How To Start A Travel Fund (And Why You Need One Right Now) – Episode 2

You have dreams of traveling the world. Whether you hope to quit your job and become a digital nomad or plan a family vacation to DisneyWorld (or Universal), at some point, the cost will cross your mind. If you’re wondering how to fund travel, you are not alone. I’ve devoted this entire website and podcast, The Thought Card , to answering this important question. Having the chance to visit 27 countries, I’ve mastered starting a travel fund and budget for travel. I believe in not letting our financial responsibilities keep us from pursuing our dreams.

While travel doesn’t have to be expensive, it does cost money. Although you no longer have to be wealthy to jet-set across the globe, I can imagine it certainly helps. Nevertheless, it’s possible to travel even if you’re on a budget.

If you want to travel more, I recommend creating a travel savings account first . Let’s walk through step-by-step how to start a travel fund and ways to save regularly .

Continue reading or listen to the episode here:

Listen on Apple Podcasts | Spotify | Pandora | Amazon Music

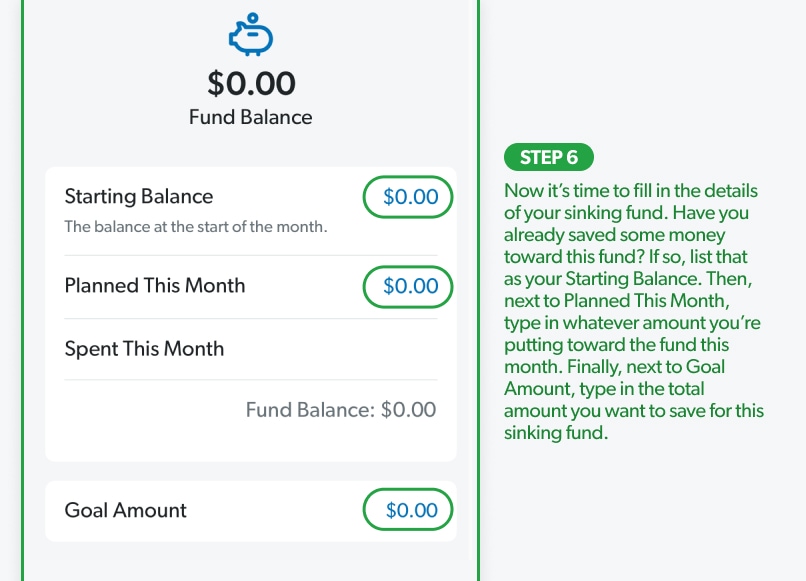

In this episode, we cover:

- What is a travel fund?

- How to start a vacation fund

- How to save for travel by treating it like a recurring bill

- Best saving accounts for vacations

- What is a Travel Fund?

Table of Contents

1. Keeps funds separate

2. avoids overspending, 3. keeps you grounded, 1. treat travel like a recurring bill, 2. start small, 3. leverage automation, ways to boost travel savings, how to save for vacations: my personal story.

A travel fund is a powerful tool you can use to help you save money for travel.

A “travel fund” or “vacation fund” is a dedicated bank account (checking, savings, or money market) devoted to your travel savings and expenses.

It helps you intentionally save money for travel, so when it comes time to spend, you have a stash to pull from.

Reasons To Start a Travel Fund

The more you commingle funds, the less likely you are to achieve your goals – both long-term and short-term money goals . Even with the best intentions, spending money on other things is easy if your funds are jumbled together.

Having a bank account specifically for travel makes things so much easier. You can check your balance at a glance and know exactly how much you can spend. Isn’t that reassuring?

Have money available for travel when you need it.

In many ways, it gives you permission to spend on what you want.

Helpful Tip: Pay for travel expenses with your travel fund and only spend what you have.

My Mindset : Although I love to travel, travel isn’t worth getting into debt. Debt is a vicious cycle that is hard to get out of, so save money for a trip and travel when you can responsibly cover all of your expenses.

With that said, here are (3) ways a travel fund can help you travel more.

When you commingle funds, you are less likely to achieve your goals.

This is why I have multiple bank accounts — a virtual envelope system where each account is set up for a specific purpose, a bill, or a goal.

A travel fund is important because it’s so much easier to save money for travel when it has its own dedicated savings account separate from everything else. So, when you have to pay for a flight or want to go on a spontaneous weekend getaway, you can tap into the funds you set aside specifically for travel expenses, like flights, lodging, attractions, and more.

Helpful Tip : I recommend personalizing the name of this account by renaming it “Cruise to Mexico” or “Disney Family Vacation.” This makes your next adventure feel a little more real.

Travel savings can also help you avoid getting into debt and paying high credit card fees. To avoid the temptation of using my travel savings on other expenses, I bank with Ally Bank, an online bank. While Ally is easy to use, it takes a few days to withdraw funds, making it less convenient than an ATM withdrawal from my brick-and-mortar bank. This slight inconvenience helps me avoid the temptation to dip into this account, which strengthens discipline.

I’ve found that having a travel fund brings clarity to my finances. It helps keep my wanderlust in check (because it can be hard to resist flight deals ).

Related: How Cheap Flight Alerts Work

For example, today, I have $500 in my vacation fund. Let’s book those flights to San Francisco for $220. On the other hand, I’m not quite ready for that all-inclusive trip to Costa Rica for $2,000.

Overall, a vacation fund makes travel more financially feasible. Know with certainty what you can afford.

How To Build a Travel Fund

Instead of saving for one trip, save for travel regularly, even if you don’t have upcoming trips planned.

Treat travel like any other recurring bill.

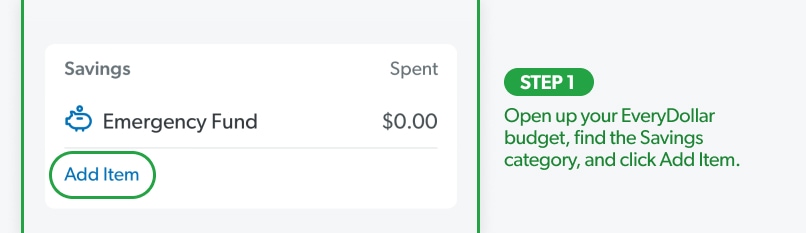

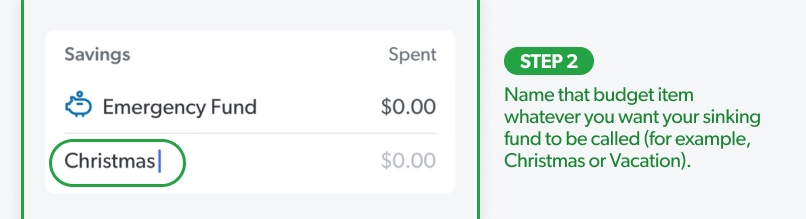

Include it as a line item in your monthly budget, making it a regular part of your financial planning. This will make travel a structured and intentional part of your life, enabling you to achieve your travel goals while managing other financial responsibilities.

Consider travel as essential as your car insurance, rent, and gym membership.

Like a recurring bill, you’ll set money aside for it every month without fail, which builds consistency.

If you treat travel like a recurring bill, you can save hundreds or thousands of dollars by the end of the year. It all depends on how aggressively you save.

Next, determine how much you want to save towards travel every pay period (weekly, biweekly, or monthly).

Start with an amount you can afford to miss as you build the discipline and confidence to increase your savings rate.

Small amounts can add up over time. Consider saving a little each week or month, such as the cost of a coffee or lunch, and watch how it accumulates.

You can set up direct deposit with your employer and choose the amount you want to transfer. This way, money from your paycheck will get deposited into your travel bank account every time you get paid. This way, your savings grow in the background without requiring constant attention. Go about your life – set it, forget it, and watch your travel savings grow!

Automation handles all the heavy lifting, so you never have to worry about moving money into your travel fund. It’s done automatically on your behalf. You’re essentially locking yourself in and sticking to your plans.

Helpful Tip: Don’t wait for the day or even the week after to move funds because you might forget. Automate your finances so that when you get paid, a portion of your check is saved automatically for your next vacation.

Related: How To Keep Your Vacation Fund Intact

Listen on Apple Podcasts | Spotify | Amazon Music | Pandora | YouTube | Any player

If you want to schedule additional automatic transfers to accelerate reaching your travel savings goals, by all means, do so.

Set regular automatic transfers into your travel fund weekly, biweekly, or monthly. Pick a transfer frequency and amount that works for you.

