each other.

- For transfer to a station which is at a distance less than 20 km from the old station and for transfer within the same station, the lump sum transfer grant and packing allowance will be restricted to one-third of the admissible amount provided a change of residence is actually involved.

B. Accommodation and Mileage Allowance for journeys by rail, steamer or by road:

(I). Journey by rail or steamer:

Accommodation and mileage allowance entitlements as prescribed in paras 2B and 2C above for journeys on tour between place connected by rail or steamer will also be applicable in case of journeys on transfer.

(II). Journey by road:

Where the Government employee himself with the members of his family travels by road on transfer, the entitlement will be in the following scale:

(a) Between places connected by rail:

Road Mileage, limited to rail mileage by the entitled class.

(b) Between places connected by road only:

(i) For journeys in full taxi or own car: Road mileage at Rs. 5 per km as under notwithstanding how the govt. employee and the members of his family travelled:

ii) For journey by bus: Actual bus fare for self and each member of the family.

C. Carriage of personal effects on transfer:

(a) When personal effects are carried by rail:

The pay range and the entitlement for carriage of personal effects will be as follows:

b) When personal effects are carried by road between places connected by rail:

A govt. employee carrying goods by road between places connected by rail may draw actual expenditure on transportation of personal effects by road or the amount admissible on transportation of the maximum admissible quantity by rail plus an additional amount not more than 25% thereof whichever is less.

(c) When personal effects are carried by road between places not connected by rail:

The allowance for carriage of personal effects between places connected by road only will be at the following uniform rates subject to existing conditions:

D. Transportation of Conveyance on transfer:

Subject to the existing conditions, the following modifications are made in the rules regarding transportation of conveyance on transfer:

(a) A Govt. employee on transfer shall be entitled to transportation of conveyance in the following scales:

(b) The rates of allowance for transportation of motor car or motor-cycle/ scooter by road on transfer shall be as follows subject to the existing terms and conditions:

E. Additional to and fro fare by entitled class to a Government employee on transfer:

An employee will be entitled to an additional fare by the entitled class for both onward and return journey, in addition to the normal transfer travelling allowance entitlement, if he has to leave his family behind because of non-availability of Government residential accommodation at the new place of posting:

Provided that-

(i) where the Government accommodation is available and the Officer does not accept the Government accommodation allotted to him on the ground of being of lower category or for any other reason, he will not be entitled to the additional fare, as the Government accommodation is available and the Officer had refused it;

(ii) where a Government employee brings family before actual allotment, in such cases, if T,AD. A. has been claimed for such family members, no additional fare will be admissible to the Government employee;

(iii) non-availability of private accommodation will not be treated as a ground for additional fare.

8. Travelling Allowance for Temporary Transfer:

In all cases of transfer for short periods not exceeding one hundred and eighty days, the journeys from the Headquarters to the station of deputation and back may be treated as on tour for purposes of regulating travelling allowance and daily allowance. Daily allowance will be paid for the halts at the out-station as per para 3(11) of this Annexure. Every transfer order should specify whether it is a regular transfer or a temporary transfer for a period not exceeding 180 days.

- No advance of pay will be allowed in the case of temporary transfer.

- No joining time shall be admissible in cases of temporary transfer. Only the actual transit time, as admissible in case of journeys on tour, shall be admissible.

- In order to obviate difficulty in Audit, the nature/ period of transfer is to be indicated in the T. A. Bill.

- The period of 180 days for drawal of daily allowance for halt at an out-station on temporary transfer will be calculated on the basis of the halt which will being from the time the forward journey ends at the out-station and will end at the time the return journey commences. The claim for daily allowance for halt at the new station will require countersignature of the Controlling Officer in respect of the post at the new station, in case of any portion of the claim remaining undrawn on retransfer to the old Headquarters.

- Save the provisions laid down above in the matter of regulating travelling allowance/ daily allowance and joining time in the case of temporary transfer, on other factors like assumption of charge of a new post, change of Headquarters, drawal of pay and allowances of the post etc. associated with the term ‘transfer’ defined in rule 5 (40) of the West Bengal Service Rules, Part-I, the normal rules shall continue to apply.

9. Travelling Allowance entitlement to the State Government employees on retirement:

Notwithstanding the provisions laid dawn in rule 132 of the West Bengal Service Rules, Part-II, travelling allowance will be admissible in respect of the journey of a retiring Government employee and members of his family from the last station of his duty to his home town or to the place where he and his family is to settle down permanently, even if, it is other than his declared home town subject to the following terms and conditions:

(a) Accommodation and Mileage allowance for journeys by rail, steamer or by road:

Entitlements shall be as for journey on transfer laid down in para 7 of this Annexure.

Explanation: In regard to the question as to how the travelling allowance in respect of the members of the family of a retiring Government employee, who do not actually accompany him is to be regulated, the provisions laid down in rule 105 of the West Bengal Service Rules, Part-II may be applied mutatis mutandis in all such cases. A member of a Government employee’s family who follows him within six months or precedes him by not more than one month may, therefore, be treated as accompanying him. The period of one month or six months, as the case may be, may be counted from the date the retiring Government employee himself actually moves. The claims of travelling allowance in respect of the family members shall not be payable until the head of the family himself or herself actually moves.

(b) The Government employee shall, besides the fares for the journey, be also eligible to draw lump sum transfer grant and packing allowance, if the distance from the last station of duty to place of settlement is more than 20 km. However, as in the case of serving employees on transfer, Government employees who, on retirement, settle at the last station of duty itself or within a distance of less than 20 km. may be paid one-third of the amount of lump sum transfer grant and packing allowance, subject to the condition that a change of residence is actually involved.

(c) Transportation of personal effects at the scale and rate laid down in pera 7 of this Annexure is allowable. The Government employee shall also be entitled to claim the cost of transportation of personal effects between railway station and residence at either end of the journey as in the case of transfer.

(d) The actual cost of transporting a motor car or other conveyance maintained by the Government employee before his retirement is reimbursable as per provisions laid down in para 7 of this Annexure.

