- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Emirates Business Class

Ramsey is a freelance travel journalist covering business travel, loyalty programs and luxury travel. His work has appeared in Travel+Leisure, Condé Nast Traveler, Reader's Digest, AFAR, BBC Worldwide, USA Today, Frommers.com, Fodors.com, Business Traveler, Fortune, Airways, TravelAge West, MSN.com, Bustle.com and AAA magazines. As someone who flies more than 450,000 miles per year and has been to 173 countries, he is well-versed in the intricacies of credit cards and how to maximize the associated perks and services.

Aaron is a freelance contributor to the travel team at NerdWallet. He has been a credit card and travel rewards enthusiast since applying for his first credit card the day he turned 18. While a student at Iowa State University, Aaron combined his knowledge of credit card rewards with a resale business to help pay his way through college. After finishing a Master of Business Administration at the University of Michigan, Aaron used points and miles to travel for six months across five continents, including a month traveling overland through Russia, Uzbekistan, Kyrgyzstan and China on the Trans-Siberian Railway Network.

He has written hundreds of articles about miles, points, travel and credit card rewards for publications, including The Points Guy, Bankrate.com, Forbes, Rolling Stone and Robb Report. He is passionate about helping others leverage their wallets into increasing their financial security and fulfilling their travel dreams.

Aaron is based in Minneapolis, Minnesota, but his favorite airport is Amsterdam Schiphol.

Meghan Coyle started as a web producer and writer at NerdWallet in 2018. She covers travel rewards, including industry news, airline and hotel loyalty programs, and how to travel on points. She is based in Los Angeles.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What to expect when flying business class with Emirates

How much does emirates business class cost, earn emirates miles quick, how to book emirates business class with miles or cash, how emirates business class compares with other emirates fare classes, is emirates business class worth the money.

If you’re looking to fly in business class, Emirates is likely on your radar.

Emirates, one of the most celebrated airlines for its in-flight premium products, is a force to be reckoned with in the airline industry. It has the world’s largest fleet of Airbus A380s and flies all around the world, connecting destinations with one of the most luxurious in-flight products.

In Emirates business class, the experience begins at your home or hotel, where you'll be picked up via the airline's own chauffeur service. From there, you'll be whisked to the airport, where you can relax in an exclusive airline lounge.

On board, you'll curl up in cozy seats that lie flat. But if you prefer to stay awake, you might order your own beverage from the stand-up lounge bar or watch a movie on a screen that's massive by airplane standards.

This guide will help you know which planes to seek out and which to avoid (if possible, given your routes), what amenities to look for when you fly business class on Emirates and how you might book a free Emirates business class seat using points.

Here’s our Emirates business class review, plus how to maximize your miles when you book.

Emirates business class. (Photo by Sally French)

Flying business class on Emirates is an experience far different from U.S.-based carriers. Many of the things you are familiar with for premium cabins are there, but the in-flight service and airport lounges are a step above Emirates’ North American competition.

Chauffeur service

If you're paying for business class (excluding mileage redemptions or the most discounted fares), Emirates will provide chauffeur service to the airport. The distance from the airport that Emirates will pick you up varies by city.

If you are departing from the United States, chauffeur service is typically offered within 50 miles of the airport, although you can circumvent the mileage restriction for a fee. Chauffeur service must be prearranged — you must book your chauffeur service at least 12 hours before your flight.

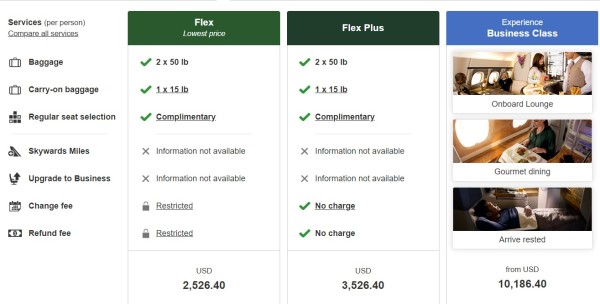

Emirates business class baggage allowance

Emirates allows passengers flying to or from the Americas up to two bags that each weigh 70 pounds (32 kilograms). You can also travel with two carry-ons — one standard carry-on and then either a briefcase or garment bag. Each carry-on can weigh a maximum of around 15 pounds (7 kilograms).

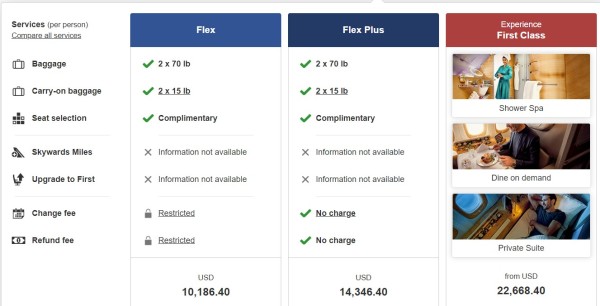

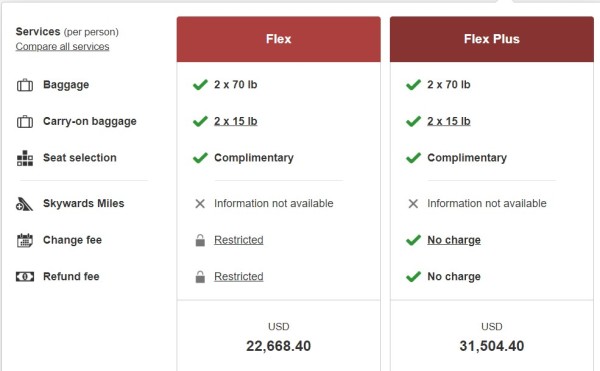

Here are the Emirates bag policies, by region, and compared across fare classes:

The Emirates checked baggage policy is especially unique when it comes to flights outside the Americas, Africa and Europe, as you can bring as many bags as you want — as long as you don't exceed the weight limit. In theory, you could check 20 bags that each weighed about 4.4 pounds (2 kilograms), which might offer some passengers more flexibility. Keep in mind that no one bag may weigh more than 70 pounds (32 kilograms).

Priority airport service

At the airport, you’ll enjoy priority check-in desks before heading to the lounge and priority baggage reclaim. From Dubai International Airport’s concourse A, business class passengers can board directly from the lounge.

Emirates business class lounges

A meal from the Emirates lounge at San Francisco International Airport. (Photo by Sally French)

There are more than two dozen Emirates lounges all over the world accessible to business and first class customers.

The airline’s Dubai base has the most impressive business class lounges (special perks include barista-made coffee and a new health and wellness buffet). In Dubai’s concourse B, you can even visit the Moët & Chandon Champagne lounge, where you can sample top-notch bubbly for free. At the Dubai airport, Emirates has three lounges in its flagship Terminal 3 exclusively for business class.

The Emirates lounge at San Francisco International Airport. (Photo by Sally French)

But you'll also find Emirates lounges at other major cities around the world, each of which carry the airline’s signature touches. For example, the San Francisco Emirates lounge still features that signature (albeit smaller) waterfall feature, plus a shower room to freshen up pre-flight.

No matter where in the world you are, these lavish lounges serve hot and cold buffets, impressive bar selections, including champagne, and sometimes a la carte meals. Beyond the food, lounge benefits include individual workstations, complimentary Wi-Fi, plasma screen TVs and quiet areas for sleeping with blankets and pillows.

Emirates business class lie-flat seats

(Photo courtesy of Emirates)

Lie-flat seat availability is one of the main reasons that people book an Emirates business class ticket, but the experience varies across Emirates planes — the airline has multiple business class configurations. It is important to know your aircraft type before understanding what seat you will find.

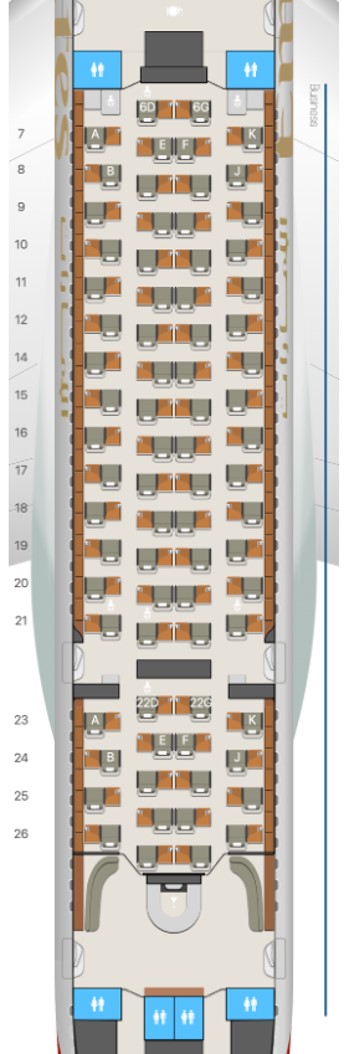

Emirates A380 business class

If you want the best experience in Emirates business class, the A380 is the plane you want to fly. On the Airbus A380, there is no need to worry about getting the dreaded middle seat, as every business class seat has direct aisle access thanks to the 1-2-1 configuration.

On the sides of the plane, seats alternate between being closer to the window or closer to the aisle. In the center section, seats vary between being closer to the aisle or tucked into the center section for more privacy from those moving in the aisle.

Seats are 18.5 inches wide, pitched up to 48 inches apart. They recline into fully flat beds and have a six-way adjustable headrest and electric footrest extension.