These additional deposits can be as small as $5 or as large as you can possibly afford. The rationale here is that these additional payments will boost your savings rate over time and help you reach your travel goals faster.

Savings challenges like the 52-Week Savings Challenge or $5 Bill Challenge can help you set aside extra cash.

With the 52-Week Saving Challenge in week 1, you save $1. In week 20, you save $20 until you save $52 in week 52. By the end of the challenge, you save $1,378.

The Reverse 52-Week Challenge is the reverse of the 52-Week Challenge. With the Reverse 52-Week Saving Challenge, you save $52 in the first week, $20 by week 20, and $1 in week 52.

Savings challenges make saving money more fun, and at the end of the challenge, you’ll have a stash of cash waiting for you at the finish line.

A travel fund money box put in a visible place in your home or office may be another fun option to save your loose change.

Here are some of my favorites from Amazon:

- Travel Fund – Piggy Bank

- Shadow Money Box For Saving Travel

- Adventure Fund Piggy Bank

Tired of reading? Listen to this podcast episode on Spotify.

It all starts with your mindset. How important is travel to you?

When I first started thinking about setting financial goals for travel, it all began during my college years. I was experiencing a serious case of FOMO—fear of missing out—while watching my friends jet off to exciting destinations for spring break. While I had enough finances to enjoy local outings, I couldn’t afford an international trip.

The pivotal moment came when I wanted to study abroad in France for a semester. The cost was astronomical, and none of my scholarships or grants covered it.

My family was facing financial difficulties at that time, and I felt guilty even considering such an extravagant trip. This experience made me realize how crucial finance is in pursuing my travel dreams. I didn’t want to feel helpless or uncertain about when I could travel again.

After graduating, I committed to prioritizing travel in my life. I understood that I needed to be strategic and smart about my finances .

I reframed my relationship with money, viewing it not as a burden but an opportunity to create experiences. I became a goal-getter, setting clear short-term financial goals aligned with my passion for travel.

I learned that saving for travel doesn’t have to be overwhelming. It starts with small, actionable steps. I began by creating a budget that included a dedicated travel fund. I automated my savings, setting aside a portion of my paycheck specifically for travel. This way, I could watch my travel fund grow without thinking about it.

Ultimately, my journey taught me that travel is not just a luxury; it’s a priority that can be achieved with careful planning and a positive mindset. By setting financial goals for travel, I transformed my dreams into reality, allowing me to explore 27 countries across four continents. If I can do it, so can you!

Do you have a travel fund? Why or why not?

Read the full transcript to the podcast episode below.

Danielle Desir Corbett: Welcome to The Thought Card, a podcast about traveling money where planning saving and creativity leads to affording travel building wealth and paying off debt. We are the financially savvy travelers. Hi everyone and welcome to episode two of the Thought Card podcast. Today, we're going to talk about the importance of having a travel fund and really how to get it started. So I'm going to take you back five years or so ago. It's been a little while, but after I graduated from grad school, I threw a nice shindig with my family to celebrate my victory. Right? And from that dinner I had, let's say about $700 in gifts. So for me at the time I hadn't traveled Because I didn't have any money, I didn't have a job really. So I put that $700 gift money into a separate account and I call that my travel fund and that's really where it all started for me and I can honestly credit my travel fund for allowing me to financially be able to travel because honestly having all my money in one-account doesn't work for me. I have a number of make accounts and we can talk about that in another episode. But really I found that a travel fund is a powerful tool that I used to help me save money for travel and honestly travel doesn't have to be expensive, but it does cost money no matter what anyone says. Travel cost money. I recently read an article from stuff dot com where a travel influencer had spent $170 on accommodation, travel The world in 12 months and that's amazing. She spent less than $200, but guess what she spent money. So regardless of what kind of travel style or what you do when you're traveling, you're going to spend some type of money. So I found that the easiest way for you to make travel financial priority in your life and the first thing I recommend to people is to start a travel fund. So what is a travel fund? A travel fund is simply a separate bank account dedicated to your travel savings and expenses. Okay, It can be a checking account, a savings account or a money market. The only caveat is if you put your travel fund money in a savings account in the United States, you are limited to six transactions per month before incurring a fee. So I recommend keeping your money into a checking account or a money market. That really makes things easier. You don't have to worry about fees, which is great. A travel fund is important because it helps you be intentional with your money by separating it out. Like I said, if you're someone like me who has really hard time with jumbling all their money together. Travel fund is great because it separates it out and when you're saving for travel, it's helping you be intentional, so when the time comes that you want to book those flights to hawaii for your honeymoon or go on a road trip with your girlfriends, you have a stash to pull from. You don't have to scratch your head like where is this money coming from? I really want to have this experience with my family and friends. You have a stash to pull from, no questions asked because hey, you've been doing the work you've been saving for it right. The point of having a travel fund is to have the money for travel available when you need it on demand. Right, Alright, Danielle. So I already have a checking account. I already got my numbers all set up. Why do I need to keep my travel fund separate? Well, it's really simple because the more you commingle your funds together, the less likely you're able to achieve your goals because in your mind, you're not distinguishing what money is what and you have to keep track of all of these numbers together and all the things that you want to do with these funds. So even with the best intentions, it's easy to spend money on other things if all of your funds are jumbled together. So that is my case for having a travel fund. A travel fund makes things so much easier because at the end of the day, you can take a look at your balance and know exactly how much you have available to spend on travel. Isn't that reassuring? So your travel fund will let you know if you can book right now or if you'll need a little bit more time to build your savings. Let's look at my travel fund right now. My travel fund actually has $245 in it right now. So I'm totally down with booking those flights in San Francisco in October because those flights are 220 and I got $24 left to spend. So that is the beauty of having a travel fund is that you can look at your bank account and know how much you have to spend. And with the travel fund you can be that exact, it helps you to avoid getting into debt paying high balances on credit cards and getting into a bunch of mess. I found that having a travel fund brings a lot of clarity into my finances and it also helps keep my wanderlust in check because it is so hard for me to resist a flight deal Guys, it is literally impossible. I love cheap flights. I love flight deals and having a travel fund really does keep me in check because if I don't have it, I don't got it. I'm not really going to book those flights. So if travel is important to you, consider consider having a travel fund and number two, consider treating it like a recurring bill. Okay, this can be groundbreaking because I treat travel like a recurring bill because it is so important to me and I set money aside for it every single month. Travel is right up there with my mortgage, my car insurance, my car note and my netflix subscription, All those things I need every day, all those things are things that help me stay alive and live my lifestyle and so does travel, travel is super important, so I treat it like everything else And this is great because it helps me create consistent saving habits and if you treat travel like a recurring bill, you'll save hundreds if not thousands of dollars by the end of the year if you don't touch it. So for example at $50 a month, that's a total of $600 in your travel savings a year and at $100 a month as a total of $1,200 in travel savings a year. So if you start small, you really can see the momentum pick up with your travel fund and your travel savings now that you have a travel fund. I suggest that you have your employer direct deposit money into your travel bank account, don't wait for the day after or even the week after to make this transaction, do not delay, do it the day you get paid and if you're a freelancer and you're getting money for a bunch of different clients, build that in to your transactions. If you have a business bank account, transfer some money into your travel fund when you're doing your drawdown every month again, this is back to the idea of consistency. Travel fund savings for me is a lot about consistency and saving in general is about consistency. Direct depositing really helps this because it really makes things easy because it's automated, You never have to remember to add money. Oh did my employer do this? Oh did I get oh I do, I know you don't have to worry about it because you said it, you forget it and you just watch it grow, which I love personally, I would say to start off with an insignificant amount that doesn't take too much sacrifice out of your budget and then build your savings rate from there. So if you want to start with $25 a month, 50 70 500 and then grow and grow and grow gradually. That really, really helps. Okay, so now if you want to schedule automatic transfers after you get paid to accelerate your goals, by all means guys go for it. So I say for travel every pay period, but recently I've decided to take things up a notch a little bit by adding an automatic transfer every Tuesday. So I'm adding a little bit of maybe $25 here, $25 there just to kind of boost things and make things accelerate so that I can travel too far and further places. So where do I suggest parking your travel fund? Like I talked about a little bit before the top of the show I recommend either a checking account or a money market that doesn't incur fee, don't put your money in big accounts where your bank is going to charge you fees for it because guess what? That's eating into your margin, that's going to affect your travel down the line. So I have my travel fund at Ally Bank. I've been their customer for many years. I think I was one of their first customers. They first came out and they're an online bank with relatively high interest rates and they're awesome because they're so easy to use setting up an account is like a piece of cake. And honestly I think I have like 10 big accounts with them right now. So I can't recommend Ally Bank enough. And I know a lot of my listeners also use ally bank. So let's recap if you want to afford travel and you want to make it truly a financial priority in your life, Start a travel fund which is simply a separate bank account devoted solely to your travel savings and your expenses. Next treat your travel like a recurring bill right up there with your mortgage, your rent, your gym membership, anything that is recurring every month, treat it like a recurring bill and lastly have your employer directly deposit money into your travel fund so that you can set it and forget it and watch it grow. Okay, automation is a powerful, powerful, powerful tool because we have so much going on that sometimes we can't even think about like you know, things that we really want in our life, we really can't think about it. So automation just makes things so much easier out of sight out of mind, which I love. I'm going to sign off by saying that the concept of saving is simple guys, it's so simple, but it is not easy and whoever said it is is lying, but some simple planning with some type of planning, you'll really get the results, you want to go on that cruise plan that bay weekend getaway and go on the excursion with your family which you deserve. Okay, I encourage you to invest in you invest in your future, invest in your future travel experiences and start saving money in your travel fund today. I want to know if you have a travel fund, why or why not? Or maybe you didn't have a travel fund before and you're reconsidering it and you are going to start one now, let me know, I would love to hear from you, I would love to hear about your transformation if you have one or if you're going to stick to your guns and like, nope, I don't need to travel fund, I'm going to still do my own thing and the best discussions happen over on the website podcast dot dot card dot com and I would love to hear from you, thank you so much for tuning in and I cannot wait to see you in the next episode. Bye.