Explanation: In regard to the time-limits applicable for transportation of personal effects, the time-limit prescribed in the Explanation below sub-para (a) above in the case of members of the family, namely, one month anterior and six months posterior to the date of the move of the retiring Government employee himself, should apply in the case of transportation of his personal effects.

(e) The grant of the concession will be further subject to the following conditions:

(i) It will be admissible by the shortest route from the last place of duty of the Government employee to his home town or to the place where he and his family are to settle down permanently even if it is other than his declared home town.

(ii) The concession may be availed of by a Government employee who is eligible for it, at any time during his leave preparatory to retirement, or within six months of the date of retirement.

(iii) The concession will be admissible to the permanent State Government employees who retire on a retiring pension or on superannuation, invalid or compensation pension.

(iv) The concession will also be admissible to the temporary State Government employees who retire on attaining the age of superannuation or become invalid or are retrenched from service without being offered alternative employment, provided that they have put in a total service of not less than 10 years under the State Government at the time of retirement, invalidation or retrenchment.

(v) Where an Officer is re employed under the State Government while he is on leave preparatory to retirement or within six months of the date of his retirement, the concession may be allowed to be availed of by him within six months of the expiry of the period of his re-employment.

(vi) A Government employee will be eligible to the retirement travelling allowance concession in full, notwithstanding the fact that he had availed of leave travel concession to home town or any place in India just before his retirement.

(f) The concession will not be admissible to Government employees.

(i) Who quit service by resignation; or

(ii) Who may be dismissed or removed from service; or

(iii) Who are compulsorily retired as a measure of punishment; or

(iv) Who are temporary employees with less than ten years of service retiring on superannuation/invalidation/retrenched.

(g) The concession will not be admissible to persons who-

(i) are not in the whole-time employ of the Government or are engaged on contract;

(ii) are paid from contingencies;

(iii) are eligible for any other form of travel concession on retirement.

(h) The claims for the concession will have to be drawn on T.A. Bill forms like Transfer Travelling Allowance claims. The claims, of officers who were their own Controlling Officers before retirement will, however, be countersigned by the next superior administrative authority.

(i) Before reimbursing the Travelling Allowance admissible under these orders, the Controlling Officer should. satisfy themselves, as far as possible, that the claimant and members of his family actually performed the journey to the home town or the other place to which he might have proceeded to settle there, e.g., by requiring the production of original railway vouchers relating to transportation of personal effects. conveyance etc.

10. Definition of family:

In supersession of rule 4(7) of the West Bengal Service Rules, Part II, the term ‘Family’ is defined as follows:

“Family means a Government employee’s wife ( but not more than one wife ) or husband, as the case may be, residing with the Government employee and legitimate children and stepchildren residing with and wholly dependent on the Government employee. It also includes parent, stepmother; sisters and minor brothers residing with and wholly dependent on the Government employee.”

- “Children” shall mean and include major sons and married daughters including widowed daughters, so long as they are residing with and wholly dependent upon the Government employee.

- The “children” shall also include children taken as wards by the Government employee, under the Guardians and Wards Act, 1890, provided such award lives with the Government employee and is treated as a member of the family and provided the Government employee through a special will, has given such a ward the same status as that of natural-born child.

- The married daughter can be said to be wholly dependent on the father/mother only in case of special and exceptional circumstances. such as where she has been divorced, abandoned or separated from the husband, and is financially dependent on the parent.

- The term “sisters” occurring above, shall mean both unmarried sisters residing with a wholly dependent on the Government employee and widowed sisters residing with and wholly dependent on the Government employee (provided their father is either not alive or is himself wholly dependent on the Government employee concerned).

Explanation: A legitimate child, stepchild, parents, sisters and minor brothers who reside with the Government employee and whose income from all sources including pension (inclusive of dearness relief, temporary increase in pension and pension equivalent of gratuity) does not exceed Rs. 1500/- p.m. shall be deemed to be “wholly dependent” upon the Government employee.

11. Conveyance Allowance to Blind and Orthopaedically handicapped employees:

In partial modification of rule 29A of the West Bengal Service Rules, Part ll and supersession of Finance Department Memo No. 5299-F, dt. 1.6.90, the rate of conveyance allowance admissible to blind and orthopaedically handicapped State Government employees shall be 5% of basic pay subject to a maximum of Rs. 200/- p.m.

12. Permanent monthly Travelling Allowance/ (unconditional) Conveyance Allowance:

The incumbents of the posts to which permanent monthly travelling allowance/ ( unconditional ) conveyance allowance is attached or such allowance has been sanctioned under general or special orders of the Government shall draw permanent monthly travelling allowance /( unconditional ) conveyance allowance at the following uniform rates according to their pay ranges under the existing terms and conditions:

Explanations:

- If the existing rates of permanent monthly travelling allowance/ ( unconditional ) conveyance allowance admissible to any category of employees are higher than the rates mentioned above, such employees will continue to draw the existing rates without further revision.

- This order does not qualify a Government employee, who was not in receipt of any permanent monthly travelling allowance/ (unconditional; conveyance allowance to draw such benefit without prior approval of the Government.

13. Conveyance Allowance:

Subject to the provisions laid down in Appendix 5 of the West Bengal Service Rules, Part II regulating the drawal of conveyance or horse allowance, the rates of conveyance allowance prescribed in rule 29 shall be as per following maxima –

a) for horse or pony Rs. 150/- p.m. b) for a motor car Rs. 450/ – p.m. c) for a motor cycle Rs. 125/- p.m. d) for a bi-cycle or tri-cycle Rs. 25/- p.m.

Note: No motor car allowance will be admissible to any Government employee drawing pay of Rs.10,000/- or less a month.

Related Publication

- Travelling Allowance Rules – Daily Allowance

- Travelling Allowance Rules – Journeys on Tour

- TA Rule – Journeys in Higher Class Accommodation

- Travelling Allowance Rules – Fourth Pay Commission

U.S. Department of State

Diplomacy in action.

Travelling allowance form

AI Summary to Minimize your effort

Transport Allowance for Salaried Employees - Meaning, Exemption, Calculation, Rules

Updated on : Jun 6th, 2024

Transport Allowance is an allowance a company or employer provides to employees to compensate for their travel from their residence to the workplace. It is a type of special allowance. Like other allowances, transport allowance is a part of CTC and has fixed pay.