There are 76 seats available in the three- and four-class configured A380 and 58 seats in the two-class configured A380.

Other A380 benefits include the airline’s famous on-board lounge and bar, which is exclusive to the A380.

Emirates 777 business class

It’s on the Boeing 777 where things get tricky. Only the Boeing 777-200LR has a 2-2-2 configuration . Most other Boeing 777s guarantee that you will have a 2-3-2 setup where the person in the very middle will have to climb over their neighbors. Emirates is currently updating its 777 fleet to include fully flat beds. The business class updates are expected to be complete by April 2025.

There are also fewer people in this business class cabin, which makes it more exclusive, as most configurations of the Boeing 777 have just 42 business class seats.

The airline uses a lot of cream, hardwoods and gold finishes to create a luxurious cabin. While it may not appeal to everyone’s design tastes, it is certainly striking. While no one wants a middle seat in a premium cabin, the top-notch in-flight service remains the same.

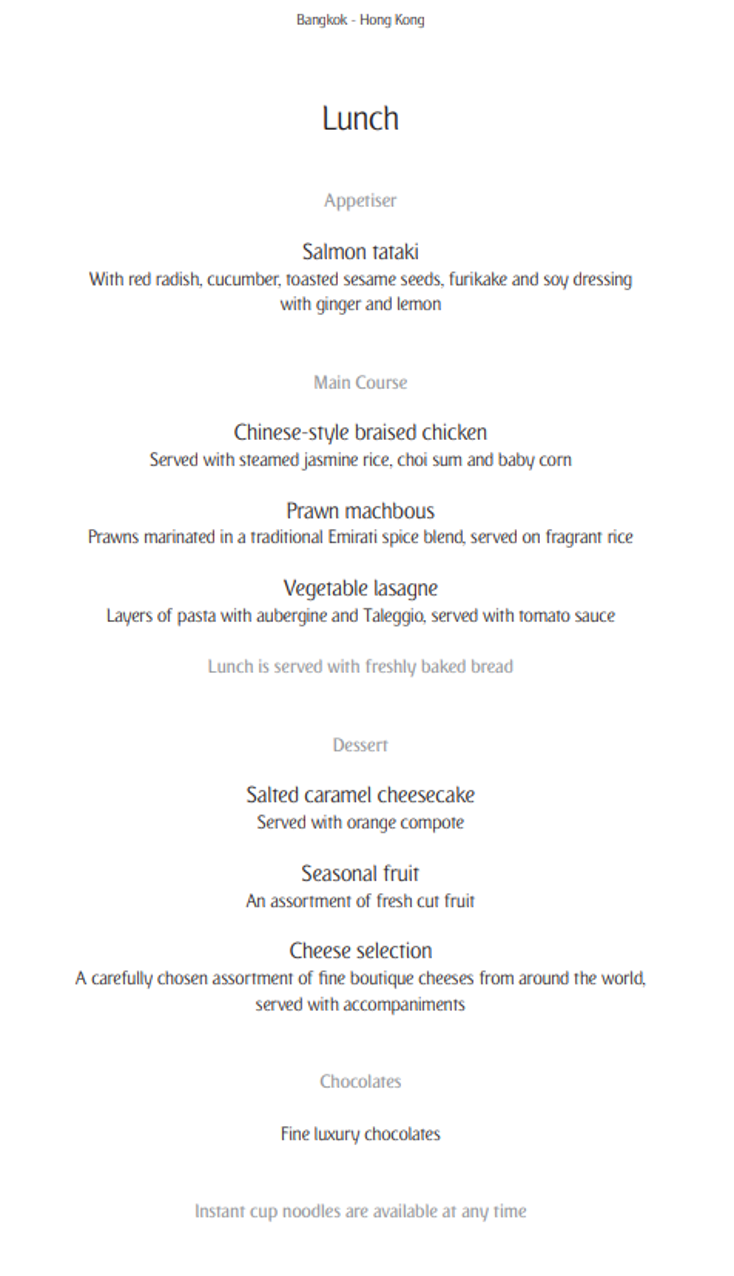

Emirates business class food and drink

Emirates offers some of the finest menu options, such as locally inspired selections like the Japanese dining experience available on flights to Tokyo or Osaka. While menus change monthly with the season, there are always menus to support most diets, including a kids menu and a vegan menu.

Emirates publishes its menus for different flights on its website. Just enter the flight details online to discover what is being served on the food and beverage list.

Meals start with an aperitif and appetizer followed by the main course and then decadent desserts. All meals on Emirates are halal. In between the main meals, there is a light bites menu that passengers can order from at any time, including items like tofu poke bowls, vegetable noodles, and lamb and rosemary pie.

The drink menu includes labels like Hennessy X.O cognac and Chivas Regal 18-year-old Scotch whisky. There are cocktails, wines and welcome champagne. A 2013 Moët & Chandon is currently on offer on long-haul business class flights. If you're not drinking alcohol, you might sip on complimentary coffee, tea, soft drinks or juice.

Emirates serves its business class meals at set times but will honor dine-on-demand requests. That's in contrast to other competing airlines, including Qatar Airways, which always offers dine-on-demand for passengers in first or business class.

Though if you do prefer dining (or drinking) on your own schedule, Airbus A380 planes have in-flight lounges where passengers can gather for a drink, sandwich, snack, dessert or even a meal.

Passengers will dine on Royal Doulton fine bone china with custom-made Robert Welch cutlery.

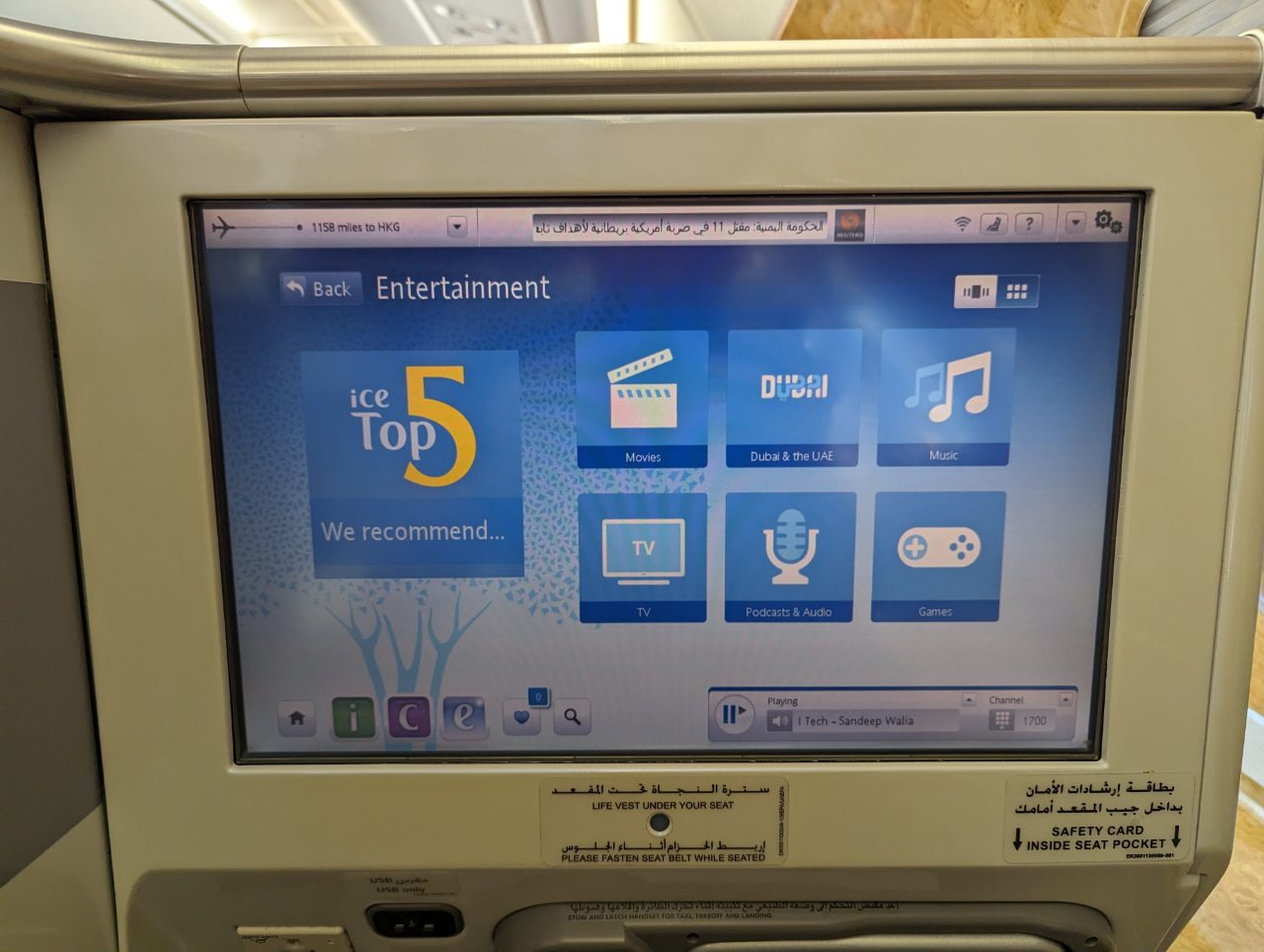

In-flight entertainment

Emirates business class seats include personal charging ports if you'd rather remain entertained by your own (fully charged) device. (Photo by Sally French)

Dubbed "ice," Emirates’ in-flight entertainment programming is among the best in the industry. There are up to 6,500 channels of entertainment, with hundreds of movies, sitcoms, documentaries, music and games to keep passengers busy.