Daphne: Yes, I do have a travel fund and the reason being is because a couple years ago I set a goal that I wanted to travel to one new country a year, which meant that I had to save up to travel to that new country every single year. Over time I decided to create a bigger budget just because that I realized I could actually do more than that and travel to more countries per year while saving money while I'm at home.

Kyle: Um no, mainly because I'd say how much I get paid doesn't really allow it right now because you know, I have savings and emergency that I can't really just spread my money over everything. I still need some money in the bank for, you know, gas or whatever.

Danielle Desir Corbett paid off $63,000 of student loan debt in 4 years, bought a house at 27, and has traveled to 27 countries, including her favorites, Iceland, China, and Bermuda. Go here to learn Danielle’s incredible story, from struggling financially and in debt to finding creative ways to earn more and live on her terms. Listen to The Thought Card Podcast , where Danielle shares how you can creatively travel more and build wealth regardless of your current financial situation. Reach out to Danielle by contacting: thethoughtcard (at) gmail (dot) com.

You might also like

Hey girl! I finally listened to this one and loved it! I also just set up a high yield savings account with Capital One. They don’t have the highest rates out there, but I already am a loyal customer and credit card user and personally wanted to limit how many different banks I have accounts with. :)

So glad that you had a chance to listen. Capital One 360 is very popular so you can’t go wrong! What episode will you listen to next?

Leave a Reply

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

What’s a Travel Grant, and How Do I Get One?

The ability to travel opens your eyes to worlds apart from your own. While this type of experience is invaluable, it does cost money — sometimes, a lot of money.

That’s where a travel grant comes in. This type of allowance provides the funds you need to get yourself around the world and back again.

What Is a Travel Grant?

In general, federal or state governments — as well as educational institutions — can provide you with a grant. As far as travel goes, though, they’re most often awarded by the latter.

Students who propose to travel to a far-flung destination should come to the awarding officer with a detailed proposal as to why this trip is essential. In most cases, they’ll have to show the type of research they’ll be able to conduct while they’re out of the country. If the university or organization providing the grant sees the value in the trip — say, it’s for research instead of relaxation — they will likely give a plan the go-ahead.

There’s a slight difference between travel grants and scholarships. To obtain the latter, one typically has to show proof of academic excellence or another exceptional talent. The money awarded often goes toward tuition fees incurred while studying abroad, which might make it harder to obtain a scholarship for research pursuits or cultural immersion.

How Do I Get One?

It may seem as though graduate and Ph.D. students are the only ones who can pursue travel grants that fund research, but that’s not always the case. In fact, there are a few organizations outside educational ones that will provide grants for travel — check with UNESCO and the UN, as well as the SPRET educational trust , which tends to choose students based in designated areas.

All these groups will fund trips aimed at personal or cultural development, not just educational growth. There might be other options, too — be sure to do your research for the best fit.

Every application for a grant will be different. In most cases, you’ll have to come up with some sort of proposal that outlines what you plan to do on your trip, as well as what you think you’ll gain. Do some research into the background of the organization you’re applying to, then cater your aims to mirror their mission and goals.

Some organizations will require an in-person interview or presentation of your proposal. From there, it’s just a waiting game to see whether you get the grant.

What Are My Other Options?

The grant isn’t the be all, end all of travel funding. In fact, there are multiple ways to see the world without breaking the bank , and some may fit your bill better than an educational or research grant.

For example, many people travel abroad to teach English as a second language. Countries like Spain and South Korea have programs that only require you to be a native speaker. You can then live, work and get paid abroad, which gives you an immersive cultural experience and the chance to travel with a sizable income.

Some charities allow you to volunteer abroad, while you can also take on odd jobs such as farming to see other pockets of the globe for free. In many cases, you’ll have to fund your flight, but your host will take care of the room and board, saving you big overall.

No matter how you make it happen, one thing is for sure: travel is one of life’s most rewarding experiences. If you want to learn more about the world — and yourself — a travel grant might be the way to do it.

About the Author:

Related Posts

Crowdfunding is a fantastic way to raise the money needed for travel, but there are other tried and true ways to save and earn the money you need. Budgeting for a trip can be daunting when you add up what you expect to spend on transport, food, and lodging. However, if you use these money saving and earning tips on your travels in conjunction with good budgeting skills, you’ll find that traveling the world does not have to be as costly as it might appear. Couch Surfing There are a surprising number of opportunities to find free lodging on your…

We know eating healthy, exercising regularly, and relieving stress is good for us. But did you know travel may be just as beneficial? Traveling is exciting and pushes us outside our comfort zones into new cultures and experiences. It is also said to enhance creativity, relieve stress, and boost mental health. Now imagine gaining all the many benefits of traveling while also making a positive impact on the world. Could you take your vacations and travel plans and use them to help save the planet? There are plenty of people already using travel as a gateway to helping animals and…

When you’re on a budget, it’s hard to get to do things you enjoy. You’re putting most of your money toward essential purchases like groceries, your gas tank and bills, and a budget means that after you pay for all of those things, you don’t have much money left. While people are going out to the movies and taking road trips, you’re back at home wishing that you could know when you’ll be able to do the same thing. Wish no more! It’s completely possible to travel while you’re on a budget. If you make some adjustments to save even…

Sometimes the most difficult part of the fundraising process is saying thank you. How do you do it? A song? A crocheted scarf? Maybe you’re not too fond of your singing-voice, but your crochet-skills are on-point. Maybe you like paint and want to create portraits of all your donors. Or maybe you simply want to say thanks in person over a nice dinner. There are numerous ways to thank donors, and the style is up to you! No matter what you think would work best, be sure to say thank you somehow. Sure, a donation is a no-strings-attached way to…

In today’s world, you can leave your work but your work won’t leave you. We have our work responsibilities and we are really busy. But sometimes we need to get out of our cubicles and wander off to beautiful places. But hey, when you finally decide to wander off, you are delegated an important assignment to complete, a meeting to attend, etc. Hence, the travel gets delayed or you end up having to work in the middle of your exciting trip. We all have become somewhat like ‘Road warriors’. While work is our necessity it’s not always easy to do…

For many people traveling abroad can be a dream trip. Most people want to explore the other side of the globe however, only a few make this dream true. Traveling to a foreign country can be an exciting thing to do. The world is full of places with both nature and man-made wonders. You might be wanting to visit the high fashioned life of Paris or the enchanting peaks of the Himalayas. Ultimately, your dream trip can be anywhere in the world. However, it takes a lot of planning and preparations for traveling abroad. If your dream city is in…

While scrolling through our Instagram & Facebook accounts, we come across an overwhelming number of inspirational quotes. Midst that downpour of posts, there are one or two quotations that capture our eyes and grip our hearts. Quotes that we personally relate to and quotes that drive us towards our purpose. We certainly save and like these and set them as social media ‘status’ or ‘stories’. Ever happened to you? We’re sure it has. For all the wander-lust hit people, here’s a roundup of 10 triggering quotes that inspire like magic. If you are a low budget traveler, you’ll relate to these even more….