As the employee’s income tax computation is done by their employers for tax deduction purposes, salaried taxpayers may or may not be very concerned about their salary structuring and details of various kinds of allowances and exemptions available to them even before arriving at gross total income. However, understanding allowances and exemptions provided on such allowances is also significant for tax planning. This helps them choose the right CTC structure and lawfully claim the tax benefit to which they are entitled. Additionally the availability of the exemption depends on the tax regime chosen by the taxpayer.

This article will discuss one such allowance, i.e., transport allowance and its tax provisions.

What is Transport Allowance?

Transport allowance could mean allowance provided for the purpose of transport from residence to the place of work . However, transport allowance under Section 10(14) of Income-tax Act,1961 read with rule 2BB of Income-tax rules can be either of the following:

- Allowance granted to an employee to meet his expenditure for the purpose of commuting between his place of residence and office/place of duty

Transport allowance is taxable in the hands of the employee since it is added to their gross salaries. However, employees can claim tax exemption for transport allowance as per the exemption limit.

Quantum of Exemption

Section 10(14) read with Rule 2BB provides for transport allowance exemption. The amount of exemption is as follows:

Changes by Finance Act, 2018

From the financial year 2018-2019, the tax exemption for medical and transport allowances has been merged. The Income Tax Department introduced a standard deduction in place of transport and medical allowance. From the financial year 2019-2020, the standard deduction is Rs 50,000, which covers the transport and medical allowance.

Thus, employees can claim the deduction of Rs 50,000 while filing their ITR without producing any bills or documents. Employers will consider the standard deduction to compute the net taxable salary while calculating the TDS. This change shall take effect from the financial year 2018-19. Accordingly, no separate transport allowance of Rs 1,600 per month is available to employees other than physically challenged employees and employees of a transport business. The limit of Rs 40,000 has been increased to Rs 50,000 in the Interim Budget 2019. Know the highlights of the Interim Budget 2019 here.

Difference Between Transport Allowance and Conveyance Allowance

A transport allowance is an allowance given to meet commuting expenses between the place of residence and office or to meet the personal expenditure of an employee of a transport business.

A conveyance allowance is an allowance granted to meet the expenditure on conveyance in the performance of office duty.

Transport allowance is fully taxable for all employees in both regimes. However it is exempt under both tax regimes to the extent of 3,200 per month for the employees who are physically challenged such as blind/deaf/dumb or orthopedically handicapped with disability of lower extremities. C onveyance allowance is exempt from tax only to the extent of actual expenditure incurred.

Illustration

Let us derive the taxable income of an employee for the FY 2017-18, FY 2018-19, FY 2019-20 and onwards.

Let us look the same illustration for an employee who is specially abled.

Transport Allowance Under the New Tax Regime

From the FY 2020-21, the government introduced the new tax regime for individual and HUF taxpayers under section 115BAC. In the new tax regime, there are flat tax rates and no deductions or exemptions. For example, an individual opting for the new tax regime cannot claim exemptions for HRA and others. Also, the individual cannot claim deductions for any tax-saving investments. However, the new tax regime allows an individual to claim the following tax-exempt allowances:

- Allowance by the employer to meet the cost of travel on tour or transfer. It includes an allowance towards the cost of travel, such as airfare, rail fare and other transportation costs.

- Any allowance by the employer to meet the ordinary daily charges incurred by an employee on account of absence from the usual place of duty. The allowance should be in respect of the tour or for the period of the journey in connection with a transfer. The allowance includes expenses an employee incurs for food and other daily costs while travelling.

- Allowance to meet conveyance expense incurred while performing duties of an office or employment of profit. However, in this case, the employer should not provide a free conveyance to the employee. The allowance includes travelling expenses an employee incurs while performing official duties.

In the case of an employee who is blind, deaf and dumb, or orthopedically handicapped, with a disability of lower extremities can claim transport allowance to meet expenditure on commuting between residence and the place of duty. The benefit is up to Rs 3,200 per month. The same would be fully taxable in the case of an employee with no disabilities.

How to Claim Transport Allowance While Filing Income Tax Return for an employee who is specially abled ?

Usually, employers take care of the tax exemption on transport allowance while deducting TDS from the paycheck. In such cases, employees have to enter the amount mentioned in Form 16 part B in the ‘Income from Salary’ column of their ITR Form .

But when an employer has given a tax benefit on transport allowance or forgotten to give the tax benefit in Form 16 , you can claim tax exemption by following the below process:

- Check the CTC structure from the salary slip.

- Check whether the amount of transport allowance is part of the CTC.

- If the amount in the CTC structure is less than Rs 3,200 per month, the entire travel allowance would be tax-free.

- If the amount in the CTC structure is more than Rs 3,200 per month, the tax-free amount would only be Rs 3,200 per month.

Related Articles

Income tax allowances and deductions Special allowance taxation Allowances and deductions available to a salaried

Frequently Asked Questions

A normal employee (other than a handicapped employee) cannot claim transport allowance for commuting between residence and place of work or employment.

The standard deduction is a flat deduction available from the taxable salary or pension income. The deduction amount is Rs. 40,000 for FY 2018-19, whereas it is increased to Rs.50,000 from FY 2019-20 and onwards.

You can furnish the proof or invoices of relocation expenses to your employer and claim tax-free reimbursement.

The tax exemption for medical reimbursement is no longer applicable. From the FY 2018-19, the fixed medical reimbursement and transport allowance stand replaced by a standard deduction.

No, if there is a company-run transportation service facility, they will not pay you a conveyance allowance whether you use the service or not.

No, your employer can pay whatever amount they find appropriate. However, only specially abled employees can avail the exemption against such allowances.

An employee who is handicapped can get the exemption of transport allowance up to Rs. 3,200 per month.

Yes, a handicapped employee can get an exemption of up to 3,200 per month if he pays taxes in any of the regime.

No, transport allowance is fully taxable in the case of a normal employee if he pays taxes in any regime.

