U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

Travel Insurance for Seniors & Retirees: 5 Top Picks

Allianz Travel Insurance »

Trawick International »

GeoBlue »

IMG Travel Insurance »

WorldTrips »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance for Seniors and Retirees.

Table of Contents

- Allianz Travel Insurance

- Trawick International

While anyone planning a trip overseas can benefit from having a travel insurance plan in place, older travelers need to prioritize this coverage more than others. The fact is, senior travelers and retirees have unique worries and risks to think about any time they travel far from home. These risks increase their need for travel health insurance and emergency medical coverage, as well as coverage for emergency medical evacuation that applies anywhere in the world.

Which travel insurance options work best for seniors? There are many travel insurance plans that were created with retirees in mind, although you'll want to compare them side by side. For example, you may want to look at coverage limits for medical expenses and coverage for preexisting conditions above all else.

U.S. News editors compared more than 20 of the top travel insurance companies to find the best plans for seniors. This list does the heavy lifting for you as you search for the best senior travel insurance of 2023, so read on to learn about the top picks.

- Allianz Travel Insurance: Best Annual Coverage

- Trawick International: Best Premium Travel Insurance for Seniors

- GeoBlue: Best Travel Medical Coverage for Expats

- IMG Travel Insurance: Best for Short-Term Travel Medical Coverage

- WorldTrips: Best for Flexibility

Available to senior travelers of all ages

Coverage for preexisting conditions is offered

Relatively low limits for emergency medical expenses

- Coverage for COVID-19

- Trip cancellation coverage up to $3,000

- Trip interruption coverage up to $3,000

- Emergency medical coverage up to $20,000

- Emergency medical evacuation coverage up to $100,000

- Baggage loss coverage up to $1,000

- Baggage delay insurance up to $200

- Travel delay coverage up to $600 ($200 daily limit)

- Rental car damage and theft coverage up to $45,000

- Travel accident coverage up to $25,000

- 24-hour hotline for assistance

- Concierge service

- Preexisting condition coverage (must be added to plan within 14 days of first trip deposit or payment)

SEE FULL REVIEW »

Customize plan with optional CFAR coverage

Incredibly high limits for medical expenses and emergency evacuation

Coverage is for trips up to 30 days if you're age 80 and older

- Up to $15,000 in trip cancellation insurance

- Up to $22,500 in trip interruption coverage

- Up to $1,000 for trip delays ($200 daily limit for delays of 12-plus hours)

- Up to $1,000 for missed connections

- Up to $150,000 for emergency medical expenses

- Up to $1 million in emergency medical evacuation coverage

- $750 in emergency dental coverage

- $2,000 in coverage for baggage and personal effects

- $400 in baggage delay coverage

- 24/7 noninsurance assistance services

Get comprehensive health insurance that applies overseas

Preventive and routine care included

Age limits apply for new applicants and renewals

- Preventive and routine care

- Professional services like surgery

- Inpatient medical care

- Ambulatory and therapeutic services

- Rehabilitation and therapy

Get overseas medical coverage for single trips or multiple trips

Plans were created with seniors and retirees in mind

Lower maximum coverage limits for travelers ages 80 and older

Limited nonmedical travel insurance benefits

- Inpatient and outpatient medical coverage such as for physician visits, hospitalization and surgery

- Emergency and nonemergency medical evacuation coverage

- Coverage for emergency reunions

- Return of mortal remains

- Trip interruption coverage worth up to $5,000

- Lost luggage coverage worth up to $250 (up to $50 per item)

- Coverage for terrorism worth up to $50,000

- Accidental death and dismemberment coverage worth up to $25,000

Customize your deductible and premiums

Generous medical limits for travelers ages 65 to 79

Limited medical coverage for travelers older than 80

- Up to $1 million in emergency evacuation coverage

- Medical benefits like hospital room and board, chiropractic care, and more

- Coverage for repatriation of remains

- Up to $25,000 in personal liability coverage

- Up to $10,000 in trip interruption insurance

- Up to $1,000 in coverage for lost checked luggage

- Up to $100 per day in coverage for travel delays of 12-plus hours

- Up to $1,500 in coverage for bedside visits

- Up to $100,000 in coverage for emergency reunions

Frequently Asked Questions

You can purchase some travel insurance plans (but not all) if you're older than 80 years old. However, your premiums may be higher and you'll typically qualify for lower coverage limits overall. Make sure you compare the best travel insurance plans for seniors to find the right fit for your needs.

Since seniors and retirees are more likely to face a medical emergency during a trip, most travel insurance plans for seniors include coverage for emergency medical expenses and emergency medical evacuation. Coverages vary among plans, as do limits, so make sure to compare options before you book a trip overseas.

Why Trust U.S. News Travel

Holly Johnson is a professional travel writer who has covered international travel and travel insurance for more than a decade. Johnson has researched and compared all the top travel insurance options for her own family for trips to more than 50 countries around the world, and she has successfully filed claims during that time. Johnson lives in Indiana with her two children and her husband, Greg, a travel agent who has been licensed to sell travel insurance in 50 states.

You might also be interested in:

9 Best Travel Insurance Companies of 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

Does My Health Insurance Cover International Travel?

Private health insurance typically doesn't cover international travel expenses.

How to Get Airport Wheelchair Assistance (+ What to Tip)

Suzanne Mason and Rachael Hood

From planning to arrival, get helpful tips to make the journey easier.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

The Best Travel Insurance Options for Seniors [Ages 65, 70, and Over 80]

Christine Krzyszton

Senior Finance Contributor

312 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3265 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

![travel insurance for the over 80's The Best Travel Insurance Options for Seniors [Ages 65, 70, and Over 80]](https://upgradedpoints.com/wp-content/uploads/2021/05/Senior-couple-on-beach-at-sunset.jpeg?auto=webp&disable=upscale&width=1200)

Table of Contents

Why purchase travel insurance, what you need to know about age and travel insurance, best travel insurance options — ages 65 to 69, best travel insurance options — ages 70 to 79, best travel insurance options — age 80 and above, credit card travel insurance, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Our senior years can be some of the most exciting years of our lives. If we’re fortunate, we’ll now have the time, and hopefully, the resources, to make our travel dreams come true.

As we age, however, traveling may pose some additional risks. We may be more likely to have health-related issues and therefore the need to seek medical attention during our journey. We may also have occasions where we need to cancel our plans due to health issues or the health of those around us.

Now, more than ever, we need to think seriously about purchasing travel insurance. The good news is that comprehensive travel insurance, regardless of your age, is widely available and relatively affordable. With that being said, chances are you could use a little help getting started with the process of finding and purchasing the right plan.

If you’re 65 years of age or older and thinking about purchasing travel insurance, don’t pull the trigger without reviewing the information in today’s article on travel insurance options for seniors.

Travel insurance can protect you from financial loss due to unforeseen events that can cause you to cancel your trip or disrupt your trip once it’s in progress. As we age and our health declines, we may be more likely to experience such an event.

Travel insurance can cover the following situations:

- You, a family member, or travel companion becomes seriously ill and you must cancel your trip

- You slip and fall while traveling abroad, require medical care, and are forced to stay in a foreign city until you can travel again

- You are on safari and break your ankle, requiring emergency evacuation to the nearest hospital

The types of coverage you can expect to find on travel insurance policies include the following:

- Emergency medical coverage

- Emergency evacuation

- Trip cancellation, trip interruption , and trip delay

- Baggage insurance and personal effects coverage

- Travel accident and accidental life insurance

You may also elect to add coverage such as cancel for any reason insurance (CFAR) , a waiver for preexisting conditions, or car rental insurance.