While, yes, the same programming is available to everyone (no matter what the cabin), business class passengers benefit from a larger screen than those seated in lower cabins of service.

Interested in what is available on your flight? You can preview the entertainment options on Emirates’ website by route or flight number.

In March 2024, we found the lowest priced fares from $4,314 for one-way trips from New York-John F. Kennedy to Dubai. This is a saver fare. A Business Flex fare on the same route was priced at $5,993.

Financing is available through Uplift .

Here are some other one-way Emirates business class fares we found:

Chicago to Dubai, $4,314.

Los Angeles to Dubai, $4,462.

Miami to Dubai, $4,314.

San Francisco to Dubai, $4,760.

Washington-Dulles to Dubai, $4,314.

One way to stave off the sticker shock is to book your business class ticket with points and miles rather than cash.

Your spending with other points programs could be a route to an affordable trip, as you can transfer those points to your Emirates Skywards account. You can transfer miles and points to Emirates Skywards from a variety of bank programs, such as:

Citi ThankYou points (1:1).

Chase Ultimate Rewards® (1:1).

American Express Membership Rewards (1:1).

Capital One Miles (1:1).

Based on our most recent analysis, NerdWallet values Emirates Skywards miles at 0.6 cent per mile. Use NerdWallet's Skywards miles calculator to understand how much your miles are worth in dollars based on our valuation:

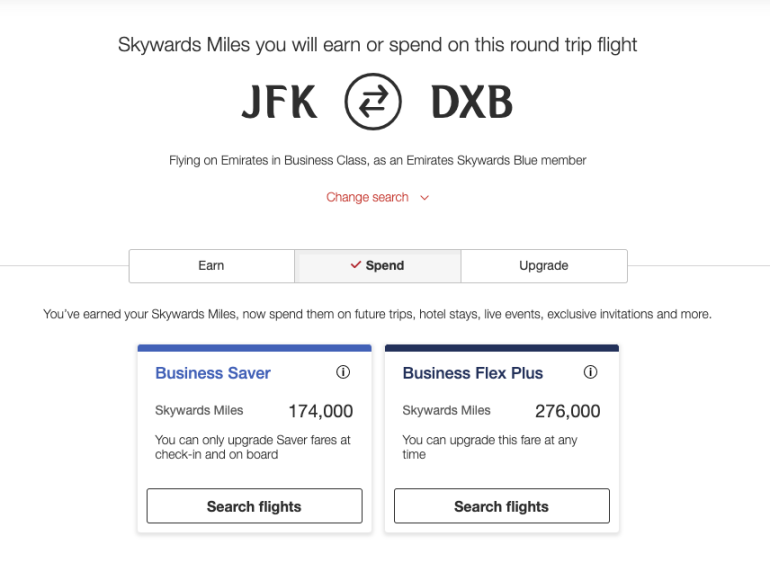

Instead of a traditional award chart, Emirates relies on an award calculator that helps travelers know how many miles they need for a flight. The number of miles you need on a particular route is always the same (no dynamic pricing), but each route can vary.

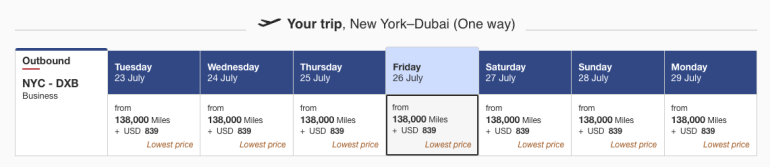

For example, business class saver awards from New York-John F. Kennedy to Dubai cost at least 138,000 miles for a one-way trip. Expect to pay a hefty amount of taxes and fees on your award ticket.

Prices are slightly better if you can find award availability on both ways of your journey. Flying round-trip between New York-JFK and Dubai will cost 174,000 miles, a 37% discount off the price of booking two one-way tickets.

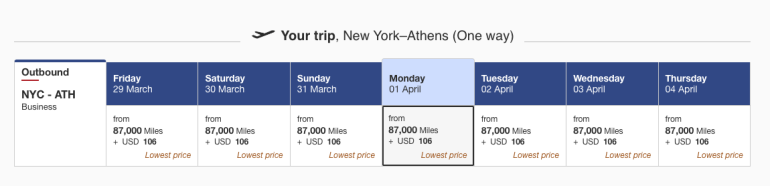

Also look out for Emirates’ fifth freedom flights between the U.S. and Europe, like Newark, New Jersey, to Athens. These cost only 87,500 miles in business class each way.

Taxes and fees on this route also come in at a reasonable $106.

Need to rack up more Emirates Skywards miles ? There are two Emirates Skywards credit cards that can help pile on the miles as well as the perks if you are a frequent Emirates flyer:

Earn 70,000 bonus Skywards Miles after spending $3,000 on purchases in the first 90 days.

Earn 60,000 bonus Skywards Miles after spending $3,000 on purchases in the first 90 days.

Those who are looking to make a one-time redemption only may prefer to stick with another credit card to accumulate valuable miles and points until they are ready for their big Emirates adventure.

» Learn more: The best airline credit cards right now

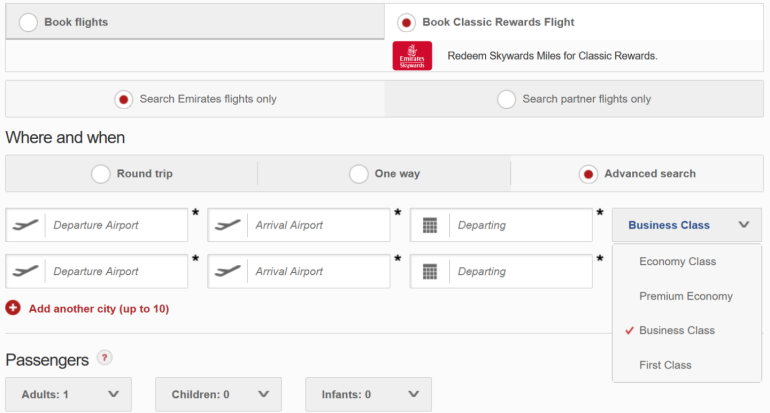

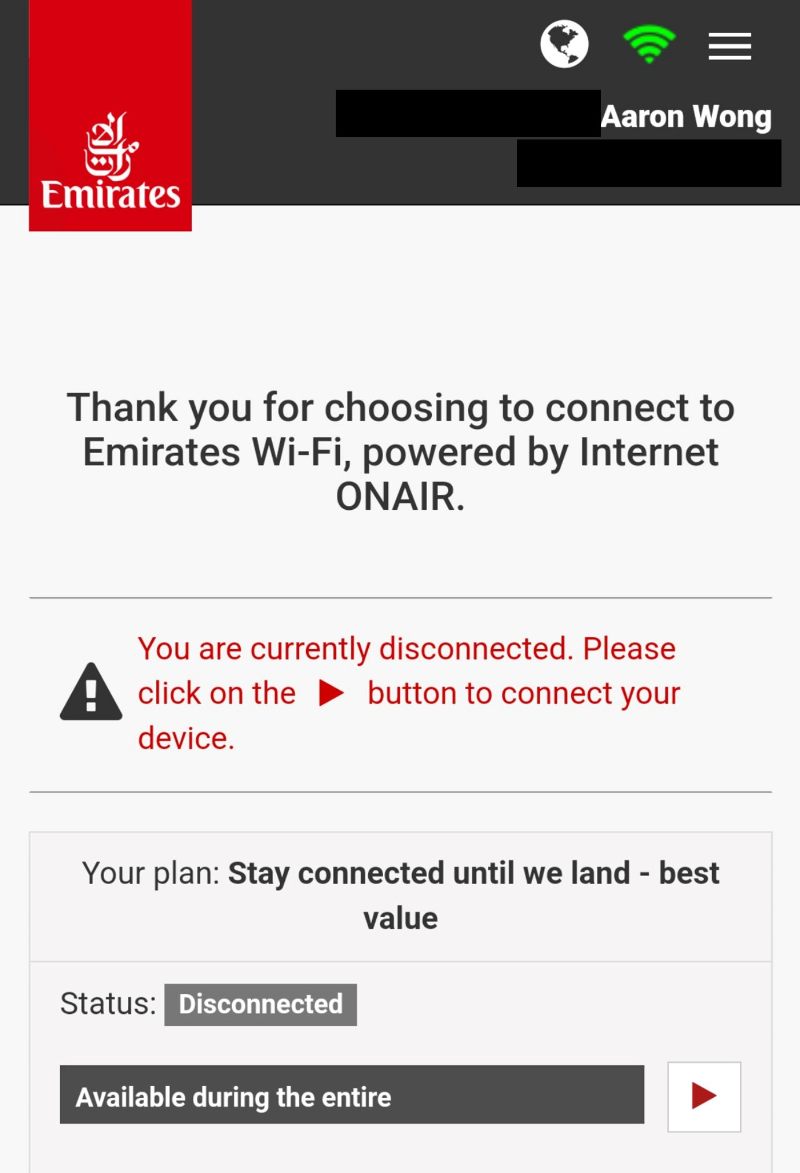

To book an Emirates ticket, navigate to the Emirates website and input your flight details to begin your search. If you're searching for flights priced in miles, you’ll need to first log in to your Skywards account. Once you’re logged in, you’ll see the option to search for "Classic rewards." Check this box to search for flights priced in miles.