70% of such allowance up to a maximum of Rs.10,000 per month will be exempted if he has not received daily allowance. Suppose If he receives a daily allowance, then he would not be eligible for this exemption.

Quick Summary

Was this summary helpful.

Clear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.

Efiling Income Tax Returns(ITR) is made easy with Clear platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law.

Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download Black by ClearTax App to file returns from your mobile phone.

Cleartax is a product by Defmacro Software Pvt. Ltd.

Company Policy Terms of use

Data Center

SSL Certified Site

128-bit encryption

Central Government Employees Latest News

7th Pay Commission Latest News Today 2023, 7th Pay Matrix Table PDF, Expected DA Calculation, DA Rates Table, 8th Pay Commission Latest News

Travelling Allowance as per 7th CPC

7th pay commission travelling allowance rules for central government employees.

Travelling Allowance is not a regular allowance for all employees! Travelling Allowance is that the permission to avail reimbursement of the expenses incurred by an employee while on duty in outstation! Travelling Allowance is the package of various allowances. Travelling Allowance and Daily Allowance (TA-DA), Hotel Charges, Travelling Charges, Food Charges, Mileage Allowance, Reservation Charges, Internet and E-Ticketing Charges, Cancellation Charges, Conveyance Charges, TA on Deputation, TA on Transfer and TA on Retirement.

(Compilation of TA/DA Rules for CG Employees)

New Revised Rate and Entitlements of Travelling allowance as per 7th pay commission with effect from 1st July 2017: For Armed Forces Defence Personnel and Railway employees, the concerned department will issue separate orders on this subject respectively. Supersession of all orders issued earlier, particularly DoE Office Memorandum No.19030/3/2008-E.IV dated 23.9.2008, in respect of Travelling Allowance rules.

Travelling Allowance (TA) on Retirement: Time-limit for submission of claims for TA on Retirement is modified from 60 days to 180 days (six months), succeeding the date of completion of the journey – Finance Ministry Orders on 15th June 2021 – Click to read more

Also Check: Transport Allowance Chart

TA/DA Rules for Central Govt Employees

What is ta/da.

TA/DA stands for Travelling Allowance and Daily Allowance (not Dearness allowance ). TA means the travel expenses as per entitlement on official duty. DA means the food and accommodation charges as per the entitlement. Travelling allowance and Daily allowance are fixed amounts as per the pay matrix level after the 7th pay commission.

What is Travelling Allowance?

A reimbursement system for travelling expenses while on duty (official duty or temporary duty). And any kind of travelling expenses is permissible as per entitlements of TA/DA Rules. Other than travel expenses, accommodation, food and other related expenses are also eligible for reimbursement under Daily Allowance. The revised rates of TA and DA allowances after the 7th pay commission are given below in detail.

Also check: Expected DA from January 2020 Calculator

- 7th Pay Commission Travel Entitlement

- 7th Pay Commission Rate of Travelling Allowance

- 7th Pay Commission Orders on Travelling Allowance

This Allowance on tour comprises fares for a journey by rail/road/air/ sea or road mileage for road journeys otherwise than by bus and Daily Allowance for the period of absence from Headquarters [Para 4.2.27 6th CPC Report]

Also read: Pay Matrix Table for Central Government Employees

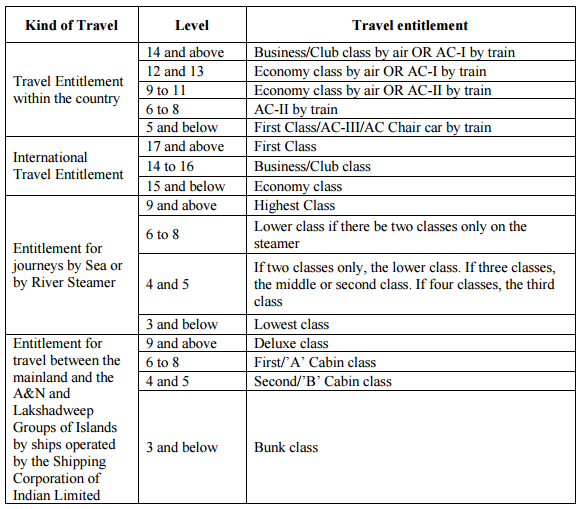

Travelling Allowance Rates 7th Pay Commission – Travel Entitlement as per Pay Level in Pay Matrix

Entitlement of Daily Allowance and Travelling Allowance as per Pay Level in Pay Matrix Table

Travel Entitlement for Tour and Training (within the Country)

Check also: CG Offices Holiday List 2022 – PDF Download

Entitlement of Premium Trains, Premium Tatkal, Suvidha, Shatabdi, Rajdhani and Duronto Trains

International Travel Entitlement

Entitlement for journeys by sea or by river steamer.

(i) For places other than A&N Group of Islands and Lakshadweep Group of Islands:-

For travel between the mainland and the A&N Group of Islands and Lakshadweep Group of Islands by ships operated by the Shipping Corporation of India Limited

Mileage Allowance for Journeys by Road

(i) At places where specific rates have been prescribed:-

Daily Allowance as per Pay Level in Pay Matrix

Rate of Daily Allowance Travelling Allowance as per Pay Level in Pay Matrix Table

Check also: 7th CPC Transport Allowance Rate Chart

Note: The Rates of Accommodation Charges, Travelling Charges, and Lump sum amount will further increase by 25% whenever DA increases by 50%.

Clarification on accommodation charges for stay in Hotels as per CCS (TA) Rules – Dated: 18.6.2018 – Click to read in detail

Reimbursement of Hotel charges

Claiming of hotel charges procedure for CG Staff and Officers with effect from 1st July 2017 as per the recommendations of 7th pay commission.

For levels 8 and below, the amount of claim (up to the ceiling) may be paid without the production of vouchers against self-certified claims only. The self-certified claim should clearly indicate the period of stay, name of dwelling, etc. additionally, for a stay in Class ‘X’ cities, the ceiling for all employees up to Level 8 would be Rs. 1,000 per day, but it will only be in the form of reimbursement upon production of relevant vouchers.