Slowly but surely, travel is changing. The magic of the internet has transformed how we connect with other people and how we find funding for our adventures. It’s no longer a matter of knowing the right people or having independent wealth (though that never hurts). If you have a the will to travel and the chutzpah to pack up and take the leap, you merely have to get in front of the right people, and the funding will come. It’s easier said than done, though, right? With so many people campaigning for their own projects, how do you set…

Traveling on a low budget is tough, and it always requires a bit of thought. One of the best ways to save is to think about your destination carefully. While it does have to be a place that you want to visit, it also needs to be in line with your budget requirements. Here’s how to go about finding a place that will work. Check the latest deals Looking for cheap deals on flights and accommodation will get you off to a good start. At different times of year, different destinations might be more expensive than at other times, they…

“There are three things in the world that deserve no mercy, hypocrisy, fraud and tyranny.” – Frederick William Robertson You’re on vacation in a foreign country. You check in to the hotel, leave your luggage in your room, grab the most needful items and go sightseeing. There’s so much to investigate! Once you’re out, you notice a souvenir shop with cute backpacks. “I need to have one,” you think. In this very moment, you remind yourself you’ve only US dollars in your purse. “Right. I need to find a currency exchange.” You look around, notice at least three, and choose…

One of the advantages of freelancing is that you are not confined to your office. Instead of spending days in the office from 9 am to 5 pm, a freelancer works any time of the day and anywhere – in a café, in a park or at an airport in anticipation of a flight. You can record a webinar, conduct an advertising campaign, polish your website and all this can be done on the way to Paris or Bangkok. With today’s challenging economy, freelance and travel can be the best way to simultaneously enjoy life and make a living. The…

Your backpack is packed. Your budget is set. Your mom has told you repeatedly to remember to stay in touch. And you’re filled with nervous anticipation for your first solo trip! Maybe your friends were busy, completely broke, or simply not interested in traveling. Or maybe a solo adventure has always been something you’ve dreamed of and you finally worked up the courage to do it. Whatever the reason, you’re about to take off on what is bound to be a life-changing adventure! If you’ve never traveled solo before, here are a few things I wish I’d known before I…

Traveling the world is a bullet on everyone’s bucket list. Many people work hard and earn money only to fulfill their eternal dream to see the whole world before they bid an adieu. This is because traveling is so much fun. But, things instantly change and the fun rises to manifolds when someone else puts their money on the table to fulfill your dream. Well, this might sound unreal, but it is not a novel thing. We of course are talking about crowdfunding. Crowdfunding is the tool that has helped many cover the tortuous path that leads them to their…

Travel provides the perfect opportunity to check out new places and cultures. It expands your mind, and the memories you create will stay with you the rest of your life. The challenge is finding the time to travel, especially if you lead a busy life or don’t have much disposable income to put towards trips. But with the right strategy, those excuses will be a thing of the past. Here are five great ways to start traveling more often. Set up Travel Alerts If you’re open regarding where you travel, then you should definitely set up alerts from a few…

We were lucky enough to be able to interview one of our most successful campaigners, Amy Abrigo. Amy isn’t only successful because she reached her FundMyTravel goal once, she has actually created and reached her goal for 3 different campaigns using the FundMyTravel platform! Her 4th campaign has only been live for a month and is already 82% funded, which you can view and donate to Fly Amy to the Abbey Theatre in Ireland. Amy caught our eye because of her story, the great campaigns she has ran, and her motivation to reach her goal. Read her interview below and…

Leave a comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

How to Start a Travel Fund and Save Money For Your Next Trip

As a travel enthusiast, you are no stranger to the allure of exploring new destinations, immersing yourself in diverse landscapes, and creating unforgettable memories. However, turning those dreams into reality often requires careful financial planning. Fortunately, with the right strategy, you can save money for your next adventure. In this guide, we’ll provide great tips on how to start a travel fund and make your dreams come true without breaking the bank.

Table of Contents

When planning a trip, you need to have a budget. Whether you are planning a trip yourself or engaging with a travel consultant to plan a trip for you, it’s always a good idea to set up a travel fund. I have been doing this for years and it’s allowed me to travel where I want to without going into debt to do so!

Disclaimer: This post may include affiliate links. If you click one of them, I may receive a small commission at no extra cost to you.

How to Start a Travel Fund

Set clear travel goals.

The first and most crucial step in saving for a travel fund is setting clear travel goals. Determine where you want to go, what experiences you want to have, and how much you’ll need for your trip. Creating specific, measurable, and achievable goals will give you a clear target to work toward.

When I decided to take a trip to South Africa, I had to start planning my trip so that I had an idea of how much money I needed to save to take the trip and do the things I wanted to do.

How To Set Up A Travel Fund: Dedicated Travel Account

Open a separate savings account specifically for your travel fund. This will help you keep your travel savings separate from your regular expenses and avoid the temptation to dip into the travel fund for other purposes. Consider setting up automatic transfers from your primary account to ensure consistent savings. There are many banks where you can set up online accounts so that you cannot access the money easily.

A couple of great options is Sofi Bank in the USA or Simplii in Canada. These companies usually offer deals that if you set up automatic deposits over a period of time, then you get a bonus of extra money. It’s a great way to get some additional cash to grow your travel fund.

How to Save For Travel Fund: Budget Wisely

To save money effectively, it’s essential to create a realistic budget. Track your monthly income and expenses to identify areas where you can cut back and redirect funds to your travel fund. There are many free budgeting apps available, but honestly I have been using a good old Excel spreadsheet for years.

I track my income, fixed expenses (rent or mortgage, insurance, fees), variable expenses (internet, tv, cellphone, utilities) and other spending (gas, groceries, dining out, spending money). There are a lot more categories but hopefully you get the jist of it. I figure out what I have that is extra that I can put into that separate account.

Save Strategically to Grow Your Travel Fund

Look for creative ways to save money for travel and boost your travel fund. Also consider setting aside extra money when you start a travel fund. Things like:

- tax refunds

- picking up overtime (if your job allows that)

- monetary gifts

Some bank accounts allow you the opportunity to round up purchases to the dollar. Say you use your debit card for a purchase of $10.30. $0.70 can be redirected into another account. You may not notice that extra money going into a travel fund, but it can add up.

Also look at if your credit card offers a cash back option. My credit card has a 2% cash back option on certain categories of spending. When I spend on restaurants, groceries or gas using my credit card, then 2% is deposited into a bank account monthly. This is a perk of the bank I am with. Just make sure if you use a credit card, you pay it off every month and don’t incur extra debt.

How to Save For Travel Fund: Earn Extra Money

There really are many creative ways to save money for travel. Explore opportunities to earn extra income through part-time work, freelancing, or selling unused items.

Embrace Frugal Living

Making small sacrifices in daily spending can add up quickly into your travel fund. Cutting unnecessary expenses can significantly impact your travel fund. Evaluate your spending habits and identify areas where you can trim costs. This may include dining out less, canceling unused subscriptions, or finding more affordable alternatives for everyday purchases.

A great tip is to find coupons and deals that will save you money at the grocery store or to drive less to save on gas.

Travel Smart

While saving for travel fund is essential, there are also ways to reduce travel expenses without compromising the quality of your trip. Look for budget-friendly accommodations, use travel rewards programs, and plan your trips during off-peak seasons to secure better deals on flights and accommodations.

Stay Committed to Saving For A Travel Fund

Regularly monitor the progress of your travel fund. Adjust your savings strategy if needed and stay motivated by tracking your progress toward your travel goals. Celebrate milestones along the way to keep your enthusiasm high.

Starting a travel fund takes time and dedication. It’s essential to stay committed to your goals, even when faced with tempting alternatives. Remind yourself of the incredible experiences and adventures that await you once you reach your savings target.

Free Resource: Trip Planning Checklist

As you start to save for your trip and build a travel fund, you may want to start planning your trip. This free checklist outlines the steps for planning your vacation.

Download it here to get started.