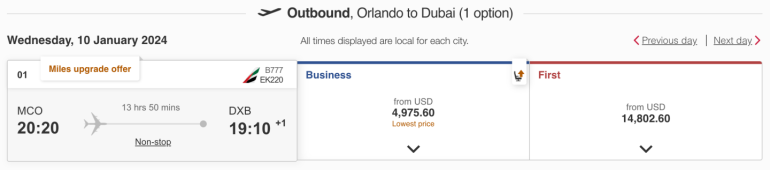

Be sure to select “Business Class” from the drop-down menu and then search. Here's a one-way flight from Orlando, Florida, to Dubai.

Emirates business class ticket in cash

Emirates business class ticket with miles

Select your flight, input passenger data and follow the prompts to complete the booking.

The in-flight shower for passengers in Emirates first class. (Photo by Sally French)

Emirates makes headlines with its in-flight showers — though the shower in the sky is reserved solely for first class. Even still, Emirates business class is among the finest experiences when it comes to air travel, thanks to lavish features such as the stand-up lounge bars (available to first and business class).

Emirates has four classes of service: first , business, premium economy and economy . But the reality is that even within business class, there are superior and inferior products. While you experience the same benefits on the ground (luxe lounges and all), the seats can vary quite a bit once on the plane.

If you absolutely cannot risk a middle seat, you might splurge even more for first class.

Emirates premium economy. (Photo by Sally French)

Meanwhile, someone who is somewhat budget conscious might consider the lower fare class of Emirates premium economy, which the airline says costs about 65% less than business class fares.

While Emirates premium economy doesn't offer the full lie-flat service of business class, there are specially designed pillows and blankets, extra recline and a leg rest so you can arrive well rested at your destination.

Premium economy won't get you the ultra-bougie perks like chauffeur service or lounge access, but you might still be able to get into the airline lounge anyway by holding certain travel credit cards .

Emirates business class seats. (Photo by Sally French)

Emirates delivers an exceptional airport and onboard experience that is miles ahead of the competition. Whether you’re going to Europe, the United Arab Emirates or beyond, you’ll be pampered no matter where you sit in the business class cabin.

That said, Emirates business class has some hiccups that keep it from being absolutely perfect. The biggest issue: middle seats in business class on certain aircraft. Just be wise when booking to avoid that dreaded seat.

Meanwhile, you can maximize your experience by racking up Emirates Skywards miles from flying with the airline, transferring points from a credit card rewards program or applying for one of the airline’s credit cards. The next time you’re enjoying a cocktail in the lounge of an Airbus A380 at 36,000 feet over planet Earth, you’ll be glad you did.

(Top photo courtesy of Emirates)

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Simple Flying

What to expect in business class with emirates.

Emirates has one of the world's most exclusive business class services.

- Emirates offers lie-flat seats with ample amenities in its Airbus A380 business class cabin, including a personal minibar and access to an onboard lounge.

- In the Boeing 777 business class cabin, passengers enjoy angled, lie-flat seats with greater width and pitch, but each row has a middle seat.

- Business class on both types features gourmet meals, amenity kits from Bvlgari, access to airport lounges, and chauffeur-drive services.

Over the last few years, many airlines have moved away from first class, offering a more enhanced and comprehensive business class product. Depending on which airline you are flying, business class travel can mean being received at the airport, exclusive lounge access, and a glass of champagne when you get to your seat.

Emirates is known for having one of the best business class products in the world. Furthermore, it remains one of the few airlines offering first class flights . As an Emirates business class customer, you can expect a wide range of exclusive services from the moment you book your flight until you arrive at your destination. However, certain cabin features depend on the aircraft you are flying on.

Emirates Airbus A380 business class

Emirates is known for operating just two aircraft types, the Boeing 777 and the Airbus A380, the latter being the world's largest passenger jet. The Dubai-based carrier is set to introduce the Airbus A350 to its fleet later this year . Emirates offers up to four classes of travel: first, business, premium economy, and economy . However, many aircraft are still to be fitted with premium economy seats .

The specific layout you can expect depends on the route and aircraft you are flying on. Despite the different configurations, Emirates A380 business class offers lie-flat seats in a modern 1-2-1 staggered configuration. The two center seats have a divider between them, providing privacy for each passenger. As such, all business class travelers have aisle access.

The cabin has plush cream leather seats with a pitch of 48 inches and a width of 18.5 inches . The seat can be changed to a fully flat bed using the touchscreen controller. It also comes with various amenities, including luxury Bvlgari fragrances and amenity kits, a personal minibar with water and beverages, reading lights, storage consoles, power outlets, and charging ports.

Business class passengers also get access to the A380's onboard lounge , where a range of snacks, desserts, and beverages are available. The lounge has seating space for socializing with fellow passengers. Earlier this year, Emirates introduced its innovative, complimentary loungewear for business class passengers . While it is perfect for sleeping in, it is suitable to wear for a drink at the A380 onboard lounge.

Flight Review: Emirates A380 Business Class Dubai To Mauritius

Emirates boeing 777 business class.

On widebodies manufactured on the other side of the pond, Emirates offers angled, lie-flat business class seats in a more dense 2-3-2 configuration. This means not all passengers get aisle access. Fortunately, the airline plans to reconfigure the 777 cabin to have seats in a 1-2-1 layout. Nonetheless, the plush cream leather seats on the Triple Seven are bigger, offering a width of 20.5 inches and a pitch of 60 inches . The soft, breathable leather fabric provides ultimate comfort for premium travelers.

Traveling in the middle seat, particularly on long flights, can be discomforting if the passenger wants to get up for any reason. Nonetheless, it still comes with comparable amenities, including a stocked personal minibar, a luxury Bvlgari amenity kit , a storage console, power outlets, and charging ports. Emirates offers unique amenity kits for men and women on long-haul flights. Another downside to the Boeing 777 is the lack of an onboard lounge.

Discover more aviation news about the passenger experience here.

Product consistency on all aircraft

Emirates business class meals.

While cabin features may differ by aircraft type, some Emirates products are consistent across its fleet, including the airline's business class meals . All meals are served on Royal Doulton fine bone china with Robert Welch cutlery exclusively made for Emirates.

Business class passengers can enjoy a wide variety of food, from sweet and savory snacks to gourmet meals and complimentary champagne. You can order your main courses up to 14 days and at least 24 hours before your flight. You can browse the menu and select your preferred dish before boarding the aircraft.

Emirates business class lounge

Like most major airlines worldwide , Emirates business passengers receive complimentary lounge access. The lounges offer free WiFi and a well-equipped business center, so you can continue working while waiting for a flight. Premium travelers can enjoy gourmet dining, snacks, beverages, quiet areas, and direct boarding. Below are some airports where you can find an Emirates lounge:

- Dubai International Airport (DXB)

- New York John F Kennedy (JFK)

- Johannesburg OR Tambo (JNB)

- Tokyo Narita International (NRT)

- London Heathrow Airport (LHR)

- Sydney Kingsford Smith Airport (SYD)

If your airport does not have an Emirates lounge , you can still relax in one of the airline's partner lounges, which can be found across all six continents. In addition to business travelers, first class customers and Emirates Skywards Platinum and Gold members also have lounge access.

Chauffeur-drive service

One of the most unique features of flying on Emirates business class is the chauffeur-drive service . The airline will comfortably drive you to and from the airport. The service is available in over 70 cities and must be booked at least 12 hours before your flight. Vehicle models are subject to availability.

What do you think of the Emirates business class product? Perhaps you have flown business class on the A380 or 777. Please share your thoughts and experiences in the comments!

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Best Ways to Book Emirates Business Class Using Points [Step-by-Step]

Spencer Howard

Former Content Contributor

51 Published Articles

Countries Visited: 21 U.S. States Visited:

Director of Operations & Compliance

6 Published Articles 1179 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

![emirates business class travel insurance Best Ways to Book Emirates Business Class Using Points [Step-by-Step]](https://upgradedpoints.com/wp-content/uploads/2017/04/Emirates-Business-Class-Seat.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

A look inside emirates business class, how to fly emirates business class, great emirates business class redemptions, how to earn enough miles for emirates business class, when should you search for award space, what makes emirates business class great, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Emirates has cultivated a reputation as one of the best airlines in the world, and it is well-deserved. Let’s be honest…you’re probably here right now because of the amazing things you’ve heard!

If you’d like to see what it’s all about, the Emirates business class cabin is a great way to go. Specifically, we’re going to talk about the experience on Emirates’ Airbus A380.

With lie-flat seats, direct aisle access, and an in-flight bar, your business class experience will be the trip of a lifetime!

From the moment you step into the Emirates business class cabin, you’ll be excited to fly. For solo travelers, the window seats provide great privacy, while couples, friends, and families can enjoy each other’s company by selecting 2 seats in the middle section.

Regardless of your seat choice, you are guaranteed direct aisle access on all A380s, so you don’t have to climb over anyone to visit the in-flight bar (we’ll get to that later). Additionally, all business class seats on Emirates’ A380 are lie-flat, so you can sleep comfortably.

When booking your flight, be sure to verify that you’re flying business class in the A380 . Otherwise, you might be surprised by a 2-3-2 configuration with angled flat seats and no direct aisle access!