It’s possible to purchase travel insurance at just about any age. If you’re healthy enough to travel, you’ll generally be able to find coverage. You’ll normally be paying more to purchase coverage as you get older, however, and most policies may have preexisting health stipulations.

The Cost of Travel Insurance

As age increases, so does the cost of purchasing travel insurance . The good news, however, is that premiums tend to vary widely between companies who offer policies for older travelers, so it pays to compare.

The easiest way to compare policies is via insurance comparison sites such as SquareMouth , InsureMyTrip , or TravelInsurance.com . Travel comparison sites make it easy to compare travel insurance policy pricing and coverage options for all ages.

We’ve used these sites to find most of the comparison quotes provided in this article.

Preexisting Conditions

As we age, we’re more likely to have preexisting health conditions, which can be excluded from most travel insurance policies. Once again, the good news is that preexisting condition exclusions are generally limited to a specified timeframe previous to the effective date of your policy.

If you have shown symptoms or been treated within a specified time period before your trip, usually 90 to 120 days, your condition may not be covered for certain coverages such as trip interruption, cancellation, or emergency medical. Each company’s requirements may differ.

Also, on a positive note is that many insurers allow you to purchase a preexisting condition waiver when you purchase your policy.

Travel Insurance and Medicare

Health insurance may or may not cover medical costs abroad. And even if there is coverage, evacuation costs may not be included. The same scenario exists with Medicare.

Medicare will not cover medical expenses incurred abroad . There are very limited situations where Medicare may grant coverage, such as if you reside in the U.S. and a foreign hospital (such as a Canadian hospital) is closer to your residence than the U.S. hospital, or you’re traveling through Canada to reach another U.S. state or territory. Also, several terms and conditions apply.

There are Medicare supplement policies you can purchase that can cover you while traveling abroad. You’ll pay a standard $250 deductible, have coverage for 80% of eligible expenses beyond that amount, and have a lifetime cap of $50,000 in coverage.

So even if you have Medicare, a Medicare supplement, or other health insurance policy, there can still be plenty of gaps in coverage when you’re traveling abroad.

For this reason, and the need for additional coverage such as trip cancellation, interruption, delay, baggage coverage, and more, it’s prudent to purchase travel insurance.

Bottom Line: Medicare will generally not cover medical expenses when you’re traveling outside of the U.S. and its territories and Medicare supplement and Advantage policies provide limited coverage. Travel insurance is a wise choice for covering medical expenses and for other travel-related events that could cause you to cancel your trip or disrupt your journey in progress.

COVID-19 and Travel Insurance

As we advance in age, the chance we will need to cancel a trip due to health-related issues increases. Fortunately, most travel insurance policies cover trip cancellations due to illness. However, travel insurance policies do not cover voluntary cancellations such as canceling your trip due to the fear of getting sick.

Cancel for any reason insurance (CFAR), when added to a travel insurance policy, will allow you to cancel your trip for any reason you deem necessary. It will even cover you if you simply decide not to go.

While CFAR insurance allows you to cancel your trip for any reason, including COVID-19-related issues, the coverage will not reimburse 100% of your costs. The coverage can only be purchased when you purchase your travel insurance or for a short window following the purchase. CFAR insurance can also be expensive.

Our article on COVID-19-related trip cancellations goes into a lot more detail.

Priorities change as we change and as a result, we may have different insurance needs at age 65 than we do at age 80. Here are some examples of travel insurance plans that might be a fit for travelers age 65-69.

World Nomads — Best For Active Seniors

If you’re under age 70, you’ll find comprehensive travel insurance coverage with World Nomads . What sets World Nomads apart from other insurance providers is that they’re experts at insuring active travelers who participate in adventurous activities.

While World Nomads does not offer CFAR insurance, COVID-19 is not excluded as an illness for trip cancellation and emergency medical coverage.

World Nomads only insures those travelers under age 70 and refers older travelers to its partner TripAssure .

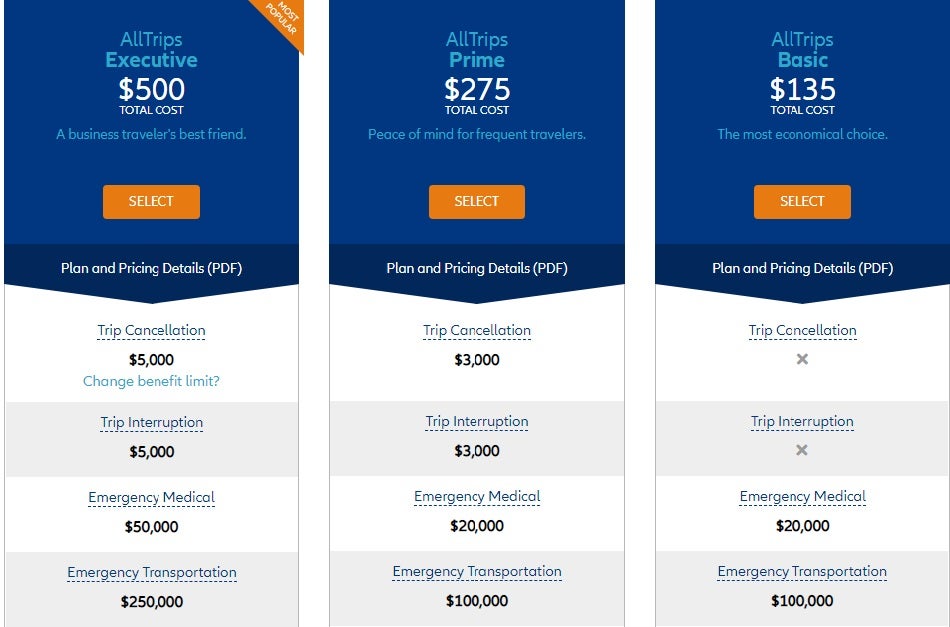

For a traveler 68 years of age, traveling to the Netherlands for 8 days, with a total trip cost of $3,000, here are some sample costs.

The main differences in these plans are that the Explorer Plan covers an expanded collection of over 200 covered adventurous activities, has higher limits for trip interruption/cancellation/delay and emergency evacuation, and includes rental car insurance.

Secure your own quote from World Nomads .

Allianz — Best for Annual Multi-Trip Policies

Allianz simplifies purchasing travel insurance with its offerings of travel insurance package policies. You can select from single trip policies with several levels of coverage options or annual multi-trip policies that cover every trip you make during the policy period, even ones you haven’t yet planned.

If you travel frequently, or even a few times each year, purchasing an annual, multi-trip plan could be a cost-effective way to protect all your trips.

To learn more about Allianz and its policy offerings , you’ll want to check out our review for details.

Hot Tip: Be sure to compare the price of an annual multi-trip travel insurance policy to a single-trip plan, even if you are only currently planning 1 trip. You may find a better value in the annual multi-trip policy and not have to purchase additional coverage if you should decide to travel again during the policy period.

Best for Covering COVID-19 Cancellations

Many policies will cover trip cancellation due to getting the virus, but none will cover cancellation due to the fear of getting the virus. To cover cancellations based on the fear of COVID-19, you’ll need a policy that allows you to add CFAR insurance .

The following are just a sampling of companies that offer this option on their policies.

- John Hancock

- Seven Corners

Please note that not every policy these companies offer allows you to add CFAR coverage.

For more information on travel insurance covering COVID-19 , we’ve put together an informative article.