Starting a travel fund and save money for your next trip is an achievable goal with careful planning and commitment. By setting clear goals, creating a dedicated fund, budgeting wisely, and adopting a frugal lifestyle, you’ll be well on your way to exploring new destinations and making your travel dreams a reality.

So, if you are wondering how to start a travel fund today, follow these tips above and embark on the trips you deserve for your hard efforts.

If you enjoyed my post, follow me on social media or subscribe to my newsletter below, so you can stay connected on future posts, trips, tips and more.

Melanie is the founder of The World Travel Girl. She has been traveling for over 12 years and decided to share her passion with others. She is a travel writer and travel planner who also loves hiking, birdwatching and watching wildlife. Her mission is to help every day people explore the outdoor world and connect with nature.

Great tips! Love your blog!

These are some really helpful tips. Saving strategically is so important when growing a travel fund.

Helpful tips! I need to get better at this haha

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Unlock Exclusive Content Delivered Directly to Your Inbox!

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Use Southwest Travel Funds

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Update: Southwest Airlines announced in July several upcoming changes to its boarding system, seat assignments and cabin configuration. Red-eye flights are also now bookable on certain routes. Read more of the news here .

Southwest is one of the most popular airlines to fly in the U.S., partially because it offers a generous cancellation and flight change policy. However, depending upon the ticket you buy, you may receive travel funds instead of a cash refund in the event your flight plans change.

Here's how to use Southwest travel funds.

How do you get Southwest travel funds?

Thanks to its no-fee change/cancellation policy, Southwest provides a full refund or issues travel funds to your account. To benefit from this generous policy, you must cancel your flight at least 10 minutes before departure.

Here’s how to determine what kind of refund you’ll get:

You get a full refund to your original payment method when you book Anytime or Business Select tickets.

You get travel funds when you book Wanna Get Away or Wanna Get Away Plus tickets. If you use Rapid Rewards points, they will be returned to your Southwest account. Any refunded taxes will go to your travel funds.

Business Select and Anytime fares offer the most flexibility, but they also cost more than Wanna Get Away fares. Wanna Get Away fares, on the other hand, offer the lowest prices. But if you need to cancel or choose to rebook to a lower-priced flight , your only choice is to receive travel funds — cash refunds aren't on the table.

» Learn more: Southwest Rapid Rewards program: the complete guide

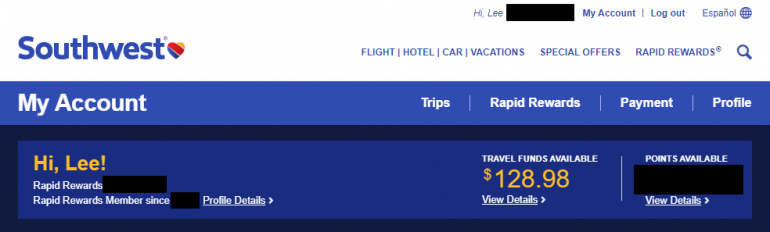

Where can you see your travel funds balance?

When you log in to your Rapid Rewards loyalty account, your travel funds appear at the top of the "My Account" screen.

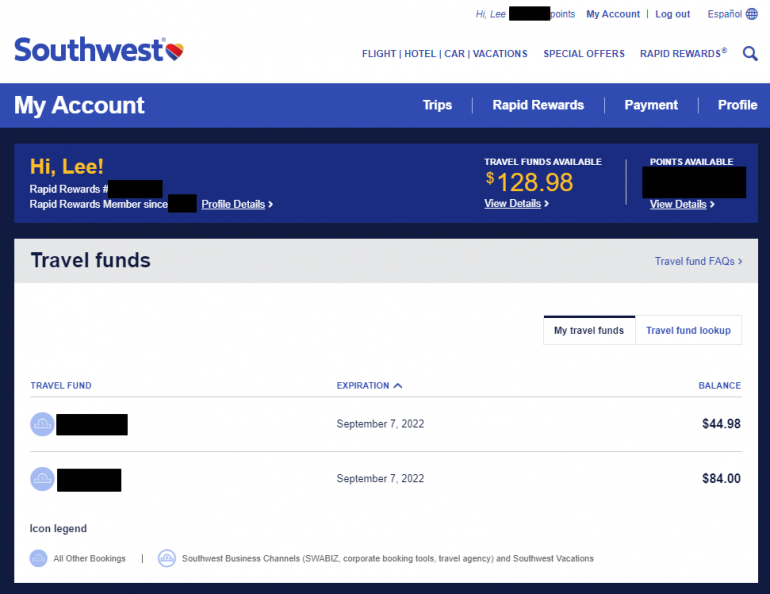

This shows the total available travel funds that you have, but it does not provide the details. You need to click on "View Details" to see the balance of the individual travel fund reservations. Here, you find the expiration date and balance for each reservation. As of July 28, 2022, any unexpired funds and any funds created from there on out will no longer expire. Southwest is updating their system, so for the time being, an expiration date of Dec. 31, 2040, will be displayed in the expiration field. Eventually, that field will go away altogether.

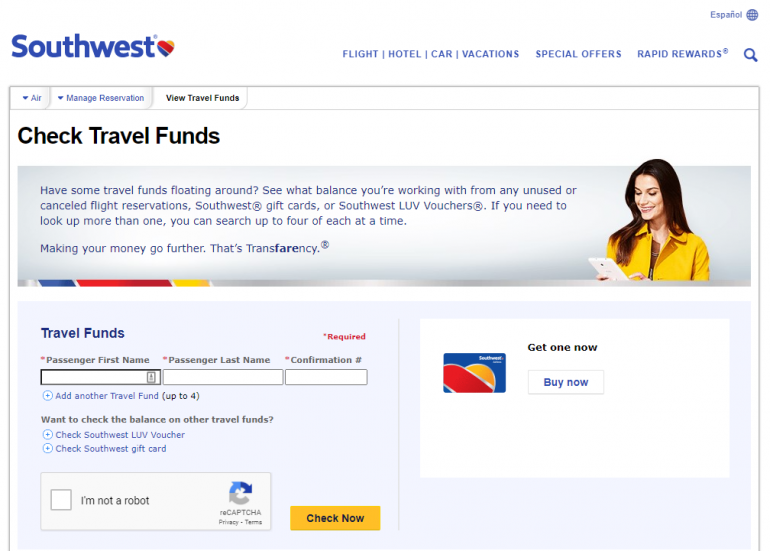

If you don't have a Southwest Airlines Rapid Rewards account, booked a flight that didn't have your loyalty number attached to it or have travel funds from a special purchase ticket, then you'll need to track them manually. Signing up for a Rapid Rewards account is free to do.

Unfortunately, you cannot manually add travel funds to your profile. To track your travel funds manually, visit the " Check Travel Funds " page on Southwest's website. You'll need to provide the passenger's first and last name plus the confirmation number from the reservation. On this page, you can also check the balance of Southwest LUV vouchers and gift cards.

» Learn more: Don't just redeem miles — redeem them wisely. Here's how

What can I do if my travel funds have expired?

While unexpired funds and newly created funds no longer have an expiration date as of July 28, 2022, what if you have travel funds that expired just before this change in policy? According to the Southwest Community message boards, your one hope is to call customer service within six months of the expiration and ask them to reinstate your travel funds as a LUV voucher. The LUV voucher will be good for another six months from the date of your call. Southwest charges $100 for this one-time extension and it comes out of your travel funds.

» Learn more: Southwest Airlines sweet spots

What can Southwest travel funds be used for?

Travel funds from Southwest can be used to book any available cash flight or to pay for the taxes and fees on award flights. They are treated like cash and can be used to pay for some or all of the amount owed. If you don't use all of the travel funds for the reservation, any remaining balance remains for future use.

» Learn more: Your guide to booking award flights on Southwest

Can I use Southwest travel fund for someone else?

Your travel funds can be transferred to someone else with a Rapid Rewards account if you bought a a Business Select , Anytime or Wanna Get Away Plus fare. That person would have to book their own flight using the travel fund, though. You won't be able to use your travel fund to book for someone else. Wanna Get Away fares are not eligible to transferred, so they can only be used by the ticketed passenger.