Also read: Travelling Allowance for Election Duty – Clarification

Reimbursement of Travelling charges

Reimbursement of TA for Central Government Officers and Staff from 1st July 2017.

Similar to Reimbursement of staying accommodation charges, for level 8 and below, the claim (up to the ceiling) may be paid without production of vouchers against self-certified claim only.

The self-certified claim should clearly indicate the period of travel, vehicle number, etc. the ceiling for levels 11 and below will further rise by 25 per cent whenever DA increases by 50 per cent. For journeys on foot, an allowance of Rs.12/- per kilometre travelled on foot shall be payable additionally.

Reimbursement of Food charges Procedure

Reimbursement of food bills procedure for CG Employees after 7th pay commission.

There will be no separate reimbursement of food bills. Instead, the lump sum amount payable will be as per Table E (i) above and, depending on the length of absence from headquarters, would be regulated as per Table (v) below.

Since the concept of reimbursement has been done away with, no vouchers will be required. This methodology is in line with that followed by Indian Railways at present (with suitable enhancement of rates). i.e. Lump sum amount payable.

Timing restrictions – Absence from HeadQuarter

Absence from Head Quarter will be reckoned from midnight to midnight and will be calculated on a per-day basis.

If absence from headquarters is less than 6 hours = 30% of Lumpsum amount

If absence from headquarters is between 6 -12 hours = 70% of Lumpsum amount

If absence from headquarters is more than 12 hours = 100% of Lumpsum amount

Travelling Allowance Rules – Implementation of the Seventh Central Pay Commission – Finmin Order No.19030/1/2017-E.IV Dt. 13.7.2017 pdf download

Transportation Rules for Personal Effects

Transportation of personal effects on transfer by road calculation. Transportation entitlement for Central Government employees with effect from 1.7.2017

Transportation Rules for Conveyance

Reimbursement for transportation of conveyance charges for CG employees effective from 1.7.2017.

Classification of pay level for Travelling allowance

Rate of transportation of conveyance on transfer

TA-DA Allowance Rules for Central Government Employees

Also read: Travelling Allowance Rates for Railway Employees in 7th cpc

SR 116 of TA Rules PDF

The travelling allowance referred to will be admissible in respect of the journey of the Government servant and members of his family from the last station of his duty to his home town or to the place where he and his family is to settle down permanently even if it is other than his declared home town and in respect of the transportation of his personal effects between the same places.

SR 147 of TA Rules PDF

S.R. 147 the expenditure on transportation of conveyance by government servants on their retirement shall be reimbursed without insisting on the requirement that the possession of the conveyance by them while in service at their last place of duty should have been in the public interest. Finance Ministry issued an important clarification order on Travelling Allowances rules and rates as per 7th Pay Commission on 13.7.2017. [ Download pdf click here ]

TA/DA Rules for Retiring Employees

TA on Retirement includes 4 components:-

- Travel entitlement for self and family

- Composite Transfer and packing grant (CTG)

- Reimbursement of charges on transportation of personal effects

- Reimbursement of charges on transportation of conveyance.

(i) Travel Entitlements

Travel entitlements as prescribed for tour/transfer in Para 2 above, except for International Travel, will be applicable in case of journeys on retirement. The general conditions of admissibility prescribed in S.R. 147 will, however, continue to be applicable.

(ii) Composite Transfer Grant (CTG)

(a) The Composite Transfer Grant shall be paid at the rate of 80% of the last month’s basic pay in case of those employees, who on retirement, settled down at places other than the last station(s) of their duty located at a distance of or more than 20 km.

However, in case of settlement to and from the Island territories of Andaman, Nicobar & Lakshadweep, CTG shall be paid at the rate of 100% of last month’s basic pay.

Further, NPA and MSP shall not be included as part of basic pay while determining entitlement for CTG.

The transfer incidentals and road mileage for journeys between the residence and the railway station/bus stand, etc., at the old and new station, are already subsumed in the composite transfer grant and will not be separately admissible.

(b) As in the case of serving employees, Government servants who, on retirement, settle at the last station of duty itself or within a distance of less than 20 km may be paid one-third of the CTG subject to the condition that a change of residence is actually involved.

(iii) Transportation of Personal Effects:- Same as Para 3(iii) above.

(iv) Transportation of Conveyance:- Same as Para 3(iv) above.

The general conditions of admissibility of TA on Retirement as prescribed in S.R. 147 will, however, continue to be applicable.

Who is eligible for Travelling Allowance?

7th cpc travel entitlements, travelling allowance and related matters | finmin orders, transfer travelling allowance form for central government employee.

Travelling Allowance Bill For Transfer

- Part-A (To be filled by the Government Servant)

Particulars of an employee

Part-B (To be filled in the Bills Section)

- Expenditure Details

Note: This bill should be prepared in duplicate-one for payment and the other as an office copy

Click to view or download the TA Application Form on Transfer as PDF format

TA/DA Advance Application Form PDF Download

Time-limit for submission of claims for Travelling Allowance (TA) on retirement regarding

The time limit for submission of TA claim in all other cases i.e. on tour, transfer and training etc. will remain 60 days. [ Click to view in order ]

Travelling Allowance (TA/DA) Chart

Travelling Allowance on transfer to/from North-Eastern Region, Union Territories of Andaman & Nicobar, Lakshadweep Island and Ladakh

If the family of Railway employee does not accompany him on. transfer to from these areas, the employee’ is entitled to carry personal effects upto 1/3rd of his entitlement and production of receipt/voucher is not mandatory to claim 1/3rd of his entitlement of transportation of personal effects.

If the family of Railway employee accompanies him on transfer to/from these areas, the employee is entitled to the admissible cost of transportation of personal effects and production of receipt/voucher is mandatory to claim admissible amount.as per his entitlement for transportation of personal effects.