Here are the flights that operate an A380 from North America:

While you’re relaxing in your seat, you’ll enjoy great meals throughout your flight as well as your choice of beer, wine, and spirits. In fact, your flight attendant will even offer you a glass of champagne when settled in your seat before takeoff.

If you’re ready to have some fun trying the business class cabin on Emirates , let’s dive into how you can book this flight.

It may sound counter-intuitive, but we don’t always recommend using Emirates Skywards miles — we’ll explain more below, but trust us when we say you have better options.

Japan Airlines Mileage Bank

Japan Airlines Mileage Bank is generally going to have the lowest miles price tag, but fuel surcharges on awards on Emirates in addition to the miles cost. For trips from the U.S. in Emirates business class, these can be as much as $1,716!

Learn more about these pesky fees in our ultimate guide to airline fuel surcharges (and how to avoid them) !

There are a few airports where you can start your trip and avoid these surcharges:

- Hong Kong (HKG)

- Tokyo (NRT)

- Sydney (SYD)

- Colombo (CMB)

- Auckland (AKL)

If you decide to book an Emirates award, then consult Japan Airlines’ distance-based chart (the longer the flight, the more Mileage Bank miles your flight will cost).

When booking, make sure you remember to calculate the distance of each segment of your itinerary and add them together. Once you have done that, you can check Japan Airlines’ partner award chart to see how many Mileage Bank miles are required.

There are some sweet spot award redemptions to be found in this chart, so play around with it and see what you can find.

You can now search for Emirates availability directly on the JAL website:

- Go to JAL’s website

- Search for your desired route

- Select your desired flight

- Pay the necessary taxes/fees and complete your booking

A couple of key points to remember when booking with Japan Airlines Mileage Bank miles:

- You are allowed up to 6 segments, 2 stopovers (stays exceeding 24 hours), and 1 open jaw per itinerary

- One-way bookings are allowed

- Use Qantas to search for flights that are not to or from the U.S.

Hot Tip: Learn about how to maximize stopovers and open-jaws in our comprehensive guide so you can get extra flights for free!

Using Japan Airline Mileage Bank miles is generally your best bet to book Emirates business class for the fewest miles.

Make sure you check out some of the other amazing redemption options provided by Japan Airlines .

Emirates Skywards

Emirates is a transfer partner with Chase Ultimate Rewards , American Express Membership Rewards , Citi ThankYou points , Capital One Miles , and Marriott Bonvoy , while JAL is only a transfer partner with Marriott.

So while JAL doesn’t have many ways to rack up miles fast, Chase Ultimate Rewards and American Express Membership Rewards will definitely help you boost your point balances to book first class!

Better yet, Emirates has recently massively reduced the carrier-imposed surcharges on flights! Depending on your award ticket, you’ll be able to leverage stopovers!

Here are a few great example of routes you can take:

- New York (JFK) – Milan (MXP) round-trip for 90,000 miles + ~$120 in taxes and fees

- New York (JFK) – Dubai (DXB) round-trip for 145,000 miles + ~$322 in taxes and fees

- Auckland (AKL) – Dubai (DXB) round-trip for 224,000 miles + ~$100 in taxes and fees

Here’s how you can book your award:

- Visit Emirates.

- Log in to your Skywards account.

- After you log in, search for flights. Be sure to check off the box that says Classic Rewards.

- Select your flights.

- Pay with your miles and any additional taxes and fees.

Even with the new surcharges, Japan Airlines may provide the best opportunity to book Emirates business class, so let’s look at a few options available for booking:

- New York City (JFK) to Dubai (DXB) round-trip in business class for 85,000 miles

- New York City (JFK) to Perth (PER) one-way in business class for 85,000 miles

- New York City (JFK) to Milan (MXP) round-trip in business class for 63,000 miles

- This routing could include a stopover in Milan or Dubai on your way to Bangkok, and a stopover in the other location on your return to New York City

Remember, you’ll want to fly business class on Emirates’ Airbus A380 to ensure maximum comfort and fun! Plus, the A380 Dubai to Los Angeles route is one of the longest nonstop flights in the world , giving you tons of time to enjoy your luxury experience.

Emirates flies to several other U.S. airports with their Boeing 777. These routes do not have direct aisle access for all business class seats, nor do they include the lie-flat seats (which means sleeping will be less comfortable).

While Japan Airlines will require fewer miles, a round-trip business class award from the U.S. to Dubai will include up to about $1,716 in taxes and fees.

Hot Tip: Check out our dedicated guide for more information on Emirates’ routing options to/from the U.S.

Amex Credit Cards

This is our preferred method of earning Emirates miles given how generous Amex credit cards are with their welcome offers and category bonuses. You can transfer Amex points at a rate of 1:1 to Emirates.

Recommended Amex Cards (Personal)

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

Apply With Confidence

Know if you're approved with no credit score impact.

If you're approved and accept this Card, your credit score may be impacted.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection ® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card ® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR ® Plus Credit: CLEAR ® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck ® application fee for a 5-year plan only (through a TSA PreCheck ® official enrollment provider), when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

- APR: See Pay Over Time APR. Carrying a balance will incur interest. Eligible charges can be included in the Pay Over Time balance, up to the Pay Over Time Limit. Pay Over Time only applies to eligible charges meeting minimum transaction amounts.

- Foreign Transaction Fees: None

American Express Membership Rewards

This is the best card for food lovers who dine out at restaurants (worldwide), order take-out and want big rewards at U.S. supermarkets!

The American Express ® Gold Card is a game-changer.

With this card, you can earn 4x Membership Rewards points at restaurants and you’ll also earn 4x Membership Rewards points at U.S. supermarkets on up to $25,000 per calendar year in purchases, then 1x.

There isn’t another card on the market that offers a 1-2 punch like this. Of course, there are several other benefits of the Gold Card as well, including extra monthly dining rewards and more.

- 4x points per dollar at restaurants, plus takeout and delivery in the U.S.

- 4x points per dollar at U.S. supermarkets, up to $25,000 per calendar year in purchases; and 1x thereafter

- 3x points per dollar on flights purchased directly from airlines or at AmexTravel.com

- $250 annual fee (see rates and fees )

- No lounge access

- Earn 60,000 Membership Rewards ® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

- Earn 4X Membership Rewards ® Points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards ® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- Earn 3X Membership Rewards ® points on flights booked directly with airlines or on amextravel.com.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $120 Dining Credit: Satisfy your cravings and earn up to $10 in statement credits monthly when you pay with the American Express ® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Get a $100 experience credit with a minimum two-night stay when you book The Hotel Collection through American Express Travel. Experience credit varies by property.

- Choose the color that suits your style. Gold or Rose Gold.

- No Foreign Transaction Fees.

- Annual Fee is $250.

Marriott Credit Cards

You can earn Marriott points and transfer those to Emirates at a rate of 3:1. Plus, for every 60,000 Marriott points that you transfer, you’ll receive a bonus of 5,000 Skywards miles. There are several Marriott credit cards available.

Emirates does not have a regular schedule for releasing business class award space to their partner airlines. However, don’t wait to search for space and book your business class award ticket.

These award tickets are popular, so start your search as soon as you know when you want to travel . As with all award searches, flexibility is your friend — the more flexible your travel dates, the easier it will be to find award space.

Also, remember to take into account the transfer time of your travel rewards cards points if you are transferring from flexible point programs. It would be a shame to miss an award because you hadn’t yet transferred your miles!

It’s probably already clear why Emirates business class should be on your list of flying experiences to try! But just in case you need some convincing, let’s dig into it a little more.

Emirates Business Class Lounge

You will have access to the Emirates Business Class Lounge in Dubai. When you are flying on the Emirates Airbus A380, you will be able to board directly from the lounge.

During your stay, you will be treated to a relaxing experience complete with champagne and a great selection of food.

Emirates has lounges in many airports across the world, so you’ll have somewhere to relax before your flight when flying business class.

World Class Catering

Right off the bat, your business class adventure will provide a buffet that includes plenty of meal options to satisfy any culinary desire. You will also have a variety of wine, beer, spirits, and champagne to pair with your meal before finishing it off with one of the many dessert options.

Of course, the fun only continues once you are in-flight. You will still have access to great food and your choice of beverages, not to mention an amazing in-flight bar.

Emirates Business Class In-Flight Bar

Enjoy a drink, a snack, and the company of your fellow passengers at Emirates’ in-flight bar on the Airbus A380.

Emirates is famous for the bar at the rear of the business class cabin on their Airbus A380. Anytime you feel the urge for a snack or a drink (they’ll make you cocktails too!), you can visit the bar and mingle with your premium cabin companions.

The Business Class Amenity Kit

No business class experience would be complete without an amenity kit, and Emirates excels with theirs, providing Bvlgari products to keep you refreshed throughout your flight.

Give Emirates a try; you won’t be disappointed! Using Japan Airlines miles or Emirates miles, you can book a great experience that would normally cost thousands of dollars.

Just because this is an exciting opportunity, don’t forget to make smart decisions when booking. Check for award availability before transferring points, and remember that flexibility is key to making business class on Emirates a reality for you.

This article should give you everything you need to get started, so get ready to go book your Emirates business class experience!

Like this Post? Pin it on Pinterest!

The information regarding the Marriott Bonvoy Bold ® Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Marriott Bonvoy Boundless ® Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of the Marriott Bonvoy Bevy™ American Express ® Card, click here . For rates and fees of the Marriott Bonvoy Brilliant ® American Express ® card, click here .