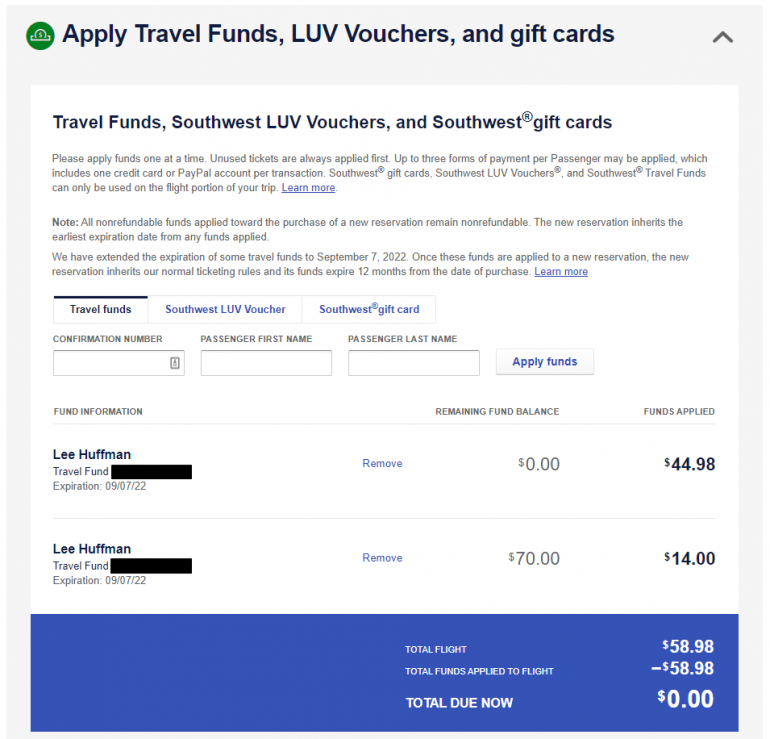

4 steps to book a flight with Southwest travel funds

Your travel funds can be used to book flights online, over the phone or at a Southwest Airlines ticket counter. For this illustration, we'll focus on booking a reservation online.

1. Have your original ticket confirmation number handy

Before booking a reservation, print out or write down the travel funds reservation number(s) that you'd like to use. Southwest's website does not allow you to choose from a list during booking.

2. Browse and select your flights

During the booking process, you'll select your travel dates, cities and times as normal.

3. Apply your travel funds

When you arrive at the "Passenger & Payment Info" page, click to expand the "Apply Travel Funds, LUV Vouchers and gift cards" section. Here is where you'll enter your travel funds' confirmation number and your first and last name before clicking "Apply funds." Then, continue the booking process as normal and pay any remaining balance owed with your preferred form of payment, such as the Southwest Rapid Rewards® Priority Credit Card .

Again, you may use your travel funds for cash fares or to pay the taxes and fees on award tickets.

Remember, travel funds from other passengers may not be applied to your ticket.

4. Get confirmation

Now that you've filled out all of the necessary information and remitted payment with your travel fund, you should see a confirmation email pop up in your inbox.

» Learn more: Is a Southwest credit card worth it?

Using Southwest travel funds

Southwest travel funds are typically created when you cancel or change a Wanna Get Away reservation. They are automatically added to your account when you attach your Rapid Rewards number to the reservation before it is canceled. These funds can be used to book cash or award travel, and any unused amount from your new reservation can be used on a future flight.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

1.5%-5% Enjoy 5% cash back on travel purchased through Chase Travel℠, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Up to $300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

How to Start & Save for a Travel Fund: An Expert’s Guide!

Last Updated: March 30, 2021

*FYI - this post may contain affiliate links, which means we earn a commission at no extra cost to you if you purchase from them. Also, as an Amazon Associate I earn from qualifying purchases. Check out our Privacy Policy and Disclosure. for more info.

“How I fund my travel” is a topic bloggers often tackle… but let’s be honest: the ‘tips’ aren’t usually the most helpful.

I mean, it has become a pretty unrealistic trend among bloggers that travel funding is as simple as tossing some coins into a piggy bank or cutting back on Starbucks.

… which is the least helpful financial advice ever.

And while I’ve also written about the ways you can save money for travel , here’s the thing: the way that travel bloggers afford travel is very different from the average person.

For one, we’re often able to score discounts and complimentary goods by virtue of our work, and often have the privilege of a ‘digital nomad’ lifestyle where we’re not tied down by responsibilities or *gulp* debt.

That’s why I wanted to bring you advice re: how to fund travel from a more helpful and relatable perspective – specifically from a non-travel blogger, and most importantly, a personal finance expert!

Save this guide on how to start and save for a travel fund!

You (and your travelling fund) will be very glad you did.

Today, I want to introduce you to Theresa Gray , a financial fitness coach who has eliminated over $110,000 of debt for herself, and now makes a living helping others do the same.

This lady knows finance much better than me (or most travel bloggers), which is why I trust her to give you the low down on creating a solid vacation budget, along with ideas on how to start a travel fund, save for a travel fund, and create a travelling fund that will finance your trip ideas for years to come.

In today’s guest post, Theresa is going to walk you through step by step how to start a fund for your travels, how to develop a badass vacation savings plan and yenno, eventually tick off yet another adventure for that bucket list. Take it away, Theresa!

Guest post by Theresa Gray, MoneyMatters.life

Picture yourself on an all-expenses-paid dream vacation.

Imagine how it feels to not worry about the costs of food or drinks and to feel free to book an extra unplanned massage.

It’s an awesome vision, right?

The sun shines a little brighter when you don’t have worries about the cost of travel.

However, often when we travel, we might think that we have most of the costs covered, and then get some surprises and just put it on a credit card.

You might stress about the costs while you are on holiday, but most of the time it doesn’t become a reality until you get home and see the bills from the trip and realize just how often you swiped plastic.

So, unless you are planning on being a winning contestant on “The Price is Right”, you need to learn how to save up money to self-fund your trip. And, I want to show you how!

My name is Theresa Gray, and I’m obsessed with helping people to create budgets so that they can live within their means, pay off their debt and have the life that they dream about.

My whole back story is here , but basically, my husband and I changed our lifestyle, lived on a budget, and paid of $110,000 in debt in just 38 months.

Our destination was ‘Debt Free’ and once we got there we rewarded ourselves with a pre-paid self-funded dream vacation to Machu Picchu and Rapa Nui (Easter Island).

No matter if your destination is ‘Debt Free’ like us, or a travel bucket list item like Oktoberfest in Germany , Christmas markets in the Alsace , or seeing Keukenhof in the Netherlands , I can show you how to make the sun shine a little brighter when you get there.

It’s not hard!

The steps are identify, quantify, prioritize and execute.

See? Easy peasy.

(Don’t you hate it when people can’t speak plainly and they try to make themselves sound smarter?) I do. So, here are the steps, in a much easier to understand format.

Step one: Pick your destination Step two: Research costs Step three: Decide how much you want it Step four: Do the work

Step one: Pick your destination

Pull out your list. Surely you’ve made a list of places that you dream about visiting!

If you haven’t made one yet – get started! Here’s some wanderlust inspo for you.

I used to have distant thoughts that went “someday I’d like to go to Australia” and “maybe when I retire I can travel the world”.

But, why wait?

We don’t know how long we have on this earth, so figure out now what you want to do and where you want to go.

Do it now and then rank them in order of the top five places.

Don’t worry about details or costs or distance or if it’s even a place. Go ahead and put Atlantis on your list. I have Wonder Woman’s island of Themyscira on mine!

Cool. Now talk about this list with someone. Dream a little out loud and see how it feels.

Do you feel more drawn to one place than another? Does anyone have insider access or personal information to share to help you make your decisions?

Do some research to see what options you might have to go where you want.

Consider when you would want to go, and what type of season is available for visitors. Experiencing Spring in Europe for instance is very different from going during the winter.

We (unknowingly) went to Rapa Nui in an off season. Bad: We were one of the few people on the island who spoke English. Good: We didn’t have to deal with crowds and the scenery was more beautifully lush because it was the rainy season.

It might be cheaper in the off season, but it is a calculated risk.

Step two: Research costs

This is the part of the process when we do have to get back to reality.

A trip to the moon is a cool conversation started on your lists, but probably cost prohibitive.

How much do your choices run?

This might help you to decide which item on your list to focus on NOW. Remember you can always do the other items in the future.

So – decide how much the actual trip costs. Calculate the obvious costs and the hidden costs.

- Obvious costs: airfare , lodging, food, souvenirs, alcohol, tips, insurance

- Hidden costs: home maintenance, pet sitter, purchases for trip (clothing, chargers, cameras, specialty gear), sun protection, new luggage, cute little toiletries, massages, parking at the airport, travel costs (uber, taxi, rail), tours once you arrive, laundry service

How much money do you need for trip? Come up with a realistic range of costs.