- Frequently Observed Shortcomings in TA/DA Claims June 17, 2023

- 7th Central Pay Commission Conveyance Allowance Revised rates to Railway Medical Officers June 17, 2023

- Conveyance Allowance to Railway Doctors after 7th Pay Commission June 17, 2023

- 7th CPC Conveyance Allowance June 17, 2023

- 7th CPC Travelling Allowance Rules – Finance Ministry Orders April 3, 2023

- Travel by Premium Trains on LTC, Official Duty, Tour, Training, Transfer – Clarification orders issued by PCAFYS April 3, 2023

- Admissibility to Travel by Tejas Express Trains on Official Tour for Central Government Employees April 3, 2023

- Clarification on Traveling Allowance During Disciplinary Proceedings – EPFO October 26, 2022

- Travelling Allowance on Transfer To/From NER Region, A&N Islands, Lakshadweep Island & Ladakh August 3, 2022

- Time limit for submission of Travelling Allowance and other claims by retired employees: Railway Board November 30, 2021

- 7th CPC Travelling Allowance Rules – Production of receipts or vouchers for reimbursement of TA and DA December 30, 2020

- Check List for Temporary Duty Claim July 15, 2020

- Check List for Permanent Duty Claim July 15, 2020

- Guidelines for Air Travel on Official Tours – Latest Railway Board Order July 10, 2020

- Travelling Allowance (TA) Rules – Submission of Boarding Pass along with TA Bill June 24, 2020

- TA Rules to Central Govt employees for participating in National and International sports events May 15, 2020

- Participation in Cultural Events Treated as on Duty with Travel Entitlements February 13, 2020

- Travelling Allowance (TA) for Election Duty 2019 November 20, 2019

- 7th CPC Travelling Allowance – Travel Entitlement as per Pay Level in Pay Matrix June 21, 2019

- 7th CPC Travel Entitlements – Clarification Orders issued by DoPT on 18.10.2018 October 19, 2018

- 7th CPC Travelling Allowance: Finmin Clarification dt. 12.9.2018 September 15, 2018

- 7th CPC TA Rules: Reimbursement of Accommodation Charges for Stay in Hotels June 25, 2018

- Time-limit for submission of claims for Travelling Allowances March 13, 2018

- TA/DA Entitlements to Defence Personnel December 14, 2017

- TA and Sitting Fee Payable to Official and Non-Official Members/Experts – UGC November 10, 2017

- 7th CPC Travelling Allowance : Railway Board Issued Modification Orders on 25.9.2017 October 6, 2017

- TA/DA entitlements of Non-officials of Committees/Boards/Panels – DoE Orders on 14.9.2017 September 14, 2017

- Instruction regarding overpayment in r/o of TA/DA on account of Temporary Duty/Tour September 12, 2017

- Air Travel is Allowed for JCOs in Defence Forces July 11, 2017

- 7th CPC Allowances Gazette Notification : Transport Allowance (TPTA) and Travelling Allowance July 7, 2017

- Clarification on admitting Travelling Allowance claim by family of deceased employees – Finmin Orders December 23, 2016

- Admissibility of Travelling Allowance (TA) and other expenditure incurred while on training by the Government Servants on probation January 21, 2016

- Travelling Allowance – Analysis and Recommendations of 7th Pay Commission December 16, 2015

- DA Over 100% – Admissible of supplementary claims for difference on arrears of TA/DA September 23, 2015

- Based on the Census of 2011 HRA and TA increased for Central Government employees June 5, 2015

- Travel by Premium Trains on Official Duty/Tour/Training/Transfer etc.- Clarification from Finmin April 23, 2015

- Travelling Allowance for Election Duty – Clarification April 13, 2015

- Finmin Orders on Travelling Allowance – Granting to the Government servant with Disabilities on travel during tour/training February 18, 2015

- Relaxation for purchase of Air-Tickets on TA (Transfer) from Private Agents: CBDT Order January 12, 2015

- Foreign travel of Government officers – Clarification issued by Finance Ministry November 10, 2014

- Transport Allowance and Travelling Allowance Rules at a glance October 24, 2014

- JCM Staff Side suggestion on Transport Allowance June 25, 2014

- Government’s Travel Allowances for the MPs June 14, 2014

What is Travelling Allowance for Govt employees?

Granting of Travelling Allowance for Central Government employees is based on the travel expenses including boarding and lodging expenses while on official duty.

What is the difference between Travelling Allowance and Transport Allowance?

Transport Allowance is a fixed monthly amount and this is common for all government employees. The Transport Allowance is grating for the expenses travelling between office and residence. Travelling Allowance is entirely different from Transport Allowance. The Travelling Allowance is generally called TA/DA. This allowance is eligible only for the employees who have travelled on official duty.

What is the accommodation charges for pay level 5 as per 7th CPC?

The accommodation charges for pay levels 1 to 5 are Rs. 450 per day after implementation of the 7th pay commission.

February 20, 2024 at 11:33 pm

I was posted at siliguri last year and joined Malda( WB) in July 2023. I took permission from HOD to keep family at siliguri as my child was studying in class 10th and accordingly didn’t claimed transfer TA and luggage transportation of family and permission was also granted to claim Transfer TA beyond 6 months. Now again I am posted to Orissa which is non family station and suppose to move in June 2024. . I intend to shift my family to delhi for better study of my children. What Transfer TA will I get in respect of my family and house hold goods shifting 1. Siliguri to Malda or Malda to Delhi or both or can I shift family and luggage directly to delhi from siliguri

February 28, 2024 at 10:46 am

Your 6 months permission was completed in January was over to shift your family. Now your duty point is ORISSA, if Orissa is temporary post you can claim Malta to Orissa only not in Delhi.

October 26, 2023 at 12:25 pm

payment gate way charges during tour are reimbursable or not please clarify.

October 27, 2023 at 9:33 am

March 9, 2023 at 11:49 pm

Kindly define public transport,. Is travel by any private bus permitted for central government employee .

July 28, 2022 at 7:23 pm

Sir, Will the central government official attending preliminary hearing in the departmental proceedings in his case at the same station (from residence to the place of hearing which are in the same city) claim TA Bill. If he allows, please share the rule provision for the same.

Thanks in advance.