There are a lot of reasons to embrace the wanderlust and travel in your 70s. By then, many have retired and perhaps have more money to spend on travel. There can also be a sense of urgency to travel while we’re still healthy.

As we’ve mentioned, however, as we age we are more apt to have health issues. Fortunately, this doesn’t mean we’ll be unable to purchase travel insurance. Even into our 70s, we’ll have plenty of travel insurance options, and coverage can still be affordable.

Best for Preexisting Conditions

Since travel insurance is meant to protect you from unforeseen events, having a preexisting health condition may rule out any chance of coverage for that issue. However, several companies allow you to purchase a waiver so that preexisting health conditions can be covered.

Here are just a few companies that offer this waiver:

- Travel Guard

- Travel Insured

Each company has its own requirements for adding a preexisting condition waiver to your policy. You must purchase the policy within a specific time period, such as within 14 to 30 days after making your first trip deposit payment. You may also be required to insure the entire cost of your trip and your health must be medically stable when purchasing the coverage.

As a senior, it becomes more and more likely that we will actually have to use our travel insurance coverage as we age. However, even at age 80 or beyond, you’ll still find travel insurance widely available and relatively affordable. Some companies are willing to insure older travelers but charge higher premiums , so it’s wise to compare the pricing of several providers.

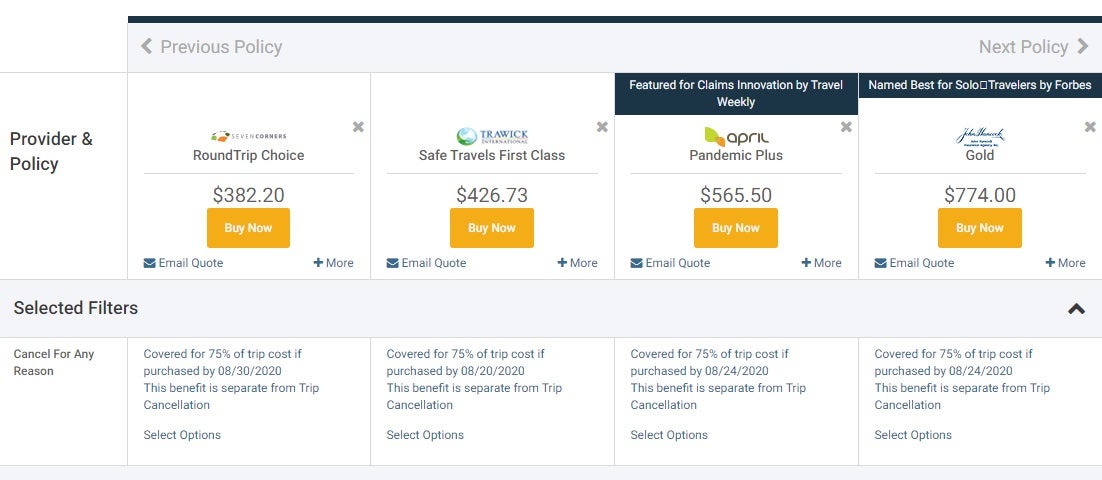

Above you’ll find a sampling of 4 SquareMouth quotes for single-trip travel insurance policies that include CFAR insurance for a traveler 80 years of age. The trip’s total cost was stated at $3,000 and was 8 days in length. Quotes ranged from $382 (Seven Corners) to well over $1,000 to insure the trip (not all quotes are shown). Coverage limits can also vary greatly, so it can be beneficial to compare policy limits.

If you’re looking to purchase travel insurance and you’re 80 years of age or older, it’s imperative to compare policies for the best pricing and coverage.

Hot Tip: Seniors ages 65 to 99 who are not interested in CFAR (cancel for any reason) insurance, may consider an annual multi-trip travel insurance plan. Allianz is a company that charges the same premium, regardless of age, for its annual plans for travelers ages 65 to 99 .

There is 1 type of travel insurance that will cover you, regardless of age . U.S.-issued credit cards come with various types of travel insurance coverages that apply to all primary cardholders.

Typical travel insurance coverage found on credit cards includes the following:

- Lost, stolen, or damaged luggage insurance

- Car rental insurance

- Roadside assistance

- Travel accident insurance

- Travel assistance hotline

Premium credit cards such as The Platinum Card ® from American Express and Chase Sapphire Reserve ® also come with valuable emergency evacuation coverage. Additionally, the Chase Sapphire Preferred ® card is known for its comprehensive travel insurance benefits, including primary car rental insurance .

To learn more about which credit cards come with travel coverage, check out our article on the best credit cards for travel insurance benefits.

Bottom Line: The travel insurance benefits that come with U.S.-issued credit cards do not generally have age limits for coverage. However, many credit card travel benefits may be secondary to other insurance you might have. This means that you might first have to file a claim with your own insurance before the credit card insurance is valid.

As seniors, purchasing travel insurance should be a priority for protecting your investment and preventing losses you might incur due to unexpected medical expenses during your travels.

With wide availability, regardless of age, it’s not only a prudent economic move, but it’s also a move that delivers peace of mind before and during your trip.

Finally, always make sure to compare policies as coverages and prices vary widely between travel insurance providers.

You can learn more about the best travel insurance companies for travelers and the basics of travel insurance in our informative articles.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

Frequently Asked Questions

What is the best travel insurance for seniors over 65.

Since travel insurance is widely available, even for seniors over 65, the best policy can be found by comparing companies and policies.

Using a travel insurance comparison site such as SquareMouth, InsureMyTrip, or TravelInsurance.com can assist you in comparing coverages and costs between only highly-rated financially stable travel insurance companies.

If you travel more than once per year, consider an annual, multi-trip, policy that covers any trip you take during the policy period.

Does travel insurance cover COVID-19?

Travel insurance is meant to cover unforeseen events. Once COVID-19 was declared a pandemic, it became a known event and is not covered as a reason for canceling your trip plans.

However, there are situations where COVID-19-related claims can be covered. If you become ill with the virus before or during your trip, you may be covered for trip cancellation, trip interruption, or emergency medical.

Does travel insurance cover preexisting medical conditions?

A standard travel insurance policy does not cover ongoing preexisting health conditions. However, many companies will insure you if you have a condition that is stabilized with medicine and no recent treatment has been sought. Requirements vary by travel insurance provider.

Also, many companies allow you to purchase a waiver that will then cover you for preexisting conditions.

Does credit card travel insurance cover flight cancellations?

The trip cancellation, interruption, or delay coverage that comes with your credit card does not cover voluntary flight cancellations.

The coverage does cover some flight cancellations due to unforeseen events such as becoming ill prior to, or during your trip. Coverage varies by credit card issuer but you will find a list of specific covered events in your card’s guide to benefits.

You can also call the number on the back of your card and speak with the claim administer.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Best overall

- Best for expensive trips

- Best for older travelers

- Best for affordability

- Best for annual plans

- Why You Should Trust Us

Best Travel Insurance for Seniors of June 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Reaching your golden years doesn't mean your adventures have to end. In fact, in this stage of life, you'll hopefully have more time and resources to travel. But as a senior citizen, you'll want to ensure you have travel insurance that covers any health-related issues arise while you travel.

Best Senior Travel Insurance Companies

- Best overall: Allianz Travel Insurance

- Best for expensive trips: John Hancock Travel Insurance

- Best for older travelers: TravelSafe Insurance

Best for affordability: GeoBlue Travel Insurance

Best for annual plans: travel guard.