Step three: Decide how much you want it

Now is when we have to keep ourselves from saying, “no duh, I want it or I wouldn’t have gone through those previous steps”.

The question isn’t “do you want to go to Themiscyra?” It is, “Do you want to keep the status quo, go on the trip and return with huge debt” OR “Are you willing to change your behaviors to pre-fund your trip so you an enjoy it without guilt”.

The difference is crucial to you going on your trip and having it paid for in advance.

Either way is cool. You’re not a bad person if you use your credit cards.

However, you might regret it later when you are struggling to make the payments.

Especially if overspending becomes a way of life, if you lose your job, if you have an accident or if you have a health crisis.

If you are committed to changing your behavior and saving for your trip (or paying off debt), then we can move to the next phase!

Step four: Do the work

All your hard mental work has paid off – we have a destination chosen and know roughly how much money we need to fund the trip.

Now we need to fill up that fund!

The ways to do that are:

- Make more money

- Sell some stuff

- Cut expenses

- Stay focused by creating a budget

If you think that you do a great job at your current job, document why you think so and take it into your boss and ask for a raise.

If you have a decent job but need to make some more money, consider taking a temporary extra job to earn some money to put into your trip fund.

Here is an article I wrote with a list of suggested “side hustles”.

Remember that this extra money is going to your Trip Fund and don’t be tempted to spend it.

It’s easy to make $50, and think “hey, I have an extra $50 to spend”, and then spend it three different times, resulting in overspending of $100 instead!

If you are anything like me, you have stuff. We are a nation of stuff!

George Carlin does a funny skit about how we love to get more stuff and don’t feel comfortable until all our stuff has a home.

I’m going to throw it out there that most of us aren’t living a minimalistic life and we all have more stuff than we have places to store our stuff. Let’s call this clutter.

Clutter is stuff without a home. And this clutter in your home causes you stress!

Messy homes and work spaces leave us feeling anxious, helpless, and overwhelmed.

Have you ever thought, “I just can’t think right now!” while standing in a messy room?

Then after taking the time to clean up you can focus clearly? It’s interesting how a clear workspace can give you mental clarity!

You can sell some of that clutter and profit. I have a huge guide on decluttering and reselling here!

Cut the fat:

How fast do you want to take that trip?

There are many ways to save money for travel . You can cut back a little on Starbucks and pedicures and go in two years, or go big and cut cable, return your leased car, and go visit Wonder Woman ancestral digs by Christmas.

It’s your life so it’s your choice – and it’s really fueled by Step 3 above – “How much do you want it?”

You might be thinking, “how do I cut the fat and how much do I need to do it?” Great questions! Creating a budget will help to give us the answers.

This is your income and expenses, charted out for each month.

Ideally, each month you should be spending less than you make, have money put aside for savings (emergency fund/retirement/special occasions, etc.), be working on paying off your debt and also be making some charitable donations.

And – get ready for this – you should do this EVERY month for the rest of your life.

Yes, I’m serious.

It’s a lot of work at first – but I swear it will make your life so much better in the long run.

Remember how I got that sweet trip to Machu Picchu and Rapa Nui? Budget.

And, how I paid off $110k? Budget. I even got a really nice new couch.

Boom. Thank you, budget.

How to Build Your Own Budget

Wondering how to fund your travels smartly with a traveling fund that can help finance your trip? It all starts with a budget. Here are some must-know tips on how to budget:

1. Budget before the month begins

Start with your income.

Whether you get paid a regular salary or an irregular commission, you need to look at the month ahead and decide on a safe number to forecast.

This includes anything you earn money from, like paychecks, side jobs, child support, or alimony.

(Unless, like in this case, where we are specifying ahead of time that all NEW EXTRA money is going straight to the Trip Fund.)

Next, identify your regular monthly expenses.

Start by covering the essentials which are food, clothing, transportation, shelter, and utilities. When you know you can keep your lights on, feed your family, and drive to work, you can focus on the other important expenses like savings, health insurance, and debt repayments.

Don’t forget to give away some of your money, to put your priorities in focus. If 10% is uncomfortable, start with an amount you feel comfortable with and then try to increase your percentage.

As you budget each month, remember that no two months are exactly the same.

It’s okay to use last month’s budget as a template, but be sure to tweak it for any new expenses on the horizon.

At the end of the day, this is your budget. Make it awesome by budgeting early, spending every dollar on paper down to a zero on the bottom line, and tracking your spending.

Finally, after everything you need to pay for the month has been accounted for, it’s time to consider what to do with your ‘want to do’ dollars.

This is where you get to see how much per month is left over for your Trip Fund, and you can begin to calculate how long it will take to fill up the fund.

If your monthly trip/traveling fund amount is small, it will take a long time to finance the trip.

So, now you need to cut some fat. Where in the regular monthly expenses can you cut back stuff?

Often the biggest spots where we overspend are where we live, what we drive, and what we eat.

2. Budget to zero

Now that you’ve accounted for all of your income and expenses, you should have zero dollars left to spend. If you don’t, adjust your budget until you do.

This is your number-one goal when allocating your income each month. By giving every dollar a name, you’re ensuring that every dollar is accounted for and working hard.

And, that my friends, is budgeting.

3. Track your spending

This budget needs to mean something more than just an exercise you do on paper.

If you budget $200 a month for clothing but then go and spend $500 you broke your budget!

While you’re out and about buying groceries or eating at restaurants, be sure to track your transactions.

What does that mean, ‘tracking transactions?’

It is making sure that if you spend a dollar, that it gets noted as being a dollar ‘spent’ for a specific budget.

So, if I have a $30 Starbucks monthly budget, and I go and get a $5 latte on the first and second days of the month, I need to know that I only have $20 left for the rest of the month.

I can do that a few different ways.

I could have a manual ledger (in a note pad) of how much I’ve spent to date per category and write down all my expenses and assign them to categories as I write them down.

I could pre-portion budget categories using cash envelopes and only spend out of the appropriate envelope and I would see exactly when I am out of cash!

Or, if I use a lot of debit or credit cards, I can use an online tracking program (like Mint or Quicken, etc.).

There should be NO UNCATEGORIZED transactions at the end of each month! No ‘miscellaneous’ transactions!

This means that when you shop at Target, you will need to split apart the transaction and divvy up the spending into correct categories (food, toiletries, clothing) and not leave in a ‘shopping’ catch-all.

The first couple months can be tricky to get the numbers right, but after 3-4 months of tracking and adjusting you will get the right balance of money in each category and start to take charge of your finances.

By this time you will have sold some stuff and made some extra money.

By knowing your budget, you will be able to calculate how much you can put in your trip budget per month and then calculate how long until you have your trip funded!

Trip Costs – Profit from Sales – Side Hustle Cash = Total $ Needed to fill Trip Fund Total $ Needed to fill Trip Fund / Budgeted Trip Savings per Month = # Months until Trip Fund is Full

And once you know when you will be ready to go on your pre-paid vacation, you can start to book your travel and start to see your dream become a reality!

Then it starts to get even more exciting! You might get even more motivated and figure out how to save more money, faster to fund the next trip on your list!

You can put whatever you want on your budget. It’s your baby. But if you are only wishing for something, odds are it won’t happen. Make a plan and live your dreams!

I hope that this helps someone to finally feel like they can afford to take a dream trip. Have any questions? Be sure to stop by my site!

I hope you enjoyed this guide to starting your own travel fund!

Hey, it’s Christina again! I hope you enjoyed that guest post from Theresa – I know I definitely learned a lot about how to create a fund and budget to help fund my travel, finance my trip goals in the future, and even start a vacation fund for those huge bucket list trips.

If you need more inspiration on what to do with your travelling fund, be sure to check out my Destinations page for ideas.

My Go-To Travel Favourites:

🧳 Eagle Creek: My favourite packing cubes

💳 Wise: For FREE travel friendly credit cards

🍯 Airalo: My go-to eSIM

🏨 Booking.com: For searching hotels

📷 Sony A7IV: My (amazing) camera

✈️ Google Flights : For finding flight deals

🌎 WorldNomads: For travel insurance

🎉 GetYourGuide: For booking activities

5 thoughts on “How to Start & Save for a Travel Fund: An Expert’s Guide!”