July 6, 2022 at 10:28 am

Sir, I have proceeded on temp duty for which I have claimed for food & lodging charges @ Rs.1550/- per day (i.e. food charges @ Rs.750/- & lodging charges @ Rs.800/-per day). In addition to the above, I have claimed conveyance charges @ Rs.225/-per day and Foot charges @ Rs.12/-as per rules, but my audit authorities have disallowed conveyance and foot charges in full without any reason or quoting any govt rules/orders. Therefore, I request to kindly confirm I am entitled to conveyance charges @ Rs.225/- and Foot charges @ Rs.12/- per day in addition to food and lodging charges as per rules, please. I aspect for your fruitful reply with quoting rules, so that I can re-submit my claim to audit authorities in support, please.

February 14, 2020 at 12:58 pm

Any Incidental charges are applicable for VII th pay commission ?

February 15, 2020 at 11:25 am

It depends upon the duty.

November 13, 2019 at 10:27 am

Please clarify about the rule of TA in case an officer travels in his own car between the places not connected by railways. He is entitled to get the prescribed rates of the car by the state transport department or he will get the rates of Auto Riksha as given in the above table

(i) At places where specific rates have been prescribed:- 14 Or Above Actual Fare By Any Type Of Public Bus Including AC Bus OR At Prescribed Rates Of AC Taxi When The Journey is Actually Performed By AC Taxi OR At Prescribed Rates For Auto Rickshaw For Journey By Auto Rickshaw, Own Car, Scooter, Motor Cycle, Moped, Etc. If your own car in this table is a topographical mistake (it was not there in 6 CPC) how to get it corrected from Finance Ministry.

November 14, 2019 at 6:07 am

If you’ve to surrender your transport allowance for the full Financial Year it will be given to you as per your basic pay rs.24/- or rs.12/- per Km.

November 22, 2019 at 8:06 pm

The logic is not understood. How Transport Allowance is connected to Road Mileage Allowance while on transfer??

November 23, 2019 at 3:10 am

Public Transport and Own/Private vehicles are playing in Road only. If you are availing road mileage in your own/private vehicle, what are purposes to give public transport allowance.?

July 3, 2019 at 9:39 pm

Kindly clarify the term places connected by rail in view of travelling allowance for central government employees and quote the relevant rule.

May 20, 2019 at 1:56 pm

Is a Central Govt. employee going to appear in departmental examination for promotion is entitled for T.A and D.A.. Where the examination centre is 200 kms away from the place of posting and the Central Govt. employee has to stay for 4 continuous days to appear in examination.

May 16, 2019 at 2:34 pm

sir , is there any limit of distance from headquarter for claiming the stay. can someone claim stay charges 10 km away from headquarter.? please code the authentic circular or O.M also.

May 20, 2019 at 10:48 am

If you are taking Transport Allowance, the T.A. will not eligible from Headquarters.

May 9, 2019 at 6:20 pm

if a person on tour for 40 days. so that can we claim ta/da for 30 days on full rate and remaining 10 day on half rate please clarify

May 10, 2019 at 11:41 am

Up to 180 days full D.A. If it is a temporary transfer/training period/tour,(if he is not is not given transport allowance for that financial year).

May 27, 2019 at 2:34 pm

If an official is absent for full calender month than there will not be any TPTA for that mont. If he is present even a single day in a calender month will be eligible for full TPTA.

April 23, 2019 at 7:49 am

Whether the newly appointed central govt officer through upsc is entitled for travelling allowance at the time of joining job station.the head of Deptt/appointing authority mentioned that t.a. will be paid as per govt.instructions. please clarify.

April 11, 2019 at 4:00 pm

Sir, I am working in IAAD . I need to go to Chennai from Mumbai for taking incentive exam for Sr Auditor. Can air fare be reimbursed ? I am in level 6 as per 7th CPC. Please reply.

March 16, 2019 at 12:52 pm

What would be the nett and gross salary of level 1 navy civilian employee @ y category city.

February 21, 2019 at 10:10 am

1. Is boarding pass mandatory to submit for TA claim for central government employees ? 2. Is boarding pass mandatory to submit for TA claim for the students of IITs?

February 14, 2019 at 4:14 pm

sir, i retired from central govt on 30.11.2018 from delhi. my pay level is 10 under 7th cpc.. my home town is gurgaon and before retirement i was residing in delhi. distance between my delhi residence/office and gurgaon residence is more than 25 kms . i have claimed my composite transfer grant (ctg) ie 80% of my last basic pay but the deptt has restricted that to 1/3 ctg. kindly clarify my admissibility with regard to rules on the subject-regards!

February 15, 2019 at 1:43 pm

As per the T.A.Rules on Transfer Rule (ii) b, CTG have been calculated the distance of less than 20 Kms. from the old station and transferred place within the same city. If it confirmed with any records of 25 Kms.(extract)) you can claim and get the 80% of your last basic pay. Please check up it is as per your pre-revised scale prior to 1.7.2017 and shifted before the date.

February 11, 2019 at 7:31 am

Sir my question is if a candidate on course for three months from his duty stn about 1500kms what are the emoluments he deserves 1068/ or above if he is level -II pl clare

February 10, 2019 at 11:57 am

Kya rest par ta milta hai ki nhi

February 7, 2019 at 7:16 am

If a govt employee travel in bus and claim bus fair with out ticket . can bus fair reimbursement to govt employees

February 7, 2019 at 1:06 pm

No. They may give punishment or they will not give one increment & you are got bad remarks it will affect your future upgradutations of MACP.

December 27, 2018 at 10:36 pm

Sir, i am primary teacher of zp school. I am handicapped. How much my ta da allowance in 7th pay commission

November 28, 2018 at 11:05 am

Whether Food expenses and accommodation expenses is admissible for appearing Dept. Competitive Examination with TA.

November 9, 2018 at 8:38 pm

Whether daily Ii.e food allowance is eligible to government employees who attended residual training programme within 20kms where accomdation and food provided for full day by the training institute itself

September 18, 2018 at 9:45 pm

My father had visited on official duty a long distance and he stayed in his own arrangement as a paying guest due to his health problem. Whether he is eligible entatiled the hotel charges or not. Kindly clarify the same.