How we rate the best senior travel insurance companies »

Compare the Best Travel Insurance for Seniors

Your health gets more unpredictable as you age, which makes travel insurance more important for seniors. Unfortunately, it's also more expensive. The best travel insurance for seniors won't have too steep of a price hike compared to rates for younger travelers. It will have high coverage limits for emergency medical coverage, trip cancellations, and and emergency medical evacuation. It's also important that your travel insurance offers pre-existing condition waivers , ideally at no extra cost to the traveler.

Here are our picks for the best travel insurance coverage for seniors in 2024.

Best overall: Allianz

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Good option for frequent travelers thanks to its annual multi-trip policies

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Doesn't increase premium for trips longer than 30 days, meaning it could be one of the more affordable options for a long trip

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Some plans include free coverage for children 17 and under

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Concierge included with some plans

- con icon Two crossed lines that form an 'X'. Coverage for medical emergency is lower than some competitors' policies

- con icon Two crossed lines that form an 'X'. Plans don't include coverage contact sports and high-altitude activities

- Single and multi-trip plans available

- Trip cancellation and interruption coverage starting at up to $10,000 (higher limits with more expensive plans)

- Preexisting medical condition coverage available with some plans

Allianz Travel Insurance is one of the most widely recognized names in travel insurance, and it stands out as one of the top travel insurance providers for seniors. It offers a wide range of policies covering medical treatments overseas and emergency medical transport.

Allianz also provides options for varying trip lengths. Its annual multi-trip policies , for example, cover any trip you make during your policy period, even if they aren't yet planned, making it an excellent option for seniors who vacation multiple times per year.

Read our Allianz Travel Insurance review here.

Best for expensive trips: John Hancock

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers 3 travel insurance plans

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cancel for any reason rider available

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Affordable travel insurance premiums

- con icon Two crossed lines that form an 'X'. Reviews of claims process are mixed

- con icon Two crossed lines that form an 'X'. Buyers may not get specialty coverage for sports equipment and other high value items

- Trip cancellation for 100% of the trip cost

- Trip interruption insurance for up to 150% of the trip cost

- Emergency medical coverage of up to $250,000 per person

- Medical evacuation coverage of up to $1,000,000

John Hancock Travel Insurance plans for seniors offer some of the best coverage available. It provides generous maximum benefit amounts while still offering affordable prices.

Each plan includes coverages like trip cancellation, emergency accident, and emergency medical, with the option to add benefits like CFAR (cancel for any reason) . Plus, getting a free online quote is a quick and straightforward process.

Read our John Hancock Travel Insurance review here.

Best for older travelers: TravelSafe Travel Insurance

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to 120 days' coverage available for travelers ages 79 and under (30 days for 80+)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $2,500 per person for missed connections over three hours or more

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Trip delay coverage of up to $150 per person per day kicks in after six hours or more

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Policy can be purchased by U.S. citizens living abroad

- con icon Two crossed lines that form an 'X'. Medical coverage ceiling of $100,000 may be low for some travelers' needs.

- con icon Two crossed lines that form an 'X'. Claims reviews from customers say performance is not always the best

- A well-rounded insurance plan for travelers who are concerned about missing connections for cruise-related travel

- Classic and Basic travel insurance plans

- GolfSafe travel insurance plans provide coverage for you and your equipment

- Travel medical insurance through partner Trawick International

TravelSafe Insurance is a great choice for older travelers, even among seniors, insuring travelers up to 100 years old. TravelSafe also offers pre-existing condition waivers for all its tiers when you purchase your policy within 21 days of your initial trip deposit. With a great deal of flexibility, travelers don't have to worry about eligibility when purchasing travel insurance with TravelSafe. TravelSafe even has two tiers of coverage devoted specifically to golfers.

Read our TravelSafe travel insurance review here.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. A subsidary of Blue Cross Blue Shield

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers strong medical plans as long as you have a regular health insurance plan, but it doesn't have to be through Blue Cross

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers long-term and multi-trip travel protection

- con icon Two crossed lines that form an 'X'. Multiple complaints about claims not being paid or being denied

- con icon Two crossed lines that form an 'X'. Does not provide some of the more comprehensive coverage like CFAR insurance

- con icon Two crossed lines that form an 'X'. Buyers who do get claims paid may need to file multiple claim forms

GeoBlue Travel Insurance is a travel insurance provider that specializes in travel medical insurance . Because it doesn't offer much trip protection or travel inconvenience coverage, it can charge cheaper premiums than its competitors.

GeoBlue's policies cover travelers who are under 95 years old, offering sizeable coverage for emergency medical treatments (up to $1 million) and medical evacuations (up to $500K). It's worth noting that while coverage for pre-existing conditions are available, it costs extra.

Read our GeoBlue Travel Insurance review here.

Trip cancellation coverage for up to 100% of the trip cost and trip interruption coverage for up to 150% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Trip cancellation coverage of up to 100% of the cost, for all three plan levels

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. CFAR covers up to 75% of total trip costs (maximum of $112,500 on some plans)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Medical coverage of up to $500,000 and evacuation of up to $1,000,000 per person

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Includes COVID coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Above average baggage loss and delay benefits

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High medical evacuation coverage

- con icon Two crossed lines that form an 'X'. Premiums may run slightly higher than competitors

Travel Guard is a well-established and highly rated name in the travel insurance industry. It offers three main coverage options to choose from, and in general its policies have above-average coverage for baggage loss and baggage delays, plus high medical evaluation coverage limits.

- Trip cancellation coverage for up to 100% of the trip cost

- Trip interruption coverage for up to 150% of the trip cost

- Preexisting medical conditions exclusions waiver must be purchased within 15 days of initial trip payment

- Annual travel insurance plan and Pack N' Go plan (for last-minute trips) available

Travel Guard offers comprehensive insurance plans for shorter and longer trips. One of its more unique offerings is its Travel Guard Annual Plan.

This annual travel insurance comes with standard coverage benefits (trip delay, baggage loss, etc.) and substantial coverage amounts, which is important for seniors who travel multiple times per year. Travel Guard also offers a pre-existing medical condition waiver, meaning those with certain medical issues can still gain coverage.

Read our AIG Travel Guard Insurance review here.

Understanding Travel Insurance for Seniors

Before diving into the specifics, it's essential to understand what travel insurance is and why it's particularly important for senior travelers. The best travel insurance offers financial protection against unexpected events affecting your trip, such as trip cancellations, medical emergencies, or lost luggage.

Types of coverage

- Medical Coverage: Ensures your medical expenses are covered in case of illness or injury.

- Trip Cancellation/Interruption Coverage: Provides reimbursement if your trip is canceled or cut short due to unforeseen events.

- Baggage Coverage: Covers loss, damage, or theft of personal items during your trip.

Benefits of travel insurance for seniors

- Peace of Mind: Knowing you're covered in case of emergencies can make your travel stress-free.

- Financial Protection: Shields you from potentially overwhelming medical costs and trip cancellations fees.

- Assistance Services: Many plans offer 24/7 assistance services, providing help whenever and wherever you need it.

Making the most of your plan

After choosing a plan, it's crucial to understand your policy fully and know what services are available to you in case of an emergency.

Understanding your policy

When you purchase a travel insurance policy, you'll be able to see a description of benefits, which is a long document that describes the exceptions and limitations to your coverage. You should carefully review this document so you're not blindsided by unexpected claim denials.

For example, if you're canceling a trip because unexpected work, you may not be eligible for coverage if you haven't worked at your company for long enough. Additionally, you should review your policy to ensure that your pre-existing condition is covered, as companies often have very specific language around what qualifies as a covered pre-existing condition.