Glad to say that I do all of these things before travelling! I always make sure I have emergency money as well, in case anything happens and I need to fly home – touchwood! That’s why more expensive/far away destinations are out of the picture at the moment, but maybe some time in the future! – Charmaine Ng | Architecture & Lifestyle Blog https://charmainenyw.com

That’s awesome – good for you haha. You’re way more on top of finances than I am haha.

Glad you liked it!

Hey Christina, The more I read your blog content, the more I feel inspired. These are amazing budget building strategies. The whole purpose of my blog is the same! To enable people to travel in shoe string budgets. Would request you to go through the same and give your valuable suggestions. http://www.wanderwithsankalp.com

Leave a Comment Cancel reply

By using this form you agree with the storage and handling of your data by this website. *

Travel Fund: 22 Ways to Save Money for Travel

So you want to travel the world. The first thing you need to do is start a travel fund. The good news is that it’s possible! The bad news (if you consider this is bad news) is that starting a travel fund will take a little bit of dedication, priority and time.

I’ve had travel funds as long as I can remember. I started to save money for travel in high school by working at a coffee shop on the weekends and off seasons when I wasn’t playing sports.

The summer before I college I took a trip to Aruba with my best friends. My first international trip and I paid for it all on my own by working a minimum wage job. I was hooked.

There were so many ways to save money on a tight budget. As well as many ways to save money while traveling .

Fast forward 18 years, my travel funds keeps getting larger because my desire to travel more places and for longer periods of time keeps getting more intense.

Table of Contents

22 Ways to Save for Travel

For full transparency, I have sprinkled some affiliate links in this post which gives me a small commission at no extra cost to you if you decided to make a purchase. As always, I would never recommend a product or service that I didn't truely believe in. If you find this post useful, you can also treat Jess to a cup coffee by clicking the icon on the bottom of the page. This will allow me to continue to create more content for you to enjoy ☕️.

How to Start a Travel Fund

1. prioritize.

The first step to starting a travel fund is to make it a priority. No person working a regular working a minimum wage job has ever saved enough money to travel the world without making a few sacrifices. Is that $100 concert a necessity or can you put that money towards your travel fund?

Let’s take a look at my story. I’ve been a bartender since I was 19 years old, I am currently 35 and still bartend to fund my travels (along with a few side hustles and tricks I mention in this post).

I say this because I want you to know that I wasn’t blessed with a trust fund or left a high paying corporate job to travel. I worked my ass off, had multiple jobs, saved as much money as I could and used all these tips I’m writing about on how to save money to travel the world in order to budget for travel.

It wasn’t easy and it didn’t come without sacrifice. Saving money for travel was my top priority and you will need to set your intentions early and stay focused.

2. Attack your Debt

Of course in order to start a travel savings you must first get out of debt. It may seem daunting at first because all of the money you are saving is going towards your debt and not your travel fund but trust me, this is the only way.

I was twenty two thousand dollars in credit card debt, got a second job, cut out unnecessary spending and paid off my debt while saving 20k in a travel fund all within a year while living in expensive Maui . I don’t say this to brag, I say this to let you know that if I can do it, you can do it.

3. Start a Seperate Online Savings Account for your Travel Fund

After you’ve set your intentions and you’ve made starting a travel fund a priority, the next step is to start a separate savings account that will house your travel savings.

You can do this through your hometown bank or what I recommend doing is to start an online banking account through Charles and Schwab. It is easy to set up and you can do so here . If you sign up through this link you can earn up to an extra $500 depending on how much you deposit. What a perfect way to jumpstart your travel fund! P.S. I get no incentive for you using this link, its all you baby! Save on my friend!

Once you’ve set up your online travel savings account you can link your original account and easily transfer money into your savings electronically. So every time you deposit money you can decide how much is going into your travel fund, transfer it over and forget about it.

I recommend banking with Charles and Schwab for several reasons.

First, they have great customer service. One time I was traveling through Thailand in Southeast Asia when I realized that my debit card was about to expire and that was my only way to withdrawal money. I made a call to customer service and within 3 days I had a new debit card delivered to my hotel in Chiang Mai .

I then proceeded to accidentally leave my new unexpired debit card in an ATM. Not my proudest travel moment. I then had to wait until I was going to be in one spot for at least one week to have them send me a new bank card. This time it was in Vang Vieng, Laos , where I again called and my second new debit card had arrived within 3 days.

If you know anything about Laos or Vang Vieng in general you know how remote and difficult it is to get to. Charles and schwab was there for me when I needed them and I will forever by a loyal customer.

Second, when you use you Charles and schwab card anywhere in the world, they reimburse your foreign transaction fees . This way you never have to be carrying a bunch of cash on you, you can pull out what you’ll spend for the day or two and it’s still cost effective because you’ll be getting back what you spent on atms at the end of each month. It’s safe and it saves. Win win.

4. Track your Expenses

Write down all of your bills for one month. Rent, electric, car payment, insurance, subscriptions, student loans and tally it up.

Next track your expenses for a week, record everything that you spend your money on. That morning coffee, parking, laundry, night cap, whatever it is write it down and see on average how much you spend a week. Once you’ve finished tracking your expenses for a whole week multiply that number times 4, this will be your average expenses you spend in a month.

There are lots of apps out there to help you track your expenses but my favorite is the Trail Wallet Travel Budget App . This app let’s you track your expenses by categories and its easy to use. Plus it was designed for travelers, you can easily switch between currencies and getting in the habit now to track your expenses will be a breeze when you are actually traveling.

Okay so you have your total bills for the month and roughly what you spend in a month on things other than bills like groceries and nights out. That number may scare you but this is a good thing because now you cut the fat. All the frivolous spending has to go in order to watch your travel savings grow. Time to put yourself on a strict budget. Here are some common ways to do this.

Expenses to Cut to Save Money to Travel

5. Cut the Coffee

If you spend $5 a day on a fancy coffee that’s $35 a week and $140 a month. Cut the coffee and make it at home.

6. Ditch the Gym & Workout at Home

Although I don’t personally use this one because my gym is my outlet, cancelling your gym membership can potentially save you a lot of money for travel.

If you go this route utilize Youtube. There are lots of free workouts online that can get your blood pumping and of course running is always free.

Related Articles:

20 Pieces of Workout Equipment you can Travel with 10 Ways to Stay Fit while Traveling

7. Trade Nights out for Dinner Parties

Just because you are on a budget doesn’t mean that you can’t enjoy your friends and have fun. Instead of going out to dinner opt for dinner in with friends. You’ll have more meaningful conversations, learn a new skill like cooking and its cost effective.

8. Cut the Extra Montly Subscriptions

Do you really need that Fab Fit Box or Wine of the Month Club? Cutting expenses means getting rid of unnecessary expenses. You can’t bring all that stuff with you when you travel anyways.

If you still pay for cable, stop right now. Stream your shows instead. If you have T-Mobile (one of the best international phone plans out there) Netflix is included with your plan. Consider switching carriers.

10. Stop Drinking

One of the biggest travel saving tips I have is to stop drinking. Drinking is not only bad for your waistline, its also bad for your budget.

If you’ve ever worked in the restaurant industry, after your shift you go to the l ate night bar for drinks to talk with your co-workers and talk about your night. Once I stopped doing this I saved hundreds of dollars a month. Cutting this expense for me was the easiest way to save for a trip.

11. Don’t Smoke

A pack of cigarettes cost $10 in Hawaii , you do the math.

12. Enjoy Free Activities

Just because you put yourself on a budget doesn’t mean you have to deprive yourself of fun activities. Enjoy free things like hiking or utilize a museum that is free to get into.

HIKING INSPIRATION:

Maui’s Best Hikes The Best Hikes of Zion National Park Epic Hikes in Peru

Hiking Arches National Park Hiking Bryce Canyon National Park Hiking the Great Wall of China without the Crowds Hiking Rio Celeste, Costa Rica

13. Use Public Transportation when you can

Save on gas and parking expenses by taking public transportation. Not only is it budget friendly but its eco friendly as well.

14. Buy in Bulk

Here on Maui groceries are expensive along with everything else. Buying in bulk is a great a way to save money for your travels.

This makes it easy to meal prep and have meals and snacks ready to go. This is especially helpful if you are living a busy life and working two jobs to build up that travel fund. When you’re busy people pay for convenience which counter acts the whole point of working a second job in the first place.

15. Shop at Farmer’s Markets