August 31, 2018 at 9:00 pm

TA/DA advance payment rules. Whether TA/DA advance can be paid if it is approved by competent authority before the tour commences and return to headquarter before the advance is cleared by accounts section

August 26, 2018 at 8:48 pm

I want to know DA for travelling in same city Mumbai

August 12, 2018 at 3:10 pm

Is these ta da rules applicable during travelling for departmental interviews?

July 23, 2018 at 8:34 pm

I am in level 6. Can I claim TA by own car on permanent transfer. What rate per kilometre ?

July 6, 2018 at 7:41 pm

sir, if an pers who falls in level 13 proceeding on TD and stayed in HQ with their accomodation but indl wants his fooding charges as per their entitlement. Please verify whether entitled or not.

March 22, 2018 at 5:05 pm

please attach hindi version.

March 22, 2018 at 11:00 pm

Attached. Thank you.

December 5, 2017 at 1:14 pm

I am in Level 7. can i travel in own car on official tour? What will be charges per Km for re-imbursement?

August 25, 2017 at 7:36 pm

In 7th CPC How long distance (K.M) to acept Travelling allowance from head quarter to working site? OR Kitna kilometers ka bad Travelling allowance milegi ?

August 24, 2017 at 4:45 pm

Please intimate if second TTA claim will be admissible to officer who is transferred 2nd time within 3 month.

Please quote relevant authority.

August 20, 2017 at 3:06 pm

I am drawing pay in the pay band with grade pay Rs.4800/- (pre-revised scale) and I booked Air ticket from Indigo through Balmer & Lawrie on 6-7-2017 for the travel during Octber, 2017. What is my eligibility ? Whether I am entitled to travel by Air ? If so, whether I will get the full fare which is less than Air India ticket fare.

July 9, 2017 at 8:26 pm

What is the rate of travelling /daily allowances to Indian railway employees ?

July 5, 2017 at 12:58 pm

What is per day Traveling Allowance for Level 5… Earlier it was 315

July 4, 2017 at 2:06 pm

what is the per Km price for personal luggage transfer during posting from z city to y city.Kindly mentioned the amount along with policy letter.

July 4, 2017 at 12:04 am

I want to know about TA DA for accommodation, food, etc etc. … I am in level 2 Please give central govt finance ministery approval details. …

July 3, 2017 at 6:27 am

Right now, I was drawing an amount of TA is 1600+TA and I was in the G.P. is Rs. 1900/- (Level-2 in Pay Matrix). Let me know, any amendment will be coming for TA who are drawing above 7440 pay. As per 7th cpc, my TA was fixed at Rs.1350+DA. The difference between present TA and will be applicable TA is Rs.2200/-. The huge amount will be loss to me. So, kindly inform

June 30, 2017 at 4:29 pm

I want to know if a central govt. employee retires from Delhi office and settled in Noida and distance from Delhi to Noida is more than 20km. then CTG will be given one third of full. kindly clarify.

June 30, 2017 at 12:31 pm

June 28, 2017 at 9:48 pm

From this site, it’s learned that from level 9 to 11 is eligible for flight economy class traveling allowance. But I’m not sure, all Central Govt employees coming under above mentioned levels are getting it. Request to make an enquiry whether all Central Govt Dept. are allowing their employees coming under levels 9 – 11, are provided to avail Air journey for official tour ?

May 16, 2017 at 1:36 pm

when the cabinet will give HRA allowances.what about TA can you give full details regarding allawances

September 8, 2016 at 6:02 pm

Will the lumbsum grant ( one months basic pay)eligiblity may be in accordance with new pay, to an employee transferred after 1.1.16 as per 7th CPC rules. The claim has not been settled yet.

September 2, 2016 at 10:17 pm

July 12, 2016 at 12:26 pm

prakashnayak J Technician T central govt emp drawing GP 1900/- but drawing basic pay 7103 & above are eligible for tpt 1600+ DA=3600 but they not getting same tpt as per 7th CPC order. As they comming in level 2. Request to consider them for same amt at least

July 2, 2016 at 7:23 pm

TPt granted for the central govt emp drawing GP 1900/- but drawing basic pay 7440 & above are eligible for tpt 1600+ DA=3600 but they not getting same tpt as per 7th CPC order. As they comming in level 2. Request to consider them for same amt at least

February 9, 2016 at 3:18 pm

Sir, I am PC (SL) officer of AOC, retired on 01 Aug 2006. Would the decision of 7th CPC affect on my pension scale after 33% commutation.

February 9, 2016 at 3:16 pm

Sir, I am a retired PC (SL) officer of AOC retired on 01 Aug 2016. Will the decision of 7th CPC affect on my pension scale after 33% commutation.

February 8, 2016 at 5:45 pm

16010 G.Pay 4600 How are the salary in the 7pay

January 27, 2016 at 12:45 am

Sir my runing basic 7900 g.p.2000 h.r.a. 10 t.a. ( 2000 ) please calculate 7th pay

November 29, 2015 at 3:34 pm

Sir driver cadre on T/D all India by govt truck/bus driving only da not ta &depotation pay on govt duty per km pay equal railway drivers 7cpc chairman ji ADA +DA+TA+Depotation+spl pay per trip +1/3 ration old pay +tool tex free& electric bill free + exserviceman benifit equal defense perosonal Danger service & road driving danger service haevy vechicles road drivers good news 1-1-2016 happy new years news drivers

November 21, 2015 at 12:38 pm

my grade pay is 1900 and basic is 12030 and present da is 3400.but In respect to 7 cpc the DA is 1350 is possible! ? what rule apply by 7th cpc to calculation of DA. The DA is decresed by 7th cpc is possible of level 1 and 2 staff? thanks for reply

November 21, 2015 at 11:10 am

My current GP is 1900 and TA 1600+DA(1904) = 3504. but as per 7th CPC recommendation the new TA stands at 1350+DA(0)=1350. Please rectify the anomaly before government notification. A large amount of employee will face the same problem.

November 20, 2015 at 7:20 pm

Simply multiply it as per 125 % da and see recommendations in hike of allowances I will easily got your results

November 20, 2015 at 11:19 am

Sir my present basic pay is 13950 grad pay is 4200 and hr is 10 % and Ta 1600. Please calculate my new pay.

November 19, 2015 at 11:28 pm