Emergency assistance services

Most companies offer a 24/7 concierge service that can help you navigate situations that arise during your trip, even issues beyond the scope of your policy. They can advise you on how to navigate these situations in accordance with your policy and make sure you acquire the necessary documentation when you need to file a claim down the line.

How to Pick Travel Insurance as a Senior Traveler

It's wise to compare several different travel insurance policies for the best coverage and pricing, as premiums vary widely between insurers and depend on factors like your age and travel destination.

That said, some of the more essential coverages to look for if you're a senior citizen include:

- Travel medical coverage - This coverage will pay for your medical bills outside the US.

- Medical evacuation coverage - If you're injured or become sick while traveling, this coverage will transport you to the nearest hospital or even back home if your condition necessitates it.

- Pre-existing conditions - Coverage for known health conditions. You'll need to purchase travel insurance within a certain time period from when you book your trip to qualify for a pre-existing condition waiver .

- Cancel for any reason (CFAR) - The name says it all! It'll cost extra and you'll need to purchase insurance early, but it's the most comprehensive trip cancellation coverage you can get. Note that CFAR insurance usually only covers up to 75% of your trip fees.

- Trip cancellation insurance - This coverage provides reimbursement for your prepaid and nonrefundable costs if you cannot make your trip due to an unforeseen event.

- Baggage delay insurance - This coverage will reimburse you for essentials like toiletries and clothes if your bags are delayed.

- Lost luggage insurance - This coverage will reimburse you up to a specified amount if your bags get lost en route.

Of these, the most critical to note are whether or not your policy covers pre-existing conditions and the limits for travel medical insurance and emergency medical evacuation.

Some insurance companies offer a waiver that will cover pre-existing conditions. You'll have to follow the requirements for adding a waiver to your policy, like insuring the entire cost of your trip. Or purchase the policy within a specific time after making your first trip deposit payments.

You'll also want to find a policy with high maximum limits for travel medical and emergency medical evacuation coverage. These types of expenses can be substantial, so you want to have appropriate coverage.

Why You Should Trust Us: How We Reviewed Senior Travel Insurance

When comparing senior travel insurance options, we looked at the following factors to evaluate each travel insurance provider:

- Coverage limits: We looked at each travel insurance company's coverage amounts for benefits like medical emergencies and trip cancellation.

- Flexibility: We looked at how customizable a policy is, so you can choose what your travel insurance policy covers .

- Coverage for pre-existing conditions: Pre-existing conditions are one of the more critical factors for travel insurance for senior citizens, so we looked at travel insurance companies that offer the best coverage for pre-existing conditions.

- Price: We compared travel insurance providers offering reasonable basic and comprehensive coverage rates.

- Benefits geared towards seniors: We compared travel insurance companies that offer solid coverage for senior citizens, like medical evacuation, COVID-19 coverage, and trip cancellation.

You can read more about our insurance rating methodology here.

Best Senior Travel Insurance FAQs

Seniors should look for travel insurance policies that offer comprehensive medical coverage, including for pre-existing conditions and emergency medical evacuation. They should also consider policies with higher coverage limits to ensure adequate protection. Additionally, seniors should seek travel insurance plans that provide 24/7 assistance services, as well as coverage for trip cancellations, interruptions, and baggage protection.

The cost of senior travel insurance coverage can vary depending on your age, overall health, state of residence, travel destination, and length of your trip. While the average travel insurance policy costs 4% to 8% of your trip's nonrefundable cost, a 65-year-old's policy may cost 15% of their trip's cost.

All travel insurance companies, except World Nomads, included in this guide offer coverage for pre-existing medical conditions as long as you buy your policy within the qualifying period from when you placed your trip deposit.

Allianz is the best travel insurance for seniors due to its wide array of medical coverages and emergency medical transport. Allianz also offers multi-trip insurance policies , which could make sense for seniors who travel frequently.

In some instances, travel insurance companies will have age eligibility restrictions, often only insuring people 80 years old and younger.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

The Guide to Senior Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

The best senior travel insurance options

Tips for selecting travel insurance for seniors, what else seniors need to know about travel insurance, travel insurance for seniors, recapped.

Travel insurance is a smart way to protect the money you have invested in a big trip in case unforeseen hurdles stop you from traveling. Seemingly now more than ever, last-minute changes can disrupt a trip, and in some cases, the money spent on nonrefundable purchases is at risk. There are numerous travel insurance options for people older than 65, but it is important to understand the nuances of senior travel insurance.

Medical issues or situations at (or en route to) your destination can stifle even the best-laid plans. Many credit cards include travel insurance as one of their benefits. These plans can assist in the event of lost or delayed baggage, flight delays and cancellations, and other adjustments to a trip paid for with that particular card.

When buying supplemental senior citizen travel insurance, don’t rely on the default option presented by your travel provider. There are many considerations to take into account, like how far from home you plan to be, the potential for injury or sickness (including your pre-existing medical conditions), and what may already be covered by other insurance plans you have.

For example, medical evacuation may not be covered, but local transportation to a hospital may be. And remember that U.S. health plans or Medicare coverage are especially limited outside of the country.

Here are some options worth reviewing from a handful of insurance providers: Allianz, Medjet, Travelers and your specific travel provider.

Here are a select few senior travel insurance options for people 65 and older.

Allianz offers excellent coverage for travelers over 65. It can help make payments for medical treatments overseas, even in the local currency and their preferred payment methods, to keep you from paying out of pocket.

For longer trips, it offers an AllTrips Prime Plan in increments of three, six or 12 months (ideal if you plan to vacation elsewhere during the winter months, for example). This plan covers emergency medical transport. The company takes into account certain pre-existing medical conditions so be sure to read the fine print.

If you fall ill or need assistance during your travels, Medjet ’s supplemental coverage for medical transportation helps you get to your home or the hospital of your choice. It includes air medical transport. This is a membership program that covers emergencies and can be tacked onto trips or purchased annually. While not technically travel insurance, this company offers an additional medical transport option for emergencies.

This coverage can be helpful if you're planning to travel in remote or unfamiliar areas, such as on safaris, to secluded islands and other far-flung destinations.

» Learn more: Does travel insurance cover medical expenses?

Most other travel insurers might only get you to the nearest appropriate hospital facility. For travelers younger than 75, Medjet offers no pre-existing medical condition exclusions and it doesn't rule out the same number of activities that other providers might.

3. Travelers

With the option to buy an annual, multi-trip protector, Travelers insurance covers a whole year of trips with the option to upgrade several features. The add-ons include “Cancel For Any Reason” insurance and trip interruption coverage.

4. Your travel provider’s own plan

On certain types of trips, say a cruise or a Caribbean resort that is prone to hurricanes, using the travel provider’s recommended insurance can be a good bet. This coverage is usually offered as an add-on during the booking process, but it can also be added after the reservation.

Most likely, these policies are designed to cover delay or cancellation issues, but be sure to read the fine print to see if medical transportation or trip interruption is also included.

Choosing a provider of your own can make sense when planning your own travel (let’s say a honeymoon to Paris or the Maldives). If a cruise line or safari outfitter offers insurance of its own, that might be the most comprehensive when it comes to that particular provider’s operations.

» Learn more: The best cruise insurance

Deciding if you need travel insurance is the first hurdle. Next comes the task of selecting the right one without spending more than the cost of what you are actually trying to protect. These are some important tips to consider.