Frequently Asked Questions

What is the best way to book emirates business class.

Use Japan Airlines’ Mileage Bank program if you want the lowest miles cost when booking, while Alaska Airlines’ Mileage Plan has higher mile costs but lower cash surcharges. You can also use Emirates miles, but those come with large surcharges too.

Emirates miles are much easier to earn, as they are transfer partners with Chase Ultimate Rewards , American Express Membership Rewards , and Marriott Bonvoy .

What do I get when flying Emirates business class?

When you fly on the Airbus A380, you’ll have access to an amazing inflight bar complete with snacks and cocktails.

Additionally, all business class seats on the A380 are lie-flat and have direct aisle access.

Before your flight, you’ll have access to the Emirates business class lounge.

Was this page helpful?

About Spencer Howard

Always a fan of flying, it was only natural that Spencer was drawn to finding a way to improve the travel experience.

Like many, he started this journey searching for cheap flights to take him around the world. This was fun for a while, but Spencer was intrigued by the idea of flying in business and first class!

Throwing himself into what became an extensive research project, Spencer spent 3-4 hours per night learning everything he could about frequent flyer miles over the course of several months (he thinks this is normal). He runs Straight to the Points, an award-seat alert platform.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Emirates’ new multi-risk travel insurance coverage

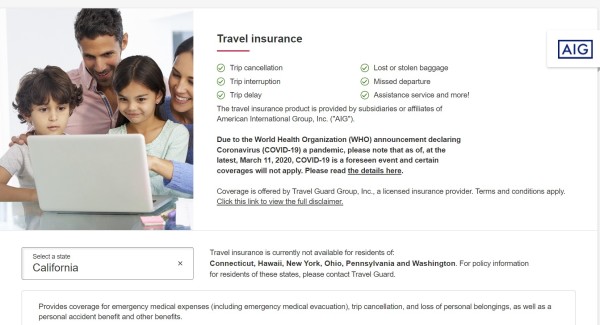

UAE-based carrier Emirates has announced a new multi-risk travel insurance coverage on top of its Covid-19 cover. The new multi-risk travel insurance coverage will be applicable on Emirates tickets purchased from December 1, 2020. The coverage will also apply to Emirates’ codeshare flights operated by partner airlines.

The newly launched insurance coverage by Emirates has provisions similar to other travel insurance such as personal accidents during travel, winter sports cover, loss of personal belongings among others.

Sheikh Ahmed bin Saeed Al Maktoum, Emirates chairman and chief executive told the media, “Emirates was the first airline to offer complimentary global Covid-19 cover for travelers back in July, and the response from our customers has been tremendously encouraging. We’ve not rested on our laurels and instead continued to look at how we can offer our customers an even better proposition. We’re very pleased to be able to now provide this new multi-risk travel insurance and Covid-19 cover, which is another industry first, to all our customers.

“We see a strong appetite for travel around the world, especially heading into the winter holidays as people seek warmer climates and family destinations like Dubai. By launching this new multi-risk travel insurance and Covid-19 cover, we aim to give our customers even more confidence in making their travel plans this winter and moving into 2021.”

Last month, Emirates said that it is looking to expand its reach in the African continent. In order to do so, it has signed an interline agreement with South Africa-based carrier Airlink. The carrier said in a statement that the deal would allow the carrier to boost its connectivity through its gateways in Johannesburg and Cape Town to more than 25 domestic and regional destinations in South Africa.

What's New

Oman records usd 6.7 billion trade surplus: data, islamic finance assets grew by 3.3% in 2023 in qatar: report, introducing technology in the workplace: how to do it, leave a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Registration

- Airlines & Airports

- Emirates Offers Expanded, Multi-Risk Travel...

Emirates Offers Expanded, Multi-Risk Travel Insurance Coverage

Emirates expands its industry-first COVID-19 cover with additional multi-risk travel cover for all customers purchasing an Emirates ticket from December 1.

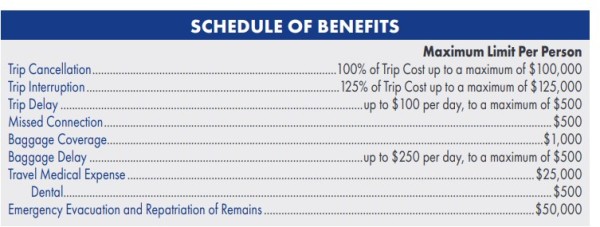

Emirates customers can now plan their travels and fly with even greater assurance and peace of mind, with the airline’s latest industry-first initiative to provide expanded, multi-risk travel cover on top of its current COVID-19 cover.

Provided by Emirates at no additional cost to its customers, and provided by AIG Travel, the cover is the first of its kind in the airline and travel insurance industry and is designed to provide all Emirates passengers with a stress-free and hassle-free travel experience.

This new multi-risk travel insurance and COVID-19 cover will automatically apply to all Emirates tickets purchased from December 1 and extends to Emirates codeshare flights operated by partner airlines, as long as the ticket number starts with 176.

READ: We Discover What All the Fuss is About at Singapore’s Ritz-Carlton Millenia

Emirates customers will be covered when they fly to any destination, in any class of travel, with coverage highlights including Out-of-Country Emergency Medical Expenses & Emergency Medical Evacuation (up to US$500,000), valid for COVID-19 (contracted during the trip) and other medical emergencies while traveling abroad; trip cancellation (up to US$7,500) for non-refundable costs if the traveller or a relative (as defined in the policy) is unable to travel because they are diagnosed with COVID-19 before the scheduled trip departure date, or for other named reasons – similar to other comprehensive travel cover products; and trip cancellation or curtailment (up to US$7,500) if the school year is extended due to COVID-19 beyond the departure date, and the traveller or a relative is a full-time teacher, full-time employee, or a student at a primary or secondary school.

Other coverage aspects include trip curtailment (up to US$7,500) for non-refundable trip costs and additional costs to return travellers to their country of residence if they or a relative falls critically ill, for instance, contracting COVID-19, while traveling abroad; travel abandonment (up to US$7,500) if the traveller fails a COVID-19-related test or medical screening at the airport and is required to abandon the trip; and US$150 per day per person, for up to 14 consecutive days if, while outside of their country of residence, the traveller tests positive for COVID-19, and are unexpectedly placed into a mandatory quarantine outside their country of residence by a governmental body.

“Emirates was the first airline to offer complimentary global COVID-19 cover for travellers back in July, and the response from our customers has been tremendously encouraging,” says Emirates Chairman and Chief Executive HH Sheikh Ahmed bin Saeed Al Maktoum. “We’ve not rested on our laurels and instead continued to look at how we can offer our customers an even better proposition. We’re very pleased to be able to now provide this new multi-risk travel insurance and COVID-19 cover, which is another industry first, to all our customers.”

READ: We Put American Airlines’ Flagship First Through its Paces

Similar to other multi-risk travel insurance products, Emirates’ generous cover also has provisions for personal accidents during travel, winter sports cover, loss of personal belongings, and trip disruptions due to unexpected air space closure, travel recommendations, or advisories.

Customers do not need to register or fill in any forms before they travel, and they are not obligated to utilize this cover provided by Emirates.

For more Airline & Airport stories click here .

STAY IN THE KNOW BY FOLLOWING US ON FACEBOOK , INSTAGRAM , & LINKEDIN

- airline news

- business travel

- business travel news

- business traveler

- business traveller

- coronavirus

- corporate travel

- corporate traveler

- corporate traveller

- travel news

About the Author

Staff Writer

Recent news.

New Business Travel Hotel for Colombo

Malaysia Airlines Enhances India Services

Is This Hong Kong's Most Indulgent New Suite?

Qantas Launches New Spirits & Winter Menus

- Privacy policy

Forgot password?

- With Twitter

- With Google +

- Autorization

Choose Your Style

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Newsletters

- Sweepstakes

- Airlines + Airports

Is Emirates Business Class Worth It? I Flew to Dubai to Find Out

The journey really is the destination in Emirates' legendary business class.

:max_bytes(150000):strip_icc():format(webp)/Skye-Sherman-author-pic-2000-d5983bed0cce41e1bafcdb645c665479.jpeg)

I have a confession. I don't subscribe to that oft-repeated, supposedly sage bit of travel advice that "the journey is the destination." No, I have a destination in mind, and I'm ready to get there. Perhaps it's why I'm not fond of road trips and frequently fail to leave enough time for wandering in my itineraries. I like flying, but I wouldn't consider any flight the point of my trip.

That is, unless we're talking about an Emirates flight in business class or better. I'd take a 16-hour flight to nowhere and back for that. Luckily, I didn't have to — Emirates launched a nonstop Miami to Dubai route that was perfect for a trip I already had to take. I booked my ticket, my bank account mourned the loss of several thousand dollars, and I was on my way (in an Uber, unfortunately; West Palm Beach is just outside the 50-mile range of Emirates' chauffeur pick-up perk).

There's no dedicated Emirates lounge at Miami International Airport like there is in Dubai, but the Turkish Airlines lounge passengers can use instead sufficed; if you have to pick one leg or the other, however, spring for the upgrade on flights departing from Dubai to gain access to the massive, multi-level Emirates lounge in the Dubai airport. There are showers, hot and cold food at all hours of the day, an ice cream cart, and attentive service on par with a five-star hotel — not to mention the private boarding area that directly connects the lounge to the plane, sans lines.