Compare plans

It is wise to compare the options available using aggregator websites like SquareMouth (a NerdWallet partner) and InsureMyTrip.com. These sites compare the options from dozens of different providers detailing what they do and do not cover.

Seeing the exclusions as well as considering them within the framework of your trip can help you select the best plan for your travel needs.

Consider existing coverage

Review your existing coverage, whether that is via your health insurance or any credit card protections you may have. Some of the benefits you might be paying extra for when getting supplemental travel insurance may already be covered.

Read the fine print

Don’t base your final decision on price, as sometimes the cheapest policy may be the most restrictive — and the most expensive policy may give you coverage for activities you won't even be doing.

What may seem like an inclusion may actually be disallowed due to a technicality (terrorist attack or war). If you’re not sure, pick up the phone and ask if your specific situation is covered.

Timing is key. The sooner you buy your travel insurance coverage, the more time you have to benefit from it. The price could also rise the closer you get to departure. If you wait until the departure date to buy it, you would be out of luck if the week before you get sick or the destination closes its borders. Buying insurance after an issue arises won't help you.

Travel insurance is a safe way to protect that sunken cost. Spending money on travel, even with the benefit of loyalty program miles and points to offset some of the cost, can be a significant investment. Chances are that you won’t even need it, but like other insurance policies, it can pay off in the event of unforeseen circumstances. Weigh the cost of potential expenses with the insurance plan. Canceling a rental car for a road trip may not be a big deal, but business class flights and a nonrefundable cruise might be.

Credit card coverage only protects you if you use that card to pay for your travel. The Chase Sapphire Reserve® and The Platinum Card® from American Express also offer travel insurance benefits when paying with points, too. Terms apply. Using the right card for your trip can help save money on other potential travel insurance costs.

» Learn more: Best travel insurance options for older adventurers

What may seem like an unnecessary extra cost can actually help save the day in certain circumstances.

It can pay dividends to understand what your existing coverage includes (especially via a particular credit card) so that travelers over 65 make the most advantageous insurance decision for their trips.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

Exclusive Seniorliving.org Offer – Get Full Protection from Viruses, Malware and Spyware Today – 80% Off for Readers

Best Travel Insurance for Seniors

The best travel insurance plans for seniors offer comprehensive, specialized coverage, affordable rates, and helpful customer service.

SeniorLiving.org is supported by commissions from providers listed on our site. Read our Editorial Guidelines

- Additional coverage for preexisting conditions with select plans

- Wide variety of customizable plans

- High coverage limits

- Plans available for seniors up to 99 years old

- Can be purchased as close as one day prior to departure

- Affordable plans and group discounts

- 14-day refund in most states

- Comprehensive coverage for baggage and personal items

- Excellent customer service

- Free online quotes

- Affordable cruise insurance

- Hassle-free claims process

- Our Top Picks

- 2. International Medical Group

- 3. John Hancock

- 4. Nationwide

- 5. Travel Guard

- Our Methodology

If you plan on traveling abroad or domestically , we recommend purchasing travel insurance for some added peace of mind. Travel insurance offers protection when you find yourself in an unexpected situation, such as an injury that requires emergency medical care, lost luggage, or canceled flights.

If you’re on the fence about purchasing travel insurance, we’ll go over some of the reasons why you might benefit from it. With affordable rates you’ll find that travel insurance can help reduce the stress of traveling and incurring unexpected out-of-pocket costs. Our team spent over 50 hours researching and comparing plans. We evaluated each plan using important factors like cost, customer service, plan options, amount of coverage, and more.

Let’s take a closer look at the best travel insurance providers for seniors.

Best Travel Insurance for Seniors in 2024

What we like most.

Allianz Global Assistance has been a trusted travel insurance provider for over 100 years. We chose Allianz because many of their policies offer protection for those with preexisting medical conditions. If you’re a senior with a preexisting condition, you’ll be covered if you need care or services while traveling. This coverage is only available with select plans, and there are some exclusions.

Fun Fact: Allianz is best known for their role in insuring the Wright Brothers’ first flight and the construction of the Golden Gate Bridge, among many other historical milestones.

Allianz offers 24/7 assistance and a variety of plans, whether you’re planning a single trip or annual trip with many destinations. One of their most popular plans is the OneTrip Prime, which provides free coverage for children 17 and under when traveling with a parent or grandparent.

Allianz offers 10 different plans depending on how often you travel, or if you’re traveling for leisure or business. For example, their OneTrip Prime plan offers the following coverages:

- Epidemic coverage endorsement

- Trip cancellation (up to $100,000)

- Trip interruption (up to $150,000 per insured)

- Emergency medical (up to $50,000 per insured)

- Emergency medical transportation (up to $500,000 per insured)

- Baggage loss/damage up to $1,000 (per insured)

- Baggage delay up to $300 (per insured)

- Travel delay up to $800 (per insured)

- 24-hour hotline assistance

- Concierge services

- OneTrip Rental Car Protector optional upgrade

- Required to work optional upgrade

- Preexisting medical condition coverage available

Pros About Allianz

- Over 21 million insured travelers

- High coverage amounts

- High trip cancellation amounts

- Rental car coverage

- 24/7 hotline assistance for travel emergencies and assistance

- Preexisting medical condition coverage on select plans

- Wide range of travel insurance plans for leisure or business

- Free Allianz TravelSmart app for iPhone and Android

Cons About Allianz

- Up to 30 days for claim reviews

- Rental car damage and theft coverage not available to KS, TX, NY, and WA residents on an annual plan

Final Thoughts

Along with a vast selection of travel insurance plans and high coverage amounts, Allianz is great for seniors who are planning single or multiple trips throughout the year. Keep in mind that select coverages and benefits may not be available to residents in some states.

Overall, Allianz offers exceptional coverage for seniors with preexisting medical conditions, emergency medical benefits up to $50,000, and 24/7 hotline assistance for any travel emergencies or questions you may have.

Established in 1990 in Indianapolis, Indiana, International Medical Group (IMG) is known for offering quality global insurance benefits and assistance for seniors who travel internationally. One of the benefits of this company is that they offer a wide range of international medical insurance and 24/7 emergency medical assistance for travelers.

Fun Fact: IMG’s GlobeHopper Senior travel health insurance plan offers an option for the extension of coverage for seniors who wish to extend their trips.

IMG earned our pick as the best international travel insurance for their affordable rates for longer trips, as well as comprehensive coverage for medical expenses and evacuation. We appreciate that IMG offers the GlobeHopper Senior, temporary health insurance for travelers ages 65 and up traveling internationally. This plan offers travel medical insurance coverage for as little as five days up to one year, along with maximum limits up to $1 million. Additionally, IMG offers travel medical insurance for individuals, families, and groups, including coverage for seniors with preexisting conditions. Many of the policies also have maximum limits of up to $8 million — which is one of the highest limits we’ve seen for travel insurance.

IMG offers four comprehensive plans for vacationers and business travelers. Their most popular package is the iTravelInsured Travel LX, which offers the following coverages.