Emirates' business and first-class flights are the stuff of legends, but not all upgrades are created equal. As I researched and deliberated (read: watched way too many reviews on YouTube), I quickly discovered there's a big difference between the two planes they fly, the Boeing 777 and the Airbus A380 — namely, the 2-3-2 seating configuration on the 777 that has the business-class community up in arms. No business-class bigwig should run the risk of getting stuck in a middle seat at the front of the plane, insisted one reviewer; another lamented the "outdated" lay-almost-flat-but-not-quite design. There are also four versions of the 777, some of which (like the 777-300ER I flew) have the flat-angle 2-3-2 seats.

I see their point — there's a marked difference in luxury level between the 777 and the A380, though you'll pay the same price for both (a discrepancy that's far from unique to this airline) and you don't really get to choose which plane Emirates flies on which route — but I have to say, seat 7K on the 777 was nothing to complain about. As I settled in, I sincerely wished for our flight to be delayed, allowing me to live in my airplane seat just a little longer — something I have, without a doubt, never wished for before.

Arguably the "least nice" of Emirates' first- and business-class options across its fleet of jets, my business class experience on the 777-300ER still checked every box: Freshly prepared in-flight meals selected from a menu that seems impossible to offer in the air, served with white tablecloths, heavy silverware, and any beverage from cappuccinos to cocktails, all included in the price; a killer selection of entertainment on a huge TV screen; so much leg room that there's even leftover storage space for anything you want to keep within easy reach; and a smartly dressed crew member ready to indulge your every in-flight whim.

As you board (and marvel at your spacious new home for the next 16 hours), you're greeted with passed trays of Champagne and juice. Sit down, and you're soon handed a toiletry kit stocked with Bulgari minis plus toothpaste, a toothbrush, hand cream, and more. Settle in, and it's not long before a crew member stops by to offer you a blanket, pillow, noise-canceling headphones, eye mask, and socks. The crew will also install your mattress pad and take your first three-course meal order.

Espresso martini, Aperol spritz, or an 18-year-old scotch? For your appetizer, Cajun prawns or a traditional Arabic mezze platter? Pan-seared sea bass or lamb kabsa for dinner? And for dessert, how about a coconut panna cotta with a side of seasonal fruit? If you somehow get hungry between meals — this same process and impressive selection repeat for breakfast, lunch, and dinner — there's also a menu of light bites like butter chicken, spinach-and-pumpkin empanadas, and poke. Not to mention sporadic arrivals of nuts fresh from the oven, the symbol of fine flying.

There's a lot to keep you awake and entertained, but don't forget that half the point of springing for business is the ability to lie back (way back) and arrive at your destination well-rested. When the lights dim and you glide your seat back to lie-almost-flat mode, look up: there's a ceiling full of stars twinkling above you in the darkness. Cozy and curled up (or not), it's easy to drift to sleep at 30,000 feet when you know a hot breakfast awaits upon waking.

Still, delightful as it is, remember that even business class can't shield you from crying babies. Bathrooms (unless you've got access to the Shower Spa in the A380 first class) are the same cramped situation they are on every flight — though it helps that these are stocked with full-size Bulgari cologne and perfume.

And you'll fly just as many hours to your destination as those in economy — even if you, unlike them, are wishing those hours would last just a little bit longer.

Related Articles

Slightly Less Than Solid Gold: Business Class on Emirates' A380 From JFK to Dubai

Update: Some offers mentioned below are no longer available. View the current offers here .

Emirates is widely regarded as one of the best airlines in the world. Its premium classes are known to offer some of the better products — both hard and soft — in the skies. I've flown with Emirates in business class before and was thoroughly satisfied with my experience.

On a recent trip to Dubai to AvGeek out and fly on the shortest A380 flight (in Emirates first class!) , I decided to get there via another experience with Emirates. Again, on an A380, and again, in business. Almost two years after my first time in the cabin, I was thrilled to experience the Emirates business-class experience one more time.

This one-way ticket was booked at the last minute — just three days before departure. At that point, Alaska Airlines Mileage Plan was showing no saver level availability for Emirates business class on the route for the date of departure I was looking for. I kept my eye on it though, hoping that availability would open up at some point.

Sure enough, the following day when I logged into my Mileage Plan account, the site was displaying business-class award availability just on the date I needed — score! I learned a few lessons here: 1. It never hurts to be patient; 2. It's true that sometimes the best availability opens at the last minute; and 3. Scenarios like this are when ExpertFlyer is incredibly valuable.

So, I ended up booking the one-way business-class ticket for 82,500 Alaska Airlines Mileage Plan miles + $20.

You can also book Emirates' famed first-class seats via Alaska's program . While Alaska miles can give you some great redemptions, they're on the harder side to earn. The best way to earn quickly is by signing up for the Alaska Airlines Visa Signature credit card, which comes with a sign-up bonus of 30,000 miles after spending $1,000 within the first 90 days.

Aside from using Alaska miles, you could book a similar flight through Emirates' own Skywards program, though rates are variable and can sometimes be absurdly high. That being said, if you're patient and can find a reasonably priced award flight, it's easy to gain Skywards points, since the program is a 1:1 transfer partner of American Express Membership Rewards .

Lounge and Boarding

The check-in process was smooth, and within a few minutes I was through security with my TSA PreCheck — thankfully Emirates is one of the participating international airlines in the PreCheck program.

Unfortunately, Emirates' lounge at JFK was under construction when I left on my trip, though it reopened soon after my flight — you can check out our first look at the new space here . So, instead of lounge access, I was given $40 to use toward dining at any restaurant in the terminal. And for first-class passengers, Emirates offered $55 for the same dining service.

I quickly found out that $40 at JFK doesn't get you far. I stopped at Le Grand Comptoir in Terminal 4 and ordered a glass of wine, which cost a mind-boggling $20. I didn't want to exceed the $40 I was given, so the high price of the wine quickly limited my options for a meal... priorities! I settled on the caprese appetizer — fresh mozzarella, tomato, basil and a balsamic drizzle. Even though it wasn't a ton of food, I ended up not too opposed to this voucher situation, as I was certainly less stuffed than I would have been had I gotten to visit a lounge. That being said, it would have obviously been more pleasant to relax in a more private and comfortable lounge before my flight. Now, though, all is back to normal — if you're flying Emirates in a premium cabin, you'll be able to take full advantage of the carrier's recently reopened lounge.

Shortly before boarding was set to begin, I headed to the gate where there were a number of passengers already lined up. But there was no signage. With masses of people waiting to board, it was near-impossible to find where premium passengers were supposed to board. Naturally, I headed toward the area closest to the boarding door, where I found a few other passengers with "Business" or "First" on the corner of their boarding passes.

Emirates Flight 202 had a scheduled departure time of 11:00pm, and boarding was set to begin around 10:20pm. That time came and went, and passengers were still congregated around the gate at 10:45pm with no word from the gate crew as to the cause of the delay. Passengers clearly grew frustrated — if nothing else, because of the lack of communication. Eventually, around 10:50pm, boarding began for those with children and those who required more time to board. Then, both first- and business-class passengers were allowed to board at the same time.

After making my way through the jet bridge to the upper deck of the enormous A380, I was greeted by a friendly Emirates flight attendant who welcomed me back to Emirates business class. Having flown the product on the A380 only once before in 2016 , I found it a nice touch that the airline recognized me for returning to the cabin.

Cabin and Seat

Our A380, registration A6-EDZ, was delivered to Emirates in 2012 and has been flying for the carrier ever since. It features a three-class configuration: first class (14 seats), business class (76 seats) or economy (399 seats). The lower deck of the aircraft is comprised only of economy seats, which are arranged in a 3-4-3 configuration. Each of the economy seats offers 32-34 inches of pitch and is 18 inches wide.

Because I was sitting in the business-class cabin, we boarded on the upper deck, which is where I stayed for the duration of the flight.

On this particular A380, the upper deck is comprised of 14 closed first-class suites arranged in a 1-2-1 configuration, which I later tried on a new version of the aircraft on the world's shortest A380 flight from Dubai (DXB) to Muscat (MCT) . Behind the first-class cabin, you'll find 76 lie-flat seats, also arranged in a 1-2-1 configuration. Each of the seats has 48 inches of pitch and is 18.5 inches wide, which seems narrow on paper, but I actually found it to be spacious enough since there was room to stretch out and I could place my belongings on the generously sized side table.

The business-class cabin is split into two mini cabins. The front one is the larger, with a total of 58 seats. Behind the barrier, you'll find a smaller cabin with just 18 seats. I find the rear mini-cabin to be more comfortable and offer more privacy. In part, it's because of the lavatory configuration. The barrier separating the two cabins doesn't include a lavatory so if you're sitting in the rear section, there isn't much foot traffic — unless passengers are going to use a lav at the rear of the aircraft or if they're heading to the bar. That being said, because of the location of the bar, the smaller mini-cabin could prove to be a bit noisy on some flights, particularly if you're sitting in the last row,

At each seat you'll find your own minibar, massive amounts of storage space and a side table on which you can put your small devices. While the bottom shelf of the minibar offers a small selection of soft drinks — soda, still water and sparking water — the top shelf contains a set of headphones and a small kit with socks and an eyeshade.

Not all seats in the business-class cabin are created equal. Some offer much more privacy than others — particularly those flush against the cabin wall — while others are better for passengers traveling as a couple. My seat, 24J, was a window seat that had its table and mini bar closer to the window, meaning my seat was closest to the aisle and subject to foot traffic and more chances for awkward eye contact with other passengers.