- Trip cancellation: 100 percent of the nonrefundable insured trip cost

- Trip interruption: 150 percent of the nonrefundable insured trip cost

- Cancel for any reason: 75 percent of the nonrefundable insured trip cost

- Trip interruption for any reason: 75 percent of the nonrefundable insured trip cost

- Trip delay (up to $250 per day)

- Change fee (up to $300 per person)

- Frequent traveler reward (up to $75 per person)

- Rental car damage and theft coverage (up to $40,000 per covered vehicle)

- Missed trip connection (up to $500 per person)

- Traveling companion/bedside companion (up to $200 per day)

- Pet kennel ($100 per day)

- Search and rescue (up to $10,000)

- Political or security evacuation and natural disaster evacuation ($50,000 per event per person)

- Baggage and personal effects ($2,500)

- Sports equipment rental (up to $500 daily)

- Baggage delay of at least 12 hours (up to $500)

- Accident and sickness medical and dental expense (up to $500,000 per person)

- Accident death and dismemberment (up to $100,000)

Pros About International Medical Group

- Plans offered to travelers up to the age of 99

- Can be purchased up to one day before departure

- Affordable minimum trip cost to be insured

- 24/7 assistance

- Lowest price guaranteed

- Affordable plans for international travel

- Group discounts

- Higher coverage limits

- Claims filed via website or mail

Cons About International Medical Group

- Some travel insurance plans can only cover 90-day trips

- Might need to purchase separate travel medical insurance and international health insurance

IMG offers travel insurance plans for seniors up to age 99 who want to travel internationally. IMG is ideal for both vacationers and business travelers. Additionally, IMG offers 24/7 emergency travel assistance and a preexisting condition review period of 60 days. If you’re a senior going on a cruise or guided tour internationally, we recommend purchasing travel medical coverage through IMG.

As an insurance provider for over 160 years, many people trust John Hancock for their investment, retirement, financial , and insurance products. John Hancock offers streamlined travel insurance packages for older adults who plan to travel internationally with ample protection. Although on the pricier side, older adults can choose from three plans ranked Gold, Silver, and Bronze depending on how much coverage they’d like for their travels. Currently, John Hancock’s plans feature comprehensive coverage including trip cancellation, trip delays, emergency accident and sickness medical coverage, and more. They also offer high coverage options and greater protection for seniors who want 24/7 assistance.

FYI: If you purchase a travel insurance plan through John Hancock within the first 14 days of booking your trip, you can get the best coverage options.

Depending on your unique situation, age, and duration of travel, you can customize a quote online and choose from three different plan tiers: Gold, Silver, and Bronze. The Silver plan offers the following coverages:

- Trip cancellation (up to 100 percent of trip cost)

- Trip interruption (up to 150 percent of trip cost)

- Trip cancellation for any reason (up to 75 percent of nonrefundable trip cost)

- Airline ticket change fee (minimum 1-hour delay $200)

- Missed connections ($750)

- Trip delay ($150 per day; maximum $750)

- Baggage delay (maximum $500; daily limit of $500)

- Baggage/personal effects (up to $1,000; per article: $250; maximum for property: $1,000)

- Accidental death and dismemberment (up to $100,000)

- Emergency accident and emergency sickness medical expense (up to $100,000)

- Emergency medical evacuation and medically necessary repatriation (up to $500,000)

- Repatriation of remains (up to $500,000)

- Preexisting conditions waiver

- Frequent travel loyalty (up to $200)

Pros About John Hancock

- Coverage for travelers with preexisting conditions

- Frequent travel loyalty perks

- Trip cancellation and trip interruption coverages

- 24/7 travel assistance

Cons About John Hancock

- Limited plans

- Some of the travel insurance plans can be expensive

- Need to speak with a licensed agent to get more information

- 14-day refund not available in states like IN, NH, and UT

John Hancock offers peace of mind and solid travel insurance plans for older adults who plan to travel alone or with their families. If you’re not satisfied or change your mind, you can call to cancel the purchase within 14 days of the effective date. John Hancock offers streamlined travel insurance coverage options — perfect for that cruise or international trip you’ve been dreaming about! Keep in mind that all travelers must reside in the same U.S. state to share a John Hancock policy.

Nationwide has been around since 1925, offering insurance, investing, and retirement products for individuals and businesses. Nationwide offers some of the best affordable cruise travel insurance plans for older adults that we’ve seen. If you’re planning a cruise with your family or friends, we recommend looking into three of their cruise plans: the Universal Cruise, Choice Cruise, and Luxury Cruise plans.

Did You Know? If you’re looking into other insurance policies for dental, vision, life insurance, check out our guide to insurance for seniors in 2024 .

The Choice and Luxury Cruise plans offer coverage for preexisting conditions. Plus, you can easily modify and add coverage even if you’ve already purchased a plan. One thing to remember: Not all coverage is available in all states, so you’ll have to check with a local travel insurance agent.

Nationwide offers single trip, annual trip, and cruise insurance. For cruise insurance, we recommend the Choice Cruise plan, as it’s flexible and affordable. Here’s what the plan covers:

- Trip cancellation (up to 100 percent of nonrefundable trip costs)

- Trip interruption (up to 150 percent of nonrefundable trip costs)

- Interruption for any reason ($500)

- Missed connection/trip delay ($1,500/$750)

- Itinerary changes ($200-$500)

- Emergency accident and sickness medical expense ($100,000)

- Accidental death and dismemberment ($25,000)

- Preexisting condition waiver (if purchased within 14 days of trip)

- Baggage and personal effects ($2,500 maximum, $600 maximum for special items, $300 per article limit of $500)

- Key cancellation/interruption covered reasons

- Cancel for any reason

- Non-medical evacuation ($25,000)

- Refund policy: 10-day review period

Pros About Nationwide

- Member of the US Travel Insurance Association

- Travel insurance plans for cruises, single- and multi-trips

- Hassle-free claims

- Affordable travel insurance rates

- Flexible annual trip plans start at $59

Cons About Nationwide

- Cruise plan refund policy not available in NY or WA

- Lower trip interruption limits compared to other providers (125 percent for Essential plan single trip)

- Some plans may have nonrefundable processing fees

Nationwide provides a variety of options for senior travelers, whether you’re flying to a new destination or cruising. The company has high coverage amounts, including a 10-day review period for refunds on some of its cruise plans. If your trip is canceled, you’ll be reimbursed for up to 100 percent of the nonrefundable trip cost.

As one of the world’s leading travel insurance companies, Travel Guard provides specialized coverages for older adults at affordable prices. Along with travel medical and concierge assistance, Travel Guard has responsive customer service and optional add-on coverages.

FYI: To get a preexisting medical conditions exclusion waiver through Travel Guard, you’ll have to purchase it within 15 days of the initial trip payment.

The provider offers three travel insurance plans: the Essential, Preferred, and Deluxe plans, with high coverage amounts up to $1 million. Coverage offerings include trip cancellation, baggage coverage, and travel medical expenses, along with specialized coverages such as car rental, medevac, and lodging expenses.

Travel Guard offers the following coverage for their Preferred plan — one of their most popular plans.

- Cancel for any reason (optional add-on)

- Baggage coverage (up to $1,000)

- Baggage delay (up to $300)

- Travel medical expense (up to $50,000)

- Travel inconvenience

- Medevac (up to $500,000)

- Car rental (optional add-on)

- Lodging expense (optional add-on)

- Trip exchange

- Security evac (optional add-on)

- Preexisting medical conditions exclusion waiver

Pros About Travel Guard

- One of the world’s leading travel insurance companies

- Specialized coverages

- Easy and fast claim process

- Family coverage options

- Preexisting medical condition exclusion waiver

- Cancel for any reason (up to 48 hours prior to departure)

- Travel insurance plans currently available in all states

Cons About Travel Guard

- Some plans don’t offer flight guard, security evacuation, trip saver, trip exchange, or other specialized coverages

Travel Guard offers a variety of affordable travel insurance plans for families, seniors, and those who frequently travel. If you’re looking for specialized coverages with higher coverage limits up to $1,000,000, we’d recommend looking into Travel Guard’s three travel insurance plans. Keep in mind that if you think you may need a preexisting medical conditions exclusion waiver, you’ll need to purchase it within 15 days of the initial trip payment.