The last time I flew Emirates business class, I was seated in seat 23J. And while it was just one row in front, it was both a bulkhead seat and flush against the window, which made it much more private. If you're seated in the front mini cabin, even-numbered seats offer more privacy, while odd-numbered seats are facing the aisle. In the rear mini cabin, the reverse holds true — you'll want to select odd-numbered seats for maximum privacy. If you're traveling with a partner, you'll want to get an even-numbered seat in the front mini cabin or an odd-numbered seat in the rear.

The two seats in the center of the cabin do feature adjustable privacy screens. So, if you're traveling alone and sitting in one of the two seats, you can raise the partition to make your seat more private. Alternatively, you can choose to leave it down — likely the preferred choice for couples.

Opposite from the seat, you'll find a large footwell — it felt comfortable even with the seat in its fully flat position. Directly above the footwell is the in-flight entertainment screen, which is built into the seat-back in front.

When it comes to storage, this particular seat is a mixed bag. Because my seat's table and minibar were flush against the cabin wall, the main storage compartment was difficult to reach. In order to get to it, you had to reach over the table and into a deep well. For smaller items, it was particularly hard to reach the bottom of the space. Instead, there's a small slot directly next to the seat, which is labeled as reserved for the in-flight literature. However, I chose to use it to store some of my smaller items that would have otherwise been difficult to reach in the main compartment — my phone, AirPods charging case and some light reading.

Emirates is the world's largest operator of A380s by a large margin. The carrier's known for its extravagant details in its cabins — think lots of burled wood and gold trim. And while the carrier's updating some of its newer A380s — including a fresh, new bar that's a bit less gaudy — some of its older aircraft are showing their age. A6-EDZ, the aircraft servicing this flight, is about six years old, and there was noticeable wear and tear at my seat. Of course, a little wear is expected on a plane, so this wasn't a big deal to me, but with some A380s getting a minor refresh, it could lead to some inconsistent experiences for passengers.

Overall, I found the cabin and seat to be comfortable. One thing Emirates does very well is the little touches. Because the cabin is open, not only does it feel airy, but you'll also be able to see the stars — not literally, but the roof of the interior features sparkling lights. (Think of a childhood bedroom, twinkling at night.) Additionally, I am a fan of the mood lighting that was employed on my flight. Warm colors were featured around dinnertime to prepare guests for bed and the same to wake you up in the morning. While one might argue that Emirates doesn't have the best business class in the sky — in fact, many would save that honor for Qatar's Qsuite — it does a great job at offering travelers a comfortable experience.

Food and Beverage

Meal service on board this flight included both dinner and breakfast. In addition, there were a number of snacks offered throughout the flight — particularly at the rear of the aircraft at the bar.

After leaving the gate around 11:45pm, dinner service started with a choice of beverages and Emirates' signature pre-meal warm nut mix. I opted for a glass of the Cloudy Bay Sauvignon Blanc, a 2017 vintage from New Zealand, which is refreshing and aromatic. It retails for about $30 per bottle.

About an hour and a half after takeoff, crew came around the cabin to take orders. The ordering process took longer than I expected because the FAs started taking orders at the very front of the cabin, not just at the front of each mini cabin.

On this flight, appetizer choices included:

- Yellow pepper and lemongrass soup, served with red pepper and herb croutons

- Pan-fried prawns, served with wakame salad with pepper chèvre, dressed with wasabi and nigella seeds

- Smoked duck, served and chilled with carrot and celery kimchi and raspberry truffle vinaigrette

I opted for the lemongrass soup, which was light and tasty, though not the best in-flight soup I've been served.

For the main course, options on this flight included:

- Roasted beef fillet, served with thyme jus, gnocchi and grilled vegetables

- Miso-glazed cod, served with edamame beans and steamed kai-lan

- Bangalore chicken, a spicy chicken with mango, served with steamed basmati rice and green vegetable curry

I chose the miso-glazed cod, which was very dense and kind of tough for a typically flaky fish. The edamame and kai-lan didn't add much flavor, but the miso glaze — served on the side rather than on the fish itself — added some flavor. I enjoyed the dish overall, but it definitely wasn't a slam dunk.

To round out meal service, Emirates offered a selection of desserts, though at that point, I was too full to indulge. Choices included:

- Chocolate fudge brownie, topped with a salted caramel profiterole, served with caramel sauce

- Mango and raspberry torte, a vanilla mousse with raspberry center, topped with mango cremeux, served with raspberry compote

- Seasonal fruit

- Cheese board

Finally, flight attendants came around with a small box of two chocolates — one dark and one milk. I saved them for later in the flight.

During the flight, there was a light bite option, but I slept right through that. A little more than two hours before landing in Dubai, flight attendants woke passengers with soft, red mood lighting and took orders for breakfast.

Choices for breakfast included:

- Eggs florentine — poached eggs with sautéed spinach on English muffins, topped with hollandaise sauce

- Courgette and goat cheese frittata, served with sautéed mushrooms and red onion chutney

- Waffles, served with cherry compote and maple syrup

- Continental cold plate, served with sliced smoked turkey, beef pastrami, feta, Monterey Jack and goat's cheese with herbs

I chose the eggs florentine, which I really liked. The eggs were served over hard and weren't as runny as I'm used to with a dish like this. That being said, they were still tasty and didn't have a spongey texture. The fruit and pastry were also very fresh.

Overall, I found the food on this flight to be good, but not great. On my first Emirates A380 business class flight, I found the food to be amazing, so this was a step down. That being said, by no means was the food on this flight bad — it just didn't meet my expectations that I had from my last experience. Maybe it's because this flight was catered in New York, whereas my other flight was catered in Dubai.

In-Flight Entertainment and Amenities

Emirates takes its in-flight entertainment and amenities seriously. It's those parts of the soft product that help to set it apart from many of its competitors. Arguably the most famous amenity on board the Emirates A380 — aside from the onboard shower, which is reserved for first-class passengers — is the bar in the rear of the upper deck.

The bar actually feels more like a lounge. There's a swanky design, a staffed bar, snacks and seating areas. It's a great place not only to grab a drink, but also to mingle. During my flight — and especially toward the end — the bar area got a bit noisy. The national cricket team of Sri Lanka happened to be on my flight and hung out in the bar area for much of the end of the flight. Because it can get noisy back there, I'd recommend sitting a bit farther up in the mini cabin if you have a choice — especially if you're a light sleeper.

I found myself hanging in the bar/lounge area quite a bit during the flight (when I wasn't sleeping). After I finished dinner, I went back to grab an Aperol Spritz. Small finger foods of the sweet and savory variety were also on display and available to grab throughout the flight.

Aside from the premium bar, which is available to travelers in business and first class, Emirates offers several other notable amenities. Business-class passengers have access to a loaded in-flight entertainment system, complete with a 23-inch touchscreen. The screen itself is huge and can be controlled three ways — via the touchscreen, a small handset in the armrest or via a small tablet, which is also capable of displaying content of its own. I found myself using the small side tablet to display my flight info, and I watched movies on the main screen. ("Ladybird" was offered on the flight. If you've never seen it, I highly recommend!) Options included newly released films and TV shows, as well as some great exterior camera shots of the aircraft, perfect for AvGeeks.

Aside from the seatback screen, passengers also have access to a power outlet, which is located right below the screen, and a USB port.

At boarding, flight attendants distributed amenity kits for business-class passengers — women and men received different kits. Inside my kit was a brush, tissues, mirror, a set of lotions and perfume from Bulgari and a dental kit. I liked the bag itself, and kept it to reuse.

Aside from the major amenities, I also found some of the smaller touches to be especially noteworthy. Each business-class passenger got a set of three stickers, which you can place on your seat when sleeping: one alerting flight attendants to not wake you at all, one telling them to wake you up for meals, and one telling them to wake you up for duty free. It's a simple way to avoid the awkward interactions that can come with the sleeping patterns on a long-haul flight.

On every flight I've taken with Emirates, the service has been consistently excellent. Emirates takes the service aspect of its soft product very seriously — and that shows in the result. I'm a firm believer that the service on board can make or break an experience, and the friendly, welcoming crew here completely made this experience a memorable one — from offering to take pictures of me to going above and beyond in every aspect of the flight.

Part of the pre-flight announcement from the cockpit included the tidbit that the operating crew hailed from 19 countries and spoke 15 languages. For a global airline like Emirates, having such a wide range of crew who can communicate with a multitude of passengers is incredibly appealing.

Overall Impression

While there are definitely some cons to the Emirates A380 business-class experience, it's still worlds better than what you can expect flying with many other carriers — especially those based in the US. On this flight in particular, the meal service didn't quite meet my expectations, and the hard product looked a little worn in spots. However, the service and in-flight amenities really help to set it apart.

Is Emirates one of the best ways to get across the Atlantic in business class? Absolutely. (Plus, who can turn down an A380?) But, as the carrier has shown it's willing to do in the past with upgrades to the in-flight bar and lounge area, I hope it continues to improve on an already-impressive flying experience.

Dubai’s Emirates to offer free multi-risk travel insurance coverage

The cover, provided by AIG Travel, is offered to Emirates passengers at no additional cost

Dubai carrier Emirates will provide expanded, multi-risk travel cover to its passengers, in addition to its current Covid-19 coverage, it announced on November 23.