Money-Saving Tip: Looking for ways to save on an upcoming trip? Check out our senior discounts guide to learn how you can save on hotels, cruises, transportation, and more!

For travelers looking for higher coverage limits, you can get up to $750 to $2,500 for baggage coverage and up to $100,000 for travel medical expense coverage. One of the perks of purchasing travel insurance through Travel Guard is that they are available in all states. You can also purchase an annual plan if you are looking for coverage for multiple trips throughout the year.

Our Methodology: How We Chose the Best Seniors Travel Insurance

When choosing the best travel insurance providers, we considered the following criteria.

- Coverages: We chose travel insurance providers that offer the best comprehensive coverage with higher limits for trip cancellations, emergency medical transportation, and baggage delay.

- Specialized coverages: We focused on companies that have optional or additional specialized coverages like car rentals or accidental death and dismemberment.

- Preexisting medical conditions: Our list features some providers that offer preexisting medical condition waivers.

- Cruise coverage: The companies on our list offer cruise coverage along with traditional travel insurance.

- Financial standing: It’s important to choose a provider with an excellent financial portfolio. We selected providers with above-average ratings by reputable ranking agencies.

- Customer service: We assessed the ease of use of navigating each insurance provider’s mobile app and claims processing center. We also evaluated how easy it was to obtain free online quotes and contact customer service.

- Affordability: The providers on our list offer budget-friendly coverage for seniors over the age of 65 and their families.

Comparing the Best Travel Insurance for Seniors

To give you a better idea of prices, we researched the average costs of travel insurance for older adults from each of our top providers. We obtained quotes for 65-year-olds on a two-week trip to Italy with an $8,000 travel budget.

What Does Travel Insurance Cover?

Many travel insurance plans cover the following benefits, with options for specialized or add-on coverages:

- Trip cancellation: Receive a reimbursement if you need to cancel your trip.

- Trip interruption: If your trip is interrupted, you can get reimbursed for the nonrefundable amount of your trip and the cost of transportation per insured person.

- Travel delay: You can get reimbursed a certain amount per day if your trip is delayed for a specified period of time.

- Cancel for any reason: Receive a refund for a portion of your trip expenses if you need to cancel your trip due to a death in the family or other situation.

- Baggage delay: If your baggage is delayed for a specified period of time, you may receive reimbursement for the hours delayed and if you need to purchase specific items due to the delay.

- Emergency medical: If you have dental or medical emergencies while traveling, this benefit can cover these expenses.

- Car rental: As an add-on, you can get car rental insurance to help cover the cost of rental car damages and other expenses if you get into an accident.

- Medical evacuation: Also known as medevac, this optional coverage provides emergency medical transportation if you need to be airlifted.

- Accidental death and dismemberment: If you die during your travels as a result of accidental death or dismemberment, your beneficiary would receive certain benefits.

- Repatriation of remains: If a traveler passes away during your trip, this benefit will cover the cost of returning them home.

- Preexisting medical condition waiver: Some insurance carriers offer coverage for those with preexisting medical conditions.

How Much Does Travel Insurance Cost for Seniors?

Based on our research after obtaining online quotes from five different travel insurance providers, we found that the average cost of travel insurance is $655.23 per insured person when you plan to spend around $8,000 for an international trip. While this might seem steep, travel insurance can help you avoid thousands of dollars in out-of-pocket expenses during an emergency. According to Forbes, the average cost of travel insurance is roughly six percent of your overall trip costs and is dependent on the amount you plan to spend on your trip.

Tips for Choosing the Best Travel Insurance for Seniors

When planning a trip, it’s important to compare travel insurance quotes to make sure you get the best deal. It’s better to plan ahead and enjoy the rest of your trip knowing you’ve purchased the best travel insurance for your needs. We’ve compiled a list of tips on how to choose the best travel insurance below:

- Coverage: Many insurance providers will highlight one of their best value plans to help you stay under budget. If cost is your main concern, choose a plan that offers the minimum coverage with the option of adding additional coverage if needed.

- Preexisting conditions: Not all providers offer preexisting conditions waivers, so it’s important to research and inquire about this if you’re so affected.

- Discounts: Agencies like AARP may offer senior discounts and travel savings if you’re a member. Consider these discounts on top of your travel insurance purchases.

- Medical expenses: Look into comprehensive travel insurance plans that offer substantial medical coverage. Some plans may require you to purchase separate travel medical insurance.

- Compare providers: Get quotes from multiple providers and compare rates and coverage. Think about the benefits that are the most important to you, along with your budget, and choose a plan accordingly

- 24/7 assistance: Some companies offer 24/7 assistance, which is essential when traveling in different time zones. Also, check to see if your provider offers concierge services.

Frequently Asked Questions About Seniors Travel Insurance

Travel insurance helps protect you and your loved ones if you experience a health emergency while traveling. It can also protect and help reimburse you if your trip gets canceled, or you lose your baggage during the trip.

Medicare does not offer health care services that you receive outside of the U.S. This is why it’s important to purchase a travel insurance policy for more coverage.

Some insurance providers won’t offer coverage for preexisting conditions, losses due to war, or inability to afford the trip.

AAA. (2021). Pandemic Prompts More Americans to Consider Travel Insurance .

What would you like to share with us?

Over 80 Travel Insurance

Written and researched by Michael Kays (Travel Insurance Expert) | Fact Checked by Danya Kristen (Insurance Agent).

Life begins at 80, right? When you’ve reached this golden age, you’ve amassed a wealth of knowledge, experience, and, most importantly, the time to explore this beautiful world.

But let’s get down to brass tacks: securing travel insurance when you’re over 80 can feel like a bit of a rollercoaster ride.

But fear not, we’re here to make it a breeze, so sit tight, and let’s unravel this over 80 travel insurance conundrum.

In this article...

Why Over 80 Travel Insurance is Crucial

The freedom of retirement often brings the opportunity to travel more frequently or for longer durations. But as we age, the risk of unexpected health issues increases, making travel insurance more important than ever.

Plus, let’s not forget those unforeseen travel hiccups like cancellations, delays, lost baggage, and even emergencies back home that could cut your trip short.

Recommended Plans

✅ Atlas America

Up to $2,000,000 of Overall Maximum Coverage, Emergency Medical Evacuation, Medical coverage for eligible expenses related to COVID-19, Trip Interruption & Travel Delay.

✅ Safe Travels Comprehensive

Coverage for in-patient and out-patient medical accidents up to $1 Million, Coverage of acute episodes of pre-existing conditions, Coverage from 5 days to 364 days (about 12 months).

✅ Patriot America Platinum

Up to $8,000,000 limits, Emergency Medical Evacuation, Coinsurance for treatment received in the U.S. (100% within PPO Network), Acute Onset of Pre-Existing Conditions covered.

Finding the Right Over 80 Travel Insurance

Navigating the travel insurance market can feel like finding a needle in a haystack, but hold your horses! You don’t have to settle for the first policy you come across.

A bit of due diligence can go a long way in finding the right coverage tailored to your needs.

Pre-existing Medical Conditions Coverage

Traveling the world in your 80s can be one of life’s greatest joys, but it can come with its own set of challenges. One of these challenges is managing pre-existing medical conditions and understanding how they impact your travel insurance coverage.

What is a Pre-existing Condition?